Evolving Human Capital Disclosures

Client Alert | January 9, 2023

A Survey of Disclosures from the S&P 100 During the Two Years Following Adoption of the Securities and Exchange Commission Rule

Human capital resource disclosures by public companies have continued to be a focus since the U.S. Securities and Exchange Commission adopted the new rules in 2020; not only for companies making the disclosures, but employees, investors, and other stakeholders reading them. This alert serves as an update to the alert we issued in 2021, “Discussing Human Capital: A Survey of the S&P 500’s Compliance with the New SEC Disclosure Requirement One Year After Adoption,” and reviews disclosure trends among S&P 100 companies, each of which has now included human capital disclosure in their past two annual reports on Form 10-K. This alert also provides practical considerations for companies as we head into 2023.

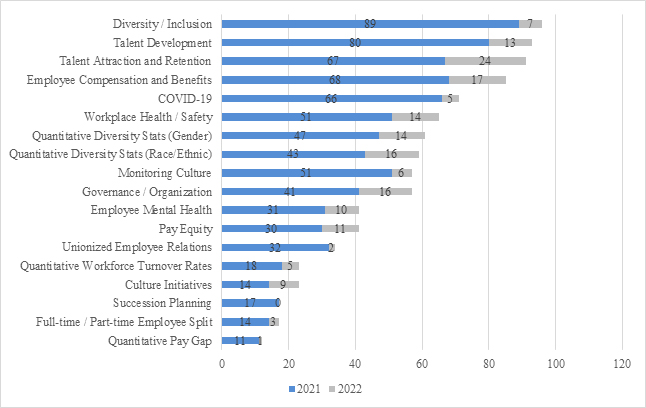

The overall takeaway from our survey, which categorized disclosures into 17 topic areas, was that companies are generally expanding the length of their disclosures, covering more topics, and including slightly more quantitative information in some areas. We note the following trends regarding the S&P 100 companies’ disclosures compared to the previous year:

- Seventy-nine companies increased the length of their disclosures, though the increases were generally modest.

- Sixty-six companies increased the number of topics covered.

- The prevalence of 16 topics increased and one remained the same.

- The most significant year-over-year increases in frequency involved the following topics: talent attraction and retention (67% to 91%), employee compensation (68% to 85%), quantitative diversity statistics on race/ethnicity (43% to 59%) and gender (47% to 61%), workplace health and safety (51% to 65%), and pay equity (30% to 41%).

- The only topic that did not see an increase in frequency was succession planning, which remained at 17%.

- Eight-five companies included more qualitative details in their disclosures compared to the previous year, including information relating to diversity, equity, and inclusion (“DEI”) initiatives and programs and the board’s role in overseeing human capital initiatives, although the depth of the additional detail provided varied greatly between companies.

- In this most recent year, DEI was discussed by 96% of companies (89% in the previous year), and 37% of companies (22% in the previous year) went beyond qualitative DEI information and disclosed quantitative data regarding the breakdown of DEI statistics by job type or level (executive level, etc.).

- Disclosure regarding the role of the board (or a human capital-focused committee) in overseeing human capital jumped to 44% of companies this most recent year from 26% the previous year.

- The topics most commonly discussed this most recent year generally remained consistent with the previous year. For example, DEI, talent development, talent attraction and retention, COVID-19, and employee compensation and benefits remained the five most frequently discussed topics, while succession planning, full-time/part-time employee split, quantitative pay gaps, culture initiatives, and quantitative workforce turnover rates continued to be the five least frequently covered topics.

- Within each industry, the trends that we saw in the previous year regarding the frequency of topics disclosed generally remained the same.

I. Background on the Requirements

On August 26, 2020, the U.S. Securities and Exchange Commission (the “Commission”) voted three to two to approve amendments to Items 101, 103, and 105 of Regulation S-K, including the principles-based requirement to discuss a registrant’s human capital resources to the extent material to an understanding of the registrant’s business taken as a whole.[1] Specifically, public companies’ human capital disclosure must include “the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction and retention of personnel).” One dissenting commissioner criticized the amendment for failing to even require disclosure of “commonly kept metrics such as part time vs. full time workers, workforce expenses, turnover, and diversity.”[2]

As discussed below, following the change in presidential administration, the Commission has indicated that it plans to revisit the human capital disclosure requirements and potentially adopt more prescriptive rules in the future.[3]

While companies disclosures under the principles-based rules varied widely, our survey was able to introduce some comparability. The next two sections show the relevant data from our survey.[4]

II. Disclosure Topics

Our survey classifies human capital disclosures into 17 topics, each of which is listed in the following chart, along with the number of companies that discussed the topic in 2021 and the number of additional companies that discussed the topic in 2022. Each topic is described more fully in the sections following the chart.

