Last week, the Small Business Administration (the “SBA”) issued two interim final rules incorporating changes to the Paycheck Protection Program (the “PPP”) prescribed by the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act, Pub. L. 116-260 (the “Economic Aid Act”). The Act extended the authority to make PPP loans to first and second-time PPP borrowers through March 31, 2021, and changed certain PPP requirements, including establishing additional eligibility criteria for applicants seeking a second PPP loan. One of the interim final rules governs new PPP loans made under the Economic Aid Act and pending loan forgiveness applications for existing PPP loans (the “First IFR”). The other interim final rule governs second draw PPP loans (the “Second IFR”). This alert will focus on some of the key provisions of these interim final rules.[1]

First IFR

The First IFR consolidates the interim final rules and significant guidance previously issued by the SBA regarding the PPP originally established under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) to provide a single regulation governing borrower and lender eligibility, loan application requirements and loan origination requirements, as well as general rules regarding PPP loan increases and forgiveness. The First IFR expressly states that it is not intended to substantively change any existing PPP rules that were not amended by the Economic Aid Act, and that the SBA plans to issue a consolidated rule governing PPP loan forgiveness and the loan review process.

Notable amendments to the rules governing the PPP implementing the changes required by the Economic Aid Act include the following:

- Certain new types of organizations that meet the PPP eligibility requirements are eligible to receive new PPP loans including:

- Certain nonprofit business associations (other than professional sports leagues and organizations formed to promote or participate in a political campaign) that do not employ more than 300 employees;[2]

- Certain news organizations that employ no more than 500 employees (or, if applicable, the employee size standard established by the SBA for the entity’s industry) per location;[3]

- Destination marketing organizations[4] that meet the requirements described in this alert for section 501(c)(6) organizations;[5] and

- Housing cooperatives that employ no more than 300 employees.

- Certain business concerns that may have been eligible for PPP Loans under prior rules are ineligible to receive new PPP loans. These business concerns include:

- Public companies (i.e., companies whose securities are listed on a national securities exchange); and

- Recipients of grants under the Shuttered Venue Operator Grant program established by the Economic Aid Act.

- All new PPP borrowers may use 2019 or 2020 for purposes of calculating their maximum loan amount.

- A PPP borrower’s forgiveness amount will not be reduced by the amount of an Economic Injury Disaster Loan (“EIDL”) advance received by the borrower. Similarly, when calculating the maximum amount of a new PPP loan that will be used to refinance an EIDL made between January 31, 2020 and April 3, 2020, borrowers should not include the amount of an EIDL advance as this advance does not need to be repaid.

- PPP loan proceeds (including PPP loans made prior to December 27, 2020, as long as the SBA has not already remitted a loan forgiveness payment to the lender with respect to the loan) may be used to pay for goods that are essential to the borrower’s operations, investments in facility modifications, personal protective equipment required for the borrower to operate safely and business software and cloud computing services that help facilitate the borrower’s business operations.

- Recipients of new PPP loans may select a covered period between eight and 24 weeks.

- The SBA will forgive a PPP loan of $150,000 or less if the borrower signs and submits a one-page certification that, among other things, requires the borrower to describe the number of employees it was able to retain because of the PPP loan. The SBA has not published the certification to date.

Second IFR

The Economic Aid Act gives PPP loan recipients the opportunity to receive, for the first time, a second PPP loan. However, the eligibility requirements are narrower than those for initial PPP loans as we first described in our recent client alert, Coronavirus Relief Package Passed by Congress Would Revive Paycheck Protection Program and Provide Additional Relief to Eligible Businesses. Each potentially eligible borrower must be an eligible recipient of an initial PPP loan and: (1) together with its affiliates, employ 300 or fewer employees (compared to the 500 employee standard for initial PPP loans); however, hotels and restaurants with a NAICS code beginning with 72 and certain news organizations are exempt from the affiliation rules and may employ 300 or fewer employees per physical location; (2) have used, or will use, the first PPP loan funds on eligible expenses before the second PPP loan is disbursed; and (3) demonstrate at least a 25% reduction in revenue in at least one quarter of 2020 relative to 2019. Borrowers whose initial PPP loans are under review will not receive a second loan until their eligibility for the first loan is confirmed.

Second draw PPP loans are eligible for loan forgiveness under the same terms as initial PPP loans, including the changes to the forgiveness rules set forth in the First IFR. Most borrowers’ maximum second draw loan amount is capped at 2.5 times monthly payroll costs up to $2 million, although eligible hotels and restaurants may receive a second draw loan of up to 3.5 times monthly payroll costs up to $2 million.

The Second IFR provides important clarifications for second draw PPP loan requirements under the Economic Aid Act:

- First, the 25% revenue reduction may be measured by comparing quarterly revenues (as established in the Economic Aid Act) or annual revenues. The Second IFR makes clear that eligible borrowers may use annual tax returns, in addition to quarterly statements, to demonstrate that they experienced at least a 25% reduction in revenue in 2020 as compared to 2019 to meet the revenue reduction criteria under the Economic Aid Act. An entity that was not in business during 2019, but was in operation on February 15, 2020, may satisfy the revenue reduction requirement for a second draw PPP loan if it had revenue during the second, third, or fourth quarter of 2020 that demonstrates at least a 25 percent reduction from the revenue of the entity during the first quarter of 2020.

- Second, borrowers may calculate payroll costs based on calendar year 2020 rather than, as provided in the Economic Aid Act, the 12-month period before the second loan is made. Noting that all second draw PPP loans will be made in 2021, the Second IFR states that this adjustment is not expected to make a significant difference in payroll costs while simplifying the payroll cost calculation and easing a borrower’s administrative burden. Adjusted calculation methodologies apply to seasonal businesses.

- Third, borrowers must determine whether their revenue was reduced in 2020 as compared to 2019 by comparing their “gross receipts” for the relevant periods. “Receipts” for this purpose is defined consistent with “receipts” as defined in SBA’s size regulations (§ 121.104) to include “all revenue in whatever form received or accrued (in accordance with the entity’s accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances.” Amounts forgiven in connection with initial PPP loans are not included in this definition.[6]

- Fourth, businesses that are part of a single corporate group may not collectively receive more than $4 million in second draw PPP loans in the aggregate. Given the maximum loan amount of $2 million, this cap is proportionately the same as the $20 million aggregate limit for first draw PPP loans to businesses that are part of a single corporate group. A borrower that has temporarily closed or temporarily suspended its business remains eligible for a second draw PPP loan, while a borrower that has permanently closed its operations is not.

- Finally, potential borrowers seeking more than $150,000 in a second draw PPP loan must submit documentation—such as annual tax forms or quarterly financial statements—at the time of their application to support the 25% reduction in revenue relative to 2019. Borrowers that receive less than $150,000 must submit such documentation prior to applying for loan forgiveness. If a borrower does not apply for loan forgiveness, this documentation is required upon request by the SBA.

_______________________

[1] For additional details about the PPP please refer to Gibson Dunn’s Frequently Asked Questions to Assist Small Businesses and NonProfits in Navigating the COVID-19 Pandemic and prior Client Alerts about the Program: Federal Reserve Modifies Main Street Lending Programs to Expand Eligibility and Attractiveness; President Signs Paycheck Protection Program Flexibility Act; Small Business Administration and Department of Treasury Publish Paycheck Protection Program Loan Application Form and Instructions to Help Businesses Keep Workforce Employed; Small Business Administration Issues Interim Final Rule and Final Application Form for Paycheck Protection Program; Small Business Administration Issues Interim Final Rule on Affiliation, Summary of Affiliation Tests, Lender Application Form and Agreement and FAQs for Paycheck Protection Program; Analysis of Small Business Administration Memorandum on Affiliation Rules and FAQs on Paycheck Protection Program; Small Business Administration Publishes Additional Interim Final Rules and New Guidance Related to PPP Loan Eligibility and Accessibility; Small Business Administration Publishes Loan Forgiveness Application; and Coronavirus Relief Package Passed by Congress Would Revive Paycheck Protection Program and Provide Additional Relief to Eligible Businesses.

[2] To be eligible, the business association must qualify for federal income tax-exempt status under section 501(c)(6) of the Internal Revenue Code and (1) it must not receive more than 15 percent of its receipts from lobbying activities; (2) its lobbying activities must not comprise more than 15 percent of its total activities; and (3) the cost of its lobbying activities must not exceed $1,000,000 during its most recent tax year ended prior to February 15, 2020.

