January 4, 2016

As we kick off our second decade of updates on the state of play in international anti-corruption enforcement, the stakes for multinational companies have never been higher. No longer may entities operating abroad focus their attention narrowly on the two domestic enforcers of the Foreign Corrupt Practices Act (“FCPA”)–the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”). Anti-corruption enforcement is now a global endeavor with regulators around the globe focusing their sights on those who seek to profit on the corruption of government officials.

On the U.S. front, DOJ continues its push to demonstrate that financial penalties for FCPA violations are not simply the cost of doing business internationally by putting culpable individuals in prison. Meanwhile, the SEC has stepped up as the predominant corporate enforcer, bringing cases founded on creative theories that ride the edges of the statute’s contours.

This client update provides an overview of the FCPA as well as domestic and international anti-corruption enforcement, litigation, and policy developments from the year 2015.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and “agents” acting on behalf of issuers and domestic concerns, as well as to “any person” that violates the FCPA while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and their agents. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts, that in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

FCPA ENFORCEMENT STATISTICS

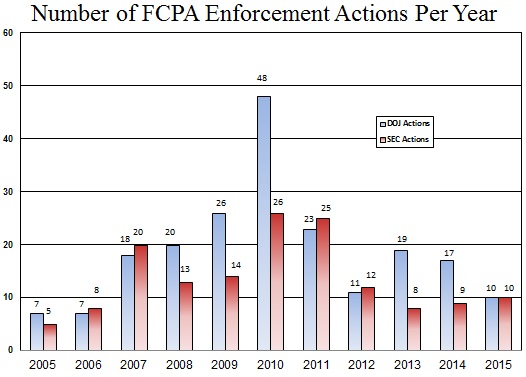

The following table and graph detail the number of FCPA enforcement actions initiated by the statute’s dual enforcers, DOJ and the SEC, during each of the past ten years.

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||

| DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC |

| 7 | 8 | 18 | 20 | 20 | 13 | 26 | 14 | 48 | 26 | 23 | 25 | 11 | 12 | 19 | 8 | 17 | 9 | 10 | 10 |

2015 FCPA Enforcement Trends

In each of our year-end FCPA updates, we seek not only to report on the year’s FCPA enforcement actions but also to identify and synthesize the developing trends that stem from these actions. In 2015, six key enforcement trends stand out from the rest.

DOJ Focuses on Individual Accountability

On September 9, 2015, U.S. Deputy Attorney General Sally Yates issued a memorandum to all federal prosecutors announcing a policy of holding individual corporate officers accountable in investigations of corporate misconduct. The “Yates Memorandum,” as it has become known, did not depart substantially from existing Departmental policy, but nevertheless is the latest in a series of increasingly direct statements from senior DOJ officials that demonstrates a renewed focus on the subject.

The Yates Memorandum, covered in greater depth in our separate client alert DOJ’s Newest Policy Pronouncement: the Hunt for Corporate Executives, outlines the following six key steps intended to strengthen DOJ’s focus on pursuing individual wrongdoers:

- To qualify for any cooperation credit, companies must provide DOJ with all relevant facts relating to the individuals involved in the corporate misconduct;

- Criminal and civil investigations should focus on individuals from their inception;

- Criminal and civil DOJ attorneys handling corporate investigations should be in routine communication with one another;

- Absent extraordinary circumstances or approved Departmental policy, DOJ will not release individuals from civil or criminal liability when resolving a matter with a corporation;

- DOJ attorneys should not resolve matters with a corporation unless there is a clear path to resolve related individual cases, and they should memorialize any declinations as to individuals in such cases; and

- Civil DOJ attorneys consistently should focus on individuals, and should evaluate whether to bring suit against an individual based on considerations beyond ability to pay.

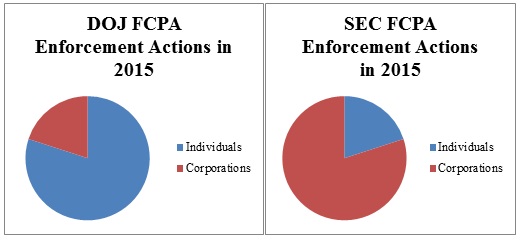

The increased focus on individual defendants is a Department-wide phenomenon that goes well beyond FCPA enforcers, but yet it is exemplified in the year’s criminal FCPA enforcement statistics. Not only did individuals make up 80% of DOJ’s FCPA enforcement docket in 2015, but in no case this year did DOJ bring an enforcement action against a corporation without also prosecuting officers associated with that corporation. While the SEC has made clear that holding individuals accountable for FCPA misconduct is likewise a focus of the Commission, 2015 statistics do not bear out this prioritization in the same way that DOJ’s statistics do. Indeed, the breakdown of FCPA enforcement actions against corporations and individuals at the SEC in 2015 was exactly the inverse of DOJ’s, with corporations constituting 80% of the SEC’s FCPA enforcement docket. A graphic breakdown of FCPA charges by DOJ and the SEC in 2015 follows:

The latest example of DOJ’s focus on individual defendants is the December 10, 2015 indictment of Roberto Enrique Rincon-Fernandez and Abraham Jose Shiera-Bastidas, respectively the president and a third-party agent of Texas-based oil services company Tradequip Services & Marine. Charging documents unsealed after the two were arrested in Houston and Miami allege that between 2009 and 2014 they conspired together and with others to secure energy contracts from Venezuela’s state-owned energy company, Petróleos de Venezuela S.A. (“PDVSA”), via corrupt payments to PDVSA officials. Among other things, Rincon-Fernandez and Shiera-Bastidas are alleged to have paid millions of dollars to their “aliados” (allies) on PDVSA’s contract steering committees to stack the list of companies eligible to bid on contracts with multiple companies owned or controlled by the defendants, thus giving the false appearance that the bids were competitive. In addition to substantive and conspiracy FCPA bribery charges, Rincon-Fernandez and Shiera-Bastidas are charged with money laundering.

This case demonstrates convincingly the proposition that focusing on individual defendants does not mean that DOJ is in any way “going small” or shying away from major corruption cases. Testimony adduced at the detention hearing appears to have been even more extensive than the indictment, with U.S. Magistrate Judge Nancy K. Johnson finding that the conspiracy may involve as much as $1 billion in illicit proceeds. This, coupled with the facts that Rincon-Fernandez is a citizen of Venezuela (which has no extradition treaty with the United States) who has revoked his legal permanent residence status in the United States, owns homes in Spain and Aruba, and is suspected to have moved at least $100 million through Swiss bank accounts, led Judge Johnson to conclude that there are no conditions of release that could outweigh the serious risk of flight that Rincon-Fernandez presents. He was thus ordered detained pending trial. Shiera-Bastidas is also being held in a Miami jail pending a January 2016 detention proceeding.

Another recent example of DOJ’s focus on individual defendants is the FCPA guilty plea of Daren James Condrey. Condrey, who operated a Maryland-based company specializing in the importation of uranium into the United States, was charged initially via a criminal wire fraud complaint in October 2014. Although the substantive allegations concerned a scheme to pay approximately $2 million to an official of JSC Techsnabexport (“TENEX”)–a Russian state-owned supplier of uranium and uranium enrichment services–in return for directing $33 million in sole-source uranium transportation contracts to Condrey’s company, the initial charges did not allege violations of the FCPA. Then, on June 16, 2015, DOJ unsealed a criminal information charging Condrey with one count of conspiracy to violate the FCPA’s anti-bribery provision and to commit wire fraud.

Charged along with Condrey in 2014 were his wife, Carol, the TENEX official alleged to have received the corrupt payments, Vadim Mikerin, and a businessman alleged to have served as a middleman for the corrupt payments, Boris Rubizhevsky. The wire fraud charges against Mrs. Condrey were dismissed in April 2015, shortly before Mr. Condrey reached a plea agreement with DOJ. Separately, Rubizhevsky and Mikerin pleaded guilty to one count each of conspiracy to commit money laundering on June 15 and August 31, 2015, respectively. Mikerin was sentenced on December 15 to 48 months’ imprisonment and to forfeit $2,126,622 in illicit proceeds. Condrey and Mikerin are scheduled to be sentenced in January 2016.

Another point illustrated by the Condrey case is the manner in which FCPA statistics account for but a portion of the anti-corruption enforcement efforts undertaken by DOJ. While only Mr. Condrey’s case was ultimately resolved with an FCPA charge, three additional individuals were charged and two were convicted of related offenses. Thus, what from a resources perspective is a four-person prosecution shows up only as a single case in the FCPA enforcement statistics.

