July 6, 2015

For years, U.S. regulators have been encouraging their foreign counterparts to pick up the mantle of international bribery enforcement and more evenly distribute the balance of prosecutions. With 2015 potentially shaping up to be a year in which transnational bribery prosecutions by foreign authorities match if not exceed U.S.-initiated actions under the Foreign Corrupt Practices Act ("FCPA"), it appears that their calls have been heeded. But the shifting balance between domestic and foreign regulators does not portend a lull for U.S. multinationals. Indeed, the present environment is more dynamic than ever, requiring exponentially more diligence as anti-corruption concerns arise from all sides. As our clients, colleagues, and friends well know, it is an interesting time to be an anti-corruption specialist.

This client update provides an overview of the FCPA as well as domestic and international anti-corruption enforcement, litigation, and policy developments from the first half of 2015.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to "issuers," "domestic concerns," and "agents" acting on behalf of issuers and domestic concerns, as well as to "any person" that violates the FCPA while in the territory of the United States. The term "issuer" covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts ("ADRs") are listed on a U.S. exchange are "issuers" for purposes of the FCPA. The term "domestic concern" is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has "accounting provisions" that apply to issuers and their agents. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts, that in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

2015 MID-YEAR FCPA ENFORCEMENT STATISTICS

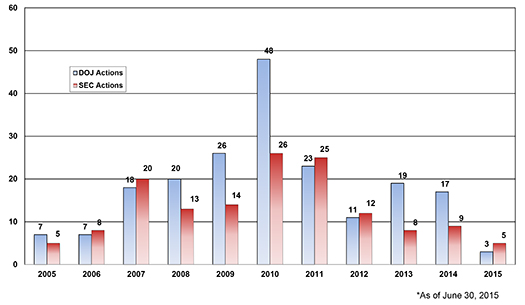

The following table and graph detail the number of FCPA enforcement actions initiated by the statute’s dual enforcers, the U.S. Department of Justice ("DOJ") and the U.S. Securities and Exchange Commission ("SEC"), during each of the past ten years.

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|||||||||||

|

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

|

7 |

5 |

7 |

8 |

18 |

20 |

20 |

13 |

26 |

14 |

48 |

26 |

23 |

25 |

11 |

12 |

19 |

8 |

17 |

9 |

3 |

5 |

2015 MID-YEAR FCPA ENFORCEMENT ACTIONS

FCPA enforcement actions were announced at a modest clip during the first half of 2015, with only eight cases between DOJ and the SEC. Of course, DOJ prosecutors (who accounted for only three of these) spent a significant portion of these six months litigating a hotly-contested trial and preparing for trials in several other previously indicted cases. Further, we are always mindful of the likely existence of additional indicted cases under the seal of various district courts across the country, just waiting for the unwitting defendant to cross a border checkpoint. A description of the first half of 2015 in FCPA enforcement actions follows.

Corporate Enforcement Actions

PBSJ Corporation

On January 22, 2015, the SEC brought its first enforcement actions of the year against a Tampa-based engineering and construction company formerly known as PBSJ and the former president of its international subsidiary, Walid Hatoum. According to the charging documents, in 2009 PBSJ (through Hatoum) agreed to pay nearly $1.4 million in bribes disguised as "agency fees" to a company owned and controlled by a Qatari government official. In return for the promised payments, PBSJ’s international subsidiary allegedly received confidential bid information that enabled it to secure two multi-million dollar contracts relating to the development of a hotel resort and light rail transit system in Qatar. These corrupt payments were never consummated, however, as PBSJ’s then-general counsel discovered the scheme shortly after the contracts were awarded and initiated an internal investigation that led to the company self-reporting to U.S. and Qatari authorities.

PBSJ, which has since been acquired by a U.K. company and delisted from U.S. exchanges, entered into a deferred prosecution agreement with the SEC to resolve its potential liability. Without admitting or denying the allegations of FCPA books-and-records and internal controls violations, PBSJ agreed to disgorge nearly $2.9 million in profits earned on a bridge contract awarded until the Qatari government could rebid the light rail project, plus pay more than $140,000 in prejudgment interest and a $375,000 penalty. PBSJ also agreed to comply with certain compliance undertakings during the two-year term of the deferred prosecution agreement.

This is only the third alternative resolution entered into by the SEC in an FCPA matter since the Commission announced its Cooperation Initiative in 2010–the other two being a deferred prosecution agreement with Tenaris S.A. in 2011 and a non-prosecution agreement with Ralph Lauren Corporation in 2013. Of the resolution with PBSJ, SEC FCPA Unit Chief Kara N. Brockmeyer said that "PBSJ ignored multiple red flags that should have enabled other officers and employees to uncover the bribery scheme at an earlier stage." Nevertheless, the SEC acknowledged that "PBSJ took quick steps to end the misconduct" after discovery and explained that the financial remedy "reflects the company’s significant cooperation with the SEC investigation." DOJ reportedly has closed its investigation without any charges against PBSJ.

Goodyear Tire & Rubber Company

On February 24, 2015, the SEC charged Goodyear with violating the FCPA’s books-and-records and internal controls provisions based on alleged corrupt payments in Africa. Specifically, the SEC claimed that between 2007 and 2011, Goodyear subsidiaries in Angola and Kenya boosted tire sales through the payment of approximately $3.2 million in bribes to government officials, local authorities, and employees of both state- and privately-owned companies.

To resolve the charges, Goodyear consented to the settled cease-and-desist proceeding, agreed to pay over $16.2 million in disgorgement and prejudgment interest, and will self-report to the SEC on the state of its compliance program over the next three years. The SEC made clear in its order that the relatively lenient disposition–which did not include a monetary penalty or a compliance monitor–was based on Goodyear’s cooperation in the investigation and remedial actions, including divesting or preparing to divest each of the two involved subsidiaries. Goodyear has announced that DOJ has closed its investigation without taking action against the company.

FLIR Systems Inc.

In our 2014 Year-End FCPA Update, we covered the SEC’s November 2014 resolution of FCPA charges against two former employees of Oregon-based defense contractor FLIR–Stephen Timms and Yasser Ramahi. On April 8, 2015, the company itself agreed to settle FCPA charges with the SEC arising out of the same core alleged misconduct.

Similar to the case against Timms and Ramahi, the SEC’s case against FLIR prominently featured a so-called "world tour" of lavish travel expenditures and gifts provided to officials of the Saudi Arabian Ministry of Interior in order to induce them to purchase FLIR products. Specifically, the SEC alleged that in 2009 FLIR (through Timms and Ramahi) sent these Ministry officials on a 20-day trip around the world–from Beirut, to Casablanca, to Dubai, to Paris, to New York City–as part of a trip for which the only legitimate purpose was a five-hour factory acceptance tour, coupled with three one-to-two hour office meetings in Boston. The SEC also alleged that FLIR (again through Timms and Ramahi) gifted five expensive watches–worth a total of approximately $7,000–to some of the same Saudi officials and then falsified documentation to make it look like the watches cost 7,000 Saudi Riyal (about $1,900) when FLIR’s finance department began asking questions. Finally, the SEC included new allegations that, between 2008 and 2011, FLIR employees provided an additional $83,000 in questionable travel expenditures for Saudi Ministry of Interior and Egyptian Ministry of Defense officials.

Without admitting or denying the SEC’s charges, FLIR consented to an administrative cease-and-desist proceeding alleging violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions, agreed to pay more than $9.5 million in disgorgement, prejudgment interest, and penalties, and agreed to self-report on the state of its compliance program for a two-year term. The SEC favorably noted FLIR’s voluntary disclosure and remedial actions. FLIR reported that DOJ has closed its investigation, declining to take action against the company.

