July 8, 2015

I. INTRODUCTION

There is no end in sight to the False Claims Act gold rush. After a record-setting 2014, which saw $5.7 billion in recoveries under the federal False Claims Act (FCA), 31 U.S.C. § 3729 et seq., 2015 looks to be another banner year. In just the first six months of 2015, the government and qui tam relators have racked up more than $1.96 billion in settlements and judgments, just off 2014’s record pace. Several of those settlements each approached or exceeded half a billion dollars, a sobering reminder of just how massive FCA liabilities can be for companies that do business with the government.

While these kinds of recoveries have become almost commonplace in the FCA arena, several of the largest recoveries in the first half of 2015 had the relatively unusual feature of coming from cases in which the government declined to intervene. That reflects a noticeable trend in recent years of increasing numbers of relators being willing to pursue cases in litigation without the government’s involvement. With 2013 and 2014 seeing record high numbers of new qui tam filings[1]–both in raw numbers and as a percentage of total new matters–we can expect a continuation of this trend and, likely, an upward trend of the number of recoveries coming from declined cases.

As in past years, the eye-popping recoveries in 2015 have been accompanied by fast-changing developments in the FCA legal landscape. Federal and state legislators, courts, and regulators continue to explore the boundaries of FCA liability. As those boundaries fluctuate, companies must keep a close eye on this continually evolving area of the law.

Perhaps the biggest FCA news of the past six months was the U.S. Supreme Court’s opinion in Kellogg Brown & Root Services, Inc. v. United States ex rel. Carter–the seventh time in the last ten years the Court has taken a look at questions under the FCA. In Carter, the Supreme Court considered whether the Wartime Suspension of Limitations Act (WSLA)–which suspends the statute of limitations for criminal FCA offenses during war time–also applies in the civil fraud context. The Supreme Court concluded that “[t]he text, structure, and history of the WSLA show that the Act applies only to criminal offenses.”[2] The Court also resolved a circuit split on the application of the so-called “first-to-file” bar, finding that it does not preclude a later-filed qui tam action if the prior suit has been dismissed.[3] Thus, both plaintiffs and defendants found something to like–and dislike–in the Court’s opinion. On balance, defendants won a reprieve from having to litigate claims unbounded in time, but they still face the prospect of having to repeatedly litigate similar claims, at least in some circumstances.

Lower appellate courts also continued to issue opinions that alter the legal landscape for companies staring down FCA suits. In just the first six months of 2015, a handful of cases from the federal courts of appeals explored some of the thorniest issues under the FCA, including when a claim is “material” for purposes of the FCA, and when an “implied certification” of compliance with statutory, regulatory, or contractual provisions can serve as the basis of FCA liability.

Congress, state legislatures, and regulators also continued to fix their sights on existing federal and state laws and regulations related to fraud, waste, and abuse of government funds during the first half of 2015. Indeed, legislative activity shows continued efforts to strengthen and expand liability under the FCA and similar state statutes. Meanwhile, regulators, including the Federal Housing Administration (FHA) and the Centers for Medicare and Medicaid Services (CMS), released new guidelines and proposals that, predictably, raise new FCA concerns for companies operating in those spaces.

We address these developments, and more, in depth below. As in years past, this mid-year alert first discusses legislative activity at the federal and state levels relating to the FCA. Next, we discuss important FCA settlements that have been announced during the first half of this year. And finally, we discuss important case law developments that have occurred during the last six months, including the Supreme Court’s recent decision. Gibson Dunn’s recent publications on the FCA, including more in-depth discussions of the FCA’s framework and operation along with practical guidance to help companies avoid or limit liability under the FCA, may be found on our website.

II. LEGISLATIVE ACTIVITY

Since our last update, there has been a variety of legislative activity, including new bills being introduced into Congress, old ones dying, and some other ones reappearing. Federal agencies like the FHA and CMS also have released guidelines and proposals related to the FCA. And at the state level, two additional states have passed or expanded state-based FCA-related laws and another passed a bill to allow for retroactive application. These developments are all discussed below.

A. Federal Activity

Over the last six months, previously introduced bills, like the Fairness in Health Care Claims, Guidance, and Investigations Act (H.R. 2931) and the Medicaid Physician Self-Referral Act of 2014 (H.R. 4676), which would have changed the application of the federal FCA, died in Congress.[4] But several new and renewed initiatives relating to regulation of government funds have appeared on the radar, both in Congress and from agencies, during this time as well.

- On February 25, 2015, Rep. Jim McDermott (D-WA) reintroduced a bill that proposes to ensure that the Physician Self-Referral Law, also known as the Stark Law, applies to claims for Medicaid-designated services.[5] This new proposed bill, the Medicaid Physician Self-Referral Act of 2015 (H.R.1083), follows its unsuccessful predecessor, the Medicaid Physician Self-Referral Act of 2014 (H.R. 4676). As the law currently stands, the Stark Law’s prohibition on certain referrals (or “kickbacks”) unequivocally applies to Medicare-designated health services, but its applicability to Medicaid-designated services has been less clear.[6] Since the Stark Law can lead to FCA liability, this legislation, if passed, could lead to increased FCA exposure for health care companies that receive Medicaid payments. H.R. 1083 was referred to the Subcommittee of Health on February 27, 2015.[7]

- In May 2015, the FHA released guidelines to clarify requirements for lenders that offer FHA loans.[8] These government-backed loans are insured by the FHA and often feature lower interest rates and less stringent qualification requirements, making them both attractive and easier to obtain for borrowers. Lenders, however, face certain hurdles when making an FHA loan. With each FHA loan a lender originates, the lender certifies the accuracy of the information on which it relied and that the mortgage is eligible for FHA insurance. In circumstances where the loan is manually underwritten, the lender also has to certify that the underwriter personally reviewed the application and any associated documents used in the due diligence process. When mistakes in these certifications allegedly have been found, the United States Department of Housing and Urban Development (HUD) and the Department of Justice (DOJ) have sometimes pursued damages under the FCA against originators or others. The proposed guidelines from the FHA for the certifications come on the heels of several settlements arising from these pursuits, and could provide needed clarity to the banking industry as to what the certifications require. However, the guidelines still have to undergo a period of review, during which stakeholders can share input on the changes. A final version is expected to be released in the late summer.[9]

- On May 26, 2015, CMS released a broad proposal on Medicaid and the Children’s Health Insurance Program (CHIP).[10] Among the suggested changes is a recommendation that Medicaid-managed plans be held to at least an 85% medical loss ratio (MLR) standard, so that at least 85% of the managed care entity’s revenue is directed to patient care rather than to administrative costs or profit. This proposal for a national standard offers states options, including mandating the minimum MLR of 85% with a corresponding repayment option (i.e., financial penalties). Should a state decide to mandate a minimum Medicaid MLR standard, it is able to set the minimum MLR percentage within the state so long as it is at least 85%. For states that choose to require repayment if a managed care entity’s Medicaid MLR is below a minimum, the proposed rule requires that the federal government receive its share of any remittances that are returned. This proposal is currently being circulated for comments, which are due by July 27, 2015.[11] Should it be implemented, managed care entities that fail to accurately report their Medicaid MLR or fail to pay any MLR penalties owed to the government may be subject to federal or state FCA risk.

