March 2, 2023

On February 20, 2023, the Hong Kong Securities and Futures Commission (“SFC”) published its highly-anticipated Consultation Paper on the Proposed Regulatory Requirements for Virtual Asset Trading Platform Operators Licensed by the Securities and Futures Commission (“Consultation Paper”).[1] This follows the passing in December 2022 of significant amendments to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (“AMLO”), which introduce a new licensing regime for virtual asset trading platforms that carry on the business of trading non-security tokens in Hong Kong and/or actively markets such services to Hong Kong investors (“AMLO Licensing Regime”).[2] The AMLO Licensing Regime will come into effect on June 1, 2023. We have previously published client alerts on this topic.[3]

The aim of the Consultation Paper is to obtain feedback from the market on the implementation of the AMLO Licensing Regime. As a first step, the SFC will be focusing on the regulation of virtual asset trading platform operators (“Platform Operators”), e.g. virtual asset exchanges and other types of virtual asset trading entities, under the AMLO Licensing Regime.

The Consultation Paper broadly covers two areas: (i) licensing and conduct requirements concerning Platform Operators and (ii) anti-money laundering and counter-financing of terrorism (“AML/CFT”) requirements applicable to virtual asset service providers (“VASP”). To aid the consultation, the SFC has helpfully included draft texts of the Guidelines for Virtual Asset Trading Platform Operators (“VATP Guidelines”) and the Guideline on Anti-Money Laundering and Counter-Financing of Terrorism (For Licensed Corporations and SFC-Licensed Virtual Asset Service Providers) (“VASP AML/CFT Guidelines”).

The Consultation Paper effectively proposes to align the regulatory requirements applicable to virtual asset service providers (“VASPs “) under the AMLO Licensing Regime with the requirements applicable to current Type 1 (dealing in securities) and Type 7 (automated trading services) licensed virtual asset trading platforms that provide trading services in at least one security token under the Securities and Futures Ordinance (“SFO”) (“SFO Licensing Regime”).[4]

Notably, the VATP Guidelines build on the existing Terms and Conditions for Virtual Asset Trading Platform Operators (“VATP Terms and Conditions”), which are currently applicable to licensed Platform Operators under the SFO Licensing Regime (“SFO-licensed Platform Operators”).[5] Whilst the VATP Guidelines have preserved much of the existing licensing conditions under the VATP Terms and Conditions, significant additions and modifications are also introduced to the existing regulatory requirements set out in the VATP Terms and Conditions. Once the VATP Guidelines come into effect, it will supersede the VATP Terms and Conditions. In this client alert, we focus on these additions or variations. A recap on key aspects of the existing requirements under the VATP Terms and Conditions are summarized in an Appendix.

I. Transitional Arrangements

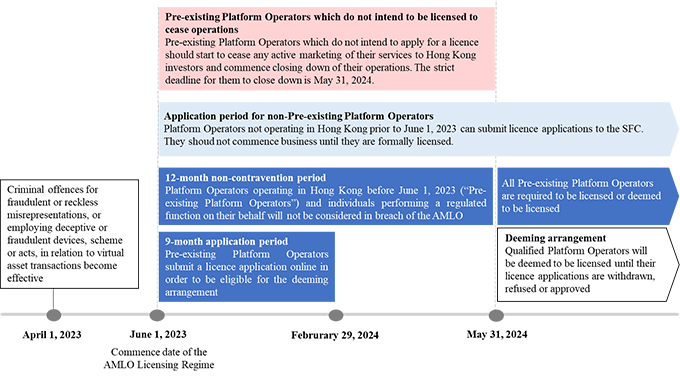

The AMLO Licensing Regime will become effective on June 1, 2023. This means that any Platform Operator operating or marketing its services to Hong Kong investors without a valid licence will commit a breach unless they qualify for the 12-month transitional period. As such, Platform Operators not operating in Hong Kong immediately before June 1, 2023 should not commence any virtual asset trading platform business in Hong Kong until they are SFC-licensed.

A 12-month transitional period will be introduced for compliance with the requirements in relation to existing clients or virtual assets currently made available by SFO-licensed platform operators. To be eligible for the transitional arrangements, a Platform Operator must be in operation in Hong Kong immediately prior to June 1, 2023 and must have meaningful and substantial presence. Considerations on whether a Platform Operator has meaningful and substantial presence in Hong Kong include whether it is incorporated in Hong Kong, whether it has a physical office in Hong Kong, and whether its key personnel are based in Hong Kong.

