July 10, 2017

These are uncertain times and the subject of continuing enforcement of the Foreign Corrupt Practices Act (“FCPA”) is certainly not immune from question as a new administration takes the reins of the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”). On the one hand, a combined 18 FCPA enforcement actions initiated by DOJ and the SEC during the first half of 2017 would suggest business as usual, if not more robust than usual. On the other hand, a careful observer would note that nearly all of these cases were brought in the final days before Chief Justice Roberts administered the presidential oath to Donald J. Trump—who in his prior life as a real estate mogul was openly hostile to the role of the American prosecutor as a global policeman under the FCPA. And yet, with scores of dedicated career lawyers and law enforcement agents driving the train, what we see in the hallways of the Bond Building, the Home Office, and the regional outposts of each agency is a continued commitment to anti-corruption enforcement. We advise our clients to stay the course of FCPA compliance that has been blazed in recent years and await what, if any, differences will present themselves in the new enforcement regime.

This client update provides an overview of the FCPA as well as domestic and international anti-corruption enforcement, litigation, legislation, and policy developments from the first half of 2017.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and “agents” acting on behalf of issuers and domestic concerns, as well as to “any person” who violates the FCPA while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and their agents. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

FCPA ENFORCEMENT STATISTICS

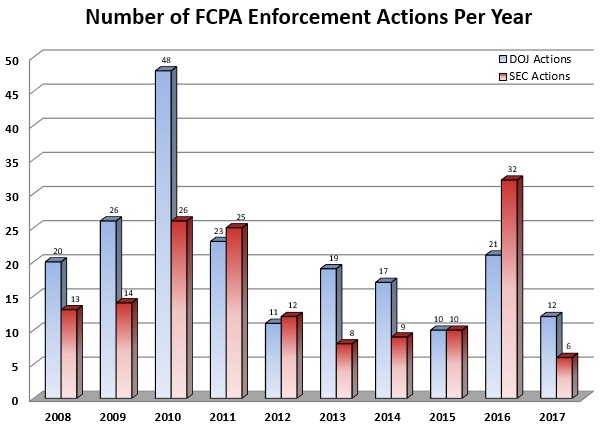

The following table and graph detail the number of FCPA enforcement actions initiated by the statute’s dual enforcers, DOJ and the SEC, during each of the past ten years.

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

||||||||||

|

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

|

20 |

13 |

26 |

14 |

48 |

26 |

23 |

25 |

11 |

12 |

19 |

8 |

17 |

9 |

10 |

10 |

21 |

32 |

12 |

6 |

2017 MID-YEAR FCPA ENFORCEMENT ACTIONS

In the world of FCPA enforcement, the first month of 2017 came in like a lion and the next five months went out like a lamb. More than 80% of the FCPA enforcement actions brought during the first half of 2017 (15 of 18) were filed in January. A description of the first half of 2017 in FCPA enforcement actions follows.

Corporate Enforcement Actions

Cadbury Limited and Mondelēz International, Inc.

The first corporate FCPA action of 2017 reflects one of the most aggressive theories of liability advanced by enforcers in recent years. On January 6, 2017, former ADR-issuer and UK confectionery company Cadbury and U.S. issuer parent Mondelēz International jointly settled an SEC-only cease-and-desist proceeding arising from alleged violations of the FCPA’s accounting provisions, agreeing to pay a $13 million civil penalty. But the basis for the alleged violations is far from clear on the face of the resolution document.

According to the SEC, in early 2010 Cadbury’s Indian subsidiary hired an agent to assist the company with obtaining licenses and approvals for a planned factory expansion. In total, the subsidiary paid the agent just over $90,000 for consultation services associated with the necessary licenses. There appears to have been no direct evidence of corruption, but based on allegations that the company failed to conduct due diligence on the agent, failed to monitor or require written documentation of his activities, and the agent’s withdrawal of his payments from the bank in cash, the SEC asserted that there was a “risk that funds paid to [the agent] could be used for improper or unauthorized purposes.” This purportedly caused the Indian subsidiary’s books and records to be inaccurate and reflected a lack of internal controls by Cadbury. Further, because Mondelēz acquired Cadbury during 2010 while the agency relationship was ongoing, the SEC asserted that “Mondelēz is also responsible for Cadbury’s violations.”

The SEC acknowledged Mondelez’s cooperation in the investigation, as well as the “substantial, risk-based, post-acquisition compliance-related due diligence review” it engaged in following the acquisition of Cadbury. Companies frequently do not receive extensive pre-acquisition due diligence under the controlling UK corporate laws. The SEC imposed no ongoing reporting requirement on Mondelēz.

Zimmer Biomet Holdings, Inc.

Biomet’s FCPA woes have been the subject of public scrutiny for several years now. As reported in our 2012 Mid-Year FCPA Update, Biomet settled FCPA charges with DOJ and the SEC in March 2012 stemming from alleged improper payments to doctors employed by public institutions in Argentina, Brazil, and China. An independent compliance monitor was imposed as part of that resolution with a three-year term, set to expire in 2015. As reported in our 2015 and 2016 Mid-Year FCPA Updates, the compliance monitor’s term was extended as the company (by that point, acquired by Zimmer Holdings) investigated new allegations in Brazil and Mexico. On January 12, 2017, the combined company Zimmer Biomet Holdings reached an unprecedented second joint FCPA resolution with DOJ and the SEC involving conduct in Brazil and Mexico that occurred prior to Zimmer’s acquisition.

The new allegations in Brazil were directly related to the company’s first settlement. Biomet represented to DOJ and the SEC during the initial investigation that it had terminated the distributor who allegedly made the corrupt payments leading, in part, to the 2012 settlement. But according to the 2017 charging documents, Biomet continued for years to use the unauthorized distributor through a related company, even after an internal audit identified the relationship between the two distributors. The government did not allege that the distributor continued to make corrupt payments in Brazil, but rather alleged that Biomet’s books and records were inaccurate by virtue of its recording transactions with the pass-through distributor when in reality the work was performed by the unauthorized distributor. The new allegations in Mexico were that a subsidiary used a customs broker to move unlicensed products across the border by making improper payments to customs officials.

To resolve the SEC proceeding, Zimmer Biomet consented to an administrative cease-and-desist order alleging FCPA bribery and accounting violations. To resolve the DOJ investigation, Zimmer Biomet entered into a deferred prosecution agreement charging a willful failure to implement internal controls and a subsidiary pleaded guilty to a single count of causing the parent company’s books and records to be inaccurate. Between the joint DOJ-SEC resolutions, Zimmer Biomet paid over $30 million and, notably, agreed to retain a second compliance monitor for an additional three-year term, meaning that the company is scheduled to operate under the supervision of a monitor for nearly eight years in total.

Sociedad Química y Minera de Chile

On January 13, 2017, Chilean chemical and mining company and ADR-issuer Sociedad Química y Minera de Chile (“SQM”) entered into a joint FCPA resolution with the SEC and DOJ arising from allegations that between 2008 and 2015 SQM made nearly $15 million in improper payments to and for the benefit of Chilean government officials. According to the charging documents, a high-level SQM executive used funds from his discretionary account to funnel money to charitable foundations controlled by or closely tied to Chilean politicians. SQM also allegedly routed money to officials through vendors that purported to, but in reality did not, provide services to the company.

To resolve the criminal investigation, SQM entered into a deferred prosecution agreement on charges of failing to implement internal controls and falsifying books and records and agreed to pay a $15.5 million criminal fine. To resolve the SEC’s investigation, SQM consented to an administrative cease-and-desist order charging FCPA accounting violations and agreed to pay a $15 million civil penalty. SQM also engaged an independent compliance monitor with a two-year term, and agreed to self-report on its FCPA compliance for a third year.

The focus on charitable giving as a conduit to government officials has been a priority of enforcers since the Schering-Plough FCPA enforcement action more than a decade ago. The cautionary advice is to scrutinize all charitable contributions for linkage to government officials.

Rolls-Royce plc

Our 2016 Year-End FCPA Update identified multi-jurisdictional anti-corruption enforcement as one of the most significant developing enforcement trends. That continued into 2017 when, on January 17, UK-based engineering company Rolls-Royce entered into an $800 million-plus combined resolution with UK, U.S., and Brazilian anti-corruption authorities.

