2022 Year-End Securities Enforcement Update

Client Alert | February 2, 2023

I. Introduction: Themes and Notable Developments

A. Themes: Aggressive Enforcement Continues

The principal theme of Securities Enforcement this year is consistent with the message this Administration has promoted since it began: this Commission and its Enforcement Division are seeking to heighten the level of enforcement by employing existing remedies and increasing the price of resolving an enforcement investigation. The Commission’s Enforcement agenda has played out in numerous ways, most notably in the increase in civil monetary penalties, but in the demand for other remedies as well.

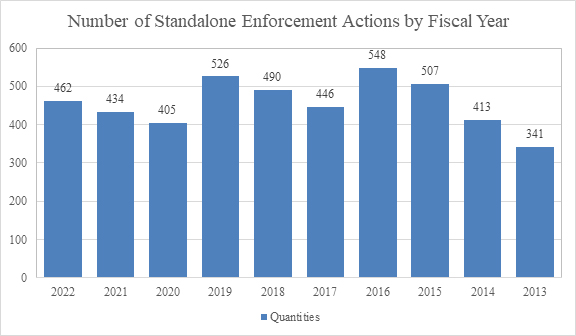

1. Notable Metrics: Increased Actions, But Particularly Penalties

The enforcement statistics for fiscal 2022 reflect a 6.5% year-over-year increase in stand-alone actions, from 434 in 2021 to 462 in 2022.[1] However, this number is still well below the five-year high of 526 actions in fiscal 2019. The distribution of actions across subject matter was generally consistent with prior years, with the majority of cases involving broker-dealers and investment advisers, public company financial reporting, and securities offerings. There were modest increases year-over-year in the percentage of stand-alone actions for issuer reporting, audit and accounting (16% of actions in 2022, compared to 12% in 2021) and insider trading (9% of actions in 2022, compared to 6% in 2021). There was a modest decrease in percentage of stand-alone actions for securities offerings (23% of actions in 2022, compared to 33% in 2021).

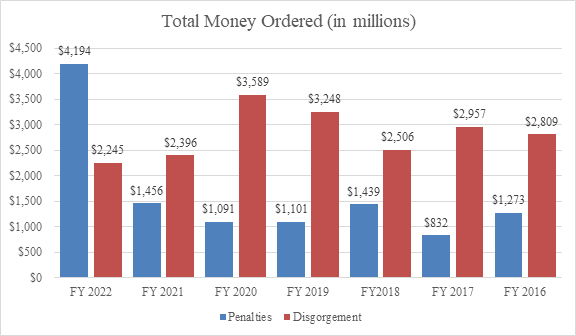

The more notable metric, and the one emphasized by the Commission, is financial remedies, particularly penalties. In fiscal 2022, total financial remedies ordered in enforcement actions totaled $6.439 billion, the highest ever, and a nearly 70% increase over 2021. That total consisted of disgorgement of $2.245 billion (reflecting a 6% decrease from 2021) and penalties of $4.194 billion, a record high, and more than double the penalties ordered in 2021.

In discussing the year’s enforcement statistics, the Commission highlighted the increase in penalties, referring to them as “recalibrated,” “designed to deter future violations,” and “not just a cost of doing business.” In this respect, the Commission has taken particular note of the fact that, unlike prior years, the penalties ordered in 2022 far exceeded the amount of disgorgement ordered during the same period. As Director Grewal discussed in a recent speech, the inversion of penalty to disgorgement ratio reflects a determination to make the cost of a violation greater relative to the arguable gain.[2]

To put these penalty metrics in context, it is important to bear in mind that of the total amount of penalties, $1.235 billion was attributable to the settlements with 17 broker-dealer firms for recordkeeping violations in connection with employee text messaging on personal devices.[3] Moreover, those settlements combined with the three other largest settlements accounted for $2.23 billion in penalties.[4] In a nod to the likelihood that the quantum of penalties in 2022 may turn out to be an outlier in future years, the Commission appeared to manage future expectations. Director Grewal expressly noted that, with respect to penalties, “we don’t expect to break these records and set new ones each year because we expect behaviors to change.”[5]

2. Individual Accountability and Use of Clawback Authority

As in prior years, the Commission emphasized its continued focus on individual accountability – bringing enforcement actions against individuals as well as entities. The Commission noted that more than two-thirds of its stand-alone enforcement actions involved at least one individual defendant or respondent.

In connection with this theme, the Commission also highlighted the use of claw-back authority under Sarbanes-Oxley Section 304 to order the return of executive compensation even though the executives were not personally accused of engaging in any misconduct. Section 304 of the Sarbanes-Oxley Act of 2002 requires the CEO and CFO of a public company that is required to restate financial results as a result of “misconduct” to reimburse the issuer for any bonus or other incentive or equity-based compensation received, and any profits realized from the sale of the issuer’s securities, by that person in the year following the initial financial report. Section 304 does not require that a chief executive officer or chief financial officer engage in, or be aware of, misconduct to trigger the reimbursement requirement. During 2022, the Commission utilized SOX 304 in at least four enforcement actions to recover compensation from executives who were not accused of engaging in misconduct.[6]

3. Cooperation: A Questionable Carrot

As a counterpoint to the overarching theme of aggressive enforcement, the Commission also sought to send a message that there are rewards to be had for companies that provide so-called “meaningful cooperation” in the context of an investigation. However, the examples cited by the Commission might lead one reasonably to question the real benefits of such cooperation. In two of the examples, the companies were still subjected to enforcement actions, albeit without incurring a civil penalty.[7] In a third action, the company was also ordered to pay a penalty of $18 million.[8] Understandably, there remains a significant perception gap in the value of cooperation as between the Commission and companies seeking to benefit by engaging in cooperation and remediation as part of an investigation.

4. Admissions Required in Some Cases – But No Standard Articulated

Finally, as we had previewed in our 2021 Year-End Alert, the Commission expressed an intent to demand admissions in a greater number of settlements. True to its word, in reviewing its fiscal 2022 results, the Commission noted that a number of settlements included some form of admissions by the settling parties, including the settlements with broker-dealers for recordkeeping issues related to text messaging. In its press release announcing the fiscal 2022 results, the Commission referred to requiring admissions “where appropriate.”[9] However, the Commission has articulated no standards by which one would know when or why admissions would be deemed “appropriate” in any particular case. Consequently, it will remain an inevitable uncertainty as to when the Commission will demand such admissions.

B. Commissioner and Senior Staffing Update

As we reported in our 2022 Mid-Year Alert, as of early July, the five-member SEC Commission was back to capacity with the swearing in of Commissioner Jaime Lizárraga on July 18.[10] Commissioner Lizárraga most recently served as a Senior Advisor to former House Speaker Nancy Pelosi, and previously worked on the Democratic staff of the House Financial Services Committee. Commissioner Lizárraga has more than 30 years in public service and joins Chair Gary Gensler as the second non-lawyer on the current Commission.

At the senior staff level, there were several changes in leadership, including at the Divisions of Investment Management and Examinations, as well as in the General Counsel’s office.

- In November, Keith E. Cassidy and Natasha Vij Greiner were named Deputy Directors of the Division of Examinations.[11] In addition to their Deputy Director positions, Cassidy and Greiner are the National Associate Directors of the Division’s Technology Controls Program (TCP) and Investment Adviser/Investment Company (IA/IC) examination programs, respectively, roles which they will continue to serve going forward.

- In December, Sarah ten Siethoff was named Deputy Director of the Division of Investment Management.[12] She previously served as Acting Director of the Division of Investment Management throughout 2021, and has been in the Division since 2008. In addition to her responsibilities as Deputy Director, she will also continue serving as the Associate Director of the Division’s Rulemaking Office, a position she has held since 2018.

- Also in December, SEC General Counsel Dan Berkovitz announced that he would be departing the agency as of January 31, 2023.[13] Current SEC Principal Deputy General Counsel, Megan Barbero, will be appointed General Counsel upon Berkovitz’s departure. Prior to joining the agency in 2021, Barbero served as Deputy General Counsel for the United States House of Representatives, and previously worked at the Department of Justice and in private practice.

Similar to the first half of 2022, there was significant turnover at the regional offices, with five of the eleven offices experiencing changes in leadership.

- In August, Nicholas P. Grippo was named Regional Director of the Philadelphia Regional Office.[14] Grippo previously served as the Chief of the Criminal Division for the U.S. Attorney’s Office for the District of New Jersey where he supervised approximately 120 prosecutors and support staff. During his time as an Assistant United States Attorney, Grippo spent five years in the office’s Economic Crimes Unit prosecuting securities fraud and white-collar crimes.

- Also in August, Monique C. Winkler was named Regional Director of the San Francisco Regional Office.[15] Winkler had been serving as the Acting Regional Director in that office since March 2022, and as the Associate Regional Director for Enforcement since 2019. Winkler has served in a variety of roles in the San Francisco Regional Office since joining the SEC in 2008.

- In October, Jason J. Burt, who had been serving as Acting Co-Director of the Denver Regional Office since July 2022, was promoted to Regional Director.[16] Burt has been at the SEC since 2004, and had served as the Office’s Associate Regional Director, overseeing the enforcement program, since 2019. While he has primarily been in the Enforcement Division, he has also spent time in the Examinations Division earlier in his career.

- In December, Fort Worth Regional Director David L. Peavler announced that, after a 19-year career at the SEC, he would be leaving the agency.[17] Eric R. Werner and Marshall Gandy will be serving as the Co-Acting Regional Directors until a permanent replacement is named.

- Also in December, Antonia Apps was named Regional Director of the New York Regional Office.[18] Apps was most recently a litigation partner at a New York law firm, focusing on criminal and regulatory matters, and earlier in her career served as an Assistant United States Attorney in the Southern District of New York’s Criminal Division, where she investigated and prosecuted securities fraud cases.

C. Environmental, Social, and Governance

The SEC continued to focus its attention on environmental, social, and governance (ESG) concerns, relying on what the Commission characterized as “time-tested principles concerning materiality, accuracy of disclosures, and fiduciary duty.”[19] For example, in September, the Commission’s Investment Advisory Committee held a panel discussion on “the importance of ESG and Greenwashing and the heightened role of ESG for investors.”[20] However, the second half of 2022 brought fewer ESG-related enforcement action compared with the first half.[21]

In November, the SEC instituted a settled administration action against an asset management firm based on alleged failure to adopt and maintain policies and procedures relating to its ESG investments.[22] The SEC’s order found that the firm did not have a written policy for certain ESG funds for more than a year, and then did not consistently follow the written policy it adopted. For example, the asset manager required personnel to complete a questionnaire before including a portfolio company in the funds, but personnel completed certain of the ESG questionnaires after they had already selected the investments for inclusion and relied on previous ESG research conducted in a different manner than what was required in the firm’s policies and practices. These practices allegedly violated Section 206(4) of the Advisers Act and Rule 206(4)-7, which require advisers to adopt and implement policies and procedures reasonably designed to prevent violations of the Advisers Act. The firm agreed to a cease-and-desist order, and a $4 million civil penalty.

D. Whistleblower Awards

The SEC’s whistleblower program continues to result in significant information being transmitted to the SEC, and the whistleblower program continues to provide significant rewards in exchange for information that ultimately contributes to an SEC action. As of year-end 2022, the SEC has awarded more than $1 billion since issuing its first award in 2012.

In August, the SEC adopted two amendments to rules for the whistleblower program.[23] The first amendment expands the SEC’s abilities to pay whistleblowers for information and assistance in connection with non-SEC, related actions even where that related action might otherwise be covered by an alternative whistleblower program through another agency. In order to be eligible for the SEC whistleblower program, the award from the other entity’s program must not be comparable to the SEC’s program, or if the maximum award under the SEC’s program would not exceed $5 million. The second amendment affirms that the SEC may consider the dollar amount of a potential award for the “limited purpose” of increasing, but not decreasing, an award. Chair Gary Gensler stated that these amendments are designed to “strengthen” the SEC whistleblower program.

Significant whistleblower awards granted during the second half of this year included:

- Three awards in July, including one award of over $3 million to a whistleblower who reported that a product in which they were solicited to invest was being misrepresented, prompting the opening of an investigation; another award of over $3 million to an insider who had initially reported their concerns internally, and later submitted a “detailed tip,” prompting the opening of an investigation;[24] and an award of more than $17 million to a whistleblower who provided information and assistance that prompted the opening of a new investigation, and resulted in a successful covered action and the success of a related action.[25]

- Two awards in August, both related to the same action—the first award of approximately $13 million was granted to a whistleblower for providing information on “difficult-to-detect” violations, including identifying key witnesses and providing “critical information”; the second whistleblower provided “important new information” during the investigation and received an award of more than $3 million.[26]

- One $10 million award in October, awarded to a whistleblower who provided documents and met with staff twice, where the information provided critical information to the investigation and there was a “close nexus” between the whistleblower’s allegations and the charges in the ultimately successful action.[27]

- One $20 million award in November, to a whistleblower who provided “new and critical information” that led to the success of an enforcement action and supported staff in their efforts to “quickly and efficiently investigate complex issues.”[28]

- Two large awards in December, including a more than $20 million award to a whistleblower for providing new information, meeting with staff multiple times, and remaining cooperative throughout the investigation, which led to a successful enforcement action.[29] The second award was more than $37 million, and was granted to a whistleblower who was the initial source of the company’s investigation, the SEC’s investigation, and an investigation by another agency. Even though the company reported the alleged conduct to the SEC and another agency, the whistleblower was given credit for the initiation of the investigations because they provided information to the SEC within 120 days of reporting it internally.[30]

II. Public Company Accounting, Financial Reporting, and Disclosure Cases

A. Financial Reporting Cases

In early August, the SEC settled an action against a surgical implant manufacturer and its former Chief Financial Officer after the company and CFO allegedly mischaracterized sales figures to investors.[31] The SEC alleged that between 2015 and 2019, the company, with permission from the CFO, shipped future orders early to accelerate revenue, a practice that violated generally accepted accounting principles (GAAP). Without admitting or denying the allegations, the company and former CFO agreed to cease and desist from future violations, and pay penalties of $2 million and over $75,000, respectively. The CFO also agreed to return over $200,000 in bonuses and other compensation to the company, and be suspended from appearing and practicing before the SEC as an accountant. The SEC separately brought a complaint against the company’s CEO, alleging the executive violated antifraud provisions of federal securities laws based on the same allegations made against the company and CFO. The complaint seeks, among other relief, the return of the CEO’s bonuses and profits from stock sales, as well as civil penalties.

In late August, the SEC announced a settled action against a construction company based on allegations that between 2017 and 2019, the company’s financial statements inflated the company’s financial performance.[32] The complaint alleges that a former executive deferred recording costs to create the appearance of inflated profit margins. The Commission credited the company with self-reporting the executive’s conduct to the Commission, and redesigning its internal accounting policies and procedures to increase the accuracy of its expected costs going forward. Without admitting or denying the allegations, the company agreed to an injunction from future violations and to pay a $12 million civil penalty. The SEC also brought a complaint against the executive based on the same conduct, charging him with violating the antifraud and other provisions of federal securities laws, and seeking, among other relief, disgorgement and civil penalties, along with an officer and director bar. In separate administrative proceedings, pursuant to Section 304 of the Sarbanes-Oxley Act, three additional executives agreed to return more than $1.4 million in bonuses and compensation.

In September, the SEC announced a settled action against a technology company relating to the company’s revenue reporting practices.[33] In the order, the SEC alleged the company delayed product deliveries to customers, which allowed it to report revenue in future quarters. The practice, the SEC alleged, concealed poor performance relative to the company’s financial projections in violation of federal securities laws. Without admitting or denying the allegations, the company agreed to cease and desist from future violations and an $8 million civil penalty.

In October, the SEC announced a settled action against a cannabis company and its former Chief Commercial Office (CCO) for accounting fraud.[34] According to the SEC, the company filed financial statements with the SEC in three separate quarters that contained material accounting errors related to revenue recognition and goodwill impairment. The SEC also alleged that in one of the quarters, the company did not know or account for an undisclosed agreement by its then CCO to sell cannabis raw material and to repurchase cannabis product in the following quarter, leading to a $2.3 million accounting error. The SEC noted that the company discovered this error internally and promptly reported the misconduct to the SEC and provided extensive cooperation and remedial efforts to improve its accounting controls. Without admitting or denying the SEC’s findings, the company and its former CCO agreed to settle the matter by agreeing to cease and desist from future violations, and agreeing to retain an independent compliance consultant to make recommendations with respect to the firm’s financial reporting and accounting controls. The SEC assessed no penalty on the company. The former CCO consented to a three-year officer and director bar, suspension from practicing before the SEC as an accountant for at least three years, and paid $54,000 to the Ontario Securities Commission for similar conduct.

B. Public Statements and Disclosures

In July, the SEC announced two settled actions relating to allegedly false statements to investors. First, the SEC settled fraud charges with a life insurance company for making materially misleading statements and omissions regarding investor fees.[35] Specifically, the SEC alleged the insurance company charged additional fees not listed in investors’ quarterly account statements, and that the insurance company gave the false impression that the account statements included all fees. Without admitting or denying the allegations, the company agreed to cease and desist from future violations, revise certain disclosures in investor account statements, and to pay a $50 million civil penalty, which will be distributed to affected investors. Several days later, the SEC announced a settled action against a health insurance distributor and its former CEO for allegedly making false statements to investors regarding its distributor compliance standards.[36] The SEC further alleged that between March 2017 and March 2020, the company and its CEO misrepresented its consumer satisfaction rates, charged consumers for products they did not authorize, and failed to cancel plans upon consumer requests. Without admitting or denying the allegations, the company and former executive agreed to cease and desist from future violations, and pay penalties of $11 million and over $1 million, respectively.

In August, the Commission instituted a settled action against a bank and its former CEO for allegedly making inaccurate statements about loans extended by the bank to the CEO’s family trusts.[37] According to the SEC, the bank’s annual reports and proxy statements from March 2015 to April 2018 did not include loans to the CEO’s family trusts, which totaled nearly $90 million. The SEC also alleged the bank did not include other loans to its directors and their family members, which totaled tens of millions of dollars, in its reports. Without admitting or denying the allegations, the bank agreed to cease and desist from future violations and pay disgorgement of more than $2.6 million and a civil penalty of $10 million. Also without admitting or denying the allegations, the former CEO agreed to a permanent injunction, a two-year officer-and-director bar, and penalties and disgorgement of more than $400,000.

In September, the Commission settled charges with an airplane manufacturer and its former CEO over alleged misstatements made in the wake of airplane crashes in 2018 and 2019.[38] The order alleged that after the crashes, the company and its CEO assured the public its planes were safe, when it knew of an ongoing safety risk. Without admitting or denying the allegations, the company and former executive agreed to cease and desist from future violations, and pay penalties of $200 million and $1 million, respectively.

Also in September, the SEC announced settled charges against a minerals company for violating the antifraud, reporting, and internal-controls provisions of the Securities Act and the Exchange Act.[39] The SEC alleged that the company repeatedly and falsely told investors in 2017 that a technology upgrade at its most prominent mine would cut costs and increase revenue, when costs were actually increasing rather than decreasing. The SEC also alleged that the company overstated the amount of salt it could produce at this mine. Separately, the SEC alleged that the company failed to properly assess the risks of mercury contamination at a former facility and the resulting cover-up. Without admitting or denying the findings, the company paid $12 million to settle the charges, agreed to cease and desist from further violations, and hired an independent compliance consultant to make recommendations concerning its internal controls.

Also in September, the SEC announced a settled action against a multinational bank for the offer and sale of unregistered securities.[40] The SEC alleged that the bank had recently lost its status as a well-known seasoned issuer and thus, the bank was required to quantify the total number of securities that it planned to offer and sell and to file a new registration statement and pay registration fees for those offerings. The SEC’s order alleged that because the bank had not established internal controls to track actual offers and sales of securities against registrations in real time, the bank offered and sold approximately $17.7 billion worth of unregistered securities. Without admitting or denying the SEC’s allegations, the bank agreed to the entry of cease-and-desist orders and to implement and audit new internal controls. The bank also agreed to pay a $200 million civil penalty and disgorgement of more than $160 million, the latter deemed satisfied by its offer to rescind the unregistered sales. As noted in the SEC’s order, the bank self-reported its violations, cooperated with the investigation, and commenced a rescission offer.

In December, the SEC announced settled fraud charges with a multinational bank for allegedly misleading investors about its deficient anti-money laundering (AML) compliance program in a foreign branch and failing to disclose the risks posed by this deficiency.[41] The SEC alleged that the bank knew or should have known that many of the branch’s customers were engaging in transactions with a high risk of involving money laundering, but it did not adequately disclose these risks, resulting in an inflated share price. These alleged misleading statements included that the bank complied with its AML obligations and that it had effectively managed its AML risks. The bank settled the charges by consenting to an order permanently enjoining it from future violations as well as penalties and disgorgement of more than $400 million. The bank ultimately agreed to pay more than $2 billion in an integrated resolution with United States and Danish regulators.

Also in December, the SEC announced that it charged the former CEO of a biotechnology company and the CEO of a research firm that had contracted with the biotech company with fraud and insider trading.[42] The SEC’s complaint alleged that the biotech CEO exaggerated the company’s progress with regard to an antibody that was being tested as a treatment for various diseases such as COVID-19 and HIV. Specifically, the SEC’s complaint alleged that the company caused its stock to rise by falsely announcing that it had submitted a completed Biologics License Application to the FDA when the company was aware that its FDA submission was inadequate. Meanwhile, the CEO sold more than $15 million in stock for a profit of almost $5 million. The SEC’s complaint further alleged that the research firm CEO aided the biotech company with the inadequate FDA submission and subsequently sold more than $400,000 of the biotech company’s stock. The SEC’s complaint, pending in federal district court in Maryland, seeks disgorgement, civil penalties, officer-and-director bars, and permanent injunctive relief.

C. Auditor Independence

In September, the SEC announced charges against an audit firm and three senior employees for improper professional conduct.[43] The SEC alleged that the firm’s planning and supervision of an audit and its evaluation of the results did not adhere to the Public Company Accountability Oversight Board’s standards. The SEC also alleged that the lead partner and senior manager on the audits did not adequately supervise and execute the audits. Another partner allegedly approved the firm’s analysis even though it inflated revenue and contained errors that were material to investors. Without admitting or denying the SEC’s findings, the firm agreed to pay a $3.75 million penalty and to a cease-and-desist order. The firm also agreed to retain an independent consultant to review its practices. Likewise, the lead partner and senior manager neither admitted nor denied the SEC’s findings, and both settled charges by agreeing to a suspension from appearing and practicing as accountants before the SEC, but did not receive a financial penalty. The third employee agreed to a censure and neither admitted nor denied the SEC’s findings, but did not receive a practice suspension nor financial penalty.

III. Investment Advisers

A. Fraud and Misrepresentations

In August, the SEC filed a settled action against an investment management firm and one of its portfolio managers in connection with allegations that they misled investors about the delinquency rates for the firm’s securitization of fix-and-flip home loans.[44] According to the SEC, the firm raised $90 million in March 2018 by securitizing loans made to borrowers for the purpose of buying, renovating, and selling residential properties. Under the terms of the deal, the firm faced a higher obligation to repay investors if delinquencies exceeded a certain threshold. The firm and one of its portfolio managers allegedly diverted funds to pay down outstanding loan balances in order to hide unexpectedly high delinquency rates from investors. Without admitting or denying the SEC’s allegations, the firm and portfolio manager agreed to a cease-and-desist order, and the imposition of $1.75 million and $75,000 in civil penalties, respectively.

Also in August, the SEC charged an investment adviser and two of its executives with defrauding clients out of more than $75 million.[45] The SEC alleged that the executives breached their fiduciary duties to their advisory clients by fraudulently causing clients to engage in undisclosed transactions with the executives’ own affiliate companies. According to the SEC, the executives used complex investment structures and a network of undisclosed affiliate companies to divert money to themselves without their clients’ knowledge.

In September, the SEC filed a settled action against an investment adviser charged with failing to disclose conflicts of interest.[46] The SEC charged the adviser with failing to provide its clients and investors with adequate information regarding conflicts between the adviser and special purpose acquisition companies (SPACs) owned by the adviser’s personnel. The adviser allegedly invested client assets in transactions that benefitted the SPACs owned by its personnel. According to the SEC, the adviser also failed to file timely a required report concerning its beneficial ownership of stock in a public company, which coincided with the adviser’s improper acquisition of additional stock in the company. Without admitting or denying the SEC’s findings, the adviser agreed to a cease-and-desist order, and a $1.5 million penalty.

B. Excess Fees

In September, the SEC filed a settled action against an exempt reporting adviser alleged to have charged excess management fees from two venture capital funds.[47] According to the SEC, the adviser made a series of errors in its own favor when calculating fees, such as by erroneously failing to reduce fees for certain securities subject to write-downs. Without admitting or denying the SEC’s findings, the adviser agreed to a cease and desist order. The adviser has also returned over $675,000 plus interest to the two funds and their limited partners, and has agreed to pay a penalty of $175,000.

C. Compliance and Oversight

In September, the SEC filed a settled action against nine investment advisers for alleged failure to comply with the Custody Rule for client assets and/or related reporting requirements.[48] The SEC charged some of the advisers with failure to have audits performed timely or to deliver audited financials to investors, in violation of the Investment Advisers Act’s Custody Rule. The SEC also alleged that some advisers failed to file promptly amended form ADVs to reflect the current status of financial statement audits. Without admitting or denying the SEC’s findings, the firms agreed to a cease and desist order, and to pay combined civil penalties exceeding $1 million.

In October, and in the context of rulemaking rather than enforcement, the SEC proposed a new rule and rule amendments prohibiting registered investment advisers from outsourcing certain services without conducting due diligence and monitoring the outsourced service providers.[49] The rule would apply to advisers that outsource certain services or functions, including those that are necessary for providing advisory services in compliance with the federal securities laws, and that if not performed or performed negligently would result in material negative impact to clients. For example, such services may include providing investment guidelines, portfolio management, models related to investment advice, indices, or trading services or software. The proposed rule would require advisers to satisfy specific due diligence elements before employing a service provider and to conduct periodic monitoring of the provider’s performance. The proposed rule would also cover advisers’ retention of third-party recordkeepers. The proposed rule would also impose record retention requirements for any adviser subject to the rule.

IV. Broker-Dealers

A. Recordkeeping

In September, the SEC announced charges and settlements with fifteen broker-dealers and one affiliated investment adviser for allegedly violating recordkeeping provisions of the federal securities laws by failing to maintain and preserve electronic communications.[50] According to the SEC, the investigation uncovered that the firms’ employees routinely communicated about business matters through text messages on their personal devices, the majority of which were not preserved by the firms as required. The firms cooperated with the investigation by gathering these communications from the personal devices of a sample of their employees. The firms admitted to the facts set forth in their respective SEC orders, acknowledging that their conduct violated the recordkeeping provisions, agreed to a cease-and-desist order, and agreed to pay a combined $1.1 billion in fines. The firms also agreed to retain compliance consultants to conduct comprehensive reviews of relevant policies and procedures. The Commodity Futures Trading Commission announced separate settlements with the firms for related conduct.

B. Registration

In August, the SEC announced settled charges against a convertible note dealer and its managing members for failing to register with the SEC as securities dealers.[51] According to the SEC, the dealer purchased convertible notes from microcap issuers, converted the notes into newly issued shares of stock at a large discount from the market price, and sold the newly issued shares at a significant profit. These activities required the dealer and its managing members to register as dealers with the SEC or associate with a registered dealer. Without admitting or denying the SEC’s allegations, the dealer and its managing members agreed to be permanently enjoined from future violations, to pay disgorgement, prejudgment interest, and a civil penalty of more than $9 million, and to a five-year penny stock bar, and to surrender or cancel securities allegedly obtained from their unregistered dealer activity. They also consented to entry of an order imposing a five-year collateral bar.

In September, the SEC announced charges against a broker-dealer for allegedly violating the municipal advisor registration rule for the first time.[52] According to the SEC, the broker-dealer, without registering as a municipal advisor, advised a Midwestern city to purchase particular fixed income securities, which it did. The SEC’s order further found that the broker-dealer did not maintain a system reasonably designed to supervise its municipal securities activities and had inadequate procedures. The broker-dealer agreed to penalties and disgorgement totaling more than $5.5 million.

In November, the SEC announced charges against two individuals and two New York-based entities they controlled for allegedly operating as unregistered broker-dealers that facilitated more than $1.2 billion of securities trading, primarily in penny stocks.[53] The SEC alleged that the individuals provided brokerage services to 60 customers including taking possession of customer securities, directing trades to executing brokers, facilitating trade settlements, and disbursing trading proceeds to customers. The individuals received at least $12 million in compensation. The individuals acted through two entities which were not registered with the SEC as broker-dealers. Litigation is ongoing.

C. Customer Data Deficiencies

In July, the SEC announced separate charges against two dual-registered broker-dealer and investment advisers, and one broker-dealer for alleged deficiencies in their programs to prevent customer identify theft.[54] According to the SEC, these deficiencies constituted violations of the SEC’s Identify Theft Red Flags Rule, or Regulation S-ID. Without admitting or denying the SEC’s findings, each firm agreed to a cease-and-desist order, and to penalties of $1.2 million, $925,000, and $425,000.

In September, the SEC announced settled charges against a dual-registered broker-dealer and investment adviser based upon allegations that the firm failed to protect the personal identifying information of approximately 15 million customers over a five-year period.[55] In particular, the SEC alleged that as far back as 2015, the firm failed to properly dispose of devices, including hard drives and servers, containing PII of millions of customers. Without admitting or denying the SEC’s allegations, the company agreed to pay a $35 million penalty.

V. Cryptocurrency and Other Digital Assets

A. Significant Developments

Throughout 2022, the SEC remained “focused on the rapidly evolving crypto asset securities space,” continuing to investigate and police fraud and misconduct in the area.[56] The agency brought high-profile enforcement actions such as its action against Samuel Bankman-Fried for fraud relating to the crypto trading platform he co-founded.[57] At the same time, in remarks in September, Chair Gensler emphasized that “nothing about the crypto markets is incompatible with the securities laws” and rather that traditional principles of investor protection applied to the crypto market, “regardless of underlying technologies.”[58]

In September, the SEC announced it would add an Office of Crypto Assets to its Division of Corporation Finance’s Disclosure Review Program (DRP), joining seven existing offices and one other new office that review issuer filings in order to protect investors.[59] The SEC said the new office would “enable the DRP to better focus its resources and expertise to address the unique and evolving filing review issues related to crypto assets.”

B. Registration Cases

In September, the SEC charged a company and its CEO with offering unregistered crypto securities.[60] The SEC’s order alleged that the company’s tokens acted as unregistered securities because the company promised that they would increase in value, that the company’s management would continue to improve its proprietary trading platform, and that it would make the tokens available on the platform. Without admitting the findings, the company and its CEO agreed to destroy the remaining tokens, request that they be removed from trading platforms, and pay more than $35 million in disgorgement and civil penalties. The SEC also brought an action against an individual who it claimed promoted the tokens on social media without registering them and without disclosing that he received a thirty-percent bonus on every token he purchased.

In November, the SEC instituted administrative proceedings against a Wyoming-based organization to determine whether to suspend the registration of two crypto assets it offered for failure to provide complete and accurate information in its Form S-1 registration statement.[61] The SEC alleged that the organization omitted required information and made misleading statements about its business, organization, and finances, and that it inconsistently claimed the transactions it sought to register were not securities transactions at all.

C. Fraud Cases

In August, the SEC brought an action against eleven individuals for an alleged cryptocurrency Ponzi scheme, including three U.S.-based promoters.[62] According to the complaint, the defendants operated and promoted a scheme that promised returns from smart contract operating on popular blockchains such as Ethereum, while actually paying earlier investors with proceeds from new investors. The SEC alleged that the scheme raised $300 million from investors in the U.S. and overseas, and continued to operate in spite of cease-and-desist orders from the Securities and Exchange Commission of the Philippines and the Montana Commissioner for Securities and Insurance. Two of the defendants agreed to settle for disgorgement and civil penalties and to be permanently enjoined from violating certain securities laws.

In September, the SEC brought an action against a corporation and two individuals for promoting unregistered crypto securities and unlawfully manipulating the price and trading volume of the securities.[63] The complaint alleged that the corporation and its then-CEO promoted a token to the public and then hired a foreign market-making firm to create the false appearance of high-volume trading using a trading software—a “bot.” The company then sold tokens at an artificially inflated price for a profit of more than $2 million. One defendant—the CEO of the foreign trading firm—consented to the entry of injunctive relief against him and agreed to pay disgorgement and a civil penalty to be determined by the court.

In October, the SEC announced that it had settled charges against a popular social media influencer for promoting a crypto asset on social media without disclosing that she was paid for the promotion.[64] The SEC’s order alleged that the influencer published a social-media post with a link to a website where purchasers could buy a crypto token, but did not disclose that she was paid $250,000 to do so. She agreed to pay $1.26 million in disgorgement, penalties, and interest and to refrain from promoting crypto securities for three years.

In November, the SEC brought an action against the promoters of what it alleged was a crypto Ponzi scheme that raised $295 million in Bitcoin from more than 100,000 investors globally.[65] According to the complaint, the defendants promised investors that a proprietary technology would generate daily returns by engaging in millions of crypto microtransactions. Instead, they siphoned off funds for their personal gain, and all investor withdrawals came from deposits by other investors.

In December, the SEC announced charges against Samuel Bankman-Fried, co-founder and CEO of FTX Trading Ltd., for defrauding equity investors in the Bahamas-based crypto trading platform he co-founded.[66] The complaint alleged that Bankman-Fried told investors that the platform was a safe and responsible crypto-trading platform, while instead diverting company assets to his privately-held crypto hedge fund and exposing company investors to inflated and illiquid crypto assets held by the hedge fund. Bankman-Fried raised $1.8 billion from investors, including $1.1 billion from U.S. investors. The SEC’s complaint seeks disgorgement and a civil penalty, an injunction against participating in the offer or sale of securities, and an officer-and-director bar. The U.S. Attorney’s Office for the Southern District of New York and the Commodity Futures Trading Commission announced parallel charges against Bankman-Fried. Relatedly, and several weeks following the initial case, the SEC brought actions against two additional executives for furthering Bankman-Fried’s scheme. The two executives agreed to permanent injunctions against participating in the issue or offer of securities, officer and director bars, and disgorgement and civil penalties. The U.S. Attorney’s Office for the Southern District of New York announced parallel criminal charges.[67]

Also in December, the SEC brought an action against four individuals for raising more than $8.4 million from predominantly Spanish-speaking retail investors for a crypto pyramid scheme.[68] The defendants allegedly sold “memberships” to hundreds of retail investors by promising returns from their crypto trading and mining operation, but knew or were reckless in not knowing that the platform could only provide returns by raising money from other investors. The U.S. Attorney for the Southern District of New York announced parallel criminal charges against two of the defendants.

VI. Insider Trading

A. Cryptocurrency Exchange

In July, the SEC announced insider trading charges against the former product manager of a cryptocurrency exchange platform for allegedly sharing confidential information in advance of market-moving announcements in the industry.[69] The SEC alleged that between at least June 2021 and April 2022, the manager provided non-public information obtained through his employment to both his brother and friend, who allegedly purchased assets ahead of the announcements. The announcements typically resulted in an increase in the assets prices, and the purchases allegedly generated aggregate profits of over $1.1 million. A representative of the SEC emphasized that insider trading would be enforced regardless of the label placed on the securities involved. The U.S. Attorney’s Office for the Southern District of New York announced criminal charges against all three individuals. This is the first instance where insider trading charges have been filed in connection with a cryptocurrency market.

B. Other Insider Trading Cases

Also in July, the SEC filed a complaint against a former U.S. Representative for Indiana’s 4th Congressional District for allegedly trading ahead of market-moving announcements by two companies.[70] After leaving office in 2011, the former representative formed a consulting firm whose clients included a major cell phone service provider. The SEC alleged that during a golf outing in 2018 an executive of the provider shared with the former representative information about a nonpublic acquisition plan and the former representative acquired stock in the target company the next day across various accounts. When news of the merger became public, he allegedly saw an immediate profit of more than $107,000. The complaint also alleged that in 2019, he purchased the stock of a company that then announced it would be acquired by one of his consulting firm’s clients resulting in profits that exceeded $227,000. The complaint seeks disgorgement, penalties, a permanent injunction, and an officer and director bar against the former representative and disgorgement by the representative’s wife. The U.S. Attorney’s Office for the Southern District of New York announced related criminal charges against the former representative.

In July, the SEC filed insider trading charges against nine individuals in connection with three alleged schemes.[71] Each action originated from the SEC Enforcement Division’s Market Abuse Unit’s (MAU) Analysis and Detection Center, which used data analysis tools to detect the transactions. In the first action, the SEC alleged that the former CISO of a technology firm, along with his friends, traded in advance of two corporate acquisition announcements by the firm in 2021 gaining over $5.2 million in profits. The SEC’s second action is against an investment banker and his close friend who allegedly traded ahead of four acquisition announcements in 2017 that the banker had confidential information about. The investment banker’s friend allegedly purchased call options on the target companies, and later wired the banker money. In the final action, the SEC alleged that a former FBI trainee and his friend made $82,000 and $1.3 million, respectively, by trading ahead of a tender offer announcement in 2021. The former trainee allegedly learned about the deal after reviewing a binder that belonged to his then-romantic partner who worked as an associate for a law firm representing the offeror. The actions were filed in the Southern District of New York and all three investigations are ongoing.

In September, the SEC announced insider trading charges against the CEO and former president of a mobile internet company.[72] The SEC alleged that the two individuals established a 10b5-1 trading plan after noticing a drop-off in advertising revenues from the company’s largest advertising partner. Allegedly, they each sold shares avoiding losses of approximately $200,000 and $100,000. Additionally in 2016, the CEO allegedly made materially misleading public statements about the company and also caused the company’s failure to disclose a material negative revenue trend in its annual report. Both individuals agreed to pay civil penalties and also to cease-and-desist orders and undertakings relating to their future securities trading.

Also in September, the SEC filed insider trading charges against two Canadian software engineers who traded ahead on non-public, market-moving financial information.[73] The SEC alleged that, from at least 2018 to 2021 the two individuals were employed by a newswire distribution company responsible for corporate press releases and used their ability to preview headlines, times, and publication dates of announcements. The SEC’s action is pending in the District of New Jersey and the Ontario Securities Commission announced that the two engineers have been charged with fraud and insider trading offenses under the Ontario Securities Act.

In November, the SEC announced that it filed insider trading charges against the Chief Information Officer of a pharmaceutical company in the United States District Court for the Western District of Pennsylvania.[74] The SEC alleged that, from at least 2017 to 2019 the CIO gave material nonpublic information about the companies unannounced drug approval, financial performance, and impending merger to his friend and former colleague generating nearly $8 million and avoiding losses. The CIO was allegedly receiving cash kickbacks in exchange for information. The friend was charged previously and the Department of Justice’s Fraud Section announced they will be filing criminal charges.

In December, the SEC filed a complaint against an employee of a major asset management firm for an alleged long-running front-running scheme to share confidential information ahead of the firm’s market moving trades.[75] The complaint also names a former employee of many financial industry firms, who allegedly received this confidential information and used it to make trades in advance of the firms’ transactions. Once the price of the security moved as expected, the two individuals would allegedly close their position gaining profits of over $47 million. The alleged fraud was uncovered by SEC staff using the Consolidated Audit Trail (CAT) database. The SEC’s action is pending in federal district court in Manhattan and the U.S. Attorney’s Office for the Southern District of New York also announced criminal charges against the two individuals.

C. Compliance Policy Update

In December, the SEC adopted amendments to Rule 10b5-1 under the Securities Exchange Act of 1934 and new disclosure requirements to enhance investor protections against insider trading.[76] The changes include updated conditions that must be met to satisfy the 10b5-1 affirmative defense. Specific additions include: cooling-off periods for persons other than issuers before trading can commence under a 10b5-1 plan, a condition that all persons entering into a Rule 10b5-1 plan must act in good faith with respect to that plan, and a requirement that directors and officers must include representations in their plans certifying that at the time of adoption they are not aware of any material nonpublic information about the issuer or its securities and that they are adopting the plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5. The amendments restrict the use of multiple overlapping trading plans and limit the ability to rely on the affirmative defense for a single-trade plan to one single-trade plan per 12-month period for all persons other than issuers.

More comprehensive disclosures about issuers’ insider trading policies and procedures are required, including quarterly disclosure regarding the use of Rule 10b5-1 plans and certain other securities trading arrangements. The final rules require disclosure of issuers’ policies and practices around the timing of options grants and the release of material nonpublic information.

The rules require that issuers use a new table to report any awards beginning four business days before the filing of a periodic report or the filing or furnishing of a current report on Form 8-K that discloses material nonpublic information (with the exception of a Form 8-K that discloses a material new option award grant under Item 5.02(e)) and ending one business day after a triggering event. Insiders reporting a transaction on Forms 4 or 5 will be required to indicate that it was intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) and to disclose the date the trading plan was adopted. Finally, bona fide gifts of securities that were previously permitted to be reported on Form 5 will now be reported on Form 4.

These final rules become effective 60 days following publication of the adopting release in the Federal Register. Section 16 reporting persons will be required to comply with the amendments to Forms 4 and 5 for beneficial ownership reports filed on or after April 1, 2023. Issuers will be required to comply with the new disclosure requirements in Exchange Act periodic reports on Forms 10-Q, 10-K, and 20-F and in any proxy or information statements in the first filing that covers the first full fiscal period that begins on or after April 1, 2023. For smaller reporting companies, there is a 6-month deferral of compliance with the additional disclosure requirements.

VII. Market Manipulation

In August, the SEC announced charges against 18 individuals and entities for an alleged international fraudulent scheme in which dozens of online retail brokerage accounts were hacked and improperly used to purchase microcap stocks to manipulate their price and trading volume.[77] The SEC alleged that the unauthorized purchases enabled those charged to sell their holdings at artificially high prices, reaping over $1 million in illicit proceeds.

In September, the SEC announced charges against three individuals, including a father and son, for alleged fraudulent manipulative securities trading schemes.[78] One of the schemes allegedly involved artificially inflating the share price of an entity operating as a New Jersey deli producing less than $40,000 in annual revenue from $1 per share in October 2019 to $14 per share by April 2021. The SEC alleged that the individuals artificially inflated the price of two entities through manipulative trading, and used the entities to acquire privately held companies in reverse mergers, intending to later dump their shares at grossly inflated prices. However, numerous articles were published discussing the inflated stock prices before the defendants were able to realize the intended profits of the scheme.

In December, the SEC announced charges against eight social media influencers for their alleged involvement in a $100 million securities fraud scheme involving the use of Twitter and Discord to manipulate stocks.[79] The SEC alleged that, since at least January 2020, seven of the defendants promoted themselves as successful traders and shared misinformation to encourage their substantial social media following to buy stocks that they had previously purchased. According to the SEC, they posted price targets or indicated that they were buying, holding, or adding to their stock positions but later sold their shares once prices and/or trading volumes rose without disclosing their plans to do so while initially promoting the securities. The complaint further charges that the eighth defendant co-hosted a podcast in which he promoted many of the other defendants as expert traders, providing them with a forum for their manipulative statements.

VIII. Offering Frauds

In August, the SEC charged a company and its owner in connection with a $1.2 million fraudulent promissory note scheme targeting older Americans.[80] According to the SEC’s complaint, the individual allegedly induced investors, ranging in age from 64 to 82, to purchase promissory notes issued by his company by promising interest rates ranging from 50% to 175%. The SEC also alleged that the individual gave investors conflicting explanations as to the nature of the company’s business and allegedly convinced them to roll-over their notes into new notes combining unpaid amounts with new investments by the investors. The SEC complaint seeks disgorgement of ill-gotten gains with prejudgment interest, civil penalties, and permanent injunctive relief. The U.S. Attorney’s Office for the District of New Jersey also announced criminal charges against the individual.

In September, the SEC charged an individual for allegedly using a false persona, as a Harvard-educated military veteran and hedge fund billionaire, in order to defraud investors.[81] According to the complaint, the individual used his false credentials to secure approximately $900,000 of investments in two different companies from more than 30 investors. The complaint also alleged that the individual sold a couple $1.8 million of shares in a penny stock at a markup of 9,000% over the price he paid and used the couple’s $4 million brokerage account to trade, at a loss, securities of microcap companies in which the individual had an undisclosed financial interest. The SEC also charged the individual and one of his associates with promoting the stock of several microcap companies on social media without disclosing their simultaneous stock sales as market prices rose. The SEC seeks permanent injunctive relief, disgorgement with prejudgment interest, civil penalties, a penny stock bar against the individual and his associate, and an officer and director bar against the individual. The U.S. Attorney’s Office for the Western District of Washington announced criminal charges against the individual.

Also in September, the SEC announced charges against six individuals and two companies for their involvement in a fraudulent scheme to promote the securities of issuers that were conducting or purporting to conduct offerings pursuant to Regulation A.[82] According to the SEC’s complaint, one of the six individuals promoted the securities of four issuers without disclosing his receipt of compensation for the promotions. The complaint also charges two associates of this individual with allegedly acting as middlemen for the promotional scheme, including by arranging to receive a percentage of investor funds raised by the issuers in exchange for arranging the promotion. The SEC also alleged that two of the issuers promoted, as well as their respective CEOs and one of the issuer’s co-founders, participated in the scheme and made material representations and omissions in their filings with the SEC and other investor materials. The complaint also charges one of the issuers and its CEO with engaging in an offering that was unregistered and not covered by a valid registration exemption. The SEC complaint seeks permanent injunctions from violations of the charged anti-fraud and anti-touting provisions, conduct-based injunctions, disgorgement, prejudgment interest, and civil monetary penalties. The two issuers, their CEOs, and one of the issuer’s co-founders agreed to settle the SEC’s enforcement action with permanent injunctions and a combined total of $2.5 million in monetary sanctions, and officer and director bars. The SEC also instituted a separate, settled, administrative proceeding against the CFO of one of the issuer’s, who agreed to pay a penalty of $25,000 and to be suspended from appearing or practicing before the SEC as an accountant, with the right to apply for reinstatement after three years.

In October, the SEC charged an investment firm and four of its former executives with allegedly running a Ponzi-like scheme that raised $600 million from approximately 2,000 investors.[83] The SEC alleged that the executives raised funds by promising investors that their money would be used to buy and to develop real estate properties, which would generate profits through a fund set up by the firm to invest in the projects. Instead, according to the complaint, investor money was allegedly used to pay distributions to other investors, to fund personal and luxury expenses, and to pay reputation management firms to thwart investors’ due diligence. The SEC also alleged that the firm manipulated the real estate fund’s financial statements and the financial information in marketing materials distributed to investors. The SEC complaint seeks injunctions against future violations of the antifraud provisions, disgorgement of ill-gotten gains, prejudgment interest, penalties, and officer and director bars against the four executives.

Also in October, the SEC announced that it had updated its Public Alert: Unregistered Soliciting Entities (PAUSE) list, a list of registered entities that use misleading information to solicit primarily non-U.S. investors.[84] The SEC added 35 soliciting entities, four impersonators of genuine firms, and four bogus regulators to the list.

In November, the SEC announced a settled action against the founder of an investment firm based on alleged violations of the antifraud provisions of the federal securities laws.[85] The individual allegedly targeted investors from the New York metropolitan area’s Muslim community with a fraudulent investment scheme. According to the SEC’s complaint, the individual obtained more than $8 million from investors and promised to invest the funds in Quran-compliant investments. Instead, the SEC alleges, the individual misappropriated the funds in an alleged Ponzi-like scheme. The individual consented to the entry of a permanent injunction and monetary relief. The U.S. Attorney’s Office for the Eastern District of New York announced the filing of criminal charges against the individual.

In December, the SEC charged a venture capital firm, its CEO, and co-founder with fraudulently offering and selling more than $6 million of securities to at least 46 individual investors in multiple states, including California, Georgia, and New York.[86] According to the SEC’s complaint, the firm and its CEO offered to sell investors shares of private companies that might hold an initial public offering without ever intending to buy any shares on behalf of the investors. The SEC alleged that, instead of purchasing the shares, the CEO used investors funds for himself. The SEC complaint sough permanent injunctive relief, disgorgement with prejudgment interest, and civil penalties against both the CEO and co-founder. The complaint seeks permanent injunctive relief and a civil penalty against the company. Without admitting or denying the allegations, the co-founder agreed to a permanent injunction from future violations and to pay disgorgement, prejudgment interest, and a civil penalty. The U.S. Attorney’s Office for the Middle District of Georgia announced the filing of related criminal charges.

IX. Municipal Bond Offerings

In September, the SEC filed charges against one firm and announced settlements with three firms, alleging that each failed to comply with municipal bond offering disclosure requirements.[87] According to the SEC, each firm purported to rely on the limited offering exemption to the typical disclosure requirements without satisfying all of the criteria for the exemption. These orders represent the first-ever enforcement proceedings against underwriters who allegedly fail to meet the disclosure requirements of Rule 15c2-12 under the Securities Exchange Act of 1934. Three firms settled the charges and, without admitting or denying the SEC’s findings, agreed to cease and desist from future violations, and pay over $1.25 million in combined disgorgement and penalties. The fourth firm faces charges for the same violations in federal district court.

X. Regulation FD

In December, the SEC announced a settlement to a previously filed action against a company and three executives related to the company’s allegedly selective disclosure of material nonpublic information to research analysts, in violation of Regulation FD and the securities laws.[88] The SEC complaint alleged that the company learned that a steeper-than-expected decline in its first quarter smartphone sales would cause its revenue to fall short of analysts’ estimates for the quarter. In response, three executives allegedly made one-on-one calls to analysts at 20 separate firms, disclosing the internal smartphone sales data. The complaint alleged that the disclosed data was the type of information generally considered “material” by the company’s investors, meaning the company was prohibited from selective disclosure of the data under Regulation FD. The company and executives, without admitting or denying the allegations, consented to final judgments permanently enjoining them from violating, or aiding and abetting violations of, Regulation FD and the securities laws. The company agreed to pay a $6.25 million penalty and the three company executives each agreed to pay $25,000.

XI. Ratings Agencies

In November, the SEC settled a previously filed action against a credit rating agency for allegedly violating conflict of interest rules that prevent sales and marketing factors from influencing credit ratings.[89] In 2017, the credit rating agency was engaged by an issuer to rate a jumbo residential mortgage backed security transaction in July 2017. The SEC alleged that the credit rating agency’s commercial employees—tasked with maintaining the relationship with the issuer—improperly attempted to influence the credit rating agency’s analytical employees—tasked with evaluating and assigning the rating—by attempting to persuade the analytics employees to assign a rating consistent with the preliminary projections given to the issuer, even though that projection was based on a calculation error. The SEC alleged that the content, urgency, and high volume of the communications by the commercial employees to the analytical employees amounted to participation in the ratings process by commercial employees who were influenced by sales and marketing factors. In response, the credit ratings agency self-reported the conduct, cooperated with the ensuing investigation, and took remedial steps to enhance its policy and procedures. Even with taking these steps, the credit rating agency agreed to a $2.5 million penalty, a cease-and-desist order, and certain compliance requirements, without admitting or denying the allegations.

_____________________________

[1] See generally SEC Press Release, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022), available at https://www.sec.gov/news/press-release/2022-206.

[2] See Remarks at Securities Enforcement Forum by Gurbir S. Grewal, Nov. 15, 2022, available at https://www.sec.gov/news/speech/grewal-speech-securities-enforcement-forum-111522.

[3] See SEC Press Release, SEC Charges 16 Wall Street Firms with Widespread Recordkeeping Failures (Sept. 27, 2022), available at https://www.sec.gov/news/press-release/2022-174; SEC Press Release, JPMorgan Admits to Widespread Recordkeeping Failures and Agrees to Pay $125 Million Penalty to Resolve SEC Charges (Dec. 17, 2021), available at https://www.sec.gov/news/press-release/2021-262.

[4] See SEC Press Release, Ernst & Young to Pay $100 Million Penalty for Employees Cheating on CPA Ethics Exams and Misleading Investigation (June 28, 2022), available at https://www.sec.gov/news/press-release/2022-114; SEC Press Release, available at https://www.sec.gov/news/press-release/2022-179; SEC Press Release, SEC Charges Allianz Global Investors and Three Former Senior Portfolio Managers with Multibillion Dollar Securities Fraud (May 17, 2022), available at https://www.sec.gov/news/press-release/2022-84.

[5] See Note 2, supra.

[6] See SEC Press Release, SEC Charges Infrastructure Company Granite Construction and Former Executive with Financial Reporting Fraud (Aug 25, 2022), available at https://www.sec.gov/news/press-release/2022-150; SEC Press Release, SEC Charges New Jersey Software Company and Senior Employees with Accounting-Related Misconduct (June 7, 2022), available at https://www.sec.gov/news/press-release/2022-101; SEC Press Release, Synchronoss Technologies to Pay $12.5 Million to Settle Charges, Former CEO to Reimburse Company (June 7, 2022), available at https://www.sec.gov/news/press-release/2022-101.

[7] See SEC Press Release, Remediation Helps Tech Company Avoid Penalties (Jan. 28, 2022), available at https://www.sec.gov/news/press-release/2022-14; SEC Press Release, SEC Charges Oilfield Services Company and Former CEO with Failing to Disclose Executive Perks and Stock Pledges (Nov. 22, 2021), available at https://www.sec.gov/news/press-release/2021-244.

[8] See SEC Press Release, SEC Charges Health Care Co. and Two Former Employees for Accounting Improprieties (Feb. 22, 2022), available at https://www.sec.gov/news/press-release/2022-31.

[9] See Note 1, supra.

[10] SEC Press Release, Jaime Lizárraga Sworn In as SEC Commissioner (July 18, 2022), available at https://www.sec.gov/news/press-release/2022-123.

[11] SEC Press Release, Keith E. Cassidy and Natasha Vij Greiner Appointed Deputy Directors of Division of Examinations (Nov. 7, 2022), available at https://www.sec.gov/news/press-release/2022-202.

[12] SEC Press Release, Sarah ten Siethoff Named Deputy Director of the Division of Investment Management (Dec. 21, 2022), available at https://www.sec.gov/news/press-release/2022-233.

[13] SEC Press Release, SEC Announces Departure of Dan Berkovitz; Megan Barbero Named General Counsel (Dec. 22, 2022), available at https://www.sec.gov/news/press-release/2022-235.

[14] SEC Press Release, SEC Names Nicholas Grippo as Regional Director of Philadelphia Office (Aug. 15, 2022), available at https://www.sec.gov/news/press-release/2022-143.

[15] SEC Press Release, SEC Names Monique Winkler as Regional Director of San Francisco Office (Aug. 15, 2022), available at https://www.sec.gov/news/press-release/2022-144.

[16] SEC Press Release, SEC Names Jason J. Burt as Regional Director of the Denver Office (Oct. 24, 2022), available at https://www.sec.gov/news/press-release/2022-190.

[17] SEC Press Release, Fort Worth Regional Director David L. Peavler to Leave SEC (Dec. 1, 2022), available at https://www.sec.gov/news/press-release/2022-212.

[18] SEC Press Release, Antonia Apps Named Director of New York Regional Office (Dec. 27, 2022), available at https://www.sec.gov/news/press-release/2022-237.

[19] See Note 1, supra.

[20] Meeting Agenda, U.S. Securities and Exchange Commission Investor Advisory Committee (Sept. 21, 2022), available at https://www.sec.gov/spotlight/investor-advisory-committee/iac092122-agenda.htm.

[21] The first half of the year brought at least two high-profile ESG enforcement actions—against a prominent investment advisor and an investment “robo-adviser” purporting to offer Shari’ah-compliant investment advice. SEC Press Release, SEC Announces Enforcement Results for FY22 (Nov. 25, 2022), available at https://www.sec.gov/news/press-release/2022-206. By contrast, the SEC only brought one comparable action in the second half of 2022.

[22] SEC Press Release, SEC Charges Goldman Sachs Asset Management for Failing to Follow its Policies and Procedures Involving ESG Investments (Nov. 22, 2022), available at https://www.sec.gov/news/press-release/2022-209.

[23] SEC Press Release, SEC Amends Whistleblower Rules to Incentivize Whistleblower Tips (Aug. 26, 2022), available at https://www.sec.gov/news/press-release/2022-151.

[24] SEC Press Release, SEC Awards Whistleblowers More than $6 Million (July 15, 2022), available at https://www.sec.gov/news/press-release/2022-122.

[25] SEC Press Release, SEC Issues More Than $17 Million Award to a Whistleblower (July 19, 2022), available at https://www.sec.gov/news/press-release/2022-125.

[26] SEC Press Release, SEC Awards More Than $16 Million to Two Whistleblowers (Aug. 9. 2022), available at https://www.sec.gov/news/press-release/2022-139.

[27] SEC Press Release, SEC Awards More than $10 Million to Whistleblower (Oct. 31, 2022), available at https://www.sec.gov/news/press-release/2022-196.

[28] SEC Press Release, SEC Awards $20 Million to Whistleblower (Nov. 28, 2022), available at https://www.sec.gov/news/press-release/2022-211.

[29] SEC Press Release, SEC Awards More Than $20 Million to Whistleblower (Dec. 12, 2022), available at https://www.sec.gov/news/press-release/2022-218.

[30] SEC Press Release, SEC Awards More Than $37 Million to Whistleblower (Dec. 19, 2022), available at https://www.sec.gov/news/press-release/2022-231.

[31] SEC Press Release, SEC Charges Surgical Implant Manufacturer Surgalign and Former Senior Executives with Accounting and Disclosure Fraud (Aug. 3, 2022), available at https://www.sec.gov/news/press-release/2022-137.

[32] SEC Press Release, SEC Charges Infrastructure Company Granite Construction and Former Executive with Financial Reporting Fraud (Aug. 25, 2022), available at https://www.sec.gov/news/press-release/2022-150.

[33] SEC Press Release, SEC Charges VMware with Misleading Investors by Obscuring Financial Performance (Sept. 12, 2022), available at https://www.sec.gov/news/press-release/2022-160.

[34] SEC Press Release, SEC Charges Canadian Cannabis Company and Former Senior Executive with Accounting Fraud (Oct. 24, 2022), available at https://www.sec.gov/news/press-release/2022-191.

[35] SEC Press Release, Equitable Financial To Pay $50 Million Penalty To Settle SEC Charges That It Provided Misleading Account Statements to Investors (July 18, 2022), available at https://www.sec.gov/news/press-release/2022-124.

[36] SEC Press Release, SEC Charges Tampa-Based Health Insurance Distributor and its Former CEO with Making False Statements to Investors (July 20, 2022), available at https://www.sec.gov/news/press-release/2022-126.

[37] SEC Press Release, SEC Charges Eagle Bancorp and Former CEO with Failing to Disclose Related Party Loans (Aug. 16, 2022), available at https://www.sec.gov/news/press-release/2022-146.

[38] SEC Press Release, Boeing to Pay $200 Million to Settle SEC Charges that It Misled Investors About the 737 MAX (Sept. 22, 2022), available at https://www.sec.gov/news/press-release/2022-170.

[39] SEC Press Release, SEC Charges Compass Minerals for Misleading Investors About Its Operations at World’s Largest Underground Salt Mine (Sept. 23, 2022), available at https://www.sec.gov/news/press-release/2022-171.

[40] SEC Press Release, available at https://www.sec.gov/news/press-release/2022-179.

[41] SEC Press Release, SEC Charges Danske Bank with Fraud for Misleading Investors About Its Anti-Money Laundering Compliance Failures in Estonia (Dec. 13, 2022), available at https://www.sec.gov/news/press-release/2022-220.

[42] SEC Press Release, SEC Charges Former CEO of Biotech Company CytoDyn with Fraud, Insider Trading (Dec. 20, 2022), available at https://www.sec.gov/news/press-release/2022-232.

[43] SEC Press Release, SEC Charges Audit Firm RSM and Three Senior-Level Employees with Failure to Properly Conduct Client Audits (Sept. 30, 2022), available at https://www.sec.gov/news/press-release/2022-180.

[44] SEC Press Release, SEC Charges Angel Oak Capital Advisors with Misleading Investors in $90 Million Fix-and-Flip Securitization (Aug. 10, 2022), available at https://www.sec.gov/news/press-release/2022-140.

[45] SEC Press Release, SEC Charges Advisory Firm and Executives with Devising an Elaborate Scheme to Defraud Clients out of More Than $75 Million (Aug. 30, 2022), available at https://www.sec.gov/news/press-release/2022-153.

[46] SEC Press Release, SEC Charges Perceptive Advisors for Failing to Disclose SPAC-Related Conflicts of Interest (Sept. 6, 2022), available at https://www.sec.gov/news/press-release/2022-155.

[47] SEC Press Release, SEC Charges Venture Capital Adviser Energy Innovation Capital Management for Overcharging Fees (Sept. 2, 2022), available at https://www.sec.gov/news/press-release/2022-154.

[48] SEC Press Release, SEC Charges Two Advisory Firms for Custody Rule Violations, One for Form ADV Violations, and Six for Both (Sept. 9, 2022), available at https://www.sec.gov/news/press-release/2022-156.

[49] SEC Press Release, SEC Proposes New Oversight Requirements for Certain Services Outsourced by Investment Advisers (Oct. 26, 2022), available at https://www.sec.gov/news/press-release/2022-194.

[50] SEC Press Release, SEC Charges 16 Wall Street Firms with Widespread Recordkeeping Failures, available at https://www.sec.gov/news/press-release/2022-174.

[51] SEC Press Release, SEC Charges Convertible Note Dealer and its Long Island-Based Owners for Failure to Register, available at https://www.sec.gov/news/press-release/2022-135.

[52] SEC Press Release, SEC Charges Loop Capital Markets in First Action against Broker-Dealer for Violating Municipal Advisor Registration Rule, available at https://www.sec.gov/news/press-release/2022-163.

[53] SEC Press Release, SEC Charges Unregistered Brokers That Facilitated More Than $1.2 Billion in Primarily Penny Stock Trades, available at https://www.sec.gov/news/press-release/2022-207.

[54] SEC Press Release, SEC Charges JPMorgan, UBS, and TradeStation for Deficiencies Relating to the Prevention of Customer Identity Theft, available at https://www.sec.gov/news/press-release/2022-131.

[55] SEC Press Release, Morgan Stanley Smith Barney to Pay $35 Million for Extensive Failures to Safeguard Personal Information of Millions of Customers, available at https://www.sec.gov/news/press-release/2022-168.

[56] SEC Press Release, SEC Announces Enforcement Results for FY22 (Nov. 25, 2022), available at https://www.sec.gov/news/press-release/2022-206.

[57] SEC Press Release, SEC Charges Samuel Bankman-Fried with Defrauding Investors in Crypto Asset Trading Platform FTX (Dec. 13, 2022), available at https://www.sec.gov/news/press-release/2022-219.