2021 Year-End Securities Litigation Update

Client Alert | February 22, 2022

Federal securities filings continued to slow during the second half of 2021. The volume of new securities cases filed in 2021 fell by 36% compared to 2020, and 51% compared to 2019. Nonetheless, federal and state securities laws continue to develop in the courts. This year-end update summarizes major developments since our last update in August 2021:

- The second half of 2021 was relatively quiet with regard to noteworthy securities litigation activity from the Supreme Court. We discuss the settlement of a case that would have asked the Court to decide whether the PSLRA’s discovery-stay provision applies in state court, and a ruling that ERISA plan fiduciaries must conduct their own independent evaluation to determine which investments may be prudently included in the plan’s menu of options.

- Three recent decisions from Delaware courts will impact how stockholder derivative claims are investigated and litigated. We also discuss two decisions that enforced an advance notice bylaw and a contractual waiver of statutory appraisal rights.

- We continue to monitor courts’ application of the disseminator theory of liability recognized by the Supreme Court’s 2019 decision in Lorenzo, including differing interpretations regarding whether liability under Lorenzo applies to a broad swath of misrepresentations, or only in the more limited context of fraudulent dissemination.

- We again survey securities-related lawsuits arising out of, or otherwise related to, the COVID-19 pandemic, including securities class actions, stockholder derivative actions, and SEC enforcement actions. As courts have begun issuing decisions on motions to dismiss filed earlier in the pandemic, plaintiffs continue bringing new securities cases, including against pharmaceutical and biotechnology companies based upon representations made concerning the development of new COVID-19 vaccines.

- In the second half of 2021, several cases interpreted and applied the Supreme Court’s 2015 Omnicare decision regarding liability based on a false opinion. During this period, a notable portion of claims survived motions to dismiss in which defendants asserted that the misrepresentations or omissions at issue were non-actionable statements of opinion under Omnicare. Although these cases illustrate that some courts are willing to let certain complaints play out, even where the allegedly false or misleading statements include explicit language noting that the content is mere belief and opinion, other cases demonstrate that Omnicare still presents a significant pleading barrier. We will continue to monitor developments in this important area.

- We continue monitoring the development of price impact theory following last year’s remand of Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System. Despite considering the “mismatch” between alleged misstatements and alleged corrective disclosures on a “sliding scale,” the trial court held that defendants failed to sever the link plaintiff established between stock price drops, alleged misstatements, and corrective disclosures.

- Finally, we address notable developments in the federal courts, including (1) the Second Circuit’s vacating the dismissal of a securities class action because Section 10(b) liability may be premised on misstatements that concern unsustainable rather than fraudulent conduct, (2) the Ninth Circuit’s holding that purchasers of shares sold in a direct listing have statutory standing, (3) a federal district court’s holding that transactions in unlisted American Depositary Receipts are not domestic under the “irrevocable liability” test, and (4) the Second Circuit’s affirming the dismissal of an event driven securities action, finding the claim was only one of corporate mismanagement rather than fraud.

I. Filing And Settlement Trends

Data from a newly released NERA Economic Consulting (“NERA”) study shows that 2021 represented a continuation of the securities litigation trends begun in 2020. 2021 was the second year of decreased filings after the steady upward figures we saw from 2017-2019. A sharp decrease in the number of merger-objection cases filed in 2021 (down to 14 from 103 in 2020) drove a decline in the number of new federal class actions filed in 2020 (down to 205 from 321 in 2010). The “Electronic Technology and Technology Services” and “Health Technology and Services” sectors now represent 57% of all filings.

The median settlement value of federal securities cases in 2021—excluding merger-objection cases and cases settling for more than $1 billion or $0 to the class—decreased substantially from prior years (at $8 million, down from $14 million in 2020 and $13 million in 2019). Consistent with this trend, average settlement values (excluding merger-objection and zero-dollar settlements) also declined in 2021 (at $21 million, down from $47 million in 2020 and $29 million in 2019).

A. Filing Trends

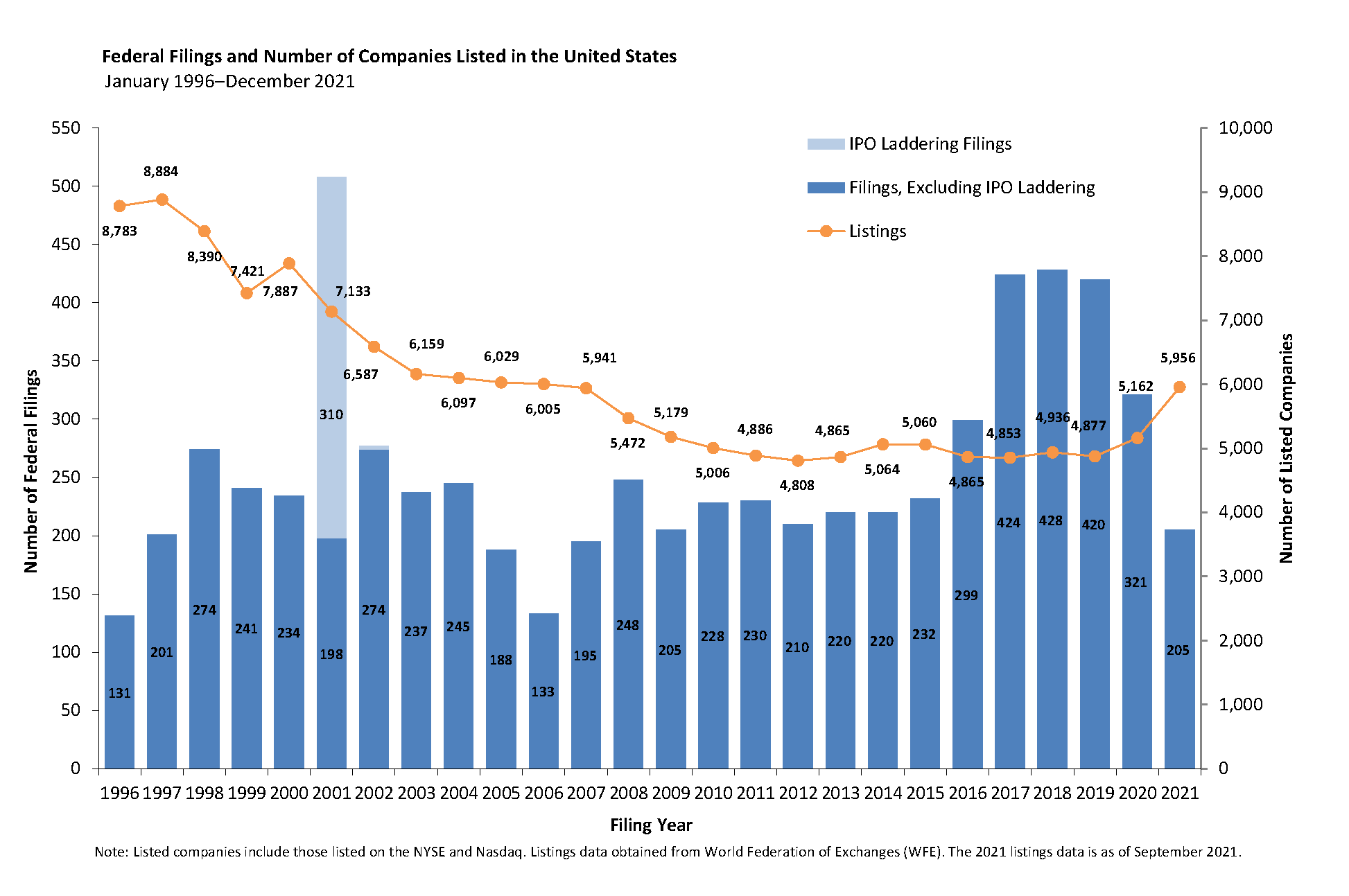

Figure 1 below reflects the filing rates of 2021 (all charts courtesy of NERA). 205 cases were filed last year, down considerably from the peak in 2017-2019. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

B. Mix Of Cases Filed In 2021

1. Filings By Industry Sector

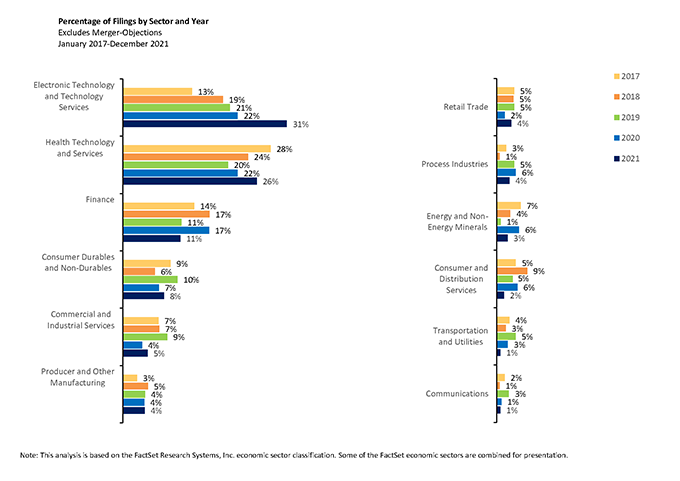

Even though the number of filings decreased in 2021 compared to 2020, the distribution of non-merger filings, as shown in Figure 2 below, was relatively consistent with the previous two years. Notably, the “Electronic Technology and Technology Services” and “Health Technology and Services” sectors now account for more than 50% of all filings, continuing the steady upward trend since 2016. “Finance” filings experienced the steepest decline, dropping by 6% (after rising by 6% in 2020).