According to the U.S. charging documents, between 2000 and 2013, Rolls-Royce caused millions in bribes to be paid to officials of state-owned oil companies in Angola, Azerbaijan, Brazil, Iraq, Kazakhstan, and Thailand. To resolve these charges with DOJ, Rolls-Royce agreed to pay a criminal fine of approximately $195.5 million as part of a deferred prosecution agreement alleging conspiracy to violate the FCPA’s anti-bribery provisions. The company also agreed to report on its anti-corruption compliance program for the three-year term of the agreement. Rolls-Royce is not listed on U.S. securities markets, hence the SEC was not involved in the resolution.

As discussed below, Rolls-Royce also entered into a deferred prosecution agreement with the UK Serious Fraud Office, agreeing to pay a fine of approximately $605 million, based on allegations that between 1989 and 2013 it paid or failed to prevent the payment of bribes in China, India, Indonesia, Malaysia, Nigeria, Russia, and Thailand. Finally, under terms finalized with the Brazilian Ministério Público Federal, Rolls-Royce agreed to pay a penalty of approximately $25.5 million in connection with conspiring to bribe Brazilian officials between 2005 and 2008. Rolls-Royce will receive dollar-for-dollar credit for the Brazilian settlement as a reduction in its DOJ penalty, bringing the actual U.S. component of the payment down to just under $170 million.

Orthofix International N.V.

On January 18, 2017, the SEC announced a settled cease-and-desist action against Texas-based medical device company Orthofix International relating to alleged FCPA accounting violations arising from improper payments to doctors at state-run hospitals in Brazil. According to the SEC, from 2011 to 2013, third-party representatives and distributors of the company’s Brazilian subsidiary used funds from commissions and discounts on sales to make these payments, which allegedly were inaccurately recorded on the subsidiary’s books. Regarding its internal controls charge, the SEC alleged that Orthofix lacked policies or mechanisms to centrally approve and monitor discounts and commissions provided by the subsidiary, which the SEC viewed as particularly egregious in light of the company’s earlier 2012 FCPA resolution premised on improper subsidiary payments in Mexico (covered in our 2012 Year-End FCPA Update). Like the Biomet case discussed above, the facts leading to this second FCPA settlement were disclosed pursuant to the company’s reporting obligations arising from the first settlement.

To settle the SEC’s allegations, Orthofix consented to an administrative cease-and-desist order and agreed to pay more than $6 million, which included nearly $3.2 million in disgorgement and prejudgment interest and a $2.9 million civil penalty. Orthofix also agreed to retain an independent compliance consultant for one year and, in a relatively unusual move for an SEC-only settlement (Orthofix announced that DOJ has closed its investigation without taking any action), the company was required to admit the facts forming the basis for the settlement. Finally, in a coordinated non-FCPA resolution, Orthofix and four former executives on the same day settled with the SEC a revenue recognition case relating to distributor sales.

Las Vegas Sands Corp.

On January 19, 2017, the day before the new administration, DOJ announced a non-prosecution agreement with Nevada-based resort and casino company Las Vegas Sands. The allegations described substantially overlap with those from the company’s April 2016 FCPA settlement with the SEC, covered in our 2016 Mid-Year FCPA Update. DOJ alleged that subsidiaries of Las Vegas Sands made approximately $60 million in payments to a Chinese consultant between 2006 and 2009, for among other things the purchase of a Chinese basketball team and a building in Beijing, continuing to make the payments even after being warned of the consultant’s allegedly dubious business practices and learning that more than $700,000 in payments could not be accounted for. No corruption was alleged, but nevertheless DOJ asserted that the company failed to maintain adequate controls to ensure the legitimacy and proper accounting of payments to the consultant.

To resolve the allegations, Las Vegas Sands agreed to pay a criminal fine of $6.96 million. DOJ will receive the reports of the compliance monitor imposed as part of the 2016 SEC FCPA resolution, and Las Vegas Sands will thereafter self-report on the state of its FCPA compliance program for the balance of the three-year term of the non-prosecution agreement.

This resolution is unusual because typically the SEC and DOJ resolve investigations on the same day and not months apart. The public record does not reveal why these resolutions were not announced simultaneously.

Pilot Program Declinations – Linde North America & CDM Smith

The only corporate FCPA enforcement actions of the Trump Era thus far have been two FCPA Pilot Program “declinations” with disgorgement and admissions during the second half of June 2017. As reported in our 2016 Mid-Year FCPA Update, the one-year Pilot Program was scheduled to expire in April 2017, but has been extended for further study as announced by Acting Assistant Attorney General Kenneth Blanco in a March 10, 2017 speech. These two declination agreements represent the sixth and seventh such agreements, respectively, under the Pilot Program.

On June 16, 2017, DOJ reached a declination letter agreement with New Jersey-based industrial gas supplier Linde North America Inc. and Linde Gas North America LLC. According to the letter agreement, from 2006 to 2009, a subsidiary acquired by Linde paid bribes to secure the purchase of certain income-producing assets from a Georgian state-owned entity. The bribes were allegedly paid by granting two officials at the state-owned entity a portion of the profits generated by the assets after their purchase. After identifying the conduct, Linde withheld payments purportedly due to the corrupt actors, voluntarily disclosed the matter, conducted an investigation, and remediated the conduct, including terminating or disciplining the implicated employees. As part of the declination letter agreement, Linde disgorged $7.82 million in alleged illicit gains, forfeited another $3.415 million owed to the sham companies set up to funnel the payments, and agreed to DOJ’s brief statement of facts.

On June 29, 2017, DOJ reached a declination letter agreement with Boston-based engineering and construction firm CDM Smith Inc. According to the letter agreement, from 2011 to 2015, employees of CDM Smith’s division responsible for Indian operations and a subsidiary of CDM Smith in India paid $1.18 million in bribes to government officials in India in exchange for highway construction supervision and design contracts and a water project contract. CDM Smith voluntarily disclosed the payments to DOJ. As part of the declination letter agreement, CDM Smith agreed to disgorge just over $4 million in profits from the tainted contracts and admitted to DOJ’s brief statement of facts. On the same day, CDM Smith reached an agreement with the World Bank Integrity Vice Presidency sanctioning the company for its failure to disclose a sub-agent who worked on a project in Vietnam. The conditional non-debarment agreement will still permit CDM Smith to participate in World Bank projects provided it meets the compliance terms set forth in the agreement for its 18-month term.

Individual Enforcement Actions

Additional PDVSA Corruption Scheme Defendants

On January 4, 2017, DOJ filed criminal FCPA informations against Charles Quintard Beech III and Juan Jose Hernandez-Comerma, two new defendants in an alleged “pay to play” corruption scheme involving Venezuelan state-owned oil company Petróleos de Venezuela, S.A. (“PDVSA”). According to the charging documents, Hernandez and Beech engaged in separate schemes to bribe PDVSA officials to ensure that their respective companies were placed on PDVSA bidding panels. Hernandez and Beech each pleaded guilty to one count of conspiracy to violate the FCPA, with Hernandez additionally pleading guilty to one substantive count of FCPA bribery.

Hernandez and Beech represent the seventh and eighth defendants charged in the PDVSA investigation. As we reported in our 2016 Year-End FCPA Update, six individuals—including three former officials of PDVSA (Alfonzo Eliezer Gravina Munoz, Christian Javier Maldonado Barillas, and José Luis Ramos Castillo) and three U.S.-based businesspersons (Abraham Jose Shiera Bastidas, Roberto Enrique Rincón Fernandez, and Moisés Abraham Millán Escobar)—previously pleaded guilty. Sentencing for all eight defendants is currently set for August 30, 2017.

Vietnamese Skyscraper Corruption Defendants

On January 10, 2017, DOJ unsealed and announced a December 2016 indictment of Joo Hyun Bahn, Ban Ki Sang, Sang Woo, and Malcolm Harris for an alleged scheme to pay bribes to facilitate the $800 million sale of a skyscraper in Hanoi, Vietnam. According to the charging documents, Bahn, a Manhattan real estate broker, and his father Sang, an executive at a South Korean construction company that owned the skyscraper, conspired to pay a $2.5 million bribe to an official at an unnamed Middle Eastern sovereign wealth fund through Harris, a New York fashion designer, to induce the sovereign wealth fund to purchase the skyscraper from Sang’s company. Woo, a co-worker of Bahn’s, allegedly helped to secure the funds to deliver to Harris. Little did they know, however, that Harris was lying about his purported connections to the foreign official and instead of delivering a bribe stole the $500,000 down payment for his own use.

