False Claims Act 2025 Year-End Update

Client Alert | January 27, 2026

This update covers recent developments in FCA jurisprudence, summarizes significant enforcement activity, and analyzes the most notable legislative, policy, and caselaw developments from the second half of calendar year 2025, picking up where our mid-year 2025 update left off.

2025 was a watershed year in the history of the False Claims Act (FCA). In the first half of the year, we witnessed unprecedented efforts by the U.S. Department of Justice (DOJ) to use the statute to advance policy priorities of the Trump Administration. Virtually overnight, companies and institutions unaccustomed to FCA exposure began to face significant enforcement risks borne of the Administration’s focus on trade and antidiscrimination issues. The second half of the year saw DOJ continue to deploy the FCA as a tool for shaping an even wider range of policies. Meanwhile, 2025 also featured record-breaking enforcement metrics from DOJ, unprecedented shifts in federal and state policies with FCA implications, and a steady diet of significant judicial decisions. Never before have so many seismic shifts in the FCA enforcement landscape occurred with such magnitude and in such rapid succession.

DOJ set new records in FY 2025, both for the total number of new cases and the total amount recovered under the FCA—representing significant increases over prior records that were already enormous in their own right when they occurred. The uptick in new cases, in particular, is likely due to a confluence of factors. The Trump Administration has publicly committed to use the FCA to advance its policy goals, directed agencies to identify potential investigative targets, and publicly—and repeatedly—exhorted would-be whistleblowers to file cases tied to the Administration’s policy priorities. Meanwhile, where qui tam cases once were dominated by relators who were company insiders, more and more cases are now brought by professional relators, aided by litigation funding and built on data mining and private investigation. If the first half of 2025 did not make sufficiently clear the power relators have under the statute, the second half of the year drove the point home with two court judgments, each totaling nine figures, in FCA cases in which DOJ had declined to intervene.

Looking beyond the numbers, the second half of 2025 is also significant for the kinds of FCA matters DOJ pursued, and for the efforts that both federal and state governments undertook to shape the policy and regulatory regimes that underlie theories of FCA liability. In areas such as corporate diversity, equity, and inclusion (DEI) programs and gender-related care, the federal government has sought to extend the FCA’s reach to new areas that create potentially significant implications for FCA enforcement risks faced by recipients of federal funding. FCA enforcement has also remained very active in the trade and cybersecurity spaces—areas where the legal theories are not novel but on which DOJ is as focused as ever. With DOJ’s announcement of its planned new Division for National Fraud Enforcement, there could be even more expansion of the ways in which the Administration seeks to use the FCA as its leading tool for fraud enforcement. And at the state level, during 2025, there was a notable amount of legislative activity seeking to influence the role that private equity plays in the health care industry, including new restrictions on health care entity ownership and control that have ramifications for the compliance representations providers make to government payors.

In this update, we cover recent developments in FCA jurisprudence, summarize significant enforcement activity, and analyze the most notable legislative, policy, and caselaw developments from the second half of calendar year 2025, picking up where our mid-year 2025 update left off. Gibson Dunn’s recent publications regarding the FCA may be found on our website, including in-depth discussions of the FCA’s framework and operation, industry-specific presentations, and practical guidance to help companies navigate the FCA.