[3] To be eligible, the news organization must be majority owned or controlled by a NAICS code 511110 business (newspaper publishers) or 5151 business (radio networks, radio stations, television broadcasting), or a nonprofit public broadcasting entity with a trade or business under NAICS code 511110 or 5151, and must certify in good faith that proceeds of the loan will be used to support expenses at the component of the organization that produces or distributes locally focused or emergency information.

[4] The Economic Aid Act defines a “destination marketing organization” as (a) engaged in marketing and promoting communities and facilities to businesses and leisure travelers through a range of activities, including assisting with the location of meeting and convention sites; providing travel information on area attractions, lodging accommodations and restaurants; providing maps; and organizing group tours of local historical, recreational and cultural attractions; or (b) engaged in, and deriving the majority of its operating budget from revenue attributable to, providing live events.

[5] In addition, to be eligible, the destination marketing organization must either be exempt from federal income taxation under section 501(a) of the Internal Revenue Code or be a quasi-governmental entity or political subdivision of a State or local government or their instrumentalities.

[6] The Second IFR also states that “receipts generally are considered “total income” (or in the case of a sole proprietorship, independent contractor, or self-employed individual “gross income”) plus “cost of goods sold,” and exclude net capital gains or losses as these terms are defined and reported on IRS tax return forms.”

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding these developments. For further information, please contact the Gibson Dunn lawyer with whom you usually work, or the following authors:

Michael D. Bopp – Washington, D.C. (+1 202-955-8256, mbopp@gibsondunn.com)

Roscoe Jones, Jr. – Washington, D.C. (+1 202-887-3530, rjones@gibsondunn.com)

Alisa Babitz – Washington, D.C. (+1 202-887-3720, ababitz@gibsondunn.com)

Courtney M. Brown – Washington, D.C. (+1 202-955-8685, cmbrown@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

In an unprecedented year for UK regulated firms and the Financial Conduct Authority (“FCA”), the regulatory agenda has at times seemed dominated by the global pandemic. However, regulated firms should be mindful of the regulatory direction of travel. This client alert assesses the regulatory landscape, now and in the coming years, through the prism of three areas of increasing regulatory focus: governance, culture and individual accountability; conduct and enforcement; and operational and financial resilience. This client alert provides practical guidance to firms to ensure continuing compliance with regulatory expectations in each of these three areas. The regulatory landscape has also been impacted as a result of the ending of the Brexit transition period on 31 December 2020. The FCA’s actions over last year will be shown to be indicators of the type of regulator that the FCA may seek to be post-Brexit.

The Gibson Dunn UK Financial Services Regulation team looks forward to discussing the matters outlined in this alert in further detail. For more analysis, please join us for our upcoming complimentary webinar presentation on 27 January 2021: UK Financial services regulatory update: what happened in 2020 and what to expect in 2021 and beyond (to register, click here).

Executive Summary

|

Governance, culture and individual accountability

Conduct and enforcement

Operational and financial resilience

Post-Brexit UK regulatory outlook

|

The year in review

2020 was an unprecedented year for both UK regulated firms and the FCA. Both had to adjust to a “new normal”, which in most cases included initiating working from home contingency planning. The regulatory agenda for the year was in many ways dominated by the global pandemic. This is illustrated by the FCA’s annual Business Plan[1], which was heavily influenced by tackling the impact of COVID-19. In response to the pandemic, the FCA delayed certain regulatory initiatives and indicated regulatory forbearance in a number of areas, while maintaining the emphasis on the importance of treating customers fairly[2].

However, the FCA continued to advance certain areas of regulatory focus. It is, therefore, possible to identify key themes that the FCA focused on during 2020 and is likely to pursue in the coming months and years. In particular, this client alert will focus on three important areas of regulatory interest: (1) governance, culture and individual accountability; (2) conduct and enforcement; and (3) operational and financial resilience. These key areas can be assessed in terms of the FCA’s developments during 2020 but also what regulated firms need to be aware of in terms of each of these areas going forward.

(1) Governance, culture and individual accountability

|

“The specifics of your culture, like your strategy, remain up to you as leaders. But there is a growing consensus that healthy cultures are purposeful, diverse and inclusive.”[3] |

Governance, culture and individual accountability are inextricably linked. As the quote above from the FCA suggests, the FCA will not dictate what a firm’s governance model or culture should be. Both are firm-specific, however, firms should be wary of the FCA’s expectations.

The FCA’s Approach to Supervision document[4] notes that the key cultural drivers in firms are: purpose; leadership; approach to rewarding and managing people; and governance. Last year the FCA reiterated the importance of these factors in its annual Business Plan and in a discussion paper on driving purposeful cultures.[5]

The importance of good governance, in particular, forms a common thread through the FCA’s supervisory correspondence to key industry sectors. For example, the FCA has emphasised that it is “important that firms have strong governance frameworks that allow their culture and values to drive decision-making across the business, including its approach to dealing with all kinds of misconduct. It is also critical that firms are headed by effective boards, with a suitable mix of skills and experience, to conduct appropriate oversight of the firms’ risks, strategy, policies and controls”.[6]

A key barometer that a firm is meeting the FCA’s expectations is the effectiveness of its implementation of the Senior Managers and Certification Regime (“SMCR”). The introduction of the SMCR was driven by a perceived lack of individual accountability and governance failings post-financial crisis. For the majority of solo-regulated firms, the SMCR has now applied for over a year, whilst a similar regime for banks and insurers has applied since 2016. The implementation of the SMCR is an iterative process. What constituted adequate implementation for 9 December 2019 will not necessarily be sufficient now. Firms should be considering how their implementation can be tested and enhanced.

|

Key practical steps for firms

|

(2) Conduct and enforcement

|

“We will remain vigilant to potential misconduct. There may be some who see these times as an opportunity for poor behaviour – including market abuse, capitalising on investors’ concerns or reneging on commitments to consumers…Where we find poor practice, we will clamp down with all relevant force.”[7] |

A key indicator of a firm’s culture is its practical response to compliance issues and, in particular, instances of potential misconduct. Market abuse (including the handling of confidential information)[8] and personal account dealing[9] remain perennial areas of regulatory focus. Working from home poses particular challenges for firms when monitoring the conduct of staff. However, the FCA expects firms to have appropriate systems and controls in place to manage the enhanced conduct risks that arise in the context of the pandemic.[10]

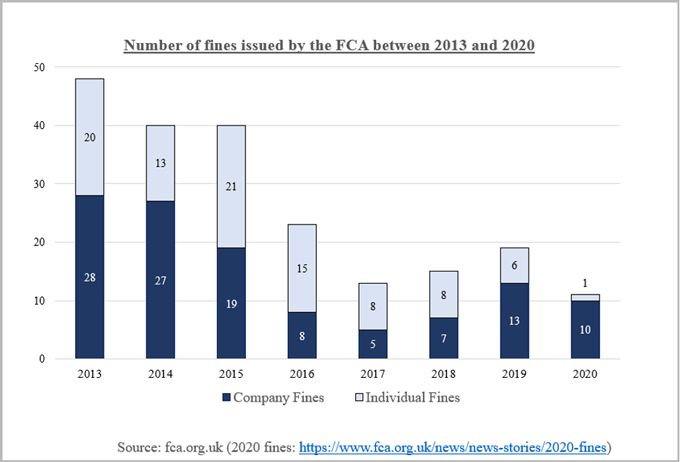

The pandemic undoubtedly had an impact on enforcement action, for example, instances of regulatory forbearance and the FCA holding back on searches / warrants. The FCA issued the lowest number of fines since its establishment in 2013:

However, the FCA took a number of high-profile enforcement actions against firms. For example, in 2020, the FCA continued to take action against firms for market misconduct[11], failures to show forbearance and due consideration to customers in financial difficulty[12] and took the first UK enforcement action under the Short Selling Regulation.[13]

The regulatory direction of travel has been towards an increased focus on non-financial misconduct and how this is tackled by firms. A increasing challenge for regulated firms is how to address non-financial misconduct and, in particular, non-financial misconduct that takes place outside of the workplace.[14] In response to the Me Too movement in 2018, firms introduced corrective responses to this important issue. However, in 2021 the FCA would expect a thorough and well-thought out response. Diversity and inclusion are now rightly integral to the FCA’s assessment of a firm’s culture.

|

Key practical steps for firms

|

(3) Operational and financial resilience

|

“We expect all firms to have contingency plans to deal with major events and that these plans have been properly tested.” “…financial pressures could give rise to harm to customers if firms cut corners on governance or their systems and controls – for example, increasing the likelihood of financial crime, poor record keeping, market abuse and unsuitable advice and investment decisions.”[16] |

It will come as no surprise that the FCA focused on regulated firms’ operational and financial resilience during 2020. For example, the FCA issued statements to firms outlining its expectations on financial crime systems and controls and information security during the pandemic.[17] In addition, in June and August 2020, the FCA issued a COVID-19 impact survey to help gain a more accurate view of firms’ financial resilience. This mandatory survey was repeated in November 2020 to understand the change in firms’ financial positions with time.[18]

However, the regulatory focus on operational and financial resilience goes beyond the pandemic. In December 2019 the FCA, alongside the Prudential Regulation Authority and the Bank of England, published a joint consultation paper on operational resilience.[19] The pandemic is indicative of the type of scenario that firms must be prepared for, but it is one of many scenarios for which the FCA would expect firms to factor into risk assessments and business continuity plans.