Bahn and Ban were each charged with substantive FCPA bribery and money laundering, as well as conspiracy to commit the same. Bahn and Harris were each charged with wire fraud, conducting monetary transactions in illegal funds, and aggravated identity theft. Woo was charged with one count of FCPA conspiracy. Bahn has pleaded not guilty; Sang has yet to be extradited from South Korea; Woo is reportedly in plea negotiations with DOJ; and Harris has pleaded guilty to wire fraud and aggravated identity theft, with an initial sentencing date scheduled for September 2017.

According to the charging documents, the foreign official with whom Harris feigned a connection was unaware of the scheme and his sovereign wealth fund had no intention of purchasing the skyscraper in question. This case has drawn considerable media attention because Ban is the brother (and Bahn the nephew) of former U.N. Secretary General Ban Ki-moon, and news of his family members’ arrests reportedly contributed to his surprise decision to end his bid to become president of South Korea.

Och-Ziff Defendants

In our 2016 Year-End FCPA Update, we covered the September 2016 FCPA resolution with New York-based hedge fund Och-Ziff Capital Management Group LLC and two of its executives relating to an alleged corruption scheme in various African counties. On January 26, 2017, the SEC filed an unsettled FCPA case against Michael L. Cohen and Vanja Baros arising out of the same alleged misconduct. In its press release announcing the charges, the SEC characterized Cohen, the former head of Och-Ziff’s European office in London, and Baros, a former analyst on Och-Ziff’s African Special Investment Team, as the “driving forces” and “masterminds” behind the scheme.

According to the civil complaint filed in the U.S. District Court for the Eastern District of New York, Cohen and Baros allegedly explored business opportunities in African countries known for corruption and worked with agents and intermediaries known to have close connections with high-ranking government officials. Cohen and Baros allegedly made payments to the intermediaries knowing that all or a portion of the funds would be used as bribes. In addition to the FCPA allegations, Cohen is also charged with Investment Advisers Act violations. The parties are currently briefing defendants’ motion to dismiss.

Samuel Mebiame, the son of the former Prime Minister of Gabon and a consultant to a mining company owned by a joint venture between Och-Ziff and another entity, was sentenced to 24 months in prison on May 31, 2017. As discussed in our 2016 Year-End FCPA Update, Mebiame pleaded guilty to a criminal conspiracy to violate the FCPA’s anti-bribery provisions.

New FCPA Charges in U.N. Bribery Case

On April 27, 2017, Francis Lorenzo, the former U.N. Deputy Ambassador for the Dominican Republic, pleaded guilty to an eight-count superseding information adding FCPA bribery and conspiracy charges to his pre-existing criminal case alleging corruption at the United Nations. As reported in our 2015 Year-End FCPA Update, in October 2015, bribery and related charges were announced against Lorenzo, now-deceased former President of the U.N. General Assembly John Ashe, and four businesspersons from whom Ashe and Lorenzo allegedly accepted bribes. The charges stem from an alleged scheme whereby the businesspersons paid more than $1 million in bribes between 2011 and 2015 to advance their interests before the United Nations, including a plan to build a U.N.-sponsored conference center in Macau.

As reported in our 2016 Year-End FCPA Update, a superseding indictment filed with respect to two of the businesspersons, Ng Lap Seng and Jeff C. Yin, added FCPA bribery charges in connection with the Macau conference center bribery scheme, based on the fact that U.N. officials qualify as foreign officials under the FCPA due to the U.N.’s designation by Executive Order as a “public international organization.” Yin pleaded guilty in April 2017 to conspiring to defraud the United States by evading taxes. As discussed below, Seng is currently in trial and Lorenzo has testified as a witness against him.

FCPA-Related Charges Unsealed in Korean Bribery Investigation

On March 14, 2017, the U.S. District Court for the Central District of California unsealed criminal money laundering charges (originally filed in December 2016) against Heon-Cheol Chi, a principal researcher at the Korea Institute of Geoscience and Mineral Resources (“KIGAM”) and the Director of KIGAM’s Earthquake Research Center. The indictment alleges that Chi solicited and received more than $1 million in purportedly corrupt payments from at least two companies—one based in the UK and one based in California—in exchange for preferential treatment and otherwise assisting the companies in selling their products in South Korea.

Chi filed a motion to dismiss the indictment, arguing among other things that the fees he received did not amount to an offense under U.S. or Korean law because they represented payments for technical advisory services unrelated to his official duties. The Court denied the motion to dismiss, finding that the arguments went well beyond the four corners of the indictment and in effect asked the Court to “grant summary judgment in a criminal case and invade the province of the jury.” Trial is currently set to begin on July 11, 2017.

2017 MID-YEAR FCPA-RELATED DEVELOPMENTS

The first six months of 2017 also saw important guidance issued from DOJ in how it administers its FCPA enforcement program and a Supreme Court decision with ramifications for FCPA enforcement.

DOJ Evaluation of Corporate Compliance Programs

On February 8, 2017, DOJ’s Fraud Section released a comprehensive set of topics and sample questions related to corporate compliance programs that companies may now expect DOJ to inquire about during investigations and related proceedings. This new guidance document, “Evaluation of Corporate Compliance Programs,” represents the first document formally issued by a DOJ component dedicated to corporate compliance matters. As reported in our 2015 Year-End FCPA Update, DOJ retained a compliance consultant to assist prosecutors in evaluating compliance programs and monitorships (the compliance consultant recently parted ways with DOJ, reportedly due to differences with the current presidential administration). Although a helpful reference document, the guidance largely reinforces the same core standards by which corporate compliance programs have traditionally been evaluated rather than plowing new ground.

The DOJ Evaluation document identifies 11 “sample” topics that it considers relevant when evaluating a corporate compliance program. Those topics relate to the full range of compliance pillars that will be familiar to our readership, including tone at the top, policies and procedures, training, compliance independence, incentives and disciplinary measures, risk management processes and analytics, and periodic testing and review. As DOJ explains, the 11 sample topics enumerated in the guidance build upon existing guidelines, such as the Resource Guide to the U.S. Foreign Corrupt Practices Act and the U.S. Sentencing Guidelines.

As a practical matter, the new guidance converts the conventional benchmarks of a strong compliance program into “common questions that [DOJ prosecutors] may ask” when evaluating the effectiveness of a company’s compliance program. To that end, the document lists questions?119 in total?related to each of the 11 topics. Several of the questions call for detailed and granular information, including the “turnover rate for compliance and relevant control function personnel” and whether “requests for resources by the compliance and relevant control functions have been denied.”

Unlike prior compliance guidelines, which prospectively offer benchmarks for corporate compliance programs, the new guidance—particularly the first sample topic, “Analysis and Remediation of Underlying Misconduct”—presupposes the existence of wrongdoing and evaluates the adequacy of the company’s program and response in light of that wrongdoing. This is because the guidance is offered to clarify how DOJ will assess a corporate compliance program under the Principles of Federal Prosecution of Business Organizations—commonly known as the “Filip Factors”—the standards guiding DOJ’s evaluation of whether to bring charges against a corporate entity. Consequently, companies should be prepared to address questions going to root causes.

Although the new guidance covers much of what is contained in the FCPA Resource Guide and other compliance literature, certain questions suggest additional emphasis or expectations compared to prior guidance. For example, some questions probe a company’s disciplinary measures for managers’ “failures of oversight,” the level of resourcing dedicated to the compliance function, the extent to which compliance expertise is available to board members, and a company’s compensation structure as it relates to incentivizing compliance and ethical behavior. Other questions may increase the importance of documenting risk assessments, particularly as they evolve over time. The new guidance asks, among other questions, “what methodology has the company used to identify, analyze, and address the particular risks it faced” and “what information or metrics has the company collected and used to help detect the type of misconduct in question?” These types of questions, particularly if asked years after the fact or in the context of evolving risks, are a reminder that companies should document their risk assessments.

