July 11, 2016

Worldwide, antitrust enforcement continues to spread and grow, with enforcement authorities in Asia becoming increasingly active and aggressive. By contrast, in the United States, where the Department of Justice’s Antitrust Division has long championed aggressive anti-cartel enforcement, 2016 has so far seen less publicly visible activity. There, if FY2015 ended with the bang of record-breaking fines and penalties of $3.89 billion, 2016 has so far begun with a whimper. Few could reasonably have expected that FY2016 could match FY2015, or involve a third consecutive year of record fines, but surely few also would have predicted that criminal antitrust fines and assessments would fall to less than 3% of FY2015’s record sum, or that they would be at the lowest level of penalties assessed in a decade. It remains to be seen whether developments later this year will lessen the apparent disparity between this year and prior years as it is widely speculated that the Antitrust Division continues to be busily engaged with a number of active investigations. That activity may yet paint a different picture for 2016.

We begin this Update with an overview, touching on significant developments over the past six months, starting with the U.S. We also revisit themes from our 2015 Year-End Update that continue to gather steam in 2016–the prioritization of individual prosecutions outlined in the “Yates Memo” and enhanced scrutiny of the financial sector. We will then highlight developments in enforcement “hot spots” in Asia and the Americas. Of course, no discussion of developments in the first half of the year is complete without considering the “Brexit,” which may ultimately have significant repercussions in UK and European enforcement, and for which we provide our early views. We end our overview with an analysis of several high court decisions out of the European Union that are likely to impact enforcement across the continent.

As with prior Updates, detailed summaries of enforcement activities during the first half of 2016 follow this overview and are organized by geography and jurisdiction.

Trends in U.S. Enforcement

For the first time in recent memory, domestic investigations dominate the story of U.S. enforcement efforts. The headlines for this year have included a string of convictions, indictments, guilty pleas, and sentences in connection with public real estate foreclosure auctions, water treatment chemicals, heir location services, and posters. In connection with these domestic investigations, since January, we have seen:

- Over $7 million in fines levied;

- 9 individuals and 2 companies pleaded guilty;

- 4 individuals indicted; and

- 11 other individuals and 1 company sentenced in connection with prior pleas or convictions.

Domestic investigations are likely to remain active, with two trials scheduled before the end of the year and another two scheduled for early 2017 in connection with real estate foreclosure auctions. The DOJ’s domestic investigation into price fixing of packaged tuna, which it launched last year, is also ongoing–with the DOJ recently joining in a stipulation with parties to related class action lawsuits to stay discovery for the remainder of the year while a grand jury continues to investigate the conduct.

Although domestic enforcement has taken center stage during the first half of 2016, several long-standing global investigations saw significant developments as well, with the auto parts investigation accounting for the bulk of the DOJ’s global enforcement activity. That investigation has resulted in $73.4 million in fines for FY2016 and a plea deal with a former president of an automotive parts company who agreed to a jail sentence of 18 months for his role in a conspiracy related to automotive body sealing products. Most notable, however, the DOJ obtained indictments of two auto parts companies, as well as six additional individuals. Corporate indictments in particular are rare; the last one was the indictment of AU Optronics in 2010, which ended with a conviction and a $500 million fine. These indictments tee up the possibility of criminal trials against corporate defendants in what the DOJ has called the largest price-fixing investigation in its history. As to its other pending global investigations, the DOJ secured a further $17.6 million in fines, a corporate guilty plea and three individual indictments in connection with its capacitors, LIBOR and “roll-on, roll-off” cargo investigations.

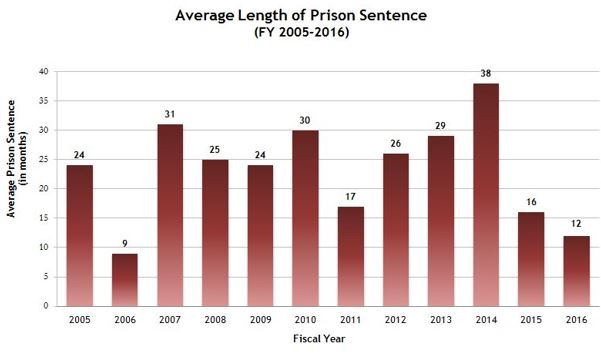

Lastly, just as fines have fallen dramatically compared to last year, the average length of jail sentences is also down significantly from 16 months to 12 months. We noted a similar decline in our 2015 Year-End Update when the average sentence dropped from 38 months to 16 months between FY2014 and FY2015 and suggested then that this could be an aberration. We continue to believe this may be the case; the overall decline appears to be driven by a combination of the relatively few sentences imposed over the past two years, and that the majority of this year’s sentences involved the New Jersey Tax Lien investigation, which affected relatively low volumes of commerce and thus allowed for rare probationary sentences for those pleading guilty to Section 1 violations. We believe that scenario is unlikely to reoccur in the majority of the DOJ’s investigations going forward.

Early Returns on the Yates Memo

As we predicted in our 2015 Year-End Update, the “Yates Memo,” named after its author, U.S. Deputy Attorney General Sally Yates, which outlines the Department’s priorities for the prosecution of individuals engaged in corporate wrongdoing, may already be having an effect on what was already a systematic focus on culpable individuals by the Antitrust Division. To date, both the number of individuals and, as a result, the number of total days sentenced for criminal antitrust violations in the U.S., have already exceeded FY2015’s totals. And while some could argue that this apparent uptick was set in motion by the Antitrust Division’s prosecutorial choices long before the release of the Yates Memo, Deputy Assistant Attorney General, Brent Snyder, has said that the Division is “embracing . . . [Yates’s] directive to do better” and has taken concrete steps in the form of “new internal procedures” crafted to “ensure that [the Division] is identifying and investigating all senior executives who potentially condoned, directed, or participated in the criminal conduct.”[1] He has also signaled that the memo is affecting the Division’s exercise of prosecutorial discretion, saying that “after the Yates memo . . . [the Antitrust Division is] even more inclined to charge and try even the toughest cases,” including those against top executives who tacitly condoned a subordinate’s conduct and for which there is “usually less evidence” of criminal liability.[2]

Continued Focus on the Financial Sector

As we explained in our last Update, the financial sector has been under intense scrutiny by a diverse range of financial regulators, competition agencies and prosecuting authorities around the globe, which have placed significant, sometimes competing demands on this sector and which have resulted in numerous, sometimes-overlapping sanctions–even before accounting for inevitable follow-on litigation. We do not see this scrutiny abating in the near term.

The most significant development in this sector in 2016 involves the United Kingdom’s Serious Fraud Office’s (“SFO”) prosecution of individuals tied to alleged LIBOR manipulation, notwithstanding the acquittal of six derivatives brokers earlier this year. On June 29, 2016, after an 11-week trial, a London jury found two former Barclays traders and a former Barclays LIBOR submitter guilty of plotting to manipulate LIBOR; the court later handed down jail sentences ranging from six-and-a-half to three years.[3] The jury failed to reach a verdict on the involvement of two other former Barclays traders, and the SFO has since announced plans to retry the case against them.[4] In a related investigation, the SFO has issued arrest warrants against four former Deutsche Bank traders and one former Société Générale trader accused of manipulating the EURIBOR benchmark rate, signaling that the UK’s criminal prosecutions in the financial sector are unlikely to end soon.

In the U.S., jail sentences of two years and one year, respectively, were imposed on two former Rabobank traders convicted last November of manipulating U.S. Dollar and Japanese Yen LIBOR. And, just last month, the DOJ announced that a grand jury had returned indictments against two former Deutsche Bank traders, one located in the U.S. and the other in London, for their participation in an alleged scheme to manipulate U.S. Dollar LIBOR. The U.S.-based trader, Michael Connolly, was taken into custody and appeared before a judge on the same day the indictments were announced.[5] Mr. Connolly entered a plea of not guilty and was released on a $500,000 bond. The DOJ has not indicated whether it intends to seek extradition of the London-based trader, Gavin Black.

Competition Enforcement Hot Spots

In our last Update, we highlighted the flurry of enforcement activity and increasing intolerance of cartel behavior in Asia. The area continues to be a focal point of anti-cartel activity. Perhaps the most significant developments this year have been the February release by China’s National Development and Reform Commission of draft “Guidelines for Applying Leniency Program to Horizontal Monopoly Agreements” and the subsequent release of draft “Guidelines on Determining the Illegal Gains Generated from Monopoly Conduct and on Setting Fines” issued by China’s Anti-Monopoly Commission of the State Council. Both agencies have sought public comment on these drafts and, once finalized, these Guidelines will provide welcome clarity for companies assessing potential fine exposure and leniency protection in China.

