Securities Enforcement 2025 Year-End Update

Client Alert | February 4, 2026

The SEC’s 2025 enforcement agenda reflected sweeping changes in leadership, priorities, and personnel, yielding dismissals, process reforms, and a new leadership structure within the Enforcement Division.

In 2026, with Chairman Paul Atkins’s team in place and the new Enforcement Director’s senior staff appointed, the year will test how they lead a smaller workforce to advance the Commission’s mission to protect investors, facilitate capital formation, and maintain fair, orderly markets.

New Leadership

As with last year, 2026 opens with a newly constituted three-member Commission—this time, all three from the President’s party and generally aligned, especially on enforcement.[1] As set forth in our Securities Enforcement 2025 Mid-Year Update, Chairman Atkins arrived with a wealth of experience at the Commission. Since taking office on April 21, 2025, he has assembled his executive team and publicly set out his priorities. In September 2025, he named Judge Margaret Ryan as Enforcement Director. Her career includes service as a senior judge on the U.S. Court of Appeals for the Armed Forces and as a judge advocate in the U.S. Marine Corps, as well as roles as a law firm partner and U.S. Supreme Court clerk. In the press release announcing her appointment, she emphasized addressing investor harm and combating fraud and manipulation in the financial markets.

Judge Ryan’s leadership team includes several senior staff with decades of experience at the SEC.[2] She joined a very experienced Commission, led by an exceptionally knowledgeable Chairman, and brings deep legal and analytical skills in addition to leadership and experience working in large organizations with significant missions that affect the public.

Rounding out the Enforcement Division’s national leadership team, on January 12, 2026, the Commission announced two new Deputy Directors from private practice: one to oversee enforcement in the Chicago, Atlanta, and Miami Regional Offices, and the other in the New York, Boston, and Philadelphia Regional Offices. Both are returning to public service, and Judge Ryan noted their “wealth of experience as trial, litigation, and appellate lawyers.” In the press release announcing their appointments, the appointees said they look forward to “identifying and pursuing sensible enforcement actions” and the “proper enforcement of U.S. securities laws,” echoing themes articulated by Chairman Atkins and Director Ryan.

Staff Reductions

The beginning of 2025 and the new administration brought sweeping changes to federal agencies, and the SEC experienced a significant reduction in its workforce. In a May 2025, SEC Town Hall speech, Chairman Atkins noted that departures from October 2024 to May 2025 had reduced the SEC’s headcount by approximately 15%, to approximately 4,200 employees and 1,700 contractors, down from May 2024 staffing levels of approximately 5,000 employees and 2,000 contractors.[3]

The SEC’s FY 2026 Budget Request to Congress referenced “a focus on returning to the core mission that Congress set for the agency” and requested $2.149 billion in support of 4,101 full-time equivalents (FTEs). The budget request was flat as compared to budgets for FY 2025 and FY 2024 but reflects a net reduction of 447 FTEs as compared to FTE levels for FY 2025 due to attrition from early retirement and buyout offers. For the Enforcement Division, the SEC’s largest division by headcount, the SEC requested budget for 1,178 FTE for FY 2026, down almost 17% from 1,424 actual FTE in FY 2024.

ENF Statistics

In October 2025, only a week after the close of FY 2025, Chairman Atkins signaled his perspective on tracking enforcement statistics: “If we reward the staff only for bringing enforcement actions, then we have discouraged the staff from determining not to recommend an enforcement action. A basic tenet of management is, ‘You get what you measure.’ The wrong incentives make it more difficult for the staff to follow the evidence and the law wherever it leads and instead encourage the staff to stretch the boundaries of existing law.”[4]

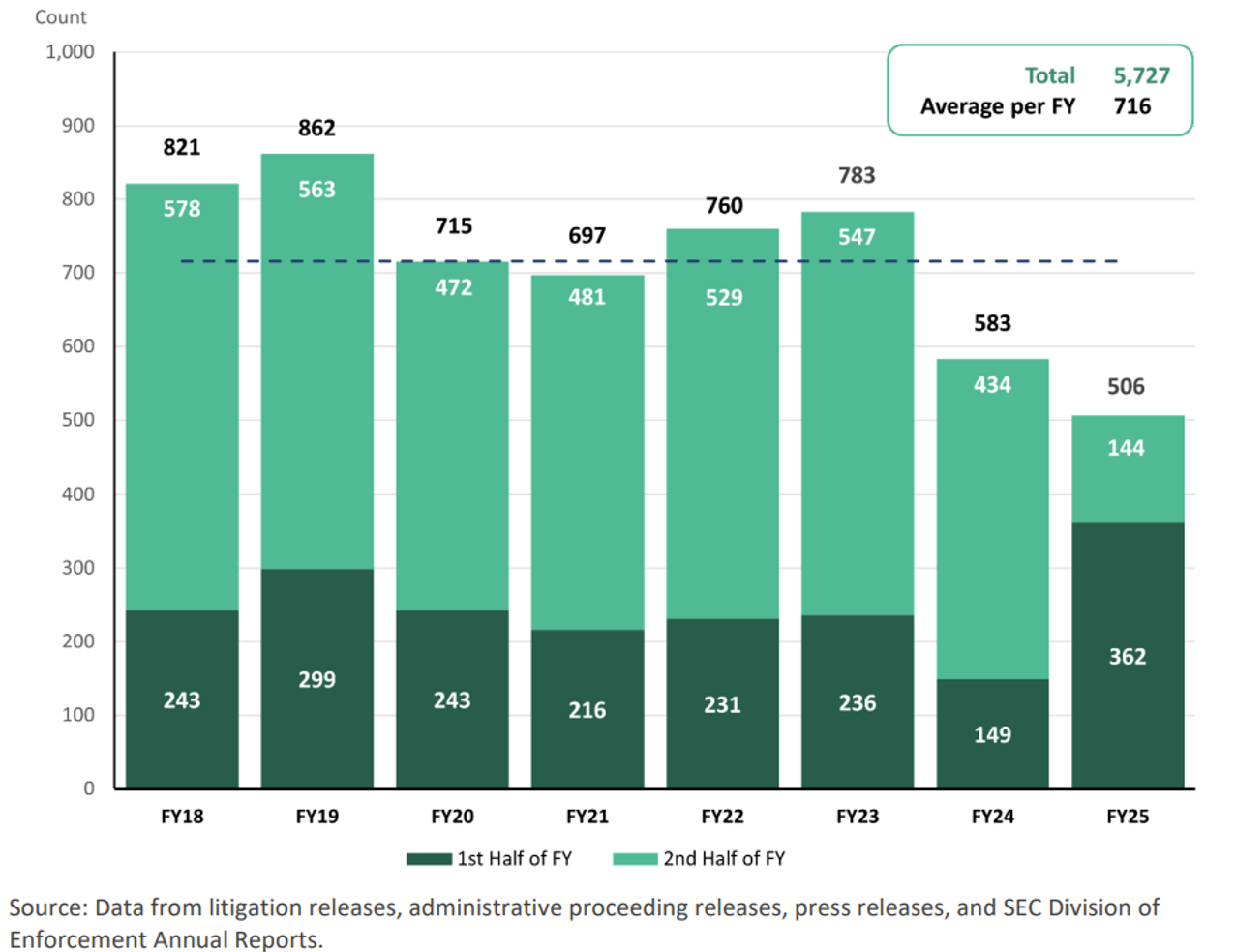

It may not come as a surprise, then, that the SEC has not yet publicly announced enforcement statistics for FY 2025. However, publicly available analysis by economists at The Brattle Group shows 506 enforcement actions in FY 2025, a 13% decline from FY 2024 levels. Enforcement actions brought in the second half of FY25 – which would coincide with Chairman Atkin’s arrival at the SEC – marked “an unprecedented decline in enforcement activity.”[5]

