July 11, 2017

The resounding global theme this year in corporate non-prosecution agreements ("NPA") and deferred prosecution agreements ("DPA")[1] is "cooperation." In the United States and abroad, enforcement authorities implementing or considering DPA regimes are consistently beating the drum of exemplary cooperation as a prerequisite to achieving this form of resolution. We highlight multiple examples across the globe in which cooperation has been acknowledged as a deciding factor in accomplishing an NPA or DPA, even in cases where wrongdoing is alleged to have been long-standing and broad in scope.

Many of the year’s most significant developments have come from abroad, as the United Kingdom flexes its DPA muscle and other jurisdictions—Australia and Scotland (which is not subject to the United Kingdom’s existing DPA program)—consider the contours of potential new DPA programs.[2] In the United States, despite a relative NPA/DPA slowdown in the first few months of the year, as the incoming U.S. Department of Justice ("DOJ") hits its stride, U.S. officials have articulated a tough stance on white collar enforcement while also acknowledging NPAs and DPAs among the many tools used by DOJ to police corporate crime. These developments suggest that—as predicted in our 2016 Year-End Update—we can anticipate that NPAs and DPAs will continue to be strongly favored tools in corporate settlements in the years to come.

This client alert, our eighteenth biannual update on NPAs and DPAs: (1) analyzes NPA and DPA agreements to date in 2017 against results from prior years; (2) discusses updates in white collar enforcement priorities in the Trump Administration, generally, and their likely impacts on NPAs and DPAs; (3) spotlights developments in the United Kingdom’s DPA program, which has yielded two DPAs to date so far in 2017; and (4) provides updates regarding developments in the creation of DPA regimes in other regions of the globe.

NPAs and DPAs in 2017

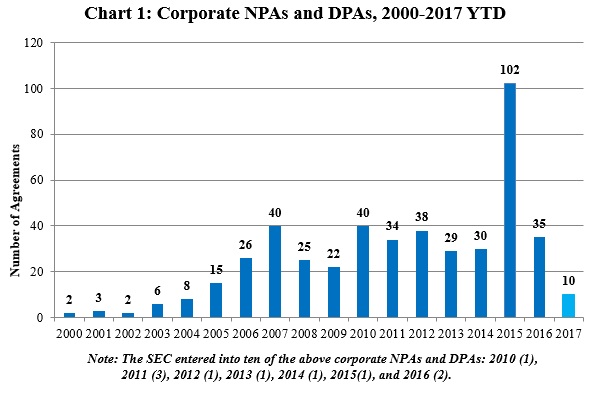

In 2017 to date, DOJ has entered into ten NPAs and DPAs, and the U.S. Securities and Exchange Commission ("SEC") has entered into none. The number of enforcement resolutions is unpredictable and any six-month window should not be cited as a trend, particularly at the beginning of an Administration. In 2004, DOJ stepped up its use of NPAs and DPAs to resolve allegations of corporate crime, which means that there is data for slightly more than a decade. The number of cases resolved by NPAs and DPAs has historically ebbed and flowed over time. From experience, we also note that there was an effort within DOJ to resolve a number of cases by the end of 2016, which led to eighteen NPAs and DPAs being executed in the last quarter of 2016, compared to seventeen in the preceding three quarters.

Finally, it is possible that there is some link to relative delays in selecting top enforcement officials at both the SEC and DOJ (Jay Clayton, Chairman of the SEC, was sworn in quite recently on May 4, 2017, and he has yet to affirmatively appoint a top enforcement official), and the Justice Department’s level of distraction with pending congressional and DOJ investigations into alleged Russian interference with the 2016 presidential election. Even so, and as discussed below, recent statements issued by DOJ indicate that the numbers of NPAs and DPAs may grow as the year progresses.

Chart 1 below shows all known corporate NPAs and DPAs since 2000.

Of the ten NPAs and DPAs this year to date, six are DPAs and four are NPAs. Six (including three DPAs and three of the four NPAs) involve some form of continued monitoring. Of the six, five resolutions require independent compliance monitors or consultants.[3] At 60%, this monitoring rate exceeds the average since we first began tracking monitoring requirements in NPAs and DPAs. Since 2000, only approximately 41% of agreements have involved some form of monitoring, including self-monitoring and reporting. Given the small size of the 2017 sample, however, it is too early to tell whether this signals a shift in policy toward favoring continued corporate reporting and monitoring. As monitors can involve extremely high corporate costs, disruptions to corporate business environments, and potential confidentiality and privacy risks—all as discussed in our prior updates—we will continue to follow any developments in this space closely.

In addition to the ten NPAs and DPAs, this year DOJ has also issued two new so-called "declination letters" that by including disgorgement terms read like NPAs. As first addressed in our 2016 Year-End Update, when there were only two, the Foreign Corrupt Practices Act ("FCPA") Pilot Program has now resulted in four such letters, each of which contains disgorgement terms, is counter-signed by the receiving company, and leaves open the possibility of prosecution.[4] Accordingly, it is likely that before the FCPA Pilot Program, these resolutions would have been either NPAs or DPAs. The FCPA Pilot Program has yielded an overall total of seven declinations to date, of which three did not require disgorgement.

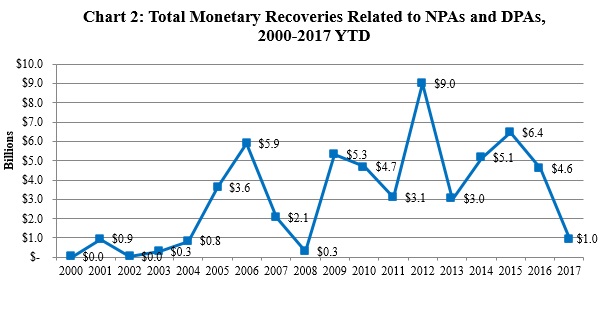

Chart 2 below illustrates the total monetary recoveries related to NPAs and DPAs from 2000 through today. Consistent with the relatively low overall yield, monetary recoveries associated with 2017’s NPAs and DPAs to date also are low.

At approximately $966 million, this year’s NPAs and DPAs approximate the values of those at this point in 2007, and are the lowest since 2011, when there were fifteen NPAs and DPAs valued at approximately $800 million by July 11. Of course, one or two large resolutions can skew the averages.

We have discussed the proliferation of NPAs and DPAs. Initially, only prosecutors in Main Justice, particularly the Fraud Section and the biggest U.S. Attorney’s offices, employed these vehicles, but in recent years many of the 93 U.S. Attorney’s Offices have turned to NPAs/DPAs to resolve complicated investigations. Although the DOJ Fraud Section has a template for both NPAs and DPAs, other offices’ approaches vary dramatically. For example, this year, the U.S. Attorney for Utah entered into an NPA with the Utah Transit Authority ("UTA"), a public state governmental entity. To begin with, it is highly unusual for a government unit to be charged criminally by DOJ prosecutors. The letter states broadly that the agreement relates to "the ongoing investigation including, but not limited to, UTA’s operation of mass public transit services, application for federal grants and funding, expenditure and use of federal funds, or the negotiation for, and/or acquisition of, real property, equipment and other capital improvements related to UTA’s operations."[5] The letter does not refer to any specific federal offenses or provide any federal criminal or statutory citations. Second, unlike the Main Justice NPA/DPA template, the UTA NPA provides that UTA "shall waive the Attorney-Client and Work Product Privilege."[6] The Agreement further provides that "[a]s part of its cooperation throughout the investigation, UTA voluntarily offered and agreed to the waiver under this Agreement, without any suggestion or prompting by this Office. The waiver shall include UTA’s previously asserted privilege claims with respect to those documents."[7] In our experience, privilege issues are becoming more frequent because organizations are seeking to position themselves to advance an extraordinary cooperation argument.

