Discussing Human Capital: A Survey of the S&P 500’s Compliance with the New SEC Disclosure Requirement One Year After Adoption

Client Alert | November 10, 2021

A main area of focus for public companies this past annual reporting season was the new human capital disclosure requirement for annual reports on Form 10-K. This client alerteviews disclosure trends among S&P 500 companies and provides practical considerations for companies as we head into 2022 and the second year of discussing human capital resources and management.

I. Background on the New Requirements

On August 26, 2020, the U.S. Securities and Exchange Commission (the “Commission”) adopted amendments to Items 101, 103 and 105 of Regulation S-K, which became effective as of November 9, 2020.[1] Among other things, these amendments added human capital resources as a disclosure topic under Item 101, which addresses what companies must include in the “Business” section of their Form 10-K. As amended, Item 101(c) requires a registrant to describe its human capital resources “to the extent material to the understanding of that registrant’s business taken as a whole.”[2] Specifically, the human capital disclosure must include “the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction and retention of personnel).”[3] Prior to this amendment, Item 101(c) required the registrant to disclose only the number of persons employed by the registrant.

Consistent with the Commission’s stated desire to implement a more “principles-based” disclosure system,[4] the new rules did not define “human capital” or elaborate on specific requirements for human capital disclosures beyond the few examples provided in the rule text. This lack of specific line item requirements was criticized by Democratic Commissioner Caroline Crenshaw, who stated that “I would have supported today’s final rule if it had included even minimal expansion on the topic of human capital to include simple, commonly kept metrics such as part time vs. full time workers, workforce expenses, turnover, and diversity. But we have declined to take even these modest steps.”[5] As discussed below, following the change in presidential administration, the Commission has indicated that it plans to revisit the human capital disclosure requirements and potentially adopt more prescriptive rules in the future.[6]

To understand how companies have responded to the current disclosure requirements, we conducted a survey of the substance and format of human capital disclosures made by the 451 S&P 500 companies that filed an annual report on Form 10-K between the date the new requirements became effective, November 9, 2020, and July 16, 2021.[7] As is to be expected from principles-based rules, companies provided a wide variety of human capital disclosures,[8] with no uniformity in their depth or breadth. The next three sections highlight our observations from this survey.[9]

II. Disclosure Topics

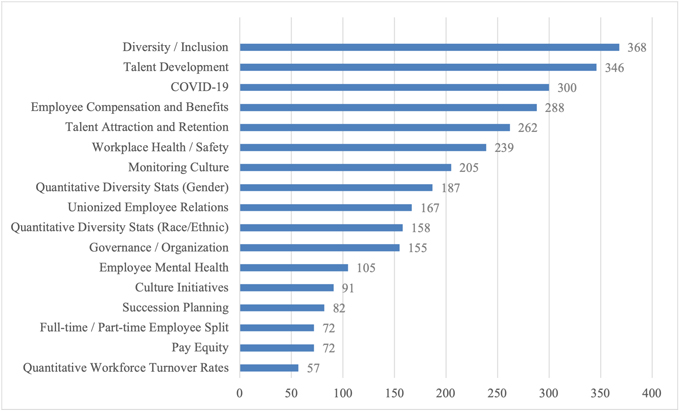

Our survey breaks down companies’ human capital disclosures into 17 topics, each of which is listed in the following chart, along with the number of companies that discussed the topic. Each topic is described more fully in the sections following the chart.

A. Workforce Composition and Demographics

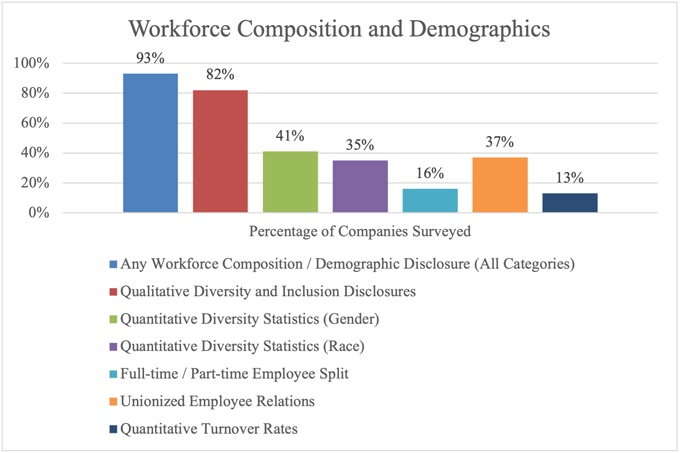

Of the 451 companies surveyed, 419, or 93%, included disclosures relating to workforce composition and demographics in one or more of the following categories:

- Diversity and inclusion. This was the most common type of disclosure, with 82% of companies including a qualitative discussion regarding the company’s commitment to diversity, equity, and inclusion. The depth of these disclosures varied, ranging from generic statements expressing the company’s support of diversity in the workforce to detailed examples of actions taken to support underrepresented groups and increase the diversity of the company’s workforce. Many companies also included a quantitative breakdown of the gender or racial representation of the company’s workforce: 41% included statistics on gender and 35% included statistics on race. Most companies provided these statistics in relation to their workforce as a whole, while a subset (21%) included separate statistics for different classes of employees (e.g., managerial, vice president and above, etc.) and/or for their boards of directors. Some companies also included numerical goals for gender or racial representation—either in terms of overall representation, promotions, or hiring—even if they did not provide current workforce diversity statistics.

- Full-time / part-time employee split. While most companies provided the total number of full-time employees, only 16% of the companies surveyed included a quantitative breakdown of the number of full-time versus part-time employees the company employed. Similarly, we saw a number of companies that provided statistics on the number of seasonal employees and/or independent contractors.

- Unionized employee relations. 37% of the companies surveyed stated that some portion of their employees was part of a union, works council, or similar collective bargaining agreement. These disclosures generally included a statement providing the company’s opinion on the quality of labor relations, and in many cases, disclosed the number of unionized employees. While never expressly required by Regulation S-K, as a result of disclosure review comments issued by the Division of Corporation Finance over the years and a decades-old and since-deleted requirement in Form 1-A, it has been a relatively common practice to discuss collective bargaining and employee relations in the Form 10-K or in an IPO Form S-1, particularly since the threat of a workforce strike could be material.

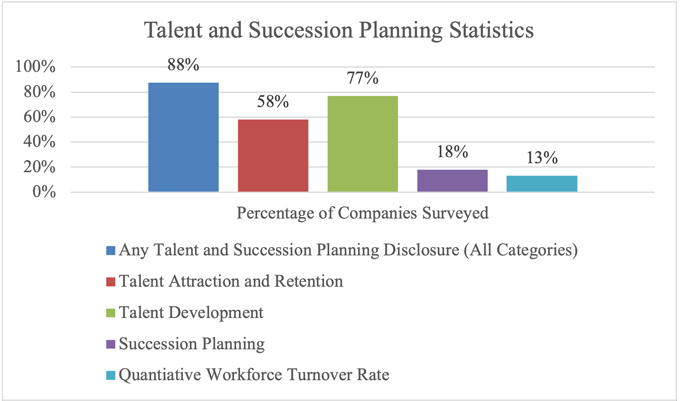

- Quantitative workforce turnover rates. Although a majority of companies discussed employee turnover and the related topics of talent attraction and retention in a qualitative way (as discussed in Section II.B. below), less than 13% of companies surveyed provided specific employee turnover rates (whether voluntary or involuntary).

B. Recruiting, Training, Succession

395, or 88%, of the companies surveyed included disclosures relating to talent and succession planning in one or more of the following categories:

- Talent Attraction and Retention. These disclosures were generally qualitative and focused on efforts to recruit and retain qualified individuals. While providing general statements regarding recruiting and retaining talent were relatively common, with 58% of companies including this type of disclosure, quantitative measures of retention, like workforce turnover rate, were uncommon, with less than 13% of companies disclosing such statistics (as noted above).

- Talent Development. The most common type of disclosure in this area related to talent development, with 77% of companies including a qualitative discussion regarding employee training, learning, and development opportunities. This disclosure tended to focus on the broader workforce rather than specifically on senior management. Companies generally discussed training programs such as in-person and online courses, leadership development programs, mentoring opportunities, tuition assistance, and conferences, and a minority also disclosed the number of hours employees spent on learning and development.

- Succession Planning. Only 18% of companies surveyed addressed their succession planning efforts, which may be a function of succession being a focus area primarily for executives rather than the human capital resources of a company more broadly.

C. Employee Compensation

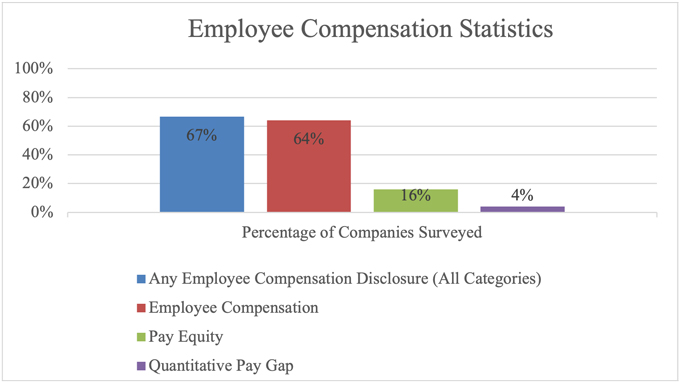

Of the companies surveyed, 300, or 67%, included disclosures relating to employee compensation. Most of those companies, or 64% of companies surveyed, included a qualitative description of the compensation and benefits program offered to employees. However, only 16% of companies surveyed addressed pay equity practices or assessments, and even fewer companies (4% of companies surveyed) included quantitative measures of the pay gap between diverse and non-diverse employees or male and female employees.

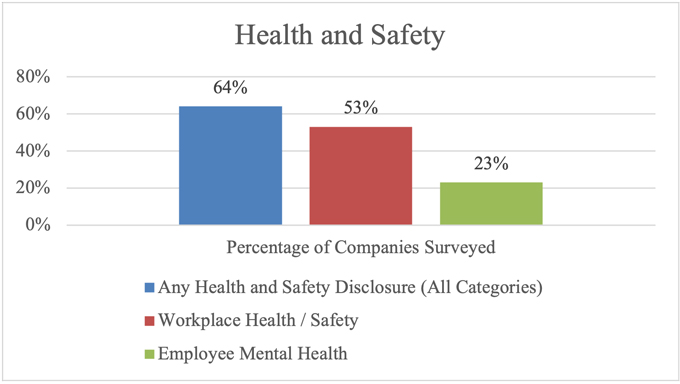

D. Health and Safety

Of the companies surveyed, 288, or 64%, included disclosures relating to health and safety in one or both of the following categories:

- Workplace health and safety. 53% of companies surveyed included qualitative disclosures relating to workplace health and safety, typically with statements around the company’s commitment to safety in the workplace generally and compliance with applicable regulatory and legal requirements. However, only 12% of companies surveyed provided quantitative disclosures in this category, generally focusing on historical and/or target incident or safety rates or investments in safety programs. These disclosures generally were more prevalent among industrial and manufacturing companies, as discussed in Section G below. Many companies also provided disclosures on safety initiatives undertaken in connection with COVID-19, which is discussed separately below.

- Employee mental health. In connection with disclosures about standard benefits provided to employees, or additional benefits provided as a result of the pandemic, 23% of companies disclosed initiatives taken to support employees’ mental or emotional health.

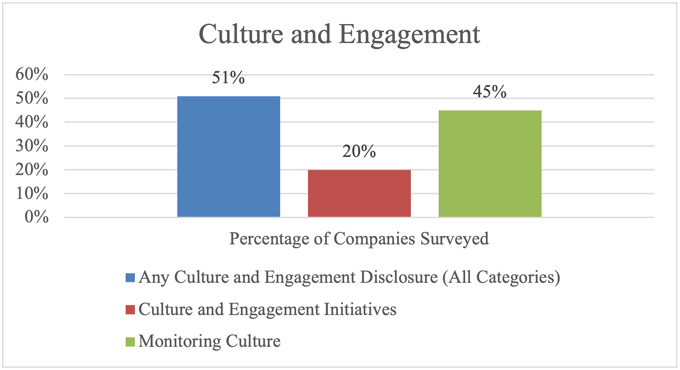

E. Culture and Engagement

In addition to the many instances where companies mentioned a general commitment to culture and values, 229, or 51%, of the companies surveyed discussed specific initiatives they were taking related to culture and engagement in one or more of the following categories:

Culture and engagement initiatives. Only 20% of companies surveyed included specific disclosures relating to practices and initiatives undertaken to build and maintain their culture and values. These disclosures most commonly discussed company efforts to communicate with employees (e.g., through town halls, CEO outreach, trainings, or conferences and presentations) and to recognize employee contributions (e.g., awards programs and individualized feedback). Many companies also discussed culture in the context of the diversity-related initiatives to help foster an inclusive culture.

- Monitoring culture. Disclosures about the ways that companies monitor culture and employee engagement were much more common, with 45% of companies providing such disclosure. Companies generally disclosed the frequency of employee surveys used to track employee engagement and satisfaction, with some reporting on the results of these surveys, sometimes measured against prior year results or industry benchmarks.

F. COVID-19

A majority of companies (67% of those surveyed) included information regarding COVID-19 and its impact on company policies and procedures or on employees generally. COVID-19-related topics addressed ranged from work-from-home arrangements and safety protocols taken for employees who worked in person to additional benefits and compensation paid to employees as a result of the pandemic and contributions made to organizations supporting those affected by the pandemic.

G. Human Capital Management Governance and Organizational Practices

A minority of companies (34% of those surveyed) addressed their governance and organizational practices (such as oversight by the board of directors or a committee and the organization of the human resources function).

III. Industry Trends

One of the main rationales underlying the adoption of principles-based—rather than prescriptive—requirements for human capital disclosures is that the relative significance of various human capital measures and objectives varies by industry. This is reflected in the following industry trends that we observed:[10]

- Finance Industries (Asset Management & Custody Activities, Consumer Finance, Commercial Banks and Investment Banking & Brokerage). For the 34 companies in the Finance Industries, a majority included quantitative diversity statistics regarding race (61%) and gender (70%). Most companies also included qualitative disclosures regarding employee compensation (70%), and, compared to other industries discussed below, a relatively higher number discussed pay equity (35%) and quantified their pay gap (17%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, unionized employee relations, quantitative workforce turnover rates, and succession planning (in each case less than 20%).

- Technology Industries (E-Commerce, Internet Media & Services, Hardware, Software & IT Services and Semiconductors). For the 68 companies in the Technology Industries, 66% discussed talent development and training opportunities and 58% discussed talent attraction, recruitment, and retention. Relatively uncommon disclosures among this group included part-time and full-time employee statistics (7%), quantitative workforce turnover rates (16%), workplace health and safety measures (23%), culture initiatives (19%), and quantitative pay gap (2%).

- Manufacturing Industries (Industrial Machinery & Goods, Auto Parts, Automobiles, and Appliance Manufacturing). For the 21 companies in the Manufacturing Industries, 85% of the companies discussed their workplace health and safety measures. Other common disclosures included those related to COVID-19 (66%), unionized employee relations (52%), employee training and development (80%), and employee compensation (57%). Relatively uncommon disclosures among this group included those relating to corporate governance, part-time and full-time employee statistics, quantitative measures of diversity like race, ethnicity or gender workforce statistics, quantitative workforce turnover rates, employee mental health, culture initiatives, succession planning, pay equity or quantitative measures of the pay gap (in each case less than 25%).

- Travel Industries (Airlines and Cruise Lines). For the 8 companies in the Travel Industries, all but one discussed COVID-19, and all 8 companies discussed their unionized employee relations. Other common disclosures related to diversity and inclusion (87%), talent development (62%), and employee compensation (62%). None of the companies in this group discussed pay equity or provided quantitative workforce turnover rates or pay gap analysis.

- Retail Industries (Food Retailers & Distributors and Multiline and Specialty Retailers & Distributors). Of the 22 companies in this Retail Industries category of our survey, 36% included disclosures related to part-time and full-time employee statistics. Relatively uncommon disclosures among this group included quantitative workforce turnover rates, employee mental health, culture initiatives, pay equity, and quantitative pay gap analysis (in each case less than 20%).

- Aerospace & Defense Industry. For the 10 companies in the Aerospace & Defense Industry, all but one included a disclosure regarding talent development and training, and 80% of the companies also discussed talent attraction and retention. Other common disclosures include those related to COVID-19 (60%), qualitative discussion of diversity and inclusion (70%), unionized employee relations (60%), workplace health and safety measures (70%), and qualitative discussion of employee compensation (60%). Uncommon disclosures for companies in this group related to part-time and full-time employee statistics, quantitative workforce turnover rates, employee mental health, culture initiatives, pay equity or quantitative measures of the pay gap (in each case 10% or less).

- Food & Beverage Industries (Agricultural Products, Alcoholic Beverages, Non-Alcoholic Beverages, Processed Foods, Meat, Poultry & Dairy). For the 17 companies in the Food & Beverage Industries, the most common disclosures included those related to qualitative discussions on diversity and inclusion (94%), workplace health and safety measures (70%), and talent development and training (82%). Less than 20% of the companies in this group included disclosures related to part-time and full-time employee statistics, quantitative workforce turnover rates, succession planning (none of the companies in this group included this type of disclosure), pay equity, or quantitative measures of the pay gap.

- Personal Goods Industries (Apparel, Accessories & Footwear, Household & Personal Products, Toys and Sporting Goods). For the 13 companies in the Personal Goods Industries, the most common disclosures were those related to a qualitative discussion on diversity and inclusion (92%), quantitative diversity statistics about gender (61%), COVID-19 (61%), talent attraction and retention (61%), talent development (76%), employee compensation (61%), and corporate governance and organization (61%). Relatively uncommon disclosures for companies in this group include quantitative workforce turnover rates (7%), employee mental health (23%), culture initiative (23%), pay equity (15%), and the quantitative pay gap (0%).

- Biotechnology & Pharmaceutical Industry. For the 18 companies in the Biotechnology & Pharmaceutical Industry, 100% included a qualitative discussion of diversity and inclusion, with many including workforce diversity statistics for race (55%) or gender (50%). Other common disclosure topics for this industry were COVID-19 (72%), workplace health and safety measures (66%), monitoring culture (61%), talent development (77%), and employee compensation (72%). Less than 25% of the companies in this industry included disclosures regarding part-time and full-time employee statistics, quantitative workforce turnover rate, culture initiative, succession planning, or quantitative pay gap measures.

- Health Care Industries (Drug Retailers, Health Care Delivery, Health Care Distributors, and Medical Equipment & Supplies). For the 37 companies in the Health Care Industries, the most common disclosures were those related to COVID-19 (67%), qualitative discussion of diversity and inclusion (86%), diversity workforce statistics of gender (56%) (statistics about race were only disclosed by 43% of this group), workplace health and safety (59%), talent development and training (83%), and employee compensation (70%). The least common disclosures, with less than 20% each, included quantitative workforce turnover rates, culture initiatives, succession planning, pay equity, and quantitative pay gap measures.

- Building Industries (Building Products & Furnishings, Engineering & Construction Services, and Home Builders). For the 11 companies in the Building Industries, the most common disclosures were those related to COVID-19 (63%), workplace health and safety (54%), talent attraction and retention (72%), talent development (72%), and employee compensation (54%). The least common disclosures, with 10% or less of the companies in this group including such disclosures, were part-time and full-time employee statistics, quantitative workforce turnover rate, employee mental health, culture initiatives, pay equity (0%) and quantitative pay gap measures (0%).

- Hotel Industries (Casinos & Gaming, Hotels & Lodging, and Leisure Facilities). Of the 9 companies in the Hotel Industries, 100% included COVID-19-related disclosure. Disclosures of over 80% of companies in this group include in their annual report a qualitative discussion on diversity and inclusion, unionized employee relations, and employee compensation. Relatively uncommon disclosures include those related to governance and corporate organization, quantitative diversity statistics regarding race and gender, quantitative workforce turnover rates, culture initiatives, monitoring culture, succession planning, pay equity, and quantitative pay gap (in each case less than 25%).

- Utilities Industries (Electric Utilities and Power Generators, Gas Utilities & Distributors, and Water Utilities). For the 26 companies in the Utilities Industries, the most common disclosures included those related to COVID-19 (69%), qualitative discussion regarding diversity and inclusion (88%), unionized employee relations (88%), workplace health and safety (88%) and workforce training (80%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, quantitative workforce turnover rate, employee mental health, culture initiatives, pay equity, and quantitative pay gap (in each case less than 20%).

- Electrical Equipment Industry (Electric & Electrical Equipment (excluding computer or similar technology equipment)). For the 18 companies in the Electrical Equipment Industry, the most common disclosures include qualitative discussion regarding diversity (83%), workplace health and safety (83%), and employee training (89%). The least common disclosures included part-time and full-time workforce statistics, employee mental health, culture initiatives, succession planning, pay equity, and quantitative pay gap measures (in each case less than 25%).

- Oil & Gas Industry. For the 21 companies in the Oil & Gas Industry, the most common disclosures included corporate governance and organization measures (57%), COVID-19 (71%), qualitative discussion of diversity (95%), workplace health and safety measures (80%), talent acquisition and retention (80%), talent development and training (80%), and employee compensation (76%). The least common disclosures for the Oil & Gas Industry, in each case less than 20%, were part-time and full-time workforce statistics, unionized workforce relations, quantitative workforce turnover rates, culture initiatives, pay equity, and quantitative pay gap measures (0% for this disclosure).

- Real Estate Industry. For the 24 companies in the Real Estate Industry, the most common disclosures included those related to COVID-19 (70%), qualitative discussion of diversity (79%), monitoring culture (67%), talent development (79%), and employee compensation (75%). Relatively uncommon disclosures among this group included unionized workforce relations, quantitative workforce turnover rates, succession planning, pay equity and quantitative pay gap (in each case less than 20%).

- Insurance and Professional Industries (Insurance and Professional & Commercial Services). For the 28 companies in the Insurance and Professional Industries, the disclosures with over 70% of occurrence each were those related to qualitative discussions of diversity, talent development and training and employee compensation. The disclosures with a less than 25% rate of inclusion were related to unionized employee relations, employee mental health, succession planning, and the pay gap.

IV. Disclosure Format

The format of human capital disclosures in companies’ annual reports varied greatly.

Word Count. The length of the disclosures ranged from 10 to 2,180 words, with the average disclosure consisting of 797 words and the median disclosure consisting of 765 words.

Metrics. While the disclosure requirement specifically asks for a description of “any human capital measures or objectives that the registrant focuses on in managing the business” (emphasis added), our survey revealed that approximately 25% of companies determined not to include any quantitative metrics in their disclosure beyond headcount numbers. Given the materiality threshold included in the requirement and the fact that it is focused on what is actually used to manage the business, this is not a surprising result. It was common to see companies identify important objectives they focus on, but omit quantitative metrics related to those objectives. For example, while 82% of companies discussed their commitment to diversity, equity, and inclusion, only 41% and 35% of companies disclosed quantitative metrics regarding gender and racial diversity, respectively.

Graphics. Although the minority practice, approximately 25% of companies surveyed also included charts or other graphics, which were generally used to present statistical data, such as diversity statistics or breakdowns of the number of employees by geographic location.

Categories. Most companies organized their disclosures by categories similar to those discussed above and included headings to define the types of disclosures presented.

V. Comment Letter Correspondence

Often times comment letter correspondence from the staff of the Division of Corporation Finance (the “Staff”) helps put a finer point on disclosure requirements like this one that are relatively open-ended and give companies broad discretion to decide what to disclose. While there have been approximately two dozen comment letters published that address the new human capital requirements, the letters we have seen so far shed relatively little light on how the Staff believes the new requirements should be interpreted. Rather, the comment letters, all of which involved reviews of registration statements, were generally issued to companies whose disclosures about employees were limited to the bare-bones items companies have discussed historically, such as the number of persons employed and the quality of employee relations. From these companies, the Staff simply sought a more detailed discussion of the company’s human capital resources, including any human capital measures or objectives upon which the company focuses in managing its business. In other words, similar to historical Staff comment practices generally in the context of the first year of new disclosure requirements, the Staff targeted “low-hanging fruit,” basically just asking companies that disclosed nothing in response to the new requirements to provide responsive disclosure. Based on our review of the responses to those comment letters, we have not seen a company take the position that a discussion of human capital resources was immaterial and therefore unnecessary.

VI. Conclusion

The principles-based nature of the new human capital requirements predictably resulted in companies providing a wide variety of disclosures, with significant differences in depth and breadth. Companies’ responses to the new requirements underscore some of the potential advantages and disadvantages of principles-based rulemaking. On one hand, the largely principles-based requirements gave each company wide latitude to tailor its discussion to its own circumstances and to highlight the measures and objectives focused on by its management team. The resulting disclosures seemed to provide insight into how each company views its human capital resources and manages that aspect of its business. On the other hand, the general lack of prescriptive requirements limited the comparability of disclosures from one company to another and failed to facilitate quantitative analyses of companies’ human capital resources. While some would argue that precluding surface-level quantitative comparisons across companies is a virtue of the new rule, others, including SEC Chair Gensler, favor more specificity. On August 18, 2020 Chair Gensler tweeted: “Investors want to better understand one of the most critical assets of a company: its people. I’ve asked staff to propose recommendations for the Commission’s consideration on human capital disclosure…. This could include a number of metrics, such as workforce turnover, skills and development training, compensation, benefits, workforce demographics including diversity, and health and safety.”[11]

Until the Commission proposes and adopts new rules governing the disclosure of human capital management, however, we expect the wide variance in Form 10-K human capital disclosures to continue. As companies prepare for the upcoming Form 10-K reporting season, they should consider the following:

- Confirming (or reconfirming) that the company’s disclosure controls and procedures support the statements made in human capital disclosures so that they are reliable, consistent, and appropriately updated, and that there is a robust verification process in place. While many companies have historically provided information like this in other contexts (e.g., hiring brochures and company websites), given the potential liability attached to disclosures in SEC filings, more rigorous controls will likely need to be put in place to ensure the accuracy and completeness of the information.

- Confirming (or reconfirming) that the human capital disclosures included in the Form 10-K remain appropriate and relevant. In this regard, companies may want to compare their own disclosures against what their industry peers did this past year as well as against any internal reporting frameworks (such as the human capital information that is regularly reported to senior management and the board or a committee).

- Setting expectations internally that these disclosures likely will evolve. Companies should expect to develop their disclosure over the course of the next couple of annual reports in response to peer practices, regulatory changes and investor expectations, as appropriate. The types of disclosures that are material to each company may also change in response to current events.

- Addressing in the upcoming disclosure the progress that management has made with respect to any significant objectives it has set regarding its human capital resources as investors are likely to focus on year-over-year changes and the company’s performance versus stated goals.

- Ensuring consistency across disclosures by being mindful of other human capital disclosures the company has already made and what the company has already said about its human capital in other filings or voluntary statements in sustainability reports, investor outreach, college campus recruiting materials or elsewhere (e.g., how is the composition of the company’s workforce described in the CEO pay ratio disclosure?).

- Addressing significant areas of focus highlighted in engagement meetings with investors and other stakeholders. In a 2020 survey, 64% of institutional investors surveyed said they planned to focus on human capital management when engaging with boards (second only to climate change, at 91%).[12]

- Addressing, to the extent material, the effect that return-to-work policies, vaccine mandates, or other COVID-related policies may have on the workforce.

- Revalidating the methodology for calculating quantitative metrics and assessing consistency with the prior year. Former Chairman Clayton commented that he would expect companies to “maintain metric definitions constant from period to period or to disclose prominently any changes to the metrics.”

_____________________________

[1] See, A Double-Edged Sword? Examining the Principles-Based Framework of the SEC’s Recent Amendments to Regulation S-K Disclosure Requirements, available here.

[2] See, 17 C.F.R. § 229.101(c)(2)(ii).

[4] See, Modernizing the Framework for Business, Legal Proceedings and Risk Factor Disclosures, available at https://www.sec.gov/news/public-statement/clayton-regulation-s-k-2020-08-26.

[5] See, Regulation S-K and ESG Disclosures: An Unsustainable Silence, available at https://www.sec.gov/news/public-statement/lee-regulation-s-k-2020-08-26.

[6] Commission Chair Gary Gensler’s Spring 2021 Unified Agenda of Regulatory and Deregulatory Actions (the “Spring 2021 Reg Flex Agenda”) shows “Human Capital Management Disclosure” as being in the proposed rule stage. Available here.

[7] Our survey captured the following information: company industry, word count of relevant disclosure, category of information covered (e.g., diversity, workplace safety, etc.), and types of metrics included.

[8] See Considerations for Preparing your 2020 Form 10-K, available at https://www.gibsondunn.com/wp-content/uploads/2021/02/considerations-for-preparing-your-2020-form-10-k.pdf; Amit Batish et al., Human Capital Disclosure: What Do Companies Say About Their “Most Important Asset”?, The Harvard Law School Forum on Corporate Governance, May 18, 2021; Marc Siegel et al., How do you value your social and human capital?; Andrew R. Lash et al., Variety of Approaches to New Human Capital Resources Disclosure in 10-K Filings, The Harvard Law School Forum on Corporate Governance, Dec. 13, 2020.

[9] Note that companies often include additional human capital management-related disclosures in their ESG/sustainability/social responsibility reports and websites and sometimes in the proxy statement, but these disclosures are outside the scope of the survey.

[10] For purposes of our survey, we grouped companies in similar industries based on both their four-digit Standard Industrial Classification code and their designated industry within the Sustainable Industry Classification System. The industry groups discussed cover approximately 85% of the companies included in our survey.

[11] Available at https://twitter.com/garygensler/status/1428022885889761292

[12] See Morrow Sodali 2020 Institutional Investor Survey, available at https://morrowsodali.com/insights/institutional-investor-survey-2020.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. For additional information, please contact the Gibson Dunn lawyer with whom you usually work, or any lawyer in the firm’s Securities Regulation and Corporate Governance practice group:

Elizabeth Ising – Washington, D.C. (+1 202-955-8287, eising@gibsondunn.com)

James J. Moloney – Orange County (+1 949-451-4343, jmoloney@gibsondunn.com)

Lori Zyskowski – New York (+1 212-351-2309, lzyskowski@gibsondunn.com)

Thomas J. Kim – Washington, D.C. (+1 202-887-3550, tkim@gibsondunn.com)

Brian J. Lane – Washington, D.C. (+1 202-887-3646, blane@gibsondunn.com)

Ronald O. Mueller – Washington, D.C. (+1 202-955-8671, rmueller@gibsondunn.com)

Michael A. Titera – Orange County (+1 949-451-4365, mtitera@gibsondunn.com)

Aaron Briggs – San Francisco, CA (+1 415-393-8297, abriggs@gibsondunn.com)

Julia Lapitskaya – New York, NY (+1 212-351-2354, jlapitskaya@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.