- On June 30, 2015, the Department of Health and Human Services’ Office of Inspector General (HHS OIG) announced the formation of a new affirmative litigation team that will focus exclusively on pursuing civil monetary penalties and exclusions in connection with Medicare and Medicaid fraud. The new “Administrative and Civil Remedies Branch” will give the HHS OIG double the number of dedicated litigators to bring cases under the civil health care laws, and the team will be looking to FCA cases as sources of potential enforcement actions. The announcement is a harbinger of increased enforcement activities by the HHS OIG and a reminder of the varied parallel actions that can grow out of a qui tam filing or other FCA actions.[12]

- Although not directly related to the FCA, another interesting development is that the Senate approved the Motor Vehicle Safety Whistleblower Act (S. 304) on April 28, 2015.[13] The purpose of this legislation is to extend rights and protections to whistleblowers in the field of auto safety. Among other things, the bill would grant the United States Secretary of Transportation discretion to allocate up to 30% of any monetary sanctions resulting from Department of Transportation or DOJ enforcement actions, so long as they exceed $1 million, to the originating whistleblower.[14] Unlike the FCA, this Act requires whistleblowers in most circumstances to report the information internally before divulging it to the federal government.[15] This Act certainly could open the door to more litigation risk for auto manufacturers. The bill now goes to the House, where it was referred to the Energy and Commerce Committee’s Subcommittee on Commerce, Manufacturing and Trade.[16]

Finally, in February of this year, a bipartisan group of senators launched the Whistleblower Protection Caucus to raise awareness of the need for adequate protections against retaliation for private sector and government employees who call attention to alleged wrongdoing.[17] The caucus is meant to foster bipartisan discussion on legislative issues affecting the treatment of whistleblowers and serve as a clearinghouse for current information on any whistleblower developments in the Senate.[18] The caucus is led by Sen. Chuck Grassley (R-Iowa), with Sen. Ron Wyden (D-Ore.) serving as vice chairman. The other caucus members include senators Ron Johnson (R-Wis.), Mark Kirk (R-Ill.), Deb Fischer, (R-Neb.), Thom Tillis (R-N.C.), Barbara Boxer (D-Cal.), Claire McCaskill (D-Mo.), Tammy Baldwin (D-Wis.), and Edward Markey (D-Mass.).[19]

B. State Activity

As predicted in the 2014 Year-End Update, state legislative activity continued during the first half of 2015, with two states passing FCA legislation and another two proposing bills related to their states’ false claims acts. However, the HHS OIG has yet to determine whether these state FCA laws are “at least as effective” as the federal FCA, as required by the Federal Deficit Reduction Act (DRA) for the states to receive the financial incentives set by that Act.

- On May 12, 2015, Maryland Governor Larry Hogan signed into law a bill expanding the Maryland False Claims Act (MFCA) to include any claims made to state or local government.[20] This law has a much broader scope than its predecessor, which was limited to Medicaid and other healthcare-related fraud. However, despite increasing protections for whistleblowers, the MFCA still does not allow for qui tam relators to continue litigation if the government decides not to intervene. This legislation took effect on June 1, 2015, but the HHS OIG has yet to announce any determination as to whether the MFCA complies with the DRA requirements.

- A few days later, on May 18, 2015, Vermont Governor Peter Shumlin signed into law H. 120, a state false claims act that largely mirrors the federal FCA.[21] Like the federal law, the Vermont False Claims Act imposes harsh penalties for submitting a false or fraudulent claim for payment of public funds, and contains a qui tam whistleblower provision.[22] It also features a retroactivity clause that permits suits that relate to fraud occurring up to 10 years before the law’s passage, but this will not take effect until March 15, 2016.[23] The enactment of this law followed the Vermont Medicaid fraud unit’s collection of $23.5 million in settlements between 2010 and 2014.[24] Had the state false claims act been enacted earlier, Vermont may have received a greater amount as part of these settlements. As with Maryland’s amendment, the HHG OIG has yet to announce any determination as to whether Vermont’s FCA complies with the DRA requirements.

- In New Jersey, the New Jersey General Assembly passed a bill on May 14, 2015 that allows for the retroactive application of its false claims act.[25] The bill passed on a vote of 42 to 27, passing with one more vote than the minimum necessary.[26] It was received in the Senate and referred to the Senate Judiciary Committee on May 18, 2015.[27] This bill is identical to S-2645, which we discussed in the 2014 Year-End Update.[28]

- New York Attorney General Eric Schneiderman announced in February that he would propose a bill to protect and reward employees who provide information about fraudulent or illegal activity in the banking, insurance, and financial services industries.[29] The Financial Frauds Whistleblower Act would provide compensation to whistleblowers who voluntarily report fraud and whose tips lead to penalties that exceed $1 million.[30] In addition, it would protect whistleblowers by ensuring the confidentiality of shared information and their identity, and by providing explicit legal protection from employer retaliation.[31] New York has its own version of the FCA, which, as we mentioned in the 2014 Mid-Year Update, was last amended in 2013 and deemed to be compliant with DRA requirements by the HHS OIG.[32]

To follow up on several items mentioned in previous updates:

- HHG OIG has yet to announce whether Wyoming‘s FCA, which the state enacted in 2013, complies with DRA requirements.

- As noted in the 2014 Year-End Update, the North Dakota legislature commissioned a study of the use of qui tam actions in other states.[33] Findings and recommendations have yet to be presented, but the resolution directed that findings and recommendations be presented to the 64th Legislative Assembly, so this may be expected in the near future.

- In South Carolina, the reintroduction of a bill to enact the “South Carolina False Claims Act” (S.B. 223) was referred to the Committee on Judiciary in January.[34]

III. NOTEWORTHY SETTLEMENTS AND JUDGMENTS DURING THE FIRST HALF OF 2015

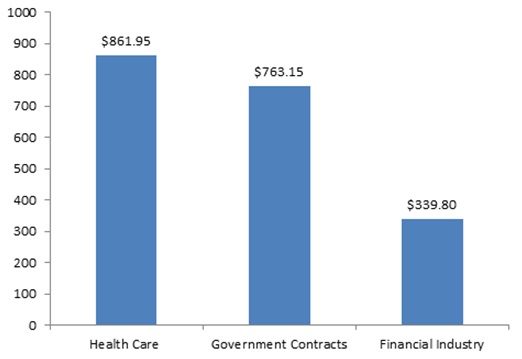

For six years now, total FCA recoveries have exceeded $3 billion per year. And 2015 looks likely to continue that trend. Indeed, the government and qui tam relators have already racked up more than $1.96 billion in settlements and judgments during the first half of the year, just off the mid-year mark we reported during the record-setting year of 2014. Consistent with long-term trends, the health care industry and government contractors contributed the majority of this amount, though several large settlements from the financial sector contributed to the government’s first-half haul, as enforcement actions arising from the mortgage crisis of recent years were still being resolved.

FCA Recoveries by Industry Announced in First Half of 2015 (in millions)

Of note, two of the largest resolutions in the first half of 2015 came in cases where the government declined to intervene in the FCA suit. In fact, qui tam relators scored two of the historically largest FCA payments–approximately $500 million each–in cases where the government did not intervene, a sign of the potential FCA risks even when the government stays on the sidelines. We discuss these and other notable settlements from the past six months below.

A. Federal Settlements

1. Health Care

By volume and dollar value, health care matters were the largest contributors to FCA recoveries in the first half of 2015.

- On January 9, 2015, a New Jersey-based global pharmaceutical company agreed to pay $39 million to settle claims that it paid kickbacks to entice physicians to prescribe certain drugs produced by the company. The whistleblower in the case, one of the company’s former sales representatives, will receive $6.1 million from the government’s recovery.[35]

- On February 2, 2015, a Tennessee-based community health systems company and three affiliated New Mexico hospitals agreed to pay $75 million to settle claims that the hospitals made illicit donations to three county governments. The DOJ alleged that the local governments used these donations to illegally fund New Mexico’s share of Medicaid payments. The case began with a qui tam suit filed by a former revenue manager with the community health company; that relator will receive slightly more than $18.6 million from the settlement proceeds.[36]

- On February 6, 2015, several hospice companies providing services in Oklahoma, Missouri, Kansas, and Texas agreed to pay $4 million to settle claims that the companies submitted false claims to federal health care programs. The case began with a qui tam suit filed by two former employees who will receive a $680,000 share of the settlement.[37]

- On February 6, 2015, a Minnesota-based medical technology and device manufacturer agreed to pay $2.8 million to settle claims that it knowingly caused dozens of doctors from around the country to submit false claims to Medicare and TRICARE. The government alleged that the company promoted an unapproved electrical impulse pain relief procedure to physicians through on-site training programs. The whistleblower in the case, a former sales representative with the company, will receive $602,000 from the settlement proceeds.[38]

