Securities Enforcement 2024 Year-End Update

Client Alert | January 30, 2025

Expect sweeping changes ahead. But when looking back, an aggressive enforcement agenda continued as the SEC reported record high financial remedies, although—like all numbers that high—the SEC’s enforcement measures in 2024 require context and came alongside a drop in new actions.

I. Introduction

The dichotomy of an aggressive enforcement agenda tempered by litigation setbacks set forth in our mid-year 2024 SEC Enforcement update persisted through the end of the SEC’s 2024 fiscal year. The SEC filed a flurry of enforcement actions up until the very end of the previous administration. Now that the Gensler-led SEC has ended and the incoming administration has nominated Paul Atkins as its new Chairman and appointed Commissioner Mark Uyeda as Acting Chairman, change is coming. To be clear, the Commission’s three-part mission and the critical role that enforcement plays in that mission will remain the same. But, from those who have worked with Atkins—and as covered in a Gibson Dunn webcast—shifts are coming at the agency.

A. 2024 Enforcement Results: The Ups and Downs

While measuring success goes beyond numbers, the reported drop in new actions piqued interest given the Commission’s aggressive enforcement posture.

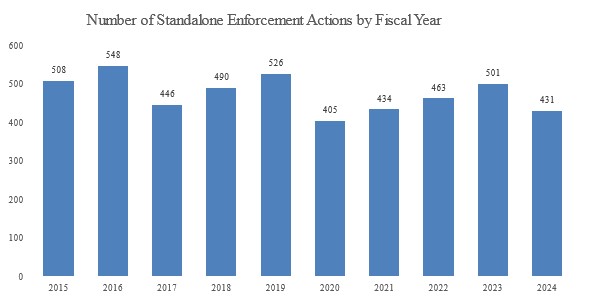

As reported by the SEC on November 22, the enforcement statistics for the fiscal year ending September 30, 2024 reflect that the Commission filed a total of 583 actions, compared to 784 actions the prior year, a drop of 26 percent.[1] Of those 583 actions, the agency reported 431 stand-alone enforcement actions—the most significant measure of activity, involving cases independently charged and not linked to a prior finding of violation—as compared to 501 stand-alone enforcement actions filed the prior year, a 14 percent drop.

|

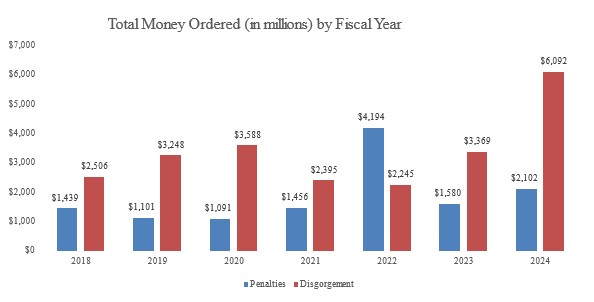

While the Commission obtained orders for an all-time aggregate high of $8.2 billion— consisting of $6.1 billion in disgorgement and prejudgment interest, the highest amount on record, and $2.1 billion in civil penalties, the second-highest amount on record—the 2024 financial remedies stem in large part from the continued off-channel communications settlements ($600 million) and a single crypto judgment ($4.5 billion in disgorgement, interest, and penalty), that received unanimous Commission support but appears uncollectible.[2] Consistent with its general pattern over the last several years, in 2024, the SEC again recovered over twice as much in disgorgement as compared to penalties.

Another important metric to highlight includes $345 million in money distributed to harmed investors in fiscal year 2024, a drop from $930 million distributed to harmed investors in fiscal year 2023. And the agency also reported fiscal year 2024 orders barring 124 individuals from serving as officers and directors of public companies, the second-highest number of such bars following the prior year’s 133 such orders.

|

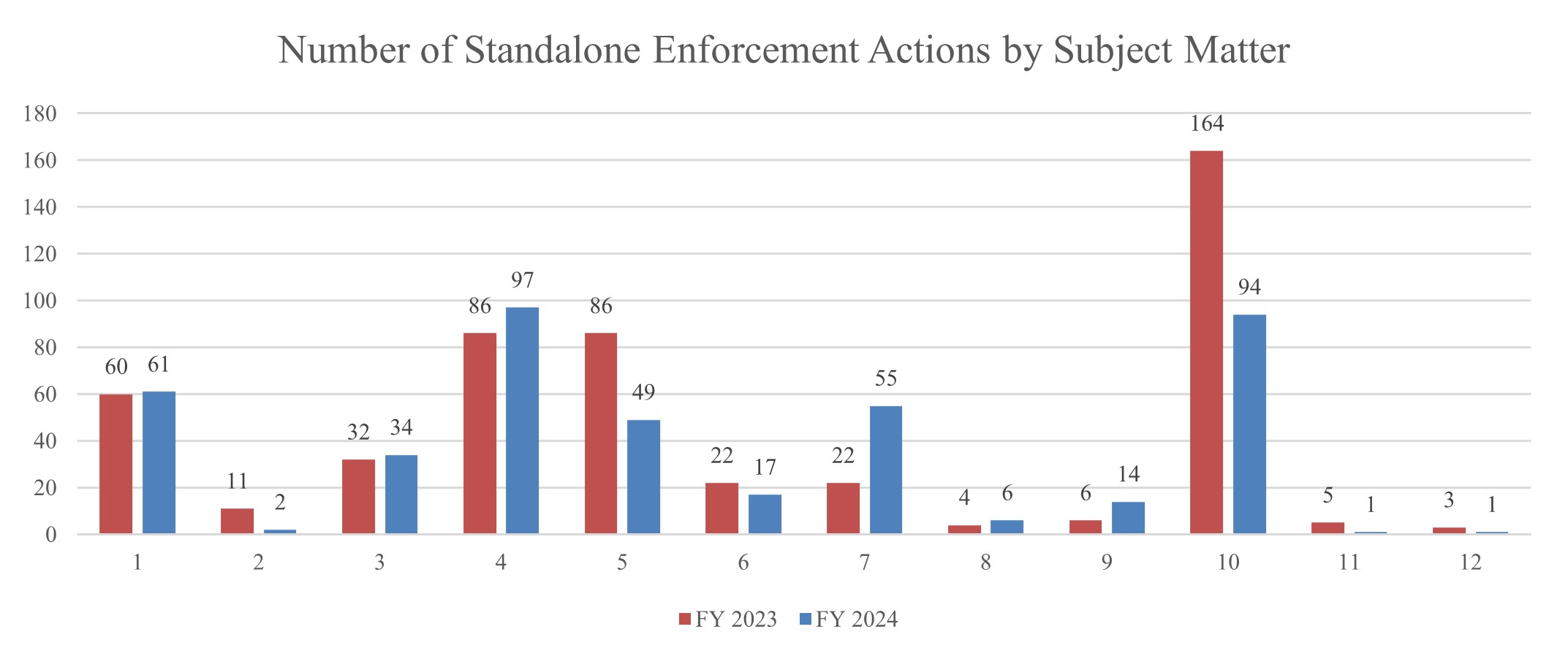

The distribution of actions across subject matter remained generally consistent with prior years. The SEC brought 97 stand-alone actions against investment advisers and investment companies (23 percent of actions in 2024) reflecting a continued focus on investment adviser and company regulation and enforcement, and an increase from the prior year (86 cases, 17 percent of actions in 2023). The 94 stand-alone enforcement actions relating to securities offerings reflected a decrease from the prior year (22 percent of actions in 2024, compared to 164 cases and 33 percent of actions in 2023), while broker-dealer enforcement remained relatively steady (61 cases and 14 percent of actions in 2024, compared to 60 cases and 12 percent of actions in 2023). There were also decreases year-over-year in the areas of issuer reporting (49 cases and 11 percent of actions in 2024, compared to 86 cases and 17 percent of actions in 2023) and—as conveyed in more detail within Gibson Dunn’s forthcoming 2024 FCPA Year-End Update—FCPA matters (two cases and zero percent in 2024, compared to 11 cases and two percent of actions in 2023). In fact, the combined number of issuer reporting and FCPA matters is the lowest since at least 1998. Finally, there was a slight increase in the percentage of stand-alone actions relating to insider trading in 2024 (34 cases and eight percent of actions in 2024, compared to 32 cases and six percent of actions in 2023).

|

B. Explaining the Numbers: Jarkesy

Impacts of recent court cases remain important to watch for the SEC and all agencies.

