January 7, 2016

In 2015, the investigation and prosecution of companies and individuals who engage in horizontal collusion continued to build upon trends observed over the past several years. Record fines continue to be imposed, new enforcement regimes arise, and cartel investigations grow evermore globalized. We begin this Update by reviewing several themes observed in 2015, and then summarize worldwide developments on the anti-cartel front for the second half of 2015.

The Financial Sector Remains A Target Of Enforcement Authorities

The financial services sector remains a priority target for enforcement authorities around the world. Over the last several years, the US Department of Justice (“DOJ”) has prosecuted over 100 companies and individuals for collusion or fraud in financial services involving foreign exchange rates, LIBOR rates, municipal bond securities, real estate foreclosure auctions, and tax lien auctions. Building upon the enforcement actions we reported in our 2015 Mid-Year Criminal Antitrust and Competition Law Update, the fines levied by the DOJ on financial institutions this year–which include several of the largest criminal antitrust fines ever imposed–have helped to triple the amount of criminal fines imposed in FY 2015 as compared to FY 2014 (which itself was a record year), with fines from the foreign-exchange rate manipulation (“FX”) investigation comprising more than 70 percent of this year’s penalties.

Around the world, a diverse range of financial regulators, not just competition agencies, have been scrutinizing suspected collusive or fraudulent conduct in the financial sector. In the US, regulators conducting parallel investigations with the DOJ include the Commodity Futures Trading Commission, Securities and Exchange Commission, Federal Reserve Board, Office of the Comptroller of the Currency, and New York Department of Financial Services. Internationally, non-competition focused regulators scrutinizing similar activity include the UK Financial Conduct Authority, German Federal Financial Supervisory Authority, Swiss Financial Market Supervisory Authority, Dutch Central Bank, Hong Kong Monetary Authority, Monetary Authority of Singapore, Japan Financial Services Agency, and Australian Securities and Investments Commission.

The investigations of the financial industry have illuminated the challenges faced by companies subject to regulation by authorities with differing charges and interests. Financial regulators may have no distinct interest in the competition aspects of alleged wrongdoing, and their policies and practices with regard to investigation, prosecution, and resolutions can, in some cases, diverge widely from those traditionally deployed by competition authorities.[1] The cumulative and frequently overlapping demands required to cooperate with these authorities’ investigations, coupled with multiple and sometimes redundant sanctions, can exact a heavy toll on financial institutions even without factoring in the costs of inevitable follow-on private litigation. For example, Barclays–which, as reported in our 2015 Mid-Year Update, pleaded guilty to criminal charges brought by the Antitrust Division in the FX investigation and paid a $650 million fine, settled related charges with the Commodity Futures Trading Commission, and paid the largest fine ever to the UK Financial Conduct Authority–recently resolved separate charges with the New York Department of Financial Services by paying a civil fine of $150 million. It also agreed to a $384 million settlement in a follow-on private class action suit.[2]

Individuals, like corporate defendants, continue to face intense scrutiny in financial services investigations. Two former London traders were recently found guilty in the first US convictions stemming from the global LIBOR investigations.[3] Another London-based trader also pleaded guilty to wire and bank fraud in connection with LIBOR manipulation, while other LIBOR-related charges remain pending against individuals in the US and abroad. The DOJ’s recent resolutions with financial institutions in the FX investigation, and widespread media reports regarding those matters, have focused on the conduct of a small group of traders; given DOJ’s continuing focus on culpable individuals, those traders may well find themselves the subject of prosecutions in the years ahead. The first LIBOR defendant in the UK was convicted and sentenced to 14 years in prison (later reduced to a still-significant 11 year-sentence by an appellate court). In reviewing the trader’s appeal, the Court of Appeal stated that a significant sentence was required to “make clear to all in the financial and other markets . . . that conduct of this type, involving fraudulent manipulation of the markets, will result in severe sentences of considerable length. . . .”[4]

The Yates Memorandum

In September 2015, US Deputy Attorney General Sally Q. Yates issued the so-called “Yates Memorandum,” which emphasizes that investigations of corporate malfeasance should focus on individual wrongdoers from the very beginning. Highlighting the goal of long-term deterrence, the memorandum requires prosecutors to determine whether any individuals should be prosecuted before a corporate settlement will be approved. In addition, to settle or receive credit for cooperating with the government, corporations must identify and disclose all relevant facts concerning all individuals involved in or responsible for the misconduct being investigated, regardless of their position in the company. The implications of the Yates Memorandum, including the extent to which it alters Antitrust Division policy, will be borne out in the coming years. But it is worth noting that the Yates Memorandum specifically identifies the Antitrust Division’s Corporate Leniency Policy as a limited means for DOJ prosecutors to negotiate a corporate resolution that includes an agreement not to prosecute individual officers or employees. We expect that the number of individuals investigated and charged in cases involving corporate entities, especially in financial services, will increase as this important shift in the DOJ’s priorities takes hold over the next year.

Asia: The New Competition Enforcement Hotspot

The recent flurry of enforcement actions in Asia demonstrates the growing assertiveness of competition authorities and mounting intolerance of cartel behavior in countries there. In particular, a number of Asian countries have shown a willingness to follow the US, Europe, and Brazil in expansively interpreting the extraterritorial reach of their competition laws, and to prosecute cartels based on the effect within a jurisdiction, even if no conduct occurred there. Earlier this year, for example, the Japanese Fair Trade Commission (“JFTC”) held for the first time that the Japanese Antimonopoly Act could be applied to a cartel whose conduct occurred outside Japan but had the effect of substantially restraining competition in Japan.[5] Similarly, prosecutors in Seoul criminally charged a Japanese manufacturer for its role in an international ball-bearing cartel–the first time a foreign company will stand trial for criminal price fixing in Korea.

Several authorities in Asia imposed significant fines in 2015. The Taiwan Fair Trade Commission (“TFTC”) recently imposed a record fine of NT$5.8 billion (approximately $176 million) on seven aluminum capacitor companies and three tantalum capacitor companies. Previously, the highest TFTC fine upheld was NT$210 million (approximately $6.3 million).[6] In computing the capacitor fines, the TFTC adopted an aggressive interpretation of a statutory cap of 10 percent of revenues for fines, construing that provision to apply to global revenue and not merely Taiwan revenue. As one commentator said, “The international community should now be paying attention to Taiwan” because the TFTC is “very aggressive–and very efficient.”[7] The increased activity of the TFTC, and its first-to-fine position in the various capacitors investigations, suggest it may become a consistently formidable regulator in coming years. And on December 28, China’s National Development and Reform Commission (“NDRC”) announced that it had imposed fines of 407 million RMB ($63 million) on seven companies in the roll-on roll-off cargo industry.

This year has also seen the creation of new competition regimes or the revamping of existing ones. Hong Kong’s Competition Ordinance took effect on December 14, 2015, and prohibits bid rigging, price fixing, and market allocation. Notably, Hong Kong’s competition law explicitly applies to any conduct that harms competition in Hong Kong regardless of where the conduct occurs, setting the stage for extraterritorial application.[8] The Philippines also established its first comprehensive antitrust regime, moving away from its earlier fragmented system of enforcement. Singapore proposed new procedures for its leniency guidelines, requiring applicants to unconditionally admit to the conduct for which leniency is sought and to grant the Competition Commission of Singapore (“CCS”) a waiver of confidentiality to contact other jurisdictions also aware of the conduct. A new fast-track procedure offers settling companies an up to 10 percent reduction in fines in addition to any discount for timely cooperation in CCS investigations. And finally, Korea’s Fair Trade Commission signed a memorandum of understanding with the DOJ and US Federal Trade Commission, pledging to continue cooperation in international enforcement and solidifying what has already been a friendly relationship between the enforcers. The US also has a memorandum of understanding with China, India, and Japan.

Courts Stemming The Tide

The aggressiveness of competition authorities has coincided with what may be an increasing willingness of courts to rein in overzealous enforcement. For example, India’s Competition Appellate Tribunal this year reaffirmed the importance of procedural rights in cartel investigations in a strongly worded judgment that overturned a 61 billion rupee (approximately $920 million) fine imposed by the Competition Commission of India (“CCI”) on 11 alleged members of a cement cartel. The tribunal determined that the CCI’s investigation was procedurally unfair and ordered that the defendants be given a new hearing. In particular, the tribunal found that the fact that the CCI’s chair had approved the fines without attending the hearing (despite the fact that six members of the CCI attended) constituted a “gross violation” of fairness and impartiality. The decision addressed the enforcer’s actions in stern terms and urged it to adopt policies incorporating principles of procedural fairness.[9]

In Chile, a court similarly threw out charges against 10 individuals for allegedly participating in price fixing of pharmaceuticals, ruling that a criminal fraud statute could not apply to an alleged antitrust violation because such a violation is governed by another set of laws and, in any event, the defendants did not explicitly deceive consumers. And in the EU, both the European Court of Justice (the highest court in the EU) and the General Court (the court of first instance) have modified or annulled penalties imposed by the European Commission in a number of cartel cases, including, as detailed below, cartels involving the air-cargo, pre-stressing steel, and cathode-ray tube industries.

In the US, juries continue to provide a backstop for prosecutions that strike the average citizen as unfair or unwarranted. For example, a jury in New Jersey recently acquitted four out of five defendants to go to trial on charges of rigging bids in tax-lien auctions.

I. THE AMERICAS

A. UNITED STATES

1. Overview of US Enforcement Trends

a. Criminal Fines & Other Monetary Assessments

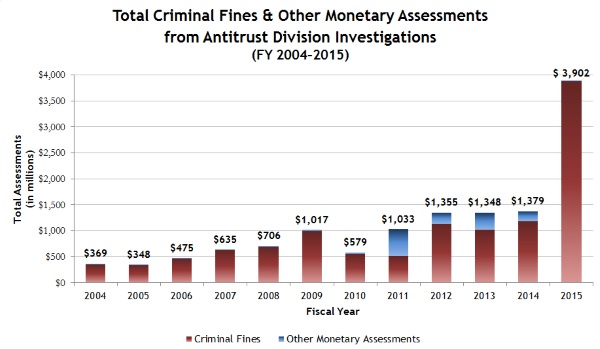

The Antitrust Division secured approximately $3.9 billion in criminal fines and monetary penalties during FY 2015, nearly three times the $1.38 billion secured in FY 2014, which was itself a record high.[10]

The DOJ obtained approximately $3.89 billion in criminal fines for violations of the Sherman Act – another all-time high. Over 70 percent of that total resulted from the nearly $2.8 billion paid by various banks in the DOJ’s ongoing investigation into the manipulation of certain foreign exchange rates. And almost 20 percent resulted from the $775 million fine paid by Deutsche Bank & DB Group Services (UK) Limited as a result of the DOJ’s LIBOR investigation, both for Sherman Act violations and for wire fraud. Both investigations are discussed in more detail below.

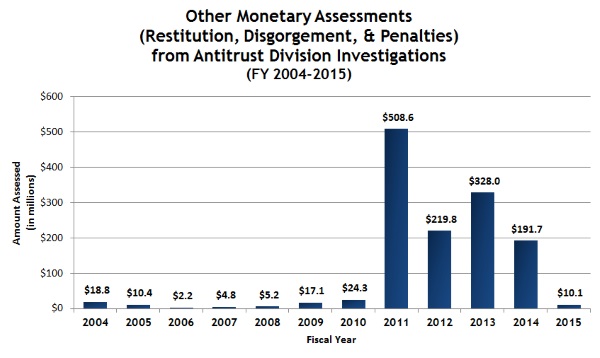

We assess the Antitrust Division’s performance by considering all of its available monetary sanctions, including criminal fines, restitution, disgorgement, and penalties (for the reasons explained at length in the 2013 Year-End Criminal Antitrust Update). While the Antitrust Division continues to embrace non-prosecution agreements and multi-agency investigations, the below chart indicates a significant dip in the use of other monetary assessments as a prosecutorial tool. Nonetheless, we believe this combined metric remains the most accurate gauge of fining activity, especially in years FY2011-2014.

In a significant decrease from past years, the DOJ obtained only approximately $16 million in restitution, penalties, and disgorgement paid to federal agencies.[11] While nearly all restitution in 2014 was imposed in connection with a single $191 million penalty, this year the DOJ sought restitution from a broader set of companies and individuals; three agreed to pay restitution of more than $1 million.

i) Criminal Fines

Approximately 90 percent of the criminal fines imposed in FY 2015 result from corporate plea agreements in two investigations: the investigation into the manipulation of certain foreign exchange rates and the LIBOR investigation. As noted in Gibson Dunn’s 2015 Mid-Year Criminal Antitrust and Competition Law Update, the largest fine was the result of the Antitrust Division’s $925 million settlement with Citicorp. Most of the other criminal fines resulted from the Antitrust Division’s long-running investigation into the auto parts industry.

|

Criminal Fines of More than $1 Million for Sherman Act Violations |

||

|

Company |

Investigation |

Criminal Fine |

| Citicorp | Foreign Exchange | $925,000,000 |

| Deutsche Bank & DB Group Services (UK) Limited | LIBOR | $775,000,000 |

| Barclays PLC | Foreign Exchange | $710,000,000 |

| JP Morgan Chase & Co. | Foreign Exchange | $550,000,000 |

| Royal Bank of Scotland plc | Foreign Exchange | $395,000,000 |

| UBS AG | LIBOR | $203,000,000 |

| NGK Insulators Ltd. | Auto Parts (ceramic substrates) | $65,300,000 |

| Kayaba Industry Co. Ltd., dba KYB Corporation (KYB) | Auto Parts (shock absorbers) | $62,000,000 |

| Nippon Yusen Kabushiki Kaisha (NYK) | Ocean Cargo Services | $59,400,000 |

| Robert Bosch GmbH | Auto Parts (spark plugs, oxygen sensors and starter motors) | $57,800,000 |

| Aisin Seiki Co. Ltd. | Auto Parts (variable valve timing devices) | $35,800,000 |

| Espar Inc. | Auto Parts(parking heaters) | $14,900,000 |

| NEC Tokin Corp. | Electrolytic Capacitors | $13,800,000 |

| Minebea Co. Ltd. | Ball Bearings | $13,500,000 |

| Continental Automotive Electronics LLC and Continental Automotive Korea Ltd. | Auto Parts (instrument panel clusters) | $4,000,000 |

| Sanden Corp. | Auto Parts (air conditioning compressors) | $3,200,000 |

| Yamada Manufacturing Co. | Auto Parts (manual steering columns) | $2,500,000 |

| Hitachi Metals Ltd. | Auto Parts (brake hoses) |

$1,250,000 |

The Antitrust Division has announced only one corporate plea agreement thus far in FY2016, which resulted in a $2.35 million fine.

| Criminal Fines of More than $1 Million for Sherman Act Violations Imposed or Agreed to During FY 2016 (October 2015–present) |

||

|

Company |

Investigation |

Criminal Fine |

| INOAC Corp. | Auto Parts (interior trim) |

$2,350,000 |

ii) Monetary Assessments

As in past years, the Antitrust Division continued to secure monetary assessments, but only two of them exceeded $1 million.

| Other Monetary Assessments of More than $1 Million from Antitrust Division Investigations During FY 2015 (October 2014–September 2015) |

||

|

Company |

Investigation |

Monetary Assessment |

| Coach USA Inc., City Sights LLC, and Twin America LLC | Hop-on, hop off bus tours |

$7,500,000 |

| Washington Gas Energy Systems | Federal Contracts |

$2,587,261 |

iii) Prison Sentences

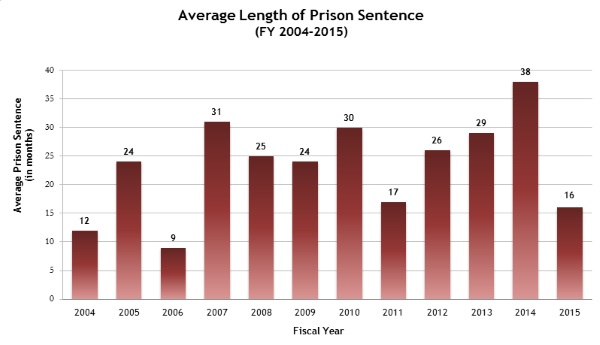

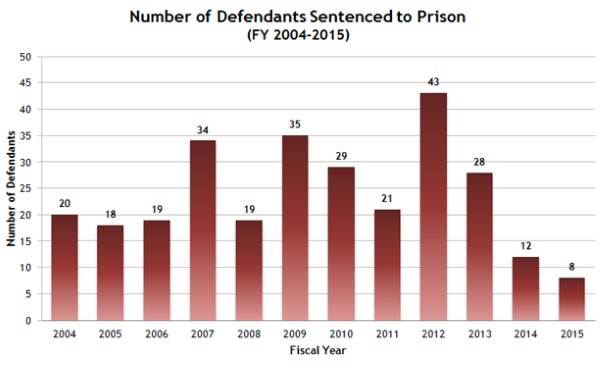

There was a marked decrease in the average prison sentence secured by the Antitrust Division in FY2015, with the average prison length decreasing to 16 months, a low not seen since FY2006.

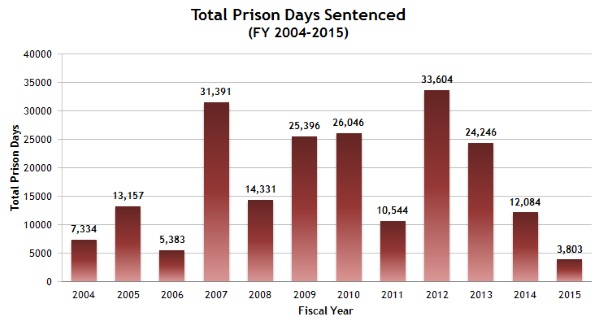

This year, 8 individual defendants have been sentenced to serve a total of 3,710 days in prison sentences, representing less than a third of the number of prison days sentenced in FY2014, and just over 10 percent of the prison days sentenced in FY2012, the highest year on record. It remains to be seen if this is a consistent trend, or an aberration. Indeed, the Antitrust Division has announced a number of indictments and guilty pleas, largely resulting from the ongoing auto parts and real estate auction investigations, with sentencing to be announced later in FY2016.

2. Developments in International Investigations

a. London InterBank Offered Rates (“LIBOR”)

On November 5, 2015, after a four week trial, a jury in the US District Court for the Southern District of New York convicted two former Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (Rabobank) derivative traders on charges related to manipulation of the LIBOR for the US Dollar (“USD”) and the Japanese Yen.[12] The defendants were UK residents Anthony Allen, who was Rabobank’s Global Head of Liquidity & Finance and the manager of the company’s money market desk in London, and Anthony Conti, who served as Rabobank’s primary USD LIBOR submitter and at times acted as Rabobank’s back-up Yen LIBOR submitter.[13] The jury found them guilty of conspiracy to commit wire and bank fraud as well as substantive counts of wire fraud based on evidence that they submitted LIBOR contributions skewed to benefit the trading positions of the bank and certain of its employees.[14] Sentencing is scheduled for March 10, 2016.

The government also obtained a guilty plea from a former Deutsche Bank trader, Michael Ross Curtler, who is the first of that bank’s employees to be charged in connection with LIBOR.[15] Curtler pleaded guilty on October 8, 2015 to one count of conspiracy to commit wire fraud and bank fraud.[16]

In a separate LIBOR manipulation case in the Southern District of New York, the District Court denied a motion to dismiss filed by defendant Roger Darin on August 3, 2015. The DOJ has charged Mr. Darin with being responsible for the Yen LIBOR submissions of UBS AG. The District Court refused to dismiss the criminal complaint alleging that Darin conspired to commit wire fraud in violation of 18 U.S.C. 1343, concluding that Darin–a citizen of Switzerland, “a nation which does not extradite its citizens for financial crimes,” who had avoided arrest by remaining in Switzerland–is a fugitive equitably prohibited from seeking judicial relief in the US courts. In the alternative, the District Court concluded that even if the fugitive disentitlement doctrine did not apply, the complaint alleged a sufficient connection between Darin’s actions and the United States to satisfy the Due Process Clause of the Fifth Amendment.[17] Darin’s appeal and petition for Second Circuit mandamus review of the District Court’s ruling remain pending.

As to the pension-administration consequences of the resolution of LIBOR allegations earlier in 2015, the Department of Labor granted temporary relief in September 2015 to Deutsche Bank, allowing its affiliates to rely on Prohibited Transaction Exemption 84-14 for nine months, while noting that Deutsche Bank affiliate DB Group Services UK Limited had been criminally convicted for one count of wire fraud in connection with LIBOR manipulation.[18]

b. Auto Parts

As predicted in our 2015 Mid-Year Criminal Antitrust and Competition Law Update,[19] it appears that the Antitrust Division’s six-year investigation into the auto parts industry is now slowing. Nevertheless, the Antitrust Division’s landmark auto parts enforcements remain important, both in terms of current actions, as well as serving as a bellwether for future global cartel enforcement. For example, the Antitrust Division regards the auto parts investigations as an example of growing cooperation and “convergence” among multinational enforcement authorities. In September 29, 2015 remarks, Assistant Attorney General Bill Baer singled out the auto parts investigation as an “impressive example [of the] close cooperation with enforcers from Asia and Europe.”[20] According to Baer, the auto parts investigations demonstrate that when “combined with the incentives to self-report created by leniency programs, [multinational cooperation] exposed an extensive and long-lasting series of conspiracies among auto parts manufacturers.”[21] Additionally, while the pace has apparently slowed, each new plea agreement or indictment announcement further increases the margin by which the auto parts investigations exceed the scope and magnitude of the Antitrust Division’s prior enforcements in any industry.

On September 3, 2015, the Antitrust Division announced that NGK Insulators Ltd., based in Nagoya, Japan, pleaded guilty to a two-count felony charge, and agreed to pay a $65.3 million criminal fine, for conduct related to a conspiracy to fix prices and rig bids for ceramic substrates used in automotive catalytic converters, as well as obstruction of justice.[22]

In mid-September, the Antitrust Division announced that Kayaba Industry Co. Ltd. (d/b/a KYB Corporation) agreed to plead guilty and pay a $62 million criminal fine for a conspiracy to fix prices for shock absorbers used in cars and motorcycles.[23] The KYB matter is the first auto parts settlement focused on shock absorbers, and is separately interesting because the company received a 40 percent “downward departure” from the fine range ($103.68 million to $207.36 million) calculated under the US Sentencing Guidelines.[24] In its motion requesting the downward departure, the Antitrust Division noted that in addition to providing substantial assistance, the company had developed and implemented a “comprehensive and innovative compliance policy . . . [that included the] hallmarks of an effective compliance policy including direction from top management at the company, training, anonymous reporting, proactive monitoring and auditing, and provided for discipline of employees who violated the policy.”[25]

On November 19, 2015, the Antitrust Division announced that INOAC Corp., based in Nagoya, Japan, agreed to plead guilty and pay a $2.35 million criminal fine for conspiracy to fix prices and rig bids for plastic interior trim parts.[26]

During the second half of 2015, the Antitrust Division also took action against individual executives. Not all involved parties with connections to Japan. On October 8, 2015, the Antitrust Division announced the indictment of Keiji Kyomoto, Mikio Katsumaru, and Yuji Kuroda for allegedly participating in a conspiracy to fix prices and rig bids regarding automotive body sealing products, such as the weather-stripping used on doors and trunk lids.[27] During the period of the alleged conduct, Kyomoto was the President of a US joint venture, which was partially owned by the Hiroshima, Japan-based company that employed Katsumaru and Kuroda. Katsumaru served in multiple managerial positions at the Hiroshima entity, while Kuroda was a sales branch manager at the same company.[28] While neither the Antitrust Division’s press release nor the indictment identify the executives’ corporate affiliation, media reports identified that they were connected to the Nishikawa Rubber Co.[29]

On December 9, 2015, the Antitrust Division announced the indictment of three German executives, Frank Haeusler, Volker Hohensee, and Harald Sailer. According to the Department, the executives and their co-conspirators allegedly met to discuss prices, and agreed to set a price floor and coordinate price increases for parking heaters, which are devices used to provide heat in commercial vehicle interiors without the need to operate the engine.[30]

To date, the Antitrust Division has charged 38 companies and 58 individuals, who have agreed to pay a total of more than $2.6 billion during the Antitrust Division’s investigation of the auto parts industry.[31] While our previous assessment that the Antitrust Division’s investigation of the industry appears to be slowing has been confirmed, we do anticipate additional developments in 2016.

c. Roll-on, Roll-off Cargo

The continuing investigation of the international roll-on, roll-off ocean shipping industry (involving cargo such as cars, trucks, and agricultural equipment that can “roll” on and off of cargo ships without the need for containers) resulted in the recent indictment of three former ocean freight executives.[32] In late 2015, Yoshiyuki Aoki (formerly of Kawasaki Kisen Kaisha (“K-Line”)), Masahiro Kato and Shunichi Kusunose (formerly of Nippon Yusen Kabushiki Kaisha (“NYK”)) were charged with a long-running price fixing conspiracy to allocate customers and routes, rig bids and fix prices for the sale of international ocean shipments to and from the United States and elsewhere. The indictment charges Aoki, Kusunose and Kato with participating in the conspiracy in dates ranging from as early as 2001 until at least September 2012. They are among seven executives charged in the investigation so far–four of whom have pleaded guilty and have been sentenced to prison.

As we reported in our 2015 Mid-Year Criminal Antitrust and Competition Law Update, several firms–NYK, K-Line, and Compañía Sud American de Vapores, S.A.–and three K-Line executives pleaded guilty in 2014 and early 2015 to charges of price fixing and customer allocation for ocean shipping services.[33] To date, these firms have pleaded guilty and paid more than $136 million in criminal fines.[34]

d. Cathode Ray Tubes

As reported previously, in 2009 and 2010, the DOJ indicted six individuals in connection with an investigation into an alleged price-fixing conspiracy by manufacturers of color display tubes (“CDTs”), a type of cathode ray tube. CDTs are display components once used in computer monitors. In the ensuing years, the DOJ obtained a guilty plea from one company. On November 17, 2015, however, the DOJ obtained its first individual guilty plea when Chun Cheng “Alex” Yeh, a former executive of a Taiwanese company, pleaded guilty to price fixing.[35] Under the plea agreement, the DOJ recommended a $20,000 fine and eight months in prison.[36] The sentencing hearing will be held on March 1, 2016 before Judge Alsup in the Northern District of California.[37]

e. Capacitors

As reported in our 2015 Mid-Year Criminal Antitrust and Competition Law Update, the DOJ, the Japanese Fair Trade Commission, the European Commission, the Korean Fair Trade Commission, the Taiwan Fair Trade Commission, China’s National Development and Reform Commission, and Brazil’s Council for Economic Defense are reported to be investigating manufacturers of certain types of capacitors.[38] In September 2015, the DOJ has announced that a company agreed to plead guilty and pay a $13.8 million criminal fine, making it the first company to agree to plead guilty in the US.[39]

3. Developments in Domestic Investigations

a. Municipal Bonds

Three former UBS executives have asked the US Supreme Court to review their convictions for (non-antitrust) charges related to fraud in the bidding process for municipal bonds.[40] As we reported in our 2015 Mid-Year Criminal Antitrust and Competition Law Update, the US Court of Appeals for the Second Circuit affirmed the judgments against Gary Heinz, Michael Welty, and Peter Ghavami on June 4, 2015, after a jury convicted them of conspiracy to commit wire fraud in violation of 18 U.S.C. §§ 371 and 1349 and, as to Heinz and Ghavami only, wire fraud in violation of 18 U.S.C. § 1343.[41] Among their many arguments on appeal, the defendants claimed that their convictions were barred by a five-year statute of limitations. The Second Circuit rejected this argument. It held that a longer, ten-year statute of limitations applied pursuant to 18 U.S.C. § 3293(2), which governs any wire fraud offense (including conspiracy to commit wire fraud) in which “the offense affects a financial institution.”[42] The court reasoned that the charged conduct–which the defendants undertook for UBS’s benefit and in a conspiracy purportedly with UBS itself–ultimately led UBS and two other banks to “incur[] significant payments and related fees” when the banks reached settlements with the Department of Justice, SEC, IRS, and 25 states.

On October 2, 2015, the defendants petitioned the US Supreme Court for a writ of certiorari, challenging the Second Circuit’s holding that their conduct “affect[ed] a financial institution” within the meaning of § 3293(2).[43] The petition calls upon the Supreme Court to interpret § 3293(2), which was enacted as part of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (“FIRREA”).[44] The defendants contend that the statute’s phrase, “affects a financial institution,” cannot apply to their conduct for several reasons: first, as a textual matter, they say that a financial institution cannot “affect itself”;[45] second, under the law of causation, they argue that actions taken by the bank’s co-conspirators cannot proximately cause legal settlements later reached by the bank;[46] and third, they contend that applying § 3293(2) against a bank and its agents would frustrate FIRREA’s purpose “to protect banks from bad actors, not from the banks themselves.”[47] Petitioners also suggest that a circuit split exists regarding the interpretation of § 3293(2), and their brief quotes various federal courts’ standards for whether charged conduct “affects” a bank.[48]

The United States filed its brief in opposition to certiorari on December 7, 2015.[49] The government’s brief leans heavily on the breadth of the word “affects” to argue that “[w]hen a bank employee exposes his employer to criminal liability and substantial monetary penalties, that employee has ‘affected’ the bank’s financial wellbeing.”[50] As for the statute’s purpose, the government argues that FIRREA does not merely protect banks themselves (the purpose on which petitioners focus), but rather, is intended to protect the broader US banking system–a purpose that the government regards as “well served by punishing bank employees who involve their employers and other banks in criminal wrongdoing.”[51] The government’s brief also denies that any meaningful circuit split exists, based on the argument that UBS’s settlements and legal fees are so closely linked to petitioners’ conduct that any “affects” standard under § 3293(2) would encompass this case.[52]

At the time of this update, the briefs have not yet been distributed to the Justices for conference, and several more months may pass before the Court decides whether to hear the appeal.

b. New Jersey Tax Lien Auctions

The fall of 2015 saw significant activity in the DOJ’s New Jersey Tax Lien investigation. The DOJ was set to try bid rigging claims against six defendants: individuals Gregg Gehring, James Jeffers, Jr., Joseph Wolfson, and Robert Jeffrey, and corporate defendants Betty Simon Trustee LLC and Richard Simon Trustee. But, in September 2015, only days before trial, Antitrust Division prosecutors dismissed price-fixing charges against Gregg Gehring.[53] The DOJ did not provide reasons for the dismissal.

The cases against the remaining five defendants were tried over three weeks. In October 2015, a jury convicted Mr. Jeffers of conspiracy in violation of the Sherman Act.[54] The remaining defendants were acquitted. Mr. Jeffers will be sentenced in March 2016.[55] A number of additional individual and corporate defendants in the investigation are also expected to be sentenced in 2016.

c. Real Estate Auctions

The Antitrust Division continued its aggressive push to root out bid rigging in public auctions for real estate foreclosures, tacking on more prosecutions following those discussed in our prior Updates.

Recent criminal enforcement efforts continue to focus primarily on foreclosure auction bid-rigging schemes in the Northern District of Georgia, but have also continued in Alabama. Since July 2015, three additional individuals have pleaded guilty or agreed to plead guilty for their roles in these bid-rigging schemes, and two more individuals have been formally charged.

In September 2015, Michael P. Barbour pleaded guilty for his role in conspiracies to rig bids and commit mail fraud at public real estate foreclosure auctions in southern Alabama. Mr. Barbour admitted to conspiring to fraudulently acquire title to foreclosed properties at artificially low prices by agreeing with others not to bid against each other at public foreclosure auctions in southern Alabama.[56] According to the DOJ, Mr. Barbour’s prosecution marks the eleventh of its kind in the state of Alabama.

In October 2015, Georgia real estate investors Morris Podber and Trent Gaines pleaded guilty to conspiring to rig foreclosure auctions and to commit mail fraud in Fulton and DeKalb counties.[57] According to the plea agreements, after foreclosure auctions, the investors and their co-conspirators would divvy up the targeted properties in private side auctions, open only to the conspirators.

As reported in our 2014 Year-End Criminal Antitrust and Competition Law Update, a jury in the Eastern District of California convicted Andrew Katakis and another co-defendant of rigging foreclosure auctions in San Joaquin County.[58] In October 2015, Mr. Katakis filed a motion for a new trial citing prosecutorial misconduct, instructional error, ineffective assistance of counsel and the cumulative effect of evidentiary spillover.[59] The DOJ has filed a motion opposing Mr. Katakis’ request for a new trial, claiming Mr. Katakis received a “vigorous, aggressive” defense.[60] As of the date of this update, the motion remains pending, and an evidentiary hearing on the motion has been set for February 2016.[61]

On January 4, 2016, two additional Georgia real estate investors pleaded guilty to bid rigging and mail fraud in connection with foreclosure auctions in Georgia. Like the Georgian defendants described above, the defendants here admitted that they agreed not to bid against others at public real estate foreclosure auctions, then used payoffs and private side auctions to divide money among themselves. These defendants were the eleventh and twelfth defendants charged as part of the ongoing investigation into bid rigging at foreclosure auctions in Georgia.[62]

d. Coastal Water Freight Transportation

As discussed in the 2015 Mid-Year Criminal Antitrust and Competition Law Update, Frank Peake, former president of Sea Star Lines, was convicted by a jury in Puerto Rico of participating in an antitrust conspiracy to fix prices and allocate market share for the transportation of goods by water to Puerto Rico in January 2013.[63] He was sentenced to five years in prison and appealed to the First Circuit. In October 2015, the First Circuit affirmed Peake’s sentence and his conviction. Peake challenged his conviction and sentence on multiple grounds, including the validity of his indictment, the scope of the search warrant executed by the government, the denial of his motion to change venue, improper remarks made by the prosecutor during trial, and the allegedly incorrect computation of the amount of commerce affected by the charged conspiracy, among other things. The court rejected Peake’s arguments and affirmed both his conviction and his sentence, which was the longest sentence ever imposed for an antitrust violation.[64]

e. Posters

In August, a grand jury in San Francisco indicted Daniel William Aston and his company Trod, Ltd. which runs a website based in the United Kingdom, for fixing prices of poster art on the Amazon Marketplace. Each faces one count of violating the Sherman Act. The indictment alleges that Aston discussed pricing with competitors and agreed to use an algorithm to set prices in accordance with the conspiracy.[65]

f. Government Contracts

The investigation into the New York Power Authority procurement fraud is ongoing and has led to a second guilty plea. During the course of the investigation, the Antitrust Division uncovered evidence that Peter Shine, a construction company owner in New Jersey, siphoned funds and underreported his income. He pleaded guilty to subscribing to a false tax return, which has a maximum penalty of three years in prison and a $250,000 fine. Assistant Attorney General Bill Baer of the Justice Department’s Antitrust Division stated that the Division will continue to work with other law enforcement agencies to prosecute any crimes uncovered during its investigations.[66]

g. Water Treatment Chemicals

As a result of an investigation into a conspiracy to eliminate competition in the market for water treatment chemicals by fixing prices, rigging bids, and allocating customers, a former executive of a water treatment chemicals manufacturer has pleaded guilty to a violation of the Sherman Act. The former executive, Frank Reichl, admitted to participating in a conspiracy not to compete for contracts for liquid aluminum sulfate by intentionally submitting losing bids, withdrawing inadvertently winning bids, and discussing prices to be quoted or bids to customers. He is the first defendant to plead guilty to his participation in this fifteen year conspiracy.[67]

h. Tuna

In December 2014, Chicken of the Sea, owned by Thai Union Frozen Products (“TUF”), announced an agreement to purchase Bumble Bee Seafoods from its owner, Lion Capital, a private equity firm. The merger would have consolidated the second and third largest tuna producers in the United States, and was expected to close in the second half of 2015.[68]

In July 2015, both Chicken of the Sea and Bumble Bee announced that they had received subpoenas from the Department of Justice related to an antitrust investigation into price fixing in the packaged seafood industry as a whole.[69] In response, TUF announced that it was postponing an offering to finance the merger with Bumble Bee.[70]

In fall 2015, TUF indicated that it would be willing to divest its Chicken of the Sea business if antitrust regulators signed off on the deal.[71] But instead, on December 3, 2015, the Justice Department informed the parties that it “had serious concerns that the proposed transaction would harm competition,” and the parties announced that they had abandoned their plans to merge.[72] The Justice Department concluded that “[o]ur investigation convinced us . . . that the market is not functioning competitively today, and further consolidation would only make things worse.” The DOJ’s criminal price-fixing investigation is ongoing.

4. Developments in the Antitrust Division

a. Speeches by Key Division Personnel

In the second half of 2015, Assistant Attorney General Bill Baer offered remarks in both domestic and international settings that focused on, among other topics, collusive cartel policing, and international cooperation and collaboration. These speeches signaled the Division would stay its course in vigilant cartel enforcement.

Assistant Attorney General Baer spoke at the New Health Care Industry Conference about the contours of antitrust enforcement in the health care sector in the wake of the rollout of the Affordable Care Act (ACA).[73] In light of the fact that health care continues to be one of the largest and fastest growing industries in the American economy, the DOJ and FTC partnered with the Department of Health and Human Services to provide guidance to medical providers about compliance with the ACA, including distinguishing permissible from anticompetitive collaboration practices among providers. Consistent with DOJ policy in other sectors, Baer stressed that merger enforcement remains a top priority in the healthcare context, particularly as applied to health insurance companies. Current merger enforcement policy in the area contemplates the interplay between physician and hospital services and insurance coverage, bargaining leverage within and between those respective markets, and the effect on consumer care options and insurance policies ranging from individual to employer-sponsored to Medicare or Medicaid enrollees. Moreover, the decision to approve or block a merger stems from a forward-looking — rather than static — evaluation of the market and the firms that populate it. In Baer’s words, “[w]e don’t just take a snapshot of the markets as we find them today, or as we found them yesterday; we assess how they are likely to evolve, including trends toward increased concentration.” In closing, Baer emphasized the illegality of anticompetitive agreements in the health services sector unrelated to price fixing, for example group boycotts or collusion on advertisement or services rendered, and vowed that antitrust enforcers will “remain vigilant” in evaluating traditional institutionalized pitfalls of the health care market like low price transparency, poor information about product quality, high barriers to entry, and the vulnerability of the consumer.

In a speech delivered at the Ninth Annual Global Antitrust Enforcement Symposium, Baer touted recent developments in international antitrust enforcement and the gravitation towards inter-jurisdictional convergence.[74] With respect to anti-cartel activity, Baer proudly announced that “there is near unanimity about the importance of fighting price fixing, bid rigging, and market allocation.”

In his speech at the 12th Annual Economic Development and Housing Conference, Baer focused on criminal sanctions and efforts to deter collusive behavior.[75] Baer drew from examples that “showcase the Antitrust Division’s strong record of criminal antitrust enforcement during the Obama Administration.” In particular, Baer cited the Division’s nearly $3 billion in foreign exchange related fines, and charges against 110 individuals involved in a bid-rigging scheme connected to foreclosure sales during the recession years. Baer explained that the DOJ’s use of criminal sanctions against over 400 individuals and 140 corporations during the Obama Administration “serve an important deterrent effect because they directly affect something that corporate executives and investors care deeply about: a company’s bottom line.”

b. Yates Memorandum

The second half of 2015 also contained notable developments with respect to the formalization of the US Department of Justice’s policy regarding the prosecution of individuals responsible for corporate wrongdoing to the overall criminal and civil enforcement regime. On September 9, 2015, US Deputy Attorney General Sally Quillian Yates issued a policy memorandum on such prosecutions to all US Attorneys and certain DOJ department heads, including the Antitrust, Criminal, and Civil Divisions (the “Yates Memo”); the memorandum was followed by a high-profile speech on the same subject matter the very next day.[76] On November 16, 2015 Deputy Attorney General Yates announced corresponding revisions to the United States Attorneys’ Manual (“USAM”), a DOJ policy manual that serves as the foundation for many of the key decisions that DOJ attorneys make during their work.

As Gibson Dunn has observed elsewhere, the Yates Memo reflects how goals and policy positions that federal prosecutors have long articulated and pursued are now being formalized in DOJ policy.[77] The Yates Memo–as well as Deputy Attorney General Yates’s public comments and the resulting changes to the USAM–nonetheless provides an opportunity to better understand how DOJ’s practices dovetail with its policy of holding individual wrongdoers accountable in antitrust cases. Critically, the Yates Memo states explicitly that it will not alter the current practices of the Antitrust Division’s Corporate Leniency Program. To the extent that the Yates Memo will affect DOJ policy going forward, such changes can be expected to occur with respect to companies negotiating guilty pleas with the Division.

Specifically, the Yates Memo sets forth “six key steps” intended to enhance the DOJ’s effort to “fully leverage its resources to identify culpable individuals at all levels in corporate cases,” which are as follows:

- No cooperation credit for companies that do not provide DOJ with all relevant facts regarding the individuals involved in corporate misconduct,

- Both civil and criminal investigations should focus on potentially culpable individuals from their inception,

- DOJ civil and criminal attorneys should be in routine communication with one another,

- Corporate resolution may only immunize individual conduct in “extraordinary circumstances,” including in the context of the Corporate Leniency Program,

- Corporate cases should not be resolved unless there is a clear path to resolve related individual cases before the statutes of limitation expire, and

- Civil attorneys should consistently focus on individuals, regardless of ability to pay.

To qualify for any cooperation credit, corporations must provide all relevant facts relating to individuals responsible for the misconduct. Perhaps the most extensive revision is to the so-called “Filip Factors,” which deal with the “Value of Cooperation.”[78] The Yates Memo revises the USAM to treat disclosure of all relevant facts related to individual wrongdoing as a threshold for the receipt of any cooperation credit.

