January 6, 2011

False Claims Act litigation and enforcement exploded in 2010 with unprecedented intensity. Indeed, the government secured more than $3 billion in civil settlements and judgments for its fiscal year ending September 30, 2010–a 25% increase over the previous year and the second-largest yearly recovery amount ever.[1] The Justice Department’s total recoveries in False Claims Act cases from January 2009 through January 2011 have exceeded $6.8 billion,[2] which is far greater than any other previous two-year period.[3] With these new numbers on the books, the total amount recovered under the False Claims Act since Congress amended the statute in 1986 has climbed to the staggering amount of more than $27 billion.[4]

The Department of Justice (“DOJ”) boasts of an “aggressive, coordinated and sustained effort at the federal level to hold perpetrators of fraud accountable, be they large companies or individuals.”[5] For its part, DOJ’s Civil Division has focused its fraud-fighting efforts on “increased use of the False Claims Act.”[6]

Further, in 2010, the False Claims Act (the “FCA” or the “Act”) remained the focus of congressional interest. After amending the Act in May 2009 (for the first time in more than twenty years), Congress amended the FCA twice in 2010, each time closing perceived loopholes in the statute and removing judicially created limitations on FCA litigation. And while the plaintiffs’ bar continues to pursue aggressive theories of liability and damages, federal courts continue to grapple with the contours of the recently-revised statute.

In this update, we briefly outline the government’s enforcement priorities and summarize significant FCA settlements announced during the second half of 2010. Next, we summarize recent legislative action, including significant amendments to the statute enacted in March and July 2010. Finally, we discuss important judicial decisions and continuing trends during the second half of 2010. A collection of Gibson Dunn’s recent publications concerning the FCA, including our 2010 Mid-Year False Claims Act Update, and several in-depth discussions of the FCA’s framework and operation, along with practical guidance to help companies avoid or limit liability under the FCA, may be found on our FCA practice page.

I. Understanding Why the FCA Is Such a Powerful Weapon

The False Claims Act, 31 U.S.C. §§ 3729-33, is one of the federal government’s primary weapons to redress fraud against government programs. In simple terms, the FCA imposes liability upon anyone who (a) knowingly submits, or causes another to submit, a false claim for payment to the United States government, or (b) knowingly avoids or decreases an obligation to pay the United States government, which may include the knowing retention of an overpayment.

The FCA is a potent weapon for three primary reasons:

First, potential damages available under the FCA can be staggering: a violator is subject to three times the amount of actual damages plus civil penalties of up to $11,000.00 per false claim. The FCA does not itself provide a framework for calculating actual damages or for calculating the number of claims. Under aggressive theories of liability and damages accepted by a handful of courts, damages may equal up to three times the amount of all money the government paid out, regardless of the value of goods or services received in exchange. The method for calculating penalties under the FCA is equally vague. For example, in a typical contract situation, “claims” may be calculated as the number of contracts (which in most instances will be a small number); the number of invoices submitted pursuant to a contract (which likely are submitted monthly, for up to 6-10 years (depending on the statute of limitations period)); or the number of line items on all claims or invoices (which may be an immense number of “claims”). The uncertainty regarding the appropriate measure of damages and penalties has contributed to massive settlements (see below at Section II) and no doubt motivates the qui tam plaintiffs’ bar.

In addition, a violator may be liable for causing another person or entity to submit false claims. An FCA defendant accordingly may face hundreds of millions of dollars in damages and penalties when that defendant, itself, neither directly submitted a claim to nor received any money from, the federal government. Consider for example the pharmaceutical company settlements announced in 2010 for alleged off-label drug promotion (discussed below at Section II.B.1). Although the pharmaceutical companies themselves did not directly submit any “claims” to the United States government for payment for the costs of those drugs, they allegedly “caused” others to seek reimbursement from government-funded health plans for uncovered medications and/or inflated costs, thereby potentially creating liability and facing substantial damages and penalties under the Act.

Second, “qui tam” provisions authorize private individual whistleblowers, known as “relators,” to sue on behalf of the United States and share in up to 30% of any recovery. Relators’ counsel also may be entitled to attorneys fee awards. Although a May 13, 2010 study released by the New England Journal of Medicine suggested that most whistleblowers in healthcare FCA cases were not motivated by financial gain,[7] it is difficult to accept that conclusion. Consider, for example, Ven-a-Care (discussed further below at Section II.B), a small Florida company that “blew the whistle” on several drug companies. In December 2010, FCA settlements with certain pharmaceutical manufacturers resulted in relator share awards to Ven-a-Care in the amount of $155.6 million.[8] Although providing incentives to private individuals may increase fraud detection and enforcement, it also may lead to abusive litigation. This point is evidenced by the fact that, as discussed further below, private individuals have initiated the majority of FCA actions over the past several years, but cases where the government declines intervention typically account for less than 3% of all FCA recoveries.[9]

Third, despite Supreme Court warnings, the FCA continues to develop into an “all-purpose anti-fraud statute.”[10] As discussed below, DOJ and relators continue to pursue theories of express or implied certification, and courts continue to accept such theories. Under these theories, plaintiffs argue that a defendant’s claims for payment are “false” if the defendant falsely certified compliance with a statute or regulatory scheme and the government would not have paid the claims had it known of such noncompliance. In this way, plaintiffs seek to use the FCA to enforce compliance with a myriad of government regulations, many of which provide alternative, less drastic remedies for noncompliance, and virtually none of which contemplate private enforcement mechanisms such as qui tam actions.

Similarly, anyone who does business with the government or receives government funds, directly or indirectly, is subject to potential liability under the Act. In the “typical” FCA case, the statute clearly applies where a party contracts to provide goods or services to the federal government and falsely bills for such goods or services. The FCA has given rise to increasingly creative theories of liability, however, such that FCA cases frequently arise in unexpected contexts. In September 2010, for example, the Wall Street Journal and the New York Daily News reported that Floyd Landis, the 2006 Tour de France winner whose title was revoked due to alleged drug use, filed a qui tam action against his former teammate and seven-time Tour de France winner, Lance Armstrong.[11] Presumably, Landis argues that Armstrong defrauded the U.S. Postal Service out of team sponsorship funds by failing to disclose his alleged use of illegal performance-enhancing drugs. (Because Landis’s complaint, if any, is under seal, Gibson Dunn cannot verify the statements in the press or the actual theory of any FCA claims).

II. FCA Enforcement Activity in 2010

A. Total Recovery Amounts–Another Record Year

As stated above, for the fiscal year ending September 30, 2010, the federal government secured more than $3 billion in civil settlements and judgments, a 25% increase over the previous year and the second-largest yearly recovery amount ever.[12] From January 2009 through January 2011, the government secured more than $6.8 billion in recoveries.[13] The total amount recovered under the FCA since 1986 has risen to more than $27 billion.[14] And although the subject of our future FCA alerts, for the first quarter of fiscal year 2011 (October through December 2010), DOJ already has announced approximately $1 billion in FCA recoveries.[15]

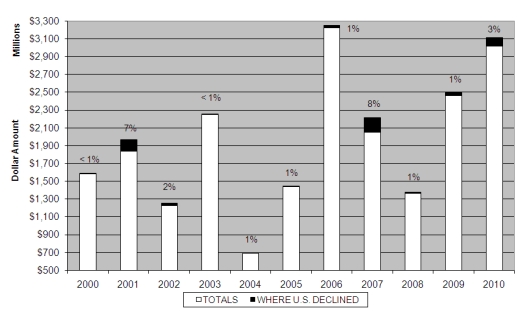

Whistleblowers continue to drive the massive recoveries under the FCA, and the government continues to rely heavily upon private plaintiffs to detect and expose fraud. Of the 709 new FCA matters opened during the last fiscal year, 573–more than 80%–were matters initiated pursuant to the Act’s qui tam provisions, and more than $380 million in recoveries were awarded to private plaintiffs under the FCA.[16] The government’s decision to intervene, however, is still a key indicator of success. Of the approximately $3 billion recovered in fiscal year 2010, only 3.2% was obtained from actions in which the government elected not to intervene, a percentage that is consistent with historical data (see chart immediately below). As a result, our advice this year remains consistent with years past–companies facing whistleblower suits are well-advised to hire qualified counsel early, to minimize the chance of government intervention and maximize the chances for a successful defense.

