July 13, 2015

Enforcement of the criminal antitrust and competition laws continues to deliver headline grabbing news. Just six months ago, we reported as dominant trends the unrelenting expansion in international enforcement, the increasing severity of punishments, and the rising level of coordination among global competition authorities when it comes to detecting and investigating companies that engage in horizontal collusion. Over the last six months, the attendant complexities of those trends have been thrown into sharper relief, particularly when viewed through the lens of the expansive global investigations of the foreign exchange (FX) markets. While the multi-billion dollar penalties already imposed have received significant attention, it is the implications of those penalties for ongoing multi-jurisdictional investigations that will continue to drive decisions within companies and enforcers alike in the coming months and years. This update addresses those issues, synthesizes related developments, and provides a summary of anti-cartel enforcement in the first half of 2015.

Large Penalties and Expanded Enforcement Activity Heighten the Necessity for International Convergence to Solve the Risk of Double Counting.

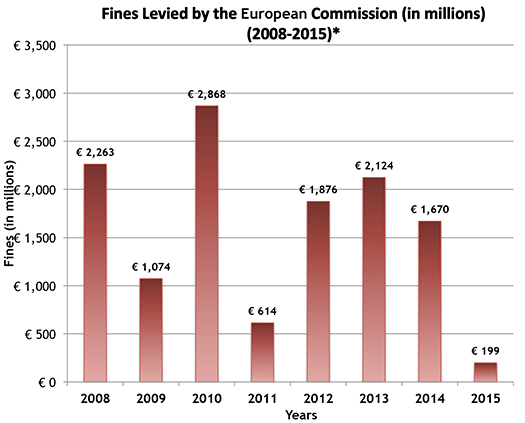

The figures are substantial. In the last six months alone, the U.S. Department of Justice has obtained over $2.6 billion in criminal fines resulting from FX-related guilty pleas by large international financial institutions, surpassing the prior annual record for fines in all matters by a factor of almost three. Similarly, in the first half of 2015, the United Kingdom’s Financial Conduct Authority added almost $700 million in FX-related fines. Large additional fines were imposed in April on financial institutions in the international investigations of LIBOR by U.S., European Commission and U.K. authorities.

Rather than simply gape at the gross volume of fines, the pertinent question remains whether global competition authorities will seek convergence in the methodologies used to calculate fines when sanctioning the same overarching conduct. As reported in our 2014 year-end update, automotive part suppliers are reportedly being investigated by competition authorities in at least 11 jurisdictions with heavy sanctions imposed to date in the U.S., European Union, Japan, China, Korea, Singapore, Australia and Canada. Ten competition authorities, four criminal prosecuting authorities, and over a dozen financial regulators around the world are reportedly conducting investigations related to FX.[1] And the publicity associated with high-dollar fines will no doubt drive further interest among authorities assessing whether to launch investigations. The efforts of global competition authorities to converge on common standards and best practices remain ongoing. It is to be hoped that the pressures created by such massive investigations as auto parts, FX, and LIBOR will spur progress. However, some notable differences remain.

The U.S. DOJ is increasingly transparent regarding its consideration of these issues. In a recent speech delivered at the New York State Bar Association Antitrust Law’s annual meeting, U.S. Deputy Assistant Attorney General Brent Snyder indicated that while prosecutions could be brought, and thus penalties calculated, on the basis of foreign component sales where there are no direct sales of a priced fixed product into the United States, he acknowledged that doing so increased the risk of duplicative sanctions under the increasingly robust global competition regime. Moreover, he disclosed that the U.S. DOJ has taken foreign penalties into account when negotiating the resolution of certain investigations.

In Europe though, the road ahead looks somewhat different. While hopes of a newly convergent approach had recently been raised in InnoLux’s appeal from the fine imposed by the European Commission in the TFT-LCD panel matter, the European Court of Justice ultimately chose to maintain the status quo. Advocate General Wathelet had opined that the Commission had overreached when it considered non-direct (or so-called “transformed”) sales of price-fixed goods outside Europe when calculating InnoLux’s punishment, noting that assessing penalties in such a manner unfairly left the parties at risk for being fined twice for the same conduct. However, the European Court of Justice disagreed, and permitted the inclusion of the end products within the Innolux fine, thereby amplifying rather than reducing the risk of double-counting.

As the trend towards a more consistent global approach to global collusion continues, competition authorities will grapple with difficulties associated with multiple jurisdictions conducting parallel investigations of the same conduct and the attendant risk of double-counting.

Enforcement Authorities Must Remain Diligent in Providing Clear Incentives for Companies to Adopt Compliance Programs.

Developments in how U.S. and other enforcement authorities treat compliance programs and third-party monitors also bear mentioning. These too have and will likely continue to receive prominent attention in connection with the FX and LIBOR matters.

This year, Assistant Attorney General Bill Baer for the first time publicly indicated that the Antitrust Division may consider increasing the use of third-party monitors as part of the terms of a negotiated plea or settlement agreement. The imposition of a monitor in an Antitrust Division case is viewed as a severe penalty associated with post-conviction sentencing, at least in part because monitorships are often expensive, intrusive, and sometimes involve adversarial relationships. The dispute between AU Optronics and its monitor over whether the company had failed to implement the court-ordered compliance program (and thus violated its probation), discussed in more detail below, provides a recent example of the difficulties companies face in complying with a monitor’s extra-judicial powers.

Mr. Baer’s comments, however, suggest that the Antitrust Division seeks–once again–to promote corporate compliance through a carrot and stick approach. That is because the threat of a monitorship is paired with the offer of incentives for the adoption and implementation of a robust compliance program. Companies that adopt such programs as part of their response to a U.S. investigation may be able to seek credit in the form of a reduction in sanctions, the avoidance of probation, and the possibility of a corporate monitor as part of negotiated resolutions. Barclay’s was a beneficiary of this new policy in connection with its recent plea agreement in the FX investigation. By contrast, in the LIBOR investigation, Deutsche Bank agreed to a monitorship as part of its deferred prosecution agreement. Importantly, this approach is not limited to the US; Canada, and the U.K. have also recently announced incentives for compliance programs; others (such as France and Columbia) are seriously considering them as well.

It is likely that in this area, as in so many other areas of anti-cartel enforcement, other jurisdictions will follow or adapt whatever U.S. framework emerges. This, too, is therefore an area where convergence is critical.

Recent Acquittals Provide a Reminder that Trial Remains a Viable Option in Certain Cases.

Against the backdrop of heightened anti-cartel enforcement comes a simple reminder that, in some cases, trial remains a viable and sensible strategy. Historically, companies that have been vindicated in criminal antitrust prosecutions by juries in U.S. courts chose to go to trial for a variety of reasons. A company may decide to litigate because the law is unclear, it was acting in the periphery of the alleged conduct and the government is overreaching, or the evidence is weak or relies heavily on the testimony of witnesses with incentives to help the government. Or it could be a combination of factors, including a company’s desire to establish its lack of culpability or the lack of merit of the government’s charges.[2]

All of these same considerations could also cause an individual to elect to go to trial, where the Antitrust Division has had particular trouble convicting individuals who earn a jury’s sympathy. Jury sympathy leads to jury nullification and can be generated many ways. Juries will acquit individuals when they perceive that the government is overreaching by, for example, charging a relatively low-level employee who only followed the instructions of superiors, whose conduct is stale (even if not strictly outside of the Statute of Limitations), or who is in or near retirement and wants only to ride into the sunset with his or her family.

The last six months have seen acquittals in high-profile criminal antitrust trials in the U.S., Canada, and the U.K., including one in the Antitrust Division’s long-running investigation concerning coastal water freight transportation between the United States and Puerto Rico. In Canada, a jury acquitted seven companies and several individuals of charges of rigging bids on government information technology contracts. Some of the acquitted defendants represented themselves pro se at trial and may have earned jury sympathy for their efforts. And in June 2015, a U.K. jury also returned a verdict in favor of two defendants charged with price fixing and other per se illegal conduct in the galvanized steel tank industry because they had not behaved “dishonestly,” as then-proscribed (but no longer required) under the operative statute.

The two recent U.S. DOJ trials involving executives charged in connection with the coastal water freight transportation between the United States and Puerto Rico starkly demonstrate the risks associated with going to trial. The first defendant was convicted by a jury and sentenced by the court to a five-year jail sentence–the longest jail term imposed for a single antitrust count. That was followed on May 8, 2015, after hundreds of court filings and a jury trial spanning more than three weeks, by the acquittal of the last individual charged in this long-running investigation.

I. THE AMERICAS

A. UNITED STATES

1. Overview of U.S. Enforcement Trends

a. Criminal Fines & Other Monetary Assessments

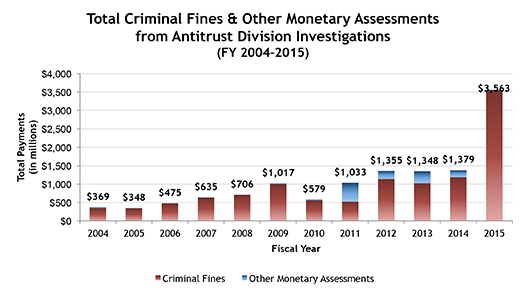

The U.S. Department of Justice Antitrust Division (DOJ or Antitrust Division) secured approximately $3.56 billion in criminal fines and monetary penalties thus far during Fiscal Year 2015, nearly three times the previous fiscal year’s record high of $1.38 billion.[3]

(*Through 6/30/2015)

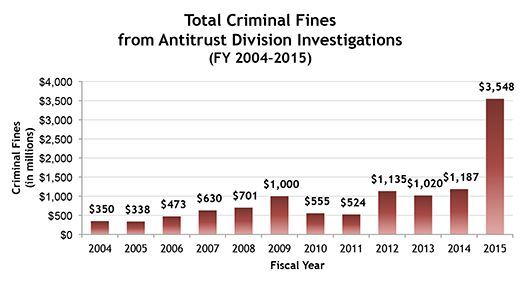

The Antitrust Division has obtained approximately $3.55 billion in criminal fines for violations of the Sherman Act–an all-time high even if no further fines are secured this fiscal year.

Roughly seventy-three percent of that total, or approximately $2.58 billion, resulted from the foreign exchange rate-related guilty pleas by Citicorp, Barclays, JP Morgan Chase, and Royal Bank of Scotland. The other fine that has made this year so exceptional was the $775 million that Deutsche Bank agreed to pay for its role in manipulating certain LIBOR transactions. Together, FX and LIBOR fines have totaled nearly ninety-five percent of the fines collected thus far this year. Disaggregating these fines, the DOJ obtained approximately $192.5 million in other matters.

(*Through 6/30/2015)

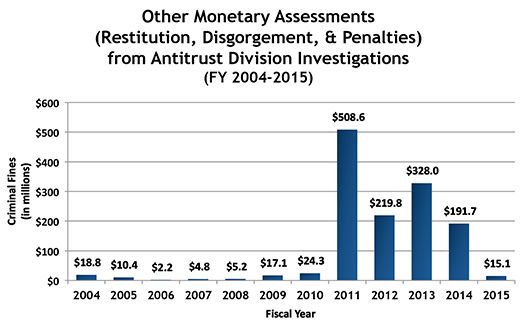

We assess the Antitrust Division’s approach to fines by considering all of its available monetary sanctions, including criminal fines, restitution, disgorgement, and penalties (for the reasons explained at length in our 2011 Year-End Criminal Antitrust Update). As the below chart illustrates, the Antitrust Division continues to embrace a broad range of prosecutorial tools such as non-prosecution agreements and multi-agency investigations. Accordingly, we believe this combined metric offers the most accurate gauge of U.S. enforcement activity.

(*Through 6/30/2015)

So far this year, the DOJ has obtained approximately $15.1 million in restitution, penalties, and disgorgement paid to federal agencies.[4] This marks a significant drop from recent years; it occurred in part because the DOJ sought and obtained traditional fine remedies in the plea agreements negotiated in its FX and LIBOR investigations. Still, taking a longer term view and for the mid-point of the year, the non-fine remedies remain substantial. And while less than last year, it still includes penalties of over $1 million for three separate companies.

(i) Criminal Fines

Nearly ninety-five percent of the criminal fines imposed thus far in FY 2015 came from guilty pleas associated with FX and LIBOR. In announcing the historic size of fines, the Antitrust Division cited the long-running and “egregious” nature of the conduct. Most of the other criminal fines result from the Antitrust Division’s long-running investigation into the automotive parts industry.

|

Criminal Fines of More than $1 Million for Sherman Act Violations Imposed or Agreed to During FY 2015 (October 2014–present) |

||

|

Company |

Investigation |

Criminal Fine |

|

Citicorp |

Foreign Exchange Rate |

$925,000,000 |

|

Deutsche Bank & DB Group Services (UK) Limited

|

LIBOR |

$775,000,000 |

|

Barclays PLC

|

Foreign Exchange Rate |

$710,000,000 |

|

JP Morgan Chase & Co. |

Foreign Exchange Rate |

$550,000,000 |

|

Royal Bank of Scotland plc

|

Foreign Exchange Rate |

$395,000,000 |

|

Nippon Yusen Kabushiki Kaisha (NYK) |

Roll On Roll Off Ocean Shipping |

$59,400,000 |

|

Robert Bosch GmbH |

Automotive Parts |

$57,800,000 |

|

Aisin Seiki Co. Ltd. |

Automotive Parts (variable valve timing devices) |

$35,800,000 |

|

Espar Inc. |

Automotive Parts (parking heaters) |

$14,900,000 |

|

Minebea Co. Ltd. |

Ball Bearings |

$13,500,000 |

|

Continental Automotive Electronics LLC and Continental Automotive Korea Ltd. |

Automotive Parts (instrument panel clusters) |

$4,000,000 |

|

Sanden Corp. |

Automotive Parts (air conditioning compressors) |

$3,200,000 |

|

Yamada Manufacturing Co. |

Automotive Parts (manual steering columns) |

$2,500,000 |

|

Hitachi Metals Ltd. |

Automotive Parts (brake hoses) |

$1,250,000 |

(ii) Monetary Assessments

As in past years, the Antitrust Division continued to secure non-fine monetary assessments.

|

Other Monetary Assessments of More than $1 Million from Antitrust Division Investigations During FY 2015 (October 2014-present) |

||

|

Company |

Investigation |

Monetary Assessment |

|

Coach USA Inc., City Sights LLC, and Twin America LLC |

New York City hop-on, hop-off bus tours |

$7,500,000 |

|

Flakeboard America Ltd and SerraPine |

MDF Mill Acquisition |

$4,995,000 |

|

Washington Gas Energy Systems |

Contract fraud |

$2,587,261 |

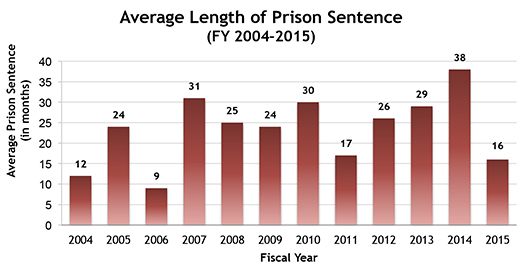

(iii) Prison Sentences

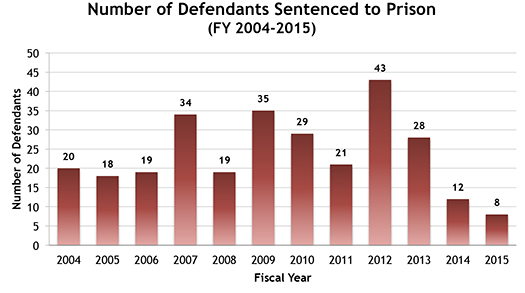

Thus far in FY 2015, the number and average length of prison sentences secured by the Antitrust Division have decreased. If this trend continues, it will represent an eight-year low for average prison sentence length.

(*Through 6/30/2015)

As for total days in prison imposed, eight defendants have been sentenced to serve 3,803 days in prison. All but one of these sentences was imposed on Japanese nationals in connection with the auto parts investigation. That may change in the second half of the year, if prison terms are entered for the scores of guilty pleas in connection with bid rigging of real estate auctions. Further, we may see individuals sentenced in the ongoing foreign exchange rate and LIBOR investigations.

(*Through 6/30/2015)

(*Through 6/30/2015)

2. Developments in International Investigations

a. Foreign Exchange Market

The U.S. DOJ’s investigation with respect to foreign exchange markets (“FX”) has dwarfed all other global anti-cartel law enforcement announcements in 2015. Since 2013, the DOJ has been engaged in a criminal investigation of suspected manipulation of certain FX markets.[5] On May 20, 2015, the DOJ announced, that as a result of the investigation, four major banks–Citicorp, JPMorgan Chase & Co., Barclays PLC, and The Royal Bank of Scotland plc–each agreed to plead guilty to a one-count felony charge of conspiring to fix prices and rig bids for U.S. dollars and euros exchanged in the FX spot market in the United States and elsewhere.[6] These parent-level guilty pleas by financial institutions are significant because parent-level pleas (rather than subsidiary-level pleas) in that industry are rare, having not happened in the United States in decades.[7] The sizes of the criminal fines imposed are also substantial: Citicorp agreed to pay $925 million, nearly double the largest antitrust fine previously imposed; Barclays agreed to pay $650 million; JPMorgan agreed to pay $550 million; and RBS agreed to pay $395 million. Prior to the imposition of these fines, the largest U.S. antitrust fine imposed was $500 million.[8]

Each of the financial institutions that acknowledged participation in the FX conduct agreed to a three-year corporate probation period. Although these financial institutions have resolved the investigations, it appears that the DOJ’s FX-related investigations are not complete, as DOJ may seek to charge individual traders for FX-related misconduct.