The document also includes questions that probe the independence and integrity of an investigation. Although prior guidelines mention the need for independent investigations generally, the section entitled “Properly Scoped Investigation by Qualified Personnel” suggests that companies should be prepared to justify whether an investigation was “independent, objective, appropriately conducted, and properly documented.” Practically, whether handled internally or by outside counsel, companies will need to show that the investigation was appropriately thorough and not tilted to a given outcome.

This new guidance can be a resource to all companies, even those looking to enhance their compliance policies and procedures outside of an acute investigation. Whether in a proactive or reactive posture, these sample topics and questions are a helpful benchmark for companies to use in defending or fine-tuning their compliance programs. The new administration has not commented on these guidelines, so it is unclear whether it will build further on this foundation.

U.S. Supreme Court Limits Temporal Scope of SEC Disgorgement

As our readership well knows, disgorgement of purportedly illicit profits frequently is the key driver in determining the cost of an FCPA resolution with the SEC. Whether SEC claims for disgorgement are subject to the five-year statute of limitations in 28 U.S.C. § 2462 has been a long-standing question. For example, as reported in our 2016 Mid-Year FCPA Update, in May 2016, the Eleventh Circuit in SEC v. Graham held that such claims are subject to the statute of limitations, which directly contravened the position consistently taken by the SEC that disgorgement is an equitable remedy not subject to any defined temporal limitation.

On June 5, 2017, the Supreme Court provided the answer the SEC did not want to hear. In Kokesh v. SEC, the Court unanimously held that disgorgement in an SEC enforcement proceeding is a “penalty” within the meaning of 28 U.S.C. § 2462 and therefore is subject to the five-year statute of limitations. This decision, discussed fully in our separate client alert United States Supreme Court Limits SEC Power to Seek Disgorgement Based on Stale Conduct, is significant because it limits the SEC’s ability to seek disgorgement based on conduct that occurred more than five years earlier, and also rejects the SEC’s long-held position that claims for equitable relief are not subject to any limitations period. The Court’s position is similar to that advocated by Gibson Dunn on behalf of amicus curiae Cato Institute.

2017 MID-YEAR CHECK-IN ON FCPA ENFORCEMENT LITIGATION

Conviction in FCPA-Related Money Laundering Trial

Our 2016 Year-End FCPA Update reported on the December 13, 2016 arrest by U.S. authorities of Mahmoud Thiam, the former Guinean Minister of Mines and Geology and a U.S. citizen who for years worked as a Wall Street banker, on money laundering charges associated with the alleged receipt of bribes to secure valuable investment rights in Guinea. The case proceeded quickly to trial and on May 4, 2017, Thiam was found guilty of one count of transacting in criminally derived property and one count of money laundering.

Thiam’s sentencing is scheduled for August 25, 2017. The prosecution was tried in part by Gibson Dunn alum and current DOJ FCPA Unit prosecutor Lorinda Laryea.

Lengthy U.N. Bribery Trial of Macau Billionaire Underway

As discussed above and covered in our 2016 Year-End FCPA Update, DOJ has indicted numerous businesspersons and U.N. officials on allegations that the former paid more than $1 million in bribes to induce the latter to advance their interests before the United Nations, including a plan to build a U.N.-sponsored conference center in Macau. After three days of jury selection (complicated by the fact that the trial is expected to last four to six weeks), trial began on June 29, 2017 in the U.S. District Court for the Southern District of New York for the last-remaining defendant, Macau billionaire Ng Lap Seng.

Based on the opening statements, it appears that the defense theory is that Ng’s efforts to support the U.N. conference center in Macau were acts of philanthropy and that the prosecution is a politically-influenced effort by the United States to limit Chinese influence over developing nations. DOJ has countered that narrative with, among other things, testimony from former U.N. diplomat and bribe recipient Francis Lorenzo, who answered the question “Why did you do what Ng asked you to do?,” with “Because I was getting paid.” Early motions in limine briefing has focused on defense access to classified information, the extent to which a U.N. report critical of the organization’s anti-corruption efforts may be shared with the jury, and whether the payments at issue were lawful under the laws of Antigua and the Dominican Republic (where the U.N. officials were posted), thus potentially availing Seng of the “lawful under foreign law” affirmative defense set forth in the FCPA.

Odebrecht / Braskem Criminal Fine Reduced Based on Ability to Pay

We reported in our 2016 Year-End FCPA Update on the December 2016 multi-jurisdictional resolution of Brazilian construction conglomerate Odebrecht S.A. and its petrochemical production subsidiary Braskem S.A. with authorities in Brazil, Switzerland, and the United States. At the time, the $419.8 million DOJ/SEC component of the multi-billion dollar resolution stood as fifth on the all-time Corporate FCPA Top 10 List. We noted that the criminal fine amounts facing Odebrecht remained an open matter, however, because DOJ and Brazilian authorities planned to review during the first quarter of 2017 Odebrecht’s representation that it could pay no more than $2.6 billion in total.

In its sentencing memorandum filed before the U.S. District Court for the Eastern District of New York, DOJ explained that it and Brazilian authorities had analyzed Odebrecht’s ability to pay and determined that the company could pay only $93 million in DOJ criminal penalties—rather than the approximately $260 million figure originally announced. After this reduction, when combined with the $94.89 million and $65 million that Braskem agreed to pay to DOJ and the SEC, the (still sizable) $252.89 million DOJ/SEC component of the resolution now falls outside of the all-time Corporate FCPA Top 10 List.

Hunt Pan Am Aviation Inc. Defendants

As reported in our 2016 Year-End FCPA Update, on December 27, 2016, DOJ announced guilty pleas by six individuals—four businesspersons and two government officials—in connection with a bribery scheme involving the payment of more than $2 million by representatives of Hunt Pan Am Aviation Inc., a Houston-based aviation services company, to secure aircraft maintenance, repair, and overhaul contracts with Mexican government-owned customers. All six defendants were sentenced during the first six months of 2017 as follows:

- Ernesto Hernandez Montemayor – 24 months in prison;

- Douglas Ray – 18 months in prison, plus $590,000 in restitution;

- Ramiro Asencio Nevarez – 15 months in prison;

- Victor Hugo Valdez Pinon – 12 months and one day in prison;

- Kamta Ramnarine – 3 years’ probation; and

- Daniel Perez – 3 years’ probation.

Magyar Telekom Defendants

As reported in our 2011 Year-End FCPA Update, in December 2011 the SEC brought civil FCPA charges against three former executives of Magyar Telekom, Plc. The unsettled enforcement action has for the past five-plus years made slow but steady progress towards what would have been the first FCPA trial ever involving the SEC. But it was not to be as, one by one, each of the three defendants reached an out-of-court settlement as follows:

- Elek Straub– $250,000 civil penalty, plus five-year officer and director bar;

- Andras Balogh – $150,000 civil penalty, plus five-year officer and director bar; and

- Tamas Morvai – $60,000 civil penalty.

Amadeus Richers Extradited from Panama

We have been reporting for years on the long-running FCPA and money laundering prosecutions stemming from the alleged corruption of officials from state-owned Telecommunications d’Haiti (“Haiti Teleco”), though the case has been quiet for some time. That changed in February 2017, when Amadeus Richers, the former director of two Florida telecommunications companies, was extradited from Panama to face the FCPA, wire fraud, and money laundering charges we first reported on in our 2011 Year-End FCPA Update.

A change of plea hearing has been scheduled in the U.S. District Court for the Southern District of Florida for July 19, 2017, at which Richers is expected to enter a guilty plea to some or all charges. Two other Haiti Teleco defendants, Washington Vasconez Cruz and Cecelia Zurita, remain outside the jurisdiction of the Court.

Dmitry Firtash Extradition Litigation

In another long-running FCPA case with an extradition angle, early 2017 saw developments in the 2013 indictment of Ukrainian billionaire Dmitry Firtash on charges that he authorized $18.5 million in bribes to government officials in India to procure mining rights. As noted in our 2015 Mid-Year FCPA Update, the Austrian trial court before which Firtash was presented after being arrested at DOJ’s request rejected the aggressive assertion of jurisdiction over conduct undertaken almost exclusively by foreign nationals outside U.S. borders and denied the U.S. extradition request.