South America is also increasingly the center of enforcement activity. Since January, Brazil’s competition authority, CADE (Conselho Administrative de Defensa Econômica), collected 82.5 million reals (approximately $24 million) in fines from 19 companies and 22 individuals and has opened seven new investigations. Chile’s National Economic Prosecutor’s Office (Fiscalía Nacional Económica or “FNE”), has enjoyed recent success in prosecutions involving ocean shipping and poultry production, and has brought charges this year against three supermarket chains for fixing the minimum retail prices of fresh chicken. None of the companies self-reported the conduct, which resulted in FNE recommending that each company be fined the legal maximum of 30,000 UTA (approximately $22.9 million). And Chile may soon join an increasing number of jurisdictions that criminalize “hard core” cartel conduct; its Senate is currently considering passage of such a law, providing for up to 10 years in jail for individuals, increased maximums for corporate fines, and codified leniency protections for the first- and second- in applicants. Lastly, Columbia also merits mention for its issuance of 185 billion pesos (approximately $62 million) in fines against four manufacturers and 21 individuals in the tissue paper industry.

Heading north, Mexico’s Federal Economic Competition Commission (“COFECE”) has steadily increased its enforcement efforts over the past year. So far this year, it has issued fines of nearly 89 million pesos (approximately $4.8 million) against 17 corporations and individuals who admitted to using a trade association to facilitate price fixing of sugar and initiated several “Statements of Probable Responsibility” covering a diverse range of industries, including air conditioner compressors, pension fund providers, vehicle towing services, and taxis servicing Mexico City’s international airport. Such Statements initiate a trial-like procedure in which the accused have the opportunity to contest allegations of monopolistic practices. Separately, this year COFECE has opened investigations into the pricing and supply of tortillas in the State of Jalisco, information-monitoring services provided to the Mexican government, and the production of live performances, including venues and ticketing services.

The “Brexit” Creates Uncertainty for Future European and UK Enforcement

It is important to note at the outset that the referendum passed by the UK electorate does not itself trigger any legal consequences. The actual timing for a UK exit (“Brexit”) from the European Union (“EU”) is uncertain. While the soon-to-be former Prime Minister, David Cameron, has indicated that the UK government will not invoke the mechanisms required under the Treaty of Lisbon to trigger negotiations leading to Brexit until a new administration is in place, the presidents of the EU institutions have said that they expect the UK to give effect to the vote “as soon as possible.”

EU law is perhaps more closely associated with competition law and regulation than any other area. While there has been significant congruence reached within the EU over the past 40 years, the UK has always maintained its own independent competition regime and agencies, all of which will play a larger role after Brexit, especially if the UK economy diverges from the rest of Europe such that it is considered separate from the EU.

We think it unlikely that the UK government will invoke the exit mechanisms under Article 50 of the Treaty of Lisbon until the end of 2016 at the earliest. A departing state invoking those mechanisms will leave the EU, and the EU Treaties will cease to apply to that state, at the end of a two-year period following the commencement of exit negotiations (save where that period is extended by unanimous vote of all member states). It thus seems unlikely that the UK will actually leave the EU until the end of 2018 at the earliest.

The immediate consequence for those doing business in the UK is to understand the uncertainties that prevail. On every transaction or investigation many issues will emerge and it will be important to consider what, if anything, can be done to manage and allocate the risks that now exist. But until such time as the UK leaves the EU, it will remain an EU member and all EU law will remain in force in the UK. There has been, and no doubt will continue to be, considerable market volatility and political uncertainty, but, for now at least, it is very much a case of “business as usual” when it comes to doing business with and in the UK and the EU–including with respect to new and ongoing anti-cartel investigations.

Court Decisions Affecting EU Enforcement

We conclude our overview by highlighting a few of the significant decisions issued by the courts of the European Union in 2016 that hold particular interest.

In Toshiba v. Commission, the Court of Justice of the EU (“CJEU”) held that the EC was within its powers to apply worldwide sales figures as the “relevant geographic area” from which to calculate Toshiba’s fine for its involvement in a worldwide cartel involving the power transformer market. The CJEU found that limiting the relevant geographic area to the European Economic Area (“EEA”) or Japan would not have appropriately reflected the “weight and economic power” of Toshiba in the overall conduct or ensured (consistent with the Commission’s 2006 Guidelines) that the fine had sufficient deterrent effect. This decision confirms the EC’s broad powers to issue fines based on conduct and sales outside of Europe when the case merits such an approach.

However, the CJEU does not always find in favor of the EC. In a series of decisions involving formal requests for information (“RFIs”) that the EC issued to various companies in the cement sector, the CJEU overturned the judgments of the General Court and annulled the RFIs because the EC had failed to clearly and unequivocally explain the legal basis and purpose of its requests. The CJEU held that this is a fundamental requirement designed not only to show that a request is justified but also to enable the targets of an investigation to assess the scope of their duty to cooperate while safeguarding their right of defense.

Lastly, the CJEU has issued a preliminary ruling with respect to the independence of the EU’s and member state’s leniency programs. The Court held that the leniency programs of the EU and member states are autonomous and independent, meaning that the grant of immunity or leniency by the EC does not entitle the recipient to similar treatment in other related member-state investigations. The practical result of this decision is that leniency applicants–in order to ensure full leniency protection–will need to consider whether the circumstances of a particular case necessitate the filing of applications with the EC as well as competition agencies of any other relevant member states that may have a significant interest in the matter.

I. THE AMERICAS

A. UNITED STATES

1. Overview of U.S. Enforcement Trends

a. Criminal Fines & Other Monetary Assessments

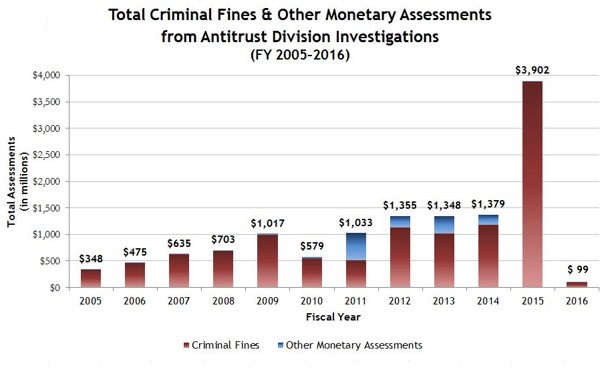

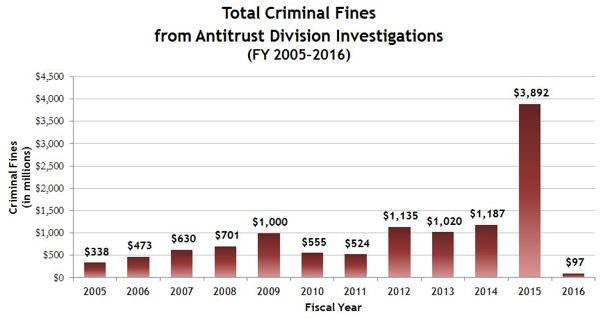

The Antitrust Division has secured approximately $99 million in criminal fines and monetary penalties thus far in FY2016. This is a dramatic slowdown from FY2015’s record-topping $3.9 billion in fines and penalties, a level largely spurred by significant fines and penalties arising from the Division’s investigation into the manipulation of certain foreign exchange rates and the LIBOR investigation. Indeed, not only is this a marked decline from last year’s record, but it is also a significant decline from the level of penalties assessed in each of the last ten years. It represents less than one-third of the fines assessed in 2005, the year with the lowest total fines in the last decade. While one would not have anticipated a third consecutive year of record fines, this dramatic drop off is, to say the least, unexpected. Of course, several months remain in the fiscal year, and subsequent penalties may be announced and bring this year closer to the level of penalties prevailing over the last decade.

Of the $99 million in criminal fines and monetary penalties thus far, approximately $97 million consisted of criminal fines for violations of the Sherman Act. The largest single criminal fine of the year was levied against Corning International K.K. for price fixing and bid rigging as to ceramic substrates used in automobiles. The Corning fine was the latest in the DOJ’s long-running investigation into collusive activity in the automotive parts industry.

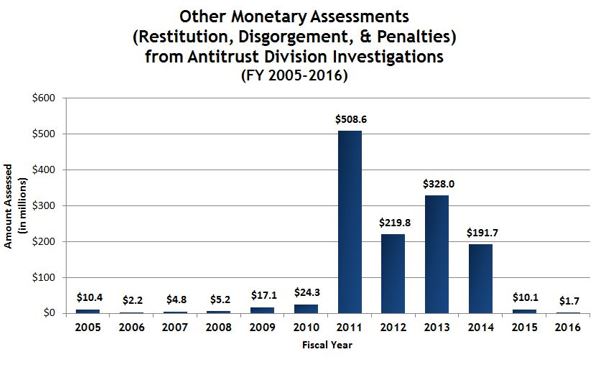

We assess the Antitrust Division’s performance by considering all of its available monetary sanctions, including criminal fines, restitution, disgorgement, and penalties (for the reasons explained at length in the 2013 Year-End Criminal Antitrust Update). While the Antitrust Division continues to embrace multi-agency investigations, the below chart indicates a significant dip in the use of other monetary assessments as a prosecutorial tool. Nonetheless, we believe this combined metric remains the most accurate gauge of fining activity.

Monetary asesssments are also down dramatically from prior years, with just $1.6 million levied so far this Fiscal Year. The lone non-fine monetary assessment levied in FY2016 was against American Pipe Bending & Manufacturing Co., following its conviction for price fixing and bid rigging as to industrial pipes. This represents just a tenth of last year’s monetary assessment activity and approximately 0.2% of the monetary assessments collected in FY2011, when non-fine assessments peaked.

More than half of this year’s criminal fines result from corporate plea agreements in the DOJ’s long-running investigation into the auto parts industry. These fines account for almost 76% of the total fines.

| Criminal Fines Exceeding $1 Million for Sherman Act Violations Imposed or Agreed to During FY2016 (Oct. 2015 – present) | ||

| Company | Industry | Criminal Fine |

|

Corning International K.K. |

Automotive Parts |

$66,500,000 |

|

NEC TOKIN |

Capacitors |

$13,800,000 |

|

GEO Specialty Chemicals Inc. |

Chemical Manufacturing |

$5,000,000 |

|

Omron Automotive Electronics Co. Ltd. |

Automotive Parts |

$4,550,000 |

|

Hitachi Chemical Co. Ltd. |

Capacitors |

$3,800,000 |

|

INOAC Corp. |

Automotive Parts |

$2,350,000 |

|

Other Monetary Assessments Exceeding $1 Million for Sherman Act Violations Imposed or Agreed to During FY2016 (Oct. 2015 – present) |

||

|

Company |

Industry |

Other Monetary Assessment (Restitution, etc.) |

|

American Pipe Bending & Fabrication Co., Inc. |

Industrial Pipes |

$1,609,953 |

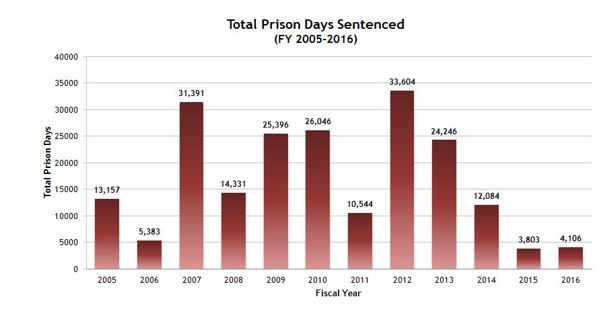

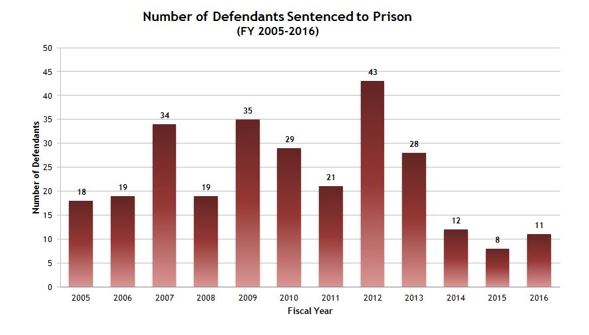

Just as fine activity has fallen dramatically thus far in FY2016, the average length of prison sentences secured by the Antitrust Division has also decreased. The average length of a prison sentence decreased from 16 months in FY2015 to 13 months this year. Both numbers are a significant departure from the average sentence secured in FY2014, when average sentence length peaked at 38 months after four years of consecutive increases. In our last Update, we noted that it would remain to be seen whether this initial reduction (from 38 months to 16 months) was a trend or an aberration. Despite a second consecutive reduction, we believe that the specific details of the largely domestic cases in which sentences have been imposed this year explain the apparent departure from past records. We believe the Antitrust Division will continue to seek significant prison terms in price-fixing cases.

While the average prison sentence thus far in FY2016 is lower than in FY2015, the number of individuals sentenced is up slightly. Ten have been sentenced so far this fiscal year, compared to a total of eight in FY2015. Because the number of individuals sentenced has increased, the total number of prison days sentenced represents a slight increase over the number of days sentenced in FY2015. This change appears reflective only of simple arithmetic, with more defendants yielding more total days in prison, rather than a broader trend in enforcement policy.

2. Developments in International Investigations

a. London InterBank Offered Rates (“LIBOR”)

In June 2016, two former Deutsche Bank AG traders were indicted for their alleged role in a scheme to manipulate the U.S. Dollar (“USD”) London InterBank Offered Rate (“LIBOR”).[6] The defendants were Matthew Connolly, the bank’s director of the pool trading desk in New York, and Gavin Campbell Black, a derivatives trader and director of the money market derivatives desk in London. A grand jury in the U.S. District Court for the Southern District of New York returned a 10-count indictment charging each defendant with one count of conspiracy to commit wire fraud and bank fraud, and nine counts of wire fraud, for their participation in an alleged scheme to manipulate certain USD LIBOR benchmark rates.

In another LIBOR-related case previously covered in our 2015 Year-End Criminal Antitrust Update,[7] two former derivatives traders at Rabobank Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (“Rabobank”) were sentenced on March 10, 2016 for manipulating LIBOR for USD and Japanese Yen (“JPY”). Anthony Allen, the bank’s former global head of liquidity and finance in London, was sentenced to 24 months in prison. Anthony Conti, a former senior trader on the bank’s money markets desk in London, was sentenced to 12 months and one day in prison.[8] Both defendants were convicted on November 5, 2015, after a four-week jury trial. Allen was found guilty of one count of conspiracy to commit wire fraud and bank fraud and 18 counts of wire fraud. Conti was found guilty of one count of conspiracy to commit wire fraud and bank fraud and eight counts of wire fraud. On July 6, 2016, Paul Thompson, a former Rabobank trader and one of Conti and Allen’s codefendants, consented to his extradition from Australia to the United States to respond to the indictment.[9]

In still another LIBOR-related case, on June 29, 2016, Magistrate Judge James L. Cott of the United States District Court for the Southern District of New York granted the DOJ’s motion to dismiss the indictments of three traders.[10] The traders were charged in September 2013 with wire fraud and conspiracy to commit wire fraud for their roles in a scheme to manipulate the Yen LIBOR.[11] All three were charged with the same conduct in the UK, and were acquitted by a Southwark Crown Court in January. Because they were acquitted in the UK of “the same underlying conduct,” the DOJ moved to dismiss the charges against them in the United States.[12]

b. Auto Parts

In the first half of 2016, the Antitrust Division’s ongoing investigation into the auto parts industry continued at a steady pace, culminating with two corporate indictments. To date, the Antitrust Division has charged a total of 64 individuals and 44 companies as part of its federal antitrust investigation into anticompetitive conduct in the automotive parts industry. In total, these individuals and companies have agreed to pay more than $2.7 billion in criminal fines,[13] and 30 have been sentenced to prison.

In a particularly notable development, the Antitrust Division announced on June 15, 2016 that federal grand juries had indicted two Japanese automotive parts companies, their U.S. subsidiaries, and a total of five executives for their alleged participation in international conspiracies to eliminate competition in the sale of certain automotive parts. The first indictment charged Tokai Kogyo Co. Ltd., its wholly-owned U.S. subsidiary, Green Tokai Co. Ltd., and executive Akitada Tazumi with conspiring to rig bids for and fix the prices of automotive body sealing products. The second indictment charged Maruyasu Industries Co. Ltd., its wholly-owned U.S. subsidiary, Curtis-Maruyasu America Inc., and executives Tadao Hirade, Satoru Murai, Kazunori Kobayashi and Yoshihiro Shigematsu with conspiring to fix prices, allocate customers, and rig bids for automotive steel tubes.[14]

These indictments are notable not only because they are the first indictments of corporations in the auto parts investigation, but also because they represent two of only a handful of such indictments in antitrust cases in the last two decades. These cases will likely attract significant interest as they proceed, whether or not they are ultimately resolved before trial.

Two additional corporations agreed to plead guilty in the auto parts investigation this spring: Omron Automotive Electronics and Corning International. On March 17, 2016, Omron Automotive Electronics Co. Ltd. agreed to plead guilty and pay a $4.55 million fine for conspiring to rig bids on power window switches.[15] U.S. District Judge George Steeh of the Eastern District of Michigan approved the plea agreement and imposed the agreed-upon fine at a sentencing hearing held on June 13, 2016.[16] On May 16, 2016, Corning International Kabushiki Kaisha agreed to plead guilty and pay a $66.5 million criminal fine for conspiring to fix prices, rig bids, and allocate the market for ceramic substrates used in catalytic converters supplied to automobile manufacturers. Just a week prior to the announcement of the plea agreement, the company’s former executive Nobuhiko Niwa was indicted for his role in the conspiracy.[17]

On April 20, 2016, Keiji Kyomoto, who was indicted in October 2015,[18] pleaded guilty and was sentenced to 18 months in prison for his role in a conspiracy to fix prices and rig bids of automotive body sealing products sold in the U.S. As part of his plea agreement, Kyomoto also agreed to pay a $20,000 criminal fine.[19]

c. Roll-on, Roll-off Cargo

During the first half of 2016, the DOJ has shown continued commitment to its ongoing investigation of the international roll-on, roll-off ocean shipping industry. The roll-on, roll-off ocean shipping industry involves international shipments of non-containerized cargo, such as cars, trucks, agricultural equipment, and construction equipment.[20] In June 2016, Mauricio Javier Garrido Garcia of Compañia Sudamericana de Vapores S.A. (CSAV) was indicted. Garcia is the eighth executive charged in the investigation to date. Garcia is charged with involvement in a long-running conspiracy that allegedly includes allocating customers and routes, bid rigging, and price fixing for international shipping services for roll-on, roll-off cargo. Four of the eight individuals charged in the investigation thus far have pleaded guilty.[21]

As we reported in our 2015 Year-End Criminal Antitrust and Competition Law Update, three international firms–CSAV, Nippon Yusen Kabushiki Kaisha, and Kawasaki Kisen Kaisha–have pleaded guilty to charges arising from the investigation. The three firms have paid more than $136 million in criminal fines collectively.[22]

d. Cathode Ray Tubes

The DOJ obtained its first–and thus far only–individual guilty plea in its long-running investigation into price fixing in the market for cathode ray tubes late last year, when Chun-Cheng “Alex” Yeh, a former executive of a Taiwanese company, pleaded guilty to price fixing on November 17, 2015.[23] On March 1, 2016, Yeh was sentenced to 6 months’ imprisonment and ordered to pay a $20,000 fine.[24] This sentence was 2 months less than the 8-month sentence contemplated by Mr. Yeh’s plea agreement, but higher than the 4-month sentence recommended by the probation office in advance of sentencing. The DOJ’s investigation has been ongoing since at least 2009, when the DOJ indicted six individuals in connection with an investigation into an alleged price-fixing conspiracy by manufacturers of color display tubes (“CDTs”), a type of cathode ray tube. CDTs are display components once used in computer monitors.[25]

e. Capacitors

As we reported in our 2015 Year-End Criminal Antitrust and Competition Law Update, enforcement authorities in Asia, South America, Europe, and the U.S. have opened investigations into manufacturers of certain types of capacitors.[26] In January 2016, NEC TOKIN, the first company to plead guilty in the investigation, was sentenced to pay a $13.8 million fine.[27] In April 2016, Hitachi Chemical Co., Ltd. agreed to plead guilty to conspiring to fix the prices of electrolytic capacitors.[28] The DOJ requested that the court impose a $3.8 million criminal fine and a three-year term of probation. In June 2016, the U.S. District Court of the Northern District of California accepted the DOJ’s recommendation as to the fine, but imposed a sentence of five years of probation.[29] Also in January, on the DOJ’s motion, the March 2015 indictment of Takuro Isawa was unsealed.[30]

3. Developments in Domestic Investigations

a. New Jersey Tax Lien Auctions

In 2016, the DOJ continued to pursue its long investigation into bid rigging in municipal tax lien auctions in New Jersey. The DOJ recently reported that its investigation has resulted in the conviction or guilty plea of 13 individuals and three companies.[31] These individuals and companies have been sentenced to pay a collective total of over $2,000,000 in criminal fines.[32]

The first of these defendants to go to trial was James Jeffers, Jr., who was convicted by a jury on October 2, 2015. On March 29, 2016, Mr. Jeffers was sentenced to serve a term of 12 months and one day in prison and to pay a $25,000 fine.[33]

Following Mr. Jeffers’ sentencing, eight individuals who had pleaded guilty to bid rigging with regard to New Jersey tax lien auctions and to cooperate with the DOJ in its prosecution of other conspirators also were sentenced. Each was sentenced to one year of probation, a fine of approximately $20,000, and certain restrictions on future employment, including refraining from employment and/or capital ventures involving the investment of tax liens. All but one defendant were further ordered to refrain from incurring debt.[34] Two were also ordered to undergo mental health treatment.[35]

Additionally, on April 6, 2016, DSBD, LLC was sentenced to two years of probation, to pay a fine of $35,000, and to abide by restrictions on the incurring of new debt.[36]

b. Real Estate Auctions

The DOJ continues to aggressively pursue its investigations into bid rigging in real estate foreclosure auctions nationwide. The first half of 2016 in particular saw several significant developments in real estate foreclosure cases, particularly in Northern California.

In March 2016, defendants in cases before United States District Judge Phyllis Hamilton in the Northern District of California filed a motion to suppress recordings that they claim were made in violation of their Fourth Amendment right against unreasonable search and seizure.[37] This follows a similar motion made by defendants in another foreclosure case before U.S. District Judge Charles Breyer (also in the Northern District) to suppress more than 200 hours of allegedly unconstitutional recordings.[38] The recordings at issue were made from devices hidden around local courthouses where the foreclosure auctions occurred, including at a bus stop, in a sprinkler control box, and on an unmarked law enforcement vehicle.[39] At the time of this Update, neither judge has ruled on the suppression motions.

In addition, on June 21, 2016, Judge Hamilton denied a motion to dismiss the indictments against two groups of defendants in the foreclosure cases before her.[40] The defendants had argued that the indictments against them contained boilerplate and conclusory allegations of fraud that were legally insufficient, but Judge Hamilton rejected the argument. Judge Hamilton also denied a separate motion made by four real estate investors to have their case tried under the so-called “rule of reason” standard. The defendants contended that their activity “performed like an efficiency-enhancing buying collective that actually encouraged competition.”[41] Judge Hamilton rejected the argument in an order issued June 21, 2016. The foreclosure cases before Judge Hamilton are nearing trial: the first is scheduled for September 19, 2016 with subsequent trials scheduled to begin in October 2016, January 2017, and April 2017.[42] To date, the investigation into real estate foreclosure auctions in the San Francisco Bay area has resulted in over 50 agreements to plead guilty and 22 indictments.[43]

Outside of California, as reported in our 2015 Year-End Criminal Antitrust and Competition Law Update, the Antitrust Division has also investigated bid rigging at public real estate foreclosure auctions in Georgia and Alabama, and this investigation continued apace with eight additional guilty pleas and two new indictments issued in the first half of 2016.

In Georgia, the DOJ secured seven new guilty pleas from real estate investors who admitted to participating in bid-rigging and fraud conspiracies in the Atlanta area. First, in January 2016, Paul Chen and Ira Eisenberg each pleaded guilty for their roles in bid-rigging and mail fraud conspiracies involving real estate foreclosure auctions in Georgia’s DeKalb and Fulton Counties.[44] Chen and Eisenberg admitted that they had agreed not to bid against others at certain public real estate foreclosure auctions and that they conspired to defraud mortgage holders and homeowners using the mail system from 2009 to 2011. Then in late June 2016, Michael Stock and Jon Stovall Jr. each pleaded guilty to similar charges–that they conspired with other real estate investors to rig bids at public foreclosure auctions and that they used the mail to defraud homeowners and mortgage holders.[45] Stock admitted to participating in a conspiracy in Fulton and DeKalb Counties from approximately August 2009 to November 2011, and Stovall admitted to participating in Fulton County from approximately October 2008 to January 2012. Two days later on July 1, 2016, three more individuals–Jeffrey Wayne Brock, David Wallace Doughty, and Stanley Ralph Sullivan–pleaded guilty to agreeing to rig auctions of foreclosed homes in Cobb County, Georgia, from June 2007 until January 2012.[46]

Separately, in February 2016, a federal grand jury in Atlanta indicted two real estate investors for bid rigging and bank fraud.[47] The indictments alleged that the conspirators held secret “second auctions” on properties they had obtained through rigged bids. Douglas L. Purdy was charged with one count of bid rigging and five counts of bank fraud for participating in an alleged conspiracy in Forsyth County, Georgia from 2008 to 2012. Clifford Wayne Hill was charged with one count of bid rigging and seven counts of bank fraud relating to foreclosure auctions that occurred in Gwinnett County, Georgia from 2007 to 2012. To date, the Division’s investigation into foreclosure bid rigging in Georgia has yielded charges against 20 defendants. Of those, 18 have pleaded guilty.[48]

Finally, in June 2016, real estate investor Adrian J. Beach pleaded guilty to conspiracy to commit mail fraud at public real estate foreclosure auctions in southern Alabama from January 2004 to March 2010.[49] This marks the fourteenth defendant charged in the Division’s ongoing investigation of bid ridding of real estate foreclosure auctions in Alabama.

c. Heir Location Services

The Department of Justice has recently secured additional guilty pleas from heir location service providers–firms that locate potential heirs and secure inheritances for individuals whose relatives have died intestate–as a result of an investigation into market division and customer allocation in the industry.

In January, Richard A. Blake, Jr., the owner of a Massachusetts-based heir location service firm, agreed to plead guilty to charges of price fixing and admitted to engaging in an illegal conspiracy to allocate the market and to share fees with competitors lasting from 1999 to 2014. Blake is awaiting criminal sentencing in the Northern District of Illinois.

Blake is the second individual to plead guilty in the ongoing investigation after Bradley N. Davis pleaded guilty in December 2015. Both Blake and Davis are cooperating with the Justice Department’s ongoing investigation into customer allocation, price fixing, bid rigging and other anticompetitive activities in the heir location services industry.[50]

d. Water Treatment Chemicals

The DOJ continues to prosecute an alleged decade-and-a-half-long conspiracy to eliminate competition among suppliers of liquid aluminum sulfate provided to municipalities and private companies. Two water treatment chemical manufacturing executives were indicted on February 17, 2016 for their alleged roles in the conspiracy. The indictment alleges that Vincent Opalewski and Brian Steppig, along with other co-conspirators, met and agreed not to compete for each other’s customers, submitted intentionally losing bids, withdrew inadvertently winning bids, and coordinated prices to be quoted to customers.[51]

In June, GEO Specialty Chemicals, Inc. pleaded guilty for its role in the conspiracy. The company admitted to conspiring to fix prices, rig bids, and allocate customers, and was sentenced to pay a $5 million fine. The company is the first corporate defendant to be charged in this conspiracy and the fourth defendant overall.[52]

In addition to the federal investigation, the Ohio Attorney General is actively investigating an alleged bid-rigging scheme involving the sale of liquid aluminum sulfate. No formal charges have been brought.[53]

e. Tuna

As reported in our 2015 Year-End Criminal Antitrust and Competition Law Update, in July 2015, the Department of Justice issued subpoenas to Chicken of the Sea and Bumble Bee as part of an investigation into alleged price fixing in the packaged seafood sector.[54] Subsequently, nine class action lawsuits alleging violations of the Sherman Act with respect to the sale of packaged seafood were filed in five federal district courts. These cases were consolidated for pretrial proceedings in the Southern District of California, and the DOJ subsequently intervened.[55] On April 21, 2016, the DOJ stipulated with the parties to stay discovery referring or relating to the criminal grand jury investigation until December 31, 2016.[56] To date, the DOJ has not announced the filing of any criminal charges in connection with this investigation.

f. Posters

On June 30, 2016, the Antitrust Division secured its first plea agreement in its ongoing investigation into the price fixing of certain posters sold on Amazon.com.[57] UK-based Trod Limited, which is now insolvent, agreed to plead guilty to one count of violating the Sherman Act and to pay a $50,000 criminal fine. Trod and its sole director and part-owner, Daniel William Aston, were indicted in August 2015. Both Trod and the DOJ agreed, in a jointly filed sentencing memorandum, that the volume of commerce affected by Trod’s conduct was $175,000. Trod is scheduled to appear before Judge William Orrick of the U.S. District Court for the Northern District of California on August 11, 2016, to enter a change of plea. Judge Orrick sought further briefing from the parties regarding counsel’s authority to enter a plea on behalf of the now-insolvent corporation prior to the hearing.[58]

4. Developments in the Antitrust Division

a. Speeches by Key Division Personnel

Over the last six months, senior officials in the DOJ’s Antitrust Division have made a number of noteworthy statements regarding key criminal antitrust law enforcement issues.

On March 9, 2016, Assistant Attorney General Bill Baer testified before the Senate Judiciary Subcommittee on Competition Policy and Consumer Rights.[59] Mr. Baer noted that “antitrust enforcement remains a good value proposition,” and observed that the prior year had yielded over $3.6 billion in criminal fines and penalties. Mr. Baer highlighted the 85% increase in the number of individuals imprisoned on an annual basis over the last decade and the corresponding 65% increase in the average sentence. In particular, Mr. Baer pointed to the even greater increases in the number of foreign individuals imprisoned over the same period for misconduct that affected U.S. commerce. The long-term trend of increasing criminal antitrust enforcement by U.S. authorities has been reported in this publication on previous occasions.[60]

Mr. Baer’s testimony also signaled that the so-called “Yates Memorandum,” issued in September 2015, has already resulted in an important shift in the Antitrust Division’s enforcement policies towards a greater emphasis in investigations of corporate malfeasance on individual wrongdoers from the very beginning, a shift predicted in our 2015 Year-End Update.[61] Echoing the Yates Memorandum, Mr. Baer testified that the Antitrust Division “strive[s] to hold accountable the highest level executives who participated” in wrongdoing, believing “the threat of prison time for individuals is the single most valuable deterrent” against hard-core pricing fixing and per se illegal conduct.

Speeches from other key Division personnel make clear that the Yates Memorandum has already affected Division policy. In remarks to the Yale School of Management made on February 16, 2016, Deputy Assistant Attorney General Brent Snyder remarked that “individual accountability is fundamental to Antitrust Division prosecutors” and acknowledged that “we are embracing . . . Deputy Attorney General [Yates’s] directive to do better.” Mr. Snyder referred to the adoption of “new internal procedures” that provided for a “more comprehensive review of the organizational structure of culpable companies to ensure that we are identifying and investigating all senior executives who potentially condoned, directed, or participated in the criminal conduct.”[62] At a June 2016 conference, Mr. Snyder left little doubt that a movement was afoot, noting that “after the Yates memo . . . we are even more inclined to charge and try even the toughest cases,” including those against top executives who tacitly condoned a subordinate’s conduct and for whom there is “usually less evidence” of criminal liability.[63]

In the first half of 2016, the globalization of competition law remained an important topic in speeches by senior Division officials. Dedicating a significant portion of his March 6 testimony to the topic, Assistant Attorney General Baer noted that the Division devotes “significant resources to providing assistance to our sister agencies around the globe” to promote the growth of “enforcement policies that are economically and legally sound and consistent.”[64] Mr. Baer said that progress over the last 15 years has been “noteworthy” and committed that the Division will “continue to strengthen [its] working relationships” with international competition authorities. In a June 23, 2016 speech in London, Principal Deputy Assistant Attorney General Renata B. Hesse embraced Mr. Baer’s views, pointing to the “remarkable” growth in international coordination in the investigation and punishment of hard-core anticompetitive conduct as “the most conspicuous area of convergence.”[65] On April 20, 2016, Section Chief Lisa Phelan provided an overview of those past and current efforts in a presentation to a largely international audience at the Japanese Embassy in Washington, DC, noting that the ongoing international investigation in the auto parts investigation is a high priority for the DOJ.

b. Personnel Changes

Several key changes to the leadership of the Antitrust Division have taken place since the beginning of 2016. Assistant Attorney General Baer, who had led the Antitrust Division since January 2013, began serving as Acting Associate Attorney General effective April 17, 2016.[66] The Associate Attorney General is the third-highest position at the DOJ. In the press release announcing the promotion, Attorney General Loretta Lynch praised Mr. Baer’s leadership of the Antitrust Division.

Principal Deputy Assistant Attorney General Renata B. Hesse has been selected to lead the Antitrust Division since Acting Associate Attorney General Baer’s promotion.[67] Before assuming leadership of the division, Ms. Hesse had served as Deputy Assistant Attorney General for Criminal and Civil Operations in the Antitrust Division for four years. She had also served as Acting Assistant Attorney General for the Antitrust Division immediately prior to Mr. Baer’s confirmation.

In June 2016, the Antitrust Division’s Deputy Assistant Attorney General for Litigation, David Gelfand, announced that he would be leaving the DOJ after three years and rejoining private practice.[68] The Division has yet to announce his successor.

June 2016 also brought a rearrangement of the Antitrust Division’s senior enforcement leadership.[69] Juan Arteaga, who had previously served as chief of staff and senior counsel to Assistant Attorney General Baer, was promoted to Deputy Assistant Attorney General for Civil Enforcement. He replaces Sonia Pfaffenroth, who is now the Antitrust Division’s Deputy Assistant Attorney General for Civil and Criminal Operations. Both Deputy Assistant Attorney General Arteaga and Deputy Assistant Attorney General Pfaffenroth joined the Antiturst Division in 2013, and had previously worked in private practice.

Finally, in San Francisco, Marc Siegel has announced that he will step down as Chief of the office. Kate Patchen, who was already serving as Assistant Chief, has been named as the new Chief.

B. CANADA

1. Enforcement

A Japanese auto parts manufacturer was fined C$13 million (approximately $10.2 million) by the Ontario Superior Court of Justice in April after having pleaded guilty to bid rigging in connection with the sale of electric power steering (EPS) gears. This represents the second largest penalty imposed by a Canadian court for bid rigging; the manufacturer is the ninth Japanese auto parts manufacturer fined for its role in pricing fixing.[70]

­Nearly five years after charges were first brought, a government contracting firm in Montreal pleaded guilty to rigging bids for municipal sewer-services contracts and was fined C$118,000 (approximately $92,000). Of the six companies originally charged, five have now pleaded guilty; the sixth conspirator obtained leniency.[71] In the private sector, a corporation and its president pleaded guilty and were fined a total of C$140,000 ($109,000) for bid rigging in the market for residential ventilation services. Eight companies were charged in 2010, but only one other company has pleaded guilty.[72]

2. Policy

The Canadian Competition Bureau (“CCB”) continues to seek significant non-monetary sanctions as well, but with few results to date. John Pecman, the head of the CCB, acknowledged as much during the ABA-IBA’s International Cartel Workshop in February, when he expressed disappointment that the CCB has not obtained a jail sentence for any individual convicted under the competition laws, despite 2010 amendments to Canada’s Competition Act intended to reduce the burden of proof for a violation. Pecman cast some of the blame on Canadian prosecutors, who prosecute criminal cases referred to them by the CCB, as well as the “inefficient” system of coordination between the CCB and prosecutors.[73] A few months later, Pecman stated that the CCB is working with prosecutors to overcome various hurdles, but prosecutors have moved to become more independent, which has further reduced the CCB’s ability to obtain prison sentences.[74] As recently as May, Pecman characterized the relationship between the CCB and prosecutors as “rocky.”[75] Regardless, when the CCB announced its priority areas in May, enforcement against bid rigging–particularly in public-sector infrastructure projects–was at the top of its list.[76] Further, with 27 individuals currently facing criminal charges, Pecman views the imposition of a sentence requiring jail time for a violation of competition laws as inevitable.

At the same time as the CCB continues to push for enhanced punishment of individuals violating the nation’s competition laws, it is seeking to limit the extent to which criminal charges may be used to enforce Canada’s intellectual property law. The CCB issued new intellectual property enforcement guidelines on March 31 in which it announced a shift in position in stating that patent violations rarely merit criminal charges. Rather, the CCB believes that criminal charges are appropriate only in instances where the use of the patent constitutes behavior that is otherwise unlawful under the competition laws as, for example, when a maker of a branded pharmaceutical and a generic competitor enter an agreement that extends beyond the life of a patent.[77]

C. BRAZIL

1. Preliminary Remarks

During the first half of 2016, Brazil’s Competition Authority, CADE (Conselho Administrativo de Defesa Econômica), continued its vigorous cartel enforcement by conducting new on-the-spot investigations, imposing fines on companies and individuals, reaching settlement agreements in eleven cartel investigations, and initiating a number of new investigations.

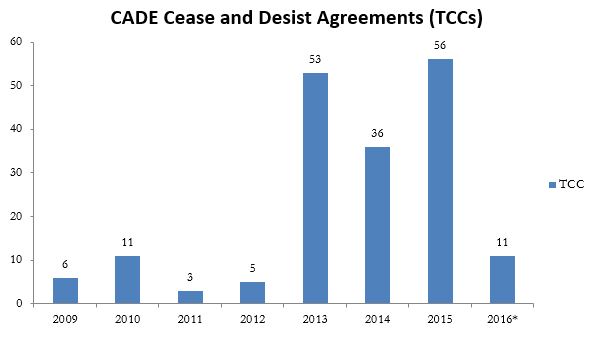

CADE keeps refining its legal tools to prosecute collusive conduct and has published a draft English version of its Guidelines on Cease and Desist Agreements (Termo de Compromisso de Cessação de Prática, “TCC”), and is currently soliciting comments from a wide range of interested parties.

2. Statistics

CADE consists of the Administrative Tribunal (the “Tribunal Administrativo,” or “Tribunal”) and the Superintendence (“Superintendência-Geral“). The Superintendence investigates cases before referring them to the Tribunal for final decision.

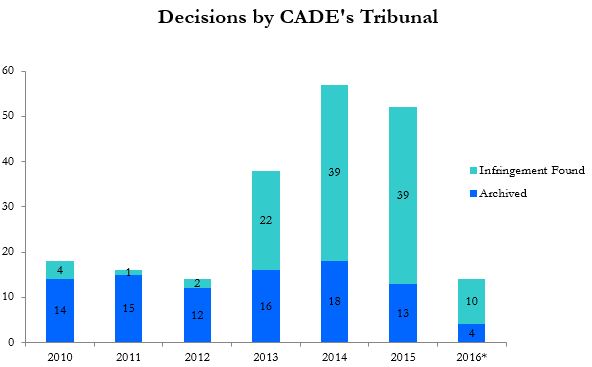

On January 20, 2016, CADE published a report (available in Portuguese only here) on its activities in 2015 (the “Report”).[78] According to the Report, CADE entered into 58 settlement agreements (known as cease and desist agreements or “TCCs”) in 2015, which resulted in fines totaling BRL 465 million (approximately $136.1 million). CADE’s Tribunal issued decisions in 52 infringement proceedings in 2015, 39 of which ended with a finding of infringement. CADE imposed fines in these proceedings totaling BRL 296 million (approximately $86.7 million). In addition, CADE announced that it entered into ten leniency agreements in 2015, the most since Brazil’s current Leniency Program went into force in 2011. 2015 also saw the first application of CADE’s “leniency plus” program, which is modelled on a similar program used by the DOJ in the U.S.

According to the latest available data, in the first half of 2016, the Tribunal issued decisions imposing fines in at least ten administrative proceedings.

Furthermore, CADE reached more than ten settlement / TCC agreements during the first half of 2016:

3. Institutional Developments

a. CADE’s President Steps Down After Four Years

CADE’s President, Vinicius Marques de Carvalho, ended his mandate on May 29, 2016.[79] Mr. de Carvalho was appointed to the highest office within CADE in 2012, coinciding with the entry into force of the “new” Brazilian Competition Act (Act 12,529/2011), and is widely credited with steering CADE to the forefront of worldwide competition enforcers.

Strong prosecution of cartel conduct has been the priority of Mr. de Carvalho. According to a CADE press release, since Mr. de Carvalho’s appointment, CADE’s Tribunal issued 170 decisions in infringement proceedings, of which 110 ended with a finding of infringement–47% were cartel cases. During this same time period, CADE imposed more than BRL 4.2 billion (approximately $1.2 billion) in fines.

Márcio de Oliveira Júnior, a member of CADE’s Tribunal, is now acting as President. Mr. de Oliveira Júnior was appointed to CADE’s Tribunal on January 16, 2014. His term as member of the Tribunal will end on January 15, 2017.

b. CADE’s Chief Prosecutor is Confirmed for a New Mandate of Two Years

On January 13, 2016, CADE’s Chief Prosecutor, Victor Santos Rufino, was reappointed for a new mandate of two years. Mr. Rufino joined CADE in 2008, became deputy chief prosecutor in 2011, and became chief prosecutor in 2014.

4. Fines Imposed and TCCs Approved by CADE’s Tribunal

Since January 1, 2016, CADE has imposed a number of sanctions against companies and individuals:

- On January 20, 2016, CADE imposed a fine of BRL 6 million (approximately $1.8 million) on three Brazilian entities (Aurobindo Pharma Indústria Farmacêutica Ltda., Brasvit Indústria, and Comércio Ltda.) and four individuals for their alleged participation in a price-fixing and bid-rigging conspiracy related to the acquisition by public laboratories of inputs for the fabrication of retroviral drugs used in the treatment of HIV. According to reporting commissioner Gilvandro Vasconcelos Coelho de Araújo, the companies reached agreements on prices and engaged in a variety of modalities of bid rigging, including the presentation of cover bids and the subsequent fraudulent subcontracting of the entity whose bid had been rejected.[80]

- On January 20, 2016, CADE imposed a fine of BRL 27.3 million (approximately $8 million) on seven companies (Brasil Sul Indústria e Comércio Ltda., Lógica Lavanderia e Limpeza Ltda., Lido Serviços Gerais Ltda., Lavanderia São Sebastião de Nilópolis Ltda., Ferlim Serviços Técnicos Ltda., Prolav Serviços Técnicos Ltda., and Sindicato das Empresas de Lavanderia do Rio de Janeiro–Sindilav) and eleven individuals for their alleged participation in a bid-rigging conspiracy related to the cleaning services of public hospitals in Rio de Janeiro. In addition, and according to reporting commissioner Alexandre Cordeiro Macedo, Brasil Sul has been prohibited from contracting with the Brazilian public authorities for five years. Other members of the conspiracy did not receive a similar prohibition as a sanction in order to avoid CADE’s intervention in an already overly concentrated market.[81]

- In addition, on January 20, 2016, CADE approved a TCC negotiated by CADE’s Superintendence in relation to an alleged conspiracy in the markets for air and maritime freight to and from Brazil.[82] The TCC was entered into between CADE, Deutsche Bahn AG, Schenker do Brasil Transportes Internacionais Ltda., Bax Global do Brasil Ltda., and two individuals. CADE collected a total of BRL 9.5 million (approximately $2.8 million) from the settling parties.

- On February 24, 2016, CADE imposed a fine of BRL 17.4 million (approximately $5 million) on Belgian-based Solvay S/A for its participation in a conspiracy in the sodium perborate market. According to the reporting commissioner, João Paulo de Resende, between 1999 and 2001, Solvay and Degussa entered into market sharing agreements whereby Degussa would cease to supply Unilever in the United Kingdom in order to supply this company in Brazil. Conversely, Solvay would cease to supply Unilever in Brazil in order to supply this company in the United Kingdom. The investigation began in 2006 with the signing of a leniency agreement between CADE, Degussa, and one individual that reported the infringement to CADE.[83]

- On March 16, 2016, CADE imposed a total of BRL 21.3 million (approximately $6.2 million) in fines on two companies (Household Compressors Holding S.p.A and Danfoss A/S e Panasonic Electric Works Co. Ltd.) and on three individuals for their alleged participation in an international conspiracy in the market for refrigerator hermetic compressors. Hermetic compressors are devices used in refrigerator systems, especially in household appliances. According to the reporting commissioner, Márcio de Oliveira Júnior, representatives of the companies held meetings, exchanged sensitive commercial information, and discussed price readjustment rates and the control of compressors supply between 1996 and 2008. CADE had opened proceedings in July 2009 based on evidence gathered by operation of Brazil’s leniency program. Notably, this was the first case in which CADE had coordinated with foreign competition authorities for the purpose of conducting dawn raids.[84]

- On April 13, 2016, CADE imposed a total of BRL 1 million (approximately $290,000) in fines on three companies (namely, The American National Red Cross–ARC, Swiss-based Octapharma AG, and its subsidiary, Octapharma Brasil S.A.) and two individuals in relation to the alleged rigging of tenders conducted by the Ministry of Health in 2004 to buy blood used in transfusions.[85]

5. Activities of the Superintendence

a. New Investigations Initiated by the Superintendence

Since January 1, 2016, the Superintendence has opened several investigations including:

- On January 25, 2016, the Superintendence opened infringement proceedings in relation to an alleged conspiracy in the market for wheat flour in Northern Brazil. According to the Superintendence, the parties involved had fixed prices both at the production and distribution levels. In addition, the parties are alleged to have boycotted the operations of distributors who did not adhere to the fixed prices.[86]

- On February 23, 2016, the Superintendence opened an investigation against nine companies in relation to an alleged international conspiracy in the market for maritime transportation of automobiles through Roll-On Roll-Off (RoRo) ships.[87] According to the Superintendence, the arrangement allocated clients between the members of the conspiracy. According to CADE’s press release, although the alleged anticompetitive conduct may have begun in 1978,[88] its most noticeable elements apparently took place between 2000 and 2012, when the Antitrust Division of the U.S. Department of Justice,[89] the European Commission, and the Japanese Fair Trade Commission initiated investigations.

- On March 9, 2016, the Supreintendence announced that it was investigating, together with the Office of the Public Prosecutor of São Paulo, a suspected conspiracy in the markets for devices for measuring energy.[90] The following companies (and a number of individuals affiliated with them) have been investigated since October 2014: Dowertech da Amazônia Indústria de Instrumentos Eletrônicos Ltda., Eletra Energy Solutions, Elo Sistemas Eletrônicos S.A., Elster Medição de Energia Ltda., Itron Sistemas e Tecnologia Ltda., Itron Soluções para Energia e Água Ltda., Itron Inc., Landis+Gyr Equipamentos de Medição Ltda., Nansen S.A. Instrumentos de Precisão e FAE Ferragens, and Aparelhos Elétricos. According to the Superintendence, the conduct lasted from 1990 to 2013.

- On March 28, 2016, the Superintendence opened infringement proceedings against nine auto parts suppliers in relation to an alleged conspiracy in the domestic and international markets for electronic power steering systems (“EPS”) for automobiles between 2007 and 2011. According to the Superintendence, the companies may have reached agreements, in Brazil and elsewhere, with the purpose of fixing prices and other trading conditions, as well as allocating bids for customers and sharing markets among them.[91] As referenced in our 2015 Mid-Year Criminal Antitrust and Competition Law Update and our 2015 Year-End Criminal Antitrust and Competition Law Update,[92] in 2014 and 2015, the Superintendence opened nine investigations into suspected cartels in relation to different automobile parts, and conducted dawn raids with respect to certain products in August 2014.

- On May 9, 2016, the Superintendence opened two investigations against 18 companies and 46 individuals in relation to an alleged conspiracy in the Brazilian market for pipes and fittings.[93] The first investigation relates to an alleged conspiracy in the domestic market of PVC pipes and fittings, which allegedly affected bids launched by public companies in the sewage and water infrastructure sector and private companies operating with civil construction and installation services. The second investigation relates to an alleged conspiracy in the national market of PEAD pipes and fittings, which allegedly affected bids launched by concessionary companies operating infrastructure in the gas sector. In both cases, the Superintendence’s preliminary opinion describes price-fixing agreements and client division implemented during meetings and telephone calls between management-level employees of these companies, with the authorization of board members and through possible e-mail exchanges discussing specific bids.

- On May 13, 2016, the Superintendence opened infringement proceedings against 12 companies and 54 individuals in relation to an alleged conspiracy in the domestic markets for the production and distribution of resins. It alleged that the accused companies and individuals agreed to restrict competition through fixing resins prices and exchanging sensitive information.[94] As referenced in our 2014 Mid-Year Criminal Antitrust and Competition Law Update,[95] the investigation started in 2014 when CADE conducted dawn raids at the offices of the investigated companies. Between the dawn raids and the opening of the proceedings, five companies approached CADE in order to negotiate TCCs. These agreements resulted in the companies paying fines for a total of BRL 50 million (approximately $14.4 million).

b. Cases referred by the Superintendence to the Tribunal

Since January 1, 2016, the Superintendence has referred the following cases to the Tribunal, recommending a finding of infringement:

- On March 28, 2016, in relation to a suspected conspiracy in relation to DRAM chips, the Superintendence recommended the prosecution of Elpida Memory Inc., Hitachi Ltd., Mitsubishi Electric Corp., Nanya Technology Corporation, and the Toshiba Corporation, together with two individuals associated with the companies. According to the Superintendence, the companies engaged in a “classic cartel” harming both direct purchasers and the final consumers of goods using DRAM chips (which are used in personal computers, printers, mobile phones, game consoles, and digital cameras). The Superintendence alleged that the conspiracy occurred between 1988 and 2002 and consisted of information exchanges related to expected capacity, market conditions, and the prices at which the end goods using DRAM chips were sold. TCCs previously entered into by CADE with other corporate entities and individuals resulted in BRL 8.2 million (approximately $2.4 million) in fines. TCCs also previously entered into by CADE with other corporate entities and individuals resulted in BRL 8.2 million (approximately $2.4 million) in fines.[96]

- On June 9, 2016, the Superintendence referred a suspected conspiracy between distributors of fuel in São Luís, in the Brazilian State of Maranhão. The participants are alleged to have fixed prices and tried to influence non-conspirators to raise prices. The evidence of the infringement apparently includes both transcripts of phone conversations (authorized by Maranhão’s judiciary) and economic analysis developed by the Agência Nacional do Petróleo, Gás Natural e Biocombustíveis, on the markets for sale of fuel in São Luís.[97]

- Also on June 9, 2016, the Superintendence referred to the Tribunal a suspected conspiracy for the provision of medical and hospital services in Fortaleza, the capital of the State of Ceará in Northern Brazil. According to the Superintendence, the Association of the Hospitals of the State of Ceará (Associação dos Hospitais do Estado do Ceará) and a number of its members conspired to impose prices and trading conditions on insurance companies.[98]

c. CADE’s Superintendence Adopts an Interim Measure and Conducts Further Dawn Raids in “Operation Dubai”

The Superintendence has continued its investigation of a suspected fuel conspiracy in Brazil’s Federal District (the so-called “Operation Dubai” described in our 2015 Year-End Criminal Antitrust and Competition Law Update).[99] On January 25, 2016, the Superintendence adopted an interim measure, which consisted of the appointment of an interim administrator who would independently manage “BR” gas stations owned by Cascol, accounting for approximately two-thirds of the company’s stations. In the event of non-compliance, Cascol would be subject to a daily fine of BRL 300,000 (approximately $75,000). On May 6, 2016, CADE, together with Brazil’s federal police, conducted dawn raids at the homes of four individuals as part of “Operation Dubai.”[100]

6. Regulatory developments

a. CADE Adopts New Leniency Guidance

On May 25, 2016, CADE adopted Leniency Guidance in the form of Frequently Asked Questions (“FAQs”).[101] As reported in our 2015 Year-End Criminal Antitrust and Competition Law Update, on November 11, 2015, CADE released a preliminary version of the FAQs for public comment until February 11, 2016.[102] The goal of the Leniency Guidance is to strengthen and expand Brazil’s Leniency Program and provide enhanced transparency and predictability in relation to leniency agreements.

Also on May 26, 2016, CADE amended a number of leniency provisions included in its Internal Rules concerning, among other things, the marker system and the calculation of Leniency Plus discounts. As described in our 2015 Year-End Criminal Antitrust and Competition Law Update, Leniency Plus is available in Brazil to those applicants who do not qualify for immunity (because they are not the first to come forward), but who offer information concerning a separate conspiracy about which CADE had no prior knowledge.[103]

b. CADE Publishes Preliminary English Version of the TCC Guidelines

On May 11, 2016, CADE adopted a formal set of guidelines for TCCs (the “TCC Guidelines”). TCCs, which are provided for under Article 85 of Act 12,529/11, are agreements entered into between CADE and the entities and/or individuals investigated for economic infringements (and, thus, not only for cartel infringements. Under the TCC Guidelines, in order to enter into a TCC in a cartel case, a company is required to: (i) admit its participation in the conduct; (ii) collaborate with the investigations; and (iii) pay a fine (technically called “pecuniary amount” and not fine). According to CADE, however, the TCC Guidelines reflect existing practices and the parameters that have previously been used in the negotiation of settlements over the past several years.[104]

c. CADE Publishes English Version of its Guidance on Compliance Programs

On February 18, 2016, CADE published an English version of its Guidance on Compliance.[105] The Guidance sets forth in detail the actions required to execute a “consistent compliance program” and the benefits of doing so. Unlike in certain jurisdictions (most notably, the U.S. and the EU), Brazil’s Guidance on Compliance expressly provides that having such programs in place at the time of the violation might constitute a criterion to be taken into consideration when determining the amount of fines. However, according to CADE’s press release, the Guidance is not binding on CADE.[106]

7. Other developments

On January 25, 2016, it was reported that CADE had suffered a cyber-attack, with hackers gaining access to information stored on the enforcer’s internal databases, although no sensitive information or data from ongoing investigations or analyses were obtained or distributed over the internet. The hacking group Anonymous claimed responsibility for the security breach, explaining it was a response to a presidential veto by Dilma Rousseff, who blocked the passage of legislation that included a proposed audit of the country’s public debt.[107]

On May 19, 2016, CADE entered into agreements with the competition authorities of Russia, India, and China to share information and experience in competition law, as well as to promote the joint participation of the authorities in investigations and in international events in this area. According to Mr. Oliveira Júnior, this agreement should “constitute the base for future cooperation agreements to be celebrated between [these countries].”[108]

D. CHILE

1. Enforcement Actions

Building on successes in several prosecutions involving the ocean shipping and poultry industries,[109] Chile continued its aggressive enforcement of cartels in the first half of 2016, bringing charges in two separate investigations–one involving tissue products and the other against supermarkets for allegedly fixing minimum retail prices for chicken meat. The difference in treatment of the defendants across the two cases reinforces Chile’s continued strategy of encouraging self-reporting through leniency applications.

In January 2016, the National Economic Prosecutor’s Office (Fiscalia Nacional Economica, “FNE”) announced charges against three supermarket chains for fixing prices of fresh chicken between 2008 and 2011. The investigation against the supermarkets was initiated based on information obtained during a separate investigation into a decade-long market sharing agreement among the country’s three largest poultry producers, and not the involvement of a leniency applicant. The FNE has requested the maximum fine allowed under the law, 30,000 UTA ($22.9 million) for each company.[110]

In contrast, as initially reported in our 2015 Year-End Criminal Antitrust and Competition Law Update, in the fourth quarter of 2015, the FNE announced charges against two tissue product manufacturers, CMPC Tissue and SCA Chile, alleging that the two manufacturers–which account for nearly 90% of tissue product sales–engaged in at least a decade-long conspiracy between 2001 and 2011. Both manufacturers filed leniency applications, and the FNE recommended that CMPC Tissue receive complete immunity and that SCA Chile receive a reduced fine of $15.5 million.[111] This year, in April, an appeals court prevented Chilean prosecutors from obtaining confidential information provided to the FNE in the defendants’ leniency petitions. This was reported to be the first time the criminal prosecutor sought confidential material from FNE, and it has appealed the denial.[112]

2. Policy Developments

Chile’s Senate is currently considering a new criminal antitrust law. The bill would criminalize “hardcore” cartels, with potential sentences of up to 10 years, and modify the maximum fine for unlawful conduct to the greater of 30% of the company’s revenues during the violation or double the economic benefit from the violation (the current maximum fine is 30,000 UAT ($22.9 million)). The legislation provides that first-in leniency applicants would be immune from any fines and criminal sanctions and that second-in applicants may obtain a 50% reduction on the fine and a reduction on the criminal sanction.[113]

In addition, the FNE is working on a revised draft of its “Internal Guidelines for Leniency in Collusion Cases” to address comments from local attorneys as well as the American Bar Association and the International Bar Association, particularly regarding the need to keep information submitted in leniency petitions confidential, so that applicants are not placed in a worse position than other cartel participants vis-à-vis potential class action litigation. The revised draft has not yet been made available to the public.

E. COLOMBIA

In May 2016, the Colombian competition authority, the Superintendencia de Industria y Comercio (“SIC”), announced that it issued fines totaling 185 billion pesos (approximately $62 million) to four manufacturers and 21 individuals for conspiratorial activity in the tissue paper market. Pursuant to its Leniency Program, the SIC awarded a 100% reduction in fines to the first company to come forward and cooperate with its investigation and a 30% penalty reduction to a second company. A third company had its application seeking a 50% reduction in fines rejected when the SIC concluded that it provided misleading statements and failed to fully cooperate with the investigation.[114]

F. MEXICO

In a year in which Mexico City hosted the International Bar Association’s Annual Competition Mid-Year Conference, the Mexican Federal Economic Competition Commission (COFECE) showed it is active in a variety of industries and geographic markets.

In February 2016, COFECE concluded an investigation into an alleged horizontal conspiracy among producers of air conditioner compressors used in automobiles, which it began in 2013, by issuing a Statement of Probable Responsibility explaining its allegations.[115] Also in February, in response to proposed industry rules that would govern the price of tortillas, COFECE issued guidance urging producers to set prices unilaterally and threatening to conduct investigations if producers failed to do so.[116]

In March 2016, COFECE publicly announced it has been conducting an ongoing investigation since December 2015 into whether government-contracting firms that provide information-monitoring services may have shared information and rigged bids.[117]

In April 2016, COFECE’s Investigative Authority concluded an investigation and issued a Statement of Probable Responsibility to COFECE’s Commissioners alleging collusive conduct between providers of pension funds.[118]

In May 2016, COFECE brought formal allegations of a price-fixing and/or supply-restricting conspiracy among providers of vehicle towing services in the State of Guerrero; it had been investigating this conduct since 2014.[119] Later that month, COFECE opened an investigation into potential collusion between competing producers of live performances (as well as the venues in which they are held and the accompanying ticketing services).[120] Also in May, COFECE announced that an administrative trial will occur related to alleged collusion between taxi drivers serving Mexico City’s International Airport.[121]

In June 2016, COFECE announced an investigation of a horizontal conspiracy related to the pricing and supply of tortillas in the State of Jalisco.[122] Finally, in June, COFECE announced fines of nearly 89 million pesos (approximately $4.8 million) against sugar producers who fixed sugar prices during a sharp decline in prices in late-2013. The fines were assessed on 17 corporations and individuals, who admitted to using a trade association to facilitate price fixing.[123]

G. URUGUAY

In November 2015, Uruguay’s competition authority, the Comisión de Promoción y Defensa de la Competencia (“CPDC”), announced that it would initiate an investigation into possible collusion in the tissue paper market, similar to the investigations conducted by Chile, Peru, and Colombia. The Chilean paper company, CMPC, through its Uruguay branch, Ipusa SA, has offered to cooperate with the investigation. Ipusa currently holds 80% of the market share in Uruguay for tissue paper. The CPDC has not yet confirmed whether price fixing occurred in Uruguay.[124]

On the policy front, legislation has been introduced that would provide the CPDC greater evidence-gathering tools and bring the enforcement agency in line with international standards.[125]

II. EUROPE

A. EUROPE

1. European Commission

a. Fines

In the first half of 2016, the European Commission (“Commission”) imposed relatively few fines. However, as several cartel investigations are ongoing, the year-end total fine amounts imposed in cartel cases may be significantly higher than the mid-year figure suggests.

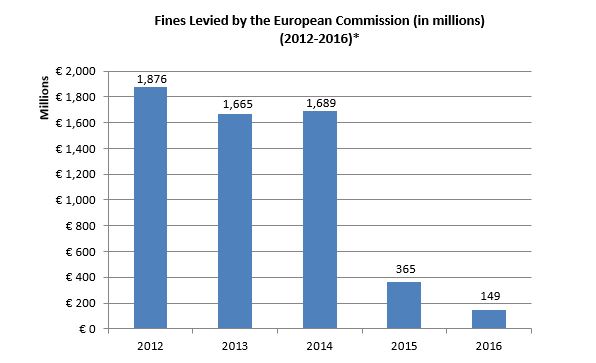

* The figures above do not take into account subsequent rulings of the European courts adjusting the levels of fines, but does reflect adjustments made by the Commission. For example, the original fine imposed in the EIRD cartel in 2013 was adjusted by the European Commission on April 6, 2016 (the Commission amended the fine, which is based on the value of sales data, for Société Générale because the bank had initially provided incorrect data to the Commission).

(i) Auto Parts

On January 27, 2016, the Commission imposed a total fine of EUR 137.79 million (approximately $153 million) on two auto parts producers, Mitsubishi Electric and Hitachi, for participating in collusion related to alternators and starters between September 2004 and February 2010. A third car parts producer, DENSO, was granted full immunity from fines under the EU’s Leniency Guidelines for revealing the conduct to the Commission. The three Japanese car parts producers colluded to coordinate prices and allocate customers or bids with regard to alternators and starters, and further, exchanged commercially sensitive information on price components and market strategies. The Commission noted that while the contacts between the competitors did not take place within the European Economic Area (“EEA”), the collusion did have an impact on customers in the EEA given that the participants sold alternators and starters to car manufacturers there. Under the Commission’s 2008 Settlement Notice, Mitsubishi Electric and Hitachi each received a 10% reduction in fines for their cooperation and acknowledgement of their involvement.[126]

(ii) Canned Mushrooms