|

|

5.4.1

|

In a Trust Scheme, the acquiror typically acquires all the units or stapled securities of a Target Entity in consideration for cash and/or the issuance of new securities of the acquiror to the existing unitholders or stapled securityholders of the Target Entity. A Trust Scheme will typically be adopted in a situation where the acquiror wishes to acquire all the units or stapled securities of a Target Entity.

|

|

5.4.2

|

A Trust Scheme will typically require:

|

|

|

|

(a)

|

the approval by the unitholders or stapled securityholders of the Target Entity to amend the trust deed constituting the Target Entity to include provisions that will facilitate the implementation of the Trust Scheme;

|

|

(b)

|

the approval by a majority in number of the unitholders or stapled securityholders of the Target Entity representing at least three-fourths in value of the units or stapled securities held by the unitholders or stapled securityholders present and voting either in person or by proxy at the meeting of the unitholders or stapled securityholders to be convened to approve the Trust Scheme; and

|

|

(c)

|

the grant of the order of the High Court of the Republic of Singapore (the “High Court”) sanctioning the Trust Scheme.

|

|

|

5.4.3

|

All Trust Schemes are subject to compliance with the Take-over Code although the SIC may, subject to conditions, exempt a Trust Scheme from selected provisions of the Take-over Code, such as those relating to the timetable of the offer.

|

|

5.4.4

|

Steps

The principal steps of a Trust Scheme are as follows:

|

|

|

(a)

|

Implementation Agreement: The acquiror and the Target Entity will typically enter into an implementation agreement setting out the terms and conditions on which the Trust Scheme will be implemented;

|

|

(b)

|

Trust Scheme Announcement: The Target Entity announces that it wishes to propose the Trust Scheme to its unitholders or stapled securityholders;

|

|

(c)

|

Court Application to Convene Meeting: The Target Entity files with the High Court an application for an order to convene a meeting for its unitholders or stapled securityholders to approve the Trust Scheme (the “Trust Scheme Meeting”);

|

|

(d)

|

Trust Scheme Document: The Target Entity issues a scheme document to its unitholders or stapled securityholders which typically sets out the terms and conditions of the Trust Scheme, its rationale and gives notice of (i) the EGM to approve amendments to the trust deed constituting the Target Entity to include provisions that will facilitate the implementation of the Trust Scheme and (ii) the Trust Scheme Meeting. The EGM and the Trust Scheme Meeting are typically convened on the same day;

|

|

(e)

|

EGM and the Trust Scheme Meeting: The unitholders or stapled securityholders approve (i) the amendments to the trust deed constituting the Target Entity at the EGM and (ii) the Trust Scheme at the Trust Scheme Meeting;

|

|

(f)

|

Court Application to Sanction the Trust Scheme: The Target Entity files with the High Court the results of the Trust Scheme Meeting and an application for the High Court to sanction the Trust Scheme; and

|

|

(g)

|

Court Order Sanctioning the Trust Scheme: The High Court grants an order sanctioning the Trust Scheme.

|

|

|

5.4.5

|

Examples of Trust Schemes

|

|

|

(a)

|

Merger of CapitaLand Mall Trust (“CMT”) and CapitaLand Commercial Trust (“CCT”)

|

|

|

(i)

|

In 2020, CMT merged with CCT by a Trust Scheme (the “CMT-CCT Trust Scheme”) where CMT acquired all of the units of CCT at a consideration per unit of (A) S$0.259 and (B) 0.72 units in CMT.

|

|

(ii)

|

At CCT’s Trust Scheme Meeting, the CMT-CCT Trust Scheme was approved by approximately 90.31% of the CCT unitholders who were present and voting either in person or by proxy, which represented approximately 98.23% in value of the total number of units held by the CCT unitholders who voted.

|

|

(iii)

|

The High Court sanctioned the CMT-CCT Trust Scheme and CCT was subsequently delisted. Following CCT’s delisting, the enlarged trust was renamed CapitaLand Integrated Commercial Trust and had a market capitalization of approximately S$11.4 billion and a total portfolio property value of approximately S$22.4 billion.

|

|

|

(b)

|

Merger of OUE Commercial REIT (“OUE C-REIT”) and OUE Hospitality Trust (“OUE HT”)

|

|

|

|

(i)

|

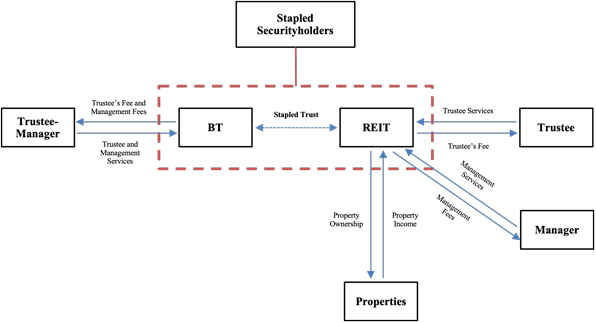

In 2020, OUE C-REIT merged with OUE HT by a Trust Scheme (the “OUE C-REIT-OUE HT Trust Scheme”) where OUE C-REIT acquired all of the stapled securities in OUE HT at a consideration per stapled security of (A) S$0.04075 and (B) 1.3583 units in OUE C-REIT.

|

|

(ii)

|

At OUE HT’s Trust Scheme Meeting, the OUE C-REIT-OUE HT Trust Scheme was approved by approximately 89.47% of the OUE HT stapled securityholders who were present and voting either in person or by proxy, which represented approximately 96.19% in value of the total number of stapled securities held by the OUE HT stapled securityholders who voted.

|

|

(iii)

|

The High Court sanctioned the OUE C-REIT-OUE HT Trust Scheme and OUE HT was subsequently delisted. This was the first merger in Singapore between a SGX-ST-listed BT and a SGX-ST-listed REIT, and the enlarged trust had a market capitalization of approximately S$2.9 billion and a total portfolio property value of approximately S$6.9 billion.

|

|

|

|

|

|

5.5.1

|

In a RTO, the acquiror transfers to a Target Entity certain assets in consideration for new units or stapled securities in the Target Entity, following which the acquiror may be required to make, or may decide to make, a take-over offer for all the remaining units or stapled securities of the Target Entity that it does not hold. The acquiror will thereafter hold all the units or stapled securities of the Target Entity.

|

|

5.5.2

|

A RTO will typically require the approval of the SGX-ST and the unitholders or stapled securityholders for (a) the acquisition of the assets from the acquiror and (b) the issuance of new units or stapled securities in the Target Entity to the acquiror and listing of such units or stapled securities on the SGX-ST.

|

|

5.5.3

|

The principal steps of a RTO are the same as a take-over offer (as set out in paragraph 5.3.5 above) with a preliminary step of the Target Entity (a) acquiring the assets from the acquiror and (b) issuing new units or stapled securityholders in the Target Entity to the acquiror.

|

|

5.5.4

|

As at the time of writing of this primer, there has only been one instance of an acquiror attempting to carry out a RTO of a Target Entity, which was eventually aborted.

|

|

5.5.5

|

In 2016, following a Lone Star Funds’ affiliate’s acquisition of all the real estate assets in Saizen REIT’s portfolio in Japan, Saizen REIT announced that it had entered into an implementation agreement with Sime Darby Property Singapore Limited (“SDPSL”), Sime Darby Eastern Investments Private Limited and Perpetual Corporate Trust Limited (in its capacity as trustee of Sime REIT Australia) in respect of Saizen REIT’s proposed acquisition of some of SDPSL’s industrial properties in Australia (the “Properties Acquisition”). The Properties Acquisition was part of a proposed RTO of Saizen REIT by SDPSL.

|

|

5.5.6

|

However, this transaction was eventually aborted as Saizen REIT, without delving into the specifics, announced that “it [was] not possible to complete the [Properties Acquisition and the RTO] by the long-stop date of the implementation agreement”.

|

|

|

|

5.6.1

|

Whether a take-over offer, a Trust Scheme or a RTO should be adopted ultimately depends on the commercial objective of the acquiror. If the acquiror wishes to acquire all of the units or stapled securities of a Target Entity, a Trust Scheme may be preferable, evident in how almost all the mergers involving REITs or BTs in Singapore till date were implemented by a Trust Scheme.

|

|

5.6.2

|

However, if the acquiror wishes to acquire only some of the units or stapled securities of a Target Entity, a partial offer would be preferable. A RTO is generally not adopted as the acquiror will have to provide certain assets prior to the take-over.

|

|

5.6.3

|

The composition of unitholders or stapled securityholders of the Target Entity would also be a relevant consideration, such as whether there are any minority unitholders or stapled securityholders which could potentially reject the take-over offer or vote against the Trust Scheme at the Trust Scheme Meeting. If so, it would be prudent for the REIT manager or the trustee-manager to engage with these minority unitholders or stapled securityholders and require them to sign irrevocable undertakings to accept the offer or vote in favor of all resolutions relating to the Trust Scheme prior to the announcement of the take-over offer or the Trust Scheme. If there is any resistance, the REIT manager or the trustee-manager should also work together with the potential acquiror to sweeten the deal.

|

|

5.6.4

|

An example of minority unitholders derailing the implementation of a Trust Scheme could be seen in the failed merger between ESR REIT and Sabana REIT.

|

|

|

(a)

|

In 2020, ESR REIT and Sabana REIT issued a joint announcement of ESR REIT’s intention to merge with Sabana REIT by a Trust Scheme (the “ESR-Sabana Trust Scheme”) with ESR REIT acquiring all the units in Sabana REIT for a consideration per unit of 0.94 units in ESR REIT (the “ESR Consideration”). The ESR-Sabana Trust Scheme required the approval by, among others:

|

|

|

(i)

|

the unitholders of Sabana REIT holding in aggregate 75% or more of the total number of votes cast for and against the resolution to approve the amendments to the trust deed constituting Sabana REIT to include provisions that will facilitate the implementation of the ESR-Sabana Trust Scheme (the “Sabana REIT Trust Deed Amendments Resolution”); and

|

|

(ii)

|

a majority in number of the unitholders of Sabana REIT representing at least three-fourths in value of the units held by the unitholders of Sabana REIT present and voting either in person or by proxy at the Trust Scheme Meeting (the “Sabana REIT Trust Scheme Resolution”).

|

|

|

The Sabana REIT Trust Scheme Resolution was contingent upon the approval of the Sabana REIT Trust Deed Amendments Resolution. This meant that in the event that the Sabana REIT Trust Deed Amendments Resolution was not passed, Sabana REIT would not proceed with the Trust Scheme Meeting.

|

|

(b)

|

At the EGM convened by Sabana REIT to pass the Sabana REIT Trust Deed Amendments Resolution (the “Sabana REIT EGM”), approximately 66.67% of the total number of votes for and against the resolution voted for the Sabana REIT Trust Deed Amendments Resolution. As less than 75% of the votes were cast in favor of the Sabana REIT Trust Deed Amendments Resolution, the Sabana REIT Trust Deed Amendments Resolution was not passed and, accordingly, Sabana REIT did not proceed with the Trust Scheme Meeting and the ESR-Sabana Trust Scheme was not implemented.

|

|

(c)

|

The failure of the Trust Scheme however did not come as a surprise.

Prior to the Sabana REIT EGM, Black Crane Investment Management Limited (“Black Crane”) and Quartz Capital Management Ltd (“Quartz Capital”), who collectively hold approximately 10% of the issued units in Sabana REIT, were vocal of their objections to the merger and embarked on a bruising campaign against the merger, which included: |

|

|

(i)

|

Black Crane and Quartz Capital issuing a letter to the manager of Sabana REIT (the “Sabana REIT Manager”) on 7 August 2020 which stated that:

|

|

|

(A)

|

both Black Crane and Quartz Capital intend to vote against the merger of ESR REIT and Sabana REIT as, among others:

|

|

|

(I)

|

the ESR Consideration was at a substantial discount to the book value of Sabana REIT and “in the 18-year history of the Singapore REIT market with multiple takeovers/mergers, there has never been a single takeover/merger of a REIT target at such a substantial discount to book value”; and

|

|

(II)