In February 2017, an Austrian appeals court reversed the trial court’s decision, thereby authorizing Firtash’s extradition to the United States. In another setback for Firtash, he was almost immediately re-arrested by Austrian police—this time based on a warrant issued by authorities in Spain, where he reportedly faces additional money laundering charges. The Austrian Ministry of Justice will determine whether and where to extradite Firtash. In a statement, his lawyers suggested that they will escalate the matter to Austria’s Supreme Court and to the European Court of Human Rights. Meanwhile, on May 9, 2017, Firtash moved in the U.S. District Court for the Northern District of Illinois to dismiss the U.S. indictment, arguing inappropriate venue, that the laws he is charged with violating have no extraterritorial effect, and that “the prosecution is a violation of [his] due process rights because the United States has no legitimate interest in prosecuting the charged conduct.” DOJ is scheduled to respond by July 17, 2017.

John Doe Litigation over “LNG Consultant” Reference in Charging Document

Taking the prize for new development in an old FCPA case during the first half of 2017 was a decision by the U.S. Court of Appeals for the Fifth Circuit tied to the September 2008 FCPA guilty plea by former Kellogg, Brown & Root, Inc. Chairman and CEO Albert Stanley. The charges against Stanley mentioned an unidentified “LNG Consultant” as allegedly involved in the corruption scheme.

In August 2015, the LNG Consultant filed a “John Doe” complaint in the U.S. District Court for the Southern District of Texas alleging that DOJ violated his due process rights by accusing him in connection with Stanley’s guilty plea and sentencing. Doe requested a declaration that his rights had been violated and an expungement of the prosecutorial statements that allegedly identified and accused him of criminal conduct. The District Court granted DOJ’s motion to dismiss on grounds that Doe’s claim was time barred.

On April 11, 2017, the Fifth Circuit (Owen, J.) affirmed the dismissal, finding that the six-year statute of limitations for an expungement claim begins to run when the government purportedly accuses an individual of criminal activity even without indicting him. Because the indictment was filed in 2008 and the lawsuit not filed until 2015, the claim was untimely.

2017 MID-YEAR KLEPTOCRACY FORFEITURE ACTIONS

DOJ’s Kleptocracy Asset Recovery Initiative uses civil forfeiture actions to freeze, recover, and, in some cases, repatriate the proceeds of foreign corruption. In remarks delivered at the American Bar Association National Institute on White Collar Crime in March 2017, Acting Assistant Attorney General Kenneth Blanco stated that DOJ’s “white collar criminal enforcement efforts[, including its] Kleptocracy efforts[,] are only becoming more pronounced with each passing year.” In his remarks, he specifically noted DOJ’s efforts with respect to 1Malaysia Development Berhad (“1MDB”)—the Malaysian sovereign wealth fund focused on promoting economic development in the country—which saw additional activity in the first half of the year.

As reported in our 2016 Year-End FCPA Update, in July 2016, DOJ filed civil forfeiture complaints seeking the forfeiture of more than $1 billion in assets associated with 1MDB. According to the complaints, from 2009 through 2015, government officials and their associates misappropriated billions from 1MDB. On December 21, 2016, certain family members referenced in the forfeiture complaints filed motions to dismiss the actions, advancing arguments that the Court lacks jurisdiction, venue is improper, and DOJ has failed to adequately plead a predicate offense. On February 22, 2017, the Honorable Dale S. Fischer of the U.S. District Court for the Central District of California denied the motions while also approving a cooperation agreement between the government and investors that will enable the development of a midtown Manhattan hotel partially financed by money allegedly misappropriated from 1MDB.

In June 2017, DOJ sought the forfeiture of another $540 million in assets, including property, jewelry, artwork, and the rights to the 2014 film Dumb and Dumber To. Already the largest single action brought by the Kleptocracy Initiative when filed in 2016, DOJ now has moved against some $1.7 billion in assets allegedly tied to 1MDB.

2017 MID-YEAR FCPA SPEAKERS’ CORNER

U.S. anti-corruption enforcement personnel continued to be active on the speaking circuit during the first half of 2017. The common theme trumpeted through the vast majority of these speeches was that the Trump Administration remains committed to enforcing the FCPA.

- Attorney General Jeff Sessions: In a speech at the Ethics and Compliance Initiative’s Annual Conference in Washington, D.C., on April 24, 2017, Sessions described FCPA enforcement as a “critical” part of DOJ’s focus. He said that DOJ “will continue to strongly enforce the FCPA and other anti-corruption laws. Companies should succeed because they provide superior products and services, not because they have paid off the right people.”

- SEC FCPA Unit Acting Chief Charles Cain: In a February 24, 2017 speech at the 46th annual SEC Speaks conference in Washington, D.C., the experienced and talented Cain discussed anticipated FCPA enforcement trends for 2017. He predicted that the SEC would bring “more significant cases,” particularly in the financial services sector, and use cooperation tools, such as non-prosecution and deferred prosecution agreements.

- SEC Commissioner Michael Piwowar: Speaking at the same SEC Speaks conference, then-Acting SEC Chairman Piwowar focused on the “forgotten investor” and discussed why the assessment of penalties against corporations for securities violations is not always appropriate, because investors often are harmed by such penalties. Nevertheless, Piwowar acknowledged that, in certain circumstances, including FCPA violations, corporate penalties are warranted. He said, “I am generally comfortable with assessing civil monetary penalties in Foreign Corrupt Practices Act cases. According to academic literature, there is evidence that when such violations are revealed to the market, the stock price does not always fall, and may even increase.”

- DOJ Criminal Division Deputy Assistant Attorney General Trevor McFadden: McFadden, a Gibson Dunn alum and recent nominee for the federal district court bench in Washington, D.C., was by far the most prolific U.S. government speaker on the anti-corruption circuit in early 2017. At several different events, McFadden emphasized DOJ’s commitment to “vigorously” enforce the FCPA to “creat[e] an even playing field for honest businesses.” In an April 18, 2017 speech at the Anti-Corruption Export Controls & Sanctions 10th Compliance Summit, McFadden noted the increasing trend of international cooperation and global resolutions, including apportionment of penalties between jurisdictions, for transnational misconduct. McFadden reiterated these priorities and trends days later in an April 20 speech at the American Conference Institute’s (“ACI”) 19th Annual Conference on the FCPA, during which he said FCPA enforcement is “as alive as ever” and described international cooperation as a “hallmark” of DOJ’s work. Later, in a May 24 speech at ACI’s 7th Brazil Summit on Anti-Corruption in São Paulo, Brazil, McFadden emphasized DOJ’s increasing cooperation with international counterparts—including those in Brazil, which he described as “one of [DOJ]’s closest allies in the fight against corruption”—and noted that DOJ will be detailing an anti-corruption prosecutor to the UK’s Financial Conduct Authority.

- DOJ Criminal Division Acting Assistant Attorney General Kenneth Blanco: Speaking at the ABA’s National Institute on White Collar Crime on March 10, 2017, Blanco also discussed DOJ’s continued commitment to FCPA enforcement. In addition to his remarks concerning the FCPA Pilot Program discussed above, he described how more and more countries are rigorously enforcing anti-corruption laws, leading to a proliferation of cross-border cooperation in investigations and enforcement.

2017 MID-YEAR FCPA-RELATED PRIVATE CIVIL LITIGATION

Although it is clear that the FCPA currently provides no private right of action (as described below, a bill has been reintroduced in the House of Representatives to change this), a variety of other causes of action have been used—with varying degrees of success—to seek private redress in U.S. courts for losses allegedly associated with public corruption abroad. A selection of matters with developments in the first half of 2017 follows.

Shareholder Lawsuits

Shareholder litigation frequently follows a company’s announcement of an FCPA event, such as a settlement with governmental authorities or even just the disclosure of an investigation. The most frequent vehicles are as a class action brought on behalf of shareholders whose stock value has dropped allegedly as a result of the misconduct or as a shareholder derivative suit brought against the company’s directors for allegedly violating their fiduciary duties to ensure corporate compliance. Examples with developments during the first half of 2017 include:

- General Cable Corporation – On January 5, 2017, a shareholder filed a putative class action lawsuit against General Cable and certain of its executives, alleging, among other things, that the company failed to disclose that it paid millions of dollars in bribes to foreign officials and that each of General Cable’s eventual disclosures caused stock prices to fall. This suit followed General Cable’s December 2016 resolution with DOJ and the SEC outlined in our 2016 Year-End FCPA Update. The case, originally filed in the U.S. District Court for the Southern District of New York, was then promptly transferred by consent to the U.S. District Court for the Eastern District of Kentucky, where General Cable is headquartered. Various law firms are currently jostling to take control as lead class counsel.