Yet another example of a case that began on non-FCPA grounds but may well trend FCPA in the near future is the recent money laundering plea of a government aviation official from Tamaulipas, one of the 31 Mexican states. On December 9, 2015, Ernesto Hernandez-Montemayor pleaded guilty to conspiracy to commit money laundering based on allegations that between 2006 and 2010 he received more than $200,000 in bribes from two unnamed employees of an unidentified Texas aviation company. Hernandez-Montemayor has been ordered held pending a February 2016 sentencing date. We expect charges against additional defendants to follow.

An example of DOJ prosecuting corporate executives together with their company is the July 17, 2015 resolutions with New Jersey engineering and infrastructure firm Louis Berger International, Inc. (“LBI”) and two of its former senior vice presidents, Richard Hirsch and James McClung. In coordinated resolutions, DOJ entered into a deferred prosecution agreement with the corporation and plea agreements with the individuals on FCPA bribery and conspiracy charges alleging that between 1998 and 2010 LBI (including through Hirsch and McClung) paid nearly $4 million in bribes to government officials in India, Indonesia, Kuwait, and Vietnam.

LBI agreed to pay a $17.1 million criminal penalty and to retain an independent compliance monitor for the three-year term of the deferred prosecution agreement. Notably, LBI’s criminal fine was reduced substantially based on its voluntary disclosure of the conduct in question, even though the disclosure came after DOJ was already investigating LBI’s predecessor entity for alleged False Claims Act violations associated with its work for the U.S. military in Iraq and Afghanistan. (The November 2010 False Claims Act resolution is covered in our 2010 Year-End False Claims Act Update.) LBI’s parent company also entered into a February 2015 resolution with the World Bank in which it consented to a one-year debarment from Bank-financed projects based on the alleged misconduct. Hirsch and McClung are scheduled to be sentenced in the U.S. District Court for the District of New Jersey in February 2016.

For another example of DOJ reaching coordinated corporate / individual resolutions in an FCPA case, please see our description of the IAP Worldwide Services, Inc. / James Michael Rama settlements of June 2015 in our 2015 Mid-Year FCPA Update.

Finally, in an example of an individual defendant resolving FCPA charges without (and potentially in advance of) his employer, on August 12, 2015 DOJ and the SEC announced resolutions with former regional director of SAP International Inc., Vincente Eduardo Garcia. In the only joint DOJ-SEC FCPA case of 2015, the agencies alleged that between 2009 and 2013 Garcia orchestrated a scheme to pay $145,000 in bribes to at least one Panamanian official in order to secure $3.7 million in software supply contracts for his employer. Garcia allegedly accomplished this by authorizing discounts to a channel partner that exceeded 80%, which allowed the partner to set up a slush fund from which to make corrupt payments. Garcia also allegedly received kickbacks from this slush fund himself.

To resolve the criminal charges, Garcia pleaded guilty to a single count of conspiracy to violate the FCPA’s anti-bribery provisions and, on December 16, 2015, was sentenced to 22 months in prison, to be followed by a three-year term of supervised release. To resolve the civil charges, Garcia consented to the filing of a settled administrative proceeding alleging violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions, and agreed to pay more than $92,000 in disgorgement and prejudgment interest. Although both DOJ and the SEC have stated that their investigations are ongoing, there have been no announcements concerning whether charges against SAP are forthcoming.

The SEC Takes the Lead in Corporate Enforcement Actions

Much as DOJ led the charge with respect to individual accountability, the SEC set the pace for corporate FCPA enforcement during 2015. Eight of the ten corporate enforcement actions filed in 2015 were brought by the SEC. Further, there were no joint DOJ-SEC FCPA prosecutions of companies in 2015, which is a stark departure from prior years in which it was more probable than not that a company subject to the jurisdiction of both agencies (corporate issuers) would resolve with both. Although it is too soon to draw any trend lines, the more discerning footprint of corporate enforcement by DOJ is consistent with statements made by Assistant Attorney General Leslie R. Caldwell at the ABA White Collar Crime Conference on March 6, 2015, in which Caldwell stated that DOJ was rethinking its “over use[]” of deferred and non-prosecution agreements in the past and predicted an “uptick in [DOJ] declinations for companies” in the future. For more on the evolving approach to deferred and non-prosecution agreements, please see our forthcoming 2015 Year-End Update on Corporate NPAs and DPAs.

Select corporate enforcement brought by the SEC in 2015, not covered elsewhere in this update, include the following:

- Mead Johnson Nutrition Co. – On July 28, 2015, Mead Johnson Nutrition, one of the world’s largest manufacturers of infant formula, agreed to pay $12 million to the SEC, without admitting or denying the findings, to resolve allegations that it violated the accounting provisions of the FCPA in connection with certain medical marketing activities in China. In particular, the SEC alleged that between 2008 and 2013 certain employees of the company’s Chinese subsidiary improperly compensated state-employed healthcare professionals in China to recommend Mead Johnson’s formula to new and expectant mothers. According to the SEC’s cease-and-desist order, funding for these payments came from funds generated by discounts provided to Mead Johnson China’s network of distributors. Under contracts between Mead Johnson China and its distributors, Mead Johnson China provided the distributors a discount for Mead Johnson’s products that was allocated for funding certain marketing and sales efforts. Although these funds contractually belonged to the distributors, the SEC contended that certain employees of the Chinese subsidiary retained some control over how this money was spent, including providing funding for the payments to healthcare professionals. Mead Johnson’s purported failure to record a portion of the discounts as payments to healthcare professionals and to implement internal controls to ensure that Mead Johnson China’s method of funding marketing and sales expenditures through its distributors was not used for unauthorized purposes, allegedly ran afoul of the FCPA’s accounting provisions.Without admitting or denying the allegations, Mead Johnson agreed to the entry of an administrative order and to pay disgorgement of $7.77 million, prejudgment interest of $1.26 million, and a civil penalty of $3 million (for a total of just over $12 million). Gibson Dunn represented Mead Johnson in its settlement with the SEC.

- Bristol-Myers Squibb Co. – On October 5, 2015, the SEC announced another settled FCPA cease-and-desist proceeding arising out China, this time against pharmaceutical company BMS. The SEC alleged that, between 2009 and 2014, certain sales representatives at a joint venture in which BMS was a majority owner made improper payments to healthcare professionals–in the form of cash, gifts, meals, travel, entertainment, and sponsorships for conferences and meetings–in exchange for prescribing BMS products. According to the SEC, the company did not respond adequately to “red flags,” including claims by certain terminated employees that it was an “open secret” that healthcare professionals in China rely upon “gray income” to maintain their livelihood and that providing various benefits to the doctors was the only way to meet sales quotas.Without admitting or denying the allegations, BMS consented to the entry of a cease-and-desist order and agreed to pay disgorgement of $11,442,000, prejudgment interest of $500,000, and a $2.75 million civil penalty (for a total of just under $14.7 million). The SEC acknowledged in its order BMS’s “significant measures” to improve upon its compliance program, including a 100% pre-reimbursement review of all expense claims, termination of more than 90 employees, and a revised compensation structure. BMS agreed to report to the SEC regarding its compliance efforts for a two-year period. Gibson Dunn represented BMS in its settlement with the SEC.

- For summaries and insights concerning the SEC’s corporate FCPA enforcement actions from the first half of 2015, including settlements with PBSJ Corporation, Goodyear Tire & Rubber Company, FLIR Systems Inc., and BHP Billiton Ltd. / Plc., please see our 2015 Mid-Year FCPA Update.

The breadth of talent across the SEC’s FCPA Unit was also showcased prominently in 2015. In addition to the Home Office in Washington, D.C., the FCPA Unit has members in six regional offices: Boston, Fort Worth, Los Angeles, Miami, Salt Lake City, and San Francisco. Each of these seven offices was responsible for at least one of the SEC’s 10 FCPA enforcement actions in 2015. DOJ’s FCPA Unit is based entirely in Washington, D.C., although certain members have been known to operate remotely from other cities as their caseloads dictate and DOJ’s FCPA Unit routinely partners with U.S. Attorney’s Offices from around the country on their matters. DOJ also recently added 10 new prosecutors to focus on FCPA enforcement.