The following timeline highlights the key dates and implementation details of the transitional arrangements:

To avoid confusion on whether a Platform Operator is operating legally during the transitional period, the SFC will publish lists on its website to inform the public of the different regulatory statuses of Platform Operators.

Note that the above transitional arrangements are only applicable under the AMLO Licensing Regime. There are no transitional arrangement for compliance with the SFO Licensing Regime. This means that Platform Operators intending to offer trading in security tokens should only commence business upon obtaining the relevant Type 1 and 7 licences from the SFC.

II. Overview of Key Proposals Introduced by The Consultation Paper

The key proposals under the Consultation Paper are summarized below:

|

Licensing Requirements |

All Platform Operators (including existing SFO-licensed Platform Operators) will be subject to the AMLO Licensing Regime. SFO-licensed Platform Operators engaging in security tokens trading will additionally be subject to the Type 1 and 7 Licensing Regime under the SFO. The SFC has expressed its view that, considering that terms and features of virtual assets may evolve (which could impact on the classification of a security / non-security token), it encourages all VASPs (including their proposed responsible officers and licensed representatives) to be dual licensed under both the SFO and AMLO Licensing Regimes. However, strictly under the law, it is not be mandatory to be dual licensed under both the SFO and AMLO Licensing Regime (see Section VI “Licensing Requirements and Procedures” for further discussion on this point). |

|

|

Retail Access |

Currently, SFO-licensed Platform Operators can only serve professional investors, and are restricted from providing services to retail investors. Under the VATP Guidelines, the SFC contemplates expanding the scope of licences to allow for retail access. To this end, the SFC has proposed safeguards intended to protect retail investors, for example:

The SFC notes that there are diverse views on whether retail investors should be granted access to services provided by Platform Operators. On one hand, such access may legitimise the trading of virtual assets, which are prone to high volatility and market manipulation. On the other hand, denying retail access may result in investor harm and push retail investors to trade on unregulated platform.

|

|

|

Token Admission and Review Committee |

As mentioned above, the SFC has proposed that each relevant Platform Operator set up a token admission and review committee. Although the functions of a token admission and review committee are normally closely associated with virtual asset exchanges, in virtual asset markets, other forms of virtual asset trading entities will have similar committees, and it will be the SFC’s expectation that all Platform Operators shall implement such committees. The token admission and review committee will have the following functions:

At a minimum, the token admission and review committee should consist of members of senior management principally responsible for managing the key business line, compliance, risk management, and information technology. The token admission and review committee will report to the Board of Directors at least monthly. To comply with the SFC’s regulatory requirements, we anticipate that Platform Operators will implement a virtual asset listing policy which covers all aspects of the token admission and withdrawal process, as well as virtual asset due diligence questionnaire to be completed for each virtual asset prior to its admission to the platform. Many global virtual asset trading platforms will have already implemented such policies and due diligence questionnaires, which can be updated to align with the regulatory requirements for Platform Operators. |

|

|

Insurance and Compensation Arrangement |

Currently, an SFO-licensed Platform Operator must maintain an insurance policy covering the risks involved with client virtual assets held in hot storage and in cold storage. In view of industry feedback on the practical difficulties with complying with these requirements, the SFC has proposed the following modifications:[10]

|

|

|

Virtual Asset Derivatives |

The current SFO Licensing Regime does not allow SFO-licensed Platform Operators to offer, trade or deal in virtual asset futures contracts or related derivatives. This restriction is preserved under the VATP Guidelines.[12] In light of growing market interest in offering virtual asset derivatives (especially to institutional investors), the SFC is keen to understand the market’s views on virtual asset derivatives. The SFC will be conducting a separate review exercise to formulate the policies around virtual asset derivatives trading.