- PTC Inc. – In March 2016, PTC investors filed a putative class action lawsuit in the U.S. District Court for the District of Massachusetts alleging, among other things, that PTC failed to disclose the full results of its investigation into whether its Chinese subsidiary violated the FCPA, which ultimately led to PTC’s FCPA settlements with DOJ and the SEC as discussed in our 2016 Mid-Year FCPA Update. On March 23, 2017, Judge William G. Young of the District of Massachusetts issued a preliminary approval order for a proposed class action settlement to resolve all claims for $2.1 million. The final approval hearing is set for July 13, 2017.

- Centrais Electricas Brasileiras SA (“Electrobras”) – On March 27, 2017, the Honorable John G. Koeltl of the U.S. District Court for the Southern District of New York declined to dismiss the majority of a putative shareholder class action against Brazilian government-controlled electric utility Electrobras, in which plaintiffs allege that Electrobras participated in a bribery and bid-rigging scheme and misled investors by making false statements about the company’s ethics and financial well-being. Judge Koeltl held that plaintiffs had adequately pleaded the allegations, as well as allegations that Electrobras acted with intent. The Court dismissed claims against Electrobras’s former CEO, holding that plaintiffs failed to adequately allege that he knew of false information in a code of ethics he signed. Plaintiffs are currently moving for class certification.

- Sociedad Química y Minera de Chile (“SQM”) – As noted above, SQM in January 2017 settled dual FCPA enforcement actions with DOJ and the SEC. Two months later, on March 28, the Honorable Edgardo Ramos of the U.S. District Court for the Southern District of New York denied SQM’s motion to dismiss a putative class action based on allegedly false statements concerning the company’s compliance with law and the effectiveness of its internal controls. The Court also denied SQM’s motion to dismiss for forum non conveniens. SQM has since answered the complaint and the parties are headed into discovery.

- Petróleo Brasileiro S.A. – Petrobras – Our 2016 Year-End FCPA Update noted that Petrobras’s shareholder litigation in the U.S. District Court for the Southern District of New York had been stayed pending the resolution of an interlocutory appeal challenging class certification. On July 7, 2017, the Second Circuit vacated Judge Rakoff’s ruling that the plaintiffs satisfied the predominance requirement under Rule 23(b)(3), holding that the district court failed to verify the domesticity of the transactions as required by Morrison v. National Australia Bank Ltd., 561 U.S. 247 (2010). The Second Circuit affirmed Judge Rakoff’s ruling that the class was entitled to a presumption of reliance under Basic Inc. v. Levinson, 485 U.S. 224 (1988).

Employee Dodd-Frank Whistleblower Lawsuits

In our 2016 Year-End FCPA Update, we discussed the potential overlap of Dodd-Frank whistleblower litigation and the FCPA that can arise when former employees claim they were fired or otherwise discriminated against in their employment based on protected reports of FCPA violations. One example we noted was the case brought by former Bio-Rad Laboratories, Inc. general counsel Sanford S. Wadler. On February 7, 2017, after a three-week trial that made public much of the company’s internal investigation leading to the FCPA settlement covered in our 2014 Year-End FCPA Update, a jury empaneled in the U.S. District Court for the Northern District of California found that Bio-Rad and its CEO violated federal and state whistleblower protections when it terminated Wadler for allegedly reporting FCPA concerns to management and the Board. The jury awarded Wadler $2.96 million in lost wages, to be doubled under Dodd-Frank, in addition to $5 million in punitive damages for Wadler’s state law wrongful termination claim. Additionally, the parties agreed to more than $3.5 million in attorneys’ fees to be awarded to Wadler. The Honorable Joseph C. Spero denied defendants’ motion to vacate the jury’s verdict on May 10, 2017, and Bio-Rad has appealed to the Ninth Circuit Court of Appeals.

Employee Defamation Action

In April 2017, the U.S. District Court for the Northern District of Indiana ruled on Zimmer Biomet‘s motion to dismiss a defamation lawsuit filed by Alejandro Yeatts, a former employee of Biomet’s Argentinian subsidiary who appears to have been caught up in the company’s reinvestigation of Brazilian misconduct leading to the DOJ and SEC FCPA settlements described above. Yeatts alleged that the parent company’s chief compliance officer and general counsel sent an e-mail accusing Yeatts of engaging in criminal activity and thereby including him on a “Restricted Parties List” of persons with whom Zimmer Biomet could not conduct business. The Honorable Michael G. Gotsch dismissed related intentional and negligent infliction of emotional distress claims, but denied the company’s motion to dismiss the defamation claims. Notably, the Court opted not to convert the motion to dismiss to a motion for summary judgment (as requested by Zimmer Biomet) and therefore declined to address Yeatts’s alleged release of all claims against the company in connection with a settlement agreement he executed upon his separation.

Civil Fraud / RICO Actions

On February 14, 2017, the Government of Bermuda initiated a Racketeer Influenced and Corrupt Organizations Act (“RICO”) action in the U.S. District Court for the District of Massachusetts against Lahey Clinic, Inc. and Lahey Clinic Hospital, Inc. Bermuda alleges that, for nearly two decades, the defendants conspired with Dr. Ewart Brown—the former Premier of Bermuda, a member of Bermuda’s Parliament, and owner of two private health clinics in Bermuda—in a scheme to bribe Brown in exchange for preferential treatment in government healthcare contract bids, access to patients, and millions of dollars in medically unnecessary tests. The defendants moved to dismiss the RICO suit in April 2017, arguing, among other things, that Bermuda failed to allege with particularity any official acts Brown took to benefit the defendants. In May, 11 Bermudian legislators filed an amicus curiae brief, arguing that the statute of limitations on Bermuda’s claims has expired and that the lawsuit is politically motivated in light of Bermuda’s upcoming general election in 2018. The motions are currently pending before the Court.

The shareholder litigation noted above is not the only lawsuit filed against Petróleo Brasileiro S.A. – Petrobras stemming from its alleged involvement in the Operation Car Wash scandal. In another such action, eight investment funds and their investment advisor filed a civil fraud suit in the U.S. District Court for the District of Columbia alleging that they financed an entity embroiled in the corruption scheme to the tune of hundreds of millions of dollars, then lost their investment when the scandal broke and the entity went bankrupt. On March 30, 2017, the Honorable Amit P. Mehta largely denied Petrobras’s motion to dismiss, finding in significant part that the plaintiffs had standing, the District of Columbia was not an overly inconvenient forum for litigating the dispute, Petrobras was not immune from civil lawsuit under the Foreign Sovereign Immunities Act, and plaintiffs adequately pleaded fraud and conspiracy claims against Petrobras. The district court litigation is presently stayed pending Petrobras’s interlocutory appeal to the U.S. Court of Appeals for the District of Columbia Circuit.

FOIA Litigation

We have been covering for several years the Freedom of Information Act (“FOIA”) lawsuit filed by media organization 100Reporters LLC against DOJ in the U.S. District Court for the District of Columbia. 100Reporters is seeking records relating to DOJ’s 2008 FCPA resolution with Siemens AG and the monitorship reports prepared by Dr. Theo Waigel and his U.S. counsel, F. Joseph Warin of Gibson Dunn.

On March 31, 2017, the Honorable Rudolph Contreras issued a comprehensive 73-page opinion that partly grants and partly denies defendants’ motions for summary judgment and denies in its entirety 100Reporters’ cross-motion for summary judgment. Notably, the Court accepted Gibson Dunn’s position on behalf of Dr. Waigel that the “consultant corollary” to the deliberative process privilege may extend to communications between a government agency and an independent monitor and thereby shield information from disclosure under FOIA Exemption 5. This is the first time a court has applied the consultant corollary to a compliance monitor. The Court denied summary judgment on these grounds because DOJ did not specifically identify the deliberative process at issue with respect to each type of documents withheld by DOJ, but will allow DOJ, Siemens, and Dr. Waigel to submit further affidavits to support this argument. The Court has also ordered DOJ to submit a copy of one monitorship work plan and one monitorship report for in camera review to assess whether any of the withheld materials can be segregated from non-exempt material.

