July 18, 2017

The UK has faced a period of extreme political flux and public policy uncertainty in the last year. While most of the political focus in 2017 has been on Brexit and the recent general election, the criminal enforcement authorities and courts have remained busy and there have been significant and far-reaching developments in the UK white collar crime space in the six months since our 2016 End of Year UK White Collar Crime Update.

Between them the Criminal Finances Act 2017 and the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 bring substantial changes to the UK’s money laundering laws; the Policing and Crime Act 2017 does likewise for trade sanctions enforcement. At the same time the Serious Fraud Office (“SFO”) has secured two further deferred prosecution agreements (“DPA”s), including the first outside the bribery and corruption sphere, and announced the first ever criminal charges brought against the head of a global bank for activities during the financial crisis.

We have seen enforcement action at record levels across multiple areas of the white-collar space: the Financial Conduct Authority (“FCA”) has imposed its highest ever fine for money laundering failings; the Competition and Markets Authority (“CMA”) has issued its highest ever fine, as has the Information Commissioner. The European Commission has imposed its highest ever fine against a single entity. We have also seen the longest custodial sentence given for bribery offences since at least the mid-1990s. Yet all of these actions pale in comparison with the Rolls-Royce DPA which has established new benchmarks for financial disgorgements and potential fines in cases of bribery and corruption offences.

Against this background of accelerating enforcement activity, increasing enforcement risk for companies and emboldening of leading enforcement authorities, there have also been important developments in the English law of legal professional privilege (“LPP”) that may impact the way that companies exposed to UK risk conduct internal investigations. Moreover, there have been major proposals for institutional change among the major UK white collar criminal enforcement agencies, the ultimate outworkings of which have been cast into doubt by political developments. We find ourselves in a remarkable period for UK white collar practice.

__________________________

Table of Contents

1. Developments Relating to the White Collar Section as a Whole

Legislation: Criminal Finances Act 2017

Future of the SFO

Continued use of DPAs

Significant decisions regarding the scope of legal professional privilege

Continued concerns about the SFO’s insistence on solicitors’ undertakings for interviews

FCA and PRA publish changes to decision-making processes

Continuing enforcement activity by the FCA

Enforcement: Bribery Act section 7

Enforcement: Bribery Act sections 1-2 – giving/receiving bribes

Enforcement: Prevention of Corruption Act 1906 and Public Bodies Corrupt Practices Act 1889

Enforcement: Ongoing Foreign Bribery Prosecutions

Enforcement: Ongoing Foreign Bribery Investigations

Enforcement: Ongoing Domestic Bribery and Corruption Prosecutions and Investigations

Introduction of a new anti-bribery reporting regime

Investigations: SFO

Enforcement: SFO

Confiscation orders: SFO

Enforcement: FCA

Confiscation orders: FCA

City of London Police and Crown Prosecution Service

Scotland

4. Financial and Trade Sanctions

Enforcement

Legislative developments

BREXIT

Trade and Export

Money Laundering Regulations 2017 enter into force

FCA final guidance on treatment of PEPs for AML purposes

FCA anti-money laundering annual report for 2016/17

Case Law

Enforcement

7. Market abuse and Insider Trading and other Financial Sector Wrongdoing

FCA Enforcement – Insider Dealing

Civil enforcement for Market Abuse

__________________________

1. Developments Relating to the White Collar Section as a Whole

Legislation: Criminal Finances Act 2017

The Criminal Finances Act 2017 (“CFA”) became law on April 27, 2017, with a date for it coming into force to be determined by later regulations. The Criminal Finances Act 2017 (Commencement No. 1) Regulations 2017 published on July 12, have now set the date of September 30, 2017 as the date on which the new offences of failing to prevent tax evasion will come into force. The official Guidance should now follow shortly to give parties time to have the required “prevention procedures” in place. The date when the rest of the CFA will come into force is as yet uncertain. The stated aim of the CFA is “to make the legislative changes necessary to give law enforcement agencies, and partners, capabilities and powers to recover the proceeds of crime, tackle money laundering and corruption, and counter terrorist financing.” In particular, the CFA amends the Proceeds of Crime Act 2002 (“POCA”), which forms the basis for the UK’s anti-money laundering regime.

As stated in our 2016 Mid-Year Alert, the background to these legislative changes is outlined in the UK Government’s Action Plan for Anti-Money Laundering and Counter-Terrorist-Finance, which was published in April 2016.

Unexplained wealth orders

The CFA grants courts in the UK the power to make unexplained wealth orders (“UWOs”), as a means of requiring those suspected of holding criminal property to explain the origin of certain assets. The National Crime Agency (“NCA”), Crown Prosecution Service (“CPS”), FCA, SFO and HM Revenue and Customs (“HMRC”) will all be able to apply for a UWO by making an application to the High Court.

In order to make a UWO, the High Court needs to be satisfied that the respondent to the application for a UWO is a politically exposed person, or that there are reasonable grounds for suspecting that the respondent is, or has been, involved in serious crime whether in the UK or elsewhere. It will be sufficient to show that a person connected with the respondent is, or has been involved, in serious crime. The Court must also be satisfied that there are reasonable grounds for suspecting that the known sources of the respondent’s obtained income (such as his or her salary and any other known assets) would have been insufficient for the purposes of enabling them to obtain the property.

A UWO will require the respondent to set out the nature and extent of his interest in the property in respect of which the order is made, and an explanation of how that property was obtained. A failure to provide a satisfactory explanation may lead to a presumption that the property is “criminal property“. The property that is the object of a UWO must be valued over £50,000. There is no requirement for the subject of the UWO to be resident in the UK.

It will be an offence to knowingly or recklessly make a false or misleading statement in response to a UWO. The High Court will also have the power to make an interim freezing order where it considers it necessary to do so for the purposes of avoiding the risk of any recovery order that might subsequently be obtained being frustrated.

New offences of failure to prevent the facilitation of tax evasion

The CFA creates two new offences of failure to prevent the facilitation of tax evasion: a domestic tax evasion offence and an overseas tax evasion offence.

A corporate person can be guilty of the domestic tax evasion offence if a person commits a UK tax evasion offence whilst acting in the capacity of someone associated with the corporate person (for example, as an employee). It will be a defence to show that the corporate person had “prevention procedures” in place that were reasonable in all the circumstances. The overseas tax evasion offence has additional requirements: there must be a sufficient nexus between the corporate person and the UK, and the relevant conduct must be recognised as criminal in both the UK and in the foreign jurisdiction in question.

The CFA provides for guidance as to what will constitute adequate “prevention procedures“. HMRC published draft guidance in October 2016. That draft guidance notes that prevention procedures ought to be informed by the following six principles: (i) risk assessment; (ii) proportionality of risk-based prevention procedures; (iii) top level commitment; (iv) due diligence; (v) communication (including training); and (vi) monitoring and review. It also acknowledged that such procedures might be independent, standalone procedures, but that as long as they properly addressed the risk of facilitating tax evasion, they might form part of a wider package of procedures, e.g. internal anti-money laundering (“AML”), Bribery Act 2010 (“Bribery Act”) or fraud prevention procedures. As just stated, we expect final guidance to be published very shortly.

Importantly, the CFA also amends the Crime and Courts Act 2013 so as to allow a company to enter into a DPA in respect of these new offences. As mentioned above, we will be issuing a detailed alert on these new offences as soon as the final guidance is published.

Suspicious activity reporting regime

The CFA modifies a number of aspects of the UK’s anti-money laundering regime, as set out in POCA.

At present, “regulated sector” entities must disclose knowledge or suspicion of money laundering to the NCA by way of a suspicious activity report (“SAR”). The submission of a SAR may provide a defence to a principal money laundering offence set out in POCA. Whilst a transaction cannot proceed without risk of committing an offence under POCA if the NCA refuses consent, the NCA is deemed to have consented if it does not notify the company that consent is refused within seven working days, or if it notifies the company within seven working days that consent is refused, but takes no further action after a further 31 calendar days (the “moratorium period”).

The CFA amends POCA so as to allow the moratorium period to be extended by the court, on an application by the NCA. The court will have the power to extend the moratorium period, on more than one occasion if necessary, but only up to a further 186 days in total. The court will have to be satisfied that the NCA is carrying out its investigation “diligently and expeditiously“.

