Five Years of Evolving Form 10-K Human Capital Disclosures

Client Alert | January 22, 2026

A Survey of Disclosures from the S&P 100 During the Five Years Following Adoption of the Securities and Exchange Commission Rule.

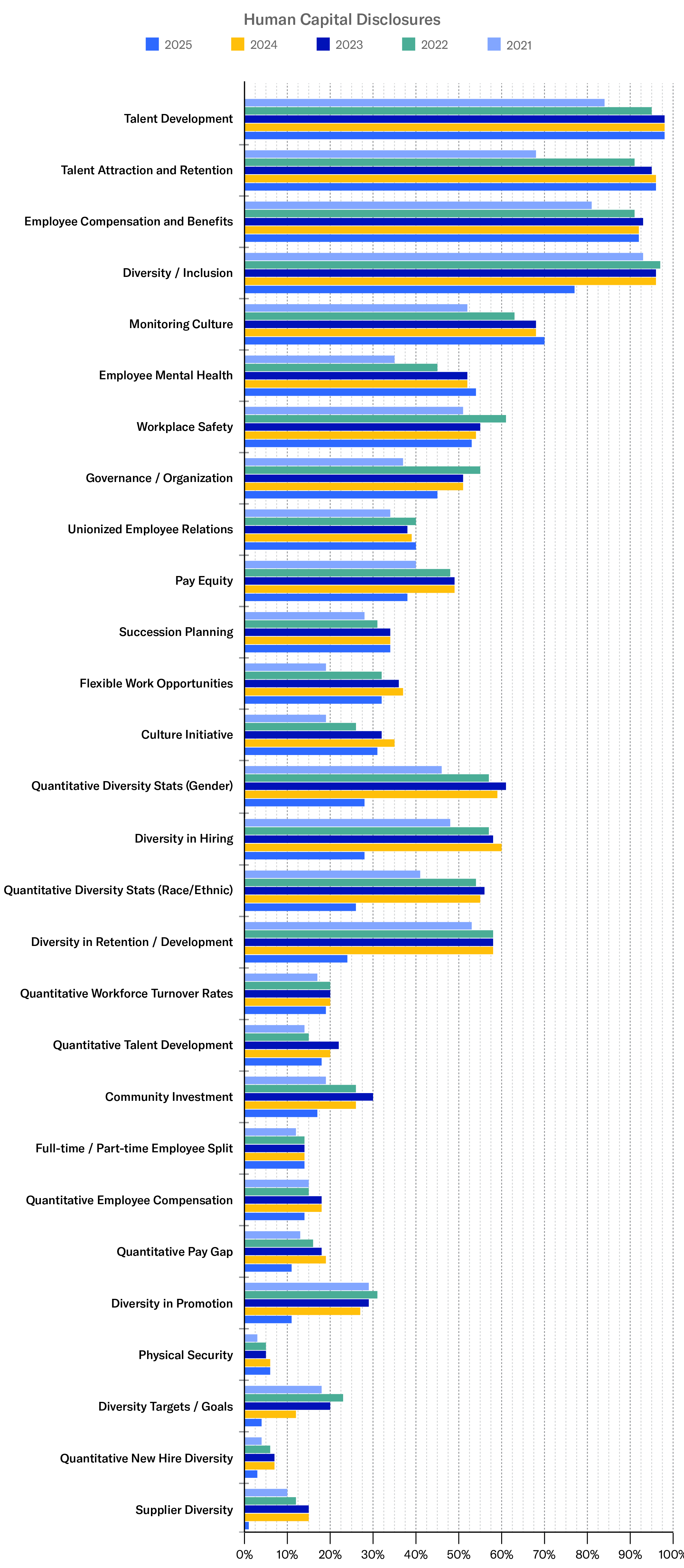

Human capital resource disclosures by public companies have continued to be a focus since the U.S. Securities and Exchange Commission (the “Commission”) adopted the new rules in 2020, not only for companies making the disclosures, but employees, investors, and other stakeholders reading them. This alert updates the alert we issued in December 2024, “Four Years of Evolving Form 10-K Human Capital Disclosures,” available here, and reviews disclosure trends among S&P 100 companies categorized into 28 topic areas.[1] Each of these companies has now included human capital disclosure in their past five annual reports on Form 10-K. This alert also provides practical considerations for companies as we head into 2026.

Overall, our findings indicate that companies are reframing their disclosures related to diversity, equity, and inclusion (“DEI”) in response to the current legal, regulatory, and political environment, with the acronyms “DEI” and “DE&I” being completely removed from all human capital disclosures of S&P 100 companies in 2025. This year, companies generally continued to shorten their human capital-related disclosures, decrease the number of topics covered, and include less quantitative information in some areas, often as a result of decreased diversity-related disclosures. Specifically, we identified the following trends regarding the S&P 100 companies’ human capital disclosures compared to the previous year:

- Length of disclosure. Eighty-five percent of companies surveyed decreased the length of their disclosures and the remaining 15% increased the length of their disclosures. The decreases in length were in most cases driven at least partially by companies scaling back diversity-related disclosures. In some cases, diversity-related discussions were deleted in their entirety. Of the 85 companies that decreased the length of their disclosures, 49 decreased the length of disclosures in both 2024 and 2025, 30 increased the length of disclosures in 2024 followed by a decrease in 2025, and the remaining six had no change in 2024 followed by a decrease in 2025.