The First Financial Services / Sovereign Wealth Fund FCPA Enforcement Action

It was October 2008 when the then-head of DOJ’s Fraud Section announced at a SIFMA conference that DOJ and the SEC were focused on interactions between financial services firms and foreign sovereign wealth funds. Nearly seven years later, the SEC announced the first FCPA charges arising out of this highly publicized industry sweep.

On August 18, 2015, the SEC brought a settled cease-and-desist proceeding for alleged FCPA violations by The Bank of New York Mellon Corporation. The SEC’s allegations were that the bank corruptly provided internships to relatives of foreign officials overseeing the sovereign wealth fund of an unnamed Middle Eastern country that BNY Mellon had serviced since 2000. In February 2010, two of the officials allegedly requested internships for their relatives, including the officials’ sons and one of the official’s nephews. These prospective interns purportedly did not meet BNY Mellon’s “rigorous criteria” for its internship program, but BNY nevertheless hired them outside of the normal process “before even meeting or interviewing them.” The SEC further alleged that the experiences given to these interns were “customized one-of-a-kind training programs,” including above-scale salaries, coordination of visa services, and a “bespoke” experience that included longer-than-normal terms. The SEC’s allegations cite twice to a BNY Mellon employee’s e-mail referring to the internships an “expensive favor.” In return for these internships, the SEC alleges that that BNY Mellon was allocated $689,000 in additional funds under management, a rather paltry difference in the $55 billion in funds managed by the bank over the course of its relationship with the sovereign wealth fund.

For these allegedly improper internships, BNY Mellon agreed to pay $8.3 million in disgorgement, prejudgment interest of $1.5 million, and a $5 million civil penalty (for a total of $14.8 million). BNY Mellon consented to the entry of a cease-and-desist order without admitting or denying the allegations, which included violations of the FCPA’s anti-bribery and internal controls provisions.

SEC Director of Enforcement Andrew J. Ceresney emphasized in announcing the settlement that “The FCPA prohibits companies from improperly influencing foreign officials with ‘anything of value,’ and therefore cash payments, gifts, internships, or anything else used in corrupt attempts to win business can expose companies to an SEC enforcement action.” The SEC’s cease-and-desist order found that although BNY Mellon had a compliance program and a FCPA-specific policy at the time of the alleged misconduct, the bank “maintained few specific controls around the hiring of customers and relatives of customers, including foreign government officials.” Specifically, the SEC alleged that “human resources personnel were not trained to flag potentially problematic hires” and that there was “no mechanism for review [of these prospective hires] by legal or compliance staff.” The SEC did note, however, that BNY Mellon had already begun the process of enhancing its control processes before being approached in connection with this investigation.

Reminders that the FCPA’s Contours Reach Beyond Government Officials

The focal point of most FCPA compliance discussions is rightly corrupt payments to officials of foreign government entities (including state-owned entities). But a point that Gibson Dunn always seeks to deliver to its clients is that the anti-bribery provisions also proscribe corrupt payments to foreign political parties and officials thereof, candidates for public office, and employees of “public international organizations.” Further, the FCPA’s accounting provisions can be employed to cover even purely commercial corruption if the improper payments are inaccurately recorded in the company’s ledger or attributable to an internal controls deficiency. This year in FCPA enforcement provided a good reminder of these important points.

On September 28, 2015, the SEC brought a rare FCPA enforcement action concerning allegedly corrupt payments to a foreign political party. The SEC alleged that Japanese conglomerate and foreign issuer Hitachi Ltd. sold a 25% stake in its South African subsidiary to a “front company” for the African National Congress (“ANC”), South Africa’s ruling political party since the end of Apartheid in 1994. This arrangement allegedly allowed the ANC–via this front company, Chancellor House Holdings (Pty) Ltd.–to share in the profits generated from two multi-billion dollar power station contracts awarded to Hitachi’s South African subsidiary by an entity owned and operated by the South African government and whose chairman simultaneously served as a member of the ANC’s National Executive Committee. Chancellor paid less than $191,000 for this 25% share, in return for which it ultimately received more than $10.5 million in “dividends,” “success fees,” and the repurchased value of the shares–a more than 5,000% return on investment over the course of 19 months.

Of interest from the Hitachi case is the level of knowledge ascribed to Hitachi concerning the allegation that Chancellor was actually a front for the ANC. The SEC alleged that “Hitachi knew or could have learned”–a departure from the “knew or should have known” standard more frequently espoused by the SEC–about the political connections of Chancellor’s executives and the fact that the partner “lacked any engineering or operational capabilities.” Among other sources, the SEC cited press reports linking Chancellor to the ANC that were published at around the time the two power station contracts were awarded to Hitachi’s South African subsidiary.

To resolve the charges, and without admitting or denying the charges, Hitachi consented to the filing of a settled civil enforcement action alleging violations of the FCPA’s books-and-records and internal controls provisions. Hitachi did not disgorge profits, which is significant given that the face value of the power plant contracts exceeded $5.5 billion. Instead, Hitachi agreed only to pay a $19 million civil penalty.

The FCPA’s prohibition of corrupt payments to employees of non-governmental “public international organizations” is evidenced by the January 2015 indictment of Dmitrij Harder, the former owner and president of a Pennsylvania-based consulting company. As described in our 2015 Mid-Year FCPA Update, the indictment alleges that Harder made “consulting” payments totaling more than $3.5 million to the sister of an official of the European Bank for Reconstruction and Development to corruptly influence contract awards to Harder’s clients. The European Bank for Reconstruction and Development, a multilateral development bank based in London and owned by more than 60 sovereign nations, has been designated by Executive Order as a “public international organization” such that its employees qualify as “foreign officials” for purposes of the FCPA’s anti-bribery provisions. The current status of Harder’s case, including a challenge to the constitutionality of this “public international organization” provision, is covered below.

The reach of the FCPA’s accounting provisions to cover even commercial corruption is evidenced, in part, by the SEC’s February 2015 settlement with Goodyear Tire & Rubber Company. As described in our 2015 Mid-Year FCPA Update, the SEC alleged that Goodyear violated the FCPA’s books-and-records and internal controls provisions by making approximately $3.2 million in corrupt payments to obtain contracts from both state- and privately-owned companies in Angola and Kenya.

DOJ Hires Compliance Expert

It is not uncommon for companies caught in the snares of an FCPA investigation–particularly those entering the negotiation phase of a potential FCPA resolution–to make a comprehensive presentation to DOJ and/or the SEC describing their FCPA compliance program. In particular, these presentations typically focus on the extent that the company’s anti-corruption policies, procedures, diligence, and training programs have been remediated since the conduct at issue such that recurrence of the conduct is less likely. Over the years, DOJ and SEC FCPA Unit attorneys have become increasingly sophisticated in these matters, and so too have their expectations for the presenters.

In November 2015, DOJ upped the ante even further by hiring Hui Chen as a dedicated compliance expert to assist its FCPA attorneys in evaluating these and other compliance issues. Chen comes to this role with significant experience in government and industry, having served as a federal prosecutor in the Criminal Division and the U.S. Attorney’s Office for the Eastern District of New York as well as more recently in high-level in-house legal and compliance positions in the financial (Standard Chartered Bank), healthcare (Pfizer), and technology (Microsoft) sectors, including posts in Beijing and Munich. Assistant Attorney General Caldwell described Chen’s main responsibilities in a recent speech as bringing an “expert eye” to helping prosecutors assess the effectiveness of companies’ compliance programs, including what remedial compliance measures should be required as part of a corporate resolution. DOJ Fraud Section Chief Andrew Weissmann also has suggested that Chen will play a key role in overseeing compliance monitorships and other corporate post-resolution reporting relationships.

The SEC’s New Threshold Requirement for Alternative Resolution Vehicles

Since announcing its Cooperative Initiative in 2010, which among other things allows for the use of deferred and non-prosecution agreements as an alternative to administrative or civil enforcement actions, the SEC has resolved only nine corporate cases by means of one of these alternative resolution vehicles. Fully one-third of these, however, have been in FCPA cases, including Tenaris S.A. (2011 deferred prosecution agreement covered in our 2011 Mid-Year FCPA Update), Ralph Lauren Corporation (2013 non-prosecution agreement covered in our 2013 Mid-Year FCPA Update), and PBSJ Corporation (2015 deferred prosecution agreement covered in our 2015 Mid-Year FCPA Update).