BHP Billiton

On May 20, 2015, the SEC announced another travel-and-entertainment-related FCPA settlement, this time with dual-listed global resource companies BHP Billiton Ltd. and BHP Billiton Plc. (collectively, "BHP Billiton"). According to the SEC, BHP Billiton invited 176 government officials (out of a total of approximately 650 invitees) to the 2008 Beijing Summer Olympics, complete with four-day hospitality packages that included "event tickets, luxury hotel accommodations, meals, other hospitality, and, in many instances, offers of business-class airfare." The alleged purpose of these invitations–which resulted in tabs of between $12,000 and $16,000 per person for the 60 government officials and guests who accepted–was improper marketing, as evidenced by internal e-mails discussing the need to "strengthen relationships" with foreign officials, "gain[] access to regions that will provide growth[,]" "gain[] port access[,]" and "help facilitate approvals for future projects." The SEC alleged that invitations were extended to government officials who were in a position to influence matters involving BHP Billiton, including officials from Burundi, the Philippines, the Democratic Republic of the Congo, and Guinea.

To settle the SEC’s books-and-records and internal controls charges, BHP Billiton consented to the entry of a cease-and-desist order, agreed to pay a $25 million civil penalty, and will self-report on the state of its compliance program to the SEC for a one-year period. The SEC noted BHP Billiton’s "significant cooperation" in the investigation, as well as the company’s "significant remedial actions." BHP Billiton has reported that DOJ also has completed its investigation into the company and decided not to file charges.

The record-setting $25 million penalty imposed by the SEC in this case is quite interesting. The SEC frequently espouses the view that companies may avoid or at least mitigate penalties if they cooperate in Commission investigations. Nevertheless, in this case the SEC imposed the largest penalty it has ever imposed in an FCPA enforcement action notwithstanding BHP Billiton’s "significant cooperation" and the comparatively modest nature of the alleged misconduct. It would appear that the SEC was unable to tie the allegedly improper travel and entertainment to the award of any particular contract for which profits could be disgorged, and that the ground-breaking penalty was a way to impose some measure of financial punishment on the company.

Another interesting aspect of this settlement is its illustration of the importance of executing upon controls designed to minimize corruption risk. According to the SEC, BHP Billiton "identified the risk that inviting government officials to the Olympics could potentially violate anti-corruption laws" and therefore developed a "hospitality application" with approval processes specifically designed for the 2008 Olympics. However, other than a small sample set reviewed for assessment purposes at the beginning of the program, the "Ethics Panel" chartered to oversee the application process did not, in fact, review individual applications. Therefore, applications that were inaccurate, incomplete, or even that explicitly said that the proposed trip was "a way of rewarding [the invitee for] the business that has previously been conducted with BHP Billiton" were approved without any scrutiny by compliance personnel. Said SEC Associate Director of Enforcement Antonia Chion of this settlement, "A ‘check the box’ compliance approach of forms over substance is not enough to comply with the FCPA."

IAP Worldwide Services Inc.

On June 16, 2015, DOJ announced an FCPA non-prosecution agreement with Florida defense contractor IAP, together with a related plea agreement with former IAP vice president James Michael Rama. According to the corporate non-prosecution agreement, IAP was interested in pursuing a homeland security project in Kuwait to outfit various government agencies with closed-circuit television cameras. This project was broken up into two phases: a design phase and an implementation phase. With the goal of positioning IAP for the latter and far more lucrative implementation phase, Rama allegedly caused IAP set up a "shell company" to bid for Phase 1 and, without disclosing this separate corporation’s relationship to IAP, tailor the Phase 2 specifications to IAP’s capabilities. As part of this effort, Rama caused IAP to retain a consultant for Phase 1 and, between 2006 and 2008, allegedly paid it approximately $1.8 million with the understanding that some or all of those funds would be diverted to Kuwaiti government officials. IAP was not a SEC registrant and accordingly there were no SEC charges.

To avoid criminal charges, IAP entered into a non-prosecution agreement that requires it to pay a $7.1 million fine and self-report to DOJ on the state of its compliance program over the three-year term of the agreement. DOJ cited IAP’s cooperation, amongst other factors, as relevant to its decision to resolve this matter via a non-prosecution agreement.

Individual Enforcement Actions

Dmitrij Harder

In the first FCPA case of 2015, on January 6 DOJ announced the indictment of Dmitrij Harder, the former owner and president of Pennsylvania-based Chestnut Consulting Group, Inc. and Chestnut Consulting Group Corporation (collectively, the "Chestnut Group"). According to the 14-count indictment, between 2007 and 2009, Harder made "consulting" payments totaling more than $3.5 million to the sister of an official of the European Bank for Reconstruction and Development ("EBRD"). These payments purportedly were for services provided by the official’s sister, but DOJ claims that in reality no such services were provided. In return for the consulting payments to his sister, the EBRD official allegedly approved loan and equity investment applications totaling more than $300 million for Chestnut Group clients, which further garnered nearly $8 million in "success fees" for Chestnut Group itself.

Harder, a Russian national, German citizen, and permanent resident alien of the United States, has pleaded not guilty to all charges–which include alleged violations of the FCPA’s anti-bribery provisions, the Travel Act, money laundering, and conspiracy–and currently is facing a September 2015 trial date in the U.S. District Court for the Eastern District of Pennsylvania. This case serves as a reminder that the FCPA’s anti-bribery provisions proscribe indirect payments (including those made through family members) to officials of public international organizations as well as those of foreign governments. The EBRD, a multilateral development bank based in London and owned by more than 60 sovereign nations, has been designated by Executive Order as a "public international organization" and thus its officials are covered by the FCPA’s anti-bribery provisions.

Walid Hatoum

As noted above, on January 22, 2015, the SEC entered into a deferred prosecution agreement with Hatoum’s former employer, PBSJ. On that same day, the Commission also initiated a cease-and-desist proceeding against the former president of PBSJ’s international subsidiary. The SEC alleged that Hatoum agreed to pay $1.4 million in bribes to a Qatari official’s side company in exchange for confidential bid information, as well as destroyed documents and offered to provide a job to a second Qatari official in exchange for assistance as the scheme began to unravel. Without admitting the FCPA anti-bribery, books-and-records, and internal controls charges against him, Hatoum consented to the proceeding and agreed to pay a $50,000 penalty.

James Michael Rama

As noted previously, on June 16, 2015 former IAP vice president James Michael Rama agreed to resolve criminal FCPA charges coincident with the announcement of a non-prosecution agreement with his former employer. Based on the same conduct outlined above, Rama pleaded guilty to a single count of conspiring to violate the FCPA’s anti-bribery provisions. Sentencing is scheduled for September 2015 in the U.S. District Court for the Eastern District of Virginia.

2015 MID-YEAR FCPA-RELATED PROSECUTIONS

Not every instance of international corruption, even among those with a U.S. component, constitutes an FCPA violation. Indeed, by far the most prominent international corruption case brought by U.S. prosecutors in 2015 to date did not involve FCPA charges.

FIFA Corruption Sweep Nets Charges Against 20 (and Counting)

Over the years, we have covered several scandals surrounding the Fédération Internationale de Football Association ("FIFA"), from reported match-fixing to allegations that World Cup host country bids were corruptly procured. But none of these measure up to the events of May 27, 2015. The U.S. Attorney’s Office for the Eastern District of New York ("EDNY USAO") announced a 47-count indictment charging nine FIFA officials and five corporate executives with (non-FCPA) corruption-related offenses, from racketeering, to wire fraud, to money laundering, to tax evasion, to obstruction of justice. In addition, the EDNY USAO announced the unsealing of six prior guilty pleas from four executives and two companies on related charges.

In an indictment so lengthy it needed a table of contents, the EDNY USAO laid out a massive, 24-year scheme pursuant to which officials of FIFA and its umbrella entities received over $150 million in bribes from sports marketing companies in return for lucrative marketing rights to the World Cup and other FIFA events. Further, the indictment alleged that a senior FIFA representative received more than $10 million from South African officials in exchange for his vote in favor of that nation’s successful bid to host the 2010 World Cup.

The government’s case against the 14 indicted individuals has yet to move far in the U.S. court system. Seven of the FIFA officials were prominently arrested before a waiting media horde outside of a luxury Zurich hotel as they prepared to attend a meeting of the 2015 annual FIFA Congress. On July 1, 2015, the United States submitted formal extradition requests to the Swiss government for these seven. Extradition requests to other nations, including Italy, Paraguay, and Trinidad and Tobago, are either in progress or likely to be forthcoming. Still other defendants have been placed on Interpol’s wanted list.