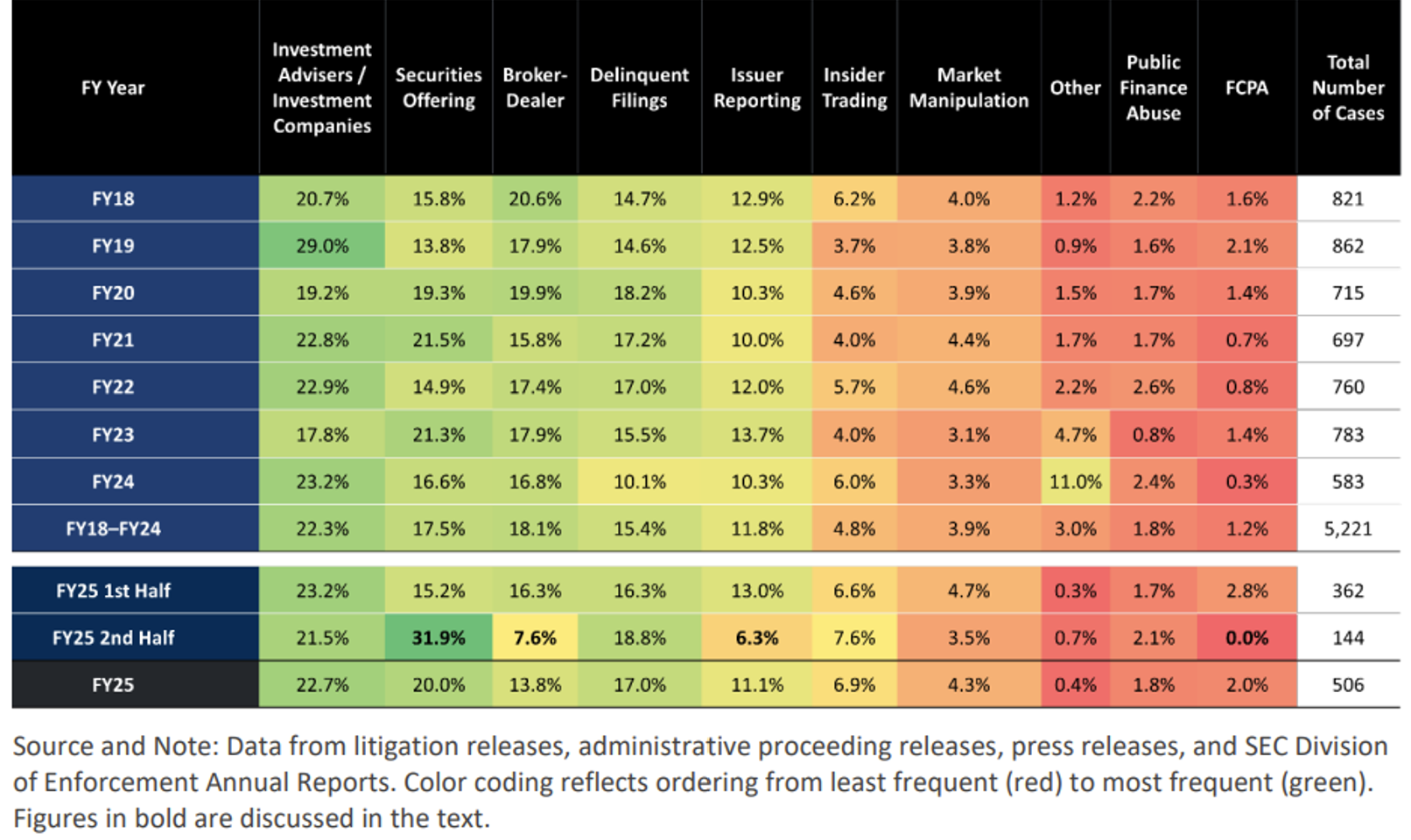

|

Frequently-brought enforcement actions in FY2025 involved investment advisers, insider trading and private placement offering frauds. Under Chairman Atkins’ tenure, enforcement actions involving offering frauds have doubled while those involving public company reporting is down by half. Perhaps unsurprisingly, the Commission instituted no new FCPA enforcement actions in the second half of FY 2025.[6]

|

Case Dismissals – Commission Exercises Its Discretion

Perhaps the most notable enforcement actions in 2025 were those that resulted in a wave of case dismissals of actions initiated by prior administrations – notably those involving crypto, FCPA, and cyberbreach disclosure. Our 2025 Mid-Year Update covered dismissals of several enforcement actions against certain digital asset and crypto platforms citing the Commission’s exercise of its “discretion” and “its judgment that the dismissal will facilitate the Commission’s ongoing efforts to reform and renew its regulatory approach to the crypto industry not on any assessment of the merits of the claims alleged in the action.”[7]

But crypto was not the only area in which the Commission exercised its discretion to dismiss cases it had previously announced and litigated.

Similar language referencing the SEC’s “exercise of its discretion” accompanied the dismissal of the SolarWinds lawsuit after two years of litigation that arose from the SUNBURST cyberattack. In July 2024, the court dismissed most of the SEC’s claims, except for a securities fraud claim based on a Security Statement on the company’s website. Defendants moved for summary judgment in April 2025, and, before there was any decision, on November 20, 2025, the Commission sought dismissal of the remaining claims with prejudice.

In the second half of 2025, the SEC also dismissed ongoing civil enforcement actions against executives who were charged in parallel criminal actions, had gone to trial, been convicted and were granted Presidential clemency. The oldest of the cases was against Devon Archer who was charged by the SEC in 2016 for defrauding investors in a Native American tribal bond scheme. Archer was convicted in June 2018 in a parallel criminal action brought by the U.S. Attorney’s Office for the SDNY. He received a presidential pardon on March 25, 2025 and the SEC announced dismissal of its civil enforcement action on September 18, 2025 “in the exercise of its discretion.”

In July 2021, the Commission announced charges against Trevor Milton, the founder of Nikola Corporation, for securities fraud; the U.S. Attorney’s Office for the SDNY brought parallel criminal charges. In December 2023, Milton was found guilty after a criminal trial of making false and misleading statements to investors and on March 27, 2025, he was granted a full and unconditional pardon. On September 11, 2025, the Commission dismissed its civil enforcement action against Milton “in the exercise of its discretion.”

Similarly, in February 2023, the SEC charged Ozy Media and its CEO Carlos Watson with securities fraud and a parallel criminal action was brought by the U.S. Attorney’s Office for the EDNY on the same day. In July 2024, Watson and Ozy Media were convicted after an eight-week trial and on March 28, 2025, they were granted commutations of their sentences with no further fines, restitution, probation, or other conditions. On September 18, 2025, the Commission dismissed its case against both defendants.

In August, the SEC filed a Joint Stipulation of Dismissal together with Ripple, a cryptocurrency company, its co-founder and chairman, and its CEO, dismissing the SEC’s appeals and company’s cross-appeal.[8] The SEC had alleged the defendants failed to register offers and sales of digital assets, including personal unregistered sales of approximately $600 million by the two individual defendants. The Joint Stipulation resolves the action against defendants and leaves the final judgment in effect, which imposed a civil penalty of over $125 million against the company.

The Commission’s exercise of its discretion to dismiss cases has continued into 2026. In early January, the SEC dismissed an enforcement action against the former CFO of a mining company who had been charged in 2017 with fraud for inflating the value of coals assets.[9] After eight years of litigation and despite surviving a summary judgment motion in February 2025 the Commission dismissed the case with prejudice.