In November 2015, SEC Enforcement Director Ceresney announced a new threshold requirement for companies hoping to secure a deferred or non-prosecution agreement with the SEC in the future. At the ACI’s annual FCPA Conference, Ceresney stated that only those companies who self-report the misconduct in question will be eligible for these alternative resolution vehicles. But even then, self-reporting does not guarantee a deferred or non-prosecution agreement, as the ultimate decision will continue to be based upon the factors set forth in the SEC’s 2001 “Seaboard Report.” Indeed, as noted in our 2015 Mid-Year FCPA Update, FLIR Systems Inc. self-disclosed corrupt payments resulting in a 2015 FCPA resolution with the SEC and still was subjected to a cease-and-desist proceeding.

2015 FCPA ENFORCEMENT LITIGATION

Lawrence Hoskins

On August 13, 2015, the Honorable Janet Bond Arterton of the U.S. District Court for the District of Connecticut issued an important decision interpreting the scope of the FCPA’s anti-bribery provisions. The ruling came in response to former Alstom S.A. executive Lawrence Hoskins’s motion to dismiss certain charges pending against him, but its well-reasoned conclusions should have ramifications beyond this case.

As reported in our 2015 Mid-Year FCPA Update, Hoskins–the only one of four former Alstom executives to challenge DOJ’s charges–moved in June 2015 to dismiss the lead conspiracy charge in the third superseding indictment. Hoskins argued that because he was not himself an “issuer” or “domestic concern,” and is not alleged to have acted corruptly “while the territory of the United States,” the only avenue for DOJ to sustain a conviction would be prove that he is an “agent” of a “domestic concern” (here, Alstom’s U.S. subsidiary). Hoskins in fact worked for an Alstom entity in Europe during the relevant period, and the degree to which he was involved in the U.S. entity’s operations is a key point of contention. DOJ responded by filing its own motion to preclude Hoskins from raising this argument at trial, contending that even if it is unable to prove Hoskins was an agent of Alstom’s U.S. subsidiary, it is enough to establish that Hoskins conspired with or aided and abetted a domestic concern.

The court sided with Hoskins, holding that a non-resident foreign national cannot be subject to criminal liability under the FCPA where he is not an agent of a domestic concern and does not act within the United States under aiding and abetting or conspiracy theories of liability. In a comprehensive, 21-page opinion analyzing the FCPA’s text and legislative history, Judge Arterton concluded that Congress had “carefully delineated the class of persons covered” under the FCPA “to address concerns of overreaching,” and thus “did not intend to impose accomplice liability on non-resident foreign nationals who were not subject to direct liability.” As a result, the court held that conspiracy / aiding and abetting liability on these facts could not withstand the Gebardi principle, which holds “that where Congress chooses to exclude a class of individuals from liability under a statute, [DOJ] may not override the Congressional intent not to prosecute that party by charging it with conspiring to violate a statute that it could not directly violate.” Importantly as to the potential scope of this decision, Judge Arterton also held that non-resident foreign nationals who do not physically enter the United States cannot be held to have conspired “while in the territory of the United States.” The court did not dismiss the count in its entirety, however, reasoning that if the government establishes that Hoskins was an agent of a domestic concern and, therefore, subject to direct FCPA liability, the Gebardi principle would not preclude his prosecution for conspiracy to violate the FCPA. DOJ has filed a motion for reconsideration, which Judge Arterton has taken under advisement.

On August 14, 2015, Judge Arterton ruled on several outstanding pre-trial and discovery motions related to Hoskins’s central defense that he was not an agent of Alstom’s U.S. subsidiary. Each party had filed motions to compel the production (Hoskins) or preclude the introduction (DOJ) of evidence relating to the general course of Hoskins’s interactions with Alstom’s U.S. subsidiary, as opposed to his interaction narrowly in the context of the project in which corrupt payments were allegedly made. The court granted in part and denied in part each side’s motions, reasoning that Hoskins’s overall “course of dealings” with the U.S. subsidiary “could provide context and be circumstantially relevant” to whether Hoskins acted as the subsidiary’s agent in the context of the specific transaction at issue. However, Judge Arterton significantly narrowed Hoskins’s requests for broad categories of documents generally related to Alstom’s corporate structure and Hoskins’s role and responsibilities with respect to all Alstom entities.

The balance of 2015 was dominated by disputes among Hoskins, DOJ, and Alstom regarding the production of Alstom documents located in France that are required to be produced pursuant to the court’s August 14, 2015 ruling. Alstom claims that producing these documents directly to Hoskins would violate France’s blocking statute. DOJ thus has issued a supplemental mutual legal assistance treaty (“MLAT”) request to the French government for these documents. Trial is currently scheduled for April 2016.

Dmitrij Harder

We reported in our 2015 Mid-Year FCPA Update on the January 2015 indictment of Dmitrij Harder on FCPA, Travel Act, and international money laundering charges for allegedly corrupt payments made to the sister of a European Bank for Reconstruction and Development (“EBRD”) official. Since then, the parties have been active briefing numerous pre-trial motions.

Harder has filed two separate motions to dismiss all 14 counts of the indictment, as well as a motion to suppress statements that he made to federal agents during what he claims was a three-hour, custodial interrogation undertaken without Miranda warnings after Harder landed at JFK International Airport following a flight from Moscow. In the motions to dismiss, Harder argues that: (1) DOJ has failed to allege facts demonstrating that he made the payments to the EBRD official’s sister with knowledge that the payments would be passed along to her brother, the foreign official; (2) the provision of the FCPA that renders employees of “public international organizations” “foreign officials” is unconstitutional; and (3) the money laundering charges–which are premised upon the same alleged payments charged as FCPA violations–violate the merger doctrine. With respect to the first motion, DOJ obtained a superseding indictment on December 15, 2015 with new language that may address, in part, Harder’s claims that DOJ has failed to allege an FCPA violation. With respect to the second motion, the President is empowered to designate, by Executive Order, entities as “public international organizations” and whose employees, therefore, are “foreign officials” within the meaning of the FCPA. President George H.W. Bush designated the EBRD as a public international organization by Executive Order on June 18, 1991. Harder challenges this grant of authority to the President as unconstitutional under the non-delegation doctrine, and also argues that the term “public international organization” is unconstitutionally vague.

For its part, DOJ has among other things moved to preclude Harder from making arguments at trial that could result in jury nullification. In particular, the Government claims that there is evidence that unless restrained Harder may attempt to argue that paying bribes is a “necessary evil” for U.S. companies hoping to compete in certain foreign countries, a premise DOJ disputes as untrue and more importantly irrelevant as a matter of law.

The Honorable Paul S. Diamond of the U.S. District Court for the Eastern District of Pennsylvania held a hearing on Harder’s suppression motion on December 10, 2015, but no ruling is yet shown on the public docket sheet. Trial currently is scheduled for May 2016.

Magyar Telkom Defendants

The SEC’s long-running FCPA civil enforcement action against three former senior executives of Magyar Telekom, Plc.‑‑Andras Balogh, Tamas Morvai, and Elek Straub–continued to move forward in 2015. Now four years into the case, the parties have completed fact and expert discovery and filed cross-motions for summary judgment on three main issues: (1) whether the Court has personal jurisdiction over the defendants; (2) whether the applicable five-year statute of limitations has run on the conduct; and (3) whether the defendants used “the mails or any means or instrumentality of interstate commerce” through e-mails that were sent in connection with the alleged bribery scheme. These motions substantially revive arguments rejected at the motion-to-dismiss stage by the Honorable Richard J. Sullivan of the U.S. District Court for the Southern District of New York, as described in our 2013 Mid-Year FCPA Update. The motions are now fully briefed and awaiting disposition.

Haiti Teleco Defendants

We discussed in our 2015 Mid-Year FCPA Update the Eleventh Circuit’s February 2015 affirmation of former Director of International Relations for Télécommunications d’Haiti S.A.M. (“Haiti Teleco”) Jean Rene Duperval’s money laundering convictions and nine-year sentence. Duperval’s petition for rehearing en banc was denied on August 20, 2015, after which Duperval petitioned the Supreme Court for writ of certiorari. The Supreme Court is expected to rule on the petition in January 2016.

