On October 25, 2021, the Dubai Financial Services Authority (“DFSA”) updated its Rulebook for “crypto” based investments by launching a regulatory framework for “Investment Tokens”. This framework follows, on the whole, the approach proposed in the DFSA’s “Consultation Paper No. 138 – Regulation of Security Tokens”, published in March 2021 (the “Consultation Paper”).

Peter Smith, Managing Director, Head of Strategy, Policy and Risk at the DFSA has noted that: “Creating an ecosystem for innovative firms to thrive in the UAE is a key priority for both the UAE and Dubai Governments, and the DFSA. Our consultation on Investment Tokens enabled us to understand what firms were looking for in a regulatory framework and introduce a regime that is relevant to the market. We look forward to receiving applications from interested firms and contributing to the ongoing growth of future-focused financial services in the DIFC.”[1]

What is an “Investment Token”?

An “Investment Token” is defined as either a “Security Token” or a “Derivative Token”[2]. Broadly speaking, these are:

- a security (which includes, for example, a share, debenture or warrant) or derivative (an option or future) in the form of a cryptographically secured digital representation of rights and obligations that is issued, transferred and stored using Distributed Ledger Technology (“DLT”) or other similar technology; or

- a cryptographically secured digital representation of rights and obligations that is issued, transferred and stored using DLT or other similar technology and: (i) confers rights and obligations that are substantially similar in nature to those conferred by a security or derivative; or (ii) has a substantially similar purpose or effect to a security or derivative.

However, importantly, the definition of “Investment Token” will not capture virtual assets which do not either confer rights and obligations substantially similar in nature to those conferred by a security or derivative, or have a substantially similar purpose or effect to a security or derivative. This means that key cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins such as Tether, will remain unregulated under the Investment Tokens regime.

Scope of framework

This regulatory framework applies to persons interested in marketing, issuing, trading or holding Investment Tokens in or from the Dubai International Financial Centre (“DIFC”). It also applies with respect to DFSA authorised firms wishing to undertake “financial services” relating to Investment Tokens. Such financial services would include (amongst other things) dealing in, advising on, or arranging transactions relating to, Investment Tokens, or managing discretionary portfolios or collective investment funds investing in Investment Tokens.

Approach taken by the DFSA

The approach taken by the DFSA has been to, rather than establish an entirely separate regime for Investment Tokens, bring these instruments within scope of the existing regime for “Investments”, subject to certain changes. The Consultation Paper noted that “in line with the approach adopted in the benchmarked jurisdictions, [the] aim is to ensure that the DFSA regime for regulating financial products and services will apply in an appropriate and robust manner to those tokens that [the DFSA considers] to be the same as, or sufficiently similar to, existing Investments to warrant regulation”.

The Consultation Paper proposed to do this through four means: (i) by making use of the existing regime for “Investments” as far as possible, whilst addressing specific risks associated with the tokens, especially technology risks; (ii) by not being too restrictive, so that the DFSA can accommodate the evolving nature of the underlying technologies that might drive tokenization of traditional financial products and services; (iii) by addressing risks to investor/customer communication and market integrity, and systemic risks, should they arise, where new technologies are used in the provision of financial products or services in or from the DIFC; and (iv) remaining true to the underlying key characteristics and attributes of regulated financial products and services, as far as practicable.

As noted at (i) above, the changes brought about on October 25, 2021 necessarily involved the addition of new requirements to address specific issues related to Investment Tokens. For instance, added requirements are imposed on firms providing financial services relating to Investment Tokens in Chapter 14 of the Conduct of Business Module of the DFSA Rulebook.

This sets out (amongst other things):

- technology and governance requirements for firms operating facilities (trading venues) for Investment Tokens – for instance, they must: (i) ensure that any DLT application used by the facility operates on the basis of permissioned access, so that the operator is able to maintain adequate control of persons granted access; and (ii) have regard to industry best practices in developing their technology design and technology governance relating to DLT that is used by the facility;

- rules relating to operators of facilities for Investment Tokens which permit direct access – for example, the operator must ensure that its operating rules clearly articulate: (i) the duties owed by the operator to the direct access member; (ii) the duties owed by the direct access member to the operator; and (iii) appropriate investor redress mechanisms available. The operator must also make certain risk disclosures and have in place adequate systems and controls to address market integrity, anti-money laundering and other investor protection risks;

- requirements for firms providing custody of Investment Tokens (termed “digital wallet service providers”) – for example: (i) any DLT application used in providing custody of the Investment Tokens must be resilient, reliable and compatible with any relevant facility on which the Investment Tokens are traded or cleared; and (ii) the technology used and its associated procedures must have adequate security measures (including cyber security) to enable the safe storage and transmission of data relating to the Investment Tokens; and

- a requirement that firms carrying on one or more financial services with respect to Investment Tokens (such as dealing in investments as principal/agent, arranging deals in investments, advising on financial products and managing assets), provide the client with a “key features document” in good time before the service is provided. This must contain, amongst other things: (i) the risks associated with, and the essential characteristics of, the Investment Token; (ii) whether the Investment Token is, or will be, admitted to trading (and, if so, the details of its admission); (iii) how the client may exercise any rights conferred by the Investment Tokens (such as voting); and (iv) any other information relevant to the particular Investment Token that would reasonably assist the client to understand the product and technology better and to make informed decisions in respect of it.

Comment

In taking the approach to Investment Tokens outlined in this alert, the DFSA has aligned with the approach taken by certain key jurisdictions. It is similar to that taken by the U.K. Financial Conduct Authority, for example, which has issued guidance to the effect that tokens with specific characteristics that mean they provide rights and obligations akin to specified investments, like a share or a debt instrument (the U.K. version of Investment Tokens) be treated as specified investments and, therefore, be considered within the existing regulatory framework[3].

The DFSA’s regime has baked-in flexibility, particularly as a consequence of the fairly high level, principles-based approach. This will likely prove helpful, given the evolving nature of the virtual assets world. However, the exclusion of key cryptocurrencies from the scope of this regime may limit the attractiveness of the regime, particularly to cryptocurrency exchanges seeking to offer spot trading. However, this may be offset to some extent by the DFSA regime’s willingness to allow operators of facilities for Investment Tokens to provide direct access to retail clients, subject to those clients meeting certain requirements (such as having sufficient competence and experience). This is in contrast to the approach proposed by the Hong Kong Financial Services and the Treasury Bureau, which has proposed restricting access to cryptocurrency trading to professional investors only.[4]

Next steps

As noted above, the Investment Tokens regime does not cover many key virtual assets. However, we understand that the DFSA is drafting proposals for tokens not covered by the Investment Tokens regulatory framework. These proposals are expected to cover exchange tokens, utility tokens and certain asset-backed tokens (stablecoins). The DFSA intends to issue a second consultation paper later in Q4 of this year.[5]

____________________________

[1] https://www.dfsa.ae/news/dfsa-introduces-regulatory-framework-investment-tokens

[2] DFSA Rulebook: General Module, A.2.1.1

[3] FCA Policy Statement (PS 19/22), Guidance on Cryptoassets (July 2019)

[4] See our previous alert on the proposed Hong Kong regime: https://www.gibsondunn.com/licensing-regime-for-virtual-asset-services-providers-in-hong-kong/

[5] https://www.dfsa.ae/news/dfsa-introduces-regulatory-framework-investment-tokens

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. If you wish to discuss any of the matters set out above, please contact any member of Gibson Dunn’s Crypto Taskforce (cryptotaskforce@gibsondunn.com) on the Global Financial Regulatory team, or the following authors:

Hardeep Plahe – Dubai (+971 (0) 4 318 4611, hplahe@gibsondunn.com)

Michelle M. Kirschner – London (+44 (0) 20 7071 4212, mkirschner@gibsondunn.com)

William R. Hallatt – Hong Kong (+852 2214 3836, whallatt@gibsondunn.com)

Chris Hickey – London (+44 (0) 20 7071 4265, chickey@gibsondunn.com)

Martin Coombes – London (+44 (0) 20 7071 4258, mcoombes@gibsondunn.com)

Emily Rumble – Hong Kong (+852 2214 3839, erumble@gibsondunn.com)

Arnold Pun – Hong Kong (+852 2214 3838, apun@gibsondunn.com)

Becky Chung – Hong Kong (+852 2214 3837, bchung@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On November 1, 2021, the President’s Working Group on Financial Markets,[1] joined by the Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC), issued its expected report (Report) on stablecoins, a type of digital asset that has recently grown significantly in market capitalization and importance to the broader digital asset markets.[2]

Noting gaps in the regulation of stablecoins, the Report makes the following principal recommendations:

- Congress should promptly enact legislation to provide a “consistent and comprehensive” federal prudential framework for stablecoins –

- Stablecoin issuers should be required to be insured depository institutions

- Custodial wallet providers that hold stablecoins on behalf of customers should be subject to federal oversight and risk-management standards

- Stablecoin issuers and wallet providers should be subject to restrictions on affiliations with commercial entities.

- In the absence of Congressional action, the Financial Stability Oversight Council (FSOC) should consider steps to limit stablecoin risk, including designation of certain stablecoin activities as systemically important payment, clearing, and settlement activities.

The Report thus calls for the imposition of bank-like regulation on the world of stablecoins, and it does so with a sense of urgency. Below we summarize the Report’s key conclusions and recommendations, and then preview the path forward if the FSOC is to take up the Report’s call to action.

Stablecoins

A stablecoin is a digital asset that is created in exchange for fiat currency that a stablecoin issuer receives from a third-party; most stablecoins offer a promise or expectation that the stablecoin can be redeemed at par on request. Although certain stablecoins are advertised as being backed by “reserve assets,” there are currently no regulatory standards governing such assets, which can range on the risk spectrum from insured bank deposits and Treasury bills to commercial paper, corporate and municipal bonds, and other digital assets. Indeed, in October, the CFTC took enforcement action against the issuers of US Dollar Tether (USD Tether) for allegedly making untrue or misleading statements about USD Tether’s reserves.[3]

The market capitalization of stablecoins has grown extremely rapidly in the last year; according to the Report, the largest stablecoin issuers had, as of October, a market capitalization exceeding $127 billion.[4] The Report states that stablecoins are predominantly used in the United States to facilitate the trading, lending, and borrowing of other digital assets – they replace fiat currency for participants in the trading markets for Bitcoin and other digital assets and allow users to store and transfer value associated with digital asset trading, lending, and borrowing within distributed ledger environments.[5] The Report further notes that certain stablecoin issuers believe that stablecoins should be used in the payment system, both for domestic goods and services, and for international remittances.[6] Stablecoins, the Report asserts, are also used as a source of collateral against which participants in the digital assets markets can borrow to fund additional activity, “sometimes using extremely high leverage,” as well as to “earn yield,” by using stablecoins as collateral for extending loans and engaging in margined transactions.[7]

Perceived Risks of Stablecoins

The Report views the stablecoin market as currently having substantial risks not subject to regulation.

First, the Report asserts that stablecoins have “unique risks” associated with secondary market activity and market participants beyond the stablecoin issuers themselves, because most market participants rely on digital asset trading platforms to exchange stablecoins with national currencies and other stablecoins.[8] In addition, the Report states that the active trading of stablecoins is part of an essential stabilization mechanism to keep the price of the stablecoin close to or at its pegged value.[9] It further asserts that digital asset trading platforms typically hold stablecoins for customers in non-segregated omnibus custodial wallets and reflect trades on internal records only, and that such platforms and their affiliates may also engage in active trading of stablecoins and as market makers.[10]

Second, the Report argues that stablecoins play a central role in Decentralized Finance (DeFi). It gives two examples – first, stablecoins often are one asset in a pair of digital assets used in “automated market maker” arrangements, and second, they are frequently “locked” in DeFi arrangements to garner yield from interest payments made by persons borrowing stablecoins for leveraged transactions.[11]

As a result, the Report describes a range of risks arising from stablecoins, including risks of fraud, misappropriation, and conflicts of interest and market manipulation; the risk that failure of disruption of a digital asset trading platform could threaten stablecoins; the risk that failure or disruption of a stablecoin could threaten digital asset trading platforms; money laundering and terrorist financing risks; risks of excessive leverage on unregulated trading platforms; risks of non-compliance with applicable regulations; risks of co-mingling trading platform funds with funds of customers; risks flowing from information asymmetries and market abuse; risks from unsupervised trading; risks from distributed-ledger based arrangements, including governance, cybersecurity, and other operational risks; and risks from novel custody and settlement processes.[12]

The Report also notes the risk of stablecoin “runs” that could occur upon loss of confidence in a stablecoin and the reserves backing it, as well as risks to the payment system generally if stablecoins became an important part of the payment system. The Report notes that “unlike traditional payment systems where risk is managed centrally by the payment system operator,” some stablecoin arrangements feature “complex operations where no single organization is responsible or accountable for risk management and resilient operation of the entire arrangement.”[13]

Finally, the Report asserts that the rapid scaling of stablecoins raises three other sets of policy concerns. First is the potential systemic risk of the failure of a significant stablecoin issuer or key participant in a stablecoin arrangement, such as a custodial wallet provider.[14] Second, the Report points to the business combination of a stablecoin issuer or wallet provider with a commercial firm as raising economic concentration concerns traditionally associated with the mixing of banking and commerce.[15] Third, the Report states that if a stablecoin became widely accepted as a means of payment, it could raise antitrust concerns.[16]

Recommendations

The Report’s key takeaway is that the President’s Working Group, the OCC and the FDIC believe that there are currently too many regulatory gaps relating to stablecoins and DeFi. The Report does note that, in addition to existing anti-money laundering and anti-terrorist financing regulations, stablecoin activities may implicate the jurisdiction of the SEC and CFTC, because certain stablecoins may be securities or commodities. Indeed, the CFTC just recently asserted that Bitcoin, Ether, Litecoin and USD Tether are commodities.[17] Nonetheless, the Report states that as stablecoin markets continue to grow, “it is essential to address the significant investor and market risks that could threaten end users and other participants in stablecoin arrangements and secondary market activity.”[18]

The Report therefore calls for legislation to close what it sees as the critical gaps. First, it argues that stablecoin issuance, and the related activities of redemption and maintenance of reserve assets, should be limited to entities that are insured depository institutions: state and federally chartered banks and savings associations that are FDIC insured and have access to Federal Reserve services, including emergency liquidity.[19] Legislation should also ensure that supervisors have authority to implement standards to promote interoperability among stablecoins.[20] Given the global nature of stablecoins, the Report contends that legislation should apply to stablecoin issuers, custodial wallet providers, and other key entities “that are domiciled in the United States, offer products that are accessible to U.S. persons, or that otherwise have a significant U.S. nexus.”[21]

Second, given the Report’s perceived risks of custodial wallet providers, the Report argues that Congress should require those providers to be subject to “appropriate federal oversight,” including restricting them from lending customer stablecoins and requiring them to comply with appropriate risk-management, liquidity, and capital requirements.[22]

Third, because other entities may perform activities that are critical to the stablecoin arrangement, the Report argues that legislation should provide the supervisor of a stablecoin issuer with the authority to require any entity that performs activities “critical to the functioning of the stablecoin arrangement” to meet appropriate risk-management standards, and give the appropriate regulatory agencies examination and enforcement authority with respect to such activities.[23]

Finally, the Report advocates that both stablecoin issuers and wallet providers should, like banks, be limited in their ability to affiliate with commercial firms.[24]

Interim Measures

The Report characterizes the need for legislation as “urgent.” While legislation is being considered, the Report recommends that the Financial Stability Oversight Council (FSOC) consider taking actions within its jurisdiction, such as designating certain activities conducted within stablecoin arrangements as systemically significant payment, clearing, and settlement activities.[25] The Report states that such designation would permit the appropriate federal regulatory agency to establish risk-management requirements for financial institutions[26] that engage in the designated activities.

Such designations would occur pursuant to Title VIII of the Dodd-Frank Act, and it would be the first time that the FSOC would make them.[27] The procedure that the FSOC must follow is set forth in Title VIII, and, absent an emergency, it appears that it would not be a quick one. First, the FSOC must consult with the relevant federal supervisory agencies and the Federal Reserve.[28] Next, it must provide notice to the financial institutions whose activities are to be designated, and offer those institutions the opportunity for a hearing.[29] The institutions may then choose to appear, personally or through counsel, to submit written materials, or, at the sole discretion of FSOC, to present oral testimony or argument.[30] The FSOC must approve the activity designation by a vote of at least two-thirds of its members, including an affirmative vote by the Chair.[31] The FSOC must consider the designation in light of the following factors: (i) the aggregate monetary value of transactions carried out through the activity, (ii) the aggregate exposure of the institutions engaged in the activity to their counterparties, (iii) the relationship, interdependencies, or other interactions of the activity with other payment, clearing, or settlement activities, (iv) the effect that the failure of or a disruption to the activity would have on critical markets, financial institutions, or the broader financial system, and (v) any other factors that the FSOC deems appropriate.[32]

Conclusion

With the Report, Treasury and the relevant federal agencies – the Federal Reserve, the SEC, CFTC, OCC, and FDIC – have made it clear that they believe that the risks of stablecoin activities are not fully mitigated by existing regulation. Their recommendations for legislation look principally to bringing stablecoins within the banking system and to bank regulation as a means of addressing those risks. It is an open question, however, whether Congress will act, much less with the urgency that the Report desires. Action by the FSOC, moreover, will almost certainly take some time, given the statutory designation procedures. In the near term, therefore, it is likely to fall to the existing agencies with some jurisdiction over stablecoins – the CFTC and SEC – to address the gaps with the tools at their disposal.[33]

__________________________

[1] The Working Group comprises representatives of the Treasury Department (Treasury), Board of Governors of the Federal Reserve System (Federal Reserve), the Securities and Exchange Commission (SEC), and Commodity Futures Trading Commission (CFTC).

[2] See https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf.

[3] See https://www.gibsondunn.com/digital-asset-developments-us-commodity-futures-trading-commission-asserts-that-tether-is-a-commodity/.

[4] Report, at 7. In addition to USD Tether, the most circulated stablecoins are USD Coin, Binance USD, Dai Stablecoin, and TrueUSD. All are pegged to the U.S. dollar.

[17] See https://www.gibsondunn.com/digital-asset-developments-us-commodity-futures-trading-commission-asserts-that-tether-is-a-commodity/.

[19] Id. at 16. Unless the insured depository institution in question is an industrial bank, requiring the stablecoin issuer to be an insured depository institution would also be a requirement for the issuer’s parent company, if any, to be a bank or thrift holding company supervised and regulated by the Federal Reserve.

[26] Title VIII defines “financial institution” broadly to reach “any company engaged in activities that are financial in nature or incidental to a financial activity, as described in section 4 of the Bank Holding Company Act,” in addition to banks, credit unions, broker-dealers, insurance companies, investment advisers, investment companies, futures commission merchants, commodity pool operators and commodity trading advisers.

[27] The FSOC has previously undertaken designations of systemically significant nonbank financial companies under Title I of the Dodd-Frank Act and systemically significant financial market utilities under Title VIII of the Dodd-Frank Act.

[33] In a press release issued just after the Report, the Director of the Consumer Financial Protection Bureau, Rohit Chopra, stated that “stablecoins may . . . be used for and in connection with consumer deposits, stored value instruments, retail and other consumer payments mechanisms, and in consumer credit arrangements. These use cases and others trigger obligations under federal consumer financial protection laws, including the prohibition on unfair, deceptive, or abusive acts or practices.” See https://www.consumerfinance.gov/about-us/newsroom/statement-cfpb-director-chopra-stablecoin-report/.

The following Gibson Dunn lawyers assisted in preparing this client update: Arthur Long and Jeffrey Steiner.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the author, or any of the following members of the firm’s Financial Institutions practice group:

Matthew L. Biben – New York (+1 212-351-6300, mbiben@gibsondunn.com)

Michael D. Bopp – Washington, D.C. (+1 202-955-8256, mbopp@gibsondunn.com)

Stephanie Brooker – Washington, D.C. (+1 202-887-3502, sbrooker@gibsondunn.com)

M. Kendall Day – Washington, D.C. (+1 202-955-8220, kday@gibsondunn.com)

Mylan L. Denerstein – New York (+1 212-351- 3850, mdenerstein@gibsondunn.com)

William R. Hallatt – Hong Kong (+852 2214 3836, whallatt@gibsondunn.com)

Michelle M. Kirschner – London (+44 (0) 20 7071 4212, mkirschner@gibsondunn.com)

Arthur S. Long – New York (+1 212-351-2426, along@gibsondunn.com)

Matthew Nunan – London (+44 (0) 20 7071 4201, mnunan@gibsondunn.com)

Jeffrey L. Steiner – Washington, D.C. (+1 202-887-3632, jsteiner@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On Friday October 15, 2021, the Commodity Futures Trading Commission (CFTC) issued an enforcement order (Tether Order) against the issuers of the U.S. dollar Tether token (USDT), a leading stablecoin, and fined those issuers $41 million for making untrue or misleading statements about maintaining sufficient fiat currency reserves to back each USDT “one-to-one.”[1] In so doing, the CFTC asserted that USDT is a “commodity” under the Commodity Exchange Act (CEA).

The Tether Order is significant for few reasons. First, it marks the first U.S. enforcement action against a major stablecoin. Second, the CFTC has now asserted that it has some enforcement authority over stablecoins, just at the time that the Biden Administration is gearing up its regulatory approach to digital currencies in general and stablecoins in particular. Securities and Exchange Commission (SEC) Chair Gary Gensler stated earlier this year that he believed that certain stablecoins, such as those backed by securities, are securities,[2] and the President’s Working Group on Financial Markets will soon be issuing a report on stablecoins.[3] Third, the CFTC’s assertion that USDT is a commodity signals that stablecoins that are backed one-to-one with fiat currency are not securities and therefore are not directly subject to the SEC’s jurisdiction.

CFTC Legal Authority

Although the CFTC is principally a regulator of the markets for commodity futures and derivatives such as swaps, it does have certain enforcement authority over commodities in the cash markets (i.e., spot commodities). Section 6(c)(1) of the Commodity Exchange Act, provides that it is “unlawful for any person, directly or indirectly, to use or employ, or attempt to use or employ, in connection with any swap, or a contract of sale of any commodity in interstate commerce, . . . any manipulative or deceptive device or contrivance, in contravention of such rules and regulations as the Commission shall promulgate.”[4] The CFTC has promulgated regulations pursuant to Section 6(c)(1), which render unlawful intentional or reckless statements or omissions “in connection with . . . any contract of sale of any commodity in interstate commerce.”[5] When those regulations were promulgated, the CFTC stated that “[it] expect[ed] to exercise its authority under 6(c)(1) to cover transactions related to the futures or swaps markets, or prices of commodities in interstate commerce, or where the fraud or manipulation has the potential to affect cash commodity, futures, or swaps markets or participants in these markets.”[6]

Tether Order

Prior to the Tether Order, the CFTC had asserted that some digital assets are commodities.[7] The Tether Order definitively states that USDT is a commodity (and, in dicta, asserts that bitcoin, ether, and litecoin are commodities as well). It then alleges that the issuers of USDT made material misstatements under Section 6(c)(1) of the CEA and its implementing regulations regarding whether USDT was backed on a one-to-one basis with fiat currency reserves and whether this reserving would undergo regular professional audits, and the issuers made material omissions regarding the timing of one of the reserve reviews that USDT issuers did take.[8] Without admitting or denying the CFTC’s findings and conclusions, the USDT issuers consented to the entry of a cease-and-desist order and civil money penalty of $41 million.[9]

Conclusion

The recent past has seen the explosive growth of the digital asset markets, with regulators globally seeking to catch up. In the United States, the challenge has been, in the absence of new legislation, to make digital asset transactions fit within existing regulatory schemes. Much initial regulation has been at the state level; most federal financial regulators have initially been attempting to regulate through enforcement. Now, however, there is the prospect of overlapping federal regulation, particularly with respect to stablecoins. The Tether Order comes at a time when media outlets have reported that the U.S. Department of Treasury will be working with U.S. financial regulators to issue a broad report on stablecoins, including how stablecoins should be regulated. And although the CFTC has taken its position on USDT, it is currently still unclear how other U.S. regulators will view stablecoins and other digital assets.

_____________________________

[1] In the Matter of Tether Holdings Limited, Tether Operations Limited, Tether Limited, and Tether International Limited, CFTC Docket No. 22-04 (Oct. 15, 2021), available at https://www.cftc.gov/media/6646/enftetherholdingsorder101521/download.

[2] Gary Gensler, SEC Chair, “Remarks Before the Aspen Security Forum” (August 3, 2021).

[3] See, e.g., Michelle Price, “Explainer: How the U.S. Regulators Are Cracking Down on Cryptocurrencies,” Reuters, September 24, 2021.

[6] CFTC, Final Rules: Prohibition on the Employment, or Attempted Employment, of Manipulative and Deceptive Devices and Prohibition on Price Manipulation, 76 Fed. Reg. 41,398, 41,401 (July 14, 2011).

[7] See, e.g., In re Coinflip, Inc., CFTC No. 15-29, 2015 WL 5535736, at * 2 (Sept. 17, 2015) (stating that bitcoin is properly defined as a commodity within the meaning of the CEA).

[9] Also on October 15, the CFTC entered into a consent order with Bitfinex, a leading digital currency exchange that has many management and operational interlocks with the USD Tether issuers, for allegedly permitting U.S. customers that were not eligible contract participants to engage in leveraged, margined or financed commodity transactions that were not carried out on a designated contract market (i.e., a CFTC registered futures exchange) in violation of the CEA’s requirements, and acting as a futures commission merchant (FCM) without being registered with the CFTC as such. The CFTC further asserted that Bitfinex had violated a 2016 CFTC order that had commanded it to cease-and-desist from such activity. Without admitting or denying the CFTC’s findings and conclusions, Bitfinex consented to the entry of the new cease-and-desist order and a $1 million fine. See In the Matter of iFinex Inc., BFXNA Inc., and BFXWW Inc., CFTC Docket No. 22-05 (Oct. 15, 2021), available at https://www.cftc.gov/media/6651/enfbfxnaincorder101521/download.

The following Gibson Dunn lawyers assisted in preparing this client update: Arthur Long and Jeffrey Steiner.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the author, or any of the following members of the firm’s Financial Institutions practice group:

Matthew L. Biben – New York (+1 212-351-6300, mbiben@gibsondunn.com)

Michael D. Bopp – Washington, D.C. (+1 202-955-8256, mbopp@gibsondunn.com)

Stephanie Brooker – Washington, D.C. (+1 202-887-3502, sbrooker@gibsondunn.com)

M. Kendall Day – Washington, D.C. (+1 202-955-8220, kday@gibsondunn.com)

Mylan L. Denerstein – New York (+1 212-351- 3850, mdenerstein@gibsondunn.com)

William R. Hallatt – Hong Kong (+852 2214 3836, whallatt@gibsondunn.com)

Michelle M. Kirschner – London (+44 (0) 20 7071 4212, mkirschner@gibsondunn.com)

Arthur S. Long – New York (+1 212-351-2426, along@gibsondunn.com)

Matthew Nunan – London (+44 (0) 20 7071 4201, mnunan@gibsondunn.com)

Jeffrey L. Steiner – Washington, D.C. (+1 202-887-3632, jsteiner@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On September 23, 2021, President Joseph Biden announced his intention to nominate Professor Saule Omarova of Cornell Law School to be the next Comptroller of the Currency. The Comptroller heads the Office of the Comptroller of the Currency (OCC), the Treasury bureau that supervises national banks and federal thrifts; the Comptroller is also an ex officio member of the Board of Directors of the Federal Deposit Insurance Corporation (FDIC).

If confirmed by the Senate, Professor Omarova will have significant influence over regulatory policy, not only for banking institutions, but also for fintech companies that seek to enter the banking system via either a national bank or FDIC-insured industrial bank charter or that have bank partners.

Professor Omarova worked in the Bush Treasury Department and has published numerous articles on financial regulation. This Alert touches on the key themes of her academic writings and addresses how these themes could translate into regulatory priorities at the OCC and FDIC, and in view of the fact that President Biden will likely soon nominate a new Vice Chair for Supervision at the Board of Governors of the Federal Reserve System (Federal Reserve).

A. Key Themes

Professor Omarova has written on numerous topics in her academic career. Early on, she analyzed 1990s OCC interpretations that expanded national bank derivatives activities to include derivatives on commodities and equities; the Federal Reserve’s granting of Section 23A exemptions immediately before and during the 2008 Financial Crisis; and the historical exemptions from the definition of a “bank” under the Bank Holding Company Act.[1] More recently, she has written on bank governance, innovation in the financial industry, “culture” at financial institutions, restructuring the Federal Reserve to take customer demand deposits, and the “Too Big to Fail” problem, among other topics.[2]

Several key themes emerge from these writings:

- Concerns that post-Financial Crisis reforms have only magnified the size and interconnectedness of the largest banking organizations

- Concerns that banking and related financial activities frequently serve only private interests

- Concerns that activities outside of narrow banking – derivatives, commodities, trading, and even certain capital markets activities – are inherently risky

- Concerns that a focus on “innovation” may result in a weakening of supervisory standards

Perhaps most interesting, however, is Professor Omarova’s recurring theme that traditional bank supervision is too narrowly focused on what she calls “micro” issues and solutions, and that a new regulatory paradigm centered on overall “macro” economic and public interest goals, and including substantially increased government intervention in the financial sector, may be needed.

1. Concern with Size and Interconnectedness

Professor Omarova, like other observers, has noted one of the ironies of post-Financial Crisis regulation – that although the size and interconnectedness of the global banking sector contributed significantly to the Crisis, the financial system was saved only by increasing the size of the nation’s largest banks:

The post-crisis increase in the level of concentration of the U.S. financial industry is difficult to deny. For example, as of the year-end 2017, top five U.S. bank holding companies (BHCs) held forty-eight percent of the country’s BHC assets. By early 2018, there were four U.S. BHCs with more than $1.9 trillion in assets on their individual balance sheets. Despite the post-crisis passage of the Dodd-Frank Act, the most wide-ranging regulatory reform in the U.S. financial sector since the 1930s, [too big to fail] remains a “live” issue on the public policy agenda.[3]

This in turn, she believes, imposes considerable challenges for supervisors: “today’s financial system is growing increasingly complex and difficult to manage. This overarching trend manifests itself not only in the dazzling organizational complexity of large financial conglomerates, but also in the exponential growth of complex financial instruments – derivatives, asset-backed securities, and other structured products – and correspondingly complex markets in which they trade.”[4] The result is that it is “extremely difficult to measure and analyze not only the overall pattern of risk distribution in the financial system but also the true level of individual financial firms’ risk exposure.”[5]

2. Private Versus Public Interest

It is fair to say that Professor Omarova is not a strong believer in the “Invisible Hand.” Her articles frequently posit a dichotomy between the driving forces of finance and the “public interest.” Her article on bank culture, for example, makes this assertion:

[New York Federal Reserve Bank President] Gerald Corrigan argued that, in exchange for the publicly-conferred benefits uniquely available to them, banks have an obligation to align their implicit codes – and their actual conduct – with the public good. In practice, however, there has been little evidence of such an alignment . . . . One of the most troubling revelations [about bank conduct before the Financial Crisis] was that, in the vast majority of these cases, banks’ and their employees’ socially harmful and ethically questionable business conduct was perfectly permissible under the existing legal rules. In each of those instances, bankers voluntarily, and often knowingly, chose to pursue a particular privately lucrative but socially suboptimal business strategy. And, as long as mortgage markets kept going up and speculative trading in mortgage assets remained profitable, bankers showed no interest in fulfilling their public duties or prioritizing moral values over pecuniary self-interest.[6]

In an article on bank governance, she returns to this theme, stating that “[a]ll too often, however, the incentives of bank managers and shareholders to pursue short-term private gains are perfectly aligned but work directly against the public interest in preserving long-term financial stability. The recent financial crisis . . . made abundantly clear that the modern system of corporate governance . . . is not a sufficiently reliable or consistent mechanism for managing this insidious and apparently pervasive conflict in a publicly beneficial way.”[7]

Although it is clear how Professor Omarova views what then-Chief Judge Cardozo called “the forms of conduct permissible in a workaday world for those acting at arm’s length,”[8] it is less clear how she defines the “public interest.” Her writings do, however, suggest that it includes a focus on maintaining financial stability and appropriately allocating capital and credit to productive use, which she argues is not likely to occur absent government intervention:

[T]o date, there has been no meaningful debate on improving the system-wide allocation of financial resources to productive enterprise. In most, if not all, post-crisis discussions on financial regulation, the underlying presumption remains that private market actors are inherently better at assessing financial risks and spotting potentially beneficial investment opportunities ‘on the ground.’ Accordingly, the existing dysfunctions in the process of system-wide credit allocation are framed predominantly in terms of specific private incentive misalignments or more general political-economy frictions.[9]

3. Preference for Narrow Banking

From her earliest writings, Professor Omarova has expressed a distrust of activities that are not at the core of traditional commercial banking. In an early article, she took issue with the OCC’s increasingly flexible approach to interpreting the phrase “business of banking” in the National Bank Act to include derivative activities related to commodities and equities, including hedging such activities through physically settled transactions, and related activities such as national bank participation in power marketing and clearing organizations.[10] She similarly criticized Federal Reserve interpretations of the Gramm-Leach-Bliley Act under which commodity activities were deemed “complementary” to financial activities, and investments in commodity-related assets could be permissible merchant banking investments.[11] (It is worthwhile remembering that under Governor Daniel Tarullo, the Federal Reserve commenced an advanced notice of proposed rulemaking to consider established commodity activities by financial holding companies.[12]) And Professor Omarova strongly supported the statutory Volcker Rule but feared that the law’s mandated administrative rulemakings had great potential to weaken it.[13]

These concerns about risks from non-traditional activities extend to capital markets activities generally, including those that were broadly permissible for bank holding companies even before the Gramm-Leach-Bliley Act was enacted. (By 1997, the Federal Reserve had interpreted the Glass-Steagall Act in a manner that posed few limits on corporate debt and equity underwriting and dealing, in addition to underwriting and dealing in bank-permissible assets.[14]) Professor Omarova states that “[i]n today’s world, secondary markets in financial assets are far bigger, more complex, and more systemically important than primary markets. . . . It is not surprising, therefore, that today’s secondary markets in financial instruments are the principal sites of both relentless transactional ‘innovation’ and chronic over-generation of systemic risk.”[15] In criticizing the Federal Reserve’s Section 23A exemptions granted during the Financial Crisis, she argued that “it is hard to deny that these extraordinary liquidity backup programs also functioned to prop up the banks’ broker-dealer affiliates, which . . . were in the business of creating, trading, and dealing in securities that needed . . . financing and, as a result, had direct exposure to . . . highly unstable markets.”[16]

4. Innovation as a Source of Risk

In contrast to former Acting Comptroller Brian Brooks, who encouraged financial innovation, most notably with respect to national charters for virtual currency companies, Professor Omarova has had a skeptical eye on the question. One of her early articles, as noted above, criticized the OCC for its interpretive approach with respect to equity and commodity derivatives:

[T]he OCC’s highly expansive interpretation of the “business of banking” . . . served to undermine the integrity and efficacy of the U.S. system of bank regulation. Through the seemingly routine and often nontransparent administrative actions, the OCC effectively enabled large U.S. commercial banks to transform themselves from the traditionally conservative deposit-taking and lending institutions, whose safety and soundness were guarded through statutory and regulatory restrictions on potentially risky activities, into a new breed of financial “super-intermediaries,” or wholesale dealers in pure financial risk.[17]

This view carries over in later discussions of pre-Financial Crisis loan securitizations and credit default swaps, as well as fintech generally. Of the latter, Professor Omarova has written:

By making transacting in financial markets infinitely faster, cheaper, and easier to accomplish, fintech critically augments the ability of private actors to synthesize tradable financial claims – or private liabilities – and thus generate new financial risks on an unprecedented scale. Moreover, as the discussion of Bitcoin and ICOs shows, new crypto-technology enables private firms to synthesize tradable financial assets effectively out of thin air. . . . The sheer scale and complexity of the financial market effectively “liberated” from exogenously imposed constraints on its growth will make it inherently more volatile and unstable . . . . The same factors, however, will also make it increasingly difficult, if not impossible, for the public to control, or even track, new technology-driven proliferation of risk in the financial system.[18]

5. The Futility of Bank Supervision

Perhaps most interestingly for someone who would be the lead supervisor of most of the nation’s largest banks, Professor Omarova’s writings show a decidedly pessimistic view of the effectiveness of financial regulation. She frequently points out the failures of what she terms “micro” entity-specific solutions to such risks, in order to argue in favor of a revised “macro,” i.e., far more fundamental and structural, approach. One example comes from her article on Too Big To Fail: “At the heart of the TBTF problem, there is a fundamental paradox: TBTF is an entity-centric, micro-level metaphor for a cluster of interrelated systemic, macro-level problems. This inherent conceptual tension between the micro and the macro, the entity and the system, frames much of the public policy debate on TBTF.”[19]

Professor Omarova’s “macro” approach includes suggestions of potential governmental interventions in the financial system on a scale unprecedented even in times of crisis – government “golden shares” in large financial companies that would allow the government to override management decisions to forestall a crisis,[20] Federal Reserve counter-cyclical intervention in a broader range of financial markets,[21] “public interest” guardians who would supplement regulatory bodies to correct the self-interest of the financial sector,[22] and a significant National Investment Authority to counteract the biases of the private investment community.[23] As Professor Omarova acknowledges, such measures would require new legislation, for which there does not currently appear to substantial appetite.

B. Consequences For Regulatory Priorities

What then do these themes likely foretell should Professor Omarova receive Senate confirmation? It is of course always a challenge to predict the future, and academic writing is frequently at its best when it seeks to challenge traditional paradigms and manners of thought. This said, it does seem that the following outcomes are certainly within the realm of possibility.

1. Size and Interconnectedness

The OCC currently supervises eight of the country’s ten largest banks: JPMorgan Chase, Bank of America, Wells Fargo, Citibank, US Bank, PNC Bank, TD Bank, and Capital One, ranging from just under $400 billion in assets to over $3 trillion in assets. Some, but not all, of them also engage broadly in investment banking activities. The OCC also regulates many banks in the next asset tier below.

The OCC does not have any general authority to break up well-managed banks or to order them to cease activities, but it is not unusual for the OCC to adjust its supervisory approach based on the risk profile of an institution. What Professor Omarova might add to this traditional approach given her views of increasing systemic risk and the importance of the “macro” is a more holistic approach, in which not only will a particular institution’s own risk profile determine its supervision, but also the perceived risks created by those institutions to which it is most connected. In addition, large banks that fail to meet supervisory expectations can face activities limitations; an early article by Professor Omarova analyzed the idea of requiring regulatory approval of complex financial products.[24]

Moreover, although mergers of bank holding companies must be approved only by the Federal Reserve, in many cases once the holding company merger has been approved, the parties seek to merge the subsidiary banks for efficiency reasons. If the resulting bank will be a national bank, the OCC must approve the transaction under the Bank Merger Act. The statutory factors that the OCC must consider are similar to those the Federal Reserve considers, but the OCC makes an independent decision. Many of the required factors relate to size – competitive effect, ability of management (including on integrating institutions), and financial stability.[25]

2. Private Interest Versus Public Interest

In terms of constraining what Professor Omarova views as the self-interest of the financial sector, it is noteworthy that the responsible agencies, including the OCC, have never completely finalized the executive compensation rulemaking required by Dodd-Frank, something to which SEC Chair Gary Gensler has recently called attention.[26] One of the more controversial aspects of the original rulemaking was the extent of permissible clawbacks of compensation, if actions by individual bankers ended up imposing losses on the financial institution involved. On this question, Professor Omarova’s characterization of the “morals of the marketplace” could be significant.

Another means by which the bank regulators have sought to address privatizing gains and socializing losses since the Crisis is bank governance. The OCC’s principal contribution in this regard is its Guidelines Establishing Heightened Standards for large national banks and federal thrifts, which impose a prescriptive approach to certain aspects of bank corporate governance.[27] These Guidelines were adopted as safety and soundness standards pursuant to Section 39 of the Federal Deposit Insurance Act, which gives the OCC the authority to issue orders for noncompliance, orders that may be enforced by the issuance of civil money penalties or in federal district court actions. The OCC could further strengthen these standards or take a more aggressive approach to enforcing them.

3. Narrow Banking

Historically, as Professor Omarova herself has noted, the OCC has been one of the most flexible agencies in its interpretations of its governing statute, the National Bank Act. Although certain of the activities that she has criticized for increasing systemic risk are conducted by bank affiliates, not all of them are: national banks conduct significant derivative activities, certain capital markets activities are bank permissible, and numerous bank activities implicate the broad definition of proprietary trading contained in the Volcker Rule. Even in the absence of revisiting, for example, the National Bank Act interpretations relating to permissible derivatives activities, the OCC has the authority to examine all national bank activities. Those banking institutions with substantial businesses in areas that Professor Omarova has characterized as non-core and risk-creating should therefore expect a much stricter supervisory approach. The Volcker Rule regulations, which as revised still invite significant supervisory discretion in practice due to the difficulty of distinguishing between prohibited trading and permissible activities like risk-mitigating hedging, could well see ramped up examination interest, and expectations of compliance programs could increase.