In our coming updates, we will follow developments on this prosecution and related investigations that are said to be ongoing into the award of World Cup hosting rights to Russia in 2018 and Qatar in 2022. For those wondering, the charges to date appear not to have included an FCPA component because, unlike the EBRD as explained in the Harder prosecution section above, FIFA is not a "public international organization"–and thus its officials are not "foreign officials"–for purposes of the FCPA by virtue of their affiliation with FIFA.

2015 MID-YEAR CHECK-IN ON ENFORCEMENT LITIGATION

James Sigelman FCPA Trial

The first FCPA trial in three years took an unexpected turn and ended in a dramatic mid-trial guilty plea to substantially reduced charges after the government’s key witness admitted to making false statements on the witness stand.

We have been covering the prosecution of Joseph Sigelman, former co-CEO of British Virgin Islands oil and gas company PetroTiger Ltd., since the January 2014 announcement of FCPA charges against him and his two PetroTiger co-defendants, former co-CEO Knut Hammarskjold and former general counsel Gregory Weisman. As noted in our 2014 Mid-Year FCPA Update, both Weisman and Hammarskjold agreed to plead guilty to a dual-purpose conspiracy count covering both FCPA and wire fraud schemes–the FCPA portion of which related to more than $330,000 allegedly paid to an official of Ecopetrol S.A., a Colombian state-owned petroleum company, in exchange for the official approving a nearly $40 million oil services contract for PetroTiger. Sigelman, however, refused to plead guilty to the six-count indictment of FCPA bribery, wire fraud, money laundering, and conspiracy charges and put DOJ to its burden of proof at trial.

The Sigelman trial began on June 1, 2015 before the Honorable Joseph E. Irenas and a jury empaneled in the U.S. District Court for the District of New Jersey. The heated pre-trial motion practice highlighted in our 2014 Year-End FCPA Update continued up to the brink of trial, including a dispute as to which portions of a surreptitiously recorded December 2012 conversation between then-cooperating witness Weisman and Sigelman could be played for the jury. On May 27, Judge Irenas ruled that Sigelman’s lawyers would be able to reference exculpatory portions of this recording during opening statements only if DOJ first mentioned the allegedly inculpatory portions in its opening statement. Concluding that the benefits outweighed the risk, FCPA Unit Chief Patrick F. Stokes opened the door by highlighting in dramatic fashion a portion of the tape in which Sigelman–apparently correctly suspicious that Weisman was wearing a wire–directed Weisman to "lift [his] shirt."

Billed as a "star witness," Weisman was called early in the government’s case-in-chief as its second witness. DOJ lost an early ruling on his testimony, as Judge Irenas ruled that Weisman could not discuss in front of the jury a spreadsheet that PetroTiger’s Director of Sales showed to him that allegedly contained a list of bribes paid by PetroTiger in Colombia. Because Weisman could not confirm that this spreadsheet pertained to government-related bribes, Judge Irenas ruled the spreadsheet and any reference to it inadmissible. Judge Irenas reasoned that if the spreadsheet contained records of only commercial bribery, it could unfairly and inaccurately plant the notion of government-related bribery in the jury’s mind, observing that "99.99% of [commercial bribery] does not fall under the purview of the Foreign Corrupt Practices Act." Nevertheless, the government recovered and elicited strongly incriminating testimony about Sigelman from Weisman.

But Weisman’s testimony quickly went awry once Sigelman’s lawyers got their turn with him. On the first day of cross-examination, Weisman testified that he continued to serve as the general counsel of a separate company owned by Sigelman after he agreed to cooperate with the government’s investigation against Sigelman. Weisman admitted cooperating with the government against his own client was a "serious ethical violation," but said DOJ prosecutors told him to do so. The next morning, Weisman admitted that he had "misremembered" the part about DOJ prosecutors telling him to commit the serious ethical violation, prompting Judge Irenas to ask in front of the jury: "Misremembered? Did you have a hallucination?" Shortly thereafter, Judge Irenas dismissed the jury and adjourned the trial until the following Monday so that the government could contemplate its next move.

That following Monday, June 15, Sigelman and DOJ reached a plea deal whereby Sigelman–who had been facing as much as 20 years in prison for the six charges against him–pleaded guilty to a single count of FCPA conspiracy with a recommended sentence of no more than one year and one day in prison. Judge Irenas did not believe even that much was a reasonable sentence, and on June 16 sentenced Sigelman to a non-custodial, probationary sentence, together with just over $239,000 in restitution to PetroTiger and a $100,000 fine.

Weisman and Hammarskjold have yet to be scheduled for sentencing. With respect to the company, DOJ has now publicly confirmed that it "declined to prosecute PetroTiger" based on its "voluntary disclosure, cooperation, and remediation, among other factors." Finally, Colombian prosecutors have arrested and are in the process of prosecuting David Duran, the Ecopetrol official who allegedly received the PetroTiger bribes, as well as Duran’s wife, a former PetroTiger employee, and several other officials from Ecopetrol.

Alstom Defendants

As reported in our 2014 Year-End FCPA Update, last year’s blockbuster Alstom S.A. FCPA enforcement action was preceded by FCPA charges against four former Alstom executives and related charges against one of the recipients of the bribery scheme. With the sole exception of former Alstom executive Lawrence Hoskins, each of the Alstom defendants charged in the United States has pleaded guilty. (As noted below, additional Alstom defendants have been charged in the United Kingdom.)

The first quarter of 2015 was quiet for the Hoskins case, at least on the public docket. In April, Hoskins filed several discovery-related motions, including motions to compel Brady material, for the issuance of letters rogatory to France, and for the issuance of Rule 17(c) subpoenas. These motions all relate to the pursuit of Hoskins’s argument that he was not an "agent" of a "domestic concern," namely Alstom’s U.S. subsidiary. DOJ not only opposed these motions, but obtained a third superseding indictment amending the charges to allege greater functional involvement by Hoskins in the U.S. subsidiary’s operations. Hoskins replied by moving to dismiss the lead conspiracy count of the new indictment, arguing that as a foreign national working abroad for a foreign, non-U.S. listed company, he is no more subject to an FCPA conspiracy charge than a substantive FCPA charge. In other words, Hoskins argues that under well-established case law, a category of persons expressly exempted from the scope of a statute may not be drawn back within the scope of that statute via an alleged conspiracy with someone who is subject to the statute (here, Alstom’s U.S. subsidiary).

These motions all remain pending before the Honorable Janet Bond Arterton of the U.S. District Court for the District of Connecticut. Trial is currently scheduled for November 2015.

In other developments related to the Alstom prosecutions, on March 23, 2015, Asem Elgawhary was sentenced to 42 months in prison for mail fraud, money laundering conspiracy, and tax evasion convictions. As reported in our 2014 Year-End FCPA Update, Elgawhary pleaded guilty on December 4, 2014, admitting that he accepted millions of dollars in bribes from Alstom and two other companies between 2006 and 2011 to skew the competitive bidding processes he oversaw as the general manager of a joint venture between Bechtel Corporation and Egypt’s state-owned utility company. In addition to the 42-month prison term, the Honorable Deborah K. Chasanow of the U.S. District Court for the District of Maryland sentenced Elgawhary to forfeit $5.2 million in illicit proceeds from his bribery scheme.

Magyar Telekom Defendants

The SEC’s long-running FCPA civil enforcement action against three former executives of Magyar Telekom, Plc.–Andras Balogh, Tamas Morvai, and Elek Straub–continues to proceed at a modest clip before the Honorable Richard J. Sullivan of the U.S. District Court for the Southern District of New York. More than three years after the SEC filed charges, fact discovery concluded in early March 2015, with the parties having collectively deposed more than 10 witnesses in Macedonia, the United States, and the United Kingdom and taken testimony from 13 additional witnesses in Germany and Hungary pursuant to the Hague Convention. Expert discovery closed in June and both sides have indicated their intention to move for summary judgment on various issues, including: (1) whether the court has personal jurisdiction over each of the defendants; (2) whether the SEC’s December 2011 claims are time-barred under the applicable five-year statute of limitations; and (3) whether the defendants made "use of the mails or any means or instrumentality of interstate commerce" through e-mails sent in connection with the alleged bribery scheme. Judge Sullivan has already ruled on some of these issues in connection with defendants’ motion to dismiss, as described in our 2013 Mid-Year FCPA Update. The Court has not yet set a briefing schedule for summary judgment, and no trial date currently is on the calendar.