Another 2015 development in the long-running Haiti Teleco prosecutions is the denial of former Terra Telecommunications vice president Carlos Rodriguez’s Rule 33 motion for a new trial. As reported in our 2015 Mid-Year FCPA Update, Rodriguez presented a declaration from Terra Telecommunications’ former general counsel contradicting evidence presented at trial that both individuals were present during a meeting that discussed bribes to Haiti Teleco officials. The general counsel reportedly did not testify at Rodriguez’s trial based on the advice of counsel. On September 2, 2015, Judge Jose E. Martinez of the U.S. District Court for the Southern District of Florida denied Rodriguez’s motion, finding that Rodriguez’s motion was time-barred and that Rodriguez’s newly discovered evidence was solely impeachment evidence. On September 18, 2015, Rodriguez filed a motion for reconsideration based on “actual innocence,” contending that his lack of knowledge of a conspiracy to defraud permits a motion that is otherwise time-barred. This motion also was denied on December 4, 2015, and Rodriguez is appealing this decision to the U.S. Court of Appeals for the Eleventh Circuit.

Andres Truppel

We originally covered the December 2011 indictment of eight former Siemens AG executives and third-party agents in our 2011 Year-End FCPA Update. For years, these charges remained stagnant on the docket as all of the defendants are foreign citizens located abroad. That changed for at least one of the defendants on September 30, 2015, when former Siemens Argentina CFO Andres Truppel appeared before the U.S. District Court for the Southern District of New York and pleaded guilty to one count of conspiracy to violate the FCPA’s anti-bribery and accounting provisions. As reported in our 2014 Mid-Year FCPA Update, Truppel agreed to cooperate with DOJ’s ongoing investigation and pay restitution in a previous settlement with the SEC. Sentencing before the Honorable Denise L. Cote has yet to be scheduled. Criminal charges against the remaining Siemens defendants remain pending.

2015 SENTENCING DOCKET FOR FCPA AND FCPA-RELATED CHARGES

Twelve defendants were sentenced on criminal FCPA and FCPA-related charges in 2015. Prison sentences ranged from probationary, non-custodial sentences to four years in prison. Interestingly, the data shows that one of the most pertinent factors in the sentencing of a defendant involved in an FCPA prosecution is not the FCPA charge, but rather whether the defendant additionally (or instead) faces a money laundering charge. Whereas the FCPA carries a statutory maximum of five years per violation, the statutory maximum for money laundering is four times greater, or 20 years. Further, the way in which sentences for money laundering offenses are calculated pursuant to the U.S. Sentencing Guidelines generally leads to higher advisory prison terms presented to the Court. Indeed, the longest sentence ever handed down in an FCPA case (15 years imposed upon Joel Esquenazi in 2011) involved more money laundering than FCPA counts of conviction.

The sentences imposed in FCPA and FCPA-related cases (including foreign official bribe recipients charged only with money laundering offenses) in 2015 follows. Although sentences in each category vary by a wide degree depending upon the unique facts of the given case, the average sentence for FCPA convictions not including a money laundering count was 17.5 months, while the average of those including a money laundering count was twice as long, at 35 months.

| Defendant | Sentence | Date | Court (Judge) | $ Laundering Conviction? |

| Asem Elgawhary | 42 months | 03/23/15 | D. Md. (Chasanow) | Yes (no FCPA charge) |

| Benito Chinea | 48 months | 03/27/15 | S.D.N.Y. (Cote) | No |

| Joseph DeMeneses | 48 months | 03/27/15 | S.D.N.Y. (Cote) | No |

| Joseph Sigelman | 0 months | 06/16/15 | D. N.J. (Irenas) | No |

| Knut Hammarskjold | Time served (0.5 months) | 09/14/15 | D. N.J. (Irenas) | No |

| Gregory Weisman | 0 months | 09/10/15 | D. N.J. (Irenas) | No |

| James Rama | 4 months | 10/09/15 | E.D. Va. (Lee) | No |

| Ernesto Lujan | 24 months | 12/4/2015 | S.D.N.Y. (Cote) | Yes |

| Tomas Clarke | 24 months | 12/08/15 | S.D.N.Y. (Cote) | Yes |

| Jose Hurtado | 36 months | 12/15/15 | S.D.N.Y. (Cote) | Yes |

| Vadim Mikerin | 48 months | 12/15/15 | D. Md. (Chuang) | Yes (no FCPA charge) |

| Vicente Garcia | 22 months | 12/16/15 | N.D. Cal. (Breyer) | No |

[WHERE WE NORMALLLY DISCUSS] FCPA OPINION PROCEDURE RELEASES

But in 2015, for the first time in 10 years, there were no FCPA opinion procedure releases. By statute, DOJ must provide a written opinion at the request of an issuer or domestic concern stating whether DOJ would prosecute the requestor under the anti-bribery provisions for prospective (not hypothetical) conduct it is considering. Published on DOJ’s FCPA website, these releases provide valuable insights into how DOJ interprets the statute, although only parties who join in the requests may rely upon them authoritatively.

Whether the absence of any opinion procedure releases in 2015 marks a trend of diminished use of this tool remains to be seen. From our perspective, the robust library of 61 opinion procedure releases over the past 35 years, coupled with the 100-plus page FCPA Resource Guide published jointly by DOJ and the SEC in 2012, not to mention the copious detail provided in many DOJ and SEC settlement documents and speeches, provide abundant guidance on how the authorities interpret the FCPA. Simultaneously, the uptick in FCPA litigation derivative of DOJ’s increased focus on individual defendants is providing a growing body of independent, judicial case law defining the statute’s contours. Finally, much more so than when the statute was passed, there is a substantial industry of experienced private-sector practitioners able to provide companies with opinions well-sourced in DOJ and SEC authorities, even if they do not carry the official imperator of DOJ.

Ultimately, we do expect that the usage of FCPA opinion procedure releases–which have averaged fewer than two per year in any event–will decline. Nevertheless, the process remains available for when the right situation presents itself, which makes the FCPA unique amongst criminal statutes.

NOT QUITE FCPA ENFORCEMENT ACTIONS – PART II

Periodically there is debate within the FCPA community about whether a particular case should be categorized as an FCPA enforcement action. As last discussed in our 2013 Mid-Year FCPA Update, because the FCPA’s books-and-records and internal controls provisions apply broadly to a wide variety of accounting misconduct that has no connection to foreign bribery, categorization of these cases can break out into shades of gray.

One case from 2015 that we do not count as an FCPA enforcement action is that involving Houston-based oil and gas exploration company Hyperdynamics Corporation. On September 29, 2015, the SEC brought a settled cease-and-desist proceeding to resolve allegations concerning the company’s operations in the Republic of Guinea. In a five-page order, the SEC alleged that between 2007 and 2008 Hyperdynamics paid $130,000 to two entities for public relations and lobbying services, only to find out later that the two entities not only were related to one another, but were controlled by one of its employees in Guinea. The company agreed to pay a $75,000 civil penalty for the alleged accounting violations, even though there was no allegation of corrupt payments to a government official and, from the public documents, it would appear just as (if not more) likely that the payments were embezzled by the employee.

The SEC’s November 30, 2015 action against Standard Bank Plc is another example. As described below, on that same day the London-based bank reached a settlement with the U.K. Serious Fraud Office to resolve U.K. Bribery Act 2010 charges arising from alleged corruption in Tanzania. Standard Bank acted as a lead manager for a $600 million sovereign debt offering by the Tanzanian government. In this offering, Standard Bank allegedly failed to disclose that its affiliate was to pay $6 million of the proceeds to an entity with an undefined role in the transaction and for which “red flags” suggested the payment was to induce Tanzanian officials to select Standard Bank as manager for the offering. Standard Bank is not a U.S. issuer, and thus not subject to the SEC’s FCPA jurisdiction. Instead, the SEC charged the bank with obtaining money in a securities offering by means of materially untrue statements or omissions. Standard Bank agreed to pay a $4.2 million civil penalty and to disgorge $8.4 million in profits, although the latter sum was deemed satisfied by the bank’s payment to the Serious Fraud Office in connection with the U.K. settlement.