Process Changes – Wells Process, Formal Orders

In his initial remarks to the staff in May 2025, Chairman Atkins highlighted the values of “[p]redictability, due process, rule of law, integrity” and “project[ing] a sense that one can get a fair shake without vindictiveness or ulterior motives.”[10] This sentiment underlies process changes during Chairman Atkins’ tenure, including announced modifications to the Wells process and coordination of waiver requests when a company seeks to settle an enforcement action with potential collateral consequences, such as on its ability to raise capital efficiently.

In a statement on September 26, 2025, Chairman Atkins announced the return to simultaneous consideration of settlement offers and related requests for waivers from collateral consequences (e.g., losing well-known seasoned issuer (WKSI) status, statutory safe harbors for forward-looking statements, and Regulation D exemptions).[11] He stated that the return to simultaneous consideration provides certainty to settling parties and efficiencies for the Commission and its staff.

In remarks delivered on October 7, 2025, Chairman Atkins announced that enforcement staff, in giving a Wells notice, will provide sufficient information for potential respondents or defendants to understand the potential charges and evidentiary basis for the charges, including testimony transcripts and key documents. Chairman Atkins stated that staff “must be forthcoming about material in the investigative file . . . and the staff must make every effort to share information it has gathered” subject to statutory and programmatic limitations.[12] The Chairman also extended the Wells submission period to at least four weeks for potential respondents and defendants. However, in the months since the Chairman’s speech, our experience is that staff willingness to share the investigative record during the Wells process remains inconsistent.

In articulating values for the enforcement program, the Chairman stated “when the Commission exercises its enforcement authority, it does so fairly, transparently, and with the procedural rigor that engenders confidence in our work.”[13]

Looking Forward

The Enforcement Division under Chairman Atkins and Enforcement Director Judge Ryan, will bring cases to “hold[] accountable those who lie, cheat and steal.”[14] With a reduced headcount and loss of experienced staff, we anticipate the Commission will focus on “cases of genuine harm and bad acts” and back-to-basics enforcement actions in traditional areas: large-scale offering frauds, insider trading, investment adviser and broker-dealer regulatory compliance violations, and public company reporting and disclosure violations. The Commission is unlikely to tout creative or first-in-kind enforcement actions.

Two areas of note include the Commission’s most recent actions against investment advisers and the establishment of the Cross-Border Task Force:

Investment Advisers

Registrants should be aware that the Commission has brought several cases in the last six months against investment advisers where the conduct does not appear to have involved genuine investor harm or outright fraud. These cases include instances of alleged misrepresentations made in Forms ADV,[15] failure to disclose conflicts of interest,[16] and failing to comply with specific rules relating to marketing, recordkeeping, and the implementation of an effective compliance program.[17]

Foreign Issuers

Another likely enforcement focus is foreign issuers that the Commission views as exploiting U.S. capital markets and the gatekeepers who enable their access. In line with the Administration’s America First Investment Policy, in September 2025 the Commission formed a Cross-Border Task Force to investigate foreign-based issuers for potential market manipulation—such as pump-and-dump schemes—and to increase scrutiny of gatekeepers, particularly auditors and underwriters, who facilitate foreign issuers’ access to the U.S. capital markets. See our Client Alert on the Cross-Border Task Force.

Since the announcement of the Cross Border Task Force, the SEC has issued over a dozen orders for trading suspensions against Asia-based companies because of “potential manipulation” of the foreign issuers’ securities made to investors by unknown persons via social media. The thirteen trading suspensions announced in the last four months is almost twice the number of trading suspensions instituted in the three years – 2022-2024 – combined.

Personnel

Significant changes occurred at the senior staff level and in regional leadership this year:

Appointments

Enforcement Division

In August, Judge Margaret Ryan was named Director of the Division of Enforcement, effective September 2, 2025.[18] Judge Ryan was previously a senior judge of the United States Court of Appeals for the Armed Forces.

- With the appointment of Judge Ryan as Director, Sam Waldon, who had been serving as Acting Director, returned, temporarily, to his role as Chief Counsel, only to transition once again to take on his current role as Deputy Director of the Enforcement Division.

- Mark Cave has moved from his prior role as an Associate Director to become Chief Counsel of the Enforcement Division.

- In January 2026, Paul H. Tzur and David M. Morrel were named as Deputy Directors of the Division of Enforcement.[19] Tzur joined the Commission on January 6, 2026, as the Deputy Director overseeing the agency’s enforcement program in the Chicago, Atlanta, and Miami Regional Offices. Mr. Morrell joined the Commission on January 12, 2026, as the Deputy Director overseeing the agency’s enforcement program in the New York, Boston, and Philadelphia Regional Offices, replacing the position previously held by Antonia Apps.

Other Divisions and Senior Leadership

- In September, James J. Moloney was named Director of the Division of Corporation Finance with Acting Director Cicely LaMothe returning to her role as Deputy Director of the Division.[20] Moloney served at the SEC as an attorney-advisor and later special counsel in the Division of Corporation Finance’s Office of Mergers & Acquisitions between 1994 and 2000, and then as a partner at Gibson, Dunn & Crutcher LLP, including as co-chair of the firm’s securities regulation and corporate governance practice group.

- On January 20, 2026, Christina M. Thomas was named as deputy director and chief advisor on disclosure, policy, and rulemaking in the Division of Corporation Finance. Ms. Thomas previously served as counsel to SEC Commissioner Elad L. Roisman and began her legal career as an attorney-adviser in the Division of Corporation Finance, where she worked with Mr. Moloney.

- In September, the Jon Kroeper was named Deputy Director of the Division of Trading and Markets.[21] Kroeper previously served twice at the Commission, including from 1994 to 2000 as an attorney-advisor, senior counsel, and counselor to a commissioner, and from 2005 to 2007 as counselor to a commissioner and to the Chairman. Mr. Kroeper also spent 17 years at the Financial Industry Regulatory Authority, from 2007 to 2024, where he served as an executive vice president in the market regulation department. Most recently, Mr. Kroeper served as a senior consultant at Patomak Global Partners.

- In December, the SEC announced that Dr. Joshua T. White would return to the agency beginning the week of January 5, 2026, to serve as Chief Economist and Director of the Division of Economic and Risk Analysis.[22] White previously served at the SEC in multiple economic roles, including as a financial economist, visiting academic scholar, and expert consultant, where he contributed to economic and cost-benefit analysis supporting Commission rulemaking and enforcement initiatives. Most recently, Dr. White occupied the role of senior advisor and acting chief economist at the PCAOB.

- In July, George R. Botic was designated to serve as Acting Chair of the Public Company Accounting Oversight Board (PCAOB), following the resignation of PCAOB Chair Erica Y. Williams.[23] Botic, a Certified Public Accountant, served as a PCAOB Board Member since October 2023, and previously held several senior leadership roles at the PCAOB, including Director of the Division of Registration and Inspections, Director of the Office of International Affairs, Special Advisor to a former PCAOB Chair, and Deputy Director of the Registration and Inspections Division.

Investment Advisers

Breach of Duty, Misleading Disclosures

In June, the SEC settled an ongoing lawsuit against two affiliated investment advisers, and two associated persons (the portfolio managers) for allegedly misrepresenting the risks of a “net short” options strategy and their risk management.[24] The SEC alleged breaches of fiduciary duty and material misstatements about worst-case loss estimates and fund risks, which helped grow assets under management and generate millions in compensation even as losses at one point exceeded $1 billion. Without admitting or denying, the defendants consented to permanent injunctions and agreed to pay more than $4.5 million in penalties and disgorgement. The two portfolio managers also accepted conduct-based injunctions, one for three years and the other for one.