- Number of topics covered. Seventy-two percent of companies surveyed decreased the number of topics covered, 11% increased the number of topics covered, and the remaining 17% covered the same number of topics. Year over year, 36 companies decreased the number of topics covered in both 2024 and 2025, 29 companies covered the same number of topics in 2024 compared to the prior year but decreased the number of topics covered in 2025, seven companies increased the number of topics covered in 2024 followed by a decrease in 2025, 11 companies made no change to the number of topics covered in both 2024 and 2025, and nine companies made no change to the number of topics covered in 2024 followed by an increase in 2025.

- Breadth of topics covered. Across all companies, the prevalence of three topics increased, 19 topics decreased, and six topics remained the same.

- The most significant year-over-year decreases related to diversity disclosures, continuing a trend from 2024, with decreases in every diversity-related category as well as in pay equity and quantitative pay gap disclosures. Other significant decreases related to disclosures addressing community investment (26% to 17%), governance and organizational practices (51% to 45%), and flexible work arrangements (37% to 32%).

- The year-over-year increases in frequency involved minor increases in unionized employee relations (39% to 40%), employee mental health (52% to 54%) and monitoring culture (68% to 70%) disclosures.

- Most common topics covered. This year, the most commonly discussed topics remained consistent with the previous three years, with the top five most frequently discussed topics being talent development, talent attraction and retention, employee compensation and benefits, diversity and inclusion, and monitoring culture. The topics least discussed this most recent year, however, changed slightly from those of the previous year as quantitative pay gap and diversity in promotion disclosures were tied as the fifth least frequently covered topics (joining physical security, diversity targets or goals, quantitative new hire diversity, and supplier diversity), replacing full-time and part-time employee split.

- Industry trends. Disclosure trends in the technology, finance, and pharmaceutical industries shifted slightly from previous years, with some industries responding differently to the changing DEI landscape than the S&P 100 as a whole, as further discussed below.

I. Background on the Requirements

As we previously discussed in our client alert titled “Discussing Human Capital: A Survey of the S&P 500’s Compliance with the New SEC Disclosure Requirement One Year After Adoption,” available here, on August 26, 2020, the Commission voted three-to-two to approve amendments to Items 101, 103, and 105 of Regulation S-K, including the principles-based requirement to discuss a registrant’s human capital resources to the extent material to an understanding of the registrant’s business taken as a whole.[2] Specifically, public companies’ human capital disclosure must include “the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction, and retention of personnel).”

Notably, from 2021 until the Fall of 2025, the Commission’s agenda list had included new human capital disclosure rules that were expected to be more prescriptive than the current rules, in part, because one of the main criticisms of the existing human capital rules is lack of comparability across companies. However, the Commission’s Spring 2025 agenda list no longer includes an item for human capital disclosure rules, and we no longer expect that more prescriptive rules are forthcoming, at least not under the current administration as the focus of this Commission is on disclosure simplification.[3] However, as our survey demonstrates, companies continue to provide and refine their human capital disclosures applying the principles-based framework, not surprisingly, leading to continued variation year over year and between industries. The next three sections show the relevant data from our survey.[4]

II. Disclosure Topics

Our survey classifies human capital disclosures into 28 topics, each of which is listed in the following chart, along with the number of companies that discussed the topic in each of 2021, 2022, 2023, 2024, and 2025. Each topic is described more fully in the sections following the chart.

|

[1] Data provided is as of November 14, 2025 and is based on the companies currently included within the S&P 100, so some statistics are slightly different than they were in the prior surveys. The categorization data necessarily involves subjective assessment and should be considered approximate.

[2] See 17 C.F.R. § 229.101(c)(2)(ii).

[3] Agency Rule List – Spring 2025 Securities and Exchange Commission, Office of Information and Regulatory Affairs (2025), available here.

[4] Note that companies often include additional human capital management-related disclosures in their ESG/sustainability/social responsibility reports, on their websites, and in their proxy statements, but these disclosures are outside the scope of the survey, which is focused on disclosures included in Part I, Item 1 of annual reports on Form 10-K.

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding these developments. To learn more about these issues, please contact the Gibson Dunn lawyer with whom you usually work in the firm’s Securities Regulation and Corporate Governance or Labor and Employment practice groups, or any of the following practice leaders and members:

Securities Regulation & Corporate Governance:

Aaron Briggs – San Francisco (+1 415.393.8297, abriggs@gibsondunn.com)

Mellissa Campbell Duru – Washington, D.C. (+1 202.955.8204, mduru@gibsondunn.com)

Elizabeth Ising – Washington, D.C. (+1 202.955.8287, eising@gibsondunn.com)

Thomas J. Kim – Washington, D.C. (+1 202.887.3550, tkim@gibsondunn.com)

Brian J. Lane – Washington, D.C. (+1 202.887.3646, blane@gibsondunn.com)

Julia Lapitskaya – New York (+1 212.351.2354, jlapitskaya@gibsondunn.com)

Ronald O. Mueller – Washington, D.C. (+1 202.955.8671, rmueller@gibsondunn.com)

Michael Scanlon – Washington, D.C. (+1 202.887.3668, mscanlon@gibsondunn.com)

Michael A. Titera – Orange County (+1 949.451.4365, mtitera@gibsondunn.com)

Geoffrey E. Walter – Washington, D.C. (+1 202-887-3749, gwalter@gibsondunn.com)

Lori Zyskowski – New York (+1 212.351.2309, lzyskowski@gibsondunn.com)

Labor and Employment:

Jason C. Schwartz – Co-Chair, Washington, D.C. (+1 202.955.8242, jschwartz@gibsondunn.com)

Katherine V.A. Smith – Co-Chair, Los Angeles (+1 213.229.7107, ksmith@gibsondunn.com)

© 2026 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.