- On February 10, 2015, an Iowa-based home health care company agreed to pay $5.63 million to settle allegations that the company submitted false billings to Medicare and Medicaid programs. Between 2009 and 2014, the company allegedly failed to document independent physician assessments of the medical necessity of each patient’s care as required by law. As part of the settlement, the State of Iowa will receive a $2.32 million share of the government’s recovery.[39]

- On February 11, 2015, a Delaware-based pharmaceutical manufacturer agreed to pay $7.9 million to settle claims that the manufacturer engaged in a kickback scheme with a pharmacy benefit manager company. The manufacturer allegedly provided remunerations to the benefit manager in exchange for its agreement to maintain the “sole and exclusive” status of one of the manufacturer’s drugs on certain formularies and through some of the company’s other related marketing activities. The case began as a qui tam suit filed by two former employees who will collectively receive $1,422,000 out of the settlement proceeds.[40] On May 20, 2015, the pharmacy benefit manager resolved related claims against it, agreeing to a settlement for the same amount as the pharmaceutical manufacturer.[41]

- On February 13, 2015, an Illinois physician pleaded guilty to allegations that he received illegal kickbacks for prescribing a generic anti-psychotic drug and agreed to pay $3.79 million to settle a parallel civil lawsuit alleging that he caused the submission of false claims for thousands of patients in Chicago-area facilities. The companies that allegedly compensated the physician in the scheme paid the United States and the State of Illinois $27.6 million back in March of 2014 to settle allegations that they violated both the Illinois and federal False Claims Acts.[42]

- On February 18, 2015, a federal district court judge approved a settlement requiring two hospice companies to pay the United States nearly $5 million and the State of New York $1.68 million. As part of the agreement, one hospice company–a subsidiary of the other–accepted responsibility for, among other things, its alleged failure to provide adequate care and to maintain adequate records. Both companies further agreed to enter into a corporate integrity agreement with the HHS OIG that will span five years.[43]

- On March 2, 2015, a California-based patient safety consultant agreed to pay $1 million to settle claims that he solicited and accepted kickbacks as the head of a consulting company and research organization. The government alleged that the consultant accepted monthly payments from a company while he served as a co-chair of a committee that reviewed, endorsed, and recommended certain health care practices. As part of the settlement, the consultant and his businesses will be excluded in the future from participating in all federal health programs.[44]

- On March 19, 2015, a Pennsylvania-based heart monitoring company agreed to pay $6.4 million to settle claims that its subsidiary overbilled federal health programs for unnecessary cardiac monitoring services. The government alleged that the company knew it could not receive reimbursements for the services at issue when patients had only mild heart palpitations. According to the government, the company billed for the more expensive procedure while providing inaccurate diagnostic codes to cover up the true conditions of the patients it treated.[45]

- On March 19, 2015, a health care corporation agreed to pay roughly $5.4 million to settle allegations that it provided radiation oncology services to Medicare and TRICARE patients without the required supervision of a qualified medical professional. The case against the corporation began as a qui tam suit brought by a radiation oncologist who was a former employee of a radiation oncology group. The oncologist will receive slightly more than $1 million out of the settlement proceeds. This settlement only partially resolves the government’s case against the health care corporation.[46]

- On March 31, 2015, an Ohio-based health systems company agreed to pay $10 million to resolve allegations that it signed sham management agreements with two physicians groups to induce referrals to the company. The government alleged that the company violated both the Anti-Kickback Statute and Stark Law by engaging in these financial relationships with the doctors.[47]

- On April 2, 2015, a medical products manufacturer and two affiliated companies agreed to pay $4.41 million to settle claims that the companies made false statements to government agencies about the origins of their products. Under the Trade Agreements Act of 1979 (TAA), companies that sell products to the United States must manufacture them within the United States or in another country designated by the law. The government contended that while the manufacturer said its products complied with the TAA, the company actually produced its products in China and Malaysia–two countries prohibited under the TAA. The three whistleblowers in the case will receive a total of roughly $750,000 from the settlement.[48]

- On April 9, 2015, a Virginia-based laboratory agreed to pay $47 million and a California-based laboratory agreed to pay $1.5 million to settle allegations that the labs paid remuneration to doctors in exchange for their referrals and for billing for unnecessary procedures. According to the government, the two laboratories, along with a third lab, routinely waived patient co-pays and deductibles and paid doctors a “processing and handling fee” of between $10 and $17 per referral for blood testing. The case began as three related qui tam actions filed by four individuals, and both laboratories agreed to enter separate corporate integrity agreements as part of the settlement.[49]

- On April 21, 2015, a Texas-based, county-owned hospital agreed to pay $21.75 million to settle claims that it illegally took referrals into account when paying doctors their bonuses. According to the government, the hospital also allegedly paid certain cardiologists more than fair market value for their services in exchange for referrals. The case against the hospital began as a qui tam suit filed by three individuals who will collectively receive $5,981,250 out of the settlement proceeds.[50]

- On April 21, 2015, a dermatology company that owned and operated a laboratory in Georgia, as well as numerous dermatology practices, agreed to pay approximately $3.3 million to settle claims that it violated the Stark Law as well as the FCA. The case against the company began as three separate qui tam lawsuits filed by three individuals who will collectively receive more than $584,000 from the settlement.[51]

- On April 27, 2015, a Georgia hospital agreed to pay $20 million to settle claims that it overbilled federal health care programs. The government alleged that between 2004 and 2008, the hospital provided outpatient or observation services while routinely billing Medicare for more expensive inpatient services. As part of the settlement, the hospital will enter into a five-year corporate integrity agreement with the HHS OIG.[52]

- On May 7, 2015, sixteen separate hospitals and their respective parent companies agreed to collectively pay $15.69 million to settle claims that the hospitals billed Medicare for unnecessary services. The whistleblower in the case will receive $2,667,300 from the settlement.[53]

- On May 4, 2015, a national kidney-dialysis company announced in public filings that it had set aside $495 million to settle a seven-year old whistleblower suit under the FCA.[54] Notably, the government did not intervene in the suit, making the settlement one of the largest ever without government intervention.[55] The parties have yet to finalize the settlement, pending approval by the Deputy Attorney General, but they expect to finalize the resolution by early July.[56]

- On May 8, 2015, nine Jacksonville, Florida hospitals and one ambulance company agreed to pay $7.5 million to settle allegations that they billed for allegedly unnecessary basic life support and nonemergency transports. The case against all 10 entities began as a qui tam lawsuit by a former employee of the ambulance company who will receive $1.2 million out of the settlement proceeds. Despite this settlement with the hospitals and ambulance company, the government did not reach a settlement with one additional ambulance company it is investigating. The DOJ intends to pursue a case against that business.[57]

- On May 14, 2015, a pharmacy agreed to pay $31.5 million to settle claims that it fraudulently billed Medicare for Schedule II controlled drugs it allegedly distributed without a valid prescription. The pharmacy will pay $23.5 million out of the total settlement amount to resolve alleged FCA violations. The case began as a qui tam suit filed by a former pharmacist employee who will receive $4.3 million out of the settlement proceeds.[58]

- On May 14, 2015, a district court judge approved a settlement requiring a New York medical center to pay $18.8 million to resolve claims that it submitted false claims to Medicare, as well as engaging in other alleged wrongdoing. According to the government, between 2000 and 2007, the medical center maintained an illicit financial relationship with a cardiology practice by paying the cardiologist practice to open a new practice with the purpose of referring patients to the center.[59]

- On May 27, 2015, a medical equipment supplier and its partial successor agreed to pay $7.5 million to settle claims that the supplier’s sales representatives knowingly altered prescriptions and other documents to receive federal health care funds. The case began as a qui tam suit filed by two former employees of the supplier; they will receive $1.5 million out of the settlement proceeds. The whistleblowers’ case also features a claim against the supplier’s former vice president that remains ongoing. The United States has intervened in that proceeding as well.[60]

- On June 1, 2015, a Florida-based pharmacy and doctor agreed to pay $3.8 million to settle claims that the doctor impermissibly sent hundreds of prescriptions to the pharmacy. Because the doctor and a senior vice president at the pharmacy were married at the time the doctor sent over the prescriptions, the government contended that the pharmacy billed federal health care programs for prescriptions allegedly stemming from an improper referral source. The case started after government investigators mined health care reimbursement data and discovered that the pharmacy was the top biller of compounding pain medications.[61]

2. Financial Industry

After several years of record-setting, multi-billion dollar settlements from companies in the financial sector, the first half of 2015 was relatively tame. But there were still several notable settlements as banks and mortgage companies unwind suits arising from the financial crisis.

