Omnibus Simplification Package Proposed by the EU Commission: Scaling Back Sustainability Reporting and Due Diligence Obligations

Client Alert | February 28, 2025

The First Omnibus Package proposes to scale back sustainability reporting obligations under the CSRD as well as due diligence obligations under the CSDDD. According to the European Commission, it aims to prevent regulatory uncertainty, avoid unnecessary compliance costs, and provide companies with a clear, realistic and manageable path towards transition, which meets their sustainability obligations.

Since the announcement by the President of the European Commission, Ursula von der Leyen, on November 8, 2024, of a “drasti[c] reduc[tion] [of] administrative, regulatory and reporting burdens” in the EU, there has existed persistent speculation about a potential reform. In particular, there have been questions as to what proposals the European Commission might make to amend two of the European Union’s flagship Sustainability Directives: the Corporate Sustainability Reporting Directive (CSRD)[1] and the Corporate Sustainability Due Diligence Directive (CSDDD)[2], both of which we have previously reported on here and here, as well as here. This week, on February 26, 2025, the European Commission presented its proposal in the form of the “First Omnibus Package”.[3]

In this client alert, we set out our initial analysis of the proposed amendments in the First Omnibus Package and the implications for in-scope businesses. We consider proposed amendments to (i) CSRD Reporting; and (ii) to the CSDDD obligations and enforcement regime.

As the legislative process unfolds, we will continue to monitor and report on any new developments.

1. Executive Summary

The First Omnibus Package is split into two separate proposals: (i) a Postponement Directive[4] to delay certain reporting obligations and due diligence obligations, and (ii) an Amendment Directive[5] to revise key elements of the EU’s sustainability reporting and due diligence frameworks.

The European Commission’s proposals must still be submitted to the European Parliament and the Council as part of the ordinary legislative process (Level 1 legislation).

It is expected that the Postponement Directive is less controversial and, therefore, likely to be adopted faster to ensure that companies are not required to implement reporting or due diligence obligations that may potentially soon be revised or lifted. This is highlighted in Article 3 of the Postponement Directive which requires the Member States to adopt laws implementing the Directive into force by December 31, 2025.

The Amendment Directive, in contrast, will most likely cause lengthy negotiations. It seeks to adjust the CSRD’s scope, reporting requirements, and assurance obligations and narrows the due diligence measures required under the CSDDD to reduce complexity and improve consistency with other EU legislation.

Overall, the most significant changes proposed by the First Omnibus Package, compared with the original texts, are as follows:

CSRD Reporting

- For the CSRD, entry into application is generally postponed by two years (except for public interest entities to which it already applies for financial year 2024), i.e. applying first to reporting on financial years 2027 (in 2028) onwards. Furthermore, an additional requirement of 1,000 employees is supposed to reduce the in-scope undertakings by approx. 80 %. The threshold for reporting on non-EU parent companies is increased to a net turnover of EUR 450 million of these non-EU companies in the EU.

- It is further proposed to significantly reduce the data points under the EU Sustainability Reporting Standards (ESRS). Also, no additional sector-specific reporting standards shall be adopted.

- Taxonomy reporting is limited to undertakings with an EU net turnover exceeding EUR 450 million and more than 1,000 employees, also expected to result in a reduction of in-scope undertakings by approximately 80 %. Also, the reporting templates shall be drastically simplified, leading to a reduction of data points by almost 70 %.

CSDDD

- For the CSDDD, entry into application will be postponed by one year, i.e. it shall apply to the first group of companies mid-2028. The in-scope companies remain unchanged.

- With explicit reference to the German Supply Chain Due Diligence Act (SCDDA) as an example, due diligence obligations are significantly reduced. In particular, they will generally be limited to companies’ own operations and direct business partners, unless there is “plausible information” suggesting adverse impacts by indirect business partners.

- There is no longer a (harmonized) requirement that a company can be held liable for damages in case of non-compliance with the CSDDD, but the various national civil liability regimes shall apply.

- Also, the original obligation for EU Member States regarding representative actions by trade unions or NGOs is revoked.

- Obligations regarding Climate Transition Plans will be limited to an adoption; to “put into effect” is no longer required.

The proposed amendments in the First Omnibus Package first and foremost will most probably give enterprises more time to prepare for CSRD reporting and CSDDD compliance. It is, however, too early to rely on the proposed amendments in substance. Generally, it can be expected that CSRD and taxonomy reporting requirements will be substantially reduced. While it will make sense to monitor the new definition of in-scope entities, the substantive reporting requirements are still subject of further discussion. Regarding CSDDD, companies should not overlook the fact that the remaining obligations will still involve considerable effort and require thorough preparation until the implementation of the CSDDD. Companies subject to already existing supply chain laws in countries such as Germany and France, can attest to the extensive demands these obligations impose.

2. CSRD Reporting

The proposed amendments in the First Omnibus Package will significantly change when and to what extent companies need to disclose information in the context of the CSRD, including which companies will be required to report. In the following, we (a) will discuss changes in the area of sustainability reporting; (b) changes regarding taxonomy disclosures; and (c) will address the implications of conflicts between the suggested amendments and already transposed legislation in the EU Member States.

(a) Proposed Amendments relating to Sustainability Reporting

The First Omnibus Package proposes amendments to the CSRD, the Directive on the Annual Financial Statements, Consolidated Financial Statements and Related Reports of Certain Types of Undertakings (Accounting Directive)[6], and the Directive on Statutory Audits of Annual Accounts and Consolidated Accounts (Audit Directive)[7]. These amendments will significantly change the requirements for sustainability reporting companies have to adhere to.

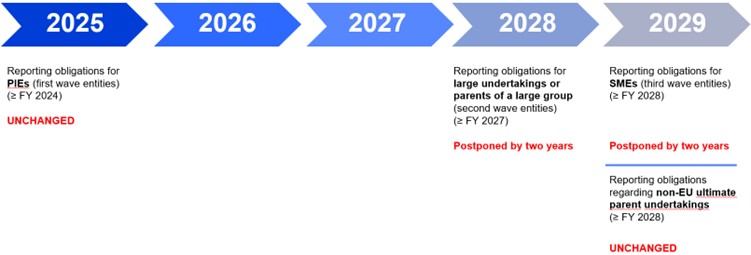

Two-Year Delay for Companies to Start Reporting, No Retroactive Effect for PIEs Reporting in 2025

The Commission’s Postponement Directive proposes a two-year delay for companies that are not yet obliged to report under the CSRD.

- This affects large undertakings and parent undertakings of a large group not classified as public interest entities (PIEs) which would have reported for the first time in 2026 for the financial year 2025. Under the Postponement Directive, their reporting obligation will not start until 2028 for financial years beginning on or after January 1, 2027 (“second wave entities”).

- It also applies to listed small and medium-sized enterprises (SMEs), originally set to report for the financial year 2026, whose reporting will be deferred to financial years starting in 2028 (“third wave entities”).

- Notably, however, this delay does not affect companies already subject to CSRD reporting obligations, such as public interest entities reporting for the first time this year for financial years starting in 2024 (“first wave entities”).

- Furthermore, the European Commission has not proposed delaying reporting obligations regarding non-EU ultimate parent undertakings under Article 40a Accounting Directive.

|

Significant Reduction of Scope of Application

As part of its Amendment Directive, the Commission proposes to significantly narrow the scope of the CSRD. The reporting obligation is now limited to large companies or the parent company of a large group with more than 1,000 employees and either a net turnover of more than EUR 50 million or a balance sheet total of more than EUR 25 million. As a result, around 80 % of companies previously expected to be in scope will no longer be subject to mandatory sustainability reporting. This major shift excludes large undertakings with up to 1,000 employees (including PIEs from the first wave and large companies from the second wave) as well as all listed SMEs (previously part of the third wave). By eliminating the distinction between listed and non-listed undertakings, the proposal aligns with the Capital Markets Union’s goal of enhancing the attractiveness of EU-regulated markets as a financing source. Notably, the exclusion of large PIEs is part of the Amendment Directive and not the Postponement Directive, thus unlikely creating a retroactive effect for companies already reporting this year (namely large undertaking public interest entities with more than 500 employees).

With regard to reporting on non-EU ultimate parent companies, the new Article 40a of the Accounting Directive raises the net turnover threshold for non-EU undertakings from EUR 150 million to EUR 450 million, increases the EU branch threshold from EUR 40 million to EUR 50 million, and limits the requirement to report on their ultimate non-EU parent to large subsidiary undertakings as defined in the Amendment Directive.

The previously leaked proposal to raise the net turnover threshold for EU undertakings to EUR 450 million was scrapped in the official draft. Instead, the revised scope locks in the existing thresholds, while adding a 1,000-employee requirement. As the Commission states, “this revised threshold would align the CSRD more closely with the CSDDD“, signaling a decisive move toward streamlining EU sustainability regulations and drastically narrowing the number of affected companies.

Voluntary Reporting Standards and Strengthened Value-Chain Cap

As part of its Amendment Directive, the Commission introduces a new voluntary reporting standard for companies no longer subject to mandatory CSRD reporting. Based on the voluntary sustainability reporting standard for non-listed micro, small and medium enterprises (VSME) by EFRAG, these new standards will be adopted as a delegated act, with a Commission recommendation to follow soon.

The Commission also envisioned the new standards to act as a shield for companies no longer in scope of the CSRD (e.g. companies with up to 1,000 employees) that are part of the value chain of a reporting entity. When reporting on their value chain, companies may not request information beyond that described in the new voluntary reporting standards. This way, the European Commission hopes to substantially reduce the trickle-down effect.

It should be noted, however, that the Delegated Act to provide for these standards will not be adopted until after the Amendment Directive enters into force. Drafting the VSME, for example, took about two years due to public consultation. Therefore, while a delegated act as a non-legislative level 2 instrument is not as time-consuming as a Level 1 legislative act, there is a possibility that the new standards will not enter into force until 2028. By then, large in-scope companies are already required to publish their sustainability statements.

Further Simplifications and Cost Reductions

The Amendment Directive introduces several additional measures to ease reporting burdens under the current legal regimes. One important measure is the planned revision of the European Reporting Standards (ESRS) to substantially reduce the number of required data points and improve consistency across EU legislation, at the latest six months after the entry into force of the Amendment Directive. While a revision is likely less time-consuming than a new draft, it can be expected that the European Commission will need at least 1.5 years to finalize the legislative process for the respective delegated act. Nevertheless, we expect the revision to significantly limit the reporting burden on companies.

Additionally, the Amendment Directive eliminates the Commission’s empowerment to adopt sector-specific reporting standards, preventing an increase in prescribed data points for reporting undertakings and ending a state of uncertainty as these standards were meanwhile delayed.

Another significant simplification with a crucial impact on reporting costs is the removal of the reasonable assurance standard whose adoption was initially envisaged for 2028. In addition, instead of a binding obligation to adopt sustainability assurance standards by 2026, the European Commission will issue targeted assurance guidelines, allowing for a more flexible response to emerging issues and avoiding unnecessary compliance burdens.

(b) Proposed Amendments to Taxonomy Reporting

While the proposed directives do not provide for explicit changes to the EU Taxonomy Directive, the Omnibus proposal does provide for changes to the Accounting Directive and the Taxonomy Delegated Regulations which will affect the EU Taxonomy reporting requirements.

Mandatory Taxonomy Reporting Thresholds

The proposal introduces a new threshold for mandatory taxonomy reporting. Only large undertakings with an EU net turnover exceeding EUR 450 million and more than 1,000 employees will be required to report their alignment with the EU Taxonomy. This change is expected to result in approximately 80 % of companies no longer being required to report their alignment against the EU Taxonomy. The significant reduction in the number of companies subject to mandatory reporting aims to alleviate the compliance burden on smaller and mid-sized enterprises.

Simplification of the Reporting Templates

The European Commission plans to amend the Taxonomy Disclosures Delegated Act and the Taxonomy Climate and Environmental Delegated Acts to drastically simplify the reporting templates. This simplification will lead to a reduction of data points by almost 70 %, significantly easing the reporting burden for companies. Furthermore, companies will be exempt from assessing the taxonomy-eligibility and alignment of their economic activities that are not financially material for their business, such as those not exceeding 10 % of their total EU turnover, capital expenditure, or total assets. This targeted materiality approach – similar to the reporting approach under the ESRS – ensures that companies focus their reporting efforts on the most relevant and impactful areas of their business.

Voluntary Taxonomy Reporting for large Companies below Threshold

For large companies that have more than 1,000 employees but an EU net turnover below EUR 450 million, the proposal prescribes voluntary taxonomy reporting. These companies will not be obligated to report their alignment with the EU Taxonomy but may choose to do so if they find it beneficial. This voluntary approach allows companies to communicate their sustainability efforts without the pressure of mandatory disclosures, potentially attracting investments by showcasing their progress towards sustainability goals.

Partial Taxonomy-Alignment Reporting

The proposal also introduces the option for companies that have made progress towards sustainability targets but only meet certain EU Taxonomy requirements to voluntarily report on their partial taxonomy-alignment. This flexibility is designed to encourage companies to disclose their sustainability efforts even if they do not fully meet all the criteria of the EU Taxonomy. The Omnibus proposal mandates the European Commission to develop delegated acts to ensure standardization in terms of the content and presentation of this partial alignment reporting, providing clear guidelines for companies to follow.

Simplification of the “Do No Significant Harm” Criteria

Lastly, the Commission seeks to simplify the most complex “Do No Significant Harm” (DNSH) criteria for pollution prevention and control related to the use and presence of chemicals. These criteria apply horizontally to all economic sectors under the EU Taxonomy. The proposed simplifications aim to make it easier for companies to comply with the DNSH requirements without compromising environmental standards. The public consultation invites stakeholders to provide feedback on two alternative options for simplifying these criteria, ensuring that the final amendments reflect the needs and concerns of the business community.

(c) Conflict with Already Transposed Member States Legislation

Certain EU Member States (Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia, Sweden) have already transposed the current version of the CSRD, thereby implementing the “old” thresholds, reporting requirements and timelines. We provide regular updates on the status of transposition of the CSRD in our monthly ESG Updates. This raises the question whether companies in these jurisdictions have to comply with the current version of CSRD legislation. Technically, these laws apply, and Member States are, in principle, not prevented from introducing stricter requirements than those provided for by an EU Directive.

However, we would expect that, as a first step, the reporting obligations for all entities other than public interest entities will be suspended before they come into effect under the Postponement Directive. As stated above, we expect that the Postponement Directive will be adopted rather quickly. Article 3 of that Directive requires Member States to implement laws necessary to comply with the two-year delay before December 31, 2025, i.e., before the reporting obligations for any undertakings and groups other than public interest entities apply. Even if national legislators fail to transpose the Postponement Directive in time, we would expect that national authorities will refrain from enforcing the requirements under the current CSRD laws against such entities with a view to the discussion on the Omnibus proposal.

Regarding the scope of sustainability reporting for already in-scope public interest entities, the assessment is less straight forward. The proposed changes to the scope of application, the reporting requirements and other substantial issues are covered in the Amendment Directive which is expected to take more time until it enters into force. There is no clear answer as to how EU Member States will handle this issue. While they could decide to refrain from enforcing reporting obligations until the Amendment Directive has been approved, it is also possible for them to insist on compliance with their national laws until that date.

In this context, it should also be noted that some EU Member States already have imposed more strict reporting requirements, opting for so-called “gold-plating” in the area of sustainability reporting. Therefore, it is possible that after the Amendment Directive enters into force, some EU Member States will require more detailed reporting than stipulated at EU level. However, we consider this risk to be low in light of the strong resistance from EU Member States, e.g. Germany, France and others who have warned of too much bureaucracy and an unreasonable reporting burden on companies and explicitly supported the European Commission’s plan to simplify sustainability reporting.

3. The CSDDD

While there are many proposed changes with respect to the CSDDD, as outlined below, the companies defined as “in scope” have remained the same, i.e. there have been no changes to the thresholds. We note, however, that it is proposed to delete the review clause on inclusion of financial services in the scope of the CSDDD.

CSDDD’s extraterritorial reach to U.S. based companies has recently been challenged in a letter signed by several members of the U.S. House of Representatives to the U.S. Treasury Secretary and Director of the National Economic Council and may become a negotiating topic in U.S.-EU trade negotiations.

(a) Proposed Amendments to the CSDDD

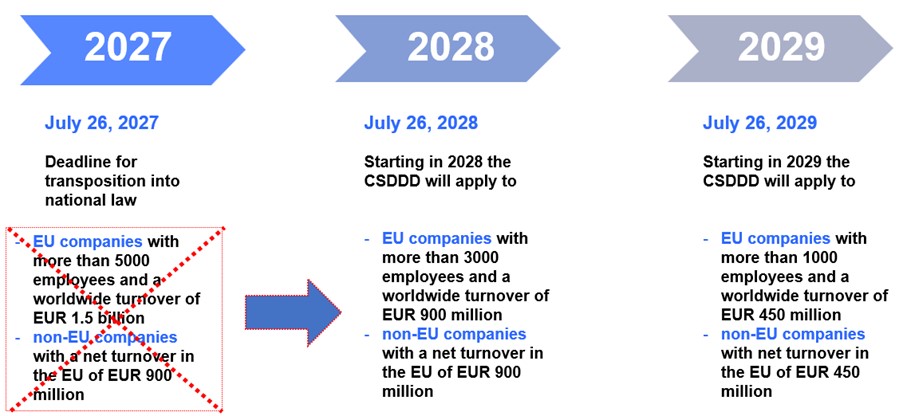

Postponement of Application for One Year

According to the proposed Postponement Directive the deadline for EU Member States to transpose the CSDDD into national law will be postponed by one year to July 26, 2027. Consequently, the first entry into application of the CSDDD obligations will also start one year later, on July 26, 2028. In other words, there will no longer be a separate timeline for entry into application for the largest EU and non-EU companies as originally foreseen:

|

Narrowing the Scope in Companies’ Supply Chains

Explicitly inspired by the German SCDDA, obligations in the supply chain will be narrowed, to companies’ own operations and direct business partners. Companies will only be required to assess adverse impacts of indirect business partners if there is “plausible information” suggesting that adverse impacts have arisen or may arise there. Without such knowledge, an in-scope company will not be obliged to proactively review the supply chain further downstream. The European Commission explains that this change “[r]eliev[es] companies from the obligation to systematically conduct in-depth assessments of adverse impacts that occur or may occur in often complex value chains at the level of indirect business partners …”.[8]

In connection with limited obligations in the supply chain, the Amendment Directive also proposes to limit the information that in-scope companies may request from their SME and small midcap business partners (i.e. companies with less than 500 employees) to the information specified in the CSRD voluntary sustainability reporting standards.

Further, the reduction of obligations within the supply chain is also reflected in the proposed amendments to stakeholder engagement. Companies will be able to limit their engagement to “relevant” stakeholders in certain areas of the due diligence process, i.e. with workers, their representatives and individuals and communities whose rights or interests are or could be directly affected by the products, services and operations of the company, its subsidiaries and its business partners, and that have a link to the specific stage of the due diligence process being carried out.

Companies shall ensure compliance with due diligence standards focusing on human rights and the environment further down supply chains through their codes of conduct (“contractual cascading”).

Private and Public Enforcement

In terms of private and public enforcement, the Amendment Directive provides for three notable proposed changes:

Firstly, in terms of private enforcement, it is significant that the requirement for harmonized EU-wide civil liability regime for damages will be abolished. Thus, private enforcement is deferred to the civil liability regime of each EU Member State, which need to ensure that, if companies are held liable in case of non-compliance with the due diligence requirements under the CSDDD, the injured parties will have a right to full compensation. Further, national law is left to define whether its civil liability provisions override otherwise applicable rules of the third country where any harm occurs.

Secondly, it is also highly notable that the obligations for EU Member States regarding representative actions by trade unions or NGOs are revoked. National law will be able to support both actions brought directly by injured parties or representative actions to reflect different rules and traditions in EU Member States.

Lastly, regarding public enforcement, penalties for violations, which could be imposed by national “Supervisory Authorities” in EU Member States, will no longer be linked to 5 % of the in-scope company’s global net turnover.

Climate Transition Plans aligned with CSRD

Concerning the much-discussed requirement under the existing CSDDD to “put into effect” a Paris Agreement-aligned Climate Transition Plan, this obligation has been softened so that requirements for climate mitigation are now aligned with the CSRD. Whilst the “put into effect” part is dropped, the adoption of a Climate Transition Plan would still be required.

Remedial Measures and Periodic Assessments

The Omnibus Package also proposes to remove the obligation to be imposed on a company to terminate the business relationship as a last resort measure. Additionally, the interval between periodic assessments will be prolonged, extending the period from one year to five years.

(b) Key CSDDD Implications for In-Scope Companies

In summary, the proposed amendments in the First Omnibus Package are helpful for companies in terms of deregulating obligations and reducing complexity in their supply chains.

Nevertheless, companies should not overlook the fact that the remaining obligations will still involve considerable effort and require thorough preparation until the actual implementation of the CSDDD. Companies subject to already existing supply chain laws in countries such as Germany and France, can attest to the extensive demands these obligations impose.

Considering the strong alignment and similarity in many parts with the German SCDDA, especially after removing the main differences in scope and civil liability regime, two years of experience with the German law should and can be utilized by companies to leverage valuable insights gained from the enforcement of the German SCDDA.

To assist in-scope companies with preparations, the European Commission has committed to providing guidelines a year earlier, in July 2026, which provides more valuable time for companies to get aligned with the CSDDD.

[1] Directive (EU) 2022/2464.

[2] Directive (EU) 2024/1760.

[3] See EU Commission Press Release of February 26, 2025, available at https://ec.europa.eu/commission/presscorner/detail/en/ip_25_614, last accessed on February 28, 2025.

[4] COM(2025) 80 final, 2024/0044 (COD) – Directive of the European Parliament and of the Council amending Directives (EU)2022/2462 and (EU) 2024/1760 as regards the dates from which the Member States are to apply certain corporate sustainability reporting and due diligence requirements.

[5] COM(2025) 81 final, 2024/0045 (COD) – Directive of the European Parliament and of the Council amending Directives 2006/43/EC, 2013/34/EU, (EU) 2022/2462 and (EU) 2024/1760 as regards certain corporate sustainability reporting and due diligence requirements.

[6] Directive (EU) 2013/34.

[7] Directive (EU) 2006/43.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s ESG: Risk, Litigation, and Reporting, Transnational Litigation, or International Arbitration practice groups, or the authors:

Ferdinand Fromholzer – Partner, ESG Group,

Munich (+49 89 189 33-270, ffromholzer@gibsondunn.com)

Robert Spano – Co-Chair, ESG Group,

London/Paris (+33 1 56 43 13 00, rspano@gibsondunn.com)

Susy Bullock – Co-Chair, ESG Group,

London (+44 20 7071 4283, sbullock@gibsondunn.com)

Stephanie Collins – London (+44 20 7071 4216, scollins@gibsondunn.com)

Carla Baum – Munich (+49 89 189 33-263, cbaum@gibsondunn.com)

Vanessa Ludwig – Frankfurt (+49 69 247 411 531, vludwig@gibsondunn.com)

Johannes Reul – Munich (+49 89 189 33-272, jreul@gibsondunn.com)

Babette Milz – Munich (+49 89 189 33-283, bmilz@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.