In a November podcast, the SEC’s former enforcement director remarked that the numbers show the impacts of, among other things, the U.S. Supreme Court decisions from last year including SEC v. Jarkesy (June 2024). The director, who announced his departure in October,[3] stated after the decisions, “we [enforcement] basically needed to hit pause” and “assess the impact of Jarkesy” on resolved, pending, and pipeline matters, which took “several months between June, July and even creeping into August.” The former director continued that “if we want to see how the last fiscal year [ending September 30] was, you should look at October and November [cases filed] because those are the two months or more that we lost as a result of Jarkesy ….” The agency filed 200 enforcement actions in the first fiscal quarter of 2025 (October to December 2024), with 75 actions in October 2024 alone. Of note, the agency sent out a press release on the last business day of the Gensler administration, touting the record number of enforcement actions in fiscal Q1 2025 (October through December 2024), and the 40 actions filed in the first two business weeks of January 2025.[4]

The CFTC similarly reported decreased enforcement numbers for its recent fiscal year, 58 new actions as compared to 96 the prior year, although the impacts of any litigation setbacks on the CFTC’s pipeline may not have been as pronounced (it filed three actions in October 2024 and no actions in December 2024).[5] At the same time, a similar trend surfaced concerning financial remedies: like the SEC, the CFTC reported record-breaking monetary results for its fiscal year, though there, too, a single crypto case played a leading role in the monetary relief.

While explaining the SEC numbers further may involve other factors such as a review of resource allocation and case priorities, former acting enforcement director Sanjay Wadhwa (who stepped down effective on January 31) stated that “[w]hat our numbers do not reflect, however, are countless investigations that may not have resulted in an enforcement action for evidentiary or other reasons, or where we declined to pursue an enforcement action, but that shined a spotlight on potentially problematic conduct and caused responsible market participants to cease engaging in it.”

Finally, other litigation setbacks remain on radar, including SEC v. Govil. That Second Circuit case, covered in detail in a prior client alert, held the SEC is not entitled to disgorgement unless it can show the allegedly defrauded investors suffered pecuniary harm. This important holding emerged in the past year in a litigated SEC case where the Southern District of New York denied the agency’s request for roughly $1 billion in disgorgement and interest based on Govil.[6] Another notable setback was in Coinbase v. SEC where the Third Circuit recently faulted the Commission for failing to provide “meaningful guidance on which crypto assets it views as securities.” In light of the Coinbase decision and the SEC’s new leadership, we expect to see significant change in the Commission’s approach to crypto assets in the coming year. Indeed, within a day of the inauguration, Acting Chairman Mark Uyeda launched a new crypto task force, led by Commissioner Hester Peirce, with the stated mission of “developing a comprehensive and clear regulatory framework for crypto assets.”[7]

C. What the Past Might Tell Us: Looking Back to the Future

Past Republican Commissioner statements note that the “vast majority of SEC enforcement actions are straightforward.”

Although steady commentary suggests a pullback on crypto and off-channel communication cases, sweeps for technical violations, and the overuse of internal controls and certain other provisions of the securities laws, other areas highlighted in the 2024 results will most likely remain in focus. Those “straightforward” areas include major fraud, individual accountability, gatekeeper accountability, and certain public company cases, among others. Moreover, investigations typically take time to complete even under the best of circumstances, with the average of all investigations taking slightly over two years. And while case outcomes might look different, the past administration’s matters (including on subject matter similar to cases filed in 2024) will most likely remain active for some time. Notwithstanding new priorities, those legacy matters may mature into actions filed in the future and shape early trends for the new administration.

Whistleblowers

The topic of whistleblowers remains an important one. Although the potential for decreased penalties in the new administration may impact the analysis for some whistleblowers, given that any bounty paid to the whistleblower derives from monetary relief, expect continued tips to the SEC and others. Credible allegations of misconduct will always be investigated vigorously under any administration.

Highlights from 2024 regarding whistleblowers:

- The SEC reported receipt of 24,000 whistleblower tips and announced awards of more than $255 million to 47 individuals, a decline from the prior year, and reportedly more than 14,000 of the 24,000 tips came from two individual whistleblowers.[8]

- The SEC also continued to aggressively enforce whistleblower protections. In an enforcement sweep announced in September 2024, the SEC ordered over $3 million in penalties against seven companies for allegedly violating whistleblower protection rules by, for example, requiring employees to waive their right to receive whistleblower awards, asking customers to agree to not contact the SEC, and requiring signees to certify that they had not provided information to the government in the past.[9]

- In one case, as reported in our mid-year update, and which received unanimous Commission support for action, a broker-dealer paid an $18 million penalty for allegedly impeding “hundreds of advisory clients and brokerage customers from reporting potential securities law violations to the SEC” by having them sign an agreement prohibiting them from “affirmatively reporting” information to the Commission staff.[10]

Artificial Intelligence

Another important area from 2024 includes cases involving emerging technologies and emerging risks. This same subject area appears in the SEC’s 2025 examination priorities. While internal agency referrals (from other SEC divisions including Exams) might change in the years ahead, they will not cease—and thus examination priorities are likely to continue to shape and become enforcement priorities.

Highlights from 2024 regarding emerging technologies and emerging risks:

- Like many other agencies, the SEC messaged a strong focus on artificial intelligence.

- The SEC’s enforcement results highlighted this particular area, and numerous speeches and other statements touched upon this significant technology. As covered in our mid-year 2024 update, the SEC announced two enforcement actions in March 2024 against investment advisers for “AI-washing” and violations of the Marketing Rule (another area of focus during the last administration) for marketing the use of AI in certain ways that were not accurate.

- The types of AI matters the Commission has brought so far are uncontroversial fraud cases. Although the new administration will have its own priorities, a focus on straightforward material misstatements by any market participant to investors will remain of significant interest to the agency.

Individual Accountability

When looking at SEC enforcement reports for years during the previous Trump administration, this topic received rightful attention given that charging culpable individuals, where appropriate, hits at the core of accountability and deterrence and also because corporate entities act through individuals. That leads to dynamic charging considerations, which as we look ahead might tip the balance of Commission thoughts towards the side of pursuing even more individual cases. In any event, while the SEC’s 2024 report reviewed multiple cases involving individual accountability, a rough through-line indeed involved allegations of fraud.

Market Abuse and MNPI

The SEC’s report further highlighted a mix of actions related to market abuse and insider trading, an area that for the most part proves less controversial for the SEC (save for certain recent cases, including one litigated in 2024). In 2024, the SEC brought or settled charges against investment adviser representatives for a “cherry-picking” scheme that allegedly “defrauded their clients out of millions,” against a hacker for illegally obtaining and trading on a public company’s MNPI, and against several investment advisers for failing to implement and enforce policies and procedures to prevent MNPI misuse. Notably, after the fiscal year end, the SEC filed a litigated matter against an investment adviser for such compliance failures.[11]

Other Notes

With respect to the largest area of enforcement cases in 2024, investment advisers and companies, and notwithstanding the strike-down of the private funds rule, these important market participants will remain in focus for egregious cases and continued examinations. With respect to new(er) rules that survived or did not receive challenges, while some added grace period may be more likely in the coming years, those areas will ripen to enforcement risk.

A note on off-channel communication cases: numerous takes foresee fewer, if any, such stand-alone technical matters. However, the communications might resurface as more and more investigations uncover the substance of any unreviewed communications where indeed the reasons for going off-channel extended beyond the mundane.

On balance, there are at present more questions than answers on what the future holds, as we all await priority pronouncements, personnel appointments of directors, what’s to come from the Department of Government Efficiency, and how litigation setbacks like Jarkesy and Govil, among others, impact the way in which the SEC and others litigate, which might be particularly important as the SEC likely pursues even more individual accountability. Nevertheless, when issues arise and bad actors reveal themselves, the SEC will come calling.