- On February 25, 2015, a mortgage finance company agreed to pay $123.5 million to settle allegations that the company created mortgage loans insured by the government that did not meet federal requirements. The company allegedly knew many of its loans were ineligible for Federal Housing Administration (FHA) insurance. Yet, according to the government, the company chose to only partially comply with federal laws requiring the company to self-report violations of FHA requirements to the government.[62]

- On June 1, 2015, a Tennessee-based bank agreed to pay $212.5 million to settle claims that it knowingly created deficient federally insured mortgage loans. The company allegedly ignored FHA origination, underwriting, and quality control requirements.[63]

- On March 12, 2015, a Miami-based lender and financial services company agreed to pay $3.8 million to settle allegations that the company made false statements to the government to secure loan guarantees. The case against the company began as a qui tam suit filed by a former owner of one of the companies obtaining one of these loans, as well as by a former attorney for that company. The two whistleblowers will receive $608,000 from the settlement proceeds.[64]

3. Procurement and Government Contractors

Government contractors have long been in the crosshairs of government regulators and the plaintiff’s bar. This year is no exception, with several notable settlements from the procurement and government-contracting realm.

- On March 23, 2015, a California-based insurance company agreed to pay $44 million to settle claims that the company knowingly issued ineligible insurance policies under a federal crop insurance program. Between 1999 and 2002, the company participated in a federal program wherein the company sold and serviced crop insurance policies that were reinsured by the government. During that time, the company allegedly forged farmers’ signatures, whited out dates, and signed documents late, among other allegedly illegal behavior.[65]

- On April 9, 2015, a wireless telecommunications company agreed to pay $15.5 million to resolve allegations that it overbilled the federal government for costs it incurred executing court-issued wiretaps, pen registers, and “trap devices.” By statute, telecommunications companies are permitted to recover those costs from the government, but the company allegedly included unallowable network infrastructure costs in its reimbursement requests.[66]

- On May 19, 2015, a delivery service company agreed to pay $25 million to settle allegations that it concealed its failure to comply with its overnight service contracts for state and federal government packages. The company allegedly recorded inaccurate delivery times and engaged in other fraudulent actions to prevent its government customers from learning when the business had actually delivered the parcels. The case began as a qui tam action filed by a former employee of the company who will receive $3.75 million out of the company’s settlement with the government.[67]

- On June 9, 2015, a federal judge in Texas issued a $663 million judgment against a guardrail manufacturer accused of producing faulty products. Pursuant to the FCA’s treble damages provisions, the final judgment tripled the $175 million verdict originally handed down by a jury last fall and added another $138 million in civil penalties. The whistleblower in the case, a former competitor of the business, alleged that he discovered that the company made changes to its guardrails without notifying federal regulators. The former competitor will receive approximately $200 million out of the judgment proceeds. The government chose not to intervene in the case.[68]

B. State Settlements

Individual states’ FCA enforcement activities also continued apace this year. Although there were not any especially large state settlements, the states continued their steady and aggressive enforcement of state and federal false claims laws.

- On January 16, 2015, a community health center agreed to pay $3.35 million to the State of Washington to settle claims that it overbilled Medicaid for thousands of dental appointments. The Washington Attorney General contended that between 2010 and 2014, the health center billed fluoride treatment, which can be performed by an assistant as part of a patient’s regular six-month checkup, as a stand-alone appointment with a dentist or hygienist. In addition, the health center also allegedly billed for appointments that exceeded the number of exams allowed per patient under Medicaid.[69]

- On March 18, 2015, a health care coordinating company agreed to pay over $2.4 million to the State of Missouri to settle claims that the company submitted false claims to Missouri’s Medicaid program. The Missouri Attorney General alleged that between 2008 and 2010, the company provided administrative services for two Medicaid programs, yet failed to fully comply with beneficiary contact and billing requirements under the programs. As part of the agreement, Missouri and the federal government could receive an additional $10 million if the owner of the company sells the business or recovers money in a lawsuit it has filed against the business’s previous owner.[70]

- On April 7, 2015, a New Jersey-based pharmaceutical manufacturer agreed to pay the State of Texas $11.25 million to settle claims that the company reported inflated drug prices to Medicaid. The federal government also will receive the same amount from the settlement. The Texas Attorney General initiated the investigation against the manufacturer under Texas’ Medicaid Fraud Prevention Act.[71]

- On April 16, 2015, an eye doctor and the doctor’s practice agreed to pay the State of Georgia $790,000 to settle claims that the doctor billed Medicaid for medically unnecessary procedures and overstated the level of services provided. As part of the settlement, the doctor is banned from all government health care programs for a period of at least five years. The Georgia Attorney General brought the case under Georgia’s False Medicaid Claims Act.[72]

- On May 4, 2015, a former public university president agreed to pay $185,000 to settle allegations that he made personal purchases with school-issued credit cards and used school funds to take family vacations. As part of the agreement, the former president must dismiss his breach of contract lawsuit against the university and cannot accept any public higher education position within the State of Massachusetts in the future. The Massachusetts Attorney General brought the case under the state’s false claims act.[73]

- On June 5, 2015, two food-service contractors agreed to pay $19.4 million to the District of Columbia to settle disputes over multi-year contracts to provide D.C. public schools (DCPS) with school meals. The case against the contractors began as a qui tam action under the District’s False Claims Act filed by a former DCPS employee whose share of the settlement amount has not yet been determined.[74]

IV. CASE LAW

A. Supreme Court Clarifies FCA Statute of Limitations and First-to-File Bar Issues

For years, there has been mounting angst and protest about the seemingly boundless possibility for FCA liability brought about by courts applying the Wartime Suspension of Limitations Act (WSLA) in the civil fraud context. Indeed, district courts had been repeatedly finding that the WSLA, which tolls the statute of limitations “applicable to any offense . . . involving fraud” against the United States during times of war or authorizations of military force, applied to a wide range of FCA cases, including financial services cases. See 18 U.S.C. § 3287 (emphasis added). In May, however, the Supreme Court put an end to all that, finding that the WSLA does not apply to toll the civil FCA’s statutory limitations period.

As we’ve covered previously in this update, the case, Kellogg Brown & Root Services, Inc. v. United States ex rel. Carter, concerned allegations under the FCA against defense contractors who provided water purification services during the armed conflict in Iraq, dating back to 2005. 135 S. Ct. 1970 (2015). The age of those claims, in which the government declined to intervene, naturally brought into play the FCA’s six-year statute of limitations. Though the Fourth Circuit held the WSLA tolled that limitations period, the Supreme Court unanimously disagreed, holding that “[t]he text, structure, and history of the WSLA show that the Act applies only to criminal offenses.” Id. at 1975. The Court focused on how “the term ‘offense’ is most commonly used to refer to crimes,” and looked at the pattern of the term’s usage in Title 18, which revealed not “a single provision . . . in which ‘offense’ is employed to denote a civil violation.” Id. at 1976.

In the same opinion, the Supreme Court also ruled on applicability of the FCA’s so-called “first-to-file bar,” which provides that “no person other than the Government may intervene or bring a related action based on the facts underlying the pending action.” 31 U.S.C. § 3730(b)(5) (emphasis added). In Carter, the Supreme Court resolved a circuit split on the question of whether the first-to-file bar applies to dismiss a later-filed qui tam if the earlier-filed suit was no longer pending when the later was filed, holding that it does not. In affirming the Fourth Circuit on this part of the case, the Court purported to interpret the term “pending” in accordance with its ordinary meaning,[75] finding that if it is “interpreted in this way, an earlier suit bars a later suit while the earlier suit remains undecided but ceases to bar that suit once it is dismissed.” 135 S. Ct. at 1978. The Court acknowledged that this interpretation might produce some practical problems, but declared that it is beyond its purview to make the FCA’s qui tam provisions “operate together smoothly like a finely tuned machine.” Id. at 1979. The bottom line was that the first-to-file bar “keeps new claims out of court only while related claims are still alive . . . [not] in perpetuity.” Id. at 1973.

To be sure, the Supreme Court’s opinion in Carter is a mixed bag for defendants looking for some closure to actual or potential FCA allegations. On the one hand, the Court has foreclosed the possibility of long-stale claims surfacing under the auspices that the WSLA tolled the limitations period for those claims. But while that limitations period remains a check on potential new claims, defendants can no longer be certain that the dismissal of a qui tam will close the book on the allegations–particularly if the dismissal is not on substantive grounds.

B. Developments in Implied False Certification Theory

In the recent history of FCA jurisprudence, perhaps no battle over the scope of FCA liability has been as hard fought between defendants and plaintiffs as the one over the so-called “implied certification” theory of liability. Over the years, some courts have recognized that one basis for a claim being “legally false” under the FCA is the idea that a defendant impliedly certifies compliance with all statutory, regulatory, or contractual provisions that are preconditions to payment every time it submits a request for that payment. The question of whether such “implied certification” has occurred is particularly difficult in the context of government spending programs, which typically initially require participants to sign an agreement to comply with various rules, the violation of which can lead to their exclusion from the program. In essence, some FCA plaintiffs argue that, once an agreement is signed, submitting claims while in violation of the terms of that agreement (e.g., the conditions of participation in a government program) create FCA liability because the noncompliance theoretically destroys the claimant’s eligibility to be paid.

In recent months, the Fourth and Seventh Circuits evaluated the merits of the implied certification theory in the traditional contract and government spending program contexts, respectively, and came to differing conclusions about the viability of its application.

1. The Seventh Circuit Declines to Adopt Implied Certification Theory of Liability

First, the Seventh Circuit declined to adopt the implied certification theory as a basis for liability on allegations of certain regulatory violations, at least where the agreement or contract in question was not fraudulently induced. In United States v. Sanford-Brown, Ltd., No. 14-2506, 2015 WL 3541422, at *1 (7th Cir. June 8, 2015), the court affirmed summary judgment for the defendants regarding a former director of education’s claims that the defendant colleges violated federal rules regarding “recruiting and retention practices,” compliance with which was a condition of participation in the subsidy program of Title IV of the Higher Education Act. Title IV requires educational institutions to sign a program participation agreement (PPA) outlining promises that the institution will abide by certain laws and regulations, including the recruiting regulations. Id. at *2. The Seventh Circuit rejected the relator’s argument that claims submitted while in violation of those regulations were false claims. Noting that the government’s administrative mechanism, not the FCA, was the proper forum for addressing regulatory violations such as the ones alleged, the court explained that “it would be . . . unreasonable for us to hold that an institution’s continued compliance with the thousands of pages of federal statutes and regulations incorporated by reference into the PPA are conditions of payment for purposes of liability under the FCA.” Id. at *12. Accordingly, the Seventh Circuit joined the Fifth Circuit in declining to adopt “this so-called doctrine of implied false certification.” Id. (citing U.S. ex rel. Steury v. Cardinal Health, 625 F.3d 262, 270 (5th Cir. 2010)).

The Seventh Circuit left open the possibility that a relator could still prevail on allegations that an institution signed the participation agreement with the intent to defraud the government at the time of entering the program. Id. at *10. Nevertheless, the court’s opinion in Sanford-Brown should come as a relief to many defendants who entered a government program in good faith, but nevertheless are peppered with allegations by FCA plaintiffs seeking a windfall fraud recovery by bootstrapping allegations of garden variety regulatory violations.

2. The Fourth Circuit Recognizes Implied False Certification Theory

While the Seventh Circuit dispelled the idea of implied certifications as a basis for FCA liability, however, the Fourth Circuit embraced it. In United States ex rel. Badr v. Triple Canopy, Inc., 775 F.3d 628, 636-37 (4th Cir. 2015), the Fourth Circuit reversed a district court’s dismissal of allegations that a defendant contractor’s submission of claims while noncompliant with a contractual requirement violated the FCA. The Fourth Circuit observed that the contract task order in question in Triple Canopy–for the defendant to provide security services at the second-largest military base in Iraq–enumerated various responsibilities related to those services, including minimum marksmanship scores by the defendant’s employees, but “[n]othing in [the task order] expressly conditioned payment on compliance with the responsibilities.” Id. at 632. Nevertheless, the court found that Triple Canopy submitted false claims (as alleged) when it invoiced the government despite its employees falling short of the minimum required marksmanship scores. Id. at 637. In the process, the Fourth Circuit expressly adopted the implied certification theory–though it questioned the use of that categorical label–and held that “the Government pleads a false claim when it alleges that a contractor, with the requisite scienter, made a request for payment under a contract and withheld information about its noncompliance with material contractual requirements.” Id. at 636-37 (internal quotation marks and citations omitted).

Like the Seventh Circuit, the Fourth Circuit recognized that the implied certification theory “is prone to abuse” by plaintiffs, particularly those seeking to elevate “violation[s] of minor contractual provisions” into FCA claims. Id. at 637. But where the Seventh Circuit declined to recognize potential liability because the violations created a mere breach of the program’s participation agreement, the Fourth Circuit said that the implied certification theory can rise above breach-of-contract cases through “strict enforcement of the [FCA’s] materiality and scienter requirements.” Id. (citing United States v. SAIC, 626 F.3d 1257, 1270 (D.C. Cir. 2010)). The Triple Canopy court went on to explain that, in particular, the materiality requirement would protect contractors from “onerous and unforeseen FCA liability as the result of noncompliance with any of potentially hundreds of legal requirements,” and found that the contractual requirement in question was indeed material to payment, as alleged. Id.

C. Developments in the FCA’s Materiality Requirement

In addition to showing the falsity or fraudulence of the claim or statement at issue, the FCA also requires a showing that the false claim or statement was material to government payment. The FCA defines “material” as “having a natural tendency to influence, or be capable of influencing, the payment or receipt of money or property.” 31 U.S.C. § 3729(b)(4). As noted above, where complex government programs are concerned, the materiality of the alleged conduct to government payment is a crucial question that can make the difference between a mere regulatory enforcement matter and a claim for fraud. Two Circuits in particular recently opined on the application of the FCA’s materiality requirement.

First, in another case involving disbursement of Title IV education funds, the Eighth Circuit reversed a district court’s award of summary judgment for the defendant on the bases of FCA scienter and materiality. United States ex rel. Miller v. Weston Educ., Inc., 784 F.3d 1198 (8th Cir. 2015). In Miller, the relators alleged that the defendant for-profit college violated Department of Education requirements–as captured in the college’s PPA to receive Title IV funds–that the college maintain accurate records showing students’ academic progress to ensure their continued eligibility. Id. at 1202. The defendant argued on appeal that the individual falsified records were not material under the FCA because they did not cause the disbursement of any Title IV funds. Id. at 1207.

The Eighth Circuit essentially responded that whether individual instances of noncompliance were material to payment misses the point if the original agreement requiring that compliance was induced by fraud. Id. at 1207-08. The court acknowledged that FCA materiality “requires a causal link” between a false statement and payment of a false claim, and that “the FCA is concerned about regulatory noncompliance only if it causes the government to pay money.” Id. at 1207. But here, the Eighth Circuit focused on whether the college intentionally and fraudulently induced participation in the Title IV program at the time it signed its PPA. Id. at 1207-09. The court found that the alleged false statements–that the college agreed to keep adequate records–were material because they were required to enter into the PPA, and the PPA was in turn required to be paid Title IV funds. In other words, the Eighth Circuit found that materiality is satisfied in a fraudulent inducement case if the false statement was material to the execution of the original participation agreement. That individual false statements “did not cause any actual harm,” as the defendant argued, did not change the materiality analysis in this context. Id. at 1209.

Second, the Fourth Circuit also recently examined the materiality element in the implied false certification setting. Triple Canopy, 775 F.3d at 637-38. As noted above, the court explained that the materiality element takes on particular significance in an implied certification case based on allegations of noncompliance with a contractual requirement. Id. at 637. After reciting the statutory definition of materiality, the Fourth Circuit did not require the existence of language expressly conditioning payment on compliance: “Express contractual language may constitute dispositive evidence of materiality, but materiality may be established in other ways, such as through testimony demonstrating that both parties to the contract understood that payment was conditional on compliance with the requirement at issue.” Id. (citing U.S. ex rel. Hutcheson v. Blackstone Med., Inc., 647 F.3d 377, 394 (1st Cir. 2011)). The court then found that the government had sufficiently pled materiality because it was simply “common sense” that whether the guards could “shoot straight” would naturally influence payment for security services in a war zone. Id. at 637-38. The court also found it relevant that the contractor covered up its employees’ deficient marksmanship scores, explaining that the defendant would not have gone to that trouble if it truly believed that the requirement was not material to payment. Id. at 638.

Triple Canopy and Miller indicate that as courts continue to recognize and wrestle with FCA claims based on alleged “legal falsity,” the contours of the materiality requirement will surely continue to develop.

D. Developments in the Public Disclosure Bar

The past six months have also seen a flurry of activity involving the FCA’s public disclosure bar, with five different circuit courts dealing with the provision in some way. The public disclosure bar compels courts to dismiss FCA allegations that are substantially similar to information disclosed in various enumerated public sources, unless the relator qualifies as an “original source” of the information. 31 U.S.C. § 3730(e)(4).

1. Applicability of the Bar to Disclosures to the Government

Among the many public disclosure issues considered by courts recently was one of first impression in the Fourth and Sixth Circuits: whether a disclosure to the government can qualify as a “public disclosure” that would trigger the statutory bar. In 1999, the Seventh Circuit held that disclosure of information to a “competent public official” constitutes a public disclosure under the FCA, on the grounds that the official is “authorized by, acting for, or representing the community.” United States v. Bank of Farmington, 166 F.3d 853, 861 (7th Cir. 1999). Since that time, however, appellate courts have increasingly rejected the holding of Bank of Farmington, finding that the disclosure in question must be made to a broader audience than just a public official. The Fourth and Sixth Circuits recently followed suit, further relegating Bank of Farmington to a minority position. United States ex rel. Wilson v. Graham Cnty. Soil & Water Conservation Dist., 777 F.3d 691 (4th Cir. 2015); United States v. Chattanooga-Hamilton Cnty. Hosp. Auth., 782 F.3d 260, 264 (6th Cir. 2015).

In Graham County, the Fourth Circuit considered whether a defendant’s audit and investigation reports to the certain state and local government officials constituted statutory public disclosures. 777 F.3d at 694. Similarly, in Chattanooga-Hamilton, the Sixth Circuit weighed whether the bar was triggered by the defendant’s prior disclosure to HHS OIG of the results of an internal investigation of potential Medicare overpayments. 782 F.3d at 266-67. Both courts rejected the application of Bank of Farmington and joined the First, Ninth, Tenth, Eleventh, and D.C. Circuits in holding that the FCA’s public disclosure bar requires “some act of disclosure outside of the government.” Graham Cnty., 777 F.3d at 697 (emphasis in original); see also Chattanooga-Hamilton, 782 F.3d at 268. The Fourth Circuit further explained that its analysis was unchanged by the facts that the disclosures were made to state and local, not federal, government officials, or that public information laws made the reports in question accessible to the public at large. Graham Cnty., 777 F.3d at 698.

2. A Trio of Courts Interpret the Bar’s “Original Source” Exception

Even in cases where the FCA allegations in question have been publicly disclosed, a relator can still survive dismissal if he qualifies as an “original source” of the information. Prior to the 2010 Patient Protection and Affordable Care Act (PPACA) amendments, “original source” was defined as someone with “direct and independent knowledge” of the publicly disclosed information. The amendments changed the definition to be someone who either voluntarily discloses the relevant information prior to the public disclosure, or who has “independent knowledge of and materially adds to” the publicly disclosed allegations. 31 U.S.C. § 3730(e)(4)(B). For conduct occurring prior to the amendments, however, courts typically have found that the earlier, pre-amendment version of the public disclosure bar applies. Three circuit courts recently declined to take a broad reading of this exception to the public disclosure bar, thus further narrowing what was already a small window for relators after the 2010 amendments to the public disclosure provisions.

First, both the Third and Sixth Circuits declined to recognize as “original sources” relators who gained information about their allegations simply by reviewing records, rather than through direct observation. United States v. Express Scripts, Inc., 602 F. App’x 880 (3d Cir. 2015); United States ex. rel. Antoon v. Cleveland Clinic Found., No. 13-4348, 2015 WL 3620519, at *1 (6th Cir. June 11, 2015). In Morgan, the court considered whether the relator, a pharmacist, alleged that the “pharmaceutical industry defendants profited from artificially inflated Average Wholesale Prices (AWPs) for brand-name drugs,” based on “an eyeball comparison of two publicly available price listings.” Morgan, 602 F. App’x at 881-82. The court found that the relator’s allegations stemmed from “public disclosures predating his complaint,” and neither his diligence in reviewing publicly available information nor his knowledge of the industry was enough to qualify him as an “original source.” Id. at 883. Similarly, the court in Antoon held that while “direct” knowledge for original source purposes can be acquired “by the relator’s own efforts,” the relator at issue had not met that standard because his review of medical records only allowed him to “speculate” about a physician’s involvement in certain surgeries at issue. 2015 WL 3620519 at *10-11. Because that review conferred only informed speculation, but not “direct and independent knowledge,” of the elements of an FCA cause of action, relator did not qualify as an original source. Id. at *11.

Second, in United States ex rel. Osheroff v. Humana, Inc., 776 F.3d 805 (11th Cir. 2015), the Eleventh Circuit exercised its first opportunity to interpret the post-amendment “original source” exception. In Osheroff, the relator alleged FCA liability based on alleged Anti-Kickback Statute violations for a health clinic’s provision of “a variety of free services for patients and health plan members,” such as free food, transportation, and salon services. Id. at 808. After finding that “newspaper advertisements and the clinic’s publicly available websites” constituted public disclosures as “news media,” the court turned to whether relator was an original source as “someone who has ‘knowledge that is independent of and materially adds to the publicly disclosed allegations or transactions.'” Id. at 814-15 (quoting 31 U.S.C. § 3730(e)(4)(B) (2012)). The relator argued he was an original source because he “conducted his own investigation” of the programs in question and discovered, for example, the specific types of food provided, the destinations of free transportation, and the frequency of free salon services. Id. at 815. The court found this was not enough, holding that merely adding background information and details to the information available in the public disclosures is insufficient to qualify one as an original source. Id.

Though the original source inquiry is inherently a fact-intensive one, Morgan, Antoon, and Osheroff show that it will be an important exercise in many cases where the claims come from the relator’s own investigation, especially with the increasing proliferation of publicly available information that putative relators could harvest to support their allegations of fraud. It also remains to be seen whether the standards in Morgan and Antoon will be applied to the post-amendment version of the public disclosure bar, which no longer requires that the knowledge in question be “direct.”

V. CONCLUSION

The first half of 2015 was very active, and if the past is any indication, we anticipate that the second half of 2015 will be just as busy for legislative, enforcement, and case law developments relating to the FCA. We will continue to watch these developments, and you can look forward to a comprehensive summary in our 2015 Year-End False Claims Act Update, which we will publish early in January 2016.

[1] For further analysis of the recent FCA enforcement data, please see our 2014 Mid-Year False Claims Act Update, available at http://www.gibsondunn.com/publications/pages/2014-Mid-Year-False-Claims-Act-Update.aspx.

[2] 135 S. Ct. 1970, 1975 (2015).

[4] See Fairness in Health Care Claims, Guidance, and Investigations Act, H.R. 2931, 113th Cong. (2013); Medicaid Physician Self-Referral Act of 2014, H.R. 4676, 113th Cong. (2014).

[5] See Medicaid Physician Self-Referral Act of 2015, H.R. 1083, 114th Cong. (2015).

[6] McDermott Introduces the Medicaid Physician Self-Referral Act of 2015, Congressman Jim McDermott – Representing Wash. State’s 7th Cong. Dist., http://mcdermott.house.gov/index.php?option=com_content&view=article&id=786:mcdermott-introduces-the-medicaid-physician-self-referral-act-of-2015 (last visited Jun. 19, 2015).

[7] See H.R. 1083, 114th Cong. (2015).

[8] Joe Light, FHA Proposal Aims to Clarify Loan Rules, Wall St. J. (May 21, 2015, 5:26 PM), http://www.wsj.com/articles/fha-proposal-aims-to-clarify-loan-rules-1432243574.

[10] Medicaid and Children’s Health Insurance Program (CHIP) Programs; Medicaid Managed Care, CHIP Delivered in Managed Care, Medicaid and CHIP Comprehensive Quality Strategies, and Revisions Related to Third Party Liability, 80 Fed. Reg. 31097 (proposed May 26, 2015).

[11] Chuck Ingoglia, CMS Releases Medicaid Managed Care Regulation: Addresses Provider Networks, Beneficiary Access, and More, Nat’l Council for Behavioral Health (May 27, 2015), http://www.thenationalcouncil.org/capitol-connector/2015/05/cms-releases-medicaid-managed-care-regulation-addresses-provider-networks-beneficiary-access/.

[12] See Tony Maida, OIG Announces New Penalty and Exclusion Litigation Team to “Level the Playing Field”, The Nat’l Law Review (July 1, 2015), http://www.natlawreview.com/article/oig-announces-new-penalty-and-exclusion-litigation-team-to-level-playing-field.

[13] Motor Vehicle Safety Whistleblower Act, S. 304, 114th Cong. (2015).

[16] S. 304 – 114th Congress (2015-2016): Motor Vehicle Safety Whistleblower Act, Congress.gov (May 1, 2015), https://www.congress.gov/bill/114th-congress/senate-bill/304.

[17] Bipartisan Group of Senators Launches Whistleblower Protection Caucus, Chuck Grassley | United States Senator for Iowa (Feb. 25, 2015), http://www.grassley.senate.gov/news/news-releases/bipartisan-group-senators-launches-whistleblower-protection-caucus.

[20] Md. False Claims Act, S.B. 0374, 435th Gen. Assemb., Reg. Sess. (Md. 2015).

[21] False Claims Act, H.B. 120, 2014 Gen. Assemb., Reg. Sess. (Vt. 2015)

[24] Morgan True, State False Claims Act To Become Law, VTDigger.org (Apr. 30, 2015, 4:20 PM), http://vtdigger.org/2015/04/30/state-false-claims-act-to-become-law.

[25] See Assemb. B. 4041, 216th Leg. (N.J. 2015).

[27] S.B. 2645, 216th Leg. (N.J. 2015).

[28] 2014 Year-End False Claims Act Update, Gibson Dunn (Jan 7, 2015), available at http://www.gibsondunn.com/publications/Pages/2014-Year-End-False-Claims-Act-Update.aspx.

[29] A.G. Schneiderman Proposes Bill To Reward And Protect Whistleblowers Who Report Financial Crimes, Attorney General Eric T. Schneiderman (Feb. 26, 2015), http://www.ag.ny.gov/press-release/ag-schneiderman-proposes-bill-reward-and-protect-whistleblowers-who-report-financial.

[32] 2014 Mid-Year False Claims Act Update, Gibson Dunn (Jul. 9, 2014), available at http://www.gibsondunn.com/publications/pages/2014-Mid-Year-False-Claims-Act-Update.aspx.

[33] 2014 Year-End False Claims Act Update, supra.

[34] S. 223 (“False Claims Act”) Status Information, South Carolina General Assembly 121st Session 2015-2016, http://www.scstatehouse.gov/sess121_2015-2016/bills/223.htm (last visited Jun. 19, 2015).

[35] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Daiichi Sankyo Inc. Agrees to Pay $39 Million to Settle Kickback Allegations Under the False Claims Act (Jan. 9, 2015), http://www.justice.gov/opa/pr/2015/January/15-civ-017.html.

[36] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Community Health Systems Professional Services Corporation and Three Affiliated New Mexico Hospitals to Pay $75 Million to Settle False Claims Act Allegations (Feb. 2, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-119.html.

[37] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, United States Settles False Claims Act Suit Against Good Shepherd Hospice Inc. and Related Entities (Feb. 6, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-150.html.

[38] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Medtronic Inc. to Pay $2.8 Million to Resolve False Claims Act Allegations Related to “SubQ Stimulation” Procedures (Feb. 6, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-142.html.

[39] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Iowa Home Care Company to Pay $5.63 Million to Settle False Claims Act Allegations (Feb. 10, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-161.html.

[40] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, AstraZeneca to Pay $7.9 Million to Resolve Kickback Allegations (Feb. 11, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-166.html.

[41] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Medco to Pay $7.9 Million to Resolve Kickback Allegations (May 20, 2015), http://www.justice.gov/opa/pr/2015/May/15-civ-646.html.

[42] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Illinois Physician Pleads Guilty to Taking Kickbacks from Pharmaceutical Company and Agrees to Pay $3.79 Million to Settle Civil False Claims Act Case (Feb. 13, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-183.html.

[43] See Press Release, U.S. Attorney’s Office, S. Dist. of N.Y., U.S. Dep’t of Justice, Manhattan U.S. Attorney Settles Civil Fraud Claims Against Compassionate Care Hospice For Fraudulently Billing Medicare And Medicaid For Hospice Nursing Services Not Adequately Provided (Feb. 18, 2015), http://www.justice.gov/usao-sdny/pr/2015/February/15-civ-046.html.

[44] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, United States Settles False Claims Act Allegations Against Patient Safety Consultant and His Companies (Mar. 2, 2015), http://www.justice.gov/opa/pr/2015/March/15-civ-254.html.

[45] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Cardiac Monitoring Company to Pay $6.4 Million for Alleged Overbilling of Government Health Care Programs (Mar. 19, 2015), http://www.justice.gov/opa/pr/2015/March/15-civ-344.html.

[46] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Adventist Health System to Pay $5.4 Million to Resolve False Claims Act Allegations (Mar. 19, 2015), http://www.justice.gov/opa/pr/2015/March/15-civ-346.html.

[47] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Ohio-Based Health System Pays United States $10 Million to Settle False Claims Act Allegations (Mar. 31, 2015), http://www.justice.gov/opa/pr/2015/March/15-civ-395.html.

[48] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Medtronic to Pay $4.41 Million to Resolve Allegations that it Unlawfully Sold Medical Devices Manufactured Overseas (Apr. 2, 2015), http://www.justice.gov/opa/pr/2015/April/15-civ-416.html.

[49] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Two Cardiovascular Disease Testing Laboratories to Pay $48.5 Million to Settle Claims of Paying Kickbacks and Conducting Unnecessary Testing (Apr. 9, 2015), http://www.justice.gov/opa/pr/2015/April/15-civ-431.html.

[50] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Texas-Based Citizens Medical Center Agrees to Pay United States $21.75 Million to Settle Alleged False Claims Act Violations (Apr. 21, 2015), http://www.justice.gov/opa/pr/2015/April/15-civ-485.html.

[51] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Family Dermatology PcC Agrees to Pay United States More Than $3.2 Million to Settle Alleged False Claims Act Violations (Apr. 21, 2015), http://www.justice.gov/opa/pr/2015/April/15-civ-486.html.

[52] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Georgia Hospital to Pay $20 Million to Resolve False Claims Act Allegations (Apr. 27, 2015), http://www.justice.gov/opa/pr/2015/April/15-civ-514.html.

[53] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Sixteen Hospitals to Pay $15.69 Million to Resolve False Claims Act Allegations Involving Medically Unnecessary Psychotherapy Services (May 7, 2015), http://www.justice.gov/opa/pr/2015/May/15-civ-569.html.

[54] DaVita Healthcare Partners, Inc., Form 8-K, Ex-99.1 (May, 4, 2015) (announcing “a settlement amount of $450 million and attorney fees and other costs of $45 million”).

[55] See Order, United States ex rel. Vainer v. Davita, Inc., No. 1:07-cv-02509, Dkt. No. 33 (N.D. Ga. Apr. 01, 2011) (reflecting government decision not to intervene).

[56] See Order, United States ex rel. Vainer v. Davita, Inc., No. 1:07-cv-02509, Dkt. No. 1098 (N.D. Ga. June 17, 2015) (extending stay to permit parties to finalize settlement agreement by July 7, 2015).

[57] See Press Release, U.S. Attorney’s Office, Middle Dist. of Fla., U.S. Dep’t of Justice, United States Settles False Claims Act Allegations Against Multiple Jacksonville Hospitals And An Ambulance Company For $7.5 Million (May 8, 2015), http://www.justice.gov/usao-mdfl/pr/united-states-settles-false-claims-act-allegations-against-multiple-jacksonville.

[58] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Long-Term Care Pharmacy to Pay $31.5 Million to Settle Lawsuit Alleging Violations of Controlled Substances Act and False Claims Act (May 14, 2015), http://www.justice.gov/opa/pr/2015/May/15-civ-614.html.

[59] See Press Release, U.S. Attorney’s Office, S. Dist. of N.Y., U.S. Dep’t of Justice, Manhattan U.S. Attorney Settles Civil Fraud Claims Against Westchester Medical Center Arising From Its Violations Of The Anti-Kickback Statute And The Stark Law (May 14, 2015), http://www.justice.gov/usao-sdny/pr/manhattan-us-attorney-settles-civil-fraud-claims-against-westchester-medical-center.

[60] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Durable Medical Equipment Suppliers to Pay $7.5 Million to Resolve False Claims Act Allegations (May 27, 2015), http://www.justice.gov/opa/pr/2015/May/15-civ-683.html.

[61] See Press Release, U.S. Attorney’s Office, Middle Dist. of Fla., U.S. Dep’t of Justice, United States Settles False Claims Act Allegations Against Jacksonville-Based Compounding Pharmacy (June 1, 2015), http://www.justice.gov/usao-mdfl/pr/united-states-settles-false-claims-act-allegations-against-jacksonville-based-0.

[62] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, MetLife Home Loans LLC, Successor to MetLife Bank N.A., to Pay $123.5 Million to Resolve Alleged Federal Housing Administration Mortgage Lending Violations (Feb. 25, 2015), http://www.justice.gov/opa/pr/2015/February/15-civ-226.html.

[63] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, First Tennessee Bank N.A. Agrees to Pay $212.5 Million to Resolve False Claims Act Liability Arising from FHA-Insured Mortgage Lending (June 1, 2015), http://www.justice.gov/opa/pr/2015/June/15-civ-700.html.

[64] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Miami-Based Lender Pays $3.8 Million to Resolve Liability Relating to U.S. Export-Import Bank Loans (Mar. 12, 2015), http://www.justice.gov/opa/pr/2015/March/15-civ-303.html.

[65] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Fireman’s Fund Insurance Company to Pay $44 Million to Settle False Claims Act Allegations (Mar. 23, 2015), http://www.justice.gov/opa/pr/2015/March/15-civ358.html.

[66] See Press Release, U.S. Attorney’s Office, C. Dist. of Cal., U.S. Dep’t of Justice, Sprint Communications, Inc. Agrees To Pay $15.5 Million To Resolve Allegations Of Overcharging Law Enforcement Agencies For Court-Ordered Wiretaps (Apr. 9, 2015), http://www.justice.gov/usao-ndca/pr/sprint-communications-inc-agrees-pay-155-million-resolve-allegations-overcharging-law.

[67] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, United Parcel Service Agrees to Settle Alleged Civil False Claims Act Violations (May 19, 2015), http://www.justice.gov/opa/pr/2015/May/15-civ-635.html.

[68] See Final Judgment, United State ex rel. Harman v. Trinity Indus., No. 2:12-cv-00089, Dkt. No. 713 (E.D. Tex. June 09, 2015).

[69] See Press Release, Office of the Attorney General, State of Washington, Sea Mar Health Centers to Pay $3.35 Million in Attorney General’s Office Investigation of Improper Billing (Jan. 16, 2015), http://www.atg.wa.gov/news/news-releases/sea-mar-health-centers-pay-335-million-attorney-general-s-office-investigation.

[70] See Press Release, Office of the Attorney General, State of Missouri, AG Koster Announces $2.4 Million for Missouri Medicaid for False Claims Submitted by Care-Coordination Company (Mar. 18, 2015), https://ago.mo.gov/home/ag-koster-announces-2.4-million-for-missouri-medicaid-for-false-claims-submitted-by-care-coordination-company.

[71] See Press Release, Attorney General of Texas, Attorney General Paxton Recovers $25 Million for State of Texas, U.S. Medicaid Program (Apr. 7, 2015), https://www.texasattorneygeneral.gov/oagnews/release.php?id=5012.

[72] See Press Release, Office of the Attorney General State of Georgia, Attorney General Olens Announces $790K Settlement with Doraville Eye Doctor (Apr. 16, 2015), http://law.ga.gov/press-releases/2015-04-16/attorney-general-olens-announces-790k-settlement-doraville-eye-doctor.

[73] See Press Release, Office of the Attorney General State of Massachusetts, Former President of Westfield State to Pay $185,000 Including Triple Damages for Personal Use of School Funds (May 4, 2015), http://www.mass.gov/ago/news-and-updates/press-releases/2015/2015-05-04-dobelle-consent-judgment.html.

[74] See Press Release, Office of the Attorney General, District of Columbia, District Reaches $19.4 Million Settlement with Food-Service Contractors for DC Public Schools (June 5, 2015), http://oag.dc.gov/release/district-reaches-194-million-settlement-food-service-contractors-dc-public-schools.

[75] The Court looked to Black’s Law Dictionary 1314 (10th ed. 2014) (defining “pending” as “[r]emaining undecided; awaiting decision”), as well as Webster’s Third 1669 (1976) (defining “pending” to mean “not yet decided; in continuance: in suspense”).

Gibson Dunn’s lawyers have handled hundreds of FCA investigations and have a long track record of litigation success. Among other significant victories, Gibson Dunn successfully argued the landmark Allison Engine case in the Supreme Court, a unanimous decision that prompted Congressional action. See Allison Engine Co. v. United States ex rel. Sanders, 128 S. Ct. 2123 (2008). Our win rate and immersion in FCA issues gives us the ability to frame strategies to quickly dispose of FCA cases. The firm has more than 30 attorneys with substantive FCA expertise and more than 30 former Assistant U.S. Attorneys and DOJ attorneys. For more information, please feel free to contact the Gibson Dunn attorney with whom you work or the following attorneys.

Washington, D.C.

F. Joseph Warin (202-887-3609, [email protected])

Joseph D. West (202-955-8658, [email protected])

Andrew S. Tulumello (202-955-8657, [email protected])

Karen L. Manos (202-955-8536, [email protected])

Stephen C. Payne (202-887-3693, [email protected])

Jonathan M. Phillips (202-887-3546, [email protected])

New York

Alexander H. Southwell (212-351-3981, [email protected])

Denver

Robert C. Blume (303-298-5758, [email protected])

John D.W. Partridge (303-298-5931, [email protected])

Orange County

Nicola T. Hanna (949-451-4270, [email protected])

Los Angeles

Timothy J. Hatch (213-229-7368, [email protected])

James L. Zelenay Jr. (213-229-7449, [email protected])

San Francisco

Charles J. Stevens (415-393-8391, [email protected])

Winston Y. Chan (415-393-8362, [email protected])

© 2015 Gibson, Dunn & Crutcher LLP