January 7, 2019

2018 was an extraordinary year in the U.S. government’s efforts to combat foreign corruption. The 38 combined FCPA enforcement actions, resulting in $1 billion in corporate fines, alone provide much to discuss. But this is only a part of the story of the year in anti-corruption enforcement, as we also saw an explosion in the pursuit of FCPA-related offenses, continued multi-national enforcement, and a rare appellate decision on the jurisdictional reach of the FCPA, among many other developments.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from the year 2018, as well as the trends we see from this activity. For more analysis on the year in anti-corruption enforcement as well as challenges in compliance and corporate governance, please join us for one or both of our upcoming complimentary webcast presentations: FCPA Trends in the Emerging Markets of Asia, Russia, Latin America, and Africa on January 8 (to register, click here) and Challenges in Compliance and Corporate Governance on January 29 (to register, click here).

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) or American Depository Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

International corruption also may implicate other U.S. criminal laws. Increasingly in recent years, prosecutors from the FCPA Unit of the U.S. Department of Justice (“DOJ”) have begun charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Perhaps most prevalent amongst these “FCPA-related” charges is money laundering—a generic term used as shorthand for several statutory provisions that together criminalize the concealment or transfer of proceeds from certain “specified unlawful activities,” including corruption under the laws of foreign nations, through the U.S. banking system. DOJ frequently deploys the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is thus increasingly commonplace for DOJ to charge the alleged giver of a corrupt payment with FCPA violations and the alleged recipient with money laundering violations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

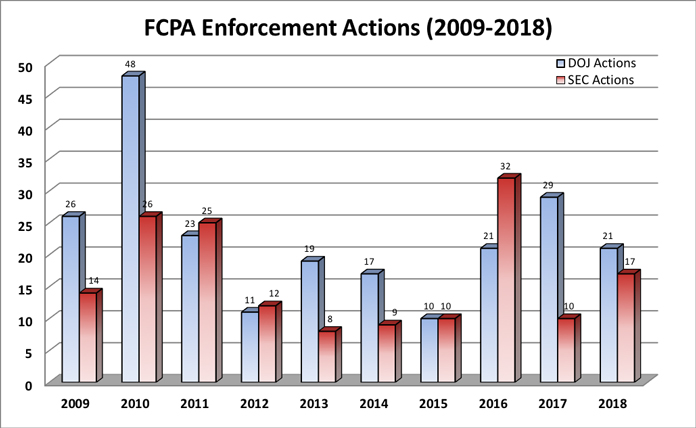

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the Securities and Exchange Commission (“SEC”), the statute’s dual enforcers, during the past 10 years.

|

||||||||||||||||||||||||||||||||||||||||

|

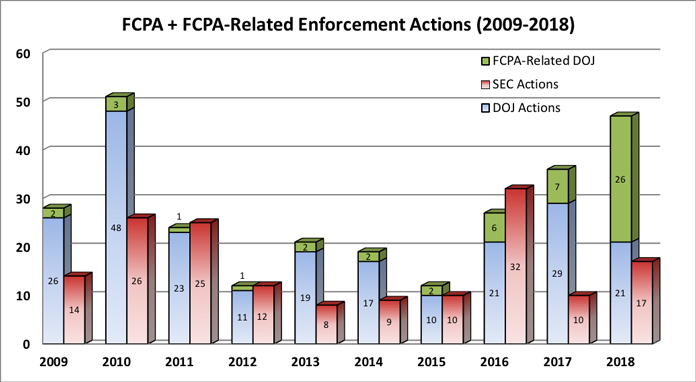

Viewed from this perspective, 2018 was undoubtedly a productive year, and enforcement trends must have a multi-year lens. When we see our counterparts in the hallways of the Bond Building, we see plenty of evidence of a continued frenetic pace of activity within the FCPA Unit. To illustrate this further, one need only look at a slightly different set of statistics that captures the activity of DOJ’s FCPA Unit rather than the number of cases it brings under a particular statute. As can be seen from the below table and graph, which includes non-FCPA charges brought by the FCPA Unit in international corruption investigations, 2018 was the second most prolific year in the history of foreign anti-corruption enforcement by the U.S. government.

|

||||||||||||||||||||||||||||||||||||||||

|

2018 FCPA + FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not only to report on the year’s FCPA enforcement actions but also to identify and synthesize the trends that stem from these actions. For 2018, seven key enforcement trends stand out from the rest:

1. DOJ brings “FCPA-related” charges against individuals at an unprecedented pace;

2. Venezuela in the spotlight;

3. Continuing scrutiny of the financial services industry;

4. Continuing reverberations from Brazil’s “Operation Car Wash”;

5. Public company executives, don’t forget about the SEC . . . ;

6. The SEC continues to assert aggressive theories in non-precedential settlements; and

7. DOJ issues four declinations under the FCPA Corporate Enforcement Policy.

DOJ Brings “FCPA-Related” Charges at an Unprecedented Pace

As discussed above, DOJ has in the past several years fundamentally changed its approach to international corruption cases. A phenomenon we first reported in our 2009 Year-End FCPA Update, when it was but a trickle, has now become a full-fledged river. In 2018, DOJ’s FCPA Unit brought 26 non-FCPA criminal cases on top of 21 FCPA enforcement actions. This is a dramatic upswing in non-FCPA prosecutions brought by the FCPA Unit, on par with the output of the prior decade combined. Accounting most significantly for this trend is DOJ’s aggressive deployment of the money laundering statute, in particular against officials of foreign governments.

For decades, it has been established law that “foreign officials”—a necessary participant in at least completed FCPA bribery schemes—are nonetheless not covered by the anti-bribery provisions. And for many years that meant that DOJ focused its criminal enforcement efforts on the “supply side” of bribery. But starting several years ago, and then exploding in the numbers shown this year, DOJ has attacked the “demand side” every bit as aggressively, principally by charging foreign official bribe recipients (though not sitting, high-level officials) with money laundering. The most prolific example would be those charged in connection with the Venezuelan bribery schemes described in the following section, although by no means is this the only example.

In addition to turning the officials of foreign sovereigns into U.S. defendants, another significant characteristic of DOJ’s money laundering explosion is the potential for theories of U.S. jurisdiction that exceed even the FCPA in their aggressiveness. For an FCPA bribery charge, the defendant should be a U.S. national, a U.S. company, an employee or agent of an issuer or U.S. company, or a foreign party alleged to have taken an action on U.S. soil. But for money laundering jurisdiction, DOJ has for some time taken the position that the mere use of U.S. correspondent bank accounts—through which the vast majority of U.S. dollar transactions worldwide are routed—is sufficient to vest the United States with jurisdiction to prosecute. Thus, if a wire for a corrupt payment in U.S. dollars is made from an account in Foreign Country A to an account in Foreign Country B, but routes instantaneously through a bank account in a U.S. dollar-denominated account in New York, DOJ may assert it has jurisdiction over that transaction even if the parties and business at issue are wholly foreign. Examples of this aggressive theory on display in 2018 can be seen in the Chi Ping Patrick Ho and Azat Martirossian prosecutions discussed below, among others. The law on this issue is at this point unclear and subject to multiple statutory and due process defenses—we expect this aggressive assertion of extra-U.S. jurisdiction to be a frequent source of litigation in the years to come.

One final point of note with respect to the DOJ FCPA Unit’s focus on money laundering charges is that increasingly FCPA Unit attorneys are teaming up with attorneys from the Money Laundering and Asset Recovery Section (“MLARS”). We have been covering in these updates the work of MLARS for years now, including through their “Kleptocracy Asset Recovery Initiative,” which uses civil forfeiture actions to freeze, recover, and, in some cases, repatriate the proceeds of foreign corruption. Several significant FCPA investigations of the recent past began as MLARS forfeiture actions, including prominently those involving “1MDB” in Malaysia and Gulnara Karimova in Uzbekistan as discussed herein, years before they became criminal FCPA cases. Further, although this update captures developments through 2018, in early January 2019 MLARS and FCPA Unit prosecutors teamed up once again in a big way with the unsealing of criminal charges against several individuals in connection with an alleged bribery and kickback scheme in Mozambique. We will continue to monitor this and other enforcement activity in future updates.

To help our clients meet these developing challenges, Gibson Dunn has on its team the former chiefs of both the DOJ FCPA Unit (Patrick F. Stokes) and MLARS (M. Kendall Day)—not to mention also the former key member of what is now the SEC’s FCPA Unit (Richard W. Grime) and former head of the Enforcement Division at the U.S. Department of Treasury’s Financial Crimes Enforcement Network, aka FinCEN (Stephanie Brooker). Few if any firms can match the depth of our bench in this area.