D. Senior Staffing Update

Beyond the more covered staffing changes—such as the nomination of Paul Atkins as Chairman, former Chair Gary Gensler’s announced retirement along with Mark Uyeda’s naming as Acting Chairman, and Gurbir Grewal’s announced departure from the Enforcement Director position along with Sanjay Wadha’s appointment as Acting Enforcement Director—there were further changes at the senior staff level and in regional leadership. Many of these changes accompanied, or immediately preceded, the change in administration.

- In July, Keith E. Cassidy was named Interim Acting Director of the Division of Examinations while Director Richard Best took a leave of absence to focus on his health. Cassidy concurrently serves as the National Associate Director of the Division’s Technology Controls Program, where he oversees the SEC’s CyberWatch program and the Cybersecurity Program Office.[12]

- In September, the SEC announced that Richard R. Best would transition to the role of Senior Advisor to the Director of the Division of Examinations from his role as Director of the Division of Examinations. Before becoming the Director of the Division of Examinations in 2022, Mr. Best served as the Director of the SEC’s New York Regional Office and also previously served as the Director of the SEC’s Atlanta Regional Office and the SEC’s Salt Lake Regional Office.

- In December, the SEC announced the departure of Trading and Markets Division Director Haoxiang Zhu. During Mr. Zhu’s tenure, the SEC shortened the settlement cycle for equities, corporate bonds, and municipal bonds to one day, expanded central clearing for Treasury repurchase and cash transactions, and updated execution rules under Regulation National Market System (NMS). David Saltiel, formerly a deputy director in the Office of Analytics and Research, assumed the role of Acting Director upon Mr. Zhu’s departure.[13]

- In December, Erik Gerding left his position as Director of the Division of Corporate Finance.[14] Gerding joined the SEC as Deputy Director of the Division of Corporate Finance in October 2021 and became the Division’s Director in February 2023. For the time being, Cicely LaMothe—who was serving as Deputy Director for Disclosure Operations within the division—will serve as Acting Director.

More staffing changes occurred at the turn of the year, in relatively quick succession, before the change in administration.

- Chief Accountant Paul Munter retired after serving in his role for two years.[15] Munter joined the Commission in 2019, was named as Acting Chief Accountant in 2021, and was appointed to Chief Accountant in early 2023. Ryan Wolfe currently serves as Acting Chief Accountant.[16]

- Chief Economist and Director of the Division of Economic and Risk Analysis (DERA) Jessica Wachter departed the Commission around the same time, announcing that she would return to the Wharton School at the University of Pennsylvania to serve as the Dr. Bruce I. Jacobs Chair of Quantitative Economics.[17] Robert Fisher currently serves as the Acting Director of DERA.[18]

- General Counsel Megan Barbero also departed the Commission. She had served as General Counsel since February 2023 and joined the SEC in July 2021 to serve as the Principal Deputy General Counsel.[19] Jeffrey Finnel currently serves as Acting General Counsel.[20]

- The Director of the Office of International Affairs, YJ Fisher, also left the Commission after serving in her position since August 2021.[21] Kathleen Hutchinson currently serves as Acting Director of the Office of International Affairs.[22]

- The Commission’s Chief of Staff, Amanda Fisher, similarly announced her departure from the Commission.[23] She first joined the Commission in June 2021 as Senior Counselor, then served as Chief of Staff from January 2023 until her departure.

- The SEC Policy Director, Corey Klemmer, also announced that she would step down from her role, which she held since May 2024.[24] Klemmer joined the Commission in July 2021 to serve as Corporate Finance Counsel.

- Director of the Office of Public Affairs, Scott Schneider, also left the SEC.[25] Schneider had served in this role since April 2021 and had also served as a counselor to Chair Gensler.

- Finally, Sanjay Wadha—who has been serving as Acting Director of the Division of Enforcement—announced that he would depart the Commission as of January 31, 2025. Wadha first joined the SEC as a staff attorney in 2003.[26] Between then and his being named Acting Enforcement Director in October 2024, Mr. Wadha served in many roles at the Commission, including Senior Associate Director of the Division of Enforcement in the New York Regional Office (NYRO), Deputy Chief of the Market Abuse Unit, and Assistant Director in the NYRO. Samuel Waldon, the previous Acting Deputy Director, currently serves as the Acting Director; and Antonia Apps as the Acting Deputy Director.[27]

E. Whistleblower Actions

As noted above, 2024 trends demonstrated that the Commission continued to make whistleblowers an important aspect of its enforcement agenda throughout the year. In three separate enforcement actions in September, the SEC announced settled charges against over 10 entities in total for alleged violations of Rule 21-F, the SEC’s whistleblower protection rule. These actions notably demonstrated that the Commission continued to interpret Rule 21-F’s scope to be broad. For example, in the first action described below, the SEC found that the whistleblower protection rule pertained to agreements made with clients, and not with employees. This action marks the second time—the first being the Commission’s settled charges against a large broker-dealer, as noted in our mid-year update—that were brought with respect to agreements made outside of the employment context. These actions further show that the Commission has interpreted the rule from asking signees to certify that they, retrospectively, had not provided information to the government in the past, before signing the agreement at issue. The Commission has taken the position that such clauses violate the whistleblower protection rules, even where other aspects of the agreement allow signees to provide information to the government prospectively, and to reap related whistleblower awards.

- The first action announced settled charges against a broker-dealer and two affiliated investment advisors for entering into confidentiality agreements with retail clients containing provisions that allegedly limited clients’ ability to provide information to the SEC by permitting communications only where the SEC first initiated an inquiry.[28] Without admitting or denying the allegations, the broker-dealer agreed to pay a civil penalty of $240,000 to settle the charges.

- The second action announced settled charges against seven entities for allegedly using employment and other agreements that either limited the signees’ ability to willingly and voluntarily provide information to the SEC, required signees to affirm that they had not provided information to the government in the past, or prevented signees from receiving whistleblower awards in return for providing information.[29] Without admitting or denying the SEC’s allegations, the entities agreed to pay civil penalties of over $3 million in the agreement, with individual penalties ranging from $19,500 to $1.4 million.

- The third action announced settled charges against a Florida-based investment advisor for allegedly entering into agreements with candidates for employment that, though allowing the candidates to provide information to the government in response to inquiries, prevented the candidates from making such disclosures voluntarily.[30] Without admitting or denying the allegations, the investment adviser agreed to pay a civil penalty of $500,000 to settle the charges.

The Commission relatedly continued to provide sizable awards to individuals that provided useful information through the whistleblower program.

- In July, the SEC announced two separate whistleblower awards, each coincidentally for approximately $37 million, to two different whistleblowers that provided information that purportedly facilitated successful enforcement actions. In one of the matters, the whistleblower purportedly provided information directly to the Commission and further conserved the Staff’s time and resources by identifying potential witnesses and documents.[31] In the other matter, the respective whistleblower initially reported their concerns internally, which led their employer to conduct an internal investigation and also eventually helped prompt the SEC to open up its own investigation. The whistleblower then purportedly facilitated the Staff’s investigation by providing ongoing, extensive, and timely assistance.[32]

- In August, the SEC announced two whistleblower awards totaling more than $98 million for information and assistance that led to an SEC enforcement action and an action brought by another agency. The first whistleblower received an award of $82 million for making the tip that prompted the opening of the investigations and for providing critical ongoing assistance to the investigations. The second whistleblower received an award of $16 million for, at a later stage of the investigations, providing information that significantly contributed to one aspect of the actions.[33]

- Also in August, the SEC awarded $24 million to two whistleblowers who, after reporting conduct internally, provided information that prompted an SEC enforcement action and an action by another agency. Although the first whistleblower’s information prompted the SEC investigation, the second whistleblower received a higher award, purportedly because their “information played a more significant role in the investigation.” The second whistleblower provided, among other things, “important information about key witnesses and their roles in the schemes,” which purportedly was “heavily” relied on by the SEC during the investigation. The $24 million award was based on the entire amount ordered by the Commission, including disgorgement and prejudgment interest, as well as on the amount collected by the other agency in its separate action.[34]

- In October, the SEC announced a $12 million award to three whistleblowers who provided critical assistance to an SEC enforcement action. In determining the amount of the award, the SEC considered, among other things, the significance of the information provided to the commission, the assistance provided, the law enforcement interest in deterring violations, and participation in internal compliance systems.[35]

II. Public Company Accounting, Financial Reporting, and Disclosure

A. Purported Fraudulent Schemes

In June 2024, the SEC announced settled charges against an advanced materials and nanotechnology company, and filed related charges against its former CEOs, for alleged violations of fraud, reporting, internal accounting controls, and books and records provisions.[36] The alleged scheme involved the two former CEOs issuing a special dividend—the value of which was allegedly overstated by the former CEOs—and effecting a merger between their former companies. When the company’s stock price did indeed rise, the company sold over 16 million shares, raising $137.5 million. The SEC alleges the true purpose of the merger and dividend were to create a short squeeze, which was allegedly never communicated publicly. The company neither admitted nor denied the findings and agreed to pay a $1,000,000 penalty. The charges against the former CEOs are pending in the U.S. District Court for the Southern District of New York, and the SEC is seeking permanent officer-and-director bars, disgorgement of ill-gotten gains, and civil penalties from them.

In August, the SEC announced that an Alabama-based shipbuilder and its Austrian parent company had agreed to settle charges brought by the SEC in the U.S. District Court for the Southern District of Alabama.[37] The SEC’s complaint alleged that the companies conducted a purportedly fraudulent revenue recognition scheme from January 2013 to July 2016 to artificially reduce the estimated cost of completion of projects for the U.S. Navy by tens of millions of dollars. As a result, the companies allegedly prematurely recognized revenue. To settle the charges, both companies consented to permanent injunctions, and the Alabama-based shipbuilder agreed to pay a $24 million civil penalty. The Department of Justice also announced settled charges against the Alabama-based shipbuilder.

B. Financial Reporting

In August, the SEC announced settled charges against an electric vehicle company, its current CEO, former Chairman and CEO, and former CFO for allegedly reporting misleading information about the company’s financial performance from 2017 to 2019.[38] Specifically, the SEC alleged that the company and the former Chairman and CEO reported 2017 revenue guidance of $300 million despite known issues that would negatively impact revenue, and misled the company’s auditor by allegedly providing a fraudulent letter of intent from a buyer in order to avoid writing down certain assets. The SEC also alleged that the company and all three individuals improperly accounted for a cryptocurrency deal in 2019, resulting in an overstatement of revenues by more than $40 million, and made false representations in the company’s financial statements. Finally, the SEC alleged that the former Chairman and CEO hid from the auditor his personal interest in two companies that received millions of dollars in cash and stock in deals with the company. Without admitting or denying the SEC’s findings, the company agreed to pay a $1.4 million penalty and retain an independent compliance consultant; the current CEO and former CFO each agreed to pay a $75,000 penalty, and the former CFO further accepted a two-year accounting suspension; in addition, the former Chairman and CEO agreed to a $200,000 civil penalty, more than $3.3 million in disgorgement, and a 10-year officer-and-director bar.

In September, the SEC charged the former CFO; former audit committee chair; and former Chair, CEO, and President of a software company in connection with the company’s alleged overstated revenue as part of two public stock offerings.[39] The complaint, filed in the U.S. District Court for the Southern District of New York, alleged that the former Chair, CEO, and President fabricated reports of successful testing of a software program, which resulted in the company’s recognizing $1.3 million in revenue—nearly all of its revenue leading up to its IPO. The SEC also alleged that the former CFO and former audit committee Chair learned that these reports were false during the company’s secondary stock offering, but continued to make false statements about revenue, and, along with the third defendant, made related misrepresentations to the company’s auditor. The former Chair, CEO, and President has agreed to a partial settlement of a permanent injunction, but continues to litigate the appropriate remedies. The SEC is seeking injunctions and civil penalties against the other two defendants, as well as disgorgement and prejudgment interest and reimbursement from the former CFO. The U.S. Attorney’s Office for the Southern District of New York also announced charges against the former Chair, CEO, and President.

In November 2024, the SEC announced settled charges against a major logistics company for allegedly misrepresenting its earnings by failing to follow generally accepted accounting principles (GAAP) in valuing one of its business units.[40] Though the company had booked a goodwill impairment with respect to the business unit at issue, the SEC alleged that the company should have booked the impairment earlier than it had, and that its late recognition of the impairment was due to purported overreliance on an allegedly inadequate analysis by a third-party consultant showing no loss in value. Without admitting or denying the findings, the company agreed to pay a $45 million civil penalty and committed to certain undertakings, including the adoption of training requirements for certain officers and employees, as well as retention of an independent compliance consultant to review and make recommendations about its fair value estimates and disclosure obligations.

C. Public Statements and Disclosures

In mid-August, the SEC announced settled charges against a publicly traded Florida-based company and its founder for allegedly failing to disclose information related to pledges of company securities.[41] In its order, the SEC alleged that the company’s founder had pledged approximately 51 to 82 percent of the company’s securities as collateral to secure personal loans and had allegedly failed to disclose such beneficial ownership to the SEC. Further, the SEC alleged that the company had also failed to disclose the founder’s pledges of securities in its filings to the Commission and its investors. In agreeing to settle the charges, the Commission considered the cooperation of the company and the founder, including providing to the Commission compilations of relevant documents, information, and data. Without admitting or denying the charges, the company and the founder agreed to pay civil penalties of $1.5 million and $500,000, respectively.

In early September, the SEC announced settled charges against a publicly traded Massachusetts- and Texas-based company for allegedly making inaccurate statements to the SEC and its investors regarding the recyclability of its product.[42] The SEC alleged that in the company’s 2019 and 2020 annual filings, the company indicated that its product was recyclable despite allegedly having some potential knowledge to the contrary. Without admitting or denying the charges, the company agreed to pay a civil penalty of $1.5 million.

Later in September, the SEC announced settled charges against a biotechnology company related to alleged misrepresentations and omissions made during and after the company’s IPO.[43] According to the SEC, the company misled investors regarding a large market opportunity, revenue prospects, and a customer pipeline for its products. Despite allegedly receiving contradictory analysis from its sales team which valued the company’s total market opportunity at five to 10 percent of the initial published projection, the company allegedly failed to reassess the market opportunity it touted to investors. Similarly, in the leadup to its IPO, the company allegedly shared revenue projections with research analysts that lacked a reasonable basis and were materially higher than the projections prepared by the company’s own sales team. Lastly, the company allegedly misled investors about the strength of its customer pipeline, omitting key adverse facts known to the company’s sales team, including delays, dropouts, and growing concerns about potential purchases. The company settled the charges without admitting or denying the SEC’s findings, agreeing to continue cooperating with the SEC’s investigation and to pay a $30 million civil penalty. The settlement is subject to bankruptcy court approval because of the company’s pending bankruptcy proceeding.

Also in September, the SEC announced settled charges against the former CEO and independent director of a publicly traded consumer goods company, alleging violations of the proxy disclosure provisions of the federal securities laws.[44] The SEC filed a complaint in the U.S. District Court for the Southern District of New York alleging that the former CEO—who was elected an independent director in 2020—failed to disclose that he maintained a close personal friendship with an executive at the company. The former CEO also allegedly asked the executive to hide the fact of their relationship to avoid the appearance of bias, so that the former CEO could, as part of his independent director role, participate in the CEO succession process, in which the executive was being evaluated for appointment as the next CEO. The former CEO settled the charges without admitting or denying the SEC’s allegations, agreeing to a five-year officer-and-director bar, permanent injunction, and civil penalty of $175,000.

In October, the SEC announced settled charges against four current and former publicly traded technology companies for allegedly making materially misleading disclosures to the Commission and investors regarding significant cybersecurity incidents that the companies had experienced in 2020.[45] The SEC alleged that, despite investigating and disclosing the cybersecurity incidents in their public filings, the companies inaccurately disclosed the incidents by minimizing their significance and not providing detailed information related thereto. The SEC further alleged that one company failed to maintain proper disclosure controls and procedures surrounding cybersecurity incidents, leading to materially misleading disclosures to the SEC and investors. In agreeing to settle the charges, the SEC considered the cooperation and remedial measures taken by the companies, including, among others, providing Commission staff with detailed explanations, analysis, and summaries of multiple specific factual issues, promptly following up on the staff’s requests for additional documents and information, and conducting internal investigations regarding the incidents. Without admitting or denying the SEC’s findings, the four companies agreed to pay civil penalties of $990,000, $995,000, $1 million, and $4 million.

In December, the SEC announced settled charges against a publicly traded Texas-based biotherapeutics company, its former CEO, and its former CFO for allegedly failing to disclose material information about two of the company’s drug candidates.[46] The Commission alleged that the company failed to disclose to the SEC and its investors that two of the company’s drug candidates had been placed on an FDA clinical hold—an order to delay proposed clinical investigations—before, during, and after a 2021 public offering. The company neither admitted nor denied the charges, and was not ordered to pay civil penalties, purportedly because of its self-reporting, cooperation, and remediation. The individual defendants, however, agreed to pay civil penalties of $125,000 and $20,000, respectively, and the company’s former CEO further agreed to a three-year officer-and-director bar.

Also in December, the SEC announced settled charges against a New Jersey-based medical device manufacturer for allegedly misleading investors between 2016 and 2020 regarding risks associated with one of its medical devices, and for allegedly overstating the company’s income and understating its costs.[47] The Commission alleged that the company knew that it could not obtain FDA clearance for the device, failed to make the necessary changes to the device to obtain FDA clearance, and failed to inform investors of the risk that the FDA would block sales of the device. Further, the SEC alleged that the company misled investors regarding its profitability in 2019 by failing to follow GAAP and not accounting for costs associated with potentially recalling the device. Without admitting or denying the charges, the company agreed to retain an independent compliance consultant to review and make recommendations concerning its disclosure controls and procedures, and to pay a civil penalty of $175 million.

Later in December, the SEC announced settled charges against a fashion retailer for allegedly failing to disclose nearly $1 million in perks to its former CEO.[48] The SEC order alleged that the company failed to disclose the perks, mostly associated with company-authorized expensing of personal travel on privately chartered aircraft in 2019, 2020, and 2021. In April 2023, the company released its fiscal year 2022 proxy statement, which included updated disclosures about perks in 2020 and 2021, and disclosed that the CEO voluntarily reimbursed the company around $454,000 for personal expenses. The SEC noted the company’s self-reporting, cooperation, and remedial efforts, and therefore did not impose a civil penalty.

D. External Accountants and Internal Accounting Controls

In early September, the SEC charged the former finance director of a technology manufacturer for allegedly manipulating the company’s internal accounting records to falsify financial results ahead of inclusion in the company’s financial statements, and that he further fabricated documents to conceal his misconduct.[49] Through its complaint filed in the U.S. District Court for the District of Massachusetts, the SEC is seeking a permanent injunction, civil penalty, and disgorgement and prejudgment interest. The SEC also announced settled charges against the technology manufacturer for allegedly failing to maintain sufficient internal accounting controls that could have prevented the alleged fraud and the company’s overstatement of its financial performance for 2019, 2020, and through Q3 2021, but did not charge the company with fraud. The company was not charged a civil penalty, purportedly because the company self-reported the violations to the SEC following an internal investigation, provided substantial cooperation to Commission staff, and implemented remedial measures. Without admitting or denying the SEC’s findings, the company agreed to cease and desist from further violations.

In mid-September, the SEC announced that two related accounting firms had agreed to settle charges in two separate cases filed by the SEC.[50] In the first case, filed in the U.S. District Court for the Southern District of Florida, the SEC alleged that the firms improperly included indemnification provisions in engagement letters for more than 200 audits, reviews, and exams in violation of auditor independence requirements. The SEC sought a permanent injunction, civil penalty, and disgorgement and prejudgment interest, and the firms agreed to permanent injunctions and to pay a combined $1.2 million in civil penalties and disgorgement. In the second case, filed in the U.S. District Court for the Southern District of New York, the SEC alleged that the firms misrepresented that they complied with Generally Accepted Auditing Standards (GAAS) in two audits of FTX, including by failing to understand the risk associated with the relationship between FTX and a hedge fund controlled by FTX’s CEO. Without admitting or denying the charges, the firms agreed to permanent injunctions and a $745,000 civil penalty—both of which the SEC sought in its complaint—and to retain an independent consultant.

In December, the SEC announced settled charges against a Louisiana-based utility company for alleged failure to maintain internal accounting controls.[51] The SEC alleged that, starting in mid-2018, the utility company included materials and supplies at their average cost as an asset on its balance sheets despite allegedly having been warned by employees and management consultants that this asset included a substantial amount of surplus. The SEC alleged that the utility company failed to follow GAAP by not establishing a process to identify surplus, remeasure it, and record as an expense the differences between the remeasured cost and the average cost. Without admitting or denying the allegations in the SEC’s complaint, which was filed in the U.S. District Court for the District of Columbia, the utility company agreed to a permanent injunction, to adopt recommendations from an independent consultant, and to pay a $12 million civil penalty.

III. Private Companies

In July, the SEC charged the founder and former CEO of a defunct social media startup for allegedly defrauding investors by making false and misleading statements about the startup’s growth and operating expenses.[52] According to the SEC, the individual misleadingly ascribed the startup’s rising userbase to viral popularity and organic growth when, in reality, the CEO allegedly paid millions of dollars through third parties for “incent” advertisements, which offered users incentives to download the app. The SEC also alleged that the founder and former CEO and his wife hid from investors hundreds of thousands of dollars in personal expenses related to clothing, home furnishings, travel, and everyday living expenses charged to the startup’s business credit cards. The SEC’s complaint, filed in the U.S. District Court for the Northern District of California, seeks a permanent injunction, an officer-and-director bar, disgorgement, and civil monetary penalties.

In September, the SEC announced settled charges against a large, privately held family company and its founder, Chairman, and former CEO in connection with the public announcement of a tender offer that the company allegedly did not have the cash to purchase.[53] The SEC alleged that the company, at the direction and approval of the founder, made a public tender offer to purchase a large, public industrial manufacturing company at $35 per share, which would have required $7.8 billion in cash to complete. The day after the public offer was made, the founder allegedly appeared on a large national news program and stated that the company had over $10 billion in cash committed to the deal, and would not put up any company assets as collateral. The SEC further alleged that the company had only one percent of the required $7.8 billion in cash, and that neither the company nor founder had a reasonable belief that the company had the financial means to complete the tender offer. The tender offer was allegedly withdrawn nine days after it was first announced. The SEC alleged violations of Section 14(e) of the Securities Exchange Act of 1934 and Rule 14e-8 thereunder. Without admitting or denying the SEC’s findings, the founder and company agreed to cease and desist from further violations and agreed to pay civil penalties of $100,000 and $500,000 respectively.

In September, the SEC filed charges in U.S. District Court for the Northern District of California against the former CEO of a technology startup, alleging that he defrauded investors by overstating revenue and forging bank statements.[54] The SEC’s complaint details that the CEO allegedly raised over $30 million from investors by falsely inflating the company’s annual recurring revenue in the millions of dollars, despite the actual recurring revenue never exceeding $170,000. The complaint further alleges that the CEO misappropriated at least $270,000 of investor funds for personal expenses such as mortgage payments and home renovations. The SEC seeks permanent injunctions, including a conduct-based injunction, disgorgement, civil penalties, and an officer-and-director bar. The U.S. Attorney’s Office for the Northern District of California also announced criminal charges against the former CEO.

Later in September 2024, the SEC charged three former executives of a digital pharmacy startup, alleging that they defrauded investors by overstating revenue with fake prescriptions while raising over $170 million.[55] The complaint filed in the U.S. District Court for the Eastern District of New York alleges the company used a subsidiary in India for accounting and financial analysis while barring U.S.-based employees from accessing financial systems in an alleged effort to conceal the fraud. The SEC seeks permanent injunctions, civil money penalties, disgorgement, and officer-and-director bars against all three defendants.

In December, the SEC announced settled charges against two private companies and one registered investment adviser for failing to file Forms D on time for multiple unregistered securities offerings.[56] The SEC alleged that over the last several years, the two private companies and the registered investment adviser independently engaged in unregistered securities offerings, soliciting hundreds of potential investors and raising close to $300 million. In reaching a settlement, the SEC credited the parties’ remedial acts and cooperation during the investigation. Without admitting or denying the allegations, the two private companies and the registered investment adviser agreed to pay a total of $430,000 in civil penalties.

IV. Investment Advisers

A. Purportedly Fraudulent Schemes

In July, the SEC charged an activist short seller and his firm for violating antifraud provisions of the federal securities laws by allegedly engaging in a $20 million scheme from March 2018 through December 2020 to defraud followers by publishing false and misleading statements regarding stock trading recommendations.[57] According to the complaint, the short seller allegedly used his website and related social media platforms to publicly recommend taking long or short positions in various companies and held out the positions as consistent with his own and his firm’s positions. The complaint goes on to allege that following the short seller’s recommendations, the price of the target stocks moved more than 12 percent on average, and that once the recommendations were issued and the stocks moved, the short seller and his firm allegedly reversed their positions to capitalize on the stock price movements. Additionally, the SEC alleged that the short seller and his firm made several false and misleading statements in connection with the scheme and that they falsely represented that the short seller’s website had never received compensation from third parties to publish information about target companies when, in fact, it had. The complaint seeks disgorgement and civil penalties against both the short seller and his firm and an officer-and-director bar, a penny stock bar and permanent injunctions against the short seller. The Fraud Section of the Department of Justice and the U.S. Attorney’s Office for the Central District of California announced charges against the short seller as well.

In September, the SEC announced settled charges against a registered investment adviser and subsidiary of a global financial services company for alleged violations of antifraud and compliance provisions of the federal securities laws.[58] The SEC’s order alleged that the adviser overvalued collateralized mortgage obligations and overstated the performance of client accounts holding those positions. The order separately alleged that the adviser executed unlawful cross trades to limit certain investor losses, favoring some investors over others. Without admitting or denying the SEC’s findings, the adviser agreed to pay a penalty and disgorgement totaling almost $80 million and to retain a compliance consultant to review its policies and procedures.

In November, the SEC charged an investment advisory firm and its owner for defrauding nearly two dozen investors out of approximately $2.1 million.[59] The SEC alleged that the firm and owner raised $10.5 million from investors to be invested in short-term loans to professional athletes and sports agents. However, the owner and his firm allegedly made misrepresentations to investors on undisclosed fees and took hundreds of thousands of dollars from these investments for themselves. The owner and his firm also allegedly misappropriated $1.5 million that was supposed to be returned to investors, allegedly using the misappropriated funds for personal expenses, such as cars, rental homes, country club dues, and college tuition. The SEC seeks a permanent injunction, disgorgement, civil monetary penalties, and a conduct-based injunction and officer-and-director bar against the firm’s owner.

In December, the SEC announced settled charges against an investment advisory firm for allegedly failing to reasonably supervise four investment advisers and registered representatives who allegedly stole millions of dollars from advisory clients and brokerage customers.[60] The SEC alleged that the firm failed to adopt policies that could have detected and prevented the alleged theft. Specifically, the SEC’s order alleged that the firm failed to prevent the advisers from using authorized third-party disbursements, which allowed hundreds of unauthorized transfers from customer and client accounts to adviser accounts. Without admitting or denying the SEC’s findings, the firm consented to undertakings, including engaging a compliance consultant to review all forms of third-party cash disbursements from customer and client accounts, and to pay a $15 million penalty.

B. Misleading Statements and Disclosures

In August, the SEC charged a China-based investment adviser, its U.S.-based holding company, and the company’s CEO with fraud violations involving the marketing of AI-based investments.[61] The SEC’s complaint alleges that the companies and the CEO misled clients about the safety of their investments, made false claims about relationships with reputable financial and legal firms, and misled investors to believe the company would soon be listed on the NASDAQ. The SEC further alleges that the company collected over $6 million from individual investors before cutting off client communication and taking down access to client accounts through their website. The SEC’s complaint in the U.S. District Court for the District of South Dakota seeks a permanent injunction, disgorgement, civil penalties, and an officer-and-director bar.

In September, the SEC announced settled fraud charges against an Idaho-based investment adviser for allegedly misleading investors and failing to comply with its own investment strategy.[62] The adviser positioned itself as having a “biblically responsible” investment strategy by utilizing a data-driven methodology to evaluate companies and exclude any companies that did not align with biblical values. Instead, according to the SEC, from at least 2019 to March 2024, the adviser allegedly used a manual research process that did not always evaluate companies based on eligibility under the investment adviser’s own investing criteria. The SEC also alleged that the adviser lacked written policies or procedures setting forth a process for evaluating companies’ activities as part of its investment process, which caused inconsistent application of criteria and led to investments in companies that failed to align with the adviser’s own stated criteria. Without admitting or denying the SEC’s findings, the adviser agreed to pay a $300,000 civil penalty and to retain a compliance consultant.

In October, the SEC announced settled charges against an investment adviser for violating antifraud provisions of the federal securities laws by allegedly misrepresenting that certain environmental, social, and governance factors (ESG) exchange-traded funds would not be used to invest in companies that were involved in fossil fuel or tobacco.[63] Between 2020 and 2022, the investment adviser allegedly used data from third-party vendors that did not screen out these company types. This practice allegedly led to fund investments in fossil fuel and tobacco-related companies, including in coal mining and transportation, natural gas extraction and distribution, and retail sales of tobacco products. The SEC also alleged that the adviser did not have any policies and procedures over the screening process that would exclude those company types. Without admitting or denying the SEC’s findings, the adviser agreed to pay a $4 million civil penalty.

In November, the SEC announced settled charges against an investment advisory firm for allegedly making misleading statements about the percentage of its parent company’s assets that were ESG integrated.[64] The SEC order alleged that though the marketing materials claimed that between 70 and 94 percent of its parent company’s assets were ESG integrated, the firm did not have a policy defining ESG integration and a substantial number of assets were allegedly held in passive ETFs that did not consider ESG factors in investment decisions. Without admitting or denying the SEC’s findings, the firm agreed to pay a $17.5 million penalty.

C. Safeguards and Policies

In August, the SEC announced settled charges against a New York-based registered transfer agent for allegedly failing to assure that client securities and funds were protected against theft or misuse.[65] The SEC claimed that the alleged failures led to the loss of more than $6.6 million of client funds as a result of two separate cyber intrusions in 2022 and 2023. Without admitting or denying the SEC’s findings, the registered agent agreed to pay an $850,000 civil penalty. The SEC’s order made note of the registered agent’s cooperation and remedial efforts, including the full reimbursement of all clients and accounts for losses resulting from the cyber incidents.

Also in August, the SEC announced settled charges against a New York-based registered investment adviser for failing to establish, maintain, and enforce written policies and procedures reasonably designed to prevent the misuse of material nonpublic information concerning its trading of collateralized loan obligations.[66] According to the SEC’s order, the adviser maintained a credit business through which it obtained material nonpublic information (MNPI) about companies whose loans were held in collateralized loan obligations that the adviser traded, but did not establish, maintain, or enforce any written policies or procedures concerning the potential impact of the MNPI for over five years. Without admitting or denying the SEC’s findings, the adviser agreed to pay a $1.8 million civil penalty. The SEC’s order made note of the adviser’s prompt remedial acts and cooperation.

In September, the SEC announced settled charges against 11 institutional investment managers for allegedly failing to file Forms 13F, which report quarterly holdings and are required for institutional investment managers that have discretion over $100 million in certain types of securities (Section 13(f) securities).[67] Two of the managers were also charged with allegedly failing to file Forms 13H, a form required for large traders with a substantial number of transactions of securities listed on national securities exchanges. All 11 managers settled without admitting or denying the SEC’s findings. Nine of the managers agreed to pay an aggregate of more than $3.4 million in civil penalties, with individual penalties ranging from $175,000 to $725,000. Two of the managers were not ordered to pay any civil penalties, however, purportedly because they self-reported the alleged violations.

D. Recordkeeping

The Commission continues to bring heavy fines against a multitude of broker-dealers, investment advisors, and dual registrants for failing to preserve electronic communications. As demonstrated below, this trend persisted through the second half of 2024, and the SEC has already announced settled charges related thereto so far in 2025 with Gensler as the Chair.[68]

In September, the SEC resolved three separate enforcement actions involving recordkeeping violations. In the first action, the SEC announced settled charges against six nationally recognized statistical rating organizations for failing to maintain and preserve electronic communications.[69] All six firms admitted to the SEC’s findings and agreed to pay an aggregate of more than $49 million in civil penalties, with firms agreeing to pay between $100,000 and $20 million individually. Five of the firms further agreed to retain a compliance consultant. In the second action, the SEC announced settled charges against 12 municipal advisors for failing to preserve electronic communications sent or received by personnel related to their activities as municipal advisors.[70] Because the failures included personnel at the supervisory level, the advisors were also charged with supervision failures. All 12 advisors admitted to the SEC’s findings and agreed to pay an aggregate of more than $1.3 million in civil penalties, with individual penalties ranging from $40,000 to over $300,000. In the third action, the SEC announced settled charges against an investment advisory firm for allegedly failing to keep records, including off-channel communications, related to recommendations and advice to purchase and sell securities.[71] Without admitting or denying the SEC’s findings, the firm agreed to a cease and desist and a censure. The SEC did not impose a penalty because the firm self-reported the conduct, promptly remediated the violations, and cooperated on the third-party investigation.

E. Custody Rule

In September, the SEC announced settled charges against a registered investment adviser for allegedly failing to comply with requirements related to the safekeeping of client assets from at least 2018 through 2022 and for its use of allegedly impermissible liability disclaimers in advisory and private fund agreements beginning in 2019.[72] According to the SEC’s order, the adviser allegedly violated the “custody rule” under the Advisors Act—which requires advisers to implement various safeguarding measures unless the adviser instead distributes audited financials prepared in accordance with GAAP—because it failed to implement the enumerated safeguards or timely distribute annual audited financial statements to investors in certain private funds that it advised. In addition, the SEC alleged that the adviser included liability disclaimers in its advisory agreements and certain private fund partnership and operating agreements that could have led a client to incorrectly believe that the client had waived non-waivable causes of action against the adviser. The order further alleged that certain of the liability disclaimers also contained misleading statements regarding the adviser’s otherwise unwaivable fiduciary duty. Without admitting or denying the SEC’s findings, the adviser agreed to pay a $65,000 civil penalty. According to the order, the SEC considered the adviser’s remedial acts—which included revising its procedures regarding compliance with the custody rule, and removing problematic clauses from its advisory and private fund agreements—when deciding upon settlement.

Also in September, the SEC announced settled charges against a privately held Florida-based advisory firm for allegedly violating the custody rule by purportedly failing to ensure that certain crypto assets held by its client were maintained with a qualified custodian.[73] The SEC further alleged that the firm misled certain investors by representing to them that redemptions required at least five business days’ notice before month-end while allowing other investors to redeem with fewer days’ notice. The firm agreed, without admitting or denying the allegations, to a civil penalty of $225,000.

F. Marketing Rule

In September, the SEC announced settled charges against nine registered investment advisers for violating the new Marketing Rule by allegedly disseminating advertisements that included untrue or unsubstantiated statements of material facts, testimonials, endorsements, or third-party ratings without required disclosures.[74] All nine advisers settled without admitting or denying the SEC’s findings and agreed to pay an aggregate of $1.24 million in civil penalties, with individual penalties ranging from $60,000 to $325,000, and to review their advertisements and certify compliance with the Marketing Rule.

V. Broker-Dealers

A. Regulation Best Interest and Pricing

In September, the SEC announced settled charges against a Tennessee-based broker-dealer for failing to maintain and enforce policies and procedures reasonably designed to achieve compliance with Regulation Best Interest (Reg BI).[75] The SEC alleged that, in 2021, the company merged with another broker-dealer, but due to incompatibilities between the two parties’ systems, the company lacked accurate customer information for more than 5,000 customer brokerage accounts that migrated to its platform. Additionally, the SEC alleged the new registered representatives that joined the company post-merger did not have access to the site the company used to review structured notes transactions flagged as non-compliant and that, as a result, the company approved such note recommendations without all the documentation required by its own Reg BI policies and procedures. Without admitting or denying the allegations, the broker-dealer agreed to a civil penalty of $325,000.

In October, the SEC announced settled charges against two affiliates of a large multinational financial services firm in five separate enforcement actions for allegedly misleading disclosures to investors, breach of fiduciary duty, prohibited joint transactions and principal trades, and failure to make recommendations in the best interest of customers.[76] Without admitting or denying the SEC’s findings, the affiliates agreed to pay more than $151 million in combined civil penalties and voluntary payments to investors.

The first three enforcement actions pertained to one affiliate. The first of these orders alleged that the affiliate made misleading disclosures to investors about the extent to which it had discretion over when to sell and the number of shares to be sold, subjecting customers to market risk and failing to sell certain shares for months, which resulted in a decline in value. The second order alleged that the affiliate failed to fully and fairly disclose the financial incentive that it and its advisers had when recommending their own portfolio management programs over third-party programs between July 2017 and October 2024. The third SEC order alleged that, in violation of Reg BI, the affiliate recommended certain mutual fund products to its retail brokerage customers despite the fact that materially less expensive ETF products already existed, and offered the same portfolio as being available between June 2020 and July 2022. No civil penalty was imposed in this third order, as the affiliate promptly self-reported, conducted an internal investigation, provided substantial cooperation, and voluntarily repaid impacted customers approximately $15.2 million.

The other two enforcement actions pertained to the second affiliate. The first of these orders alleged that the affiliate caused $4.3 billion in prohibited joint transactions that advantaged an affiliated foreign money market fund. The second SEC order alleged that this same affiliate engaged in or caused 65 prohibited principal trades with a combined notional value of approximately $8.2 billion between July 2019 and March 2021. The order alleged that the affiliate directed an unaffiliated broker-dealer to buy commercial paper or short-term fixed income securities from the affiliate, which the affiliate then purchased back on behalf of its clients.

B. Market Manipulation

In September, the SEC announced settled charges against a registered broker-dealer for allegedly manipulating the U.S. Treasury cash securities market through an illicit trading strategy known as spoofing.[77] The SEC order alleged that between April 2018 and May 2019, a trader employed by the broker-dealer entered orders on one side of the market that they had no intention of executing in order to obtain more favorable execution prices on bona fide orders on the other side of the market. Allegedly, once the bona fide orders were filled, the spoofed orders were then canceled. The broker-dealer allegedly lacked adequate controls and failed to take reasonable steps to scrutinize the trader after receiving warnings of his potentially irregular trading activity. The broker-dealer settled the charges and agreed to pay a penalty and disgorgement totaling more than $6.9 million, which will be credited from a monetary sanction of more than $15 million from a deferred prosecution agreement the broker-dealer entered into with the DOJ. The broker-dealer separately agreed to pay a $6 million fine to FINRA to resolve related charges.

C. Safeguards and Policies

In July, the SEC announced settled charges against a California-based parent company of a cryptocurrency bank, its former CEO, and former Chief Risk Officer for allegedly misleading investors.[78] The Commission alleged that from 2022 to 2023, the company and its officers misled investors about the strength of its Bank Secrecy Act/Anti-Money Laundering compliance program and falsely stated in its SEC filings that it conducted ongoing monitoring of its high-risk crypto customers. The SEC further alleged that following the collapse of one of its customers, the company misrepresented its financial condition. Without admitting or denying the charges, the company agreed to pay a civil penalty of $50 million, and its officers agreed to pay civil penalties of $1 million and $250,000, respectively, in addition to five-year officer-and-director bars. In parallel actions, the company also settled charges with the Federal Reserve System (FRB) and the California Department of Financial Protection and Innovation (DFPI).

In August, the SEC announced settled charges against a New York-based broker-dealer for allegedly failing to adopt or implement reasonably designed anti-money laundering policies and procedures between March 2020 to May 2023.[79] As a result, the broker-dealer allegedly did not surveil certain types of purportedly risky transactions for red flags of potentially suspicious conduct, nor did it allocate sufficient resources to review alerts generated from its automated surveillance of other types of transactions. Without admitting or denying the alleged facts, the broker-dealer agreed to a censure and a cease-and-desist order, in addition to paying a $1.19 million penalty.

In September, the SEC announced settled charges against two investment adviser firms for allegedly exceeding clients’ designated investment limits over a two-year period beginning in March 2016.[80] The SEC order alleged that one of the firms was the primary investment adviser and portfolio manager for a trading strategy in which options were traded in a volatility index with the aim of generating incremental returns. The firm allegedly allowed many accounts to exceed the exposure levels that investors had set, including dozens of accounts that exceeded the limit by 50 percent or more. The other firm allegedly introduced its clients to the trading strategy despite knowing that investors’ exposure levels were being exceeded, and purportedly failed to adequately inform affected investors. Both firms allegedly received management and incentive fees, as well as trading commissions from the trading strategy. The SEC also alleged that both firms neglected to adopt and implement policies and procedures reasonably designed to ensure that they kept their clients abreast of material facts and excessive exposure. Without admitting or denying the findings, both firms agreed to civil penalties and disgorgement totaling $5.5 million and $3.8 million, respectively.

In November, the SEC announced settled charges against three broker-dealers related to suspicious activity reports (SARs) filed by the broker-dealers that allegedly lacked certain important, required information.[81] Over a four-year period beginning in 2018, the three broker-dealers filed multiple allegedly deficient SARs in violation of Section 17(a) of the Exchange Act, as well as Rule 17a-8 promulgated thereunder. Without admitting or denying the charges, the firms agreed to civil penalties of $125,000, $75,000, and $75,000, respectively, and two of the broker-dealers further agreed to have their anti-money laundering programs reviewed by compliance consultants.

In December, the SEC filed charges against a registered investment adviser for allegedly failing to establish, implement, and enforce written policies and procedures reasonably designed to prevent the misuse of material nonpublic information (MNPI) relating to its participation on ad hoc creditors’ committees.[82] The SEC’s complaint focused on one of the investment adviser’s attorney-consultants, who sat on the private side of the investment adviser’s information barrier, which was the subject of extensive policies and procedures. The SEC alleged that this attorney-consultant sat on an ad hoc creditors’ committee in connection with certain distressed municipal bonds and received MNPI pursuant to a customary confidentiality agreement. According to the complaint, the attorney-consultant then allegedly had unspecified communications with the investment adviser’s public trading desk when he had MNPI and while the firm continued to buy the distressed issuer’s bonds. The SEC did not allege, and presumably had no evidence, that any MNPI was communicated by the attorney-consultant to the public-side investment team; nor did the SEC allege any improper trading violation of any kind nor any harm to investors. The investment adviser is charged with allegedly violating provisions of the Investment Advisers Act of 1940 related to establishing and enforcing reasonably designed compliance policies and procedures. The SEC is seeking a civil penalty and permanent injunctive relief. The investment adviser has stated that it fully cooperated with the SEC in its years-long investigation and would not agree to settle a dispute in which there was no wrongdoing nor any deficiency in its detailed information barrier policies or its compliance program.

D. Recordkeeping

In August, the SEC announced settled charges against 26 broker-dealers and investment advisers for alleged widespread and longstanding failures by the firms and their personnel to maintain and preserve electronic communications.[83] The firms admitted to the facts alleged against them and agreed to pay civil penalties of $392.75 million in the aggregate, ranging between $400,000 and $50 million each. Three of the firms self-reported their violations and resultingly incurred lower civil penalties. The CFTC also announced settlements for related conduct with three of the entities.

In September, the SEC announced settled charges against 12 broker-dealers and investment advisers for failures to maintain and preserve electronic communications.[84] The firms admitted to the facts alleged against them and agreed to pay civil penalties of over $88 million in the aggregate, ranging between $35 million and $325,000. One firm will not pay a penalty because it self-reported, self-policed, and demonstrated substantial efforts at compliance. Two other firms similarly self-reported and incurred lower civil penalties as a result. The CFTC announced a settlement for related conduct with an additional entity on the same day.

E. Failure to Register

In September, the SEC announced settled charges against three sales agents from a Delaware investment advisor for unregistered broker activity, including selling membership interests in LLCs that purported to invest in shares of pre-IPO companies.[85] The SEC alleged that the sales agents engaged in broker activities—including providing investors with marketing materials, advising investors on the merits of investments, and receiving transaction-based compensation—despite not being registered as brokers. Without admitting or denying the findings, each sales agent agreed to industry and penny stock bars, and to pay disgorgement ranging from $431,287 to $1,392,367, along with a civil penalty ranging from $90,000 to $300,000. One of the sales agents also settled related fraud charges that the SEC had previously announced in March 2023.

F. Technical Violations

In December, the SEC announced settled charges against two broker-dealer firms for failing to provide complete and accurate securities trading information to the SEC, known as blue sheet data.[86] The SEC orders found that, over a period of several years, due to a number of errors, one broker-dealer made approximately 11,195 blue sheet submissions to the SEC with missing or inaccurate data, while the other firm made approximately 3,679 submissions with misreported or missing data. The SEC orders did find that both broker-dealers engaged in remedial efforts to correct and improve their blue sheet reporting systems and controls, and that one of the broker-dealers self-identified and self-reported all but one of the errors affecting its blue sheet submissions. The broker-dealers admitted the findings, agreed to be censured, and to each pay a $900,000 penalty. The broker-dealers separately settled with FINRA for related conduct.

Also in December, the SEC announced settled charges against a registered broker-dealer for failing to file certain Suspicious Activity Reports (SARs) in a timely manner.[87] According to the order, in certain instances between April 2019 and March 2024, the broker-dealer received requests in connection with law enforcement or regulatory investigations/litigation but allegedly failed to conduct or complete SARs investigations within a reasonable period of time. The broker-dealer settled the charges and agreed, without denying or admitting the allegations, to pay a $4 million civil penalty, to a censure, and to cease and desist.

VI. Cryptocurrency

A. Purported Fraud

In July, the SEC filed fraud charges against a high-profile software engineer and social media platform founder.[88] The SEC accused the individual of raising more than $257 million from unregistered offers and sales of crypto assets, while falsely telling investors that proceeds would not be used to compensate him or other employees. The SEC alleged that the individual nonetheless spent more than $7 million of investor funds on personal expenditures, and further misled investors by portraying his company as a decentralized project. The individual was charged with violating the registration and anti-fraud provisions of the Securities Act of 1933 and the anti-fraud provisions of the Securities Exchange Act of 1934.

In August, the SEC announced partially settled fraud charges against a privately held entity, the entity’s co-owner and CEO, its co-owner and COO, and its promoters.[89] The SEC alleged that, from 2019 through 2023, the entity was operated as a multi-level marketing and crypto asset investment program. The SEC further alleged that the entity and individuals misled investors by claiming they would invest their funds on crypto assets and foreign exchange markets despite using the majority of investor funds to make payments to existing investors and to pay commissions to promoters. The co-owners further allegedly siphoned millions of dollars of investor assets for themselves, allegedly raising more than $650 million in crypto assets from more than 200,000 investors worldwide. The SEC charged most parties involved with violations of the registration regulations and antifraud provisions of the federal securities laws, and seeks permanent injunctive relief, disgorgement of ill-gotten gains, and civil penalties. The case is still ongoing against the entity and co-owners, but one of the parties involved agreed, without admitting or denying the allegations, to a $100,000 civil penalty and an injunction.

B. Unregistered Offerings

In August, the SEC charged a privately held Georgia-based crypto asset lender for allegedly operating as an unregistered investment company and for offering unregistered securities.[90] The SEC Complaint alleged that, in and around 2020, the company used their crypto lending program to offer and sell a product, which the SEC alleged qualified as a security, that allowed U.S. investors to tender their crypto assets in exchange for the company’s promise to pay a variable interest rate. The SEC further alleged that the company operated for at least two years as an unregistered investment company because it issued securities and held more than 40 percent of its total assets, excluding cash, in investment securities, including its loans of crypto assets to institutional borrowers. The company agreed, without admitting or denying the allegations, to an injunction and to pay a civil penalty of $1,650,000.