January 4, 2017

The pendulum swung sharply back this year from 2015’s record volume of corporate non-prosecution agreements ("NPAs") and deferred prosecution agreements ("DPAs"), but the overall yield remained generally consistent with the prosecutions we have seen since the 2008–2009 economic recession.[1] As we approach 2017 and the changes that the incoming administration will inevitably bring, it is difficult to determine what the future holds for NPAs and DPAs; however, there are several reasons to believe that they will continue to play a prominent role in criminal and civil enforcement, as explored in the sections that follow.

This client alert, our seventeenth biannual update on NPAs and DPAs, caps the year in corporate enforcement actions by: (1) summarizing NPA and DPA highlights from 2016 and analyzing results in light of prior years; (2) spotlighting Foreign Corrupt Practices Act ("FCPA") enforcement, which dominated the NPA and DPA sphere in 2016; (3) drawing upon historical trends to forecast the continued role of NPAs and DPAs in the next administration; (4) addressing developments in compliance monitorship arrangements, including continued attempts to invade monitorship confidentiality and judicial involvement in monitor selection; and (5) overviewing international DPA regime developments in the United Kingdom and France.

NPAs and DPAs in 2016

In 2016, the Department of Justice ("DOJ") and the Securities and Exchange Commission ("SEC") collectively entered into thirty-five corporate NPAs and DPAs, of which twenty-one were NPAs and fourteen were DPAs. The SEC, which heavily favors administrative orders over NPAs or DPAs for resolving enforcement actions, accounted for two of the thirty-five agreements–both NPAs addressing alleged violations of the FCPA. This is only the second time in history that the SEC has issued more than one corporate NPA or DPA in a single year. The last time was in 2011, when the SEC negotiated NPAs with Federal Home Loan Mortgage Corporation (Freddie Mac) and Federal National Mortgage Association (Fannie Mae) over securities fraud allegations, and a DPA with Tenaris S.A. over FCPA allegations.

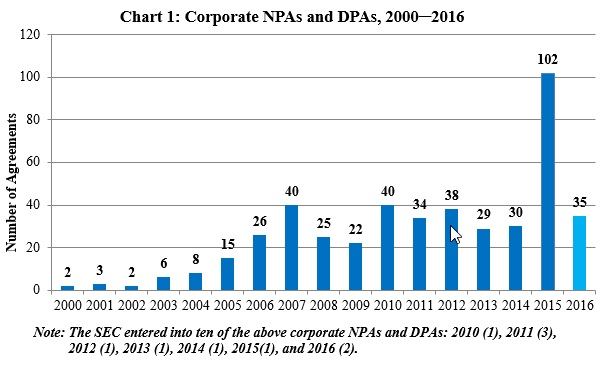

As shown below, the number of corporate NPAs and DPAs slowed considerably after 2015, a year in which the number of concluded NPAs was drastically inflated due to the DOJ Tax Division’s Program for NPAs or Non-Target Letters for Swiss Banks (the "Swiss Bank Program").[2] In 2016, we identified thirty-five publicly available corporate NPAs and DPAs, including the final three NPAs issued under the Swiss Bank Program.[3] This is not, however, inconsistent with recent years; although the number of agreements identified in 2015 exceeded one hundred, only twenty-six of these agreements involved matters other than tax-related and monetary transaction offenses. And in 2014 and 2013, we saw thirty and twenty-nine agreements, respectively. Setting aside the outsized impact of the Swiss Bank Program, therefore, the number of corporate NPAs and DPAs has been relatively consistent in recent years.

Chart 1 below shows all known corporate NPAs and DPAs since 2000.[4]

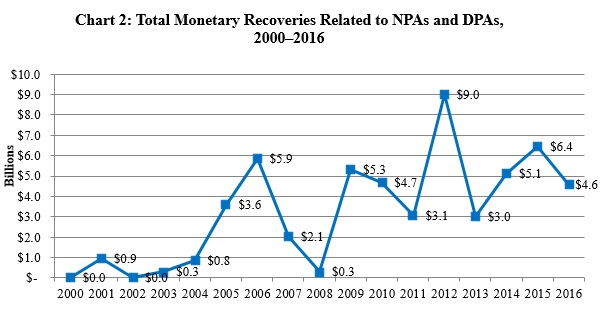

Chart 2 below illustrates the total monetary recoveries related to NPAs and DPAs from 2000 through today. Monetary recoveries associated with 2016 NPAs and DPAs also were consistent with recoveries in years past. Where 2014 and 2015–with 30 and 102 agreements, respectively–saw $5.1 billion and $6.4 billion in recoveries, 2016 saw $4.6 billion.

A Reinvigorated Foreign Corrupt Practices Act

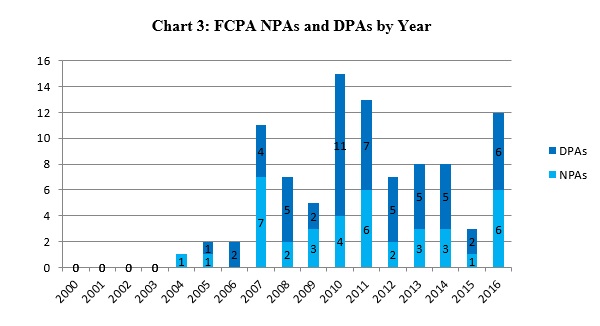

As discussed in our 2016 Mid-Year Update, 2016 was a year of redoubled focus on FCPA enforcement by both DOJ and the SEC. Indeed, at twenty-five, FCPA corporate resolutions in 2016 exceeded every other year in FCPA enforcement since the FCPA’s enactment in 1977. Consistent with this increase, NPAs and DPAs concluded this year for FCPA allegations were at their highest point since 2011.

Importantly, while the number of FCPA NPAs and DPAs did not reach a record high in 2016, this does not necessarily indicate that the Fraud Section is opting for other resolution methods. The percentage of corporate FCPA resolutions involving at least one NPA or DPA (whether parent- or subsidiary-level, DOJ- or SEC-driven) has fluctuated over the years, but has averaged approximately 54% per year since 2004. Unlike 2004 and 2015, when the percentage of corporate FCPA resolutions involving NPAs or DPAs did not breach 30%, 2016’s rate of 44% is not a meaningful outlier.

|

Year |

Resolved with at Least One NPA or DPA |

Resolved without NPAs or DPAs |

Total Resolutions |

NPA/DPA Use as Percentage of Total |

|

2004 |

1 |

3 |

4 |

25% |

|

2005 |

2 |

2 |

4 |

50% |

|

2006 |

2 |

1 |

3 |

67% |

|

2007 |

11 |

5 |

16 |

69% |

|

2008 |

7 |

3 |

10 |

70% |

|

2009 |

4 |

7 |

11 |

36% |

|

2010 |

14 |

8 |

22 |

64% |

|

2011 |

9 |

6 |

15 |

60% |

|

2012 |

9 |

3 |

12 |

75% |

|

2013 |

7 |

3 |

10 |

70% |

|

2014 |

5 |

5 |

10 |

50% |

|

2015 |

3 |

8 |

11 |

27% |

|

2016 |

12 |

13 |

25 |

44% |

|

Average |

6.6 |

5.2 |

11.8 |

54% |

Indeed, at ninety-three agreements, FCPA NPAs and DPAs have accounted for more than 20% of corporate NPAs and DPAs since we first began tracking them in 2000. The FCPA piece of the NPA/DPA enforcement pie is the largest occupied by a single statute, with the only larger category of NPAs/DPAs–at approximately 30%–broadly encompassing all forms of fraud. Given this history, FCPA enforcement is an area where we expect to see steady application of these settlement agreements.

Furthermore, there are a number of institutional factors that militate in favor of continued FCPA enforcement activity in the near term. At the moment there are a significant number of FCPA matters at various points in the investigative/resolution process which will likely linger well into, and beyond, 2017, and there is a sizeable enforcement division within DOJ dedicated to their prosecution.[5] Additionally, FCPA resolutions currently account for a material portion of DOJ monetary recoveries. While DOJ has yet to release statistics for Fiscal Year 2016, assuming that DOJ’s total recoveries for all criminal and civil cases remained constant for FY 2016, penalties in connection with DOJ’s FCPA resolutions with corporate defendants will represent just over 3% of total collections.

HMT LLC and NCH Corporation "Declination" Letters

In the latter half of 2016, DOJ’s Fraud Section also released two so-called "declination" letters that drew our attention because they look remarkably similar to NPAs. These two letters, issued to HMT LLC and NCH Corporation, contain traditional declination language to the effect that DOJ is "closing its investigation(s)," but they go on to impose disgorgement requirements ($2,719,412 and $335,342, respectively) and find that both companies violated the FCPA.[6] Both letters were issued pursuant to the FCPA Pilot Program, which was announced on April 5, 2016, and addressed in our 2016 Mid-Year Update.