In order for a company to receive any consideration for cooperation under this section, the company must identify all individuals involved in or responsible for the misconduct at issue, regardless of their position, status or seniority, and provide to the Department all facts relating to that misconduct. This principle applies both to settlement agreements and to sentencing factors taken into consideration following a successful prosecution.[79]

Aware that this change in official policy may encompass the privileged work product generated during an internal investigation, in her November speech Deputy Attorney General Yates clarified that nothing in the USAM revisions requires companies to waive the attorney-client privilege in order to receive cooperation credit; instead, companies are expected only to disclosure relevant facts identified during the course of an investigation.[80] This position is also articulated in the USAM itself.[81]

Furthermore, USAM now expands on the recognition that voluntary disclosure may be an ongoing process that itself informs the scope of an internal investigation into wrongdoing. Section 9-28.700 now contains language that recognizes that an initial voluntary disclosure may occur “even before all facts are known to the company,” and therefore explains that DOJ “does not expect that such early disclosures would be complete.”[82] Finally, the provision explains that where a company is unable to “get access to certain evidence or is actually prohibited from disclosing it to the government . . . the company seeking cooperation will bear the burden of explaining the restrictions it is facing to the prosecutor.”[83] The formal recognition of difficulties in collecting or disclosing certain evidence may also reflect the reality that data privacy laws or blocking statutes imposed in other countries may impede or otherwise burden internal investigations conducted by companies with operations worldwide.[84]

The requirement to disclose all wrongdoing by individual officials is already a requirement of the DOJ’s Corporate Leniency Program, so this shift of focus will likely have limited application to Leniency applicants in antitrust cases. However, this policy, which Yates described in her speech at New York University as a “substantial shift from prior practice,” will likely have an impact on entities in a cartel case who have not applied for Leniency, who might otherwise have gotten some cooperation credit by, for example, disclosing the conduct of colluding competitors, producing foreign-located documents, or making witnesses available at company expense, regardless of the completeness of disclosure regarding the culpability of individuals within the company. Whether this results in a discernable difference in how the Division determines the appropriate metrics for cooperation credit (including in the computation of the volume of commerce) will likely play out as new investigations are launched and plea agreements negotiated in the coming years.

From their inception, criminal and civil corporate investigations should focus on individuals. The Yates Memo details the importance of focusing “on wrongdoing by individuals from the very beginning of any investigation of corporate misconduct,” including the need for government attorneys to act promptly in light of limitations periods.[85] Accordingly, the revised USAM contains language expressing that pursuing individual wrongdoers is “[o]ne of the most effective ways to combat corporate misconduct” because it “deters future illegal activity, incentivizes changes in corporate behavior, ensures that the proper parties are held responsible for their actions, and promotes the public’s confidence in our justice system.”[86] Apparently in response to criticisms that certain areas of the DOJ had been too lenient in pursuit of corporate wrongdoing, former section 9-28.100 has been modified with the apparent focus on removing indications that DOJ shares common goals with corporate directors and officers under investigation.[87]

The need to focus on–and therefore tailor an investigation towards–individuals potentially responsible for corporate malfeasance in an expeditious manner was a goal articulated throughout the Yates Memo and Deputy Attorney General Yates’s September and November speeches.[88] We expect that this shift, as with the requirement for disclosure of individual wrongdoing to earn cooperation credit, may lead prosecutors to insist on much more detail about specific individuals at earlier stages in discussions with corporate defendants.

Criminal and civil DOJ attorneys handling corporate investigations should remain in routine communication with one another. The Yates Memo clearly states that “[c]riminal and civil attorneys handling corporate investigations should be in routine communication with one another.”[89] Accordingly, the revisions to the USAM include directives for civil and criminal DOJ attorneys to share information as early as permissible in order to “permit[] consideration of the fullest range of the government’s potential remedies” in order to ensure that both civil and regulatory alternatives to criminal punishment are explored over the lifespan of an investigation.[90] The revisions caution, however, that coordination should be “handled carefully in order to avoid allegations of improper release of grand jury material or abuse of civil process.”[91]

DOJ will not release culpable individuals from civil or criminal liability when resolving a matter with a corporation absent extraordinary circumstances or approved policy. In a notable shift–on paper–from prior DOJ policy, the Yates Memo and the revised USAM prohibit corporate resolutions from immunizing individuals or dismissing charges against them, except in “extraordinary circumstances.” However, two considerations may limit the extent to which this announcement meaningfully alters the course of the DOJ’s investigations in antitrust cases. First, this policy does not apply to applicants for the Antitrust Division’s Corporate Leniency Program. Second, and perhaps equally importantly, even before the Yates Memo, it was rare for current resolution agreements to provide culpable individuals with such protections. At a minimum, though, this new guideline may increase the amount of oversight of division attorneys by the Division’s front office: under the revised USAM, any release of individual liability (whether pursuant to an approved policy or not) must be vetted and approved by the relevant Assistant Attorney General or a United States Attorney. And, it may, in certain close cases, mean that the Division declines to include an individual with some degree of culpability within the non-prosecution protections of the corporate plea agreement–even if the Division does not ultimately seek to initiate charges against such individuals.

DOJ attorneys should not resolve civil matters against a corporation without a clear plan to resolve related individual cases. As Ms. Yates stated in her November 16 speech, the Yates Memo’s revisions to the USAM would allow DOJ civil attorneys “to resolve corporate cases only when there is a clear plan to pursue individuals[,]”[92] a directive also reflected in the Yates Memorandum.[93] Accordingly, it appears that DOJ officials will now be required to formalize their analysis of whether any individual wrongdoers can be prosecuted before a corporate settlement can be approved.

DOJ attorneys should evaluate whether to bring suit against an individual based on considerations beyond an individual’s ability to pay and may consider whether charges against responsible individuals satisfy prosecutorial goals. In keeping with the Yates Memorandum’s emphasis on the fact that individual prosecutions are among the highest priority of any corporate investigation, the revisions to the USAM provide that determinations as to whether to bring suit against an individual should not be based solely on the individual’s ability to pay a judgment. Instead, by focusing broadly on the need to hold corporate wrongdoers accountable, federal prosecutions serve the “twin goals of recovering the losses caused by the misconduct and deterrence through individual accountability.”[94] Relatedly, the USAM now includes a section that requires prosecutors to “consider whether charges against the individuals responsible for the corporation’s malfeasance will adequately satisfy the goals of federal prosecution.”[95] Without saying so explicitly, these revisions appear to reflect the possibility that a company that discloses misconduct early and completely will informally benefit where individual wrongdoers are identified and prosecuted.

5. International Cooperation

The second half of 2015 saw further success for the Antitrust Division and the FTC in solidifying working arrangements with foreign enforcement agencies across the globe. Ranging from joint investigations with European agencies to partnership agreements with Asian enforcers, the Division continues to aggressively pursue its goal of attaining international convergence and inter-jurisdictional cooperation.

On September 8, the DOJ and FTC signed a Memorandum of Understanding (MOU) with Korea’s Fair Trade Commission (KFTC) memorializing both countries’ pledge to continue cooperating in international enforcement.[96] Effective immediately, the agreement was signed by the heads of each of the three agencies: Assistant Attorney General Bill Baer of the Antitrust Division, Chairwoman Edith Ramirez of the FTC, and Chairman Jeong Jae-chan of the KFTC. The MOU records the agencies’ intentions to coordinate enforcement efforts while pursuing matters under common review, sets a framework for inter-agency communication, and details confidentiality policies on information shared between the KFTC and US enforcement agencies. The MOU makes Korea the third East Asian country to form an antitrust accord with the US, joining Japan (1999) and China (2011). Baer added that “Enforcement cooperation – including candid and constructive dialogue – is critical to maintaining competitive markets in the United States, Korea, and around the world.”

B. CANADA

In the second half of 2015, the Canadian Competition Bureau (“CCB”) secured its eighth guilty plea in a long-running investigation into bid rigging in the auto parts industry. On December 9, 2015, the CCB announced that Toyo Tire & Rubber Company, a Japanese manufacturer of automobile and truck tires as well as other rubber components, had agreed to plead guilty to three counts of bid rigging under the Competition Act for the company’s participation in an international conspiracy related to the supply of anti-vibration components to Toyota Motor Company.[97] Toyo also agreed to pay a fine of CAD 1.7 million ($1.25 million). The CCB’s auto parts investigation has yielded a total of more than CAD 58 million ($42.7 million) in fines since April 2013.

The CCB also secured a fine in another multiyear investigation, this one into anticompetitive behavior in Ontario’s residential water heater industry. On October 30, 2015, the CCB announced it had fined Direct Energy Marketing Limited CAD 1 million ($737,000) to resolve concerns that Direct Energy restricted competition and limited consumer choice in Ontario’s residential water heater market.[98] Direct Energy, which has since exited the Ontario market, also agreed to establish and maintain a corporate compliance program in the event it re-enters that market in the next 10 years. The CCB’s investigation began in December 2012 when the bureau filed allegations against Direct Energy and Reliance Comfort Limited Partnership charging that the two companies used return policies and procedures designed to make it more difficult for customers who rented water heaters to switch to products offered by competitors. In November 2014, the CCB announced that it had obtained a commitment from EnerCare Inc., the company that had acquired Direct Energy’s water heater rental business in Ontario, that EnerCare would not continue Direct Energy’s alleged anticompetitive policies and practices. At the same time, the CCB announced it had reached a consent agreement with Reliance that included payment of a CAD 5 million ($3.7 million) fine.[99]

The CCB suffered a blow in late 2015 when the Public Prosecution Service of Canada (PPSC) decided to drop a high-profile prosecution into an alleged chocolate cartel. On November 18, 2015, the PPSC announced that it would stay charges against Nestlé Canada Inc. and a former Nestlé executive, thereby ending the bureau’s investigation into alleged price fixing by five companies.[100] The CCB launched the investigation into the alleged chocolate cartel in 2007 after Cadbury Adams Canada Inc. reported the conduct under the CCB’s immunity program. In June 2013, Hershey Canada Inc., which cooperated with the CCB in return for leniency, pleaded guilty to a criminal charge of price fixing and was fined CAD 4 million ($2.9 million). Also in June 2013, criminal charges were filed against Nestlé, Mars Canada Inc., and ITWAL Limited (a national network of independent wholesale distributors), as well as three current and former executives from Nestlé and ITWAL. But the prosecution began to collapse in early September 2015 when the PPSC dropped charges against all defendants except for Nestlé and a former Nestlé executive. Although neither the PPSC or the CCB provided an explanation for the decision to drop charges against the remaining defendants in November, one publication suggested it was in part because the charges–which stemmed from conduct alleged to have occurred in 2007–were too old to comport with Canadian law that guarantees defendants that their cases will go forward in a “reasonable time.”[101]

Meanwhile, the second half of 2015 also saw the CCB launch investigations into the airline industry. In July 2015, the CCB asked a federal judge in Ottawa to order Air Canada to turn over information related to a proposed joint venture between the flag carrier and Air China.[102] Air Canada and Air China had previously announced a joint venture that would increase cooperation between the two firms in sales, marketing, and airport operations, as well as share revenue. The CCB’s probe marks the second time in recent years that the bureau has investigated Air Canada for a joint venture: in October 2012, the CCB reached a settlement with Air Canada and United Continental that barred the two airlines, which had entered into a joint venture, from coordinating on key aspects of competition.

On the judicial front, a Canadian court issued a decision that could have implications for companies that plead guilty to a regulatory offense and subsequently find themselves barred from entering into public contracts. In 9060-1766 Québec inc. c Agence de revenu du Québec, 2015 QCCS 3339, a company charged with providing inaccurate information to tax officials decided not to fight the charges, instead pleading guilty and paying a $500 fine.[103] The company later learned that as a result of its guilty plea, it was barred from entering into contracts with the Québec government. The company applied to the Superior Court of Québec for authorization to withdraw its guilty plea, and the court granted the request. According to the court, there was no evidence that the company, which had not sought legal advice with respect to its guilty plea, knew or could have known the consequences of its plea. The court further suggested that prosecutors should consider spelling out the collateral consequences of a guilty plea in the statement of offence for regulatory offenses, to ensure that the accused makes an informed decision.

C. BRAZIL

As forecasted in our 2015 Mid-Year Criminal Antitrust Update, 2015 was an active year for Brazilian cartel enforcement. In the second half of 2015, Brazil’s competition authority, the Administrative Council for Economic Defense (“CADE”) continued its investigations in “Operation Car Wash” and into foreign exchange rates. In addition, CADE upheld the historic fines imposed in the 2014 cement case. Moreover, CADE reached settlements, rendered decisions imposing high fines, and initiated a number of new investigations. Finally, CADE published two important documents to provide guidance to companies on (i) implementing internal compliance programs, and (ii) its leniency program.

1. “Operation Car Wash” Continues

As reported in our 2015 Mid-Year Criminal Antitrust Update, the General Superintendence of CADE has been coordinating with Brazilian federal prosecutors in an investigation named “Operação Lava Jato” or “Operation Car Wash” (after the network of laundromats and gas stations allegedly used to move illicit funds).[104] Operation Car Wash investigates suspected bid rigging in contracts with Petrobras, Brazil’s state-owned energy company, and Electrobras, Brazil’s state-owned electric utilities company.

Much of the activity in Operation Car Wash in the second half of 2015 involved one construction company–Construções e Comércio Camargo Corrêa S.A (“Camargo Corrêa”). The developments in the General Superintendence’s investigation of Camargo Corrêa in July and August provide a useful example of the different types of cooperation arrangements available to entities under investigation by CADE. CADE uses three types of cooperation arrangements: (i) leniency agreements, (ii) leniency plus agreements, and (iii) cease-and-desist agreements (Termo de Compromissos de Cessação de Prática or “TCC”).[105]

Leniency agreements are available to only the first company to admit its involvement in a cartel to CADE. Successful leniency applicants are granted immunity before CADE and–if the agreement is signed jointly with the Federal Public Prosecutor’s Office–immunity from criminal prosecution, provided that the applicants cease involvement in the misconduct, admit their wrongdoing, and cooperate fully. As reported in our 2015 Mid-Year Criminal Antitrust Update, Setal Group signed a leniency agreement with CADE’s General Superintendence and the Federal Public Prosecutor’s Office in connection with an Operation Car Wash investigation in Paraná in March.[106]

The second type of agreement, leniency plus, is available to those applicants who do not qualify for immunity (because they are not the first to come forward), but who offer information concerning a separate collusion about which CADE had no prior knowledge.[107] Those who receive leniency plus can obtain all the benefits of leniency in proceedings concerning the newly reported conduct and up to an additional one-third reduction in sanctions in the first investigation (beyond whatever reduction it obtained for its cooperation in that investigation). On July 31, 2015, Camargo Corrêa and some of its former employees signed a leniency plus agreement with CADE’s General Superintendence and the Federal Public Prosecutor’s Office in which Camargo Corrêa self-reported participation in bid rigging involving the Angra 3 power plant in Rio de Janeiro.[108] CADE formally opened administrative proceedings with respect to the Angra 3 cartel conduct in Rio de Janeiro on November 19, 2015.[109]

On August 19, Camargo Corrêa entered into the third type of cooperation arrangement with CADE–a TCC.[110] A TCC is a cease-and-desist agreement available to companies who are not the first to come forward, but who are willing to admit their wrongdoing and cooperate with the authority. The first company to enter a TCC can obtain a reduction of thirty to fifty percent of its sanctions. Because Setal Group had already been granted leniency with respect to the Paraná matter, Camargo Corrêa availed itself of a TCC.

By signing a leniency plus agreement for the Angra 3 collusion in Rio de Janeiro and a TCC for the Paraná conduct, Camargo Corrêa was entitled to a sixty percent reduction in sanctions in the Paraná proceedings and full immunity in the Rio de Janeiro proceedings. Camargo Corrêa was ultimately fined BRL 104 million ($27.3 million) after the sixty percent reduction was applied. This fine is the highest ever established under a TCC.[111]

The information acquired from Camargo Corrêa’s cooperation also formed part of the foundation for an administrative proceeding opened by CADE on December 22, 2015, into alleged collusion in public bids with Petrobras for engineering, construction, and onshore industrial assembly services. According to CADE, there is evidence that at least twenty-one companies and fifty-nine individuals engaged in price fixing, market sharing, and bid rigging.[112]

2. Historic Fines Upheld in Cement Cartel Case

Our 2014 Year-End Criminal Antitrust Update examined in detail the historic sanctions imposed by CADE in May 2014 in a cement cartel case.[113] CADE fined six companies, three industry associations, and six individuals a record BRL 3.1 billion ($1.3 billion[114]) for their involvement. On July 29, 2015, CADE clarified its decision and modified one of the sanctions.[115] CADE reduced the so-called “media obligation,” which required certain investigated parties, including a number of individuals, to file multiple advertisements in a variety of media outlets publicizing the decision. CADE modified this remedy to require only the companies to file, and to do so in only one leading newspaper, based on the fact that the decision was already greatly publicized and the requirement placed a considerable financial burden on the affected individuals. Notably, however, CADE upheld the record fines. CADE’s decisions are subject to judicial review, and an appeal is expected.[116]

3. CADE Investigates Foreign Exchange Market

CADE’s General Superintendence continues to investigate alleged anticompetitive conduct involving foreign exchange rates, as reported in our 2015 Mid-Year Criminal Antitrust Update.[117] On July 2, 2015, CADE’s General Superintendence announced that it had initiated proceedings against fifteen financial institutions and thirty individuals related to alleged collusion over exchange rates for local and foreign currencies. CADE disclosed the names of the thirty individuals being investigated, but did not release details as to the specific allegations against each of them.[118]

4. New Cease-and-Desist Agreements (TCCs)

CADE continued to secure cease-and-desist agreements in the second half of 2015. On August 19, CADE signed a TCC (cease-and-desist agreement) which imposed BRL 10 million (approximately $2.5 million) in fines on a parking lot company and seven individuals that participated in collusion among parking lot operators in São Paulo.[119]

On September 2, CADE’s Tribunal approved four cease-and-desist agreements in the following investigations: (i) dynamic random access memory (“DRAM”),[120] (ii) liquefied petroleum gas (“LPG”), (iii) resins, and (iv) railway logistics services.[121] CADE collected a total of approximately BRL 9.8 million (approximately $2.4 million) from these four settlements.

