August 16, 2016

This Client Alert provides an update on shareholder activism activity involving domestically traded public companies with equity market capitalizations above $1 billion during the first half of 2016. Despite the uncertain domestic and international economic and political climates, shareholder activism continues to be common.

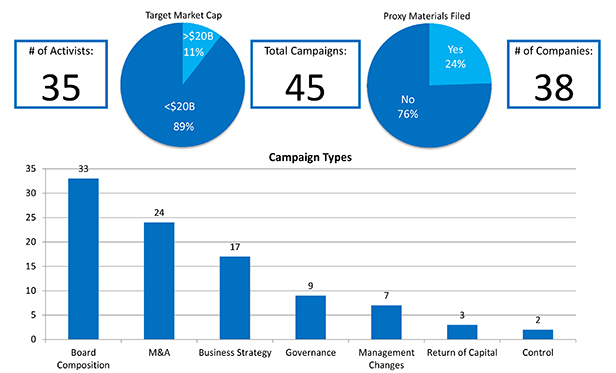

In this edition of Activism Update, our survey covers 45 total public activist actions, involving 35 different activist investors and 38 companies targeted, during the period from January 1, 2016 to June 30, 2016.[1] Seven of those companies faced advances from multiple investors, including two companies that faced coordinated actions by two investors.[2] Equity market capitalizations of the targets range from just above our study’s $1 billion minimum to approximately $334 billion.

By the Numbers – H1 2016 Public Activism Trends

*Study covers selected activist campaigns involving domestically traded companies with equity market capitalizations of greater than $1 billion as of June 30, 2016 (unless company is no longer listed).

**All data is derived from the data compiled from the campaigns studied for the 2016 Mid-Year Activism Update.

Additional statistical analyses may be found in the complete Activism Update attached below.

For the first half of 2016, both change in board composition, including gaining representation on the board (73.3%), and goals related to M&A, including pushing for spin-offs and advocating both for and against sales or acquisitions (53.3%), continued to be the most common objectives of activist investors. While large capitalization companies were not immune from activist pressure (10.5% of the companies included in our 2016 mid-year survey had equity market capitalizations above $20 billion), the majority of public activist actions involved small capitalization companies, as 55.3% of the companies in our survey had equity market capitalizations below $5 billion.

Our survey also covers 17 settlement agreements publicly filed in the first half of 2016. Within such settlement agreements, non-disparagement clauses, standstill periods and voting agreements all remain nearly ubiquitous, while we note an uptick in the number of agreements providing for other strategic initiatives (e.g., replacement of management, spin-off company governance, etc.) (82.4% in H1 2016 vs. 58.8% in 2014 and 2015). We delve further into the data and the details in the following pages.

In this edition of Gibson Dunn’s Activism Update, we have included a chart of the activist campaigns covered by the survey and statistical analyses of various trends for H1 2016, as well as a survey of settlement agreement terms with breakdowns of settlement agreements publicly filed during the first half of 2016 and updated statistics on key settlement terms from 2014 through the end of H1 2016.

We hope you enjoy Gibson Dunn’s 2016 Mid-Year Activism Update. If you have any questions, please do not hesitate to reach out to a member of your Gibson Dunn team.

[1] Several companies faced actions from multiple activist investors, some of whom were acting in concert while others were acting independently vis-à-vis the target.

[2] The other five companies were subject to multiple activists acting independently.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this publication. For further information, please contact the Gibson Dunn lawyer with whom you usually work, or any of the following authors in the firm’s New York office:

Barbara L. Becker (212.351.4062, [email protected])

Richard J. Birns (212.351.4032, [email protected])

Dennis J. Friedman (212.351.3900, [email protected])

Eduardo Gallardo (212.351.3847, [email protected])

Adam J. Brunk (212.351.3980, [email protected])

Please also feel free to contact any of the following practice group leaders and members:

Mergers and Acquisitions Group:

Jeffrey A. Chapman – Dallas (214.698.3120, [email protected])

Stephen I. Glover – Washington, D.C. (202.955.8593, [email protected])

Jonathan K. Layne – Los Angeles (310.552.8641, [email protected])

Securities Regulation and Corporate Governance Group:

Brian J. Lane – Washington, D.C. (202.887.3646, [email protected])

Ronald O. Mueller – Washington, D.C. (202.955.8671, [email protected])

James J. Moloney – Orange County, CA (949.451.4343, [email protected])

Elizabeth Ising – Washington, D.C. (202.955.8287, [email protected])

Lori Zyskowski – New York (212.351.2309, [email protected])

© 2016 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.