Figure 2:

2. Merger Cases

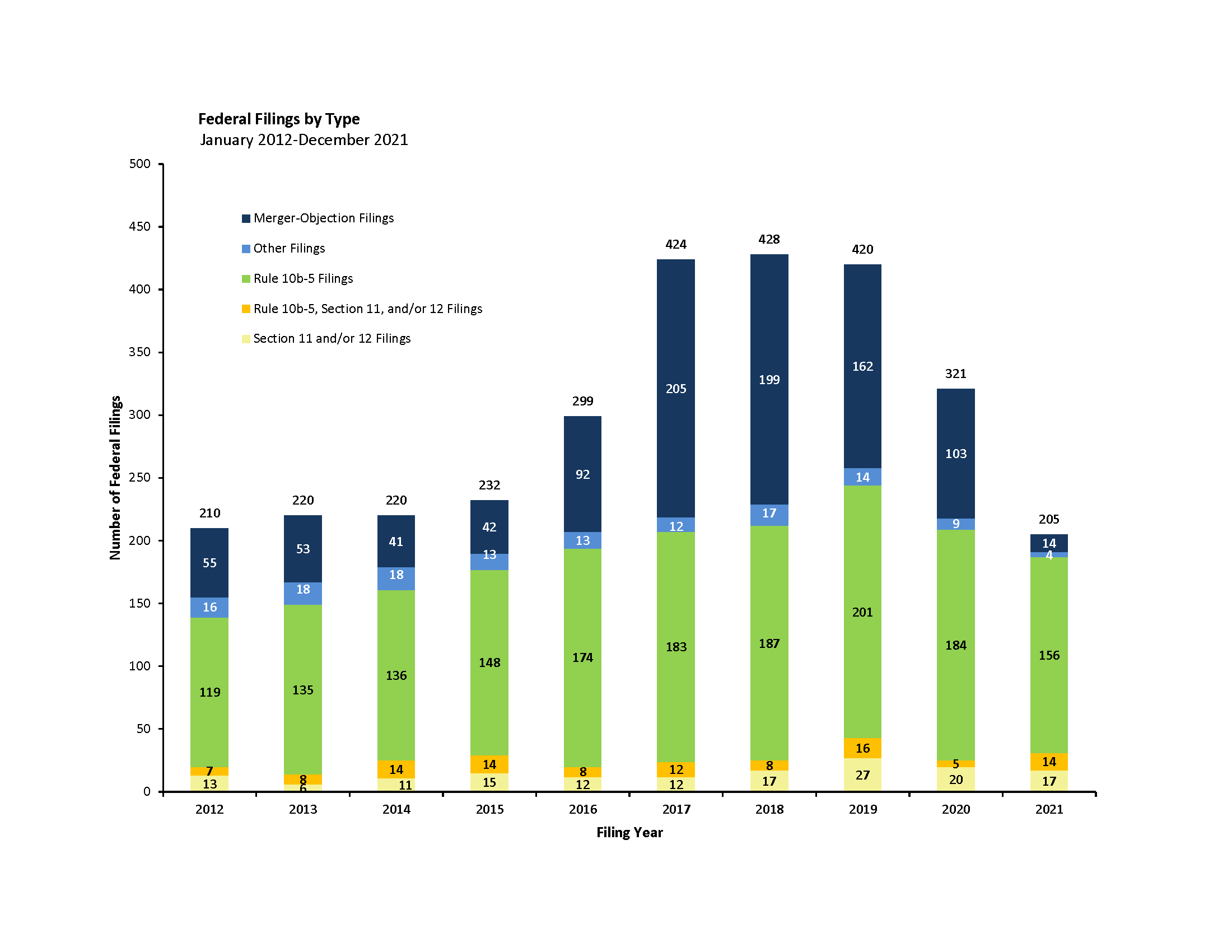

As shown in Figure 3 below, there were 14 merger-objection cases filed in federal court in 2021. This represents an 86% year-over-year decrease from 2020, a 94% year-over-year decrease from 2019, and the lowest number of such filings since 2010. This figure is significantly lower than in 2016, when the Delaware Court of Chancery put an effective end to the practice of disclosure-only settlements in In re Trulia Inc. Stockholder Litigation, 29 A.3d 884 (Del. Ch. 2016), which helped drive the increase in merger-objection filings between 2015 and 2017.

Figure 3:

C. Settlement Trends

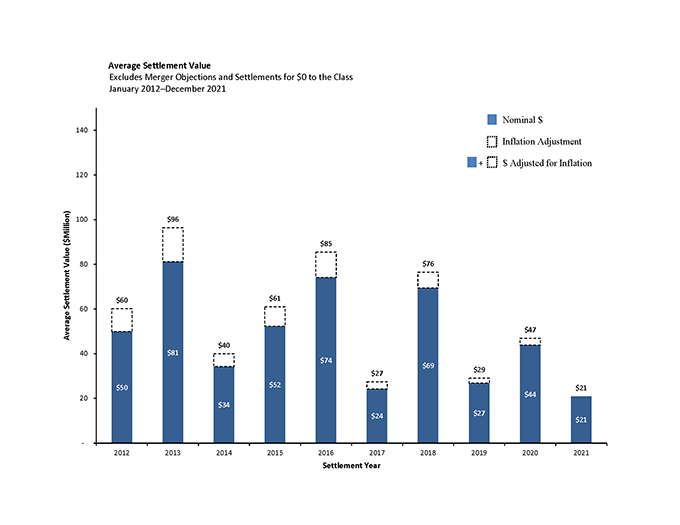

As reflected in Figure 4 below, the average settlement value declined by over 50% in 2021, reaching $21 million, after rebounding from $29 million in 2019 to $47 million in 2020.

Figure 4:

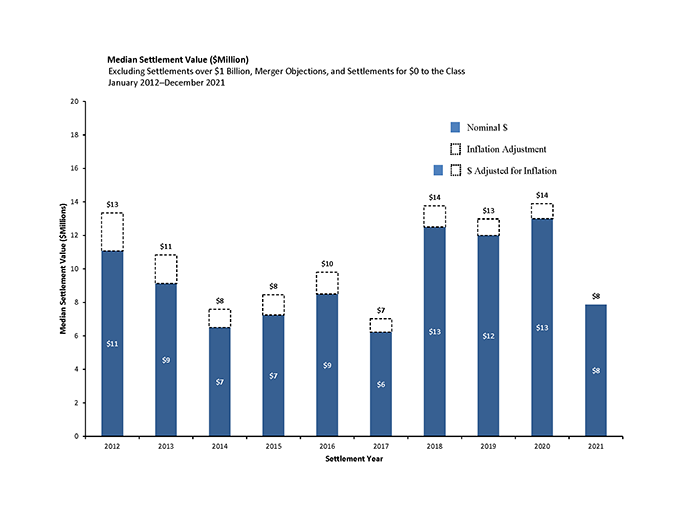

Turning to the median settlement value, Figure 5 shows that the consistency of 2018 to 2020, when median settlement value remained $13-14 million, came to an end in 2021. Last year saw the median value drop to $8 million. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, and zero-dollar settlements.)

Figure 5:

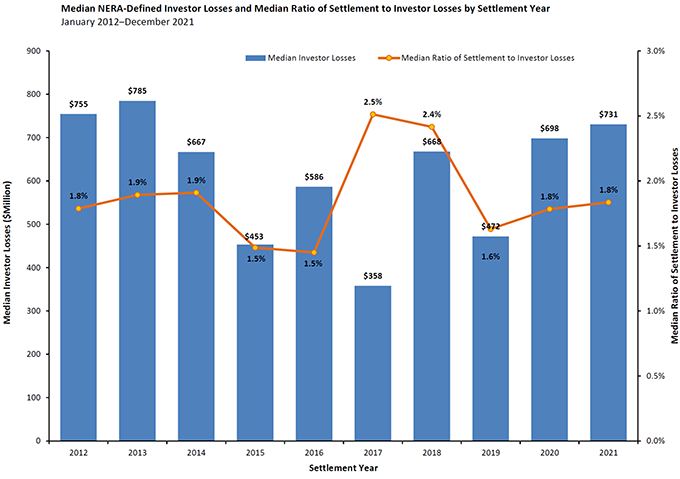

Finally, as shown in Figure 6, Median NERA-Defined Investor Losses were steady in 2021, rising to $731 million from $698 million in 2020. The Median Ratio of Settlement to Investor Losses also held steady at 1.8% in both years.

Figure 6:

II. What To Watch For In The Supreme Court

The second half of 2021 was relatively quiet with regard to noteworthy activity from the Supreme Court in the area of securities litigation. Two developments of note are discussed below.

A. Pivotal Settlement

As we previewed in our 2021 Mid-Year Securities Litigation Update, on July 2, 2021, the Supreme Court granted certiorari in Pivotal Software, Inc. v. Superior Court of California, No. 20-1541. That case involved the question whether the discovery-stay provision in the Private Securities Litigation Reform Act (“PSLRA”)—which requires a stay prior to adjudication of a motion to dismiss—also extends to stockholder actions brought in state court. State courts have been increasingly divided on the issue since the Supreme Court’s 2018 decision in Cyan, Inc. v. Beaver County Employees Retirement Fund, 138 S. Ct. 1061 (2018), affirming potential state court jurisdiction over Securities Act claims.

On January 13, 2022, the parties in Pivotal notified the Court that they have finalized a settlement, and filed a motion for preliminary approval with the Superior Court of California. See Letter from the Parties Updating Clerk on Settlement Proceedings, Pivotal Software, Inc. v. Superior Court of Cal., No. 20-1541 (Jan. 13, 2022). As a result, the question whether the PSLRA’s discovery-stay provision applies to private actions in state court will not be answered by the Supreme Court in Pivotal. Although the provision will remain a known quantity in federal court, until such time as the Supreme Court has another opportunity to revisit the issue, parties in state courts will be left to grapple with the meaning of the PSLRA’s instruction that the discovery stay is required “[i]n any private action.” 15 U.S.C. § 77z-1-(b)(1).

B. Northwestern University ERISA Decision

On January 24, 2022, the Supreme Court issued its decision in Hughes v. Northwestern University, — S. Ct. —-, 2022 WL 199351 (U.S. Jan. 24, 2022). In a unanimous decision, the Court held that offering low-cost investment options alongside the other allegedly high-cost options in a defined-contribution retirement plan does not, in and of itself, categorically foreclose a claim for breach of ERISA’s duty of prudence. Id.

Petitioners—former and current employees of Northwestern University—alleged that Northwestern University violated its ERISA-imposed duty of prudence by providing employees with a menu of investment options for their defined-contribution plans, some of which were high-cost options that caused employees to incur excessive fees. Id. at *2. Northwestern responded that the plan also offered low-cost investment options alongside the higher-cost options. Id. at *3. The Seventh Circuit affirmed the dismissal of petitioners’ claims for failure to plausibly allege a breach of fiduciary duty, primarily relying on the inclusion of low-cost options. Id. at *4.

The issue presented to the Supreme Court was whether participants in a defined-contribution retirement plan may state a claim for breach of ERISA’s fiduciary duty of prudence on the theory that investment options offered in the plan were too numerous and that many of the options were too costly, notwithstanding that the plan’s fiduciaries offered low-cost investment options in the plan as well. Relying on the obligation to monitor plan investment options articulated in Tibble v. Edison International, 575 U.S. 523 (2015), the Court ruled that the Seventh Circuit had erred in dismissing the claims without making a “context-specific inquiry” that “take[s] into account [a fiduciary’s] duty to monitor all plan investments and remove any imprudent ones.” Hughes, 2022 WL 199351, at *2. Justice Sotomayor, writing for the Court, noted that “even in a defined-contribution plan where participants choose their investments, plan fiduciaries are required to conduct their own independent evaluation to determine which investments may be prudently included in the plan’s menu of options.” Id. at *4.

As a case-specific application of Tibble, the Northwestern decision likely does not significantly change the litigation landscape for ERISA claims involving plan investment options. The decision does make clear that merely making available alternative investment options does not categorically prevent ERISA plaintiffs from stating a plausible claim for breach of the duty of prudence. At the same time, the Court recognized that “[a]t times, the circumstances facing an ERISA fiduciary will implicate difficult tradeoffs, and courts must give due regard to the range of reasonable judgments a fiduciary may make based on her experience and expertise.” Hughes, 2022 WL 199351, at *4.

III. Delaware Developments

A. Delaware Supreme Court Adopts A Universal Three-Part Test For Demand Futility In Derivative Actions

In September, the Delaware Supreme Court in United Food & Commercial Workers Union & Participating Food Industry Employers Tri-State Pension Fund v. Zuckerberg, 262 A.3d 1034 (Del. 2021) (en banc), adopted a three-part demand futility test that blended the long-standing tests set forth in Aronson v. Lewis, 473 A.2d 805 (Del. 1984) (for affirmative decisions made by a majority of the same board considering the demand, which focused on the substance of the challenged transaction), and Rales v. Blasband, 634 A.2d 927 (Del. 1993) (for all other situations, which focused on the independence of the decision on a litigation demand).

In Zuckerberg, Plaintiff filed a derivative complaint in the Court of Chancery, seeking damages related to Facebook’s expenditures in a class action suit that challenged a stock reclassification that was ultimately abandoned. Zuckerberg, 262 A.3d at 1040. Plaintiff did not make a pre-suit demand on Facebook’s board, arguing demand was futile under Aronson because the negotiation and approval of the reclassification was an invalid exercise of the board’s business judgment and because a majority of directors were allegedly beholden to Facebook’s CEO. Id. The Court of Chancery found Aronson’s framework “not up to the task,” and instead applied a new three-part blended test and dismissed the complaint for failure to plead that demand was futile. Id. at 1057–58.

Under this new test, courts will consider whether a complaint pleads particularized facts demonstrating that each director (1) “received a material personal benefit from the alleged misconduct that is the subject of the litigation demand;” (2) would face “a substantial likelihood of liability on any of the claims that are the subject of the litigation demand;” and (3) “lacks independence from someone who received a material personal benefit from the alleged misconduct that is the subject of the litigation demand or who would face a substantial likelihood of liability on any of the claims that are the subject of the litigation demand.” Id. at 1058. Demand is excused as futile under this test if the answer to any of these questions is “yes” for at least half of the members of the board. Id. at 1059.

The Delaware Supreme Court affirmed, adopting the Court of Chancery’s blended three-part test as the “universal test for assessing whether demand should be excused as futile.” Id. at 1058. The Court explained that “changes in the law have eroded the ground upon which [the Aronson] framework rested . . . and it is both appropriate and necessary that the common law evolve in an orderly fashion to incorporate these developments.” Id. In particular, where a corporation has a Section 102(b)(7) clause in its charter that exculpates directors from liability for breaches of the duty of care, directors do not face a “substantial likelihood of liability” that would excuse a pre-suit demand under Aronson’s second prong. Id. at 1050–54.

The ruling provides clarity and simplifies the process for determining demand futility by offering a “universal test” that focuses the “inquiry on the decision regarding the litigation demand, rather than the decision being challenged,” and eliminating the complexity over whether to apply the Aronson or Rales tests. Id. at 1058–59.

B. Delaware Court Of Chancery Demonstrates The “High Hurdle” Of Pleading Wrongful Demand Refusal Is Not Insurmountable

In October, the Court of Chancery in Drachman v. Cukier, 2021 WL 5045265 (Del. Ch. Oct. 29, 2021), issued a rare decision declining to dismiss a complaint that alleged a board wrongfully refused a litigation demand, finding that it was reasonable to infer from the pleading that “the directors just did not care about complying with the legal requirements of Delaware law.” Id. at *8. In Drachman, plaintiffs made a pre-suit demand notifying the company’s board that proposals at an annual stockholder meeting failed to receive the requisite votes and thus the company erred in approving the proposals. Id. at *2. The board responded that the demand was without merit and declined to take remedial action, id.; indeed, the company did not take corrective action until one year later, when it obtained the requisite votes to ratify the challenged amendments, id. at *3.

To meet the “high hurdle” necessary to plead wrongful refusal under Court of Chancery Rule 23.1, as the Drachman plaintiffs did, plaintiffs must allege particular facts raising a reasonable doubt that “(1) the board’s decision to deny the demand was consistent with its duty of care to act on an informed basis, that is, was not grossly negligent; or (2) the board acted in good faith, consistent with its duty of loyalty.” Id. at *6, 8. The Drachman court reasoned that “the [d]emand pointed out a straightforward violation of Section 242(b), yet—despite the language of the [proxy materials] explaining how votes would properly be tabulated—the Board rejected the [d]emand and waited nearly a year to remedy the mistake.” Id. at *8. This opinion serves as a reminder that although directors enjoy wide discretion in exercising their business judgment with respect to stockholder demand letters—and plaintiffs face a “steep road” in pleading wrongful refusal, id. at *6—a board’s decision declining to take correction in the face of a valid demand may not be entitled to deference in court.

C. Delaware Supreme Court Overrules Gentile In Favor Of Simple Test To Distinguish Direct From Derivative Claims

In a re-examination of the law on overpayment claims, the Delaware Supreme Court overruled its 15-year-old precedent set forth in Gentile v. Rossette, 906 A.2d 91 (Del. 2006), holding that “equity overpayment/dilution claims, absent more, are exclusively derivative.” Brookfield Asset Mgmt., Inc. v. Rosson, 261 A.3d 1251, 1267 (Del. 2021). We discussed this possibility in our 2020 Year-End Securities Litigation Update. In Rosson, former minority stockholders brought a claims for breach of fiduciary duty to challenge TerraForm Power’s private placement of common stock to controlling stockholder Brookfield for alleged inadequate value. Id. at 1255.

The Court of Chancery denied defendants’ motion to dismiss, which sought to classify the dilution claims as derivative and thus extinguished by a recent merger. Id at 1260. The lower court turned first to the “simple test” of Tooley v. Donaldson, Lufkin & Jenrette, Inc., 845 A.2d 1031, 1033 (Del. 2004), under which the question of whether a stockholder’s claim is direct or derivative “must turn solely on the following questions: (1) who suffered the alleged harm (the corporation of the stockholders, individually); and (2) who would receive the benefit of any recovery or other remedy (the corporation or the stockholders, individually?).” Relying on Tooley, the court held that “dilution claims are classically derivative,” even where “a controlling stockholder allegedly causes a corporate overpayment in stock and consequent dilution of the minority interest.” Rosson, 261 A.3d at 1260. Nevertheless, the lower court found that the stockholders properly stated direct claims under Gentile’s “unsatisfying” exception to Tooley’s rule when a controlling stockholder is involved in transactions that resulted in an improper transfer of value and voting power from minority stockholders. Id. at 1261.

On appeal, the Delaware Supreme Court agreed with the Chancery Court’s analysis that the direct claims would not survive without Gentile’s carveout because the stockholders’ overpayment claim alleged derivative harm to the corporation. Id. at 1266. After examining the “clear conflict between Gentile and Tooley, the confusion Gentile imposes on Tooley’s straightforward analysis, and the policy reasons for removing the exception,” the court overruled Gentile and reversed the lower court’s denial of defendants’ motion to dismiss. Id. at 1267. The court recognized three issues with Gentile: (1) economic and voting dilution is not an injury to stockholders independent of injury to the corporation; (2) Gentile applied “confusing” standards, including an out-of-date “special injury test” that detracts from Tooley’s “goal of adding clarity to a difficult and important area of our law”; and (3) the focus of a court’s inquiry should be on who suffered the harm and who would receive the benefit of the recovery, not on the identity of the wrongdoer. Id. at 1267–74. The Supreme Court further observed that Gentile “creates the potential practical problem of allowing two separate claimants to pursue the same recovery.” Id. at 1277.

As it did just three days later in Zuckerberg, discussed supra Section III.A, in Rosson, the Court provided a much needed simplification of Delaware law on derivative claims and demonstrated a willingness to adapt the common law to meet real-world developments.

D. Court of Chancery Relies On Equitable Principles To Enforce Advance Notice Bylaw

In October, the Court of Chancery declined to apply both the enhanced scrutiny of Blasius Industries, Inc. v. Atlas Corp., 564 A.2d 651 (Del. Ch. 1988), and the business judgment rule in examining a board’s decision to enforce an advance notice bylaw and reject a rival slate of board nominees. Plaintiff dissident stockholders submitted advance notice of their intent to nominate a slate of candidates for pharmaceutical company CytoDyn Inc.’s board, which the board rejected as contrary to CytoDyn’s bylaws. Rosenbaum v. CytoDyn Inc., 2021 WL 4775140, at *1 (Del. Ch. Oct. 13, 2021). After a paper trial on the stockholders’ request for injunctive relief allowing their candidates to stand for election, the court adopted the company’s argument that the stockholders’ notice was deficient because it failed to disclose who supported their efforts and failed to disclose that one of the nominees might seek to facilitate an insider transaction. Id. at *2.