Similarly, the FCA’s focus on financial resources is wider than in the context of the pandemic. The FCA has indicated that it will implement its own version of the Investment Firms Regulation and that the new regime will come into force on 1 January 2022. The FCA has also published final guidance on a framework to help financial services firms ensure they have adequate financial resources and to take effective steps to minimise harm.[20] In particular, the FCA notes that the guidance does not place specific additional requirements on firms because of COVID-19, but the crisis underlines the need for all firms to have adequate resources in place and to assess how those needs may change in the future.

|

Key practical steps for firms

|

Forward looking regulatory priorities

Looking to the future, it is very likely indeed that the FCA’s priorities will, at least in part, mirror those areas of focus in 2020 (being: (1) governance, culture and individual accountability; (2) conduct and enforcement; and (3) operational and financial resilience).

(1) Governance, culture and individual accountability

Whilst the FCA has been relatively quiet from an enforcement perspective to date, firms should not be drawn into a false sense of security. This is particularly the case given that the extension of the regime brought within scope a significant number of firms (approximately 47,000). Additionally, a number of these firms are also more likely to be viewed as “low hanging fruit” by the FCA – some firms will perhaps have less sophisticated governance procedures in place (meaning potentially more breaches) and it will be much easier for the FCA to identify the decision-making processes of these solo-regulated firms when it is investigating breaches.

As at 17 August 2020, there were 25 open FCA investigations relating to senior managers. Of these, the majority related to retail misconduct, wholesale misconduct and senior manager conduct rule breaches.

It appears that resolution of these matters has been delayed by the pandemic but we expect to see some of these senior manager outcomes in 2021. We also anticipate an increase in new enforcement action from the FCA in this area, as we move away from the implementation phase of the SMCR for solo-regulated firms.

(2) Conduct and enforcement

As noted above, there is evidence to suggest that the pandemic has had some impact on enforcement action, for example, instances of regulatory forbearance and the FCA holding back on searches / warrants. However, it is likely that there will be a regulatory review of how firms treated clients during pandemic. As the FCA’s pronouncements since March 2020 have indicated, regulatory forbearance in certain areas does not replace regulated firm obligations under the regulatory system and, in particular, to treat customers fairly. It is highly likely that the FCA will conduct a retrospective review of firms’ conduct.|

This will likely include a review of firms’ financial crime controls during the pandemic. In Guidance it issued in May, the FCA acknowledges operational issues faced by firms but was clear that firms should not adjust their risk appetites in the face of new risks.[21] There will undoubtedly be a focus on fraud and other crimes committed during the pandemic, and firms will face scrutiny if there were red flags that were missed or not escalated. Firms may wish to, therefore, take the opportunity now to review the efficacy of the controls they have in place, as a general “health check”.

As at 17 August 2020, there were 571 open FCA investigations, with a significant focus on consumers, with retail misconduct accounting for 192 of these investigations. Other common areas responsible for investigations included: unauthorised business (103); insider dealing (60); financial crime (57); financial promotions (49) and wholesale conduct (33). We would, therefore, expect a number of these investigations to crystallise into final notices producing a series of messages around expected standards throughout the course of 2021.

Another potential area of regulatory focus in the conduct space is the transition from LIBOR. The FCA has already indicated that a member of senior management should be responsible for LIBOR transition, where applicable to the business.[22] Firms need to consider whether any LIBOR-related risks are best addressed within existing conduct risk frameworks or need a separate, dedicated program. Amongst other things, firms should keep appropriate records of management meetings or committees that demonstrate they have acted with due skill, care and diligence in their overall approach to LIBOR transition and when making decisions impacting customers.

(3) Operational and financial resilience

As noted above, whilst the pandemic firmly brought the operational and financial resilience of firms into the FCA’s cross-hairs, this was a particular area of interest of the regulator pre-COVID-19. As stated by the FCA’s Executive Director of Supervision: Investment, Wholesale and Specialist in December 2019, the “[FCA’s] intention is to bring about change in how the industry thinks about operational resilience – a shift in mindset as it were – informed and driven by the public interest”.[23]

The industry disruption caused by the pandemic, however, provides the FCA with an invaluable opportunity in a “real life” context, as opposed to simulated scenario, to kick the tyres of firms’ policies and procedures in order to determine how they coped with the operational and financial stresses brought about during the unprecedented circumstances of 2020. Whereas in 2020, the focus of the regulator was much more reactive, in terms of (for example) issuing statements outlining its expectations on financial crime systems and controls, we anticipate that 2021 will be much more centred around retrospective reviews of firms – for example, through looking at their business continuity plans, amongst other things.

Post-Brexit UK regulatory framework

The route map

A long awaited free trade agreement between the UK and EU was agreed on 24 December 2020, governing their relationship post-Brexit transition period. The financial services industry is addressed in the agreement, albeit to a much lighter extent than for goods and other services. The contents of the provisions on financial services are unlikely to come as a great surprise to the industry – amongst other things, the agreement does not provide for passporting rights nor address equivalence decisions. It is worth noting, however, that a joint declaration draft states that the parties will, by March 2021, agree a memorandum of understanding establishing the framework for structured regulatory co-operation on financial services. The aim of this is to provide for transparency and appropriate dialogue in the process of adoption, suspension and withdrawal of equivalence decisions.

In the months leading up to the eventual conclusion of the free trade agreement, the UK government produced a number of documents that indicate what a post-Brexit UK regulatory framework may look like. The Financial Services Bill[24] states that the UK Government has a number of objectives including: (1) enhancing the UK’s world-leading prudential standards and promoting financial stability; (2) promoting openness between the UK and overseas markets; and (3) maintaining the effectiveness of the financial services regulatory framework and sound capital markets. The UK Government has also published the Phase II consultation of its Financial Services Future Regulatory Framework Review.[25] The UK Government’s approach is intended to “to ensure that [the UK] regulatory regime has the agility and flexibility needed to respond quickly and effectively to emerging challenges and to help UK firms seize new business opportunities in a rapidly changing global economy.”

In its response to the global pandemic, the FCA’s actions are also indicative of the type of regulator it may be post-Brexit. Through its exercise of regulatory forbearance, for example, the FCA has proven itself to be more nimble and pragmatic.

Regulatory divergence

The UK approach in an environmental, social and governance (“ESG”) setting is another sign as to what the industry might expect in a post-Brexit world. Rather than onshore the EU Sustainable Finance Disclosure Regulation, the UK has announced that it will introduce disclosure rules aligning with the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”).[26] This will make the UK the first country in the world to make TCFD-aligned disclosures mandatory. It was also announced that the UK will implement a green taxonomy – a common framework for determining which activities can be defined as environmentally sustainable. This will take the scientific metrics in the EU taxonomy as its foundation and a UK Green Technical Advisory Group will be established to review these metrics to ensure they are appropriate for the UK market.

Whilst this by no means signals a radical departure from the EU in terms of regulatory approach – indeed, the UK Government has flagged the need in the ESG sphere for, where possible, consistency between UK and EU requirements – the UK Government’s willingness to diverge from the EU in certain regulatory matters raises important questions regarding the likelihood of any future EU equivalence decisions.