In July, the SEC announced settled charges against an investment adviser for allegedly breaching its fiduciary duty by failing to disclose broker-dealer conflicts that generated additional fees, and for overbilling and backdating documents by its former chief compliance officer and former president.[25] The adviser allegedly led clients to believe an unaffiliated clearing broker set their fees while failing to disclose that client bills included an affiliated broker-dealer’s markups. The SEC also alleged that: the adviser overbilled clients on certain alternative investments; failed to return prepaid advisory fees on terminated accounts; and produced to Exam staff backdated materials purporting to memorialize annual compliance reviews over three years. Without admitting or denying the allegations, the adviser agreed to pay $1,750,000; the former chief compliance officer, $10,000; and the former president, $20,000. The SEC noted the adviser’s remedial efforts, including reimbursing clients.

In August, the SEC settled charges with two investment advisers for allegedly failing to adequately disclose conflicts when recommending an affiliated managed account service.[26] The SEC alleged the advisers misled clients by recommending enrollment without disclosing financial incentives—bonuses and raises—to steer clients into the service, and that the advisers lacked adequate policies and procedures for such recommendations. Without admitting or denying, each adviser agreed to a $750,000 civil penalty, and one also agreed to approximately $4.5 million in disgorgement.

Also in August, the SEC settled charges with another adviser for allegedly failing to adequately disclose conflicts when recommending the managed account service.[27] The SEC alleged the firm did not adequately disclose that it incentivized its advisors—through bonuses, salary increases, and sometimes promotions—to enroll and keep clients in the service, and failed to adopt and implement reasonably designed policies and procedures. Without admitting or denying, the adviser agreed to a $19.5 million civil penalty.

In September, the SEC announced a settled district court action against two investment advisers and the person who controlled both for fiduciary breaches and material misrepresentations to private funds and their investors between 2017 and 2022.[28] The SEC alleged three categories of misconduct: (i) causing funds to make short-term, below-market loans to one of the advisers—including to cover shortfalls at other funds—in violation of partnership agreements and without disclosure; (ii) sending misleading investor letters during an attempted buyout of limited partnership interests that failed to disclose conflicts or obtain consent; and (iii) making material misstatements in marketing and offering materials for a multi-strategy fund regarding the auditor’s existence, assets under management, investment strategy, and the adviser’s regulatory filing status. Without admitting or denying the allegations, the defendants consented to injunctions and agreed to pay more than $9.5 million in penalties and disgorgement.

In November, the SEC filed litigated district court actions against six purported investment advisers, alleging material misrepresentations and unsubstantiated statements in Forms ADV regarding, among other things, their organizations, office locations, assets under management, and clients.[29] The SEC alleged that the entities made various claims in ADV filings submitted in 2023 and 2024 that it has been able to substantiate. The claims include that the funds managed between $1 million and $10 million in assets in the United States, advised private funds, and that a separate registered investment adviser reported information about the private funds. The SEC states that each registrant has failed to respond to requests for books and records to substantiate information on the Forms ADV. The SEC’s complaints seek injunctive relief and civil penalties.

Specific Rules – Custody, Marketing, Reg SP, Reg M

In August, the SEC announced settled charges against an investment adviser for allegedly:

Violating the Custody Rule by failing to comply with the independent verification requirement for client funds and securities over which it had custody.[30] The SEC alleged that the adviser violated the Custody Rule by failing to arrange for the required surprise examinations from at least 2018 through 2024. Without admitting or denying the SEC’s findings, the adviser agreed to pay a $50,000 civil penalty.

Violating Rule 105 of Regulation M by purchasing equity during the restricted period. The SEC alleged the adviser shorted securities and then purchased the same securities in a covered offering for six private fund clients, outside any Rule 105 exception, obtaining shares at a discount to market.[31] Without admitting or denying the SEC’s findings, the investment adviser agreed to pay a civil penalty of $250,000. The SEC noted the adviser’s cooperation and remedial efforts.

Breaching its fiduciary duty to its private fund clients when it failed to credit certain transaction fees to reduce the cost of management fees, as agreed to under the applicable limited partnership agreements.[32] The SEC alleged that the adviser’s failure to offset the management fees resulted in more than $500,000 in excess fees. Without admitting or denying the SEC’s findings, the investment adviser agreed to pay a penalty and disgorgement totally more than $680,000, and to distribute funds to affected limited partners.

In September, the SEC filed a district court action against an individual and his newly-formed advisory firm with breaches of fiduciary duties and violations of Reg SP relating to the individual defendant’s in launching the new advisory firm while still employed at another investment adviser.[33] The complaint alleges that by spring 2023 the defendant had misappropriated his then-employer’s clients’ nonpublic personal information (PPI)—including names, contact details, account balances/values, fees, and other data—emailing it to himself and to his future business partner. He also allegedly breached his fiduciary duty at his prior firm by placing a client in investments contrary to the client’s instructions, leading to his termination. Shortly thereafter, he launched his own advisory firm and allegedly fraudulently induced prospective advisory clients to hire his new firm by misrepresenting his disciplinary history and prior termination on the firm’s website and in the adviser’s brochure. The complaint seeks permanent injunctions, disgorgement, and civil penalties.

Also in September, the SEC announced a settled action against an investment adviser for alleged violations of the marketing, recordkeeping, and compliance program rules.[34] The SEC alleged that the adviser disseminated marketing claims stating “it refused all conflicts of interest” while recognizing various conflicts of interest in its Form ADV Part 2A brochure and, therefore, lacked a reasonable basis for believing it would be able to substantiate the claim in its advertisement. The SEC also alleged that the adviser failed to retain copies of advertisements for the required periods and violated the Compliance Rule by failing to implement and annually review its recordkeeping compliance policies and procedures. Without admitting or denying the findings, the adviser agreed to comply with remedial undertakings including conducting a compliance review and providing certifications, and to pay a $75,000 civil penalty. The SEC noted remedial efforts undertaken by the adviser and its cooperation, including removal of the advertisement and retention of compliance consultants and a third-party firm to assist with books and records preservation.

In November, the SEC instituted settled actions against:

An investment adviser and its principal for allegedly failing to annually review the adequacy of its compliance policies and procedures and to implement those policies.[35] The SEC alleged that the adviser repeatedly failed to conduct annual compliance reviews, to maintain accurate fee disclosures, to obtain written advisory agreements with clients, and to maintain required records of brochure delivery, and that the principal caused certain of the firm’s violations despite prior SEC enforcement actions and examination findings. Without admitting or denying the findings, the firm agreed to certain undertakings, including retaining an independent compliance consultant, and to pay a $150,000 civil penalty.

A dual registered broker-dealer and investment adviser for alleged violations of Reg S-ID and Reg SP. Specifically, the SEC alleged the firm failed, between 2019 and 2024, to adopt and implement written policies and procedures reasonably designed to protect customer records and information and protect against identity theft.[36] The SEC alleged that inadequate policies and controls contributed to email account takeovers at several branch offices exposing records and customer information and affecting thousands of individuals. Without admitting or denying the findings, the firm agreed to pay a $325,000 civil penalty. The SEC noted extensive remedial measures undertaken by the firm, including enhancements to information security and cybersecurity programs.

An investment adviser for allegedly causing a registered investment company to violate the requirement that its financial statements be certified by an independent public accountant.[37] The SEC alleged that the accountant hired to audit the fund violated the independence rules set by the Commission and the Public Company Accounting Oversight Board because the auditor’s wife held investments in the fund, which the adviser was allegedly aware of. Without admitting or denying the findings, the adviser agreed to pay a $10,000 civil penalty.