5. Proceedings before CADE’s Tribunal

A number of significant cases were decided by, or referred to, CADE’s Tribunal (CADE’s decision-making body) in the second half of 2015.

a. Decisions Rendered

In August, CADE fined an association of toy manufacturers and its president for allegedly holding a meeting with representatives of participant companies aimed at discussing price fixing and market division.[122]

In September, CADE fined a union of automobile dealers and two of its top officials for suspected price fixing.[123] The union was fined BRL 532,000 (approximately $132,000), the former president was fined BRL 319,200 ($82,000), and the vice president was fined BRL 266,000 (approximately $66,000). The same month, the Tribunal condemned six companies for allegedly participating in a bid-rigging scheme for solar heater contracts.[124] The companies were fined a total of BRL 21.4 million (approximately $5.3 million). Also in September, CADE imposed a total of BRL 6.9 million (approximately $1.7 million) in fines on the Brazilian Association of Blood Banks and seven blood banks for their alleged participation in a blood bank cartel between 2002 and 2004 in the metropolitan region of Goiânia.[125]

In November, CADE imposed a fine of BRL 532,000 (approximately $132,000) on the Sociedade Brasileira de Anestesiologia (“SBA”) for allegedly coordinating price fixing in the Brazilian anesthesia market.[126]

b. Pending Cases

Since July 2015, CADE’s General Superintendence has referred various cases to CADE’s Tribunal. For example, in October, CADE’s General Superintendence recommended to the Tribunal that three companies, two cooperatives, a labor union, and ten individuals be convicted for their participation in a milk cartel.[127] In November, CADE’s General Superintendence recommended to the Tribunal the conviction of four companies and seven individuals suspected of price fixing, customer allocation, and stifling technological innovations in the international cathode ray tubes (“CRT”) market.[128]

CADE’s General Superintendence continued to use its authority to prosecute conduct that occurred more than a decade ago, a troubling practice previously reported in our 2014 Year-End Update Criminal Antitrust and Competition Law Update.[129] In July, CADE’s General Superintendence recommended to its Tribunal the condemnation of a cartel in the international sodium perborate (a bleaching agent used in laundry detergents) market for conduct that occurred between 1998 and 2001.[130]

In December, based on an investigation triggered by a leniency application, the General Superintendence recommended that its Tribunal sanction 11 companies that allegedly agreed to fix prices, rig bids, and geographically divide the market for gas-insulated switchgear–combined electrical disconnect switches used to control energy flow and protect electricity distribution grids in power plants–between 1988 and 2004. This appears to be a further example of CADE completing its investigations long after other competition authorities. For example, the European Commission concluded its investigation into the gas-insulated switchgear cartel in 2007 and fined several of its members EUR 750 million (approximately $1.01 billion).[131]

6. New Investigations Initiated by CADE’s General Superintendence

The second half of 2015 also saw the initiation of several new investigations into allegedly collusive behavior. In 2015, CADE opened seven new investigations in the auto parts industry. Four of these probes were discussed in the 2015 Mid-Year Criminal Antitrust and Competition Law Update, including investigations related to clutch facings, windshield wipers, thermal systems, and safety devices.[132] Since the mid-year update, CADE has opened three new investigations into suspected price fixing and market allocation in the auto parts industry. On September 28, 2015, the General Superintendence opened an investigation regarding the car bumpers market.[133] On November 11, 2015, CADE announced the initiation of an investigation into ten wire harness and electrical component companies.[134] According to publicly available sources, this investigation marked the sixth auto parts probe this year and the eighth investigation in the industry since 2014. Then, on December 21, 2015, the General Superintendence opened an investigation into potential collusion in the clay substrates market. Clay substrates are a component of catalysts in car exhaust systems. CADE has also reported that there have been dawn raids that could result in administrative proceedings in the following auto parts industries: lighting (headlights, flashlights, and brake lights); emergency switches (hazard lights and turn signals); access mechanisms (cylinders set, handles, and locks); and clutches.[135]

In November, CADE worked with police and prosecutors in the so-called “Operação Dubai” or “Operation Dubai,” to conduct forty-two raids of homes and offices in Brasilia and Rio de Janeiro in connection with a suspected fuel cartel.[136] According to publicly available sources, of the cartel cases decided by CADE between October 1999 and October 2014, one quarter were linked to the fuel industry.

CADE also initiated investigations into suspected cartels in the following industries in the second half of 2015: (i) refractory ceramic rollers,[137] (ii) computer equipment and materials,[138] (iii) gas stations and fuel distributors,[139] (iv) hydrometers (devices used by residential consumers to measure water),[140] and (v) certain implantable medical devices (orthoses and prostheses).[141]

7. CADE Hosts Bid Rigging Seminar with OECD

On November, 3, 2015, CADE hosted a seminar with the Organization for Economic Cooperation and Development (“OECD”) titled “OECD-CADE Competition Summit: Public Procurement & Fighting Bid Rigging.”[142] In the opening panel, CADE’s President, Vinicius Marques de Carvalho, stated that fighting cartels in public procurement is a priority for CADE and explained that CADE must have the support of other Brazilian governmental bodies to fight these cartels across the country. Also in the opening panel, Angel Gurría, OECD’s Secretary General, remarked that combating bid rigging in public procurement is particularly relevant in a struggling Brazilian economy, because public bids generate large expenses for the government. There was also a panel on international best practices in fighting bid rigging in public procurement and a panel on Brazil’s experiences fighting these cartels.

8. CADE Publishes Two New Guidelines Documents

CADE also published two important guidelines documents in the second half of 2015.

First, on August 19, it released a preliminary version of its Guidelines for Competition Compliance Programs. These guidelines are intended to be used by companies to create an internal compliance program that will prevent competition law violations or, if they do occur, detect them more quickly. CADE accepted comments on the document until October 18. The final guidelines have not yet been published. Companies are not required to implement a compliance program based on the guidelines but CADE announced that it might consider the implementation of a compliance program as evidence of good faith and a mitigating factor when calculating a fine. According to the preliminary guidelines, the burden of proof will be on the company to prove a program’s effectiveness and robustness.[143]

Second, on November 11, CADE released a preliminary version of Frequently Asked Questions (“FAQs”) regarding its Leniency Program for public comment. The goal of the document is to strengthen and expand Brazil’s Leniency Program and provide enhanced transparency and predictability in relation to leniency agreements. According to CADE, the FAQs are not binding on the authority, but will instead serve as a reference in negotiating leniency agreements. CADE will accept comments on the preliminary version until January 10, 2016. When it published the FAQs, CADE also announced its intention to amend its internal regulations. The proposed amendments to the regulations aim to clarify important aspects of CADE’s practices identified during the drafting of the FAQs. The proposed amendments include the regulation of leniency plus, as well as the reconsideration of certain internal deadlines which would allow the negotiation of leniency agreements to be quicker and better monitored.[144]

D. CHILE

The second half of 2015 saw Chilean courts hand antitrust defendants one significant loss and one large victory. First, in late July 2015, the Fourth Criminal Court of Santiago threw out criminal charges against 10 individuals who allegedly participated in price fixing in the pharmaceutical industry. The public prosecutor had filed the criminal case in 2011, charging 10 individuals–former and current employees at Framacias Ahumada, Cruz Verde, and Salcobrand pharmacies–with fraudulently modifying the natural price of goods. These charges followed an investigation by Chile’s National Economic Prosecutor (“FNE”) that found the country’s leading pharmacy chains fixed the prices of more than 200 drugs between December 2007 and March 2008, resulting in administrative fines. But the Public Prosecutor’s criminal prosecution unraveled this past July when a majority of the Fourth Criminal Court found that the 10 defendants did not explicitly deceive customers, and therefore did not act fraudulently. One judge dissented, arguing that the evidence showed that four of the 10 defendants should be punished for acting fraudulently. The Court’s decision came as Chile weighs whether to re-impose criminal liability for certain antitrust activity; in early 2015 the country’s president signed a draft bill that would re-introduce criminal penalties for price fixing and bid rigging.[145]