A. Workforce Composition and Demographics

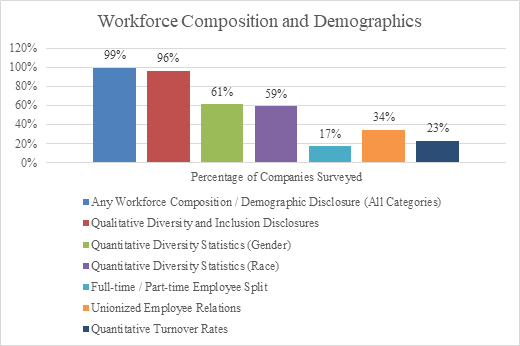

Of the 100 companies surveyed, 99 included disclosures relating to workforce composition and demographics in one or more of the following categories:

- Diversity and inclusion. This was the most common type of disclosure, with 96% of companies including a qualitative discussion regarding the company’s commitment to diversity, equity, and inclusion, up slightly from 89% the previous year. The depth of these disclosures varied, ranging from generic statements expressing the company’s support of diversity in the workforce to detailed examples of actions taken to support underrepresented groups and increase the diversity of the company’s workforce. Many companies also included a quantitative breakdown of the gender or racial representation of the company’s workforce: 61% included statistics on gender and 59% included statistics on race (compared to 47% and 43% in the previous year, respectively). Most companies provided these statistics in relation to their workforce as a whole; however, an increased subset (37% in the most recent year compared to 22% in the previous year) included separate statistics for different classes of employees (e.g., managerial, vice president and above, etc.) and/or for their boards of directors. Some companies also included numerical goals for gender or racial representation—either in terms of overall representation, promotions, or hiring—even if they did not provide current workforce diversity statistics.

- Full-time/part-time employee split. While most companies provided the total number of full-time employees, only 17% of the companies surveyed included a quantitative breakdown of the number of full-time versus part-time employees the company employed, up only slightly from 14% the previous year. Similarly, we saw a number of companies that provided statistics on the number of seasonal employees and/or independent contractors or a breakdown of employees by geographical location.

- Unionized employee relations. Of the companies surveyed, 34% stated that some portion of their workforce was part of a union, works council, or similar collective bargaining agreement, up slightly from 32% the previous year.[5] These disclosures generally included a statement providing the company’s opinion on the quality of labor relations, and in many cases, disclosed the number of unionized employees.

- Quantitative workforce turnover rates. Although a majority of companies discussed employee turnover and the related topics of talent attraction and retention in a qualitative way (as discussed in Section II.B. below), only 23% of companies surveyed provided specific employee turnover rates (whether voluntary or involuntary), up slightly from 18% the previous year.

B. Recruiting, Training, Succession

Of the companies surveyed, 96% included disclosures relating to talent and succession planning in one or more of the following categories:

- Talent attraction and retention. These disclosures were generally qualitative and focused on efforts to recruit and retain qualified individuals. While providing general statements regarding recruiting and retaining talent were relatively common, with 91% of companies including this type of disclosure (compared to 67% in 2021), quantitative measures of retention, like workforce turnover rate, were uncommon, with less than 23% of companies disclosing such statistics (as noted above).

- Talent development. The most common type of disclosure in this area related to talent development, with 93% of companies including a qualitative discussion regarding employee training, learning, and development opportunities, up from 80% the previous year. This disclosure tended to focus on the workforce as a whole rather than specifically on senior management. Companies generally discussed training programs such as in-person and online courses, leadership development programs, mentoring opportunities, tuition assistance, and conferences, and a minority also disclosed the number of hours employees spent on learning and development.

- Succession planning. Only 17% of companies surveyed addressed their succession planning efforts (unchanged from 2021), which may be a function of succession being a focus area primarily for executives rather than the human capital resources of a company more broadly.

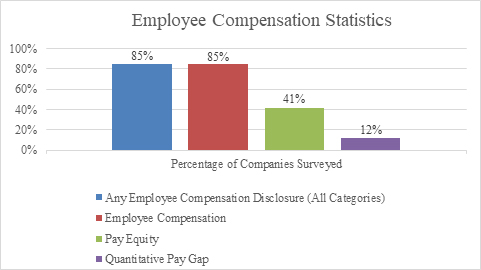

C. Employee Compensation

Of the companies surveyed, 85% included disclosures relating to employee compensation, up from 68% the previous year. All of those companies included a qualitative description of the compensation and benefits program offered to employees. Of the companies surveyed, 41% addressed pay equity practices or assessments (compared to 30% in 2021), and substantially fewer companies (12% of companies surveyed in 2022 and 11% in 2021) included quantitative measures of the pay gap between diverse and nondiverse employees or male and female employees.

D. Health and Safety

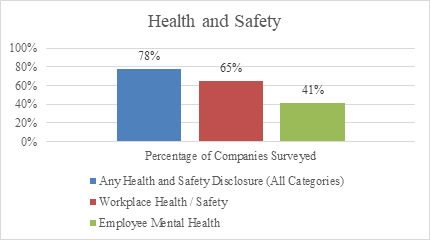

Of the companies surveyed, 78% included disclosures relating to health and safety in one or both of the following categories:

- Workplace health and safety. Of the companies surveyed, 65% included qualitative disclosures relating to workplace health and safety, up from 51% in the previous year, typically with statements around the company’s commitment to safety in the workplace generally and compliance with applicable regulatory and legal requirements. However, 10% of companies surveyed provided quantitative disclosures in this category, generally focusing on historical and/or target incident or safety rates or investments in safety programs. These disclosures tended to be more prevalent among industrial and manufacturing companies. Many companies also provided disclosures on safety initiatives undertaken in connection with COVID-19, which is discussed separately below.

- Employee mental health. In connection with disclosures about standard benefits provided to employees, or additional benefits provided as a result of the pandemic, 41% of companies disclosed initiatives taken to support employees’ mental or emotional health and wellbeing, up from 31% the prior year.

E. Culture and Engagement

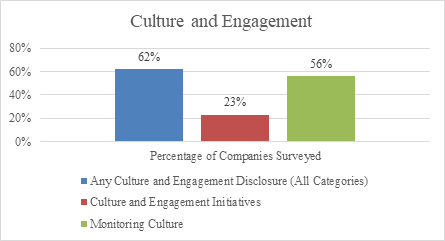

In addition to the many instances where companies mentioned a general commitment to culture and values, 62% of the companies surveyed discussed specific initiatives they were taking related to culture and engagement in one or more of the following categories:

- Culture and engagement initiatives. Of the companies surveyed, 23% included specific disclosures relating to practices and initiatives undertaken to build and maintain their culture and values, up from 14% in the previous year. These companies most commonly discussed efforts to communicate with employees (e.g., through town halls, CEO outreach, trainings, or conferences and presentations) and to recognize employee contributions (e.g., awards programs and individualized feedback). Many companies also discussed culture in the context of diversity-related initiatives to help foster an inclusive culture.

- Monitoring culture. Disclosures about the ways that companies monitor culture and employee engagement were much more common, with 56% of companies providing such disclosure, up from 51% the previous year. Companies generally disclosed the frequency of employee surveys used to track employee engagement and satisfaction, with some reporting on the results of these surveys, sometimes measured against prior year results or industry benchmarks.

F. COVID-19

A majority of companies (71% of those surveyed compared to 66% in 2021) included information regarding COVID-19 and its impact on company policies and procedures or on employees generally. COVID-19-related topics addressed ranged from work-from-home arrangements and safety protocols taken for employees who worked in person to additional benefits and compensation paid to employees as a result of the pandemic and contributions made to organizations supporting those affected by the pandemic.

G. Human Capital Management Governance and Organizational Practices

Over half of the companies (57% of those surveyed compared to 41% in 2021) addressed their governance and organizational practices (such as oversight by the board of directors or a committee and the organization of the human resources function).

III. Industry Trends

One of the main rationales underlying the adoption of principles-based—rather than prescriptive—requirements for human capital disclosures is that the relative significance of various human capital measures and objectives varies by industry. This is reflected in the following industry trends that we observed:[6]

- Technology Industries (E-Commerce, Internet Media & Services, Hardware, Software & IT Services and Semiconductors). For the 20 companies in the Technology Industries, 90% discussed talent development and training opportunities, talent attraction, recruitment and retention, employee compensation, and diversity. Relatively uncommon disclosures among this group included part-time and full-time employee statistics (10%), culture initiatives (15%), succession planning (10%), and quantitative pay gap (10%).

- Finance Industries (Asset Management & Custody Activities, Consumer Finance, Commercial Banks and Investment Banking & Brokerage). For the 13 companies in the Finance Industries, a large majority included quantitative diversity statistics regarding race (85%) and gender (85%). The same number of companies also included qualitative disclosures regarding employee compensation (85%), and, compared to other industries discussed below, a relatively higher number discussed pay equity (62%) and quantified their pay gap (38%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, unionized employee relations, quantitative workforce turnover rates, and succession planning (in each case less than 16%).

IV. Disclosure Format

The format of human capital disclosures in companies’ annual reports continued to vary greatly.

Word Count. The length of the disclosures ranged from 109 to 1,995 words, with the average disclosure consisting of 960 words and the median disclosure consisting of 949 words. Compare this to 2021, which saw a range of 105 to 1,931 words, with an average of 823 words and median of 818 words.

Metrics. While the disclosure requirement specifically asks for a description of “any human capital measures or objectives that the registrant focuses on in managing the business” (emphasis added), our survey revealed that 25% of companies determined not to include disclosure in any of the quantitative categories we discuss above, and 10% did not include any type of quantitative metrics in their disclosure beyond headcount numbers (down from 36% and 14%, respectively, in 2021). Given the materiality threshold included in the requirement and the fact that it is focused on what is actually used to manage the business, this is not a surprising result. It was common to see companies identify important objectives they focus on, but omit quantitative metrics related to those objectives; however, that group has been shrinking as more companies include metrics. For example, while 96% of companies discussed their commitment to diversity, equity, and inclusion (compared to 89% in 2021), only 61% and 59% of companies disclosed quantitative metrics regarding gender and racial diversity, respectively (compared to 47% and 43%, respectively, in 2021).

Graphics. Although the minority practice, 24% of companies surveyed also included charts or other graphics, up from 21% the previous year, which were generally used to present statistical data, such as diversity statistics or breakdowns of the number of employees by geographic location.

Categories. Most companies organized their disclosures by categories similar to those discussed above and included headings to define the types of disclosures presented.

V. Comment Letter Correspondence

Comment letter correspondence from the staff of the Division of Corporation Finance (the “Staff”), which often helps put a finer point on principles-based disclosure requirements like this one, has shed relatively little light on how the Staff believes the new requirements should be interpreted. Consistent with what we found at this time last year, the comment letters, all of which involved reviews of registration statements, were generally issued to companies whose disclosures about employees were limited to the bare-bones items companies have discussed historically, such as the number of persons employed and the quality of employee relations. From these companies, the Staff simply sought a more detailed discussion of the company’s human capital resources, including any human capital measures or objectives upon which the company focuses in managing its business. There were also a few comment letters where the Staff asked companies to clarify statements in their human capital disclosures. Based on our review of the responses to those comment letters, we have not seen a company take the position that a discussion of human capital resources was immaterial and therefore unnecessary.

VI. Conclusion

During the most recent year, we generally saw companies expanding the length of their human capital disclosures, covering more topics, and including slightly more quantitative information in some areas; however, the principles-based nature of the disclosure requirements has continued to result in companies providing a wide variety of disclosures, with significant differences in depth and breadth.

Given how high the Human Capital Management Disclosure rulemaking appears on the Fall 2022 Reg Flex Agenda (it appears as an action item for the first quarter of 2023), it seems unlikely we will see another year pass without more prescriptive rules being proposed and possibly adopted.

There has been no shortage of investors, politicians, and activists chiming in with input on the forthcoming rules. For example, earlier this year, several members of Congress wrote a letter asking the Commission to resist requests for more specific and quantitative disclosures on human capital, which expressed particular concerns about requiring metrics on full-time employees, part-time employees, independent contractors, subcontractors, or contingent employees.[7] In June 2022, the Working Group on Human Capital Accounting Disclosure, a group composed of academics and former SEC officials, submitted a rulemaking petition requesting the Commission to require more financial information about human capital in companies’ disclosures.[8]

Until the Commission proposes and adopts new rules governing the disclosure of human capital management, however, we expect the wide variance in Form 10-K human capital disclosures to continue. As companies prepare for the upcoming Form 10-K reporting season, they should consider the following:

- Confirming (or reconfirming) that the company’s disclosure controls and procedures support the statements made in human capital disclosures and that the human capital disclosures included in the Form 10-K remain appropriate and relevant. In this regard, companies may want to compare their own disclosures against what their industry peers did these past two years, including specifically any notable additional disclosures made in the past year.

- Setting expectations internally that these disclosures likely will evolve. As shown by the measurable increase in disclosure in the second year of reporting, companies should expect to develop their disclosure over the course of the next couple of annual reports in response to peer practices, regulatory changes, and investor expectations, as appropriate. The types of disclosures that are material to each company may also change in response to current events.

- Addressing in the upcoming disclosure, if not already disclosed, the progress that management has made with respect to any significant objectives it has set regarding its human capital resources as investors are likely to focus on year-over-year changes and the company’s performance versus stated goals.

- Addressing significant areas of focus highlighted in engagement meetings with investors and other stakeholders. In a 2021 survey, 64% of institutional investors surveyed cited human capital management as a key issue when engaging with boards (second only to climate change at 85%).[9]

- Revalidating the methodology for calculating quantitative metrics and assessing consistency with the prior year. Former Chairman Clayton commented that he would expect companies to “maintain metric definitions constant from period to period or to disclose prominently any changes to the metrics.”

__________________________

[1] See 17 C.F.R. § 229.101(c)(2)(ii).

[2] See Regulation S-K and ESG Disclosures: An Unsustainable Silence, available at https://www.sec.gov/news/public-statement/lee-regulation-s-k-2020-08-26.

[3] Commission Chair Gary Gensler’s Fall 2022 Unified Agenda of Regulatory and Deregulatory Actions (the “Fall 2022 Reg Flex Agenda”) shows “Human Capital Management Disclosure” as being in the proposed rule stage. Available at https://www.reginfo.gov/public/do/eAgendaMain?operation=OPERATION_GET_AGENCY_RULE_LIST¤tPub=true&agencyCode&showStage=active&agencyCd=3235.

[4] Note that companies often include additional human capital management-related disclosures in their ESG/sustainability/social responsibility reports and websites and sometimes in the proxy statement, but these disclosures are outside the scope of the survey.

[5] While never expressly required by Regulation S-K, as a result of disclosure review comments issued by the Division of Corporation Finance over the years and a decades-old and since-deleted requirement in Form 1-A, it has been a relatively common practice to discuss collective bargaining and employee relations in the Form 10-K or in an IPO Form S-1, particularly since the threat of a workforce strike could be material.

[6] For purposes of our survey, we grouped companies in similar industries based on both their four-digit Standard Industrial Classification code and their designated industry within the Sustainable Industry Classification System. The industry groups discussed in this section cover 33% of the companies included in our survey.

[7] Available at https://www.warner.senate.gov/public/index.cfm/2022/2/warner-brown-call-on-sec-to-update-human-capital-disclosures-so-that-companies-report-the-number-of-employees-who-are-not-full-time-workers.

[8] Available at https://www.sec.gov/rules/petitions/2022/petn4-787.pdf.

[9] See Morrow Sodali 2021 Institutional Investor Survey, available at https://morrowsodali.com/insights/institutional-investor-survey-2021.

The following Gibson Dunn attorneys assisted in preparing this update: Meghan Sherley and Mike Titera.

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding these issues. To learn more about these issues, please contact the Gibson Dunn lawyer with whom you usually work in the Securities Regulation and Corporate Governance practice group, or any of the following practice leaders and members:

Securities Regulation and Corporate Governance Group:

Elizabeth Ising – Washington, D.C. (+1 202-955-8287, eising@gibsondunn.com)

James J. Moloney – Orange County, CA (+1 949-451-4343, jmoloney@gibsondunn.com)

Lori Zyskowski – New York, NY (+1 212-351-2309, lzyskowski@gibsondunn.com)

Brian J. Lane – Washington, D.C. (+1 202-887-3646, blane@gibsondunn.com)

Ronald O. Mueller – Washington, D.C. (+1 202-955-8671, rmueller@gibsondunn.com)

Thomas J. Kim – Washington, D.C. (+1 202-887-3550, tkim@gibsondunn.com)

Michael A. Titera – Orange County, CA (+1 949-451-4365, mtitera@gibsondunn.com)

Aaron Briggs – San Francisco, CA (+1 415-393-8297, abriggs@gibsondunn.com)

Julia Lapitskaya – New York, NY (+1 212-351-2354, jlapitskaya@gibsondunn.com)

Labor and Employment Group:

Jason C. Schwartz – Washington, D.C. (+1 202-955-8242, jschwartz@gibsondunn.com)

Katherine V.A. Smith – Los Angeles (+1 213-229-7107, ksmith@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.