These letters, which read like "declinations plus" or "NPAs lite," are unprecedented. Like NPAs, they go on to recite the many factors that went into DOJ’s decisions, including, in both cases: (1) voluntary self-disclosure; (2) comprehensive internal investigation; (3) full cooperation with DOJ (including provision of all relevant known facts about individuals involved in, or responsible for, the alleged misconduct) and commitment to continued cooperation; (4) an agreement to disgorge profits from the alleged illegal conduct; (5) improvements to the company’s compliance program and internal accounting controls; and (6) full remediation (including disciplinary action against relevant employees). Like NPAs, but unlike traditional declination letters, these letters–also tellingly referred to as "letter agreement[s]"–are counter‑signed by HMT LLC and NCH Corporation, and include "agreements" by these companies to the disgorgement terms and to the facts and conditions set forth in the letters. Furthermore, like NPAs, these letters do not have the ring of finality; each ends with the warning that "if [DOJ] learns any information that changes its assessment of any of the factors outlined above, it may reopen its inquiry." Although DOJ may be calling these "declinations,"[7] they very much encroach on NPA territory. Please see our 2016 Year-End FCPA Update for further analysis regarding these letters.

NPAs and DPAs in the Trump Administration

Donald J. Trump assumes the Presidency on January 20, 2017, and his inauguration will bring inevitable changes to the composition and mandate of DOJ. While it may be tempting to dissect campaign rhetoric to predict broad swings in the future of corporate enforcement, the effect of campaign positions and historical statements on actual policy is always unpredictable. Senator Jefferson Beauregard Sessions III, who was tapped for the Attorney General role in late November 2016, was among Mr. Trump’s first announced cabinet appointees, but ultimately, the direction of corporate enforcement in the next administration will be heavily influenced by the Deputy Attorney General ("DAG")–the second-ranked position in the Justice Department–and the Assistant Attorney General for the Criminal Division. Several recent DAGs have issued foundational policy pronouncements shaping the standards for corporate prosecution, including the Holder Memorandum,[8] the Thompson Memorandum,[9] the Filip Memorandum,[10] and the McNulty Memorandum[11]. Most recently, DAG Sally Quillian Yates issued a memorandum to DOJ setting policy regarding individual accountability for corporate wrongdoing (the "Yates Memorandum").[12]

What we do know is that the individuals named to Mr. Trump’s DOJ landing team are highly respected professionals with distinguished careers in government and private practice, many of whom are veterans of the Justice Department;[13] they can be expected to approach the transition with professionalism and pragmatism. Furthermore, with more than ten thousand attorneys nationwide across ninety-three U.S. Attorneys’ Offices, multiple litigation divisions, and management, policy, investigatory and law enforcement offices, DOJ is an apparatus that by virtue of its size and institutional history is largely characterized by measured–not drastic–shifts. As is typical of any changing of the guard, some members of DOJ leadership will rotate out, but others will remain to provide a degree of continuity. Most notable among those who have already agreed to stay is Preet Bharara, whom Mr. Trump asked in early December to continue on as U.S. Attorney for the Southern District of New York.[14]

The following discussion first explores in general terms the next administration’s potential approach to corporate enforcement. It then evaluates the role that NPAs and DPAs will have in shaping corporate enforcement settlements in the years to come.

Corporate Enforcement under a Sessions Department of Justice

While much speculation swirls around the potential impacts of a Sessions DOJ on immigration, terrorism, and enforcement of federal drug and gun laws,[15] at present, there are signs of some degree of stability and continuity in white collar enforcement. Mr. Bharara’s acceptance of a continued role as U.S. Attorney for the Southern District of New York,[16] for example, has been seen by commentators and bar leaders alike as an indicator of a continued, sharp focus on white collar prosecutions, generally.[17]

Senator Sessions also has made statements suggesting a tough stance on corporate criminal enforcement, including expressions of support for an approach to corporate enforcement that would "reinvigorate traditional prosecutions in the [DOJ]."[18] He has warned that "a prosecutor cannot be a weak‑kneed person [when] going up against a major corporation in a fraud case,"[19] and expressed the view that corporations should not be treated differently from individuals in making charging decisions, noting: "Normally, I was taught, if they violated the law, you charge them. If they did not violate the law, you do not charge them."[20] Elaborating further, Senator Sessions stated that focusing on the collateral or systemic effects of a corporate prosecution is a "philosophy [that] has some danger to it."[21] Discussing one company in particular, Senator Sessions said that it "should be held liable . . . to the extent of [its] existence."[22]

As noted above, statements like these–made on the legislative record and not from the helm of DOJ–must be taken with a grain of salt, but they do set the tone for a DOJ that will continue to be tough on crime, both individual and corporate.

A Place for NPAs and DPAs in the Next Administration

Given the tremendous efficacy of NPAs and DPAs in resolving allegations of corporate wrongdoing over the past two decades, and the financial recoveries that they have secured for the government, there is every reason to expect that they will continue to be used in the next administration. Indeed, in the sixteen years that we have been tracking corporate NPAs and DPAs, we have counted approximately $17.6 billion in criminal penalties recovered by these vehicles, and over $55 billion in overall associated recoveries, including ancillary settlement values.[23] Figures like these suggest that NPAs and DPAs have been a remarkably effective tool for addressing corporate wrongdoing.

Furthermore, and as we have highlighted in prior updates, NPAs and DPAs are widely recognized as the scalpel to the sledgehammer of prosecution: over decades, DOJ and the SEC have honed these critical tools to resolve complex issues in a manner that addresses wrongdoing and corporate structural weaknesses, while preserving the well‑functioning and valuable elements of corporations. In the modern era of multi-national conglomerates, in which illegal conduct frequently is limited to a handful of bad actors, lower‑level personnel, or a single subsidiary, rarely is corporate wrongdoing so pervasive that it warrants punishing not only individual wrongdoers, but also innocent stakeholders like the employees, shareholders, and communities that depend upon a charged company’s continued vitality. The extreme fines, draconian terms, and reputational damage that come with indictment and findings of guilt should be reserved only for those cases where wrongdoing is so extreme, or so pervasive, that it warrants the risk of corporate dissolution.

Importantly, beyond the substantial fines they impose–which we have highlighted in these updates, and which do have meaningful impacts on companies’ bottom lines–NPAs and DPAs frequently involve tough and exacting terms relating to corporate compliance and continued reporting that impose multi-year burdens and obligations with the goal of achieving meaningful corporate reform. As we discussed in our 2015 Mid-Year Update, such terms frequently include the establishment of rigorous compliance program reforms and tighter accounting and internal control measures, the appointment of third-party monitors to oversee company operations, and required self-investigation and reporting.[24] In some cases, NPA and DPA terms have gone so far as to require corporate board alterations and market restrictions.[25] NPAs and DPAs also are effective at addressing a remarkable range of potential behavior, as illustrated by the Park Tudor School matter concluded this year, which resolved an allegation of Misprision of Felony pursuant to 18 U.S.C. § 4–a charge that we rarely see levied against companies successfully.[26]

Any move toward diminishing the role of NPAs and DPAs could also impact the present cooperative posture favored by many companies faced with government enforcement action. An NPA or DPA can take years of costly litigation, reputational injury and outcome uncertainty off the table, and is therefore an important "carrot" to the "stick" of traditional prosecution.

As a corollary, any chilling of corporate cooperation and self-disclosure also could make prosecutors’ investigatory work more challenging. Given the realities of government funding and resource limitations, even the highly talented and capable prosecutorial force at DOJ frequently relies–to varying extents–on corporations’ good-faith self-assessments and voluntary cooperation. Today, many companies that receive NPAs and DPAs are lauded by DOJ for their thorough internal investigative work and full voluntary disclosure of results. In our experience, this cooperation frequently involves not only turning over relevant documents and proffering detailed factual information obtained through privileged communications, but also synthesizing facts for the government and presenting them in a coherent way that assists prosecutors with evaluating (and building) their cases. As veterans of government and private practice alike will recognize from experience, an alternate universe in which companies fight the government tooth-and-nail, engage in lengthy and expansive discovery with no fact synthesis, and perhaps do not disclose potential wrongdoing in the first instance, would be expensive and wearing for all parties involved.