Corporate Enforcement under the New Administration

As the Trump Administration has rolled out its policy priorities in 2017, the line on white collar enforcement has held steady with the changing of the guard. Recent speeches by Attorney General Jefferson Beauregard Sessions and Acting Principal Deputy Assistant Attorney General Trevor McFadden have expressed a continued tough stance on prosecution of both companies and individuals for white collar crimes. These statements, coupled with an implicit endorsement of NPAs and DPAs by Attorney General Sessions in a recent memorandum, suggest that NPAs and DPAs are likely to continue to feature prominently in DOJ’s enforcement regime.

In an April 24, 2017 speech at the Ethics and Compliance Initiative Annual Conference, Attorney General Sessions emphasized that DOJ’s renewed focus on prosecuting crimes related to drugs, immigration, and violence[8] would not reduce its efforts in other areas.[9] Recognizing that "there can be some uncertainty when there is a new Administration or new leadership at the Justice Department," he emphasized that DOJ would "still enforce the laws that protect American consumers and ensure that honest businesses aren’t placed at a disadvantage" by continuing to prosecute corporate fraud and misconduct, bribery, public corruption, trade secret theft, money laundering, securities fraud, government fraud, health care fraud, and Internet fraud.[10] Attorney General Sessions also praised the FCPA for "creat[ing] an even playing field for law-abiding companies" in an economy where he believed "[c]ompanies should succeed because they provide superior products and services, not because they have paid off the right people."[11] During the Q&A following his prepared statement, Attorney General Sessions promised to look into potential abuses in certain enforcement areas, including, for example, cases where a company may be threatened by penalties from multiple jurisdictions over the same conduct.[12] The piling on by various enforcers has become a particular challenge for managing cross-border investigations.

Attorney General Sessions also focused on the importance of good compliance leadership and said that DOJ had "done [its] part to reward effective compliance programs." For example, he reminded attendees that, when charging decisions are made, DOJ will take into account whether companies have good compliance programs, self-disclosed problems, remediated them, and cooperated in any government investigation.[13] Because "honest corporate shareholders end up having to pay the price for dishonest corporate leadership," Attorney General Sessions said he wanted to hold individuals responsible for corporate misconduct, though he recognized it was "not always possible."[14] Sessions said that he did not think a company should "be subjected to millions of dollars in lawsuits or criminal penalties beyond a rational basis because one person went awry, or even one division chief somewhere, went awry."[15] Although Attorney General Sessions did not comment on NPAs and DPAs specifically, he also has recently referred to NPAs and DPAs among a list of "useful tool[s] for [DOJ] attorneys to achieve the ends of justice at a reasonable cost to the taxpayer."[16] This articulated "tough but fair" positioning on corporate wrongdoing, coupled with Sessions’s express continued support for the use of NPAs and DPAs, indicate continued willingness by DOJ to consider and execute NPAs and DPAs with companies that employ good compliance programs but where a rogue actor may have engaged in misconduct.

Just days before the Attorney General’s remarks, on April 20, 2017, Acting Principal Deputy Assistant Attorney General Trevor McFadden, who spoke at the American Conference Institute’s 19th Annual Conference on FCPA, gave a statement sounding similar themes. McFadden opened his remarks by declaring his intent to "dispel [the] myth" that "the Department of Justice no longer is interested in prosecuting white collar crime."[17] He said that DOJ "is fully engaged in combatting crime in all its forms, and no matter what color collar its perpetrators wear."[18]

After a lengthy discussion about violent crime prosecutions, McFadden went on to discuss a number of examples of recent enforcement successes by the Department to show what he called the "great deal of the Criminal Division’s work [that] continues to focus on a wide array of white collar crime matters, such as: fraud, bribery, public corruption, organized crime, trade secret theft, money laundering, securities fraud, government fraud, healthcare fraud and computer and Internet fraud – to name a few."[19]

McFadden’s comments seemed to indicate continued openness to corporate NPAs and DPAs. He noted that the "Fraud Section and FCPA Unit’s aims are not to prosecute every company we can, or break our own records for the largest fines or longest prison sentences." Rather, their focus is on the goal of "motivat[ing] companies and individuals voluntarily to comply with the law." Like Sessions, McFadden said that "the department . . . regularly takes into consideration voluntary self-disclosures, cooperation and remedial efforts when making charging decisions."[20] These themes frequently are cited as reasons for granting NPAs and DPAs to companies, and may suggest continued vitality for such agreements. McFadden also commented that the FCPA Pilot Program for self-disclosure and penalty reductions "will continue in full force,"[21] further supporting the notion that DOJ may be amenable to corporate NPAs or DPAs for companies that seek to comply with the law, readily remediate any identified shortcomings, and are forthcoming about their compliance programs to DOJ.

McFadden also stated that, with respect to FCPA prosecutions that feature concurrent jurisdiction, DOJ will "seek to reach global resolutions that apportion penalties between the relevant jurisdictions so that companies seeking to accept responsibility for their prior misconduct are not unfairly penalized for the same conduct by multiple agencies,"[22] another point that the Attorney General echoed the following week. This hints at the continuation of a trend we have seen in recent years of increasing emphasis on cross-border cooperation and coordinated settlements in multiple jurisdiction investigations.

The remarks of the Attorney General and the Acting Principal Deputy Assistant Attorney General, less than a week apart, seem to have been coordinated to send a consistent message about corporate enforcement. It appears that DOJ will continue to pursue white collar crimes in a manner largely consistent with that of the previous administration, including continued emphasis on self-reporting and robust compliance programs. We might also anticipate a heightened preference for prosecuting individuals rather than corporations. In all of this, there is every reason to expect that NPAs and DPAs will continue to be used as prominent vehicles to resolve complicated corporate investigations.

The UK DPA Program Heats Up in 2017

The UK Serious Fraud Office’s ("SFO") former Joint Head of Bribery and Corruption—Ben Morgan, who left the SFO earlier this year to enter private practice—recently called DPAs "the new normal" for resolving corporate criminal charges in the UK.[23] With two DPAs reached this year in close succession, there may indeed be an emerging trend establishing DPAs as the preferred vehicle for resolving certain kinds of corporate criminal charges. Although the United Kingdom established a DPA program in February 2014, after nearly three years in operation, the SFO had only secured two DPAs by the end of 2016. This year, however, it secured agreements with both Rolls-Royce and Tesco Stores Limited within three months of each other, and Morgan’s calling DPAs "the new normal" in March may signal that there are more to come. We briefly analyze each of 2017’s UK agreements below, and further highlight Morgan’s March 2017 speech in connection with the Rolls-Royce DPA.

Rolls-Royce

In January 2017, the SFO resolved its sprawling investigation into Rolls-Royce by entering into a DPA with the company (the "Rolls DPA").[24] At the time, this marked the third use of a DPA by the SFO to resolve a criminal investigation since the power became available to UK prosecutors in 2014, and concludes the SFO’s largest-ever single investigation, costing £13 million, spanning four years, and involving some seventy SFO personnel.[25]

The SFO was first alerted by, and commenced its own inquiry following, anonymous postings on an Internet blog which raised concerns about Rolls-Royce’s business in China and Indonesia.[26] In addition to fully complying with the SFO’s investigation following this discovery, Rolls-Royce also carried out its own internal investigation and disclosed its findings to the SFO.

The indictment, which has been suspended for the term of the DPA, covers twelve counts of conspiracy to corrupt, false accounting, and failure to prevent bribery.[27] The DPA not only requires Rolls-Royce to disgorge all alleged profits, but also mandates that the company pay a significant financial penalty, reimburse the SFO’s costs for the investigation, and implement an anti-bribery and compliance program at its own expense.[28]

Although there have only been four DPAs since 2014, as noted above, DPAs appear poised to become a more frequent prosecutorial tool in the UK. In that same period there has been only one corporate conviction for bribery offenses. In his speech in March 2017, concerning the Rolls DPA as well as the future of DPAs more generally, Morgan underscored the SFO’s commitment to rewarding those companies that engage in full cooperation during the course of an investigation and to utilizing the DPA to resolve corporate criminal conduct—even if the company engages in widespread misconduct over a long time span. In response to critics who have questioned the use of a DPA with Rolls-Royce, he emphasized Rolls-Royce’s extensive cooperation, noting that Rolls-Royce provided "unfiltered access to their own records – some 30 million documents . . . agreed to independent review of those records for privilege . . . agreed to automated review of material for privilege and relevance . . . reported frankly on areas of concern . . . made available to [SFO] written accounts of interviews . . . [and] dealt with the press, and governments home and abroad in a responsible way . . ."[29] Morgan punctuated the importance of cooperation by stating that "[f]or those that behave responsibly . . . disposal of corporate criminal risk through resolutions like those in Standard Bank, XYZ and Rolls-Royce will become increasingly common."[30]

The Rolls DPA is noteworthy also because of the significant financial penalties that Rolls-Royce agreed to as part of the DPA. In the two DPAs executed by the SFO prior to the Rolls DPA—involving Standard Bank and an unnamed company (referred to by the SFO as "XYZ Limited"), respectively—the SFO levied relatively modest financial sanctions.[31] As part of this DPA, however, Rolls-Royce has agreed to disgorge alleged profits of £258,170,000, pay a financial penalty of £239,082,645, and reimburse the SFO’s costs of £12,960,754.[32] This is in addition to payments of $169,917,710 to DOJ and $25,579,645 to the Brazilian authorities, plus the £123 million in costs incurred by Rolls-Royce in investigating its conduct in multiple jurisdictions.[33] It is the largest penalty that has ever been levied by the SFO in a bribery matter.[34]

Finally, the Rolls DPA is notable in that, unlike the Standard Bank and XYZ Limited DPAs, the SFO entered into a DPA with Rolls-Royce despite the fact that the company did not self-report its violations. With both Standard Bank and XYZ Limited, the SFO and Sir Brian Leveson, President of the Queen’s Bench Division and the Judge who has approved all DPAs to date, had indicated that self-reporting was an extremely important—if not essential—consideration in choosing not to prosecute.[35]

Nonetheless, in connection with Rolls-Royce, it appears that this detriment was overcome by the company’s fulsome cooperation with the investigation, especially because the SFO had only very limited knowledge of the extent of Rolls-Royce’s misconduct prior to engaging with the company. Sir Brian Leveson in his judgment stated that, beyond self-reporting, "the company could not have done more to expose its own misconduct, limited neither by time, jurisdiction or area of business," and he therefore equated this cooperation to self-reporting.[36]

In addition, Morgan explained that despite learning of Rolls-Royce’s possible misconduct from a blog post, the SFO still possessed very limited information and that "the company ultimately reported and resolved conduct ranging far beyond what [the SFO] already knew."[37] He went on to say that "[s]elf reporting is not dead; far from it. . . . It is still a key feature of the profile of a case suitable for resolution by DPA," but that in the case of Rolls-Royce, the company still had a "deficit" that needed to be closed and it did so by cooperating fully with the investigation, noting that this cooperation was particularly beneficial where Rolls-Royce could supplement the SFO’s understanding of the alleged corrupt payments.[38]

For more on the detailed terms of the Rolls DPA and the underlying conduct, see our forthcoming 2017 Mid-Year UK White Collar Crime Alert.

Tesco Stores Limited

The SFO’s fourth-ever DPA came close on the heels of Rolls-Royce, in April 2017. Specifically, the SFO entered into a DPA with Tesco Stores Limited ("Tesco Ltd."), the UK subsidiary of one of the largest grocery and general merchandise retailers in the world, upon the Crown Court’s approval on April 10, 2017.[39] The Tesco Ltd. DPA follows a two-and-a-half-year investigation into Tesco Ltd. for allegedly overstating its profits in 2013 and 2014 by £284 million.[40] It is the first DPA to be entered into in relation to offenses other than bribery and corruption. Unlike the Rolls-Royce DPA, which is publicly available in full, the Tesco Ltd. DPA, its statement of facts, and the Crown Court’s fairness ruling on the DPA are currently unavailable to the public pending the conclusion of trials against three former Tesco Ltd. employees in connection with the same underlying set of facts.[41] Though details of the deal are scant, the SFO announced that Tesco Ltd. will be made to pay £129 million in penalties, ratcheting up the total amount of financial penalties (including fines, compensation, and disgorgement) paid through only four UK DPAs to over £660 million.[42] The penalty itself, though not as high as the one levied against Rolls-Royce at £497 million (including disgorgement), still far eclipses those of Standard Bank and XYZ at $31.5 million and £6.5 million, respectively. Tesco Ltd. will also be required to retain an external auditor to recommend and review the implementation of additional financial and accounting controls.[43]

The SFO’s efforts in brokering a DPA appear to have been closely coordinated with the UK’s Financial Conduct Authority ("FCA"). When the SFO announced its criminal investigation into Tesco Ltd. in October 2014, the FCA had already been investigating the company for the same underlying conduct.[44] The FCA subsequently discontinued its investigation, allowing the SFO to take the lead.[45] Though the SFO spearheaded the investigation, the two enforcement agencies acted in concert when it came time for final resolution. On the same day that Tesco Ltd. announced brokering a DPA, the FCA released a statement that Tesco Ltd. and its parent company, Tesco PLC, agreed that they committed market abuse by disseminating false and misleading information concerning the value of Tesco shares.[46] In lieu of imposing a financial penalty, and perhaps due to the existing monetary payouts under the DPA, the FCA for the first time exercised its authority to establish a restitution fund for investors. Under the terms of their agreement with the FCA, Tesco Ltd. and Tesco PLC must pay an estimated £85 million to the fund.[47]

Whether and to what extent Tesco Ltd.’s cooperation with the SFO resulted in a reduction in fines remains to be seen. In the SFO’s two most recent DPAs, XYZ Limited and Rolls-Royce received a 50% discount owing to "extraordinary" cooperation. The FCA’s order, which "relates to substantially similar conduct" to that set forth in the DPA, offers high praise to Tesco Ltd. and its parent company, characterizing their cooperation as "exemplary."[48] If the FCA’s order is any indication, one would presume that £129 million represents a substantially reduced fine due to cooperation.

There still may be more to write about Tesco in a future update. The DPA explicitly carves out Tesco Ltd.’s parent company, as well as all current and former employees or agents of the parent company and Tesco Ltd.[49]

Developments in Other Jurisdictions

Australia Proposes New DPA Model

In our 2016 Mid-Year Update, we reported on the Australian Attorney-General’s Department ("AGD") proposal to implement a possible DPA regime in Australia. In an initial consultation paper issued on March 16, 2016, the AGD analyzed existing DPA regimes in the United States and the United Kingdom, and sought public comment on how a system of voluntary negotiated settlements could help to incentivize self-reporting by Australian companies.[50] A range of stakeholders responded to the AGD’s invitation for public comment, including government agencies, business groups, academics, law firms and lawyers’ associations, and non-governmental organizations.[51] All but two of the seventeen written submissions were in favor, or conditionally in favor, of implementing a DPA scheme in Australia.

Taking into account the 2016 submissions, as well as consultation with federal agencies including the Office of the Commonwealth Director of Public Prosecutions ("CDPP") and the Australian Federal Police, on March 31, 2017, the AGD released a second public consultation paper outlining in detail a proposed model for DPAs in Australia.[52]

The 2017 proposed model borrows heavily from the existing DPA schemes in the United Kingdom and United States, with the stated aim of implementing a more efficient and effective way of holding corporations accountable without the cost and uncertainty traditionally associated with criminal trials.[53] As in the United Kingdom, the proposed Australian DPAs would only be available to corporations and would be limited to violations of particular provisions of Australia’s Criminal Code, namely fraud; false accounting; foreign bribery; money laundering; dealing with proceeds of crime; forgery and related offenses; exportation and/or importation of prohibited or restricted goods; specific offenses under the Corporations Act; and any ancillary offense relating to an offense to which the DPA scheme explicitly applies.[54] The AGD is still considering whether other types of crimes, such as cartel offenses and environmental crimes, also should be included. After two years, the AGD will reassess the list of eligible criminal offenses and the decision to limit DPAs to companies.[55]

The description of the proposed DPA framework outlined in the AGD’s public consultation paper is organized according to the chronological life cycle of a DPA, beginning with the proposed negotiation process, and proceeding through proposed mechanisms for approving, overseeing, and concluding DPAs. The following summary addresses each stage in the life cycle of a DPA, as envisioned by the AGD.

DPA Negotiation. Under the proposed model, the CDPP may, at its discretion and in consultation with relevant investigative agencies, invite a company to enter into a DPA.[56] In some cases, companies may self-report misconduct and engage the CDPP in discussions regarding a potential DPA; in others, the regulator may independently detect corporate misconduct, but nevertheless the CDPP may offer a DPA after the firm’s "full and genuine cooperation."[57] The AGD suggests that such cooperation would likely include providing "complete and accurate details about corporate and individual misconduct."[58] The AGD acknowledges the need for clear guidelines detailing, with some degree of precision, the circumstances under which the CDPP will offer a DPA and proposes offering such guidelines in the Prosecution Policy of the Commonwealth and related documents.[59] Possible considerations include, in addition to self-reporting, the company’s past conduct, role in the offense(s), and level of cooperation with any ongoing investigations.[60]

Once the CDPP sends a formal invitation to negotiate a DPA, under the proposed model, the prosecutor has almost plenary discretion to conduct the negotiations as they see fit.[61] Prosecutors would also be responsible for preparing a full and accurate record of the negotiation, obtaining information from the corporate defendant, and ensuring that the final DPA "fairly and accurately reflects the severity of the company’s alleged offending" and represents the entirety of the agreement.[62] Corporations, for their part, would be required to keep the negotiations confidential, provide full and accurate information, cooperate fully with investigative agencies, and maintain any materials relevant to the matter.[63]

However, any negotiations would be kept confidential, and the prosecutors would be prohibited from disclosing these discussions or using any material prepared in connection with the DPA in a subsequent proceeding against the corporate defendant, with certain exceptions.[64] Drawing on the UK model for DPAs, under the Australian proposal, material created solely to facilitate, support, or record DPA negotiations—including minutes of negotiations, draft DPAs, and reference documents—would only be disclosed to relevant enforcement and investigative agencies. Such material could only be used in subsequent criminal or civil proceedings relating to: (1) providing false or misleading information in violation of part 7.4 of the Australian Criminal Code; (2) knowingly providing inaccurate, misleading, or incomplete information during the DPA negotiations; (3) material breach of the DPA; or (4) making statements inconsistent with the DPA-related material in a prosecution for some other offense.[65]

On the other hand, it appears that other information not created specifically for use during DPA negotiations might not be subject to the same protections. Indeed, the proposal makes clear that the protections would not apply, for example, to the books and records regularly maintained by the company, though it specifically points out that sharing such information in advance "may demonstrate that the company has been cooperative and is therefore an appropriate candidate for a DPA."[66] As a result, materials related to the conduct under investigation could be available to the authorities for use in any further prosecution, in the event the DPA negotiations are unsuccessful or the DPA is not approved.[67]

In entering into the DPA negotiation process, a corporation must be prepared to provide considerable amounts of information to the CDPP relating to the conduct under investigation. Much of that information will be incriminating for the corporation and may also be the result of legally privileged investigations—such as investigative reports and witness statements. The AGD’s proposal would make these materials available for use in further prosecutions, if DPA negotiations are unsuccessful, or the DPA is not approved. This aspect of the proposal would differ significantly from current practice in the United States, where Federal Rule of Evidence 408(a) broadly prohibits the admission of evidence relating to "conduct or a statement made during compromise negotiations,"[68] including those involving DPAs.

The AGD’s proposal would require certain elements be included in each DPA. These terms include, among other things, an agreed statement of facts with the "particulars relating to each offense" and "details of any financial gain or loss, with supporting material."[69] The AGD also is "considering whether the DPA would require the company’s formal admission of criminal liability for specified offenses, consistent with any relevant laws of evidence."[70] This latter requirement would be a departure from other DPA models, including that of the United States, in which a corporate defendant will adopt a statement of facts as opposed to formally admitting guilt, and would be a strong disincentive for corporations to enter into these agreements, as any such acknowledgments of criminal wrongdoing could lead to follow-on civil litigation.[71]

Prior to finalizing any agreement, under the proposed model, the prosecutor must satisfy certain factors, including that (i) there are reasonable grounds to believe a crime has been committed; (ii) if the investigation continued it would unearth further admissible evidence that could secure a conviction; (iii) the full extent of the company’s offending has been identified; and (iv) the public interest is served by the DPA.[72]

DPA Approval. Perhaps most controversially, the AGD proposes having the CDPP provide a written application for the DPA’s approval to a retired judge to "determine whether these terms are in the interests of justice and are fair, reasonable and proportionate."[73] Although some argue that Australia’s courts should approve any DPA, as is the case in the United Kingdom,[74] under Australia’s constitution, prosecutors may not engage in sentencing negotiations in typical criminal proceedings, and as a result, any such agreements with potential defendants must be outside of normal proceedings.[75]

Another suggestion rests sole discretion for approving or rejecting the DPA with the Director of the CDPP, and the AGD makes clear that it would be open to considering comments on such an alternative.[76] Although under this alternative approach the CDPP would effectively have sole discretion to offer, negotiate, and approve DPAs, the AGD suggests that it would also provide greater certainty because the CDPP would be empowered both to offer and approve the terms of a DPA.[77]

Upon approval, DPAs would be published on the CDPP’s website, absent exceptional circumstances (such as the potential to prejudice court proceedings). The CDPP would also publish details regarding each company’s compliance with its DPA, or any breach, variation, or termination thereof.[78] The AGD suggests that this public database of DPAs would contribute to greater transparency and provide an additional source of guidance regarding the operation and implementation of the DPA regime.[79]

DPA Oversight. Once the DPA is entered into between the CDPP and the corporate defendant, the AGD suggests that, in many cases, an independent monitor would be appropriate to monitor the corporation’s compliance with its obligations under the agreement. Such obligations could include commitments to reform corporate compliance culture to avoid future offenses; periodic reporting obligations; or requirements to make payments over a period of time.[80] The proposed external monitorship requirement reflects the limited resources of the CDPP to monitor corporations’ compliance with DPAs, but is a costly consideration for any company considering entering into a DPA.[81]

DPA Conclusion. The AGD is considering three options to address a material breach of the DPA: (a) having the retired judge who approved the application examine the matter; (b) referring it to a court; and (c) as is the case in the United States, giving the prosecution sole discretion to determine whether a breach has occurred.[82] If there is no breach, then upon the expiry of the agreement, the CDPP could give the company an "undertaking" under the Director of Public Prosecutions Act 1983 (Cth) that it will not prosecute it.[83]

Submissions for this public consultation paper closed on May 1, 2017, after eighteen responses were transmitted on behalf of various academics, law societies, business groups, government agencies, and non-governmental organizations.[84] There is no definitive timeline for finalizing or implementing a proposal for a DPA regime in Australia, but the public consultation on this issue is part of the Open Government National Action Plan, which includes a broader effort to strengthen the Australian government’s ability to prevent, detect, and respond to corporate crime.[85] This broader effort also includes proposed reforms to the foreign bribery offense in the Criminal Code Act 1995 (Cth), as discussed in greater detail in our 2017 Mid-Year FCPA Update.

OECD Tells Scotland to Implement a DPA Program

In March, the Organisation for Economic Co-operation and Development ("OECD") released its Phase 4 monitoring report on the United Kingdom’s progress in implementing the OECD’s Anti-Bribery Convention, which focuses on combatting bribery of foreign public officials in international business transactions. The report ranks the UK among "the major enforcers" of the Anti-Bribery Convention within the OECD Working Group.[86] Yet the report also recommends a number of areas for potential improvement. In particular, the OECD recommends that Scotland (which administers its own criminal justice system, courts, and prosecuting agencies) bring its enforcement practices in line with those of England and Wales by introducing DPAs.[87] As described in our 2012 Year End FCPA Update, since the Bribery Act came into force on July 1, 2011, Scotland’s Crown Office and Procurator Fiscal Service has run an amnesty program which allows for the resolution of self-reported bribery through a civil settlement and disgorgement of profits system.[88] This program has been renewed on an annual basis since 2012, and although the OECD report records the Scottish government as being "open" to the introduction of DPAs, in the meantime the amnesty program is likely to remain in place, not least because the initiative has already been used to resolve four cases of bribery, two of which involved foreign bribery.

In its recent report, the OECD raised concerns about the adequacy and transparency of civil settlements in foreign bribery cases. According to the OECD, the "seriousness of foreign bribery offending usually warrants a punitive fine against the legal person involved, which the mere disgorgement of profit through a civil settlement does not achieve."[89] Furthermore, in the OECD’s view, "civil settlements tend to lack transparency."[90] Critical of Scotland’s civil settlement scheme, the OECD highlighted that it focuses on the disgorgement of ill-gotten profits rather than on the imposition of punitive fines, "has no role for the courts at all" in approving the resulting settlements,[91] and must grapple with companies, like oil and gas companies, that operate in "corruption-sensitive sectors."[92]

To remedy these perceived shortcomings, the OECD report encourages "Scotland to adopt a scheme comparable to the DPA scheme in the UK"[93] that has been operating in England and Wales since February 2014 and has resulted in four DPAs.[94] Under that scheme, as detailed in our 2015 Year-end Update, DPAs are subject to approval by a court, which must make a public declaration explaining why the DPA is in the interests of justice and why its terms are fair, reasonable, and proportionate.[95] These DPAs may also provide for stiff financial penalties. Indeed, any financial penalty imposed pursuant to a DPA "must be broadly comparable to the fine that a court would have imposed on [the defendant] on conviction for the alleged offense following a guilty plea."[96]

It remains to be seen whether Scotland will act upon the OECD’s recommendation—although it is noteworthy that, according to the OECD, Scotland has indicated some openness to considering a DPA scheme.[97] Adopting a DPA scheme would require action by the Scottish Parliament. Under the UK Crime and Courts Act 2013, which introduced the DPA scheme in England and Wales, the Act does not extend outside England and Wales, either to Scotland or to Northern Ireland.[98] Moreover, under the Scotland Act 1998, authority over criminal justice matters has been devolved to Scotland, which has a "separate criminal legal system from England and Wales."[99]

It is also debatable whether the introduction of a DPA scheme that includes large punitive measures as the OECD proposes would better incentivize businesses to self-report foreign bribery. The OECD, which credits the introduction of DPAs in England and Wales for "bolster[ing]" incentives to self-report, appears to believe this would be the case.[100] Yet, as noted above, one of the four DPAs entered under that scheme—the SFO’s agreement with Rolls-Royce—originated with a whistleblower rather than with self-reporting by the company.[101] Indeed, if a business risks incurring a high fine "broadly comparable" to that resulting from a guilty plea, the business might rationally question the benefits of self-reporting, particularly where the consequences of self-reporting may be costly and uncertain, and particularly if its customer base was not dominated by the public sector where debarment from bidding for public contracts would come into play. Under the Scottish civil settlement scheme, self-reporting companies are required to conduct a "thorough investigation" of the suspected bribery before they can even be considered for a settlement.[102] If carried over into a Scottish DPA scheme, that requirement could increase the cost, and thus decrease the likelihood, of a company self-reporting foreign bribery. In considering the adoption of a DPA scheme, Scottish policymakers will need to carefully consider the framework and implementation of such a scheme to properly incentivize companies.

__________________________________________

APPENDIX: 2017 YTD Non-Prosecution and Deferred Prosecution Agreements

The chart below summarizes the agreements concluded by DOJ and the SEC in 2017 to date. The complete text of each publicly available agreement is hyperlinked in the chart.

The figures for "Monetary Recoveries" may include amounts not strictly limited to an NPA or a DPA, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term "Monitoring & Reporting" includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in settlement agreements.

