January 10, 2017

2016 saw a continuation of some recent trends in criminal antitrust enforcement, including the growth of enforcement efforts outside the United States and Europe, continuing efforts by enforcers to increase their levels of cooperation across borders, and a continuing increase in the complexity and severity of the repercussions of collusive activity (traditionally in the form of criminal sanctions, but, more-recently, civil penalties as well). This Update provides a summary overview of these trends and criminal antitrust enforcement activity in 2016.

This year’s Update debuts a more streamlined format than our previous Criminal Antitrust Updates. First, we focus on major international policy and legislative developments from jurisdictions around the world, including the implications of the election of Donald Trump as President of the U.S. and the Brexit process in Europe. The clear message from these developments is that collusion will be vigorously prosecuted with growing intensity and frequency as more and more jurisdictions around the world adopt and refine their anti-cartel enforcement regimes. Second, we summarize the most significant and notable investigations, actions, and court rulings that have occurred in those jurisdictions where anti-cartel enforcement is most active. Several of these investigations are multi-jurisdictional in nature, so we address them first. We also summarize domestic cases in countries where anti-cartel enforcement is most active. Our usual tables and charts describing the most significant fines and sentences in 2016 are included in these sections. Third, we have a country-specific section providing additional detail per country on the topics discussed in our substantive sections.

As we discussed in our recent Gibson Dunn client alert “Antitrust in the Trump Administration,”[1] we expect the Antitrust Division’s cartel enforcement and policy positions during the Trump Administration to track roughly the approaches of recent Republican administrations, producing the same or higher levels of anti-cartel enforcement. Republicans and Democrats alike tend to believe that collusive conduct is particularly harmful to competition and consumers, so we do not anticipate that the presidential transition will result in any major shakeups in how the Antitrust Division approaches cartel investigations and prosecutions. Notably, Mr. Trump’s appointee for Attorney General, Jeffrey Sessions, as well as those involved in the administration’s antitrust transition, including Josh Wright and David Higbee, have in the past placed significant emphasis on cartel enforcement and strengthening the Antitrust Division’s leniency program. Additionally, if the Administration is successful in increasing infrastructure spending, as President-elect Trump has indicated may be a priority, there may be an upswing in bid-rigging investigations.

In Europe, one of the key topics for 2017 will be the continuing consideration of Brexit and its impact on antitrust enforcement and private actions in the UK. At the moment, there is still considerable uncertainty regarding how and when Brexit will actually be triggered and, importantly, whether Brexit will be “hard” or “soft” and whether transitional arrangements will be negotiated. During 2017, we will undoubtedly see further developments in this respect. Until the UK actually leaves the EU, however, EU law remains in force and the UK is obliged to give effect to EU legislation (including competition law). Further, regardless of whether Brexit is “soft,” “hard,” or something in between, the UK’s deep infrastructure, professional service industries, culture, geography, language, and well-established legal processes and protections should continue to ensure that London remains an important global center, including for damages actions in the future.

Antitrust enforcement has continued to increase in the Asia Pacific region. This trend is likely to accelerate in 2017 as several countries have or are in the process of adopting their leniency rules (Singapore, China), or have ongoing investigations reaching their final stages (Hong Kong, South Korea). It is noteworthy that in 2016, several enforcers have devoted considerable resources to investigating abuse of dominance cases, in particular in high tech industries, but this does not detract from their stated goal to root out cartels. South America also saw continuing enforcement efforts, not only in countries typically known for aggressive cartel enforcement such as Brazil, but in several other jurisdictions including, Chile, Columbia, Peru, Argentina, and Costa Rica, as well.

I. POLICY/LEGISLATIVE DEVELOPMENTS

In this section we cover, first, the major policy and legislative developments emerging generally from the international antitrust enforcement community and, second, major domestic developments from specific countries and regions.

A. International Trends

Throughout 2016 international anti-cartel enforcers continued their efforts to increase cooperation and coordination. The year also saw continuing progress toward the implementation of the EU Damages Directive and similar legislation in other jurisdictions, and some signs that the odds of cartel participants being extradited may be increasing.

a. EU Damages Directive / Global Settlement Regimes

i. Implementation of the EU Damages Directive and major private actions

As noted in earlier Updates, the European Union adopted a Directive on Private Damages Actions in Competition Law (the “Directive”) in November 2014. The deadline for transposition of the Directive into the national laws of Member States was December 27, 2016.

The overarching aim was to establish a less fragmented regime for the pursuit of antitrust damages actions across the 28 Member States of the EU. It was intended to approximate the procedural rules of national courts in relation to damages actions based on the infringement of EU or national competition rules. The Directive seeks to make it more straightforward for victims of anticompetitive conduct across the EU to obtain compensation. It sets out minimum standards to achieve its goals, while leaving it open to Member States to introduce measures that might go beyond the prescribed standard in the Directive, provided that they are consistent with the Directive’s aims.

While implementation of the Directive has progressed, there is currently something of a patchwork across EU Member States, with some States having fully implemented the Directive, others nearing the end of the process, and still others being far from completion.

Member States including Denmark, Finland, Luxembourg, and Sweden have implemented the Directive in full, and the relevant legislation is scheduled to enter into force. The United Kingdom has laid its legislative proposals before Parliament. Hungary is also on the cusp of completing the process, with implementation scheduled for January 15, 2017.

In Austria, France, Germany, Ireland, the Netherlands, Poland and Portugal, legislation is pending, with implementation expected to occur over the course of 2017. In Belgium, a public consultation has been completed, and legislation is expected to be introduced shortly.

In other Member States, such as Greece and Spain, the process is further delayed. Legislation is not yet pending, and implementation is not expected for quite some time.

Pending EU-wide implementation of the EU’s Damages Directive, damages actions in competition cases continue to be brought mainly in Germany, the Netherlands, and the UK. The most significant of these include a claim following-on from the Commission’s 2008 Decision in the Car Glass cartel case, class actions in the Netherlands arising out of the Paraffin Wax and Elevators cartel decisions, and various actions (both individual and collective) in the UK against MasterCard. Detail on each of these can be found in Section IV, below.

It is too early to tell whether the implementation of the Directive will lead to a significant increase in claims being brought in other Member States (particularly as the Directive will require a significant departure from previous domestic law in many countries, such as Greece). However, we anticipate that by the end of 2017 some indications of the prospects for increased claims may be available. Further, as discussed below, it will be some time before we can see whether Brexit will cause the UK to lose its position as one of the three preeminent jurisdictions.

ii. Private litigation developments in Brazil

European efforts to boost private litigation have found an echo in Brazil. On December 7, 2016, Brazil’s Administrative Council for Economic Defense (the “Conselho Administrativo de Defesa Econômica” or “CADE”) launched a public consultation process on a number of regulatory amendments to enhance the effectiveness of Brazil’s rules on private enforcement and their interaction with Brazil’s leniency program.[2] The consultation is open until February 6, 2017.[3] Some of CADE’s proposals appear to mirror the solutions adopted by the EU in the Damages Directive.[4] According to publicly available information, the changes include: (i) fine reductions for cartelists who provide compensation to victims of the infringement; (ii) a recommendation that leniency applicants should no longer be held jointly liable for damages in follow-on civil litigation; and (iii) guidelines on the operation of limitation periods for damages claims.

CADE also proposes to provide access to some documents filed in support of leniency applications. CADE’s previous position was never to make such documents public. The policy shift is expected to foster damages claims by making more evidence available to potential plaintiffs. It remains to be seen, however, how much this policy shift will actually assist private litigants, because not all documents are subject to disclosure. Whether a document will be disclosed to third parties will depend on (i) the nature of the document and (ii) the procedural stage at which CADE’s investigation is pending. Documents prepared specifically to assist CADE’s investigation are not subject to disclosure.

iii. Israeli Court Limits Class Actions for Extraterritorial Conduct

Israel has a well-established private redress system, which includes class action relief. The availability of that relief in follow-on litigation related to international cartels has, in recent days, come into question. The case involved claims based on global investigations regarding certain TFT-LCD panels and wholly extraterritorial conduct. That is, no acts of collusion occurred in Israel, and no defendant sold the allegedly price-fixed product (TFT-LCD panels) in Israel or to an Israeli customer. The district court found that in those circumstances, where the parties to the cartel did not perform “an action or an omission” in Israel, Israeli procedural law did not provide for service of the petition to certify the action as a class action on the foreign defendant companies. If the district court’s decision withstands appellate review, and absent any corrective action by the Knesset, it will limit the reach of Israeli price-fixing law in civil actions to overseas entities with only indirect sales in Israel.

b. Developments International Cooperation and Extradition

The Antitrust Division of the U.S. DOJ (“Antitrust Division” or “Division”) has continued to strengthen international cooperation in antitrust investigations with its foreign counterparts,[5] and in no area is this development more apparent than in the extradition of individuals. Recent extraditions and official remarks demonstrate that the Antitrust Division is determined to use this tool to prosecute individuals abroad.