Venezuela in the Spotlight

PDVSA “pay-to-play” procurement scheme

For three years now, we have been covering the steady expansion of charges brought by DOJ in connection with an alleged “pay-to-play” corruption scheme involving procurement processes at Venezuelan state-owned energy company Petróleos de Venezuela S.A. (“PDVSA”). As we first reported in our 2015 Year-End FCPA Update, DOJ alleges that between 2009 and 2014 U.S. businesspersons paid millions of dollars in bribes to PDVSA officials to influence the award of competitive energy contract procurements, as well as to secure preferential treatment in the payment of outstanding debts owed by PDVSA.

During the second half of 2018, DOJ unsealed charges against five new defendants in the PDVSA procurement investigation. On July 31, Jose Manuel Gonzalez-Testino was arrested at Miami International Airport based on a criminal complaint filed in the U.S. District Court for the Southern District of Texas alleging substantive and conspiracy FCPA charges for the payment of at least $629,000 in bribes to an official of PDVSA’s purchasing arm, which based on the allegations appears to be Cesar David Rincon-Godoy, who pleaded guilty to one count of money laundering earlier in the year. In another pairing of charges against bribe payer and bribe recipient, on September 13, DOJ announced guilty pleas by Juan Carlos Castillo Rincon and Jose Orlando Camacho, respectively a former manager for a Houston-based logistics and freight forwarding company and a former PDVSA procurement official. Castillo Rincon pleaded guilty to FCPA conspiracy for making corrupt payments to Orlando Camacho, who himself pleaded guilty to money laundering conspiracy for receiving the payments. On October 30, another former PDVSA procurement official, Ivan Alexis Guedez, pleaded guilty to a money laundering conspiracy charge in connection with his receipt of corrupt payments. Finally, on December 10, former PDVSA official Alfonzo Eliezer Gravina Munoz pleaded guilty for the second time in connection with the PDVSA investigation. As previously reported in our 2016 Mid-Year FCPA Update, Gravina Munoz pleaded guilty in 2016 to money laundering conspiracy and tax charges associated with his alleged receipt of bribes. Gravina Munoz agreed to cooperate with U.S. investigators as part of the original guilty plea, yet according to his 2018 guilty plea to obstruction of justice, he concealed information about a co-conspirator and tipped that person off about the investigation, leading the co-conspirator to destroy evidence and attempt to flee the United States (based on the timing of his arrest at the airport in July 2018, some have reported that the co-conspirator is Gonzalez-Testino).

In total, DOJ has (publicly) brought 20 cases of FCPA and FCPA-related charges against 19 individuals associated with the PDVSA procurement corruption investigation. Fifteen of these defendants have pleaded guilty in connection with 16 of these cases, all awaiting a 2019 sentencing date before the Honorable Gray H. Miller of the U.S. District Court for the Southern District of Texas. Three of the remaining four defendants are listed as fugitives and have yet to be brought within the jurisdiction of the court, while the fourth (Gonzalez-Testino) awaits a trial date.

Venezuelan currency exchange schemes

There can be no question that the above-described PDVSA procurement case is significant. But developments in 2018 in separate corruption-related cases out of Venezuela may ultimately prove to be even more substantial.

According to a July 23 affidavit in support of multiple arrest warrants, a confidential witness approached federal agents in 2016, confessed to his or her involvement in a corrupt currency conversion / embezzlement scheme involving PDVSA funds, and agreed to cooperate in a surreptitious manner. Two years and more than 100 recorded conversations later, “Operation Money Flight” has yielded (public) charges against nine individuals for $1.2 billion in alleged money laundering.

Although complex in operation, the genesis of the scheme relates simply to a substantial difference between the official and unofficial rates at which Venezuelan bolivars could be exchanged for U.S. dollars. Co-conspirators allegedly entered into contracts to convert PDVSA bolivars into dollars at the unofficial rate (e.g., 60:1) and then, with the assistance of corrupt payments to government officials, allegedly converted the purchased bolivars back into dollars at the official rate (e.g., 6:1). In so doing, co-conspirators allegedly were able to receive as much as 10 times their investment by effectively embezzling money from PDVSA.

The first charges were announced on July 25, 2018, with the arrest of Matthias Krull, a German national resident in Panama working for a European bank, and Gustavo Adolfo Hernandez Frieri, a naturalized U.S. citizen who operated financial services firms out of Florida. Also charged in connection with the money laundering scheme are businesspersons Francisco Convit Guruceaga, Jose Vincente Amparan Croquer, Hugo Andre Ramalho Gois, Marcelo Federico Gutierrez Acosta y Lara, and Mario Enrique Bonilla Vallera, former legal counsel for the Venezuelan Ministry of Oil and Mining Carmelo Urdaneta Aqui, and former PDVSA Finance Director Abraham Edgardo Ortega. Only weeks after his arrest in Miami, Krull pleaded guilty to a single money laundering conspiracy count and was sentenced on October 29, 2018 to 10 years in prison. Ortega, who was arrested in September and pleaded guilty to a single money laundering conspiracy count on October 31, 2018, awaits an April 2019 sentencing date. Frieri, who was arrested in Italy reportedly while on vacation with his family, is still undergoing extradition proceedings. The remaining defendants have yet to make an appearance in the U.S. District Court for the Southern District of Florida and are designated as fugitives.

A second set of charges connected to alleged currency conversion corruption in Venezuela (though not specific to PDVSA) was announced on November 19, 2018, when DOJ unsealed an indictment against Raul Gorrin Belisario, the billionaire owner of the Globovision news network, charging him with conspiracy to violate the FCPA and numerous money laundering counts. On the same day, DOJ unsealed money laundering guilty pleas by former Venezuelan National Treasurer Alejandro Andrade Cedeno and former bank owner Gabriel Arturo Jimenez Aray. According to the charging documents, Gorrin Belisario bribed two successive Venezuelan National Treasurers, including Andrade Cedeno, to enter into contracts for foreign exchange transactions at favorable rates. Gorrin Belisario and Jimenez Aray allegedly laundered the bribes and proceeds of the scheme through a Dominican bank owned by the latter. Jimenez Aray was sentenced to three years in prison, while Andrade Cedeno was sentenced to 10 years in prison and agreed to forfeit a staggering $1 billion in cash and luxury assets that he allegedly received as bribes. Gorrin Belisario has yet to make an appearance in the U.S. District Court for the Southern District of Florida and is designated a fugitive.

Continuing Scrutiny of the Financial Services Industry

1MDB

We have been tracking for several years now investigative activity related to Malaysian sovereign wealth fund 1Malaysia Development Berhad (“1MDB”). As covered in our 2016 Year-End FCPA Update, the investigations first surfaced with a massive civil forfeiture action filed by MLARS in the U.S. District Court for the Central District of California seeking to recover funds allegedly misappropriated from 1MDB. On November 1, 2018, the investigation took a turn with prosecutors from the FCPA Unit and MLARS unsealing criminal FCPA charges in the U.S. District Court for the Eastern District of New York against Malaysian businessperson Low Taek Jho and two former bankers, Tim Leissner and Ng Chong Hwa. Collectively, the three are alleged to have participated in the diversion of more than $2.7 billion from 1MDB, between 2009 and 2014 and in connection with three separate bond offerings, for the illicit purposes of making payments to officials of state-owned investment funds of Malaysia and the UAE and embezzlement for their own personal benefit.

Leissner has pleaded guilty to a two-count information charging him with a dual FCPA conspiracy—both to violate the anti-bribery provisions and to circumvent his former issuer-employer’s internal controls—as well as money laundering conspiracy. Sentencing is currently set for January 2019, although of note Leissner already has agreed to forfeit more than $40 million in connection with the scheme. Ng and Low were each indicted on FCPA bribery and money laundering charges, with Ng additionally being charged with FCPA internal controls violations. Ng has been arrested in Malaysia and is awaiting extradition proceedings, while Low remains at large.

Legg Mason Inc.