U.S. Deferred and Non-Prosecution Agreements in 2017 YTD |

||||||

|

Company |

Agency |

Alleged Violation |

Type |

Monetary Recoveries |

Monitoring & Reporting |

Term of |

|

DOJ Money Laundering and Asset Recovery |

Bank Secrecy Act |

NPA |

$237,440,000 |

Yes |

12 |

|

|

W.D.N.C.; DOJ Consumer Protection |

FDCA |

DPA |

$18,158,000 |

No |

30 |

|

|

S.D. Fla. |

Theft of Government Property |

DPA |

$5,212,825 |

No |

12 |

|

|

N.D.W. Va |

Conspiracy to impede the IRS |

DPA |

$250,000 |

No |

36 |

|

|

DOJ Fraud |

FCPA |

NPA |

$15,960,000 |

Yes |

36 |

|

|

Pharmaceutical Technologies, Inc. |

E.D. Tex. |

Anti-Kickback Statute |

NPA |

$8,500,000 |

Unknown |

Unknown |

|

DOJ Fraud |

FCPA |

DPA |

$30,487,500 |

Yes |

36 |

|

|

D. Mass; DOJ Fraud |

Fraud (wire fraud; securities fraud) |

DPA |

$64,600,000 |

Yes |

36 |

|

|

D. Utah |

Misuse of public funds |

NPA |

$0 |

Yes |

36 (with possible indefinite extension) |

|

|

DOJ Criminal (Money Laundering and Asset Recovery Section); M.D. Pa.; C.D. Cal.; E.D. Pa.; |

AML, aiding and abetting wire fraud. |

DPA |

$586,000,000 |

Yes |

36 |

|

FCPA Pilot Program Declination Letters with Disgorgement in 2017 |

||||||

|

DOJ Fraud |

FCPA |

Declination |

$4,037,138 |

Yes |

N/A |

|

|

DOJ Fraud |

FCPA |

Declination |

$3,415,000 |

Yes |

N/A |

|

[1] NPAs and DPAs are two kinds of voluntary, pre-trial agreements between a corporation and the government, most commonly DOJ. They are standard methods to resolve investigations into corporate criminal misconduct and are designed to avoid the severe consequences, both direct and collateral, that conviction would have on a company, its shareholders, and its employees. Though NPAs and DPAs differ procedurally—a DPA, unlike an NPA, is formally filed with a court along with charging documents—both usually require an admission of wrongdoing, payment of fines and penalties, cooperation with the government during the pendency of the agreement, and remedial efforts, such as enhancing a compliance program and—on occasion—cooperating with a monitor who reports to the government. Although NPAs and DPAs are used by multiple agencies, since Gibson Dunn began tracking corporate NPAs and DPAs in 2000, we have identified approximately 457 agreements initiated by the DOJ, and ten initiated by the SEC.

[2] In our 2016 Year-End Update, we analyzed the details and impact of France’s public interest judicial agreement (Convention judiciaire d’intérêt public), a type of DPA now permitted under the recently enacted French anti-corruption law Sapin II. Since then, there have been a few procedural clarifications found in Decree No. 2017-660, issued on April 27, 2017 by then-Prime Minister Bernard Cazeneuve, but no major changes. Although there are not yet any public interest judicial agreements to report on, we will monitor this new DPA regime closely and provide analysis in future updates.

[3] In two cases, monitoring requirements were imposed by parallel settlements with other agencies, but the DPAs required parallel reporting to DOJ of the monitors’ findings.

[4] Seven total declinations have been issued to date under the FCPA Pilot Program, of which four have been decline-and-disgorge letters. The two decline-and-disgorge letters from this year include the following: Letter from U.S. Department of Justice, Fraud Section, to Lucinda Low & Thomas Best, Linde North America Inc, Linde Gas North America LLC (June 16, 2017) (requiring disgorgement of a total of $7,820,000 and forfeiture of $$3,415,000), available athttps://www.justice.gov/criminal-fraud/file/974516/download; Letter from U.S. Department of Justice, Fraud Section, to Nathaniel B. Edmonds, re CDM Smith Inc. (June 21, 2017) (requiring disgorgement of $4,037,138), available at https://www.justice.gov/criminal-fraud/page/file/976976/download.

[5] Utah Transit Authority NPA at 1 (Apr. 4, 2017).

[6]Id. at 3.

[7]Id.

[8]See, e.g., Memorandum for all Federal Prosecutors from the Attorney General Regarding Commitment to Targeting Violent Crime (Mar. 8, 2017), available at https://assets.documentcloud.org/documents/3513186/Read-the-memo-sent-by-Sessions-on-violent.pdf (calling for U.S. Attorneys to make violent crimes a "special priority"); Jeff Sessions, Attorney General, DOJ, Remarks on Efforts to Combat Violent Crime and Restore Public Safety Before Federal, State and Local Law Enforcement (Mar. 15, 2017), available at https://www.justice.gov/opa/speech/attorney-general-jeff-sessions-delivers-remarks-efforts-combat-violent-crime-and-restore (calling for DOJ to fight violent crime and drug cartels and promising to "secure [the U.S.] border and bring the full weight of both the immigration courts and federal criminal enforcement to combat this attack on our national security and sovereignty").

[9] Jeff Sessions, Attorney General, DOJ, Remarks at Ethics and Compliance Initiative Annual Conference (Apr. 24, 2017), available athttps://www.justice.gov/opa/speech/attorney-general-jeff-sessions-delivers-remarks-ethics-and-compliance-initiative-annual.

[10]Id.

[11]Id.

[12]C-SPAN: Ethics and Compliance Initiative Conference, Attorney General Sessions (C-SPAN television broadcast April 24, 2017), available at https://www.c-span.org/video/?427358-1/attorney-general-jeff-sessions-delivers-remarks-ethics-compliance-initiatives-confernece.

[13] Sessions, supra note 9.

[14] C-SPAN, supra note 12; see also Matt Zapotosky, "Sessions: Focus on Violent Crime Doesn’t Mean Lax Enforcement for White Collar Offenses," Washington Post (Apr. 24, 2017), https://www.washingtonpost.com/world/national-security/sessions-focus-on-violent-crime-doesnt-mean-lax-enforcement-for-white-collar-offenses/2017/04/24/d36d4034-2906-11e7-be51-b3fc6ff7faee_story.html?utm_term=.a02a9b8a216a

[15]C-SPAN, supra note 12.

[16] Attorney General of the United States, Memorandum re Prohibition on Settlement Payments to Third Parties (June 5, 2017), available athttps://www.justice.gov/opa/speech/attorney-general-jeff-sessions-delivers-remarks-ethics-and-compliance-initiative-annual.

[17] Trevor N. McFadden, Acting Principal Deputy Assistant Attorney General, DOJ, Remarks at the American Conference Institute’s 19th Annual Conference on Foreign Corrupt Practices Act (April 20, 2017), available at https://www.c-span.org/video/?427358-1/attorney-general-jeff-sessions-delivers-remarks-ethics-compliance-initiatives-confernece.

[18]Id.

[19]Id.

[20]Id.

[21]Id. The FCPA Pilot Program announced in April 2016, which is intended to motivate voluntary corporate self-disclosure of FCPA violations, is discussed in our 2016 Mid-Year Update and 2016 Mid-Year FCPA Update.

[22] McFadden, supra note 17.