Haiti Teleco Defendants

Our readers are quite familiar with the long-running prosecution of numerous individuals involved in a scheme to bribe officials of the Haitian state-owned telecommunications company Télécommunications d’Haiti S.A.M. ("Haiti Teleco").

On February 9, 2015, the U.S. Court of Appeals for the Eleventh Circuit affirmed the convictions and nine-year sentence of former Haiti Teleco Director of International Relations Jean Rene Duperval. As reported in our 2012 Mid-Year FCPA Update, after a weeklong trial in March 2012, Duperval was convicted by a jury sitting in the U.S. District Court for the Southern District of Florida of 21 counts of money laundering arising from his receipt of bribes from two telecommunications companies. In affirming that conviction, the Eleventh Circuit employed the same standard set by an earlier panel of the court in United States v. Esquenazi (discussed in our 2014 Mid-Year FCPA Update) to determine that Haiti Teleco was an "instrumentality" of the Haitian government for FCPA purposes. In another FCPA-related holding, the Court rejected Duperval’s argument that his administration of multi-million telecommunications contracts constituted "routine governmental action" within the scope of the FCPA’s "facilitating payments" exception. Adopting an analysis similar to the Fifth Circuit in the 2004 United States v. Kay decision–the only other appellate case to address this exception–the Eleventh Circuit held that this is a "limited" exception that applies only to payments for "largely non-discretionary, ministerial activities performed by mid- or low-level foreign functionaries." Duperval has filed a motion for rehearing en banc before the entire Eleventh Circuit, which remains pending as of the date of this publication.

Another defendant convicted in the Haiti Teleco prosecution, Terra Telecommunications vice president Carlos Rodriguez, has filed two post-trial motions in the U.S. District Court for the Southern District of Florida: a 28 U.S.C. § 2255 motion to vacate his sentence based on the alleged ineffective assistance of trial counsel and a Rule 33 motion for a new trial based on newly discovered evidence. In support of the latter motion, Rodriguez attaches a declaration by the former Terra Telecommunications general counsel contradicting the government’s trial evidence that both Rodriguez and the general counsel were present for a meeting where bribes to Haiti Teleco officials were discussed. The general counsel reportedly did not testify at Rodriguez’s trial based on the advice of his own counsel and his Fifth Amendment right to remain silent. DOJ has not yet responded to either of Rodriguez’s post-trial motions.

Dmitry Firtash

In our 2014 Mid-Year FCPA Update, we reported on the indictment of six foreign nationals accused of scheming to bribe Indian government officials for mining rights that was unsealed when one of the six–billionaire Ukrainian gas mogul Dmitry Firtash–was arrested on a U.S. warrant in Vienna, Austria. On April 30, 2015, Judge Christoph Bauer of the Landesgerichtsstrasse Regional Court in Vienna denied the United States’s request to extradite Firtash to answer the U.S. FCPA charges. In denying the request, Judge Bauer agreed with Firtash that the case against him was a thinly-veiled, politically-motivated attempt by the United States to pursue foreign policy goals in Ukraine. Firtash contended, and the Austrian court agreed, that DOJ began investigating him to exert pressure on someone whom the United States felt had destabilized the region’s politics by representing Russian interests in Ukraine.

For its part, DOJ denies that political motivations underlie the indictment of Firtash or his co-defendants. Despite the Austrian Judge’s ruling, DOJ’s indictment against the six defendants still stands, potentially awaiting another extradition contest if and when one of the six is caught in a country that maintains an extradition treaty with the United States.

Direct Access Partners Defendants

Since 2013, we have been reporting on DOJ’s prosecution of several former executives of New York broker-dealer Direct Access Partners LLC ("DAP") for their alleged scheme to pay kickbacks to a senior official of a Venezuelan state-owned bank. On March 27, 2015, the final two defendants–former CEO Benito Chinea and former managing director Joseph DeMeneses–appeared before the Honorable Denise L. Cote of the U.S. District Court for the Southern District of New York for sentencing. Each defendant received a four-year prison term for his single-count FCPA/Travel Act conspiracy conviction, and Chinea was ordered to forfeit more than $3.6 million while DeMeneses was ordered to forfeit nearly $2.7 million.

In an interesting twist, DAP submitted letters to the Court mere days before the sentencing hearings requesting that DAP be recognized as a "victim" of the conspiracy and that the Court order restitution against Chinea and DeMeneses for the compensation that the defendants received from DAP during the criminal conspiracy, as well as the cost of DAP’s internal investigation and assistance to DOJ. DOJ and the defendants opposed DAP’s request, with DOJ arguing that as a "closely-held, private company," DAP was effectively a participant in and beneficiary of the conspiracy and "should not be entitled to restitution for its own conduct." Judge Cote agreed and denied DAP’s request prior to announcing the sentences of Chinea and DeMeneses.

A separate civil fraud case brought by the SEC against Chinea, DeMeneses, and other DAP defendants currently remains stayed due to DOJ’s ongoing investigation, with DOJ due to report back to the court no later than October 1, 2015.

Angela Aguilar Forfeiture Appeal

We last reported on DOJ’s FCPA prosecution of Lindsey Manufacturing Company and certain of its employees and agents in our 2012 Mid-Year FCPA Update, where we discussed the unopposed vacatur of a May 2011 jury verdict against one of the company’s third-party intermediaries, Angela Aguilar. As discussed in our 2011 Year-End FCPA Update, the vacatur of Aguilar’s conviction followed a December 2011 ruling by the Honorable A. Howard Matz of the U.S. District Court for the Central District of California vacating the convictions of Lindsey Manufacturing and Aguilar’s other co-defendants on grounds of prosecutorial misconduct.

Following her conviction–but prior to Judge Matz’s December 2011 decision–Aguilar agreed not to contest the forfeiture of approximately $2.4 million in funds in a brokerage account held in the name of Grupo Internacional de Asesores S.A. ("Grupo"), a company controlled by Aguilar that was allegedly used to funnel unlawful payments to officials of a Mexican state-owned utility. In exchange, DOJ agreed to recommend a sentence of time served for Aguilar. The government initiated civil forfeiture proceedings against the brokerage account funds after Aguilar was sentenced, and default was entered against Aguilar and all other potential claimants in November 2011. After Judge Matz’s December 2011 decision, however, Aguilar and Grupo opposed the government’s motion for entry of a default judgment–and then moved to set it aside after Judge Matz granted the government’s motion–arguing that their failure to oppose the initial entry of default was due to "excusable neglect."

On April 10, 2015, the U.S. Court of Appeals for the Ninth Circuit affirmed Judge Matz’s denial of Aguilar’s and Grupo’s motion to set aside the default judgment of forfeiture. Although recognizing that default judgments generally should be set aside except in "extreme circumstances," the Ninth Circuit concluded that there is no requirement that a district court use any "magic words" to explain its reasoning and that Judge Matz had appropriately considered the factors relevant to that determination. The Court also concluded that Aguilar and Grupo had failed to show that they had any "meritorious defense" to forfeiture, agreeing with Judge Matz that (1) Aguilar was not entitled to an "innocent owner" defense because there was no evidence that she personally owned the funds in the account; and (2) despite the "potential issues with the government’s case" identified in Judge Matz’s December 2011 decision, the government’s complaint had adequately stated a claim for forfeiture.

Biomet, Inc. Deferred Prosecution Agreement Extended

Though not technically an "enforcement update," the extension of Biomet’s 2012 deferred prosecution agreement has caught the attention of many informed members of the FCPA community. As reported in our 2012 Mid-Year FCPA Update, in March 2012, the Warsaw, Indiana-based orthopedics and dental products company entered into a deferred prosecution agreement to resolve an FCPA matter relating to alleged corrupt payments to doctors in Argentina, Brazil, and Mexico. The three-year term of this deferred prosecution agreement was scheduled to expire early this year, but in a March 13, 2015 SEC filing the company announced that the agreement–and the compliance monitorship that went along with it–had been extended by an additional year due to an ongoing investigation into new whistleblower complaints in Brazil and Mexico. This extension highlights the government’s increasingly aggressive approach toward companies subject to post-resolution monitoring agreements, a trend discussed extensively in our forthcoming 2015 Mid-Year Update on Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements.

2015 MID-YEAR KLEPTOCRACY FORFEITURE ACTIONS

For several years now, we have been covering DOJ’s efforts to recover the proceeds of foreign corruption through forfeiture actions, known as the Kleptocracy Asset Recovery Initiative. DOJ’s focus in this area appears only to have increased in recent times, including a very active first half of 2015 as described below:

- On January 13, 2015, DOJ filed a civil forfeiture complaint in the U.S. District Court for the Eastern District of Louisiana seeking the forfeiture of nine New Orleans properties, worth approximately $1.5 million in the aggregate, that are beneficially owned by Mario Zelaya, the former Executive Director of the Honduran Institute of Social Security ("HISS"). DOJ’s complaint alleges that these properties were purchased using funds traceable to approximately $2 million in bribes paid to Zelaya by a private Honduran company seeking to prioritize and expedite payments owed to it by HISS. Zeyala is opposing DOJ’s complaint, and the case is in discovery with a March 2016 trial date on the calendar.

- On March 4, 2015, DOJ announced the settlement of several civil forfeiture cases against certain assets of Chun Doo Hwan, the former president of the Republic of Korea. As reported in our 2014 Mid-Year and Year-End FCPA Updates, Hwan was convicted by a Korean court in 1997 of accepting more than $200 million in bribes from Korean businesses. Pursuant to the 2015 settlement with DOJ, Hwan agreed to forfeit approximately $1.1 million in assets. DOJ noted that its joint investigation with Korean authorities also helped to secure the return of an additional $27.5 million from an associate of Hwan’s in partial satisfaction of the criminal judgment entered against Hwan in Korea.

- On June 29, 2015, DOJ filed a civil forfeiture complaint in the U.S. District Court for the Southern District of New York seeking the forfeiture of approximately $300 million in assets allegedly traceable to corrupt payments by two Russian telecommunications companies to a close relative of Uzbekistan President Islam Karimov in return for access to the Uzbek telecommunications market. No response has yet been filed by any party with a potential interest in the proceeds.

- On June 30, 2015, DOJ filed a civil forfeiture complaint in the U.S. District Court for the District of Columbia seeking the forfeiture of approximately $34 million in bribes allegedly paid by Canadian energy company Griffiths Energy International Inc. to Mahamoud Adam Bechir, Chad’s former ambassador to the United States and Canada, and Youssouf Hamid Takane, Chad’s former Deputy Chief of Mission. As reported in our 2013 Year-End FCPA Update, Griffiths Energy pleaded guilty to violations of Canada’s Corruption of Foreign Public Officials Act in February 2013 arising out of alleged bribes to Bechir to influence the award of oil development rights in Chad. This forfeiture action follows a separate November 2014 action filed in the same district seeking the forfeiture of approximately $106,000 in alleged bribe proceeds from Bechir as reported in our 2014 Year-End FCPA Update. Bechir is opposing the earlier forfeiture action. There is no indication yet as to the response to the June 2015 forfeiture action.

FCPA SPEAKERS’ CORNER

U.S. government regulators were again busy on the speaking circuit in the first half of 2015, providing the FCPA community with insights into their agencies’ investigative priorities and expectations for companies that come before them.

- Assistant Attorney General Leslie R. Caldwell – Caldwell has been prolific in her speaking appearances over the past six months. In these speeches, she has provided invaluable guidance summarizing DOJ’s expectations for everything from corporate compliance programs, to cooperating with DOJ investigations, to deferred and non-prosecution agreements, as set forth below:

- "Hallmarks of Effective Compliance Programs" – In a May 19, 2015 speech at the Compliance Week Conference, Caldwell outlined 10 "hallmarks of effective [corporate] compliance programs":

- senior leadership should provide "strong, explicit and visible support" for compliance programs;

- this support should be conveyed not only in written policies, but also through other messages conveyed to employees, such as in-person meetings, e-mails, compensation incentives, etc.;

- compliance programs should be overseen by senior executives, with direct access to independent monitoring bodies (e.g., auditors and the Board);

- compliance policies should be written in an easily understandable manner;

- compliance teams should be adequately funded and should have "an appropriate stature within the company";

- companies should have an "effective process" for investigating allegations of misconduct;

- companies should periodically review their compliance policies and practices "to keep [them] up to date with evolving risks and circumstances," including changes in the company’s risk profile such as through the acquisition of a foreign entity;

- companies "should have an effective system for confidential, internal reporting of compliance violations";

- companies should implement mechanisms that both incentivize compliance and discipline violations; and

- companies should "sensitize third parties" to their compliance expectations through more than just "boilerplate language" in contracts, including terminating relationships if the third parties demonstrate a lack of respect for compliance.

- Cooperating with DOJ Investigations – In two separate speeches to the New York University Program on Corporate Compliance and Enforcement and New York City Bar Association’s White Collar Crime Institute, delivered on April 17 and May 12, 2015, respectively, Caldwell outlined her expectations for companies that wish to receive cooperation credit in DOJ investigations. Caldwell observed that although "[m]ost companies have no obligation to cooperate," if they do "we expect that cooperation to be candid, complete and timely." Caldwell rejected criticism that DOJ is to blame for companies spending years and hundreds of millions of dollars on far-flung investigations (explicitly referencing the infamous Avon investigation, among others), stating that "a good investigation should focus on the problem at issue, determine the scope of the problem and investigate accordingly, and also focus on what compliance or cultural shortcomings allowed that problem to exist." Caldwell specifically rejected the oft-cited notion that an allegation of misconduct in one country necessarily must lead to a global review of compliance in every country, stating that "absent a reason to do so, we do not expect the company to provide us with a clean bill of health for the entire company worldwide [and] boil the ocean." Caldwell also provided guidance on the nettlesome issue of foreign-located documents subject to data privacy laws. Recognizing that although "there may be some real legal hurdles to the provision of some types of data and information," Caldwell said that a company’s "first instinct" if in cooperation-mode should be "how can I get this information to the government," and not a "kneejerk invocation of foreign data privacy laws designed to shield critical information from our investigation." Finally, and as she put it "[p]erhaps most critically," Caldwell says that she expects "cooperating companies to identify culpable individuals–including senior executives if they were involved–and provide facts about their wrongdoing."

- Thinking "Long and Hard" About Alternative Prosecution Vehicles – Caldwell also provided guidance this year on DOJ’s approach to deferred and non-prosecution agreements. For example, at the ABA White Collar Crime Conference on March 6, 2015, Caldwell said that DOJ is rethinking its approach to these agreements, calling them "over used." As reported in Global Investigations Review, Caldwell said: "We are going to see an uptick in declinations for companies that actually come in and do everything that they are supposed to do." On the other side, however, "We are also looking . . . to charge companies . . . when cooperation is inadequate or non-existent . . . ." Finally, at the April 17 NYU speech referenced above, Caldwell proclaimed with respect to existing deferred and non-prosecution agreements that they must have "real teeth" and that DOJ "will not hesitate to tear up a DPA or NPA and file criminal charges, where such action is appropriate and proportional to the breach. . . . A company that is already subject to a DPA or NPA for violating the law should not expect the same leniency when it crosses the line again." For more on DOJ’s evolving approach to deferred and non-prosecution agreements, please see our forthcoming 2015 Mid-Year Update on Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements.

- "Hallmarks of Effective Compliance Programs" – In a May 19, 2015 speech at the Compliance Week Conference, Caldwell outlined 10 "hallmarks of effective [corporate] compliance programs":

- SEC Director of Enforcement Andrew J. Ceresney – Ceresney used a May 13, 2015 appearance at the University of Texas School of Law’s Government Enforcement Institute as a platform to extoll the virtues of the SEC’s Cooperation Initiative, announced five years ago in 2010. Pertinent to the FCPA community, Ceresney reminded everyone of his previously expressed view that "companies are gambling if they fail to self-report FCPA misconduct to us." If a company did not self-report because it did not know of the misconduct, Ceresney said there will be questions about why its compliance program did not identify the issue. Even worse, if the company did know about serious misconduct and chose not to disclose it, Cereseny warned "[t]here will be significant consequences."

- DOJ FCPA Unit Chief Patrick F. Stokes – Stokes similarly professed the benefits of voluntary disclosure at a March 12, 2015 panel event at the Georgetown University Law Center. As reported by Law360, Stokes said the benefits of disclosure are "measurable and clear." Giving the blockbuster December 2014 enforcement actions against Alstom and Avon as examples, Stokes claimed that the companies could have saved $565 million and $20 million off of their respective $772 million and $62 million DOJ fines had they received sentencing guideline credit for voluntary disclosure.

- SEC FCPA Unit Chief Kara N. Brockmeyer – As reported by Mainjustice.com, Brockmeyer said of the SEC’s enforcement priorities at a February 2015 conference, "We won’t focus only on the multinationals, but also on the small and medium-sized companies [that] may be going into foreign markets for the first time and not thinking consistently about the types of risk that they face and the changes that they may need to make to their compliance program and their income controls."

- FBI Assistant Director Joseph Campbell – In January 2015, the FBI announced that it was more than tripling (from around 10 to more than 30) the number of agents assigned to overseas bribery investigations. In an interview with the Wall Street Journal surrounding the announcement, Campbell observed, "With the growing global economy and the growing nature of international commerce with globalization of more companies and economies, it’s creating more opportunities for the potential of FCPA and corruption." Campbell said that the newly assigned agents will work out of FBI field offices in Boston, Los Angeles, Miami, New York, San Francisco, and Washington, D.C.

2015 MID-YEAR FCPA-RELATED PRIVATE CIVIL LITIGATION

As in past years, the first half of 2015 featured plaintiffs pursuing private redress in the United States for public corruption abroad. Although the FCPA provides no private right of action, plaintiffs’ attorneys have used various other causes of action to seek recompense for losses associated with FCPA-related misconduct. These actions demonstrate the ramifications corruption can present beyond the criminal and civil penalties sought by government regulators.

Although we are tracking literally dozens of these lawsuits in courts across the country, a selection of matters either filed or resolved in the first half of 2015 appears below.

Shareholder Lawsuits

On January 20, 2015, aluminum giant Alcoa, Inc. secured a long-awaited resolution to a 2012 shareholder derivative suit that alleged breaches of fiduciary duty by directors and officers associated with the conduct that led to the company’s January 2014 FCPA settlement (reported in our 2014 Mid-Year FCPA Update). Chief Judge Donetta W. Ambrose of the U.S. District Court for the Western District of Pennsylvania accepted the settlement that called for Alcoa to pay $3.75 million in attorneys’ fees and adopt a wide range of compliance reforms designed to mitigate the risk of future violations of anti-corruption laws. These reforms included: (1) hiring the company’s first Chief Ethics and Compliance Officer, who will report directly to Alcoa’s Chief Legal Officer and make periodic reports to the Audit Committee and the Board of Directors; (2) developing a specific corporate anti-corruption policy; (3) requiring enhanced mandatory FCPA compliance training for all employees at least annually; and (4) implementing anti-corruption due diligence procedures for mergers and acquisitions.

On March 4, 2015, the Delaware Court of Chancery set boundaries on shareholders’ ability to access corporate information on FCPA investigations via books-and-records inspection demands. Following a November 2014 trial (profiled in our 2014 Year-End FCPA Update), the court denied a Parker Drilling Company stockholder’s request to identify the company’s executives who were implicated in a long-running Nigerian customs investigation by the DOJ and SEC, which was resolved in April 2013 as reported in our 2013 Mid-Year FCPA Update. This suit followed several failed derivative actions brought against Parker Drilling, including one by the same shareholder, arising out of the company’s FCPA investigation and settlement. The Court found that the shareholder failed to establish a proper purpose for an inspection of the books and records because it was estopped from further derivative litigation and because the information itself was not necessary for a board demand.

Alcoa and Parker Drilling were not the only companies to resolve an FCPA enforcement action in 2014, only to find themselves embroiled in collateral shareholder litigation in 2015. Bio-Rad Laboratories, Inc. settled FCPA claims with DOJ and the SEC in November 2014 stemming from allegedly improper payments in Russia, Thailand, and Vietnam (as reported in our 2014 Year-End FCPA Update). In 2015, additional shareholders filed a derivative action in California state court and a records demand in Delaware Chancery Court. Both complaints are pending.

Over the past several years, Avon Products, Inc. has been the target of numerous shareholder suits stemming from conduct at a Chinese subsidiary that led to the company’s December 2014 FCPA settlement with DOJ and the SEC. As outlined in our 2014 Year-End FCPA Update, the Honorable Paul G. Gardephe for the U.S. District Court for the Southern District of New York dismissed without prejudice a securities fraud class action against Avon. Not deterred, plaintiffs filed a second amended complaint on October 24, 2014, and the case now is in mediation. In addition to the securities fraud action, plaintiffs brought a derivative action against Avon in the same court and made a novel attempt to shoehorn state law claims–including waste of corporate assets and unjust enrichment–before the federal tribunal on the grounds that the claims were purportedly inextricably tied to the FCPA and raised substantial questions of federal law. On March 16, 2015, Judge Gardephe granted defendants’ motion to dismiss for lack of subject matter jurisdiction, finding that it would be "tantamount to recognizing a private right of action under the FCPA" and would "open the floodgates" to a number of similar claims, which, in the court’s opinion, would be "an outcome directly contrary to Congress’s apparent intent."

RICO Actions

We reported in our 2014 Year-End FCPA Update on a Racketeer Influenced and Corrupt Organizations ("RICO") Act lawsuit brought by Mexican state-owned oil company Petróleos Mexicanos ("PEMEX") against Hewlett-Packard Co. following the computer giant’s resolution of FCPA charges with DOJ and the SEC that included allegations of PEMEX-related corruption. On June 25, 2015, the Honorable Beth Labson Freeman of the U.S. District Court for the Northern District of California heard arguments on HP’s motion to dismiss the complaint on jurisdictional and other grounds. No decision has yet been published.

Employee Lawsuits

The collateral fallout in 2015 from Bio-Rad’s 2014 FCPA settlement expanded beyond shareholder litigation. On May 27, former Bio-Rad general counsel Sanford S. Wadler filed a Sarbanes-Oxley whistleblower lawsuit in the U.S. District Court for the Northern District of California. The former general counsel alleges that in light of discovering the conduct in Russia, Thailand, and Vietnam that resulted in the 2014 FCPA resolution with DOJ and the SEC, Bio-Rad determined to undertake an internal investigation of its business in China. Although Bio-Rad’s outside counsel found no evidence of an FCPA violation there, Wadler himself later discovered information that he believed did evidence misconduct. When Wadler attempted to report this evidence to senior management, they allegedly engaged in "repeated stonewalling" and pressured him to "sweep [the findings] under the rug." Wadler claims that when he refused he was terminated in retaliation. The case is pending.

Last, but certainly not least, on May 15, 2015, the Texas Supreme Court dismissed a closely-watched employee defamation action arising out of an FCPA investigation. Specifically, the court ruled that former Shell Oil Co. employee Robert Writt could not maintain his lawsuit alleging that the company defamed him when it reported to DOJ as part of an internal investigation that he "engage[d] in unethical conduct" in approving certain payments to third parties. Reversing the judgment of the intermediate court of appeals, Justice Phil Johnson ruled for a unanimous Court that Shell’s statements to DOJ "were made preliminarily to a proposed judicial proceeding and were absolutely privileged" under Texas law. The Court observed that "DOJ’s leverage over Shell vis-à-vis the FCPA and its somewhat draconian potential penalties" compelled Shell to undertake a robust internal investigation and report its findings to DOJ. The Court’s ruling was consistent with the position advocated for by Gibson Dunn on behalf of amici Chamber of Commerce of the United States, National Association of Manufacturers, and the American Petroleum Institute, and the Court also cited a Gibson Dunn FCPA update as evidence of the uptick in FCPA enforcement activity over the course of the past decade.

2015 MID-YEAR INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

World Bank Enforcement

The first half of 2015 saw several significant sanctions imposed in anti-corruption actions brought by the World Bank’s Integrity Vice-Presidency:

- On January 29, 2015, German consulting company GKW Consult GmbH entered into a negotiated resolution with the Bank after a local employee in Liberia allegedly accepted payments in return for approving falsified contractor documents in connection with an urban sanitation project. Under the terms of the settlement, GKW is debarred for 10 months and will pay $325,000 in restitution.

- On February 4, 2015, the architectural and engineering firm Louis Berger Group, Inc. was debarred for one year for alleged improper payments to Vietnamese government officials in connection with two Bank-financed projects.

- On February 25, 2015, Seng Enterprise Co., Ltd. was debarred for three years for allegedly making corrupt payments to government officials in connection with a Bank-financed contract in Cambodia.

- On April 23, 2015, Alcatel-Lucent Trade International A.G. and Alcatel Saudi Arabia Limited entered into a negotiated resolution with the Bank and were debarred for 18 months after an investigation found that two agents hired to help win a bid for a Bank-financed $30.4 million contract in Iraq had not been properly disclosed.

- On June 1, 2015, Spanish electric utility Iberdrola S.A. and a subsidiary entered into a negotiated resolution with the Bank to resolve allegations that the subsidiary failed to disclose agency arrangements in 2004 and 2005 tenders for Albanian power projects. Even without any allegation of corruption, the failure to disclose the agency relationship itself was found to constitute a "fraudulent practice" under Bank guidelines. Under the terms of the agreement, the subsidiary is debarred for one year followed by a six-month conditional non-debarment period, and will pay $350,000 in restitution to the Albanian government, while the parent received a letter of reprimand. The Bank lauded Iberdrola’s cooperation in the investigation and remedial actions. Said World Bank Integrity Vice President Leonard Frank McCarthy, "This case offers a clear example of how a company shifted course and sought corrective action in light of investigative evidence. Our objective is to work with more companies to achieve that goal."

Europe

United Kingdom

The U.K. Serious Fraud Office ("SFO") continues to aggressively pursue foreign bribery cases under the Bribery Act 2010 and its predecessor, the Prevention of Corruption Act 1906. Indeed, the first half of 2015 saw developments unmatched in recent U.K. anti-corruption enforcement history. Enforcement developments included:

- On January 20, 2015, the SFO brought its first foreign-bribery case under the Bribery Act 2010. (Because the Bribery Act applies only prospectively from its entry into force on July 1, 2011, prior international anti-corruption prosecutions were brought under the statute’s predecessor, Prevention of Corruption Act 1906.) The Overseas Anti-Corruption Unit of the City of London Police arrested two men–and Norwegian authorities arrested a third–in connection with $150,000 allegedly paid to a Norwegian government official to procure the sale of six decommissioned naval vessels. The names of the defendants have not yet been disclosed.

- Between January and May 2015, the SFO brought Prevention of Corruption Act 1906 charges against Alstom Network UK Ltd. and three of its employees–Michael John Anderson, Graham Hill, Jean-Daniel Laine–based on collective alleged corruption in Budapest, India, and Poland. These charges follow prior SFO enforcement actions brought against another Alstom subsidiary and other employees in 2014.

- On February 12, 2015, Christopher John Smith and Nicholas Charles Smith, respectively the chairman and sales and marketing director of printing company Smith and Ouzman Ltd., were sentenced for their Prevention of Corruption Act 1906 convictions. As reported in our 2014 Year-End FCPA Update, the two Smiths and their company were convicted by a jury of participating in the corrupt payment of £395,000 to public officials for business contracts in Kenya and Mauritania. Christopher and Nicholas Smith were sentenced to 18 months’ and three years’ imprisonment, respectively. The company will be sentenced at a hearing in October 2015, which will also deal with confiscation proceedings against the company and both individuals.

- On May 4, 2015, a Nigerian court authorized the extradition of the former head of the Nigerian Security, Minting and Printing Company, Emmanuel Okoyomon, to face corruption and money laundering charges in the United Kingdom based on his alleged receipt (through a U.K. bank account) of bribes from Australian company Securency International, allegedly to secure currency printing contracts in Nigeria.

- On June 2, 2015, a jury at Southwark Crown Court acquitted Trevor Bruce, Bharat Sodha, and Nidhi Vyas of foreign bribery charges brought under the Prevention of Corruption Act 1906. The three defendants, plus a fourth (Paul Jacobs) whose charges were dismissed pre-trial due to ill health, were arrested in 2012 (as reported in our 2012 Year-End FCPA Update) on suspicion of engaging in a conspiracy to make nearly £200,000 in corrupt payments to officials of Nigerian Boards of Revenue in 2008 and 2009. The employer of these four individuals, U.K. oil and gas manpower services company Swift Technical Solutions Ltd., cooperated in the SFO’s investigation and was not charged. The acquittals followed an earlier win for the prosecution in the Court of Appeal on the preliminary issue that it was not necessary for the prosecution to prove that an agent’s principal had consented to a corrupt payment; it was sufficient that the payment was made corruptly.

Another recent development in U.K. anti-corruption enforcement that is of keen interest to corporates is the announcement by the SFO that it has issued invitation letters to parties with which it is willing to negotiate deferred prosecution agreements. For more on this development, please see our forthcoming 2015 Mid-Year Update on Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements.

France

French anti-corruption prosecutors suffered several setbacks during the first half of 2015.

First, on January 7, the Paris Court of Appeals set aside the 2012 conviction of Safran S.A., while at the same time upholding the trial court’s acquittal of two Safran executives–Jean-Pierre Delarue and François Perrachon. Under French law, a company may only be held criminally liable if it is tied to the criminal actions of an employee, and arguably only to the actions of a senior employee. Absent the conviction of either employee before the trial court below, the appeals court held that Safran, as a legal entity, could not itself be held liable for the alleged bribery scheme. Some critics of France’s current liability regime have cited this case to illustrate that France’s legal system is ill-equipped to prosecute corporate entities. Nonetheless, given the size of the modern global corporation and the U.S. concept of respondeat superior, this seems to be a sensible and practical approach.

Second, on June 18, a Paris criminal trial court cleared 14 companies accused of bribing government officials in Saddam Hussein-era Iraq in exchange for contracts as part of the United Nations Oil-For-Food Program. Although the judgment has not yet been released, several of the companies appear to have been acquitted based on double jeopardy concerns arising from the fact that they had previously entered into deferred prosecution agreements with DOJ.

On the legislative front, the Central Service for the Prevention of Corruption (Service Central de Prévention de la Corruption), an autonomous inter-ministerial component of the French ministry of justice, on April 1 published a series of new, non-binding guidelines intended "to strengthen the fight against corruption in commercial transactions." These guidelines, developed after input from numerous key stakeholders with an interest in the prevention of corruption, are intended to provide guidance for companies in developing and implementing anti-corruption policies and programs. The guidelines are organized around six primary principles:

- commitment of the leaders at the highest level of an organization to implement and enforce an anti-corruption program;

- a thorough evaluation of the corruption risks faced by the organization in order to properly tailor a program that meets the organization’s needs;

- the establishment of an anti-corruption compliance program, including the appointment of a Chief Compliance Officer who reports directly to senior management, the creation of a code of conduct, the implementation of a whistleblowing policy, and training on the new program;

- the implementation of an adequate system of internal and external controls;

- an emphasis on communication of and training related to the compliance procedures within the organization as well as to targeted third parties according to the specific risk areas identified by the organization; and

- the implementation of a clear sanctions policy for violations of the anti-corruption program.

Designed as a hands-on tool, the guidelines also include practical tips to ease the implementation of these six principles.

Germany

Germany continues to tighten its legal framework around bribery. As reported in our 2014 Year-End FCPA Update, last year witnessed Germany’s enactment of the new statutory offense, "Passive and Active Bribery of Members of Legislative Bodies," as well as the ratification of the U.N. Convention against Corruption. While no new anti-corruption related legislation took effect during the first half of 2015, several legislative projects have gained momentum.

First, on February 4, 2015, a draft bill proposing a new criminal offense of "Passive and Active Bribery in the Healthcare Business" was presented, which would prohibit medical professionals from requesting, accepting, or receiving an advantage, and any person from giving or offering such advantages, in exchange for favorable treatment with regard to the acquisition, prescription, or release of medical products or the assignment of patients to medical treatment (1) with undue preference in domestic or foreign competition, or (2) in violation of other professional duties. The new offense would close an existing gap resulting from the restrictive interpretation of current German laws by the courts, which, as currently interpreted, exclude private medical practitioners working outside of public health institutions from the category of "public officials," even when those private practitioners’ medical treatments are funded by public health insurance.

Second, on March 18, 2015, the German government proposed a bill to Parliament called the "Act to Combat Corruption." The majority of provisions in the proposed act would not change the substance of current German anti-corruption laws. Rather, as a matter of legislative housekeeping, they would integrate relevant provisions from several other acts into the key bribery provisions of the German Criminal Code (Strafgesetzbuch – StGB), most notably, provisions regarding the international application of German bribery laws. Under the most significant amendment, however, the existing offense of "Passive and Active Bribery in Business Dealings" that prohibits bribery in private business transactions would be significantly broadened, to include not only advantages requested, promised or provided in exchange for an undue preference in domestic or foreign competition, but also those that are provided in violation of the recipient’s obligations vis-á-vis his or her employer. This aspect of the draft is the subject of heavy dispute, and it is not yet clear whether, when, or in what form the bill will pass.

Greece

Organization for Economic Cooperation and Development ("OECD") examiners who visited Greece in November 2014 to evaluate its transnational anti-corruption enforcement efforts came away unimpressed, publishing a critical report in March of this year. Examiners even went so far as to suggest that Greece is sending "the unfortunate message that foreign bribery . . . is an acceptable means to win overseas business and improve Greece’s economy." Greece appears to have taken notice and responded, bringing two recent high-profile international anti-corruption enforcement actions, both of which follow U.S. FCPA enforcement matters by several years. Interestingly, given the current state of relations between the two nations in the Greek financial crisis, the charges were against two German headquartered companies and for extremely stale conduct.

In our 2014 Year-End FCPA Update, we reported on the indictment of 64 individuals in the Siemens – OTE corruption case. Greek prosecutors had filed a nearly 2,400 page indictment with the Highest Regional Court in Athena alleging corruption-related offenses from 1998 to 2003 stemming from a transaction between Siemens AG and OTE A.E., the Greek state-owned telecommunications company. The 64 individuals indicted, including former Siemens CEO Heinrich von Pierer, have been accused of active and passive bribery and money laundering in connection with $85 million in improper payments allegedly paid to secure a $1.5 billion contract with OTE A.E. On March 9, 2015, a panel of judges of the Highest Regional Court in Athena decided that the accused individuals should stand trial for the charges. So far no trial date has been set. In the meantime, a number of the defendants, including former Siemens Board Member Volker Jung, have sought application to the European Court of Human Rights, asserting that the proceedings in Greece are a violation of their right to a fair trial. They argue that further proceedings would violate the prohibition of double jeopardy (principle of "ne bis in idem") because this group of individuals has already been convicted by German courts.

On April 27, 2015, Greek prosecutors charged seven Daimler AG managers with bribery and money laundering for their alleged involvement in corrupt payments in exchange for contracts for the supply of military vehicles and buses by Daimler to the Greek government from 1997 to 2000. According to prosecutors, Daimler representatives made approximately €2 million in improper payments to secure approximately €100 million in contracts. The indictment further alleges that Daimler used third parties and offshore bank accounts for the corrupt payments to Greek state officials.

Russia

The state of play in Russian anti-corruption enforcement during the first half of 2015 is much as we typically report it to be–a mixed bag. Although Russia recently dropped another nine places on Transparency International’s Corruption Perceptions Index–from the already low 127, to 136–Russian authorities deny that this captures their true progress in combatting corruption. There are no international anti-corruption enforcement efforts to speak of, and developments on the legislative front are not clearly headed in the right direction. In March, President Putin signed into law a bill that reduces fines for corruption offenses and the Russian government recently exempted executives of 25 of the largest Russian state-owned public companies, including Russian Railways, Gazprom, and Rosneft, from an obligation to disclose their income to the public.

Ukraine

Our 2014 Year-End FCPA Update described Ukraine’s efforts to revamp its anti-corruption legislation, which went into effect on April 26, 2015. Among other provisions, the new legislation made establishing an anti-corruption compliance program mandatory for majority-state-owned entities with more than 5,000 employees and an annual turnover of more than $3.3 million and for private entities participating in public tenders involving purchases of goods of more than $47,000 or services of more than $230,000. The new law also mandated the latter category of entities to appoint a compliance officer responsible for the implementation of the compliance program. Law enforcement agencies may consider failure to meet these requirements in deciding whether to bring corruption charges, whereas establishing a workable compliance program and taking effective anti-corruption steps may be viewed as a mitigating circumstance. Other positive developments in Ukraine’s efforts to root out historic corruption include the appointment of the country’s first National Anti-Corruption Bureau Chief and amendments to criminal enforcement laws that will enable the creation of a specific anti-corruption department within the Prosecutor General’s Office.

The Americas

Brazil

As reported extensively in our 2013 Mid-Year and Year-End FCPA Updates, Brazil enacted Law 12.846/2013, an anti-corruption law known as the "Clean Companies Act," on August 1, 2013. Although the law has been in effect since January 29, 2014, the federal government did not issue implementing regulations until March 19, 2015, when Decree 8.420/2015 came into effect. Among other things, the Decree establishes guidelines for the calculation of corporate fines, sets forth the requirements for corporate leniency agreements, and provides a framework for evaluating corporate compliance programs. The enactment of Decree 8.420/2015 is an important step in Brazil’s anti-corruption efforts, and it creates important considerations for companies operating in Brazil, particularly with respect to the enforcement authorities’ expectations regarding corporate compliance programs.

The Clean Companies Act states that fines will range from 0.1% to 20% of the company’s gross revenues in the year preceding the initiation of proceedings against the company, but it does not detail how fines will be assessed within that range. The Decree provides additional guidance, establishing a number of criteria for calculating the fine. For example, the fine will range from 1% to 2.5% if the wrongdoing continued over time or if management knew of or tolerated the wrongdoing. Additionally, the fine will range from 1% to 4% if the wrongdoing interrupted the provision of public services or resulted in the execution of the contracted work. If the wrongdoing has recurred, then the fine will be 5% of the company’s gross revenues. The Decree also provides that the fine will be decreased by certain percentages for mitigating factors, including restitution of damages and the existence of a compliance program in accordance with the Decree’s requirements. In addition to fines, the Decree also allows for the publication of the decision sanctioning the company and, in certain situations, debarment of the company.

Decree 8.240/2015 also provides the framework for entering into leniency agreements with the Comptroller General of Brazil (the "CGU"). First, the company must admit its participation in the wrongdoing, cooperate with the investigations and administrative proceedings, and rapidly provide information about the infraction. Additionally, the company must identify those individuals involved in the wrongdoing, when appropriate. Finally, the Decree provides that leniency agreements must contain provisions regarding the implementation and enhancement of the company’s compliance program, in accordance with the requirements set forth in the Decree. Companies may enter into leniency agreements at any time until the preparation of the report of the administrative proceeding.