July 5, 2016

From the pilot program to the Panama Papers, the first six months of 2016 brought with them a number of important anti-corruption-related developments, including a reinvigorated level of enforcement under the U.S. Foreign Corrupt Practices Act (“FCPA”) that already has equaled the total from 2015. Enforcement actions arising out of multinationals’ China operations continue to dominate the landscape. It is against this backdrop that we are thrilled to announce the addition of Patrick Stokes, the most recent head of DOJ’s FCPA Unit, to Gibson Dunn’s team of FCPA specialists.

This client update provides an overview of the FCPA as well as domestic and international anti-corruption enforcement, litigation, and policy developments from the first half of 2016.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and “agents” acting on behalf of issuers and domestic concerns, as well as to “any person” that violates the FCPA while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and their agents. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts, that in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

2016 MID-YEAR FCPA ENFORCEMENT STATISTICS

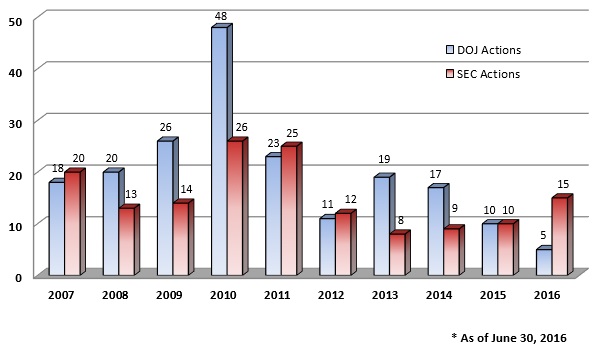

The following table and graph detail the number of FCPA enforcement actions initiated by the statute’s dual enforcers, the U.S. Department of Justice (“DOJ”) and the U.S. Securities and Exchange Commission (“SEC”), during each of the past ten years.

|

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

||||||||||

|

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

|

18 |

20 |

20 |

13 |

26 |

14 |

48 |

26 |

23 |

25 |

11 |

12 |

19 |

8 |

17 |

9 |

10 |

10 |

5 |

15 |

2016 MID-YEAR FCPA ENFORCEMENT ACTIONS

FCPA enforcement actions were filed at a rapid clip during the first half of 2016, with the SEC leading the way. In fact, the SEC already has brought more FCPA enforcement actions in the first six months of this year than it has in any full year since 2011. Of the twelve corporate enforcement actions, eight were brought by the SEC alone, three were brought jointly by DOJ and the SEC, and one was prosecuted only by DOJ. Four of the five enforcement actions against individual defendants were brought by the SEC, with DOJ filing only one case (publicly) against an individual in 2016. Finally, although the total mix of enforcement actions cover a wide variety of industries and geographies, China–figuring in roughly half of them–continues to stand out as an FCPA enforcement hotspot.

A description of the first half of 2016 in FCPA enforcement actions follows.

Corporate Enforcement Actions

SAP SE

In our 2015 Year-End FCPA Update, we covered the August 2015 joint DOJ-SEC FCPA enforcement actions against Vincente Eduardo Garcia, the former Vice President of Global and Strategic Accounts for Germany-based software manufacturer and ADR-issuer SAP. On February 1, 2016, the SEC filed FCPA charges against Garcia’s former employer arising out of the same alleged misconduct.

The SEC’s case against SAP was premised upon Garcia’s alleged offer and payment of bribes to Panamanian government officials in order to secure software contracts. Specifically, the SEC alleged that between 2009 and 2013, SAP’s internal controls failed to prevent Garcia from scheming with a local partner to pay $145,000 in bribes to a senior Panamanian government official and offer bribes to two others, leading to four contracts that generated $3.7 million in profits for SAP. According to the charging document, Garcia arranged for SAP’s local partner to receive a steep discount, thereby enabling the partner to earn a significant margin, a portion of which was used to create a pool of funds from which bribes were paid. The SEC alleged that SAP’s internal controls were inadequate to ensure that large discounts provided to third parties–frequently a legitimate and pro-competitive sales tactic–were not misused as a vehicle for third-party bribery.

Without admitting or denying the SEC’s charges, SAP consented to the resolution of an administrative cease-and-desist proceeding alleging violations of the FCPA’s accounting provisions and agreed to pay more than $3.8 million in disgorgement and prejudgment interest. The SEC did not impose a post-resolution reporting requirement upon SAP and acknowledged the company’s cooperation and remedial actions, which included conducting a thorough internal investigation after learning about the conduct as a result of the SEC’s inquiry, firing Garcia, and auditing all of its recent public-sector business in Latin America. Garcia was previously sentenced to 22 months in prison for his misconduct.

SciClone Pharmaceuticals, Inc.

Three days later, on February 4, 2016, the SEC announced another settled FCPA cease-and-desist proceeding, this time against California-based SciClone Pharmaceuticals. The SEC alleged that employees of SciClone subsidiaries drove sales by providing improper benefits to Chinese health care professionals between 2007 and 2012, particularly by providing money, gifts, and travel benefits. In one instance, while SciClone had license applications pending in China, “a well-connected regulatory affairs specialist” hired to facilitate their approvals allegedly arranged for two licensing officials to attend an academic conference in Greece at the company’s expense. But when the officials could not get visas for the trip, the specialist instead gave them more than $8,000 in “lavish gifts.” Although SciClone fired the specialist and conducted an internal investigation after learning about this, the SEC faulted the company’s response for “not look[ing] more broadly at sales and marketing practices in China” or leading to further remediation. Indeed, according to the SEC, trips were subsequently provided to Chinese health care providers to attend various conferences in the United States, Japan, and elsewhere that featured extensive sightseeing and recreational activities and little legitimate business purpose.

Without admitting or denying the SEC’s allegations, SciClone consented to an administrative cease-and-desist order alleging violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions. The company agreed to pay more than $12.8 million in disgorgement, prejudgment interest, and penalties, and to self-report on the status of its FCPA remediation efforts over a three-year period following the resolution. The SEC acknowledged that SciClone ultimately engaged in significant remediation, including a comprehensive review of historical promotional expenses.

The SEC’s civil anti-bribery charge against SciClone serves as a reminder of one of the ways that, according to the SEC’s interpretation of the FCPA, a parent issuer can be held liable for the corrupt acts of its foreign subsidiary even absent direct involvement by the parent. Although there was no allegation that the parent company directed or participated in the misconduct, the SEC charged the parent with bribery for the foreign subsidiary’s behavior on the theory that the foreign subsidiary was acting as an “agent” of the parent. Specifically, to show an agency relationship, the SEC alleged that SciClone “direct[ed] the relevant operations of [the subsidiary] and overs[aw] [the subsidiary’s] operations through various means including through the appointment of directors and officers . . . , review and approval of its annual budget, business and financial goals, and oversight of its legal, audit, and compliance functions”; “review[ed] and approve[d] annual marketing and promotion budgets of [the subsidiary]”; and had certain corporate officers who “also served as officers and/or directors of [the subsidiary], traveled frequently to China to participate in the management of [the subsidiary], and were responsible for negotiating its contracts with its Chinese distributors.”

PTC Inc.

On February 16, 2016, DOJ and the SEC jointly announced another travel-and-entertainment-related FCPA resolution involving Massachusetts-based software company PTC and its Hong Kong- and Shanghai-based subsidiaries. Between 2006 and 2011, the subsidiaries allegedly provided more than $250,000 in gifts and entertainment and trips worth more than $1 million–ostensibly to visit PTC’s U.S. headquarters in Needham, but then including extensive recreational travel to places like Hawaii, Las Vegas, Los Angeles, New York, and San Diego–to customers employed by Chinese state-owned enterprises. Funding for the trips was obtained in part by building the costs into commissions to third parties, who then paid for the trips. According to the SEC, PTC realized more than $11.8 million in profits from business with the state-owned enterprises whose officials participated in these trips.

To resolve the DOJ investigation, the two implicated PTC subsidiaries jointly entered into a single non-prosecution agreement and agreed to pay a $14.5 million criminal fine. To resolve the SEC proceeding, without admitting or denying the allegations, PTC consented to an administrative cease-and-desist order alleging FCPA bribery and accounting violations and agreed to pay $13.6 million in disgorgement and prejudgment interest. Like its action against SciClone discussed above, the SEC’s anti-bribery charge against PTC relied on an agency theory of liability.

Of interest, the non-prosecution agreement binds only the two implicated subsidiaries–and not the parent company, PTC–to the standard compliance undertakings included in these agreements, including the obligation to self-report to DOJ on the state of their compliance program for a three-year period. Further, although both the DOJ and SEC resolutions acknowledge PTC’s self-disclosure following an internal investigation in 2011, PTC did not receive full credit for this disclosure because the company allegedly failed to disclose all of its relevant findings from the investigation until after DOJ and the SEC independently became aware of them. Finally, the SEC’s first ever deferred prosecution agreement with an individual defendant in an FCPA case, reached with an employee of one of PTC’s Chinese subsidiaries, Yu Kai Yuan, is discussed below.

VimpelCom Ltd.

On February 18, 2016, Dutch telecom company and ADR-issuer VimpelCom and its Uzbek subsidiary, Unitel, entered into a $795 million resolution with DOJ, the SEC, and Dutch regulators arising from allegations that the companies made more than $110 million in improper payments to an Uzbek government official to facilitate market entry and secure preferential treatment in the country. The DOJ/SEC component of the resolution, comprising $397.6 million, marks the sixth-largest monetary settlement in the history of the FCPA.

According to the charging documents, to facilitate entry into the Uzbek market, certain VimpelCom executives acquired a local telecom company in which the official held an interest–Buztel–but without disclosing her ownership stake to VimpelCom’s board as part of the approval process. After VimpelCom merged Buztel with another acquired Uzbek telecom, the official secured an ownership stake in that company that VimpelCom later repurchased at a nearly $40 million profit. VimpelCom also allegedly paid the official tens of millions of dollars through a Gibraltar-based shell corporation.

To resolve the criminal investigation, VimpelCom entered into a deferred prosecution agreement on charges of conspiracy to violate the FCPA’s anti-bribery and books-and-records provisions and a substantive violation of the internal controls provision, and Unitel pleaded guilty to one count of conspiracy to violate the anti-bribery provisions. To resolve the SEC’s investigation, VimpelCom consented to the entry of judgment on a civil complaint charging FCPA bribery and accounting violations. VimpelCom also reached a parallel resolution with the Public Prosecution Service of the Netherlands (Openbaar Ministrie, or “OM”). After netting out a series of financial credits and offsets between the resolutions, VimpelCom agreed to pay $397.5 million to the OM, $230.2 million to DOJ, and $167.5 million to the SEC. VimpelCom also agreed to retain an independent compliance monitor for a three-year term.

In addition to the charges against VimpelCom and Unitel, DOJ simultaneously brought two complaints under its Kleptocracy Asset Recovery Initiative seeking forfeiture of a combined $850 million in allegedly tainted funds paid to the Uzbek official that are currently held in Swiss banks and other European countries. In June, DOJ obtained seizure orders for assets held in banks in Belgium, Ireland, and Luxembourg. With regard to this parallel enforcement action, DOJ Assistant Attorney General Leslie Caldwell remarked, “The Criminal Division’s FCPA enforcement program and our Kleptocracy Initiative are two sides of the same anti-corruption coin.”

Qualcomm Incorporated

On March 1, 2016, the SEC announced a settlement with California-based telecom company Qualcomm relating to alleged FCPA bribery and accounting violations arising from purportedly corrupt hiring practices in China. According to the SEC, between 2002 and 2012 Qualcomm provided or offered full-time employment and paid internship opportunities to relatives and acquaintances of Chinese government officials, in some cases despite reservations about the applicants’ skills or qualifications and even after the normal hiring process resulted in their rejection. Qualcomm also allegedly provided Chinese officials and their family members with meals, lavish gifts, and travel, including sightseeing tours, golf outings, and hospitality packages at major sporting events, all of which lacked a valid business purpose. These benefits were allegedly provided to influence officials of the Chinese government and state-owned enterprises to adopt Qualcomm’s mobile-network technologies, and allegedly caused in part by the company’s failure to provide regular FCPA compliance training to employees in the human resources and hospitality planning functions.

Without admitting or denying the findings, Qualcomm consented to an SEC cease-and-desist order, agreeing to pay a $7.5 million civil penalty and to self-report on the state of its compliance program to the SEC for a two-year term. Significantly, despite the “billions in revenue” that Qualcomm allegedly gained by inducing foreign officials and state-owned enterprise executives to license and adopt Qualcomm technologies, the settlement did not include a disgorgement component. It would appear that the SEC had difficulty tying the alleged improper benefits to specific contracts with profits that could be disgorged.

This settlement, like the August 2015 resolution with BNY Mellon discussed in our 2015 Year-End FCPA Update, demonstrates the risk involved in hiring so-called “princelings,” or relatives of well-connected foreign officials. While the FCPA does not strictly prohibit hiring a relative of a foreign official, these cases show that decision whether to do so often benefits from close FCPA scrutiny.

Olympus Latin America, Inc.

On March 1, 2016, DOJ announced a deferred prosecution agreement with medical equipment distributor Olympus Latin America, a subsidiary of Olympus Corporation of the Americas, based on alleged corrupt payments in Argentina, Bolivia, Brazil, Colombia, Costa Rica, and Mexico. According to DOJ, between 2006 and 2011 Olympus Latin America used regional training centers as a means to provide health care practitioners working in government-owned hospitals with money and gifts in order to induce them to purchase Olympus equipment. In particular, Olympus Latin America allegedly identified health care practitioners who could influence purchasing decisions and paid them $65,000 per year to manage the training centers, as well as providing a 50% discount on Olympus equipment and a $130,000 budget for so-called “VIP Management.” Olympus Latin America also allegedly established a “miles program” through which it offered the health care practitioners operating the training centers thousands of “miles” (worth thousands of dollars) that could be used for personal travel, without any pre-approval or review. According to DOJ, the illicit payments totaled nearly $3 million and generated more than $7.5 million in profits.

To resolve the FCPA bribery and conspiracy to commit bribery charges, Olympus Latin America agreed to pay a $22.8 million criminal penalty and to engage an independent compliance monitor for a three-year term. But the FCPA resolution was only a modest part of a much larger picture. On the same day, DOJ announced that parent company Olympus Corporation of the Americas had entered into a separate deferred prosecution agreement with DOJ, agreeing to pay more than $623 million to resolve alleged violations of the domestic Anti-Kickback Statute and federal and state false claims acts based on providing kickbacks to doctors and hospitals in the United States. The deferred prosecution agreement similarly requires Olympus Corporation of the Americas to engage a compliance monitor, and the same person reportedly will serve as monitor under both agreements. This settlement also resolves a qui tam suit by Olympus Corporation of America’s former-chief-compliance-officer-turned-whistleblower, who reportedly will receive a more than $50 million payout under the U.S. False Claims Act. Together, these resolutions serve as a keen reminder that the FCPA risks in dealing with government-employed physicians abroad are similar to those under the Anti-Kickback Statute when operating (and receiving payments from federal health care programs) in the United States.

Nordion (Canada) Inc.

On March 3, 2016, the SEC announced a settled administrative proceeding against global health science company Nordion (Canada). According to the charging document, which the company neither admitted nor denied, between 2004 and 2011 Nordion allegedly violated the FCPA’s books-and-records and internal controls provisions in connection with payments to a third-party agent to obtain Russian government approval for a medical treatment. In particular, the SEC alleged that upon the recommendation of engineer Mikhail Gourevitch (whose individual FCPA resolution is discussed below), Nordion engaged Gourevitch’s childhood friend and one of the friend’s companies to help it obtain government approval for, register, license, and distribute a liver cancer treatment. Gourevitch and the agent allegedly schemed to use a portion of the agent’s fees to bribe Russian officials to approve the treatment, as well as to pay kickbacks to Gourevitch.

To resolve the allegations, Nordion consented to an administrative cease-and-desist order and agreed to pay a $375,000 civil penalty–marking the lowest monetary resolution in a corporate FCPA enforcement action in five years. Because Nordion’s agent was unsuccessful in securing regulatory approval for the distribution of Nordion’s liver cancer treatment in Russia, Nordion realized no profits on the sale of the product in Russia and therefore did not pay disgorgement. The SEC acknowledged Nordion’s self-reporting to authorities in the United States and Canada, internal investigation, and “extensive remedial measures,” which included hiring a new corporate compliance director and enhancing its policies and procedures for hiring third parties.

Notably, despite being a defendant in an SEC enforcement action, Nordion is no longer an SEC issuer. In 2014, Nordion was taken private as part of a corporate acquisition. Nevertheless, because the conduct occurred prior to the delisting, Nordion’s FCPA liability survived the transaction.

Novartis AG

On March 23, 2016, the SEC announced another FCPA settlement with a pharmaceutical company based on allegedly improper payments to Chinese physicians, with Swiss-based ADR-issuer Novartis agreeing to pay $25 million to resolve allegations that between 2009 and 2013, employees of its Chinese subsidiaries engaged in “pay-to-prescribe” schemes by providing gifts, travel, and other benefits to Chinese health care professionals. Funding for the benefits was allegedly obtained through false expense reports, by arranging “education events” through local travel companies with more recreation than educational content, and by commissioning studies that rewarded doctors who prescribed Novartis medications to treat their patients.

Without admitting or denying the allegations in the SEC’s administrative cease-and-desist order, Novartis agreed to pay disgorgement and prejudgment interest of just over $23 million and a civil penalty of $2 million, and to self-report to the SEC on its compliance program for a two-year period. The SEC credited the steps Novartis took after learning of the SEC’s investigation into the scheme, which included reviewing its relationships in China with travel and event planners, disciplining the employees involved, strengthening the subsidiaries’ anti-corruption controls, and reevaluating the company’s use of Chinese vendors.

Las Vegas Sands Corp.

On April 7, 2016, the SEC announced an FCPA settlement with Nevada-based resort and casino company Las Vegas Sands, arising from allegations that the company failed to properly authorize or document payments to a Chinese consultant who had been hired purportedly to mask the company’s involvement in certain transactions in China and Macao. According to the SEC, Las Vegas Sands used the consultant, who claimed to be a well-connected former Chinese official, to indirectly purchase a Chinese Basketball Association team in order to circumvent the Association’s prohibition against a gaming company doing so. Las Vegas Sands also allegedly used the consultant to purchase a government-owned building in Beijing. Among other alleged record-keeping irregularities, almost $1 million in payments to the consultant were recorded as payments for “property management services” that the SEC contended were never provided. Further, in connection with its Macao operations, Las Vegas Sands allegedly failed to properly monitor expense reimbursement programs. As a result, Las Vegas Sands was unable to identify whether expenses were being used to make payments to foreign officials.

Without admitting or denying the SEC’s findings, Las Vegas Sands consented to a cease-and-desist order, agreed to pay a $9 million civil penalty, and retained an independent compliance consultant for a two-year period. Like the settlement with Qualcomm discussed above, the resolution did not include a disgorgement component but included a civil penalty. The charging documents do not allege bribery, but contend that Las Vegas Sands’s internal controls could not account for significant sums paid to the consultant and through expense reimbursements “in an environment where significant bribery risks were present.”

Akamai Technologies Inc. and Nortek Inc.

In the first six years following the announcement of its Cooperation Initiative in 2010, the SEC resolved one FCPA case via a non-prosecution agreement (Ralph Lauren Corporation, covered in our 2013 Mid-Year FCPA Update). On June 7, 2016, the SEC resolved two FCPA cases in this manner, reaching its second- and third-ever FCPA non-prosecution agreements with Akamai Technologies, a Massachusetts-based internet services provider, and Nortek, a Rhode Island-based building products manufacturer, respectively.

According to its non-prosecution agreement, between 2013 and 2015 the regional sales manager of Akamai’s Chinese subsidiary paid more than $150,000 in cash and gifts–while other employees provided more than $30,000 in improper gifts and entertainment–to officials of state-owned customers to induce the award of contracts to their employer. In the Nortek matter, the SEC’s allegations were that between 2009 and 2014 employees of Nortek’s Chinese subsidiary made more than 400 payments totaling nearly $300,000 to Chinese officials. Both companies immediately initiated an investigation after learning of the improper conduct and quickly disclosed its matter to DOJ and the SEC, providing “comprehensive, organized, and real-time cooperation.” Of the resolutions, SEC Director of the Enforcement Andrew Ceresney said that “[w]hen companies self-report and lay all their cards on the table, non-prosecution agreements are an effective way to get the money back and save the government substantial time and resources while crediting extensive cooperation.” Each company was required to disgorge the illicit profits earned via this alleged misconduct, with Akamai paying just over $670,000 in disgorgement plus prejudgment interest and Nortek paying more than $320,000 in disgorgement plus prejudgment interest.

Notably, DOJ released publicly its declination letters to Akamai and Nortek. The increased transparency on these matters is consistent with DOJ’s efforts to encourage voluntary disclosures as part of its FCPA Pilot Program (discussed below), as is the result in these matters. Nevertheless, the facts alleged in the SEC’s non-prosecution agreement do suggest that DOJ may have had difficulty in obtaining jurisdiction in this matter, given the apparent lack of knowledge or involvement of the U.S. issuer parent companies.

Analogic Corp.

On June 21, 2016, the SEC and DOJ announced a joint FCPA resolution with Massachusetts-based medical devices company Analogic and its Denmark-based subsidiary BK Medical ApS, respectively. According to the charging documents, between 2001 and 2011 BK Medical engaged in a scheme whereby it allowed its largest global distributor to over-invoice BK Medical and then took direction from this distributor on making payments of the excess amounts to third-party accounts that were unknown to BK Medical. In total, BK Medical allegedly made at least 180 payments worth more than $16 million to this distributor for sales in Russia, as well as at least 80 similar payments totaling more than $3 million to distributors in Ghana, Israel, Kazakhstan, Ukraine, and Vietnam.

To avoid criminal charges, BK Medical entered into a three-year non-prosecution agreement with DOJ and agreed to pay a $3.4 million penalty. In a settled administrative cease-and-desist proceeding against Analogic, the SEC imposed $11.48 million in disgorgement and prejudgment interest and also resolved charges against BK Medical’s former CFO, Lars Frost (discussed further below). BK Medical (but not Analogic) will self-report on the progress of its compliance program for a three-year period.

Individual Enforcement Actions

Moisés Abraham Millán Escobar

On January 7, 2016, DOJ filed a criminal information charging Moisés Abraham Millán Escobar, the former employee of a third-party engaged by Texas-based oil services company Tradequip Services & Marine, Inc., with one count of conspiring to violate the FCPA’s anti-bribery provisions. According to the charging document, Millán Escobar assisted an official of Venezuela’s state-owned oil company, Petróleos de Venezuela SA (“PDVSA”), in opening a bank account in Panama in order to receive bribe payments outside of Venezuela, and thereafter participated in e-mail discussions about improper payments to be provided to PDVSA officials. Millán Escobar has pleaded guilty and is awaiting a September 2016 sentencing date, but the paperwork associated with his plea remains under seal.

This case is related to those we reported in our 2015 Year-End FCPA Update against Roberto Enrique Rincón Fernandez and Abraham José Shiera Bastidas, respectively the president and a third-party agent of Tradequip Services & Marine, who were charged in December 2015 with conspiring to corruptly obtain PDVSA contracts. More on these developments in these cases, as well as related cases against three PDVSA officials, is contained below.

Notably, the charges against Millán Escobar were initially filed under seal, with DOJ citing concerns relating to the safety of the defendant’s family in Venezuela–as well as relating to the integrity of its investigation–if news of his cooperation were to become public. Although the case was subsequently unsealed, this demonstrates the difficulty of tracking DOJ FCPA enforcement actions in real time given that many such actions do not become public until long after they are filed.

Ignacio Cueto Plaza

On February 4, 2016, the SEC announced an administrative cease-and-desist settlement with Ignacio Cueto Plaza, the CEO of Chile-based LAN Airlines S.A., for alleged violations of the FCPA’s books-and-records and internal controls provisions. According to the charging document, upon entering the Argentine market in 2005, LAN encountered work stoppages and slowdowns from unions representing many of its employees, who threatened to enforce certain provisions of their collective bargaining agreement if LAN did not agree to substantial wage increases. In 2006 and 2007, Cueto allegedly approved the retention of, and $1.15 million in payments to, a consultant to negotiate agreements with the unions, even as he understood that it was possible that the consultant might pay union officials.

Without admitting or denying the SEC’s allegations, Cueto agreed to pay a $75,000 civil penalty, certify compliance with the company’s code of conduct and other compliance policies, and attend all anti-corruption training sessions required for LAN senior executives. Cueto also agreed to cooperate with the SEC’s ongoing investigation of the company relating to these activities. Gibson Dunn represented Cueto in his settlement with the SEC.

Yu Kai Yuan

As noted above, on February 16, 2016 the SEC announced its first ever deferred prosecution agreement with an individual in an FCPA case, a former sales executive of PTC’s Chinese subsidiaries, Yu Kai Yuan. Interestingly, other than recounting the allegations against the company as described above, and alleging generically that Yuan caused these violations, the SEC made no specific allegations with respect to his purported misconduct.

Yuan received no monetary sanction, and the FCPA books-and-records and internal controls charges will be deferred for a three-year period. According to the SEC’s press release announcing the resolution: “DPAs facilitate and reward cooperation in SEC investigations by foregoing an enforcement action against an individual who agrees to cooperate fully and truthfully through the period of deferred prosecution. FCPA changes will be deferred for three years against Yu Kai Yuan . . . as a result of significant cooperation he has provided during the SEC’s investigation.”

Mikhail Gourevitch

Coincident with its FCPA enforcement action against Nordion, on March 3, 2016 the SEC announced a settlement with Mikhail Gourevitch, a Canadian-Israeli citizen of Russian extraction and former engineer of Nordion. As discussed above, the SEC alleged that Gourevitch facilitated the company’s hiring of his childhood friend as a consultant to help the company obtain regulatory approvals from the Russian government, and thereafter engaged in repeated discussions with the agent concerning the payment of bribes to Russian officials and the need to conceal them from Nordion. Gourevitch was further alleged to have pocketed more than $100,000 in kickbacks from the invoices to his friend’s company for his own benefit, a fact he did not disclose to Nordion.

Without admitting or denying the alleged FCPA bribery and books-and-records violations, Gourevitch consented to a cease-and-desist order and agreed to pay $100,000 in disgorgement, $12,950 in prejudgment interest, and a civil penalty of $66,000 (for a total of more than $175,000).

Lars Frost

As part of its June 21, 2016 FCPA resolution with Analogic, the SEC also charged the former CFO of its BK Medical subsidiary, Danish citizen Lars Frost, with causing the parent company’s violations of the FCPA’s accounting provisions, as well as himself knowingly circumventing the company’s internal controls and falsifying its books and records. According to the SEC, between 2008 and 2011 Frost personally approved approximately 150 of the questionable payments to unknown third parties despite knowing that they did not comply with the company’s accounts payable procedures. Frost also allegedly applied his initials to invoices describing services these third parties never performed, and failed to note these questionable transactions in his quarterly SOX sub-certifications. To resolve the allegations, Frost agreed to pay a $20,000 civil penalty.

2016 MID-YEAR FCPA-RELATED DEVELOPMENTS

In addition to the robust pursuit of individual FCPA cases by DOJ and the SEC, the first six months of 2016 also saw important programmatic changes in how DOJ administers its FCPA enforcement program, as well as significant anti-corruption-related developments prominent in the public sphere.

DOJ’s FCPA Pilot Program

On April 5, 2016, DOJ Fraud Section Chief Andrew Weissmann penned a nine-page memorandum highlighting a three-step plan for enhancing FCPA enforcement: (1) adding prosecutors to the FCPA Unit and creating three dedicated squads of FBI special agents to support these investigations;

(2) increased efforts to collaborate with foreign anti-corruption prosecutors; and (3) a new one-year “pilot program” to provide greater transparency on expectations for mitigation credit for voluntary self-disclosure, cooperation, and remediation in FCPA investigations. The first two steps are formal announcements of developments that have been in the works–and which we have been reporting on–for years. The third step relating to the pilot program is significant and deserves further attention.

Under the pilot program, if a company voluntarily self-discloses FCPA-related misconduct, cooperates fully in the ensuing investigation, and appropriately remediates the misconduct, it may receive “up to a 50% reduction” off of the bottom of the applicable U.S. Sentencing Guidelines fine range, and DOJ also “will consider” declining prosecution altogether. For companies that do not self-disclose, but otherwise cooperate and undertake appropriate remediation, DOJ will provide “at most a 25% reduction” off the bottom of the Guidelines range. In all events, companies will be expected to disgorge ill-gotten profits earned as a result of the misconduct, which in the case of issuers will frequently be covered in parallel SEC enforcement actions, but in the case of domestic concerns may take the form of civil forfeiture actions.

With respect to cooperation, the pilot program memorandum provides a detailed list of 11 “threshold requirements” that must be met to receive full credit. These requirements emphasize proactive engagement with DOJ and include providing “all relevant facts known to [the company], including all relevant facts about the individuals involved in any FCPA violation.” Regarding remediation, DOJ identifies several elements that “will generally be required” for a company to receive credit, including the implementation of an effective compliance program, appropriate discipline of employees, and “[a]ny additional steps that demonstrate recognition of the seriousness of the corporation’s misconduct.” However, no credit will be awarded for remediation unless the company fully cooperated. DOJ has indicated that it will be assisted by Hui Chen, its dedicated compliance expert hired in November 2015, in evaluating a company’s remedial actions.

DOJ’s one-year FCPA pilot program expires in early April 2017, at which point DOJ will evaluate whether to extend, jettison, or modify its provisions. It is yet too soon to evaluate the effectiveness of this program, but we will report on its impact in our forthcoming 2016 Year-End FCPA Update.

FIFA Update

We have been covering the corruption scandal that has engulfed the Fédération Internationale de Football Association (“FIFA”) since the May 2015 pre-dawn raid at a luxury Swiss hotel made waves last year. To date, more than 40 individuals and companies have been publicly charged with (non-FCPA) corruption-related offenses for their roles in a decades-long scheme that saw FIFA officials allegedly award lucrative marketing contracts in exchange for hundreds of millions of dollars in bribes. More than a dozen defendants have pleaded guilty, including in 2016:

- Rafael Callejas – former President of Honduras and former president of the country’s soccer federation, pleaded guilty in March 2016 in U.S. federal court to racketeering and wire fraud conspiracy for taking bribes in exchange for awarding media rights for FIFA World Cup qualifier matches;

- Alfredo Hawit – FIFA’s former vice president and an executive committee member, pleaded guilty in April 2016 to one count of racketeering conspiracy, two counts of wire fraud conspiracy, and one count of conspiracy to obstruct justice for a similar scheme; and

- Miguel Trujillo – a FIFA match agent, pleaded guilty to one count of money laundering conspiracy, two counts of wire fraud conspiracy, and one count of filing a false tax return for his role in schemes to bribe FIFA officials.

Panama Papers

Since the news first broke on April 3, 2016, the massive leak of information relating to hundreds of thousands of offshore entities–collectively known as the “Panama Papers”–has taken the corporate and legal communities by storm. In total, the leak extends to 11.6 million documents (2.6 terabytes of information) from Panama-based law firm Mossack Fonseca, including internal e-mails, financial spreadsheets, passports, and corporate records reflecting the owners of various offshore bank accounts and companies and institutions.

An anonymous source reportedly obtained the documents and leaked them to the International Consortium of Investigative Journalists, which, in turn, worked with more than 100 media organizations to analyze the trove of information. In April, a fraction of the data was publicly released, followed by a May 9 release of a larger set of information. We anticipate additional releases in the future.

Although uncertainties abound with respect to the ability to use this information in light of the questionable nature of the publication of arguably privileged documents, U.S. law enforcement officials have signaled their interest in using the documents to investigate potential FCPA violations. SEC FCPA Unit Chief Kara Brockmeyer said recently that the SEC will be reviewing the Panama Papers for indications of potential corruption. Another, unnamed senior law enforcement official is reported as remarking that prosecutors are “chomping at the bit” to “exploit” the Panama Papers “bonanza,” which “will keep a lot of agents very busy for a very long time.”

Unaoil

Another major corruption-related story from early 2016 involves a series of articles published in February based on tens of thousands of leaked e-mails and documents that make sweeping allegations that Monaco-based Unaoil bribed officials in the Middle East, Central Asia, and North Africa for many years to secure lucrative oil contracts on behalf of a client base that reads like a who’s who of multinationals. On the heels of these provocative articles, authorities in the United States, Australia, Iraq, and the UK have launched a large-scale bribery investigation, which, upon the request of the Serious Fraud Office (“SFO), prompted raids by Monaco authorities at Unaoil’s head office and at the residences of certain executives. For its part, Unaoil has stridently denied the allegations, claiming to be a victim of extortion, and has pledged to take legal action against the media for the reputational harm caused by the reporting.

Disgorgement Developments

Any follower of FCPA enforcement knows that disgorgement is frequently the key driver in determining the cost of an FCPA settlement with the SEC. The first six months of 2016 saw two key developments in this area.

First, on May 6, 2016, the IRS released a Chief Counsel Advice Memorandum (CCA 201619008) in which it concluded that a taxpayer could not claim a U.S. federal income tax deduction for a disgorgement payment made to the SEC for FCPA violations. Although U.S. tax rules generally permit taxpayers to deduct ordinary and necessary business expenses, Section 162(f) of the Internal Revenue Code prohibits a deduction for any fine or similar penalty paid to a government for a law violation. The majority of authorities in non-tax contexts have recognized that disgorgement is remedial and not punitive in nature, and thus it has been standard practice for companies resolving FCPA matters to claim a deduction for the disgorgement portion of the settlement (but not portions relating to criminal or civil fines or penalties). In this CCA, the IRS appears to be signaling its litigation position that tax deductions for disgorgement payments in FCPA cases may not always be appropriate. The CCA is not, however, binding legal precedent and it will be for the courts to determine whether disgorgement constitutes a non-deductible fine or penalty.

Second, on May 26, 2016, the Eleventh Circuit in SEC v. Graham held that claims by the SEC for disgorgement and declaratory relief are subject to the five-year statute of limitations set forth in 28 U.S.C. § 2462. This decision, discussed fully in our separate client alert Eleventh Circuit Limits SEC Power to Seek Disgorgement and Declaratory Relief, is significant because it would limit the ability to seek disgorgement for FCPA violations to five years from the time of the claim’s accrual. While the decision represents a significant victory for securities market participants, it remains to be seen whether the Eleventh Circuit’s interpretation of § 2462 will be adopted by other circuits.

2016 MID-YEAR CHECK-IN ON ENFORCEMENT LITIGATION

PDVSA Defendants

We reported in our 2015 Year-End FCPA Update on the FCPA charges against Roberto Enrique, Rincón Fernandez, and Abraham José Shiera Bastidas for allegedly conspiring to corruptly obtain PDVSA contracts. Shiera, a Venezuelan national who resides in Florida, pleaded guilty on March 22, 2016 to one count of violating the FCPA and one count of conspiracy to violate the FCPA and commit wire fraud. Rincón, a U.S. permanent resident of Venezuelan origin, initially pleaded not guilty to all counts but, on June 16, 2016–days before his jury trial was set to begin–pleaded guilty to a revised criminal information charging one count of conspiracy to violate the FCPA, one count of violating the FCPA, and one count of fraud and false statements in connection with his 2010 U.S. federal income tax return.

Four others charged in the case also have pleaded guilty to charges unsealed on March 22, including Moisés Abraham Millán Escobar (whose FCPA plea is discussed above) and three former PDVSA officials. The former PDVSA employees–José Luis Ramos Castillo, Christian Javier Maldonado Barillas, and Alfonzo Eliezer Gravina Munoz–pleaded guilty to conspiracy to commit money laundering, admitting to accepting bribes from Shiera and Rincón in exchange for help securing PDVSA contracts, and to conspiring with Shiera and Rincón to launder the bribes. Gravina also pleaded guilty to making false statements on his 2010 U.S. federal income tax return, for failing to report the bribe payments he received. As foreign government officials, the former PDVSA employees are not subject to the FCPA, but as has been repeatedly demonstrated in recent years, DOJ aggressively pursues bribe recipients under other U.S. statutes such as money laundering.

All defendants are currently scheduled to be sentenced on September 30, 2016.

BANDES Defendants

We have been following for several years now the prosecution of numerous employees of Wall Street broker-dealer Direct Access Partners LLC for their payment of kickbacks to a former official of the Venezuelan state-owned economic development bank, Banco de Desarrollo Económico y Social de Venezuela (“BANDES”). On January 15, 2016, the beneficiary of this pay-to-play scheme–Maria de los Angeles Gonzalez de Hernandez–was sentenced to time served after spending nearly 17 months in prison during the course of the investigation, and ordered to forfeit $8.3 million. At the sentencing hearing, prosecutors detailed extensively Gonzalez’s cooperation, which “enabled [them] to get all the way up to the c-suite,” while U.S. District Judge Denise Cote of the Southern District of New York acknowledged Gonzalez’s apparent remorse and individual circumstances.

On April 6 and 7, 2016, U.S. District Judge Jesse Furman of the Southern District of New York entered final judgments against each of the Direct Access Partners defendants from the SEC’s 2013 civil suit, based on consent agreements entered into with the SEC. The defendants were ordered to pay a combined total of $42.5 million in disgorgement and prejudgment interest, which was deemed satisfied by the forfeiture orders previously entered in the parallel criminal cases.

Dmitrij Harder

When we last reported on the FCPA prosecution of Dmitrij Harder in our 2015 Year-End FCPA Update, Harder had filed motions to dismiss the January 2015 indictment arguing, among other things, that the provision of the FCPA that renders employees of “public international organizations” “foreign officials” is unconstitutional both under the non-delegation doctrine and because it is unconstitutionally vague. On March 2, 2016, the Honorable Paul S. Diamond of the U.S. District Court for the Eastern District of Pennsylvania denied Harder’s motions to dismiss, rejecting both constitutional arguments. With respect to the non-delegation argument, the Court held that it is permissible for Congress to delegate to the Executive Branch the ability to designate “public international organizations” (and thus their employees “foreign officials” for purposes of the FCPA) because the FCPA provides a clear legislative goal of promoting foreign commerce by American businesses, clearly confers the authority to the President, and narrowly tailors this authority by requiring congressional involvement (in the form of ratifying treaties) in the process. With respect to the vagueness argument, Judge Diamond held that a person of ordinary intelligence would have no difficulty identifying the relevant organization (European Bank for Reconstruction and Development) as a public international organization within the FCPA’s ambit.

Following the resolution of the motions to dismiss, a flurry of pre-trial motions were filed by both sides relating to, among other issues, the availability of Rule 15 depositions of foreign-based witnesses, the preclusion of certain arguments from trial, and the admissibility of certain evidence. Significantly, on April 15, 2016, the Court denied Harder’s motion to suppress statements he gave during a border control interview at JFK International Airport, finding that the interview was non-custodial. Five days later, Harder pleaded guilty to two counts of violating the FCPA.

On June 2, 2016, Harder filed a motion in the U.S. Court of Appeals for the Third Circuit seeking his release from custody pending sentence; the appellate court denied bail on June 22, 2016. Harder’s sentencing before the district court–originally scheduled for July 21–has now been postponed to November 3, 2016.