Most recently, in October 2016, the Division secured the extradition from Bulgaria of an Israeli national, Yuval Marshak, a former owner and executive of an Israel-based defense contractor. Marshak allegedly participated in multiple schemes between 2009-2013 to defraud the United States Foreign Military Financing (FMF) program. His extradition was based on charges of fraud for allegedly falsifying bid documents to make it seem like certain contracts for the FMF program had been bid on competitively when they had not.[6] Marshak was charged with two counts of wire fraud, one count of mail fraud, one count of major fraud against the United States, and one count of international money laundering.[7] He pleaded not guilty to all charges in federal court.[8] In announcing the indictment, Acting Assistant Attorney General Renata Hesse emphasized the Division’s resolve to work with foreign authorities in order to prosecute individuals abroad: “Marshak’s extradition marks another step forward in [the Division’s] efforts to coordinate investigations with foreign authorities and is further evidence that the Antitrust Division will continue to vigorously pursue individuals and companies that compromise essential government programs regardless of where they reside.”[9]

The extradition of Mr. Marshak follows the extradition of two individuals of Italian and Canadian nationality in 2014. As described in our 2014 Mid-Year Criminal Antitrust and Competition Law Update, the extradition of Italian businessman Romano Pisciotti was the first successfully litigated extradition on an antitrust charge.[10] As Assistant Attorney General William Baer commented in connection with the Pisciotti case, the conviction “demonstrates the Antitrust Division’s ability to bring to justice those who violate antitrust laws, even when they attempt to avoid prosecution by remaining in foreign jurisdictions.”[11] The extradition of a Canadian national, John Bennett, was based on fraud charges, rather than the bid-rigging charges also asserted against him.[12]

In light of the Division’s recent activity and increased focus on international cooperation, more extraditions for antitrust charges will likely follow. Because extradition generally requires that the conduct be criminal in both countries, as more countries criminalize price fixing and bid rigging, we expect that extraditions based on antitrust charges will increase. For example, Assistant Attorney General Baer noted earlier this year during the ABA International Cartel Workshop that extradition is still on the tables for individuals indicted on charges of auto-parts price fixing: “[o]nce we file charges, and that foreign national has not come back to the United States, he or she is considered a fugitive under U.S. law.”[13] Looking ahead, we expect “deeper, more frequent, and more extensive case cooperation” by the Antitrust Division with international counterparts, with an increased focus on legal assistance.[14]

B. Americas

a. United States

i. Anti-Poaching Guidelines

On October 20, 2016, the Antitrust Division of the Department of Justice (“DOJ”) and Federal Trade Commission (“FTC”) jointly issued guidance for human resource (“HR”) professionals regarding the application of the U.S. federal antitrust laws to hiring practices and compensation decisions.[15] The guidance focuses on HR professionals as gatekeepers, explaining that they “often are in the best position to ensure that their companies’ hiring practices comply with the antitrust laws.” According to the U.S. DOJ and FTC, “HR professionals can implement safeguards to prevent inappropriate discussions or agreements with other firms seeking to hire the same employees.”

In addition to providing practical guidelines for HR professionals, the guidance announces a significant shift in the DOJ’s enforcement policies with its statement that the DOJ intends to proceed criminally against “naked wage-fixing and no-poaching agreements,” i.e., standalone agreements that are not a legitimate part of a broader joint venture or other lawful collaboration. In the past, both the DOJ and FTC instituted civil enforcement actions against companies for allegedly entering into such agreements. Many of those actions ended in consent decrees. For example, in 2010 the DOJ entered into a widely-publicized consent decree with six high tech companies after alleging that the companies agreed not to cold call one another’s employees.[16]

It is unclear whether the courts will agree with the DOJ and FTC that no-poaching agreements are per se unlawful criminal violations under the U.S. antitrust laws. While the U.S. antitrust agencies and private plaintiffs have previously argued for per se treatment in the civil context, no U.S. court has yet applied the per se analysis (much less criminal sanctions) to employee “no-poach” agreements, and there is a general judicial hesitance to extend the per se rule to new categories of conduct. Moreover, many of the recent no-poaching cases have been settled before courts could reach the issue of whether a per se, quick look, or rule of reason standard applied. In the civil litigation that followed the DOJ’s investigation of high tech employers, a U.S. district court found that plaintiffs had plausibly plead a violation of the Sherman Act, but at the same time declined to decide, on the pleadings, what mode of analysis applied.[17] The litigation was settled before the court reached the issue. Thus, while the guidance makes clear that the U.S. antitrust agencies will pursue these types of agreements as per se offenses in certain circumstances, it is less clear whether U.S. courts will agree and ultimately hold defendants liable under such an analysis.

The guidance, which directs HR professionals to avoid sharing competitively sensitive information with competitors, may also signal an increased focus by the U.S. antitrust agencies on information exchanges. Specifically, the agencies assert that even absent an express or implicit agreement on wages or terms of employment between firms, evidence of exchanges of wage information (including discussion of compensation levels or policies at industry meetings or events) could be sufficient to establish an antitrust violation. The guidance for H.R. professionals acknowledges that information exchanges would most likely be reviewed under the rule of reason and are permissible in certain circumstances. For example, the U.S. antitrust agencies note that it may be appropriate for a company to obtain competitively sensitive information in the course of M&A due diligence, but only if suitable precautions are taken. Under past guidance regarding information exchanges (i.e., the so-called “safe harbor provisions”), the U.S. antitrust agencies asserted that antitrust risk presented by sharing competitively sensitive information can be mitigated under certain circumstances.[18]

With the issuance of this guidance, the U.S. antitrust agencies have clearly communicated their intent, going forward, to closely scrutinize recruitment and hiring practices, as well as information exchanges between competing employers, for potential antitrust violations. This includes the pursuit of criminal charges and per se liability against HR professionals and companies alleged to participate in wage-fixing and no-poaching agreements. While it remains to be seen whether courts will follow the agencies’ lead and afford per se treatment to no-poaching agreements, the added specter of individual and corporate criminal liability creates increased risk for companies.

ii. Prosecution of Individuals

The end of 2016 marked the anniversary of U.S. Deputy Attorney General Sally Q. Yates issuing the so-called “Yates Memo,” which sought to formalize department-wide policy concerning the prosecution of individuals responsible for corporate misconduct in violation of the civil and criminal enforcement regime. Among other things, the memorandum requires prosecutors to focus on individual wrongdoers at the inception of investigations and to determine whether any individuals should be prosecuted before a corporate settlement will be approved. In addition, to settle or receive credit for cooperating with the government, corporations must identify and disclose all relevant facts concerning all individuals involved in or responsible for the misconduct being investigated, regardless of their position in the company, in an expeditious manner. The memorandum applies to both settlement agreements and to sentencing factors taken into consideration following a successful prosecution. Significantly, however, the Yates Memo explicitly states that it does not alter the prevailing practices of the Antitrust Division’s Corporate Leniency Program.[19]

In our 2015 Year-End Criminal Antitrust and Competition Law Update, we emphasized that “[t]he implications of the Yates [Memo], including the extent to which it alters Antitrust Division policy, will be borne out in the coming years.”[20] Although understanding the full impact of the Yates Memo will require additional passage of time, a number of trends have already emerged, some of which may inadvertently undermine the speed, utility, and efficacy of internal and government investigations of corporate misconduct.

One trend that has emerged is the potential change in calculus for corporations undertaking internal investigations of possible collusive conduct and considering whether to avail themselves of the Antitrust Division’s Corporate Leniency Program. Consistent with Gibson Dunn’s observations elsewhere, the adoption of the Yates Memo has not altered this pillar of U.S. antitrust enforcement, which allows the first corporation to self-report possible cartel violations to receive immunity from prosecution. However, the DOJ Criminal Division has been reluctant to give corporations such credit and, in contrast to how the Antitrust Division administers its Leniency Program, often requires corporate guilty pleas as a condition of settlement, despite the fact that the Yates Memo expressly recognizes that the Antitrust Division’s Corporate Leniency Program is a legitimate framework to resolve instances of corporate wrongdoing generally and, overall, is intended to promote uniformity across the DOJ divisions.