The CFA also grants the court the power, on application by the NCA, to make a “further information order” against the entity that either filed the SAR, or which is an entity in the “regulated sector“.

Disclosure orders

The CFA extends the current use of disclosure orders (which require a person subject to an order to answer questions or provide information or documents to an investigator) from their current use in POCA for corruption and fraud investigations, to money laundering and terrorist financing investigations.

Information sharing

The CFA amends POCA so as to allow explicit information sharing between regulated companies relating to money laundering prevention. A condition of sharing such information is that the sharing party must be satisfied that “the disclosure of the information will or may assist in determining any matter in connection with a suspicion that a person is engaged in money laundering“. That information sharing may result in a joint SAR which, if made in good faith, will be treated as satisfying any requirement to make disclosure on the part of the persons who jointly make the report.

Future of the SFO

In our last update, we noted that the SFO’s future could be subject to some uncertainty, given that the then newly appointed Prime Minister, Theresa May, had been looking at ways to abolish the SFO during her time as Home Secretary.

In the lead up to the recent British election the governing Conservative Party (of which Theresa May is the leader) included in its election manifesto an intention to subsume the SFO into the NCA. The manifesto read:

“We will strengthen Britain’s response to white collar crime by incorporating the Serious Fraud Office into the National Crime Agency, improving intelligence sharing and bolstering the investigation of serious fraud, money laundering and financial crime.“

A worse-than-expected election result for the Conservative Party has meant that this pledge has not subsequently been incorporated in the government’s legislative programme (which is dominated by Brexit-related matters), indicating that the Government has, at least for the time being, parked its idea to disband the SFO.

On July 6, 2017, SFO Director David Green QC, in a speech at a London conference on corporate crime, vigorously defended the agency and called for its future to be put beyond doubt, saying it “works well in a very difficult field” and is a “huge brand abroad“. He noted that doubt over the SFO’s future had already affected recruitment, retention and the agency’s credibility with “allies” such as the U.S. Department of Justice (“US DoJ”). At the same time, Mr Green, who is due to step down in April 2018, reiterated his support for law reform in relation to corporate criminal liability, which would ease the burden of proof required to prosecute companies for economic crimes other than bribery.

Continued use of DPAs

The SFO secured one DPA in 2015 and one in 2016, whereas it secured two in the first half of 2017: one with Rolls Royce Plc in January 2017 and the other with Tesco Plc in April 2017.

The Rolls Royce DPA was noteworthy for a number of reasons, including that the company received a significant discount on the potential penalty, despite the fact that the SFO learned initially of potential concerns from an internet blog and subsequently approached the company; unlike the two DPAs that had gone before there was no self-report. The SFO (which had sole right of initiative in this respect) nonetheless offered Rolls Royce a DPA, in recognition of the level of cooperation provided by the company to the SFO following the start of its investigation. We report extensively on this DPA in the Bribery and Corruption section below.

Little is available regarding the terms and scope of the April 2017 Tesco DPA, as reporting restrictions are in place pending the prosecution of three individuals in relation to the conduct of Tesco Stores Limited’s business. That trial is scheduled to take place in London from September 4, 2017.

Lord Justice Leveson, President of the Queen’s Bench Division of the High Court, has approved all four DPAs the SFO has secured since the regime came into force.

Significant decisions regarding the scope of legal professional privilege

The judgments of Hildyard J in the RBS Rights Issue Litigation [2016] EWHC 3161 (Ch) (“RBS“) and Andrews J in Serious Fraud Office v Eurasian Natural Resources Corporation Limited [2017] EWHC 1017 (QB) (“ENRC“) have cast doubt over the scope of LPP and in particular its availability in the context of criminal and regulatory investigations.

In RBS, the claimants sought disclosure of notes recording interviews with current and former employees of RBS. The interviews were conducted by in-house and outside counsel as part of two internal investigations carried out by the bank. RBS sought to withhold disclosure of the interview notes on different bases, including that they were subject to legal advice privilege, that they were “lawyers privileged working papers”, or that the English Court should apply US law which recognises the notes as privileged. The High Court rejected these arguments and held that the notes of interviews were not privileged, for reasons that follow.

Legal advice privilege applies to communications between lawyer and “client“. The RBS judgment narrowly defines a corporate ‘client’ for the purposes of legal advice privilege. As legal advice privilege only applies to lawyer-client communications, a restriction on who can be considered a client will drastically reduce the availability of this strand of LPP. In RBS, Hildyard J followed (and arguably went further than) the earlier, and much criticised, Court of Appeal authority in Three Rivers (No 5) [2003] QB 1556. The Court held that interview notes and other recorded communications with lawyers were not privileged where interview subjects were not the individuals actually authorised to or responsible for instructing lawyers and receiving legal advice. The result of this line of reasoning is a sharp restriction on the availability of legal advice privilege in the context of an internal investigation, given that it will not extend to lawyers’ communications with the majority of employees within a company or organisation.

The Court also rejected the notion that the interview notes were lawyers’ working papers, which can be protected by legal privilege. The Court rejected the notion that privilege would apply simply because the documents could reveal the lawyer’s train of enquiry; it found that the documents must at least give a clue as to the actual advice given or sought before legal privilege will apply.

The ENRC judgment concerns an investigation by the SFO into the activities of Kazakh mining company ENRC, now owned by Eurasian Resources Group (“ERG”). The opening of the investigation followed a period of dialogue between the SFO and ENRC, during which ENRC was reporting to the SFO. The investigation focused on allegations of fraud, bribery and corruption.

As part of its investigation, the SFO sought to compel the production of documents (including interview notes and factual updates) that had been prepared by ENRC’s lawyers during the course of an internal investigation. Assertions of both legal advice privilege and litigation privilege were made in respect of the documents sought by the SFO. All assertions of privilege, save for a limited legal advice claim in respect of a narrow group of documents, failed.

Litigation privilege protects certain communications between lawyers and their clients, as well as third parties, made for the purpose of obtaining information or advice in connection with litigation that is in reasonable contemplation, where the communications are made for the sole or dominant purpose of conducting that (anticipated) litigation, and where the litigation is adversarial and not investigative or inquisitorial. In ENRC, Andrews J held that a criminal investigation by the SFO is not adversarial litigation; it is a preliminary step that comes before any decision to prosecute. According to the Court, in such cases litigation privilege can only apply in circumstances where a prosecution is in reasonable contemplation. Whether or not a prosecution is in reasonable contemplation will depend on an assessment of the facts of each case. The assessment would include a consideration of what an internal investigation had unearthed and whether or not a prosecutor would be likely to satisfy the test for commencing a prosecution.

The court also distinguished between documents whose dominant purpose was to conduct litigation and those that were created as part of an internal investigation that was intended to avoid rather than conduct adversarial proceedings. ENRC represents an unexpected narrowing of both the ‘adversarial proceedings’ and the ‘dominant purpose’ elements of litigation privilege.

The treatment of arguments in respect of legal advice privilege followed the approach taken in RBS. Andrews J took the view that none of the interviewees were individuals authorised to instruct lawyers or receive legal advice. As such, interview notes and the materials used to compile them were only preparatory to the actual process of seeking legal advice and therefore not privileged. The only claim for LPP that succeeded was a claim for legal advice privilege in respect of PowerPoint slides used to give legal advice to the ENRC board.

Notably, following the ENRC decision the President of the Law Society of England and Wales wrote in an open letter to the editor of The Financial Times that the outcome of the decision is “deeply alarming“, as it appears to narrow the scope of LPP available to corporations facing criminal investigations. He noted that “The Law Society has vigorously opposed other recent attempts to undermine legal privilege — always supposedly for some ‘greater good’.”

The ENRC decision is a disappointing one and leaves many questions unanswered. Given the various types and stages of Government authority investigations that we now see so frequently, proper focus needs to be given to how LPP applies in the investigations context.

ENRC is appealing the decision. It is hoped that the appellate Courts will take the opportunity to properly consider the scope of LPP under English law in the criminal and regulatory context. The status quo is deeply undesirable.

