EU Omnibus Simplification Package Update

Client Alert | June 18, 2025

Draft Report by European Parliament’s Rapporteur proposes further cutbacks to sustainability reporting and due diligence obligations.

On June 12, 2025, the European Parliament’s rapporteur for the EU’s Omnibus Simplification Package, Swedish MEP Jörg Warborn (“Rapporteur”), presented his draft report[1] on the proposed amendments to the Corporate Sustainability Reporting Directive (CSRD)[2] and the Corporate Sustainability Due Diligence Directive (CSDDD)[3] (“Draft Report”). As we have reported previously, the legislative process was set into motion by the European Commission with its publication of the “First Omnibus Package” on February 26, 2025[4] (see here).[5]

In this alert, we analyze the proposed amendments of the Rapporteur within the context of the Omnibus Simplification Package discussions, and their implications for in-scope businesses under the CSRD and CSDDD. We also provide an update on the status of the Omnibus Process more broadly, including the expected next steps.

As the legislative process unfolds further, we will continue to monitor and report on any new developments.

1. Executive Summary and Key Takeaways

The Rapporteur’s proposal reflects his previously announced goal to “cut costs for companies and reduce burdens even more”. While the Draft Report is broadly in line with the European Commission’s Omnibus recommendations, it proposes even more significant cutbacks – especially regarding the scope of the CSRD and the due diligence obligations under the CSDDD. However, there is a possibility that the Rapporteur explicitly chose this approach to leave room for negotiations in the European Parliament.

Overall, the key changes in the Draft Report compared to the European Commission’s proposal are:

- The introduction of a raised, uniform threshold for CSRD, CSDDD and the EU Taxonomy Regulation,[6] limiting applicability to companies with an average of more than 3,000 employees and more than EUR 450 million net turnover.

- For U.S. or other non-EU companies, CSDDD applicability depends on a net turnover in the EU exceeding EUR 450 million (without employee thresholds).

CSRD Reporting

- The obligation to request and obtain information from out-of-scope companies in the reporting entities’ chain of activities is significantly reduced as a result of the increased applicability thresholds because requests to out-of-scope companies shall be limited to so called voluntary reporting standards.

- Companies are no longer required to report on a Climate Transition Plan, which aligns with the Paris Agreement, but on any Climate Transition Plan, if such a plan already exists.

- It is clarified that trade secrets are generally exempted from sustainability reporting obligations.

- Ultimate parent companies that are financial holding companies not involved in management activities are exempted from direct sustainability reporting obligations, if a designated subsidiary in the EU complies with reporting on their behalf.

CSDDD Obligations

- The obligation to adopt a Climate Transition Plan is eliminated. The purpose of this amendment is to reduce the administrative burden on companies and competent authorities.

- The full harmonization provisions of the CSDDD prohibiting deviations from the CSDDD in the transposition by the EU member states are expanded to include key elements such as scope, definitions, due diligence obligations, and supervisory mechanisms in order to prevent “gold-plating” by EU member states.

- Due diligence obligations are further reduced:

- Companies may prioritize and forego addressing less significant adverse impacts.

- First scoping of areas of adverse impacts shall only be done on the basis of reasonably available information without information requests to direct business partners.

- Further assessment of areas of adverse impacts at direct business partners with fewer than 3,000 employees shall be limited to reduced standards (i.e., voluntary reporting standards under the CSRD).

- Companies may forego suspending business relationships due to adverse impacts if doing so would cause substantial prejudice, provided they justify the decision – and thereby balancing due diligence obligations with economic and operational realities.