Settlements or Judgments in Cases where the Government Declines Intervention as a Percentage of Total Annual FCA Recoveries

B. Industry Breakdown

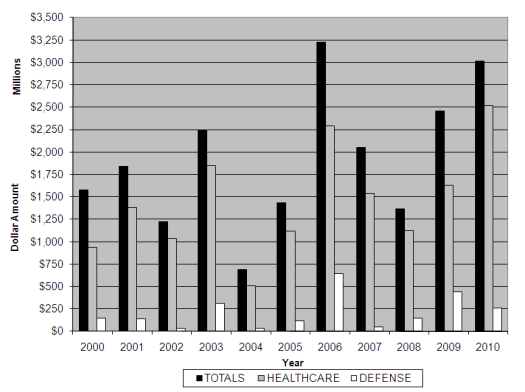

In December 2010, Assistant Attorney General Tony West noted the “cases that make up that record-breaking amount [of FCA recoveries] cover the full spectrum of Civil Division fraud cases: from the financial fraud cases like mortgage fraud that victimize homeowners who are already struggling to hold on to their homes; to procurement fraud cases involving substandard provisions supplied to our troops in Iraq and Afghanistan; to the investor fraud scams involving fake business opportunities that cheat honest small businesspeople out of their hard-earned investments.”[17] The overwhelming majority of FCA recoveries in the past decade, however, have come from the healthcare sector; and 2010 was no exception. The new Patient Protection and Affordable Care Act (“PPACA”), passed by Congress in 2010 (discussed below at Section III), brought an even greater emphasis on detecting and preventing healthcare fraud, resulting in a record year for FCA recoveries in this sector. The following chart tracks total recoveries as well as recoveries in the healthcare and defense sectors over the last ten years.

Annual FCA Recoveries By Industry

1. Healthcare

In the words of Attorney General Eric Holder, the DOJ has “taken [the government’s] fight against health-care fraud to a new level.”[18] 2010 was a record-breaking year for FCA cases in the healthcare sector, with the total amount recovered exceeding a staggering $2.5 billion.[19] In addition, each of the ten largest FCA recoveries in FY 2010 involved healthcare, including several massive recoveries against pharmaceutical companies such as AstraZeneca and Ortho-McNeil.[20]

The passage of major healthcare reform legislation in 2010–which included several provisions strengthening and broadening the FCA–suggests healthcare fraud will continue to be a top priority for the DOJ. Tony West, the Assistant Attorney General for the DOJ’s Civil Division, stated in October 2010 that “[f]rom Day One, President Obama and Attorney General Eric Holder have been focused like a laser beam on tacking health care fraud in all of its many forms.”[21] This “laser” focus is reflected in the government’s Health Care Fraud Prevention and Enforcement Action Team, or “HEAT,” a collaboration between the DOJ and the Department of Health and Human Services that began in 2009.[22] Legislative changes in 2010 further ensured programs like HEAT would strengthen in the coming years. For example, the PPACA allocates $350 million over the next decade to healthcare fraud enforcement.[23] And with private advocacy groups suggesting that the FCA generates more than $15 in recoveries for every $1 spent on healthcare fraud enforcement[24]–a view the government appears to share[25]–the government will continue to fund the effort.

In the second half of calendar year 2010, the DOJ announced settlements in numerous high-profile cases against pharmaceutical companies, including the following:

- Abbott, Roxane, B. Braun Medical, and Dey Inc.: In December 2010 (the government’s fiscal year 2011), the DOJ resolved allegations against Abbott Laboratories, Inc., Roxane Laboratories, Inc., B. Braun Medical, Inc., Dey Inc. and related entities. The settlements addressed allegations that the companies illegally inflated the reported “Average Wholesale Price” of various drugs, thereby increasing the reimbursement amount the government paid for the drugs under programs such as Medicare. Collectively, the companies paid $701.2 million as part of the settlements.[26]As mentioned above, Ven-A-Care, a small Florida company, initiated the cases against Abbot, Roxane, B. Braun and Dey under the qui tam provisions of the FCA.[27] In connection with the settlements of the cases announced in December 2010 against Abbott, Roxane, B. Braun and Dey, Ven-A-Care received approximately $155.6 million.Notably, on December 24, 2010, four days after DOJ announced the $280 million settlement with Dey,[28] Mylan Inc., Dey’s parent company, announced that it settled lawsuits brought against it on behalf of the federal government and the state of Texas for $65 million.[29] And, just one year ago, in October 2009, DOJ announced that Mylan Pharmaceuticals and UDL Laboratories agreed to pay $118 million to resolve claims that they violated the FCA by failing to pay proper rebates to state Medicaid programs for drugs paid for by those programs.[30] Whistleblower Ven-a-Care received approximately $10.8 million as its share of that settlement.

- Elan Corporation: On December 15, 2010, the DOJ announced a settlement with Elan Corporation PLC and its U.S. subsidiary Elan Pharmaceuticals Inc. to resolve civil and criminal allegations stemming from the alleged illegal promotion of an epilepsy drug.[31] In addition to approximately $100 million in criminal fines and forfeitures, Elan agreed to pay nearly $102.9 million to resolve FCA claims and entered into a corporate integrity agreement with the Office of Inspector General of the Department of Health and Human Services. In a separate, related civil settlement, a Japanese drug marketer, which purchased the epilepsy drug from Elan, agreed to pay $11 million to resolve FCA claims premised on off-label marketing. The civil settlements also resolved a qui tam action; the whistleblower in that action will receive more than $1l million from the federal share of the two settlements.

- GlaxoSmithKline: On October 26, 2010, the DOJ announced that SB Pharmco Puerto Rico Inc., a subsidiary of GlaxoSmithKline, PLC, had agreed to plead guilty to criminal charges relating to the manufacture and distribution of adulterated drugs.[32] In addition to a criminal fine and forfeiture of $150 million, the company agreed to pay civil penalties of $600 million to resolve allegations that it caused false claims to be submitted to government health care programs for adulterated drugs. The federal share of the civil settlement amount is approximately $436.4 million. The civil settlement also resolved a qui tam action; the whistleblower in that case will receive approximately $96 million from the federal share of the settlement.

- Novartis: On September 30, 2010, the DOJ announced that Novartis Pharmaceuticals Corporation agreed to pay $422.5 million to resolve criminal and civil liability arising from the alleged illegal marketing of certain drugs. The federal share of the FCA settlement was $149.2 million. The FCA settlement resolved four qui tam actions. The relators in those actions, all former Novartis employees, reportedly were awarded more than $25 million from the federal government’s share of the civil recovery.[33]

- Forest Laboratories: On September 15, 2010, the DOJ announced that Forest Pharmaceuticals, Inc., a subsidiary of Forest Laboratories, Inc., agreed to a $313 million settlement to resolve allegations that the company illegally distributed an unapproved drug product, Levothroid; promoted “off-label” uses for the drug Celexa; caused false claims to be submitted to federal health care programs for Levothroid, Celexa, and another drug, Lexapro; and paid kickbacks to induce physicians to prescribe Celexa and Lexapro. In addition to criminal penalties, Forest paid $149 million in civil penalties to resolve allegations under the FCA, including $14 million paid to the private whistleblowers who initiated the case.[34]