The parties advocated for competing standards of review on the board’s refusal to put the nominations to a vote. The stockholders argued that under Blasius, the board bore “the heavy burden of demonstrating a compelling justification” because it acted “for the primary purpose of impeding the exercise of stockholder voting power.” Id. at *13 (citing Blasius, 564 A.2d at 661). The company argued that the proper standard was the deferential business judgment rule because the board’s decision is covered by contract, namely the bylaws. Id. The court rejected both approaches.

First, the Court of Chancery held that Blasius should not be held so broadly as to apply to “all cases where a board of directors has interfered with a shareholder vote.” Id. at *14. Instead, its exacting standard should be used “sparingly” when “self-interested or faithless fiduciaries” engaged in “manipulative conduct” to “deprive stockholders of a full and fair opportunity to participate in the matter. Id. (citing In re MONY Group, Inc. S’holder Litig., 853 A.2d 661, 674 (Del. Ch. 2004)). Though the board delayed responding to the nomination notice, the court credited the fact that the advance notice bylaw was reasonable, “commonplace,” and was adopted years earlier. Id. The court also rejected the company’s preferred business judgment standard due to the inherent “structural and situational conflict” present when a board enforces bylaws against stockholders. Id.

Instead, the court drew on longstanding principles of equity to examine whether the board unreasonably applied the validly enacted bylaws under the circumstances. Id. at *15. The court held that stockholders played “fast and loose” by submitting their deficient nominations on the eve of the deadline, leaving themselves with no opportunity to cure under bylaws that did not contain an express process to do so. Id. at *2. Had the stockholders provided their nominations earlier, they “might have a stronger case that the Board’s prolonged silence upon receipt of the notice was evidence of manipulative conduct.” Id. at *17. But under the circumstances, it was incumbent upon the stockholders to submit a compliant notice, and the court found that the board was justified in rejecting their slate.

E. Delaware Supreme Court Enforces Ex Ante Waiver of Statutory Appraisal Rights

Over a rare dissent, the Delaware Supreme Court recently enforced a provision in a stockholder agreement waiving corporate stockholders’ right to pursue statutory appraisal for certain transactions. Manti Holdings, LLC v. Authentix Acquisition Co., Inc., 261 A.3d 1199 (Del. 2021). In 2017, Authentix Acquisition Company, Inc. (“Authentix”) merged with a third-party entity. Minority stockholders filed a petition for appraisal of their stock under Section 262 of the Delaware General Corporation Law (“DGCL”). Id. at 1199. As we discussed in our 2018 Year End Securities Litigation Update, upon Authentix’s motion, the Court of Chancery enforced the stockholders’ agreement “that they ‘refrain’ from exercising their appraisal rights with respect to the merger” and dismissed the petition. Id. at 1203 (quoting agreement).

On appeal, the majority, with Justice Montgomery-Reeves writing, held that “neither statutory law nor public policy prohibits Authentix from enforcing the [waiver] against the petitioners.” Id. at 1214 (cleaned up). Although the majority agreed with petitioners that “the DGCL has mandatory provisions that are fundamental features of the corporate entity’s identity” that “cannot be varied by a contract,” it was cognizant of “Delaware’s strong policy favoring private ordering.” Id. at 1203, 1216. Thus, the majority did not read Section 262’s provision that stockholders “shall be entitled to an appraisal” as creating an unassailable right, since case law permits mandatory rights to be waived unless prohibited. Id. at 1219 (citing Graham v. State Farm Mut. Auto. Ins. Co., 565 A.2d 908, 912 (Del. 1989)). It was also “unconvinced” that “the fundamental nature of appraisal rights” “play a sufficiently important role in regulating the balance of power between corporate constituencies” to justify forbidding their waiver as a matter of public policy. Id. at 1223, 1224. Instead, the majority held that “Section 262 does not prohibit sophisticated and informed stockholders, who were represented by counsel and had bargaining power, from voluntarily agreeing to waive their appraisal rights in exchange for valuable consideration.” Id. at 1204; see also id. at 1224. Such was the case here, as the court repeatedly noted.

The majority’s ruling may permit ex ante contractual waivers of other stockholder rights set forth in the DGCL. In dicta, it recognizes that “there may be other stockholder rights that are so fundamental to the corporate form that they cannot be waived ex ante.” Id. at 1226. Except for “certain rights designed to police corporate misconduct or to preserve the ability of stockholders to participate in corporate governance,” however, the majority stops short of providing a ready list. In dissent, Justice Valihura would have held that Section 262 appraisal rights are fundamental, mandatory features of corporate governance that cannot be waived, but even if they could be modified, such a provision should, at the very least, be contained within the corporate charter. Id. at 1250–51 (Valihura, J., dissenting).

IV. Further Development Of Disseminator Liability Theory Upheld In Lorenzo

As initially discussed in our 2019 Mid-Year Securities Litigation Update, the Supreme Court held in Lorenzo v. SEC, 139 S. Ct. 1094 (2019), that those who disseminate false or misleading information to the investing public with the intent to defraud can be liable under Section 17(a)(1) of the Securities Act, Section 10(b) of the Exchange Act, and Rules 10b-5(a) and 10b-5(c), even if the disseminator did not “make” the statement within the meaning of Rule 10b-5(b). In the wake of Lorenzo, secondary actors—such as financial advisors and lawyers—could face “scheme liability” under Rules 10b-5(a) and 10b-5(c) simply for disseminating the alleged misstatement of another, if a plaintiff can show that the secondary actor knew the alleged misstatement contained false or misleading information.

Since our 2021 Mid-Year Securities Litigation Update, courts in the Second and Eleventh Circuits have wrestled with the scope of Lorenzo, considering whether Lorenzo allows a plaintiff to bring Rule 10b-5(a) and (c) scheme liability claims based on the same conduct as Rule 10b-5(b) misrepresentation claims absent allegations of dissemination.

Applying Lorenzo broadly, district courts in Florida and New York have denied motions to dismiss Rule 10b-5(a) and (c) claims after holding that scheme liability can now arise from the same conduct forming the basis for a Rule 10b-5(b) claim. For example, in SEC v. Complete Business Solutions Group, Inc, 538 F. Supp. 3d 1309, 1317, 1340 (S.D. Fla. 2021), the SEC accused defendants of selling unregistered securities—backed by small business loans—to investors and making several misrepresentations about the underlying loans’ risk. The district court determined that the SEC had adequately alleged that the defendants made misrepresentations or omissions under Rule 10b-5(b). The court also denied the defendants’ motion to dismiss the Rule 10b-5(a) and (c) claims of scheme liability, which were based on the very same statements that formed the 10b-5(b) claims, reasoning that, after Lorenzo, a plaintiff no longer has to plead “deceptive acts distinct from the alleged misrepresentation forming the basis of a Rule 10b-5(b) claim.” Id. at 1339–40.

Similarly, in SEC v. Sequential Brands Group., Inc., 20-CV-10471 (JPO), 2021 WL 4482215, at *6 (S.D.N.Y. Sept. 30, 2021), the SEC alleged that Sequential Brands Group engaged in a deceptive scheme by covering up quantitative evidence of an impairment to its goodwill. When multiple quantitative analyses showed that its goodwill had fallen by millions of dollars, Sequential Brands Group did not disclose those calculations but instead changed its methodology to a purportedly “biased” qualitative assessment that suggested goodwill had not been impaired. This withholding of information and change of methodology “resulted in regular misleading statements on public filings.” Id. The district court held that such allegedly fraudulent accounting practices could form the basis for scheme liability, analogizing to the deceptive dissemination at issue in Lorenzo. Gibson Dunn represents Sequential Brands Group in this matter. In SEC v. GPL Ventures LLC, 21 Civ. 6814 (AKH), 2022 WL 158885, at *9 (S.D.N.Y. Jan. 18, 2022), the SEC charged GPL Ventures (“GPL”), an issuer, and others with participating in a pump and dump fraud scheme in connection with the purchase of more than 1.5 billion shares of HempAmericana, Inc. The district court concluded that, because GPL was accused of being a “puppetmaster[] of a scheme to launder their investments for profit,” it could potentially be held liable for the misleading promotions, despite not making or disseminating the alleged misrepresentations itself. Id. at *10.

But on the other side of the coin, in SEC v. Rio Tinto PLC, another court in the Southern District of New York dismissed the SEC’s scheme liability claims after concluding that the SEC failed to “allege that Defendants disseminated [the] false information, only that they failed to prevent misleading statements from being disseminated by others.” See 17 Civ. 7994 (AT) (DCF), 2021 WL 818745, at *2 (S.D.N.Y. Mar. 3, 2021). Since we discussed this case in our 2021 Mid-Year Securities Litigation Update, the district court certified an interlocutory appeal to the Second Circuit on this issue. The appeal is fully briefed and should provide the Second Circuit with an opportunity to weigh in on Lorenzo’s reach. Gibson Dunn represents Rio Tinto in this and other litigation.

As these developments suggest, the application of the Lorenzo disseminator liability theory continues to evolve among and within the circuits. We will continue to monitor closely the changing applications of Lorenzo and provide a further update in our 2022 Mid-Year Securities Litigation Update.

V. Survey Of Coronavirus-Related Securities Litigation

As the third year of the COVID-19 pandemic begins, we are seeing new trends in coronavirus-related securities litigation. With the continuing development of vaccines, tests, and treatments for COVID-19, there has been a shift from cases focused on safety and travel to suits against pharmaceutical and biotechnology companies based on claims regarding the efficacy and authorization of their drugs.

As vaccines have been approved and businesses have reopened, we are also seeing more suits against companies related to statements made about their pandemic-related successes or losses and whether those trends should be expected to continue post-pandemic.

Courts have begun to issue orders on motions to dismiss in some of the pandemic-related cases we identified in previous updates. We report on notable decisions in this section, but it is still too early to identify any lasting COVID-specific jurisprudence in how courts have treated these cases. We will continue to monitor developments in these and other coronavirus-related securities litigation cases. Additional resources regarding company disclosure considerations related to the impact of COVID-19 can be found in the Gibson Dunn Coronavirus (COVID-19) Resource Center.