Fraud Actions

The SEC filed a number of enforcement actions alleging fraud by investment advisers, or purported advisers. Many of these cases alleged Ponzi schemes and other offering frauds not catalogued here. Below we note cases alleging more particularized fraud.

In July, the SEC commenced an unsettled district court action against an investment adviser and its CEO alleging fraudulent billing practices.[38] The complaint alleged that the defendants charged unauthorized and undisclosed fees totaling more than $2.4 million, including circumventing their brokerage firm’s requirement for direct client authorization of additional fees by logging into client’s accounts without consent. The SEC seeks disgorgement, civil penalties, and permanent injunctions against both defendants, as well as a permanent bar from acting as or being associated with a broker, dealer, or investment adviser.

An investment adviser, its CEO, and its largest sub-adviser for allegedly engaging in a multi-year fraud to conceal losses from investors.[39] The SEC’s complaint says that the defendants (1) concealed losses of over $350 million for hedge funds they advised, including by fabricating documents to deceive the funds’ auditor and administrator; (2) misled investors that dozens of sub-advisers were allocated funds to trade in securities after posting cash collateral to offset losses when in fact the majority of the capital went to the large sub-adviser, which incurred massive trading losses while collecting management and incentive fees. The SEC seeks permanent injunctions, civil penalties, disgorgement, and officer and director bars. The U.S. Attorney’s Office for the District of New Jersey also brought criminal charges against the CEO in a parallel action. The SEC previously charged the investment adviser’s president and CCO with fraud in connection with the same scheme.[40]

Broker Dealers

In September, the SEC filed charges against a Russian national for his alleged role in a multi-year fraudulent scheme to hack U.S. retail brokerage accounts and manipulate the price and trading volume of hundreds of securities listed on multiple U.S. markets.[41] The SEC alleged that, between 2014 and 2019, the individual used over 20 fake identities to open over 100 foreign and domestic bank and brokerage accounts to trade in securities that were simultaneously manipulated by hackers through forced trades in compromised U.S. brokerage accounts. The SEC alleged that the Russian national generated approximately $31 million in gross proceeds from his trades, and approximately $1.5 million in net profits. The complaint seeks a permanent injunction, disgorgement, and civil penalties.

In September, the SEC announced settled charges against a broker-dealer that provides market data to paying customers. Per the complaint, marketing material distributed between September 2018 and June 2019 stated that U.S. options market data was delivered “in fractions of seconds,” when the broker-dealer knew the data was regularly delayed—sometimes by several minutes during high-volume periods, with average delays of about 23 seconds. The SEC alleged that by failing to adequately inform all customers or correct its ongoing marketing claims, the broker-dealer led some customers to place options orders based on untimely information. Without admitting or denying the allegations, the broker-dealer agreed to a settled order finding a negligence-based violation and ordered a civil penalty of $5 million. The SEC took into consideration certain remedial acts by the company, including notifying certain customers of the delays and publishing a clarifying disclosure on various screens that display U.S. options market data.

In December, the SEC reached a settlement of previously filed litigation with a market maker concerning its representations to customers regarding its policies and procedures reasonably designed to prevent the misuse of material, nonpublic information (MNPI).[42] Allegedly, for a 15-month period ending in April 2019, the broker-dealer lacked barriers to prevent its proprietary traders from potentially accessing information concerning retail customer orders submitted to its trade execution business. Without admitting or denying the allegations, the broker-dealer consented to the entry of a final judgment on a negligence-based violation, including a permanent injunction and a civil monetary penalty of $2.5 million. In all other respects, the SEC’s complaint was dismissed.

Municipal Offerings

In December, the SEC resolved a litigated action filed in 2022 against a middle-market investment bank and municipal advisor for allegedly selling municipal bond offerings in reliance on a “limited offering exemption” despite not meeting the criteria for the exemption. When satisfied, the exemption exempts certain municipal securities offerings from the general requirement of providing disclosures to investors. The complaint alleged that the firm: (1) did not satisfy the exemption requirements for the offerings; (2) inaccurately represented to issuers that it had satisfied the requirements; and (3) did not have policies and procedures reasonably designed to ensure that it complied with the limited offering exemption when acting as underwriter in these municipal bond offerings.[43] Without admitting or denying the allegations, the company agreed to permanent injunctions from violations of Rule 15c2-12 of the Securities Exchange Act (Municipal Securities Disclosures), MSRB Rules G-17 (Fair Dealing) and G-27 (Supervision), and Exchange Act Section 15B(c)1 (which makes a violation of MSRB rules a violation of the Exchange Act) and a civil penalty of $1.2 million.

Reg BI

In August, the SEC announced a settled action against a dual registered broker-dealer and investment adviser for the broker-dealer’s alleged violations of Regulation Best Interest.[44] The SEC alleged that the firm failed to comply with its Care Obligation by recommending bonds to retail customers without exercising reasonable diligence, care, and skill to have a reasonable basis to believe the recommendations were in the best interest of each particular client. The SEC further alleged that the firm willfully violated its Compliance Obligation by failing to establish, maintain, and enforce written policies and procedures designed to achieve compliance with Regulation Best Interest. Without admitting or denying the allegations, the company agreed to pay a penalty and disgorgement totaling more than $100,000.

Global Research Analyst Settlement Modification

In December, the SEC consented to modify the remaining restrictions imposed on certain bulge bracket broker-dealers under a court-approved settlement from the early 2000s (the Global Research Analyst Settlement).[45] The SEC acted in response to motions by several settling firms arguing that the restrictions are unnecessary because comprehensive, industry-wide regulation—particularly FINRA Rule 2241, adopted in 2015—fully address the conflicts of interest that the settlement provisions were intended to target. Commissioner Uyeda said the modification is “the kind of good government reform that will better serve investors, issuers, and the integrity of our U.S. capital markets.”[46] The proposed modifications remain subject to court approval.

Securities Based Swaps Dealer

Substituted Compliance

In August, the SEC announced settled charges against a United Kingdom-based security-based swap dealer for allegedly violating the requirements of a substituted compliance order.[47] The SEC alleged that the dealer violated capital recordkeeping, financial reporting, compliance, internal supervision, and internal risk management requirements with which it was required to comply pursuant to an SEC-issued substituted compliance order for UK-regulated firms. The SEC further alleged that the dealer made untrue statements concerning its policies and procedures in its registration with the SEC. Without admitting or denying the SEC’s allegations, the dealer agreed to pay a $9.8 million penalty and engage a compliance consultant for a comprehensive review of its program.

Public Accountants

In August, the SEC announced settled charges against an accounting firm and its managing partner.[48] The SEC alleged that the partner and his firm failed to take action upon learning that an individual and three related companies created and filed with the SEC multiple fake audit reports bearing the partner’s signature as though they were made by the accounting firm. The SEC also alleged that the partner and the firm helped conceal the fake reports and enabled a scheme to inflate the performance of the three companies and thereby defraud investors. Without admitting or denying the allegations, the partner and the accounting firm agreed to permanent injunctions, civil penalties over $100,000, and suspension from practice as accountants before the SEC for at least six years.

Public Companies

In September, the SEC filed a litigated action against the former chief medical officer of a biopharmaceutical company for allegedly making false and misleading statements about the cardiovascular safety of the company’s then-primary drug candidate.[49] The SEC alleged that from November 2019 to March 2021, the CMO misled investors by claiming that the new drug candidate was safer than the primary existing alternative without disclosing that she had directed changes to test results in an effort to make the drug appear superior. The SEC further alleged that the CMO made these claims in a variety of forums, including a high-profile industry presentation, SEC filings, an earnings call, and a published article in a leading industry journal. The SEC is seeking permanent injunctive relief, a permanent officer-and-director bar, disgorgement and civil penalties.