In addition to these antitrust and related penalties, Barclays PLC settled related charges by the U.S. Commodity Futures Trading Commission (CFTC) for attempted manipulation, false reporting, and aiding and abetting other banks’ attempts to manipulate FX markets.[9] According to the CFTC, the amount of the civil fine reflects in part that Barclays did not settle at an earlier stage of the investigation. As reported in our 2014 Year-End Criminal Antitrust and Competition Law Update, several other banks previously reached settlements with the CFTC in connection with the attempted manipulation of the FX markets.[10]

b. LIBOR and Other Global Benchmark Rates

The DOJ’s investigation of potential manipulation of global benchmark interest rates, including LIBOR and EURIBOR, also resulted in record level fines in 2015. In April, Deutsche Bank AG entered into a deferred prosecution agreement to settle claims with the DOJ, the New York State Department of Financial Services (DFS), the CFTC, and the U.K. Financial Conduct Authority (FCA) relating to the manipulation of LIBOR and another key benchmark rate.[11] To resolve the investigation, Deutsche Bank pleaded guilty to one count of wire fraud and one count of price fixing, and it also paid fines of $625 million to the DOJ, $600 million to the DFS, $800 million to the CFTC, and $344 million to the FCA.[12] The deferred prosecution agreement requires Deutsche Bank to retain an independent compliance monitor for a three-year term. As part of the investigation, Deutsche Bank’s wholly owned subsidiary, DB Group Services (UK) Limited, also pled guilty to one count of wire fraud in connection with its role in manipulating LIBOR and agreed to pay a $150 million fine. Taken together, these fines of more than $2.3 billion are the largest fines that any financial institution has paid in connection with the LIBOR investigations.

In addition, in May 2015, the DOJ determined in its sole discretion that the conduct UBS voluntarily reported concerning the FX markets breached the company’s December 2012 non-prosecution agreement resolving the LIBOR investigation.[13] As a result, UBS AG was required to plead guilty to one count of wire fraud relating to legacy conduct and to pay a $203 million criminal.

Like UBS, Barclays also had entered into a non-prosecution agreement in 2012 to resolve allegations relating to manipulation of LIBOR. Barclays admitted that its FX-related conduct violated a principal term of its non-prosecution agreement and it agreed to pay an additional $60 million criminal penalty based on that violation, but its non-prosecution agreement was not revoked.

The DOJ has also continued its pursuit of individuals in these investigations. In 2015, Anthony Allen and Anthony Conti, former British traders at Rabobank who were indicted in October 2014 on conspiracy and wire fraud charges in connection with an alleged scheme to manipulate USD and Yen LIBOR, pleaded not guilty to the charges in the U.S. District Court for the Southern District of New York and were released on bail pending trial. Allen, who was the first defendant charged by the DOJ in LIBOR-related cases to waive extradition, will stand trial with Conti, who later also waived extradition, in October 2015.[14] In addition, in March 2015, a federal magistrate judge rejected former UBS trader Roger Darin’s motion to dismiss the charge that he conspired to manipulate the Yen LIBOR.[15] In June 2015, Darin, a Swiss citizen who has not appeared in the United States to fight the charge, asked U.S. District Court Judge Paul Crotty to reverse the magistrate judge’s decision.[16] A decision is pending.

c. Auto Parts

The Division’s investigation into the auto parts industry continued unabated in this, its sixth year, resulting in more plea agreements with significant fines and prison sentences. In the first half of 2015, plea agreements or indictments involving individuals have outnumbered those involving corporations, as is customary at the tail end of investigations. Over 50% of the individuals carved out of the protections of their employers’ corporate plea agreements in the auto parts investigation have now been indicted by the Department of Justice or have agreed to plead guilty.

The Division began the year by announcing a plea agreement with Sanden Corporation on January 27, 2015 for its involvement in a conspiracy to fix prices of air conditioning systems sold to Nissan North America. Sanden agreed to pay a $3.2 million fine.[17] On March 12, 2015, the Division announced that Espar, Inc. had agreed to plead guilty to a conspiring to fix prices of parking heaters and would pay a $14.97 million fine. Espar, Inc. is a subsidiary of Eberspaecher Climate Control Systems International Beteiligungs-GmbH.[18] The Espar plea is the first involving parking heaters.

On March 31, 2015, the Division announced a plea agreement by Robert Bosch GmbH (“Bosch”); the German-based company is the world’s largest independent auto parts supplier. Bosch pleaded guilty to fixing prices of certain spark plugs, oxygen sensors, and starter motors, and agreed to pay a $57.8 million fine.[19] Yamada Manufacturing Co. agreed to plead guilty to a conspiracy to fix prices for manual steering columns on April 28, 2015. Yamada will pay a $2.5 million criminal fine.[20]

The Division also took significant actions against individual executives in the first half of 2015. On January 22, 2015, the Division announced the indictment of former Takata Corp. executive Hiromu Usuda. Usuda was the Group and Department Manager in Takata’s Customer Relations Division from January 2005 until at least February 2011, and was indicted for his alleged role in conspiring to fix prices of seatbelts.[21] The Division also indicted two former Mitsuba Corp. executives, Hiroyuki Komiya and Hirofumi Nakayama, on a two-count indictment alleging both conspiracy to fix prices and obstruction of justice.[22]

On April 23, 2015, the Division announced that it had reached an agreement with Takashi Toyokuni of Hitachi to plead guilty to conspiring to fix prices of alternators and starter motors. Toyokuni will serve 15 months in federal prison, pay a $20,000 criminal fine, and provide ongoing cooperation to the Division’s investigation.[23]

In May, the Division announced indictments of three additional executives. Michitaka Sakuma of T.RAD Co. Ltd., a former executive and member of the board of directors, was indicted for his alleged role in conspiring to fix prices of radiators.[24] The Division also indicted two executives of NSK Spark Plug, Norio Teranishi and Hisashi Nakanishi, for allegedly conspiring to fix prices regarding spark plugs, oxygen sensors, and air fuel ratio sensors.[25]

To date, the Division has charged 55 individuals in this investigation, and 35 companies have pleaded guilty or agreed to plead guilty and have agreed to pay a total of more than $2.5 billion in criminal fines. Although the Division’s investigation into the industry appears to be slowing, we anticipate that there will be further developments before the end of 2015.

d. TFT-LCD Panels

The first half of 2015 also marked noteworthy developments in the long-running proceeding brought by the Department of Justice against Taiwan-based AU Optronics Corporation, its U.S. subsidiary AU Optronics Corporation America, and certain company executives (AUO) regarding the scope and nature of AUO’s obligations under judicially-imposed monitorship, as well as the culmination of AUO’s attempts to obtain an appellate reversal of their conviction.

As detailed in previous Updates, the TFT-LCD case reflected a significant development in terms of the duration of probationary period required by the court and the imposition of a court-appointed monitor to oversee the companies’ compliance with the terms of probation. As previously noted, these heightened obligations were in large part based on AUO’s refusal to accept responsibility for what was viewed as egregious price fixing conduct. The import of these requirements–not just for the parties alone but the antitrust community at large–became evident once again this spring when the United States District Court for the Northern District of California, the trial court responsible for supervising the TFT-LCD case, issued a series of orders that called into question AUO’s ability to meet the terms of its probation.

On April 1, 2015, the district court ordered AUO to appear for a hearing to determine whether it had violated the condition of its probation obligating it to “develop, adopt, and implement, an effective compliance and ethics program.”[26] This order followed a report by the court-appointed monitor on AUO’s alleged non-compliance. The monitor’s report specifically criticized AUO for failing to meet certain milestones, but more critically, averred that AUO had improperly disregarded “basic compliance measures and recommendations…previously proposed by the monitor” and had “not proactively monitored the compliance program or responded to detected risks of non-compliance.” Shortly thereafter, the parties, the U.S. Probation Office, and the court-appointed monitor entered into an agreement to forego a hearing to address the alleged probation violation in exchange for a fifteen month extension to the probationary period, including the submission of additional compliance reports.[27] While the submissions by the parties contain very little discussion of the underlying facts and circumstances, the overall framework of the agreement suggests that AUO had significant difficulties in conforming its behavior to the monitor’s interpretation of terms of probation and that the monitor expected AUO to substantiate its compliance over the term of the extended probationary period.

This year also marked the end of the various AUO defendants’ attempts to obtain appellate reversal of their convictions.

At the close of 2014, AUO was also seeking en banc review of an adverse unanimous panel ruling on their Ninth Circuit appeal, which had affirmed their convictions, fines, and sentences. Although the Ninth Circuit denied the request for en banc review, the panel issued an amended opinion on January 30, 2015.[28] Leaving most of its prior opinion untouched, the three-judge panel made two substantive changes. First, it revised its discussion of differences between the TFT-LCD matter and the Court’s prior decision in Metro Industries v. Sammi Corp.[29] Previously, the panel had dismissed as unnecessary dicta Metro Industries‘ statement that the rule of reason should be applied to foreign conduct. In its revised opinion, the panel instead distinguished the facts of the AUO case from Metro Industries and reached the conclusion that the rule of reason statement in Metro Industries does not apply when part of the conduct and the effects of that conduct occurred in the United States.[30] Second, the panel addressed on the merits the “domestic effects” prong of the Foreign Trade Antitrust Improvements Act (“FTAIA”); specifically, whether AUO’s conduct was sufficiently “direct, substantial and reasonably foreseeable” with respect to the effect on United States commerce. The panel concluded that it was, reasoning that the “constellation of events that surrounded the conspiracy” led to the conclusion that the impact on the United States was “an immediate consequence” of the price fixing. The court also quoted the Seventh Circuit’s observation in Motorola Mobility LLC v. AU Optronics Corp. that the indirect-purchaser doctrine of Illinois Brick did not block the Department of Justice from seeking criminal remedies.[31]

The AUO defendants sought a writ of certiorari, relying in large part on an alleged split of appellate authority regarding the meaning of the FTAIA in connection with TFT-LCD cases. Specifically, as reported in our 2014 Year-End Criminal Antitrust and Competition Law Update, the U.S. Court of Appeals for the Seventh Circuit had issued an opinion in Motorola in which it held that Motorola could not maintain U.S. Sherman Act claims for the purchase abroad of allegedly price-fixed LCD panels by its foreign subsidiary because of the FTAIA’s limits on the application of U.S. antitrust law.[32] AUO argued that the different interpretations of the FTAIA by the two appellate courts–each in connection with the same underlying conduct–warranted review.[33] The DOJ opposed review, arguing that the two opinions were fully consistent because both courts recognized that conspiring to fix the prices of TFT-LCD panels to be sold for delivery to the United States fell within the FTAIA section 6a’s import-commerce exclusion.[34] Additionally, the DOJ argued that both circuits recognized that the price fixing of a component abroad can have a direct effect on U.S. commerce in finished products incorporating the price-fixed component–an effect for which the jury made a specific finding in the AUO case. Concurrently, Motorola sought review of the Seventh Circuit’s decision.

On June 15, 2015, the U.S. Supreme Court denied both petitions for writ of certiorari.[35]

e. Roll-On, Roll-Off Cargo

The ongoing investigation into price fixing and bid rigging in the international roll-on, roll-off ocean shipping industry (involving cargo such as cars, trucks, and agricultural equipment that can “roll” on and off of cargo ships without the need for containers) entered a new phase in the first half of 2015. Several firms–Nippon Yusen Kabushiki Kaisha (NYK), Kawasaki Kisen Kaisha, Ltd. (K-Line), and Compañía Sud American de Vapores, S.A.–pleaded guilty in 2014 to charges of price fixing and customer allocation for ocean shipping services and, to date, more than $135 million in fines have been levied.[36]

In early 2015, two K-Line executives pleaded guilty and were sentenced in conjunction with the investigation. The first executive to plead guilty in January 2015 was Hiroshige Tanioka, a K-Line assistant manager, team leader, and general manager. He received an 18-month prison term, and agreed to pay a $20,000 fine.[37] Mr. Tanioka admitted to participating in the conspiracy from at least as early as 1998, continuing through until at least April 2012, which was significantly longer than any of the other executives charged. One week later, Takashi Yamaguchi, a K-Line general manager and executive officer, pleaded guilty and received a 14-month prison term, along with a criminal fine of $20,000.[38] Toru Otuda, a K-Line general manager, also pleaded guilty in March 2015, and received an 18-month prison term, and a $20,000 criminal fine.[39]

In addition to the three K-Line executives, Susuma Tanaka, an NYK assistant manager, team leader, and general manager, pleaded guilty in March 2015 and received a 15-month prison term, and a $20,000 criminal fine.[40]

Notably, thus far all of the individuals charged have come from the two Japanese firms–NYK and K-Line–and none from Compañía Sud American de Vapores, which was the first firm to plead guilty in February 2014.

f. Precious Metals

As noted in our 2014 Year-End Criminal Antitrust and Competition Law Update, it has been reported that both the Criminal and Antitrust Divisions of the DOJ, as well as several other U.S. and global regulators and enforcers, are investigating potential manipulation of precious metals markets.[41] On February 23, 2015, HSBC confirmed certain of these reports, disclosing that it received a request for the production of documents relating to the DOJ’s criminal antitrust investigation into precious metals markets.[42] HSBC also reported that the CFTC issued a subpoena to HSBC USA seeking production of documents and information related to HSBC’s precious metals trading operations.[43] Similarly, in March 2015, Barclays disclosed that it has been providing information to the DOJ in connection with the DOJ’s criminal investigation into precious metals markets.[44]

g. Capacitors

As we reported in our 2014 updates, manufacturers of capacitors have reported receiving inquiries from enforcement authorities in Asia, Europe, and the U.S. regarding an investigation into possible collusion.[45] The investigations are being conducted by China’s National Development and Reform Commission, the U.S. DOJ, the Japanese Fair Trade Commission, the European Commission, the Korean Fair Trade Commission, and the Taiwan Fair Trade Commission. The investigations reportedly were prompted by leniency applications in the U.S. and other jurisdictions. Private treble damages lawsuits have been consolidated in a multi-district litigation proceeding in the U.S. District Court for the Northern District of California. According to statements made by the Antitrust Division in those civil proceedings, the investigation is ongoing. No pleas or indictments have been announced as of the date of this update.

3. Developments in Domestic Investigations

a. Municipal Bonds

The United States Court of Appeals for the Second Circuit, on June 4, 2015, upheld the convictions of Gary Heinz, Michael Welty, and Peter Ghavami after a jury in the Southern District of New York convicted them of conspiracy to commit wire fraud in the bidding process for municipal bonds while employed at UBS Financial Services, Inc., in violation of 18 U.S.C. §§ 371 and 1349 and, as to Heinz and Ghavami, wire fraud in violation of 18 U.S.C. § 1343.[46] On appeal from the conviction on those non-antitrust charges, the defendants argued that the District Court erred by denying their motion to dismiss the superseding indictment as time barred. The Second Circuit concluded that relevant charges were within the 10-year statute of limitations provided in 18 U.S.C. § 3293(2) for wire fraud offenses (including conspiracy to commit wire fraud) in which “the offense affects a financial institution,” because the charged conduct led UBS and two other banks to reach resolutions with the Department of Justice and other regulators in which the banks “admitted wrongdoing, accepted responsibility for the illegal conduct of certain former employees, and agreed to pay more than $500 million in fines and restitution to federal agencies and municipalities.”[47]

The U.S. District Court for the Western District of North Carolina on May 18, 2015, sentenced Phillip D. Murphy, the former managing director of Bank of America’s municipal derivatives group from 1998 to 2002, to a 26-month prison term.[48] As a result of the Antitrust Division’s municipal bonds investigation, Murphy had pleaded guilty on February 10, 2014, to non-antitrust charges of participation in a conspiracy and scheme to defraud related to bidding for contracts for the investment of municipal bond proceeds and other municipal finance contracts. The Government alleged that the conspiracy increased the number and profitability of particular investment agreements municipalities awarded to Bank of America.

b. Tax Lien Auctions

In March 2015, a New Jersey federal judge refused to dismiss the indictment against Gregg Gehring, an investor who allegedly conspired to manipulate the bidding process at auctions conducted by New Jersey municipalities for the sale of tax liens. Gehring claimed that an earlier order excluding time to accommodate discovery review from the 70-day speedy trial calculation violated his right to a speedy trial, and asked the court to dismiss his indictment. U.S. District Judge Susan Wigenton denied Gehring’s motion without an accompanying explanation.[49]

c. Real Estate Auctions

The Antitrust Division continued its aggressive push to root out bid rigging in public auctions for real estate foreclosures, tacking on more prosecutions following those discussed in our prior Updates.

Recent criminal enforcement efforts continue to focus primarily on foreclosure auction bid-rigging schemes in the Northern District of California, but have also continued in Georgia and North Carolina. Since January 2015, eight additional individuals have pleaded guilty or agreed to plead guilty for their roles in these bid-rigging schemes, and two individuals have been indicted.

In the Northern District of California, Mark Roemer and Bradley Roemer pleaded guilty to conspiring to rig foreclosure auctions and to commit mail fraud in Alameda County[50], while Chung Li “George” Cheng pleaded guilty to conspiring to rig foreclosure auctions and to commit mail fraud in both Alameda and Contra Costa Counties.[51] Wayne Lippman pleaded guilty to conspiring to rig foreclosure auctions in both Alameda and Contra Costa Counties. Each faces potential imprisonment and fines.[52] Most recently, on July 8, 2015, real estate investors John Shiells, of Danville, California, and Miguel De Sanz, of San Francisco, California, each pleaded guilty to three counts of bid rigging at foreclosure auctions, and three counts of mail fraud, in Alameda, Contra Costa, and San Francisco Counties. According to the DOJ, to date 56 individuals have pleaded guilty to criminal charges as a result of the Department’s aggressive investigation and prosecution of bid rigging and fraud at public foreclosure auctions in Northern California alone. Additionally, multicount indictments for bid rigging and fraud are pending against 19 individual real estate investors in the Northern District of California. Officials at both the FBI and the DOJ have indicated that they will continue in full force to investigate and prosecute individuals who engage in fraudulent bid rigging and other anticompetitive activities at foreclosure auctions.[53]

Also in the Northern District of California, Ramin Rad “Ray” Yeganeh, was indicted by a grand jury on June 26, 2015, for conspiring to rig foreclosure auctions in Alameda County, and his not guilty plea was subsequently accepted by U.S. Magistrate Judge Kandis Westmore. Prosecutors sought Mr. Yeganeh’s indictment when his lawyer announced his intention to plead not guilty, after first agreeing with prosecutors to plead guilty just one month prior.[54]

The government also intensified its efforts in Georgia in early 2015, obtaining guilty pleas from four individuals for their participation in bid-rigging conspiracies across the state. Mohammad Adeel Yoonas and Kevin Shin pleaded guilty to conspiring to rig foreclosure auctions and to commit mail fraud in Gwinnett County.[55] Eric Hulsman and David Wedean pleaded guilty to conspiring to rig foreclosure auctions and to commit mail fraud in Fulton and DeKalb Counties.[56] According to the DOJ, David Wedean’s prosecution marks the eighth of its kind in the state of Georgia.[57]

Additionally, in North Carolina, a federal grand jury indicted Rodney S. Daw for conspiracy to commit mail fraud as part of a scheme related to public real estate foreclosure auctions. The indictment accuses Daw of conspiring with others to make and receive payoffs from co-conspirators in exchange for agreements not to compete in public auctions, and to divert money away from homeowners, financial institutions and others with a legal interest in selected properties.[58] According to the DOJ, to date two individuals have pleaded guilty to criminal charges as a result of the Department’s ongoing investigation and prosecution of bid rigging and fraud at public foreclosure auctions in North Carolina.[59]

d. Coastal Water Freight Transportation

Legal proceedings continue in both district courts and courts of appeal in the DOJ’s long-running investigation of collusion with respect to coastal water freight transportation between the continental United States and Puerto Rico.

In January 2013, a jury in Puerto Rico convicted Frank Peake, former president of Sea Star Line. He was subsequently sentenced to five years in prison, the longest-ever sentence for an antitrust violation.[60] On March 2, 2015, the United States Court of Appeals for the First Circuit heard argument on Peake’s appeal, in which he argued that the DOJ unfairly appealed to the jury’s sympathy by emphasizing the alleged effect of the conspiracy on Puerto Rico’s economy. Peake also cited a number of other technical and procedural defects in the prosecution’s case.

Relatedly, on May 8, 2015, after hundreds of motions and briefs and a jury trial spanning more than three weeks, a jury in Puerto Rico acquitted Thomas Farmer of conspiracy charges for allegedly violating the Sherman Act in the same conspiracy. Specifically, the DOJ accused the former executive of Crowley Liner Services, along with others including Frank Peake, of conspiring to fix and maintain rates, allocate customers among them, and rig bids for freight services in order to suppress natural price fluctuations. The DOJ’s investigation concerning the price fixing conspiracy on ocean shipping routes between the United States and Puerto Rico resulted in Crowley, Sea Star Line and Horizon Lines paying more than $46 million in criminal fines.[61]

e. Posters

On April 6, 2015, a former executive of e-commerce company Art.com, David Topkins, agreed to plead guilty to one felony charge for fixing the prices of certain posters sold online through Amazon Marketplace in late 2013.[62] The case represents the DOJ’s first-ever criminal antitrust prosecution against a conspiracy specifically targeting e-commerce. The DOJ alleged that Topkins and his co-conspirators used commercially available algorithm-based pricing software to coordinate changes to their respective prices and wrote code that instructed the software to set prices in conformity with their agreement. Topkins agreed to plead guilty to violating the Sherman Act, pay a $20,000 fine, and cooperate with the ongoing investigation by the Department of Justice and the FBI. The identity of other co-conspirators and the potential impact of the conspiracy have not been disclosed.

f. Small Ball Bearings

In February, the Antitrust Division announced that it had reached an agreement with Minebea Co., Ltd. in which the company agreed to plead guilty for its role in conspiring to fix prices for small ball bearings and pay a $13.5 million criminal fine.[63] Small ball bearings are used in numerous products across several industries and serve to reduce friction between parts rolling past each other.

g. Government Contracts

In 2015, the DOJ continued to target potential antitrust violations in the context of government contracts. Such prosecutions remain an Antitrust Division priority and have uncovered a multitude of crimes, including non-antitrust violations.

For example, the DOJ recently indicted several independent contractors for conspiracy to eliminate competition for municipal school bus operator contracts in Puerto Rico.[64] The independent contractors allegedly rigged bids and strategically allocated the market for bus operator contracts . In addition to the antitrust violations, the conspirators were also indicted for various other crimes, including conspiracy to commit mail fraud.

In other cases, these investigations led to the discovery of other wrongdoing beyond the initial antitrust concerns. For example, while investigating bid rigging for government contracts in New York, a joint federal and state investigation uncovered a conspiracy to defraud the New York Power Authority (NYPA) on the part of the recipient of one of the NYPA’s contracts.[65] In this case, the owner of a construction service company who had won a contract with the NYPA ultimately pleaded guilty to submitting fraudulent payroll statements in order to receive unearned refunds from the NYPA. The individual has not yet been sentenced.

h. State Investigations

In Michigan, the State Attorney General settled with Chesapeake Energy Corp. regarding allegations that the company colluded with Encana Corp. to keep the price of natural gas leases in the state artificially low.[66] On April 24, 2015, Chesapeake agreed to pay $25 million and plead no contest to one count of criminal attempted antitrust violations and one count of false pretenses. The money will compensate landowners, and once claims are paid out, $5 million will be given to Michigan’s Department of Natural Resources and state antitrust enforcement activities.

4. Developments in the Antitrust Division

a. Speeches by Key Division Personnel

In the first half of 2015, officials at the Antitrust Division delivered a series of policy speeches that focused on the Division’s coordination with other enforcement agencies in domestic and international cartel investigations. Though consistent with past Division policies, the speeches signaled to businesses that their behavior across borders continues to be subject to vigorous scrutiny under the U.S. antitrust laws. At the same time, the speeches referenced measures that would provide the business community with greater clarity surrounding the Division’s enforcement objectives and reduce certain burdens on companies facing international investigations into alleged price fixing.

In a speech delivered at the New York State Bar Association Antitrust Law Section’s annual meeting[67], Deputy Assistant Attorney General Brent Snyder announced that even though the Antitrust Division has so far only challenged foreign cartels that involved at least some direct imports into the United States, in its view, cases can be brought on the basis of foreign component sales where there were no direct sales of a price-fixed product in the United States. If this approach is recognized by the courts, it could subject companies facing DOJ investigations to a more expansive view of what constitutes impermissible conduct under the antitrust laws as well as higher volumes of commerce for fine calculations. Snyder also asserted that the Foreign Trade Antitrust Improvements Act (“FTAIA”), which limits the reach of the U.S. antitrust laws to foreign conduct that distorts competition in a U.S. market, should not be interpreted in a way that impairs the Division’s ability to obtain criminal sanctions sufficiently severe to deter cartels that harm U.S. consumers. In his remarks, Snyder also confirmed that, when negotiating plea agreements, the Division has considered a company’s global sales in situations where there is a risk that the ordinarily-calculated penalty under the sentencing guidelines might significantly understate the harm to U.S. consumers. At the same time, Snyder acknowledged the risk of duplicative sanction under the increasingly robust global competition regime. Accordingly, Snyder said that international enforcers should avoid penalizing the same company for the same sales in multiple jurisdictions. In so doing, he cautioned that such an approach was discretionary and not compelled by the U.S. Sentencing Guidelines.

In the same speech, Snyder reaffirmed the protections that the DOJ’s leniency policy affords those who cooperate with the DOJ’s investigative efforts. While Snyder cautioned that the ringleader exclusion could apply under certain circumstances to deny leniency to organizers or ringleaders of cartels–if, for example, a company had significant market power and was the only player to take proactive steps to run a cartel or otherwise engages in acts of coercion as to other participants–he reemphasized the DOJ’s reluctance to deny leniency to a company that has voluntarily identified and implicated itself.

Assistant Attorney General Bill Baer delivered a speech at the Global Competition Review Fourth Annual Leaders Forum[68] in which he highlighted the Division’s engagement and coordination with other enforcement agencies as a “crucial” element of effective antitrust enforcement. He noted that the DOJ works with the FTC, state attorneys general, fellow enforcers from other jurisdictions, and international organizations such as the International Competition Network and the Organization for Economic Cooperation and Development to share best practices and engage in international antitrust enforcement. Baer also announced the Division’s intent to provide “meaningful, front-end guidance” to businesses about the Division’s enforcement priorities and current approach to antitrust analysis, revealing an effort to provide insight into the Division’s decision-making processes to allow businesses to compete vigorously without committing antitrust law violations.

Baer further signaled increased transparency surrounding the Antitrust Division’s enforcement goals and initiatives in remarks delivered before the Chatham House Conference on “Politicization of Competition Policy – Myth or Reality?”, in which he rearticulated the DOJ’s commitment to making antitrust enforcement decisions that are “fact-based, analytically sound, and legally grounded” and emphasized the importance of providing “actionable guidance to the broader business community” to instill confidence in corporate executives that they will receive a fair hearing before the antitrust enforcement agencies.[69]

In addition to recognizing that cooperation with other enforcement agencies aids the Division’s enforcement efforts, in a speech delivered at the Sixth Annual Chicago Forum on International Antitrust Issues at Northwestern University School of Law[70], Snyder advocated for antitrust enforcement agencies to synchronize numerous aspects of their investigations in order to limit the costs for companies to cooperate with worldwide cartel probes. Snyder suggested that antitrust enforcement agencies: (1) coordinate dawn raids and searches; (2) use predictive coding to be more strategic in document requests; (3) have each enforcer focus on the parts of the cartel that had effects within its own borders; (4) harmonize timetables and deadlines; and (5) coordinate the timing and location of witness interviews to limit the demands on witnesses whose testimony is needed in multiple jurisdictions. Snyder cautioned that the DOJ will not defer to other jurisdictions on sanctions, but said that enforcers should discuss how each jurisdiction plans to calculate fines to minimize the risk of overlap or double-counting and ensure a consistent approach across jurisdictions. Snyder noted that in certain investigations the DOJ has coordinated with other jurisdictions to take into account foreign fines imposed for the same conduct, and has occasionally credited fines issued by other jurisdictions that it believes address some of the harm the cartel caused in the U.S.

Additionally, Snyder said that when calculating fines, the Division has been willing to give companies credit for extraordinary efforts to put in place a compliance program and change a corporate culture that allowed a cartel offense to occur. He remarked, however, that “credit will require action and results, not just mere promises of future action.” Snyder also warned that companies should be careful about arguing that their participation in a global cartel stemmed from a rogue employee, saying that he has never seen that prove true in an investigation and that the DOJ will take “frivolous” rogue employee arguments into account when deciding whether a company is truly taking responsibility during the plea process. Finally, he cautioned that companies should be acutely aware that the DOJ will closely scrutinize the actions of senior executives when determining criminal penalties.

Despite the Division’s repeated pronouncements this year that it will continue to coordinate with other enforcement agencies, Snyder was careful to point out during remarks at the American Bar Association Antitrust Spring Meeting that U.S. prosecutors are not obligated to consider fines imposed by antitrust regulators in other jurisdictions when calculating their own criminal penalties.[71] He explained that the DOJ calculates fines using direct U.S. imports and it would be rare for the Division to impose a fine that excludes price-fixed products directly imported into the United States. He also noted that situations of true double-counting are rare. As Baer remarked separately during the Meeting, the largest criminal antitrust fines in the United States have been imposed on foreign companies because the U.S. calculates fines based on the volume of affected commerce, and international cartels “inevitably” affect large economies.[72]

b. Extradition for Targets of Antitrust Enforcement Actions

As discussed in more detail in the 2014 Year-End Criminal Antitrust Update, in 2014 the Antitrust Division of the DOJ successfully obtained extradition of two individuals. First, in April 2014, Italian citizen Romano Pisciotti was extradited from Germany to Florida for fixing prices on the sale of marine hoses, marking the first time that a foreign national was extradited to the U.S. solely for an antitrust offense.[73] Upon his extradition, Pisciotti pleaded guilty and was sentenced to serve a two-year prison sentence.[74] Then, in November 2014, the DOJ obtained the extradition of Canadian businessman John Bennett, who is charged in New Jersey with non-antitrust violations related to the Superfund kickback scheme.[75] Bennett arrived in New Jersey on November 14, 2014, and faces a maximum penalty of $250,000 and five years in prison for the fraud conspiracy. Bennett’s trial is currently scheduled for November 9, 2015, in Newark, New Jersey.[76]

So far in 2015, Assistant Attorney General of the Antitrust Division Bill Baer has spoken out about the DOJ’s intention to aggressively pursue extradition of foreign nationals for trial in the U.S. on antitrust charges. In a hearing before the Subcommittee on Regulatory Reform, Commercial and Antitrust Law on May 15, 2015, Baer stated that “[f]oreign nationals do not escape responsibility when they conspire to injure American consumers from afar. We prosecute foreign companies and their executives, and seek extradition of foreign nationals who attempt to evade the jurisdiction of the U.S. courts.”[77] That same day, in an interview with Law360, Baer highlighted that the use of Interpol Red Notices to arrest those seeking to evade charges by travelling abroad. This program, he explained, imposes a “real cost to not coming to grips with antitrust misconduct even if you’re a foreign national and even if the country in which you reside does not have an extradition treaty with the United States.”[78] According to Baer, this threat has “caused many individuals to agree to come to the United States, to plead guilty, to serve a sentence in a U.S. jail…because the costs of being a fugitive are very, very real.”

5. International Cooperation

The Antitrust Division continues to prioritize building and maintaining constructive relationships with foreign competition authorities and enforcement agencies. Assistant Attorney General Baer participated in numerous discussions around the world, signaling the Antitrust Division’s commitment to international collaboration.

The DOJ, along with 70 other jurisdictions, attended the annual International Competition Network (ICN) meeting held from April 28 to May 1, 2015 in Sydney, Australia. Assistant Attorney General Baer emphasized that “[c]ooperation with other jurisdictions makes our own enforcement stronger, particularly in a globalized economy where the number of companies operating in multiple jurisdictions continues to rise and there is a greater risk that anticompetitive transactions or conduct in one jurisdiction will harm consumers in other parts of the world.” The ICN was created in 2001 to encourage convergence towards best practices around the world.[79]

Notably, this year the DOJ co-chaired the Cartel Working Group (CWG) of the ICN together with the German Bundeskartellamt and the Netherlands Authority for Consumers and Markets (ACM). The CWG discussed investigative powers to fight international cartels and sanctioning international cartels in the context of multi-jurisdictional investigations. It also drafted a chapter of the Anti-Cartel Enforcement Manual on Cooperation with Procurement Agencies and updated the Anti-Cartel Enforcement Templates.[80]

On May 21, 2015, Baer met with the heads of antitrust agencies from Mexico and Canada in Mexico City to discuss antitrust enforcement cooperation in North America. These annual meetings are designed to facilitate policy dialogue between the North American countries. This year, the topics included discussions regarding the implementation of Mexico’s new competition law, enforcement priorities, and the use of technology. Baer spoke about the importance of anti-cartel enforcement at the public conference.[81]

The continuing international reach of the Antitrust Division’s prosecutorial efforts and ongoing cooperation between the DOJ and other federal agencies were also demonstrated in Baer’s remarks at a press conference in May announcing guilty pleas by multiple international institutions in the Department’s investigation into collusion affecting foreign exchange markets, at which he commended the ongoing cooperation in financial services cases between the DOJ and the Commodities Futures Trading Commission.[82]

B. CANADA

In a decision with wide ramifications for Canadian leniency applicants, an Ontario judge ruled in February that factual information disclosed to the Canadian Competition Bureau (CCB) by a company seeking to qualify for immunity or leniency was subject to disclosure to criminal defendants.[83] The decision came in the context of a longstanding investigation into price fixing in the chocolate market. Cadbury Canada and Hershey Canada contacted the CCB in 2007 and self-reported collusion in exchange for immunity and leniency agreements. In June 2013, the CCB announced charges against additional companies and individuals involved in the same alleged conspiracy.[84] Two, Cadbury and Hershey, argued that the government could not disclose certain documents because they were protected by settlement privilege arising from immunity and leniency negotiations. The court disagreed, finding that neither settlement privilege nor attorney-client privilege applied to factual information, although these protections could apply to legal opinions and information about the negotiations themselves. Moreover, the court found that even if a privilege did apply, the applicants had waived it by agreeing to provide information that they knew could be used in subsequent criminal proceedings. It is unclear whether this decision will alter the nature, quality or volume of information Canadian leniency applicants agree to provide, or whether it will dissuade future companies from doing so. To the extent that it is consistent with the procedural protections in the U.S. and Europe, for example, its implications may be more significant for domestic than international cartel matters.

Ongoing investigations into domestic collusion have continued to be a core focus of Canadian enforcement in the first half of this year, including new fines in long running matters and the announcement of new investigations. The CCB conducted dawn raids of over a dozen asphalt companies suspected of price fixing, market allocation, and bid-rigging in March.[85] In April, the Ontario-based fuel company Les Pétroles Global, Inc., was ordered to pay a $1 million fine for fixing the price of retail gasoline in Quebec.[86] The fines result from a long-running investigation of 39 individuals and 15 companies accused of price fixing between 2008 and 2012. Les Pétroles was one of the first to be charged by the Bureau in 2008 and was found guilty of price fixing in August 2013. To date, 33 individuals and 8 companies have pleaded or were found guilty, resulting in over $4 million in fines. Six of the individuals have received prison sentences.

The CCB suffered a defeat in April when a jury acquitted seven companies and several individuals charged with bid-rigging.[87] Specifically, the CCB charged several information technology companies with secretly coordinating bids for government contracts. That loss has not, however, hindered the CCB’s efforts to address unlawful collusion for government contracts. The CCB brought new charges in June against three companies and four individuals for allegedly rigging bids for water services in Quebec.[88] That investigation addresses bid-rigging activity that allegedly dates back to 2005, and was initiated following a 2011 leniency application. One company, Les Entreprises Paysagistes Gaspard Inc., has already pleaded guilty and has agreed to pay $117,000 for its role in the conspiracy.

In June, the CCB finalized its Corporate Compliance Programs Bulletin, which provides for a reduction in fines where a company has implemented a “credible and effective” compliance program.[89] Even if the compliance program fails to completely prevent improper conduct, its existence will be treated as a mitigating factor in determining penalties. Further, compliance policies implemented or strengthened after an offense occurs may also result in reduced fines, though to a lesser degree. The Bureau’s newly-created “Compliance Unit” will be responsible for reviewing the credibility and effectiveness of a company’s compliance program.

Finally, Canada and the United States continue to address extradition matters. A U.S. Magistrate Judge ruled in February that John Bennett, a Canadian citizen currently facing charges in the United States, would remain bound by his bail terms.[90] The first Canadian to have been extradited to the United States on antitrust charges, Bennett is currently confined to house arrest while awaiting trial for rigging environmental cleanup bids. As reported in our 2014 Year-End Criminal Antitrust and Competition Update, Bennett was charged in New Jersey for participating in a Superfund kickback scheme and extradited to the United States in November 2014.[91] He faces a maximum penalty of five years imprisonment and a $250,000 fine.

Meanwhile, Canadian authorities are not working to extradite John Cassandra, a U.S. resident charged with rigging bids for information technology services awarded by Library and Archives Canada.[92] Another individual implicated in the same conspiracy pleaded guilty in May, accepting a $23,000 fine and an 18-month conditional sentence.[93] Although the Canadian Commissioner of Competition announced last May that the CCB planned to proceed with Cassandra’s extradition, Canada’s Public Prosecution Service (PPSC) has not begun formal extradition procedures. If extradited, Cassandra would be the first person extradited to face antitrust charges in Canada.

C. BRAZIL

1. Preliminary Considerations

June has just ended and it is already safe to say that 2015 will be an eventful year in Brazilian cartel enforcement. More than half of the Commissioners and the General Superintendent were recently confirmed for crucial senior positions within Brazil’s Competition Authority, CADE (Conselho Administrativo de Defesa Econômica). CADE continues to partner with Brazilian prosecutors in the highly-publicized “Operation Car Wash” investigation involving suspected bid rigging and corruption relating to Petrobras contracts. News of the investigation has led to massive public demonstrations and has substantially raised the public profile of bid rigging conduct as well as of CADE and its leniency program.

The fines imposed by CADE during the first half of the year do not reach the historic record level of BRL 3.1 billion ($1.3 billion) imposed against cement producers in May 2014. Nevertheless, CADE sanctioned a number of companies and individuals in domestic and international cartel investigations, with many of the cases resolved through CADE’s recently adopted settlement system.[94] Notably, on July 3, CADE became the tenth competition authority, according to publicly available information, to open an investigation into suspected anticompetitive conduct involving the foreign exchange market.[95] Lastly, CADE also continues to test the limits of Brazilian antitrust law by bringing new cases and imposing fines based on “invitation to collude” theories. In the past six months, CADE brought its third invitation to collude case, and also imposed a fine on an entity based on an alleged attempt to collude.

2. Brazil’s President Proposes and Brazil’s Federal Senate

Confirms New Commissioners and General Superintendent

On June 2, 2015, a plenary session of Brazil’s Federal Senate confirmed the appointment of four new Commissioners and a new General Superintendent at CADE.[96] The new appointees had been designated for these positions by the President of the Republic, Ms. Dilma Rousseff, at the end of April.[97] The Federal Senate referred the names to the Presidency of the Republic to proceed with their formal designation. The Brazilian competition bar has been widely reported to welcome the new appointments.[98]

a. CADE’s New Commissioners

The Senate approved the appointment of João Paulo de Resende, Paulo Burnier da Silveira, Alexandre Cordeiro de Macedo and Cristiane Alkmin Junqueira Schmidt as Commissioners of CADE’s decision-making body, the Tribunal of Economic Defence (the “Tribunal”). The Tribunal is composed of seven Commissioners, including its President, each appointed for a term of four years. Its decisions are taken by majority vote.

Prior to his appointment, Mr. Burnier da Silveira led CADE’s international unit since 2011. Mr. Paulo Resende headed a unit in charge of public-private partnerships at the Brazilian Ministry for Planning since 2012. Mr. Cordeiro Macedo served as executive secretary of the Ministry of Cities and as an auditor at the Office of the Comptroller General. Ms. Alkim Junqueira Schmidt was an economist for Itaú, an asset management company. She holds a Ph.D. in Economics from the Postgraduate School of Economics of the Fundação Getúlio Vargas and worked in different positions at the Secretariat of Economic Affairs of the Ministry of Finance from 2000 to 2003, including the position of Deputy Secretary.

b. CADE’s New Superintendent

Eduardo Frade Rodrigues was confirmed by the Senate as CADE’s General Superintendent for a term of two years. The General Superintendence, which is CADE’s investigative arm, is led by a General Superintendent and two Deputy Superintendents. Since June 2014, Mr. Frade Rodrigues has been the Acting General Superintendent of CADE, where he had previously worked as Deputy Superintendent (2012-2014) and as an advisor to CADE’s Commissioners (2007-2011).

In a joint interview of Mr. Frade Rodrigues and Mr. Vinicius Marques de Carvalho, the President of CADE, Brazil’s top two antitrust enforcers hinted that the new appointments were unlikely to dramatically change Brazil’s enforcement priorities. Mr. Frade Rodrigues specifically included among CADE’s priorities strengthening Brazil’s leniency program, by “making the program […] more transparent and more predictable” and bolstering CADE’s ability to successfully discover and prosecute cartel cases without leniency applications.[99]

3. Statistics

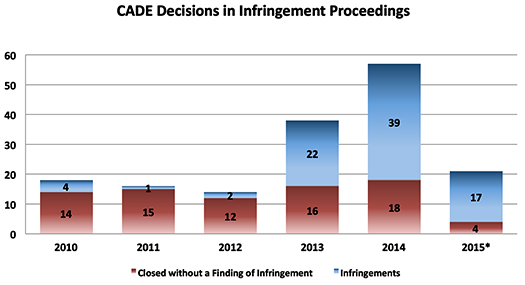

April 29, 2015 was the third anniversary of Brazil’s new Competition Act (Law no. 12.529/2011).[100] In recognition, in the following month CADE published consolidated statistics on its activities under the Competition Act (the “May 2015 Statistics”).[101] The May 2015 Statistics demonstrate that the new legislation has resulted in greater enforcement, with CADE issuing more than twice as many infringement decisions in the first half of 2015 alone than in the three years spanning 2010 through 2012.

According to the May 2015 Statistics, since the new law was adopted, CADE has issued decisions in 61 administrative infringement proceedings. Of these, 46 have resulted in formal findings of infringement, 40 of which concern cartelistic behavior.