Continued concerns about the SFO’s insistence on solicitors’ undertakings for interviews

In our 2016 Year-End United Kingdom White Collar Crime Update we reported that the SFO had issued guidance in June 2016 on the presence of interviewee’s legal adviser at a section 2 interview (in which a person is compelled to provide answers in furtherance of the SFO’s investigation). We indicated that while it is possible to sympathise with the SFO’s desire to have unimpeded conduct of its investigation, the fact that access to legal advice for those being interviewed by the SFO is subject to restriction at the discretion of the SFO will not be welcome in all quarters. This has certainly turned out to be the case.

Many practitioners have reported negative experiences with the SFO’s implementation of the guidance and are concerned by the limited “consultation” the SFO carried out before the guidance was issued.

In a Practice Note dated May 4, 2017, the Law Society for England and Wales set out a number of issues that could arise for practitioners as a result of the guidance. The Practice Note recognises that SFO interviews can be difficult and stressful experiences for clients and that witnesses are entitled to receive proper legal advice. In strongly worded terms the Note reminds lawyers that “they do not have to accept unnecessary and inappropriate restrictions on their ability to represent clients.”

At a minimum the SFO should consider launching a consultation to hear the valid concerns of practitioners.

FCA and PRA publish changes to decision-making processes

Following a long period of consultation, on February 1, 2017 the FCA and Prudential Regulation Authority (“PRA”) published a Policy Statement that sets out the changes the organisations agreed to make to their enforcement decision making processes. While some changes came into effect in January, most of the changes came into effect on March 1, 2017. Changes were made to both the Decision Procedure and Penalties Manual (“DEPP”) and the Enforcement Guide. The PRA is expected to publish a policy statement later this year.

Changes have been to many stages of the investigations process, including how decisions are made to refer a matter to formal enforcement or regulatory action, greater provision of information to the subject of an investigation, and a process for dealing with partly contested cases:

- Where a decision is made to refer a matter to FCA Enforcement, the FCA will now provide to the subject of the investigation an explanation of the referral criteria applied to come to this decision and give a summary of the circumstances and reasons for the referral. When making a referral decision the FCA will consider factors addressing: available supporting evidence and the proportionality and impact of opening an investigation; the purpose or goal to be served by enforcement action in the relevant case; and relevant factors to whether or not the goal of the enforcement action will be met. In market abuse cases greater emphasis will be put on the severity and deterrent value of a particular case.

- The FCA will give periodic updates to the subjects of an investigation on at least a quarterly basis. These will cover the investigative steps taken to date and the next steps that are anticipated.

- Provision for FCA Supervision to be involved in and updated on investigations and for senior individuals at the FCA to be involved in settlement discussions.

- The FCA will give 28 days’ notice of the beginning of the “Stage 1” settlement period and will identify the key evidence on which its case relies and which underpins its outline findings. It will now also offer a preliminary “without prejudice” meeting at this stage “where appropriate“. Stage 1 is the period from the start of an investigation until the point at which the FCA has “sufficient understanding of the nature and gravity of the breach to make a reasonable assessment of the appropriate penalty; and communicated that assessment to the person concerned and give them reasonable opportunity to reach agreement on the amount of the penalty“.

- Changes are made to the stages at which a subject can receive an early settlement discount as part of the FCA’s settlement regime. Previously there were three levels of discount. Discounts for settlement at stages two and three of the investigative process are abolished, meaning that discounts for early settlement are no longer available after a subject has been issued with a warning notice.

- It will now be possible for the subject of an FCA investigation to partially contest the case against them (including challenging particular findings as well as challenging penalty), but still settle on certain matters. This will give a subject the opportunity to obtain a discount on the penalty that will reflect the extent to which issues have been agreed. Where a partially contested case then goes to the Regulatory Decisions Committee (“RDC”), the RDC will not be able to depart from findings set out in the settlement agreement.

Continuing enforcement activity by the FCA

On July 5, 2017 the FCA issued its Annual Report and Accounts for 2016/17 (“Report”).

In the foreword to the Report, the Chairman of the FCA writes “regulatory arbitrage, at least in the conduct area, is a game no longer worth playing“. The regulator’s main challenge going forward, he opines, will be to make sure that the focus of firms remains firmly on conduct, with neither complacency nor “the pendulum of regulation” being allowed to creep or swing back in.

The FCA’s Report notes that in 2016/17 the FCA issued 180 final notices (155 against firms and 25 against individuals), secured 209 outcomes using its enforcement powers (198 regulatory/civil and 11 criminal) and imposed 15 financial penalties. The cumulative value of the penalties imposed was £181 million. This compares to 34 financial penalties with a combined value of £884.6 million in 2015/16 and 43 penalties with a cumulative value of £1.4 billion in 2014/15. The 2015/16 and 2014/15 figures included exceptional fines related to FX and LIBOR misconduct. 115 cases (excluding threshold condition cases) were concluded by executive settlement in 2016/17. The section 166 power – which enables the FCA to obtain an independent view on aspects of a firm’s activities that cause concern or where further analysis is required – was used 49 times.

The FCA’s significant achievements in 2016/17, each of which is discussed in further detail in their respective sections below, included its action against Deutsche Bank over failed AML controls that led to the imposition of a £163 million financial penalty, the largest for such failures; its action against Tesco plc and Tesco Stores Ltd for market abuse arising from a misleading trading update issued in August 2015, that will, it is estimated, lead to Tesco making payment of c. £85 million plus interest to c. 10,000 retail and institutional investors; and the completion of the FCA’s longest and most complex insider dealing case, which led to five convictions, with one defendant sentenced to 4.5 years – the largest jail term ever imposed for insider dealing.

The Report acknowledges that Brexit will have important implications for the financial sector’s regulatory framework and how the FCA operates, including in respect of its engagement with counterparts around the world. The FCA has been, the Report notes, working with HM Treasury to provide technical input on the Great Repeal Bill, and working with the Government to provide impartial technical advice to support the EU withdrawal negotiations.

Other headline points arising from the Report include:

- the market cleanliness statistic for takeover announcements in 2016 remains steady at the 2015 rate of 19%; that figure is up against the 2014 figure of 15.2%;

- the number of whistleblowers is down for the second year in a row, with only 900 intelligence cases from whistleblowers during 2016/17. The FCA believes that this reduction is attributable to the fact that whistleblowers are now more aware of their firm’s internal reporting mechanisms and so are reporting internally instead of proceeding straight to the FCA; and

- in an effort to further embed the importance of good conduct at the core of the UK’s financial sector, the Senior Managers and Certification Regime will be, from 2018, extended from banking and insurance firms to all other regulated firms.

Separate annual reports on Competition, Enforcement, Anti-Money Laundering and Diversity were also issued. The Annual Reports follow the publication of the FCA’s Mission in April 2017 and its Business Plan for 2017/18.

2. Bribery and Corruption

It is fair to say that enforcement of the UK’s anti-corruption laws has continued apace during the first half of 2017. These six months have seen the largest ever fine imposed for breaches of the UK’s anti-corruption legislation; the largest ever disgorgement of profits in this space; and the three longest individual custodial sentences to be imposed in many years, as well as a total of seven custodial sentences in all.

The number of companies actively facing investigation or prosecution is growing. Indeed a recent report stated that there are 38 active foreign bribery investigations being conducted by the UK authorities, while the NCA is the headquarters of International Anti-Corruption Coordination Centre for the next four years. This is a new body jointly set up by the authorities of the UK, Australia, Canada, New Zealand, Singapore, the US and Interpol to provide a hub for the combatting of corruption, embezzlement and the abuse of power.

At the very end of 2016 we have also seen a new reporting regime introduced by way of the Companies, Partnerships and Groups (Accounts and Non-Financial Reporting) Regulations 2016.

Enforcement: Bribery Act section 7

Rolls-Royce PLC – Deferred Prosecution Agreement

On January, 17 2017, Rolls-Royce PLC (“Rolls-Royce”) entered into the UK’s most significant deferred prosecution agreement (“DPA”) to date, following its approval by Lord Justice Leveson. The resolution represents the highest ever criminal enforcement action against a company in the UK following an extensive four-year investigation by the SFO. The investigation concerning the conduct of individuals remains ongoing.

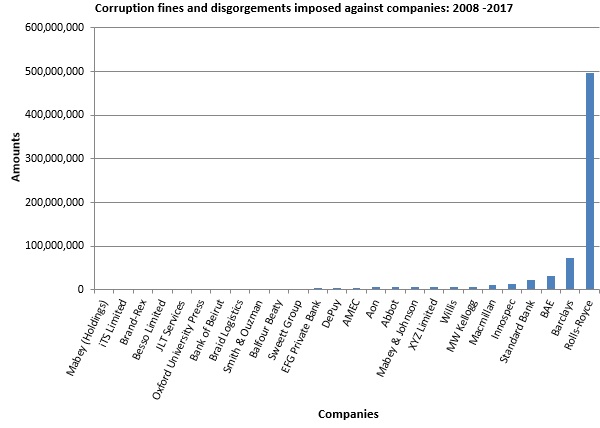

Under the terms of the DPA, Rolls-Royce agreed to pay £497.25 million (comprising disgorgement of profits of £258.17 million and a financial penalty of £239.08 million) plus interest, as well as the SFO’s costs of the investigation amounting to approximately £13 million. As the table below shows, this total penalty is significantly larger than any penalty previously imposed. These sums, when added to settlements reached by the company with the US DoJ (US$170 million) and Brazil’s Ministério Público Federal (US$25 million), amounts to a global penalty of approximately £671 million.

The Rolls-Royce DPA provides significant insight into the considerations and approach of the SFO and High Court when awarding a DPA, including how the financial penalties, and any discounts, may be determined, including under the relevant Sentencing Guidelines.

The Rolls-Royce DPA was the third DPA to be awarded in the UK. There has subsequently been a fourth and Lord Justice Leveson has presided over all four. This consistency was designed to establish guiding jurisprudence on DPAs, which now feature prominently among the SFO’s armoury to combat corruption.

The indictment against Rolls-Royce comprised 12 counts falling into three categories: (i) conspiracy to corrupt under the Prevention of Corruption Act 1906, (ii) false accounting, and (iii) failure to prevent bribery under section 7 of the Bribery Act. It involved Rolls-Royce’s Civil Aerospace and Defence Aerospace businesses and its former Energy business, and related to the sale of aero engines, energy systems and related services. The conduct covered by the DPA took place across seven jurisdictions and over the last three decades.

- In Indonesia, it is alleged that senior employees of Rolls-Royce agreed to pay US$2.25 million to an intermediary, as a reward for Rolls-Royce winning a contract for engines for six Airbuses when the intermediary acted as an agent of the President’s office. There was also an indictment for failure to prevent bribery allegations arising from Rolls-Royce’s appointment of an intermediary to bribe a member of a competitor consortium to submit an uncompetitive bid, and a separate intermediary to bribe state officials in relation to airline engines and care packages.

- In Thailand, the allegations concerned Rolls-Royce agreeing to pay nearly US$19 million to two intermediaries, with the intention that part of these funds would be paid to state agents and Thai Airways employees to procure the purchase Rolls-Royce engines. Two further counts relate to the actions of those intermediaries concerning other contracts.

- In India, there were counts of false accounting and conspiracy to corrupt, the latter in relation to the Indian tax authorities.

- In Russia, the allegations relate to Rolls-Royce using an intermediary to pay a commission to a Gazprom official in order to win a contract to support Gazprom with gas compression equipment.

- In Nigeria, there was a count of failure to prevent bribery concerning Rolls-Royce’s failure to prevent a company, with which it worked in Nigeria, from paying bribes to Nigerian officials in a bid to aid the company win two key tenders.

- In China, there was another count of failure to prevent bribery in relation to Rolls-Royce failing to prevent its employees from providing US$5 million cash credit to China Eastern Airlines at the request of a board member, in return for the board member favouring the company in the purchase of a number of engines and associated care agreements.

- Finally, in Malaysia, there was a failure to prevent bribery count on the basis that Rolls-Royce had failed to prevent its employees from providing an Air Asia Group executive with credits worth US$3.2 million to pay for the maintenance of a private jet, in order for Rolls-Royce to win contracts.

Importantly, this conduct spanned three decades from 1989 until 2013. Under English law, there is no limitation period in respect of corruption matters. This is unlike the FCPA which only permits the sanction of conduct that took place within the last five years.

Rolls-Royce did not self-report to the SFO. The criminal conduct came to the SFO’s attention via a whistleblower’s blog which detailed allegations against the engineering company’s civil aviation business in China and Indonesia. On the basis of that information, the SFO launched an investigation and requested a response from the company. At this point, Rolls-Royce was under new management, and it conducted significant internal investigations, and engaged in a highly cooperative and proactive manner with the SFO’s investigation. It reported back to the SFO in relation to the China and Indonesia issues, as well as other civil and defence issues of which the SFO had not been aware.

The SFO investigation quickly became both broad and deep, and scrutinized Rolls-Royce’s business across multiple jurisdictions over the course of four years. Rolls-Royce waived privilege over some 30 million un-reviewed documents, and allowed the SFO to conduct interviews with former and current employees. The investigation absorbed considerable resource from the SFO, involving over 70 members of its staff, four Case Controllers, and a counsel team of six (including two Queen’s Counsel).

The investigation into Rolls-Royce led to 36 staff members being investigated, followed by the dismissal of six and the resignation of 11. The company also reviewed 250 intermediary relationships, and suspended 88.

While the Rolls-Royce DPA has resolved the SFO’s investigation of the company, as noted above, the SFO’s investigation into some of the company’s former employees is ongoing.

In the SFO deciding to offer a DPA to Rolls-Royce, and in the High Court approving it, it was necessary to weigh up the very serious criminal conduct of Rolls-Royce against public interest considerations of pursuing a criminal conviction against the company.

There was no doubt that the conduct in question was serious. Lord Justice Leveson’s judgment states (at paragraph 61):

“My reaction when first considering these papers was that if Rolls-Royce were not to be prosecuted in the context of such egregious criminality over decades, involving countries around the world, making truly vast corrupt payments and, consequentially, even greater profits, then it was difficult to see when any company would be prosecuted.“

Indeed, the investigation revealed systemic bribery in the company that was notable for its aggravating features. This included the wide-range of offences across multiple jurisdictions and multiple parts of Rolls-Royce’s business, the conduct spanning three decades, the substantial funds being made available to fund bribe payments, the evidence of careful planning, the involvement of senior employees, the very substantial amounts of profit earned on the back of that conduct, and the fact that the offences had caused and/or will cause substantial harm to the integrity and confidence of markets.

There were, however, a number of countervailing factors that the SFO took into account when deciding to offer the DPA to Rolls-Royce, and which the High Court took into account when approving the DPA.

Broadly, these were: (i) the extraordinary cooperation of the company with the SFO’s investigation; (ii) the change in culture and personnel; (iii) the negative impact that a conviction of company would have on the company itself, its employees, and other third parties; (iv) the financial penalties imposed by a DPA would have the same effect as a fine imposed by a conviction; (v) the costs (including financial) the SFO would incur if it were to proceed to a full trial; and (vi) the fact that a DPA would likely incentivise self-reporting from other companies. For more detail on the reasoning of the High Court see our 2017 Mid-Year NPA and DPA Alert.

The DPA is accompanied by a Statement of Facts. Under the DPA’s terms, Rolls-Royce agrees that the Statement of Facts is true and accurate to the best of its knowledge and belief, and that it may be treated as an admission in the event that it becomes necessary for the SFO to pursue the prosecution deferred by the DPA.

(i) Duration of the DPA

The DPA expires on the earlier of January 17, 2022 or a date after January 17, 2021 on which the SFO notifies the company that the DPA has concluded. Should Rolls-Royce fully comply with all of its obligations under the DPA, then at the conclusion of the term, the SFO agrees that it will not continue the prosecution against Rolls-Royce, and that the proceedings against the company will be discontinued.

(ii) Carve-outs

Importantly, the DPA does not provide any protection against prosecution for conduct not disclosed by Rolls-Royce prior to the date on which the DPA comes into force, nor against prosecution for any future criminal conduct committed by Rolls-Royce. In addition, these terms do not provide any protection against prosecution of any present or former officer, director, employee or agent of Rolls-Royce. Further, after the DPA expires, the SFO may institute fresh proceedings if it believes that during the course of negotiations of the DPA, Rolls-Royce provided inaccurate, misleading or incomplete information and Rolls-Royce knew, or ought to have known the same (Rolls-Royce, and its legal advisors, provided a warranty in respect of the same in the DPA).