- Allergan: On September 1, 2010, the DOJ announced a $600 million settlement with pharmaceutical manufacturer Allergan, Inc., to resolve allegations that the company marketed its drug Botox for “off-label” uses. The Food and Drug Administration had not approved the drug to treat certain conditions and, as a result, the company’s marketing efforts allegedly violated the Food, Drug, and Cosmetics Act. As part of the total settlement, which included criminal and civil charges, the company paid $225 million to resolve allegations under the FCA with $37.8 million awarded to the qui tam relators who initiated the action. Furthermore, in addition to these monetary penalties, the settlement required the company to execute a five-year Corporate Integrity Agreement, which mandates that the company implement a comprehensive compliance program. This agreement and the company’s compliance efforts will be overseen by the Department of Health and Human Services.[35]

The foregoing pharmaceutical settlements announced during the second half of 2010 followed on the heels of several other massive pharmaceutical settlements earlier in 2010. As we reported in our 2010 Mid-Year False Claims Act Update, in a one-week period, from April 27, 2010 to May 4, 2010 alone, the DOJ announced four separate settlements of FCA claims by pharmaceutical manufacturers totaling more than $695 million. One of those settlements, with AstraZeneca Pharmaceuticals LP, resulted in “the largest amount ever paid by a company in a civil only settlement of off-label marketing claims.”[36]

On December 16, 2010, the Public Citizen’s Health Research Group released a study that focused specifically on civil and criminal settlements within the pharmaceutical industry.[37] In that study, the authors reported, “Of the 165 settlements comprising $19.8 billion in penalties during [the last] 20-year interval, 73 percent of the settlements (121) and 75 percent of the penalties ($14.8 billion) have occurred in just the past five years (2006-2010). Four companies (GlaxoSmithKline, Pfizer, Eli Lilly, and Schering-Plough) accounted for more than half (53 percent or $10.5 billion) of all financial penalties imposed over the past two decades.” [38]

2. Government Contracting and Procurement

As military operations and reconstruction efforts continue in Iraq and Afghanistan, and the government continues to pump huge sums of money into the national economy through various recovery efforts, the DOJ’s attention remained focused on combating procurement fraud. In November 2010, Assistant Attorney General Lanny Breuer remarked, “given the size and number of the contracts, grants, and loans awarded under the [American Reinvestment and Recovery] Act, we must be prepared for financial criminals to work hard at devising fraudulent schemes aimed at stealing the moneys disbursed under the Act.”[39] He continued, “protecting the integrity of Recovery Act funds is a priority for the Administration and for the Justice Department, and we are 100 percent committed to following through on any case that merits it.”[40]

As a result, the government initiated various programs to police the expenditure of government funds in the past year, including the National Procurement Fraud Initiative and the Financial Fraud Enforcement Task Force. And a primary weapon of these government initiatives is the FCA.

Significant settlements obtained during the second half of 2010 as a result of these efforts include:

- Louis Berger Group: In November 2010, New Jersey-based engineering company Louis Berger Group, Inc., settled criminal and civil claims against it regarding its handling of reconstruction contracts in Iraq and Afghanistan. According to the government, the company allegedly overbilled for overhead costs relating to work performed overseas. As part of the settlement, the company agreed to pay a criminal penalty of $18.7 million and entered into a civil settlement requiring payment to the government of $46.3 million, in addition to credits provided to the government totaling an additional $4.3 million.[41] A former employee of the company’s accounting department initiated the case under the FCA’s qui tam provisions. According to the whistleblower’s attorney, the $69 million total settlement against the Louis Berger Group was “the largest recovery in a case involving war-zone contractors in Afghanistan and Iraq.”[42]

- Cisco: On September 7, 2010, the DOJ announced that Cisco Systems and Westcon Group North America agreed to pay $48 million to settle FCA claims that the companies made misrepresentations to General Services Administration (“GSA”) contracting officers, which allegedly resulted in defective pricing of Cisco products and the submission of false claims.[43]

- U.S. Foodservice: Also in September 2010, U.S. Foodservice, Inc., a major food supplier for the Departments of Defense and Veterans Affairs, paid $30 million to settle allegations under the FCA. The DOJ alleged that the company overcharged for food products supplied under various contracts, including contracts involving military bases in the United States. The case was brought by the DOJ’s Civil Frauds Unit, in coordination with the Financial Fraud Enforcement Task Force.[44]

3. Other Sectors

In second half of 2010, the government also used the FCA to combat fraud against companies in other industries, including the following:

- Student Aid Lenders: In November 2010, the DOJ announced a settlement with four student aid lenders for a total recovery amount of $57.75 million. The lenders allegedly created billing systems that allowed them to receive improperly inflated interest rate subsidies from the Department of Education. A former employee of the Department of Education initiated these actions under the qui tam provisions of the FCA and will receive a total of $16.65 million from the settlements. Notably, the DOJ did not intervene in this action.[45]

- Mortgage Fraud: In his testimony before the Financial Crisis Inquiry Commission at the outset of 2010, Assistant Attorney General Lanny Breuer announced, “Since Fiscal Year (FY) 2006, the Department has used the False Claims Act to recover $116 million in matters involving mortgage fraud and has enforced the False Claims Act against a variety of fraudulent mortgage practices.”[46] In March 2010, the United States Attorney’s Office for the Southern District of New York announced the formation of a special Civil Frauds Unit to combat “‘large-scale and sophisticated financial frauds'” through the FCA and other civil enforcement mechanisms.[47] Working in coordination with President Obama’s Financial Fraud Enforcement Task Force, the special Unit has already obtained results. For example, on December 13, 2010, the United States Attorney for the Southern District of New York announced that the government filed a civil fraud lawsuit, which includes FCA claims, against 14 defendants, including sellers, lenders, and appraisers, alleged to have engaged in a conspiracy to commit mortgage fraud in New York City.[48]

III. Legislative Action in 2010

As Assistant Attorney General Tony West remarked halfway through this year, recent “legislation has greatly increased the [False Claims] Act’s power and effectiveness.”[49] We described much of this legislative activity in our 2010 Mid-Year Client Alert, which included the PPACA. The PPACA made sweeping changes to the FCA, including (a) a change to the public disclosure bar for qui tam suits that made it easier for putative relators to bring suit; and (b) an expansion of the definition of a “false claim” that increased the scope of conduct giving rise to an FCA violation.[50] Indeed, legislative activity in the second half of 2010 continued the trend of strengthening the FCA.

A. Dodd-Frank Wall Street Reform and Consumer Protection Act Expands Whistleblower Protections

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), signed into law on July 21, 2010, includes an amendment to the FCA that expands protected whistleblower conduct.[51] Specifically, section 1079A expands coverage to preclude retaliation for “lawful acts done by the employee, contractor, or agent or associated others in furtherance of an action under this section or other efforts to stop 1 or more violations of [the FCA].”[52] Thus, the statute protects anyone “associated” with the whistleblower, and a broad range of activities related to bringing an FCA suit or stopping potential FCA violations. Arguably, this legislative expansion could extend liability to relationships outside the employment context, although “discrimination” is limited to that affecting “the terms and conditions of employment” as a result of taking protected action.

Section 1079A of the Dodd-Frank Act also amends the FCA to clarify the statute of limitations for FCA-related whistleblower retaliation actions, allowing a civil action to be brought within three years from the date of the discriminatory or retaliatory conduct.[53]

The Dodd-Frank Act includes considerable expansion of whistleblower protections in other contexts as well, including securities laws and the Sarbanes-Oxley Act of 2002, providing incentives and protection for those who provide tips. Considering the success whistleblowers have had in bringing qui tam suits under the FCA in recent years, the Dodd-Frank Act’s expansions are likely to increase whistleblower activity in all contexts, including the False Claims Act. In fact, the Dodd-Frank Act requires the SEC to set up a “whistleblower office” to attend to this increased activity, although in light of the current budget freeze, the SEC recently announced that it is delaying those plans.[54]

B. State Legislative Action

As described in our 2010 Mid-Year False Claims Act Client Alert, more than thirty states and the District of Columbia have some version of a false claims act, as do several cities. Indeed, the financial incentive provided in section 1909 of the Social Security Act, as enacted by section 6031 of the Deficit Reduction Act of 2005 (“DRA”), encourages states to enact qualifying false claims acts.[55] Specifically, states whose law meets the federal standards may receive 10% of any recoveries of federal Medicaid funds recovered through a state action.[56] States continue to enact false claims acts in response to the DRA’s incentive, and continue to strengthen existing laws.