As discussed in our 2016 Year-End FCPA Update, on December 9, 2016, Just Anti-Corruption journalist Dylan Tokar filed a FOIA lawsuit in the U.S. District Court for the District of Columbia challenging DOJ’s failure to respond to his request seeking the names of monitor candidates for 15 companies that resolved FCPA allegations with a monitorship requirement, as well as information about the DOJ committee responsible for evaluating and ultimately selecting monitors. On January 27, 2017, DOJ provided Tokar with the names of the firms associated with the candidates, as well as the names of members of the DOJ committee, but DOJ continues to withhold the names of the monitorship candidates on privacy grounds. DOJ’s motion for summary judgment is currently due on July 19, 2017.

2017 MID-YEAR LEGISLATIVE DEVELOPMENTS

After a relative break in recent years in legislative developments pertinent to the FCPA, the first half of 2017 saw three such developments relevant to FCPA enforcement.

- Foreign Business Bribery Prohibition Act of 2017 (H.R. 1549): U.S. Representative Ed Perlmutter (D-Colo.) reintroduced a bill substantially the same as the one he proposed in 2016 (and before that, in 2011, 2009, and 2008), which would “authorize certain private rights of action under the [FCPA] for violations that damage certain businesses.” As discussed in our 2009 Mid-Year FCPA Update, this legislation would create a private right of action enabling individuals and entities subject to the FCPA to sue foreign concerns not subject to the statute for actions that would be FCPA violations if the jurisdictional element of the statute were satisfied. Successful plaintiffs would be awarded treble damages (and attorneys’ fees and costs) for the value of any contract that they lost because of the defendants’ corrupt practices or for the value of any contract that the defendants thereby gained. Because the bill implicates issues under the jurisdiction of the House Judiciary, Financial Services, and Energy and Commerce Committees, portions of it were assigned to each committee in March 2017. There has been no action on the bill since it was referred to the House Subcommittee on the Constitution and Civil Justice in March 2017.

- Dodd-Frank Section 1504 & SEC Rule 13q-1 (Extractive Resource Payments): Section 1504 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) requires drilling and mining companies to disclose, on a project-by-project basis, any non-de minimis payments made to the U.S. federal government or any foreign governmental entity for the purpose of commercial resource development. Although Dodd-Frank became law in 2010, the SEC implemented Section 1504’s disclosure provisions in July 2016 by adopting Rule 13q-1, which would have required most companies to begin disclosing payments of greater than $100,000 in 2019 (an earlier version of the rule was struck down by the U.S. District Court for the District of Columbia upon challenge by Gibson Dunn on behalf of the U.S. Chamber of Commerce and other industry groups). Because Rule 13q-1 was adopted late in President Obama’s second term, it was subject to the Congressional Review Act, which allows Congress to strike down end-of-term regulations with a simple majority vote. In February 2017, the Republican-controlled Congress did just that in a joint resolution that President Trump signed on February 14, 2017. The Administration concluded that Rule 13q-1 “would impose unreasonable compliance costs on American energy companies” and potentially create for American businesses “a competitive disadvantage in cases where their foreign competitors are not subject to similar rules.” Given these comments, and that the Congressional Review Act prohibits reissuance of Rule 13q-1 (or a similar rule) without specific authorization by a subsequently enacted law, the SEC is unlikely to promulgate new implementing regulations for Section 1504 in the near term.

- Financial CHOICE Act of 2017 (H.R. 10): Legislation currently working its way through Congress would repeal many provisions of Dodd-Frank, including Section 1504. On June 8, 2017, the House of Representatives voted 233-186 along party lines to pass H.R. 10, Representative Jeb Hensarling’s (R-Tex.) Financial CHOICE Act of 2017 (CHOICE Act 2.0). As detailed in a recent Gibson Dunn Client Alert, the bill would dramatically scale back Dodd-Frank and overhaul the administrative state by, among other things, placing major constraints on the Consumer Financial Protection Bureau and reining in the SEC’s enforcement authority. The bill would completely repeal Dodd-Frank Section 1504, while also significantly increasing statutory criminal fines for FCPA anti-bribery violations—$4 million for issuers (up from $2 million) and $250,000 for individuals (up from $100,000)—though, as a practical matter, criminal fines are in most criminal cases governed by the Alternative Fines Act, which allows for financial penalties of up to twice the gain or loss of the activity.

2017 MID-YEAR INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

New World Bank Integrity Vice President

In April 2017, the World Bank announced that Chief Suspension and Debarment Officer Pascale Hélène Dubois would succeed Leonard McCarthy as World Bank Group Integrity Vice President, effective July 1, 2017. Ms. Dubois is extremely knowledgeable and has a wealth of experience. The Bank’s Integrity Vice Presidency (“INT”) investigates and seeks sanctions with respect to misconduct in Bank-funded activities. This will be somewhat of a change for Dubois, who in her prior role served as an independent check on INT by reviewing its allegations for sufficiency.

In her new role, Dubois will lead a unit that, as we have been reporting for several years now, is playing an increasingly robust global enforcement role. Under McCarthy’s leadership, between Fiscal Year 2008 and Fiscal Year 2016, more than 400 entities and individuals were sanctioned and a number of new functions were added within INT, including an Integrity Compliance Office, which monitors sanctioned companies’ satisfaction of conditions for release from debarment.

Australia

In the first half of 2017, the Australian government introduced proposals to amend the country’s foreign bribery law and implement a deferred prosecution agreement scheme similar to those in place in the United States and United Kingdom. On the enforcement front, the Victorian Supreme Court upheld civil charges arising from the U.N. Oil-for-Food Program (“OFFP”).

Australia’s Criminal Code prohibits foreign bribery and implements the country’s obligations as a party to the OECD Anti-Bribery Convention. On April 4, 2017, the Australian Minister for Justice released a public consultation paper, proposing amendments to both refine the existing law and introduce two new offenses for: (1) recklessly bribing a foreign official; and (2) failing to prevent bribery. For the latter, like the UK Bribery Act, a company that failed to implement adequate procedural safeguards could be strictly liable for bribes by employees, contractors, and agents. The deadline for commentary on the amendments closed on May 1—notably including criticism from the Law Council of Australia (the top national representative body of the Australian legal profession), that the recklessness offense would be out of step with UK and U.S. law—and the government is now giving further consideration to the proposed amendments in light of the feedback received.

On March 31, 2017, the Australian government issued a separate consultation paper, inviting comment on a proposed corporate deferred prosecution scheme. Under the proposed approach, prosecutors could agree to defer charges if a company complies with conditions aimed at rectifying the harm and preventing further wrongdoing. Key features of the proposed scheme include: (1) it would apply only to a list of economic crimes, including foreign bribery; (2) prosecutors would have discretion with respect to offering these agreements, but the government would publish factors to guide those decisions; (3) deferred prosecution agreements may include financial penalties and costs of administration; and (4) independent monitors may be appointed to assure compliance with an agreement. The commentary period closed on May 1, with a strong measure of support. For more on this development, we direct our readers to our forthcoming 2017 Mid-Year Update on Corporate NPAs and DPAs, which will be released on July 11, 2017.

In April 2017, the Victorian Supreme Court upheld a civil charge brought by the Australian Securities and Investment Commission (“ASIC”) alleging that former Chairman and Director of the Australian Wheat Board (“AWB”) Trevor Flugge failed to exercise due care and diligence in connection with AWB sales in Iraq under the OFFP. As our longtime readers will recall, a U.N. commission headed by Paul Volcker identified massive amounts of illicit surcharges imposed by the Iraqi government in connection with OFFP contracts in violation of U.N. sanctions. After the AWB was singled out in these reports, Australia established a Royal Commission to investigate, resulting in civil charges by ASIC against Flugge and another former senior AWB official, Peter Geary. The Victorian Supreme Court ultimately dismissed charges against both defendants alleging they knew that the fees in question violated U.N. sanctions, but with respect to Flugge only found that he breached his duty to exercise reasonable care by failing to inquire into the AWB’s transportation fee payments after being informed in 2000 that the U.N. was examining whether the AWB was making improper payments. The Court imposed a fine of AUD 50,000 and barred Flugge from managing a corporation for five years.

Europe

United Kingdom

The first half of 2017 saw a new high-water mark for foreign bribery enforcement in the United Kingdom, with the largest fine and disgorgement of profits ever imposed for violations of the UK’s anti-corruption laws. For much more on anti-corruption enforcement in the UK, we direct our readers to our forthcoming 2017 Mid-Year UK White Collar Crime Alert, which will be released on July 17, 2017.

Rolls-Royce plc

As noted above, on January 17, 2017, Rolls-Royce received a deferred prosecution agreement in the largest UK criminal corporate enforcement action ever. According to the public allegations, which involved counts under both the Prevention of Corruption Act 1906 and Bribery Act 2010, as well as false accounting charges, the company for three decades offered, paid, or failed to prevent bribes involving the sale of engines, energy systems, and related services in seven foreign jurisdictions—China, India, Indonesia, Malaysia, Nigeria, Russia, and Thailand. The UK Serious Fraud Office (“SFO”) opened an inquiry after a whistleblower’s blog made allegations against the company’s civil aviation business in China and Indonesia, at which point a significant internal investigation was launched and the company began cooperating with the SFO. Four years later, the company agreed to pay £258 million in disgorgement, a £239 million financial penalty, and the SFO’s investigative costs of approximately £13 million. While Rolls-Royce received a 50% discount on its penalty because of its significant cooperation, which included a limited waiver of privilege for certain materials, combined with its settlements with DOJ and Brazil’s Ministério Público Federal, Rolls-Royce will pay approximately £671 million in all.

The Rolls-Royce deferred prosecution agreement is the fourth awarded in the UK. For an in-depth analysis of the Rolls-Royce deferred prosecution agreement, we direct our readers to our forthcoming 2017 Mid-Year Update on Corporate NPAs and DPAs, which will be released on July 11, 2017.

Former EBRD Banker Who Received FCPA Bribes

On June 8, 2017, following a five-week trial, former European Bank for Reconstruction and Development (“EBRD”) banker Andrey Ryjenko was convicted on Prevention of Corruption Act 1906 charges. He was subsequently sentenced to six years for receiving more than $3.5 million in bribes to approve loans to finance gas and oil projects in former Soviet states. The payer of those bribes, Dmitrij Harder, was convicted on FCPA charges in April 2016, as covered in our 2016 Mid-Year FCPA Update. Harder testified against Ryjenko in the UK trial and is scheduled to be sentenced in U.S. court on July 18, 2017.

F.H. Bertling Limited

Between April and May 2017, the SFO announced charges against logistics and freight operations company F.H. Bertling Limited and seven individuals (Georgina Ayres, Colin Bagwell, Stephen Emler, Christopher Lane, Robert McNally, Giuseppe Morreale, and Peter Smith) pertaining to an alleged conspiracy to “give or accept corrupt payments for assisting F.H. Bertling Ltd in being awarded or retaining contracts for the supply of freight forwarding services relating to a North Sea oil exploration project.” The offenses are alleged to have taken place between January 2010 and May 2013. These charges are in addition to those announced in July 2016 pertaining to F.H. Bertling and individuals relating to an alleged conspiracy to bribe an agent of Angolan state-oil-company Sonangol, discussed in our 2016 Year-End FCPA Update.

Norwegian Official Convicted for Receipt of Bribes

As reported in our 2015 Mid-Year FCPA Update, in January 2015, the SFO brought its first foreign-bribery case under the Bribery Act 2010 relating to a bribe allegedly paid to a Norwegian official to procure the sale of decommissioned naval vessels. It is alleged that the official, Bjorn Stavrum, was paid to help hide from Norwegian authorities the real destination of the vessels, which were being sold to a former Nigerian warlord. The joint investigation with Norwegian authorities led to the arrest of Stavrum and three British nationals. In May 2017, Stavrum was convicted by a Norwegian court, and sentenced to nearly five years in prison.

France

Our recent check-ins concerning anti-corruption developments in France have centered around the passage into law of the Loi Sapin II anti-corruption legislation. During the first half of 2017, there were enforcement developments (relating to other statutory regimes) to report on.

In June 2017, Teodoro Nguema Obiang Mangue, the son of the President of Equatorial Guinea, went on trial in France for allegedly embezzling more than $112 million from his country’s treasury. Obiang is the Second Vice President of Equatorial Guinea, and has claimed immunity from prosecution based on his current position. Obiang earned less than $100,000 a year while serving as minister of agriculture and forestry in his father’s government, but during this same period allegedly spent $225 million abroad. The trial is ongoing and expected to conclude in early July. As reported in our 2014 Year-End FCPA Update, Obiang settled a 2011 Kleptocracy forfeiture action against Obiang’s property worth approximately $70 million. French authorities have seized his $28 million Paris mansion, luxury cars, and his art collection in connection with the current proceedings.

Also in June 2017, it was reported that the Paris Court of Appeals held that the French corruption prosecution of British-Israeli lawyer Jeffrey Tesler is precluded by a 2011 plea agreement entered in U.S. court. As covered in our 2011 Mid-Year FCPA Update, Tesler was extradited to the United States where he pleaded guilty to FCPA bribery and conspiracy charges and served nearly a year in U.S. prison. As is typical in U.S. plea agreements, Tesler waived his right to challenge the agreed-upon facts in any future proceeding. French prosecutors also charged Tesler in 2012 in connection with the same course of conduct, but in late 2016 the Court of Appeals deemed that this prosecution was precluded because his inability to contest the statement of facts from the FCPA plea agreement deprived him of his right against self-incrimination in the French proceedings.

Germany

On June 2, 2017, the German Parliament (Bundestag) passed a law to establish a federal register of companies convicted of certain offenses, including bribery, money laundering, tax evasion, and breaches of competition law. The legislation requires public authorities to consult the register before tendering contracts in excess of €30,000 and enables them to exclude blacklisted companies. In light of the lack of corporate criminal liability under German law, a company will be registered based upon a criminal act by a corporate executive acting on behalf of the company. Records will generally be stored for up to five years, although the Federal Antitrust Authority (Bundeskartellamt), which will administer the database, may delete an entry early if the company has established its remediation in view of the misconduct. The draft bill, which has received some criticism based on the possibility of inaccurate entries, still needs to pass the German upper house (Bundesrat).

Other 2017 developments that may impact anti-corruption issues in Germany include a new tool launched by the European Commission in March to make it easier for individuals to alert the Commission about cartels and other competition violations and the entry into force in April of Germany’s “law to strengthen companies’ non-financial disclosure in their management reports and group management reports” (Gesetz zur Stärkung der nichtfinanziellen Berichterstattung der Unternehmen in ihren Lage- und Konzernlageberichten), which law adopts EU Directive 2014/95/EU. With respect to the latter Corporate Social Responsibility Directive, reporting of a covered company’s anti-corruption activities may consist of a description of the processes and controls implemented by the company to prevent as well as detect corrupt behavior.

Romania

On January 31, 2017, Romania’s government, under Prime Minister Sorin Grindeanu, passed “Emergency Ordinance 13,” which repealed the previous law’s criminalization of official misconduct involving financial damage of less than £38,000. Tens of thousands of anti-corruption protestors flooded the streets of Bucharest (and thousands in other Romanian cities), leading Grindeanu to withdraw the ordinance less than a week later. Perhaps bolstered by the public outcry, the National Anti-Corruption Directorate continues to aggressively investigate local politicians and international companies alike.

Russia

On March 26, 2017, thousands of anti-corruption protesters took to the streets of Moscow, St. Petersburg, and more than 80 other Russian cities led by Alexei Navalny, the most prominent opposition figure in Russia. Despite efforts by Navalny and his supporters to register these planned marches and to obtain permission from the municipal governments, most cities denied these requests and, as a result, many of the marches were unsanctioned and led to arrests of hundreds of participants. Navalny himself was jailed 15 days for resisting arrest.