[23] Ben Morgan, Joint Head of Bribery and Corruption, Serious Fraud Office, The Future of Deferred Prosecution Agreements After Rolls-Royce (Mar. 8, 2017), https://www.sfo.gov.uk/2017/03/08/the-future-of-deferred-prosecution-agreements-after-rolls-royce/.

[24]See News Release, Serious Fraud Office, SFO Completes £497.25m Deferred Prosecution Agreement with Rolls-Royce PLC (January 17, 2017) [hereinafter SFO News Release], https://www.sfo.gov.uk/2017/01/17/sfo-completes-497-25m-deferred-prosecution-agreement-rolls-royce-plc/.

[25]Id.

[26] Krystina Shveda, Global Investigations Review, David Green: Rolls-Royce Deserved DPA Despite Not Self-Reporting (January 20, 2017), available athttp://globalinvestigationsreview.com/article/1080345/david-green-rolls-royce-deserved-dpa-despite-not-self-reporting

[27] SFO News Release, available at https://www.sfo.gov.uk/2017/01/17/sfo-completes-497-25m-deferred-prosecution-agreement-rolls-royce-plc/.

[28] Id.

[29] Serious Fraud Office, News Release, The future of Deferred Prosecution Agreements after Rolls-Royce (March 8, 2017) [hereinafter Ben Morgan Speech], available athttps://www.sfo.gov.uk/2017/03/08/the-future-of-deferred-prosecution-agreements-after-rolls-royce/.

[30]Id.

[31]See Serious Fraud Office, News Release, SFO secures second DPA (July 8, 2016), available athttps://www.sfo.gov.uk/2016/07/08/sfo-secures-second-dpa/ and Serious Fraud Office, News Release, SFO agrees first UK DPA with Standard Bank (November 30, 2015), available athttps://www.sfo.gov.uk/2015/11/30/sfo-agrees-first-uk-dpa-with-standard-bank/ (levying a £6.5 million and a $25.2 million financial penalty, respectively).

[32]Serious Fraud Office v. Rolls Royce PLC, Rolls Royce Energy Systems Inc., Crown Court at Southwark, Deferred Prosecution Agreement, available athttps://www.sfo.gov.uk/cases/rolls-royce-plc/.

[33]Id.

[34] Suzi Ring and Benjamin D. Katz, Rolls to Pay $807 Million to End U.K., U.S. Bribery Probes, Bloomberg (January 16, 2017), available athttps://www.bloomberg.com/news/articles/2017-01-16/rolls-royce-will-pay-807-million-in-settlement-of-bribery-cases.

[35]See Corruption Watch UK, The UK’s First Deferred Prosecution Agreement (December 2015), available athttp://www.cw-uk.org/wp-content/uploads/2015/12/Corruption-Watch-UK-Report-and-Analysis-UKs-First-Deferred-Prosecution-Agreement-December-2015.pdf, at 8 ("In assessing mitigating factors, heavy emphasis was placed both by the SFO and Leveson on the fact that Standard Bank had self-reported and that without such self-disclosure ‘the conduct at issue may not otherwise have come to the attention of the SFO.’").

[36]Serious Fraud Office v. Rolls Royce PLC, Rolls Royce Energy Systems Inc., Crown Court at Southwark, Deferred Prosecution Agreement, available athttps://www.judiciary.gov.uk/wp-content/uploads/2017/01/sfo-v-rolls-royce.pdf, at 12.

[37] Ben Morgan Speech, available athttps://www.sfo.gov.uk/2017/03/08/the-future-of-deferred-prosecution-agreements-after-rolls-royce/.

[38]Id.

[39] Serious Fraud Office, News Release, SFO agrees Deferred Prosecution Agreement With Tesco (April 10, 2017), available athttps://www.sfo.gov.uk/2017/04/10/sfo-agrees-deferred-prosecution-agreement-with-tesco/.

[40] Tesco, News Release, Deferred Prosecution Agreement in Relation to Historic Accounting Practices (Mar. 28, 2017), available at https://www.tescoplc.com/news/news-releases/2017/deferred-prosecution-agreement-in-relation-to-historic-accounting-practices/.

[41] Available information may be sourced at: Serious Fraud Office, News Release, SFO agrees Deferred Prosecution Agreement With Tesco (April 10, 2017), available at https://www.sfo.gov.uk/2017/04/10/sfo-agrees-deferred-prosecution-agreement-with-tesco/; FCA Final Notice (Mar. 28, 2017), available athttps://www.fca.org.uk/publication/final-notices/tesco-2017.pdf, at 5.

[42] Serious Fraud Office, News Release, SFO agrees Deferred Prosecution Agreement With Tesco (April 10, 2017), available at https://www.sfo.gov.uk/2017/04/10/sfo-agrees-deferred-prosecution-agreement-with-tesco/.

[43] U.K. Financial Conduct Authority, Final Notice to Tesco plc and Tesco Stores Limited, ¶ 4.10 (Mar. 28, 2017), https://www.fca.org.uk/publication/final-notices/tesco-2017.pdf.

[44] Statement, U.K. Financial Conduct Authority, FCA Statement Regarding Tesco (Oct. 29, 2014), https://www.fca.org.uk/news/statements/fca-statement-regarding-tesco.

[45] Id.

[46] Press Release, U.K. Financial Conduct Authority, Tesco to Pay Redress for Market Abuse (Mar. 28, 2017), https://www.fca.org.uk/news/press-releases/tesco-pay-redress-market-abuse.

[47] Id.

[48] Tesco Final Notice, ¶¶ 4.8, 4.11.

[49] News Release, U.K. Serious Fraud Office, SFO Agrees Deferred Prosecution Agreement with Tesco (Apr. 10, 2017), https://www.sfo.gov.uk/2017/04/10/sfo-agrees-deferred-prosecution-agreement-with-tesco/.

[50] Australia Attorney-General’s Department, Deferred Prosecution Agreements – Public Consultation, https://www.ag.gov.au/consultations/Pages/Deferred-prosecution-agreements-public-consultation.aspx (last visited July 10, 2017).

[51] Public Consultation Paper, Australia Attorney-General’s Department, A Proposed Model for a Deferred Prosecution Agreement Scheme in Australia, at 1 (Mar. 31, 2017), https://www.ag.gov.au/Consultations/Documents/Deferred-prosecution-agreement-scheme/A-proposed-model-for-a-deferred-prosecution-agreement-scheme-in-australia.pdf (hereinafter "Public Consultation Paper").

[52]Id. at 2.

[53]Id. at 3.

[54]Id. at 6.

[55]Id.

[56]Id. at 7.

[57]Id.

[58]Id.

[59] Public Consultation Paper at 7.

[60] Id.

[61]Id. at 8.

[62]Id.

[63]Id. at 8-9.

[64] Id. at 8.

[65]Id. at 14.

[66]Id.

[67] Richard Flitcroft, Partner, Corrs Chambers Westgarth, "Nearly there? Deferred Prosecution Agreements (DPAs) in Australia," Apr. 4, 2017, available at http://www.corrs.com.au/thinking/insights/nearly-there-deferred-prosecution-agreements/; Ashurst, "Corporate crime crackdown: Australia looks to introduce deferred prosecution agreements," Apr. 3, 2017, available at https://www.ashurst.com/en/news-and-insights/legal-updates/regulatory-update-03mar2017-corporate-crime-crackdown-170403/.