The Big Apple Bites Back: During the second half of 2010, New York amended its false claims act to increase the protections and incentives available to whistleblowers and the availability of qui tam suits,[57] exceeding the federal False Claims Act in many respects. As of August 27, 2010, qui tam plaintiffs in New York may bring actions for tax fraud where the defendant’s net income or sales exceeds $1 million (thereby including most small businesses) and where damage to the State of New York exceeds $350,000.[58] The federal FCA, by contrast, expressly prohibits suits based on the Internal Revenue Code.[59] Although other states, including Florida,[60] do not expressly prohibit false claims suits based on tax violations, New York is the first state to expressly authorize such actions.[61] In addition, the level of scienter required for tax fraud qui tam suits under the New York law is lower than the federal standard– “reckless disregard” of the state’s tax laws is sufficient.[62] And qui tam relators may move to compel the disclosure of a defendant’s tax records, provided the attorney general approves the request.[63]

As amended, the New York False Claims Act further encourages qui tam suits by expanding whistleblower protections to “any current or former employee, contractor, or agent,” and protecting them from, among other things, retaliation for taking materials from their employer in support of a false claims act action.[64] This latter protection–for stealing confidential or otherwise sensitive documents from the workplace–exists even where taking those materials would violate a contract, employment term, or duty owed to the employer or contractor.[65] And New York allows a relator to bring suit within ten years of a violation; the federal FCA’s statute of limitations generally is only six years (absent the application of a tolling provision available in limited circumstances).[66] New York’s law, creating significant exposure for those doing business with the State while at the same time affording significant protection to whistleblowers, may signal a new standard for state false claims acts. Gibson Dunn will closely monitor how the private enforcement of state tax laws and other statutory provisions plays out in New York.

Illinois also amended its false claims act in the second half of 2010, improving both its investigatory abilities and its ability to recover the costs of investigating and litigating false claims act cases.[67] The Illinois act also includes whistleblower protections for those who report fraud, and rewards for those who assist the state in recovering monies.

Other states that have joined in passing false claims acts in 2010 with qui tam enforcement provisions and other protections include Colorado and Maryland.[68]

As state false claims acts increase in number and coverage, the complexity and cost of FCA litigation is likely to increase. The ABA notes that enforcement actions and recoveries under state versions of the FCA are “skyrocketing.”[69] Businesses face more eligible qui tam plaintiffs, additional acts that can give rise to potential liability, and an increased pool of potential government intervenors from both federal and state governments.

IV. Case Law Developments and Judicial Trends in 2010

In our 2010 Mid-Year False Claims Act Update, we discussed several important judicial decisions during the first half of 2010. In the second half of 2010, federal courts continued to be active in deciding FCA-related cases, with more than 200 federal court decisions citing to the FCA during that time. And the Supreme Court has agreed to hear yet another FCA case in its upcoming term. As stated above, according to DOJ statistics, 709 “new matters” (including referrals, investigations and qui tam actions) were opened during fiscal year 2010, including 573 qui tam actions.[70] Moreover, thousands of FCA cases remain under seal. Thus, FCA cases will continue to fill federal court dockets and we will continue to provide updates on significant decisions throughout the coming year.

A. Interpreting the Public Disclosure Bar

1. Supreme Court Developments

During the second half of 2010, the Supreme Court granted certiorari in the case of United States ex rel. Kirk v. Schindler Elevator Co., 601 F.3d 94 (2d Cir. 2010), cert. granted, 79 U.S.L.W. 3092, 79 U.S.L.W. 3159, 79 U.S.L.W. 3194 (Sept. 28, 2010) (No. 10-188), to resolve a circuit split over the issue of whether a federal agency’s response to a Freedom of Information Act (“FOIA”) request is a “report … or investigation” within the meaning of the FCA public disclosure bar, 31 U.S.C. § 3730(e)(4). The First, Third, Fifth, and Tenth Circuits have all held that FOIA responses constitute “administrative reports” or “investigations” within the meaning of the FCA’s jurisdictional bar because the FOIA response itself is a “report” or “investigation.” Id. at 104-05 (discussing cases). The Second Circuit, however, followed the Ninth Circuit in holding that whether a FOIA response constitutes a public disclosure “depends on the nature of the document[s]” disclosed. Id. at 98, 105-07. This will be the sixth FCA case before the Supreme Court in as many years. The Court will hear argument on this matter on March 1, 2011.

2. Do Disclosures to Government Officials Qualify as “Public Disclosures”?

The Western District of Tennessee followed the First, Ninth, Tenth, and Eleventh Circuits in holding that a company’s voluntary disclosure to certain government entities does not constitute a public disclosure or otherwise bar the plaintiff’s qui tam suit. United States ex rel. Cox v. Smith & Nephew, Inc., No. 08-2832, 2010 WL 4365467 at *8 (W.D. Tenn. Nov. 4, 2010). The court held that allowing disclosure to government officials to substitute for disclosure to the public would “conflate the statute’s use of ‘government’ and ‘public’ without any textual basis indicating that Congress intended the two terms to be used interchangeably.” Id. Although this issue had been litigated in other jurisdictions, it was an issue of first impression for courts in the Sixth Circuit. The district court rejected the Seventh Circuit’s ruling that disclosure to officials with “managerial responsibility for the very claims being made” qualified as a public disclosure. Id. at *6 (quoting United States ex rel. Mathews v. Farmington, 166 F.3d 853, 861 (7th Cir. 1999)). Notably, the district court did not rely on the 2010 amendments to the public disclosure bar contained in the PPACA. The court did note, however, that the outcome of the case would not have been any different under the amendments. Id. at *5.

3. Public Disclosure Through a Publicly-Searchable Database

In a matter of first impression, the United States District Court for the Southern District of New York held that the FCA’s public disclosure bar prohibited a relator from pursuing an FCA claim based upon information obtained from a publicly-searchable database. United States, ex rel. Rosner v. Glenn Gardens Associates, L.P., Nos. 06 Civ. 7115 (SAS), 06 Civ. 11440 (SAS), 2010 WL 2670829, at *7 (S.D.N.Y. July 2, 2010). The court concluded that the tenant’s FCA claim against a housing complex, alleging fraudulent reports to the Department of Housing and Urban Development to obtain federal housing assistance payments, failed because the searchable database, available on a state government website, qualified as an administrative report within the meaning of Section 3730(e)(4)(A). Id. at *6-7.

B. A New Circuit Split Over the Failure to Comply with Filing Requirements

The FCA specifies that a qui tam relator must file a complaint under seal, and that the seal must remain in place for at least 60 days. But what happens when a qui tam plaintiff fails to abide by those requirements? The Sixth Circuit recently weighed in on this issue and set itself apart from the Second and Ninth Circuits. In a case involving a qui tam plaintiff who failed to file the complaint under seal, the Sixth Circuit affirmed dismissal of the case with prejudice, adopting a per se rule that “violations of the procedural requirements imposed on qui tam plaintiffs under the False Claims Act preclude such plaintiffs from asserting qui tam status.” United States ex rel. Summers v. LHC Group, 623 F.3d 287, 296 (6th Cir. 2010). The Second Circuit and Ninth Circuit had adopted more of a case-by-case analysis, but the Sixth Circuit expressly declined to adopt the Ninth Circuit’s three-part balancing test, dismissing the test as “a form of judicial overreach.” Id.; see also United States ex rel. Lujan v. Hughes Aircraft Co., 67 F.3d 242, 245-46 (9th Cir. 1995); United States ex rel. Pilon v. Martin Marietta Corp, 60 F.3d 995, 997-1000 (2d Cir. 1995).