Lawrence Hoskins

As discussed in our 2015 Year-End FCPA Update, DOJ submitted a motion for reconsideration on August 27, 2015 after the Honorable Janet Bond Arterton of the U.S. District Court for the District of Connecticut partially granted former Alstom S.A. executive Lawrence Hoskins‘s motion to dismiss certain charges pending against him. The Court previously held that Hoskins could not be criminally liable for conspiring to violate or aiding and abetting a violation of the FCPA, pursuant to the Gebardi principle, unless the government establishes that he was acting as an “agent” of a “domestic concern” (here, Alstom’s U.S. subsidiary) in connection with the alleged bribery scheme.

On March 16, 2016, Judge Arterton denied the Government’s motion for reconsideration. Two weeks later, in a relatively rare move that underscores the programmatic importance of this issue to the Department, DOJ filed an interlocutory notice of appeal to the U.S. Court of Appeals for the Second Circuit. DOJ’s brief to the Second Circuit is due on August 15, 2016.

Biomet, Inc. Deferred Prosecution Agreement Extended (Again)

We reported in our 2015 Mid-Year FCPA Update on the rare extension of Biomet‘s reporting obligations pursuant to its 2012 FCPA-related deferred prosecution agreement with DOJ and civil settlement with the SEC. These obligations, which originally were set to expire in March 2015, were extended just before the expiration of their term due to an investigation into new whistleblower complaints in Brazil and Mexico. In March 2016, Biomet disclosed that DOJ and the SEC were continuing to evaluate the situation and that the obligations of the 2012 agreements would remain in force until the new investigations were resolved. Then, in a June 6, 2016 status report filed in the U.S. District Court for the District of Columbia, DOJ stated that it has determined that Biomet breached its deferred prosecution agreement based on the conduct in Mexico and Brazil and the company’s alleged failure to implement an adequate compliance program. According to the status report, discussions between Biomet and the government are ongoing and Biomet remains committed to cooperating with DOJ and the SEC.

2016 MID-YEAR FCPA-RELATED PRIVATE CIVIL LITIGATION

Our readership is well aware that the FCPA provides no private right of action, yet plaintiffs’ attorneys continue to employ other causes of action to seek recompense for losses allegedly associated with purported FCPA-related misconduct. A selection of matters that saw developments in the first half of 2016 follows.

Shareholder Lawsuits

Cobalt International Energy, Inc.

In our 2014 Year-End FCPA Update, we reported on the November 30, 2014 securities fraud lawsuit brought by a putative class of shareholders in the U.S. District Court for the Southern District of Texas alleging that Cobalt lost billions of dollars because it “misrepresented, and failed to disclose, the corrupted nature of its business in Angola and the true value of the Company’s Angolan oil wells.” This came after Cobalt announced that it had received a “Wells Notice” indicating that the SEC Staff were prepared to recommend charges against the company for alleged FCPA violations in Angola. Since then, two additional shareholder suits (one securities fraud, the other shareholder derivative) have been brought against Cobalt arising from similar allegations. Notably, on January 28, 2015, the SEC Staff advised the company that it was declining to recommend any enforcement action relating to Angola, although DOJ’s investigation reportedly remains ongoing.

All three cases are currently assigned to the Honorable Nancy F. Atlas. On January 19, 2016, Judge Atlas dismissed the claims in the consolidated securities fraud action against the securities underwriters, but the suit continues with respect to the remaining defendants. Meanwhile, in the derivative case, Judge Atlas granted the Cobalt directors’ motion to dismiss on November 25, 2015, citing the plaintiff’s failure to allege the relevant dates of his acquisition and retention of his shares and failure to allege why presenting the demand to the Board of Directors would have been futile. The motion was granted with leave to file a second amended complaint, but the plaintiff neither filed an amended complaint nor requested an extension of the January 8, 2016 deadline, and, as a result, the derivative case was dismissed and terminated on February 2, 2016.

Freeport-McMoRan Inc.

On January 26, 2016, shareholders filed a securities fraud class-action suit against Freeport-McMoRan Inc. in the U.S. District Court for the District of Arizona, alleging that the NYSE-listed natural resources company failed to disclose that the head of the company’s Indonesian subsidiary bribed Indonesian government officials in exchange for an extension of the company’s right to operate in the country, in violation of the FCPA. The suit follows testimony that the president-director of Freeport Indonesia gave to an ethics tribunal of the Indonesian House of Representatives last December, in which he stated that the speaker of the House of Representatives had solicited a bribe constituting a 20% interest in the company in exchange for contract renewal. It is unclear whether DOJ and the SEC are investigating this matter.

Key Energy Services, Inc.

As described in our 2014 Year-End FCPA Update, on August 15, 2014 a putative class of Key Energy Services, Inc. shareholders filed a securities fraud complaint in the U.S. District Court for the Southern District of Texas, alleging that Key Energy fraudulently concealed that it had engaged in corrupt practices in Russia. After multiple judicial recusal orders and reassignments, Key Energy filed a motion to dismiss the complaint in 2015. On March 31, 2016, the Honorable Melinda Harmon granted the motion to dismiss, focusing on the plaintiff’s failure to plead adequately the elements of their fraud claims, and specifically holding that plaintiff did not plead specific facts to show that key management personnel knowingly made false statements. The defendant chose not to file any subsequent motions, and the case was terminated on April 26, 2016. Key Energy has reported that DOJ has closed its investigation of the company, and that the company is in discussions with the SEC to resolve the matter.

RICO Actions

Yahoo! Inc.

In our 2014 Year-End FCPA Update, we reported that two private Mexican companies–Worldwide Directories, S.A. de C.V. and Ideas Interactivas, S.A. de C.V.–initiated a RICO suit in the U.S. District Court for the Southern District of New York against Yahoo! Inc., Yahoo!’s Mexican subsidiary, and the companies’ law firm, Baker & McKenzie LLP. The plaintiffs alleged that the defendants corruptly influenced members of the Mexican judiciary in order to overturn an unprecedented $2.7 billion judgment in the plaintiffs’ favor. The defendants moved to dismiss the RICO suit in March 2015, noting that, by that time, multiple Mexican courts had ruled in the plaintiffs’ favor.

On March 31, 2016, the Honorable Alison J. Nathan dismissed the RICO suit with prejudice. The Court noted that the plaintiffs failed to plausibly allege Yahoo!’s involvement. The RICO claims against Baker & McKenzie were also dismissed for the plaintiffs’ failure to plead a predicate act. Gibson Dunn represents Yahoo! in this matter.

Siemens FOIA Litigation

As reported in our 2014 Year-End FCPA Update, non-profit news media organization 100Reporters LLC has filed a Freedom of Information Act (“FOIA”) lawsuit in the U.S. District Court for the District of Columbia against DOJ seeking the release of records related to its 2008 FCPA resolution with Siemens AG and the monitorship that followed. Siemens and its former compliance monitor, Dr. Theo Waigel, were allowed to intervene in the lawsuit and assert their interests.

On March 22, 2016, DOJ, Siemens, and Dr. Waigel filed motions for summary judgment, arguing that the materials sought by 100Reporters are exempt from disclosure under four FOIA exemptions. Supporting the motions were extensive declarations from an Assistant Chief in DOJ’s FCPA Unit, a former DOJ Fraud Section attorney, an Assistant Director of SEC Enforcement involved in the monitorship, independent U.S. counsel to Dr. Waigel during the monitorship, Siemens’ Associate General Counsel and Head of Compliance Regulatory Case Handling for the Americas, and an information specialist in the DOJ FOIA/Privacy Act Unit. On April 22, 2016, 100Reporters filed a consolidated opposition and cross-motion for summary judgment, arguing that the exemptions do not apply and challenging DOJ’s Vaughn Index justifying the FOIA bases for withholding the documents in question. According to the most recent scheduling order, reply briefs are due in the second half of 2016. Gibson Dunn represents Dr. Waigel in this matter, as it did during the monitorship itself.

Although the underlying FOIA litigation has not been resolved, the Court’s opinion on intervention recognizes an independent monitor’s confidentiality interests and the importance of disclosure protections to ensure that a monitor can access the books, records, employees, and facilities of a monitored entity. While the Court has not reached the ultimate merits of the monitor’s position, it has recognized the importance of his interest in preserving confidentiality by granting him the opportunity to intervene and advocate for nondisclosure.

2016 MID-YEAR INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

World Bank Enforcement

Perhaps the most important development over the past six months for the increasingly robust enforcement role played by the World Bank Integrity Vice Presidency (“INT”) was the decision of the Canadian Supreme Court in the closely watched case of World Bank Group v. Wallace. As discussed in our 2015 Year-End FCPA Update, former employees of SNC-Lavalin Group Inc. were charged with Corruption of Foreign Public Officials Act violations in Canada after INT provided information to Canadian prosecutors arising from its own investigation and the Canadian prosecutors then obtained wiretaps based on INT’s lead. The defendants challenged the wiretap authorizations and sought an order requiring INT to produce certain investigative records. INT claimed sovereign immunity as is its normal practice, but this time the trial court held that the World Bank had waived its immunity by voluntarily providing evidence to prosecutors. While the case was on appeal, INT suspended its standard practice of making referrals to national authorities, in Canada and elsewhere.

On April 29, 2016, the Canadian high court upheld the Bank’s asserted privileges and immunities. While lauding the World Bank’s place “at the frontlines of international anti-corruption efforts” and suggesting that an implied waiver of immunity would “have a chilling effect on collaboration with domestic law enforcement,” the Court also determined that the defendants had not established that the records sought would have even been relevant to their wiretap challenge–perhaps sidestepping a showdown between the Bank’s privileges and immunities and issues of fundamental fairness and due process.

Bank personnel have indicated that they are considering refinements to their referral practices in light of the decision. Members of the defense bar, meanwhile, have expressed concern that immunity for the Bank in similar circumstances could result in concomitant reductions in due process protections for criminal defendants.

Europe

United Kingdom

After a flurry of concluded enforcements at the end of 2015, the first half of 2016 saw one individual convicted of foreign bribery, two companies receive sentences related to alleged corruption, and one company enter into a civil settlement.

Enforcement

As we reported in our 2014 Year-End FCPA Update, on December 22, 2014, Smith & Ouzman Limited was found guilty of three counts of corruptly agreeing to make payments in violation of Section 1(1) of the Prevention of Corruption Act 1906, the Bribery Act’s predecessor statute. On January 8, 2016, the company was sentenced and ordered to pay a total of £2.2 million, which includes a confiscation order of £881,158. The confiscated funds will be sent to Kenya.

Following its December 18, 2015 guilty plea to a Section 7 offense for failing to prevent its subsidiary from paying bribes to win a hotel construction contract in Dubai (covered in our 2015 Year-End FCPA Update and 2015 Year-End United Kingdom White Collar Crime Update), Sweett Group PLC was sentenced on February 19, 2016 and ordered to pay a fine of £1.4 million, disgorge more than £850,000 in profits, and pay approximately £95,000 in costs.

Following on the Brand-Rex settlement (covered in our separate client alert Serious Fraud Office v Standard Bank Plc: Deferred Prosecution Agreement), in April, Braid Logistics (UK) Limited became the latest company to enter into a civil settlement with Scotland’s Civil Recovery Unit under the amnesty program run by the Crown Office and Procurator Fiscal Service. After becoming aware of potential improper activities related to two freight forwarding contracts in 2012, Braid conducted an investigation and voluntarily self-reported to the Crown Office. Limited information has been reported to date regarding the underlying conduct as the authorities are considering whether to prosecute the individuals involved, but on one of the contracts, a Braid employee appears to have schemed to pay for benefits, including personal travel, gifts, and cash for a customer employee, funded by submitting inflated invoices to the customer. During the investigation of this contract, separate concerns were identified relating to a profit sharing arrangement with a director of a second customer. Under the terms of the agreement, which includes Section 1 and Section 7 offenses, Braid will pay £2.2 million, representing profits resulting from the unlawful conduct.

On May 11, following a joint investigation by the SFO and Australian Federal Police and a five-week trial, Peter Chapman, a former manager of Securency PTY Ltd., was convicted of four counts of making corrupt payments to a foreign official in violation of the Prevention of Corruption Act 1906, while being acquitted of two other counts. In particular, Chapman was alleged to have paid bribes of $205,000 to an agent of Nigerian Security Printing and Minting PLC, in order to secure orders for the purchase of products from his former employer. Following the conviction, Chapman was sentenced to 30 months in prison on each count, to be served concurrently.

Legislation

On May 20, 2016, the Bermudan Attorney General announced plans to introduce new legislation to modernize the country’s laws on bribery and corruption. The new act will be based on the U.K. Bribery Act 2010, creating four new offenses modelled on Sections 1, 2, 6 and 7 of the Bribery Act. The proposed act also will contain the “adequate procedures” defense available under the Bribery Act. As reported in our 2012 Year-End FCPA Update, this announcement follows the Isle of Man enacting its Bribery Act in May 2013, as well as publication of a white paper in June 2012 through which the U.K. government stated that it “expected” the British overseas territories, including Bermuda, to implement anti-corruption legislation reflecting the OECD Convention. Feedback on the proposed law was requested by May 31, and we will continue to monitor related developments.

France

Enforcement

We noted in our 2015 Year-End FCPA Update the July 2013 acquittal of French oil company Total S.A. and Swiss energy trading company Vitol of foreign corruption charges arising out of the U.N. Oil-for-Food Program by a Paris regional criminal court. On February 26, 2016, the Paris appeals court overturned the acquittals, and ruled that Total and Vitol had to pay €750,000 and €300,000, respectively. The appeals court found Total guilty of corrupting foreign officials, based on French prosecutors’ accusations that Total had bypassed a designated U.N. escrow account when purchasing oil from Iraq between 2000 and 2002, which allowed it to make extra payments to the Iraqi government through its suppliers. Total has challenged the Paris appeals court’s decision before the French Cour de cassation.

Legislation

We also covered in our 2015 Year-End FCPA Update Loi Sapin II, the anti-corruption legislation proposed by French Finance Minister Michel Sapin in July 2015 that, if passed, would create a new administrative anti-corruption agency, a legal basis for the implementation of independent compliance monitors, and a new requirement that French businesses implement internal anti-corruption compliance programs. In January 2016, draft legislation was amended to include provisions for a new settlement tool similar to deferred prosecution agreements–the “convention de compensation d’intérêt public” (“CCIP”)–that would allow companies to pay fines and engage in remediation in exchange for suspension of charges against them. On March 24, however, the Conseil d’État–France’s highest administrative court, which is tasked with reviewing draft legislation sponsored by non-members of Parliament–issued an advisory opinion critical of the CCIP, leading this provision to be omitted from the version of the bill later submitted to the French Parliament’s National Assembly. A settlement mechanism was reinserted during the parliamentary process, in the form of a “convention judiciaire d’intérêt public,” a procedure that requires a judge to oversee a public and adversarial proceeding before approving a settlement proposed by the prosecutor. On June 14, 2016, the National Assembly adopted Loi Sapin II, which is now proceeding through the other legislative chamber, the Senate, according to an accelerated process (which requires only one reading of the bill in each chamber of Parliament). As of June 22, 2016, the bill has emerged from a Senate committee with the settlement procedure intact–subject to some editorial modifications, and now styled as a “transaction judiciaire.” The Senate is scheduled to discuss Loi Sapin II during public sessions the week of July 4, 2016, and we will continue to monitor its status.

Germany

Introduction of Section 335a to the German Criminal Code

On November 26, 2015, the Act to Combat Corruption entered into force. The Act added Section 335a to the German Criminal Code (Strafgesetzbuch – StGB), which was among other things designed to implement the Criminal Law Convention on Corruption of the Council of Europe of January 27, 1999, as well as the Additional Protocol of May 15, 2003 appended thereto. The new Section 335a references Sections 331 et seq. of the German Criminal Code, which sanction offenses committed in public office and also contain substantial anti-corruption legislation governing German public officials. Section 335a broadens the applicability of Sections 331 et seq. to certain foreign and international judges, certain staff members who are associated with foreign public service or international organizations, and certain members of the armed forces. Our clients should be aware that the parity of foreign public officials with German public officials under Section 335a applies even outside of German territory if there is a nexus to Germany. As a consequence, German anti-corruption standards, for example, for presents and invitations, must be observed in this case when interacting with foreign public officials abroad.

