M&A Report – 2020 Year-End Activism Update

Client Alert | February 22, 2021

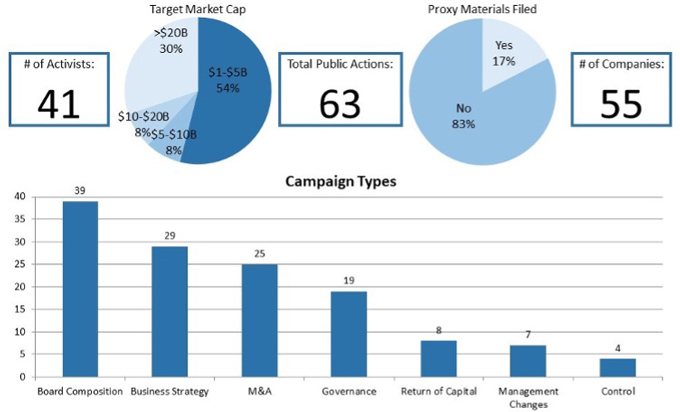

This Client Alert provides an update on shareholder activism activity involving NYSE- and Nasdaq-listed companies with equity market capitalizations in excess of $1 billion and below $100 billion (as of the last date of trading in 2020) during the second half of 2020. Announced shareholder activist activity increased relative to the second half of 2019. The number of public activist actions (35 vs. 24), activist investors taking actions (31 vs. 17) and companies targeted by such actions (33 vs. 23) each increased substantially. On a full-year basis, however, owing to the market disruption caused by the COVID-19 pandemic, 2020 represented a modest slowdown in activism versus 2019, as reflected in the number of public activist actions (63 vs. 75), activist investors taking actions (41 vs. 49) and companies targeted by such actions (55 vs. 64). During the period spanning July 1, 2020 to December 31, 2020, two of the 39 companies targeted by activists—CoreLogic, Inc. and Monmouth Real Estate Investment Corporation—were the subject of multiple campaigns. CoreLogic, Inc. was the subject of an activist campaign led by Cannae Holdings and Senator Investment Group; their efforts, in turn, ultimately drew the support of Pentwater Capital Management LP. In addition, certain activists launched multiple campaigns during the second half of 2020: Elliott Management, NorthStar Asset Management and Starboard Value. These three activists represented 23% of the total public activist actions that began during the second half of 2020.

*Study covers selected activist campaigns involving NYSE- and Nasdaq-traded companies with equity market capitalizations of greater than $1 billion as of December 31, 2020 (unless company is no longer listed).

**All data is derived from the data compiled from the campaigns studied for the 2020 Year-End Activism Update.

Additional statistical analyses may be found in the complete Activism Update linked below.

The rationales for activist campaigns during the second half of 2020 changed in certain respects relative to the first half of 2020. Over both periods, board composition and business strategy represented leading rationales animating shareholder activism campaigns, representing 55% of rationales in the first half of 2020 and 49% of rationales in the second half of 2020. M&A (which includes advocacy for or against spin-offs, acquisitions and sales) took on increased importance; the frequency with which M&A animated activist campaigns rose from 9% in the first half of 2020 to 19% in the second half of 2020. At the opposite end of the spectrum, management changes, return of capital and control remained the most infrequently cited rationale for activist campaigns. (Note that the above-referenced percentages total over 100%, as certain activist campaigns had multiple rationales.) These themes are all broadly consistent with those observed in 2019. Proxy solicitation occurred in 14% of campaigns for the second half of 2020 and for 17% of campaigns in 2020 overall. These figures represent modest declines relative to 2019, in which proxy materials were filed in approximately 30% of activist campaigns for the entire year.

Eight settlement agreements pertaining to shareholder activism activity were filed during the second half of 2020 and only 17 were filed for the entire year, which continues a trend of diminution (relative to 22 agreements filed in 2019 and 30 agreements filed in 2018). Those settlement agreements that were filed had many of the same features noted in prior reviews, however, including voting agreements and standstill periods as well as non-disparagement covenants and minimum and/or maximum share ownership covenants. Expense reimbursement provisions were included in half of those agreements reviewed, which is consistent with historical trends. We delve further into the data and the details in the latter half of this Client Alert. We hope you find Gibson Dunn’s 2020 Year-End Activism Update informative. If you have any questions, please reach out to a member of your Gibson Dunn team.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this publication. For further information, please contact the Gibson Dunn lawyer with whom you usually work, or any of the following authors in the firm’s New York office:

Barbara L. Becker (+1 212.351.4062, [email protected])

Dennis J. Friedman (+1 212.351.3900, [email protected])

Richard J. Birns (+1 212.351.4032, [email protected])

Eduardo Gallardo (+1 212.351.3847, [email protected])

Andrew Kaplan (+1 212.351.4064, [email protected])

Saee Muzumdar (+1 212.351.3966, [email protected])

Daniel S. Alterbaum (+1 212.351.4084, [email protected])

Lisa Phua (+1 212.351.2327, [email protected])

Please also feel free to contact any of the following practice group leaders and members:

Mergers and Acquisitions Group:

Jeffrey A. Chapman – Dallas (+1 214.698.3120, [email protected])

Stephen I. Glover – Washington, D.C. (+1 202.955.8593, [email protected])

Jonathan K. Layne – Los Angeles (+1 310.552.8641, [email protected])

Securities Regulation and Corporate Governance Group:

Brian J. Lane – Washington, D.C. (+1 202.887.3646, [email protected])

Ronald O. Mueller – Washington, D.C. (+1 202.955.8671, [email protected])

James J. Moloney – Orange County, CA (+1 949.451.4343, [email protected])

Elizabeth Ising – Washington, D.C. (+1 202.955.8287, [email protected])

Lori Zyskowski – New York (+1 212.351.2309, [email protected])

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.