|

|

|

Proprietary Trading |

The SFO Licensing Regime currently prohibits SFO-licensed Platform Operators from engaging in proprietary trading or market-making activities on a proprietary basis (see Appendix, “Conflict of Interest”). This restriction is adopted under the VATP Guidelines, with a slight modification. The SFC proposes to carve out an exception, such that Platform Operators will be allowed to engage in off-platform back-to-back transactions entered into by the Platform Operator,[13] and any other limited circumstances approved by the SFC on a case-by-case basis. |

|

|

Corporate Governance |

Platform Operators and their responsible officers seeking a licence must demonstrate to the SFC that they are a fit and proper, and that they have the ability to carry out licensed activities competently.[14] The introduction of the fit and proper and competence requirements is modelled on the same requirements for the licensing of regulated activities under the SFO.[15] The VATP Guidelines also introduce a series of general principles governing the conduct of Platform Operators. Again, these general principles take after the general principles under the SFC’s “Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission”.[16]. Further, to align corporate governance standards with those applicable to licensed corporations, the SFC has introduced requirements for Platform Operators to establish independent audit, risk management and compliance functions. The SFC has emphasised that there should be appropriate segregation between compliance and internal audit functions, and operations to preserve independence. |

|

|

AML/CFT |

In light with the Financial Action Task Force’s recommendation on wire transfers (i.e., the travel rule),[17] the SFC has proposed to impose similar requirements on virtual asset transfers (see Section V “Virtual Asset Transfers and Application of the Travel Rule” for further discussion on this point).

|

|

|

Disciplinary Fining Guidelines |

The SFC has set out a set of guidelines providing insight on its disciplinary powers in relation to breaches of the AMLO Licensing Regime by regulated persons. In short, where a regulated person is guilty of misconduct,[18] or the SFC is of the opinion that a regulated person is or was not a fit and proper, the SFC has the power to impose a fine up to a maximum of HK$10 million or three times of the profit gained or loss avoid as a result of the misconduct, whichever is higher.[19] The SFC can use the number of affected persons as the multiplier in assessing the appropriate level of the fine; by way of an illustration, the SFC may impose a fine not exceeding HK$10 million for each person affected by the misconduct. The appropriate approach will be determined on a case-by-case basis.

|

In the subsequent sections, we will provide discuss some of the significant aspects of the proposals under the Consultation Paper.

III. Token Admission Criteria

The VATP Guidelines require Platform Operators to exercise due skill, care and diligence when selecting virtual assets to be made available for trading, irrespective of whether they are made available to retail investors. The VATP Guidelines introduce general due diligence factors applicable to all token offerings, and specific due diligence factors applicable only to retail investors offerings, as set out below:

|

General Due Diligence Factors |

The VATP Guidelines list out some non-exhaustive factors which a Platform Operator must consider when conducting due diligence on all virtual assets before admitting them for trading. As illustrations:

|

|

Due Diligence Factors Applicable to Retail Offerings |

In addition to the general due diligence factors explained above, where a Platform Operator intends to make a specific virtual asset available for trading by its retail investors, it should also ensure that the virtual asset is a large-cap virtual asset. A large-cap virtual asset refers to a specific virtual asset that have been included in at least two accepted indices issued by at least two separate index providers. An acceptable index is an index which has a clearly defined objective to measure the performance of the largest virtual asset. In particular, the index should be objectively calculated and rules-based, the constituent virtual assets of the index should be sufficient liquid, and the methodology and rules of the index should be consistent and transparent. Among the two indices, a Platform Operator should ensure that at least one of them is issued by an index provider which has experience in publishing indices for the traditional non-virtual asset financial market. If the virtual asset concerned does not meet the criteria of being a large-cap virtual asset, but meets all of the general due diligence criteria mentioned above, the Platform Operator may submit a detailed proposal on the virtual asset at issue for the SFC’s consideration on a case-by-case basis |

A Platform Operator is under a duty to monitor each virtual asset admitted for trading on an ongoing basis, consider whether the virtual asset continues to satisfy all the token admission criteria, and provide regular reports to the token admission and review committee. As an illustration, if an admitted virtual asset falls outside the constituent pool of an acceptable index, a Platform Operator may consider whether there are any material adverse news or underlying liquidity issues surrounding the virtual asset. If the concerns are unlikely to be resolved in the near future, the token admission and review committee should assess whether to halt trading, or restrict retail access. Where this is the case, the Platform Operator should notify affected clients holding the virtual asset at issue, and inform them of the remedial options available.

IV. Suitability Obligations

A Platform Operator is required to ensure the suitability of the recommendation or solicitation for the client is reasonable when making a recommendation or solicitation to retail investors. Whether there has been a recommendation or solicitation is assessed in light of the circumstances leading up to the point of sale or advice, for example, a relevant consideration is the context (such as the presentation) and content of product-specific materials posted on the platform and/or website, assessed against the overall impression created by such content. Generally, posting factual, fair and balanced product-specific materials would not itself amount to solicitation or recommendation, and therefore, would not trigger suitability requirements.

The same suitability assessments must also be conducted in respect of the solicitation and recommendation of complex products, i.e. a virtual asset whose terms, features and risks are not reasonably likely to be understood by a retail investor due to its complex structure.[21] Where a Platform Operator determines a virtual asset to be complex product, it should ensure that there are clear warning statements to warn clients about the complexity of the product prior to and reasonably proximate to the point of sale and advice. Note that these requirements are not triggered in the absence of solicitation and recommendation. As a general market observation, a virtual asset which is assessed to be a complex product is also likely to have features similar to “securities”.

V. Virtual Asset Transfers and Application of The Travel Rule

Given that Platform Operators are exposed to money laundering and terrorist financing (“ML/TF”) risks arising from the distinct characteristics of virtual assets, Platform Operators are required to comply with additional virtual-asset specific AML/CFT requirements introduced by the VASP AML/CFT Guidelines. A Platform Operator is allowed to accept virtual asset transfers provided that the following are met (i.e., the ‘Travel Rule’):

- When acting as an ordering institution of virtual asset transfers, a Platform Operator must obtain, record and submit the required information of the originator and recipient to the beneficiary institution immediately and securely;

- When acting as a beneficiary institution, a Platform Operator must obtain and record information submitted by the ordering institution or intermediary institution;

- A Platform Operator must conduct due diligence on a virtual asset transfer counterparty (i.e. the ordering institution, intermediary institution or beneficiary institution) to identify and assess any associated ML/TF risks, and apply risk-based AML/CFT measures as appropriate; and

- When conducting virtual asset transfers to or from unhosted wallets,[22] a Platform Operator should obtain and record the required information from its customer who may be the originator or recipient, and take reasonable measures to mitigate and manage the ML/TF risks associated with the transfers.

Separately, AML/CFT provisions on the identification of suspicious transactions and sanctions screening, similar to those imposed on licensed incorporations, are also provided in the VASP AML/CFT Guidelines.[23]

VI. Licensing Requirements and Procedures

As previously explained, the SFO Licensing Regime and the AMLO Licensing Regime will run in tandem. Since the AMLO Licensing Regime is itself a standalone licensing regime, virtual asset trading platforms should be able to choose to either:

- be licensed under the AMLO Licensing Regime only, or

- be dual licensed under both the SFO Licensing Regime and the AMLO Licensing Regimes.

The decision will depend on the contemplated business plan and the types of virtual assets proposed to be offered. Virtual asset trading platforms planning to offer only non-security tokens may consider only applying for a licence under the AMLO Licensing Regime (and not the SFO Licensing Regime). However these platform operators will need to have robust systems and controls in place (including ongoing monitoring) to ensure that they are aware of and can address situations where a virtual asset’s classification may change from a non-security token to a security token. The potential regulatory risk of not having the dual licence is that, in the event a virtual asset’s classification changes from a non-security token to a security token and the platform operator is unaware of the changes and therefore continues to offer trading in the re-classified security token, then the platform operator could be in breach of the SFO for carrying on unlicensed dealing in securities.

To address the risk of a virtual asset’s classification changing from a non-security token to a security token, the SFC encourages virtual asset trading platforms to apply for approvals under both the SFO Licensing Regime and the AMLO Licensing Regime. The SFC intends to implement a streamlined application process for virtual asset trading platforms applying to be dually licensed (i.e., under both the SFO Licensing Regime and the AMLO Licensing Regime) and approved. However, it is important to note that even if a Platform Operator is dual-licensed, it still cannot offer security tokens to retail investors.

To assist the application process, the SFC will require Platform Operator applicants to engage an external assessor to assess its business going forward, and submit the assessor’s reports to the SFC (i) when submitting the licence application (“Phase One Report”); and (ii) after approval-in-principle is granted (“Phase Two Report”).

The Phase One Report will cover the design effectiveness of the Platform Operator’s proposed structure, governance, operations, systems and controls, with a focus on key areas including token admission, custody of virtual assets, governance, AML/CFT, market surveillance and risk management.

The Phase Two Report will contain the assessor’s assessment of the implementation and effectiveness of the actual adoption of the planned policies, procedures, systems and controls. The SFC will only grant final approval if it is satisfied with the findings of the Phase Two Report.

VII. Conclusion

The Consultation Paper contains substantive and important proposals in relation to the AMLO Licensing Regime. Interested parties are encouraged to respond to the proposals prior to the close of the consultation period on March 31, 2023.

In the meantime, Platform Operators minded to continue or commence operations in Hong Kong are encouraged to review their internal policies and practices to ensure compliance with the AMLO Licensing Regime.

APPENDIX: Overview of Existing Requirements Applicable to SFO-Licensed Platform Operators

The table below summarizes the key requirements currently applicable to SFO-licensed Platform Operators, as contained in the VATP Terms and Conditions, which are also adopted by the VATP Guidelines. Note that once effective, the VATP Guidelines will supersede the VATP Terms and Conditions.

|

Financial Soundness |

|

|

Onboarding Requirements |

|

|

Custody of Client Assets |

|

|

Risk Management |

|

|

Prevention of Market Manipulation and Abusive Activities |

|

|

Conflict of Interest |

|

|

Auditing |

|

_________________________

[1] “Consultation Paper on the Proposed Regulatory Requirements for Virtual Asset Trading Platform Operators Licensed by the Securities and Futures Commission”, Securities and Futures Commission (February 20, 2023), available at https://apps.sfc.hk/edistributionWeb/gateway/EN/consultation/doc?refNo=23CP1

[2] Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance, available at https://www.legco.gov.hk/yr2022/english/ord/2022ord015-e.pdf; Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615), available at https://www.elegislation.gov.hk/hk/cap615

[3] Hong Kong Introduces Licensing Regime for Virtual Asset Service Providers”, Gibson, Dunn & Crutcher (June 30, 2022), available at https://www.gibsondunn.com/hong-kong-introduces-licensing-regime-for-virtual-asset-services-providers/; “Hong Kong Licensing Regime for Virtual Asset Service Providers Passed with Three-Month Delay to Implementation Timelines”, Gibson, Dunn & Crutcher (December 8, 2022), available at https://www.gibsondunn.com/hong-kong-licensing-regime-for-virtual-asset-service-providers-passed-with-three-month-delay-to-implementation-timelines/

[4] Securities and Futures Ordinance (Cap. 571), available at https://www.elegislation.gov.hk/hk/cap571?xpid=ID_1438403467298_001

[5] Terms and Conditions for Virtual Asset Trading Platform Operators, Securities and Futures Commission, available at https://apps.sfc.hk/publicreg/Terms-and-Conditions-for-VATP_10Dec20.pdf

[6] “Securities” is defined under Part 1, Schedule 1 of the SFO.

[7] See Part IV of the SFO.

[8] See Part II and Part XII of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32), available at https://www.elegislation.gov.hk/hk/cap32

[9] Under the VATP Guidelines, written legal advice in the form of a legal memorandum or opinion confirming that the virtual asset does not fall within the definition of securities under the SFO is only required for virtual assets to be traded and made available by retail investors. The requirement will not apply to virtual assets only made available to professional investors.

[10] As noted in the Consultation Paper, industry participants have reported on the difficulty of complying with the current insurance requirements as many insurers are unwilling to provide coverage for risks associated with hot storage, and even if they are willing to do so, the insurance premiums meant that maintaining such a policy would not be commercially viable.

[11] “Associated Entity” means a company which (i) has notified the SFC that it has become an “associated entity” of the licensee Platform Operator, (ii) is incorporated in Hong Kong, (iii) holds a “trust or company service provider licence”, and (iv) is a wholly owned subsidiary of the Platform Operator.

[12] See paragraph 7.23 of the VATP Guidelines.

[13] “Back-to-back transactions” refer to those transactions where a Platform Operator, after receiving (i) a purchase order from a client, purchases a virtual asset from a third party and then sell the same virtual asset to the client; or (ii) a sell order from a client, purchases a virtual asset from the client and then sells the same virtual asset to a third party, and no market risk is taken by the Platform Operator.

[14] Under the AMLO Licensing Regime, an applicant wishing to be licensed as a VASP have at least two responsible officers who will assume general responsibility of overseeing the licensed VASP’s operations. Any person who may carry out regulated functions of providing a virtual asset service must also apply to be a licensed representative. Both the responsible officers and licensed representative must be fit and proper, with reference to criteria such as their financial integrity, education, experience, reputation, character, and reliability.

[15] See section 129 of the SFO. See also the “Guidelines on Competence”, Securities and Futures Commission (January 2022), available at https://www.sfc.hk/-/media/EN/assets/components/codes/files-current/web/guidelines/guidelines-on-competence/Guidelines-on-Competence.pdf?rev=17109ba82b614119a9c463d08e6e344f

[16] “Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission”, Securities and Futures Commission (August 2022), available at https://www.sfc.hk/-/media/EN/assets/components/codes/files-current/web/codes/code-of-conduct-for-persons-licensed-by-or-registered-with-the-securities-and-futures-commission/Code_of_conduct_05082022_Eng.pdf?rev=0fd396c657bc46feb94f3367d7f97a05

[17] See Recommendation 16 of “International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation: The FATF Recommendations”, Financial Action Task Force (March 2022), available here.

[18] See section 53ZSR of the AMLO for the definition of “misconduct”. Note that the definition includes an act or omission relating to the provision of any virtual asset service by a regulated person which, in the SFC’s opinion, is or is likely to be prejudicial to the interests of the investing public or to the public interest.

[19] This is consistent with the SFC’s current disciplinary powers in respect of breaches of its code, guidelines and circulars with respect to licensed corporations.

[20] Note that under the existing SFO Licensing Regime, one of the licensing requirements relating to “security tokens” require SFO-licensed Platform Operators to only admit security tokens that are (i) asset-backed; (ii) approved or registered with regulators in comparable jurisdictions; and (iii) with a post-issuance track record of 12 months. The SFC has revisited this provision in the Consultation Paper. Considering the changes in the market landscape and the emergence of tokenised securities, the SFC has decided to remove this requirement, and going forward, the VATP Guidelines and future SFC guidance on distribution of security tokens will apply.

[21] The VATP Guidelines have provided some factors to assist Platform Operators to determine whether a virtual asset constitutes a “complex products”; for instance, whether the virtual asset is a derivative product; whether there is a risk of losing more than the amount invested; whether there are any features of the virtual asset that might render the investment illiquid or difficult to value; and whether any features or terms of the virtual asset could fundamentally alter the nature or risk of the investment or pay-out profile or include multiple variables or complicated formulas to determine the return (such as investments that incorporate a right for the issuer to convert the instrument into a different investment).

[22] “Unhosted wallets” refer to software or hardware that enables a person to store and transfer virtual assets on his/her behalf, with a private key controlled or held by that person.

[23] See paragraphs 12.7.6, 12.8.1 to 12.8.3 in Chapter 12 of the VASP AML/CFT Guidelines.

[24] Securities and Futures (Financial Resources) Rules (Cap. 571N), available at https://www.elegislation.gov.hk/hk/cap571N?xpid=ID_1438403475924_002

[25] Note that the SFC has proposed to introduce an exception to this restriction under the Consultation Paper, such that Platform Operators will be allowed to engage in off-platform back-to-back transactions entered into by the Platform Operator, and any other limited circumstances approved by the SFC on a case-by-case basis. Please refer to Section II of this client alert, under the sub-heading “Proprietary Trading”.

The following Gibson Dunn lawyers prepared this client alert: William Hallatt, Arnold Pun, Becky Chung, and Jane Lu.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. If you wish to discuss any of the matters set out above, please contact any member of Gibson Dunn’s Digital Asset Taskforce or the Global Financial Regulatory team, including the following authors in Hong Kong and Singapore:

William R. Hallatt – Hong Kong (+852 2214 3836, [email protected])

Grace Chong – Singapore (+65 6507 3608, [email protected])

Emily Rumble – Hong Kong (+852 2214 3839, [email protected])

Arnold Pun – Hong Kong (+852 2214 3838, [email protected])

Becky Chung – Hong Kong (+852 2214 3837, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.