A. Securities Class Actions

1. False Claims Concerning Commitment To Safety

Hartel v. GEO Grp., Inc., No. 20-cv-81063, 2021 WL 4397841 (S.D. Fla. Sept. 23, 2021): In our 2020 Year-End Securities Litigation Update, we reported on the filing of this lawsuit, in which the plaintiffs alleged that GEO Group, a private corrections facilities operator, misled investors about the effectiveness of its COVID-19 response—exposing residents and employees to health risks and leaving the company “vulnerable to significant financial and/or reputational harm.” Dkt. No. 1 at 3, 9, 12. After a COVID-19 outbreak was reported in one GEO-run facility, GEO’s stock price fell by ten percent in two days. 2021 WL 4397841, at *2. In December 2020, the defendants filed a motion to dismiss, arguing in part that the complaint ignored material, explicit disclosures of risks during the relevant period; that the forward-looking statements that formed the basis for some claims were not actionable; and that the plaintiffs failed to plead falsity, loss causation, and scienter. Dkt. No. 36 at 8–13, 15–19. On September 23, 2021, Judge Rodney Smith granted the defendants’ motion to dismiss in part—as to certain statements and certain individual defendants—and directed the filing of a second amended complaint that did not include any claims based on non-actionable forward-looking statements, puffery, corporate optimism, or opinion. 2021 WL 4397841, at *15. The plaintiffs filed a second amended complaint on October 4, see Dkt. No. 46, and in November the parties completed briefing on a new motion to dismiss, which remains pending, see Dkt. No. 53.

2. False Claims About Vaccinations, Treatments, And Testing For COVID-19

a. Updates On Previously Reported Cases

Yannes v. SCWorx Corp., No. 1:20-cv-03349, 2021 WL 2555437 (S.D.N.Y. June 21, 2021): As we discussed in our 2020 Mid-Year Securities Litigation Update, this case involved allegations that the company artificially inflated its stock price with a false claim that it had received a purchase order for millions of COVID-19 rapid testing kits. Dkt. No. 1 at 1. In September 2020, this case was consolidated with other stockholder class actions. Dkt. No. 40. Judge Koeltl denied a motion to dismiss in June 2021, finding that the complaint adequately pleaded a strong inference of defendants’ scienter and alleged that the statements were materially misleading. 2021 WL 2555437, at *3–8. On January 5, 2022, the action was stayed to allow the parties to prepare a joint stipulation of settlement. Dkt. No. 74.

In re Sorrento Therapeutics, Inc. Sec. Litig., No. 20-cv-00966, 2021 WL 6062943 (S.D. Cal. Nov. 18, 2021): We previously discussed this case in our 2020 Mid-Year Securities Litigation Update, under the name Wasa Medical Holdings v. Sorrento Therapeutics, Inc. As we described in that Update, a stockholder filed this lawsuit against Sorrento after Sorrento allegedly claimed that it had discovered a “cure” for COVID-19. In November 2021, Judge Battaglia granted the defendants’ motion to dismiss, in part because the challenged statement that “there is a cure” for COVID-19 was a “statement of corporate optimism” that could not be the basis for a claim under Section 10(b) of the Securities Exchange Act. 2021 WL 6062943, at *7. The plaintiffs filed an amended complaint on November 30, 2021, Dkt. No. 58, and defendants filed a motion to dismiss on December 30, 2021, Dkt. No. 61.

b. Newly Filed Cases

Sinnathurai v. Novavax, Inc., No. 21-cv-02910 (D. Md. Nov. 12, 2021): A stockholder of Novavax, a company that develops and produces vaccines, alleges that the company and certain officers made false and misleading statements about the timeline and prospects for the company’s COVID-19 vaccine. Dkt. No. 1 at 1–2. As alleged in the complaint, in March 2021, Novavax announced that it had been in dialogue with the FDA to obtain an Emergency Use Authorization (“EUA”) for its product NVX-CoV2373, which was “in development as a vaccine for COVID-19.” Id. at 1, 6. In that announcement, Novavax specified that the EUA filing could occur as early as the second quarter of 2021 and that it expected to have capacity to manufacture “over 2 billion annualized doses” in mid-2021. Id. at 6–7. In May 2021, a newspaper reported that Novavax’s EUA filing would be delayed until at least June, due to “a regulatory manufacturing issue,” and Novavax announced that day that its EUA filing was delayed until at least July 2021. Id. at 8–9. In August 2021, Novavax announced further delay of its EUA filing until the fourth quarter of 2021. Id. at 12. And in October 2021, another news article reported on manufacturing issues at Novavax that had been “so severe that they strained global COVID-19 vaccination efforts.” Id. at 15. Thereafter, in November 2021, the stockholder filed suit, alleging that after each of these disclosures, Novavax’s share price declined. Id. at 2–3. In December 2021, the defendants filed a notice of intent to file a motion to dismiss. Dkt. No. 13.

In re Emergent Biosolutions Inc. Sec. Litig., No. 8:21-cv-00955, 2021 WL 6072812 (D. Md. Dec. 23, 2021): In this suit, stockholders allege that Emergent, a biopharmaceutical company, and certain officers and high-level employees misled the public about the company’s business and operations though misrepresentations and omissions. Dkt. No. 1 at 14. In June 2020, Emergent received funds through the federal government’s Operation Warp Speed program, which was created to “encourage rapid development, manufacturing, and distribution of COVID-19 vaccines.” 2021 WL 6072812, at *1. The Operation Warp Speed funding was provided to reserve space for vaccine manufacturing at Emergent’s facilities in Baltimore and for Emergent to upgrade those facilities. Id. Emergent also signed agreements with Johnson & Johnson and AstraZeneca to support the mass production of their vaccines, once they were approved for distribution. Id. As alleged in the complaint, in the press releases announcing these agreements and in other statements, Emergent drew attention to its “manufacturing strength” and “expertise in development and manufacturing.” Dkt. No. 1 at 7–9. But Emergent failed to disclose “myriad issues” at the Baltimore facilities, which had been identified in FDA inspections but not disclosed to the public until after a March 31, 2021 article reported on the Baltimore facilities’ contamination of up to 15 million doses of the Johnson & Johnson vaccine. Id. at 2–3, 9–10. After additional reporting revealed the severity of the contamination and Emergent’s “history of violations,” Emergent’s stock price declined “precipitously.” Id. at 10. In December 2021, the court consolidated three class action suits, appointed a lead plaintiff, and selected lead counsel. 2021 WL 6072812, at *6–7.

3. Failure To Disclose Specific Risks

Martinez v. Bright Health Grp. Inc., No. 1:22-cv-00101 (E.D.N.Y. Jan. 6, 2022): This putative class action alleges that Bright Health’s June 25, 2021 offering documents overstated Bright Health’s post-IPO business and financial prospects and failed to disclose that Bright Health was ill-equipped to handle the impact of COVID-19 related costs, which led to a 32.33% fall in stock price on November 11, 2021. Dkt. No. 1 at 2–4. Bright Health has not yet responded to the complaint.

4. False Claims About Pandemic And Post-Pandemic Prospects

In re Progenity, Inc., No. 20-cv-1683, 2021 WL 3929708 (S.D. Cal. Sept. 1, 2021): This putative class action alleges that Progenity, a biotechnology company that develops testing products, made misleading statements and omitted material facts in its registration statement. Dkt. No. 1 at 2. Specifically, the complaint alleges that Progenity allegedly failed to disclose that it had overbilled government payors and that it was suffering from negative trends in Progenity’s testing volumes, selling prices, and revenues as a result of the COVID-19 pandemic. Id. The complaint further alleges that Progenity falsely emphasized its “resilient” business and that it had already “observed positive signs of recovery” from the COVID-linked slowdown. Id. at 8. On September 1, 2021, the court dismissed the case with leave to file a second amended complaint, finding no actionable false or misleading statements. Dkt. No. 48. Plaintiffs filed a second amended complaint on September 22, 2021. Dkt. No. 49. The case was transferred on January 3, 2022 to Judge Lopez, who is currently considering a second motion to dismiss. Dkt. Nos. 52–54.

Dixon v. The Honest Co., Inc., No. 2:21-cv-07405 (C.D. Cal. Sept. 15, 2021): Stockholders of the Honest Co., a seller of “clean lifestyle” products, filed this putative class action alleging that the company’s registration statement omitted the fact that the company’s results were impacted by a multimillion-dollar COVID-19 stock-up of diapers, wipes, and household and wellness products, and that at the time of its IPO the company was experiencing decelerating demand for the products. Dkt. No. 1 at 1, 3. The complaint alleges that as a result, the company’s statements about “its business, operations, and prospects, were materially misleading and/or lacked a reasonable basis.” Id. The court recently granted a motion to consolidate this case with other, similar cases brought against the Honest Co. Dkt. No. 47.

Douvia v. ON24, Inc., No. 21-cv-08578 (N.D. Cal. Nov. 3, 2021): This putative class action by stockholders of ON24, Inc., a “cloud-based digital experience platform,” alleges that the company’s offering documents were materially inaccurate, misleading, and incomplete because they failed to disclose that the company’s surge in new customers due to COVID-19 did not fit the company’s traditional customer profile and thus the customers were unlikely to renew their contracts, leading to a decrease in the company’s financial results. Dkt. No. 1 at 1, 2. Motions to consolidate, appoint a lead plaintiff, and appoint lead counsel are currently before the court. Dkt. No. 65.

Hollywood Police Officers’ Ret. Sys. v. Citrix Sys., Inc., No. 21-cv-62380 (S.D. Fla. Nov. 19, 2021): The plaintiffs allege that Citrix made materially false and misleading statements that caused substantial losses to investors. Dkt. No. 1 at 2. Citrix, a software company that provides users with secure remote access to computer networks, decided to shift to a subscription license model. Id. Due to the COVID-19 pandemic, however, Citrix offered shorter duration, on-premise licenses that would later transition to subscription licenses. Id. According to the complaint, because of this offer and the COVID-19 pandemic, Citrix’s sales were boosted, and the company touted its success to investors. Id. The plaintiffs allege that, in reality, the company’s transition to subscription licenses was not as successful as the company had disclosed, as customers failed to make the transition, instead preferring short-term on-premise licensing due to the COVID-19 pandemic. Id. at 3. Motions to appoint lead plaintiff and to appoint lead counsel are currently before the court. Dkt. Nos. 16–21.