Importantly, a chilling of corporate disclosure also would have collateral, negative effects on individual actions. The recent Yates Memorandum stated that cooperation credit would only be available to companies providing "all relevant facts relating to the individuals responsible for the [corporate] misconduct."[27] As some have noted, this was "not really a shift in policy from what the Criminal Division . . . and also some U.S. [A]ttorneys’ offices have been doing in practice";[28] indeed, major policy statements by DOJ over the last two decades have made clear that individual prosecutions and corporate actions are of equal importance as corporate actions.[29] As the Yates Memorandum also notes, however, there are significant and unique challenges to pursuing individual accountability for corporate crime, which render individual prosecutions notoriously difficult.[30] NPAs and DPAs are another important incentive for the corporate cooperation often required to effectively identify and prosecute individuals responsible for financial and other organizational misconduct. Please see our September 2015 Client Alert and our 2015 Year-End Update for additional analysis regarding the Yates Memorandum.

Developments in Corporate Compliance Monitorships

This year also has seen important developments in corporate monitorships, which frequently form part of corporate NPA and DPA resolutions. In particular, in August 2016, Judge William H. Pauley, of the Southern District of New York, deviated from the normal corporate monitor appointment process and imposed a monitor in Commodity Futures Trading Commission v. Deutsche Bank AG, based exclusively on his own research. This move represents a further foray by a judge into discretionary decision-making typically reserved for prosecutors, a development that has particularly troubled us in the context of DPAs.[31] We also provide an update on developments in the effort to protect the privacy of HSBC’s monitor report, a battle that we have followed in our 2015 Mid-Year and 2016 Mid-Year Updates.

Deutsche Bank

It is not unusual for the government to require an external monitor as part of a corporate settlement. We have reported on several of these monitorships in prior updates. Normally, courts appoint external monitors with the mutual consent of the corporate defendant and the enforcing authority. In a rare move, a district court in the Southern District of New York appointed its own monitor over the joint recommendation of Deutsche Bank and the U.S. Commodity Futures Trading Commission ("CFTC").

In September 2015, the CFTC entered into a settlement with Deutsche Bank stemming from purported failures in the bank’s swaps data reporting system.[32] On August 18, 2016, the CFTC filed suit in the Southern District of New York, alleging that an April 2016 malfunction in Deutsche Bank’s swaps data reporting system violated the September 2015 settlement agreement.[33] Both parties filed a same-day motion seeking the appointment of an external monitor to ensure Deutsche Bank’s compliance with its swaps data reporting obligations under the Dodd-Frank Act.[34] In a September 22, 2016 order, Judge William H. Pauley ordered the CFTC to submit at least three recommendations for appointment of an independent monitor.[35] Noting that his "duty extends beyond that of a ‘rubber stamp,’" Judge Pauley directed the CFTC to also submit an explanation supporting the need for a compliance monitor.[36]

Shortly thereafter, the parties jointly proposed three external monitors.[37] According to the parties’ filing, the three recommendations were reached after a vetting process overseen by Deutsche Bank and the CFTC. One of the recommendations, Chatham Financial, was the parties’ top choice; they argued that Chatham Financial was "best-suited to operate as the monitor in this matter" after it had been "deeply vetted" by both the CFTC and Deutsche Bank.[38] The other candidates, according to the parties’ filing, were less well suited as monitors because they did not have the resources of large firms, many of which "could not be considered ‘independent’ due to ongoing business relationships with Deutsche Bank."[39]

In an October 20, 2016 order, Judge Pauley rejected all three recommendations, believing that the two unfavored candidates "were offered merely to comply in form with this Court’s earlier order."[40] The court noted that counsel for the CFTC conceded during a hearing that neither of the less favored candidates had been vetted, while newly appointed counsel for Deutsche Bank "disavowed any involvement in proposing those candidates to the CFTC." Based on the court’s "own research," the details of which are not presented in the order, Judge Pauley appointed Paul S. Atkins, Esq. of Patomak Global Partners, LLC, a consultancy firm based in New York and Washington, DC.[41] Neither party has contested Judge Pauley’s ruling.

In our experience both serving as independent monitor and advising clients in the selection of independent monitors, substantial vetting and arms-length negotiation occurs between the government and a corporate defendant before any monitors are recommended as part of a settlement. Moreover, joint recommendations reflect a careful balancing of objectives from both a business and enforcement standpoint. Consequently, we believe courts should be extremely reluctant to overturn such recommendations–should they do so at all–let alone appoint their own monitors who, without vetting by either party involved, may not satisfy the delicate balance of enforcement and business interests at stake.

HSBC Monitorship Report

In recent updates, we have reported on the protracted battle that has ensued over the confidentiality of HSBC’s compliance monitorship. Specifically, in our 2016 Mid-Year Update we discussed the dispute over the extent to which the "First Annual Follow-Up Review" report ("Monitor’s Report" or "Report")–written by HSBC’s appointed compliance monitor and filed with Judge John Gleeson of the Eastern District of New York–should be unsealed for public viewing. Judge Gleeson made a March 9, 2016 ruling redacting portions of the Report in preparation for disclosure, but ordering that it remain under seal pending appellate review.[42]

We noted in our 2015 Mid-Year Update that this case is intertwined with the recent Fokker Services case, because Judge Gleeson’s ruling in HSBC effectively laid the groundwork for Judge Richard Leon, of the District Court for the District of Columbia, to reject the DPA at issue in United States v. Fokker Services B.V., based on its content.[43] Judge Leon’s decision, however, has since been overturned; in April 2016, the D.C. Circuit unanimously concluded that charging decisions are the sole domain of the Executive Branch, and that the Speedy Trial Act–which requires courts to approve the delay of trial for purposes of a DPA–does not confer judicial authority to review the merits of charging decisions made by the Executive Branch.[44] HSBC and DOJ have cited the D.C. Circuit’s reversal of Judge Leon’s decision as further grounds for maintaining the privacy of the Monitor’s Report.

The HSBC case is now before the Second Circuit; HSBC, DOJ, and Hubert Moore ("Moore"), who seeks access to the Report because he contends it might shed light on his mortgage dispute with HSBC, have submitted briefs to the court. The disagreement turns on two questions: (1) whether the Report constitutes a "judicial document," which would be a prerequisite for finding any constitutional right of access to it; and (2) even if the Report does constitute a "judicial document," whether it meets the First Amendment "experience and logic" test, which would support making the information publicly available. A "judicial document" is one that is critical to the execution of judicial duties, and the "experience and logic" test examines whether: (1) documents have historically been open to the press and the public, and (2) if access to the information plays a significant positive role in the functioning of the process in question.

HSBC and DOJ, in their opening briefs submitted in July, argued that Judge Gleeson wrongly intruded on Executive Branch functions by concluding that the courts have the authority and the duty to monitor the ongoing implementation and execution of HSBC’s DPA.[45] HSBC and DOJ asserted that the district court was under a "misapprehension of its authority regarding the DPA"[46] and that the court’s only "authority regarding the DPA is limited to excluding time under the Speedy Trial Act and ruling on any future motion to dismiss the indictment pursuant to Federal Rule of Criminal Procedure 48(a)."[47] HSBC and DOJ noted that the Monitor’s Report is not relevant to either of those concerns.[48] Moreover, HSBC and DOJ maintained that, even under the court’s misconception of its supervisory role over the DPA, the Monitor’s Report is not a judicial document because it is not relevant to ensuring that the "implementation of the DPA remains within the bounds of lawfulness and respects the integrity of [the] court."[49] Finally, HSBC and DOJ argued that the Monitor’s Report is not subject to a First Amendment right of access because it does not meet the "experience and logic" test, which examines (1) whether documents have historically been open to the press and the public; and (2) if access to the information plays a significant positive role in the functioning of the process in question.[50] To support their position, they highlighted the fact that a DPA is not analogous to a plea agreement, which generally would be made available to the public, because it does not involve any formal judicial action imposing or adopting its terms.[51] HSBC and DOJ also argued that because the Report is not relevant to the district court’s role in the DPA process, it would not be helpful in informing the public of how the judge is performing his job.[52]

Moore countered in his reply brief that the public has the same right of access to a compliance monitor’s report as it would to a plea deal.[53] He disputed HSBC’s and DOJ’s characterization of the district court’s authority over a DPA, arguing that "the Fokker court acknowledged the existence of the supervisory authority that Judge Gleeson exercised — citing his very order in this case with approval."[54] Moore defended classifying the Monitor’s Report as a judicial document, stating that it will be integral to the court’s decision-making process because it is a court record that will form the basis of a judge’s decision to dismiss the charges or revive them at the end of the case.[55] He also pushed back on HSBC and DOJ’s "experience and logic" position, arguing that DPAs are similar to plea deals, which are generally made public, and that "public access to such records improves the functioning of courts, prosecutors, and monitors alike."[56]

In support of Moore’s "experience and logic" position, media organizations led by the Reporters Committee for Freedom of the Press filed an amicus brief with the court, arguing that the information contained within the Report is of significant public interest.[57] Like Moore, the organizations cited the similarities between DPAs and plea agreements, and pressed the benefits of having access to judicial documents, especially where fraud affecting the public and Executive Branch conduct is at issue.