2. Status Quo of the Omnibus Process and Expected Timeline

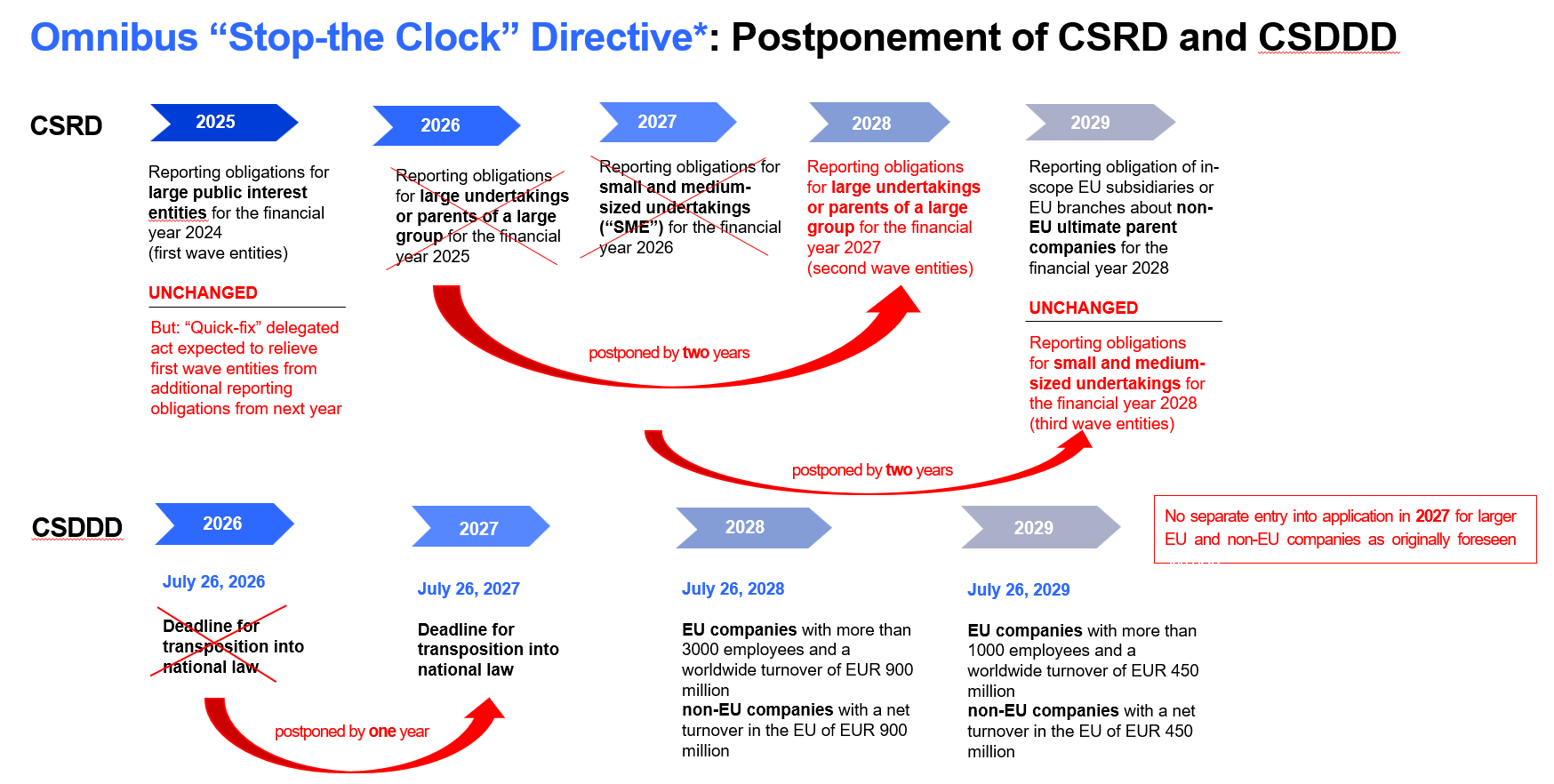

As reported previously, the First Omnibus Package by the European Commission in February consisted of two separate proposals: (i) a Stop-the-Clock Directive[7] delaying certain reporting obligations and due diligence obligations, and (ii) an Amendment Directive,[8] revising key elements of the EU’s sustainability reporting and due diligence frameworks.

(a) Stop-the-Clock Directive already enacted

As expected, the Stop-the-Clock Directive[9] entered into force on April 17, 2025, without further legislative negotiations. This postponed entry of application of the CSRD by two years and of the CSDDD by one year (see below timeline). The Stop-the-Clock Directive does not include any amendments in substance, i.e. regarding thresholds for applicability. Therefore, the suggested amendments under the EU Commission’s and the Rapporteur’s proposals are not reflected in the graphic below.

|

Several EU member states have already transposed or started to transpose the Stop-the-Clock Directive into national law, including Bulgaria, Denmark, Estonia, Finland, France, Lithuania, Luxembourg, Poland and Sweden.[10] Ensuring swift transposition is important because the majority of EU member states have already transposed the current CSRD (Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia, Sweden). Therefore, the respective sustainability reporting obligations under national law must now also be delayed for two years.

There remain nine member states – Austria, Cyprus, Germany, Luxembourg, Malta, Netherlands, Portugal and Spain – where the CSRD transposition process has not been completed despite the expiry of the transposition deadline on July 6, 2024.

Regarding first wave companies (i.e. large Public Interest Entities (PIEs)), due to report under CSRD from January 1, 2025 and unaffected by the Stop-the-Clock Directive, the EU executive’s team leader for sustainability reporting, Tom Dodd, confirmed at a meeting of the European Parliament’s Committee on Legal Affairs on May 13, 2025 that the European Commission intended to adopt a “quick fix” delegated act “very soon” that would require first wave companies to continue reporting, while introducing a two-year delay for the phase-in provisions under the (current) European Sustainability Reporting Standards (ESRS).

(b) Discussion on Amendments in Substance Still Ongoing

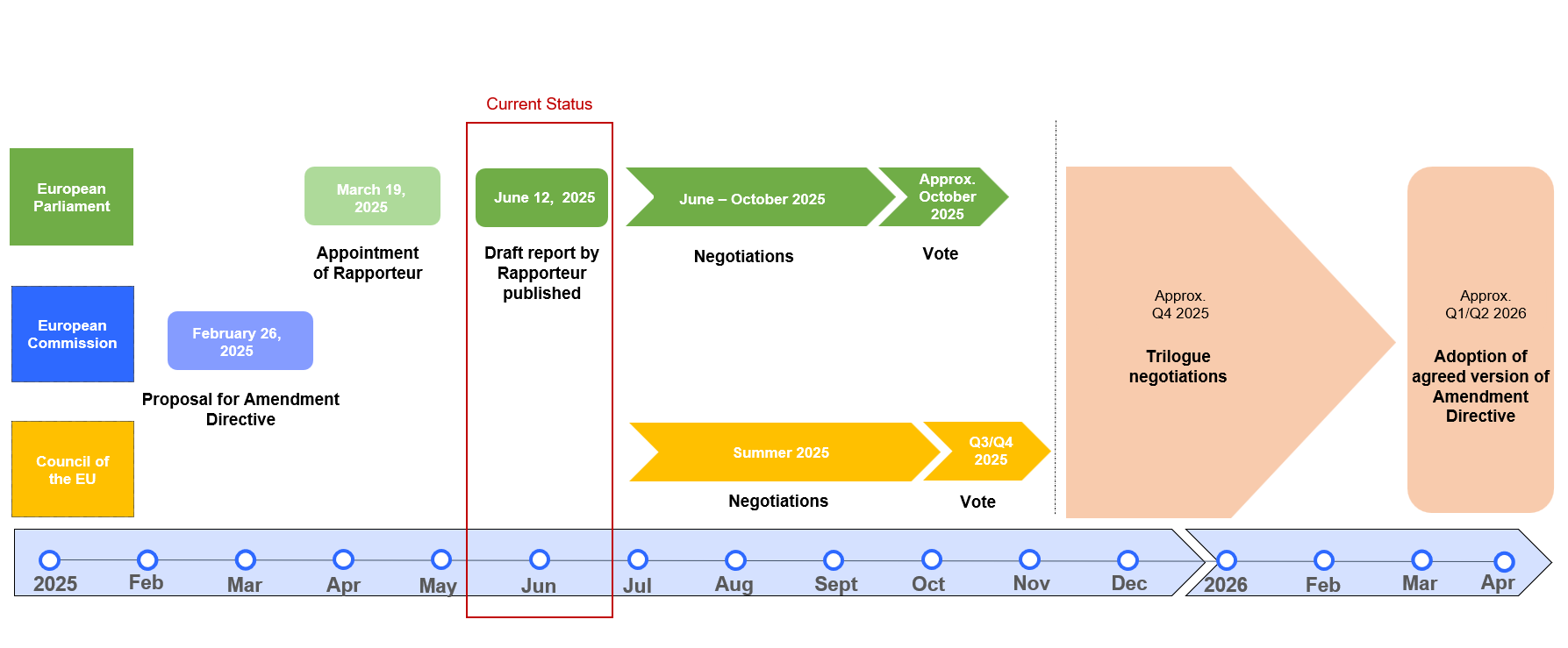

The amendments in substance, i.e. the Amendment Directive, are being intensively discussed, and are not without controversy. The legislative process requires that all three legislative bodies of the EU (the European Commission, the European Parliament, and the Council of the EU) agree on a joint proposal.

- The European Commission started the process with its proposed Amendment Directive published in February (see above).

- The Draft Report by the European Parliament’s Rapporteur is a first step towards the ultimate proposal by the European Parliament and will form the basis of discussion for its members. It is currently expected that the European Parliament will conduct a final vote on the proposed amendments in October 2025.

- The Council of the EU has also started discussions in its plenary bodies and will likely present its position later in 2025.

After that, when all three legislative bodies have presented their proposals, so-called “trilogue negotiations” between the European Commission, the European Parliament and the Council of the EU will commence. There are currently no indications as to how long these negotiations will take. In a best-case scenario, the final adoption vote will occur in the first or second quarter of 2026.

|

We note that, regarding the CSDDD, German Chancellor Friedrich Merz and French President Emmanuel Macron have called for a full elimination of the Directive to improve European competitiveness against the U.S. and China, arguing that the Directive imposes excessive regulatory burdens on businesses. Such statements were softened at a later stage. Other EU member states – including Belgium and Denmark – as well as the Rapporteur reject any elimination.

(c) Expected Timeline for Revision of the ESRS

Regarding sustainability reporting, the proposed revisions of ESRS will have a significant impact in practice, as the ESRS define the scope and content of the information to be disclosed in the sustainability statements of in-scope companies. The European Financial Reporting Advisory Group (EFRAG) has already presented a work plan for the simplification mandate from the European Commission[11] and intends to deliver its first ESRS simplification update by June 20, 2025, and a second version in mid-July of 2025. After a short public consultation in August and September, EFRAG aims to provide further technical advice on the draft amendments to ESRS in October 2025. There are currently no indications regarding when the final version of the revised ESRS will be adopted by the European Commission.

3. Proposed Amendments in the Rapporteur’s Draft Report

Introducing a uniform sustainability reporting threshold for CSRD, CSDDD and EU Taxonomy

A notable change in the Draft Report is the suggestion to use a common threshold of an average of more than 3,000 employees and more than EUR 450 million net turnover for the obligations under the CSRD, the CSDDD and the EU Taxonomy Regulation to apply to EU companies (subject to phase-in for CSDDD, see graphic above).[12]

While the European Commission’s Omnibus Proposal did not suggest any amendments to the scope of application of the CSDDD, but maintained the original threshold of more than 1,000 employees and a worldwide turnover of EUR 450 million, it did propose raising the threshold for CSRD and EU Taxonomy reporting from small and medium sized entities (SMEs) to large companies or parents of a large group with more than 1,000 employees and either a net turnover of more than EUR 50 million or a balance sheet total of more than EUR 25 million. The now proposed uniform threshold of more than 3,000 employees and more than EUR 450 million net turnover will significantly limit the number of companies in scope of all three legislative acts.

This particularly applies to reporting on non-EU ultimate parent companies by an EU branch pursuant to Article 40a of the Accounting Directive[13] as amended by CSRD: Instead of an EU branch’s net turnover of originally EUR 40 million, reporting shall only apply in case of a net turnover of the branch of EUR 450 million, increasing the threshold more than tenfold.

Notably, in the context of Article 40a of the Accounting Directive, the Rapporteur’s proposal abolishes the previous requirement of a net turnover generated in the EU by the non-EU ultimate parent company.[14] Regarding reporting on its ultimate parent company, this could create an obligation for EU subsidiaries operating as holding of hub companies which consolidate turnover of non-EU subsidiaries or generate turnover through non-EU branches. It is unclear whether net turnover by such EU subsidiaries generated outside of the EU on a consolidated basis or through non-EU branches counts towards the threshold to report on the non-EU parent company under Article 40a of the Accounting Directive. This could likely be addressed in further negotiations.

It can be expected that the applicability thresholds will be heavily debated during the legislative process. According to public reports, the Council of the EU has suggested to raise the CSDDD thresholds to more than 5,000 employees and a net turnover of more than EUR 1.5 billion.

(a) Proposed Amendments relating to CSRD Reporting

Reporting exemption for ultimate parent companies that are financial holding companies only

The draft report proposes that ultimate parent companies which are financial holding undertakings not engaging in operational or management decisions, may be exempted from direct sustainability reporting obligations. This exemption – mirroring the exemption in the CSDDD – is conditional upon the designation of an EU-based subsidiary to fulfill the reporting duties on behalf of the parent company.

Harmonize terminology by replacing the term “value chain” under the CSRD by the CSDDD’s term “chain of activities”

To harmonize terminology across EU legislation, the draft report replaces “value chain” in the CSRD with “chain of activities”. This change aims to reduce confusion and ensure consistency in reporting and due diligence obligations.

No link to Paris Agreement required for Climate Transition Plans

Pursuant to the Rapporteur’s proposal, companies are no longer required to report on a Climate Transition Plan specifically ensuring alignment with the Paris Agreement to limit global warming to 1.5⁰C under the CSRD, but on any Climate Transition Plan, if such a plan already exists.

Extending the subsidiary reporting exemption

The proposal extends the reporting exemption to all subsidiaries, including those classified as PIEs (and regardless of size), provided that the parent company reports at the consolidated level. Under the current CSRD, large PIEs were obliged to report even if a parent company was reporting as well.

Strengthening the protection of trade secrets

The draft report explicitly clarifies that sustainability reporting obligations do not override existing protections for trade secrets. Companies are not required to disclose information that qualifies as intellectual property, know-how, or business-sensitive data under Directive (EU) 2016/943. This safeguard ensures that transparency requirements do not compromise competitive advantages or legal confidentiality.

Setting a clear date for limited assurance

The proposal reaffirms that the European Commission must adopt limited assurance standards for sustainability reporting by October 1, 2026. While the European Commission is encouraged to consider stakeholder concerns and allow flexibility in the standards, the fixed date shall ensure timely implementation.

(b) Proposed Amendments to CSDDD obligations

Preventing “gold-plating” by EU member states

To avoid regulatory fragmentation, the draft report intends to limit the ability of EU member states to introduce stricter or divergent national rules – commonly referred to as “gold-plating”. It expands the full harmonization provisions of the CSDDD to include key elements such as scope, definitions, due diligence obligations, and supervisory mechanisms. This aims to ensure a consistent legal framework across the EU, enhancing legal certainty and reducing compliance complexity for companies operating in multiple jurisdictions.

Right to prioritize adverse impacts

Companies may duly prioritize and forego to address less significant adverse aspects without being exposed to fines.

Abolishing the obligation to adopt a climate transition plan

The draft report removes the mandatory requirement for companies to adopt a climate transition plan under the CSDDD in order to reduce the administrative burden on both companies and supervisory authorities, who would otherwise be responsible for monitoring and enforcing compliance with this obligation.

Reduced information request rights from direct business partners

The Rapporteur seeks to further reduce the due diligence obligations of in-scope companies and to protect companies with fewer than 3,000 employees from excessive data requests by in-scope companies. The Rapporteur’s proposal, therefore, suggests a risk-based approach to identify areas where adverse impacts are most likely to occur and to be most severe.