Leventhal v. Chegg, Inc., No. 5:21-cv-09953 (N.D. Cal. Dec. 22, 2021): This putative class action alleges that Chegg, a textbook, tutoring, and online research provider, falsely claimed that as a result of its “unique position to impact the future of the higher education ecosystem” and “strong brand and momentum,” Chegg would continue to grow post-pandemic. Dkt. No. 1 at 2. The complaint alleges that Chegg knew that its growth was a temporary effect of the pandemic and was not sustainable. Id. at 2–3. As a result, the plaintiff alleges that Chegg took advantage of its artificially inflated stock price by selling $1 billion of common stock to investors in its secondary offering. Id. at 3.

Collins v. DocuSign, Inc., No. 21-cv-07071 (E.D.N.Y. Dec. 22, 2021): The plaintiffs allege that DocuSign, a software company that “enables users to automate the agreement process and provide legally binding e-signatures from nearly any devise,” made false and misleading statements and failed to disclose the impact of COVID-19 on the company’s business. Dkt. No. at 1, 2, 13. Specifically, plaintiffs allege that Docusign failed to disclose that COVID-19 had a positive impact of the company and that DocuSign downplayed the impact that a “return to normal” would have on the company’s growth and business. Id.

5. Insider Trading And “Pump and Dump” Schemes

In re Eastman Kodak Co. Sec. Litig., No. 6:21-cv-6418, 2021 WL 3361162 (W.D.N.Y. Aug. 2, 2021): We discussed the first in the series of cases that have now been consolidated under the heading In re Eastman Kodak Co. Securities Litigation in our 2020 Year-End Securities Litigation Update and then followed up on it in our 2021 Mid-Year Securities Litigation Update. Tang v. Eastman Kodak Co., No. 20-cv-10462 (D.N.J. Aug. 13, 2020), was a putative class action in which stockholders alleged Eastman Kodak violated Sections 10(b) and 20(a) of the Exchange Act by failing to disclose that the company’s officers were granted stock options before the company’s public announcement that it had received a loan to produce drugs for the treatment of COVID-19. Dkt. No. 1 at 2. As we noted in our 2021 Mid-Year Update, Tang v. Eastman Kodak Co. was transferred from the District of New Jersey to the Western District of New York. Around the same time, another class action against Eastman Kodak, McAdams v. Eastman Kodak Co., No. 21-cv-6449 (S.D.N.Y. Aug. 26, 2020), was transferred from the Southern District of New York to the same court. 2021 WL 3361162, at *1. In late June 2021, the court in the Western District of New York consolidated the two actions, and in August, the court appointed lead plaintiff and lead counsel. Id.

In re Vaxart Inc. Sec. Litig., 3:20-cv-05949, 2021 WL 6061518 (N.D. Cal. Dec. 22, 2021): Stockholders allege that Vaxart insiders—directors, officers, and a major stockholder—profited from misleading statements that (1) overstated Vaxart’s progress toward a successful COVID-19 vaccine; and (2) implied that Vaxart’s “supposed vaccine” had been “selected” by the federal government’s Operation Warp Speed program. Dkt. No. 1 at 6–7. After Vaxart’s stock price rose in response to these statements, the insiders “cashed out,” exercising options and warrants worth millions of dollars. Id. at 7–8.

After this case was consolidated with other, related stockholder class actions (including Hovhannisyan v. Vaxart, Inc., No. 20-cv-06175 (N.D. Cal. Sept. 1, 2020), which we first discussed in our 2020 Year-End Securities Litigation Update), Judge Chhabria issued a decision on the defendants’ motion to dismiss on December 22, 2021, and, in doing so, observed that the case is an “unusual” one. 2021 WL 6061518. The court noted that the plaintiffs easily satisfied the pleading requirement for scienter, which can be a high hurdle for private plaintiffs. Instead, the court observed plaintiffs faced a challenge pleading that the statements at issue were materially misleading to a reasonable investor, where the press releases and other statements at issue “included several accurate passages alongside highly misleading ones,” so that an investor might have been able to “sift through” them and find the false statements untrustworthy. Id. at *1. Judge Chhabria ultimately concluded, however, that, considering the totality of the statements and the “unique context” of the Operation Warp Speed program, the plaintiffs had sufficiently alleged that the statements were materially misleading. Id. at *1, *4–5. The motion to dismiss was granted only as to the major-stockholder defendant, as the plaintiffs had failed to allege that the entity was a “maker” of the misleading statements or controlled Vaxart’s public statements. Id. at *8.

B. Stockholder Derivative Actions

Equity-League Pension Tr. Fund v. Great Hill Partners, L.P., No. 2020-0992-SG, 2021 WL 5492967 (Del Ch. Nov. 23, 2021): In November 2020, Wayfair stockholders initiated this derivative action asserting that (1) the directors had breached their fiduciary duties in connection with a private investment in a public equity (“PIPE”) transaction undertaken during the COVID-related economic downturn in early 2020, see 2021 WL 5492967, at *4; (2) noteholders had been unjustly enriched by that transaction, id. at *5; and (3) a private equity investor and its designee director had been unjustly enriched in an early March 2020 purchase of Wayfair stock, id. In November 2021, the Court of Chancery granted defendants’ motion to dismiss in its entirety because the plaintiffs had failed to plead demand futility. Id. at *1.

In re Vaxart, Inc. Stockholder Litig., No. 2020-0767-PAF, 2021 WL 5858696 (Del. Ch. Nov. 30, 2021): Unlike the Vaxart class action securities litigation discussed above, this case was filed derivatively on behalf of the Vaxart corporate entity. In particular, Vaxart stockholders alleged that the officers, directors, and purported controlling stockholder kept private the announcement regarding the company’s selection to participate in Operation Warp Speed so that they could keep the stock price artificially low before exercising their options. 2021 WL 5858696, at *1, *13. Because the plaintiffs failed to plead demand futility as to their derivative claims, on November 30, 2021, the court granted the defendants’ motion to dismiss as to the derivative claims, and requested supplemental briefing on other issues. Id. at *24.

C. SEC Cases

SEC v. E*Hedge Sec. Inc., No. 1:20-cv-22311 (S.D. Fla. June 3, 2020): We previously discussed this case in our 2020 Mid-Year Securities Litigation Update. The SEC filed suit against an internet investment advisor firm and its president for failing to turn over its books and records while touting investment opportunities related to treatments and vaccines for COVID-19. Dkt. No. 1 at 1–2, 6. Although the defendants responded to the initial complaint, they subsequently failed to answer or otherwise respond to the SEC’s amended complaint. See Dkt. No. 29 at 1. On March 9, 2021, the court issued an order granting the SEC’s motion for default judgment for a permanent injunction restraining E*Hedge Securities from violating Sec. 204 of the Investment Advisor’s Act of 1940 by failing to turnover books and records as required by the statute, and being registered with the SEC as an investment adviser while it is statutorily prohibited from doing so under Sec. 203A of the same statute. Dkt. No. 29 at 2.

SEC v. Berman, No. 20-cv-10658, 2021 WL 2895148 (S.D.N.Y. June 8, 2021): We previously discussed a related criminal case in our 2020 Year-End Securities Litigation Update. In the criminal case, a federal grand jury indicted the CEO of Decision Diagnostics Corp. (also a defendant in this civil case) on December 15, 2020, for allegedly attempting to defraud investors by making false and misleading statements about the development of a new COVID-19 rapid test, which the CEO falsely claimed was on the verge of FDA approval. Dkt. No. 1 at 6–7. As alleged, the product in question was actually still in its conceptual stage. Id. at 9. On December 17, 2020, two days after the indictment in the criminal case, the SEC filed a civil enforcement action based on the same underlying facts and alleging that both Decision Diagnostics Corp. and its CEO, Keith Berman, violated Section 10(b) of the Exchange Act and Rule 10b-5. 2021 WL 2895148, at *1. In this civil case, the court stayed discovery in June 2021 in light of the parallel criminal case against the CEO. Id.

SEC v. Wellness Matrix Grp., Inc., No. 21-cv-1031, 2021 WL 6104812 (C.D. Cal. Oct. 14, 2021): We previously discussed this case in our 2021 Mid-Year Securities Litigation Update. The SEC charged Wellness Matrix, a wellness company, and its controlling stockholder with violations of Section 10(b) and Rule 10b-5 by allegedly misleading investors regarding the availability and approval status of the corporation’s at-home COVID-19 testing kits. Dkt. No. 1 ¶¶ 6–7, 9. On August 23, 2021, the controlling stockholder filed his answer in which he asserted several counterclaims against the SEC, including for trademark infringement, libel, and slander. 2021 WL 6104812, at *1. On October 14, 2021, the court granted the SEC’s motion to dismiss defendants’ counterclaims but denied the SEC’s motion to strike defendant’s unclean hands defense and challenges to the court’s jurisdiction. Id. The SEC’s motion was unopposed and the court’s decision to dismiss the defendant controlling stockholder’s counterclaims validated the SEC’s argument that Section 21(g) of the Exchange Act “bars defendants from bringing a counterclaim in an SEC enforcement action without the SEC’s consent.” Id. at *2. The court chose to deny the SEC’s motion as to the defendant’s unclean hands and jurisdictional defenses, however, because the SEC failed to identify the language in the answer it was seeking to strike, and the court “decline[d] to sift through the Answer and guess.” Id. at *3.

VI. Falsity Of Opinions – Omnicare Update

There was significant activity in the second half of 2021 with respect to “opinion” liability under the federal securities laws. Lower courts continue to examine the standard for imposing liability based on a false opinion as set forth by the Supreme Court in Omnicare, Inc. v. Laborers District Council Construction Industry Pension Fund, 575 U.S. 175 (2015). In Omnicare, the Supreme Court held that “a sincere statement of pure opinion is not an ‘untrue statement of material fact,’ regardless whether an investor can ultimately prove the belief wrong,” but that an opinion statement can form the basis for liability in three different situations: (1) the speaker did not actually hold the belief professed; (2) the opinion contained embedded statements of untrue facts; or (3) the speaker omitted information whose omission made the statement misleading to a reasonable investor. Id. at 184–89.

In the second half of 2021, courts continued the trend of applying Omnicare to claims under the Exchange Act (Omnicare was decided in the context of a Section 11 claim), including in numerous actions under Section 10(b) and Rule 10b-5. For example, in Villare v. Abiomed, Inc., No. 19 CIV. 7319 (ER), 2021 WL 4311749, at *19–20 (S.D.N.Y. Sep. 21, 2021), the Southern District of New York applied, without discussion or note, the Omnicare analysis to claims under the Exchange Act. See also Del. Cnty. Emps. Ret. Sys. v. Cabot Oil & Gas Corp., No. CV H-21-2045, 2022 WL 112029, at *10 (S.D. Tex. Jan. 12, 2022) (applying Omnicare to a claim brought under Section 10(b) of the Securities Exchange Act); Constr. Indus. & Laborers Joint Pension Tr. v. Carbonite, Inc., 22 F.4th 1, 7(1st Cir. 2021) (holding that the plaintiff adequately stated a Section 10(b) claim under Omnicare).

A notable portion of claims survived motions to dismiss in which defendants asserted that the misrepresentations or omissions at issue were non-actionable statements of opinion under Omnicare. For example, the First Circuit in Carbonite, Inc., 22 F.4th 1, held that a plaintiff adequately stated a Section 10(b) claim against a software company based on misleading statements by the company’s executives. Id. at 7. The plaintiffs in that case alleged that a software company misstated and misled investors as to the capabilities of a new data-backup product. Id. at 4-5. The complaint cited a statement made by the chief financial officer touting that the company “put something out that we think is just completely competitive and just a super strong product.” Id. at 7. The plaintiffs painted a different picture, claiming that the product “never worked.” Id. at 5. Despite being phrased in the form of a belief (“we think”), the First Circuit noted that the CFO’s opinion was precisely the type of actionable statement contemplated by Omnicare. Id. at 7–8. The court explained that the CFO’s statement “plausibly conveyed” several facts: first, that the CFO actually believed the product would be “completely competitive” and “super strong;” second, that the CFO’s belief “fairly align[ed] with the information” he possessed at the time; and third, that the CFO’s opinion was based on “the type of reasonable inquiry that an investor in context would expect to have been made.” Id. at 7 (citing Omnicare, 575 U.S. at 188–89). Because the complaint plausibly alleged that “at least one and possibly all three of these facts must be false,” it “sufficiently allege[d] that [the CFO] misled investors.” Id. at 8.

In Sheet Metal Workers Loc. 19 Pension Fund v. ProAssurance Corp., No. 2:20-CV-00856-AKK, 2021 WL 5866731, at *15 (N.D. Ala. Dec. 10, 2021), the court held that plaintiffs plausibly alleged that defendants’ statements of opinion “contained embedded statements of fact that the defendants allegedly knew were false or misleading,” which nullified the fact that “the defendants used the word ‘belief’ to couch some of their statements.” Similarly, in In re 2U, Inc. Sec. Class Action, No. CV TDC-19-3455, 2021 WL 3418841 (D. Md. Aug. 5, 2021), the District of Maryland found that some forward looking statements of opinion were nonetheless actionable where an officer expressed confidence in continued growth rates that were inconsistent with internal projections. Id. at *11. The officer noted that the positive projections were based on “information currently available,” despite the officer knowing that the growth rates were in fact declining. Id. Thus, the statement was materially misleading because the speaker “provided no warnings or other information that would have corrected a reasonable person’s reading of those statements.” Id.; see also Enzo Biochem, Inc. v. Harbert Discovery Fund, LP, No. 20-CV-9992 (PAC), 2021 WL 4443258, at *12 (S.D.N.Y. Sept. 27, 2021) (“Even if the [statements regarding the qualifications of the board candidates] were statements of opinion, liability could still attach under Section 14(a) if a jury were to find that [defendant] failed to accurately state its opinion in the proxy solicitations.”).

Although these cases illustrate that courts are willing to let certain complaints play out, even where the allegedly false or misleading statements include explicit language noting that the content is mere belief and opinion, Omnicare still presents a significant pleading barrier. For example, in Turnofsky v. electroCore, Inc., No. CV 19-18400, 2021 WL 3579057 (D.N.J. Aug. 13, 2021), the District of New Jersey relied on Omnicare to dismiss a Section 11 claim against a bioelectronic medicine company. Id. at *5. The plaintiffs alleged that electroCore, a company seeking to develop nerve stimulation technology, misrepresented its “competitive strengths” in its registration statement. Id. at *4. Although the registration statement noted that the company’s proprietary technology was “novel,” the complaint alleged that the opposite was true: “several other competitors were also being granted FDA clearance for the same [technology].” Id. The court disagreed, noting that the plaintiffs had not demonstrated the statements “were plausibly false” or even “materially misleading.” Id. at *5. The court also noted that the statements highlighted by the plaintiffs were opinions protected under Omnicare. Id. For example, the preamble to the registration statement included the language “we believe” immediately prior to the statements concerning the company’s “competitive strengths” and “novel” technology. Id. Additionally, the company’s statements did “not imply that similar medical devices were not entering the market” or that “competitors had not been granted FDA clearance.” Id.; see also, e.g., Sayce v. Forescout Techs., Inc., No. 20-CV-00076-SI, 2021 WL 4594768, at *6 (N.D. Cal. Oct. 6, 2021) (holding that a general belief in a favorable outcome, such as statements that the company “expect[ed]” and “look[ed] forward” to a closing, “[did] not create an affirmative impression or promise that [the closing]” would actually occur); In re Progenity, Inc., No. 20-CV-1683-CAB-AHG, 2021 WL 3929708, at *9 (S.D. Cal. Sept. 1, 2021) (finding the statement “we believe our business is resilient and we have observed positive signs of recovery so far” was not actionable under Omnicare); Employees’ Ret. Sys. of City of Baton Rouge & Par. of E. Baton Rouge v. MacroGenics, Inc., No. GJH-19-2713, 2021 WL 4459218, at *13 (D. Md. Sept. 29, 2021) (“[T]he statement that ‘we anticipate’ a positive trend to continue is also protected as a ‘sincere statement of pure opinion’ under Omnicare.”).

Another category of cases have held that an opinion is not actionable solely because there are underlying facts cutting against the opinion. In In re Philip Morris International, Inc. Securities Litigation, No. 1:18-CV-08049 (RA), 2021 WL 4135059, at *9 (S.D.N.Y. Sept. 10, 2021), the plaintiffs alleged that the defendants made false and misleading statements to the effect that studies of a cigarette alternative were “very encouraging,” and the product “has the potential to reduce the risk of smoking-related diseases.” The court considered the statements to be opinions because of the use of qualifiers such as “potential” or “likely” in connection with statements about the product’s reduction in harm from smoking cigarettes. Id. The defendants’ failure to disclose certain adverse test results was not actionable because “[i]t is well-established that a statement of opinion is not misleading simply because the issuer knows, but fails to disclose, some fact cutting the other way.” Id. (internal quotation marks omitted); see also Villare, 2021 WL 4311749 at *20 (explaining that “failure to include a fact that would have potentially undermined Defendants’ optimistic projections,” was not actionable because “Defendants were only tasked with making statements that fairly aligned with the information in the issuer’s possession at the time”) (internal quotation marks omitted)).

Courts continue to sort through what qualifies as a statement of opinion versus a statement of fact. A recent decision notes that the absence of language such as “I think” or “I believe” suggests that the statement is, indeed, a statement of fact. In re Quantumscape Securities Class Action Litig., No. 3:21-CV-00058-WHO, 2022 WL 137729, at *16 (N.D. Cal. Jan. 14, 2022) (“None of these statements use opinion-qualifying language such as ‘I think’ or ‘I believe.’ All express ‘certainty’ about an existing thing or occurrence.”). Other courts have taken a categorical approach, holding, for example, that “[a] goodwill determination is a statement of opinion.” SEC v. Sequential Brands Grp., Inc., No. 20-CV-10471 (JPO), 2021 WL 4482215, at *7 (S.D.N.Y. Sept. 30, 2021).

A recent federal district court decision also highlighted a “split in authority regarding whether” an audit report is an “opinion” subject to Omnicare. Hunt v. Bloom Energy Corp., No. 19-CV-02935-HSG, 2021 WL 4461171, at *13 (N.D. Cal. Sept. 29, 2021); compare Special Situations Fund III QP, L.P. v. Marrone Bio Innovations, Inc., 243 F. Supp. 3d 1109, 1116 (E.D. Cal. 2017) (“Omnicare did nothing to upset prior caselaw holding auditors liable for erroneous financial statements in registration statements.”) with Querub v. Hong Kong, 649 F. App’x 55, 58 (2d Cir. 2016) (applying Omnicare to an auditor’s report in a summary order), and Johnson v. CBD Energy Ltd., No. CV H-15-1668, 2016 WL 3654657, at *10 (S.D. Tex. July 6, 2016) (collecting cases).

Finally, several recent decisions have emphasized the significance of the context surrounding the statements in question to determine whether the opinion is actionable under Omnicare. In Delaware County Employees Retirement System v. Cabot Oil & Gas Corporation, No. CV H-21-2045, 2022 WL 112029, at *10 (S.D. Tex. Jan. 12, 2022), the Southern District of Texas granted a motion to dismiss a Section 10(b) claim because the context surrounding the allegedly impermissible statement mitigated any potential misunderstanding. There, plaintiffs alleged that an oil and gas company had misled investors by providing a general explanation of the “legal [and] regulatory requirements” in the industry. Id. The complaint alleged that these general statements of applicable regulations had “hid[den] the fact that [the company] had received Notices of Violation.” Id. The court rejected this notion by pointing to the fact the company, in the very same document as the statements the plaintiffs took issue with, had disclosed the “substantial costs and liabilities related to environmental compliance issues” it may face. Id. The court cited Omnicare for the proposition that an investor would read a statement “in light of all its surrounding text.” Id.; see also Turnofsky, 2021 WL 3579057 at *5 (finding that other sections of a registration statement had “disclosed competitors’ advantages,” thereby undermining the plaintiffs’ claim that the defendant had omitted that information; the court also noted that Omnicare commanded lower courts to “address the statement’s context”).

We will continue to monitor developments in these and similar cases.

VII. Halliburton II Market Efficiency And “Price Impact” Cases

We continue to follow developments as the federal courts interpret the Supreme Court’s 2014 decision in Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014) (“Halliburton II”), preserving the “fraud-on-the-market” presumption of class-wide reliance in Rule 10b-5 cases, but also permitting defendants to rebut this presumption at the class certification stage with evidence that the alleged misrepresentation did not impact the issuer’s stock price. As detailed in our 2021 Mid-Year Securities Litigation Update, the Supreme Court’s decision in Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System, 141 S. Ct. 1951 (2021) (“Goldman Sachs”), has resolved a number of recurring questions lower courts struggled with following the Halliburton II decision. There, the Court confirmed that in deciding whether to certify a class after defendants challenge the Basic presumption of reliance, the need to consider all evidence of price impact extends to considering the generic nature of allegedly fraudulent statements, even if such evidence overlaps with merits issues, such as loss causation or materiality. See id. at 1955, 1960–61. The Court also held that at the class certification stage defendants bear the burden of persuasion on the issue of price impact in order to rebut the presumption of reliance. Id. at 1962–63.

Another issue that was addressed by the Court in Goldman Sachs but not resolved was the so-called “inflation-maintenance theory,” used by plaintiffs to show price impact where the statement itself does not induce inflation but a later “corrective disclosure” is accompanied by a drop in the stock price. See Goldman Sachs, 141 S. Ct. at 1959 n.1, 1961. Although the Court expressly declined to take a position on the “validity or . . . contours” of the inflation-maintenance theory, it noted that the mismatch between generic misrepresentations and later, specific corrective disclosures will be a key consideration in the price-impact analysis, and that where such a mismatch exists, “there is less reason to infer front-end price inflation . . . from the back-end price drop.” Id.

On remand, the Second Circuit found that it was unclear whether the district court considered the generic nature of the alleged misrepresentations, and therefore remanded the case for the district court to consider the parties’ price impact arguments a third time. Arkansas Tchr. Ret. Sys. v. Goldman Sachs Grp., Inc., 11 F.4th 138, 143 (2d Cir. 2021).

Back in the District Court, Judge Crotty considered the parties’ price impact evidence again in light of the Supreme Court’s enhanced guidance, including the extent of the “mismatch” between the alleged misstatements and alleged corrective disclosures on a “sliding scale.” In re Goldman Sachs Grp., Inc. Sec. Litig., 2021 WL 5826285, at *13–14 (S.D.N.Y. Dec. 8, 2021). The court again held that plaintiff linked the stock price drops to both the corrective disclosures and the alleged misstatements and that defendants failed to sever that link. Id. at *9–10. It also held that the statements were not so generic “as to diminish their power to maintain pre-existing price inflation,” but rather “did in fact maintain price inflation.” Id. at *11. Judge Crotty also held that, although the challenged statements and corrective disclosures “do not present equivalent levels of genericness,” defendants failed to identify a sufficient “mismatch” to undermine the inference of price impact. Id. at *14. Following Judge Crotty’s third certification order, Goldman Sachs has appealed the decision to the Second Circuit for the third time.

We will continue to follow the Goldman Sachs case and other developments in this area. We anticipate that upcoming opinions will continue to address the extent to which a mismatch between the challenged statement and corrective disclosure can undermine the evidence of price impact in cases based on inflation-maintenance theory, and we will report on significant matters in future updates.

VIII. Other Notable Developments

A. Second Circuit Revives Class Action Because Section 10(b) Does Not Require That Misstatements Concern An Underlying “Fraudulent Scheme Or Practice”

In In re Hain Celestial Group, Inc. Securities Litigation, 20 F.4th 131 (2d Cir. 2021), the Second Circuit vacated the dismissal of securities fraud claims brought under Section 10(b) of the Exchange Act and Rule 10b-5. The plaintiff investors alleged that the defendant health food product company had engaged in “channel stuffing,” “whereby valuable and unsustainable sales incentives—including price reductions and grants of an absolute right to return unsold merchandise—were given near the end of each quarter to Hain’s largest distributors to induce them to buy more product than needed so that Hain would meet its quarterly sales targets and analysts’ estimates.” Id. at 132–33. The plaintiff class argued both that the defendants’ failure to attribute Hain’s performance to channel stuffing in various financial statements rendered those statements materially misleading, in violation of Rule 10b-5(b), and that the channel stuffing itself constituted an unlawful scheme to defraud investors, in violation of Rule 10b-5(a) and (c). In re Hain Celestial Grp. Inc. Sec. Litig., 2020 WL 1676762, at *9 (E.D.N.Y. Apr. 6, 2020). The district court rejected these arguments and dismissed the complaint entirely. It first held that the alleged channel stuffing constituted a legitimate business practice, and therefore could not be the predicate for liability under Rule 10b-5(a) or (c). Id. at *12. The district court also rejected the Rule 10b-5(b) claim, because “its predicate is the illegitimacy of the channel stuffing practices the Court already found to be legitimate” and “the Defendants were under no generalized obligation to disclose wholly legal sales incentives simply because the Lead Plaintiffs allege those incentives to be unsustainable.” Id.

On appeal, the plaintiffs challenged only the Rule 10b-5(b) dismissal. In re Hain, 20 F.4th at 136. The Second Circuit vacated the dismissal of that claim, holding that “[t]he district court mistakenly imported the requirement of clauses (a) and (c) of a fraudulent scheme or practice into clause (b), which includes no such requirement.” Id. The appellate court explained that “[t]he success of . . . a complaint in alleging a violation of clause (b) does not depend on whether the alleged channel stuffing practices themselves were fraudulent or otherwise illegal.” Id. at 137. In doing so, however, the Second Circuit did not address the district court’s analysis of prior Circuit precedent holding that, “up to a point, companies must be permitted to operate with a hopeful outlook, and that as a result, executives are not required to take a gloomy, fearful or defeatist view of the future.” In re Hain, 2020 WL 1676762, at *13 (internal quotation marks omitted). Nor did the Second Circuit address the district court’s reliance on past district court decisions finding that companies are not obligated to disclose “unsustainable” practices “where [they] engaged in no misconduct and the statements at issue attributed the company’s growth to broad trends and corporate strengths, without pointing to any specific factors or sources of revenue.” Id. at *14 (internal quotation marks and alterations omitted). Instead, the Second Circuit only instructed the district court to consider anew whether a Rule 10b-5(b) claim had been adequately pleaded. See In re Hain, 20 F.4th at 138. This decision indicates that corporations and executives could be exposed to securities fraud liability if they fail to accurately attribute financial performance to unsustainable practices, even if those practices are wholly legitimate.

B. Ninth Circuit Finds Statutory Standing For Purchaser In Direct Listing

In Pirani v. Slack Technologies, Inc., 13 F.4th 940 (9th Cir. 2021), the Ninth Circuit became the first court of appeals to address whether purchasers of shares sold in a direct listing had statutory standing to assert claims under Sections 11 and 12 of the Securities Act. In a 2-1 decision, the panel majority affirmed the district court’s holding that shareholders do have standing to bring such claims.

In 2018, the New York Stock Exchange introduced a rule, approved by the SEC, that allows companies to go public through a Selling Shareholder Direct Floor Listing (a “direct listing”). Id. at 944. Under this procedure, the company does not issue or sell any new shares. Instead it files a registration statement “solely for the purpose of allowing existing shareholders to sell their shares on the exchange.” Id. at 944. This procedure differs from a traditional initial public offering (“IPO”), in which all of the shares sold to the public are newly issued shares that are all registered under a registration statement. Id. at 943. Another major difference between a direct listing and an IPO is that in a direct listing, both shares registered under the registration statement and shares that are not registered (because they are exempt from the registration requirements of the Securities Act pursuant to SEC Rule 144) may be sold as soon as the company goes public. See id. By contrast, in an IPO, unregistered shares typically are subject to a lock-up period which prevents them from being sold when a company first goes public. Id. This means that all of the shares that initially trade after an IPO are registered. Id. at 943. Therefore, whereas an investor would know that any shares purchased following an IPO must be registered, an investor who purchased shares following a direct listing would have no way of knowing whether the shares he purchased were registered or unregistered. Id. at 944.

In June 2019, Slack went public through a direct listing, which permitted its existing shareholders to sell up to 118 million registered shares and 165 million unregistered shares. Id. The plaintiff purchased 30,000 Slack shares on the day of the public listing, and 220,000 additional shares in ensuing months. Id. He later brought claims under Sections 11 and 12 of the Securities Act, alleging that the registration statement Slack issued in connection with the direct listing omitted material information that rendered Slack’s disclosures misleading. Id. at 944–45. The question presented to the Ninth Circuit was whether the plaintiff had statutory standing to bring these claims despite the fact that he had no knowledge of whether the shares he purchased were registered under the challenged registration statement. Id. at 945.

Under well-settled precedent, a plaintiff must be able to trace the shares he purchased to those registered under the registration statement being challenged in order to have statutory standing. Courts have consistently held that it is nearly impossible for plaintiffs to trace in cases involving “successive registrations, whereby a company issues a secondary offering to the public such that there are multiple registration statements under which a share may be registered,” because plaintiffs will not know whether the shares they purchased came from the challenged registration statement instead of another registration statement. Id. at 946. Slack argued this same problem was present in its direct listing because the market contained both shares registered under the challenged registration statement (which may confer standing) and many more shares that were unregistered (which may not). Id. at 948. Nevertheless, the panel majority concluded that the plaintiff had standing “[b]ecause this case involves only one registration statement” and “does not present the traceability problem identified by [the Ninth Circuit] in cases with successive registrations.” Id. at 947. The panel majority reasoned that both registered and unregistered shares could confer standing because, under NYSE direct listing rules, both could be sold on the exchange only because Slack had an effective registration statement. Id. The panel majority further reasoned that a contrary interpretation would “create a loophole” exempting issuers from Section 11 and Section 12 liability so long as they go public via a direct listing. Id. at 948.