C. Courts Continue to Grapple with False Certification Theories

1. Two More Circuits Recognize the Theory of Implied Certification

The implied certification theory of liability under the FCA “is based on the notion that the act of submitting a claim for reimbursement itself implies compliance with governing federal rules that are a precondition to payment.” Mikes v. Straus, 274 F.3d 687, 699 (2d Cir. 2001). In the second half of 2010, two more circuits endorsed some variety of this theory of liability. Notably, however, the FCA claims in both cases ultimately failed. In Ebeid ex rel. United States. v. Lungwitz, 616 F.3d 993 (9th Cir. 2010), the Ninth Circuit joined the Second, Sixth, Tenth, and Eleventh Circuits in “recognizing a theory of implied certification under the FCA,” but nevertheless affirmed the district court’s order dismissing the second amended complaint with prejudice because the relator failed to sufficiently plead an implied certification claim with the particularity required under Federal Rule of Civil Procedure 9(b). Id. at 996-99 (9th Cir. 2010) (“Implied false certification occurs when an entity has previously undertaken to expressly comply with a law, rule, or regulation, and that obligation is implicated by submitting a claim for payment even though a certification of compliance is not required in the process of submitting the claim.”). [71] In United States v. Science Applications Int’l Corp., No. 09-5385, 2010 WL 4909467 (D.C. Cir. Dec. 3, 2010), the court recognized an implied certification theory, holding, “to establish FCA liability under an implied certification theory, the plaintiff must prove by a preponderance of the evidence that compliance with the legal requirement in question is material to the government’s decision to pay.” Id. at *10. Nevertheless, the court vacated the FCA liability judgment and remanded the case for a new trial based on an erroneous jury instruction with respect the FCA’s scienter element.

2. The Fifth Circuit Holds that a False Certification is Not Actionable Under the FCA Unless the Government Has Conditioned Payment on Certification of Compliance

Noting that “[n]ot every breach of a federal contract is an FCA problem,” the Fifth Circuit recently held that a false certification FCA claim requires that the certification be a prerequisite to receipt of payment. United State ex rel. Steury v. Cardinal Health, Inc., 625 F.3d 262, 268-69 (5th Cir. 2010). Without reaching the general viability of an implied false certification theory–still unresolved in the Fifth Circuit–the court in Steury found that the relator had failed to provide an adequate factual basis in support of an implied false certification under the FCA. Id. at 268. “[E]ven if a contractor falsely certifies compliance (implicitly or explicitly) with some statute, regulation, or contract provision, the underlying claim for payment is not ‘false’ within the meaning of the FCA if the contractor is not required to certify compliance in order to receive payment.” Id. at 269.

In so holding, the court cited with approval to Mikes v. Straus, 274 F.3d 687, 700 (2d Cir. 2001), a Second Circuit case that similarly held a false certification must be a prerequisite for payment in order to support an FCA violation. The relator in Steury, who premised her FCA claim on the sale of allegedly defective intravenous fluid pumps to the Department of Veteran Affairs, could not show that government conditioned payment on compliance with the warranty of merchantability. Steury, 625 F.3d at 270.

The Steury decision also is noteworthy insofar as it addresses (albeit briefly) retroactivity issues. As noted in our 2010 Mid-Year Alert, the overwhelming majority of courts addressing the issue have held that the FCA amendments enacted as part of the Fraud Enforcement and Recovery Act of 2009 (“FERA”) apply retroactively only to actions in which claims for government payment were pending on June 7, 2008. However, without much discussion, the Fifth Circuit in Steury appears to have taken the contrary view that the FERA amendments apply to cases pending on June 7, 2008. Id. at 267 n.1 (as Steury’s complaint was pending on June 7, 2008, it was assessed under the current version of § 3729(a)(1)(B)).

3. Court Rejects Implied False Certification Claim Against Pharmacies

The day before DOJ announced a $313 million settlement with Forest Laboratories to resolve alleged off-label promotion claims (see above at Section II) a district court in Massachusetts rejected similar claims against Pfizer and Pharmacia Corporation. In United States ex rel. Rost v. Pfizer, Inc., No. 03-11084-PBS, 2010 WL 3554719, at *1 (D. Mass. Sept. 14, 2010), the relator alleged that Pfizer and Pharmacia induced pharmacies to submit false Medicaid claims by providing illegal kickbacks to physicians who prescribed a certain medication off-label. The court held that the pharmacies’ claims were not false or fraudulent under a theory of implied certification because there are no statutes, regulations, or express certifications supporting that contention. Id. at *10. The Court reasoned that certification is specific to the party seeking reimbursement and does not apply to the entire transaction: “Neither the government nor the parties have cited any cases that have stretched an implied certification theory to reach back to impose FCA liability on a payer of kickbacks where the person who submitted the claim was innocent of wrongdoing and where (a) the claim itself was not factually false, (b) the claim was not legally false due to an express certification of compliance with the [Anti-Kickback Statute] or (c) compliance with the federal statute was not an expressly stated precondition of payment.” Id.

Notably, this case likely would have been decided differently under the recent PPACA amendments to the FCA, which did not apply in Rost. Indeed, the court noted that “the federal [Anti-Kickback Statute], 42 U.S.C. § 1320a-7b, was recently amended to include language stating that ‘a claim that includes items or services resulting from a violation of this section constitutes a false or fraudulent claim for the purposes of the [False Claims Act].'” Id.

D. The D.C. Circuit Rejects the Government’s Expansive “Collective Knowledge” and Damages Theories

As detailed in our December 6, 2010 and January 3, 2011 client alerts, the D.C. Circuit vacated a FCA judgment that had been premised on a broad theory of scienter and a sweeping theory of damages that barred the jury from considering the value of the services actually provided. United States v. Science Applications Int’l Corp., No. 09-5385, 2010 WL 4909467, at *1 (D.C. Cir. Dec. 3, 2010). The court agreed with Science Applications International Corporation (“SAIC”) (represented by Gibson Dunn), in holding that the district court’s “collective knowledge” instruction — which permitted the jury to find that SAIC acted with scienter even if no particular employee knew the company’s claims were false — was legally deficient. Id. at *13. The court also found that the jury instruction with respect to damages was “flawed” in that it barred the jury from considering the value of the services that SAIC actually provided. Id. at *17-18. The court concluded that “proper measure of damages” was a “benefit-of-the-bargain framework” requiring the government to prove “that the performance [it] received was worth less than what it believed it had purchased.” Id. at *18.

E. Claims Against State Officials

As mentioned in our Mid-Year Update, earlier in 2010, the Middle District of Alabama concluded that the 2009 FERA amendments to the FCA did not provide a clear statement of congressional intent to waive sovereign immunity. Bell v. Dean, No. 2:09-CV-1082-WKW, 2010 WL 1856086, at *3-4 (M.D. Ala. May 4, 2010). Although certain claims for relief were dismissed under this holding, the court ordered additional briefing on claims for official-capacity injunctive relief and individual-capacity relief.

In a second decision, the court has now found that state officials are not entitled to qualified immunity for retaliation suits initiated under the FCA: “Such retaliation, if sufficient to actually violate the statute, has no conceivably legitimate purpose, and applying the judicially created doctrine of qualified immunity to bar [retaliation suits] would seem at odds with the purpose of the FCA, and specifically with the purpose of the retaliation provision, as recently expanded by Congress.” Bell v. Dean, 2:09-CV-1082-WKW, 2010 WL 2976752, at *2 (M.D. Ala. July 27, 2010).