The first scoping of areas of adverse impacts shall only be done on the basis of reasonably available information without information requests to direct business partners. The further assessment of areas of adverse impacts at direct business partners with fewer than 3,000 employees shall be limited to reduced standards (voluntary reporting standards under the CSRD).

An assessment of indirect business partners has already been limited by the European Commission’s Omnibus Proposal to cases of plausible information of adverse impacts. The Rapporteur suggests clarifying that such plausible information must be “objective, factual and verifiable”.

Increasing flexibility regarding suspension of relationships with business partners

The proposal introduces greater flexibility for companies when deciding whether to suspend business relationships due to adverse impacts. If suspending a supplier would cause substantial prejudice – such as threatening the company’s financial stability or production capacity – companies may opt not to suspend, provided they justify the decision to supervisory authorities. Under the Commission’s Omnibus Proposal, such option was limited to situations where the adverse impact from suspending the business relationship was more severe than the unmitigated adverse impact by the business partner. This approach balances due diligence obligations with economic realities, especially in cases involving critical suppliers. It also requires companies to assess whether suspension would cause more harm than the issue it seeks to address.

Furthermore, companies shall face no fines and civil liability as long as there is a reasonable expectation that their enhanced prevention action plan will succeed.

[1] European Parliament, Committee on Legal Affairs, Draft Report 2025/0045 (COD), available at https://www.europarl.europa.eu/doceo/document/JURI-PR-774282_EN.pdf, last accessed on June 18, 2025.

[2] Directive (EU) 2022/2464, available here, last accessed on June 18, 2025.

[3] Directive (EU) 2024/1760, available here, last accessed on June 18, 2025.

[4]See EU Commission Press Release of February 26, 2025, available at https://ec.europa.eu/commission/presscorner/detail/en/ip_25_614, last accessed on June 18, 2025.

[5] See also our monthly ESG Updates here and here.

[6] Regulation (EU) 2020/852, available here, last accessed on June 18, 2025.

[7] COM (2025) 80 final, 2024/0044 (COD) – Directive of the European Parliament and of the Council amending Directives (EU)2022/2462 and (EU) 2024/1760 as regards the dates from which the member states are to apply certain corporate sustainability reporting and due diligence requirements, available here, last accessed on June 18, 2025.

[8] COM (2025) 81 final, 2024/0045 (COD) – Directive of the European Parliament and of the Council amending Directives 2006/43/EC, 2013/34/EU, (EU) 2022/2462 and (EU) 2024/1760 as regards certain corporate sustainability reporting and due diligence requirements, available here, last accessed on June 18, 2025.

[9] Directive (EU) 2025/794, available here, last accessed on June 18, 2025.

[10] We provide regular updates on the current transposition status in our monthly ESG Updates.

[11] See link to EFRAG Work Plan here, last accessed on June 18, 2025.

[12] The threshold for non-EU companies under CSDDD remains unaffected (net turnover of EUR 450 million).

[13] Directive 2013/34/EU, available here, last accessed on June 18, 2025.

[14] The original threshold was a net turnover in the EU of EUR 150 million which the European Commission suggested to increase to EUR 450 million.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s ESG: Risk, Litigation, and Reporting, International Arbitration, or Transnational Litigation practice groups, or the authors:

Ferdinand Fromholzer – Partner, ESG Group, Munich (+49 89 189 33-270, ffromholzer@gibsondunn.com)

Susy Bullock – Co-Chair, ESG Group, London (+44 20 7071 4283, sbullock@gibsondunn.com)

Robert Spano – Co-Chair, ESG Group, London/Paris (+33 1 56 43 13 00, rspano@gibsondunn.com)

Stephanie Collins – London (+44 20 7071 4216, scollins@gibsondunn.com)

Carla Baum – Munich (+49 89 189 33-263, cbaum@gibsondunn.com)

Vanessa Ludwig – Frankfurt (+49 69 247 411 531, vludwig@gibsondunn.com)

Johannes Reul – Munich (+49 89 189 33-272, jreul@gibsondunn.com)

Babette Milz – Munich (+49 89 189 33-283, bmilz@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.