We covered DOJ’s June 2018 non-prosecution agreement with Maryland-based investment firm Legg Mason in our 2018 Mid-Year FCPA Update. As anticipated therein, the SEC followed with its own FCPA charges, announcing on August 27, 2018 a settled cease-and-desist proceeding associated with the alleged scheme to bribe Libyan officials to secure investment opportunities. To resolve the SEC’s FCPA internal controls charge, Legg Mason agreed to pay $34.5 million in disgorgement and prejudgment interest. This resolution is unusual because typically the SEC and DOJ resolve investigations on the same day and not months apart, but the cases were coordinated in that the investment firm received credit in the DOJ resolution for disgorgement ultimately paid to the SEC and the SEC’s order does not include a separate civil penalty in recognition of Legg Mason’s $32,625,000 criminal fine.

Joo Hyun Bahn

After pleading guilty earlier this year to criminal FCPA charges in connection with the feigned Vietnamese skyscraper plot covered in our 2017 Year-End and 2018 Mid-Year FCPA updates, on September 6, 2018, former real estate broker Joo Hyun Bahn consented to an administrative cease-and-desist order with the SEC based on the same conduct. To resolve civil FCPA anti-bribery, books-and-records, and internal controls allegations, Bahn agreed to pay $225,000 in disgorgement, which was deemed satisfied by the forfeiture and restitution payments that Bahn was ordered to pay in the criminal proceeding. On the same day that the SEC resolution was announced, the Honorable Edgardo Ramos of the U.S. District Court for the Southern District of New York sentenced Bahn to six months in prison, to forfeit $225,000, and pay to $500,000 in restitution.

Notably, there have been no reports of a pending resolution involving Bahn’s former employer, real estate firm Colliers International. If this continues to the case, it may reflect a judgment that charges are not appropriate given Bahn’s alleged deceit toward his former employer coupled with the fact that the deal in question was never consummated.

Continuing Reverberations from Brazil’s “Operation Car Wash”

Our readership is well aware that the long-running “Operation Car Wash” investigation has resulted in significant corruption-related enforcement activity both within and without Brazil. To say nothing of its seismic domestic impact, where it is credited with toppling a presidential administration, viewed strictly from a U.S. FCPA perspective Operation Car Wash has become one of the most significant “clusters” of FCPA enforcement activity ever. Prior FCPA enforcement actions with connections to this investigation against Braskem S.A., Keppel Offshore & Marine Ltd., Odebrecht S.A., Rolls-Royce plc, and SBM Offshore N.V. are covered in our 2016 and 2017 year-end FCPA updates. Said Principal Deputy Assistant Attorney General John P. Cronan at the recent Latin Lawyer / Global Investigations Review Anti-Corruption and Investigations Conference in São Paulo, “our close relationship with Brazil has borne fruit with some of the Department of Justice’s most significant FCPA resolutions over the past 12 months.”

On September 27, 2018, DOJ and the SEC added to the “Operation Car Wash” numbers by announcing a joint FCPA resolution with Petróleo Brasileiro S.A. – Petrobras (“Petrobras”), Brazil’s state-owned oil company. Petrobras entered into a non-prosecution agreement with DOJ to resolve FCPA accounting allegations based on the conduct of certain former executives who already have been convicted in Brazil for concealing their engagement in a scheme of embezzlement and political payoffs that harmed and caused severe loss to Petrobras. The SEC likewise alleged that Petrobras violated the FCPA’s accounting provisions, as well as certain non-scienter-based provisions of the Securities Act and the Exchange Act through allegedly misleading statements to U.S. investors in connection with a stock offering completed in 2010. In moves illustrative of the unusual nature of the resolution, DOJ explicitly recognized that Petrobras was a victim of its former employees’ embezzlement, and the SEC acknowledged the company’s “significant cooperation” with the SEC’s investigation and its status as an Assistant to the Prosecution in 51 proceedings in Brazil.

Although some have reported the financial resolution reached by Petrobras as high as $1.78 billion, the amount to be paid by the company in connection with the FCPA resolutions is far more modest. To resolve the criminal case, Petrobras agreed to a fine of $853.2 million, but will pay only $85.3 million (10%) of that to DOJ, with an 80% offsetting credit applied against $682.56 million to be paid to fund social responsibility programs in Brazil as part of an agreement with the Brazilian Federal Prosecutor’s Office and a 10% offsetting credit applied against a civil penalty imposed by the SEC. Similarly, the SEC imposed $933.5 million in disgorgement and prejudgment interest and an $853.2 million penalty, but takes only $85.3 million of that after crediting the Brazilian resolution against the penalty and, in a first-of-its kind for FCPA resolutions, crediting the entire disgorgement amount against the shareholders’ class action settlement described in our 2018 Mid-Year FCPA Update. Said SEC FCPA Unit Chief Charles E. Cain of this latter credit while speaking at the Securities Enforcement Forum on November 1, 2018: “It made sense for this case,” and other companies should not expect the same result moving forward. Thus Petrobras will in effect pay just over $170 million to resolve its FCPA resolutions with DOJ and the SEC.

In another Operation Car Wash-related FCPA enforcement action, Houston-based offshore drilling company Vantage Drilling International resolved SEC allegations that it lacked adequate internal controls over payments to its supplier of drilling assets—a Taiwanese shipping magnate who was the company’s largest shareholder and sat on its board—and the engagement of a third-party agent without due diligence to assist in marketing the company to Petrobras. According to the SEC, Vantage Drilling failed to respond to red flags indicating a risk that the director and the agent would bribe Petrobras officials in connection with obtaining a $1.8 billion contract that benefitted the company. Vantage Drilling previously has identified the Taiwanese director as Hsin-Chi Su, one of several people who along with former Vantage Drilling CEO Paul Bragg have been charged by Brazilian prosecutors.

Without admitting or denying the allegations, Vantage Drilling consented to the cease-and-desist proceeding and agreed to pay $5 million in disgorgement. The SEC did not impose additional penalties in light of Vantage’s financial condition. The company initiated bankruptcy proceedings after Petrobras terminated its drilling services contract in 2015 in reaction to the corruption allegations. DOJ closed its investigation into the company in 2017 without taking action.

Public Company Executives, Don’t Forget about the SEC . . .

It is a frequent and misguided critique of FCPA enforcement that executives in high-profile positions are not held to account for the misdeeds that occur on their watch. Although frequently there are legitimate jurisdictional, prudential, or other explanations for this purported phenomenon, DOJ and the SEC have each made a point in recent years of underscoring their commitment to holding individuals accountable for corporate misconduct. For example, SEC FCPA Enforcement Chief Charles E. Cain said recently, “Corporate culture starts at the top, and when misconduct is directed by the highest level of management it is critical that they are held accountable for their conduct.” Two examples of the SEC charging public company executives in 2018 FCPA enforcement actions in the wake of corporate resolutions follow.

On September 25, 2018, the SEC announced a settled cease-and-desist proceeding against Patricio Contesse González, the former longtime CEO of Chilean chemical and mining company and ADR-issuer Sociedad Química y Minera de Chile, S.A. (“SQM”), which 20 months earlier paid more than $30 million to resolve DOJ / SEC FCPA enforcement actions as covered in our 2017 Mid-Year FCPA Update. The SEC’s order alleges that González used a discretionary “CEO account” to funnel $15 million to Chilean politicians and then failed to disclose these payments to SQM’s internal and external auditors. To resolve the SEC’s allegations that he caused SQM to violate and himself violated the FCPA books-and-records and internal controls provisions, as well as signed misleading management representation letters to SQM’s external auditor and signed false certifications in SQM’s filings, González agreed to pay a civil penalty of $125,000.

Similarly, on December 18, 2018, the SEC announced a settled cease-and-desist proceeding with Paul A. Margis, the former CEO of Panasonic Avionics Corporation (“PAC”), a U.S. subsidiary of Japanese electronics company and former American Depositary Share-issuer Panasonic, which together with PAC paid more than $280 million in an April 2018 DOJ / SEC FCPA resolution as covered in our 2018 Mid-Year FCPA Update. The SEC alleged that Margis authorized $1.76 million in payments to three third parties, one of whom was a government official actively negotiating with PAC for a post-retirement position as he simultaneously negotiated with PAC for a major contract extension on behalf of his state-owned airline employer, even though these third parties provided little-to-no work on behalf of PAC. To resolve the charges that he circumvented PAC’s internal controls, falsified PAC’s books and records, caused Panasonic to violate the FCPA’s accounting provisions, and misled external auditors in certifications and representation letters, Margis agreed to pay a civil penalty of $75,000. While not an FCPA resolution, PAC’s former CFO Takeshi Uonaga agreed in a parallel resolution to pay a $50,000 civil penalty to resolve allegations that he backdated a contract to allow for untimely recognition of revenue in connection with a contract with the same state-owned airline.