4. Innovation and Fintechs

There are currently several pressing fintech-related issues at the OCC. First is the question of whether the OCC will grant a national bank charter to a company that proposes to make loans but not take FDIC-insured deposits, and that is not a statutorily authorized national trust bank. The OCC has claimed the authority under the National Bank Act to issue such a charter, but it has not acted on one such application, and it has been sued in federal court by state banking supervisors who believe that granting such a charter goes beyond the business of banking in the National Bank Act. Professor Omarova’s statements on the potential perils of innovation for supervisors and her general “public interest” concerns may well be relevant on this question.

Second, shortly before and just after President Biden was inaugurated, the OCC granted three trust company charters to digital currency companies, and issued a broad interpretation of permissible digital currency activities under the National Bank Act. The OCC is currently re-examining the bases for such charters, with Acting Comptroller Hsu expressing safety and soundness concerns over certain virtual currency activities. For Professor Omarova, virtual currencies and other digital assets are one of the areas where innovation is most likely to cause systemic risk.[28]

Third, Professor Omarova will be a voting member of the FDIC Board, which determines whether a state industrial bank may receive deposit insurance, and which also must approve any change of control transaction involving an FDIC-insured industrial bank. Under Chair Jelena McWilliams – but with a Republican-appointed Comptroller and Republican-appointed Director of the Consumer Financial Protection Bureau – the FDIC Board approved two such applications, one for Square and one for Nelnet. In one of her earliest articles, Professor Omarova analyzed the historical exemption for industrial banks in the Bank Holding Company Act,[29] and since that writing, Congress has refused to repeal the exemption, and the FDIC has finalized a framework for supervising the parents of industrial banks. It is certainly possible that given her preference was “narrow” banking, Professor Omarova would wish to see a linkage to traditional banking activities, with ancillary activities being preferable when conducted in an agency capacity, when considering such applications.

Finally, many fintechs operate via bank partnerships. Under the Trump Administration, the OCC issued fintech-friendly interpretations regarding the “true lender” and “valid when made” doctrines, which engendered opposition from consumer groups and certain state regulators and attorneys general. Congress used the Congressional Review Act this summer to void the “true lender” rule, but the “valid when made” interpretation remains. Professor Omarova’s criticism of the elasticity of the OCC’s interpretations of the National Bank Act on derivatives matters during the 1990s could extend beyond the derivatives area to bank-fintech partnership issues. Demonstrating a lack of increased risk to banks and the system from such partnerships, therefore, could become significant.

5. The Quarles/Brainard Divide – Likely Positioning

It is also important to note that Professor Omarova’s appointment is not taking place in a vacuum. In several weeks, Vice Chair Randal Quarles’s term as the Federal Reserve Governor in charge of bank supervision will come to an end, although a mere Governor Quarles could remain at the Federal Reserve for another decade. During the last four years, Vice Chair Quarles has shepherded through a number of “reforms to the reform” wrought by the Dodd-Frank Act. Many of the more important actions drew dissents from Governor Lael Brainard, who is one of the contenders to be Governor Quarles’ successor. Of these actions, quite a few implicated rules promulgated by the OCC as well as the Federal Reserve:

- Loosening the regulatory restrictions of the Volcker Rule

- Tailoring capital and liquidity requirements for an institution’s asset size and other factors, with institutions between $100 billion and $250 billion in assets particularly benefiting

- Reducing margin requirements for inter-affiliate uncleared swap transactions

- Proposing to reduce the enhanced supplementary leverage ratio for the largest banks and their holding companies

From her articles, Professor Omarova would appear to be decidedly in Governor Brainard’s camp on these four issues.

Conclusion: The Limits of Bank Supervision and Regulation

In her writings, Professor Omarova is a strong proponent for government intervention in the financial system, and a skeptic of a light-touch supervisory approach. In this way, she is reminiscent of the first de facto Federal Reserve Governor for bank supervision, another banking law professor turned regulator, Daniel Tarullo. Governor Tarullo, of course, oversaw the implementation of a highly prescriptive top-down approach to bank supervision at the Federal Reserve, which even he noted in his “farewell address” may have gone too far in some areas, particularly for non-systemic banks.[30] Professor Omarova also has quite a bit in common with former FDIC Chair Sheila Bair, who herself was a professor of regulatory policy, was critical of bank derivative activities, and pushed the Collins Amendment to the Dodd-Frank Act because of her suspicions regarding internal bank financial models.

But it is also fair to say that neither Governor Tarullo nor Chair Bair appeared to have quite as skeptical views on the limitations of bank supervision and regulation as Professor Omarova. What will a proponent of a new paradigm approach to the American banking industry do in the absence of any legislative appetite for departing from the reigning paradigm since the New Deal?

This is perhaps the most difficult question of all to answer. A logical response, however, is that in those areas that are perceived to pose the greatest risk, such a proponent would double down on the supervisory tools that are currently available in order to counter perceived risks at inception. Large federal banking institutions that depart from core deposit and lending activities should therefore expect searching supervisory reviews of their non-traditional activities.

_________________________

[1] Saule T. Omarova, “The Quiet Metamorphosis: How Derivatives Changed the ‘Business of Banking,’” 63 U. Miami L. Rev. 1041 (2009); Saule Omarova, “From Gramm-Leach-Bliley to Dodd-Frank: The Unfulfilled Promise of Section 23A of the Federal Reserve Act,” 89 N.C. L. Rev. 1683 (2011); Saule T. Omarova and Margaret E. Tahyar, “That Which We Call a Bank: Revisiting the History of Bank Holding Company Regulation in the United States,” 31 Rev. Banking & Fin. L. 113 (2012).

[2] Saule T. Omarova, “Bank Governance and Systemic Stability: The ‘Golden Share’ Approach,” 68 Ala. L. Rev. 1029 (2017); Saule T. Omarova, “New Tech v. New Deal: Fintech as a Systemic Phenomenon,” 36 Yale J. on Reg. 735 (2019); Saule T. Omarova, “Ethical Finance as a Systemic Challenge: Risk, Culture, and Structure,” 27 Cornell J.L. & Pub. Pol’y 797 (2018); Saule T. Omarova, “The ‘Too Big to Fail’ Problem,” 103 Minn. L. Rev. 2495 (2019).

[3] “The ‘Too Big to Fail’ Problem,” supra note 2.

[6] “Ethical Finance as a Systemic Challenge: Risk, Culture, and Structure,” supra note 2.

[7] “Bank Governance and Systemic Stability: The ‘Golden Share’ Approach,” supra note 2.

[8] Meinhard v. Salmon, 164 N.E. 528 (N.Y. 1928).

[9] Saule T. Omarova, “What Kind of Finance Should There Be?”, 83 Law & Contemp. Probs. 195 (2020).

[10] “The Quiet Metamorphosis: How Derivatives Changed the ‘Business of Banking,’” supra note 1.

[11] Saule T. Omarova, “The Merchants of Wall Street: Banking, Commerce, and Commodities,” 98 Minn. L. Rev. 265 (2013).

[12] See https://www.federalreserve.gov/newsevents/pressreleases/bcreg20140114a.htm.

[13] Saule T. Omarova, “The Dodd-Frank Act: A New Deal for A New Age?”, 15 N.C. Banking Inst. 83 (2011)

[14] See https://www.federalreserve.gov/boarddocs/press/boardacts/1996/19961220/ (increasing limit on bank ineligible revenues for Section 20 companies to 25 percent of total revenues).

[15] “What Kind of Finance Should There Be?”, supra note 9.

[16] “From Gramm-Leach-Bliley to Dodd-Frank: The Unfulfilled Promise of Section 23A of the Federal Reserve Act,” supra note 1.

[17] “The Quiet Metamorphosis: How Derivatives Changed the ‘Business of Banking,’” supra note 1.

[18] “New Tech v. New Deal: Fintech as a Systemic Phenomenon,” supra note 2.

[19] “The ‘Too Big to Fail’ Problem,” supra note 2.

[20] “Bank Governance and Systemic Stability: The ‘Golden Share’ Approach,” supra note 2.

[21] “The ‘Too Big to Fail’ Problem,” supra note 2.

[22] Saule T. Omarova, “Bankers, Bureaucrats, and Guardians: Toward Tripartism in Financial Services Regulation,” 37 J. Corp. L. 621 (2012).

[23] Robert C. Hockett & Saule T. Omarova, “Private Wealth and Public Goods: A Case for a National Investment Authority,” 43 J. Corp. L. 437 (2018).

[24] Saule T. Omarova, “License to Deal: Mandatory Approval of Complex Financial Products,” 90 Wash. U. L. Rev. 63 (2012).

[26] Akayla Gardner & Ben Bain, “Wall Street Pay Clawback Rule to Get New Push at SEC,” Bloomberg News (September 22, 2021).

[27] 12 C.F.R. Part 30 (Appendix D).

[28] “New Tech v. New Deal: Fintech as a Systemic Phenomenon,” supra note 2.

[29] “That Which We Call a Bank: Revisiting the History of Bank Holding Company Regulation in the United States,” supra note 1.

[30] See https://www.federalreserve.gov/newsevents/speech/tarullo20170404a.htm.

The following Gibson Dunn lawyers assisted in preparing this client update: Arthur Long.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the author, or any of the following members of the firm’s Financial Institutions practice group:

Matthew L. Biben – New York (+1 212-351-6300, mbiben@gibsondunn.com)

Michael D. Bopp – Washington, D.C. (+1 202-955-8256, mbopp@gibsondunn.com)

Stephanie Brooker – Washington, D.C. (+1 202-887-3502, sbrooker@gibsondunn.com)

M. Kendall Day – Washington, D.C. (+1 202-955-8220, kday@gibsondunn.com)

Mylan L. Denerstein – New York (+1 212-351- 3850, mdenerstein@gibsondunn.com)

William R. Hallatt – Hong Kong (+852 2214 3836, whallatt@gibsondunn.com)

Michelle M. Kirschner – London (+44 (0) 20 7071 4212, mkirschner@gibsondunn.com)

Arthur S. Long – New York (+1 212-351-2426, along@gibsondunn.com)

Matthew Nunan – London (+44 (0) 20 7071 4201, mnunan@gibsondunn.com)

Jeffrey L. Steiner – Washington, D.C. (+1 202-887-3632, jsteiner@gibsondunn.com)

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

The torrid pace of new securities class action filings over the last several years slowed a bit in the first half of 2021, a period in which there have been many notable developments in securities law. This mid-year update briefs you on major developments in federal and state securities law through June 2021:

- In Goldman Sachs, the Supreme Court found that lower courts should hear evidence regarding the impact of alleged misstatements on the price of securities to rebut any presumption of classwide reliance at the class-certification stage, and that defendants bear the burden of persuasion on this issue.

- Just before its summer recess, the Supreme Court granted certiorari in Pivotal Software, teeing up a decision on whether the PSLRA’s discovery-stay provision applies to state court actions, which may impact forum selection in private securities actions.

- We explore various developments in Delaware courts, including the relative decline of appraisal litigation, and the Court of Chancery’s (1) decision to enjoin a poison pill, (2) rejection of a claim that the COVID-19 pandemic constituted a material adverse effect, (3) approach in a potential bellwether SPAC case, and (4) analysis of post-close employment opportunities with respect to Revlon fiduciary duties.

- We continue to survey securities-related lawsuits arising in connection with the coronavirus pandemic, including securities class actions, stockholder derivative actions, and SEC enforcement actions.

- We examine developments under Lorenzo regarding disseminator liability and under Omnicare regarding liability for opinion statements.

- Finally, we explain important developments in the federal courts, including (1) the widening circuit split regarding the jurisdictional reach of the Exchange Act based on recent decisions in the First and Second Circuits, (2) the Eighth Circuit’s holding that class action allegations, including those under Section 10(b), can be struck from pleadings, (3) Congress’s codification of the SEC’s disgorgement authority in the National Defense Authorization Act, (4) a federal district court’s holding that a forum selection clause superseded anti-waiver provisions in the Exchange Act, and (5) the Ninth Circuit’s broad interpretation of the PSLRA’s safe harbor for forward-looking statements.

I. Filing and Settlement Trends

According to Cornerstone Research, both the number of new filings and the average approved settlement amount in securities class actions decreased relative to the same period last year and historically. However, the number of approved settlements is the highest it has been since the second half of 2017, indicating that 2021 may be on track to set a record in terms of the number of approved securities class action settlements even if the total dollar amount falls short of last year.

The decline in total filings is driven by a sharp decline in new mergers and acquisitions filings, which are at the lowest level since the second half of 2014. Despite the decline in filings, 2021 has nonetheless already set a record for new SPAC-related filings by doubling both the 2020 and 2019 full-year totals in this category.

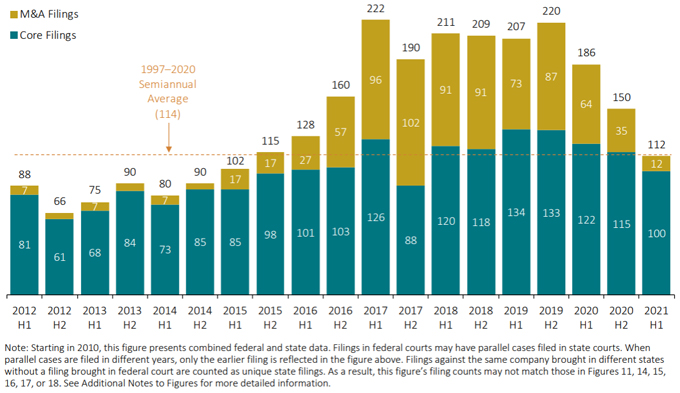

A. Filing Trends

Figure 1 below reflects filing rates for the first half of 2021 (all charts courtesy of Cornerstone Research). The first half of the year saw 112 new class action securities filings, a nearly 40% decrease from the same period last year and a 25% decrease from the second half of 2020. The decrease is largely driven by a drop in new M&A filings, from 64 and 35 in the two halves of 2020, respectively, to 12 in the first half of 2021. This represents a 66% decline in M&A filings from the second half of 2020, and 83% decline against the biannual average for M&A filings dating back through 2016.

Figure 1:

Semiannual Number of Class Action Filings (CAF Index®)

January 2012 – June 2021

B. Industry and Other Trends in Cases Filed

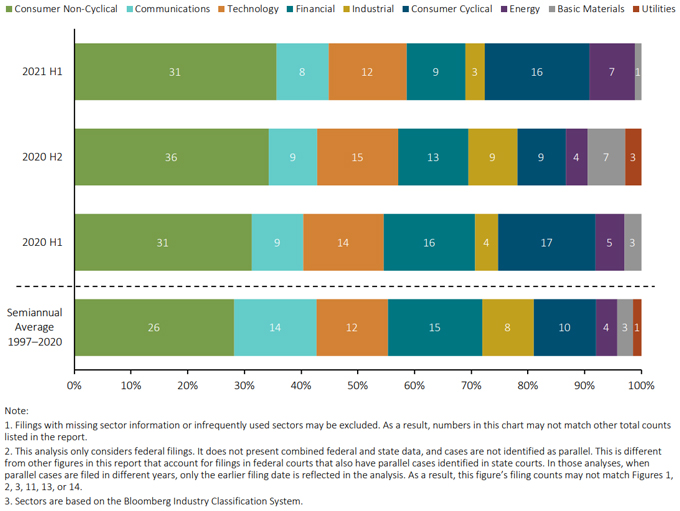

Keeping with recent trends, new filings against consumer non-cyclical firms continued to make up the majority of new federal, non-M&A filings in the first half of 2021, as shown in Figure 2 below. New filings against communications and technology sector firms remained fairly steady, and an increase in filings against firms in the consumer cyclical and energy sectors partially offset the decline in filings against firms in the basic materials, industrial and financial sectors.

Figure 2:

Core Federal Filings by Industry

January 1997 – June 2021

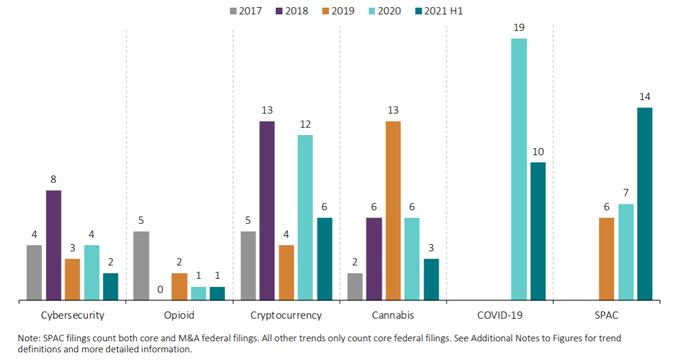

As noted at the start and illustrated in Figure 3 below, the number of SPAC-related filings in the first half of 2021 exceeds those filed in both 2019 and 2020 combined. The increase is driven by filings in the consumer cyclical industry, and specifically, firms in the Auto manufacturers and Auto Parts & Equipment industries. In addition to notable activity in the SPAC space, cybersecurity-, cryptocurrency- and cannabis-related filings are all on pace to meet or exceed the 2020 totals, and 2021’s increased activity in ransomware attacks has already resulted in an uptick in cybersecurity filings in the second half of 2021. On the other hand, the majority of the new filings related to COVID-19 occurred earlier in the year, indicating that, as mentioned below, it is still too early to tell what the full year brings in terms of filings related to COVID-19.

Figure 3:

Summary of Trend Case Filings

January 2017 – June 2021

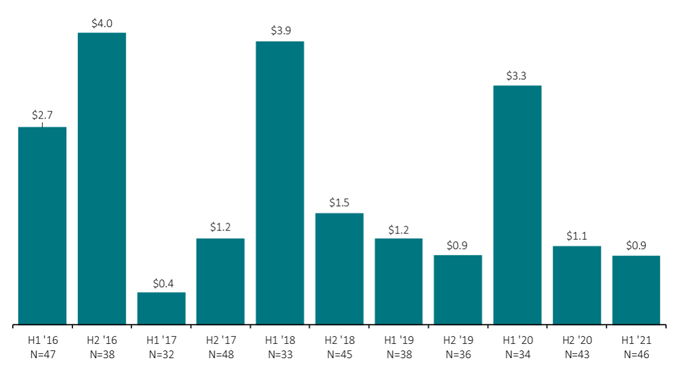

C. Settlement Trends

As shown in Figure 4, the total settlement dollars, adjusted for inflation, is down 72.7% against the same period last year despite a 35% increase in the number of settlements approved. Two settlements in the first half of 2021 exceeded $100 million, as compared to six such settlements last year and four in 2019, and the median value of approved settlements through the first half of the year is $7.9 million, reflecting an 18% decline against the same period last year. The difference between the magnitude of the decline in settlement amounts is likely driven by an outlier settlement in first half of last year.

Figure 4:

Total Settlement Dollars (in billions)

January 2016 – June 2021

II. What to Watch for in the Supreme Court

A. Supreme Court Issues Narrow Decision in Price-Impact Case

As we previewed in our 2020 Year-End Securities Litigation Update, in Goldman Sachs Group Inc. v. Arkansas Teacher Retirement System, 141 S. Ct. 1951 (2021), the Supreme Court this Term considered questions regarding price-impact analysis at the class-certification stage in securities class actions. Recall that in Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014) (“Halliburton II”), the Supreme Court preserved the “fraud-on-the-market” theory that enables courts to presume classwide reliance in Rule 10b-5 cases, but also permitted defendants to rebut that presumption with evidence that the alleged misrepresentation did not affect the issuer’s stock price.

Goldman Sachs presented the Court with the opportunity to decide how courts can address cases in which plaintiffs plead fraud through the “inflation maintenance” price impact theory, which claims that misstatements caused a preexisting inflated price to be maintained instead of causing the artificial inflation in the first instance. In granting certiorari, the Supreme Court accepted two questions for review: (1) “[w]hether a defendant in a securities class action may rebut the presumption of classwide reliance recognized in Basic Inc. v. Levinson, 485 U.S. 224 (1988), by pointing to the generic nature of the alleged misstatements in showing that the statements had no impact on the price of the security, even though that evidence is also relevant to the substantive element of materiality,” and (2) “[w]hether a defendant seeking to rebut the Basic presumption has only a burden of production or also the ultimate burden of persuasion.” Petition for a Writ of Certiorari at I, Goldman Sachs, 141 S. Ct. 1951 (No. 20-222).

In its June 21, 2021 decision, the Court declined to take a position on the “validity or . . . contours” of the inflation-maintenance theory in general, which it has never directly approved. Goldman Sachs, 141 S. Ct. at 1959 n.1. On the first question, the Court unanimously agreed with the parties that lower courts should hear evidence—including expert evidence—and rely on common sense to make determinations at the class-certification stage as to whether the alleged misrepresentations were so generic that they did not distort the price of securities. Id. at 1960. This analysis is permitted at the class-certification stage even though such evidence may also be relevant to the question of materiality, which is reserved for the merits stage. Id. at 1955 (citing Amgen Inc. v. Connecticut Ret. Plans and Tr. Funds, 568 U.S. 455, 462 (2013)). Importantly, the Court noted that in the context of an inflation-maintenance theory, the mismatch between generic misrepresentations and later, specific corrective disclosures will be a key consideration in the price-impact analysis. Goldman Sachs, 141 S. Ct. at 1961. “Under those circumstances, it is less likely that the specific disclosure actually corrected the generic misrepresentation, which means that there is less reason to infer front-end price inflation—that is, price impact—from the back-end price drop.” Id. The Court, with only Justice Sotomayor dissenting, then remanded the case for further consideration of the generic nature of the statements at issue here, explicitly directing the Second Circuit to “take into account all record evidence relevant to price impact, regardless whether that evidence overlaps with materiality or any other merits issue.” Id. (emphasis in original).

As to the second question, the Court held by a 6–3 majority that defendants at the class-certification stage bear the burden of persuasion on the issue of price impact in order to rebut the presumption of reliance—that is, to convince the court, by a preponderance of the evidence, that the challenged statements did not affect the price of securities. The Court determined that this rule had already been established by its previous decisions in Basic and Halliburton II: Basic recognized that defendants could rebut the presumption of classwide reliance by making “[a]ny showing that severs the link between the alleged misrepresentation and . . . the price,” and in Halliburton II, the Court again referenced defendants’ ability to rebut the Basic presumption with a “showing.” Id. at 1962 (internal citations omitted). The majority rejected an argument by the defendants, taken up by Justice Gorsuch (joined by Justices Thomas and Alito), that these references to a “showing” by the defense imposed only a burden of production. Id. at 1962; see also id. at 1965–70 (Gorsuch, J., concurring in part and dissenting in part). That reading would have allowed defendants to rebut the presumption of reliance “by introducing any competent evidence of a lack of price impact”—and would have imposed on plaintiffs the requirement to “directly prov[e] price impact in almost every case,” a requirement that had been rejected in Halliburton II. Id. at 1962–63 (emphasis in original). However, the Court noted that imposing the burden of persuasion on defendants would be unlikely to alter the outcome in most cases, as the “burden of persuasion will have bite only when the court finds the evidence is in equipoise—a situation that should rarely arise.” Id. at 1963.

B. Supreme Court to Decide whether the PSLRA’s Discovery Stay Applies in State Court

On July 2, 2021, just before its summer recess, the Court granted certiorari in Pivotal Software, Inc. v. Tran, No. 20-1541, which raises the question of whether the Private Securities Litigation Reform Act’s (“PSLRA”) discovery-stay provision applies to state court actions in which a private party raises a Securities Act claim. The PSLRA provides that the stay applies “[i]n any private action arising under” the Securities Act before a court has addressed a motion to dismiss, 15 U.S.C. § 77z-1-(b)(1), but state courts are sharply divided over whether the stay applies to suits in state court, rather than only to those in federal court. In opposition, respondent plaintiffs argued that not only is the issue moot (because they have agreed to adhere to the stay provision and the state court will have issued a decision on the motion to dismiss before the Supreme Court can issue an opinion), but also that no court of appeals has ever decided the issue. Brief in Opposition at 7–16, Pivotal Software, Inc. v. Tran, No. 20-1541. Petitioners countered that the issue will only ever arise in state courts and that state trial courts are divided, with at least a dozen decisions refusing to apply the stay and seven applying it, with many more decisions unreported. Moreover, the issue evades appellate review because it is time-sensitive and unlikely to affect a final judgment, rendering any error harmless. Reply Brief for Petitioners at 1–12, Pivotal Software, Inc. v. Tran, No. 20-1541.

Given the costs of discovery in securities actions, Pivotal could have a lasting impact on both the choice of forum in which securities actions are brought and on how discovery progresses in the early stages of a case.

C. The Court Addresses Constitutional Challenges to Administrative Adjudicators

Recall that in Lucia v. SEC, 138 S. Ct. 2044 (2018), the Court held that the SEC’s administrative law judges (“ALJs”) were “Officers of the United States” who must be appointed by the President, a court of law, or the SEC itself. Building on Lucia, the Supreme Court issued two decisions this Term that raised further questions on the constitutionality of administrative officers’ appointments.