The potential for divergent policies between the Criminal and Antitrust Divisions presents serious complications for “hybrid” or “mixed-conduct” cases. These cases involve conduct that has traditionally been considered as falling under the federal antitrust enforcement regime, such as bid-rigging, but that also has the potential to be characterized as violations of other criminal statutes that would fall under the purview of the Criminal Division. In these situations, where a leniency application to the Antitrust Division could be referred to the Criminal Division, a corporation that is considering whether to self-report must recognize that the benefits of the Antitrust Division’s Leniency Program might be entirely illusory. Indeed, the prospect that an application for leniency might be referred to the Criminal Division, which often demands a plea of guilty, places an almost irreversible thumb on the scale in favor of not self-reporting possible antitrust violations to the Antitrust Division, or at least substantially delaying self-reporting until the corporation has fully investigated the conduct and understands all relevant facts. This applies with even greater force to companies involved in government contracting or governmental licenses. Such an outcome would clearly undermine the well-settled expectations provided by the Antitrust Division’s universally acclaimed Leniency Program, as well as frustrate the DOJ’s broader commitment to the Yates Memo and policy uniformity.

Another unintended consequence of the Yates Memo is the potential for its emphasis on holding individuals accountable for corporate misconduct to undermine the ability of the corporation to resolve any related charges in a reasonable and appropriate manner. For example, upon submitting a leniency application and disclosing all known, relevant facts about the individuals responsible for the underlying conduct, in most instances the “target” of resulting government investigation will retain his or her own counsel and embark on his or her own negotiations with the government, particularly over the degree to which the target will cooperate. As a result, the corporation may very well lose access to a central figure and find it difficult to continue any internal investigation concerning the scope of potential wrongdoing. In such instances, it is the corporation, not the individual, who should be rewarded with cooperation credit, and the DOJ should be mindful that complying with the Yates Memo’s requirement for expeditious cooperation may inadvertently frustrate the corporation’s attempt to ferret out and disclose additional evidence relevant to the investigation.

iii. Changes in Cooperation Credit for Companies with an Inability to Pay the Sentencing Guidelines Fine

2016 saw a significant change to the manner in which the Antitrust Division provides credit, in the form of a fine reduction, for companies that demonstrate an inability to pay. Section 8C3.3(b) of the United States Sentencing Guidelines provides that a court may impose a fine below that otherwise required if it finds “that the organization is not able and, even with the use of a reasonable installment schedule, is not likely to become able to pay the minimum fine required by §8C2.7 (Guideline Fine Range – Organizations) and §8C2.9 (Disgorgement). Provided, that the reduction under this subsection shall not be more than necessary to avoid substantially jeopardizing the continued viability of the organization.”[21] The Antitrust Division is skeptical of claims of an inability to pay and subjects them to great scrutiny, but has accepted those claims and recommended a reduction of a fine when the circumstances warrant. When doing so, the Division’s historical practice has been to calculate the proposed fine under the guidelines and (where the circumstances warranted it) a downward departure pursuant to §8C4.1(a) for substantial assistance before assessing whether the organization has the ability to pay the fine.[22]

2016 marked a change in the Division’s approach. In recommending a proposed fine against Rubycon Corporation for rigging bids and fixing prices of capacitors, the Division changed the order of the calculations. It calculated the proposed fine under the guidelines, then determined that the fine should be reduced because of an inability to pay, and then recommended a further reduction for substantial assistance.[23] The effect of the change is to reduce the level of the proposed fine. The United States District Court for the Northern District of California held an initial hearing on the proposed sentence on October 12, 2016, after which it entered an order requiring the Division and Rubycon to submit additional information concerning Rubycon’s financial condition and to make the Division’s outside forensic accounting expert available for questioning by the Judge.[24] Another hearing is set for January 25, 2017.

There is a strong argument in favor of the Division’s new approach. Under the old approach, a corporation that was confident that it would be in an ability to pay status would have to question whether it made economic sense to invest resources in providing the government with higher levels of assistance because the inability to pay assessment ultimately determined the level of the proposed fine. By applying the downward departure after the fine has already been reduced to reflect an inability to pay, the Division has provided a clear economic incentive for financially weak corporations to nevertheless provide high levels of cooperation and assistance.

b. South America

Significant developments have taken place in 2016 in South America, both on the legislative front and in terms of policy announcements. In Chile, as anticipated in our 2016 Mid-Year Criminal Antitrust and Competition Law Update, a new antitrust bill was signed into law.[25] The Bill introduces a series of measures to strongly deter companies against participating in “hard-core” cartels, including increased fines, the introduction of a “collusion” felony, and facilitation of class actions to recover damages. In Argentina, the National Commission for Competition Defense (CNDC) launched a consultation process on a bill that will be sent to Congress in the next few months to amend Argentine’s Law 25,156.[26] The changes in the bill are similar to the Chilean legislation, in that they introduce stricter fines and facilitate private litigation. They also introduce a leniency program. Finally, as noted in our 2016 Mid-Year Criminal Antitrust and Competition Law Update, in May, Brazil’s CADE adopted Leniency Guidance in the form of Frequently Asked Questions (“FAQs”).[27]

In Mexico, COFECE is preparing to bring its first criminal charges for cartelistic conduct. Finally, in November, Guatemala announced that it would shortly adopt competition regulations but has so far not yet enacted any law to this effect.

C. Europe

Other than the continuing progress towards implementation of the EU Damages Directive, there were relatively few developments in EU national cartel laws. The changes that did occur include the adoption of new leniency guidelines in Belgium, the introduction of a cartel settlement procedure in Greece, and the codification in Spain of practices relating to dawn raids on domestic premises. In Hungary, changes were introduced to settlement procedure and the possibility of obtaining leniency in relation to vertical agreements was introduced. In the Netherlands, the national authority’s fining guidelines were amended to increase the maximum fines that can be imposed–now 10% of an undertaking’s annual turnover. Finally, in Germany, a draft bill was adopted to bring company liability into line with the existing European model of a single economic unit.

D. Africa and the Middle East

Developments in this region were seen in Egypt, Kenya, and Israel. In a somewhat controversial development, in September 2016, the Egyptian Prime Minister issued executive regulations that, among other things, create a rebuttable presumption that separate companies owned by members of the same family are a single economic unit in antitrust investigations. How this presumption will work in Egypt, where much of the economy is owned by the same families, remains to be seen. In Kenya, amendments have been proposed to the consumer protection provisions of the Competition Act, including changes that would enable the Competition Authority to conduct investigations on its own volition. In Israel, the Antitrust Authority proposed legislative changes relating to the disclosure of documents to companies that are appealing authority decisions.

E. Asia and the Pacific

2016 saw significant developments in the region.

As we have reported in our 2016 Mid-Year Criminal Antitrust and Competition Law Update, several jurisdictions have adopted or modified their arsenal to combat collusive conduct. In particular, China has published draft guidelines dealing with leniency, and with the calculation of fines and the Philippines have adopted implementation rules for its new competition regime.

In November 2016, the Competition Commission of Singapore (“CCS”) published amendments to a number of guidelines. According to the CCS, the new guidelines “will make it easier for businesses, consumers and other stakeholders to understand how CCS will administer and enforce the Competition Act.”[28]

The new guidelines, which took effect on November 1, 2016, include several key changes related to cartel enforcement. Most notably, revisions to the CCS’ Leniency Programme now require applicants for leniency to: (1) give an unconditional admission of the conduct for which leniency is sought, although an admission of an infringement of the Competition Act is still not mandated; (2) provide detailed information at the stage of applying for a marker, including the relevant markets in which the cartel activity occurred and the impact of the conduct on the markets identified by the applicant; and (3) grant an “appropriate” waiver of confidentiality that will permit the CCS to communicate with other competition authorities in jurisdictions where the applicant has applied for leniency. The requirement of mandatory waivers of confidentiality was included despite strong opposition from many quarters, and may reduce the willingness of multinational companies to apply for leniency in Singapore. Further, the new guidelines clarify that coercers and initiators of cartels may apply for leniency and qualify for a 50% discount in financial penalty. This stands in contrast to regimes in other jurisdictions, notably the United States, where the “ringleader” of a cartel is not eligible for any reduction.

Other significant changes include amendments to CCS’s financial penalty framework. The guidelines now utilize six separate and distinct steps used to calculate a financial penalty, which closely resemble the approaches used by the European Commission and the Competition and Markets Authority in the United Kingdom. Of particular note, a company’s turnover used in the calculation of the base penalty in step one of the process will now be the company’s turnover during the last year of the alleged infringement, as opposed to the turnover in the year prior to the imposition of the fine. Another important feature is the special emphasis the CCS has placed on the seriousness of bid rigging, by clarifying that the duration of an infringement for bid rigging will not typically be set at less than one year because of the recognition that this type of violation has long-lasting negative effects.

The CCS also amended Section 34 of the guidelines related to anticompetitive agreements. These amendments include clarification and/or explanation that: (1) being parties in a vertical relationship with each other does not preclude the finding of a horizontal agreement or concerted practice between them; (2) aside from agreements relating to price fixing, bid rigging, market sharing and output limitations, if an agreement is found to restrict competition, it will be similarly regarded as restrictive of competition to an appreciable extent, and there is no need to prove appreciable adverse effects on competition; (3) any provision and/or exchange of information, including price or non-price information, with the objective of restricting competition, will generally be considered as a restriction of competition by object; and (4) price recommendations by a trade or professional recommendations may be harmful to competition.