In HSBC and DOJ’s most recent reply brief, filed on December 2, 2016, they argued that Moore wrongly cited Fokker Services as support for his position.[58] They denied that Fokker Services provides support for the district court’s claim of supervisory power over the implementation of the DPA. Rather, they stated that the D.C. Circuit explained that "the prosecution–and the prosecution alone–monitors a defendant’s compliance with [a DPA’s] conditions and determines whether the defendant’s conduct warrants dismissal of the pending charges."[59]

International Deferred Prosecution Agreement Regimes

2016 saw significant advances in the further development of DPA regimes in the United Kingdom and France. In the United Kingdom, the Serious Fraud Office ("SFO") reached its second-ever DPA, and in France, the National Assembly approved the final version of a bill giving life to the country’s DPA legislation, which was signed into law in early December 2016. Both of these developments are addressed in detail below.

The United Kingdom Continues to Develop Its Deferred Prosecution Record

We addressed the United Kingdom’s new DPA regime in our 2015 Year-End Update, following the country’s inaugural DPA, a 2015 agreement between the SFO and Standard Bank Plc. 2017 will mark the third anniversary of the United Kingdom’s DPA scheme, which was introduced via legislation in 2014.[60] The legislation is operationalized by the DPA Code of Practice, a guidance document issued jointly by the SFO and the Crown Prosecution Service.[61] Under this program, designated prosecution agencies (including the SFO) may invite a corporate entity, partnership, or unincorporated association against which proceedings are contemplated to enter into DPA negotiations.[62] The prosecuting authority has the exclusive right to consider and initiate DPA negotiations.[63]

The most notable development over the latter half of 2016 was approval of the United Kingdom’s second DPA, an agreement between the SFO and an unnamed subsidiary, "XYZ," of an also-unnamed U.S. parent company, "ABC."[64] The names of both the subsidiary and parent company were withheld from the final judgment due to pending proceedings about individual former employees of XYZ.

XYZ’s DPA arose out of conduct that took place from 2004 to 2012.[65] The offenses which were the subject of the DPA were the section 1 offense under the Bribery Act 2010 of bribery, and also the section 7 offense of a corporation failing to prevent its associated person from committing bribery. XYZ, which relied upon exports to Asian markets for the majority of its revenue stream, allegedly bribed officials in foreign jurisdictions in order to exert influence to help XYZ win contracts.[66] This alleged conduct was discovered in 2012, following ABC’s implementation of a global compliance program at XYZ.[67] Having determined that the case was of sufficient legal complexity, and that XYZ had shown "exemplary co-operation" sufficient to warrant a DPA,[68] the SFO negotiated the agreement with XYZ and submitted it to the courts for a determination that it was in the public interest.[69] Lord Justice Levinson, sitting at the Royal Courts of Justice, heard the case and issued preliminary and final judgments. In making the required determination as to whether a DPA served the interests of justice, Lord Justice Levinson considered the following factors: "(i) the seriousness of the predicate offence or offences; (ii) the importance of incentivizing the exposure and self-reporting of corporate wrongdoing; (iii) the history (or otherwise) of similar conduct; (iv) the attention paid to corporate compliance prior to, at the time of and subsequent to the offending; (v) the extent to which the entity has changed both in its culture and in relation to relevant personnel; (vi) the impact of prosecution on employees and others innocent of any misconduct."[70]

Militating against the invocation of a DPA was the seriousness of the conduct by XYZ.[71] Twenty-eight of seventy-four total contracts entered into by XYZ from 2004 to 2013, valued at £17.24 million, were deemed corrupt.[72] This represented nearly 16% of the total revenue XYZ generated during the same time period.[73] However, the court noted that the seriousness was mitigated somewhat because the scheme was unsophisticated, culpable XYZ employees were neither incentivized nor instructed by XYZ to instigate the alleged bribes, and the XYZ employees did so at great risk of personal criminal liability.[74]

Lord Justice Levinson also cited several factors in support of the DPA. Most important among these was the incentivization of self-reporting and cooperation, which the court noted was a central policy goal in the creation and implementation of DPAs in the United Kingdom.[75] Lord Justice Levinson also lauded ABC for implementation of a new compliance program,[76] in addition to XYZ’s full investigation and external report of the allegations, conducted and submitted to the SFO by outside counsel.[77] In particular, he credited the thoroughness of XYZ’s investigation and the extent to which XYZ provided interview summaries, facilitated interviews for the SFO, and responded to requests for additional materials.[78] As a further mitigating factor, the court noted the absence of a commission payment scheme that would have further incentivized such bribes–XYZ employees did not receive direct financial compensation for the contracts they allegedly won through illicit conduct.[79] Lord Justice Levinson also considered the lack of direct evidence of any illegal agreements (e.g., explicit correspondence).[80]

Importantly, the court noted that ABC–which was not party to the DPA–did not knowingly profit from the alleged bribes, nor should it have known about the illicit conduct while it was happening.[81] ABC also made significant improvements in the culture of XYZ, which included dismissing two senior executives and all seven suspect agents who allegedly instigated the bribes.[82]

Finally, the court analyzed the present financial position of XYZ; the court determined that a DPA was appropriate, in part, because the impact of additional legal costs and financial penalties would risk insolvency, harming the interests of workers, suppliers, and the wider community.[83] The court’s logic echoed the SFO’s position. David Green, Director of the SFO, acknowledged that the court’s opinion "endors[ed] the approach we took," and he stated that "[t]he decision as to whether to force a company into insolvency must be balanced with the level and nature of co‑operation."[84]

The court levied a financial penalty of £352,000, which it found commensurate with XYZ’s profitability and financial capacity to pay pursuant to Section 164(4) of the Criminal Justice Act 2003.[85] In so doing, the court noted that the initial calculated penalty of £8.2 million was "wholly unrealistic for XYZ," and that "the interests of justice did not require XYZ to be pursued into insolvency."[86] In addition, the court ordered a total disgorgement of £6,201,085, which included profits gained by XYZ and dividends paid to ABC.[87] The DPA has a duration of three to five years, which the opinion noted "allows the financial terms to be met."[88] The SFO’s press release, perhaps offering clarification, noted that the term is "dependent upon when the financial penalty is paid in full."[89]

The DPA also contains compliance and monitoring requirements, including annual updates regarding the efficacy of XYZ’s new compliance scheme.[90] The SFO’s press release further notes that XYZ’s self-reports will specifically address all transactions with third-party intermediaries, as well as the effectiveness of XYZ’s anti-bribery and corruption controls, policies, and procedures.[91]

As the SFO gains experience with DPAs, more will come. In an October 2016 parliamentary committee meeting, SFO Director David Green told committee members that they could expect to see "significant" DPAs over the coming months.[92] For additional information on U.K. White Collar developments, please see our 2016 Mid-Year United Kingdom White Collar Crime Update.

Updates on French Deferred Prosecution Efforts

On December 9, 2016, France enacted the Law on Transparency, Fight against Corruption and Modernization of Economic Life (Loi relatif à la transparence, à la lutte contre la corruption et à la modernisation de la vie économique, referred to as "Sapin II," after Finance Minister Michel Sapin, who presented the legislation).[93] Sapin II makes available the public interest judicial agreement (convention judiciaire d’intérêt public),[94] a new prosecutorial tool resembling the DPA process in the United States. This alternative to criminal prosecution has been the subject of heated debates in the French Parliament, the early part of which we covered in our 2016 Mid-Year Update.

As in the United States, both of the French legislative chambers (the Senate and the National Assembly) must pass the same version of the bill before it is signed into law by the President.[95] On June 14, 2016, the National Assembly passed the Sapin II bill.[96] Shortly thereafter, on July 8, 2016, the Senate passed a different version of the bill.[97] A Parliamentary Joint Committee met to reconcile the differences but, on September 14, 2016, announced that it was unable to reach a consensus.[98] Pursuant to Article 45, Section 4 of the French Constitution, if the National Assembly, the Senate, and the Parliamentary Joint Committee fail to produce a joint bill, the Government may ask that each chamber perform an additional reading and that the National Assembly definitively adopt the final version of the bill, which the National Assembly did on November 8, 2016.[99] President François Hollande then signed the Sapin II bill, enacting it into law, on December 9, 2016.[100]

According to Sapin II, the Public Prosecutor (procureur de la République) may offer a public interest judicial agreement to a legal entity accused of one of the following offenses: (i) corruption; (ii) trading in influence; or (iii) laundering of tax fraud proceeds.[101] In contrast, the U.S. DPA process is available to both corporations and individuals for all criminal offenses. The French approach is similar to that taken in the United Kingdom, which also limits its DPAs to organizations and specific offenses.[102]