Sections 299a and 299b to the German Criminal Code

On June 4, 2016, the German Act to Combat Corruption in the Healthcare Sector (Gesetz zur Bekämpfung von Korruption im Gesundheitswesen) entered into force. The Act’s major element is the addition of Sections 299a and 299b to the German Criminal Code (Strafgesetzbuch – StGB), which sanctions passive and active bribery in the healthcare sector, respectively. A legislative reaction to a 2012 ruling by the Federal High Court of Justice (Bundesgerichtshof) holding that resident medical practitioners are not to be treated as public officials under German anti-corruption legislation, Sections 299a and 299b now apply to all healthcare professionals whose profession requires a state-recognized, vocational education, and penalize corrupt conduct related to medical prescriptions, the supply of certain medical products, and referral of patients with imprisonment of up to three years or a fine.

German Federal Constitutional Court on Extradition to the United States

A recent decision by the German Federal Constitutional Court (Bundesverfassungsgericht) may be of crucial importance for future extraditions between Germany and the United States in multi-jurisdictional matters. In March 2016, the court remanded a 2015 ruling by the Higher Regional Court of Frankfurt and thereby stopped the deportation by German authorities of a Swiss national to the United States. The Federal Constitutional Court’s ruling took issue with a 2015 decision by the U.S. Court of Appeals for the Second Circuit in United States v. Suarez regarding the contours of the Principle of Specialty under international law. For the sake of international comity, the Principle of Specialty generally requires a country seeking extradition to adhere to any limitations placed on prosecution by the surrendering country. In interpreting this principle, the Suarez court held that an extradited person lacks standing to challenge the requesting nation’s adherence to the doctrine absent an official protest by the extraditing nation. Because German law requires courts to assess whether a requesting nation adheres to the Principle of Specialty before extraditing a person in German custody to that nation, the Federal Constitutional Court noted its disapproval with the Suarez decision in holding that the complainant could not be extradited to the United States. Specifically, it held that the mere reference to the opportunity of requesting the extraditing nation to raise an official protest generally violates the Right to Personal Freedom guaranteed by Article 2 subsection 2 of the German Constitution, and, in any case, violates the General Freedom of Action guaranteed by Article 2 subsection 1.

The Netherlands and Norway

As discussed above, a global settlement was reached with Dutch-based VimpelCom Ltd. in February 2016 involving DOJ, the SEC, and the Dutch Public Prosecution Service. The penalties imposed by the Dutch Public Prosecution Service totaled approximately $397.5 million. At the time of the settlement, the Prosecution Service announced that it is investigating several individuals in connection with the case.

A related investigation by the National Authority for Investigation and Prosecution of Economic and Environmental Crime in Norway (ØKOKRIM) reportedly remains ongoing. Norwegian authorities have not yet withdrawn charges against former CEO Jo Lunder, who was arrested in November 2015 on suspicion of corruption relating to business in Uzbekistan. Lunder denies the charges.

Russia

Documents leaked as part of the Panama Papers name one of President Putin’s childhood friends–renowned cellist Sergei Roldugin, who continuously denies having any business dealings–as the owner of several offshore entities that entered into transactions with state-run companies. The Panama Papers also have prompted inquiries about commercially questionable transactions involving some of President Putin’s other close associates. President Putin’s administration has responded by stating that these allegations constitute yet another attempt to attack personally Russia’s president and to destabilize the Russian government.

In other developments, Vladivostok mayor Igor Pushkarev has been charged with commercial bribery and is being held without bail. Prosecutors contend that between 2009 and 2014, Pushkarev used his position to facilitate an arrangement whereby his friend’s construction company purchased supplies at inflated prices from another company controlled by Pushkarev’s close relatives, and, as a result, Pushkarev received kickbacks in excess of $2.4 million. Pushkarev denies involvement in this scheme and has expressed willingness to cooperate with the investigation.

Ukraine

Investigative Developments

During the first half of 2016, the newly established National Anti-Corruption Bureau of Ukraine initiated a few high-profile anti-corruption investigations, including an investigation into Ukraine’s largest commercial airline, and an investigation into natural gas sales by Ukraine’s national natural gas exploration company. The latter investigation has led to several high-profile arrests and the Ukrainian Parliament’s approval of the arrest of a member of Parliament. Nevertheless, Ukrainian enforcement agencies still experience challenges in securing convictions in anti-corruption matters, a trend that many hope the judicial reform and the creation of a specialized anti-corruption court will address.

In other Panama Papers developments, documents leaked name President Petro Poroshenko as an indirect owner of a British Virgin Islands entity. President Poroshenko and his advisors have claimed that the entity was created to facilitate the transfer of President Poroshenko’s confectionary business to a revocable trust to be run by an international investment firm. President Poroshenko’s advisors also have claimed that no tax laws were violated because this entity, and its subsidiaries in Cyprus and the Netherlands, did not engage in any transfers of funds. Many in Ukraine believe that President Poroshenko may have violated his obligation to declare assets, but the National Anti-Corruption Bureau of Ukraine has stated that it has no jurisdiction over the President, and the Parliament is still to decide whether and how to investigate the matter.

Legislative Developments

The first half of 2016 saw the passing of two key pieces of legislation aimed at combatting corruption in Ukraine: first, a measure requiring public officials and government employees to declare their full income and assets; and second, a constitutional reform seeking to curtail the incidence of bribery within Ukraine’s judicial branch. Both laws were enacted–at least in part–to satisfy Ukraine’s obligations under the European Union’s Action Plan on Visa Liberalization.

The first law encountered some difficulties and was vetoed by President Poroshenko in its initial iteration, which did not create liability for providing false information in the declarations submitted by public officials and government employees. This earlier draft mandated the declaration of income, real estate, and vehicles, the value of which exceeds a minimal government salary by factors specified in the legislation; however, the draft postponed the criminalization of false declarations until 2017. In its final form, by contrast, the law instituted criminal liability–fines or even prison time–for submitting egregiously false declarations, effective April 1, 2016.

The second legislative action, the judicial constitutional reform, increases the accountability of judges, limits judicial immunity, creates an anticorruption court, and reinstates the three-level judicial system with a Supreme Court at the top. The latter provision abolishes the additional specialized courts, established by former president Victor Yanukovych in what many viewed as his effort to dilute the judiciary’s independence by appointing judges beholden to him to courts not subject to the Supreme Court’s appellate jurisdiction.

The Americas

Argentina

Investigations into alleged corruption in the administrations of now-deceased President Néstor Kirchner and his wife and successor, Cristina Fernández de Kirchner, have intensified since the latter left office in December 2015. The two former presidents, as well as members of their governments, have been implicated in a variety of schemes.

One of the accusations made against Fernández involves the Central Bank of Argentina’s decision to sell up to $17 billion of dollar futures contracts at artificially low prices, allegedly in an effort to make the country’s finances appear stronger ahead of the November 2015 presidential election (which Fernández’s party lost). The undervalued dollar futures contracts lost Argentina roughly $5.5 billion. On May 13, 2016, Fernández and more than a dozen others–including Axel Kicillof, the former economy minister, and Alejandro Vanoli, the former head of the Central Bank–were indicted in connection with the scheme on charges of “unfaithful administration to the detriment of public administration.”

Fernández also is the subject of two other criminal investigations. The first relates to accusations that the Kirchner family was involved in a large-scale international money laundering scheme, in which millions of dollars were funneled to a Swiss bank via offshore companies owned by the Kirchners’ business partner, Lázaro Báez. Báez and his employee Leonardo Fariña were arrested this spring in connection with the investigation.

Other members of the Kirchner and Fernández administrations are also under investigation, including former Minister of Planning and Public Investment Julio de Vido and José Francisco López, the former Secretary of Public Works. On June 14, 2016, López was arrested while attempting to bury more than $8 million in various currencies and several luxury watches in the garden of a monastery outside Buenos Aires.

The Bahamas