In December, the SEC announced a settled action against a company that operates an online firearms and outdoor gear marketplace and unsettled actions against three former executives of the company.[50] According to the settled SEC order, the company failed to disclose (i) that an accountant sanctioned by the SEC and barred from serving as a director or officer of a public company served as an undisclosed officer of the company and (ii) two related-party transactions involving the accountant. The SEC further alleged that the company made misleading statements with respect to its adjusted EBITDA. The SEC noted the company’s remedial efforts, including hiring a compliance consultant to conduct a comprehensive review and assist with its remediation of material weaknesses in internal control over financial reporting. Without admitting or denying the allegations, the company agreed to undertakings to adopt and implement all the compliance consultant’s recommendations within two years of the settlement.

In the litigated complaint against the three former executives,[51] the SEC alleged that the executives, including the accountant who was barred from serving as a director or officer and allegedly served as an undisclosed officer, made misleading statements in the company’s public SEC filings and financial statements for the general purpose of obfuscating unfavorable information about the management and operations of the company. The SEC is seeking permanent injunctions, civil penalties, officer and director bars, disgorgement, and reimbursement.

Insider Trading

The SEC instituted a number of insider trading actions against individual, retail traders during the latter half of 2025. The cases often were accompanied by parallel criminal actions, including cases with relatively modest trading profits.

In July, the SEC announced settled charges against:

A former senior director at an publicly traded animal health company and her friend for allegedly misappropriating and trading on material nonpublic information (MNPI) concerning the company’s then-confidential acquisition of a publicly traded pet therapeutics company.[52] The SEC alleged the employee participated in the acquirer’s due diligence process, purchased 500 shares of the target’s stock, and later tipped her friend, who purchased 38,000 shares the day before the deal announcement. The target’s stock price rose by about 46% following the announcement. Both defendants admitted the allegations set forth in the SEC’s complaint and consented to the entry of judgments including permanent injunctions, officer-and-director bars, and civil penalties and disgorgement, if any, to be determined by the court. Each defendant also pleaded guilty in parallel criminal actions brought by the U.S. Attorney’s Office for the Southern District of New York.

A long-time banking supervisor and examiner at the Federal Reserve Bank of Richmond for insider trading based on MNPI concerning financial institutions under his oversight.[53] The SEC’s complaint alleged that, on one occasion, the supervisor received advance knowledge of a positive earnings announcement for one supervised bank and used that information to purchase the bank’s stock hours before the announcement. On a second occasion, he allegedly learned of unexpected loan losses at a different supervised bank and purchased put options two days before the related earnings announcement. The supervisor agreed to permanent injunctions and more than $650,000 in disgorgement, which was deemed satisfied by a forfeiture order entered in a parallel criminal proceeding brought by the U.S. Attorney’s Office for the Eastern District of Virginia, in which he pleaded guilty and was sentenced to 24 months in prison.

An individual for allegedly trading on MNPI about a potential acquisition of a publicly traded trucking company that he learned from a friend who held a senior position at the potential acquirer.[54] The SEC alleged that the defendant purchased shares of the target after learning that negotiations for the acquisition were ongoing and sold them after the target announced the acquirer had made an offer and its stock price rose nearly 300%. Without admitting or denying the allegations, the defendant consented to entry of a final judgment imposing a permanent injunction and agreed to pay a penalty and disgorgement totaling more than $167,000.

An employee of a biopharmaceutical company for allegedly trading on MNPI about his employer’s intention to acquire a publicly traded biotechnology company.[55] The SEC alleged that the defendant became aware of his employer’s interest in acquiring the target, purchased shares of the target over the course of approximately three months preceding the anticipated transaction, and sold the shares after the acquisition was announced, realizing approximately $260,000 in illicit profits. The defendant consented to entry of a final judgment imposing a permanent injunction, a permanent officer-and-director bar, and disgorgement of more than $290,000. A portion of the defendant’s disgorgement obligation was deemed offset by a forfeiture order entered in a parallel criminal proceeding brought by the U.S. Attorney’s Office for the District of Massachusetts, in which he pleaded guilty and was sentenced to two months in prison.

In August, the SEC announced settled charges against:

A former executive of a publicly traded medical-robotics company for alleged insider trading in advance of an announcement that the company would be acquired.[56] The SEC alleged that, while involved in internal discussions regarding the potential acquisition, the executive tipped MNPI to a close friend, who then tipped another friend. The two tippees allegedly made multiple purchases of the company’s securities and realized approximately $500,000 in combined trading profits, and the first tippee later allegedly provided the executive with a $25,000 kickback in exchange for the MNPI. The executive consented to entry of a final judgment imposing a permanent injunction and a permanent officer-and-director bar, and disgorgement of more than $32,000.

A finance professional and his father-in-law for alleged insider trading in relation to the upcoming acquisition of a mattress company by a private equity firm.[57] The finance professional allegedly received MNPI from his employer regarding the acquisition and tipped that information to his father-in-law. Between August and November 2021, ahead of the acquisition’s public announcement on November 15, 2021, both respondents made multiple purchases of stock in the mattress company. On the day of the announcement, the stock price rose by 88%. Without admitting or denying the SEC’s findings, the respondents agreed to pay a total of approximately $55,000 in disgorgement and civil penalties.

An individual who, in 2023, allegedly misappropriated MNPI about the acquisition of a publicly traded meal-kit company from an immediate family member who was a senior executive at the meal-kit company.[58] The individual traded while in possession of that MNPI for a realized profit of more than $500,000. Without admitting or denying the SEC’s findings, the individual consented to the issuance of a cease-and-desist order and agreed to pay disgorgement and a civil penalty totaling more than $1.1 million.

Also in August, the SEC filed charges against:

A Texas resident for alleged insider trading relating to the merger of a privately held biotechnology company with a publicly traded biotechnology company.[59] In the complaint, the SEC alleged that the individual received MNPI in July 2020 about the merger from employees of an investment advisory firm who recommended an investment in the private company. Between July and August 2020, shortly after investing in the private company, the individual allegedly purchased shares in the public merger target across fifteen personal and family-associated trading accounts. On the day of the merger announcement, the public biotechnology company’s stock price rose by 215%. The SEC seeks injunctive relief, disgorgement, and civil penalties.

A managing director at an investor relations consulting firm and two of his friends.[60] The SEC’s complaint alleged that between 2019 and 2024, the director, whose firm’s clients included publicly traded pharmaceutical and biotechnology companies, repeatedly tipped his friends MNPI about those clients, including drug test results, financial results, and upcoming mergers and acquisitions. His friends then allegedly purchased stocks and options and short-sold stocks based on that information and shared some of the resulting profits with the director. All three individuals consented to an order imposing a permanent injunction and, for the director, a conduct-based injunction barring him from associating with a broker or dealer and an officer-and-director bar but reserving the issues of disgorgement and civil penalties for determination by the court. All three defendants pled guilty in a parallel criminal action by the U.S. Attorney’s Office for the Southern District of New York.

An executive and two friends for alleged insider trading relating to the acquisition of the publicly traded parent company of the executive’s employer.[61] The SEC’s complaint alleged that in December 2023, the executive received MNPI from the parent company of a planned sale, and that he proceeded to tip his friend with the intent of having someone trade on his behalf. The friend then allegedly tipped another friend, who in turn tipped a fourth individual who was not charged. Both friends, as well as the fourth individual, allegedly purchased stocks and options on the tipped information. Upon the announcement of a private equity firm’s acquisition of the parent company in January 2024, stock in the parent company rose by 101%. In September and October, both friends consented to orders imposing permanent injunctions but reserving the issues of disgorgement and civil penalties for determination by the court. Against the executive, the SEC seeks injunctive relief, civil penalties, and an officer-and-director bar. All three defendants pled guilty in a parallel criminal action by the U.S. Attorney’s Office for the Southern District of New York.

