Capital Markets | Year in Review

Summary

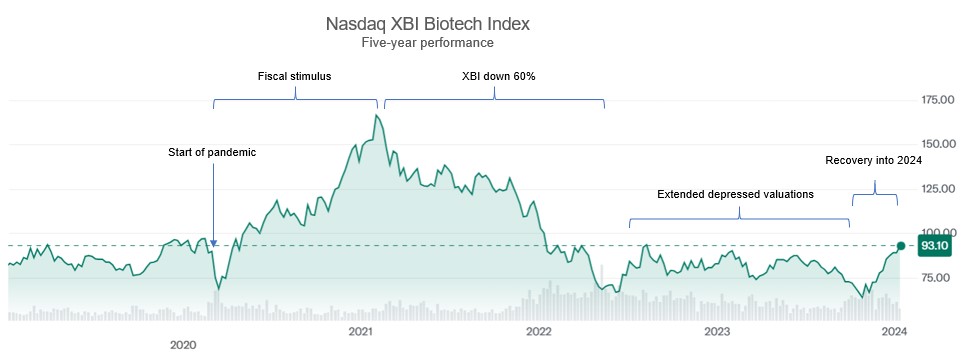

Through much of 2023, the capital raising environment for biopharma companies continued to be very challenging, which continued a downward trend on equity valuations that started with the decline of the Nasdaq XBI biotech index starting in February 2021 (representing a peak-to-trough decline of 61% through 2023). The decline appears to have bottomed out in late 2023, with the XBI recovering 39% in the fourth quarter of 2023 and ending the year up 7%. Over the course of 2022 and 2023, many public companies experienced stock price declines even on the announcement of positive data, as material news would catalyze higher trading volumes and allow institutional investors the opportunity to further unwind their positions, even if at a loss. For the small subset of public and private companies raising capital that happened to be in high demand (e.g., attractive therapeutic space, de-risked programs, etc.), these companies had no apparent difficulty accessing capital markets at reasonable valuations. But for the majority of the public and private biopharma companies, 2023 continued to be a challenging year to raise capital, with a glimmer of hope coming at the end of 2023 that the coming year will represent a return to a more balanced market environment.

Private Capital Markets

The number of “first financings” (a metric that reflects biotech company creation) continued to trend downward in 2023, after peaking on a quarterly basis in Q1 of 2021 (161). As a broader trend, venture capital has continued to fund outstanding new ideas, but has demonstrated more selectivity, as reflected in the 56 “first financings” completed in Q3 of 2023. Healthcare-focused funds continued to lead this effort, with generalist funds largely sitting on the sidelines or temporarily leaving the sector. The frequency of larger venture rounds tracked a similar decline with $100mm+ rounds declining from 37 to 18 over the same period. Overall, quarterly VC funding has largely stabilized at ~$5B per quarter, which is roughly only one half of the highest quarterly fundraising totals of 2020 and 2021, but is nonetheless higher than any quarter between 2010 and late 2017. Mimicking the IPO market (more below), crossover rounds by the top public biotech funds have also decreased to a range of roughly 10 to 20 per quarter (as compared to nearly 60 in Q1 of 2021).

Public Capital Markets

The 12 biotech IPOs completed in 2023 barely eclipsed the 11 completed in 2022, with many issuers opting to continue lurking in the private markets or choosing to go public via reverse merger. Accordingly, the backlog of late-stage private companies doubled between Q2 of 2021 (65) and the end of 2023 (130+), suggesting a potential traffic jam on the public company offramp in 2024 and 2025 as many companies compete for capital. Whether this will translate into an influx of IPOs or continue to contribute to the validation of reverse mergers as a “going public” option, remains to be seen. With the continued glut of fallen angels trading below cash, the reverse merger opportunity is likely to remain viable for at least another year or six quarters.

As companies continued to reach data-driven catalysts, the follow-on public offering market maintained its strength in 2023 with approximately 30-40 transactions per quarter for total gross proceeds between $5 and $7B. Follow-on offerings, including PIPEs, reached a 2023 volume peak in Q2 with 47 deals grossing $20mm or more. Many companies, however, discovered that only exceptional data generate the desired pre-financing market reaction and companies with merely “good” data received a flat or negative reaction, as data releases would catalyze higher trading volumes, which would frequently provide an opportunity to liquidate existing positions without regard to price or valuation. In contrast, the 2024 biotech new issue market appears to be off to a promising start prior to the JP Morgan Healthcare Conference, with eight follow-on offerings and one convert completed in the first week of January with aggregate gross proceeds of $1.9B, versus ten follow-on offerings completed in all of January 2023 with aggregate gross proceeds of $1.3B.

Representative Capital Markets Transactions

Consistent with the theme from 2023 of high quality companies being able to raise capital despite an overall challenging macro environment, three biopharma IPOs stand out (Acelryin, Apogee Therapeutics and RayzeBio), each having raised over $300 million in their IPOs.[1] Among these, the Apogee IPO is distinguished as having a particularly strong performance post-IPO and an accelerated timeline from initial formation in February 2022, a $169 million Series B crossover round in November 2022 and an IPO in July 2023. The accelerated funding pathway for Apogee and strong performance post-IPO was due to investor interest in the inflammatory and immunology space, a strong management team and a blue chip investor base since formation. This combination made Apogee a strong candidate for private and public capital markets and made Apogee one of the best performing biopharma IPOs in 2023.

The Apogee IPO also is notable as certain pre-IPO investors elected to receive shares of non-voting common stock in lieu of common stock upon conversion of the preferred stock at the time of the IPO. Non-voting stock is used in this context to keep beneficial ownership of the voting stock below certain thresholds for SEC reporting and compliance purposes. The non-voting stock issued in this context is similar to the issuance of pre-funded warrants or “toothless” preferred stock, each of which are frequently used by other issuers in follow-on offerings. However, the use of non-voting common stock, if authorized in an issuer’s charter (such as at the time of an IPO), offers certain advantages over the use of pre-funded warrants or toothless preferred stock.

* * *

Note: Gibson Dunn represents Apogee Therapeutics.

Special thanks to Jefferies for contributing data regarding 2023 biotech new issuances.

[1] Additionally, Johnson & Johnson spun out Kenvue, its consumer health business, with a $4.2 billion IPO in 2023.