(iii) Financial consequences

Under the terms of the DPA, Rolls-Royce has agreed to the following payments:

- Rolls-Royce’s disgorgement of profit of £258,170,000;

- a financial penalty of £239,082,645;

- costs of approximately £13 million which represents the costs of the SFO’s investigation; and

- financing of a compliance and reporting programme.

The disgorgement and financial penalty are to be paid by Rolls-Royce in four tranches over the next five years, with the first tranche of £119 million payable by June, 30 2017, and the final tranche of approx. £148 million to be paid by January, 31 2021. Late payment by Rolls-Royce will lead to significant interest being charged, along with the risk of the DPA being breached.

The financial penalty was calculated by reference to the Sentencing Guidelines and the harm caused and the company’s culpability in relation to the charges. The culpability was classed as “high” for all but one charge, which led to “harm multipliers” of 250-400% being applied to the financial gain intended to be derived from the conduct. This led to a figure of £478 million.

Importantly, Rolls-Royce received a 50% discount on this financial penalty because of its cooperation, thereby saving it £238 million in fines . The substantial discount marks a departure from the Sentencing Guidelines. Under the Deferred Prosecution Agreement Code, financial penalties imposed in a DPA “must provide for a discount equivalent to that which would be afforded by an early guilty plea…“. In the Sentencing Guidelines for bribery, this discount is stated as being 33%. Nonetheless, Lord Justice Leveson considered that, in light of Rolls-Royces extraordinary co-operation, a discount of 50% was warranted (see our observations on this discount below).

(iv) Compliance programme

Under the DPA Rolls-Royce is required to provide the SFO, by no later than June 31, 2017, a written plan to implement recommendations contained in the Third Report of Lord Gold (who was retained by Rolls-Royce in January 2013 to conduct an independent review of the approach of Rolls-Royce to anti-bribery and corruption compliance), as well as any outstanding recommendations contained in his First and Second Interim Reports. Further, Rolls-Royce must implement the recommendations within a one-year period.

Upon completion of the plan, Lord Gold is to provide a final report to Rolls-Royce and the SFO assessing whether the plan had been successfully complied with. In addition, Rolls-Royce must continue to review its internal controls, policies and procedures regarding compliance and if necessary and appropriate it must adopt new or modify existing controls, policies and procedures in order to ensure it complies with all applicable anticorruption laws. The DPA stresses that the ultimate responsibility for identifying, assessing and addressing risks remains with the Board of Directors of Rolls-Royce.

(v) Requirement to cooperate

Under the DPA Rolls-Royce is required to fully and honestly cooperate with the SFO in relation to any prosecution brought by the SFO in respect of any conduct under investigation or pre-investigation by the SFO at any time during the term of the DPA. Further, at the reasonable request of the SFO, Rolls-Royce must cooperate with other domestic or foreign law enforcement and regulatory authorities and agencies, as well as the Multilateral Development Banks, in any investigation or prosecution of any of its present or former officers, directors, employees, agents, and consultants, or any other third party, in any and all matters relating to the conduct which is the subject of the indictment and described in the Statement of Facts. Rolls-Royce is to provide disclosure of the relevant information and material in its possession, and to use its best efforts to make available for interview present or former officers, directors, employees, agents and consultants of Rolls-Royce.

(vi) Ongoing disclosure obligation

Rolls-Royce has on ongoing legal obligation, throughout the term of the DPA, to notify the SFO if it becomes aware of information that it knows or suspects would have been relevant to the offences particularised in the indictment.

(vii) Breaches of the DPA

Should Rolls-Royce breach any of the terms of the DPA, the SFO must decide whether to accept a proposal from Rolls-Royce in respect of remedying the breach. If it does not accept such a proposal it may make a breach application to the High Court. In the event that the High Court terminates the DPA, the SFO may make an application for the lifting of the suspension of the indictment and reinstitute the criminal proceedings.

Observations

The first two UK DPAs, concerning ICBC Standard Bank (November 2015) and XYZ Limited (July 2016), involved companies that had self-reported to the SFO. The significant emphasis on self-reporting placed by Lord Justice Leveson in his judgments for those companies had led certain commentators to assert that self-reporting was a pre-condition to obtaining a UK DPA. The Rolls-Royce DPA dispels this myth, and comments by the SFO and the judge made in relation to the Rolls-Royce DPA emphasize instead the critical importance of cooperation.

As noted above, the SFO Director noted in a speech at the International Bar Association’s anti-corruption conference in Paris on June, 13 2017 that Rolls-Royce had been offered a DPA because of its “genuine and demonstrable cooperation“.

This was echoed in the DPA judgment itself which greatly emphasized the “extraordinary” level of co-operation that the SFO had received from Rolls-Royce, and the fact that its proactive method of co-operating meant the SFO received some information which may not otherwise have come to light.

In a speech given to the Fraud Lawyers Association on June, 16 2016, Lord Justice Leveson said that companies can receive a benefit for cooperating if they self-report, or “even if the first murmurings about misbehavior come out via a whistleblower or press report.” He said that companies may be awarded a DPA if the announcement of the misconduct is then followed by “full, unambiguous cooperation, directly focused on uncovering what’s happened and how what’s gone wrong has come about“.

The Court applied a further 16.7% discount on top of the 33% discount for pleading guilty at the first possible opportunity to reward Rolls-Royce for its cooperation. This was similar to the approach to the DPA with XYZ Limited, which saw its fine halved for cooperation.

The SFO’s approach has shown that a company that only starts to cooperate after being approached by the authorities may still find that a DPA is within reach. There will be those that wonder what incentive remains for a company to self-report in such circumstances.

The fact that Rolls-Royce received a 50% discount in the absence of a self-report begs the question of whether companies which self-report should receive even greater reductions. In the US, for example, self-reporting entities may benefit from a discount up to and including 100% (excluding disgorgement of profits).

In his June 16, 2016 speech, Lord Justice Leveson emphasised the point that it is “individuals who arrange payments to bribe officials“. In this regard, he was of the view that a company which takes appropriate measures to address systemic issues should be offered a DPA to avoid catastrophic consequences to the company and those in the market that could be affected by its demise.

The SFO’s approach is to separate the company and its shareholders on the one hand, and senior executives accused of improper behavior, on the other. The company can avoid prosecution and obtain a significant discount on its fine but it must first lose its implicated management and embark upon a root-and-branch overhaul of its compliance systems.

Lord Justice Leveson confirmed in his judgment that some of the corruption involved the “senior management and, on the face of it, controlling minds of the company“. There are outstanding prosecutions against individuals, and it is likely, in light of the above comments, that these will be diligently pursued.

Enforcement: Bribery Act sections 1-2 – giving/receiving bribes

Tracey Miller

On July 4, 2017 Tracey Miller, an insurance firm manager, was sentenced for the offence of receiving a bribe under section 2 of the Bribery Act and ordered to pay disgorgement of the bribe within 12 months. She was also sentenced to two-years in prison, suspended for two years. Ms Miller pleaded guilty to having provided confidential information in exchange for a £4,500 bribe to a man who used the information to make cold calls to potential claimants following road accidents. This is the second conviction under the Bribery Act against an insurance company employee selling confidential information, the first was reported in our 2016 Mid-Year United Kingdom White Collar Crime Update. This case demonstrates the continuing trend in the UK for prosecution in respect of low value bribes, and Ms Miller’s is the seventeenth conviction of an individual under the Bribery Act.

Gary West

As mentioned in our 2016 Year-End United Kingdom White Collar Crime Update, Gary West, James Whale and Stuart Stone were convicted on December 5, 2014 of fraud and section 1 and 2 offences under the Bribery Act following the SFO’s investigation into the Sustainable Growth Group including its subsidiaries Sustainable AgroEnergy PLC and Sustainable Wealth Investments (UK) Limited. Gary West’s contested section 23 POCA (reduction of confiscation order) application hearing was heard at Southwark Crown Court on June, 26 2017, which resulted in a reduction of £7,986.45 from the original order.