[68] Fed. R. Evid. 408(a).

[69] Public Consultation Paper at 9.

[70]Id. at 15.

[71] Richard Flitcroft, Partner, Corrs Chambers Westgarth, "Nearly there? Deferred Prosecution Agreements (DPAs) in Australia," Apr. 4, 2017, available at http://www.corrs.com.au/thinking/insights/nearly-there-deferred-prosecution-agreements/.

[72] Public Consultation Paper at 9-10.

[73]Id. at 10.

[74]Id. at 11.

[75] Michael Griffiths, Global Investigations Review, "Australia Releases DPA Proposal," Apr. 11, 2017, available athttp://globalinvestigationsreview.com/article/1139216/australia-releases-dpa-proposals.

[76] Public Consultation Paper at 10-11.

[77]Id. at 11.

[78]Id. at 15.

[79]Id. at 16.

[80]Id. at 11.

[81]Id.

[82]Id. at 12.

[83]Id. at 13.

[84] Australia Attorney-General’s Department, Proposed Model for a Deferred Prosecution Agreement Scheme in Australia (last visited July 10, 2017), https://www.ag.gov.au/Consultations/Pages/Proposed-model-for-a-deferred-prosecution-agreement-scheme-in-australia.aspx.

[85] Public Consultation Paper at 4.

[86] Organisation for Economic Co-operation and Development, Implementing the OECD Anti-Bribery Convention 5 (Mar. 16, 2017), available athttp://www.oecd.org/corruption/anti-bribery/UK-Phase-4-Report-ENG.pdf.

[87]Id. at 59.

[88]Crown Office & Procurator Fiscal Service, Guidance on the Approach of the Crown Office and Procurator Fiscal Service to Reporting by Businesses of Bribery Offenses 3 (June 2016).

[89]Id. at 57.

[90]Id.

[91]Id. at 58.

[92]Id. at 41.

[93]Id. at 59.

[94]Id. at 56.

[95]Id.; see also Crimes & Courts Act 2013, c. 22, § 45, sch. 17(8)(1),(6).

[96] Crimes & Courts Act 2013, c. 22, § 45, sch. 17(5)(4); Organisation for Economic Co-operation and Development, supra note 89, at 56.

[97] Organisation for Economic Co-operation and Development, supra note 89, at 56.

[98] Crimes & Courts Act 2013, c. 22, § 61(13).

[99] Organisation for Economic Co-operation and Development, supra note 89, at 31 n.49; Scotland Act 1998, c. 46, § 30, sch. 5 (reserving particular matters for the UK rather than Scottish Parliament); Scottish Parliament, Devolved & Reserved Matters (July 10, 2017), http://www.parliament.scot/visitandlearn/Education/18642.aspx (listing "law and order" as a devolved rather than reserved matter).

[100]See Organisation for Economic Co-operation and Development, supra note 89, at 16.

[101]Id. at 16, 56–57.

[102] Crown Office & Procurator Fiscal Service, supra note 91, at 4.

The following Gibson Dunn lawyers assisted in preparing this client update: F. Joseph Warin, Michael Diamant, Mark Handley, Courtney Brown, Melissa Farrar, Jason Smith, Naomi Takagi, Jeffrey Bengel, William Hart, Patricia Herold, and Audi Syarief.

Gibson Dunn’s White Collar Defense and Investigations Practice Group successfully defends corporations and senior corporate executives in a wide range of federal and state investigations and prosecutions, and conducts sensitive internal investigations for leading companies and their boards of directors in almost every business sector. The Group has members in every domestic office of the Firm and draws on more than 125 attorneys with deep government experience, including more than 50 former federal and state prosecutors and officials, many of whom served at high levels within the Department of Justice and the Securities and Exchange Commission. Joe Warin, a former federal prosecutor, served as the U.S. counsel for the compliance monitor for Siemens and as the FCPA compliance monitor for Alliance One International. He previously served as the monitor for Statoil pursuant to a DOJ and SEC enforcement action. He co-authored the seminal law review article on NPAs and DPAs in 2007. Debra Wong Yang is the former United States Attorney for the Central District of California, and has served as independent monitor to a leading orthopedic implant manufacturer to oversee its compliance with a DPA.

Washington, D.C.

F. Joseph Warin (+1 202-887-3609, [email protected])

Richard W. Grime (202-955-8219, [email protected])

Scott D. Hammond (+1 202-887-3684, [email protected])

Stephanie L. Brooker (+1 202-887-3502, [email protected])

David P. Burns (+1 202-887-3786, [email protected])

David Debold (+1 202-955-8551, [email protected])

Stuart F. Delery (+1 202-887-3650, [email protected])

Michael Diamant (+1 202-887-3604, [email protected])

John W.F. Chesley (+1 202-887-3788, [email protected])

Daniel P. Chung (+1 202-887-3729, [email protected])

Patrick F. Stokes (+1 202-955-8504, [email protected])

New York

Reed Brodsky (+1 212-351-5334, [email protected])

Joel M. Cohen (+1 212-351-2664, [email protected])

Mylan L. Denerstein (+1 212-351-3850, [email protected])

Lee G. Dunst (+1 212-351-3824, [email protected])

Barry R. Goldsmith (+1 212-351-2440, [email protected])

Christopher M. Joralemon (+1 212-351-2668, [email protected])

Mark A. Kirsch (+1 212-351-2662, [email protected])

Randy M. Mastro (+1 212-351-3825, [email protected])

Marc K. Schonfeld (+1 212-351-2433, [email protected])

Orin Snyder (+1 212-351-2400, [email protected])

Alexander H. Southwell (+1 212-351-3981, [email protected])

Lawrence J. Zweifach (+1 212-351-2625, [email protected])

Denver

Robert C. Blume (+1 303-298-5758, [email protected])

Ryan T. Bergsieker (+1 303-298-5774, [email protected])

Orange County

Nicola T. Hanna (+1 949-451-4270, [email protected])

Los Angeles

Debra Wong Yang (+1 213-229-7472, [email protected])

Marcellus McRae (+1 213-229-7675, [email protected])

Michael M. Farhang (+1 213-229-7005, [email protected])

Douglas Fuchs (+1 213-229-7605, [email protected])

Eric D. Vandevelde (+1 213-229-7186, [email protected])

Palo Alto

Benjamin B. Wagner (+1 650-849-5395, [email protected])

San Francisco

Thad A. Davis (+1 415-393-8251, [email protected])

Marc J. Fagel (+1 415-393-8332, [email protected])

Charles J. Stevens (+1 415-393-8391, [email protected])

Michael Li-Ming Wong (+1 415-393-8234, [email protected])

Winston Y. Chan (+1 415-393-8362, [email protected])

Dubai

Graham Lovett (+971 (0) 4 318 4620, [email protected])

Hong Kong

Kelly Austin (+852 2214 3788, [email protected])

Oliver D. Welch (+852 2214 3716, [email protected])

London

Patrick Doris (+44 20 7071 4276, [email protected])

Mark Handley (+44 20 7071 4277, [email protected])

Munich

Benno Schwarz (+49 89 189 33-110, [email protected])

Mark Zimmer (+49 89 189 33-130, [email protected])

© 2017 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.