As with U.S. DPAs, the public interest judicial agreement is available prior to the commencement of public prosecution (action publique). The Public Prosecutor can initiate agreement negotiations on his or her own accord. Alternatively, the investigative judge, who is tasked with conducting a judicial investigation,[103] can refer to the Public Prosecutor any company eligible for a public interest judicial agreement.[104] If such a referral occurs, the Public Prosecutor has three months to negotiate an agreement and obtain court approval before the investigation must resume.[105]

All public interest judicial agreements are reviewed and approved by the Court of First Instance (tribunal de grande instance) after a public adversarial hearing which any alleged victims may attend.[106] This is similar to the requirement in the United States that a DPA[107] must be approved by a court. However, as suggested by the D.C. Circuit’s recent decision in United States v. Fokker Services, discussed above, a U.S. court’s ability to reject a DPA may be limited.[108] Sapin II gives little guidance on the standards that French courts will employ; we will monitor and report in subsequent alerts any developments on this front. Uniquely, Sapin II also offers an opt-out period for a company, whereby it may withdraw from a public interest judicial agreement up to ten days after court approval.[109]

Under a public interest judicial agreement, in exchange for a suspended prosecution, a company may be obligated to do one or more of the following: (1) pay a monetary penalty in an amount proportionate to the seriousness of the facts and the profits derived from the offense, capped at 30% of the company’s average annual revenue for the previous three years; or (2) implement a compliance program, at the company’s expense, and under the supervision of the French Anticorruption Agency (Agence française anticorruption)[110] for a period of up to three years. The public interest judicial agreement must, in addition, provide for the indemnification, within a one-year period, of any identified victims of the alleged offense.[111] In all cases, the public interest judicial agreement is subject to a press release and published on the French Anticorruption Agency’s website. Also, as in the United States, companies that enter into these agreements are not shielded from any civil lawsuits from private parties.

Similar to the U.S. DPA process, Sapin II does not require that a company admit guilt when signing a public interest judicial agreement. This issue was a point of contention throughout the legislative process. On September 23, 2016, the National Assembly considered and rejected Amendment No. 206, which would have eliminated the public interest judicial agreement.[112] The amendment’s sponsors argued that this process sets up a "two-speed judicial system," containing one track for wealthy companies and another track for everyone else.[113] Critics of this aspect of the law also have pointed out that, if a company avoids a guilty plea or conviction on its criminal record, it can reap a tax benefit by deducting the cost of any financial penalty from its taxable income.[114] In the United States, NPAs and DPAs traditionally contain express clauses prohibiting the application of any tax deductions to financial penalties paid in connection with the agreements.

…………………………………..

APPENDIX

2016 Non-Prosecution and Deferred Prosecution Agreements

The chart below summarizes the agreements concluded by DOJ and the SEC in 2016. The complete text of each publicly available agreement is hyperlinked in the chart.

The figures for "Monetary Recoveries" may include amounts not strictly limited to an NPA or a DPA, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term "Monitor" includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in settlement agreements.

U.S. Deferred and Non-Prosecution Agreements in 2016 |

||||||

|

Company |

Agency |

Alleged Violation |

Type |

Monetary Recoveries |

Monitor |

Term of DPA/NPA (months) |

|

SEC |

FCPA |

NPA |

$671,885 |

No |

No term specified; continuing cooperation |

|

|

E.D. Va.; DOJ Criminal Division (Fraud) |

Fraud |

DPA |

$1,625,125 |

No |

36 |

|

|

S.D.N.Y.; approved by DOJ Tax |

Fraud and Tax-Related Offenses |

DPA |

$547,250,000 |

No |

36 |

|

|

E.D.N.C.; DOJ Criminal Division (Fraud) |

FDCA |

NPA |

$7,800,000 |

Yes |

30 |

|

|

DOJ Criminal Division (Fraud); |

FCPA |

NPA |

$11,074,651 |

Yes |

36 |

|

|

E.D.N.Y. |

Anti-Gambling Compliance; Anti-Money Laundering Compliance |

NPA |

$22,500,000 |

No |

24 |

|

|

DOJ Antitrust Division |

Antitrust |

NPA(a) |

$66,500,000 |

No |

No term specified |

|

|

DOJ Criminal Division (Fraud) |

FCPA |

DPA |

$185,533,381 |

Yes |

36 |

|

|

DOJ Criminal Division (Fraud) |

FCPA |

NPA |

$75,751,592 |

Yes |

36 |

|

|

N.D. Tex.; DOJ Civil Division (Consumer Protection) |

FDCA |

NPA |

$2,250,000 |

No |

60 |

|

|

Hale Products, Inc.(b) |

DOJ Antitrust |

Antitrust |

NPA |

$60,200 |

Unknown |

Unknown |

|

DOJ Tax |

Tax-Related and Monetary Transaction Offenses |

NPA |

$49,757,000 |

No |

48 |

|

|

E.D.N.Y.; DOJ Criminal Division (Fraud) |

FCPA |

NPA |

$264,491,405 |

Yes |

36 |

|

|

DOJ Criminal Division (Fraud) |

FCPA |

DPA |

$22,187,788 |

Yes |

36 |

|

|

DOJ Tax |

Tax-Related and Monetary Transaction Offenses |

NPA |

$500,000 |

No |

48 |

|

|

E.D. Cal. |

Immigration Violations |

NPA |

$1,503,000 |

Yes |

24 |

|

|

D. Mont. |

FDCA |

DPA |

$76,063 |

No |

36 |

|

|

National Oilwell Varco, Inc.(c) |

S.D. Cal. |

Trade Sanctions |

NPA |

$25,000,000 |

Unknown |

Unknown |

|

SEC |

FCPA |

NPA |

$322,058 |

No |

No term specified; continuing cooperation |

|

|

DOJ Criminal Division (Fraud); E.D.N.Y. |

FCPA |

DPA |

$412,100,856 |

Yes |

36 |

|

|

Octal Corp.(d) |

DOJ Antitrust Division |

Antitrust |

NPA |

$460,000 |

Unknown |

Unknown |

|

D.N.J.; DOJ Civil Division (Fraud) |

Federal Anti-Kickback Statute |

DPA |

$612,000,000 |

Yes |

36 |

|

|

DOJ Criminal Division (Fraud); D.N.J. |

FCPA |

DPA |

$22,800,000 |

Yes |

36 |

|

|

Parametric Technology (Shanghai) Software Co. Ltd. and Parametric Technology (Hong Kong) Limited |

DOJ Criminal Division (Fraud) |

FCPA |

NPA |

$28,162,000 |

Yes |

36 |

|

S.D. Ind. |

Misprision of a Felony |

NPA(e) |

$0 |

Yes |

16 |

|

|

E.D.N.Y. |

Fraud |

DPA |

$9,195,858 |

Yes |

24 |

|

|

S.D. Cal. |

Fraud; |

DPA |

$0(f) |

No |

18 |

|

|

N.D. Ill.; |

Anti-Bribery |

NPA |

$100,000(g) |

Yes |

24 |

|

|

D. Conn. |

Environmental (Clean Water Act) |

DPA |

$1,000,000(h) |

No |

84 |

|

|

DOJ Criminal Division (Fraud); N.D. Ga. |

Federal Anti-Kickback Statute |

NPA |

$512,788,345 |

Yes |

36 |

|

|

DOJ Criminal Division (Fraud) |

FCPA |

DPA |

$519,279,172 |

Yes |

36 |

|

|

Torneos y Competencias S.A.(i) |

E.D.N.Y. |

Fraud |

DPA |

$112,822,616 |

No |

48 |

|

DOJ Tax |

Tax-Related and Monetary Transaction Offenses |

NPA |

$187,767,000 |

No |

48 |

|

|

D.N.J. |

Anti-Bribery |

NPA |

$2,250,000 |

Yes |

24 |

|

|

DOJ Criminal Division (Fraud) |

FCPA |

DPA |

$795,326,398(j) |

Yes |

36 |

|

|

(a) DOJ agreed not to prosecute Corning Incorporated in connection with its plea agreement with Corning International Kabushiki Kaisha, Corning Incorporated’s Japanese subsidiary. (b) The Hale Products Inc. NPA was not publicly available at the time of publication. Data here is reflected as announced by DOJ on October 15, 2016, in connection with the extradition and arraignment of an individual defendant.[115] (c) The National Oilwell Varco, Inc. NPA was not publicly available at the time of publication. The data here is derived from a November 14, 2016 statement by the Department of the Treasury regarding a related enforcement action.[116] (d) The Octal Corp. NPA was not publicly available at the time of publication. Data here is reflected as announced by DOJ on October 15, 2016, in connection with the extradition and arraignment of an individual defendant.[117] (e) While the Park Tudor School agreement is styled as a DPA, it has all of the characteristics of an NPA, as it appears not to have been filed in court with charging documents. (f) The DPA for Prime Holdings International, Inc. imposed no direct penalty, but required Prime Holdings International, Inc. to consent to be held jointly and severally liable for any penalties imposed on co-defendants Medex Solutions, Inc. and Meridian Medical Resources, Inc. in related actions. (g) The Redflex Traffic Systems NPA imposed restitution of $100,000, in addition to "the amount of any final judgment that may be issued in favor of the City [of Chicago], or that Redflex and the City of Chicago may agree to in a settlement agreement" in a pending civil case. (h) In addition to a $1,000,000 penalty imposed by the DPA, Sheffield Pharmaceuticals LLC also agreed to consent to a civil penalty and injunctive relief sought by the Connecticut Department of Energy and Environmental Protection. (i) The Torneos y Competencias S.A. DPA was not publicly available at the time of publication. Data here is reflected as announced by the U.S. Attorney’s Office for the Eastern District of New York on December 13, 2016.[118] (j) The SEC agreed to credit the forfeiture paid to DOJ as part of its agreement with VimpelCom Ltd., resulting in a combined total of criminal and regulatory penalties, including U.S. and Dutch settlement figures, of $795,326,398.40. |

||||||

[1] NPAs and DPAs are two kinds of voluntary, pre-trial agreements between a corporation and the government, most commonly the Department of Justice. They are standard methods to resolve investigations into corporate criminal misconduct and are designed to avoid the severe consequences, both direct and collateral, that conviction would have on a company, its shareholders, and its employees. Though NPAs and DPAs differ procedurally–a DPA, unlike an NPA, is formally filed with a court along with charging documents–both usually require an admission of wrongdoing, payment of fines and penalties, cooperation with the government during the pendency of the agreement, and remedial efforts, such as enhancing a compliance program and–on occasion–cooperating with a monitor who reports to the government. Although NPAs and DPAs are used by multiple agencies, since Gibson Dunn began tracking corporate NPAs and DPAs in 2000, we have identified approximately 447 agreements initiated by the Department of Justice, and 10 initiated by the Securities and Exchange Commission.

[2] For additional information regarding the Program for NPAs or Non-Target Letters for Swiss Banks, please see our 2015 Mid-Year and Year-End Updates.

[3] DOJ announced the formal close of the Swiss Bank Program on December 29, 2016. Press Release, U.S. Dep’t of Justice, Justice Department Reaches Final Resolutions Under Swiss Bank Program (Dec. 29, 2016), https://www.justice.gov/opa/pr/justice-department-reaches-final-resolutions-under-swiss-bank-program.

[4] This chart reflects two additional 2015 NPAs compared to last year’s reporting: one between the U.S. Attorney’s Office for the Southern District of Texas and Curvature LLC (announced April 3, 2015), and one between the U.S. Attorney’s Office for the Eastern District of New York and Granite Construction, Incorporated (Nov. 24, 2015).

[5] Jenna Greene, DOJ Under Trump: Radical Change or More of the Same? Litig. Daily (Dec. 8, 2016), http://www.litigationdaily.com/id=1202774171599/DOJ-Under-Trump-Radical-Change-or-More-of-the-Same; see also our 2016 Mid-Year Update, which addressed the more than 50% expansion of DOJ’s FCPA Unit.

[6] Declination Letter, NCH Corporation (Sept. 29, 2016), available at https://www.justice.gov/criminal-fraud/file/899121/download; Declination Letter, HMT LLC (Sept. 29, 2016), available at https://www.justice.gov/criminal-fraud/file/899116/download.

[7] U.S. Dep’t of Justice, Foreign Corrupt Practices Act Pilot Program: Declinations (updated Sept. 29, 2016), https://www.justice.gov/criminal-fraud/pilot-program/declinations.

[8] U.S. DEP’T OF JUSTICE, MEMORANDUM REGARDING BRINGING CRIMINAL CHARGES AGAINST CORPORATIONS (1999), available at https://www.justice.gov/sites/default/files/criminal-fraud/legacy/

2010/04/11/charging-corps.PDF [hereinafter Holder Memorandum].

[9] U.S. DEP’T OF JUSTICE, MEMORANDUM REGARDING PRINCIPLES OF FEDERAL PROSECUTION OF BUSINESS ORGANIZATIONS (2003), available at http://www.americanbar.org/content/dam/aba/migrated/

poladv/priorities/privilegewaiver/2003jan20_privwaiv_dojthomp.authcheckdam.pdf [hereinafter Thompson Memorandum].

[10] U.S. DEP’T OF JUSTICE, MEMORANDUM REGARDING PRINCIPLES OF FEDERAL PROSECUTION OF BUSINESS ORGANIZATIONS (2008), https://www.justice.gov/sites/default/files/dag/legacy/2008/11/03/dag-memo-08282008.pdf [hereinafter Filip Memorandum].

[11] U.S. DEP’T OF JUSTICE, MEMORANDUM REGARDING PRINCIPLES OF FEDERAL PROSECUTION OF BUSINESS ORGANIZATIONS (2006), https://www.justice.gov/sites/default/files/dag/legacy/

2007/07/05/mcnulty_memo.pdf[hereinafter McNulty Memorandum].

[12] U.S. DEP’T OF JUSTICE, MEMORANDUM FROM DEPUTY ATTORNEY GEN. SALLY QUILLIAN YATES REGARDING INDIVIDUAL ACCOUNTABILITY FOR CORPORATE WRONGDOING (2015), available at http://www.justice.gov/dag/file/769036/download [hereinafter Yates Memorandum].

[13] See The Transition Team: Agency Landing Teams, https://greatagain.gov/agency-landing-teams-54916f71f462#.ljjop6iqi; Katie Bo Williams, Trump Names Justice Department Landing Team, The Hill, Nov. 21, 2016, http://thehill.com/policy/national-security/307056-trump-names-justice-department-landing-team.

[14] Mark Hamblett, Trump to Keep Bharara as Southern District U.S. Attorney, The Am. Lawyer (Dec. 1, 2016), http://www.americanlawyer.com/id=1202773605965/Trump-to-Keep-Bharara-as-Southern-District-US-Attorney-?kw=Trump%20to%20Keep%20Bharara%20as%20Southern%20District%20U.S.%20

Attorney&et=editorial&bu=The%20American%20Lawyer&cn=20161201&src=EMC-Email&pt=Afternoon

%20Update&slreturn=20161112113946.

[15] Eric Lichtblau, Jeff Sessions, as Attorney General, Could Overhaul Department He’s Skewered, N.Y. Times, (Nov. 18, 2016), http://www.nytimes.com/2016/11/19/us/politics/jeff-sessions-donald-trump-attorney-general.html?_r=0.

[16] Mark Hamblett, Trump to Keep Bharara as Southern District U.S. Attorney, The Am. Lawyer (Dec. 1, 2016), http://www.americanlawyer.com/id=1202773605965/Trump-to-Keep-Bharara-as-Southern-District-US-Attorney-?kw=Trump%20to%20Keep%20Bharara%20as%20Southern%20District%20U.S.%20

Attorney&et=editorial&bu=The%20American%20Lawyer&cn=20161201&src=EMC-Email&pt=Afternoon

%20Update&slreturn=20161112113946.

[17] See id.

[18] Nomination of James Michael Cole, Nominee to Be Deputy Attorney General, U.S. Department of Justice: Hearing Before the S. Comm. on the Judiciary, 111th Cong. 99 (2010) [hereinafter Cole Nomination].

[19] Examining Approaches to Corporate Fraud Prosecutions and the Attorney‑Client Privilege Under the McNulty Memorandum: Hearing Before the S. Comm. on the Judiciary, 110th Cong. 8 (2007).

[20] Cole Nomination, supra note 18, at 99.

[21] Id.

[22] Id. at 98.

[23] See Appendix for a description of associated monetary recoveries.

[24] See F. Joseph Warin, Senator Warren, Let the ‘Cops’ Do Their Jobs, The Hill (Apr. 27, 2015, 4:00 p.m.), http://thehill.com/blogs/congress-blog/economy-budget/240042-senator-warren-let-the-cops-do-their-jobs, also available at http://www.gibsondunn.com/wp-content/uploads/documents/publications/Warin-Senator-Warren-Let-The-Cops-Do-Their-Job-The-Hill-04.27.2015.pdf.

[25] E.g., Deferred Prosecution Agreement at 6, United States v. Aibel Group Limited. (S.D. Tex. Jan. 4, 2007) (No. 4:07-cr-00005) (implementing a revised compliance and governance structure including the appointment of an independent executive board member, the establishment of a compliance committee, and the engagement of outside compliance counsel); Non-Prosecution Agreement at 2, United States v. TNT Software LLC (May 5, 2015) (expressly prohibiting certain sweepstakes-related activities without expressing any opinion as to the legality of such conduct, and further requiring written notice to the U.S. Attorney’s Office if TNT should engage in any sweepstakes activity not covered by the prohibition).