The SEC Continues to Assert Aggressive Theories in Non-Precedential Settlements

In 2018, the SEC resolved 10 corporate FCPA enforcement actions that did not have a corresponding DOJ resolution. In several of these SEC-only resolutions, the SEC leveraged the accounting provisions to bring cases predicated upon aggressive theories of FCPA liability that, at least on the face of the charging documents, bore a tenuous (or non-existent) connection to foreign bribery. In another case, the SEC seemed to stretch (if not break) the boundaries of the anti-bribery provision. Thus continues a trend we have observed periodically over the years, including most recently in our 2017 Year-End FCPA Update. Although settlements are clearly non-binding in the legal sense, any FCPA practitioner knows that they are frequently bandied about as precedent in settlement discussions and thus become a very real part of the body of FCPA enforcement that must be contended with.

In our 2018 Mid-Year FCPA Update, we reported on two cases involving aggressive interpretations of the accounting provisions: (1) the SEC’s cease-and-desist proceeding against Elbit Imaging Ltd., where the violation alleged by the SEC concerned the use of third parties on whom due diligence was not performed and no evidence of work performed; and (2) the SEC’s cease-and-desist proceeding against Kinross Gold, where the alleged violations related to the slow implementation of compliance controls at two acquired subsidiaries, failure to respond to internal audits flagging the inadequate controls, and inadequate efforts to ensure that payments to vendors and consultants were used appropriately. In neither case did the SEC directly allege specific corrupt payments.

More recently, on September 28, 2018, the SEC announced a settled cease-and-desist proceeding against Michigan-based medical technology company Stryker Corporation, related to alleged violations of the FCPA’s accounting provisions. The allegations relate to the company’s internal controls purportedly being insufficient to detect the risk of improper payments in India, China, and Kuwait. Specifically, the SEC alleged that an internal forensic review of Stryker’s Indian subsidiary identified no supporting documentation for 27% of higher-risk transactions tested, as well as inflated invoices in connection with third-party sales to private hospitals. The SEC further alleged that Stryker’s Chinese subsidiary used at least 21 sub-distributors that were not vetted, approved, or trained as required by company policy, which increased the risk of improper payments, and that Stryker did not test or otherwise assess compliance with its policies by a distributor in Kuwait that made over $32,000 in duplicative per diem payments to health care professionals over the course of three years. To resolve these FCPA accounting allegations, and without admitting or denying the SEC’s findings, Stryker consented to the entry of a cease-and-desist order and agreed to pay a $7.8 million civil penalty. Stryker also was required to retain an independent compliance consultant, narrowly focused on reviewing Stryker’s anti-corruption policies and procedures and internal controls applicable to third parties, for an 18-month term. It is likely that the compliance monitor was imposed, at least in part, because this was Stryker’s second FCPA resolution, having resolved a prior FCPA enforcement action with the SEC in October 2013 as detailed in our 2013 Year-End FCPA Update.

Employing a different sort of aggressive FCPA theory, on September 12, 2018, the SEC announced a settled cease-and-desist proceeding against a multinational conglomerate for alleged violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions. The company was alleged among other things to have made improper payments with respect to public housing officials in Azerbaijan to retain sales. What makes this case stand out as aggressive in its charging theory is the Section 30A bribery charge relating to the conduct in Azerbaijan. The only clear allegation of involvement by the parent in its Russian subsidiary’s alleged conduct is that the parent “failed to detect the conduct”—seemingly an inadequate internal controls theory, if that. Further, there is a prominent allegation of U.S. jurisdictional nexus via the fact that the payments made on behalf of the Russian subsidiary “were [made] in U.S. dollar denominations and involved U.S. correspondent banks.” To resolve the allegations, the company agreed to pay $13.9 million, consisting of nearly $10 million in disgorgement and prejudgment interest and a $4 million penalty. DOJ closed its investigation in March 2018 without bringing its own enforcement action.

Finally, on December 26, 2018, the SEC brought an FCPA enforcement action unlike any other of which we are aware. The SEC charged Brazilian state-owned power company and issuer Centrais Elétricas Brasileiras S.A. (“Eletrobras”) with violations of the FCPA’s books-and-records and internal controls provisions based entirely on the alleged self-dealing of its now-former executives, which had no apparent benefit to the company. Specifically, the SEC alleged that executives of an Eletrobras subsidiary managing a massive nuclear power plant construction project received kickbacks from private Brazilian construction companies in exchange for paying inflated or sham invoices on behalf of the company. Payments also were allegedly made to Brazilian political party and government officials, which is why we count this as an FCPA enforcement action; however, the payments were made on behalf of the Brazilian construction companies and only funded, in part, out of the alleged sham invoices and inflated contract prices paid by the Eletrobras subsidiary. There is no allegation that Eletrobras received an improper benefit via these payments, and indeed it would seem that the company was a victim in this course of conduct. Nonetheless, the SEC alleged that Eletrobras maintained deficient internal controls and had inaccurate books and records as a result of this scheme. To resolve the SEC proceedings, without admitting or denying the findings, Eletrobras consented to the entry of a cease-and-desist order and agreed to pay a $2.5 million civil penalty. There was no disgorgement as there was no benefit to Eletrobras alleged. The company previously announced that DOJ closed its investigation without taking enforcement action.

DOJ Issues Four Declinations under the FCPA Corporate Enforcement Policy

DOJ issued four public declination letters in 2018 pursuant to the FCPA Corporate Enforcement Policy. Two of these coincided with parallel SEC FCPA enforcement actions, one anticipates a future foreign regulatory action, and the fourth stands alone as a corporate action (but follows an individual enforcement action). All of the letters followed decisions by the named companies to make voluntary disclosures, which is a threshold requirement under the FCPA Corporate Enforcement Policy.

The first declination letter of 2018 concerned Dun & Bradstreet as we covered in our 2018 Mid-Year FCPA Update. Descriptions of the three declination letters from the second half of 2018 follow:

- Güralp Systems Limited – On August 20, 2018, DOJ issued a public declination letter to UK seismology company Güralp Systems in connection with the same set of events leading to the U.S. money laundering conviction of Heon-Cheol Chi, former Director of the Korea Institute of Geoscience and Mineral Resources (“KIGAM”) Earthquake Research Center, described in our 2017 Year-End FCPA Update. DOJ stated in the letter that it was closing its investigation without charges against Güralp Systems, despite evidence of corrupt payments to Chi, based on a variety of factors, including most prominently that Güralp Systems, “a U.K. company with its principal place of business in the U.K., is the subject of an ongoing parallel investigation by the U.K.’s Serious Fraud Office for violations of law relating to the same conduct and has committed to accepting responsibility for that conduct with the SFO.” As described below, several former Güralp Systems executives have been charged in the UK, but the UK investigation of Güralp Systems remains ongoing.

- Insurance Corporation of Barbados Limited – Three days later, on August 23, 2018, DOJ issued a public declination letter to Barbadian insurance company ICBL. This letter came several weeks after DOJ unsealed a March 2018 indictment charging Donville Inniss, a former Minister of Industry and member of Parliament of Barbados, with money laundering in connection with his alleged receipt of $36,000 from ICBL in exchange for agreeing to award government contracts to the insurer. Pursuant to the declination letter, which is countersigned by ICBL’s Board Chair, ICBL agreed to the letter’s brief recitation of facts and to disgorge nearly $94,000 in profits received from the tainted contracts, making it the first so-called “declination with disgorgement” agreement under the official FCPA Corporate Enforcement Policy (although prior such agreements were reached under the predecessor FCPA Pilot Program). Inniss’s trial is scheduled for June 2019 before the Honorable Kiyo A. Matsumoto of the U.S. District Court for the Eastern District of New York. Interestingly, a redacted superseding indictment filed by DOJ in the case makes clear that money laundering charges have been filed under seal against the former CEO and a senior vice president of ICBL.

- Polycom, Inc. – The year’s final FCPA enforcement event, announced on December 26, 2018, involved a coordinated SEC cease-and-desist order entered against, and DOJ declination letter issued to, California telecommunications provider Polycom. The allegations set forth in the SEC order, which charge violations of the FCPA’s books-and-records and internal controls provisions, assert that between 2006 and 2014 employees of Polycom’s Chinese subsidiary provided discounts to distributors or resellers while knowing that those discounts would be used to fund improper payments to government end customers. To resolve these allegations, Polycom agreed to pay $12.5 million in disgorgement and prejudgment interest plus a $3.8 million civil penalty. DOJ then issued a letter declining to prosecute Polycom for the China conduct, prominently noting the company’s voluntary disclosure, cooperation, and agreement to enter into the SEC resolution. What is perhaps most noteworthy about the Polycom settlement is that whereas the SEC explicitly limited its disgorgement to illicit profits earned on or after September 27, 2012—clearly in recognition of the five-year statute of limitations imposed by 28 U.S.C. § 2462 and Kokesh v. SEC, 137 S. Ct. 1635 (2017)—DOJ made a condition of its declination letter that Polycom disgorge an additional $20.3 million representing profits earned outside “the time limits prescribed by 28 U.S.C. § 2462.”

Rounding Out the 2018 FCPA Enforcement Docket

Additional 2018 FCPA enforcement actions not covered above or in our 2018 Mid-Year FCPA Update are as follows:

- Roger Richard Boncy – On October 30, 2018, DOJ filed a superseding indictment in the case against retired U.S. Army colonel and Haitian non-profit founder Joseph Baptiste, covered in our 2017 Year-End FCPA Update, to add Boncy as a defendant on the FCPA conspiracy, Travel Act, and money laundering conspiracy charges. Boncy is a former lawyer of dual U.S.-Haitian citizenship who once served as Haiti’s Ambassador-at-Large. According to the indictment, Boncy and Baptiste solicited bribe money from two undercover FBI agents who were posing as prospective investors for a multi-million dollar port development project in Haiti. But instead of funneling the bribe money to Haitian officials, Baptiste allegedly pocketed it. Although the trial of Baptiste nearly went forward in late 2018, in light of the superseding indictment, a joint trial for Baptiste and Boncy is now scheduled for June 2019.

- Sanofi – On September 4, 2018, the SEC announced a settled FCPA accounting resolution with Paris-headquartered and U.S.-listed pharmaceutical manufacturer Sanofi, pursuant to which the company agreed to pay $25.2 million in disgorgement, prejudgment interest, and penalties to resolve allegations regarding corrupt payments to government procurement officials and healthcare providers in Kazakhstan and the Middle East. Sanofi also agreed as part of the resolution to self-report about anti-corruption compliance to the SEC for a two-year period.

- Juan Andres Baquerizo Escobar – On July 11, 2018, DOJ filed a criminal money laundering charge against another defendant involved in the ongoing investigation of corruption at Ecuador’s state-owned oil company, Petroecuador. Baquerizo Escobar, an Ecuadorian businessperson, pleaded guilty two months later to facilitating the transfer of $1.72 million in bribes to Petroecuador officials between 2012 and 2016. He awaits a January 2019 sentencing date. As discussed in our 2017 Year-End and 2018 Mid-Year FCPA updates, charges have been brought against four other defendants in this investigation—money laundering charges against former Petroecuador officials Arturo Escobar Dominguez and Marcelo Reyes Lopez, money laundering charges against Ecuadorian businessperson Jose Larrea, and FCPA and money laundering charges against Ecuadorian businessperson Frank Roberto Chatburn Ripalda. The first three have all now pleaded guilty, including Larrea on September 11, 2018, and been sentenced to prison terms of 53 months (Reyes Lopez), 48 months (Escobar Dominguez), and 27 months (Larrea), respectively. Chatburn Ripalda was scheduled to go to trial in February 2019, but a superseding indictment charging him with additional alleged bribes to Petroecuador officials was filed on December 13, 2018. A hearing on the superseding indictment and likely a new trial date is set for January 2019.

2018 FCPA-RELATED ENFORCEMENT LITIGATION

Second Circuit Issues Important FCPA Jurisdictional Decision in Hoskins

On August 24, 2018, the U.S. Court of Appeals for the Second Circuit issued a long-awaited decision in the criminal FCPA case filed against former Alstom executive Lawrence Hoskins. As we reported in our 2015 Year-End and 2016 Mid-Year FCPA updates, the Honorable Janet Bond Arterton of the U.S. District Court for the District of Connecticut ruled below that Hoskins, a UK national working for a UK subsidiary of a French company, could not be held liable under the FCPA pursuant to a theory of conspiring with or aiding-and-abetting a person who was subject to the statute where it could not be shown that Hoskins was himself subject to the statute. In an unusual move underscoring the programmatic importance of this issue, DOJ took an interlocutory appeal to the Second Circuit.

The Second Circuit largely affirmed the judgment of the district court, in an opinion authored by the Honorable Rosemary S. Pooler. Specifically, the Second Circuit affirmed the lower court’s ruling that the government may not charge a defendant under the FCPA based on conspiracy or aiding-and-abetting theories if that defendant does not himself fall within one of the “three clear categories of persons who are covered by [the FCPA’s anti-bribery] provisions.” The Court’s opinion extensively reviews the FCPA’s legislative history and concludes that the text of the statute reflected “surgical precision” on its drafters’ part in clearly establishing its jurisdictional reach to specifically exclude foreign persons who are neither agents of U.S. companies and who did not act within the territory of the United States. Thus, under the interpretive principle established in the Supreme Court’s landmark Gebardi decision, such persons likewise cannot be charged with FCPA conspiracy or aiding-and-abetting offenses. The Second Circuit went on to observe that the general presumption against the extraterritorial application of statutes provided an independent basis to preclude the government from charging Hoskins with FCPA conspiracy given an absence of clearly expressed congressional intent to allow conspiracy and aiding-and-abetting liability to broaden the FCPA’s extraterritorial reach. The Court did, however, hold that the government should be permitted to make a showing that Hoskins acted as an agent of a domestic concern (namely, Alstom’s U.S. subsidiary), in which case he could be held liable for conspiring with Alstom’s U.S. employees or other foreign nationals who did act within the territory of the United States.

Given the paucity of appellate decisions interpreting and construing the FCPA, this decision is a significant precedent limiting the government’s ability to prosecute non-resident, foreign defendants who do not act within U.S. territory and are not agents of a U.S. issuer or domestic concern. Of course, DOJ may well respond by attempting to rely on an expanded view of agency liability to reach non-resident defendants who did not act within U.S. territory. Further, as set forth in other portions of this Update, DOJ is increasingly relying upon the money laundering statute as an alternative basis for criminal liability where corrupt transactions pass through the U.S. banking system. As for Hoskins’s case, it has been returned to the District of Connecticut with a March 2019 trial date.

DOJ Secures FCPA Trial Conviction

We reported in our 2018 Mid-Year FCPA Update on the then-pending motion to dismiss of Chi Ping Patrick Ho, the head of a China and Virginia-based NGO who was indicted in December 2017 on FCPA and money laundering charges associated with his alleged role in separate corruption schemes in Chad and Uganda. Following oral argument on July 19, 2018, the Honorable Loretta A. Preska of the U.S. District Court for the Southern District of New York denied Ho’s motion to dismiss the indictment making two separate findings: (1) it is not inconsistent to charge Ho both as a foreign national acting within the territory of the United States pursuant to 18 U.S.C. § 78dd-3 and at the same time as an agent of a domestic concern subject to 18 U.S.C. § 78dd-2—these are factual questions to be addressed by the jury; and (2) that wire transfers from one foreign jurisdiction to another foreign jurisdiction, passing through the United States via a correspondent banking account transfer as most U.S. dollar transactions do, may survive a facial challenge to a money laundering charge. The Court deferred Ho’s due process challenge to the latter charge pending the evidence to be submitted at trial.

Motion to dismiss denied, Ho proceeded to trial. The evidence presented at the seven-day trial included that Ho offered gift boxes containing $2 million in cash to the President of Chad, who rejected the offer and provided no illicit benefit to Ho or his employer. Ho then turned his attention to the second corruption scheme in Uganda, whereby he allegedly paid $500,000 via wire transfer to a purported charitable foundation designated by the Foreign Minister and a $500,000 cash “campaign donation” to the President. On December 5, 2018, after only three hours of deliberation, the federal jury in Manhattan returned a guilty verdict on seven of the eight counts set forth in the indictment, including FCPA and money laundering charges. A key witness for the government at Ho’s trial was Cheikh Gadio, the former Foreign Minister of Senegal alleged to have been Ho’s co-conspirator. Gadio himself had been charged with money laundering, as reported in our 2017 Year-End FCPA Update, but on September 14, 2018 DOJ dismissed that charge. On December 18, 2018, Ho filed a one-paragraph motion to set aside the verdict pursuant to Rule 29(c), which was denied by Judge Preska in a one-word order dated December 19. Ho is scheduled to be sentenced in March 2019.

Court Dismisses Civil FCPA Charges against Former Och-Ziff Executives

In our 2017 Mid-Year FCPA Update, we discussed the SEC’s civil FCPA charges against two executives of New York-based hedge fund Och-Ziff Capital Management Group LLC, Michael L. Cohen and Vanja Baros, arising out of an alleged corruption scheme in various African countries. Cohen and Baros filed separate motions to dismiss the SEC’s charges based on the Kokesh decision, in which the Supreme Court unanimously held that disgorgement is a “penalty” as defined in 28 U.S.C. § 2462 and therefore subject to the five-year statute of limitations. The defendants argued that the conduct alleged in the SEC’s complaint, which occurred between 2007 and 2012, was time-barred.

On July 12, 2018, the Honorable Nicholas G. Garaufis of the U.S. District Court for the Eastern District of New York agreed with the defendants and dismissed the SEC’s charges. In a 32-page memorandum opinion, Judge Garaufis held that: (1) the Court can and should consider a statute-of-limitations defense on a motion to dismiss, determining whether the relief sought by the SEC operates as a penalty based on the allegations set forth in the complaint; (2) the SEC may not allege conduct that is untimely in the complaint only then to seek discovery of whether there are additional violations within the statute-of-limitations period; (3) a tolling agreement executed by Cohen, which would have made timely certain of the SEC’s claims concerning alleged conduct in sub-Saharan Africa, was limited by its express language to the SEC’s initial investigation in Libya and therefore did not encompass investigations that arose from the initial investigation; and (4) the SEC’s claim began to accrue at the time of the alleged violations of law, not when the defendants allegedly received illicit benefits from that misconduct, and in any event the SEC did not specifically allege that the defendants received illicit benefits within the applicable statute-of-limitations period.

Although the Court’s decision is undoubtedly significant for the growing body of FCPA case law, it represents only a partial victory for defendant Cohen. As reported in our 2018 Mid-Year FCPA Update, Cohen has been charged by criminal indictment with FCPA-related offenses arising from his alleged failure to disclose his interest in an African mining operation to a charitable foundation client and subsequent acts to cover up the transaction after the SEC opened an investigation. The criminal case also is before Judge Garaufis, but the allegations, timing, and theory of that case are different and it is unclear whether the statute of limitations will be a viable defense for Cohen. Discovery in that matter is ongoing, with the next status hearing set for February 2019.

Court Dismisses FCPA-Related Charges against Former Military Contractor

In an FCPA-related case that has largely flown under the radar of the FCPA community, in December 2017 DOJ charged former military contractor Charley Dean Hill with making false statements to FBI agents investigating payments by Hill’s employer—a security and infrastructure provider—to obtain government licenses and permits from Iraqi officials. Specifically, DOJ alleged that in a 2010 interview Hill stated falsely that he had never sent cash from Iraq to the United States.

The single-count false statements charge was initially filed by way of criminal information, pursuant to a plea agreement, but then Hill backed out of the plea agreement and was charged by indictment in February 2018. Hill filed a motion to dismiss the indictment on the grounds that it was untimely to charge him nearly eight years after the alleged false statement. DOJ defended on the grounds that it timely sought and received a tolling order pursuant to 18 U.S.C. § 3292, which permits DOJ to toll the statute of limitations for up to three years while it seeks foreign-located evidence from a foreign government pursuant to a Mutual Legal Assistance Treaty. But following a lengthy and spirited oral argument on the motion before the U.S. District Court for the District of South Carolina, the Honorable Henry M. Herlong, Jr. determined that because DOJ did not enumerate the false statements statute (18 U.S.C. § 1001) as one of the crimes under investigation in its § 3292 tolling application, the tolling order did not cover the crime ultimately charged and DOJ’s indictment was untimely. The Court therefore granted Hill’s motion to dismiss.

Defendant Sentenced in HISS Case

As we first reported in our 2015 Mid-Year FCPA Update, in January 2015 DOJ filed a civil action in the U.S. District Court for the Eastern District of Louisiana to forfeit nine New Orleans properties allegedly purchased with the proceeds of corruption involving the former Executive Director of the Honduran Institute of Social Security (“HISS”). Several years later, as discussed in our 2018 Mid-Year FCPA Update, a grand jury returned an indictment charging Carlos Alberto Zelaya Rojas, the nominal owner of the properties, with 12 counts of money laundering and other offenses. The indictment alleged that Zelaya Rojas assisted his brother, the former HISS Executive Director, who was himself criminally charged in Honduras with taking millions of dollars in bribes from two Honduran businessmen, with laundering at least $1.3 million in bribe payments, including through the purchase of the nine New Orleans properties. Following his June 2018 guilty plea to a single count of money laundering conspiracy, on October 3, 2018, Zelaya Rojas was sentenced by the Honorable Martin L.C. Feldman to 46 months in prison, in addition to the forfeiture of the nine properties.

Court Refuses to Consider Motion to Dismiss on Fugitive Disentitlement Grounds

The U.S. District Court for the Southern District of Ohio recently issued a decision in the ongoing prosecution of Azat Martirossian on an important and recurring issue in FCPA and FCPA-related prosecutions. As readers of our updates well know, FCPA and FCPA-related indictments are frequently filed under seal where they wait months or even years for an internationally located defendant to cross a border subject to the long-arm of U.S. law enforcement. But, for a variety of reasons, DOJ will frequently unseal an indictment with one or more defendants still outside of their jurisdictional reach. The oft-recurring question in these cases is whether the international defendant may challenge the basis for their indictment without coming to the United States and physically submitting him or herself to the jurisdiction of the court.

In the instant case, on May 24, 2018, Martirossian—an Armenian citizen and Chinese resident “who has never set foot in the United States”—was added to the Rolls-Royce related indictment most recently described in our 2018 Mid-Year FCPA Update. Weeks later, on June 22, 2018, counsel for Martirossian filed a motion to dismiss the money laundering charges even as Martirossian himself remained outside the United States. DOJ responded by invoking the “fugitive disentitlement doctrine” and asking the Court to hold the motion in abeyance. On October 9, 2018, the Court granted the government’s motion, and stayed Martirossian’s motion “until or unless he submits to the jurisdiction of this Court.” Martirossian has since filed both an interlocutory appeal and a writ of mandamus with the U.S. Court of Appeals for the Sixth Circuit, which both remain pending as of publication.

FCPA-Related Charges Unsealed 10 Years Later

We have been reporting for some time now on the unusual case of Lebanese businessman Samir Khoury. Khoury has long suspected that he was the so-called “LNG Consultant” described in public charging documents arising from the Bonny Island, Nigeria corruption cases of a decade ago, and further that there was an indictment against him filed under seal, just waiting for him to travel to the United States or a country with an extradition treaty. In a remarkably aggressive strategy, Khoury filed multiple civil suits in the U.S. District Court for the Southern District of Texas seeking to unseal the indictment if, as he suspected, it exists. Khoury has gotten his wish.

On July 9, 2018, the Honorable Keith P. Ellison granted Khoury’s motion to unseal a November 2008 indictment charging him with mail and wire fraud offenses arising out of the Bonny Island, Nigeria scheme, as discussed in our 2009 Mid-Year FCPA Update, among others. Within days of the indictment being unsealed, Khoury filed a motion to dismiss the indictment for violation of his rights under the Speedy Trial Act, or, alternatively, as time-barred under the applicable statute of limitations. DOJ responded by arguing that Khoury’s motion should not be considered, under the fugitive disentitlement doctrine, until he appears before the court to answer the charges. A hearing on the motion was held on November 29, 2018, at which Judge Ellison declined for a second time to apply the fugitive disentitlement doctrine. Khoury has moved to compel the government to produce certain additional evidence necessary to file a revised motion to dismiss and a hearing on this motion is scheduled for January 2019.

Third Circuit Affirms FCPA Sentence

We reported in our 2016 Mid-Year FCPA Update on the April 2016 guilty plea of Dmitrij Harder, former owner and president of a Pennsylvania-based consulting company, based on FCPA bribery charges that he made more than $3.5 million in “consulting” payments to the sister of an official of the European Bank for Reconstruction and Development to corruptly influence the award of contracts to clients of Harder’s. As noted in our 2017 Year-End FCPA Update, Harder was sentenced in July 2017 to 60 months in prison by the U.S. District Court for the Eastern District of Pennsylvania.

Harder appealed his sentence to the U.S. Court of Appeals for the Third Circuit, claiming that the District Court failed to meaningfully consider his arguments concerning sentencing disparity and mitigation, including a chart prepared by a law professor concluding that the average sentence for FCPA defendants is only 13 months, as well as a novel argument that Harder deserved a reduced sentence because the Russian energy projects promoted by his bribes had delivered “exceptionally positive economic results” in Eastern Siberia. On November 8, 2018, the Third Circuit affirmed the District Court’s sentence. The Honorable Eugene E. Siler, sitting by designation from the Sixth Circuit, authored the unanimous, unpublished panel opinion finding that the district court had properly considered all of Harder’s arguments for a lower sentence.

2018 FCPA-RELATED POLICY DEVELOPMENTS

DOJ Revises Standard Non-Waiver Agreement Following Fourth Circuit Decision

Non-waiver agreements between companies and DOJ historically have been used as an imperfect truce between companies attempting to preserve privilege protections and DOJ seeking to obtain the benefits of information identified during internal investigations. Pursuant to these agreements, companies agreed to share the work product fruits of their investigations with DOJ and DOJ agreed not to assert that this disclosure constituted a waiver of various privileges. On June 27, 2018, the U.S. Court of Appeals for the Fourth Circuit upset the metaphorical applecart with a significant (though unpublished) decision, In re Grand Jury 16-3817 (16-4), enforcing a non-waiver provision against DOJ. Already its impacts are being seen by all who practice in FCPA matters before DOJ.

To facilitate cooperation with a DOJ investigation, “X Corp.” (whose identity is under seal) executed agreements allowing employees, including a former in-house attorney, to share privileged material in interviews with DOJ while expressly disclaiming waiver. Years later, DOJ subpoenaed the attorney to testify before a grand jury about the same statements made during the interview. X Corp. intervened and sought a protective order.

On appeal from the district court’s denial of the protective order, the U.S. Court of Appeals for the Fourth Circuit reversed. The Court held that the plain language of the agreement with DOJ showed that X Corp. expressly reserved its privileges as to DOJ. Accordingly, X Corp. could assert privilege over the information before the grand jury as if the prior interview never occurred.

In response to the Fourth Circuit’s decision, DOJ has adopted a new form agreement that is significantly less protective of company interests. How this will impact DOJ’s ability to obtain cooperation in corporate FCPA investigations—which is a very complicated issue influenced by many factors beyond privilege—remains to be seen.

Does the “China Initiative” Signal Enhanced FCPA Scrutiny of Chinese Companies?

On November 1, 2018, in the context of announcing criminal and civil enforcement proceedings against a Chinese company, a Taiwanese company, and three Taiwanese nationals in connection with the alleged theft of trade secrets from a U.S. company, then-Attorney General Jeff Sessions declared a “China Initiative” to be led by DOJ’s National Security Division, with participation from other DOJ offices, including the Criminal Division (which houses the Fraud Section / FCPA Unit). While the primary focus of the so-called “China Initiative” seems to on countering economic espionage, lurking among the initiative’s 10 stated goals is to “[i]dentify [FCPA] cases involving Chinese companies that compete with American businesses.”

Although we have been reporting for years on the risks of doing business in China, and our studies have demonstrated that China is the most frequent situs of conduct charged in FCPA enforcement actions, we have seen nothing in the public sphere or our confidential caseload to suggest that DOJ’s FCPA Unit will be departing from its historical focus on conduct rather than nationality. For example, when asked about the China Initiative several weeks later at the ACI FCPA Conference, Unit Chief Daniel S. Kahn responded, “We are prosecutors, and we follow evidence, and that’s what we have always done.” It is noteworthy that although many FCPA cases involve Chinese conduct, far fewer involve Chinese nationals or companies. No doubt this is in significant part due to the jurisdictional challenges of DOJ bringing such an action. All of this is to say, time will tell whether and if so how the China Initiative’s FCPA goal will be operationalized by DOJ’s FCPA Unit, which is led by dedicated, career civil servant prosecutors, many layers removed from those who announced the policy.

Of course, if the Chinese Initiative is perceived as leveraging the FCPA to achieve political objectives, the Chinese government may counter with steps to frustrate DOJ investigations. As we note below, in October 2018, China enacted a new blocking statute, the International Criminal Judicial Assistance Law, that could be used to prevent Chinese companies from providing evidence or assistance to foreign authorities like DOJ.

DOJ Provides Additional Guidance Concerning Criminal Division Monitors

Speaking at the New York University School of Law on October 12, 2018, Assistant Attorney General Brian A. Benczkowski announced a new namesake memorandum (the “Benczkowski Memorandum”) providing additional guidance for the selection of compliance monitors. The memorandum reaffirms prior guidance on this issue from the “Morford Memorandum” of March 2008, while elaborating on considerations Criminal Division attorneys should take into account when deciding whether to require a monitor. These considerations include the potential costs of a monitor, not only in monetary terms but also with respect to “whether the proposed scope of a monitor’s role is appropriately tailored to avoid unnecessary burdens to the business’s operations.”

Benczkowski’s remarks also are of interest in another respect. Monitors have tremendous power and discretion in their activities and, in some situations, the power dynamic leads companies facing what they believe are unreasonable demands to feel that they have little practical recourse. Rejecting the notion that companies should suffer in silence and emphasizing the active role that DOJ should play in policing monitors, Benczkowski remarked that “it is incumbent on our prosecutors to ensure that monitors are operating within the appropriate scope of their mandate” and that “we absolutely want to know of any legitimate concerns regarding the authorized scope of the monitorship, cost or team size.” These are welcome remarks for companies undergoing or facing the prospect of an FCPA monitorship.

Of final note, Benczkowski broke from the recent movement to centralize corporate compliance expertise within a single “compliance counsel” position, and declared a renewed focus on “a workforce better steeped in compliance issues across the board.” To that end, he announced as a priority the hiring of attorneys not only with courtroom prosecutorial experience, but with experience evaluating corporate compliance programs to supplement the already talented and experienced DOJ workforce.

DOJ Extends FCPA Corporate Enforcement Policy to M&A

In a July 25, 2018 speech before ACI’s Global Forum on Anti-Corruption Compliance in High Risk Markets, Deputy Assistant Attorney General Matthew S. Miner announced important guidance for companies that identify FCPA issues in pre-acquisition due diligence or post-acquisition compliance integration. Specifically, acknowledging that DOJ wishes to encourage M&A activity by companies with strong compliance programs and not to have “the specter of enforcement . . . be a risk factor that impedes such activity by good actors,” Miner announced that “we intend to apply the principles contained in the FCPA Corporate Enforcement Policy to successor companies that uncover wrongdoing in connection with mergers and acquisitions and thereafter disclose that wrongdoing and provide cooperation, consistent with the terms of the Policy.” One month later, at a GIR Live event, Miner expanded his comments to make clear that they apply to “other types of potential wrongdoing, not just FCPA violations,” unearthed in connection with an acquisition and disclosed to DOJ.

These announcements make good policy sense given the number of FCPA enforcement matters that arise from acquisitions, including notably in 2018 the Polycom matter described above.

2018 FCPA-RELATED PRIVATE CIVIL LITIGATION

The FCPA does not provide a private right of action, but as we often note, civil litigants long have pursued a variety of causes of action against companies in connection with FCPA-related conduct, with varying success. The second half of 2018 certainly was no exception. Examples of matters with material developments over the past six months include:

Shareholder Lawsuits

- Freeport-McMoRan Inc. – As covered in our 2016 Mid-Year FCPA Update, on January 26, 2016, shareholders filed a securities fraud class-action alleging that the international mining company failed to disclose bribery in Indonesia. The suit followed reports that the Indonesian House of Representatives was investigating payments by a senior executive of Freeport Indonesia to the speaker of the House. On August 3, 2018, the Honorable Diane J. Humetewa of the U.S. District Court for the District of Arizona granted Freeport’s motion to dismiss. The Court found, among other things, that plaintiffs failed to plead sufficient facts to plausibly claim that the executive attempted to bribe Indonesian officials. Rather, the pleadings only left open this possibility and suggested that Freeport Indonesia may have been solicited for a bribe and not itself committed any wrongdoing.