F. Fourth Circuit Hears Oral Argument in Challenge to FCA’s Seal Provision

As noted above, a qui tam relator must file his or her compliant under seal, and the complaint shall remain under seal for at least 60 days. 31 U.S.C. § 3730(b)(2). The 60-day period is designed to allow the government time to investigate and decide whether to intervene and conduct the action or decline to intervene and allow the relator to conduct the action on the government’s behalf. The government may move to extend the seal period for “good cause.” 31 U.S.C. § 3730(b)(3). By most accounts, more than 1,000 qui tam actions presently remain under seal.

As noted in our 2009 Year-End FCA Alert, in January 2009, the American Civil Liberties Union (“ACLU”), OMB Watch and the Government Accountability Project challenged the constitutionality of the FCA’s seal provisions. See ACLU v. Holder, No. 652 F.Supp.2d. 654, 671 (E.D. Va. 2009). After the Eastern District of Virginia rejected the constitutional challenges and dismissed the action, plaintiffs appealed to the Fourth Circuit (Case No. 09-2086). On September 21, 2010, the Fourth Circuit heard oral argument in the case and a decision is pending.

The seal provision is yet another fascinating aspect of the FCA. Although the federal government does not release statistics on the average length of time a qui tam action remains under seal, the statutorily-mandated 60-day period now seems the exception rather than the norm. Navigant Consulting, Inc. reported on five qui tam actions unsealed during the third quarter of 2010, ranging from 105 days to 486 days under seal.[72] Gibson Dunn sampled qui tam cases unsealed or first served on defendants in 2010, and noted that several remained under seal for more than two years, as opposed to two months. The following are some examples:

- United States ex rel. King v. Solvay S.A., Civil Action No. H-06-2662, 2010 WL 2851725, at *1 (S.D. Tex. July 20, 2010). The initial complaint was filed under seal on June 10, 2003, and remained under seal for approximately six and a half years, until December 2009. The compliant was first served on Solvay Pharmaceuticals, Inc. on January 12, 2010.

- United States ex rel. Denenea v. Allstate Ins. Co., Civil Action No. 2:07-cv-02795 (E.D. La. . Sept. 21, 2010). The complaint was filed under seal on May 4, 2007. After granting several extensions, the court lifted the seal more than 40 months later, on September 21, 2010.

- United States ex rel. Frascella v. Oracle Corp., No. 1:07-cv-00529, 2010 WL 4623793, at *3 (E.D. Va. Nov. 2, 2010). The complaint was filed under seal on May 29, 2007. The court lifted the seal approximately three years later, on April 2, 2010.

- United states ex rel. Davis v. Blackwater Lodge and Training Center, Inc., Civil Action No. 1:08-cv-01244 (E.D. Va. Feb. 2, 2010). Relator filed the complaint in camera on December 1, 2008. The court lifted the seal 26 months later, on February 2, 2010.

- United States ex rel. Resnick v. Omnicare, Inc., Civil Action No. 1:07cv5777 (N.D. Ill. Jan. 8, 2010). The complaint was filed under seal on October 11, 2007, and remained under seal for approximately 27 months, until January 8, 2010.

- United States ex rel. Hauger v. The Health Alliance of Greater Cincinnati, Civil Action No. 1:07cv00631 (S.D. Ohio June 4, 2010). The complaint was filed under seal on August 3, 2007, and remained under seal for approximately 34 months until the case was unsealed (and dismissed) on June 4, 2010.

As the foregoing examples suggest, often, a defendant named in a qui tam action may be unaware of the action for a lengthy period of time, during which time whistleblowers may be surreptitiously collecting evidence of wrongdoing, all the while allowing potentially fraudulent practices to continue and potential damages to mount (when, for example, a corporate defendant is unaware of improper conduct secretly carried out by an agent or employee). After some initial seal period, the government frequently will obtain a partial lifting of the seal to inform the defendant of the pendency of the action and nature of the claims, which presents an opportunity for the government and a defendant to investigate and negotiate without fear of negative publicity. But this partial lifting of the seal may create additional dilemmas. For example, publicly-traded companies may have disclosure obligations under securities laws, but risk violating the seal provision (and contempt of court) if they reveal the existence of the qui tam action. As of today, this “catch-22” remains unresolved.

V. Risk Mitigation: Take Employee Complaints Seriously

Two studies published in 2010 concluded that most FCA whistleblowers are corporate insiders who first raised their concerns internally. First, in a December 17, 2010 formal submission to the SEC, entitled “Impact of Qui Tam Laws on Internal Compliance,” the National Whistleblowers Center reported that based on its review of FCA qui tam cases filed between 2007 and 2010, “89.7% of employees who would eventually file a qui tam case initially reported their concerns internally, either to supervisors or compliance departments.”[73] Second, a study published in the New England Journal of Medicine on May 13, 2010 (referred to above), similarly concluded that nearly all of the whistle-blowing insiders “first tried to fix matters internally.”[74] The study also noted that many whistleblowers wore personal recording devices, taped phone calls, and copied relevant documents, often working closely with government investigators to collect evidence of wrongdoing.[75] The lesson to be learned from these studies: take employee complaints seriously. Any company that does business directly or indirectly with the government should consider educating its workforce about the FCA and establishing standard procedures for raising complaints and responding to them.

VI. Conclusion

By all accounts, 2010 was a busy year for legislators, courts, prosecutors and FCA practitioners. With the DOJ’s increased resources and “unparalleled focus” on fighting fraud through “aggressive” use of the FCA and recent legislative and judicial expansion of whistleblower protections and application of the Act, we expect to see an even greater increase in FCA activity in 2011.

[1] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Department of Justice Recovers $3 Billion in False Claims Cases in Fiscal Year 2010 (Nov. 22, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-civ-1335.html.

[2] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Seven Hospitals in Six States to Pay U.S. More Than $6.3 Million to Resolve False Claims Act Allegations Related to Kyphoplasty (Jan. 4, 2011), available at http://www.justice.gov/opa/pr/2011/January/11-civ-006.html.

[3] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Department of Justice Recovers $3 Billion in False Claims Cases in Fiscal Year 2010 (Nov. 22, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-civ-1335.html.

[5] U.S. Dep’t of Justice, Briefing Room, Department of Justice Assistant Attorney General Tony West Speaks at Press Conference Announcing Major Settlements with Pharmaceutical Manufacturers (Dec. 7, 2010), available at http://www.justice.gov/civil/opa/pr/speeches/2010/civ-speech-101207.html.

[6] Tony West, Remarks at the American Bar Association National Institute on the Civil False Claims Act and Qui Tam Enforcement, at 1 (June 3, 2010), at http://www.scribd.com/doc/32485437/Tony-West-Aba-Fca-qui-Tam-6-3-10.

[7] Aaron S. Kesselheim, David M. Studdert & Michelle M. Mello, Special Report, Whistle-Blowers’ Experiences in Fraud Litigation against Pharmaceutical Companies, 362 N. Engl. J. Med. 1832, 1834-35 (2010), available at http://www.nejm.org/doi/pdf/10.1056/NEJMsr0912039.

[8] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Manufacturer to Pay $280 Million to Settle False Claims Act Case (Dec. 20, 2010), available at http://www.justice.gov/opa/pr/2010/December/10-civ-1464.html; Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Manufacturers to Pay $421.2 Million to Settle False Claims Act Cases (Dec. 7, 2010), available at http://www.justice.gov/opa/pr/2010/December/10-civ-1398.html.

[9] See U.S. Dep’t of Justice, Civil Div., Fraud Statistics (Nov. 23, 2010), available at http://www.justice.gov/civil/frauds/fcastats.pdf.

[11] Vanessa O’Connell & Reed Albergotti, U.S. Mulls Joining Cycling Lawsuit, Wall St. J., Sept. 4, 2010; Nathaniel Vinton, Source: Justice Department notifies defendants, including Lance Armstrong, in Floyd Landis lawsuit, N.Y. Daily News, Sept. 3, 2010.

[12] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Department of Justice Recovers $3 Billion in False Claims Cases in Fiscal Year 2010 (Nov. 22, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-civ-1335.html.