[26] Deferred Prosecution Agreement, Park Tudor School, at 2 (2016). We note that while this agreement is styled as a DPA, it has all of the characteristics of an NPA, as it appears not to have been filed in court with charging documents.

[27] Yates Memorandum, supra note 12.

[28] David Vascott, An Interview with Leslie Caldwell, Global Investigations Rev., Sept. 30, 2015, http://globalinvestigationsreview.com/article/1018198/interview-leslie-caldwell.

[29] See U.S. Dep’t of Justice, Memorandum Regarding Bringing Criminal Charges Against Corporations (1999), available at https://www.justice.gov/sites/default/files/criminal-fraud/legacy/2010/04/11/charging-corps.PDF (stating that "[p]rosecution of a corporation is not a substitute for the prosecution of criminally culpable individuals within or without the corporation"); U.S. Dep’t of Justice, Memorandum Regarding Principles of Federal Prosecution of Business Organizations (2003), http://www.americanbar.org/

content/dam/aba/migrated/poladv/priorities/privilegewaiver/2003jan20_privwaiv_dojthomp.authcheckdam.pdf (stating that "imposition of individual criminal liability may provide the strongest deterrent against future corporate wrongdoing. Only rarely should provable individual culpability not be pursued, even in the face of offers of corporate guilty pleas"); U.S. Dep’t of Justice, Memorandum re: Principles of Federal Prosecution of Business Organizations (2006), https://www.justice.gov/sites/default/files/dag/

legacy/2007/07/05/mcnulty_memo.pdf; Filip Memorandum, supra note 10, at 2 (stating that "[o]nly rarely should provable individual culpability not be pursued, particularly if it relates to high level corporate officers, even in the face of an offer of a corporate guilty plea or some other disposition of the charges against the corporation").

[30] See Yates Memorandum, supra note 12.

[31] For additional analysis of the trend toward greater judicial involvement in deferred prosecution decisions typically reserved to prosecutors, please see our 2015 Mid-Year, 2015 Year-End and 2016 Mid-Year Updates, which discuss these themes in the context of United States v. Fokker Services, No. 1:14-cr-00121-RJL, 2015 WL 729291 (D.D.C. Feb. 5, 2015) and United States v. HSBC Bank, No. 12-cr-763, 2013 WL 3306161 (E.D.N.Y. July 1, 2013).

[32] Complaint, U.S. Commodity Futures Trading Comm’n v. Deutsche Bank AG, No. 1:16-cv-6544 at 4 (S.D.N.Y. Aug. 18, 2016).

[33] Id. at 6-9.

[34] [Proposed] Consent Order of Preliminary Injunction And Other Equitable Relief Against Deutsche Bank AG, U.S. Commodity Futures Trading Comm’n v. Deutsche Bank AG, No. 1:16-cv-6544 at 2 (S.D.N.Y. Aug. 18, 2016).

[35] Order, U.S. Commodity Futures Trading Comm’n v. Deutsche Bank AG, at 2, No. 1:16-cv-6544 (S.D.N.Y. Sept. 22, 2016).

[36] Id. at 1.

[37] See generally Attachment 1 to Memorandum of Points and Authorities in Support of Plaintiff’s Motion for Entry of the Proposed Consent Order of Preliminary Injunction and Other Equitable Relief Against Deutsche Bank AG, Proposed Monitors, at 4, U.S. Commodity Futures Trading Comm’n v. Deutsche Bank AG, No. 1:16-cv-6544 (S.D.N.Y. Sept. 30, 2016).

[38] Id. at 1-2.

[39] Id.

[40] Opinion & Order Appointing Independent Monitor, U.S. Commodity Futures Trading Comm’n v. Deutsche Bank AG, No. 1:16-cv-6544 at 4 (S.D.N.Y. Oct. 20, 2016).

[41] Id. at 4-5.

[42] Order at 3, United States v. HSBC Bank USA, N.A., No. 12-cr-763 (E.D.N.Y. Mar. 9, 2016).

[43] United States v. Fokker Servs. B.V., No. 1:14-cr-00121-RJL, 2015 WL 729291 (D.D.C. Feb. 5, 2015).

[44] United States v. Fokker Servs. B.V., No. 15-3016 (D.C. Cir. Apr. 5, 2016).

[45] Opening Brief for the United States, United States v. HSBC Bank USA, N.A., No. 16-308 (2d Cir. July 21, 2016).

[46] Id. at 27.

[47] Id. at 18.

[48] Id.

[49] Id. at 34.

[50] Id. at 39-43.

[51] Id. at 40.

[52] Id. at 42.

[53] Brief for Appellee, United States of America v. HSBC Bank USA, N.A, No. 16-308 (2nd Cir. Oct. 20, 2016).

[54] Id. at 24. See also our 2015 Mid-Year, 2015 Year-End and 2016 Mid-Year Updates.

[55] Id. at 11-12.

[56] Id. at 2.

[57] Brief of Amici Curiae The Reporters Committee for Freedom of the Press and 24 News Media Organizations in Support of Appellee, HSBC Bank USA, N.A., No. 16-308 (2d Cir. Oct. 27, 2016).

[58] Reply Brief for Defendants-Appellants, HSBC Bank USA, N.A., No. 16-308 (2d Cir. Dec. 2, 2016).

[59] Id. at 10 (citing United States v. Fokker Servs. B.V., No. 15-3016 (D.C. Cir. Apr. 5, 2016)).

[60] Crime and Courts Act 2013, c. 22, sch. 17.

[61] U.K. Serious Fraud Office & CPS, Deferred Prosecution Agreements Code of Practice (Feb. 2014).

[62] Id. ¶ 2.1.

[63] Id.

[64] SFO v. XYZ Ltd., Approved DPA (July 8, 2016).

[65] Id. ¶ 6.

[66] Id.

[67] Id. ¶ 11.

[68] Press Release, U.K. Serious Fraud Office, SFO Secures Second DPA (July 8, 2016), https://www.sfo.gov.uk/2016

/07/08/sfo-secures-second-dpa/.

[69] SFO v. XYZ Ltd., Preliminary DPA ¶ 18 (June 24, 2016).

[70] Id. ¶ 20.

[71] Id. ¶¶ 21–22.

[72] Id. at ¶ 9.

[73] Id.

[74] Id. at ¶ 23.

[75] SFO v. XYZ Ltd., Approved DPA ¶ 16 (July 8, 2016).

[76] SFO v. XYZ Ltd., Preliminary DPA ¶¶ 29-30. (June 24, 2016)

[77] Id. ¶¶ 24–26.

[78] Id. ¶ 27.

[79] SFO v. XYZ Ltd., Approved DPA ¶ 8.

[80] Id.

[81] Id. ¶ 17.

[82] SFO v. XYZ Ltd., Preliminary DPA ¶ 31.

[83] SFO v. XYZ Ltd., Approved DPA ¶ 18.

[84] Press Release, U.K. Serious Fraud Office, supra note 67.

[85] SFO v. XYZ Ltd., Approved DPA ¶ 24.

[86] Id. ¶¶ 23-24.

[87] Id.

[88] Id. ¶ 19.

[89] Press Release, U.K. Serious Fraud Office, supra note 67.

[90] SFO v. XYZ Ltd., Approved DPA at ¶ 19.

[91] Press Release, U.K. Serious Fraud Office, supra note 67.

[92] See Suzi Ring, ‘Significant’ Corporate Plea Deals Coming, U.K. Prosecutor Says, Bloomberg (Oct. 25, 2016, 7:26 AM), https://www.bloomberg.com/news/articles/2016-10-25/-significant-corporate-plea-deals-coming-u-k-prosecutor-says.

[93] See Law on Transparency, Fight against Corruption and Modernization of Economic Life, No. 2016-1691 of 9 December 2016, French Official Gazette, No. 0287 (Dec. 10, 2016) [hereinafter Law on Transparency], available at https://www.legifrance.gouv.fr/eli/loi/2016/12/9/2016-1691/jo/texte.

[94] Id. at Art. 22.

[95] However, unlike in the United States, the French President does not have the power to veto legislation. Nicolas Boring, Library of Congress, National Parliaments: France, January 2016, https://www.loc.gov/law/help/national-parliaments/france.php.

[96] National Assembly, Bill No. 3623 on Transparency, the Fight against Corruption and Modernizing the Economy, Text Adopted No. 755 (June 14, 2016), available at http://www.assemblee-nationale.fr/14/ta/ta0755.asp.

[97] Senate, Bill No. 691 on Transparency, the Fight against Corruption and Modernizing the Economy, Text Adopted No. 174 (July 8, 2016), available at http://www.senat.fr/leg/tas15-174.html.