|

the merger was a “bold attempt by ESR to potentially solve [a] conflict of interest issue at the expense of Sabana [REIT] unitholders”;

|

|

|

(B)

|

a conflict of interest existed as (I) ESR Cayman Limited was the ultimate controlling shareholder of the manager of ESR REIT (the “ESR REIT Manager”) and the Sabana REIT Manager and (II) ESR Cayman Limited, together with the parties acting in concert with it, were “top unitholders of both REITs with overlapping investment mandates”; and

|

|

(C)

|

the “substantial undervaluation” of the ESR Consideration “raises concerns on whether the fiduciary duty of [the Sabana REIT Manager’s] board and management to act and protect all unitholders’ interest has been potentially compromised”;

|

|

|

(ii)

|

Black Crane and Quartz Capital issuing a letter to the MAS and the SGX-ST on 17 August 2020 highlighting, among others, the “significant conflict of interest and corporate governance issues resulting from ESR Cayman Limited controlling [the ESR REIT Manager and the Sabana REIT Manager]”;

|

|

(iii)

|

Black Crane and Quartz Capital issuing a letter to the trustee of Sabana REIT on 3 September 2020 highlighting, among others, the “corporate governance and potential conflicts of interests of the [Sabana REIT Manager] due to: (A) the controlling ownership of ESR [Cayman Limited] in both [the ESR REIT Manager and the Sabana REIT Manager]; (B) the overlapping investment mandate of Sabana REIT and ESR REIT; and (C) ESR [Cayman Limited] together with its concert parties being substantial unitholders of both Sabana REIT and ESR REIT”;

|

|

(iv)

|

Black Crane and Quartz Capital requisitioning an EGM under the CIS Code relating to (A) the appointment of Ms. Ng Shin Ein as an independent director despite Ms. Ng Shin Ein having had “substantial business relationships with ESR Cayman [Limited] and its affiliates” and (B) the employment of three ex-ESR employees to senior management roles at the Sabana REIT Manager;

|

|

(v)

|

Black Crane and Quartz Capital requisitioning an EGM under the CIS Code relating to (A) the proposed removal of the Sabana REIT Manager and (B) the appointment of an “internal REIT manager owned by and for all unitholders”;

|

|

(vi)

|

Black Crane and Quartz Capital hosting a zoom webinar on 25 November 2020 relating to their vote against the merger;

|

|

(vii)

|

Black Crane and Quartz Capital issuing a letter to the Sabana REIT Manager on 15 December 2020 stating, among others, that the Sabana REIT Manager “is fully responsible for the failure of the disastrous and value destructive proposed merger between Sabana and ESR REITs”; and

|

|

(viii)

|

Black Crane and Quartz Capital creating the website, <www.savesabanareit.com> “to enable visitors to carefully monitor how sincerely the board and management of Sabana REIT address unitholders’ proposals, listen to unitholders’ views and endeavour to increase the value of the Sabana REIT units in the best interest of all unitholders”.

|

|

|

(d)

|

Both the ESR REIT Manager and the Sabana REIT Manager attempted to put out the fire created by Black Crane and Quartz Capital through a series of announcements which in summary:

|

|

|

(i)

|

acknowledged that there was a discount to the net asset value (“NAV”) of Sabana REIT, but the merger of ESR REIT and Sabana REIT would create an enlarged REIT, which “offer[ed] the best opportunity for re-rating and for reducing the NAV discount in the long term as part of a larger, more liquid and scalable REIT”;

|

|

(ii)

|

stated that (A) there were “strict internal controls” in both ESR REIT and Sabana REIT, (B) ESR Cayman Limited’s stake in the Sabana REIT Manager is held through an independent third party trustee licensed in Singapore, (C) there are no overlaps in the management teams of both the ESR REIT Manager and the Sabana REIT Manager and (D) there is no sharing of information between both the ESR REIT Manager and the Sabana REIT Manager; and

|

|

(iii)

|

stated that Black Crane’s and Quartz Capital’s claims were unsubstantiated and they “owe it to unitholders to act responsibly and justify their statements”.

|

|

|

(e)

|

Suffice to say both the ESR REIT Manager’s and the Sabana REIT Manager’s efforts were not successful against Black Crane’s and Quartz Capital’s onslaughts on the merger.

|

|

(f)

|

If the Sabana REIT Manager had engaged with Black Crane and Quartz Capital prior to the announcement of the Trust Scheme, perhaps this debacle would not have occurred, with no ink spilled and no sharp exchanges between both sides.

Even if the Sabana REIT Manager was not able to engage with Black Crane and Quartz Capital prior to the announcement of the Trust Scheme due to perhaps confidentiality reasons, it should have done so the moment the first signs of resistance surfaced. Instead of going on the defensive, the Sabana REIT Manager could have engaged with Black Crane and Quartz Capital, while simultaneously working with the ESR REIT Manager to sweeten the deal.

It is crucial to note that Quartz Capital had on 14 November 2019 proposed that ESR REIT merge with Sabana REIT “in a cash and unit transaction where 0.92 units of ESR REIT and S$0.067 of cash will be exchanged for one unit of Sabana REIT” so as to “solve the critical issue of overlapping investment mandates between the two trusts”. This may suggest that the minority unitholders’ principal objection lay in the offer price and if there were any sweeteners to the deal, such as revising the offer price, the minority unitholders’ could likely be struck by cupid’s arrow and agree to the merger. After all, no one is entirely immune from cupid’s arrow.

Introducing deal sweeteners is not uncommon. In the merger of CMT and CCT, the respective REIT managers worked together and sweetened the deal by ensuring a higher accretion to their respective distribution per unit and the manager of CMT also waived the acquisition fees due from CMT that amounted to approximately S$111.2 million. In the take-over of Forterra Trust, New Precise Holdings raised its cash offer from S$1.85 to S$2.25 per unit.

If the foregoing actions were taken, the merger could perhaps have succeeded. More importantly, the Sabana REIT Manager would not be caught in the situation it is in after the failed merger – dealing with the reputational fallout arising from the failed merger and the adversarial stance of Black Crane and Quartz Capital, as well as the increased public scrutiny on its management of Sabana REIT.

Black Crane and Quartz Capital, perhaps emboldened by the failed merger, have repeatedly opposed certain management decisions of the Sabana REIT Manager since the failed merger. Recently, after Mr. Chan Wai Kheong was appointed as an independent non-executive director of the Sabana REIT Manager, Black Crane and Quartz Capital requisitioned an EGM on 2 August 2021 to pass a resolution that the appointment of Mr. Chan Wai Kheong “be endorsed by the independent unitholders”. Black Crane and Quartz Capital highlighted that Mr. Chan Wai Kheong was arguably not independent and there exists a “real and significant risk” of a conflict of interest as he “had received a substantial premium of approximately S$22 million over market price from ESR Cayman [Limited] and is also a substantial unitholder of AIMS APAC, a major competitor to Sabana REIT”.

The Sabana REIT Manager rejected convening the EGM stating, among others, that (i) the unitholders have “the opportunity to vote in relation to the endorsement of Mr. Chan Wai Kheong as an independent director by the next annual general meeting” and (ii) “it would be in the best interest of unitholders for the [Sabana REIT Manager] to be allowed to focus on improving Sabana REIT’s performance and results instead of convening [the EGM]”. |

|

(g)

|

Whether the failed merger is a victory or pyrrhic victory for the unitholders of Sabana REIT remains to be seen. It is nevertheless a cautionary tale of the importance of considering the composition of the unitholders or stapled securityholders and engaging any minority unitholders or stapled securityholders prior to announcing any take-over offer or Trust Scheme. Where necessary, deal sweeteners should be introduced.

|

|

|

5.6.5

|

If the acquiror wishes to gain control of the management of a Target Entity, a more cost effective alternative to acquiring the units or stapled securities in the Target Entity would be to acquire the shares of the REIT manager and/or trustee-manager of the Target Entity. As a REIT manager manages the business of a REIT and a trustee-manager manages the business of a BT, such an acquisition allows the acquiror to effectively control the Target Entity. Additional approvals (such as approval from the MAS in relation to an acquisition of shares of a REIT manager) may however be required.

|

|