Enforcement: Prevention of Corruption Act1906 and Public Bodies Corrupt Practices Act 1889

Lynden Scourfield, David Mills, Michael Bancroft, Mark Dobson

On February 7, 2017, six individuals were found guilty at Southwark Crown Court of corruption, fraudulent trading and money-laundering offences and sentenced to a total of 47 years imprisonment. The case is worthy of note due to the length of the sentences handed down.

Lynden Scourfield, lead director of Halifax Bank of Scotland (“HBOS”) in Reading, formed a corrupt relationship with business consultant David Mills between 2003 and 2007. In return for expensive gifts and meals, cash and money transfers, foreign travel with luxury accommodation and parties with sex workers, Scourfield referred his clients (small companies in financial distress) to Mills and his associates Michael Bancroft and Tony Cartwright as a condition for those clients being able to obtain any further credit from HBOS. This allowed Mills and his associates to demand huge fees and take over some of the struggling companies for personal benefit. In addition, Mills provided Scourfield with his own American Express card and expensed foreign travel to one of the struggling companies.

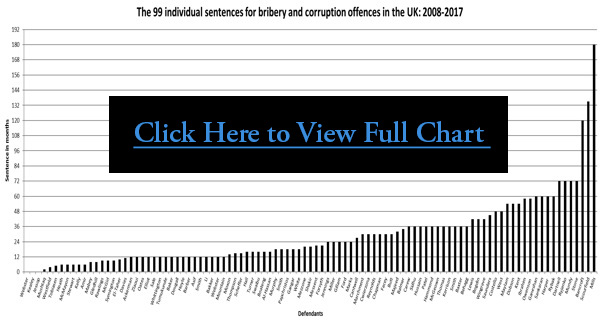

Following trial, Mr Mills was sentenced to a total of 15 years’ imprisonment, Bancroft was sentenced to 10 years’ imprisonment, and Scourfield to 11 years. As demonstrated in the graph below, these are the three longest custodial sentences to be given for corruption offences by a considerable order of magnitude. Not since 1997 (R v Donald [1997] 2 Cr App R (S) 272) has a defendant been sentenced to 11 years, and we are unaware of any sentence as long as that imposed on Mr Mills. Another colleague was sentenced to four and half years’ jail.

On April 7, 2017, the FCA announced that it had resumed it probe, suspended in early 2013, into the events surrounding the discovery of misconduct within the Reading-based Impaired Assets team of HBOS. The FCA’s investigation is focused on the extent and nature of HBOS’ knowledge of the misconduct and its communications with the FCA’s predecessor, the Financial Services Authority (“FSA”) after the initial discovery of the misconduct.

Stephen Dartnell and Simon Mundy – R v Alexander & others

In our 2016 End of Year UK White Collar Crime Update, we reported that trial had commenced on September 5, 2016 against six defendants charged with conspiracy to make corrupt payments in connection with the purchase of agreements by KBC Lease (UK) Limited and Barclays Asset Finance from Total Asset Finance Limited. The case began after the SFO commenced an investigation in 2010 into Total Asset Finance Limited, the main source of funding of the company H20 Networks Limited, one of the UK’s early pioneers of alternative fibre optic broadband networks.

On February 7, 2017, four individuals, Stephen Dartnell, George Alexander, Carl Cumiskey and Simon Mundy, were convicted at Southwark Crown Court, two for corruption offences. KCB’s Mr Mundy was found to have received a £900,000 bribe to be the “inside man” at KBC to approve nearly £160 million in finance. He, and Mr Dartnell, were each sentenced to six years’ jail.

Andrey Ryjenko and Tatjana Sanderson

On June 20, 2017, Andrey Ryjenko was sentenced to six years’ jail following a five-week trial. During his time at a global development bank based in London Mr Rykenko received over US$3.5 million in bribes between July 2008 and November 2009 to approve loans to finance oil and gas projects in former Soviet states. The bribes were paid by Dmitri Harder, who himself pleaded guilty to FCPA charges in April 2017, and paid into bank accounts owned by Ryjenko’s sister, Tatjana Sanderson, in an attempt to disguise the money. Dmitri Harder testified for the prosecution and Ms Sanderson was not tried due to mental health issues.

Peter Chapman

Peter Chapman was sentenced on May 12, 2016 to 30 months’ imprisonment for making corrupt payments to a Nigerian official under the Prevention of Corruption Act 1906 in order to secure contracts of polymer for his company, Securency PTY Limited. The total value of the bribes amounted to £143,000. Having already spent one year and five months remanded in custody, this time was deducted from his 30 month sentence meaning that Chapman was released immediately on licence. In relation to confiscation proceedings against him, there is a hearing scheduled at Southwark Crown Court on September 29, 2017, followed by a confiscation hearing on March 29, 2018.

Edinburgh City Council – disgorgement

As we reported in our 2015 Year-End UK White Collar Crime Alert, four individuals pleaded guilty to offences under the Public Bodies Corrupt Practices Act 1889 for giving and receiving bribes to or as government officials in return for the awarding of public contracts. On March 16, 2017 one of the government officials Charles Owenson was made subject to a confiscation order for £22,000, and on April 4, 2017 the two bribe payers, Kevin Balmer and Brendan Cantwell received their own confiscation orders in the sums of £95,000 and £171,223.92 respectively.

Enforcement: Ongoing Foreign Bribery Prosecutions

Wassim Tappuni

On July 13, 2017 the trial commenced of health equipment consultant Wassim Tappuni for his alleged involvement in a corrupt scheme designed to defraud World Bank and United Nations development projects.

At the time Mr Tappuni was arrested in October 2011, he was engaged as a consultant by the World Bank and United Nations Development Programme. The CPS alleges that Mr Tappuni entered into corrupt agreements with medical equipment suppliers from the Netherlands, Germany, France, Austria and Kazakhstan. The Crown estimates the value of those corrupted contracts at approximately £43 million. Mr Tappuni admits to receiving some payments from medical companies; however, he maintains that those payments were legitimate.

The UK authorities previously sought extradition of Anton Schlenger, who is alleged to have acted as an intermediary for Mr Tappuni. However, extradition was denied on the basis that Mr Schlenger is currently the subject of a German investigation into matters related to the Tappuni case.

Sarclad Limited – individuals

As noted in our 2016 Year-End UK White Collar Crime Update, a company named only as XYZ Limited entered into the UK’s second DPA with the SFO for offering/ the payment of bribes to secure contracts in foreign jurisdictions. It has now been confirmed that this company is in fact Sarclad Limited, a Rotherham-based company that specialises in producing technology products for the metal industry. Michael Sorby, former director, and Adrian Leek, former sales manager of Sarclad were both charged with conspiracy to corrupt, contrary to section 1 of the Prevention of Corruption Act 1906 and one count of conspiracy to bribe under section 1 of the Bribery Act. Their next hearing is due to take place at Southwark Crown Court on September 4, 2017.

For an in-depth discussion of the terms of the XYZ DPA, see our 2016 Mid-Year United Kingdom White Collar Crime Update.

ENRC

Along with its many other implications the judgment in ENRC v SFO, referred to in the opening section of this Update, also reveals that the SFO continues with its investigation relating to allegations of bribery in Kazakhstan and Africa.

[Withheld]

Enforcement: Ongoing Foreign Bribery Investigations

There are currently 38 active foreign bribery investigations in the UK

The UK has been an increasingly dominant force in international anti-bribery efforts. It was reported in late 2016 that there were 38 active foreign bribery investigations being conducted in the UK. The UK’s regulators have been cooperating closely with those in the US, Canada, and Australia to investigate credible allegations of foreign bribery.

Airbus

In March 2017, the French authorities joined the SFO in investigating allegations of fraud and bribery in relation to Airbus‘ use of third party consultants to win international aircraft orders. For further information, see our 2016 Mid-Year UK White Collar Crime Update.

Unaoil

In our 2016 Year-End UK White Collar Crime Update, we drew attention to the growing tactic of using judicial review proceedings to challenge decisions taken by prosecutors. We also drew attention to Unaoil’s judicial review of the SFO’s steps in gathering evidence via raids in Monaco. Consistent with our conclusions that British authorities are not yet welcoming to this practice of judicial review, the High Court rejected Unaoil’s judicial review claim in R (on the application of) Unaenergy Group Holding Pte Limited & others v The Director of the Serious Fraud Office [2017] EWHC 600.

The claimants (Unaoil) argued that the SFO had acted unlawfully when it sent a letter of request for mutual legal assistance to Monegasque authorities (“LOR”) to search the premises of the claimants and obtain business records, which resulted in the offices of Unaoil and the homes of its directors being raided on March 29, 2016 and the seized material taken to London. As remedy, the claimants asked the Court to declare the SFO’s LOR unlawful and to order the return of all material seized during the raid on the grounds that the LOR had (1) failed to disclose key information, and (2) was so impermissibly wide that it could be considered a fishing expedition. In its decision, the Court ruled that the SFO had not failed to give key information in the LOR and also rejected the claimants allegation of an unlawful fishing expedition by the SFO.

The SFO continues to investigate allegations of corruption and bid-rigging in the oil and gas industry made against Unaoil and its directors, employees, and agents. For earlier background, see our 2016 Mid-Year UK White Collar Crime Update and 2016 Year-End UK White Collar Crime Update. The SFO’s ongoing inquiries on Unaoil have opened up the doors for the SFO to begin investigating a number of other companies’ involvement with Unaoil.

Unaoil – ABB

In connection with the activities of Unaoil, the SFO announced on February 10, 2017 that it had “commenced an investigation into the activities of ABB Limited’s United Kingdom subsidiaries, their officers, employees and agents for suspected offences of bribery and corruption“. ABB Limited had already reported two days earlier on its 2016 Annual Report (see page 179) that they self-reported to the SFO about past dealings with Unaoil and their subsidiaries and that the SFO had begun an investigation into the matter, which includes allegations of improper payments made by Unaoil and its subsidiaries to third parties.

Unaoil – Amec

On April 28, 2017, the SFO required Amec Foster Wheeler to produce information relating to its past dealings with Unaoil. Amec Foster Wheeler is cooperating with the SFO in connection with the Unaoil matters.

In a press release dated 11 July, 2017, the SFO confirmed that it had commenced an investigation into the activities of Amec Foster Wheeler “and any predecessor companies owning or controlling the Foster Wheeler business, together with the activities of any subsidiaries, company officers, employees, agents and any other person associated with any of these companies.” While there was no mention of Unaoil in the news release, the SFO nonetheless announced that their investigation into Amec Foster Wheeler was for “suspected offences of bribery, corruption and related offences.”

Unaoil – Wood Group

According to a published prospectus British oil services company John Wood Group has also been conducting their own internal investigation into their past dealings with Unaoil, and has provided information to the SFO, and informed the Scottish Crown Office and Procurator Fiscal Service of its progress in the matter.

Unaoil – Petrofac

On May 12, 2017, the SFO confirmed that it was “investigating the activities of Petrofac PLC, its subsidiaries, and their officers, employees and agents for suspected bribery, corruption and money laundering” in connection with Unaoil. In response, Petrofac immediately announced their prior engagements with Unaoil for the “provision of local consultancy services in Kazakhstan between 2002 and 2009“. Petrofac has been and continues to cooperate with authorities, and the SFO has questioned Petrofac’s Chief Executive Officer and Chief Operating Officer.

On May 25, 2017, Petrofac’s shares dropped by as much as 29% following their announcement that Chief Operating Officer, Marwan Chedid, had been suspended and had resigned from the board. Petrofac noted that the decision had been taken to “retain its focus on its operations and clients, whilst also ensuring the Company is able to continue to engage with the SFO’s investigation.” In its statement, Petrofac also explained that they had set up a Committee of the Board and engaged a senior external specialist to cooperate with the SFO’s investigation in light of an earlier refusal by the SFO to accept Petrofac’s independent investigatory findings in relation to its dealings with Unaoil.

Arrests in the UK re cricket corruption/spot fixing

As part of an ongoing investigation into spot-fixing in international cricket, in February 2017 the NCA arrested three men in their thirties on charges of bribery offences. All three men have since been released on bail pending further enquiries from the NCA, who have been working closely in the matter with the anti-corruption units of the International Cricket Council (“ICC”) and the Pakistan Cricket Board (“PCB”). One of the arrested three men has had his passport confiscated until the NCA concludes its inquiries. The NCA’s arrests followed shortly after reports came out on February 10, 2017 that two cricketers from the Pakistan Super League (“PSL”) had been questioned and provisionally suspended by the PCB’s anti-corruption unit for spot-fixing. Since February 2017, the PCB have suspended six players from the PSL and formed a three-man anti-corruption tribunal to hear the cases against some of the players suspended.

On May 18, 2017, Sir Ronnie Flanagan, the head of ICC’s anti-corruption and security unit, appeared as a witness in PCB’s three-man anti-corruption tribunal. Flanagan testified that the ICC first received a tip-off about the spot-fixing allegations from the NCA which was then shared with the PCB:

“At a certain stage, we received intelligence that was passed to us by the British National Crime Agency, we passed that intelligence to PCB’s vigilance and security unit. And it coincided exactly with intelligence they already had.”

Cas-Global and former Norwegian official

As reported in our 2015 Mid-Year FCPA Update, UK company Cas-Global is being investigated by the City of London Police for possible offences under section 6 of the Bribery Act, as well as anti-corruption investigators in the US, Nigeria, and Norway. The investigation relates to an alleged bribe paid by Cas-Global to a Norwegian official, Bjorn Stavrum, as part of the sale of seven decommissioned naval vessels from 2012 onwards. It is alleged that Stavrum was paid to assist Cas-Global to disguise the real destination of the vessels from the Norwegian authorities. The vessels were being sold to a former Nigerian warlord, Government Ekpemupolo. The joint investigation with the Norwegian authorities has led to the arrest of Bjorn Stavrum and three British nationals.

On May 16, 2017 Bjorn Stavrum was convicted by a Norwegian court, and sentenced to four years and eight months jail.

Enforcement: Ongoing Domestic Bribery and Corruption Prosecutions and Investigations

F.H. Bertling Limited

Between April 28, 2017 and May 17, 2017, the SFO announced charges against F. H. Bertling Limited and seven individuals (Colin Bagwell, Robert McNally, Georgina Ayres, Giuseppe Morreale, Stephen Emler, Peter Smith, and Stephen Emler). The charges relate to an alleged conspiracy to “give or accept corrupt payments for assisting F.H. Bertling Limited in being awarded or retaining contracts for the supply of freight forwarding services relating to a Northern Sea oil exploration project“. The offences are alleged to have taken place between January 2010 and May 2013.

In addition, Colin Bagwell, Christopher Lane and Peter Smith were also charged with a separate count of conspiracy to give or accept corrupt payments between January and December 2010.

These charges follow separate charges made last year against F.H. Bertling Limited and seven individuals in relation to an alleged conspiracy to bribe an agent of the Angolan state oil company, Sonangol.

Barratt Developments PLC

Following the arrests mentioned in our 2016 Year-End Update of the London Chief of Barratt Developments PLC, Alistair Baird as Managing Director and an unnamed employee in October 2016, two further arrests were made on November 8, 2016. The names of the 47-year-old man and 49-year-old woman were not given by police and internal investigations are continuing.

National Assets Management Agency (“NAMA”)

The NCA investigation into NAMA‘s sale of its Northern Ireland property portfolio to Cerberus Capital Management in 2014 continues. In addition, the Irish Government approved a draft Order and Terms of Reference for a Commission of Investigation into NAMA on May 9, 2017. Before the Commission can be established, the draft Order requires approval from both the Dáil and Seanad. For further information, see our 2016 Year-End UK White Collar Crime Update.

Introduction of a new anti-bribery reporting regime

The Companies, Partnerships and Groups (Accounts and Non-Financial Reporting) Regulations 2016 (the “Regulations”) implement the Non-Financial Reporting Directive (2014/95/EU). The Regulations came into effect on December 26, 2016 and amend Part 15 of the Companies Act 2006 by creating two new sections requiring public interest entities (e.g. listed companies, banks, insurers and financial services institutions) with over 500 employees to prepare a non-financial statement as part of their strategic report and prescribing the contents of that statement.

The information that must be set out in the statement includes (to the extent necessary to understand the company’s development, performance and position and the impact on its activities) a description of the company’s anti-corruption and anti-bribery policies, the results of such policies and the management of the principal risks relating to those matters. Similar disclosures are required for environmental matters, employees and social matters, and respect for human rights. Where a reporting entity does not pursue policies in relation to any of the above matters, the statement must provide a reasoned explanation for the entity not doing so.

Whilst the Regulations provide for situations where there may be duplication of information in terms of overlap with the enhanced business review, they go further than the current strategic report in terms of requiring disclosure of anti-corruption and anti-bribery matters.

There is an exception to the required disclosures in relation to information about impending developments or matters in the course of negotiation if disclosure would, in the opinion of the directors, be seriously prejudicial to the commercial interests of the company. The Explanatory Notes to the Regulations fail to provide further commentary on what is deemed to be covered by this exception, but a likely example would be ongoing negotiations with a regulator or prosecutor in order to resolve an enforcement action.

The Regulations apply in relation to all financial years commencing on or after January 1, 2017.

3. Fraud

The SFO has launched ambitious investigations and criminal prosecutions in the first half of 2017. Particularly notable were high profile investigations into Airbus and Tesco and an increasing focus on investigations into serious frauds emerging after a financial collapse of a company. In a speech at a conference on January 19, 2017, the SFO’s Joint Head of Fraud, Hannah von Dadelszen, highlighted that the SFO did not make charging decisions on the basis of a monetary threshold but rather based on the overall seriousness and complexity of the case.

In the meantime, the FCA appears to be focused on pursuing lower-profile fraud prosecutions.

Investigations: SFO

Ethical Forestry Limited

In March 2017, the SFO opened a criminal investigation into an alleged fraudulent investment scheme in a forestry plantation in Costa Rica marketed by Ethical Forestry Limited and associated companies between 2007 and 2015.

According to reports , around 3,000 investors invested a minimum of £18,000 each in the scheme – and a total of around £50 million. The investment scheme entered into liquidation in early 2016, and in June 2016 it was reported that the FCA was probing whether Ethical Forestry Limited and its connected entities had been operating an unauthorised collective investment scheme. According to press reports, HMRC is also investigating the company’s tax liability. The SFO has confirmed that the investigation includes, but is not limited to, the following companies: Avacade, Cherish Wealth Management, Alexandra Associates and Think About Money.

On March 8, 2017, the SFO executed search warrants at three addresses in Dorset in connection with the investigation.

Capita Oak Pension and Henley Retirement Benefit schemes, SIPPS and others

On May 22, 2017 the SFO announced that it was opening an investigation into an alleged pensions scam involving the Capita Oak Pension and Henley Retirement Benefit schemes, Self-Invested Personal Pensions (“SIPPS”) as well as other storage pod investment schemes. The investigation includes the Westminster Pension Scheme and Trafalgar Multi Asset Fund. Over a thousand individual investors have purportedly been affected, and the amounts invested total over £120 million between 2011 and 2017.

According to the Guardian, it is unclear whether investors will ever recover their money as the two companies acting as trustees to Capita Oak Pension and Henley Retirement Benefit were wound up by the High Court in July 2015 following allegations of “cold calling”. The SFO is bringing its investigation under the mantle of Project Bloom, a multi-agency group set up to tackle pension liberation fraud, and is being assisted by the NCA, the Pensions Regulator and Spanish authorities.

Bank of England liquidity auctions

In our 2015 Year-End UK White Collar Crime Update we reported that the SFO had opened a criminal investigation into the Bank of England’s liquidity auctions carried out during the financial crisis in 2007 and 2008 when it was holding money-market auctions for UK lenders. We noted in our 2016 Year-End White Collar Crime Update that charges had yet to be pursued.

On June 23, 2017 the SFO closed its investigation, which had centred on whether banks and building societies were told by the Bank of England to bid for liquidity funding in late 2007 and early 2008 at a particular rate to avoid questions about the health of their balance sheets. In a statement on its website, the SFO announced that after “a thorough investigation the SFO concluded that there is no evidence of criminality in relation to this matter“.

Enforcement: SFO

R v Alexander and others

As mentioned above in the Bribery section, on February 7, 2017, after a 5-month trial, George Alexander, Stephen Dartnell, Simon Mundy and Carl Cumiskey were found guilty of conspiracy to commit fraud and conspiracy to make corrupt payments against two business lenders, in order to obtain close to £160 million between 2007 and 2010.

George Alexander and Stephen Dartnell, both of Total Asset Limited, trading as Total Asset Finance (“TAF”), were sentenced to 12 and 15 years’ imprisonment respectively for the fraud counts. Simon Mundy, who worked for KBC Lease (UK) (“KBC”) and Carl Cumiskey of H2O Networks Limited (“H2O”) were sentenced to seven and 10 years’ imprisonment respectively for their fraud counts. Two other defendants in the case were found not guilty.

Dartnell, Alexander and Cumiskey had conspired to create, sign and sell falsely inflated or entirely false contracts from the company H2O to high profile business lenders, including KBC Lease (UK). H2O supplied fibre-optic internet cable connections, using sewers as channels for the cables, and targeted public institutions such as local authorities, universities, colleges and the NHS for long-term payment contracts. Mundy was paid nearly £900,000 to approve the funding provided by KBC to TAF.

Solar Energy Savings Limited

Following the announcement on December 5, 2014 of its criminal investigation into Solar Energy Savings Limited, PV Solar Direct Limited and Ultra Energy Global Limited, the SFO released a statement on March 29, 2017 that five British men, including three former directors of Solar Energy Savings Limited, have been charged with conspiracy to commit fraud. The fraud is said to involve the selling of solar panels to customers of Solar Energy Savings Limited with the promise of a return of 100% of the investors’ purchase monies on maturity (known as a “360 Returns Scheme”). The total loss of the victims of the scheme is estimated at over £13 million.

Two further individuals allegedly involved in the scheme failed to report to police in February 2017 and are still being sought by the SFO.

As mentioned earlier in this Update, on March 28, 2017, the SFO confirmed that it had entered into a DPA in principle with Tesco Stores Limited. The DPA was approved on April 10, 2007 at a public hearing before Lord Justice Leveson. It was the fourth DPA to be entered into in England, and the first for offences other than bribery and corruption. The Tesco DPA follows a two-and-a-half year investigation into Tesco Stores Limited for allegedly overstating its profits in 2013 and 2014 by £284 million. The DPA “only relates to the potential criminal liability of Tesco Stores Limited and does not address whether liability of any sort attaches to Tesco PLC or any employee, agent, former employee or former agent of Tesco PLC or Tesco Stores Limited“.

The publication of the DPA has been postponed until after the trial of three individuals in relation to the conduct of Tesco Stores Limited’s business, following a contempt of court order. See our 2016 Year-End United Kingdom White Collar Crime Update for more information on the proceedings against the three individuals charged, who are due to be tried in September 2017 at Southwark Crown Court.

The settlement reached is for a total of £235 million, comprising a £129 million settlement with the SFO, a £85 million settlement with the FCA in compensation for investors who lost money in relation to a £326 million accounting scandal, and related costs. Tesco Stores Limited is also required to retain an external auditor to recommend and review the implementation of additional financial and accounting controls.

The SFO’s efforts in brokering a DPA appear to have been closely coordinated with the FCA. When the SFO announced its criminal investigation into Tesco in October 2014, the FCA was already investigating the company for the same underlying conduct. The FCA subsequently discontinued its investigation, allowing the SFO to take the lead. Though the SFO spearheaded the investigation, the two enforcement agencies acted in concert when it came time for final resolution. On the same day that Tesco Stores Limited announced that it had negotiated a DPA, the FCA released its statement that Tesco Stores and its parent company, Tesco PLC, agreed that they had committed market abuse by disseminating false and misleading information concerning the value of Tesco shares. In lieu of imposing a financial penalty, and perhaps due to the existing monetary payouts under the DPA, the FCA for the first time exercised its authority to establish a restitution fund for investors. Under the terms of their agreement with the FCA, Tesco Stores Limited and Tesco PLC must pay an estimated £85 million to the fund.