[13] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Seven Hospitals in Six States to Pay U.S. More Than $6.3 Million to Resolve False Claims Act Allegations Related to Kyphoplasty (Jan. 4, 2011), available at http://www.justice.gov/opa/pr/2011/January/11-civ-006.html.

[15] See generally U.S. Dep’t of Justice, Briefing Room, http://www.justice.gov/opa/pr/2010/December/index.html (last visited Dec. 27, 2010) (featuring DOJ press releases regarding recent recoveries under the FCA).

[16] See U.S. Dep’t of Justice, Civil Div., Fraud Statistics, at 2 (Nov. 23, 2010), available at http://www.justice.gov/civil/frauds/fcastats.pdf.

[17] U.S. Dep’t of Justice, Briefing Room, Department of Justice Assistant Attorney General Tony West Speaks at Press Conference Announcing Major Settlements with Pharmaceutical Manufacturers (Dec. 7, 2010), available at http://www.justice.gov/civil/opa/pr/speeches/2010/civ-speech-101207.html.

[18] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Departments of Justice and Health and Human Services Team Up to Crack Down on Health Care Fraud (Nov. 5, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-ag-1256.html.

[19] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Department of Justice Recovers $3 Billion in False Claims Cases in Fiscal Year 2010 (Nov. 22, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-civ-1335.html.

[20] See Patrick Burn, Over $3 Billion in Fraud Recoveries Under the False Claims Act in FY 2010, Taxpayers Against Fraud Education Fund ,Oct. 25, 2010, available at http://www.taf.org/whistle295.htm.

[21] Tony West, Assistant Attorney Gen. for the Civil Div., U.S. Dep’t of Justice, Remarks at the GlaxoSmithKline Press Conference (Oct. 26, 2010) (transcript of remarks as prepared for delivery available at http://www.justice.gov/civil/opa/pr/speeches/2010/civ-speech-101026.html).

[22] See generally STOP Medicare Fraud, http://www.stopmedicarefraud.gov/heatsuccess/index.html (last visited Dec. 27, 2010) (describing the HEAT Task Force’s mission and ongoing actions).

[23] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Departments of Justice and Health and Human Services Team Up to Crack Down on Health Care Fraud (Nov. 5, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-ag-1256.html.

[24] Jack A. Meyer, Fighting Medicare Fraud: More Bang for the Federal Buck, Taxpayers Against Fraud Education Fund, at 4 (July 2006), available at http://www.taf.org/FCA-2006report.pdf.

[25] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Departments of Justice and Health and Human Services Team Up to Crack Down on Health Care Fraud (Nov. 5, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-ag-1256.html (“Investments in fraud detection and enforcement pay for themselves many times over, and the administration’s tough stance against fraud is already yielding results.”).

[26] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Manufacturer to Pay $280 Million to Settle False Claims Act Case (Dec. 20, 2010), available at http://www.justice.gov/opa/pr/2010/December/10-civ-1464.html; Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Manufacturers to Pay $421.2 Million to Settle False Claims Act Cases (Dec. 7, 2010), available at http://www.justice.gov/opa/pr/2010/December/10-civ-1398.html.

[27] Ven-A-Care, founded in 1987 as a small pharmacy providing in-home services, has evolved into a professional whistleblower over the past 20 years, netting hundreds of millions in relator’s share awards and prompting settlements from some of the largest pharmaceutical companies in the world, including Bayer AG, GlaxoSmithKline, Mylan and Teva Pharmaceuticals. See David S. Cloud & Laurie McGinley, Medicare Monitor: How a Whistle-Blower Spurred Pricing Case Involving Drug Makers’ High U.S. Reimbursement Caught Eye of Newcomer to Home-Care Business, Wall St. J., May 12, 2000, at A1; Joni James, State Files Drug Price Lawsuit, St. Petersburg T., July 21, 2005, at 1B.

[28] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Manufacturer to Pay $280 Million to Settle False Claims Act Case (Dec. 20, 2010), available at http://www.justice.gov/opa/pr/2010/December/10-civ-1464.html.

[29] See Press Release, Mylan Inc., Mylan Finalizes Pricing Case Settlements Previously Disclosed in Principle in 2009 10-K (Dec. 24, 2010), available at http://investor.mylan.com/releasedetail.cfm?ReleaseID=538849.

[30] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Four Pharmaceutical Companies Pay $124 Million for Submission of False Claims to Medicaid (Oct. 19, 2009), available at http://www.justice.gov/opa/pr/2009/October/09-civ-1120.html.

[31] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Companies to Pay $214.5 Million to Resolve Allegations of Off-label Promotion of Zonegran (Dec. 15, 2010), available at http://www.justice.gov/opa/pr/2010/December/10-civ-1444.html.

[32] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, GlaxoSmithKline to Plead Guilty & Pay $750 Million to Resolve Criminal and Civil Liability Regarding Manufacturing Deficiencies at Puerto Rico Plant (Oct. 26, 2010), available at http://www.justice.gov/opa/pr/2010/October/10-civ-1205.html.

[33] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Novartis Pharmaceuticals Corp. to Pay More Than $420 Million to Resolve Off-label Promotion and Kickback Allegations (Sept. 30, 2010), available at http://www.justice.gov/opa/pr/2010/September/10-civ-1102.html.

[34] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Drug Maker Forest Pleads Guilty; To Pay More Than $313 Million to Resolve Criminal Charges and False Claims Act Allegations (Sept. 15, 2010), available at http://www.justice.gov/opa/pr/2010/September/10-civ-1028.html.

[35] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Allergan Agrees to Plead Guilty and Pay $600 Million to Resolve Allegations of Off-Label Promotion of Botox? (Sept. 1, 2010), available at http://www.justice.gov/opa/pr/2010/September/10-civ-988.html.

[36] Eric Holder, Attorney Gen., U.S. Dep’t of Justice, Remarks at the AstraZeneca Settlement Announcement (Apr. 27, 2010) (transcript of remarks as prepared for delivery available at http://www.justice.gov/ag/speeches/2010/ag-speech-100427.html).

[37] Sammy Almashat, Charles Preston, Timothy Waterman & Sidney Wolfe, Rapidly Increasing Criminal and Civil Monetary Penalties Against the Pharmaceutical Industry: 1991-2010, PublicCitizen, Dec. 16, 2010, available at http://www.citizen.org/hrg1924.

[39] Lanny A. Breuer, Assistant Attorney Gen. for the Criminal Div., U.S. Dep’t of Justice, Remarks at the “Focus on Recovery” Biennial National Procurement and Grant Fraud Conference (Nov. 17, 2010) (transcript of remarks as prepared for delivery available at http://www.justice.gov/criminal/pr/speeches/2010/crm-speech-101117.html).

[41] See Press Release, U.S. Attorney’s Office for the Dist. of Md., Scheme to Defraud Government on Reconstruction Contracts Leads to Criminal Charges and Civil Penalties for Louis Berger Group, Inc. (Nov. 5, 2010)

[42] See PR Newswire, Whistleblower Exposed Fraud By The Louis Berger Group; $69.3 Million Settlement Sets Record for Afghanistan and Iraq Contractor Fraud Case, PR Newswire, Nov. 5, 2010, available at .

[43] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Cisco Systems and Westcon Group North America Pay $48 Million to Settle False Claims Act Allegations (Sept. 7, 2010), available at http://www.justice.gov/opa/pr/2010/September/10-civ-1002.html.

[44] See Press Release, U.S. Attorney’s Office for the S. Dist. of N.Y., U.S. Foodservice to Pay United States $30 Million to Resolve Civil Fraud Allegations (Sept. 13, 2010), available at http://www.stopfraud.gov/news/news-09132010-2.html.

[45] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Four Student Aid Lenders Settle False Claims Act Suit for Total of $57.75 Million (Nov. 17, 2010), available at http://www.justice.gov/opa/pr/2010/November/10-civ-1351.html (despite not intervening, the government did provide assistance in this case, including during the settlement process).