[98] Parliamentary Joint Committee, Report No. 831 (Sept. 14, 2016), available at http://www.senat.fr/leg/pjl15-831.html.

[99] National Assembly, Bill No. 4187 on Transparency, the Fight against Corruption and Modernizing the Economy, Text Adopted No. 830 (Nov. 8, 2016), available at http://www.assemblee-nationale.fr/14/ta/ta0830.asp.

[100] See Law on Transparency. One day prior, on December 8, 2016, the Constitutional Council ruled that the public interest judicial agreement (i.e., Article 22) was constitutional. See Constitutional Council, Decision No. 2016-741 (Dec. 8, 2016), available at http://www.senat.fr/dossier-legislatif/pjl15-691.html.

[101] Law on Transparency at Art. 22. The legislature may have been reluctant to extend coverage to general tax fraud offenses because they typically must go through a "very specific process" that involves the French Tax Administration. There is no such requirement for the money laundering of proceeds gained from tax fraud. See Waithera Junghae, France’s National Assembly rejects Senate amendments to anti-corruption bill, Global Investigations Review (Oct. 5, 2016), available at http://globalinvestigationsreview.com/article/1069004/france

%E2%80%99s-national-assembly-rejects-senate-amendments-to-anti-corruption-bill.

[102] U.K. SERIOUS FRAUD OFFICE, DEFERRED PROSECUTION AGREEMENTS, https://www.sfo.gov.uk/publications/guidance-policy-and-protocols/deferred-prosecution-agreements/.

[103] French criminal procedure begins when the police believe that an offense has been committed. The Public Prosecutor and the police lead a preliminary inquiry (enquête preliminaire) to gather additional facts. At the conclusion of the preliminary inquiry, the Public Prosecutor may take further action, which can include dismissal of the case or, for serious or complex crimes, transferring it to the investigating jurisdiction (juridiction d’instruction) for further judicial investigation by an investigative judge.

[104] Law on Transparency at Art. 22.

[105] Id.

[106] Id.

[107] In contrast, U.S. NPAs do not require court approval.

[108] United States v. Fokker Servs. B.V., No. 15-3016, 2016 WL 1319226, at *1 (D.C. Cir. Apr. 5, 2016). For an in-depth analysis, see our 2016 Mid-Year Update.

[109] Law on Transparency at Art. 22.

[110] This agency is newly created by Sapin II. See Law on Transparency at Art. 1.

[111] Id. at Article 22.

[112] National Assembly, Amendment No. 206, Bill No. 4045 on Transparency, the Fight against Corruption and Modernizing the Economy (Sept. 23, 2016).

[113] Id.

[114] Carnets de Justices, Sapin II: A Christmas present for delinquent firms, November 12, 2016, available at http://www.carnetsdejustices.fr/2016/11/le-deferred-prosecution-agreement-a-la-francaise-du-reve-americain-a-la-bouffonnerie.html?utm_source=flux&utm_medium=flux-rss&utm_campaign=economy-finance-legal.

[115] Press Release, U.S. Dep’t of Justice, Israeli Executive Extradited and Arraigned on Fraud Charges Involving the Foreign Military Financing Program (Oct. 14, 2016), https://www.justice.gov/opa/pr/israeli-executive-extradited-and-arraigned-fraud-charges-involving-foreign-military-financing.

[116] Press Release, U.S. Dep’t of Treasury, Office of Foreign Assets Control, National Oilwell Varco, Inc. Settles Potential Civil Liability for Apparent Violations of the Cuban Assets Control Regulations, the Iranian Transactions and Sanctions Regulations, and the Sudanese Sanctions Regulations (Nov. 14, 2016), https://www.treasury.gov/resource-center/sanctions/CivPen/Documents/

20161114_varco.pdf.

[117] Press Release, U.S. Dep’t of Justice, Israeli Executive Extradited and Arraigned on Fraud Charges Involving the Foreign Military Financing Program (Oct. 14, 2016), https://www.justice.gov/opa/pr/israeli-executive-extradited-and-arraigned-fraud-charges-involving-foreign-military-financing.

[118] Press Release, U.S. Dep’t of Justice, Argentine Sports Marketing Company Admits to Role in International Soccer Bribery Conspiracy and Agrees to $112 Million in Forfeiture and Criminal Penalties (Dec. 13, 2016), https://www.justice.gov/usao-edny/pr/argentine-sports-marketing-company-admits-role-international-soccer-bribery-conspiracy.

The following Gibson Dunn lawyers assisted in preparing this client update: F. Joseph Warin, Michael Diamant, Patrick Doris, Mark Handley, Melissa Farrar, Jason Smith, Christina Dahlman, Edward Patterson, William Hart, Michael Dziuban, Audi Syarief, Tyler Valeska, Ben Belair, Chelsea Ferguson, and Brittany Raia.

Gibson Dunn’s White Collar Defense and Investigations Practice Group successfully defends corporations and senior corporate executives in a wide range of federal and state investigations and prosecutions, and conducts sensitive internal investigations for leading companies and their boards of directors in almost every business sector. The Group has members in every domestic office of the Firm and draws on more than 125 attorneys with deep government experience, including more than 50 former federal and state prosecutors and officials, many of whom served at high levels within the Department of Justice and the Securities and Exchange Commission. Joe Warin, a former federal prosecutor, served as the U.S. counsel for the compliance monitor for Siemens and as the FCPA compliance monitor for Alliance One International. He previously served as the monitor for Statoil pursuant to a DOJ and SEC enforcement action. He co-authored the seminal law review article on NPAs and DPAs in 2007. Debra Wong Yang is the former United States Attorney for the Central District of California, and has served as independent monitor to a leading orthopedic implant manufacturer to oversee its compliance with a DPA.

Washington, D.C.

F. Joseph Warin (+1 202-887-3609, [email protected])

Richard W. Grime (202-955-8219, [email protected])

Scott D. Hammond (+1 202-887-3684, [email protected])

Stephanie L. Brooker (+1 202-887-3502, [email protected])

David P. Burns (+1 202-887-3786, [email protected])

David Debold (+1 202-955-8551, [email protected])

Stuart F. Delery (+1 202-887-3650, [email protected])

Michael Diamant (+1 202-887-3604, [email protected])

John W.F. Chesley (+1 202-887-3788, [email protected])

Daniel P. Chung (+1 202-887-3729, [email protected])

Patrick F. Stokes (+1 202-955-8504, [email protected])

New York

Reed Brodsky (+1 212-351-5334, [email protected])

Joel M. Cohen (+1 212-351-2664, [email protected])

Mylan L. Denerstein (+1 212-351-3850, [email protected])

Lee G. Dunst (+1 212-351-3824, [email protected])

Barry R. Goldsmith (+1 212-351-2440, [email protected])

Christopher M. Joralemon (+1 212-351-2668, [email protected])

Mark A. Kirsch (+1 212-351-2662, [email protected])

Randy M. Mastro (+1 212-351-3825, [email protected])

Marc K. Schonfeld (+1 212-351-2433, [email protected])

Orin Snyder (+1 212-351-2400, [email protected])

Alexander H. Southwell (+1 212-351-3981, [email protected])

Lawrence J. Zweifach (+1 212-351-2625, [email protected])

Denver

Robert C. Blume (+1 303-298-5758, [email protected])

Ryan T. Bergsieker (+1 303-298-5774, [email protected])

Orange County

Nicola T. Hanna (+1 949-451-4270, [email protected])

Los Angeles

Debra Wong Yang (+1 213-229-7472, [email protected])

Marcellus McRae (+1 213-229-7675, [email protected])

Michael M. Farhang (+1 213-229-7005, [email protected])

Douglas Fuchs (+1 213-229-7605, [email protected])

Eric D. Vandevelde (+1 213-229-7186, [email protected])

Palo Alto

Benjamin B. Wagner (+1 650-849-5395, [email protected])

San Francisco

Thad A. Davis (+1 415-393-8251, [email protected])

Marc J. Fagel (+1 415-393-8332, [email protected])

Charles J. Stevens (+1 415-393-8391, [email protected])

Michael Li-Ming Wong (+1 415-393-8234, [email protected])

Winston Y. Chan (+1 415-393-8362, [email protected])

Dubai

Graham Lovett (+971 (0) 4 318 4620, [email protected])

Hong Kong

Kelly Austin (+852 2214 3788, [email protected])

Oliver D. Welch (+852 2214 3716, [email protected])

London

Patrick Doris (+44 20 7071 4276, [email protected])

Mark Handley (+44 20 7071 4277, [email protected])

Munich

Benno Schwarz (+49 89 189 33-110, [email protected])

Mark Zimmer (+49 89 189 33-130, [email protected])

© 2017 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.