OTHER U.S. TRANSNATIONAL ANTI-CORRUPTION PROSECUTIONS

Further Charges in FIFA Corruption Investigation

As promised in our 2015 Mid-Year FCPA Update, we have continued to follow developments in the unfolding corruption scandal involving Fédération Internationale de Football Association, commonly known as “FIFA.” On December 3, 2015, there was yet another pre-dawn raid on a luxury Zurich hotel that resulted in the arrests of the current presidents of the regional confederations of North America, Central America, and the Caribbean (“CONCACAF”) and South America (“CONMEBOL”). Fourteen hours later, the U.S. Attorney’s Office for the Eastern District of New York unsealed a 92-count superseding indictment, charging 16 additional defendants (on top of 20 charged earlier in the investigation) for their role in a decades-long kickback scheme in which sports marketing companies allegedly bribed certain FIFA officials in exchange for marketing rights for the World Cup and other prestigious tournaments, such as the Copa America and Gold Cup. The newly charged defendants include seven current or former officials from the CONCACAF region and nine current or former officials from the CONMEBOL region. Of the 16 individuals charged, five are either current or former members of FIFA’s Executive Committee. In addition, DOJ unsealed guilty pleas for eight individuals, including three of the defendants indicted in May 2015 and most notably former CONCACAF President Jeffrey Webb.

The second half of 2015 also saw significant movement on the extradition front, as Switzerland’s Federal Office of Justice has approved DOJ’s extradition requests for five foreign nationals arrested in Switzerland during the May 2015 sweep. Swiss authorities also have continued their own, parallel criminal investigation into the awarding of the 2018 and 2022 World Cups to Russia and Qatar respectively. Perhaps one of the more significant developments to emerge from the Swiss investigation is the opening of criminal proceedings against departing FIFA President Joseph “Sepp” Blatter for criminal mismanagement of FIFA funds. The charges stem in part from a multi-million dollar television rights deal with former FIFA Executive Committee member Jack Warner, who was charged by U.S. authorities in May.

Clearly this is an investigation that will be making headlines in the international anti-corruption space, even if not FCPA, for some time to come. We will continue to monitor and report on developments.

Arrests in U.N. Corruption Investigation

On October 6, 2015 the U.S. Attorney’s Office for the Southern District of New York announced bribery and related charges against John Ashe, the former U.N. Ambassador for Antigua and Barbuda, and President of the U.N. General Assembly; Frances Lorenzo, the former U.N. Deputy Ambassador for the Dominican Republic; and four businessmen from whom Ashe and Lorenzo allegedly accepted bribes. The indictment alleges that between 2011 and 2015, Ashe (with the assistance of Lorenzo) received $1.3 million in bribes from Chinese businesspersons Ng Lap Seng, Jeff C. Yin, Shiwei Yan, and Heidi Hong Piao to advance the interests of these businesspersons’ clients before the United Nations and in Antigua, including most notably a plan to build a U.N.-sponsored conference center in Macau. The allegedly corrupt payments to Ashe took the form of cash, a family vacation, the construction of a private basketball court at Ashe’s home, and a monthly salary for his wife.

Ashe currently is charged only with tax offenses related to his failure to report the illicit income on his personal income tax returns. The other five defendants are charged with bribery involving federal programs and conspiracy to commit the same, and Yan and Piao additionally are charged with money laundering. No trial date has yet been set.

2015 KLEPTOCRACY FORFEITURE ACTIONS

Another prong of DOJ’s transnational anti-corruption strategy–one of increasing importance in recent years–is its Kleptocracy Asset Recovery Initiative. This initiative utilizes civil forfeiture actions to freeze and ultimately recover the proceeds of foreign corruption, typically from the foreign officials believed to have personally enriched themselves through bribes or embezzlement. In some recent cases, DOJ has repatriated the funds seized in these actions to the countries from which they were stolen.

In addition to the activity described in our 2015 Mid-Year FCPA Update, DOJ brought the following kleptocracy-related actions in 2015:

- On July 14, 2015, DOJ filed a civil forfeiture complaint in the U.S. District Court for the Central District of California seeking the forfeiture of assets worth approximately $12.5 million connected to Philippine businesswoman Janet Napoles, including several properties, a stake in a consulting company, and a Porsche Boxster. DOJ alleges that Napoles paid tens of millions of dollars in bribes and kickbacks to Philippine politicians and officials in connection with government contracts awarded to Napoles’s NGOs for development assistance and disaster relief. Naples’s NGOs allegedly failed to provide or under-delivered on the promised support, and Napoles took the government funds for her own personal use.

- On November 9, 2015, DOJ returned to the Republic of Korea approximately $1.1 million in forfeited assets associated with former president Chun Doo Hwan’s graft schemes. Hwan was convicted by a Korean court in 1997 of accepting more than $200 million in bribes from Korean businesses.

- In our 2015 Mid-Year FCPA Update, we reported on a civil forfeiture action DOJ filed in the U.S. District Court for the Southern District of New York seeking the forfeiture of approximately $300 million in assets allegedly traceable to corrupt payments by two Russian telecommunications companies to a close relative of the President of Uzbekistan in return for access to the Uzbek telecommunications market. On November 23, 2015, the Honorable Andrew L. Carter, Jr. issued an order to show cause why a default judgment should not be granted. No response was filed prior to the December 21 deadline set by the Court, meaning that a forfeiture may issue (although as of the date of this publication, it has not). Meanwhile, U.S. authorities have reportedly enlisted the assistance of Swedish and Swiss authorities to seize another $670 million, bringing the total potential asset forfeiture close to $1 billion.

- On December 9, 2015, DOJ filed a motion to dismiss a forfeiture action against approximately $115 million involved in alleged bribe payments and money laundering by former FCPA defendants James H. Giffen and his company Mercator Corporation. As reported in our 2010 Year-End FCPA Update, Giffen was indicted in 2004 on 65 counts stemming from an alleged scheme to funnel more than $78 million to high-level government officials in Kazakhstan to secure oilfield drilling rights. But the prosecution unraveled after he raised an “act of state” defense, claiming that he was acting at the behest of the Central Intelligence Agency. Giffen ultimately pleaded guilty to a misdemeanor tax offense and was sentenced to time served and a $25 assessment. Mercator was sentenced to a $32,000 fine on a single FCPA count associated with the gifting of two snowmobiles. Pursuant to a settlement agreement, the $115 million previously seized in connection with the matter was released to an independent Kazakh foundation targeting the needs of poor youth in Kazakhstan.

2015 YEAR-END FCPA-RELATED PRIVATE CIVIL LITIGATION

Our consistent refrain in these semi-annual updates is that the FCPA provides for no private right of action. Nevertheless, there are a variety of causes of action that can and have been used–with varying degrees of success–to pursue private redress in the United States for public corruption committed abroad. Indeed, the second half of 2015 saw a continued uptick in private, collateral lawsuits arising from the announcement of FCPA investigations and resolutions, further underscoring that the risks of corruption extend beyond negotiations with the U.S. government.

Shareholder Lawsuits

A frequent collateral effect of the announcement of an FCPA enforcement action, or even investigation, is shareholder litigation. Indeed, it is now commonplace for a company’s announcement of an FCPA event to be followed immediately by a plaintiff firm’s solicitation for plaintiffs to bring a private lawsuit. Historically, this has meant either a class action lawsuit brought on behalf of shareholders whose stock value has dropped allegedly as a result of the misconduct or a shareholder derivative lawsuit brought against the company’s directors for allegedly violating their fiduciary duties to run the business in a compliant manner. Sometimes, companies even find themselves the unfortunate targets of both types of lawsuits, in addition to the underlying government investigation.

Avon Products, Inc.

As outlined in our 2014 Year-End FCPA Update, on October 24, 2014 Avon shareholders filed a second amended complaint in a securities fraud “stock drop” lawsuit pending in the U.S. District Court for the Southern District of New York alleging that Avon falsely inflated its stock price by concealing the FCPA violations that ultimately resulted in the company’s December 2014 settlement with DOJ and the SEC. According to the complaint, Avon falsely implied that its success in the Americas and China was a result of growth in direct sales when, in fact, its success was due to illegal bribes. Following mediation before the Honorable Layn R. Phillips, the parties entered into a $62 million settlement agreement on August 18, 2015. The settlement agreement contemplates certification of a class of all persons and entities who purchased or otherwise acquired Avon’s common stock from July 31, 2006 through and including October 26, 2011–the day before Avon disclosed in its Form 10-Q that it had received an SEC subpoena. A motion for final approval of the settlement and plan of allocation remains pending as of the date of this publication.

Net1 UEPS Technologies, Inc.

On September 16, 2015, telecommunications company Net1 secured a victory in the 2013 securities-fraud class action that alleged that the company misled investors by failing to disclose that a significant contract with the South African government might be invalidated because of corruption concerns. U.S. District Judge Edgardo Ramos of the Southern District of New York dismissed the claims against Net1, its CEO, and CFO, finding that the plaintiffs failed to allege adequately that Net1 made material misrepresentations about the risk, or that the CEO or CFO had the requisite intent to defraud investors when they failed to disclose the events in question. The dismissal came just a few months after the SEC concluded its FCPA investigation of Net1, declining to bring an enforcement action. A DOJ investigation reportedly remains open.

Petróleo Brasileiro S.A.

Between December 2014 and December 2015, Petrobras was named as a defendant in one putative class action and 28 individual securities-fraud actions filed in the U.S. District Court for the Southern District of New York. The suits allege that Petrobras, the Brazilian state-owned energy company that has ADRs and ADSs traded on the New York Stock Exchange, misrepresented facts and failed to disclose a multi-year, multi-billion dollar money-laundering and bribery scheme.

The suits have been consolidated before the Honorable Jed S. Rakoff. Judge Rakoff promptly trimmed the complaints by dismissing certain Exchange Act and Securities Act claims concerning debt securities purchased on the international markets (thus lacking a domestic connection) and purchased before 2010 (thus barred by the statute of repose), as well as certain state law claims barred by the Securities Litigation Uniform Standards Act.

RICO Actions

One of the most interesting and developing areas of FCPA-related private civil litigation involves claims brought pursuant to the Racketeer Influenced and Corrupt Organizations (“RICO”) Act. Passed into law in 1970, principally as a tool to combat organized crime families, the RICO statute permits a private litigant who has been “damaged in his business or property” by a “pattern” of “racketeering activity” to bring a suit for up to three times his loss.

More and more frequently, we have seen foreign government entities, whose own officials solicited bribes, bring RICO lawsuits against the U.S. companies that allegedly paid them (leading to some ironic allegations as to which entity is truly the “corrupt organization”).

PEMEX v. Hewlett-Packard Co.

In our 2015 Mid-Year FCPA Update, we noted that on June 25, 2015 the Honorable Beth Labson Freeman of the U.S. District Court for the Northern District of California heard arguments regarding Hewlett-Packard Co.’s (“HP’s”) motion to dismiss Petróleos Mexicanos’s (“PEMEX”) civil RICO lawsuit on jurisdictional and other grounds. PEMEX sued HP on December 2, 2014, alleging that HP engaged in a bribery scheme to win government contracts in Mexico. The suit followed HP’s resolution of FCPA charges with DOJ and the SEC arising, in part, out of PEMEX contracts.

On July, 13, 2015, Judge Freeman granted, in part, HP’s motion to dismiss, but allowed PEMEX leave to amend various deficiencies in the complaint. PEMEX did so, after which HP immediately moved to dismiss the complaint yet again, this time alleging that PEMEX’s own recent SEC filing barred its continued maintenance of this suit. In the SEC filing PEMEX asserted that it had conducted an internal investigation into the conduct alleged in the DOJ and SEC settlement documents and found no evidence that improper payments occurred in connection with the contracts at issue. Subsequently, the parties submitted a joint stipulation to dismiss the suit with prejudice on November 4, 2015. No additional details pertaining to an agreement between HP and PEMEX are publicly available.

Yulia Tymoshenko v. Dmytro Firtash

As reported in our 2014 Year-End FCPA Update, Judge Kimba M. Wood of the U.S. District Court for the Southern District of New York dismissed a RICO lawsuit brought by former Ukrainian Prime Minister Yulia Tymoshenko and others against Ukrainian natural gas oligarch Dmytro Firtash with leave to amend the complaint. Plaintiffs thereafter filed an amended complaint alleging that Firtash and his co-defendants laundered money through fraudulent real estate transactions to help fund an unfounded and malicious prosecution that resulted in Tymoshenko’s imprisonment.

On September 18, 2015, Judge Wood granted a motion to dismiss this amended pleading because it did “not plead a predicate act of racketeering that proximately caused Plaintiffs’ injuries.” Judge Wood dismissed the amended complaint with prejudice “[g]iven that this is now Plaintiff’s fourth unsuccessful attempt to plead RICO claims.”

Orthofix International N.V.

In our 2014 Year-End FCPA Update, we reported on the RICO action brought against Orthofix International N.V. by the Mexican government agency Instituto Mexicano del Seguro Social (“IMSS”). The lawsuit was filed after Orthofix resolved an FCPA enforcement action with U.S. authorities that arose from corrupt payments that its Mexican subsidiary allegedly made to IMSS officials in exchange for healthcare device contracts.

On February 10, 2015, Orthofix moved to dismiss the complaint, arguing that the U.S. District Court for the Eastern District of Texas lacked subject matter jurisdiction over Orthofix’s extraterritorial conduct, and that IMSS failed to plead a viable RICO claim. Following the initial motion to dismiss, IMSS amended its complaint twice, and each time, Orthofix subsequently moved to dismiss on the grounds that RICO does not apply extraterritorially. Then, on November 19, 2015, the Court granted the parties’ joint motion to stay the litigation until February 1, 2016, as the parties reportedly have entered into a settlement agreement, which currently is pending approval by Orthofix’s board of directors and confirmation that the settlement is permissible under Mexican law.

Rio Tinto PLC

We reported in our 2014 Year-End FCPA Update on Judge Richard M. Berman’s December 17, 2014 order rejecting defendant Vale, S.A.’s and BSG Resources’forum non conveniens motion to dismiss the RICO lawsuit brought by Rio Tinto PLC in the Southern District of New York. In its suit, Rio Tinto alleges that the defendants and their representatives conspired to steal Rio Tinto’s trade secrets and then utilized them to corruptly procure Guinean iron-ore mining concessions that had previously belonged to Rio Tinto.

But on November 20, 2015, Judge Berman dismissed the suit with prejudice, finding that Rio Tinto failed to file its complaint within the four-year statute of limitations. The Court found that Rio Tinto’s injury became known in December 2008, when the Guinean Government informed Rio Tinto that it had lost its mining rights and announced that it was awarding the rights to BSG Resources. Rio Tinto unsuccessfully argued that the statute of limitation should be tolled to 2010, when the defendants announced their joint venture. In his opinion, Judge Berman noted that “[t]he statute of limitations begins to run on the date that the plaintiff learned of his or her injury, not on the date that the plaintiff learned that his or her injury may have resulted from racketeering activity,” and that Rio Tinto had “failed to demonstrate that it exercised due diligence in pursuing discovery of its claim during the period it seeks to have tolled.”

Other Civil Litigation

Bio-Rad Whistleblower Lawsuit

As we reported in our 2015 Mid-Year FCPA Update, the former general counsel for Bio-Rad Laboratories, Inc., Sanford S. Wadler, filed a whistleblower lawsuit against the company and numerous company officers and directors in the U.S. District Court for the Northern District of California, alleging violations of the anti-retaliation provisions of both the Sarbanes-Oxley Act (“SOX”) and Dodd-Frank. Wadler claims that he was terminated unlawfully, after nearly 25 years with the company, when he continued to pursue what he believed was evidence of corruption associated with the company’s operations in China even after an internal investigation undertaken by outside counsel found no such evidence.

The Bio-Rad defendants moved to dismiss, but in a ruling dated October 23, 2015 Chief Magistrate Judge Joseph C. Spero allowed the majority of claims to proceed to trial. Significantly, Judge Spero held that individual board members may be held personally liable for allegedly retaliatory activity they engage in as part of their corporate duties under both SOX and Dodd-Frank, although the SOX claims he found were untimely as against the director defendants. The Court further waded into the hotly contested debate as to whether one such as Wadler who reports suspected misconduct internally within the company but not externally to the SEC is a “whistleblower” protected by Dodd-Frank’s anti-retaliation provisions, finding that he was. (For more on the circuit split on this issue, please see our recent webcast, Navigating the Minefield of Dodd-Frank’s Whistleblower Provisions and the FCPA). When the smoke cleared, Judge Spero allowed the anti-retaliation claims under one or both statutes to proceed against the company, its directors, and its CEO. Bio-Rad sought a certificate for an interlocutory appeal, but this was denied by the Court on December 15, 2015.

Viktor Kozeny Served

On December 3, 2015, businessman Viktor Kozeny was finally located and served with a summons to appear in the Supreme Court of New York County and defend against investors who claim he defrauded them during a 1990s Czech voucher privatization scheme. Kozeny was tried for the alleged fraud in a municipal criminal court in Prague, but fled to the Bahamas. In 2010, he was convicted in absentia and ordered to pay $410 million in restitution to his investors. The investors then sought to enforce the Czech judgment against him in New York Supreme Court, but it was not until this year that he was located at his condominium in the Bahamas and served with a summons and the complaint, in addition to the Czech judgment against him.

If he elects to return to the United States to defend this lawsuit, Kozeny would likely face other legal challenges. As we reported most recently in our 2012 Mid-Year FCPA Update, Kozeny was indicted by a federal grand jury in the Southern District of New York in 2005 on FCPA charges associated with an allegedly fraudulent privatization scheme in Azerbaijan. Kozeny was arrested in the Bahamas and spent 19 months in an island prison, but was released after the U.K. Privy Council blocked his extradition on jurisdictional grounds and also because, even if true, the transnational bribery allegations would not have constituted an offense against the law of the Bahamas had they taken place within the Bahamas. Kozeny’s three co-defendants have since been convicted of FCPA violations, and it seems unlikely that he would tempt fate and return to the United States to defend a civil lawsuit.

Siemens AG FOIA Lawsuit

As reported in our 2014 Year-End FCPA Update, non-profit media organization 100Reporters LLC has filed a Freedom of Information Act (“FOIA”) lawsuit against DOJ challenging its refusal to turn over records relating to its 2008 FCPA resolution with Siemens AG, as well as the compliance monitorship that followed. Siemens and its former compliance monitor, Dr. Theo Waigel, have been permitted to intervene in the lawsuit and assert their interests.

In 2015, DOJ produced its Vaughn Index justifying the FOIA bases for withholding the documents in question. Summary judgment briefing has been set for the first half of 2016. Gibson Dunn represents Dr. Waigel in this matter, as it did during the monitorship itself.

2015 INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

2015 witnessed a surge in international anti-corruption prosecutions brought by foreign regulators. Indeed, this may be the year where the center of gravity in transnational bribery prosecutions shifted eastward to London, or perhaps southbound to São Paulo. Long gone are the days where general counsel could reliably count on one hand the number of regulators with whom they will need to interact in a wide-ranging anti-corruption investigation.

Europe

United Kingdom

Anti-corruption enforcement in the United Kingdom reached new heights in 2015. The number of individuals convicted under the Bribery Act 2010 hit double digits, the first foreign corruption charges under the new statute were levied, including for violations of the much-discussed Section 7, and the Serious Fraud Office (“SFO”) entered into its first-ever deferred prosecution agreement.

The year began with the first foreign-bribery cases brought under the Bribery Act, with three individuals arrested for $150,000 in allegedly corrupt payments to a Norwegian government official for the sale of decommissioned naval vessels, as described in our 2015 Mid-Year FCPA Update. Not to coast on this milestone, the SFO followed up with its first-ever deferred prosecution agreement for its first-ever Section 7 foreign bribery offense, reached with Standard Bank Plc on November 30, 2015, as mentioned above. The alleged conduct related to a bond sale for the government of Tanzania in which Tanzanian officials were paid a percentage commission on the transaction. Penalties imposed on Standard Bank under the deferred prosecution agreement included a fine of $16.8 million; payment of $6 million compensation to Tanzania plus interest of just over $1 million; disgorgement of all of Standard Bank’s profits on the transaction amounting to $8.4 million, and the SFO’s costs of £330,000. Further, as noted above Standard Bank reached a parallel resolution with the U.S. SEC. For more information on the Standard Bank resolution, please see Gibson Dunn’s analysis, Serious Fraud Office v Standard Bank Plc: Deferred Prosecution Agreement.

On December 18, 2015, the construction company Sweet Group PLC admitted guilt to a Section 7 offense for allegedly failing to prevent its subsidiary from paying bribes to win a hotel construction contract in Dubai. It is unclear why Sweet Group admitted guilt at this stage, although we did note in our 2014 Year-End FCPA Update that tensions had developed between the SFO and Sweet Group regarding the appropriate observation of legal privilege covering the company’s internal investigation. In announcing the company’s decision to plead guilty, Sweet Group’s CEO simultaneously stated that the company is pulling out of the Middle East altogether.

This year also saw the U.K. Financial Conduct Authority (“FCA”) impose its highest-ever fine on a firm for alleged failings in preventing financial crime risks. On November 26, 2015, Barclays Bank PLC was ordered to pay more than £72 million to disgorge all profits and pay a penalty in connection with a £1.88 billion transaction that the bank allegedly arranged for high net-worth, politically exposed clients in 2011 and 2012. The FCA found that Barclays “went to unacceptable lengths to accommodate” certain of these clients and “did not obtain information that it was required to obtain to comply with financial crime requirements.” Notably, there was no finding that any actual financial crime was facilitated by the alleged control lapse. However, the FCA is clearly of the view that the risk of financial crime is enough to endanger the integrity of the U.K. financial system and necessitate strong enforcement measures.

In October 2015 the U.K.’s National Crime Agency arrested five Nigerian nationals, including former Oil Minister Deziani Alison-Madueke, on suspicion of bribery and money laundering. Raids in relation to these arrests were conducted simultaneously in Nigeria and London. The following month, another former Nigerian Oil Minister, Dan Ete, brought an application to unfreeze $85 million held in English accounts pursuant to a mutual legal assistance request from Italian authorities. The funds are alleged to be the corrupt proceeds of a deal under which a company partially owned by Ete acquired a valuable oil concession from the Nigerian government. Judgment is currently pending. Finally, in July 2015 the SFO won a judgment upholding an order to freeze assets that it had obtained pursuant to a mutual legal assistance request from the United States. The assets were shares in the Canadian oil company Caracal Energy Inc., held through a U.K. account by Ikram Saleh, a former a staff member at Chad’s embassy in Washington D.C. Saleh allegedly obtained the shares as part of a corrupt scheme to promote the interests of Caracal in Chad. As reported in our 2015 Mid-Year FCPA Update, related confiscation proceedings are ongoing in U.S. courts.

France

We covered in our 2013 Year-End FCPA Update the July 2013 decision of a Paris regional criminal court acquitting Total S.A., Vitol Group, and numerous individual defendants of foreign corruption charges arising out of the U.N. Oil-For-Food Program in Iraq. Among other things, the three-judge panel held that the allegedly corrupt payments in question were made to the Government of Iraq rather than to any particular Iraqi official, and thus did not fall within the definition of a bribe under French law. Further, with respect to the oil companies, the court noted that each had resolved charges arising from the same conduct in the United States, and for the first time applied the principle of double jeopardy in the international setting. After more than two years of waiting, the case was finally argued in the appellate courts in November 2015. There is no word yet on when a decision may come down.

On the legislative front, in July 2015 Finance Minister Michel Sapin proposed legislation that would establish a new anti-corruption agency, create a legal basis for the imposition of independent monitors akin to those imposed by U.S. enforcement authorities in numerous corporate settlements, and for the first time impose a legal requirement that French businesses adopt internal anti-corruption controls. The proposed new agency would replace the existing Service Central de Prévention de la Corruption, which has limited abilities to enforce anti-corruption laws. The legislation has yet to be finalized, so we will continue to follow this development for our clients.

Italy

In October 2015, a judge in Milan ordered Italian oil and gas services firm SaipemS.p.A. and three of its former senior executives, as well as two third-party agents, to stand trial for allegedly paying more than $220 million in bribes to the Algerian state-owned hydrocarbon firm Sonatrach in exchange for $9 billion in contracts. Saipem’s parent company and several of its top executives were cleared of wrongdoing by the court. Trial is now set to begin on January 25, 2016, with Saipem stating that it is “confident that it will be able to demonstrate that there are no grounds for the company to be held liable.” On a related note, Saipem has publicly acknowledged that prosecutors in Milan are also probing a 2011 contract awarded to Saipem by Brazilian state-owned multinational energy corporation Petrobras.

On July 9, 2015, the Corporate Governance Committee of Italian-listed companies (Comitato per la Corporate Governance) approved several amendments to Italy’s Corporate Governance Code, including recommendations that boards of directors give increased attention to anti-corruption risks. While adherence to its principles is voluntary, the Code serves as the primary source of guidance regarding corporate governance for Italian-listed companies, and has inspired several legislative reforms of Italian corporate law.

Norway