The global stage

Perhaps in common with the UK’s desire to remain a key player on the global stage post-Brexit, despite not forming a part of the more influential EU, the FCA is also keen not to become isolated from other regulators across the world and to keep working closely on matters spanning different jurisdictions. By way of an example, the TFS-ICAP final notice[27] (under which the FCA fined TFS-ICAP Ltd, an FX options broker, £3.44 million for communicating misleading information to clients), indicated that the FCA continues to work in tandem with overseas regulators (in this instance, the Commodity Futures Trading Commission in the United States).

Conclusion

Firms may be lured into a false sense of security that they can in some way “take the foot off the gas” from a regulatory perspective after having made it through a tumultuous 2020. However, this could not be further from the truth. Whilst 2020 was an unprecedented year, the FCA by no means gave firms carte blanche when it came to regulatory compliance, particularly in instances where there is a risk of customer detriment. It is in 2021 that we expect to see action from the FCA towards those firms who did not meet its expectations. This will be the case not just for firms but also, as we move away from the implementation phase of the SMCR for solo-regulated firms, individuals as well.

[1] FCA Business Plan: 2020/2021 (https://www.fca.org.uk/publications/corporate-documents/our-business-plan-2020-21)

[2] For example: Press Release, “FCA highlights continued support for consumers struggling with payments”, 22 October 2020 (https://www.fca.org.uk/news/press-releases/fca-highlights-continued-support-consumers-struggling-payments)

[3] Speech by Jonathan Davidson, Executive Director of Supervision – Retail and Authorisations, Financial Conduct Authority, “The business of social purpose”, 26 November 2020 (https://www.fca.org.uk/news/speeches/business-social-purpose)

[4] FCA Mission: Approach to Supervision, April 2019 (https://www.fca.org.uk/publication/corporate/our-approach-supervision-final-report-feedback-statement.pdf)

[5] FCA Discussion Paper (DP 20/1), “Transforming culture in financial services: Driving purposeful cultures”, March 2020, here.

[6] FCA Dear CEO letter to wholesale market broking firms, 18 April 2019 (https://www.fca.org.uk/publication/correspondence/dear-ceo-letter-wholesale-market-broking-firms.pdf)

[7] FCA Business Plan 2020/2021 (https://www.fca.org.uk/publication/business-plans/business-plan-2020-21.pdf)

[8] FCA Market Watch 63, May 2020 (https://www.fca.org.uk/publication/newsletters/market-watch-63.pdf)

[9] FCA Market Watch 62, October 2019 (https://www.fca.org.uk/publication/newsletters/market-watch-62.pdf)

[10] https://www.gibsondunn.com/uk-financial-conduct-authority-outlines-expectations-for-managing-enhanced-market-conduct-risks-in-the-context-of-the-pandemic/

[11] FCA Final Notice, TFS-ICAP, 23 November 2020 (https://www.fca.org.uk/publication/final-notices/tfs-icap-2020.pdf)

[12] FCA Final Notice, Barclays Bank UK PLC, Barclays Bank PLC, Clydesdale Financial

Services Limited, 15 December 2020 (https://www.fca.org.uk/publication/final-notices/barclays-2020.pdf)

[13] https://www.gibsondunn.com/fca-fines-non-uk-asset-manager-in-the-first-uk-enforcement-action-taken-under-the-short-selling-regulation/

[14] https://www.gibsondunn.com/the-challenge-of-addressing-non-financial-misconduct-in-uk-regulated-firms/

[15] https://www.gibsondunn.com/the-challenge-of-addressing-non-financial-misconduct-in-uk-regulated-firms/

[16] Speech, Megan Butler, Executive Director of Supervision – Investment, Wholesale and Specialists, FCA, “The FCA’s response to COVID-19 and expectations for 2020”, 4 June 2020 (https://www.fca.org.uk/news/speeches/fca-response-covid-19-and-expectations-2020)

[17] https://www.gibsondunn.com/covid-19-uk-financial-conduct-authority-expectations-on-financial-crime-and-information-security/

[18] FCA webpage, “Coronavirus (Covid-19) Financial Resilience Survey”, updated 6 November 2020 (https://www.fca.org.uk/news/statements/coronavirus-covid-19-financial-resilience-survey)

[19] FCA Consultation Paper (CP19/32), “Building operational resilience: impact tolerances for important business services and feedback to DP18/04”, December 2019 (https://www.fca.org.uk/publication/consultation/cp19-32.pdf)

[20] FCA Finalised Guidance (FG 20/, “Our framework: assessing adequate financial resources”, June 2020 (https://www.fca.org.uk/publication/finalised-guidance/fg20-1.pdf)

[21] https://www.gibsondunn.com/covid-19-uk-financial-conduct-authority-expectations-on-financial-crime-and-information-security/

[22] FCA Dear CEO letter, “Asset management firms: prepare now for the end of LIBOR”, 27 February 2020 (https://www.fca.org.uk/publication/correspondence/dear-ceo-asset-management-libor.pdf)

[23] Speech, Megan Butler, Executive Director of Supervision: Investment, Wholesale and Specialist, FCA, “The view from the regulator on Operational Resilience”, 5 December 2019 (https://www.fca.org.uk/news/speeches/view-regulator-operational-resilience)

[24] Financial Services Bill, 21 October 2020 (https://www.gov.uk/government/news/financial-services-bill-introduced-today)

[25] HM Treasury, CP305, “Financial Services Future Regulatory Framework Review Phase II Consultation”, October 2020, here.

[26] Policy Paper, “UK joint regulator and government TCFD Taskforce: Interim Report and Roadmap”, 9 November 2020 (https://www.gov.uk/government/publications/uk-joint-regulator-and-government-tcfd-taskforce-interim-report-and-roadmap)

[27] FCA Final Notice, TFS-ICAP, 23 November 2020 (https://www.fca.org.uk/publication/final-notices/tfs-icap-2020.pdf)

Gibson Dunn’s UK Financial Services Regulation team looks forward to discussing the matters outlined in this alert in further detail in a client webinar in the near future, details of which will be provided shortly. Please feel free to contact the Gibson Dunn lawyer with whom you usually work, or any of the following authors:

Michelle M. Kirschner (+44 (0) 20 7071 4212, mkirschner@gibsondunn.com)

Matthew Nunan (+44 (0) 20 7071 4201, mnunan@gibsondunn.com)

Steve Melrose (+44 (0) 20 7071 4219, smelrose@gibsondunn.com)

Martin Coombes (+44 (0) 20 7071 4258, mcoombes@gibsondunn.com)

Chris Hickey (+44 (0) 20 7071 4265, chickey@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On January 11, 2021, the Supreme Court in a summary disposition vacated the U.S. Court of Appeals for the Second Circuit’s major insider trading decision in United States v. Blaszczak, 947 F.3d 19 (2d Cir. 2019), remanding the case to the Second Circuit for further consideration in light of the Supreme Court’s recent decision in Kelly v. United States, 140 S.Ct. 1565 (2020). See Blaszczak v. United States, 2021 WL 78043 (Jan. 11, 2021); Olan v. United States, 2021 WL 78042 (Jan. 11, 2021). The Supreme Court’s decision raises important questions regarding whether, and to what extent, the Second Circuit will retreat from the significant expansion of insider trading liability it enunciated in Blaszczak barely more than one year ago.

United States v. Blaszczak

As we described in greater detail in a prior client alert, in Blaszczak, the U.S. Department of Justice (“DOJ”) alleged that, between 2009 and 2014, certain Centers for Medicare & Medicaid Services (“CMS”) employees disclosed confidential information relating to planned changes to medical treatment reimbursement rates to David Blaszczak, a former CMS employee who became a “political intelligence” consultant for hedge funds. Blaszczak allegedly provided this “predecisional” confidential information to employees of the hedge fund Deerfield Management Company, L.P., which then shorted stocks of healthcare companies that would be hurt by the planned reimbursement rate changes.

The DOJ indicted Blaszczak, one CMS employee, and two Deerfield employees for the alleged insider trading scheme. After an April 2018 trial, the jury returned a split verdict, acquitting all the defendants on certain counts, but finding the defendants guilty on other counts, including conversion, wire fraud, and (except for the CMS employee) Title 18 securities fraud. The defendants appealed.

In December 2019, the Second Circuit upheld the convictions and, in doing so, heightened the risk of investigation and prosecution in certain types of insider trading cases in two significant respects. First, in traditional civil and criminal insider trading cases against both tippers and tippees for Title 15 securities fraud under the Securities Exchange Act, the government must prove, among other things, that the tipper breached a duty in exchange for a direct or indirect personal benefit, and that the downstream tippee knew that the tipper had done so. The Second Circuit held that, by contrast, there is no “personal benefit” requirement in criminal insider trading cases charging Title 18 offenses like wire fraud and the criminal securities fraud provisions added in 2002 in the Sarbanes-Oxley Act.

Second, the court held that the “predecisional” confidential information relating to planned medical treatment reimbursement rate changes constituted government “property” necessary to bring insider trader cases under an embezzlement or misappropriation theory. In so holding, the Second Circuit found that this confidential government information was more akin to The Wall Street Journal’s confidential business information that the Supreme Court held constituted property for insider trading purposes in Carpenter v. United States, 484 U.S. 19 (1987), than to the fraudulently-obtained Louisiana state video poker licenses that the Supreme Court found did not constitute property in Cleveland v. United States, 531 U.S. 12 (2000), because “the State’s core concern” in granting video poker licenses was “regulatory.”

The Second Circuit’s decision thus expanded potential criminal insider trading liability in cases where there was limited-to-no evidence of a personal benefit to the tipper or that the downstream tippee knew of such a benefit, as well as in cases involving disclosure of nonpublic government information.

Kelly v. United States

In May 2020, five months after the Second Circuit’s decision in Blaszczak, the Supreme Court in Kelly addressed the scope of government “property” under federal fraud statutes. Specifically, the Supreme Court reviewed the criminal convictions of two “Bridgegate” defendants on federal-program and wire fraud charges arising out of their alleged involvement in a scheme to limit the number of lanes in Fort Lee, New Jersey accessing the George Washington Bridge as political retribution against the city’s mayor. To convict under both fraud provisions, the government was required to show “that an object of their fraud was money or property.”

The Supreme Court reversed the convictions, holding that “[t]he realignment of the toll lanes was an exercise of regulatory power—something this Court has already held fails to meet the statutes’ property requirement. And the [traffic engineers and toll collectors’] labor was just the incidental cost of that regulation, rather than itself an object of the officials’ scheme.” In reaching this conclusion, the Supreme Court relied heavily on Cleveland, noting that the defendants “exercised the regulatory rights of ‘allocation, exclusion, and control,’” and “under Cleveland, that run-of-the-mine exercise of regulatory power cannot count as the taking of property.”

Blaszczak Appeal to Supreme Court

In September 2020, three of the Blaszczak defendants petitioned the Supreme Court for a writ of certiorari, arguing that the Second Circuit had improperly expanded criminal insider trading liability by holding that there was no “personal benefit” requirement in Title 18 insider trading cases and that, contrary to the Supreme Court’s rulings in Cleveland and Kelly, predecisional confidential information constituted government property. See Petition for a Writ of Certiorari, Blaszczak v. United States (Sept. 4, 2020) (No. 20-5649); Petition for a Writ of Certiorari, Olan v. United States, 2020 WL 5439755 (Sept. 4, 2020).

Rather than address the propriety of the Second Circuit’s decision head-on, the government in its response brief instead argued that “the appropriate course is to grant the petitions for writs of certiorari, vacate the decision below, and remand the case for further consideration in light of Kelly.” Mem. for the United States, Blaszczak v. United States (Nov. 24 2020) (Nos. 20-306 & 20-5649).

On reply, the petitioners argued that the Supreme Court should squarely rule on their petition, rather than vacate and remand, noting that the Second Circuit may only “reverse[] itself on the ‘property’ issue,” without needing to again address its prior holding that there was no personal benefit requirement in Title 18 insider trading cases. Reply Brief for Petitioners, Olan v. United States, 2020 WL 7345516 (Dec. 8, 2020). As a result, “unless the [Second Circuit’s] existing erasure of the personal-benefit requirement…is repudiated, prosecutors in the Second Circuit will continue to feel free to charge insider-trading crimes even where there is no proof of personal benefit. And district courts in the Circuit (where most insider-trading prosecutions are brought) would likely follow the Second Circuit’s lead even if it were not technically binding….”

Despite the concerns that petitioners raised, on January 11, 2021, the Supreme Court agreed to the course that the government proposed, granting certiorari and directing that “[t]he judgment is vacated, and the case is remanded to the…Second Circuit for further consideration in light of Kelly….” Blaszczak v. United States, 2021 WL 78043 (Jan. 11, 2021); Olan v. United States, 2021 WL 78042 (Jan. 11, 2021).

Implications of Supreme Court’s Blaszczak Decision

It is unclear at this juncture what effect, if any, the Supreme Court’s decisions in Kelly and Blaszczak will have on the Second Circuit’s expansion of insider trading liability. In an expansive reading, for example, the Second Circuit could distinguish the “exercise of regulatory power” in Kelly from the “predecisional” government information in Blaszczak and continue to analogize confidential government information to the confidential business information that the Supreme Court ruled in Carpenter constitutes property for insider trading purposes. In a narrower reading, the Second Circuit could find that the principle of Kelly should apply to predecisional government information and thus that it does not constitute property under Title 18 securities fraud.

If the Second Circuit concludes that, after Kelly, confidential government information does not constitute property, the Court could reverse the convictions on this ground while leaving unaddressed its prior holding that there is no personal benefit requirement in Title 18 insider trader cases. As the petitioners warned the Supreme Court, prosecutors in this scenario would likely treat this silence as a green light to continue to charge insider-trading crimes where there is little to no evidence of a personal benefit to the tipper, or tippee knowledge of that benefit. Of course, under such circumstances, prosecutors would not have the benefit of Blaszczak to rely on, and thus there could be litigation risk to the government depending on the facts of the particular case.

Clouding the picture even further is that the Second Circuit ruling in Blaszczak was a 2-1 decision. And one of the two judges who joined in the majority ruling has since retired. As a result, the outcome of Blaszczak could be impacted significantly by the views of the third judge assigned to the panel. Should that new judge join with the original dissenting judge, the Blaszczak holding will change substantially. In addition, regardless of how the Second Circuit rules on remand, the losing side may seek the Supreme Court’s review of that decision. Blaszczak will therefore continue to be an important case to monitor in the ongoing court battles to define the scope of insider trading liability.

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding these developments. For additional information, please feel free to contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Securities Enforcement or White Collar Defense and Investigations practice groups, or the following authors:

Reed Brodsky – New York (+1 212-351-5334, rbrodsky@gibsondunn.com)

Barry R. Goldsmith – New York (+1 212-351-2440, bgoldsmith@gibsondunn.com)

M. Jonathan Seibald – New York (+1 212-351-3916, mseibald@gibsondunn.com)

Please also feel free to contact any of the following practice leaders:

Securities Enforcement Group:

Barry R. Goldsmith – New York (+1 212-351-2440, bgoldsmith@gibsondunn.com)

Richard W. Grime – Washington, D.C. (+1 202-955-8219, rgrime@gibsondunn.com)

Mark K. Schonfeld – New York (+1 212-351-2433, mschonfeld@gibsondunn.com)

White Collar Defense and Investigations Group:

Joel M. Cohen – New York (+1 212-351-2664, jcohen@gibsondunn.com)

Nicola T. Hanna – Los Angeles (+1 213-229-7269, nhanna@gibsondunn.com)

Charles J. Stevens – San Francisco (+1 415-393-8391, cstevens@gibsondunn.com)

F. Joseph Warin – Washington, D.C. (+1 202-887-3609, fwarin@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On January 9, 2021, the Ministry of Commerce of the People’s Republic of China (the “MOFCOM”) issued the MOFCOM Order No. 1 of 2021 on Rules on Counteracting Unjustified Extraterritorial Application of Foreign Legislation and Other Measures (the “Chinese Blocking Statute”). The Chinese Blocking Statute establishes the first sanctions blocking regime in China to counteract the impact of foreign sanctions on Chinese persons.[1] While the law is effective immediately, as noted below, it currently only establishes a legal framework. The law will become enforceable once the Chinese government denotes the specific extraterritorial measures—likely sanctions and export controls the United States is increasingly levying against Chinese companies—to which it then will apply.

The European Union has a comparable set of rules – known as the “EU Blocking Statute” – which seeks to restrict the impact on EU parties of unilateral, extraterritorial U.S. sanctions.[2] The new Chinese rules appear to borrow much from the European model.

There are several core components to the new Chinese rule:

Reporting Obligation: The Chinese Blocking Statute creates a reporting obligation for Chinese persons and entities impacted by extraterritorial foreign regulations. Under the new rules, when “a [Chinese] citizen, legal person or other organization … is prohibited or restricted by foreign legislation and other measures from engaging in normal economic, trade and related activities with a third State (or region) or its citizens, legal persons or other organizations,” the Chinese person or entity is required to report such matters to China’s State Council within 30 days.[3] Critically, this reporting obligation is applicable to Chinese subsidiaries of multinational companies.

A comparable reporting requirement, including the 30-day reporting obligation, is also found in the EU Blocking Statute.[4]

Implicated Foreign Laws: Unlike the EU Blocking Statute, the specific laws and measures covered by the Chinese Blocking Statute have yet to be identified. Specifically, the Chinese Blocking Statute establishes a mechanism for the government to designate specific foreign laws as “unjustified extraterritorial applications,” and subsequently issue prohibitions against compliance with these foreign laws. Under the Chinese Blocking Statute, a “working mechanism” led by the State Council is responsible for assessing and determining whether the foreign sanctions laws constitute “unjustified extra-territorial application of foreign legislation and other measures.” The law sets out an open-ended and largely undefined list of factors for the State Council to consider, including whether the law represent “a violation of principals of international relations,” impacts China’s “national sovereignty, security and development interests,” or effects the “legitimate rights and interests” of Chinese persons and entities, as well as “other factors that shall be taken into account.”[5] If the working mechanism confirms the existence of an “unjustified extraterritorial application” of a foreign law, it will direct the State Council to issue an order prohibiting parties in China from complying with the law.[6]

The EU Blocking Statute, in comparison, applies only to a specific set of laws specified in its Annex[7]–which presently consists principally of certain U.S. sanctions on Cuba and Iran. While the Chinese model may appear to provide individuals and entities with time to adjust and comply as the Chinese government will only list laws and measures in the future, the Chinese rules might eventually target substantially more foreign laws and measures.

Exemption Process: A Chinese person or entity will be able to apply for an exemption from compliance with the prohibition by submitting a written application to the State Council. Such request will need to provide the reasons for and the scope of the requested exemption. The State Council will then decide whether to approve such application within 30 days or less.[8] The format for applying for an exemption is not yet clear.

The EU Blocking Statute has a similar exemption mechanism. However, the EU Blocking Statute provides for approval “(…) without delay”[9]—which in practice can mean significantly more than 30 days.

Private Right of Action: Like the EU Blocking Statute, the Chinese rule creates a private right of action for Chinese persons or entities to seek civil remedies in Chinese courts from anyone who complies with prohibited extraterritorial measures, unless the State Council has granted an exemption to the prohibition order.[10] Under the EU Blocking Statute, EU entities are also entitled to sue for damages, including legal costs, arising from the application of the extraterritorial measures (enforcement of which claims may extend to seizure and sale of assets).[11]

A Chinese person or entity who suffers “significant losses” due to a counterparty’s compliance with a prohibited law may also obtain “necessary support” from the Chinese government[12].

Consequences of Non-Compliance: A Chinese person or entity who fails to comply with the reporting obligation or the prohibition order may be subject to government warnings, orders to rectify, or fines.[13] Under the EU Blocking Statute, individual member states exercise enforcement authority. In several such states, entities have been threatened with fines, and have even been subject to mandated specific performance of contractual obligations which may expose them to risk of liability under U.S. sanctions.

While the Chinese regulations remain nascent and the initial list of extra-territorial measures that the Blocking Statute will cover has yet to be published, the law marks a material escalation in the longstanding Chinese rhetoric threatening counter-measures against the United States (principally) by establishing a meaningful Chinese legal regime that will challenge foreign companies with operations in China. If the European model for the Blocking Statute continues to be Beijing’s inspiration, we will likely see both administrative actions to enforce the measures as well as private sector suits to compel companies to comply with contractual agreements, even if doing so is in violation of their own domestic laws.

U.S. authorities recognize the challenge posed by the EU Blocking Statute, and the recent increasingly robust public and private sector enforcement of it. However, the U.S. Government has not formally adjusted U.S. sanctions programs to account for the legal conflict faced by U.S. and European companies eager to remain on the right side of both U.S. and European regulations. The question for the United States with respect to this new Chinese law will be how to balance the progressively aggressive suite of U.S. sanctions and export control measures levied against China—which the U.S. Government is unlikely to pare back—against the growing regulatory risk for global firms in China that could be caught between inconsistent compliance obligations.

As has long been the case, international companies will continue to be on the front lines of Beijing-Washington tensions and they will need to remain flexible in order to respond to a fluid regulatory environment and maintain access to the world’s two largest economies.

______________________

[1] MOFCOM Order No.1 of 2021 on Rules on Counteracting Unjustified Extra-Territorial Application of Foreign Legislation and Other Measures (January 9, 2021) (“Chinese Blocking Statute”), http://www.mofcom.gov.cn/article/b/c/202101/20210103029710.shtml (Chinese), http://english.mofcom.gov.cn/article/policyrelease/questions/202101/20210103029708.shtml (English)

[2] https://www.gibsondunn.com/new-iran-e-o-and-new-eu-blocking-statute-navigating-the-divide-for-international-business/

[3] Chinese Blocking Statute (Article 5)

[4] Article 2 of Council Regulation (EC) No 2271/96 of 22 November 1996 protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom.

[5] Chinese Blocking Statute (Articles 4 & 6)

[7] Id. (Article 5); Annex of Council Regulation (EC) No 2271/96 of 22 November 1996 protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom. Under Article 11a, the European Commission has power to adopt legislation adding further foreign extraterritorial laws to the Annex to the EU Blocking Statute.

[8] Chinese Blocking Statute (Article 8)

[9] Article 5 of Commission Implementing Regulation (EU) 2018/1101 of 3 August 2018 laying down the criteria for the application of the second paragraph of Article 5 of Council Regulation (EC) No 2271/96 protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom.

[10] Chinese Blocking Statute (Article 9)

[11] Article 6 of Council Regulation (EC) No 2271/96 of 22 November 1996 protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom.

[12] Chinese Blocking Statute (Article 11)

[13] Chinese Blocking Statute (Article 13)

The following Gibson Dunn lawyers assisted in preparing this client update: Kelly Austin, Judith Alison Lee, Adam M. Smith, Patrick Doris, Ronald Kirk, Ning Ning, Chris Timura, Stephanie Connor, and Richard Roeder.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the above developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any of the following leaders and members of the firm’s International Trade practice group:

United States:

Judith Alison Lee – Co-Chair, International Trade Practice, Washington, D.C. (+1 202-887-3591, jalee@gibsondunn.com)

Ronald Kirk – Co-Chair, International Trade Practice, Dallas (+1 214-698-3295, rkirk@gibsondunn.com)

Jose W. Fernandez – New York (+1 212-351-2376, jfernandez@gibsondunn.com)

Marcellus A. McRae – Los Angeles (+1 213-229-7675, mmcrae@gibsondunn.com)

Adam M. Smith – Washington, D.C. (+1 202-887-3547, asmith@gibsondunn.com)

Stephanie L. Connor – Washington, D.C. (+1 202-955-8586, sconnor@gibsondunn.com)

Christopher T. Timura – Washington, D.C. (+1 202-887-3690, ctimura@gibsondunn.com)

Ben K. Belair – Washington, D.C. (+1 202-887-3743, bbelair@gibsondunn.com)

Courtney M. Brown – Washington, D.C. (+1 202-955-8685, cmbrown@gibsondunn.com)

Laura R. Cole – Washington, D.C. (+1 202-887-3787, lcole@gibsondunn.com)

Jesse Melman – New York (+1 212-351-2683, jmelman@gibsondunn.com)

R.L. Pratt – Washington, D.C. (+1 202-887-3785, rpratt@gibsondunn.com)

Samantha Sewall – Washington, D.C. (+1 202-887-3509, ssewall@gibsondunn.com)

Audi K. Syarief – Washington, D.C. (+1 202-955-8266, asyarief@gibsondunn.com)

Scott R. Toussaint – Washington, D.C. (+1 202-887-3588, stoussaint@gibsondunn.com)

Shuo (Josh) Zhang – Washington, D.C. (+1 202-955-8270, szhang@gibsondunn.com)

Asia and Europe:

Kelly Austin – Hong Kong (+852 2214 3788, kaustin@gibsondunn.com)

Fang Xue – Beijing (+86 10 6502 8687, fxue@gibsondunn.com)

Qi Yue – Beijing – (+86 10 6502 8534, qyue@gibsondunn.com)

Joerg Bartz – Singapore – (+65 6507 3635, jbartz@gibsondunn.com)

Peter Alexiadis – Brussels (+32 2 554 72 00, palexiadis@gibsondunn.com)

Attila Borsos – Brussels (+32 2 554 72 10, aborsos@gibsondunn.com)

Nicolas Autet – Paris (+33 1 56 43 13 00, nautet@gibsondunn.com)

Susy Bullock – London (+44 (0)20 7071 4283, sbullock@gibsondunn.com)

Patrick Doris – London (+44 (0)207 071 4276, pdoris@gibsondunn.com)

Sacha Harber-Kelly – London (+44 20 7071 4205, sharber-kelly@gibsondunn.com)

Penny Madden – London (+44 (0)20 7071 4226, pmadden@gibsondunn.com)

Steve Melrose – London (+44 (0)20 7071 4219, smelrose@gibsondunn.com)

Matt Aleksic – London (+44 (0)20 7071 4042, maleksic@gibsondunn.com)

Benno Schwarz – Munich (+49 89 189 33 110, bschwarz@gibsondunn.com)

Michael Walther – Munich (+49 89 189 33-180, mwalther@gibsondunn.com)

Richard W. Roeder – Munich (+49 89 189 33-160, rroeder@gibsondunn.com)

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

The Trump administration recently finalized a rule that clarifies that the incidental killing of migratory birds is not punishable under the Migratory Bird Treaty Act (the “MBTA”).

Part of a multinational effort to protect migratory birds, the MBTA was enacted in 1918 as a response to concern over poaching and over-hunting.

The Act criminalizes the hunting, taking, capturing or killing of birds – “by any means or in any manner” – and does not expressly exempt activities whose underlying purpose is one other than inflicting such harm. The possibility of MBTA liability has therefore long lurked in the shadows of petroleum refineries, wind projects, electric transmission lines, and other energy and infrastructure projects whose normal business operations may result in inadvertent impacts to birds. Indeed, the federal government has, albeit infrequently, wielded the MBTA to hold parties accountable for accidental bird kills in the past, including several prosecutions of oil and gas industry actors during the Obama Administration. More often, regulators use the threat of MBTA liability to encourage energy projects and other operators to voluntarily adopt bird impact mitigation best practices.

The U.S. Department of the Interior (“DOI”) claims that its new regulation reaffirms the original meaning and intent of the MBTA and that it is consistent with the interpretation of “several” federal courts (more on that in a moment).[1] While the rule intends to provide legal certainty to landowners and business interests, it is likely to meet immediate resistance on multiple fronts.

Environmentalists and their political allies have been quick to voice their opposition to a regulatory move that DOI has conceded will likely result “in increased bird mortality.”[2] A senior official in the Biden transition team has already indicated that the new administration will work to roll back the regulation,[3] with reversal options including new rulemaking(s) or Congress’s use of the Congressional Review Act (the “CRA”) to rescind the rule. The CRA allows Congress, with Presidential approval, to rescind a rulemaking by simple majority within 60 legislative days of the rule’s finalization. Democrats’ recent clinching of Senate control increases the odds that the CRA option will be exercised.

In the meantime, environmentalists are likely to take their case to court, undeterred by the likely obstacle of agency deference, which would preserve DOI’s interpretation of the MBTA so long as a court deems the interpretation reasonable. Such deference was not on the table when a federal judge recently rejected an earlier DOI legal opinion from December 2017 that informally adopted the MBTA interpretation now codified via formal rulemaking. The U.S. District Court for the Southern District of New York concluded that the MBTA is broad enough to criminalize incidental bird impacts, and rejected the December 2017 legal opinion under the Administrative Procedure Act as contrary to law. The court recognized that the Court of Appeals for the Fifth Circuit had previously limited the MBTA’s prohibition to deliberate acts done directly and intentionally to migratory birds, but sided with prior opinions from the Second and Tenth Circuits that held that incidental impacts are also criminal.[4]

A circuit split will once again be the status quo if DOI’s rule is administratively, legislatively, or judicially undone, unless and until the Biden Administration goes a step further and promulgates a formal rule interpreting the MBTA as prohibiting the incidental take of migratory birds.

Assuming the new DOI rule is ultimately overturned, exactly how the Biden Administration will approach MBTA enforcement is uncertain. Environmentalists will bring pressure to take an aggressive approach to wildlife protection, but it is reasonable to expect that the President-elect’s friendly outlook toward the renewable energy sector, which potentially faces the most significant impact from a stringent application of the law, will result in continued leniency for wind energy operators and supporting facilities that implement bird protection best practices. Whether the Biden Administration would be inclined to extend such goodwill more broadly is less clear.

___________________

[1] U.S. Fish and Wildlife Service Finalizes Regulation Clarifying the Migratory Bird Treaty Act Implementation, U.S. Fish & Wildlife Service (January 5, 2021), https://www.fws.gov/news/ShowNews.cfm?ref=us-fish-and-wildlife-service-finalizes-regulation–clarifying-the-&_ID=36829.

[2] Page 8 of Final Environmental Impact Statement, Regulations Governing Take of Migratory Birds, prepared by Fish & Wildlife Service, U.S. Department of Interior (November 2020).

[3] Lisa Friedman, Trump Administration, in Parting Gift to Industry, Reverse Bird Protections, New York Times (January 5, 2021), https://www.nytimes.com/2021/01/05/climate/trump-migratory-bird-protections.html.

[4] Nat. Res. Def. Council, Inc. v. U.S. Dep’t of the Interior, No. 18-CV-4596 (VEC), 2020 WL 4605235, at 7 (S.D.N.Y. Aug. 11, 2020). The Court also posited that the Eighth and Ninth Circuits, in separate decisions regarding MBTA liability, have both left the door open to finding that the MTBA creates criminal liability for incidental bird kills.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Environmental Litigation and Mass Tort practice group, or the authors:

Michael K. Murphy – Washington, D.C. (+1 202-955-8238, mmurphy@gibsondunn.com)

Kyle Neema Guest – Washington, D.C. (+1 202-887-3673, kguest@gibsondunn.com)

Please also feel free to contact the leaders of the Environmental Litigation and Mass Tort practice:

Stacie B. Fletcher – Washington, D.C. (+1 202-887-3627, sfletcher@gibsondunn.com)

Daniel W. Nelson – Washington, D.C. (+1 202-887-3687, dnelson@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

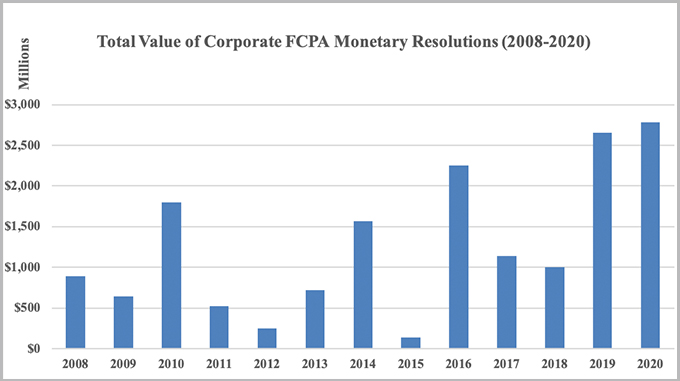

Recovering from a relatively slow start to the year, due in no small part to the global pandemic, the U.S. Foreign Corrupt Practices Act (“FCPA”) Units of the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”) closed the year with a bang. With 32 combined FCPA enforcement actions, 51 total cases including ancillary enforcement, and a record-setting $2.78 billion in corporate fines and penalties (plus billions more collected by foreign regulators), 2020 marks another robust year in the annals of FCPA enforcement.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2020, as well as the trends we see from this activity. We at Gibson Dunn are privileged to help our clients navigate these challenges daily and are honored again to have been ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices, the fourth time we have been so honored in the last five years. For more analysis on the year in anti-corruption enforcement, compliance, and corporate governance developments, please view or join us for our complimentary webcast presentations:

- 11th Annual Webcast: FCPA Trends in the Emerging Markets of Asia, Russia, Latin America, India and Africa on January 12 (view materials; recording available soon);

- FCPA 2020 Year-End Update on January 26 (to register, Click Here); and

- 17th Annual Webcast: Challenges in Compliance and Corporate Governance (date to be announced).