(*Through 5/29/2015)

The May 2015 Statistics also show that the number of dawn raids carried out by CADE has doubled since the new law was implemented in May 2012. CADE carried out six dawn raids in the three-year period from 2009 to 2011 as compared with 11 under the new law.[102]

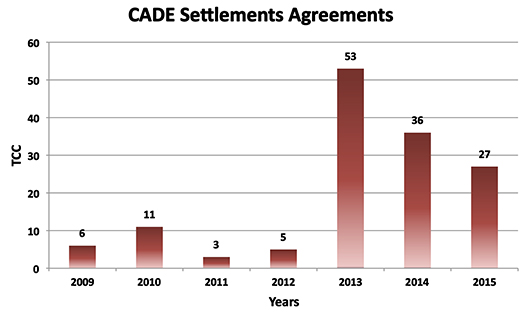

4. Settlement Agreements (TCCs)

As described in our 2013 Mid-Year Criminal Antitrust and Competition Law Update, in March 2013, CADE introduced new rules governing settlement procedures in antitrust investigations, known as Cease and Desist Agreements (Termo de Compromisso de Cessação de Prática or TCC).[103] Under the new procedures, parties to settlement agreements with CADE are required to admit to their participation in cartel conduct and collaborate with CADE’s investigation. According to the May 2015 Statistics, since implementation of the new Competition Act, CADE has entered into around 120 settlement agreements, collecting approximately BRL 438 million ($143 million) in the so-called “pecuniary contributions” (i.e., fines) to the Diffuse Rights Defense Fund.[104] CADE continues to see success in securing settlement agreements in 2015; it entered into 27 settlement agreements in the first five months of 2015, nearly equal to the 2014 total.

(*Through 5/29/2015)

Examples of settlement agreements entered into the first half of 2015 include:[105]

- On January 29, 2015, CADE settled with a hospital accused of jointly negotiating with health care plan operators to raise the prices charged for the provision of medical and hospital services. The hospital agreed to pay a fine of BRL 4 million ($1.3 million).[106]

- On February 11, 2015, CADE approved six settlements in three separate investigations: (i) tubes for colored displays for computer monitors (“CDT”); (ii) air and sea international services to and from Brazil and (iii) dynamic random access memory (“DRAM”).[107] In addition, CADE collected a total of BRL 53.1 million ($17.2 million) from the settling companies and individuals.

- On March 25, 2015, CADE approved three settlements in a cartel investigation in the Brazilian market for meters of consumption of residential, commercial, and industrial electricity. CADE collected a total of BRL 18.3 million ($ 6 million) from two settling equipment producers and one company executive.[108]

- On May 6, 2015, CADE signed separate settlements with two medical associations in an investigation relating to an alleged collective boycott of public hospitals and health insurance companies that did not adopt a scale of minimum prices for medical fees. The settling associations agreed to pay a fine and committed not to “carry out boycotts or withdrawals, nor to encourage their associates to quit jobs from public hospitals, nor to give up public examinations from medical positions”.[109]

5. CADE Continues To Push Legal Boundaries With “Invitation

to Collude” Cases

In an opinion published on April 17, 2015, CADE’s General Superintendence recommended to CADE’s Tribunal that a certain gas distributor be found guilty of an infringement for merely “influencing a uniform commercial behavior” in the market for distribution of liquefied petroleum gas in the state of São Paulo between 2010 and 2012.[110] According to the Superintendence, the distributor encouraged its competitors to adopt a minimum price for the distribution of certain sized containers, which in its view qualified as an illegal “invitation to cartelization.” The press release noted that this was CADE’s second investigation to lead to charges relating to an invitation to collude, following a 2010 decision imposing fines on a speedometer maker.

Later on June 10, 2015, CADE imposed a fine of BRL 350,000 ($113,352) on Brazil’s Federal Council for Auditing (Conselho Federal de Contabilidade), again based on the theory that it had tried to “influence the adoption of a uniform conduct.” CADE found the entity responsible for issuing a decision to its members (i) establishing general parameters for setting the price of audit services; and (ii) making it an ethical breach for auditors to ignore these parameters.[111]

CADE’s ability to sanction a unilateral invitation to collude using the provisions of the law applying to actual collusion has been criticized and will likely face a court challenge.[112]

6. Fines

CADE also issued a number of significant sanctions against companies and individuals.

On February 25, 2015, CADE imposed a total of BRL 13.5 million ($4.4 million) in fines on three companies, as well as against an individual, for their participation in the marine hose international cartel.[113] Members of the cartel were previously prosecuted in multiple jurisdictions, including the United States, European Union and United Kingdom. According to CADE, the collusion involved price fixing and market allocation between at least 1985 until 2007. According to the reporting Commissioner Mr. Márcio de Oliveira Júnior, the “estimated damage resulting from the cartel activities […] was at least BRL 40 million” ($13 million). The Tribunal also decided to close the cases (i) against an investigated company and four accused individuals due to insufficient evidence; and (ii) against two investigated entities and an individual as a result of the running of the statutes of limitation.[114]

On April 8, 2015, CADE imposed a total of BRL 19.6 million ($6.4 million) in fines on two companies and five of their executives for their participation in an alleged bid-rigging scheme targeting the public entity Basic Sanitation Company of the State of São Paulo. The fines imposed on the individuals were approximately BRL 1 million ($320,000). According to Reporting Commissioner Ms. Ana Frazão, one of the colluding companies deliberately missed a deadline established by SABESP, allowing the second colluding company to obtain a 23% premium when retained.[115]

On May 20, 2015, 27 gas stations and nine individuals were fined a total of BRL 65.7 million ($21.5 million) for their alleged collusion in the market for fuel in the metropolitan area of Vitória, in the Brazilian state of Espírito Santo. According to reporting Commissioner Mr. Márcio de Oliveira Júnior, CADE relied on information obtained from wiretaps showing employees agreeing to set the same or similar prices. In addition to the fines imposed, CADE announced its intention to recommend to the Brazilian tax authorities that tax incentives and subsidies be cancelled to the members of the cartel. The conduct in question is alleged to have taken place between 2006 and 2007, nearly eight years before CADE’s decision.[116]

In addition, CADE has also imposed a number of other fines during the first half of 2015. These appear to relate mainly, but not exclusively to the healthcare industry. CADE’s attention to the healthcare sector was highlighted in a June 30, 2015 study it published of its enforcement actions.[117] Fines imposed by CADE during the first half of 2015 include the following:

- A total of BRL 18,638,000 ($6 million) in fines were imposed on two hospitals for their alleged participation in a cartel in the market for hospital and health services in the D.F. (i.e., Brazilia).[118]

- Two associations and a union were fined a total of BRL 383,000 ($122,000) for allegedly fixing prices of medical and hospital services.[119]

- A total of BRL 14.6 million ($4.7 million) in fines for participating in a bid-rigging scheme on contracts for road maintenance and other services in the municipality of Jahu, São Paulo.[120]

- Five entities owning hospitals in the state of Bahía, along with a trade association for the hospitals and healthcare services in the state of Bahía and a trade union for hospital employees, were fined a total of BRL 10.9 million ($3.5 million) for their alleged participation in collusive conduct in the municipality of Feira de Santana.[121]

7. Petrobras

As reported in our 2014 Year-End Update on FCPA[122], on December 11, 2014, Brazilian prosecutors charged 36 individuals with bribery, money laundering, and cartel-related offenses arising out of their highly-publicized “Operação Lava Jato” or “Operation Car Wash” investigation.[123] Prosecutors allege that executives colluded to inflate the price of Petrobras contracts and channel kickbacks from Petrobras to Brazilian politicians and political parties, and have demanded the return of approximately 1.18 billion BRL (approximately $448 million).

The General Superintendence of CADE is coordinating with public prosecutors in conducting a parallel administrative investigation of the bid–rigging allegations. On March 20, 2015, CADE’s General Superintendence announced that it had entered into a leniency agreement with two companies of the Setal Group.[124] Notably, the agreement was also signed by the Federal Public Prosecutor’s Office in the state of Paraná. The investigation started by the Federal Prosecutor’s Office has been named “Operation Car Wash” (after the network of laundry mats and gas stations used to move illicit funds).[125] CADE also published a public document titled the “History of the Conduct,” which contains more details about the case: (i) summary description of the investigated conduct (ii) signatories of the leniency agreement; (iii) participants of the investigated conduct; (iv) competitors and clients in relation to the suspected conduct; (v) duration of the suspected conduct; (vi) detailed description of the conduct; (vii) documentary evidence in relation to the suspended conduct and (vii) acronyms and conclusions.[126] Although CADE expressly noted that the leniency applicant had voluntarily waived the confidentiality of the agreement and its annexes, a number of commentators have indicated that the information revealed by CADE may facilitate private damage claims and potentially jeopardize the effectiveness of Brazil’s leniency program.[127]