Lastly, the CCS adopted a new “Fast Track Procedure” that is designed to provide parties with a financial incentive to settle a case at the beginning of an investigation. More specifically, a party will be granted a 10% reduction in the overall financial penalty in exchange for (1) unequivocally admitting liability for the infringement, and (2) agreeing to limit their representations during the decision-making process procedure. Before utilizing this procedure, the CCS and the party must sign an agreement, which will include the maximum amount of financial penalties that may be imposed (taking into consideration any reductions from participation in the leniency program).

In Hong Kong, the Competition Ordinance marked its first anniversary on December 14, 2016. During its first year, approximately130 cases have been subject to a further assessment and about10 percent of these cases were subject to an in-depth investigation.[29] The Hong Kong Competition Commission (“HKCC”) expects to bring its first case before the Competition Tribunal in 2017.

On September 27, 2016, the Korea Fair Trade Commission (“KFTC”) announced amendments to its “Public Notification on Implementation of Leniency Program including Corrective Measures Against Voluntary Confessors, etc. of Unfair Cartel Activities.”[30] According to the KFTC, the purpose of the amendments “includes improvement of the leniency application procedure, clarifying the standard of amnesty plus, employing stricter conditions for order of rank succession and amendment of the judging criteria on repeated violations.”[31]

II. INVESTIGATIONS/FINES

A. International

a. Largest Worldwide Fines

As discussed more fully below in relation to each country’s domestic developments, the international community of anti-cartel enforcers has had a busy 2016. The top ten fines in terms of dollar volume in 2016 were as follows:

|

Fine |

Competition Authority |

Date |

Industry |

|

$3.04 billion (2.926 billion euro) |

European Commission |

7/19/2016 |

Trucks |

|

$1 billion (Rs 6700 crores) |

Competition Commission of India |

8/31/2016 |

Cement |

|

$520 million (485 million euro) |

European Commission |

12/7/2016 |

Interest rate derivatives |

|

$306 million (351.6 billion won) |

Korea Fair Trade Commission |

4/26/2016 |

Korea Gas Corp. bids by construction companies |

|

$185 million (214.8 billion won) (combined fines for the same charge) |

Korea Fair Trade Commission |

6/14/2016 |

Corrugated cardboard suppliers |

|

$176.2 million (166 million euros) |

European Commission |

12/12/2016 |

Rechargeable lithium-ion batteries |

|

$149 million (137.8 million euro) |

European Commission |

1/27/2016 |

Automobile parts |

|

$143 million (128.8 million euro) |

Spanish National Authority for Markets and Competition |

5/26/2016 |

Adult Diapers |

| $130 million | United States Dep’t of Justice | 9/23/16 | Automobile parts |

|

$112 million (100 million euro) |

Italian Competition Authority |

6/14/2016 |

Vending operators in the food and beverage sector |

These fines were imposed in Europe, Asia, and Africa. Not one of the top ten fines was imposed in the United States. There can be no question that international cartel enforcement is now truly global in nature.

b. Financial Markets

For the past several years the financial sector has faced intense scrutiny by a diverse range of financial regulators, competition agencies, and prosecuting authorities around the globe in connection with alleged collusive conduct involving the London Interbank Offered Rate (LIBOR), the Euro Interbank Offered Rate (EURIBOR), other benchmark rates, and foreign exchange (FX) markets.

2016 was no different, with fines exceeding $768 million and investigations in the U.S. and UK increasingly focused on individual prosecutions. While government investigations against banks may be winding down with respect to LIBOR and EURIBOR, we see the focus on the financial sector continuing with respect to FX and other areas for the foreseeable future. Indeed, as we went to press, the U.S. Antitrust Division announced its first individual guilty plea for price fixing in connection with its FX investigation.[32]

i. LIBOR

The long-running and far-reaching “LIBOR” related investigations continued into 2016 with resolutions reached domestically and internationally involving a working group of U.S. State Attorneys General and the Swiss Competition Commission (“COMCO”) respectively.

In August, the New York Attorney General (NYAG) announced a $100 million, 44-state settlement with Barclays for fraudulent and anticompetitive conduct involving the alleged manipulation of U.S. dollar (USD) LIBOR and EURIBOR. The NYAG alleged that nonprofit organizations in New York and elsewhere as well as government entities “were defrauded of millions of dollars when they entered into swaps and other financial contracts with Barclays without knowing that Barclays and other banks on the USD-LIBOR-setting panel were manipulating LIBOR.” Eligible entities with “LIBOR-linked swaps and other investment contracts with Barclays” were set to receive restitution from the $93.35 million fund, with the remainder of the proceeds covering investigation and other expenses under state law. New York and Connecticut led the working group of State Attorneys General investigating Barclays.[33]

In December, COMCO reached settlements with a number of banks in connection with its investigations into Swiss franc, Japanese yen (JPY) LIBOR, and the Euroyen Tokyo Interbank Offered Rate (TIBOR), imposing total fines of approximately CHF 48.3 million ($47 million) on four banks. JPMorgan Chase (JPMorgan) was fined approximately CHF 35.6 million ($34.7 million) to settle both investigations, Royal Bank of Scotland (RBS), which received full immunity for revealing the existence of the conduct related to Swiss franc LIBOR, received a fine of approximately CHF 3.9 million ($3.8 million) related to its conduct involving JPY LIBOR and Euroyen TIBOR, while Deutsche Bank and Citigroup received fines in connection with JPY LIBOR and Euroyen TIBOR of approximately CHF 5 million ($4.8 million) and CHF 3.8 million ($3.7 million), respectively.[34]

In a separate but related investigation, COMCO also reached settlements with Crédit Suisse, JPMorgan, RBS, and UBS related to conduct involving “bid-ask” spreads on certain Swiss franc interest rate derivatives and issued total fines of approximately CHF 5.4 million ($5.3 million). COMCO fined JPMorgan approximately CHF 2.5 million ($2.4 million), Credit Suisse 2 million ($1.95 million), and RBS CHF 856,000 ($835,000), while granting UBS full immunity for revealing the conduct. While COMCO’s investigations into the two Swiss franc investigations are now terminated, its investigation into JPY LIBOR and Euroyen TIBOR continues against four banks (HSBC, Lloyds, Rabobank, and UBS), and other financial firms (interdealer/Cash Brokers: ICAP, RP Martin, and Tullett Prebon).[35]

In 2016, the U.S. and UK continued their prosecutions of numerous individuals for LIBOR-related conduct. In the U.S., four former traders from Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (Rabobank) received sentences ranging from two years to time served (based on one trader’s cooperation with the prosecution). In August, the U.S. DOJ obtained superseding indictments for alleged LIBOR manipulation by two former Deutsche Bank traders; after they pleaded not guilty in September, the District Court scheduled a trial for January 2018.[36]

Perhaps the most significant development for this sector in 2016 has been the UK’s Serious Fraud Office’s (“SFO”) prosecution of individuals for alleged LIBOR manipulation, notwithstanding the acquittal of six derivatives brokers early in the year. On June 29, 2016, after an 11-week trial, a jury in London found two former Barclays traders and a former Barclays LIBOR submitter guilty of plotting to manipulate LIBOR. The jury failed to reach a verdict on the involvement of two other former Barclays traders, and the SFO has announced plans for a retrial. Subsequently, the court handed down jail sentences ranging between two years and nine months and six-and-a-half years (for a combined total of 17 years) against the three defendants and a fourth co-conspirator who had previously pled guilty.[37] In November, a London judge declined the three defendants’ request for permission to appeal.[38]

ii. EURIBOR

In December, both the European Commission (EC) and COMCO issued fines in connection with their investigations related to the EURIBOR benchmark interest rate. The EC found a violation with respect to Euro-based interest rate derivatives, including the sharing of desired or intended EURIBOR submissions, and imposed fines totaling €485 million (about $520 million) including a fine of €337 million (about $352 million) issued against JPMorgan and fines of €115 (about $123 million) and €34 million (about $36 million) issued against Crédit Agricole and HSBC, respectively. The banks have denied wrongdoing and were said to be weighing an appeal to the European Union courts. The fines followed the EC’s settlement in December 2013 with four other financial institutions concerning the same conduct.[39]

In December, COMCO also reached a settlement with the same four banks that had settled with the EC regarding the same EURIBOR-related conduct. COMCO imposed individual fines totaling approximately CHF 45.3 million (about $44.2 million) on three of the four settling banks: Barclays (CHF 29.8 million ($29.1 million)), RBS (CHF 12.3 million ($12.0 million)), and Société Générale (CHF 3.3 million ($3.2 million)). The fourth bank, Deutsche Bank, received full immunity for revealing the conduct to COMCO. The Swiss agency said its investigation would continue against BNP Paribas, Crédit Agricole, HSBC, JPMorgan, and Rabobank.[40]

With respect to individual prosecutions, in 2016 the UK’s SFO issued criminal proceedings against 11 individuals accused of manipulating EURIBOR. Six of the 11 appeared in court on January 11, 2016, where they were charged with conspiracy to defraud. Five individuals did not appear and prosecutors were granted European Arrest Warrants for four Germans and one Frenchman. The SFO is in the process of enforcing those warrants as the case proceeds against the other six.[41]

iii. Foreign Exchange (FX)

In December, Brazil’s antitrust enforcement agency, CADE, announced that it had reached settlements with five banks concerning its FX investigation involving offshore conduct affecting the Brazilian real (BRL) and foreign currencies, as well as manipulation of FX benchmarks. CADE approved cease-and-desist orders against Barclays, Citicorp, Deutsche Bank, HSBC, and JPMorgan with penalties issued against the banks totaling BRL 183.5 million (about $54.3 million). CADE also announced that it had opened a new investigation regarding the onshore FX market based on “strong evidence of anticompetitive conduct” in the FX spot and futures markets involving at least five banks and evidence of involvement “to a lesser extent” by another five. The new allegations include attempts to affect the PTAX, a BRL exchange benchmark maintained by the Brazilian Central Bank.[42]

In the U.S., U.S. District Judge Stefan R. Underhill of the District of Connecticut held sentencing hearings on the criminal pleas entered into by Citigroup, Barclays, JPMorgan, and RBS in May 2015. The court issued fines totaling $2.5 billion–Citigroup ($925 million), Barclays ($650 million), JPMorgan ($550 million) and RBS ($395 million))–consistent with the plea agreements the banks had reached with DOJ but less than the fines that could have been imposed under federal sentencing guidelines. The DOJ had urged the court to agree to the fine departures in light of the cooperation provided by each of the banks. While UBS was not charged by the DOJ for FX-related conduct, the court also sentenced UBS on separate charges for breach of an earlier Non-Prosecution Agreement (NPA) related to the DOJ’s LIBOR investigation and issued the $203 million fine agreed to under UBS’s plea agreement. The DOJ determined that UBS’s involvement in certain FX-related conduct had breached that NPA.[43]

Meanwhile, a published report suggests that South Korea’s competition agency (KFTC) was expected to finalize an investigation report in its investigation of FX rates for the U.S. dollar and euro.[44]

iv. Other Benchmarks

In 2016, the reach of the benchmark investigations broadened to include rates set by the Association of Banks in Singapore. In November, two banks agreed to pay AUD $13.5 million (approximately $11.2 million), plus contributions to the Australia Competition authority’s costs.[45]

c. Other International Investigations

i. Auto Parts

The long-running investigations into collusive activity in the automotive parts industry continued in the second half of 2016, with four additional corporate guilty pleas in the United States, and one substantial fine in Mexico. As of year-end 2016, 47 companies and 65 executives had been charged in the U.S. alone in the investigation, which began in 2010.[46] According to Deputy Assistant Attorney General Brent Snyder, “[t]his investigation is not completed, and the division will continue to prosecute automotive parts manufacturers and executives that sought to maximize their profits through anticompetitive means.”[47] To date, the DOJ has collected some $2.9 billion in criminal fines in the course of the investigation.

Notably, 2016 brought a second guilty plea for Hitachi Automotive Systems Ltd., which previously pleaded guilty to price fixing and bid rigging in 2013.[48] In 2013, Hitachi pleaded guilty and paid a $195 million fine for price fixing and bid rigging as to starters, alternators, and certain other automotive parts, and received substantial assistance credit for cooperating with the DOJ’s investigation. However, Hitachi’s subsequent internal investigation failed to reveal that Hitachi had also conspired as to shock absorbers. Acting Assistant Attorney General Renate Hesse stated that Hitachi “compound[ed] its error” by “fail[ing] to clean house and uncover its participation in the shock absorbers conspiracy. The Division will continue to take a hard line when companies fail to uncover additional anticompetitive behavior.”[49] The Division recommended a substantial increase in Hitachi’s fine relative to the range provided under the Sentencing Guidelines, and recommended that Hitachi serve three years of probation. Hitachi agreed to pay an additional fine of at least $55.48 million; sentencing is set for February 2017.

Despite the long-running nature of the DOJ’s investigation, companies pleaded guilty with respect to additional products, including steel tubes, body-sealing products, and access mechanisms. In late July, Nishikawa Rubber Co. Ltd. agreed to plead guilty to price fixing and bid rigging as to body-sealing products, including weather-stripping, trunk lids, and related products, and to pay a $130 million criminal fine.[50] Nishikawa’s U.S. plea also resolved an investigation into its conduct by the Competition Bureau of Canada, because sales of parts manufactured in the U.S. and shipped to Canada for assembly into cars sold in the U.S. were included in the volume of affected commerce used to calculate Nishikawa’s U.S. fine and, accordingly, the Commissioner of the Competition Bureau of Canada exercised his discretion not to pursue an enforcement action. The Nishikawa fine demonstrates that the DOJ continues to cooperate actively with foreign competition authorities and to take an expansive view of what constitutes affected commerce in the United States for purposes of sentencing calculations.

Later in the year, Alpha Corporation agreed to plead guilty and pay a $9 million fine for price fixing and bid rigging related to access mechanisms, including door handles, trunk handles, keys, and locks.[51] Alpha is, to date, the sole entity charged related to access mechanisms, but became the 46th entity charged in the auto parts investigation. Likewise, in November, Shimizu-based parts manufacturer Usui Kokusai Sangyo Kaisha Ltd. agreed to plead guilty and pay a $7.2 million fine for price-fixing and bid-rigging as to automotive steel tubes.[52] As we reported in our 2016 Mid-Year Criminal Antitrust and Competition Law Update, Maruyasu Industries and four of its sales executives were indicted for alleged conduct related to steel tubes earlier this year, which marked the DOJ’s first corporate indictment in several years.

In August, Mexico’s Federal Economic Competition Commission (COFECE) fined Mitsubishi Heavy Industries and DENSO for collusive activity related to air conditioning systems for automobiles.[53] Mitsubishi Heavy Industries provides engineering and services for such systems, which DENSO manufactures. COFECE fined the two entities 36 million pesos each (approximately $1.74 million) for rigging a bid to supply General Motors with certain air conditioning compressors between 2012 and 2016. Although the ultimate fine amounts were small by U.S. standards, COFECE’s decision is noteworthy because it appears to have withdrawn leniency status and benefits to a leniency applicant because of a failure to cooperate fully with the authority throughout the investigation. According to some commentators, this is the first such decision by COFECE, but it may be part of a continued trend to exact more substantial and extensive cooperation from leniency applicants before leniency is ultimately awarded. Later this year, the Korea Fair Trade Commission levied a $9.7 million fine against the companies for the same conduct, as it affected cars sold by General Motors in Korea.[54]

ii. Ocean Shipping/Roll-on, Roll-off Cargo

During the second half of this year, both the U.S. DOJ and the Australian Competition and Consumer Commission (ACCC) continued their investigations related to the roll-on, roll-off cargo industry. Roll-on, roll-off cargo is non-containerized cargo–cars, trucks, and mining, construction, and agricultural equipment–that can be rolled onto and off of an ocean-going vessel. To date, four companies have pleaded guilty and paid nearly $235 million in criminal fines, along with the indictments of eight individuals, four of whom have since been convicted and sentenced.[55]

In July 2016, Wallenius Wilhelmsen Logistics AS (WWL), a Norwegian Corporation, agreed to plead guilty and pay a $98.9 million fine.[56] WWL’s fine was the largest by far in DOJ’s investigation, accounting for nearly half of the total fines collected to date. Later in the year, the ACCC brought its first-ever criminal charges against two roll-on, roll-off cargo companies, Nippon Yusen Kabushiki Kaisha (NYK) and Kawasaki Kisek Kaisha (K-Line), both of whom had previously pleaded guilty in the United States and agreed to pay significant fines.[57] NYK pleaded guilty in Australia as well, and will face significant fines there. The Australian Competition and Consumer Act exposes cartel defendants to fines totaling the largest of A$10 million ($7.6 million), three times the total illegal benefits obtained as a result of the conduct, or ten percent of the company’s total turnover in Australia. K-Line, however, is contesting the charges.[58]

iii. Capacitors

As we reported in our 2016 Mid-Year Criminal Antitrust and Competition Law Update,[59] enforcement authorities in Asia, South America, Europe, and the U.S. have been investigating manufacturers of certain types of capacitors. During the second half of 2016, most public activity related to these investigations occurred in the U.S. The DOJ filed charges against three companies in August, bringing to five the total number of companies that have been charged and agreed to plead guilty.[60] One of those companies, Rubycon Corporation, pleaded guilty in October and agreed to pay a reduced fine based on its alleged inability to pay; but while the U.S. District Court for the Northern District of California accepted the guilty plea, the court deferred sentencing and requested additional information about Rubycon’s financial status.[61] As such, none of the three companies that announced plea agreements in August have yet been sentenced. In November and December, the DOJ announced superseding indictments charging a total of nine executives from at least four different companies who allegedly colluded regarding electrolytic capacitor prices.[62]

iv. Posters

In August 2016, Trod Ltd. pled guilty in the U.S. to a one-count indictment for fixing the prices of posters sold through the Amazon.com Marketplace, allegedly through means of a price-fixing algorithm. Trod was originally indicted in late 2015, as part of an investigation dating to 2013.[63] Trod ultimately agreed to pay a $50,000 fine in the U.S.. Daniel Aston, a Trod director who was also indicted, agreed to guarantee the payment.[64] UK authorities continued their investigation into the online poster space as well, and settled their case against Trod in late July. Trod was fined £163,371 (approximately $201,000) after 20% discount reflecting resource savings to the UK Competition and Markets Authority (CMA) as result of its admission of guilt and cooperation, and Aston was disqualified from serving as the director of any UK company for five years.[65] The CMA’s decision to debar Aston was the first successful imposition of this sanction, which was first enacted in 2003.[66] GB eye, a co-conspirator, was a successful applicant under the CMA’s leniency policy and received immunity from fines.[67] We expect that these investigations will not be the last we see in the e-commerce space, as Acting Assistant Attorney General Renate Hesse has signaled the Division’s ongoing commitment to such investigations, noting that “customers must be confident that they will receive the same benefits of vigorous competition on the web as they do at brick-and-mortar stores.”[68]

B. Americas

a. United States

i. Fines and Sentences

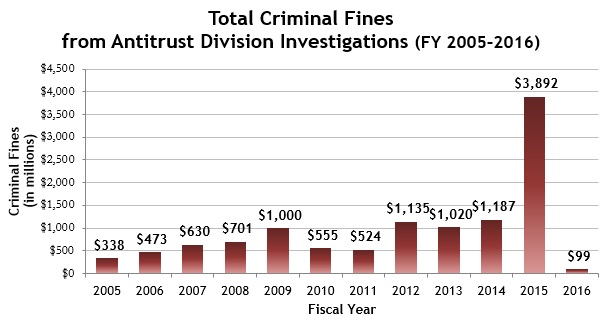

The Antitrust Division secured approximately $321 million in criminal fines and monetary penalties in FY2016. As we reported in our2016 Mid-Year Criminal Antitrust and Competition Law Update, this is a dramatic slowdown from FY2015’s record-topping $3.9 billion in fines and penalties, although that record year was largely spurred by significant fines and penalties arising from the Division’s investigation into the manipulation of certain foreign exchange rates and the LIBOR investigation. FY2016’s $321 million figure is also a significant decline from the level of penalties assessed in each of the last ten years. Indeed, it is the lowest total in the last decade. While one would not have anticipated a third consecutive year of record fines, this dramatic drop off is, to say the least, unexpected.

Of the criminal fines and monetary penalties thus far, the vast majority were imposed for violations of the Sherman Act. The largest single criminal fine of the year was levied for price fixing and bid rigging of ceramic substrates used in automobiles. The fine was the latest in the DOJ’s long-running investigation into collusive activity in the automotive parts industry, which gave rise to more than half of the fines assessed this year.

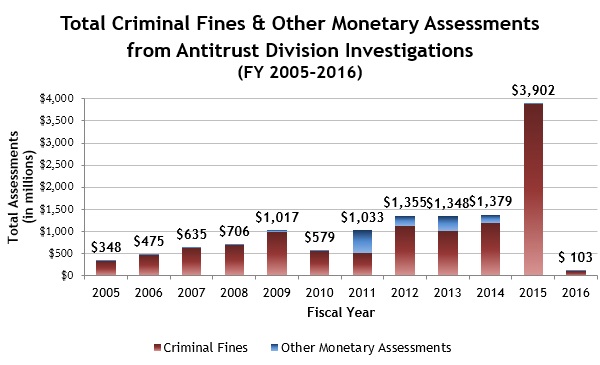

We assess the Antitrust Division’s performance by considering all of its available monetary sanctions, including criminal fines, restitution, disgorgement, and penalties (for the reasons explained at length in the2013 Year-End Criminal Antitrust and Competition Law Update). While the Antitrust Division continues to embrace multi-agency investigations, the below chart indicates a significant dip in the use of other monetary assessments as a prosecutorial tool. Nonetheless, we believe this combined metric remains the most accurate gauge of fining activity.

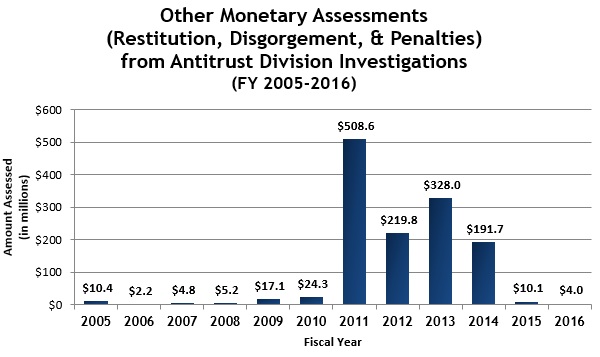

Monetary assessments are also down dramatically from prior years, with just $7.6 million levied in total this Fiscal Year. This, too, represents the smallest total of monetary assessment activity in the last eight years, and just over 1% of the monetary assessments collected in FY2011, when non-fine assessments peaked.

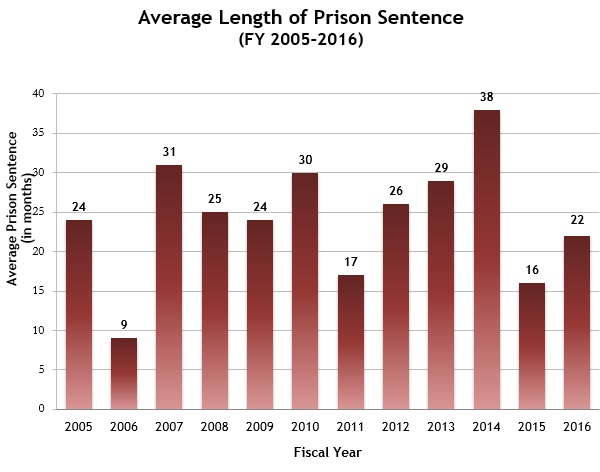

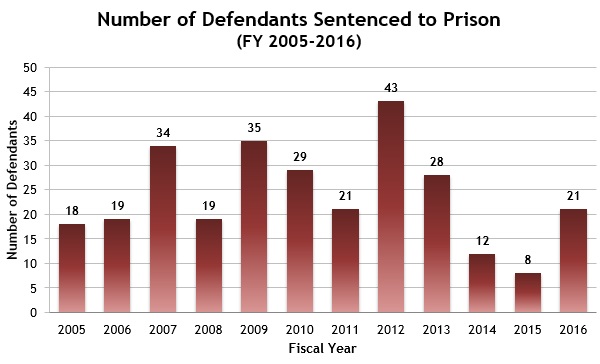

Although fine activity has fallen dramatically thus far in FY2016, the average length of prison sentences secured by the Antitrust Division is more or less on trend. The average length of a prison sentence increased from 16 months in FY2015 to 22 months this year. Both numbers are a significant departure from the average sentence secured in FY2014, when average sentence length peaked at 38 months after four years of consecutive increases. In our2015 Year-End Criminal Antitrust and Competition Law Update, we noted that it would remain to be seen whether this initial reduction (from 38 months to 16 months) was a trend or an aberration. Although average sentences have rebounded some this year, they have not regained their FY2014 height. Nonetheless, we believe that the specific details of the largely domestic cases in which sentences have been imposed this year explain the apparent departure from past records and that the Antitrust Division will continue to seek significant prison terms in price-fixing cases.

ii. Real Estate Foreclosure Auctions

In the second half of 2016, the DOJ’s investigation into bid rigging at real estate foreclosure auctions in California and Georgia netted 17 new guilty pleas, numerous prison sentences, and over $4.3 million in criminal fines. However, the DOJ also suffered a setback when a California federal judge suppressed warrantless FBI recordings made of alleged conspirators at foreclosure auctions, even as a different federal judge denied a similar motion to suppress in a separate case.

Specifically, as reported in our 2016 Mid-Year Criminal Antitrust and Competition Law Update, defendants in two different foreclosure cases in the Northern District of California filed motions to suppress recordings made outside local courthouses where public foreclosures auctions were held. The defendants each argued that the warrantless recordings violated their Fourth Amendment rights against unreasonable search and seizure. The two judges reached different results. First, on July 22, 2016, U.S. District Judge Phyllis J. Hamilton denied the motion to suppress, finding that although it was “unsettling” that the government would plant warrantless audio recording devices outside a courthouse, doing so did not violate the Fourth Amendment.[69] Judge Hamilton also held that the defendants failed to show they had a “subjective expectation of privacy in the conversations at issue.”[70] Trial in these cases is set for May 15, 2017.[71]

Less than two weeks later, on August 1, 2016, U.S. District Judge Charles R. Breyer–who presided over the second foreclosure case–reached the opposite conclusion and granted defendants’ motion to suppress.[72] Judge Breyer found that the defendants established an expectation of privacy in the recorded conversations. Judge Breyer took the government to task, holding that it had “utterly failed to justify a warrantless” bugging of a courthouse, and further noting that the recording equipment was able to pick up conversations in “hushed tones” by judges, attorneys, and court staff entering and exiting the courthouse.[73]

Meanwhile, the DOJ’s nationwide investigation into bid-rigging and fraud at public real estate foreclosure auctions continued to result in guilty pleas and prison sentences in the second half of 2016. A total of 15 defendants were sentenced for their alleged roles in conspiracies to designate winning bidders at foreclosure auctions in Northern California and Georgia, with the average prison sentence totaling just over five months among defendants who received a prison sentence.[74] The California defendants were ordered to pay on average much larger fines than defendants sentenced in Georgia: the 10 defendants sentenced in California were ordered to pay fines of between $5,000 and $1 million, with the average fine at approximately $460,000. Georgia defendants, on the other hand, were ordered to pay between $20,000 and $75,000 in fines, with the average fine at approximately $40,000. In total, 15 defendants in both California and Georgia were ordered to pay approximately $2.3 million in restitution to victims. Finally, an additional four defendants–three in California and one in Georgia–pleaded guilty during the latter half of 2016 to participating in similar bid-rigging conspiracies. As of the time of publication, these four defendants had not yet been sentenced.

At the time of this report, at least 100 individuals have agreed to plead guilty or been indicted in connection with collusion with respect to mortgage foreclosure auctions.

iii. Tuna

The DOJ’s investigation into alleged price-fixing in the packaged seafood sector saw its first criminal charges this year, with two executives from Bumble Bee Foods agreeing to plead guilty in late December. First, on December 7, 2016, Bumble Bee Seafood’s current senior vice president of sales Walter Scott Cameron[75] agreed to plead guilty to a single charge of price fixing for conspiring with competitors to fix the price of canned seafood. Two weeks later on December 21, 2016, Kenneth Worsham, the current senior vice president trade of marketing for Bumble Bee, agreed to plead guilty to a one-count felony price-fixing charge.[76] The DOJ alleged that Worsham and others entered into a price-fixing conspiracy over packaged seafood, including canned tuna, sold in the U.S. from approximately 2011 through 2013. Both pleas are subject to court approval and will require cooperation with the ongoing investigation.

As reported in our 2016 Mid-Year Criminal Antitrust and Competition Law Update, as well as our 2015 Year-End Criminal Antitrust and Competition Law Update, the DOJ’s investigation into the packaged seafood industry began in July 2015, when the department issued subpoenas to Chicken of the Sea and Bumble Bee Seafoods. The subpoenas came in the wake of the announcement of a proposed merger between Chicken of the Sea, owned by Thai Union Frozen Products, and Bumble Bee, owned by the private equity firm Lion Capital. The merger would have united the second and third largest tuna producers in the U.S., but it was called off in December 2015 after the DOJ expressed serious concerns that it would harm competition.

iv. Generic Drugs

On December 14, the Antitrust Division announced the first criminal charges to result from its investigation into the generic pharmaceuticals industry. Jeffrey Glazer and Jason Malek, former senior executives at Heritage Pharmaceuticals Inc., were each charged in a two-count felony information for their respective roles in conspiracies to fix prices, rig bids, or allocate customers in the markets for two generic drugs; a plea hearing has been scheduled for January 9. Heritage Pharmaceuticals terminated both executives in August 2016 following an internal investigation and subsequently initiated its own legal action against them in November 2016 for stealing millions of dollars in profits and property through an elaborate embezzlement and self-dealing scheme they operated for at least seven years. The Antitrust Division’s investigation into the generic pharmaceuticals industry is ongoing and further charges are expected in the coming year.

b. Canada

The Canadian Competition Bureau has brought significant bid-rigging charges in the last six months. In August, a former director at a technology company pleaded guilty to bid rigging in connection with IT supply contracts. She received an 18-month conditional sentence, a $20,000 fine, and 90 hours of community service. The first six months of her sentence are to be served under home confinement. While the fine amount is relatively small compared to other fines discussed in this Update, the sentence is notable because the defendant also agreed to participate in two public presentations aimed at raising awareness about Canada’s Competition Act, the first time this has happened in Canada.[77]

In October, a construction company pleaded guilty to participating in a bid-rigging conspiracy related to a road construction and sewage treatment project. The remaining defendants involved in the alleged conspiracy are scheduled to be tried in early 2017. Since June 2012, the investigation into road construction and sewage treatment projects has resulted in 83 criminal charges against 13 individuals and 11 companies.[78]

c. South America

2016 saw considerable enforcement activity in South America, particularly in Brazil, Chile, and Colombia.

In Brazil, between January and October 2016, CADE adopted 24 infringement decisions, imposed a total of BRL 115,647,480 in fines (approximately $33,759,500), and reached 35 settlements, collecting a total of BRL 208,512,038 (approximately $63,669,400) from settling parties. CADE has focused particularly on bid-rigging conduct, given the importance of procurement to the national economy. To further this objective, CADE launched a screening platform which in turn has resulted in a number of cases. In 2016, CADE also reached a historic BRL 300 million (approximately $91.5 million) settlement in relation to collusion in the procurement of oranges from farmers, and imposed fines related to DRAM (for conduct that ended in June 2002). New investigations included those in the real estate sector and liquefied petroleum gas market.

In Chile, the National Prosecutor’s Office (the “Fiscalía Nacional Económica” or “FNE”) lodged a formal complaint against laboratories for rigging bids in public tenders for the procurement of injectable medicines. Chile’s judicial bodies have also been active, considering appeals in relation to a December 2015 decision relating to asphalt producers, and ruling on the circumstances in which information obtained from leniency applications can be provided to criminal prosecutors.

In Colombia, the Colombian competition authority, the Superintendencia de Industria y Comercio (“SIC”), issued fines totaling 185 billion pesos (approximately $62 million) to four manufacturers and twenty-one individuals for conspiratorial activity in the tissue paper market, and found that two companies had participated in a cartel on the price of notebooks, imposing a fine of 14.8 billion pesos ($4.9 million).

The latter half of 2016 also saw enforcement action in other South American countries. In Peru, fines were imposed on five pharmacy chains for fixing the prices of diabetes, migraine, stomach and neurological drugs, as well as vitamins. The five chains were also ordered to conduct ongoing training of board members. In Argentina, the CNDC opened investigations into industries that allegedly present market concentration and other characteristics facilitating antitrust infringements. These industries include laundry detergent, aluminum, steel, petrochemical, mobile communications, credit cards and electronic payments, oil, milk, meat, city ground transportation and air transport. Finally, the Costa Rican Commission to Promote Competition (“Comisión para Promover la Competencia” or “COPROCOM”) opened an investigation against two public institutions for unfair practices relating to their procurement regarding an electronic invoicing project, as well as an investigation into sugar manufacturers for anticompetitive practices.

C. Europe

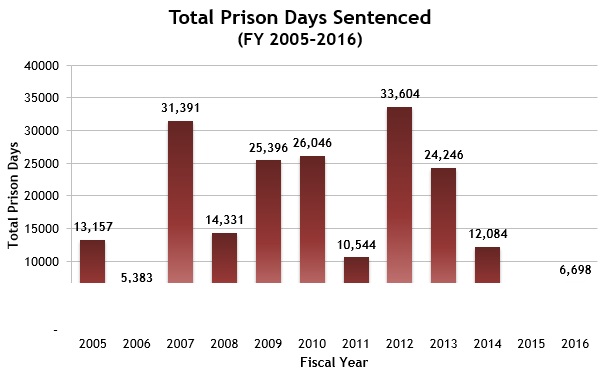

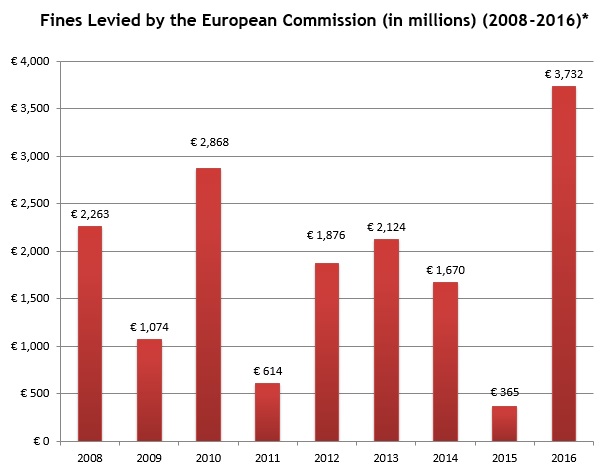

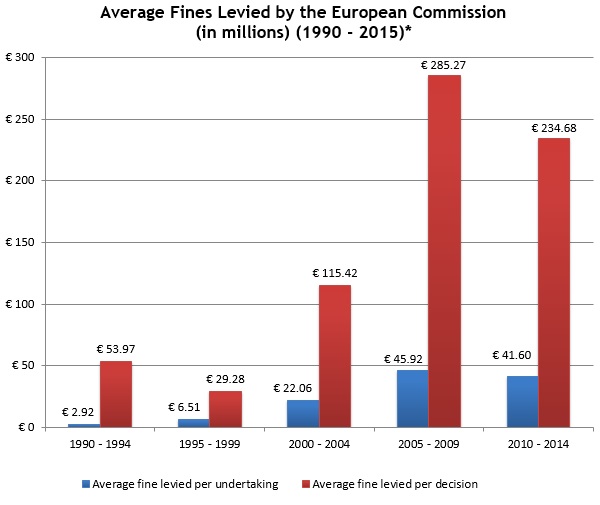

As illustrated in the charts below, the fines imposed by the European Commission (the “Commission” or “EC”) in 2016 significantly exceed the level of fines imposed in 2015 and are more in line with Commission practice between 2012 and 2014, where annual fines ranged between EUR 1.6 -1.9 billion ($1.67 – 1.98 billion). While 2015 had marked a moderate start to Margrethe Vestager’s term as European Commissioner for Competition, the Commission’s results in 2016 show that it will continue to strictly enforce competition rules by imposing significant fines for collusive behavior.

However, the second half of 2016 saw relatively limited enforcement at the national level against horizontal cartels. Instead, more emphasis is being placed on vertical agreements, for which significant penalties can also be imposed. This trend is expected to continue into 2017.

a. EU Fines

* Pursuant to the Commission’s methodology, the figures above do not take into account subsequent rulings of the European Courts adjusting the levels of fines, or the impact on previous years of the re-issue of fines by the Commission following the annulment of previous decisions by the European Courts.

b. EU cartel decisions

Aside from the Commission’s EURIBOR decision in December 2016 (discussed above), the primary EU decisions during the second half of 2016 are as follows.

i. Trucks

On July 19, 2016, the Commission imposed a fine of EUR 2.926 billion ($3.04 billion) on five major international truck manufacturing groups for their participation in price-fixing.[79] The Commission found that the companies infringed EU antitrust rules by colluding on truck prices, the timing for the introduction of emission technologies, and passing on to consumers the costs for meeting environmental standards.

The infringement covered the entire European Economic Area and lasted 14 years, from 1997 until 2011, when the Commission carried out unannounced inspections of the firms. According to the Commission, between 1997 and 2004, meetings were held at the senior manager level, sometimes at the margins of trade fairs or other events. Such meetings were complemented by phone conversations. From 2004 onwards, the cartel was organized via the German subsidiaries of the truck producers, with participants generally exchanging information electronically.

The case was begun by a whistleblower, who received full immunity. Further leniency applications were made by three other parties. All parties agreed to settle the case with the Commission, thereby achieving a reduction of 10% in their respective fines. The highest individual fine (EUR 1.009 billion, or $1.051 billion) took into account a further 30% reduction under the leniency regime. The remaining fines were EUR 753 million ($784 million), EUR 670 million ($697.6 million) and EUR 495 million ($515 million) respectively, which included some discounts under the leniency regime.

ii. Rechargeable Batteries

On December 12, 2016, the Commission fined three rechargeable battery makers companies a total of EUR 166 million ($184 million) for price fixing.[80] The Commission’s investigation was triggered by an immunity application from one of the participants.

According to the Commission, the four companies agreed on temporary price increases that were triggered by a temporary increase in the price of cobalt, a raw material used in the production of lithium-ion batteries. The parties also reportedly exchanged commercially sensitive information such as supply and demand forecasts, price forecasts or intentions concerning particular competitive bids organized by specific manufactures of products such as phones, laptops or power tools.

All parties agreed to settle the case, thereby achieving a reduction of 10% in their respective fines, which otherwise ranged between EUR 29.8 million ($33.06 million) and EUR 97.15 million ($101.15 million).

iii. Heat Stabilizers

On June 29, 2016, the Commission re-adopted two amending decisions relating to heat stabilizers, following an earlier annulment of the decisions by the EU General Court.[81] In 2009, the Commission had fined ten producers of heat stabilizers EUR 173 million ($180 million) for fixing prices, sharing customers, allocating markets, and exchanging sensitive commercial information. As a result of a calculation error, the fine imposed on one of the companies exceeded the ceiling set by EU antitrust rules, namely 10% of the company’s turnover. To correct this error, the Commission adopted an amending decision in 2010. In 2011, following a judgment by the EU Court of Justice in a different case which held that the claim was time-barred as to a second company, the Commission repealed the 2009 Decision as to that company and adopted an amending decision. However, in July 2015, the EU General Court annulled the 2010 amending decision, as one of the other companies concerned was not able to submit its views before the Commission adopted the amending decision.

In 2016, the Commission gave all companies the opportunity to present their views and re-adopted the 2010 and 2011 amending decisions.

c. Country-level investigations

Enforcement at country-level across Europe continued in 2016 but, on the whole, was not as significant in terms of output as 2015. All the same, there were important enforcement activities during the second half of 2016 particularly in France, Germany, Spain, and the UK.

In Germany, the Bundeskartellamt imposed fines in 2016 totaling EUR 46.3 million ($48.4 million). Compared to the fines imposed in 2015 (EUR 190 million; $207 million) and 2014 (EUR 1 billion; $1.01 billion), this is a relatively low figure. The most significant enforcement actions were taken against TV-studio operators and in the retail food market. The latter involved vertical price fixing of beer and the total fines imposed amounted to approximately EUR 18.3 million (approximately $19.1 million).

For the UK, on the other hand, 2016 was ground-breaking in a number of respects. The CMA’s enforcement record includes the first director disqualification, which was secured in the Trod Ltd. posters case, discussed above. In addition, the CMA imposed the highest ever fine on an undertaking (£84.2 million, or approximately $104 million) for unfair pricing in relation to pharmaceuticals.[82] The CMA’s enforcement activity focused on the online sector, where it had a number of cases, and on its ongoing criminal cartel cases. The Serious Fraud Office also saw significant developments in the LIBOR and EURIBOR cases, as discussed above.

In France, while fines were low, the authority was quite active during the latter half of 2016. It imposed fines on the main professional union of modelling agencies and 37 individual modelling agencies for price-fixing conduct,[83] and also on two suppliers and one distributor of liquid fuel back-up heating units for horizontal and vertical pricing infringements.[84] Interestingly, as none of the infringing companies in either investigation received immunity from fines, it appears that neither case stemmed from a leniency application. The authority also launched new investigations, carrying out dawn raids in relation to the energy services and energy supply sectors,[85] as well as in relation to the manufacture and distribution of sandwiches.[86]

The Spanish competition authority continued its vigorous enforcement through the second half of the year, imposing a number of significant fines. Highlights include fines totaling EUR 29.17 million (approximately $30.73 million) on 23 cement companies for price fixing and market allocation[87] and fines totaling EUR 46.44 million (approximately $48.93 million) in relation to a market-allocation cartel involving the secure handling and transportation of cash in Spain.[88] In the latter case, the CNMC also imposed fines on executives of the cartel members, in what is part of a wider trend of reliance on its (rarely invoked) power to impose fines on individuals involved in hard-core cartels.

Enforcement action in other countries was more limited but nonetheless ongoing during the second half of 2016. In Belgium, two river cruise operators were fined for market allocation. In December 2016, the Danish competition authority reportedly brought to an end its long-running case involving a price-fixing cartel in the construction sector. In Portugal, the authority imposed fines on five companies for a price-fixing and customer-allocation cartel in relation to paper envelopes.[89] The Swedish court imposed a fine on two telecom operators for a non-compete agreement, halving the fine originally proposed by the competition authority. Finally, in Switzerland, eight road-building and civil engineering companies were fined for their involvement in a bid-rigging cartel.[90]