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) or American Depository Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

Foreign corruption also may implicate other U.S. criminal laws. Increasingly, prosecutors from the FCPA Unit of DOJ have been charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Perhaps most prevalent among these “FCPA-related” charges is money laundering—a generic shorthand term for several statutory provisions that together criminalize the concealment or transfer of proceeds from certain “specified unlawful activities,” including corruption under the FCPA or laws of foreign nations, through the U.S. banking system. DOJ now frequently deploys the money laundering statutes to charge “foreign officials”—most often, employees of state-owned enterprises, but occasionally political or ministry figures—who are not themselves subject to the FCPA. It is thus increasingly commonplace for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations. DOJ has even used these foreign officials to cooperate in ongoing investigations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

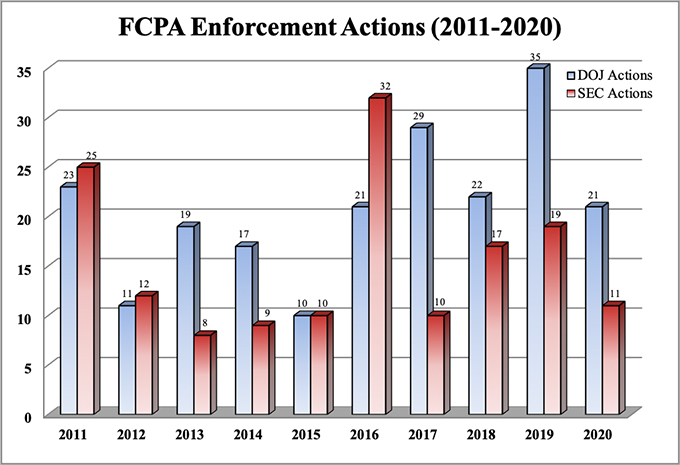

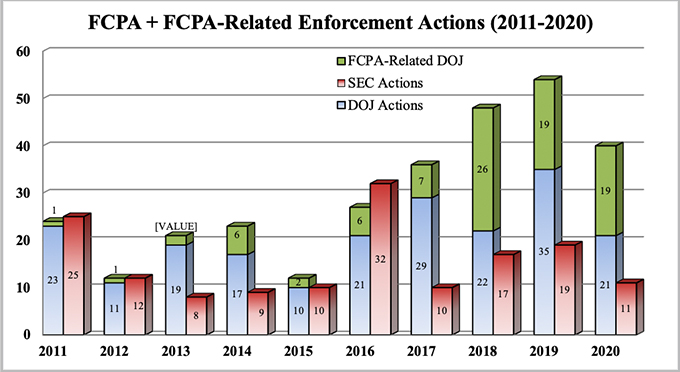

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, during each of the past 10 years.

|

The regularity of non-FCPA charges brought by DOJ FCPA Unit prosecutors was noted by the OECD Working Group on Bribery, which published a thorough Phase 4 report on the United States in November 2020. It praised the United States for “further increas[ing] its strong enforcement of the [FCPA] [and] maintaining its prominent role in the fight against transnational corruption,” noting in particular that “U.S. enforcement authorities have made broad use of other statutes and offences to prosecute payments to foreign government officials and intermediaries either in addition to or instead of FCPA charges.” With 19 such actions in 2020 (vs. 21 FCPA cases), thus continues what has matured into a multi-year trend of substantial extra-FCPA enforcement by DOJ.

|

2020 FCPA + FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not merely to report on each of the year’s FCPA enforcement actions, but more so to distill the thematic trends that we see stemming from these individual events. For 2020, we have identified five key enforcement trends that we believe stand out from the rest:

- Yet another high-water mark for corporate FCPA financial penalties;

- The CFTC dives into FCPA waters;

- The cautionary tale of Beam Suntory;

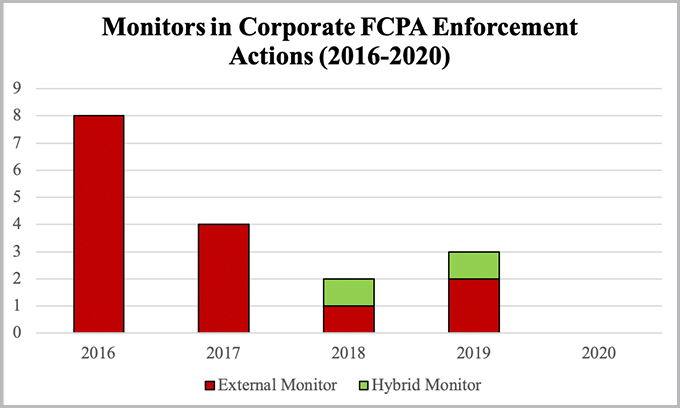

- No FCPA-related monitorships in 2020; and

- Spotlight on Latin America.

Yet Another High-Water Mark for Corporate FCPA Financial Penalties

For all of the fears expressed by some with respect to our 45th President—Donald J. Trump has been recorded as openly hostile to the FCPA—one that did not come to pass was diminishment of enforcement of the FCPA. Put simply, the modern era of FCPA enforcement largely has been indifferent to shifting political winds.

As just one measure of this phenomenon, one year ago we reported in these pages that corporate fines in FCPA cases had topped $2.5 billion for the first time in the history of the statute. In large part, this was because the record for highest single corporate FCPA resolution was set twice over in 2019—first, with the $850 million resolution with Mobile TeleSystems PJSC in March 2019, only to be outdone months later with the $1 billion resolution with Telefonaktiebolaget LM Ericsson in December 2019 (both covered in our 2019 Year-End FCPA Update). In 2020, the aggregate and individual records fell yet again.

Our readership is familiar with the long-running corruption investigation related to Malaysian sovereign wealth fund 1Malaysia Development Berhad (“1MDB”). From a massive civil forfeiture action seeking to recover allegedly misappropriated funds, to criminal FCPA actions against Malaysian businessperson Low Taek Jho (“Jho Low”) and former bankers Tim Leissner and Roger Ng Chong Hwa, even to charges under the Foreign Agents Registration Act (“FARA”) against individuals allegedly trying to lobby the Trump Administration on Jho Low’s behalf, the 1MDB scandal has resulted in significant enforcement activity and scrutiny over the last several years. Collectively, the former bankers and Jho Low allegedly participated in the diversion of more than $2.7 billion from 1MDB, between 2009 and 2014 and in connection with three separate bond offerings, for the illicit purposes of making payments to officials of state-owned investment funds of Malaysia and the UAE and embezzlement for their own personal benefit. Now added to the 1MDB enforcement list is the largest monetary corporate FCPA resolution ever. On October 22, 2020, global financial institution The Goldman Sachs Group Inc. reached a multi-billion dollar coordinated resolution in connection with the same core allegations with the SEC, DOJ, other U.S. authorities, as well as authorities in Singapore, the United Kingdom, and Hong Kong.

On the U.S. enforcement front, Goldman Sachs resolved the criminal case by entering into a three-year deferred prosecution agreement with DOJ alleging conspiracy to violate the FCPA’s anti-bribery provisions, while its Malaysian subsidiary pleaded guilty to one count of conspiracy to violate the anti-bribery provisions. The criminal penalty was calculated at $2.315 billion, but after a variety of offsets for payments to other regulators—domestic and foreign—Goldman Sachs agreed to pay $1.263 billion to DOJ. To resolve the civil case with the SEC, the bank consented to the entry of a cease-and-desist order charging anti-bribery, books-and-records, and internal controls violations, and agreed to pay a $400 million civil penalty, bringing the total FCPA financial resolution to $1,663,088,000. The SEC also ordered disgorgement of $606 million, but fully credited the amount against payments Goldman Sachs made under an earlier settlement in Malaysia pursuant to which the bank agreed to a $2.5 billion payment, as well as a guarantee of the return of $1.4 billion of 1MDB assets seized by authorities around the world.

Goldman Sachs also reached parallel resolutions with the Federal Reserve ($154 million), New York State Department of Financial Services ($150 million), UK Financial Conduct Authority ($63 million) and Prudential Regulation Authority ($63 million), Singaporean authorities ($122 million), and Hong Kong Securities and Futures Commission ($350 million). All told, total payments under the various resolutions exceed $5 billion.

In addition to Goldman Sachs and the Airbus and Novartis FCPA resolutions covered in our 2020 Mid-Year FCPA Update, two other 2020 corporate FCPA enforcement actions that topped the $100 million mark in combined penalties and disgorgement include: