U.S. anti-corruption enforcement has continued apace through the first eight months of 2022. Although some will point to declining numbers of Foreign Corrupt Practices Act (“FCPA”) enforcement actions in 2022 to date, particularly against corporations, as compared to the heights of recent years, our view from the trenches is that enforcement is evolving, not fading. As evidenced by the bevvy of activity catalogued in the pages that follow, our experience is prosecutors at the U.S. Department of Justice (“DOJ”) and enforcers at the U.S. Securities and Exchange Commission (“SEC”) remain acutely focused on international anti-corruption enforcement and that the compliance challenges faced by global corporations are as complicated today as they have ever been. In addition, the expanded employment of money laundering charges has broadened prosecutors’ reach.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from the first eight months of 2022. In January 2023, we will publish our comprehensive year-end update on 2022 FCPA developments.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depositary Receipts (“ADRs”) or American Depositary Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal accounting controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal accounting controls deficiency.

International corruption also may implicate other U.S. criminal laws. Frequently, prosecutors from DOJ’s FCPA Unit charge non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Without question, the most prevalent amongst these “FCPA-related” charges is money laundering—a generic term used as shorthand for statutory provisions that generally criminalize conducting or attempting to conduct a transaction involving proceeds of “specified unlawful activity” or transferring funds to or from the United States, in either case to promote the carrying on of specified unlawful activity, to conceal or disguise the nature, location, source, ownership or control of the proceeds, or to avoid a transaction reporting requirement. “Specified unlawful activity” includes over 200 enumerated U.S. crimes and certain foreign crimes, including the FCPA, fraud, and corruption offenses under the laws of foreign nations. Although this has not always been the case, in recent history, DOJ has frequently deployed the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is not unusual for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

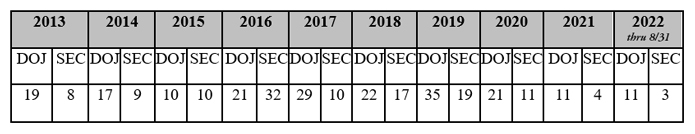

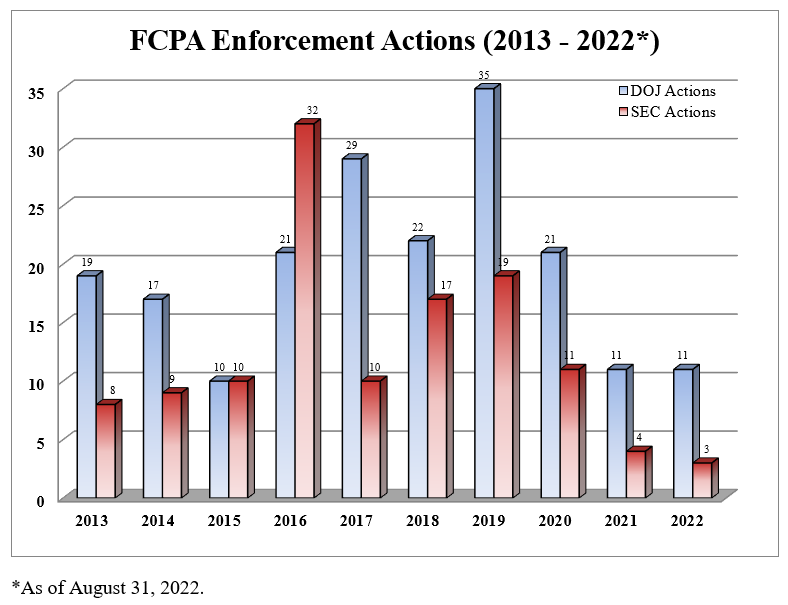

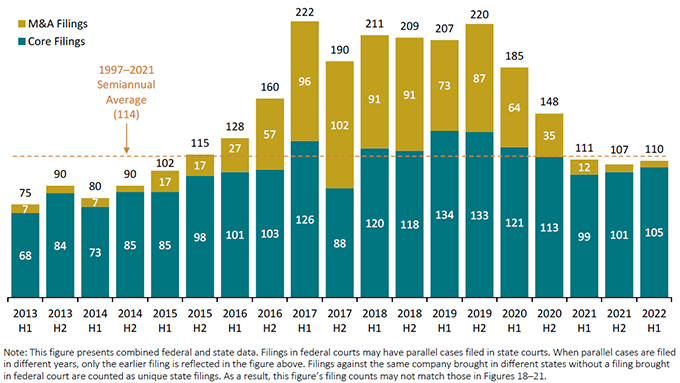

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, during the past 10 years.

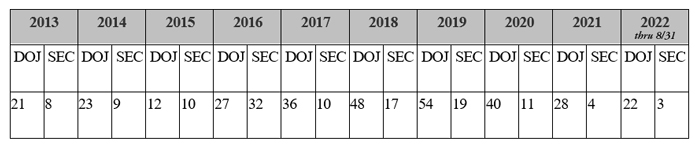

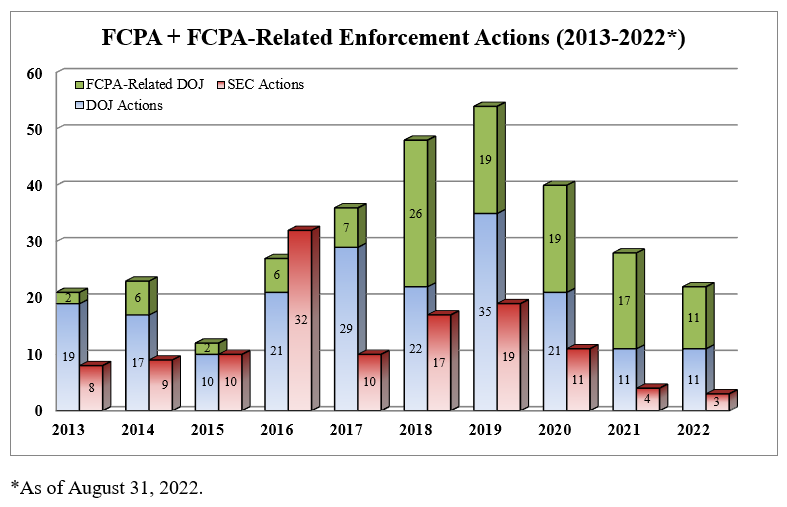

But as our readers know, the number of FCPA enforcement actions represents only a piece of the robust pipeline of international anti-corruption enforcement efforts by DOJ. Indeed, the increasing proportion of “FCPA-related” charges in the overall enforcement docket of FCPA prosecutors is a trend we have been remarking upon for years. In total, DOJ brought 11 such FCPA-related actions in the first eight months of 2022, bringing the overall count to 22 cases that DOJ’s FCPA unit filed, unsealed, or otherwise joined since the beginning of the year. The past 10 years of FCPA plus FCPA-related enforcement activity is illustrated in the following table and graph.

2022 MID-YEAR FCPA + FCPA-RELATED ENFORCEMENT ACTIONS

CORPORATE ENFORCEMENT ACTIONS

Through August, there were three corporate FCPA enforcement actions from each of DOJ and the SEC in 2022, which is on par with the corporate enforcement activity for all of 2021 but still down from recent historical trends. There have been additional resolutions in September not covered herein, and we will continue tracking the pace of corporate FCPA enforcement in our forthcoming year-end update and beyond to see if this is a momentary lull or a longer-term trend. In the meantime, the five companies subject to FCPA enforcement in the year to date follow.

Tenaris S.A.

Most recently, on June 2, 2022, Luxemburg-based global steel pipe supplier Tenaris, an ADR-issuer, consented to the entry of an administrative cease-and-desist order by the SEC to resolve FCPA bribery, books and records, and internal controls charges. According to the SEC’s Order, between 2008 and 2013, agents and employees of Tenaris’s Brazilian subsidiary paid approximately $10.4 million in bribes to a high-ranking procurement manager at Brazil’s state-owned oil and gas company Petróleo Brasileiro S.A. (“Petrobras”) to persuade the procurement manager not to open up the subsidiary’s ongoing pipe supply project to competition, ultimately leading to the award of over $1 billion in contracts. To resolve the charges, Tenaris agreed to pay more than $78 million, consisting of approximately $42.84 million in disgorgement, $10.26 million in prejudgment interest, and a $25 million civil money penalty. Tenaris also agreed to self-report to the SEC for two years on the status of its remediation and implementation of compliance measures related to its compliance program and accounting controls. As we have discussed in earlier updates, Gibson Dunn represented Petrobras and successfully negotiated a non-prosecution agreement with DOJ and an SEC resolution and navigated seamlessly a three-year self-monitorship.

According to a statement released by Tenaris, DOJ closed its investigation into this matter without taking action. Notably, this is Tenaris’s second brush with the FCPA, having resolved dual FCPA enforcement actions with DOJ and the SEC in 2011 arising out of alleged corruption in Uzbekistan.

Glencore International A.G.

Undoubtedly the bombshell FCPA enforcement matter of 2022-to-date came on May 24, when Swiss multinational commodity trading and mining company Glencore resolved criminal FCPA bribery charges in seven African and Latin American countries. Simultaneously, Glencore entered into a parallel criminal and civil market manipulation resolution with a different unit of DOJ’s Fraud Section and the U.S. Commodity Futures Trading Commission (“CFTC”) founded, in part, on the same conduct, in addition to separate anti-corruption resolutions with Brazilian and UK authorities. According to the corruption-related allegations, from 2007 to 2018, Glencore provided more than $100 million in payments and other items of value to intermediaries for the purpose of bribing foreign officials in Brazil, Cameroon, the Democratic Republic of the Congo, Equatorial Guinea, Ivory Coast, Nigeria, and Venezuela to obtain contracts and other benefits.

The assessment of criminal and civil penalties against Glencore for the web of related resolutions involves a complex set of credits and offsets, but in total Glencore is expected to pay approximately $1.5 billion to resolve all of the matters. The total payment to U.S. enforcement agencies is expected to be $1.02 billion, of which approximately $700.7 million is allocable to the FCPA case comprised of a criminal fine of $428.521 million and criminal forfeiture of $272.186 million. On top of that, Glencore agreed to pay $39.6 million to the Brazilian Federal Prosecutor’s Office, and as discussed below in our UK Enforcement Update, a subsidiary pleaded guilty to UK Bribery Act charges and is scheduled to be sentenced in November 2022. Glencore has stated that the resolution in the UK, and other pending proceedings in the Netherlands and its home country of Switzerland, are together expected to increase the overall resolution to $1.5 billion. Additionally, Glencore agreed to a three-year compliance monitor in connection with the FCPA resolution and a separate three-year compliance monitor in connection with the market manipulation resolution, the scope of which are still being negotiated.

Beyond the sheer size of the matter, there are numerous notable aspects to the Glencore resolution:

- First, Glencore is neither a U.S. company nor issuer (hence, no SEC resolution), and DOJ’s FCPA jurisdiction appears to be premised loosely on the approval of certain payments by employees (including former West African oil trader Anthony Stimler, who pleaded guilty to FCPA charges as covered in our 2021 Year-End FCPA Update) while in the United States, the transmittal of at least one email from the United States by Stimler, and the use of U.S. correspondent banking accounts for at least some of the alleged bribe payments. The details of DOJ’s allegations and jurisdictional theories are not fully fleshed out in the corporate charging documents, but DOJ’s approach seems to be that a multi-country corruption conspiracy taking place largely outside of the United States may be brought within U.S. jurisdiction in its entirety due to correspondent banking transactions or through a single act taken by one co-conspirator while in the United States, potentially even a low-level trader involved in one spoke of the alleged conspiracy.

- Second, although there is precedent in corporate FCPA enforcement actions for relatively modest criminal forfeiture actions to accompany criminal fines, generally offset in the criminal fine calculation, Glencore is the first of which we are aware in which the amount of gain was used by DOJ both as the primary input for the Guidelines fine and, on top of that, disgorged by DOJ through parallel forfeiture. In this manner, DOJ not only applied a criminal penalty, which is customary, but it also disgorged all allegedly tainted profits, which is not customary in a non-issuer case (i.e. where the SEC is not involved). While DOJ has applied forfeiture in a limited way in some FCPA cases, this appears to be the first time it has required a company to disgorge all ill-gotten gain in the absence of a parallel SEC action. This practice has precedent in other types of white collar corporate cases, particularly by prosecutors in the Southern District of New York, but not to our knowledge in the FCPA cases.

- Third, as noted above, a part of the CFTC’s charges were founded on the same alleged corruption conduct covered in the DOJ FCPA resolution, making this the second time that the CFTC has charged corruption as “manipulative and deceptive conduct” under the Commodity Exchange Act. The first instance was the case against Vitol, Inc., covered in our 2020 Year-End FCPA Update, which arose out of the same fact pattern.

Stericycle, Inc.

The only dual FCPA enforcement action to date in 2022 came on April 20, when Illinois-based waste management company Stericycle resolved FCPA bribery and accounting charges with DOJ and the SEC arising from allegations of corruption in Argentina, Brazil, and Mexico. The charging documents collectively allege that, between 2011 and 2016, Stericycle representatives paid approximately $10.5 million in bribes to government officials to obtain contracts and other benefits that cumulatively netted the company approximately $21.5 million in profits.

To resolve the criminal charges, Stericycle entered into a deferred prosecution agreement with a $52.5 million penalty and requiring the imposition of a compliance monitor for a two-year term. The SEC resolution requires the disgorgement of approximately $28 million in profits and prejudgment interest, together with the imposition of the same compliance monitor. In addition, Stericycle entered into a parallel $9.3 million resolution with Brazil’s Controladoria-Geral da União and the Advocacia-Geral de União, which after offsets in the DOJ / SEC resolutions will net out to a total resolution of approximately $84 million. Parallel United States and Brazilian enforcement actions, such as seen here, have become commonplace.

Jardine Lloyd Thompson Group Holdings Ltd.

On March 18, 2022, DOJ announced its first “declination with disgorgement” FCPA resolution in nearly two years, with UK insurance company JLT Group. DOJ’s declination letter asserted that it had found evidence that JLT Group, through an employee and its agents, paid approximately $3.15 million in alleged bribes to Ecuadorian officials between 2014 and 2016, through an intermediary based in Florida, in order to obtain or retain insurance contacts with Ecuadorian state-owned surety Seguros Sucre. The underlying conduct is the same covered in our 2020 Mid-Year FCPA Update where we reported on the prosecution of four defendants—including former JLT Group executive Felipe Moncaleano Botero—in the Southern District of Florida for money laundering conspiracy.

DOJ declined to prosecute based on JLT Group’s voluntary disclosure of the misconduct, full and proactive cooperation, prompt and comprehensive remediation, and agreement to disgorge just over $29 million in alleged improper gains. JLT Group affiliates also reached resolutions with Colombian and UK authorities, as covered below in our international enforcement developments section. Gibson Dunn represented JLT Group in obtaining the DOJ declination, and in the international resolutions.

KT Corporation

First in but last up, the initial FCPA corporate enforcement action of 2022 came on February 17, when Korea’s largest telecommunications operator and ADS issuer KT Corporation resolved FCPA books-and-records and internal controls charges with the SEC. According to the administrative cease and desist order, KT Corporation maintained multiple “slush funds” between 2009 and 2017, from which it made illegal contributions to legislative officials in Korea who sat on committees with influence over the telecommunications industry and also to Vietnamese government officials to receive contracts.

Without admitting or denying the allegations, KT Corporation agreed to settle with a $3.5 million civil penalty and the disgorgement of $2.8 million in profits plus prejudgment interest. KT Corporation also will self-report on FCPA compliance remediation for a two-year term. There is no indication to date of a parallel DOJ enforcement action.

INDIVIDUAL ENFORCEMENT ACTIONS

There were FCPA and FCPA-related charges filed or unsealed, or in which DOJ FCPA prosecutors first entered an appearance, against 19 individual defendants during the first eight months of 2022.

Additional PDVSA Charges

In recent years, we have covered numerous corruption-related fact patterns arising out of international business dealings with Venezuela’s state-owned and state-controlled oil company, Petróleos de Venezuela, S.A. (“PDVSA”). The first eight months of 2022 was no exception to this longstanding trend.

On March 8, 2022, a grand jury sitting in the Southern District of Florida indicted two former senior prosecutors from the anti-corruption division of the Venezuelan Attorney General’s Office, Daniel D’Andrea Golindano and Luis Javier Sanchez Rangel, for allegedly laundering $1 million in bribes through a bank account in Florida. The indictment asserts that Rangel and Golindano accepted payments from a contractor that was itself under investigation by the Attorney General’s Office for allegedly receiving over $150 million in contracts from PDVSA entities, in exchange for closing the investigation without seeking criminal charges against the contractor. The defendants have yet to make an appearance in court and have been transferred to fugitive status.

In a separate alleged PDVSA-related scheme, on June 23, 2022, Jhonnathan Marin, former Mayor of Guanta, Venezuela, pleaded guilty to a single count of money laundering conspiracy. According to the criminal information, between 2015 and 2017, Marin accepted $3.8 million in bribes from an unnamed PDVSA contractor to influence several PDVSA joint ventures operated in the port town area to award tens of millions of dollars’ worth of business to the contractor. Marin currently awaits a September 2022 sentencing date before the Honorable Robert N. Scola, Jr. of the U.S. District Court for the Southern District of Florida.

In a third case involving PDVSA, on July 12, 2022 a grand jury sitting in the Southern District of Florida returned an indictment charging financial asset managers—Ralph Steinmann and Luis Fernando Vuteff—with participating in the $1.2 billion “Operation Money Flight” PDVSA currency conversion / embezzlement scheme that we first covered in our 2018 Year-End FCPA Update. The genesis of the scheme arises from the substantial difference between the official and unofficial rates at which Venezuelan bolivars could be exchanged for U.S. dollars, with members of the scheme causing PDVSA to enter into contracts to convert bolivars at the “unofficial rate” of 60:1, then back into dollars at the official rate of 6:1, thereby instantly increasing the outside investment tenfold at the expense of PDVSA and with the assistance of corrupt payments. For their part, Steinmann and Vuteff are each charged with one count of money laundering, with the indictment alleging that between 2014 and 2018 they laundered more than $200 million in proceeds from the scheme, including by opening bank accounts on behalf of Venezuelan government officials to receive the alleged bribe payments. Vuteff has reportedly been arrested and is pending extradition from Switzerland. Steinmann is not before the court and DOJ has asserted that he is a fugitive.

Finally, in yet another case involving a still different PDVSA corruption fact pattern, on August 24, 2022, a grand jury sitting in the Southern District of Florida returned an indictment charging Venezuelan businessman Rixon Rafael Moreno Oropeza with money laundering offenses in connection with an alleged bribery scheme involving Petropiar, a joint venture between PDVSA and a U.S. oil company. Moreno is alleged to have paid millions in bribes from bank accounts in Florida to a senior Venezuelan government official and senior Petropiar employees to obtain as much as $30 million in contracts from Petropiar at prices that were inflated as much as 100-times market value. Based on public records, it does not appear that Moreno is yet in U.S. custody.

Additional Vitol & Sargeant Marine Defendants

We have been covering ongoing, and at times overlapping, investigations in Latin America involving energy trading firm Vitol Inc. and asphalt company Sargeant Marine, Inc., as well as numerous individual defendants, since our 2020 Year-End Update. In March 2022, there were several additional developments, including new charges and new FCPA Unit connections to existing charges.

On March 16, 2022, DOJ charged Dutch citizen and former Vitol trader Lionel Hanst with a single count of conspiracy to commit money laundering alleging that, from November 2014 to September 2020, Hanst laundered bribes from and on behalf of Vitol for the benefit of officials at Ecuadorian, Mexican, and Venezuelan state oil companies Empresa Publica de Hidrocarburos del Ecuador (“PetroEcuador”), Petróleos Mexicanos (“PEMEX”), and PDVSA. Hanst pleaded guilty and is awaiting sentencing before the Honorable Eric N. Vitaliano of the U.S. District Court for the Eastern District of New York.

Right around the same time, from March through May 2022, DOJ FCPA Unit prosecutors involved in the Hanst case entered appearances in several ongoing cases. Although these cases were filed in earlier years, there were no press releases nor entries of appearance by FCPA Unit members to identify them as FCPA-related enforcement actions—until this year.

In May 2021, Eastern District of New York prosecutors charged Gonzalo Guzman Manzanilla and Carlos Espinosa Barba, former employees of PEMEX’s procurement subsidiary, with conspiracy to commit money laundering in connection with the Vitol bribery scheme. The allegations are that, between 2017 and 2020, Guzman and Espinosa agreed to provide a Vitol trader with confidential, inside information on PEMEX-related bids in exchanges for bribes. Both have pleaded guilty to single counts of conspiracy to commit money laundering and also await sentencing before Judge Vitaliano.

The same DOJ FCPA Unit prosecutors entered their appearances in March 2022 in 2020 cases against brothers Antonio and Enrique Ycaza, who have each been charged with conspiracy to violate the FCPA and money laundering statutes in connection with alleged bribery that straddles the Sargeant Marine and Vitol investigations. The allegations are that, between 2011 and 2019, the brothers operated purported consulting companies that were used to funnel approximately $22 million in bribes to PetroEcuador officials on behalf of Sargeant Marine and Vitol. Like the others, the Ycaza brothers have pleaded guilty and await sentencing before Judge Vitaliano.

Finally, in May 2022, FCPA Unit prosecutors entered their appearances in additional 2020 cases against a different set of brothers, Bruno and Jorge Luz. The Luz brothers have each pleaded guilty to a single count of conspiracy to violate the FCPA’s anti-bribery provisions, associated with a scheme to create shell companies that were allegedly used to launder more than $5 million in bribes to Petrobras officials on behalf of Sargeant Marine. Like the others, the Luz brothers await sentencing before Judge Vitaliano.

Additional Odebrecht-Related Charges

We have been covering an ongoing stream of corruption charges arising from the 2016 blockbuster FCPA resolution with Brazilian construction conglomerate Odebrecht S.A. since our 2016 Year-End FCPA Update, including most recently in our 2021 Year-End FCPA Update. On March 24, 2022, another case was added to the pile with the indictment of former Comptroller General of Ecuador Carlos Ramon Polit Faggioni on six counts of money laundering. According to the indictment, between 2010 and 2016, Polit solicited and received over $10 million in bribes from Odebrecht in exchange for using his political position to benefit Odebrecht’s business in Ecuador. Although the bribery scheme took place substantially outside of the United States, the U.S. nexus is that Polit allegedly directed a member of the conspiracy to launder certain of the payments through Florida-based companies to be used to purchase and renovate properties in Florida.

Polit has pleaded not guilty and currently awaits a May 2023 trial date in the U.S. District Court for the Southern District of Florida.

Additional Corsa Coal Defendant

We covered in our 2021 Year-End FCPA Update the FCPA guilty plea of Frederick Cushmore, Jr., former Head of International Sales for an unnamed Pennsylvania-based coal company. That coal company has since identified itself as Corsa Coal, and on March 31, 2022 further charges were announced. On that date, a grand jury sitting in the U.S. District Court for the Western District of Pennsylvania indicted former Vice President Charles Hunter Hobson on seven counts of FCPA bribery, money laundering, and wire fraud conspiracy. The indictment alleges that Hobson participated in a scheme to pay $4.8 million to an agent with the intention that a portion would be used to pay bribes to officials of state-owned Egyptian company Al Nasr Company for Coke and Chemicals to procure $143 million in coal delivery contracts, and also sought to procure a percentage of the illicit payments as kickbacks for his own benefit. The indictment further alleges that Hobson and his co-conspirators communicated via encrypted messaging services, such as WhatsApp, and personal email addresses in an effort to conceal the scheme.

Hobson has pleaded not guilty and no trial date has yet been set. Corsa Coal has reported that it is cooperating with DOJ and also the Royal Canadian Mounted Police, but no public charges have yet been filed against the entity as of the date of publication.

Additional Seguros Sucre Defendants

We covered above DOJ’s ongoing investigation of suspected corruption involving Seguros Sucre, Ecuador’s state-owned insurance company, with the corporate JLT Group declination with disgorgement. Seemingly independent of that matter, at least in part, we saw developments in two other Seguros Sucre-related corruption cases during the first eight months of 2022.

First, on March 24, 2022, financial advisor Fernando Martinez Gomez pleaded guilty to one count of money laundering associated with alleged corrupt payments to officials of Seguros Sucre and Seguros Rocafuerte, another Ecuadorian state-owned insurer, as well as a separate wire fraud scheme involving the misuse of client assets held by Martinez’s employer, Biscayne Capital, in a pyramid scheme that ultimately led to the liquidation of Biscayne. The FCPA-related money laundering charge arises out of the same scheme leading to the charges against four individuals—including Chairman of Seguros Sucre and Rocafuerte Juan Ribas Domenech—covered in our 2020 Mid-Year FCPA Update. Martinez awaits sentencing before the Honorable Carol Bagley Amon of the U.S. District Court for the Eastern District of New York.

On July 14, 2022, in another seemingly separate Seguros Sucre investigation, a grand jury sitting in the Southern District of Florida returned an indictment against three insurance brokers—Luis Lenin Maldonado Matute, Esteban Eduardo Merlo Hidalgo, and Christian Patricio Pintado Garcia—charging them each with seven counts of FCPA and money laundering violations associated with alleged bribes paid to officials of Seguros Sucre and Seguros Rocafuerte. Merlo, a Florida resident, has been arrested and currently faces a September 2022 trial date. Maldonado and Pintado, both Ecuadorian citizens residing in Costa Rica, have been transferred to fugitive status, although Pintado has made an appearance through counsel.

2022 MID-YEAR CHECK-IN ON FCPA-RELATED ENFORCEMENT LITIGATION

As our readership knows, following the filing of FCPA or FCPA-related charges, criminal and civil enforcement proceedings can take years to wind their way through the courts. The substantial number of enforcement cases from prior years, especially involving contested criminal indictments of individual defendants, has led to an active first eight months of enforcement litigation in 2022. A selection of prior-year matters that saw material enforcement litigation developments follows.

Second Circuit Affirms Dismissal of Hoskins FCPA Charges

For years, we have been following the case of Lawrence Hoskins, the UK citizen working for a UK subsidiary of French multinational Alstom S.A. on a project in Indonesia without ever setting foot in the United States and who yet somehow ended up in U.S. court answering FCPA and money laundering charges. Most recently, in our 2020 Mid-Year FCPA Update, we covered the grant of Hoskins’s Rule 29 Motion for a Judgment of Acquittal on the FCPA charges, but denial as to the money laundering charges, by the Honorable Janet Bond Arterton of the U.S. District Court for the District of Connecticut, following the jury trial conviction on all of those counts in November 2019. Cross-appeals followed and the case wound its way back to the U.S. Court of Appeals for the Second Circuit for a second time.

On August 12, 2022, in an opinion authored by the Honorable Rosemary S. Pooler, a split panel of the Second Circuit affirmed the district court’s ruling rejecting the jury’s FCPA convictions but affirming the jury’s money laundering convictions. To understand this opinion, however, one must go back to the first time Hoskins’s case was before the Second Circuit. As covered in our 2018 Year-End FCPA Update, the Second Circuit in large part affirmed the lower court’s pretrial ruling that DOJ could not charge a defendant under the FCPA based on conspiracy or aiding-and-abetting theories if that defendant does not himself fall within one of the “three clear categories of persons who are covered by [the FCPA’s anti-bribery] provisions,” which Hoskins as a foreign national acting outside of the United States did not himself fall into. The Second Circuit did, however, hold that the government should be permitted to make a showing that Hoskins acted as an agent of a domestic concern (namely, Alstom’s U.S. subsidiary), which would bring him within the statute’s reach. That set the stage for the 2019 trial, where DOJ persuaded the jury that Hoskins acted on behalf of Alstom Power, Inc. (the U.S. entity), but could not then get over the hurdle of Judge Arterton’s searching exegesis of the FCPA on Rule 29. This was the decision now up for review by the Second Circuit.

Fundamentally, the Second Circuit majority agreed with Judge Arterton that there was no agency relationship as between Hoskins and the U.S. Alstom entity. There was no real question after the trial as to whether corrupt payments were made to Indonesian government officials to assist Alstom obtain a major power plant contract, or whether Hoskins participated in procuring the agents through which those payments were made, knowing the purpose of those payments. The question, rather, was whether under common law principles of agency, the U.S. subsidiary and Hoskins established a fiduciary relationship whereby Hoskins would act as an agent on behalf of the U.S. entity as the principal. And the Second Circuit majority found that “[c]onspicuously missing from the evidence is anything indicating that [Alstom Power] representatives actually controlled Hoskins’s actions as Hoskins and his [] counterparts operated under separate, parallel employment structures.” Although Hoskins received certain tasks from Alstom Power representatives, the Second Circuit found insufficient evidence for the jury to find beyond a reasonable doubt that Hoskins had authority to act on behalf of the U.S. entity or that the U.S. entity was able to hire, fire, or otherwise control him. The one dissenting vote, from the Honorable Raymond J. Lohier, Jr., focused principally on the deference accorded to jury verdicts coupled with a belief that there was sufficient (if not uncontroverted) evidence of agency in this case.

Although the case represents an important affirmance of the limits of FCPA jurisdiction and agency law, for Hoskins himself it must not be lost that the money laundering counts were affirmed by all three judges on the panel. The Second Circuit turned away his Speedy Trial Act and related Sixth Amendment claims, finding that although more than six years elapsed from indictment to trial, the vast majority of that time was properly excludable for Speedy Trial Act purposes and insufficient prejudice was shown from the delay. And the Court affirmed the jury instructions on withdrawal from conspiracy and venue for the money laundering counts. On that last point, as DOJ’s money laundering appetite grows it is noteworthy that the Second Circuit held that for venue purposes a multi-part wire transfer (in this case from Alstom Power in Connecticut to the agent in Maryland and then on to Indonesia) may be prosecuted as a single, continuing transaction in any of the U.S. districts through which the transaction traversed.

Roger Ng Trial Conviction

On April 8, 2022, following a nearly two-month trial and three days of deliberation, a federal jury in Brooklyn returned a guilty verdict on all three counts against former Goldman Sachs affiliate managing director Ng Chong Hwa (“Roger Ng”). The convictions of conspiracy to commit FCPA bribery, conspiracy to commit money laundering, and knowing circumvention of the FCPA’s internal controls provision, arose from the massive corruption scheme involving 1Malaysia Development Bank (“1MDB”) that we have been following for years.

According to the Government’s trial evidence, between 2009 and 2014, Ng participated in a scheme to launder billions of dollars from the Malaysian state-controlled economic development fund, including by misleading his firm into backing three bond transactions that were, in part, procured through the payment of more than $1 billion in bribes to government officials in Malaysia and the United Arab Emirates. The fund proceeds were allegedly laundered through the U.S. banking system, including famously for backing Hollywood blockbuster “The Wolf of Wall Street,” and other high-profile investments. Ng himself reportedly received $35 million for his role in the scheme.

As discussed in our 2021 Year-End FCPA Update, the Court previously denied Ng’s pretrial motion to dismiss the internal controls count, which argued that Ng could not have circumvented issuer Goldman Sachs’s internal accounting controls because the alleged bribes used 1MDB (and not bank) funds. The Honorable Margo K. Brodie of the U.S. District Court for the Eastern District of New York affirmed that ruling in denying Ng’s Rule 29 motion for a judgment of acquittal from the bench at the close of DOJ’s case, and explained her reasoning in a written post-trial opinion issued on April 8, the day of the jury’s verdict. Judge Brodie explained that the trial evidence was sufficient to show beyond a reasonable doubt that Ng and cooperating co-defendant Timothy Leissner, who testified against Ng, purposefully hid from various approval committees within the bank the involvement of well-known politically exposed person Low Taek Jho (“Jho Low”) in the 1MDB investment, as well as that the approval of various government officials in the investment was procured through bribery. While acknowledging that the term “internal accounting controls” could be read literally to apply only to safeguards concerning an issuer’s own accounting entries, the Court held that such a narrow reading would frustrate the overall intent of the statute and read out the explicit requirement in the statute that issuers establish controls to authorize specific transactions.

Ng is currently scheduled to be sentenced in November 2022.

Baptiste and Boncy FCPA Charges Dismissed on the Eve of Retrial

We covered in our 2021 Year-End FCPA Update the reversal of FCPA jury trial convictions of retired U.S. Army colonel Joseph Baptiste and businessperson Roger Richard Boncy, premised on an FBI sting simulating a bribery scheme involving Haitian port project investments, based on the ineffective assistance of Baptiste’s counsel infecting the fundamental fairness of the joint trial. The retrial was set to begin in July, but on June 27, 2022 DOJ moved to dismiss all charges with prejudice, and DOJ’s motion was granted by the Honorable Allison D. Burroughs of the U.S. District Court for the District of Massachusetts the following day.

The cause for the collapse of the prosecution stems from a December 2015 phone call with Boncy that an undercover FBI agent recorded during the investigation. The FBI inadvertently did not preserve the recording, which became a flashpoint during the initial trial as Boncy insisted that he made exculpatory statements during that conversation that would show he did not believe the investment in question was corrupt. That claim found late vindication when, leading up to the second trial, the FBI discovered text messages on an FBI server that contemporaneously described the contents of the December 2015 phone call, including a statement by Boncy that the money at issue would not be used to pay bribes. Aggressive discovery requests were the key driver to achieve this dismissal.

Baptiste and Boncy are now discharged and free from charges.

Eleventh Circuit Remands Case to Address Foreign Diplomat Immunity Defense

In our 2021 Year-End FCPA Update we covered the denial of motion to make a special appearance and challenge the money laundering indictment facing Alex Nain Saab Moran, a joint Colombian and Venezuelan national charged with money laundering offenses in connection with a $350 million construction-related bribery scheme in Venezuela. The Honorable Robert N. Scola, Jr. of the U.S. District Court for the Southern District of Florida rejected the motion on the basis of the fugitive disentitlement doctrine, given that Saab was not present in the United States himself.

On June 2, 2022, the U.S. Court of Appeals for the Eleventh Circuit in a per curiam order declined to address the merits of Saab’s appeal. With respect to the request to make a special appearance to challenge the indictment, the issue had been mooted by Saab’s interceding extradition from Cabo Verde. But with respect to Saab’s claim that he was a foreign diplomat immune from prosecution, the Eleventh Circuit remanded the case for the district court to address that issue in the first instance. Saab’s renewed motion to dismiss is now set for a week-long evidentiary hearing back before Judge Scola, beginning in October 2022.

District Court Finds Broad Privilege Waiver From Cooperation with DOJ

In our 2019 Year-End and 2020 Mid-Year FCPA updates, we covered the FCPA charges against and extensive post-indictment litigation involving the former Cognizant Technology Solutions President and Chief Legal Officer. The case is currently set for trial in the U.S. District Court for the District of New Jersey in October 2022, but the pretrial disputes continue apace. The individual defendants have moved to compel discovery on a number of issues, which the Honorable Kevin McNulty addressed in five separate memorandum opinions dated January 24 (two), March 23, April 27, and July 19, 2022.

Chief among the issues in dispute concerns the recurring dilemma of how companies are to navigate cooperation with government investigations without waiving the attorney-client privilege. Here, as part of its substantial cooperation efforts that ultimately led to a criminal declination, Cognizant provided DOJ with “detailed accounts” of numerous company employee witness interviews conducted by outside counsel. The individual defendants sought access to all materials associated with those interviews, which Judge McNulty in large part granted. The Court held that by disclosing privileged information to DOJ, Cognizant waived attorney-client privilege and work product protection “as to all memoranda, notes, summaries, or other records of the interviews themselves,” regardless of whether the interview summaries were conveyed orally or in writing. Further, “to the extent the summaries directly conveyed the contents of documents or communications, those underlying documents or communications themselves are within the scope of the waiver.” Finally, Judge McNulty held that “the waiver extends to documents and communications that were reviewed and formed any part of the basis of any presentation, oral or written, to the DOJ in connection with this investigation.”

As noted above, the former executives are currently scheduled to go to trial in October 2022. But this date may be imperiled by defendants’ recent motion to conduct numerous Rule 15 depositions in India, including through the compulsion of letters rogatory. We will undoubtedly return to this matter in future FCPA updates.

SEC Obtains Default Judgment in 2019 Case

In another development this year in a case initiated in 2019, on June 27, 2022 the Honorable J. Paul Oetken of the U.S. District Court for the Southern District of New York issued a default judgment against Yanliang “Jerry” Li. As discussed in our 2019 Year-End FCPA Update, Li, the former China Managing Director of a “multi-level marketing company,” later identified as Herbalife Nutrition Ltd., was indicted by DOJ and charged by the SEC for FCPA bribery and accounting violations arising from an alleged scheme to bribe Chinese government officials to obtain direct sales licenses and stifle negative media coverage about the company. Li has yet to make an appearance in U.S. court, even though he was served with the SEC’s complaint in China, and Judge Oetken assessed an Exchange Act Tier II penalty (ranging from $80,000 to $97,523) for each of five violations—(1) falsifying an expense report; (2) falsifying a SOX sub-certification; (3) endorsing a false audit report; (4) submitting a second false SOX certification; and (5) giving false testimony to the SEC—for a total of $550,092 in penalties.

PDVSA-related Defendants Move to Dismiss Indictments on Jurisdictional Grounds

We covered in our 2021 Year-End FCPA Update the seismic grant of Daisy Teresa Rafoi Bleuler’s motion to dismiss the FCPA and money laundering charges against her in the U.S. District Court for the Southern District of Texas by the Honorable Kenneth M. Hoyt. Judge Hoyt found that, as a matter of law, the indictment was deficient in alleging the actions abroad by Swiss citizen Rafoi, who did not set foot in the territory of the United States during the alleged PDVSA-related corruption scheme (and was challenging her indictment from abroad), were insufficient to bring her within the scope of U.S. jurisdiction. DOJ has appealed this dismissal, arguing that “a foreign national who actively participated in a US-linked scheme to pay bribes, can be liable for FCPA conspiracy even if she is not an enumerated FCPA actor who is liable as a principal,” and further that whether Rafoi qualified as an agent was a question of fact for a jury to decide.

On the heels of Judge Hoyt’s decision in the Rafoi case, co-defendant Paulo Jorge Da Costa Casqueiro Murta filed a motion to dismiss his own charges, raising many of the same jurisdictional arguments. On July 11, 2022, Judge Hoyt granted the motion for much the same reasoning as in the Rafoi case, but additionally on statute-of-limitations grounds and also granting a motion to suppress statements made by Casqueiro during a custodial interview in Spain. With respect to the statute-of-limitations matter, the Court waded through the complexities of multiple 28 U.S.C. § 3292 tolling orders and found that the return of an indictment against a co-defendant in 2017 ended the tolling period as to the subsequently indicted Casqueiro even though a later tolling order was issued and further Mutual Legal Assistance Treaty responses were filed by Swiss authorities. With respect to the suppression of statements, Judge Hoyt found that the circumstances of Casqueiro’s interview were impermissibly coercive where the defendant was summoned to the interview in Portugal by a local prosecutor, did not feel like he was permitted to leave the interview under Portuguese law, and was not advised of his protections under the U.S. constitution by the U.S. Department of Homeland Security agents who conducted the interview.

DOJ immediately filed a motion to stay the Casqueiro dismissal pending appeal, arguing that the defendant had been extradited to the United States to face these charges and would likely leave the United States if he was not maintained on pretrial release pending appeal. Judge Hoyt denied the stay request at the district court level, but on August 3, 2022 the U.S. Court of Appeals issued a stay pending resolution of the merits appeal, coupled with an order to expedite that appeal. On DOJ’s request, the Casqueiro and Rafoi appeals were then consolidated for argument, which is currently scheduled for October 2022. We expect these appeals will lead to a further important appellate ruling on the breadth of FCPA and money laundering statutes’ jurisdiction over foreign nationals, supplementing the Second Circuit’s decision in Hoskins discussed above.

Finally, a third co-defendant in the same sprawling case—Nervis Gerardo Villalobos Cárdenasg—filed his own motion to dismiss the indictment in February 2022, like Rafoi doing so from abroad. For reasons that may only be explained in a series of sealed orders, the Villalobos motion has proceeded on a slower track than the Casqueiro motion. DOJ makes many of the same arguments opposing dismissal as in the other cases, including renewing the same “fugitive disentitlement” challenge to the propriety of a court addressing a motion to dismiss filed by a so-called fugitive not before the court as it made (and was rejected) in Rafoi’s case. The motion to dismiss remains pending as of the date of publication.

Former Venezuelan National Treasurer Extradited; Motion to Dismiss Denied

On May 24, 2022, former Venezuelan National Treasurer Claudia Patricia Díaz Guillén made her initial appearance in the U.S. District Court for the Southern District of Florida and entered a not guilty plea to the money laundering charges against her. As described in our 2020 Year-End FCPA Update, Díaz is alleged to have accepted bribes to facilitate more favorable rates for foreign exchange transactions. Promptly following her extradition, Díaz moved to dismiss the charges on jurisdictional grounds similar to those raised by the PDVSA defendants in Houston described above. But the Honorable William P. Dimitrouleas, unpersuaded by Judge Hoyt’s rulings in Rafoi and Casqueiro, made short work of the motion by disposing of the matter as an issue for the jury in a two-page opinion dated July 12, 2022. Díaz currently faces an October 2022 trial date.

Fourth Circuit Affirms Lambert FCPA Trial Conviction

In our 2019 Year-End FCPA Update we covered the trial conviction of former Transport Logistics International, Inc. President Mark T. Lambert. On July 21, 2022, the U.S. Court of Appeals for the Fourth Circuit, in a per curiam opinion, affirmed the FCPA bribery and wire fraud convictions. The court found no error by the trial court in ruling on various evidentiary exclusions, nor in issuing an Allen charge when the jury initially could not agree on a verdict. On the substance of the charges, the Fourth Circuit found sufficient evidence to support the wire fraud convictions based on DOJ’s evidence that Lambert actively concealed material facts from the victim customer by virtue of quoting inflated costs that secretly included the costs of bribing one of the customer’s representatives, Vadim Mikerin, who also was prosecuted by DOJ.

Fifth Circuit Declares SEC Practice of Imposing Civil Monetary Penalties in Administrative Proceedings Unconstitutional

Those who have followed our client updates over the years may recall that many of the SEC’s settled FCPA enforcement actions for the first three decades of the statute were filed as civil complaints in federal district court. That all changed with the Dodd-Frank Wall Street Reform Act of 2010 (“Dodd-Frank”), which among many other important reforms granted the SEC authority to impose civil monetary penalties in administrative proceedings in which the SEC seeks a cease-and-desist order. Soon thereafter, the vast majority of settled enforcement actions (in FCPA and other cases) began being filed as administrative cease-and-desist proceedings.

Potentially imperiling that practice, on May 18, 2022 a three-judge panel from the U.S. Court of Appeals for the Fifth Circuit held in Jarkesy v. SEC that the SEC imposing civil monetary penalties in administrative proceedings is unconstitutional because Congress delegated its legislative power to the SEC without providing an intelligible principle by which the SEC could exercise that power. The Honorable Jennifer Walker Elrod, writing for the Court, recognized that Congress had authority to assign disputes to agency adjudication in “special circumstances,” but here found that Congress had given the SEC “exclusive authority and absolute discretion to decide whether to bring securities fraud enforcement actions within the agency instead of in an Article III court” while saying “nothing at all indicating how the SEC should make that call.” The Fifth Circuit further concluded that the SEC’s in-house adjudication violated the Petitioners’ Seventh Amendment right to a jury trial.

This decision does not involve FCPA enforcement directly, but its reverberations will certainly be felt in FCPA as well as other SEC enforcement areas until the law settles. For more on the Jarkesy decision, please see our separate article, “Jarkesy Wins Relief from ALJ Control After Years of Fighting for his Right to a Jury Trial.”

Continued Deferred Prosecution Agreement Scrutiny

We covered in our 2021 Year-End FCPA Update Deputy Attorney General Lisa O. Monaco’s October 2021 announcement that DOJ was modifying certain of its corporate criminal enforcement policies, and simultaneously highlighting increasing scrutiny that DOJ was giving to companies’ compliance with pretrial diversion (deferred and non-prosecution) agreements. The thrust of Monaco’s statements in the latter category was to express a concern that some companies continued to violate the law or otherwise failed to live up to their obligations during the period of their deferred and non-prosecution agreements. As we noted in our last update, close in time to this speech a number of companies announced that DOJ was conducting so-called “breach investigations,” including in the FCPA context such as the following example (among others):

- On March 3, 2022, Mobile TeleSystems Public Joint Stock Company (“MTS”) announced a one-year extension of its 2019 FCPA deferred prosecution agreement (also covered in our 2019 Year-End FCPA Update), together with the monitorship that accompanied it. MTS reported that there had been no determination that it had breached the terms of its agreement, but that the extension was due to a variety of factors, including the COVID-19 pandemic and to allow sufficient time for MTS to implement enhancements to its anti-corruption compliance program and have those enhancements reviewed by the monitor.

There is no question that DOJ and the SEC are applying increased scrutiny to companies under the supervision (active as in a monitorship, or passive as in self-reporting) that comes with deferred and non-prosecution agreements. We expect additional developments in this area in the months and years to come.

CEO and CCO Certifications of Compliance Programs

When the May 2022 Glencore FCPA resolution described above required the company’s Chief Executive Officer and Chief Compliance Officer each to certify at the conclusion of the three-year term of the monitorship that the company’s compliance program is reasonably designed and implemented to meet the requirements of the plea agreement the compliance industry sat up and took notice. Compliance-focused advocacy organizations have argued that imposing this requirement on CCOs puts them in an untenable position, and, in effect, puts a target on their back for any imperfections in the corporate compliance program they oversee.

DOJ officials have gone on the speaking circuit in defense of this new policy. On May 26, 2022, Deputy Attorney General Monaco asserted at a SIFMA event that this was in fact DOJ’s “effort to empower the gatekeepers” and ensure that CCOs are kept in the loop on compliance matters. Echoing this sentiment, DOJ FCPA Unit Chief David Last said at a June 14, 2022 International Bar Association event that this certification “is not meant to be a gotcha game,” but rather designed to “incentivize” CEOs and CCOs to “make sure they’re checking that [their] compliance program is up to snuff.” And DOJ Fraud Section Assistant Chief Lauren Kootman said at a Women’s White Collar Defense Association event on June 22, 2022 that “[t]he intention is not to put a target on the back of a chief compliance officer,” but rather to ensure that companies appropriately resource their compliance departments. These assurances have provided cold comfort to many in the compliance industry, and likely this will be a continuing source of discussion as the policy is implemented more broadly. On that note, Kootman has confirmed that this requirement “most likely” will be incorporated into all corporate FCPA resolutions going forward.

2022 MID-YEAR FCPA-RELATED LEGISLATIVE AND POLICY DEVELOPMENTS

In addition to the enforcement developments covered above, the first eight months of 2022 saw numerous important developments in FCPA-related legislative and policy areas.

DOJ Issues Increasingly Rare FCPA Opinion Procedure Release (22-01)

By statute, DOJ must provide a written opinion at the request of an issuer or domestic concern stating whether DOJ would prosecute the requestor under the anti-bribery provisions for prospective (not hypothetical) conduct it is considering. Once a common staple of FCPA practice, this procedure has seen seldom use in recent years. Indeed, DOJ’s last opinion procedure release (covered in our 2020 Year-End FCPA Update) was issued in August 2020, and was itself then the first since 2014. On January 21, 2022, DOJ issued a new opinion procedure release (its 63rd overall) interpreting how the FCPA applies to payments made under physical duress in response to extortionate demands by foreign officials.

Requestor is a U.S. domestic concern that owns and operates maritime vessels. While awaiting entry to the port of Country B, one of Requestor’s vessels inadvertently anchored in the territorial waters of Country A, where it was intercepted by that country’s navy. The vessel’s captain was detained in a local jail without access to care needed to address his “serious medical conditions,” at which point a third party who claimed to be acting on behalf of Country A’s navy contacted Requestor and demanded $175,000 in cash in exchange for the captain’s release and permission to leave Country A’s territorial waters. After unsuccessfully trying to obtain formal documentation explaining the legal basis for the payment, and failed attempts at obtaining intervention by other agencies of the U.S. government, Requestor sought DOJ’s opinion that it would not be prosecuted for making the payment to obtain the release of its vessel’s captain and crew.

In light of the exigent, life-threatening circumstances, DOJ acted swiftly and issued an initial response within two days of the October 2021 request, following up with the full opinion in January 2022 upon the submission of additional information. DOJ concluded that it would not pursue an enforcement action on these facts because “Requestor would not be making the payment ‘corruptly’ or to ‘obtain or retain business.’” With respect to the “corrupt intent” element of the FCPA, DOJ concluded it would not be met here because Requestor’s primary motivation in making this payment was to “avoid imminent and potentially serious harm to the captain and the crew.” Notably, DOJ distinguished this circumstance of physical duress from the more commonly experienced circumstance of economic duress—where companies are “shaken down” for corrupt payments at the risk of unjust financial consequences—observing that payments made in response to financially coercive demands may well be illegal under the FCPA. With respect to the “obtain or retain business” element of the FCPA, DOJ concluded that it would not be met here because Requestor had no ongoing or anticipated business in Country A. DOJ further noted Requestor’s transparent efforts to address this situation in response to the payment demand, which did not evince a corrupt intent.

While FCPA Opinion Procedure Release 2022-01 does not break any genuinely new ground and, like other opinion releases, is expressly limited to the specific facts at hand, it does nonetheless offer useful guidance to companies and practitioners alike regarding DOJ’s interpretation of these two important elements of the FCPA. In particular, the ability to make even a large cash payment under questionable circumstances to preserve the physical safety and wellbeing of employees is genuinely helpful. Nonetheless, we must caution our readers to exercise caution in expanding the logic of this opinion into the realm of economic coercion, which DOJ does treat differently as expressed in its opinion.

FinCEN Advisory Regarding Kleptocracy and Foreign Public Corruption

On April 14, 2022, the Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) released its “Advisory on Kleptocracy and Foreign Public Corruption,” which was developed to provide guidance to financial institutions in identifying and disclosing transactions involving the proceeds of foreign public corruption. As detailed in our 2021 Year-End FCPA Update and standalone client alert, “U.S. Strategy on Countering Corruption Signals Focus on Enforcement,” in December 2021, the Biden Administration—which previously identified the fight against corruption as a “core national security interest of the United States”—released a United States Strategy on Countering Corruption, articulating an ambitious, whole-of-government approach to combating corruption and its downstream societal effects. FinCEN describes this latest Advisory as part of the Biden Administration’s broader anti-corruption efforts.

Unsurprisingly, the Advisory describes Russia as a jurisdiction of “particular concern” in this area given “the nexus between corruption, money laundering, malign influence and armed interventions abroad, and sanctions evasion,” which is consistent with the United States’ broader efforts to combat and disrupt Russia-related financial activity following its invasion of Ukraine, including asset freezes and seizures conducted through Task Force KleptoCapture, discussed further in our separate client alert “United States Responds to the Crisis in Ukraine with Additional Sanctions and Export Controls.” The Advisory describes two typologies and patterns of activity associated with kleptocracy and foreign public corruption. First, “wealth extraction,” or the “siphoning off” of national resources by oligarchs and elites, is characterized as being conducted through bribery and extortion schemes involving foreign public officials or the misappropriation of embezzlement of public assets for private enrichment, which can commonly be accomplished through public procurement in the defense and health sectors or through bribes and kickbacks paid in the context of large infrastructure or development projects. Second, the Advisory notes that kleptocrats and other corrupt public officials will engage in similar activity to drug traffickers or other criminal actors to launder the proceeds of corruption, such as through the use of complex networks of shell companies or offshore accounts or the conversion of ill-gotten gains into the purchase of high-value assets such as luxury real estate, private jets and yachts, art and antiquities, or hotels.

The Advisory concludes with a set of 10 common “red flag” indicators that financial institutions should look out for in an effort to identify, prevent, and report potentially suspicious transactions involving the proceeds of kleptocracy or foreign public corruption. These include transactions involving multiple government contracts being awarded to the same entity or entities with common ownership, transactions in which government business is being conducted through personal accounts, transactions involving foreign public officials and the purchase of high-value or luxury assets and/or jurisdictions with which the officials do not have known ties, the use of third parties or shell companies to obscure the involvement of foreign public officials, transactions involving excessive charges or inconsistent or incomplete documentation, and transactions involving entities beneficially owned by individuals connected to known kleptocrats or their family members.

2022 MID-YEAR CHECK-IN ON THE FCPA SPEAKER’S CORNER

U.S. government anti-corruption enforcement personnel were active on the speaking circuit in the first eight months of 2022, offering a glimpse into DOJ and SEC priorities and expectations for the companies that appear before them. In many instances, these statements are more broadly focused on white collar crime in general, but the lessons may be applied in the FCPA context. We will cover the September 15, 2022 speech by U.S. Deputy Attorney General Lisa Monaco in a separate, forthcoming client alert.

Attorney General Merrick Garland

Speaking to the ABA Institute on White Collar Crime in Washington D.C. on March 3, 2022, Attorney General Merrick Garland made clear that DOJ’s first priority in corporate criminal cases is the prosecution of individuals who “commit and profit from corporate malfeasance.” Garland stated that DOJ’s focus on individual accountability is the best way to deter corporate crimes in the first place because corporations are only able to act through individuals. In addition, Garland argued that the prosecution of individuals is necessary because it bolsters Americans’ trust in the rule of law. Toward the end of his remarks, Garland noted that over the long course of his career he has seen DOJ’s interest in prosecuting corporate crime “wax and wane,” and concluded that “today, it is waxing again.”

Assistant Attorney General Kenneth Polite

In a March 25, 2022 speech before NYU Law’s Program on Corporate Compliance and Enforcement, Assistant Attorney General for the Criminal Division Kenneth Polite provided details on how DOJ evaluates corporate compliance programs. He stated that DOJ’s goal with such evaluations is to ensure that “companies are designing and implementing effective compliance systems and controls, creating a culture of compliance, and promoting ethical values.” First, according to Polite, a company’s compliance program must be well-suited to the company’s specific risk profile. Second, a compliance program must demonstrate a company’s commitment to compliance at all levels of the company. Third, DOJ wants to see evidence that the corporate compliance program actually works in practice. Finally, Polite emphasized that companies should be able to demonstrate an “ethical culture” that permeates all areas of the corporate structure.

Principal Deputy Assistant Attorney General Nicholas McQuaid

In a speech delivered at a forum hosted by the American Conference Institute on January 27, 2022, Criminal Division Principal Deputy Assistant Attorney General Nicholas McQuaid admonished attendees to not focus on the number of prosecutions of FCPA violations in the last year. Although as noted in our 2021 Year-End FCPA Update, FCPA resolutions in 2021 fell to their lowest level since 2015, McQuaid stated that DOJ entered 2022 with a “robust pipeline” of cases and that he expects there to be “significant resolutions” over the next year.

2022 MID-YEAR CHECK-IN ON FCPA-RELATED PRIVATE CIVIL LITIGATION

Although the FCPA does not provide for a private right of action, our readership knows well that civil litigants have pursued a variety of causes of action in connection with FCPA-related conduct, with varying degrees of success. A selection of matters with material developments in the first eight months of 2022 follows.

Select Shareholder Lawsuits / Class Actions

- Mobile TeleSystems PJSC – As covered in our 2021 Year-End FCPA Update, shortly following MTS’s 2019 joint FCPA resolution with DOJ and the SEC for alleged corruption in Uzbekistan, the company found itself a defendant in a class action suit filed in the U.S. District Court for the Eastern District of New York, alleging that the company issued false and misleading statements about the its inability to predict the outcome of the U.S. government’s investigations, the effectiveness of its internal controls and compliance systems, and its cooperation with U.S. regulatory agencies. In March 2021, the Honorable Ann M. Donnelly dismissed the lawsuit, finding that the plaintiffs did not demonstrate that the challenged claims were false or misleading, that MTS could have predicted the outcome of the investigation, or that its disclosures about the existence of the investigation were insufficient. Just over a year later, on March 31, 2022, the U.S. Court of Appeals for the Second Circuit issued a summary order affirming Judge Donnelly’s dismissal. The Second Circuit held that the complaint was “devoid of any factual allegations that with particularity establish that MTS executives knew that they could reasonably estimate their potential liability arising from the government investigations but opted not to do so.”

Select Civil Fraud / RICO Actions

- Stryker / Zimmer Biomet – In March 2022, Mexican government healthcare agency Instituto Mexican del Seguro Social (“IMSS”) lost two appeals of lawsuits involving alleged bribery of foreign officials. In both suits, one in the Sixth Circuit (Stryker) and the other in the Seventh Circuit (Zimmer Biomet), the Circuit Court affirmed the respective district court’s decision to grant a motion to dismiss on forum non conveniens grounds in cases where the relevant agents, evidence, and injury were all found to be based in Mexico and there was no showing that the Mexican court system was an inadequate forum.

- Olympus Latin America – IMSS suffered another litigation defeat, this time for different reasons and in the U.S. District Court for the Southern District of Florida, when on August 31, 2022 the Honorable Kathleen M. Williams dismissed with prejudice the Mexican state agency’s fraud claim against Olympus arising from a portion of the facts that led to Olympus’s 2016 FCPA resolution described in our 2016 Year-End FCPA Update. Judge Williams determined that IMSS’s 2021 complaint was untimely because it was filed more than four years after Olympus’s 2016 deferred prosecution agreement. The Court rejected IMSS’s arguments that it did not know that its contracts with Olympus were covered in the FCPA resolution because they were not named specifically, holding that there was a duty to exercise diligence upon the public release of the deferred prosecution agreement.

- Odebrecht S.A. – We last caught up on the bevvy of civil litigation filed against Brazilian construction conglomerate Odebrecht in the wake of its 2016 anti-corruption settlements with U.S., Brazilian, and Swiss authorities in our 2018 Year-End FCPA Update. On July 19, 2022, in a civil fraud case brought by bond purchasers that was allowed to proceed to discovery, U.S. Magistrate Judge Barbara Moses of the U.S. District Court for the Southern District of New York imposed severe sanctions on Odebrecht for discovery violations. The Court had previously ordered Odebrecht to provide discovery to the bondholders concerning materials previously provided to U.S. and Brazilian authorities but, without seeking a protective order or otherwise objecting, Odebrecht simply failed for more than a year to turn over the documents on the grounds that they were prohibited from doing so under Brazilian law. As a consequence, Judge Moses imposed Rule 37 sanctions establishing as a fact in the matter that the Odebrecht defendants made material misrepresentations to plaintiff bondholders with scienter. One week later the parties requested a settlement conference with Judge Moses.

Select Anti-Terrorism Act Suits

- Certain Pharmaceutical and Medical Device Companies – We reported in our 2020 Year-End FCPA Update on a decision by the Honorable Richard J. Leon of the U.S. District Court for the District of Columbia dismissing a lawsuit brought by U.S. service members and their families alleging that certain pharmaceutical and medical device companies violated the Anti-Terrorism Act (“ATA”) by paying bribes to officials at the Iraqi Ministry of Health, which was controlled by the terrorist group Jaysh al-Mahdi (“JAM”), which JAM then used to fund attacks against the plaintiffs. Judge Leon ruled that the Court lacked personal jurisdiction over the foreign defendants, and the plaintiffs had failed to adequately plead a violation under the ATA as to the rest. On January 4, 2022, the U.S. Court of Appeals for the District of Columbia, in an opinion by Honorable Cornelia T.L. Pillard, reversed the dismissal and revived the case, finding that causation was adequately alleged and the district court’s jurisdictional analysis was “unduly restrictive.” Defendants have petitioned for a rehearing en banc, which remains pending as of the date of publication.

Other Civil Lawsuits

- Cicel (Beijing) Science & Tech. Co. – We last covered the breach-of-contract lawsuit brought by Cicel against Misonix, Inc. in our 2017 Year-End FCPA Update. Cicel claimed wrongful termination of a distribution contract with Misonix, which then defended by arguing that it terminated only after discovering potentially corrupt conduct and disclosing it to DOJ and the SEC. On October 7, 2017, the Honorable Arthur D. Spatt of the S. District Court for the Eastern District of New York denied Misonix’s motion to dismiss, allowing the case to proceed to discovery. But earlier this year, on January 20, 2022, the Honorable Gary R. Brown granted Misonix’s motion for summary judgment, finding that undisputed facts conclusively proved Cicel’s involvement in illegal conduct, which Misonix moved swiftly to remediate upon discovery by conducting an internal investigation, terminating the relationship, and disclosing the matter to DOJ and the SEC. No prosecution was brought against Misonix, as both DOJ and the SEC closed their investigations in 2019.

2022 MID-YEAR INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

World Bank

The World Bank has been quite active during the first eight months of 2022 in debarring companies and individuals for corrupt practices:

- On January 4, 2022, the World Bank announced a 12-month debarment followed by a 12-month conditional non-debarment of ADP International S.A., a French-based airport developer, operator, and manager, for allegedly attending improper meetings with government officials during the tender for a contract and failing to disclose that fees paid to a retained agent were partially transferred to a non-contracted consultant. Colas Madagascar S.A. was also debarred for two years for arranging the improper meetings with government officials, and Bouygues Bâtiment Int’l was sanctioned with conditional non-debarment for 12 months for attending the meetings.

- On February 23, 2022, the World Bank announced a 34-month debarment followed by an 18-month conditional non-debarment of AIM Consultants Limited, a consultancy company based in Nigeria, and its managing director, Amin Moussali. According to the World Bank, AIM through Moussali paid approximately $45,500 in kickbacks to various project officials after receiving payment for a service contract in connection with a $908 million World Bank-funded project designed to reduce soil vulnerability and erosion in certain sub-watersheds in Nigeria. As part of a settlement agreement, Moussali agreed to complete corporate ethics training, and AIM agreed to implement an integrity compliance program in accordance with the principles set out in the World Bank Group’s Integrity Compliance Guidelines.

- On March 30, 2022, the World Bank debarred a Nigerian technology consulting company and its managing director for 50 months and 5 years, respectively, for acting as a consultant and making “appreciation” payments to project officials. According to the World Bank, SofTech IT Solutions and Services Ltd., under the direction of its managing director Isah Salihu Kantigi, served as a conduit through which he and other consultants made illegal payments to project officials in connection with a $1.8 billion project funded by the World Bank, which was designed to provide targeted cash transfers to poor and vulnerable households under an expanded national social safety net. As part of a settlement, Kantigi committed to taking corporate ethics training that demonstrates a commitment to personal integrity and business ethics, and SoftTech committed to implementing a corporate ethics training program.

- On April 14, 2022, the World Bank sanctioned Germany-based Voith Hydro Holding GmbH & Co. KG and two subsidiaries for their alleged corrupt practices in power projects in the Democratic Republic of The Congo and Pakistan. According to the World Bank, between 2012 and 2016, Voith Hydro took actions to gain unfair tender advantages, including making improper payments to a commercial agent to gain favorable decisions in contract executions and failing to disclose those payments. The Voith Hydro entities face a range of 15-34 months of debarment, followed by conditional non-debarment terms.

Inter-American Development Bank

On March 18, 2022, The Inter-American Development Bank (“IDB”), which provides financing in Latin America, announced a three-year debarment of Brazilian construction company Construtora COESA and 26 subsidiaries for simulating competition for a contract, failing to act upon knowledge of corruption, and making illicit payments totaling $1.7 million to public officials involved in supervising and managing the contracts. In 2019, an affiliated entity settled with Brazilian authorities in relation to these and other matters for $460 million. The IDB credited the prior fine and Construtora COESA’s cooperation for a reduced sanction.

Europe

United Kingdom

JLT Specialty Limited

On June 22, 2022, the UK Financial Conduct Authority (“FCA”) announced a resolution with JLT Specialty, a UK subsidiary of JLT Group which, as noted above, reached a declination with disgorgement resolution with the U.S. DOJ and, as covered below, also reached a resolution with Colombian authorities. JLT Specialty agreed to pay the FCA £7.8 million for alleged failings concerning the risk management systems that it had in place between 2013 and 2017 that were responsible for countering the risks of bribery and corruption, which fine was reduced based on the assistance the company provided throughout the investigation, as well its self-report to relevant authorities and remediation. The FCA also commented that this was its second anti-corruption enforcement action against JLT Specialty, with the first occurring in 2013 as covered in our 2013 Year-End FCPA Update. Gibson Dunn represented JLT Group in connection with the FCA and U.S. investigations.

Glencore Energy (UK) Limited

On June 21, 2022, UK Glencore subsidiary Glencore Energy pleaded guilty to seven counts of bribery in connection with the same coordinated, multi-jurisdictional resolution with the U.S. DOJ and Brazilian authorities described above, but with the slightly different five-country line-up of Cameroon, Equatorial Guinea, Ivory Coast, Nigeria, and South Sudan. The SFO alleged that Glencore Energy paid over $28 million in bribes for preferential access to oil in these countries, including increased cargoes, valuable grades of oil, and preferable dates of delivery. Sentencing is currently scheduled to take place in November 2022.

KPMG Audit plc and Anthony Sykes

On May 24, 2022, the UK Financial Reporting Council (“FRC”) announced that it had imposed sanctions against a KPMG network firm in the United Kingdom and the responsible Audit Engagement Partner Anthony Sykes, in relation to the 2010 statutory audit of Rolls-Royce Group plc. According to the FRC, the respondents did not adequately respond to matters arising during the audit that indicated a risk of corruption by Rolls-Royce, including payments made by Rolls-Royce to agents in India that formed part of the company’s 2017 resolution with the Serious Fraud Office (“SFO”) and other authorities as covered in our 2017 Mid-Year FCPA Update.

Petrofac-Related Seizures

On April 28, 2022, the SFO recovered over £567,000 from three personal bank accounts linked to deceased UAE businessman Basim Al Shaikh, who allegedly paid bribes to secure contracts for Petrofac while working as a so-called “fixer agent.” As covered in our 2021 Year-End FCPA Update, in October 2021 Petrofac admitted to failing to prevent former senior executives of the group’s subsidiaries from using agents to pay bribes of £32 million to win oil contracts worth approximately £2.6 billion in Iraq, Saudi Arabia, and the United Arab Emirates between 2011 and 2017 and was ordered to pay over £77 million to settle the claims.

Unaoil Defendants Convictions Overturned

We covered most recently in our 2021 Year-End FCPA Update the several individual prosecutions arising out of the SFO’s Unaoil-related investigation of corruption in Iraq. For example, SBM Offshore Sales Manager Paul Bond was convicted in March 2021, though that conviction was then called into question when the conviction of co-defendant and former Unaoil Manager Ziad Akle was overturned in December 2021. The issue leading to the conviction reversal was the interaction between senior SFO officials and a “fixer” working on behalf of Unaoil founders Cyrus Allen Ahsani and Saman Ahsani, who themselves pleaded guilty to FCPA charges in the United States as discussed in our 2019 Year-End FCPA Update and hired the so-called fixer to place pressure on other defendants, unbeknownst to their lawyers, to likewise plead guilty. On March 24, 2022, the Court of Appeal of England and Wales also overturned Bond’s conviction. Then, on July 21, 2022, a third defendant, former SBM Offshore Vice President Stephen Whiteley, had his conviction overturned.