Two employees of a firm providing EDGAR filing services to clients, who from January 2025 to June 2025, repeatedly traded on MNPI obtained from client SEC filings sent to the firm for processing.[62] On at least thirteen occasions, both employees accessed client-submitted filings containing disclosures such as financial results or merger information, purchased client shares, and then sold those shares immediately following each public announcement, realizing combined profits of over $2.2 million. The SEC seeks injunctive relief, disgorgement, and civil penalties. Both defendants pled guilty in a parallel criminal action brought by the U.S. Attorney’s Office for the Eastern District of New York.

The former director of a biopharmaceutical company and four of the director’s friends and family members.[63] The SEC’s complaint alleged that the director received MNPI about a proposed acquisition of the biopharmaceutical company, then tipped that information to his friends and family members, after which each of them, including the director, purchased stock and/or options in the biopharmaceutical company ahead of the announcement of the acquisition. Collectively, all five made over $500,000 in trading profits. The SEC seeks injunctive relief, disgorgement, and civil monetary penalties as to all defendants, and an officer-and-director bar as to the former director. In December, the director and three of the director’s friends and family members were convicted by a federal jury in a parallel criminal action brought by the DOJ, with sentencing to occur later in 2026.[64]

In September, the SEC filed and settled insider-trading charges against an individual who allegedly used MNPI that he obtained, in 2022 and 2023, in his capacity as head of Equity Trading at an investment firm to trade in the securities of at least ten different publicly traded companies.[65] Without admitting or denying the SEC’s allegations, the individual consented to the entry of a final judgment imposing permanent injunctions and agreed to pay approximately $240,000 in disgorgement. In a related DOJ action in the United States District Court for the District of Connecticut, the individual pleaded guilty to securities fraud, based on the same conduct.[66] In October, the individual was sentenced to two months’ imprisonment, 18 months’ supervised release, and a fine of more than $300,000.

[1] U.S. Sec. & Exch. Comm’n, Commission Votes (2026), available at https://www.sec.gov/about/commission-votes/2026/commission-votes-2026-01.xml

[2] U.S. Sec. & Exch. Comm’n, Division of Enforcement, Staff Directory (as of February 2, 2026), https://www.sec.gov/about/divisions-offices/division-enforcement/division-enforcement-staff-directory

[3] https://www.sec.gov/newsroom/speeches-statements/atkins-townhall-05062025.

[4] Paul S. Atkins, Chairman, U.S. Securities and Exchange Commission, “Keynote Address at the 25th Annual A.A. Sommer, Jr. Lecture on Corporate Securities and Financial Law,” October 7, 2025. (Sommer Address)

[5] The Brattle Group, “SEC Enforcement Activity for Fiscal Year 2025: A Tale of Two Halves, (October 28, 2025) available at https://www.brattle.com/insights-events/publications/sec-enforcement-activity-for-fiscal-year-2025-a-tale-of-two-halves.

[6] Id.

[7] U.S. Sec. & Exch. Comm’n Press Release, SEC Announces Dismissal of Civil Enforcement Action Against Coinbase (Feb. 27, 2025), available at https://www.sec.gov/newsroom/press-releases/2025-47; SEC Litigation Release, SEC Announces Dismissal of Civil Enforcement Action Against Cumberland (Mar. 27, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26276; SEC Litigation Release, SEC Announces Dismissal of Civil Enforcement Action Against Consensys Software Inc. (Mar. 27, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26277; SEC Litigation Release, SEC Announces Dismissal of Civil Enforcement Action Against Kraken (Mar. 27, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26278.

[8] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Announces Joint Stipulation to Dismiss Appeals, Resolving Civil Enforcement Action Against Ripple and Two of Its Executives (Aug. 7, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26369.

[9] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Announces Dismissal of Civil Enforcement Action Against Former Rio Tinto Executive Guy Elliott (January 9, 2026), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26459.

[10] Chairman Paul S. Atkins, Opening Remarks at the SEC Town Hall (May 6, 2025), available at https://www.sec.gov/newsroom/speeches-statements/atkins-townhall-05062025.

[11] Chairman Paul S. Atkins, Statement on Simultaneous Commission Consideration of Settlement Offers and Related Waiver Requests (Sept. 26, 2025) available at https://www.sec.gov/newsroom/speeches-statements/atkins-2025-simultaneous-consideration-settlement.

[12] Sommer Address.

[13] Id.

[14] Chairman Paul S. Atkins, Opening Remarks at the SEC Town Hall (May 6, 2025), available at https://www.sec.gov/newsroom/speeches-statements/atkins-townhall-05062025.

[15] U.S. Sec. & Exch. Comm’n Litigation Release, Bluesky Eagle Capital Management Ltd., Supreme Power Capital Management Ltd., AI Financial Education Foundation Ltd., AI Investment Education Foundation Ltd., Invesco Alpha Inc., Adamant Stone Limited (Nov. 17, 2025) available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26416.

[16] U.S. Sec. & Exch. Comm’n, Administrative Proceeding, SEC Charges Vanguard Advisers for Failing to Adequately Disclose Conflicts of Interest to Clients (Aug. 29, 2025) available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6912-s; U.S. Sec. & Exch. Comm’n, Administrative Proceeding, Engaged Capital LLC (June 16, 2026) available at https://www.sec.gov/files/litigation/admin/2026/ia-6940.

[17] U.S. Sec. & Exch. Comm’n, Administrative Proceeding, Meridian Financial, LLC (Sept. 4, 2025) available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6916-s.

[18] SEC Press Release, SEC Names Judge Margaret Ryan as Director of the Division of Enforcement (Aug. 21, 2025), available at https://www.sec.gov/newsroom/press-releases/2025-108-sec-names-judge-margaret-ryan-director-division-enforcement.

[19] U.S. Sec. & Exch. Comm’n Press Release, Paul Tzur and David Morrell Named Deputy Directors of the Division of Enforcement (January 12, 2026), available at https://www.sec.gov/newsroom/press-releases/2026-4-paul-tzur-david-morrell-named-deputy-directors-division-enforcement.

[20] U.S. Sec. & Exch. Comm’n Press Release, SEC Names James Moloney Director of Division of Corporation Finance (Sept. 10, 2025), available at https://www.sec.gov/newsroom/press-releases/2025-115-james-moloney-named-director-division-corporation-finance.

[21] U.S. Sec. & Exch. Comm’n Press Release, Jon Kroeper Named Deputy Director of the Division of Trading and Markets (Sept. 24, 2025), available at https://www.sec.gov/news/press-release/2025-123.

[22] U.S. Sec. & Exch. Comm’n Press Release, Joshua T. White Named SEC Chief Economist (Dec. 17, 2025), available at https://www.sec.gov/newsroom/press-releases/2025-143-joshua-t-white-named-sec-chief-economist.

[23] U.S. Sec. & Exch. Comm’n Press Release, SEC Announces George Botic to Serve as Acting Chair of the Public Company Accounting Oversight Board (July 21, 2025), available at https://www.sec.gov/newsroom/press-releases/2025-100-sec-announces-george-botic-serve-acting-chair-public-company-accounting-oversight-board.

[24] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Settles Charges Against Advisers and Portfolio Managers in Lawsuit Alleging Misrepresentations About Risks in Funds That Lost More than $1 Billion (July 1, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26338.

[25] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Former Investment Adviser for Failing to Adequately Disclose Conflicts of Interest, Overbilling, and Producing Compliance Documents Backdated by its CCO and President (July 11, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6893-s.