[46] Lanny A. Breuer, Assistant Attorney Gen. for the Criminal Div., U.S. Dep’t of Justice, Testimony to the Financial Crisis Inquiry Commission (Jan. 14, 2010) (transcript of remarks as prepared for delivery available at http://www.fcic.gov/hearings/pdfs/2010-0114-Breuer.pdf).

[47] Jonathan Stempel, US attorney in Manhattan creates civil fraud unit, Reuters, Mar. 24, 2010, available at http://www.reuters.com/article/idUSN3121166020100331 (quoting Preet Bharara, the U.S. Attorney for the Southern District of New York).

[48] Press Release, U.S. Attorney’s Office for the S. Dist. of N.Y., Manhattan U.S. Attorney Sues Sellers, Lenders, and Appraisers Alleging Broad Consumer Mortgage Fraud Conspiracy (Dec. 13, 2010).

[49] Tony West, Assistant Attorney Gen. for the Civil Div., U.S. Dep’t of Justice, Remarks at the American Bar Association National Institute on the Civil False Claims Act and Qui Tam Enforcement, at 1 (June 3, 2010) (transcript of remarks as prepared for delivery available at http://www.scribd.com/doc/32485437/Tony-West-Aba-Fca-qui-Tam-6-3-10).

[50] See Gibson Dunn, 2010 Mid-Year False Claims Act Update, July 9, 2010, available at http://www.gibsondunn.com/Publications/Pages/2010Mid-YearFalseClaimsActUpdate.aspx (explaining the PPACA’s changes to the public disclosure bar and the definition of a false claim).

[51] Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, § 1079A (2010), available at http://www.govtrack.us/congress/bill.xpd?bill=h111-4173.

[54] Id. at § 924(d); see also Jessica Holzer, SEC Delays Plans for Whistleblower Office, Wall St. J., Dec. 3, 2010.

[55] Deficit Reduction Act of 2005, Pub. L. No. 109-171, § 6031, 120 Stat. 4, 72 (2006), available at http://origin.www.gpo.gov/fdsys/pkg/PLAW-109publ171/pdf/PLAW-109publ171.pdf.

[56] See 42 U.S.C. § 1396h(a) (2010) (“[I]f a State has in effect a law relating to false or fraudulent claims that meets the requirements of subsection (b), the Federal medical assistance percentage with respect to any amounts recovered under a State action brought under such law, shall be decreased by 10 percentage points.”); Publication of OIG’s Guidelines for Evaluating State False Claims Acts, 71 Fed. Reg. 48,552 (Dep’t of Health and Human Serv. Aug. 21, 2006) (notice of new guidelines); U.S. Dep’t of Health and Human Serv., Office of Inspector Gen., State False Claims Act Reviews, http://oig.hhs.gov/fraud/falseclaimsact.asp (last visited Dec. 27, 2010) (posting reviews of state laws).

[61] Press Release, NY Senate Homepage, Senator Eric T. Schneiderman Shepherds Historic Anti-Fraud Taxpayer Protection Measure Through Legislature (July 1, 2010).

[67] See Whistleblower Reward and Protection Act, 740 I.L.C.S. § 175 (2010); Press Release, Ill. Attorney Gen., Madigan Heralds Newly Strengthened False Claims Act (July 28, 2010), available at http://www.illinoisattorneygeneral.gov/pressroom/2010_07/20100728b.html.

[68] See Colo. Medicaid False Claims Act, C.R.S. §§ 25.5-4-305 — 25.5-4-310 (2010); Md. False Health Claims Act of 2010, Md. Ann. Code §§ 2-601–2-611 (2010).

[69] Am. Bar Ass’n, CLE Program Guide, The Eighth Annual National Institute on the Civil False Claims Act and Qui Tam Enforcement (June 2-4, 2010), available at http://new.abanet.org/calendar/civil-false-claims-act-and-qui-tam-enforcement-2010/Documents/cen0cfc_Website_Brochure_5-7-10.pdf.

[70] U.S. Dep’t of Justice, Civil Division, Fraud Statistics, at 2 (Nov. 23, 2010), available at http://www.justice.gov/civil/frauds/fcastats.pdf. Navigant Consulting, Inc. reports that approximately 150 new FCA cases were filed in the first three quarters of 2010. See Navigant Consulting, Inc., Health Care Disputes, Compliance, and Investigations Practice, False Claims Act Case Tracker, at 1 (2010), available at http://www.navigantconsulting.com/downloads/FalseClaimsCaseTrack_1010.pdf (showing, in Figure 1, cases filed each quarter for January 2007- September 2010).

[71] See United States ex rel. Conner v. Salina Reg’l Health Ctr., Inc., 543 F.3d 1211, 1217-18 (10th Cir.2008); McNutt ex rel. U.S. v. Haleyville Med. Supplies, Inc., 423 F.3d 1256, 1259 (11th Cir.2005); United States ex rel. Augustine v. Century Health Serv., Inc., 289 F.3d 409, 415 (6th Cir.2002); Mikes v. Straus, 274 F.3d 687, 699-700 (2d Cir. 2001).

[72] Navigant Consulting, Inc., Health Care Disputes, Compliance, and Investigations Practice, False Claims Act Case Tracker, at 2 (2010), available at http://www.navigantconsulting.com/downloads/FalseClaimsCaseTrack_1010.pdf (reporting on trends in the third quarter of 2010).

[73] Nat’l Whistleblowers Center, Impact of Qui Tam Laws on Internal Compliance: A Report to the Sec. Exch. Comm’n, at 4 (Dec. 17, 2010), (submitted in response to the SEC’s Proposed Rules for Implementing the Whistleblower Provision of Section 21F of the Securities and Exchange Act of 1934).

[74] Aaron S. Kesselheim, David M. Studdert & Michelle M. Mello, Special Report, Whistle-Blowers’ Experiences in Fraud Litigation against Pharmaceutical Companies, 362 N. Engl. J. Med. 1832, 1834 (2010), available at http://www.nejm.org/doi/pdf/10.1056/NEJMsr0912039.

Gibson Dunn’s lawyers have handled hundreds of FCA investigations and have a long track record of litigation success. Gibson Dunn successfully argued the landmark Allison Engine case in the Supreme Court, a unanimous decision that prompted Congressional action. See Allison Engine Co. v. United States ex rel. Sanders, 128 S. Ct. 2123 (2008). Most recently, on December 3, 2010, Gibson Dunn persuaded a panel of the United States Court of Appeals for the D.C. Circuit to vacate a FCA judgment against Science Applications International Corporation and to reject the government’s expansive “collective knowledge” and damages theories. Our win rate and immersion in FCA issues gives us the ability to frame strategies to quickly dispose of FCA cases. The firm has more than 30 attorneys with substantive FCA expertise and more than 20 former Assistant U.S. Attorneys and DOJ attorneys. For more information, please feel free to contact the Gibson Dunn attorney with whom you work or the following attorneys:

Washington, D.C.

F. Joseph Warin (202-887-3609, [email protected])

Joseph D. West (202-955-8658, [email protected])

Andrew S. Tulumello (202-955-8657, [email protected])

Karen L. Manos (202-955-8536, [email protected])

New York

Randy M. Mastro (212-351-3825, [email protected])

Jim Walden (212-351-2300, [email protected])

Denver

Robert C. Blume (303-298-5758, [email protected])

Jessica H. Sanderson (303-298-5928, [email protected])

Laura Sturges (303-298-5929, [email protected])

Dallas

Robert B. Krakow (214-698-3124, [email protected])

Evan S. Tilton (214-698-3156, [email protected])

Orange County

Nicola T. Hanna (949-451-4270, [email protected])

Los Angeles

Timothy J. Hatch (213-229-7368, [email protected])

James L. Zelenay Jr. (213-229-7449, [email protected])

© 2011 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice