January 6, 2016

A bit less, but no less impressive–that is how we would characterize False Claims Act enforcement in 2015. This past year, the federal government recovered approximately $3.6 billion in either settlements or judgments in cases brought under the False Claims Act (“FCA” or the “Act”). An impressive amount, no doubt. But what is remarkable is that this significant sum reflects a down year in FCA recoveries compared to last year’s haul of almost $5.7 billion. 2015’s sum brings total recoveries under the Act–which is the government’s primary vehicle for recovering funds allegedly obtained from the government by fraud–to more than $21 billion for the last 5 years. We continue to believe–and the numbers continue to support–that the Act remains one of the most powerful weapons in the government’s arsenal against fraud and corruption, and the government has continued to demonstrate that it is not afraid to use it.

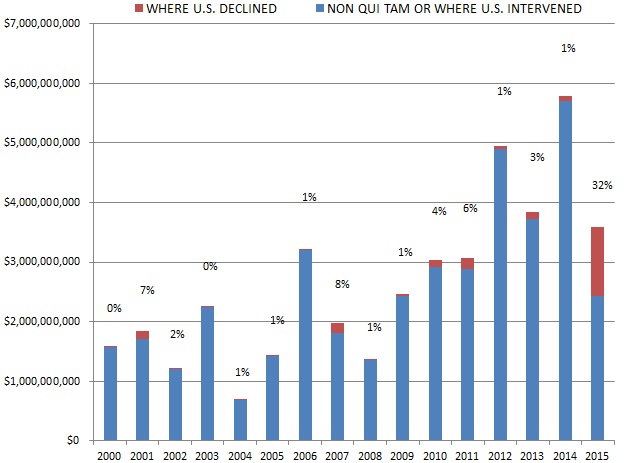

Further, 2015 proved that the government does not stand alone in its use of the Act. In one of the most interesting developments of 2015, a significant portion of the $3.6 billion recovered–32% of the year’s recoveries, totaling $1.1 billion–came from cases filed by whistleblowers (called qui tam “relators” under the Act) in which the government declined to intervene. Although qui tam actions recently have represented the majority of suits filed under the Act, these types of cases historically yielded little success compared to cases in which the government intervened. Indeed, recoveries from non-government cases amounted to as little as 1% of the amount that the government recouped annually. But 2015 marked a shift: the $1.1 billion haul in whistleblower-driven cases this last year exceeded the recovery in whistleblower-driven cases in all prior years combined. Is this a trend? Or was 2015 an anomaly? Hard to know. What we do know is that whistleblower recoveries of this magnitude likely will embolden relators and their counsel to file more cases and pursue them even when the government declines to intervene.

In 2015, as in prior years, FCA enforcement continued to cover any and all industries where government funding plays a role, large or small. From health care to defense contracting to housing finance to education to technology to postage to imported bedroom furniture, the breadth of industries in which FCA actions were brought (indeed even in some markets where one might not expect to see such actions) was impressive and made clear that wherever government dollars go, FCA lawsuits follow.

On the legislative front, 2015 saw Congress pass a law that will further incentivize the government and relators to pursue FCA cases (and may push recoveries back to the levels we saw in 2014) by increasing the per-claim penalties available in FCA cases. The current penalty range, which extends up to $11,000 per false claim, is itself a significant hammer that the government and relators use in FCA cases and particularly in settlement talks (in addition to the automatic trebling of actual damages under the Act). Because government contractors sometimes submit thousands of claims to the government daily, the potential exposure from per-claim penalties often dwarfs the government’s actual damages in FCA cases. But, to date, numerous courts–including a court in the last six months–have been slow to strike these penalties as unconstitutional. The new law, the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, requires that the Department of Justice (“DOJ”) increase FCA penalties to account for inflation beginning as early as July 2016, and for each year following, raising penalties to potentially as much as $18,600 per false claim in this coming year alone.

And in perhaps the most important jurisprudential development of the last several years, just weeks ago the Supreme Court granted certiorari to review the validity of the so-called “implied certification” theory of falsity under the FCA (and to assess the bounds of the theory if the Court holds that it is viable). Under this expansive theory, government contractors may be liable under the Act for accepting government funding while in knowing violation of statutes, regulations, rules, or contractual provisions to which government contractors are subject. According to some–but not all–circuits, government contractors impliedly certify compliance with applicable statutes, regulations, rules, and contractual provisions when they seek government reimbursement and those certifications may be false for purposes of the FCA. Depending on how the Supreme Court resolves this split, the decision may reshape the current and future landscape of FCA litigation.

As in years past, this update first addresses enforcement activity under the FCA during the Fiscal Year ending September 30, 2015–focusing on total recoveries; the growing percentage of FCA lawsuits brought as qui tam lawsuits and the substantial increase in recoveries from those lawsuits; settlements and judgments in the last six months; and industry breakdowns of FCA activity. We then analyze significant developments in FCA legislation during the latter half of the year, including Congress’s decision to increase FCA penalties. Last, we turn to the developments in FCA jurisprudence during the latter half of the year. (Our 2015 Mid-Year False Claims Act Update assessed the legislative and case law developments over the first half of the year.) A collection of Gibson Dunn’s recent publications on the FCA, including more in-depth discussions of the FCA’s framework and operation along with practical guidance to help companies avoid or limit liability under the FCA, may be found on our Website.

I. FCA Enforcement Activity

A. Total Recovery Amounts: The DOJ Continues its Streak of Annual Recoveries of More Than $3 Billion

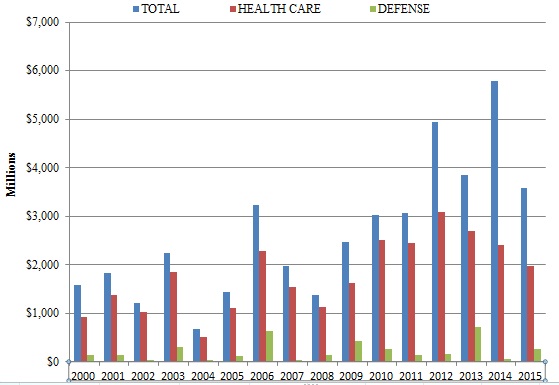

The federal government obtained nearly $3.6 billion in civil settlements and judgments under the FCA during the 2015 Fiscal Year.[1] This marks the sixth year in a row in which total recoveries in FCA matters exceeded $3 billion.[2] Although the 2015 total was lower than last year’s record $5.7 billion haul, that difference derives mostly from last year’s sui generis series of settlements (totaling $2.2 billion) with major financial institutions arising out of the 2008 housing crisis. As detailed below, this past year’s lower recovery total does not reflect decreased FCA activity.

In 2015, as in most previous years, DOJ recoveries from the health care industry constituted the bulk of federal recoveries (nearly $2 billion in 2015). And, as indicated above, perhaps the most remarkable feature of this year’s total was how much of it came from qui tam cases in which the government declined to intervene. In the 2015 Fiscal Year, recoveries in declined cases surpassed an incredible $1.1 billion–more than in all previous years of qui tam cases combined.[3]

Looking forward, there is no reason to believe that Fiscal Year 2016 will be any different. The DOJ already has announced thirteen FCA settlements during the first quarter of Fiscal Year 2016 (October through December 2015), including a $256 million settlement with a major health care provider.[4] The coming year likely will witness yet another change in landscape for FCA enforcement (like this last year’s increased recoveries in relator-driven cases), as the Civil Division announced its intent to follow the DOJ’s new policy memorandum–widely known as “the Yates memorandum”–that promises a more aggressive stance towards individual “flesh-and-blood” defendants in addition to corporations.[5] And relators surely will continue their record levels of activity in qui tam cases, given that 2015 was the fifth straight year in which relators filed at least 700 new FCA matters. Below, we discuss 2015’s highlights from an activity and recovery perspective.

B. Qui Tam Activity

Although whistleblower suits have long catalyzed FCA enforcement activity, relators reached new heights in 2015, recovering more than $1.1 billion in cases where the government declined to intervene. This sum marks a notable 32% of all government recoveries last year (and exceeds the total of $1.0 billion between 1986 and 2014). Relators’ haul from declined cases in 2015 resulted in significant part from a $450 million settlement with a dialysis provider.[6] But even ignoring that weighty component, recoveries in all other cases where the government declined to intervene totaled nearly $700 million, roughly the amount recovered in relator-driven cases from 2007 through 2014.[7]

Whistleblowers initiated approximately 86% of the FCA cases filed in the last Fiscal Year (632 out of 737). This percentage demonstrates the incredible increase in relator activity since Congress further incentivized qui tam relators to bring suit through 1986 amendments to the FCA. Back in 1986, only 8% (30 of 373) of FCA cases were originated by whistleblowers. But whistleblowers have filed more than 10,000 qui tam suits since then, resulting in more than $33 billion in recoveries accounting for almost 69% of all FCA recoveries since 1986. Out of that sum, whistleblowers have netted for themselves $5.3 billion in awards, including $597 million during Fiscal Year 2015 alone. Of the $538 million total paid out in whistleblower awards in cases where the government declined to intervene since 1986, almost $335 million–more than 62%–came in the 2015 Fiscal Year alone.

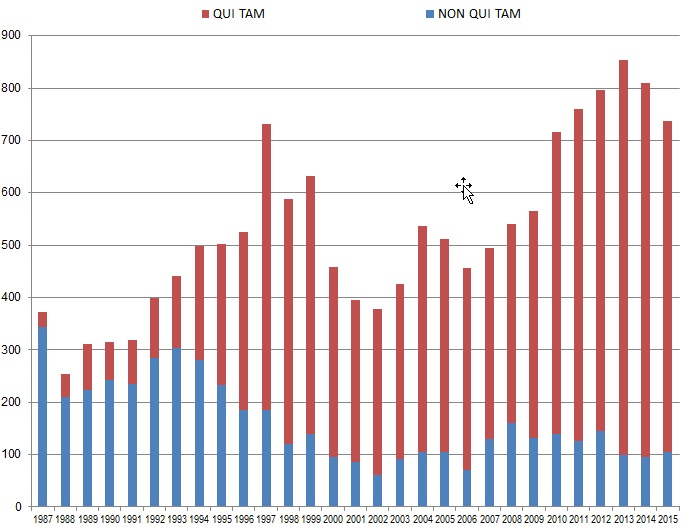

The chart below demonstrates both the increase in overall FCA litigation activity since 1986 and the distinct shift from largely government-driven investigations and enforcement to qui tam-initiated lawsuits.

Number of FCA New Matters, Including Qui Tam Actions

Source: DOJ “Fraud Statistics – Overview” (Nov. 23, 2015)

Historically, the government has chosen to intervene in qui tam lawsuits about 20% of the time.[8] In every year before 2015, that 20% of cases has accounted for the vast majority of total recoveries in qui tam suits–never less than 91% in any given year. In 2015, however, 32% of total qui tam suit recoveries came in cases in which the government declined to intervene, but the relator exercised his or her right to continue to pursue the case on the government’s behalf. This shift reflects relators’ increased willingness in recent years to pursue cases beyond declination and into litigation. FCA defendants must take FCA cases seriously even after the government steps back from intervening.

The chart above also shows that 2015 was the second year in a row when the number of FCA lawsuits dropped. But this drop likely does not portend any let-up in FCA enforcement, as there have been over 700 FCA cases filed each year since 2010, and 2015 was no exception. And despite the fact that 2015 saw about 100 fewer cases than 2013’s record total, the flurry of filings in 2013 likely reflects activity relating to the financial crisis and publicity regarding the Patient Protection and Affordable Care Act (“Affordable Care Act”). In our view, FCA enforcement activity remains robust.

The chart below shows the dramatic increase over the last year in recoveries coming from non-intervened FCA qui tam cases.

Settlement or Judgments in Cases where the Government Declined Intervention as a Percentage of Total FCA Recoveries

Source: DOJ “Fraud Statistics – Overview” (Nov. 23, 2015)

C. Industry Breakdown

As in most prior years (with the notable exception of 2014), health care industry participants paid the majority of the amount recovered under the FCA in 2015. But companies in other industries, including the defense industry, contributed significant sums as well. In the section below, we note this past year underscored that the FCA reaches nearly every industry that sees some flow of government dollars.

1. Health Care and Life Sciences Industries

In 2015, the health care industry resumed its traditional post as the largest category of FCA settlements and judgments, again accounting for more than half of all government recoveries. FCA cases in the health care industry generally involve allegations that the defendant defrauded federal health care programs, such as Medicare, Medicaid, and TRICARE, which provides health care to members of the armed services and their dependents. Since January 2009, the DOJ has recovered $16.5 billion for health care fraud under the FCA.[9] The DOJ obtained just shy of $2 billion in health care fraud recoveries in Fiscal Year 2015.[10]

Although the DOJ’s recoveries from the health care industry failed to top $2 billion for the first time since 2009, the broad base of recoveries in 2015 was notable: it was the first year in recent memory without a blockbuster settlement exceeding $1 billion. By comparison, a pharmaceutical and medical device company paid $1.1 billion in a single settlement in 2014;[11] that company also entered into a $2.2 billion settlement relating to FCA claims in 2013;[12] and another pharmaceutical company paid $2 billion for alleged FCA violations as part of a larger settlement in 2012.[13] Even absent a ten-figure settlement in 2015, the DOJ recovered nearly $2 billion in health care industry FCA cases in 2015. This highlights just how active the DOJ has been in its enforcement efforts.

In its Spring 2015 Semiannual Report to Congress, the Department of Health and Human Services (“HHS”) Office of Inspector General (“OIG”) reported that it commenced 320 civil actions (including, but not limited to, FCA actions) in the first half of Fiscal Year 2015,[14] a sharp rise over the 266 it initiated for the same period in 2014.[15] HHS OIG also reported expected recoveries of approximately $1.8 billion, including about $1.26 billion in “investigative receivables.”[16] This HHS OIG activity–and its projections– reflect the federal government’s firm commitment to combating health care fraud.[17] As a DOJ official reiterated in September 2015 public remarks, the DOJ is focused on health care fraud and has placed a particular emphasis on scrutinizing skilled nursing facilities that allegedly provide medically unnecessary care and hospitals that allegedly compensate physicians at above fair market value in violation of the Stark Law.[18] True to its word, in 2015, the DOJ reached several significant settlements with hospitals relating to alleged improper physician compensation arrangements and with skilled nursing home companies relating to alleged medically unnecessary care.

Two key components of the DOJ’s and HHS OIG’s enforcement activities in health care fraud cases are the Anti-Kickback Statute (“AKS”) and the Stark Law, which aim to ensure that patients receive medical care based on their actual needs, without undue influence from providers’ financial incentives. The AKS prohibits offering, paying, soliciting, or receiving payment to induce referrals of products or services covered by federally funded health care programs.[19] The Stark Law, in brief, prohibits physicians from referring Medicare patients to a provider with which the physicians have a financial relationship.[20] Under the Affordable Care Act, a claim for payment by a federal health program that “includes items or services resulting from” an AKS violation “constitutes a false or fraudulent claim” for FCA purposes.[21] Just a few months into Fiscal Year 2016, the DOJ has already secured a settlement worth $256 million ($227 million of which is specifically for alleged FCA violations) for alleged unnecessary drug testing procedures, including alleged violations of the AKS and Stark Law.[22]

The DOJ enforced these particular statutes aggressively alongside the FCA in Fiscal Year 2015. Hospitals were particular targets of Stark Law crackdowns, as the government entered into settlements with one hospital system for $115 million,[23] another hospital system for $69.5 million,[24] and a third system for as much as $35 million.[25] Similarly, a pharmaceutical company settled for $39 million with the government after allegedly paying kickbacks to doctors to persuade them to prescribe certain medications.[26]

Although pharmaceutical and medical device companies have, in recent years, seen a great deal of focus as targets of FCA enforcement, cases involving health care providers led the government’s list of recoveries in Fiscal Year 2015. Most notably, an outpatient dialysis provider entered into two separate settlements totaling $800 million last year–one to resolve allegations of wasteful drug spending,[27] and another to resolve allegations of kickbacks paid to doctors.[28]

2. Government Contracting and Defense/Procurement

After a down year for recoveries from government contracting and defense industry firms in 2014, recoveries from such companies jumped to $1.1 billion in Fiscal Year 2015.[29] Yet no single company and no single settlement involved more than $146 million, again showing the breadth of government recoveries during the last year. At the highest end of the range of these settlements, a Dubai-based defense logistics company paid $146 million to settle FCA claims, while an affiliated company paid a $288 million criminal fine for related alleged conduct.[30]

Cases involving General Services Administration (“GSA”) contracts were also particularly noteworthy in 2015. In two such cases involving GSA funds, two software companies paid $75.5 million and $44.5 million, respectively, for allegedly overcharging GSA for software.[31]

3. Financial Industry

Recoveries for housing and mortgage fraud fell to earth in 2015, dropping from $3.1 billion in Fiscal Year 2014 to a still-robust $365 million in Fiscal Year 2015.[32] Whereas recoveries in 2014 were dominated by large settlements with some of the largest financial institutions in the world, the government showed in 2015 that it continues to target the conduct that allegedly led to the financial crisis of seven years ago. For example, the government settled with a smaller financial institution for the still-substantial sum of $212.5 million for allegedly fraudulent mortgage-lending practices from 2006 to 2008.[33]

II. Noteworthy Settlements and Judgments Announced During the Second Half of 2015

As noted above, by volume and dollar value, health care matters continued to dominate FCA recoveries in the second half of 2015, which saw even more activity than the first half in terms of notable enforcement actions and related settlements.

This past year also saw individual states continue to more aggressively pursue state FCA enforcement actions, with notable success. State settlements for the second half of 2015 totaled more than $52 million, bringing this year’s total for state settlements to approximately $133 million in recoveries by 27 states and the District of Columbia. We summarize below a number of notable settlements announced during the past six months (including several that will be tallied in the federal government’s 2016 Fiscal Year).

A. Federal Settlements

1. Health Care and Life Sciences Industries

- On June 15, 2015, a pediatric hospital and its affiliated entities agreed to pay $12.9 million to settle allegations that they submitted false cost reports and applications to HHS and to the Virginia and District of Columbia Medicaid Programs, leading to overpayment by these programs. The case began as a qui tam lawsuit brought by a former employee of the organization who will receive nearly $1.9 million of the settlement proceeds.[34]

- On June 16, 2015, a Florida skilled nursing facility, its subsidiaries and affiliates, along with its former president and executive director agreed to pay $17 million to settle claims that the facility hired physicians for allegedly fake positions as medical directors and then paid the physicians for patient referrals, rather than for performing the duties for their positions. This settlement is the largest AKS-related FCA settlement to date for a skilled nursing facility. The purported whistleblower, the facility’s former Chief Financial Officer, will receive $4.25 million of the settlement proceeds.[35]

- On June 18, 2015, a hospice company agreed to pay more than $10.1 million to settle claims that it overcharged federal health care programs for hospice services during a two-year period. The federal government will receive nearly $9.6 million of the settlement, with Alabama and Florida jointly recovering more than $550,000.[36]

- On June 24, 2015, a national kidney-dialysis company agreed to pay $450 million to settle allegations in a declined qui tam lawsuit that it allegedly created unnecessary waste of its drugs when administering the drugs to patients and then charged the federal government for the wasted drug amounts.[37]

- On July 6, 2015, a multinational drug manufacturer agreed to pay $46.5 million plus interest, and another drug manufacturer agreed to pay $7.5 million plus interest, to the United States and participating states. The settlement resolved claims that the companies knowingly underreported prices for certain drugs, leading to underpayment of quarterly rebates owed to the states under the Medicaid Drug Rebate Program and overcharges to the United States for payments to the states. Although these settlements largely resolve the underlying qui tam lawsuit, the pharmacist whistleblower’s share has not yet been determined.[38]

- On July 30, 2015, a medical device manufacturer agreed to pay $13.5 million to settle allegations that the company marketed a product for uses that were not approved by the Food and Drug Administration, thereby causing health care providers to submit alleged false claims to federal health care programs for surgeries that were not eligible for reimbursement. The company also allegedly paid improper kickbacks to physicians to induce them to use the product. The case began as a qui tam lawsuit filed by a former sales representative who will receive approximately $2.2 million of the settlement proceeds.[39]

- On August 3, 2015, a pediatric health care company and related entities agreed to pay $6.88 million to settle claims that the company knowingly submitted false claims to federal health care programs that overstated the length of services provided, knowingly failed to disclose and return overpayments from federal health care programs, and knowingly submitted false claims to the Georgia Pediatric Program. The case began as a qui tam lawsuit filed by former employees of the companies, who will share $1.1 million of settlement proceeds. The companies agreed to enter into a Corporate Integrity Agreement with HHS OIG. Notably, this is the first FCA settlement of claims applying the “reverse FCA” provisions to alleged overpayments as defined by HHS’s not-yet-finalized “60-day rule,” which requires recipients of overpaid federal funds to return the overpayment within 60 days of “identif[ying]” it.[40]

- On September 3, 2015, a biotechnology subsidiary of a foreign pharmaceutical company agreed to settle civil and criminal misbranding claims against the company in relation to its alleged unlawful distribution of an adulterated device. As part of the settlement, the company entered into a deferred prosecution agreement for at least two years, admitted to the facts of the case, agreed to pay a $32.5 million criminal penalty, and agreed to enter into a Corporate Integrity Agreement, in addition to a $22.28 million civil penalty the company paid in 2013 regarding the same claims.[41]

- On September 4, 2015, a Georgia hospital system and a physician employee agreed to pay more than $25 million to settle allegations that they submitted false claims to federal health care programs and also violated the Stark Law. The health system agreed to pay $25 million, as well as contingent payments of up to $10 million, and the physician agreed to pay $425,000. The federal government will receive $24.6 million; Georgia will receive $758,960. The health system also agreed to enter into a Corporate Integrity Agreement. This case was originally brought by a former executive, whose share of the settlement is undetermined.[42]

- On September 8, 2015, a federal judge in Texas ordered two principals of an oxygen therapy provider to pay more than $2.1 million, plus attorneys’ fees and costs, in a lawsuit regarding the defendants’ alleged submission of false claims to Medicare.[43] The principals allegedly double-billed Medicare for oxygen therapy sessions. The case began as a qui tam lawsuit brought by a former employee. The government declined to intervene in the relator’s suit, but did bring criminal charges against the providers. The providers pled guilty in 2014 to conspiracy to commit health care fraud, were sentenced to five years in prison and were ordered to pay more than $1.5 million in restitution.[44]

- On September 15, 2015, a Florida hospital taxing district operating hospitals and health care facilities agreed to pay $69.5 million to settle claims that it paid certain referring physicians improper, excessive compensation that exceeded fair market value in violation of the Stark Law (and thereby caused violations of the FCA). The case was originally filed by a physician whistleblower, who will receive more than $12 million from the settlement proceeds.[45]

- On September 21, 2015, a health system operating in 10 states agreed to pay a total of $118.7 million to federal and state governments to settle allegations that it submitted false claims to federal health care programs by providing illegal financial incentives to referring physicians and also miscoding certain claims submitted to Medicare. The federal government received $115 million, with the remainder going to the states. The case arose from two separate qui tam lawsuits filed by former employees of the health system, who will share an undetermined amount of the settlement.[46]

- On October 7, 2015, one of the country’s largest home pharmacy companies agreed to pay $9.25 million to settle allegations that it both solicited and received kickbacks from a pharmaceutical manufacturer in exchange for recommending a certain drug to nursing home residents. The United States will receive approximately $6.75 million from the settlement proceeds, with the remaining $2.5 million earmarked for state Medicaid programs. This case was originally brought by former employees of the pharmaceutical manufacturer, one of whom will receive a $1 million share. The pharmaceutical manufacturer previously reached a $1.5 billion civil and criminal settlement with the United States in May 2012.[47]

- On October 16, 2015, a health care system agreed to pay $72.4 million to resolve claims that it allegedly violated the Stark Law and engaged in illegal Medicare billing practices. The health care system allegedly contracted with physicians to require them to refer their outpatient procedures to the health care system, paying them compensation that was above fair market value. This settlement resolves a prior judgment of more than $237 million imposed by a district court in 2013 and affirmed by the Fourth Circuit in July 2015. The relator, a physician who refused to sign a contract with the health care system, will receive $18.1 million of the settlement proceeds. As part of the settlement, the health care system also agreed to be sold to a different health care system within the same state and to enter into a five-year Corporate Integrity Agreement.[48]

- On October 19, 2015, a drug testing laboratory agreed to pay $256 million to settle claims that the company violated the FCA by billing federal health care programs for unnecessary drug and genetic tests, and for violating the Stark Law and the AKS by providing free testing equipment to physicians. The $256 million includes $227 million to resolve claims related to allegedly unnecessary drug testing and $10 million to resolve allegations relating to genetic testing performed without a determination of medical necessity. The settlement total includes $19.2 million to the Centers for Medicare and Medicaid Services. The qui tam relators will receive a $30.35 million share from the urine drug testing portion of the settlement and $1.48 million from the genetic testing portion of the settlement. The laboratory also entered into a Corporate Integrity Agreement as part of the settlement.[49]

- On October 29, 2015, a pharmaceutical manufacturer agreed to pay $125 million to settle criminal and civil claims that the manufacturer illegally marketed certain drugs, caused the submission of false claims to government health care programs, violated the AKS by paying physicians illegal remuneration, and caused the submission of false prior authorization requests for certain drugs. A subsidiary of the pharmaceutical manufacturer also agreed to plead guilty to a charge of felony health care fraud for the same actions. The manufacturer will pay a criminal fine of $22.94 million and a civil settlement of $102.06 million. Of the civil settlement, the United States will receive $91.5 million and state Medicaid programs will receive approximately $10.6 million.[50]

- On October 30, 2015, the DOJ announced 70 settlements with 457 hospitals spanning 43 states, for a total settlement of over $250 million. Each of the settling hospitals allegedly implanted cardiac devices into Medicare patients during a prohibited time period in violation of Medicare requirements. Most of the defendants were named in a qui tam lawsuit brought by two relators, who will share more than $38 million of the settlement proceeds.[51]

- On November 20, 2015, a pharmaceutical company agreed to pay $390 million to settle claims that it provided improper kickbacks in the form of financial incentives and patient referrals to specialty pharmacies, allegedly in exchange for prescriptions of specific drugs produced by the company, which were purportedly less effective and costlier than alternatives. The company will pay $370 million to resolve state and federal FCA claims, comprised of $286.9 million for the federal government and $83.1 million for the settling states. The company also will pay $20 million in forfeited proceeds under the federal civil forfeiture statute. The company also agreed to admit to wrongdoing and to amend a previously existing Corporate Integrity Agreement. The case began as a qui tam lawsuit filed by a former company sales manager, whose share has not yet been determined.[52]

- On November 25, 2015, six Florida-based compounding pharmacies and owners agreed to pay more than $30 million in combined fines and repayments to settle claims that they fraudulently billed TRICARE. The largest individual payment, of more than $4.7 million, came from one pharmacy that resolved allegations that it provided illegal kickbacks to marketers, filled prescriptions that it knew or should have known were illegitimate, and mailed prescriptions to states in which it had no license. Another pharmacy paid $4.1 million to settle claims it filled prescriptions that it knew or should have known were being written outside the ordinary course of practice. The other four pharmacies agreed to resolve similar allegations in exchange for payments of $3 million, $2.2 million, $2.1 million, and $10,000. Two of the settling pharmacies also agreed to pay 50% of their net profits for the next five years as part of the settlement amounts.[53]

- On November 30, 2015, a skilled nursing facility company agreed to pay nearly $3.2 million to resolve claims that it violated the AKS by accepting kickbacks from ambulance companies in return for providing rights to the companies for profitable transportation referrals for Medicare and Medicaid. According to the DOJ, this is believed to be the first settlement to hold a medical facility accountable for this type of alleged behavior, rather than ambulance companies. The state of Texas will receive approximately $533,000 from the settlement proceeds. The company also agreed to enter a five-year Corporate Integrity Agreement.[54]

- On December 18, 2015, 32 hospitals agreed to pay a total of more than $28 million to resolve allegations that the hospitals submitted false claims to Medicare. The hospitals allegedly billed Medicare for inpatient kyphoplasty procedures when the procedures can typically be performed on a less costly outpatient basis. The government has now settled with more than 130 hospitals regarding these claims, resulting in more than $105 million in settlement proceeds. In addition to these settlements, the government previously settled with the corporate successor of a medical device company that allegedly caused false claims to be submitted to Medicare by advising hospitals to perform inpatient kyphoplasty procedures rather than performing outpatient procedures. That company agreed to pay $75 million to resolve those claims. Twenty-nine of the hospitals in this settlement were originally named in a qui tam lawsuit filed by a former reimbursement manager and a former regional sales manager of the medical device company. The relators will receive approximately $4.75 million from this settlement.[55]

- On December 18, 2015, a Maryland-based splint supplier and its founder and president agreed to pay approximately $10.3 million to settle claims that they knowingly mischarged Medicare for splints provided to patients staying in skilled nursing facilities. Medicare pays one bundled payment to cover all of a patient’s needs while staying at a skilled nursing facility. Because splints are covered under the bundled payment, the defendants allegedly should not have been separately reimbursed for the splints. To receive separate payment from Medicare for the splints, the company allegedly asserted that patients were not staying at skilled nursing facilities, when in fact, they were. This case began as a qui tam lawsuit filed by a former sales executive of the company. The relator will receive at least $1.98 million from the settlement proceeds. As part of the settlement, the company agreed to forfeit approximately $8.5 million in payments owed to it that were suspended by the Centers for Medicare and Medicaid Services in August 2013 due to the allegations of fraud.[56]

- On December 18, 2015, a Florida-based cancer care provider agreed to pay $19.75 million to settle allegations that it submitted claims to federal health care programs for medically unnecessary laboratory tests. The provider also allegedly incentivized four doctors to order the unnecessary tests by providing bonuses that were partially based on the number of tests referred to the provider’s laboratory. The case began as a qui tam lawsuit filed by a former medical assistant for the provider, who will receive $3.2 million from the settlement proceeds. This settlement only resolves the provider’s civil liability and does not resolve claims against the individual doctors who allegedly ordered the unnecessary tests.[57]

2. Government Contracting and Defense/Procurement

- On June 24, 2015, a for-profit education company agreed to pay $13 million to settle allegations that it submitted false claims to the Department of Education to receive student aid funding for its programs. The company allegedly altered admissions test scores, falsified applications for federal student aid, and falsified student diplomas. Three employees were criminally convicted in connection with these allegations. This case began as five separate qui tam lawsuits, and the whistleblowers will share approximately $1.8 million of the settlement proceeds.[58]

- On June 30, 2015, a California-based software company and a Maryland information technology corporation agreed to pay $75.5 million to settle allegations that they falsely represented commercial pricing practices for products and services under a GSA Program contract, thereby overcharging the government. The case began as a qui tam lawsuit filed by a former vice president at one of the companies. His share of the settlement proceeds has not yet been determined.[59]

- On July 6, 2015, a services company and its principals agreed to pay $7.8 million to settle a qui tam lawsuit claiming that they obtained government contracts through the Small Business Administration (“SBA”) by making false statements about the qualifying socio-economic status of one of the company’s principals. The purported whistleblowers, former company employees, also alleged additional fraud claims, but the government intervened only with respect to one part of the qui tam lawsuit. The whistleblowers will share $1.5 million of the settlement proceeds.[60]

- On July 9, 2015, a moving company and its related entities agreed to pay $5 million to settle allegations that they submitted false claims for payment for inflated weights of goods shipped or stored for federal employees and members of the armed forces. The case began as two qui tam lawsuits filed by former employees of the company who will split $1.25 million plus attorneys’ fees from the settlement proceeds.[61]

- On August 11, 2015, a technology company agreed to pay $5.9 million to settle allegations that the company illegally raised the price of computers ultimately resold to the National Nuclear Security Administration. The technology company allegedly failed to provide credits for rebates and discounts that were required by its contract, thereby causing the submission of false claims to the government for inflated computer prices. In a related matter, in April 2015, the technology company entered into a three-year non-prosecution agreement over similar claims that employees engaged in a fraudulent computer-pricing scheme; that agreement required the company to terminate certain employees and retain an independent compliance monitor.[62]

- On August 19, 2015, a government contractor and its parent company agreed to forego payments of at least $30 million owed to them by the U.S. Office of Personnel Management (“OPM”) to settle allegations that the company falsely represented compliance with certain requirements regarding background investigations in its contract with OPM.[63] One of the company’s former executives originally filed the case as a qui tam lawsuit, and he will receive $6 million of the settlement proceeds.[64]

- On August 21, 2015, an engineering and science laboratory agreed to pay nearly $4.8 million to settle claims that the company illegally used federal funds for lobbying activities in violation of the Byrd Amendment between 2008 and 2012.[65]

- On September 2, 2015, a government contractor agreed to pay $3.8 million to resolve allegations that the company knowingly mischarged the Department of Energy for employee reimbursement expenses that the company knew were contractually ineligible for reimbursement.[66]

- On September 28, 2015, a defense contractor agreed to pay $4.63 million to settle claims that the defense contractor falsely billed the government for hours that its independent contractors did not actually work. This case began as a qui tam lawsuit filed by a former independent contractor, who will receive $798,675 from the settlement proceeds.[67]

- On October 5, 2015, an oil company agreed to pay $82.6 million to settle an FCA investigation and to reimburse the United States for royalties allegedly lost as a result of the April 2010 oil spill in the Gulf of Mexico.[68] This settlement was part of a $20.8 billion settlement between the oil company, the United States, and five states.[69]

- On October 13, 2015, a global technology company agreed to pay $9.4 million to settle allegations that the company improperly claimed postage discounts offered by the U.S. Postal Service. The company allegedly claimed discounts on postage for mail that was not in compliance with certain requirements necessary to obtain the discount, resulting in underpayment of postage charges to the United States.[70]

- On October 14, 2015, a defense contractor agreed to pay $18 million to settle claims that the company submitted false claims for certain charges associated with U.S. Air Force contracts. According to the government, the company knowingly overcharged the U.S. Air Force for labor charges associated with the maintenance and repair of certain aircraft. The lawsuit was originally brought by a purported whistleblower whose share has not yet been determined.[71]

- On October 27, 2015, an ocean carrier agreed to pay $9.8 million to settle allegations that it billed the Department of Defense for services it did not adequately provide under the parties’ contract. The contract required the carrier to attach a tracking device to every container to provide tracking services. The carrier allegedly billed the Department of Defense for tracking services when it knew that the tracking devices were either failing to properly transmit data or were not attached to the shipping containers as was required.[72]

- On November 2, 2015, two technology companies agreed to pay $11.4 million and $1.35 million, respectively, to settle claims that they used employees who had no security clearances to perform work on a Defense Information Systems Agency (“DISA”) contract despite knowing that the contract required employees to have security clearances. According to the government, the use of these employees caused the submission of false claims for payment to DISA. The case began as a qui tam lawsuit brought by a former employee of the prime contractor. He will receive more than $2.3 million of the settlement proceeds.[73]

- On November 16, 2015, a for-profit education company agreed to pay $95.5 million to settle claims that the company falsely certified that it was compliant with Title IV of the Higher Education Act and similar state statutes. This settlement resolved four separate qui tam lawsuits, as well as a consumer fraud investigation by 40 state Attorneys General. The United States and five states intervened in one of the qui tam lawsuits. Under the terms of the consumer fraud investigation settlement, the company must adopt compliance measures. The relators will split $11.3 million from the United States’ $52.6 million share, with the remaining amount shared among the states.[74]

- On November 20, 2015, a state university agreed to pay $19.8 million to settle claims that the university misused funds from hundreds of federal grants awarded over a five-year period by overcharging the HHS for employee salaries, administrative costs, and services provided by an affiliate of the university.[75]

- On November 25, 2015, a defense contractor, its president, and its parent company agreed to pay $25.6 million to settle claims that the contractor knowingly sold defective holographic weapon sights to the U.S. Department of Homeland Security, the U.S. Department of Defense, and the Federal Bureau of Investigation. The contractor allegedly did not disclose the defects for years after selling the equipment to the government, in violation of the contract. As part of the settlement, all three of the defendants admitted to the alleged misconduct.[76]

- On December 9, 2015, a shipbuilder agreed to pay $8.5 million and release contract claims to settle allegations that the company falsely misrepresented the longitudinal strength of boats that it retrofitted under a contract with the Coast Guard. The misrepresentations allegedly led to the boats having insufficient longitudinal strength, which caused the boats to fail after they were in service.[77]

- On December 21, 2015, a furniture import company and its general partner agreed to pay $15 million to settle claims that the company knowingly made or conspired with others to make false statements on documents provided to U.S. Customs and Border Protection to avoid paying antidumping duties on bedroom furniture imported from the People’s Republic of China. The company allegedly classified the bedroom furniture as other types of furniture that are not subject to duties. The case began as a qui tam lawsuit filed by another furniture company, which will receive $2.25 million from the settlement proceeds.[78]

3. Financial Industry

- On August 28, 2015, a financial services company and its CEO agreed to settle claims that the company failed to pay the SBA payments due under the loan program, failed to maintain an adequate amount of money in a reserve fund as required under the SBA, and knowingly concealed information from the SBA about troubled loans. The settlement amount includes a total of approximately $6 million in payments and assets given to the United States.[79]

- On September 4, 2015, an investment company agreed to pay $29.63 million to settle claims in a qui tam suit that the company’s subsidiaries submitted false claims in connection with the Department of Housing and Urban Development (“HUD”) Home Equity Mortgages Program when it allegedly knowingly failed to comply with the program’s regulatory requirements and deadlines, failed to disclose its lack of compliance, and misrepresented certain fees as lawful sales commissions. The relator, a former executive of one of the company’s subsidiaries, will receive $5.15 million from the settlement proceeds.[80]

- On October 6, 2015, a national bank and its subsidiaries agreed to pay nearly $85 million to settle claims that the bank certified mortgage loans as eligible for Federal Housing Administration Insurance and did not report the ineligibility to HUD after allegedly later determining that the loans were, in fact, ineligible. The bank’s settlement proceeds will cover alleged federal losses for approximately 500 loans for which HUD paid insurance claims after they defaulted. The bank also agreed to indemnify HUD for any losses which may occur due to future default. As part of the settlement, the bank admitted and accepted responsibility for violating HUD requirements of self-reporting defects, fired all responsible employees, and reformed its business plans. Although the case began in part as a qui tam lawsuit, the bank voluntarily disclosed the alleged noncompliance to the government without knowledge of the qui tam suit.[81]

- On October 16, 2015, the estate of a former owner and president of a financial corporation and its subsidiary agreed to pay $4 million to settle claims relating to alleged false statements about the financial condition of the corporation and its intended use of Troubled Asset Relief Program (“TARP”) funds, causing the Department of Treasury to invest TARP funds in the corporation. The subsidiary also will receive $6.9 million from the estate. Criminal actions against certain executives of the corporation and its subsidiary also are pending.[82]

- On December 2, 2015, a mortgage company agreed to pay $70 million to settle allegations that it knowingly originated and underwrote mortgage loans that did not meet the requirements to become insured by HUD’s Federal Housing Administration (“FHA”). The company also allegedly failed to follow quality control requirements, causing FHA to insure ineligible loans and suffer losses. As part of the settlement, the company agreed to admit to certain facts and wrongdoing.[83]

B. State Settlements

- On June 29, 2015, a New York City pharmacy agreed to pay more than $2.5 million to the New York Medicaid program and the federal Medicaid program to settle claims of improper conduct and false billing practices relating to the delivery of specific drugs resulting in the alleged submission of false claims to Medicaid. The state’s investigation also allegedly found that the companies that acquired the pharmacy failed to ensure its compliance with relevant regulations. The case began as a qui tam lawsuit filed in the state of New York by a former employee of the pharmacy. The New York Medicaid program will receive approximately $1.5 million from the settlement proceeds and the federal Medicaid program will also receive a portion.[84]

- Two weeks later, on July 10, 2015, the same pharmacy agreed to pay $22.4 million to settle separate claims filed in the state of New York of allegedly improper conduct and false billings to Medicaid related to a specific drug, including allegedly improperly obtaining patient information and unauthorized use of physician names on prescriptions. The pharmacy also allegedly falsely billed Medicaid by submitting claims for unauthorized, invalid orders and refills and by billing for excessive amounts of the drug by overstating patients’ weights. The State of New York will receive $12.2 million of the proceeds from the second settlement and the federal Medicaid program will receive the remainder of the proceeds.[85]

- On August 5, 2015, a drug manufacturer agreed to pay the State of Oregon and a nonprofit or governmental organization selected by the state $1.1 million to settle claims that the company marketed a specific drug for off-label uses. The manufacturer also allegedly provided doctors with improper incentives to induce doctors to prescribe the drug, targeted doctors to prescribe the drug who were not qualified to do so, and engaged in deceptive promotion of the drug. Under the settlement agreement, the manufacturer will pay $533,000 to the State of Oregon and $567,000 to a nonprofit or governmental organization chosen by the Oregon Attorney General.[86]

- On August 20, 2015, three construction companies agreed to pay a total of $1.4 million to settle claims that they allegedly violated the Massachusetts False Claims Act by falsely certifying that the companies complied with certain state and federal equal opportunity requirements relating to public construction contracts. One company and its principal agreed to pay $1.05 million, the second company agreed to pay $150,000, and the third company agreed to pay $200,000. As part of the settlement, one of the companies is permanently enjoined from entering into any contract with the Commonwealth of Massachusetts. A portion of the settlement will help fund a program promoting equal opportunity programs in multiple sectors.[87]

- On August 24, 2015, a hospital management corporation, its CEO, and certain hospitals agreed to pay more than $8 million to settle allegations brought jointly by the New York Attorney General and the U.S. Attorney’s Office that the management corporation received kickbacks in exchange for illegal patient referrals to specific hospitals and medical centers throughout New York. The hospital management corporation and its CEO agreed to pay $6 million and enter into a Corporate Integrity Agreement. Three involved hospitals agreed to pay $880,000, $600,000, and $650,000, respectively. This case began as a qui tam lawsuit filed by two relators under the New York False Claims Act. Two separate, earlier settlements with other hospitals in this same case were reached, with settlement payments of $13.4 million and $4.5 million.[88]

- On August 24, 2015, a Brooklyn, New York-based home health care agency agreed to pay $6 million to the State of New York to settle allegations that the agency received overpayments from Medicaid due to its improper reporting of employee hours and costs, as well as improper allocation of costs, leading the state allegedly to reimburse the agency for over $3 million to which it was not entitled.[89]

- On November 3, 2015, an international oil company agreed to pay $4.4 million, including $2.5 million to the State of Massachusetts and $1.9 million to the Massachusetts Underground Storage Tank Petroleum Product Cleanup Fund (“UST Fund”), to settle claims that it falsely certified that applications to the UST Fund were compliant with regulations.[90]

- On October 20, 2015, a delivery service company agreed to pay $4.2 million to more than a dozen state and city governments to settle claims that the company concealed its failure to timely deliver state and federal government packages as required under government contracts. The company allegedly knowingly recorded inaccurate delivery times, used exception codes in order to excuse any late deliveries, and provided the government with inaccurate data on deliveries under federal contracts. The case began as a qui tam lawsuit filed by a former employee.[91] As discussed in our 2015 Mid-Year Update, in May 2015, the company agreed to pay $25 million to the federal government and State of New Jersey to settle the same claims, with the same relator receiving a $3.75 million share.[92]

- On December 10, 2015, a New Jersey-based environmental firm agreed to pay the State of New Jersey $2 million to settle claims that it submitted false claims to the state by not following federal Environmental Protection Agency requirements during testing. Over $900,000 of the settlement proceeds will resolve allegations that the company violated the New Jersey Department of Environmental Protection regulations, while the remainder of the settlement resolves false claims act claims.[93]

III. Legislative Activity

Since our last update, there have been several notable legislative and regulatory developments that could affect companies’ FCA liability. At the federal level, the big news was an act that may nearly double the FCA’s civil, per-claim penalties. At the state level, the activity was generally less newsworthy, with the exception of Wisconsin’s repeal of its version of the false claims act. These and other notable developments are discussed below.

A. Federal Activity

In a development with potentially far-reaching consequences for companies facing FCA liability, Congress passed legislation in October 2015 that requires agencies to increase civil penalties, including FCA penalties, to account for inflation. Enacted as part of the Bipartisan Budget Act of 2015, the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (the “2015 Adjustment Act”)[94] requires the DOJ to make a one-time “catch up” adjustment to FCA penalty levels, which were last adjusted in 1999, to account for inflation through October 2015. The Act also mandates annual inflation adjustments thereafter, which will be pegged to the Consumer Price Index.[95]

The initial increase could see FCA penalties balloon from their current levels of $5,500 to $11,000 per false claim to as much as approximately $9,300 to $18,600 per false claim. The changes may take effect as soon as July 2016.[96]

Under the 2015 Adjustment Act, the DOJ has discretion to decrease the amount of the “catch up” adjustment under certain circumstances, so long as the Director of the Office of Management and Budget concurs. In particular, the DOJ may depart from the full-fledged adjustment if, after notice and comment rulemaking, it finds that the increase to the penalties would have “a negative economic impact” or that “social costs . . . outweigh the benefits.”[97]

It seems unlikely that the DOJ will avail itself of this opportunity. Even if the 2015 Adjustment Act included fewer administrative obstacles to such a decrease, the DOJ routinely touts the size of its FCA recoveries and may well view the increased penalties as a new bargaining chip for settlement negotiations with FCA defendants.

The likely result, therefore, is that companies confronting FCA liability in the future will face drastically higher potential per-claim penalties even absent commensurate damages to the government. In past updates and this one as well, we report(ed) on case law in which defendants leveled Eighth Amendment and Due Process challenges at judgments including substantial FCA penalties where the government or relators failed to prove any damage to the government (or the damages were limited). See, e.g., 2014 Year-End Update (discussing United States ex rel. Bunk v. Gosselin World Wide Moving, 741 F.3d 390 (4th Cir. 2013)). Indeed, FCA defendants have regularly raised–but rarely won–constitutional challenges to FCA judgments with significant penalty components. See, e.g., United States ex rel. Drakeford v. Tuomey, 792 F.3d 364, 387–89 (4th Cir. 2015).

As penalties diverge even more drastically from damages–especially in cases involving thousands of allegedly false claims–defendants are likely to invoke the Eighth Amendment and the Due Process Clause even more energetically. The penalty adjustments may provide ammunition for defendants as they seek to show that the ratio of punitive penalties to compensatory damages exceeds the constitutional rule of thumb established by the Supreme Court in a line of punitive damages cases. Cf. id. at 389 (citing State Farm Mut. Auto Ins. Co. v. Campbell, 538 U.S. 408, 418 (2003), and discussing the Supreme Court’s 4:1 guideline for the ratio of punitive to compensatory damages). This will surely be a critical issue to watch during the new year and beyond.

Elsewhere on the federal front, this past September, the FHA proposed new loan documents and a new approach to certifying loans in an effort to incentivize more banks to make mortgage loans under FHA loan programs.[98] The new certifications seek to provide assurance to lenders that minor mistakes on certification forms would not lead to penalties against banks. In the past, the government has pursued recoveries, including under the FCA, for even minor errors on loan certification documents. Many banks are still wary of past enforcement activities and are unsatisfied with the proposed changes, which–according to the banks–may still expose them to significant liability for mere mistakes.[99] The proposed documents will undergo a period of review and the FHA will take comments on the documents before releasing a final version of the certifications, most likely in the spring.[100]

One other important development on the horizon for 2016 is the Centers for Medicare and Medicaid Services’ (“CMS”) proposed changes to regulations affecting Medicaid and the Children’s Health Insurance Program (“CHIP”).[101] As discussed in our Mid-Year False Claims Act Update, those changes included a recommendation that Medicaid-managed plans be held to at least an 85% medical loss ratio standard, so that at least 85% of the managed care entity’s revenue is directed to patient care rather than to administrative costs or profit. Reporting requirements tied to that recommendation could expose companies to a new FCA risk. CMS circulated its proposal for comments and received nearly 900 comments by the deadline on July 27, 2015.[102] CMS has yet to publish the final rule, which is expected to be released by early 2016.[103]

There has been no further action on the Motor Vehicle Safety Whistleblower Act (S. 304) since it was discussed in our 2015 Mid-Year Update.[104] The Senate approved the bill on April 28, 2015 and the bill moved to the House, where it was referred to the Energy and Commerce Committee’s Subcommittee on Commerce, Manufacturing, and Trade on May 1, 2015.[105]

B. State Activity

In a highly unusual step, on July 12, 2015, Wisconsin repealed its False Claims for Medical Assistance Act.[106] Enacted in 2007, the False Claims for Medical Assistance Act was the state’s version of the federal FCA.[107] Wisconsin lawmakers did not explain the repeal, and the state’s Joint Committee on Finance did not have any hearings or public discussion regarding the repeal.[108] Wisconsin’s unusual action is especially notable during a time when most states have been active in improving or creating state versions of the federal False Claims Act, rather than repealing them.

Aside from Wisconsin’s repeal of its false claims act, there was little legislative activity at the state level in the second half of 2015. To follow up on several items that we mentioned in previous updates:

- On May 18, 2015, the Governor of Vermont signed into law the Vermont False Claims Act, a state false claims act that is very similar to the federal FCA. On August 5, 2015, HHS OIG determined that the Vermont False Claims Act complies with the Deficit Reduction Act of 2005 (“DRA”), which offered states financial incentives to enact false claims statutes modeled after the federal FCA.[109]

- The New Jersey general assembly, the lower house of the state’s legislature, passed a bill on May 14, 2015, that allows for the retroactive application of New Jersey’s false claims act. The state’s Senate received the bill and referred it to the Senate Judiciary Committee on May 18, 2015, but there has been no further action on the bill.[110]

- In South Carolina, there has been no further action since January 2015 on a bill to enact the “South Carolina False Claims Act” (S.B. 223) that was referred to the Committee on Judiciary in January 2015.[111]

- New York Attorney General Eric Schneiderman announced in February 2015 that he would propose a bill to protect and reward employees who provide information about fraudulent or illegal activity in the banking, insurance, and financial services industries.[112] Assembly Member Annette Robinson introduced the proposed bill on May 4, 2015, on behalf of the Department of Law.[113] The bill was referred to the Assembly Banks Committee, and there has been no further action on the bill.[114]

- Wyoming continues to await word from HHS OIG regarding whether Wyoming’s False Claims Act, which the state enacted in 2013, complies with the requirements under the DRA.[115]

- HHS OIG also has yet to announce whether Maryland’s expanded False Claims Act, which took effect on June 1, 2015, complies with DRA requirements.[116]

IV. Case Law

There have been several significant developments in FCA jurisprudence during the last six months, even apart from the Supreme Court’s decision to weigh in on a critical issue that has divided the circuits. As detailed below, the federal courts have provided further authority relating to the FCA’s jurisdictional limits in qui tam cases, FCA penalties, the role a relator’s misconduct may play in a qui tam case, and a variety of other topics.

A. The Supreme Court Decides to Step in on the False Certification Issue

As those who follow FCA litigation know well, perhaps the most hotly contested issue over the last several years in FCA litigation is the viability and scope of the so-called “implied false certification” theory of liability. Under this theory, an entity may be liable under the FCA not just for submitting false claims for payment to the government, but also for submitting claims for payment to the government while in knowing violation of a statutory, regulatory, or contractual term relating to the entity’s participation in a government program. Some circuits have rejected this theory entirely, others have adopted it, and others have adopted it with certain restrictions (e.g., by holding that the statutory, regulatory, or contractual term at issue and allegedly violated must be identified somewhere and somehow as an “express condition of payment” to provide the basis for FCA liability).

Given the vast number of statutory, regulatory, and contractual terms to which government contractors are subject, this theory of liability has huge implications and threatens to convert the FCA into a blunt instrument for enforcing compliance with all statutes, regulations, and contractual terms, upon threat of treble damages and massive penalties (and with non-government relators’ attorneys often pursuing the cases).

In the last six months, several circuits issued decisions on the implied certification theory, most prominently the Seventh Circuit in United States v. Sanford-Brown, Ltd., 788 F.3d 696 (7th Cir. 2015). There, the Seventh Circuit held in a strongly worded opinion that the relator’s alleged implied false certification theory of liability was not actionable. Id. at 711–12. In fact, the Seventh Circuit deemed it “unreasonable” for the relator to argue or suggest, as he had, that lack of compliance with any of the “thousands of pages of federal statutes and regulations” could provide the basis for FCA liability. Id. at 711. Instead, the court held, administrative agency proceedings, not the FCA, are the proper mechanism for enforcing these statutes and regulations. Id. at 712. This decision deepened the present circuit split over the issue, including with the First Circuit, which concluded earlier this year in United States ex rel. Escobar v. Universal Health Services, Inc., 780 F.3d 504, 517 (1st Cir. 2015), that a medical provider’s alleged violations of state medical licensing and supervision regulations could provide the basis for federal FCA liability under this theory.

On December 4, 2015, the Supreme Court granted certiorari in the Escobar case. 2015 WL 4078340 (U.S. Dec. 4, 2015). The Supreme Court identified two questions for review:

(1) Whether the “implied certification” theory of legal falsity under the FCA–applied by the First Circuit below but recently rejected by the Seventh Circuit–is viable; and

(2) If the “implied certification” theory is viable, whether a government contractor’s reimbursement claim can be legally “false” under that theory if the provider failed to comply with a statute, regulation, or contractual provision that does not state that it is a condition of payment, as held by the First, Fourth, and D.C. Circuits; or whether liability for a legally “false” reimbursement claim requires that the statute, regulation, or contractual provision expressly state that it is a condition of payment, as held by the Second and Sixth Circuits.

Id.; see also Petition for Writ of Certiorari, Escobar (No. 14-1423).

The Supreme Court’s decision on if (and how) the implied certification theory applies in FCA cases may well be the most significant high court FCA decision in recent memory. At stake is the potential scope of government contractor’s liability (especially in light of relators’ attorneys’ efforts to cast FCA liability over a broad swath of behavior that does not involve any factual falsity or express misrepresentation). This case will be hotly contested, heavily briefed, and closely followed.

B. Circuit Courts Offer Differing Decisions Regarding the FCA’s Jurisdictional Rules

There are two primary jurisdictional impediments to a qui tam relator filing an FCA case against a government contractor. First, the so-called “public disclosure bar” precludes a qui tam relator from filing an FCA case based upon information that has already been publicly disclosed in certain forums (such as prior federal litigation and the news media), unless the relator can show he or she is an “original source” of the information. 31 U.S.C. § 3730(e)(4)(A). Second, the so-called “first to file” rule states that a qui tam relator cannot bring an FCA qui tam action if an earlier related qui tam action is pending at the time the latter action is brought. 31 U.S.C. § 3730(b)(5). At a very high level, the basic concept behind both provisions is to prevent the filing of duplicative qui tam lawsuits, after the information is already available (either in the form of a public disclosure or an earlier case) to alert the government to the potential claims so that it can investigate the claims and determine whether it wants to pursue them. During the last six months, there have been two circuit court decisions that have provided noteworthy guidance regarding these jurisdictional rules.

First, in United States ex rel. Hartpence v. Kinetic Concepts, Inc., 792 F.3d 1121 (9th Cir. 2015), the Ninth Circuit–sitting en banc–overturned long-standing Ninth Circuit precedent and held that to be an “original source” under the public disclosure bar, a relator need not show that he “had a hand” in making the public disclosure. The Ninth Circuit’s earlier decision in United States ex rel. Wang v. FMC Corp., 975 F.2d 1412 (9th Cir. 1992), had imposed this requirement, but the en banc court concluded that “there are two, and only two, requirements” for a whistleblower to be an “original source”: “(1) Before filing his action, the whistleblower must voluntarily inform the government of the facts which underlie the allegations of his complaint; and (2) he must have direct and independent knowledge of the allegations underlying his complaint.” 792 F.3d at 1122. The Ninth Circuit reasoned that the Circuit’s earlier, additional requirement “impermissibly graft[ed] onto the statute a requirement nowhere to be found in the statute’s text.” Id. at 1127–28.

Second, in United States ex rel. Gadbois v. PharMerica Corp., No. 14-2164, 2015 WL 9093650 (1st Cir. Dec. 16, 2015), the First Circuit analyzed the FCA’s first-to-file bar. As stated above, the first-to-file bar provides that no qui tam relator may bring a related qui tam action if an earlier-filed action is pending. This raises the question: what if the earlier-filed action is dismissed while the second action remains alive for one reason or another (because, for example, its dismissal is on appeal)? The First Circuit answered this question by concluding that at least in the First Circuit the relator in the second action, under Rule 15 of the Federal Rules of Civil Procedure, could simply supplement his or her pleadings in the second action to add facts stating that the earlier action had been dismissed, and that may solve the potential barring effect of the earlier case. In so holding, the First Circuit split from the Fourth Circuit, Seventh Circuit, and Tenth Circuit, which have indicated that if an action is filed at the time an earlier action is still pending, it must be dismissed (and it cannot simply be amended after dismissal of the earlier action to resolve the failure). United States ex rel. Carter v. Halliburton Co., 710 F.3d 171, 182 (4th Cir. 2013); United States ex rel. Chovanec v. Apria Healthcare Grp. Inc., 606 F.3d 361, 362 (7th Cir. 2010); United States ex rel. Grynberg v. Koch Gateway Pipeline Co., 390 F.3d 1276, 1279 (10th Cir. 2004). The First Circuit’s decision also conflicts with recent decisions of the United States District Court for the District of Columbia and Eastern District of Virginia. See United States ex rel. Shea v. Verizon Commc’ns, Inc., No. 09-1050, 2015 WL 7769624 (D.D.C. Oct. 6, 2015); see also United States ex rel. Carter v. Halliburton Co., No. 1:11cv602, 2015 WL 7012542 (E.D. Va. Nov. 12, 2015).

More importantly, the First Circuit’s decision also departs from the Supreme Court’s recent decision in Kellogg Brown & Root Services, Inc. v. Carter, 135 S. Ct. 1970 (2015). There, the Supreme Court–faced with a second-filed case at a time when the earlier case had been dismissed–affirmed dismissal of the second action, and did not indicate leave to amend could be granted to overcome the jurisdictional hurdle. This emerging circuit split will be another to watch, as it could percolate to the Supreme Court for review.

C. D.C. Circuit Overturns Jury Verdict in Favor of the Government

On November 24, 2015, the D.C. Circuit rejected what had been the potential conclusion of one of the longest running cases in FCA history (United States ex rel. Purcell v. MWI Corp., 807 F.3d 281 (D.C. Cir. 2015)) when it overturned a jury verdict in favor of the government, and–in doing so–provided important precedent for defendants in FCA cases. Purcell was originally filed in 1998 by a qui tam relator, who alleged that the defendant Moving Water Industries (“MWI”) had made false statements to the government in connection with a loan that MWI and Nigeria jointly sought from the Export-Import Bank to fund Nigeria’s purchase of equipment from MWI. Specifically, the relator claimed that MWI’s statement in its application that it paid only “regular commissions” to agents in connection with the transaction was false. MWI, meanwhile, contended that its statement was true, based upon its good faith interpretation of the term “regular commissions,” or at the least that its interpretation was objectively reasonable, precluding any finding of scienter or “knowledge” under the FCA.

The DOJ intervened and pursued the case through trial, obtaining a jury verdict against MWI. But on appeal, the D.C. Circuit reversed and ordered the district court to enter judgment in favor of MWI. The D.C. Circuit concluded that it could not be said that MWI ever acted with the requisite knowledge under the FCA, because the term “regular commissions” was vague and ambiguous, MWI’s interpretation of the term was reasonable, and there was no contrary formal regulatory guidance. In reaching this conclusion, the court also rejected numerous arguments advanced by the government, including that “informal” government guidance was sufficient to put defendant on notice of the government’s view regarding the meaning of “regular commissions” (and thereby show that the defendant acted at least recklessly).

This decision will help defendants in FCA cases that revolve around vague and ambiguous regulations that relators attempt to take advantage of through FCA litigation. The Purcell decision will support the defendants’ arguments in such situations that they cannot–and should not–be held liable under the FCA.

D. Federal Courts Address Statistical Sampling in FCA Cases

Several district courts recently have analyzed the question of whether statistical sampling may be used by the government or relators in FCA cases to attempt to prove either liability or damages. Depending upon the facts and context of the claims at issue, courts have provided differing answers to this question, with a number of courts holding that when it comes to the question of damages, statistical sampling may be a valid technique to extrapolate total damages from a statistically significant sample in certain contexts. See, e.g., United States v. Rogan, 517 F.3d 449, 453 (7th Cir. 2008); United States ex rel. Ruckh v. Genoa Healthcare, LLC, No. 8:11-cv-1303-T-23TBM, 2015 WL 1926417, at *3 (M.D. Fla. Apr. 28, 2015); United States ex rel. Loughren v. UnumProvident Corp., 604 F. Supp. 2d 259, 263 (D. Mass. 2009); United States ex rel. Martin v. Life Care Ctrs. of Am., Inc., Nos. 1:08-cv-251, 1:12-cv-64, 2014 WL 4816006 (E.D. Tenn. Sept. 29, 2014); United States v. Fadul, No. DKC 11-0385, 2013 WL 781614, at *14 (D. Md. Feb. 28, 2013). Other courts, however, have disagreed. See, e.g., United States ex rel. Crews v. NCS Healthcare of Ill., Inc., 460 F.3d 853, 857 (7th Cir. 2006); United States ex rel. El-Amin v. George Wash. Univ., 533 F. Supp. 2d 12, 31 n.9 (D.D.C. 2008); United States ex rel. Hockett v. Columbia/HCA Healthcare Corp., 498 F. Supp. 2d 25, 66 (D.D.C. 2007); United States ex rel. Trim v. McKean, 31 F. Supp. 2d 1308, 1314 (W.D. Okla. 1998); United States v. Friedman, No. 86-0610-MA, 1993 U.S. Dist. LEXIS 21496 (D. Mass. July 23, 1993). Given that the FCA imposes automatic treble damages and per-claim penalties of as much as $11,000 for each false claim, any attempt by the government or relators to prove “false claims” without actually proving an FCA violation with respect to each of those claims is of significant concern to FCA defendants.

The Fourth Circuit will soon become one of the few federal courts of appeals to examine the question of whether statistical sampling is a valid method for proving either liability or damages in an FCA case. In United States ex rel. Michaels v. Agape Senior Community, Inc., two former employees brought an FCA claim against a nursing home operator, alleging that it defrauded Medicare and other federal health care programs by submitting false claims for payment for hospice care and general inpatient services. No. 0:12-3466-JFA, 2015 WL 3903675, at *1 (D.S.C. June 25, 2015). According to the district court, the total number of potential claims arguably subject to the allegations was “staggering,” with estimates ranging from approximately 50,000 to 60,000, and experts predicting that reviewing all claims on an individual basis could cost over $36 million. Id. As a result, the relators in the case pushed for statistical sampling to prove their claims. The district court squarely rejected this argument, finding that it would violate the law and stating that the medical charts for all of the contested claims were “intact and available for review.” Id. at *6–7. The court recognized, however, that other courts had permitted the use of sampling in certain situations and certified its ruling for immediate appeal. Id. at *8–9. The Fourth Circuit agreed to hear the case on September 29, 2015. We will track this case closely.

E. The Fourth Circuit Offers Guidance on When FCA Damages and Penalties May Be Unconstitutional

The Fourth Circuit is the latest appellate court to weigh in on the issue of the constitutionality of damages and penalties awarded under the FCA. In United States ex rel. Drakeford v. Tuomey, 792 F.3d 364 (4th Cir. 2015), the Fourth Circuit affirmed a $237 million verdict against Tuomey Hospital. Tuomey argued that the damages and penalties were unconstitutional under the Excessive Fines Clause of the Eighth Amendment and the Due Process Clause of the Fifth Amendment. In assessing these arguments, the Fourth Circuit regarded the entire civil penalty amount awarded ($119.5 million) as punitive, the actual damages ($39.3 million) as compensatory, and the additional sum resulting from the trebling of actual damages ($78.6 million) as a hybrid of the two, with the portion allocated under the law to the relator being compensatory and the balance punitive. Id. at 389. Based upon this calculation, the court determined that the ratio of punitive damages to compensatory damages was approximately 3.6-to-1, which it concluded fell just under the ratio the Supreme Court deems constitutionally suspect under the Due Process Clause. Id.

Tuomey‘s legacy may be its method of calculating what is “punitive” versus “compensatory” under the FCA, at least for purposes of determining the constitutionality of damages and penalties awards. If the entire amount of penalties awarded in a case is “punitive” and that amount dwarfs a minor “compensatory” damages number, then Tuomey may compel the conclusion that such an award is unconstitutional. Similarly, it will be interesting to see whether other courts agree with the Fourth Circuit’s view that part, but not all, of the trebled amount of compensatory damages is punitive.

F. The Fifth Circuit Addresses When a Relator’s Violation of the FCA’s Seal Requirement Should Result in a Dismissal of the Case

When a relator initially files an FCA qui tam case, the relator must serve it only on the government and file it under seal–meaning it is not served on the defendant and is confidential. 31 U.S.C. § 3730(b)(2). This allows the government to investigate the allegations without providing notice to the defendant.

In United States ex rel. Rigsby v. State Farm Fire & Casualty Co., the Fifth Circuit examined whether a relator’s violation of the FCA’s seal requirement–by disclosing the existence of the lawsuit while it remains under seal–warrants dismissal. 794 F.3d 457, 470 (5th Cir. 2015). There, the relator allegedly “disclosed the existence of the lawsuit to several news outlets” while it was still under statutorily required and court-ordered seal. Id. at 471.