[26] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Empower Advisory Group, LLC and Empower Financial Services, Inc. for Failing to Adequately Disclose Conflicts of Interest to Retirement Plan Participants (Aug. 29, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/34-103809-s.

[27] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Vanguard Advisers for Failing to Adequately Disclose Conflicts of Interest to Clients (Aug. 29, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6912-s.

[28] U.S. Sec. & Exch. Comm’n Litigation Release, Tomislav Vukota and His Two Advisory Firms Settle Charges for Breaches of Fiduciary Duty and Misrepresentations (Sept. 9, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26393.

[29] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Six Investment Advisers with Making Misrepresentations in Forms Filed with the Agency (Nov. 17, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26416.

[30] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Investment Adviser for Custody Rule Violations (Aug. 1, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6901-s.

[31] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Colorado-Based Investment Adviser with Violating Trading Rule (Aug. 4, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/34-103629-s.

[32] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges New York-Based Investment Adviser with Breaching Fiduciary Duty by Overcharging Management Fees to Private Funds (Aug. 15, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6908-s.

[33] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges California Investment Adviser and His Advisory Firm with Fraud and Improper Disclosure of Client Nonpublic Personal Information (Sept. 11, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26395.

[34] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Massachusetts-Based Investment Adviser with Marketing, Books and Records, and Compliance Rule Violations (Sept. 4, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6916-s.

[35] U.S. Sec. & Exch. Comm’n Administrative Proceedings Order, In re Rudney Associates, Inc. and Eric A. Rudney (Nov. 24, 2025), available at https://www.sec.gov/files/litigation/admin/2025/ia-6927.pdf.

[36] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Oregon Firm for its Deficient Cybersecurity and Identity Theft Prevention Programs (Nov. 25, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/34-104255-s.

[37] U.S. Sec. & Exch. Comm’n Administrative Proceedings Order, In re MH Investment Management, Inc., (Nov. 21, 2025), available at https://www.sec.gov/files/litigation/admin/2025/ic-35810.pdf.

[38] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Chicago-Based Investment Adviser with Charging Improper Fees (July 3, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26339.

[39] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Prophecy Asset Management, its CEO/CIO, and Largest Sub-Adviser in $500 Million Advisory Fraud (Sept. 29, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26414.

[40] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges President/CCO of Prophecy Asset Management Advisory Firm with Multi-Year Fraud (Nov. 2, 2023), available at https://www.sec.gov/newsroom/press-releases/2023-231.

[41] U.S. Sec. & Exch. Comm’n Press Release, SEC Charges Russian National in Account Takeover Scheme Involving U.S. Brokerage Accounts (Sept. 24, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26410.

[42] U.S. Sec. & Exch. Comm’n Press Release, SEC Obtains Final Consent Judgment as to Virtu Broker-Dealer Regarding Alleged Failure to Establish, Maintain, and Enforce Policies and Procedures Reasonably Designed to Prevent Misuse of Its Customers’ Material Nonpublic Information (Dec. 3, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26427.

[43] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Obtains Final Consent Judgment as to Oppenheimer & Co. Inc. Regarding Alleged Failure to Comply with Municipal Bond Offering Disclosure Requirements (Dec. 12, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26435.

[44] U.S. Sec. & Exch. Comm’n Administrative Proceedings Order, In re Emerson Equity, LLC (Aug. 11, 2025), available at https://www.sec.gov/files/litigation/admin/2025/34-103674.pdf.

[45] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Consents to Termination of Undertakings in Global Research Analyst Settlement (Dec. 5, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26434.

[46] Statement of Commissioner Mark T. Uyeda, Statement on the Global Research Analyst Settlement (Dec. 5, 2025), available at https://www.sec.gov/newsroom/speeches-statements/uyeda-statement-global-research-analyst-settlement-120525.

[47] U.S. Sec. & Exch. Comm’n Administrative Proceeding Release, SEC Charges UK Security-Based Swap Dealer with Violating Laws for Dealing in U.S. Markets (Aug. 6, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/34-103646-s.

[48] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Obtains Final Judgment Against Accounting Firm and Managing Partner Charged with Aiding and Abetting Massive Fraud (Aug. 13, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26373.

[49] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Former FibroGen Chief Medical Officer for False and Misleading Claims about Clinical Trial Results (Sept. 10, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26394.

[50] U.S. Sec. & Exch. Comm’n Administrative Proceeding Order, In re Ammo, Inc. n/k/a Outdoor Holding Company (Dec. 15, 2025), available at https://www.sec.gov/files/litigation/admin/2025/33-11397.pdf.

[51] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Sues Former Executives of Arizona-Based Company for Accounting and Disclosure Fraud (Dec. 15, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26446.

[52] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Former Animal Health Company Senior Director and Tippee with Insider Trading (July 11, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26348.

[53] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Obtains Final Judgment against Richmond Federal Reserve Banking Supervisor Charged with Insider Trading (July 21, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26356.

[54] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Scottsdale Resident with Insider Trading (July 22, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26359.

[55] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Obtains Final Judgment Against Former Pharmaceutical Employee Charged with Insider Trading (July 30, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26364.

[56] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Obtains Final Judgment in Insider Trading Case Against Doron Tavlin (Aug. 6, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26367.

[57] U.S. Sec. & Exch. Comm’n Administrative Proceedings Order, In re Vincent Barbuto (Aug. 1, 2025), available at https://www.sec.gov/files/litigation/admin/2025/34-103615.pdf; SEC Administrative Proceedings Order, In re Anthony Finale (Aug. 1, 2025), available at https://www.sec.gov/files/litigation/admin/2025/34-103614.pdf.

[58] U.S. Sec. & Exch. Comm’n Press Release, SEC Settles Insider Trading Charges Related to Blue Apron Acquisition (Aug. 22, 2025), available at https://www.sec.gov/enforcement-litigation/administrative-proceedings/34-103764-s.

[59] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Texas Resident with Insider Trading (Aug. 11, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26370.

[60] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Former Investor Relations Executive and Two Friends with Insider Trading (Aug. 18, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26376.

[61] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Former Executive and Friends in Insider Trading Scheme (Aug. 18, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26378.

[62] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Two Brooklyn Men with $2 Million Insider Trading Scheme (Aug. 21, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26380.

[63] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Former Director and Four Others with Insider Trading (Aug. 22, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26383.

[64] U.S. Attorney’s Office Press Release, Four Individuals Convicted of Insider Trading Scheme (Dec. 17, 2025), available at https://www.justice.gov/opa/pr/four-individuals-convicted-insider-trading-scheme.

[65] U.S. Sec. & Exch. Comm’n Litigation Release, SEC Charges Connecticut Resident with Insider Trading in Multiple Securities (Sept. 5, 2025), available at https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26388.

[66] U.S. Attorney’s Office Press Release, Weston Man Sentenced to Prison for Insider Trading (Sept. 23, 2025), available at https://www.justice.gov/usao-ct/pr/weston-man-sentenced-prison-insider-trading.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Securities Enforcement practice group, or the authors:

Mark K. Schonfeld – New York (+1 212.351.2433, mschonfeld@gibsondunn.com)

David Woodcock – Dallas (+1 214.698.3211, dwoodcock@gibsondunn.com)

Jina L. Choi – San Francisco (+1 415.393.8221, jchoi@gibsondunn.com)

Osman Nawaz – New York (+1 212.351.3940, onawaz@gibsondunn.com)

Tina Samanta – New York (+1 212.351.2469, tsamanta@gibsondunn.com)

Lauren Cook Jackson – Washington, D.C. (+1 202.955.8293, ljackson@gibsondunn.com)

© 2026 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.