- General Cable Corp. – On July 23, 2018, the Honorable William O. Bertelsman of the U.S. District Court for the Eastern District of Kentucky granted General Cable’s motion to dismiss a putative class action, which contended that the company inflated its stock value by failing to disclose that employees of its foreign subsidiaries had violated the FCPA in connection with the conduct ultimately leading to General Cable’s December 2016 resolutions with DOJ and the SEC described in our 2016 Year-End FCPA Update. In dismissing the suit, the Court concluded that plaintiffs had not met the stringent pleading standard for breach-of-prudence claims based on non-public information and that their breach of loyalty and duty to monitor claims were similarly deficient. The plaintiffs have noticed an appeal to the U.S. Court of Appeals for the Sixth Circuit.

- Grupo Televisa S.A.B. – On August 6, 2018, shareholders filed an amended complaint against ADR-issuer and Mexican media giant Grupo Televisa in the U.S. District Court for the Southern District of New York, alleging that it failed to disclose the payment of millions of dollars in bribes to secure broadcast rights for the FIFA World Cup. The action came after the former CEO of Argentine sports marketing company Torneos y Competencias (which, as covered in our 2016 Year-End FCPA Update, entered into a $113 million, four-year deferred prosecution agreement) testified at the corruption trial of three former FIFA officials that Grupo Televisa had participated in the scheme. This witness previously pleaded guilty in November 2015 to wire fraud and other charges and agreed to testify on the government’s behalf. Grupo Televisa moved to dismiss the complaint on October 15, and the plaintiffs filed their opposition on November 16, 2018.

- KBR Inc. – On August 31, 2018, the Honorable Ewing Werlein, Jr. of the U.S. District Court for the Southern District of Texas dismissed an investor class action lawsuit filed soon after the Serious Fraud Office announced in April 2017 that it was investigating KBR in connection with its ongoing Unaoil investigation. In dismissing the case, the Court noted that the “Plaintiffs act as if the opening of an investigation is all they need to make wholesale allegations of bribery against KBR.” Although the Court granted leave to file an amended complaint, none was filed, and the case was terminated on September 24, 2018.

- Rio Tinto plc – On August 31, 2018, the Honorable Andrew L. Carter of the U.S. District Court for the Southern District of New York dismissed an investor lawsuit alleging that former executives of the mining company bribed an acquaintance of Guinea’s then-President to maintain mining contracts in the country and misled investors by failing to disclose the alleged bribery. The suit came on the heels of Rio Tinto notifying authorities in the United States, the United Kingdom, and Australia that it was investigating a payment to the third party. Rio Tinto moved to dismiss for, among other reasons, failure to state a claim, arguing that the payment was not made to a “foreign official” and therefore did not violate the FCPA. In granting the motion to dismiss, Judge Carter agreed that plaintiffs failed adequately to allege that the recipient of the payments in question was a “foreign official,” and likewise rejected that the recipient could be an “instrumentality,” a term he found covers entities, not individuals.

Civil Fraud / RICO Actions

The multi-billion-dollar resolution between Odebrecht S.A. and authorities in Brazil, Switzerland, and the United States discussed in our 2016 Year-End FCPA Update has spurred civil litigation in federal court with the Brazilian construction conglomerate. In June 2017, investment funds filed a civil fraud suit in the U.S. District Court for the Southern District of New York, alleging that the Odebrecht bonds they purchased lost value when the scandal broke. On August 8, 2018, the U.S. District Court for the Southern District of New York allowed certain federal and state law claims to proceed.

This is not the only suit against Odebrecht stemming from the resolution discussed above. On June 12, 2018, Ecuadorian manufacturer Plastiquim and its owner initiated a suit in Florida state court against Odebrecht and others alleging fraud, RICO violations, conspiracy, and unfair business practices. According to the filings, Odebrecht failed to disclose that a business loan Plastiquim obtained through an Odebrecht affiliate was a vehicle for laundering money tied to Odebrecht’s bribery scheme. On December 18, 2018, Odebrecht filed a motion to dismiss the complaint.

2018 INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

World Bank Enforcement

The World Bank Group continued its active role in global anti-corruption enforcement. In its most-recent fiscal year, the World Bank debarred 78 firms and individuals, recognized 73 cross-debarments from other multilateral development banks, and referred 43 matters to national authorities.

Europe

United Kingdom

Alstom Executives

On December 19, 2018, a global sales manager for Alstom Power Ltd.’s Boiler Retrofits unit, Nicholas Reynolds, was found guilty of conspiracy to corrupt by a jury at Blackfriars Crown Court. Two days later, he was sentenced to 4.5 years in prison and made to pay costs of £50,000. As a result of Reynolds’ conviction, the Serious Fraud Office (“SFO”) lifted reporting restrictions and revealed additional details of the investigation dating back several years.

Reynolds was charged at the same time as John Venskus, the former Business Development Manager at Alstom Power Ltd., who pleaded guilty in October 2017 and was sentenced to 3.5 years in prison. Göran Wikström, the former Regional Sales Director at Alstom Power Sweden AB, also pleaded guilty in June 2018 and was sentenced to 31 months in prison and made to pay £40,000 in costs.

Reynolds, Venskus, and Wikstom allegedly were part of a conspiracy to bribe officials and politicians to secure contracts for a Lithuanian power station. The SFO alleged that they falsified records to circumvent bribery and corruption controls, causing Alstom companies to pay more than €5 million to secure contracts worth €240 million. Alstom Power Ltd. pleaded guilty to conspiracy to make corrupt payments in May 2016 and paid a fine of £6.3 million, compensation to the Lithuanian government of nearly £11 million, and prosecution costs of £700,000.

The SFO further reported that, on April 10, 2018, Alstom Network UK Limited was found guilty of one count of conspiracy to corrupt in relation to bribes allegedly paid to win a Tunisian tram and infrastructure contract. The company and two former executives were acquitted of other charges relating to Indian and Polish transport contracts.

Earlier in this Update we discuss the declination letter received by UK seismology company Güralp Systems Limited for alleged payments to Heon-Cheol Chi, Director of the KIGAM Earthquake Research Center in Korea. As noted above, one of the principal reasons asserted by DOJ in support of its declination was Güralp’s commitment to accepting responsibility in connection with an ongoing SFO investigation. Although no corporate resolution has yet been reached with Güralp, three of its former executives—founder Cansun Güralp, former managing director Andrew Bell, and former head of sales Natalie Pearce—have been charged by the SFO with conspiracy to make corrupt payments in violation of Section 1 of the Criminal Law Act 1977 and Section 1 of the Prevention of Corruption Act 1906. Trial dates have not yet been set.

Gulnara Karimova Asset Seizure

We reported in our 2016 Mid-Year and 2017 Year-End FCPA updates on the foreign bribery resolutions involving alleged bribes to Gulnara Karimova, daughter of the late Uzbek President, to influence telecommunications matters in Uzbekistan. On October 3, 2018, the SFO issued a claim in the High Court in London against Karimova and acquaintance Rustam Madumarov, pursuant to the Proceeds of Crime Act 2002, to recover assets that were allegedly obtained using the bribes. A hearing on the matter has yet to be scheduled. For her part, Karimova is reportedly serving a sentence of house arrest in Uzbekistan.

ENRC Ruling

On September 5, 2018, the English Court of Appeal issued judgment in The Director of the Serious Fraud Office and Eurasian Natural Resources Corporation Limited, reversing a highly criticized High Court judgment, finding that interviews conducted by outside lawyers and work conducted by forensic accounts in an internal investigation is covered by legal privilege. For more on this important decision, please see our Client Alert, “Court of Appeal in London Overturns Widely Criticised High Court Judgment in SFO v ENRC.”

Look for much, much more on UK white collar developments in our forthcoming 2018 Year-End United Kingdom White Collar Crime Update, to be released on January 22, 2019.

Greece

More than two years after trial began in the so-called cash-for-contracts scandal, Prodromos Mavridis—a former telecommunications manager for Siemens’ Greek affiliate—testified in October 2018 that he did not pay politicians from a slush fund to secure state contracts. Mavridis, whose testimony centered on a contract for Siemens to digitize the network of OTE, Greece’s primary telecommunications provider, testified that Siemens’ Managing Board had unfairly pinned on him responsibility for the slush fund. The trial, which has been postponed repeatedly, continues more than a decade after authorities first launched a probe into Siemens’ activities.