I. FCA ENFORCEMENT ACTIVITY

A. NEW FCA ACTIVITY

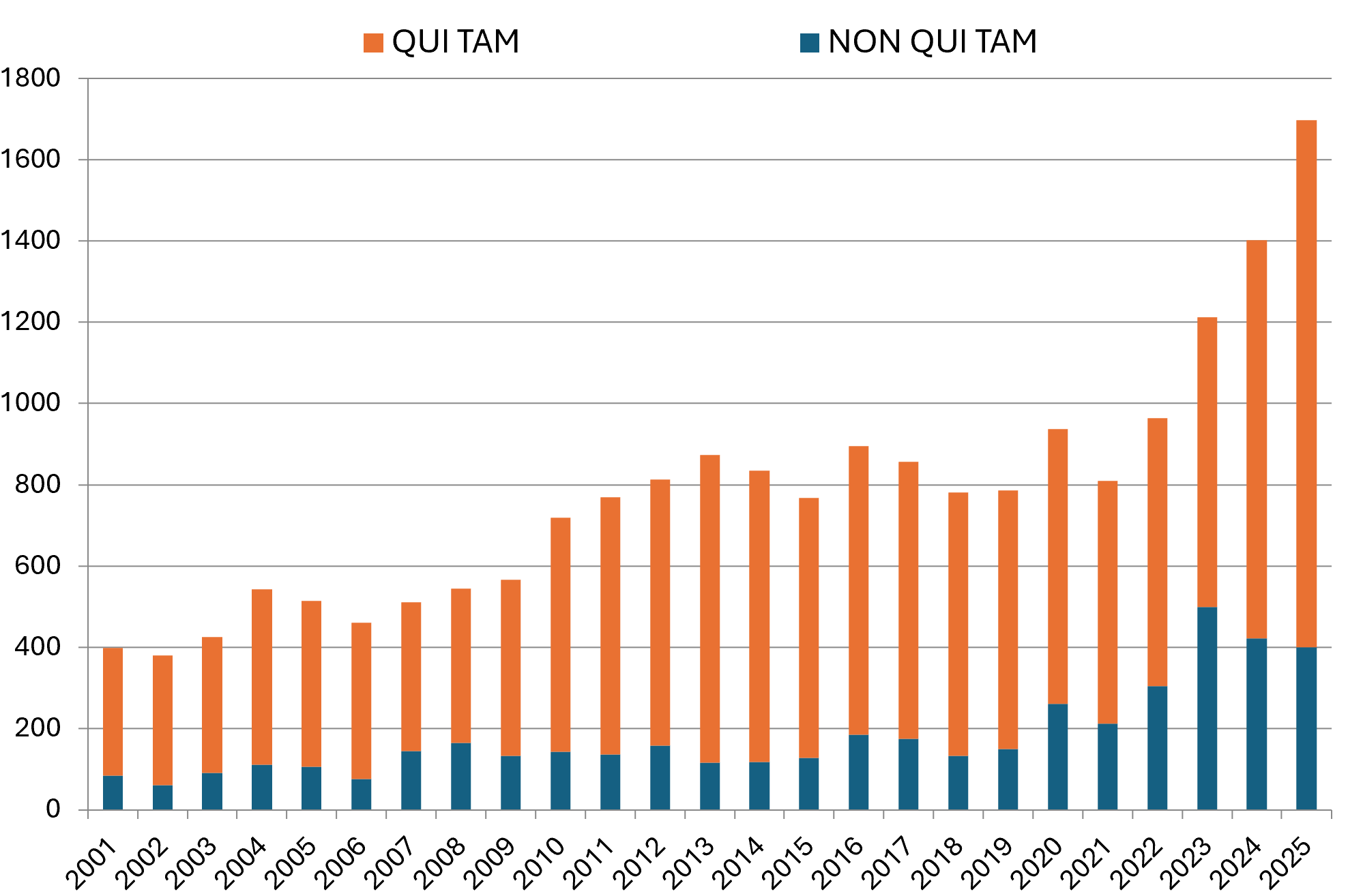

FCA enforcement in FY 2025 shattered previous records. DOJ and qui tam relators filed 1,698 new cases, establishing an all-time high and smashing last year’s record by nearly 300 cases.[1] Of these new cases, 1,297 were initiated by qui tam relators—itself a record in the statute’s modern history, and a staggering 32% increase from last year’s high-water mark of 980.[2]

DOJ, meanwhile, initiated 401 non-qui tam FCA matters in FY 2025.[3] This figure is consistent with the overall increase in non-qui tam matters over the last five years, driven by a concerted effort on DOJ’s part to generate its own FCA leads. These cases can come from a variety of sources but increasingly have been driven by data analysis within DOJ and other federal agencies to identify potential sources of fraud, waste, and abuse in federal programs and contracts.

Number of FCA New Matters, Including Qui Tam Actions

|

Source: DOJ “Fraud Statistics – Overview” (Jan. 16, 2026).

B. TOTAL RECOVERY AMOUNTS

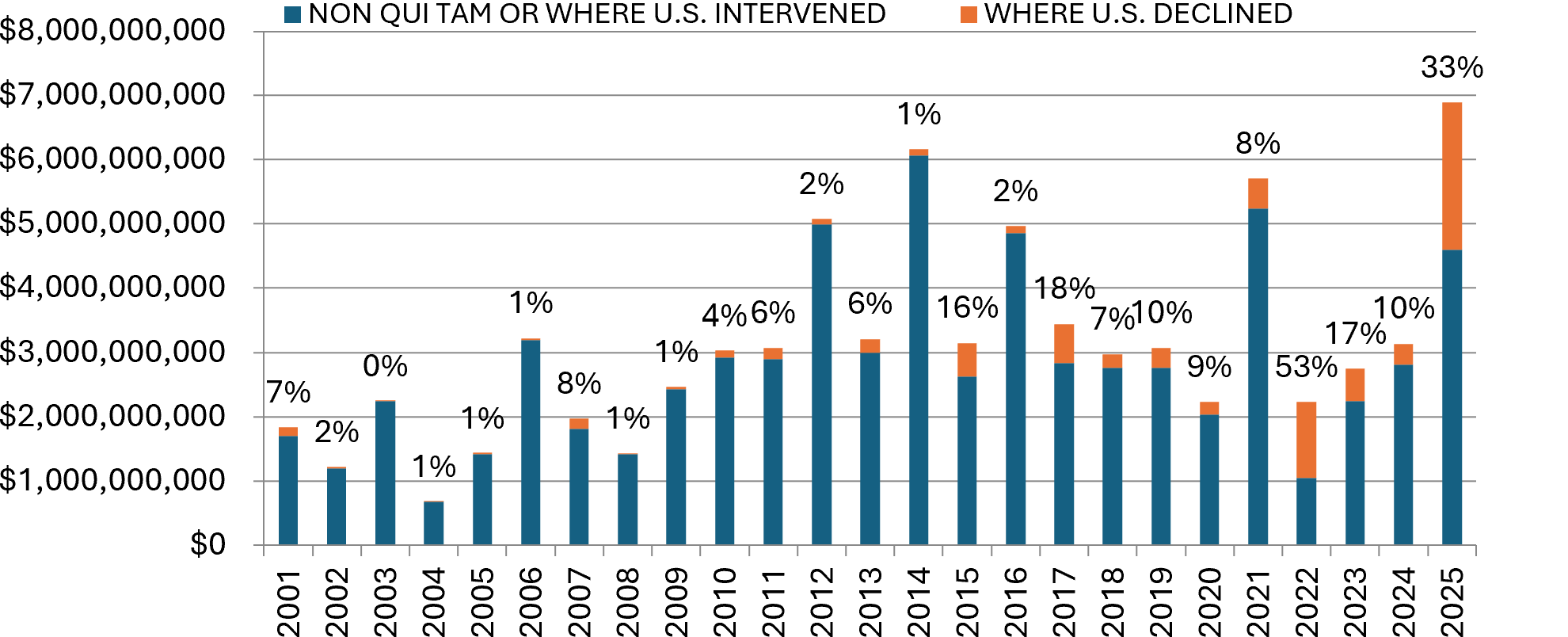

In FY 2025, settlements and judgments under the FCA resulted in blockbuster monetary recoveries totaling $6.8 billion—more than double last year’s $3.1 billion, and $1.1 billion more than the prior record of $5.7 billion in 2021.[4]

Notably, in FY 2025, more than 33%––or almost $2.3 billion––of the total announced recoveries were in declined cases.[5] Historically, qui tam suits in which the government elects to intervene have represented the bulk of DOJ’s recoveries. For example, in 2023, only 17% of the total amounts recovered were from declined cases, and in 2024, the figure was 10%.[6] The last time we witnessed declined cases representing a significant share of recoveries was in 2022, when 53% of the total amounts recovered were in declined cases.[7] The spike this year is likely attributable in significant part to a number of large dollar-value judgments and verdicts in declined cases—some of which are still on appeal and may ultimately result in lower actual recoveries for the government. Notably, in a single ruling in March 2025, a U.S. District Court judge for the District of New Jersey ordered a defendant pharmaceutical company to pay $1.64 billion after a jury verdict in a declined case.[8] That judgment by itself represents nearly 25% of DOJ’s total FCA recoveries in FY 2025, and nearly 72% of the total recoveries in declined cases in the same period. The judgment is on appeal to the Third Circuit.[9]

Settlements or Judgments in Cases Where the Government Declined Intervention as a Percentage of Total FCA Recoveries

|

Source: DOJ “Fraud Statistics – Overview” (Jan. 16, 2026).

C. FCA RECOVERIES BY INDUSTRY

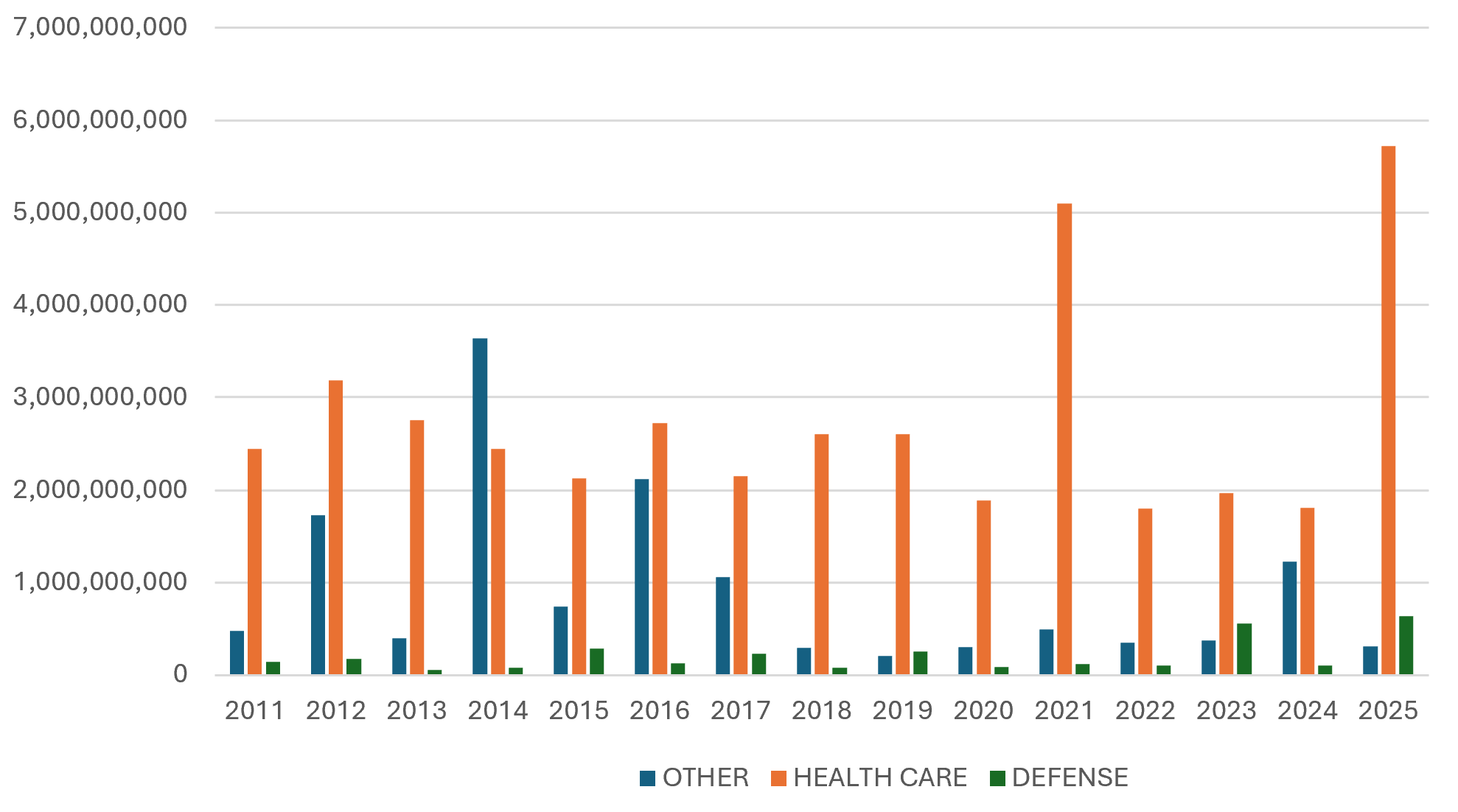

Once again, the vast majority of recoveries under the FCA in 2025 came from the health care industry, which saw approximately $5.7 billion in settlements and judgments. That figure represents a noteworthy increase from last year’s $1.8 billion in health care-related recoveries. Health care-related recoveries made up 83% of total recoveries under the FCA in FY 2025, with defense-related settlements and judgments making up more than 9% of the total. While the dominance of the health care sector in DOJ’s recoveries in FY 2025 appears to be due in part to several large resolutions, it also stems in significant part from judgments and verdicts. Indeed, virtually all notable FCA verdicts and judgments (including affirmances on appeal) last year were in health care cases.

In a late-breaking reminder of the outsized role health care recoveries play in FCA enforcement, on January 14, 2026, DOJ entered into a $556 million resolution of an FCA case involving allegations related to Medicare Part C (also known as Medicare Advantage).[10] Not only does this resolution suggest that FY 2026 will be another year of significant DOJ recoveries, but it also indicates that Part C cases will remain a pillar of DOJ’s FCA enforcement in the health care space.

FCA Recoveries by Industry

|

Source: DOJ “Fraud Statistics – Health and Human Services”; “Fraud Statistics – Department of Defense”; “Fraud Statistics – Other (Non-HHS and Non-DoD)” (Jan. 16, 2026).

II. NOTEWORTHY DOJ ENFORCEMENT ACTIVITY DURING THE SECOND HALF OF 2025[11]

A. JUDGMENTS AND VERDICTS

In the second half of 2025, there were two significant FCA judgments, both of which were in declined cases.

- On August 19, a judge in the Eastern District of Pennsylvania ordered a pharmacy benefits manager (PBM) company to pay $290 million in an FCA case involving overbilling allegations.[12] The order trebled a damages award on which we reported in our Mid-Year Update.

- On September 11, the Seventh Circuit affirmed an $183 million judgment against a pharmaceutical manufacturer in an FCA case alleging inaccurate drug rebate calculations.[13] We discuss this case in more detail in Section IV.D below.

In another notable development, on November 7, a jury found a pharmaceutical manufacturer not liable under the FCA in a case involving allegations that the company paid kickbacks and promoted off-label uses of a hemophilia drug.[14]

B. SETTLEMENTS[15]

1. Health Care and Life Sciences Industries

- On July 13, a former chief executive officer and owner of a South Carolina–based clinical laboratory agreed to the entry of a consent judgment of approximately $27.5 million in a federal and multistate FCA case, one day before the trial for civil liability was set to begin. This judgment adds to the $87 million already collected in judgments against and settlements with other defendants in the case, bringing the total to more than $114 million. DOJ alleged that the defendants orchestrated a multistate scheme to generate medically unnecessary cancer genetic testing for Medicaid beneficiaries by paying kickbacks to marketers who targeted low-income individuals at public locations and obtained DNA samples through sham screening events. The marketers allegedly relied on telemedicine orders from providers without treating relationships with the patients, rendering the tests medically unnecessary and the claims for them “tainted” by violations of the Anti-Kickback Statute (AKS).[16]

- On August 19, a California-based behavioral health services company agreed to pay approximately $2.8 million to settle allegations that it submitted false claims to federal health care programs for psychotherapy services. From 2015 through 2022, the company providers allegedly submitted claims for reimbursement using Current Procedural Terminology (CPT) codes for “add-on” services despite failing to provide those services or appropriately documenting that those services were provided.[17]

- On September 10, a medical device manufacturer agreed to pay $29.8 million—approximately half of which was restitution—to resolve allegations that it caused health care providers to submit false reimbursement requests to Medicare for diagnostic testing that did not meet coverage requirements. DOJ alleged that the manufacturer improperly represented to its health care provider customers that tests using two of its devices qualified for Medicare coverage. According to DOJ, the manufacturer continued to market its devices in this manner for a 14-year period despite numerous reports from concerned third parties that the tests were not reimbursable. In parallel with the DOJ resolution, the manufacturer entered into a five-year Corporate Integrity Agreement with the HHS Office of Inspector General (HHS-OIG), in which it agreed to internal compliance measures to prevent future misconduct. The manufacturer’s former distributor for both devices also settled with DOJ on September 3, agreeing to pay $7.2 million.[18]

- On September 16, a medical device company based in Florida agreed to pay $8 million to resolve allegations that it submitted or caused the submission of false claims in connection with defective knee-replacement devices. DOJ alleged that the company knew components of its knee replacement systems were failing at a higher than acceptable rate, making the systems not medically necessary or reasonable for reimbursement under federal health care programs.[19]

- On October 31, a national pharmacy chain agreed to pay approximately $18.3 million to the United States and California to resolve allegations that it falsely certified and submitted reimbursement claims for prescriptions when those prescriptions did not meet the requirements for the relevant drug category imposed by California’s Medicaid program (Medi-Cal). Approximately $10.7 million of the settlement is restitution.[20]

- On November 13, an Indiana diagnostic laboratory agreed to pay $9.6 million to settle claims that the laboratory entered a marketing agreement under which it made payments for laboratory test referrals and for services that supported false or medically unnecessary infectious disease testing. DOJ alleged that these tests were billed to Medicare for reimbursement in violation of the FCA and AKS.[21]

- On November 14, a Tampa pharmacy agreed to pay over $17 million to resolve allegations that it violated the FCA by submitting false claims for Medicare reimbursement for COVID-19 tests that were allegedly either never provided to patients or were provided months after the tests were billed to Medicare. The pharmacy had participated in a project by the Centers for Medicare and Medicaid Services (CMS) that allowed certain Medicare beneficiaries to request over-the-counter COVID-19 tests from participating providers, for which the providers could then seek reimbursement.[22]

- On November 17, a Washington-based urgent care clinic agreed to pay approximately $2.8 million to settle allegations that it falsely billed Medicare and Medicaid for certain diagnostic tests. The State of Washington further alleged that the clinic billed the programs for tests that were not medically necessary.[23]

- On November 17, a Pennsylvania medical device company agreed to pay $38.5 million to resolve claims that it violated the FCA by selling knee-replacement devices that it knew were not reasonable and necessary for use during knee replacement surgery due to higher-than-normal rates of failure, resulting in false Medicare and Medicaid claims. The DOJ further alleged that the company violated the AKS by paying an orthopedic surgeon in Georgia to induce him to recommend the use of the devices.[24]

- On November 21, a physician and his companies agreed to pay $45 million to resolve allegations that they falsely billed Medicare for medically unnecessary surgical procedures, higher-paying procedures that were not performed, and other non-billable services. As part of the settlement, one of the companies agreed to enter into a five-year Corporate Integrity Agreement with HHS-OIG.[25]

- On December 10, a national recovery center located in Pennsylvania and Maryland agreed to pay $1 million to resolve allegations that it failed to dispense controlled substances in the manner mandated by the Controlled Substance Act, and another $1 million for violating the FCA by billing the Federal Employees Health Benefits Program and Medicaid for drug and alcohol treatment services that it failed to provide adequately.[26]

- On December 12, the owners of several Arizona wound-graft companies agreed to pay over $309 million to resolve FCA allegations that they hired untrained sales representatives to recruit mainly elderly and hospice patients, directed these representatives to order and providers to apply expensive bioengineered skin grafts regardless of medical necessity, and then billed Medicare and other programs. The conduct was allegedly driven by illegal kickbacks from a graft distributor and resulted in grafts being applied to inappropriate wounds, non-existent wounds, and to terminally ill patients. The company owners also pleaded guilty in October 2024 and January 2025 to criminal charges of conspiracy to commit health care fraud and wire fraud related to the scheme and were ordered to pay restitution and sentenced to prison for between 14 and 16 years.[27]

- On December 16, a New England cancer treatment and research center agreed to pay $15 million, around $8.6 million of which is restitution, to resolve allegations that between 2014 and 2024, it violated the FCA by making materially false statements and certifications related to National Institutes of Health (NIH) research grants. DOJ alleged that the center used funds from six NIH grants to conduct research that resulted in 14 publications in scientific journals containing misrepresented or duplicated information. DOJ further alleged that some of these publications were then used in future grant submissions without disclosing that certain images and data were misrepresented and/or duplicated. The center cooperated with the government by summarizing voluminous materials relevant to the government’s investigation, voluntarily disclosing additional allegations of relevant misconduct, voluntarily producing materials without a subpoena, accepting responsibility, and implementing remedial measures. The center received credit under DOJ guidelines that credit disclosure, cooperation, and remediation in FCA cases—although, as in other settlements, the agreement does not specify how much credit the center received and the weight DOJ assigned to the different aspects of cooperation.[28]

- On December 22, a New York hospital agreed to pay $6.8 million plus interest, of which $3.2 million is restitution, to resolve allegations that it violated the FCA and committed health care fraud by improperly paying an oncology practice to induce patient referrals to the hospital, which the hospital then billed to Medicare and Medicaid. DOJ alleged that, between 2011 and 2019, the hospital paid the oncology practice over $4 million pursuant to three agreements for work that was either not performed, not performed as required by the agreements, or for which the hospital had no time records. The hospital also entered into a separate agreement with the State of New York and paid $367,353 to resolve related state law claims.[29]2. Government Contracting and Cybersecurity

- On July 21, a biotech company agreed to pay over $9.8 million, $4.3 million of which is restitution, to resolve allegations that its genomic sequencing system software sold to federal agencies contained cybersecurity vulnerabilities and that its cybersecurity product program and systems to monitor for and remediate vulnerabilities were inadequate. Although DOJ alleged the software had vulnerabilities, it did not allege that any cybersecurity incidents occurred as a result.[30]

- On September 9, a vessel-repair company agreed to pay over $4 million, approximately $2 million of which is restitution, to resolve allegations that it improperly billed the federal government for labor performed by individuals who were not authorized to work in the United States. DOJ alleged that the company utilized multiple subcontractors owned or controlled by its Risk Manager for work on U.S. Navy ships. DOJ further alleged that after the company’s Risk Manager was notified by DHS that a subcontractor she owned was employing individuals not verified to work in the United States, she fired the unauthorized employees but then quickly took steps to have them hired by a different subcontractor. The Risk Manager individually pleaded guilty to a criminal charge of knowingly hiring and continuing to employ individuals not authorized to work in the United States.[31]

- On August 22, a government contractor and its owner agreed to pay $3.1 million to resolve allegations that they violated the FCA in their acquisition and performance of dozens of federal contracts. DOJ alleged that contractor and owner knowingly misrepresented the identities of individuals it claimed were its employees, using unknown persons and fraudulent credentials to make their contract bids more appealing, and misrepresenting the company’s size to acquire set-aside contracts in violation of Small Business Administration (SBA) rules.[32]3. Customs, Financial Industry, and Miscellaneous Federal Funding

- On July 17, a Pennsylvania-based patio furniture manufacturer agreed to pay $4.9 million to resolve FCA and related allegations that it evaded antidumping and countervailing duties on furniture components made of extruded aluminum originating from the People’s Republic of China. According to the settlement agreement, DOJ alleged that, between 2014 and 2021, the manufacturer knowingly submitted or caused the submission of false customs declarations stating that certain imported aluminum parts were not subject to antidumping and countervailing duties, including by mischaracterizing the parts as components of finished “kits” and by failing to correct prior false filings after learning of their inaccuracy. The settlement amount includes approximately $2.5 million in restitution, with interest, reflecting unpaid duties owed to U.S. Customs and Border Protection (CBP).[33]

- On July 27, two related Northeast-based importers of plastic resin agreed to pay approximately $6.9 million to resolve FCA allegations arising from the evasion of customs duties on imports manufactured in the People’s Republic of China. DOJ alleged that, from 2019 through early 2025, the importers knowingly misrepresented the country of origin and value of certain plastic-resin products, failed to mark imports properly, and underpaid applicable duties. The settlement amount includes approximately $4.6 million in restitution, with interest, reflecting unpaid duties. The agreement expressly credited the importers for voluntary self-disclosure, cooperation, and remediation, including conducting an independent internal investigation, sharing non-public facts and a damages analysis with the government, and implementing compliance enhancements and personnel discipline.[34]

- On November 26, an audio-electronics company agreed to pay $11.8 million to resolve allegations that it violated the FCA and related customs laws. DOJ alleged that the company evaded antidumping and countervailing duties on imported goods made with extruded aluminum from the People’s Republic of China, and then concealed that failure when confronted by authorities.[35]

- On December 18, a distributor of tungsten carbide products agreed to pay $54.4 million, of which $27.2 million is restitution, to resolve allegations that it violated the FCA by knowingly and improperly failing to pay duties and tariffs it owed on tungsten-carbide products imported from the People’s Republic of China. DOJ alleged that the distributor: (1) knowingly misrepresented the country of origin on Chinese-manufactured products by transshipping them to Taiwan before shipping them to the United States and misrepresenting that the products originated in Taiwan; (2) knowingly misclassified tungsten carbide products using the incorrect Harmonized Tariff Schedule code to further reduce the duties owed to CBP; and (3) failed to mark certain merchandise with the country of origin and failed to pay the necessary marking duties.[36] The settlement is the largest customs-related FCA settlement ever reached by DOJ, and the largest—by nearly $10 million—since 2012.[37]

4. Paycheck Protection Program (PPP) Resolutions

There were a notable number of PPP-related FCA resolutions in the second half of 2025, including the examples detailed below. Overall, DOJ recovered over $79 million in PPP-related cases.

- On July 22, a Georgia-based manufacturer of compressed-air products agreed to pay approximately $3.7 million to resolve FCA allegations that it was part of a larger corporate group with more than 500 employees worldwide and therefore ineligible for the program.[38]

- On July 23, a Massachusetts-headquartered union agreed to pay over $2 million and admitted to allegations that it applied for PPP loans it was ineligible to receive due to the union’s status as a 501(c)(5) nonprofit organization. The union received credit for producing materials without a subpoena, cooperating with the government’s investigation, and “immediately” acknowledging wrongdoing and seeking resolution.[39]

- On August 12, three Chinese-owned entities that are part of a multinational automotive corporation agreed to pay over $21.6 million to resolve FCA allegations that the entities had obtained PPP loans in violation of the program’s size and ownership requirements.[40]

- On September 3, a New Jersey-based concrete-product manufacturer and supplier agreed to pay over $2.9 million to settle FCA allegations that it had improperly received a PPP loan because it was ineligible under the program’s workforce cap.[41]

- On November 14, DOJ announced that an organization that provides emergency fire services in Chatham County, Georgia agreed to pay nearly $3.5 million to resolve allegations that it improperly obtained a PPP loan for which it was not eligible due to its status as a Section 501(c)(4) nonprofit entity.[42]

- On November 17, two New York transportation companies agreed to pay $4.4 million to settle FCA allegations that they improperly obtained PPP loans by falsely certifying that each company had fewer than 300 employees.[43]

- On November 17, an Idaho-based construction company agreed to pay just under $5.8 million to settle FCA allegations that it was ineligible for a PPP loan because it failed to include temporary workers in its employee count.[44]

- On December 3, a Guam duty-free store agreed to pay $3.4 million to resolve FCA allegations that the store received PPP loans for which it was not qualified because it was a subsidiary of a much larger company.[45]

- On December 15, a New Jersey tour company agreed to pay $4.43 million to settle FCA allegations that its size made it ineligible for two PPP loans for which it applied.[46]

- On December 16, three subsidiaries of a Chinese-owned company agreed to pay over $7.3 million to resolve allegations that they violated the FCA by submitting applications for PPP loans that contained misrepresentations about the companies’ loan eligibility under applicable headcount and ownership rules.[47]

- On December 18, a Houston-based company that provides ocean bottom node seismic acquisition services to energy companies agreed to pay approximately $4.2 million to resolve allegations that it obtained PPP loans by misrepresenting its total employee count.[48]

- On December 19, a non-profit organization agreed to pay $8.4 million to resolve allegations that it violated the FCA by falsely certifying its size in seeking a PPP loan.[49]

III. LEGISLATIVE AND POLICY DEVELOPMENTS

A. FEDERAL POLICY AND LEGISLATIVE DEVELOPMENTS

The second half of 2025 continued a trend witnessed in the first half of 2025, namely the use of FCA enforcement—and regulatory and executive actions with FCA enforcement implications—to advance policy goals of the Trump Administration. In particular, DEI, trade, and gender-related care remained key areas of focus for DOJ and the Administration.

1. DEI

a. DOJ Publishes Guidance Memorandum Regarding Federal Antidiscrimination Laws

On July 29, 2025, DOJ issued a memorandum to federal agencies titled “Guidance for Recipients of Federal Funding Regarding Unlawful Discrimination.”[50] The memorandum states that “[e]ntities receiving federal funds, like all other entities subject to federal antidiscrimination laws, must ensure that their programs and activities comply with federal law and do not discriminate on the basis of race, color, national origin, sex, religion, or other protected characteristics.”[51] The memorandum provides a non-exhaustive list of what it characterizes as unlawful and potentially unlawful practices, including race-based scholarships, preferential hiring or promotion practices, “cultural competence” requirements, and “trainings that promote discrimination based on protected characteristics.”[52]

The guidance memorandum provided the most detailed statement to date of the types of DEI practices that could face DOJ scrutiny under the FCA. Previously, as discussed in our Mid-Year Update, Executive Order 14173 required agency contracts and grant awards to include a term “requiring the contractual counterparty or grant recipient to agree that its compliance in all respects with all applicable Federal anti-discrimination laws is material to the government’s payment decisions for purposes of [the FCA].”[53] DOJ followed with a memorandum from Deputy Attorney General Todd Blanche on May 19, 2025, announcing DOJ’s Civil Rights Fraud Initiative, the purpose of which is to use the FCA to prevent violations of civil-rights laws, including anti-discrimination laws.[54] Whereas the EO and the Blanche memorandum afforded little insight into the Department’s views on what sorts of DEI practices create FCA risk, the July memorandum provides some potential datapoints. The guidance would only apply prospectively; in cases involving past periods when federal guidance on DEI issues was different, different considerations would apply.

DEI developments with FCA implications continue to occur at the state level as well. The week before this alert went to publication, Texas Attorney General Ken Paxton issued an opinion declaring various DEI programs unconstitutional.[55] Although Texas’s false claims law is limited to the state’s Medicaid program, the opinion could still create the risk of potential false claims allegations against health care entities.

b. Executive Order 14319: Preventing Woke AI in the Federal Government

The Administration’s focus on DEI issues with FCA implications also extended into the AI sphere. On July 23, 2025, President Trump issued Executive Order (EO) 14319, Preventing Woke AI in the Federal Government.[56] The EO, Office of Management and Budget (OMB) guidance flowing from it, and eventual agency-level changes could have FCA implications, particularly given that the OMB guidance explicitly exhorts agencies to designate requirements identified in the guidance as “material to eligibility and payment under the contract.”[57]

The EO expresses concern over DEI-related “ideological biases” and “social agendas” that it states have been “built into AI models.”[58] It asserts that the federal government “has the obligation not to procure models that sacrifice truthfulness and accuracy to ideological agendas,” directs OMB to issue implementation guidance for agencies within 120 days, and directs agencies to include terms in federal contracts requiring that procured large language models (LLMs) comply with the “Unbiased AI Principles”—”truth-seeking” and “ideological neutrality.”[59]

OMB issued its guidance memorandum on December 11, 2025.[60] Among other things, the memorandum provides a “threshold for enhanced LLM transparency” that it notes agencies may want to apply to “public-facing LLMs” in order to “assess whether LLM outputs and associated controls or safeguards meet the goals of the Unbiased AI Principles.”[61] Reviewing an LLM at this level would involve seeking details about “pre-training and post-training activities” such as “[a]ny modifications or configurations undertaken to comply with any regulation from a government other than the U.S. Federal Government.”[62] The latter information would include steps taken to comply with state laws that may be more protective of DEI programs than current federal law and policy.

2. Trade

Consistent with its broader focus on utilizing the FCA as a principal tool for furthering its policy agenda, the Trump Administration also has prioritized using the statute to police customs laws.

On August 29, 2025, DOJ and the Department of Homeland Security (DHS) launched an interagency Trade Fraud Task Force (the Task Force) to strengthen coordination and increase the volume of enforcement actions against parties that attempt to evade tariffs or duties or import prohibited goods into the United States.[63] The DOJ press release states that the Task Force will “aggressively pursue” violations using a range of enforcement mechanisms, including FCA actions.[64]

The launch of the Task Force is one of several developments from the latter half of 2025 that indicate the sheer magnitude of customs-related FCA enforcement facing companies. As in other policy areas, such enforcement is likely to be driven in significant part by qui tam relators. The statute already gives private individuals enormous power—and enormous incentives—to mobilize DOJ’s investigative machinery by filing qui tam complaints. In fact, the DOJ press release announcing the Task Force’s launch explicitly encourages whistleblowers to initiate their own qui tam actions (or, alternatively, to submit referrals through DOJ’s criminal Corporate Whistleblower Program).[65] Customs-related qui tam cases also have a unique potential to be brought by a company’s competitors or by other entities in its import chain. And by the same token, the FCA’s conspiracy provision is a powerful tool by which DOJ and relators can seek to implicate multiple entities in a given import chain. This dynamic both heightens enforcement risks for companies overall and increases the chances that whistleblowers could emerge from the ranks of an import partner.

DOJ’s $54.4 million settlement with a distributor of tungsten carbide products in December 2025 is a reminder of the significant FCA enforcement risks facing companies that have potential customs obligations to the U.S. government.[66] Here, as in other customs cases, DOJ’s theory was that the company avoided higher duties by misclassifying goods under applicable tariff schedules and misrepresenting the goods’ countries of origin—thus violating the “reverse” FCA by “knowingly conceal[ing] or knowingly and improperly avoid[ing] or decreas[ing] an obligation” to pay money to the government.[67] The settlement is the largest customs-related FCA resolution, by dollar value, since a 2012 settlement with an ink manufacturing company.[68] At the same time, both settlements reiterate that even before the beginning of the second Trump Administration, DOJ had significant experience handling customs-related FCA cases. Indeed, the qui tam case underlying the tungsten carbide distributor settlement has been underway since 2022; and between 2011 and early 2025, DOJ amassed nearly $250 million in recoveries from over 40 resolutions of FCA matters involving alleged customs violations. These matters have given DOJ and relators significant experience exploring and testing the factual and legal theories at stake in customs-related FCA cases. This reality may serve to increase the volume of qui tam filings that the Trump Administration’s tariffs are surely prompting already. We can expect to see additional resolutions in this space, potentially with even higher dollar values than in the past. And if the U.S. Supreme Court concludes that the Trump Administration’s tariffs are legal under the IEEPA,[69] that will likely set the stage for an additional uptick in FCA enforcement activity.

3. Gender-Related Care

In late December 2025, CMS issued two proposed rules aimed at eliminating federal funding used in relation to gender-related procedures.[70]

Under the first rule, CMS proposes to require that states ensure that Medicaid plans and Children’s Health Insurance Program (CHIP) plans will not use federal Medicaid or CHIP dollars to pay for gender-related procedures for children under 18 (and under 19 for CHIP).[71] Under the second rule, CMS proposes to “prohibit Medicare and Medicaid-participating hospitals from performing” such procedures “on any child,” as a Condition of Participation (CoP) in Medicare and Medicaid. The proposed rule exempts gender-related procedures that are “to treat an individual with a medically verifiable disorder of sexual development,” “for purposes other than attempting to align an individual’s physical appearance or body with an asserted identity that differs from the individual’s sex,” or for “[t]reating [c]omplications.”[72]

These proposed rules are the latest in a series of efforts by the Trump Administration related to the provision of certain types of gender-related care to minor patients. If the rules come into effect, they will carry new FCA risks for health care providers who receive funding from Medicare and Medicaid. Under the proposed rules, providers would have to specifically certify compliance with the new CoP in order to continue receiving Medicare and Medicaid funding (thus effectively turning it into a condition of payment, not just participation). DOJ and qui tam relators pursuing FCA liability likely would focus on the accuracy of those certifications in light of a provider’s claims for payment, and—in turn—the accuracy of the claims in light of the medical records of the actual patients in question.

B. STATE LEGISLATIVE DEVELOPMENTS

In November 2025, the Pennsylvania House of Representatives introduced and referred to the House Committee on Judiciary a bill that adopts significant portions of the federal False Claims Act.[73] This bill is substantially similar to one introduced earlier in the year by the Pennsylvania Senate, a development we discussed in our 2025 Mid-Year Update.[74] Notably, both versions of the bill would impose liability on any person who is the “beneficiary of an inadvertent submission of a false claim, subsequently discovers the falsity of the claim and fails to disclose the false claim to the Commonwealth within a reasonable time after discovery of the false claim.”[75] This “beneficiary” version of FCA liability has no direct counterpart in the federal FCA, but it does exist in other state false claims laws—including that of Massachusetts.[76]

As we discussed in prior client alerts, Massachusetts notably expanded its FCA in early 2025, to explicitly target private equity owners and investors. This move promulgated a theory of liability that, in the world of federal FCA enforcement, has remained the subject of statutory interpretation rather than explicit statutory language. As the federal FCA lacks both the “beneficiary” version of liability and explicit liability for owners and investors, DOJ typically has had to establish that a private equity firm or its investors exercised control over a portfolio company and then either participated in an alleged FCA violation (for example, by approving or funding it) or later learned of the alleged violation and ratified it.[77]

Over the course of 2025, several other states passed laws to address private equity firm influence over health care organizations. None of these laws deploy FCA liability in the direct way that the Massachusetts FCA amendments did, but they all have implications for FCA enforcement in the health care space.

- California: In October 2025, Governor Gavin Newsom signed S.B. 351 into law, which prohibits private equity firms from making hiring decisions regarding clinical staff, making coding or billing decisions, and interfering with the professional judgment of providers or exercising power over overall patient care.[78]

- Maine: In June 2025, Maine enacted a law that institutes a moratorium on private equity firms acquiring or increasing ownership of hospitals in the state until June 2029.[79] The law also prohibits private equity firm operational control over hospitals, which includes both influencing hospital policy and influencing leadership position staffing.[80]

- Oregon: In June 2025, Governor Tina Kotek signed S.B. 951, which restricts management services organizations (MSOs) and their employees from controlling medical practices or the clinical judgment of providers.[81] It also restricts private equity firm control over clinical staff hiring and staffing levels, as well as over policy and price setting for clinical services.[82]

All of these changes could create FCA enforcement risks at both the state and federal level. Under the “implied false certification” theory, an entity that bills a government health care program can have FCA liability if it fails to disclose information about a material statutory or regulatory noncompliance that renders the entity’s “specific representations” to the payor false or misleading.[83] The materiality of restrictions on private equity involvement in health care practices receiving federal funding thus may become an active issue in FCA investigations and litigation. Thus, an entity that bills a government health care program while noncompliant with new restrictions on private equity control over health care practices, could risk FCA scrutiny. Given the nuances inherent in assessing whether a private equity firm or MSO has influence over policy or providers’ clinical judgment, investigations premised on violations of the new laws are likely to involve complex factual and legal questions around materiality as well as scienter and falsity.

With the Pennsylvania false claims bills still pending, in the second half of 2025, there were no states that enacted false claims laws that were reviewed for eligibility for federal incentives under Section 1909 of the Social Security Act. That provision grants states a 10-percentage-point increase in their share of any amounts recovered under state false claims laws, if those laws are on par with certain features of the federal FCA such as the qui tam provisions.[84]

IV. CASE LAW DEVELOPMENTS

A. First Circuit Holds That Clinical Laboratories May Generally Rely on Physician Orders to Establish Medical Necessity

In December 2025, in a case of first impression, the First Circuit held that in FCA cases alleging Medicare fraud based on laboratory testing, a clinical laboratory may generally rely on a physician’s order to establish that a test was “reasonable and necessary” under 42 U.S.C. § 1395y(a)(1)(A). United States ex rel. Omni Healthcare Inc. v. MD Spine Solutions LLC, 160 F.4th 248, 261 (1st Cir. 2025). Medicare reimbursement is not available for items and services that are not “reasonable and necessary” for a patient’s diagnosis or treatment, see 42 U.S.C. § 1395y(a)(1)(A); representations of reasonableness and necessity therefore can carry FCA liability if the representations are knowingly false. Under the First Circuit’s decision, once a laboratory invokes a physician’s order as evidence of medical necessity, the burden shifts to the FCA plaintiff to rebut or otherwise undermine that showing to create a genuine dispute of material fact as to the laboratory’s scienter. Id. at 261–62.

The case arose from Medicare claims submitted for polymerase chain reaction (PCR) testing to diagnose urinary tract infections. PCR testing is newer and more expensive than traditional bacterial urine culture (BUC) testing, but can produce results more quickly. Between 2017 and 2019, relator Omni Healthcare—a medical practice—submitted hundreds of physician orders to MD Labs for PCR UTI testing. Omni later filed a qui tam action alleging that MD Labs violated the FCA by seeking Medicare reimbursement for PCR testing that was medically unnecessary because it allegedly offered no material benefit over less expensive BUC testing. Id. at 254–57. The record, however, showed that Omni’s owner instructed staff to order PCR testing exclusively—even when providers requested BUC testing—in an effort to manufacture evidence for a future FCA case against MD Labs. Id. at 256. There was no evidence that MD Labs was aware of this alleged scheme or had reason to believe that the PCR orders reflected anything other than physicians’ good-faith determinations of medical necessity. Id.

The district court granted summary judgment for MD Labs in full, concluding that Omni failed to produce evidence that MD Labs acted with the requisite scienter. Id. at 257. Omni appealed only that determination, and the First Circuit affirmed.

The court grounded its analysis in both the Medicare regulatory framework and the FCA’s scienter requirement as clarified by the Supreme Court in United States ex rel. Schutte v. SuperValu Inc., 598 U.S. 739 (2023). While it acknowledged that laboratories have a duty not to submit claims for medically unnecessary tests, the court nonetheless emphasized that neither the Medicare statute nor implementing regulations require laboratories to independently reassess medical necessity in the face of a physician’s order. Omni, 160 F.4th at 261–62 (quoting United States ex rel. Groat v. Boston Heart Diagnostics Corp., 296 F. Supp. 3d 155 (D.D.C. 2017)).

Against that backdrop, the court held that a physician’s order generally provides a “safe harbor” for purposes of FCA scienter. Absent a concrete reason to question the ordering provider’s judgment—such as evidence that the laboratory manipulated requisition forms, misled physicians, or otherwise caused unnecessary testing—a laboratory does not act “knowingly” (within the meaning of the FCA) by submitting claims consistent with physician orders. Id. at 260–63.

Based on this analysis, the First Circuit affirmed the district court’s findings on scienter. Omni’s principal scienter evidence consisted of internal MD Labs emails noting that PCR testing was more expensive and suggesting that the lab seek guidance from Medicare contractors. See id. at 262–64. The court found this insufficient, characterizing it as, at most, a generalized remark that did not show awareness of a “substantial and unjustifiable risk” that the specific claims at issue were false. Id. at 263–64 (quoting SuperValu, 598 U.S. at 751). The court also emphasized the practical consequences of Omni’s theory, warning that imposing a duty on laboratories to second-guess physician orders would risk delaying care and distorting clinical decision-making. Id. at 260–61.

The decision is a significant development in the wake of the Supreme Court’s SuperValu decision. That decision emphasized that FCA scienter must be measured by reference to a defendant’s contemporaneous subjective beliefs. SuperValu, 598 U.S. at 749. In doing so, SuperValu rejected the defendant’s post-hoc interpretation of the relevant regulations. By rejecting Omni’s attempt to recast a hindsight-based disagreement over medical judgment as fraud, the Omni decision confirms that SuperValu applies with equal force to post-hoc interpretations by relators and DOJ.

B. D.C. Circuit Clarifies the Scope of the “Original Source” Exception to the Public Disclosure Bar

The D.C. Circuit recently clarified its interpretation of the contours of the FCA’s “original source” exception, holding that a relator can still materially add to publicly disclosed information and overcome the bar even if the alleged fraud is substantially similar to prior disclosures. United States ex rel. O’Connor v. U. S. Cellular Corp., 153 F.4th 1272, 1280 (D.C. Cir. 2025).

The case arose from allegations that U.S. Cellular fraudulently obtained Federal Communications Commission (FCC) small-business bidding credits by secretly controlling a nominally independent entity, Advantage Spectrum, L.P. Id. at 1275–77. FCC regulations prohibit recipients of such credits from transferring control to an ineligible entity within five years of license issuance. Id. at 1276. Relators alleged that U.S. Cellular exercised de facto control over Advantage and that the parties had an undisclosed agreement for U.S. Cellular to acquire Advantage’s spectrum licenses after the five-year unjust-enrichment period expired. Id. at 1275–77.

Defendants moved to dismiss under the FCA’s public disclosure bar, arguing that Advantage’s relationship with U.S. Cellular had already been disclosed in FCC filings submitted during the licensing process. Id. at 1277, 1279. The district court agreed and dismissed the action on the ground that the alleged fraud was publicly disclosed and that relators were not original sources. Id. at 1277. Relators appealed.

The D.C. Circuit reversed and held that relators plausibly qualified as original sources because their allegations materially added to the publicly disclosed information. Id. at 1280–82.

In reaching that conclusion, the court rejected the Seventh Circuit’s view that allegations of fraud that are “substantially the same” as prior disclosures necessarily preclude a finding that a relator “materially add[ed]” to those disclosures within the meaning of the original source exception. See Cause of Action v. Chi. Transit Auth., 815 F.3d 267, 283 (7th Cir. 2016). The D.C. Circuit explained that such an approach would collapse the distinct statutory inquiries under the public disclosure bar and the original source exception and render the “materially adds” requirement superfluous. O’Connor, 153 F.4th at 1280–81. Instead, consistent with decisions from the First, Third, Sixth, and Tenth Circuits, the court held that a relator may allege substantially similar fraud (and thus trigger the public disclosure bar) while still contributing new, significant information that meaningfully advances the government’s understanding of the scheme (thus qualifying as an original source). Id. In this way, the decision largely confirms what had already been clear from other cases, namely that public disclosures are not a sure path to dismissal of a qui tam action.

C. D.C. Circuit Narrows the Scope of “Obligation” in Reverse FCA Cases Based on Immigration and Payroll Practices

In August 2025, the D.C. Circuit largely affirmed dismissal of a reverse false claims action, holding that the relator failed to plausibly allege an existing “obligation to pay or transmit money or property to the Government” within the meaning of the FCA. United States ex rel. Kini v. Tata Consultancy Servs., Ltd., 146 F.4th 1184, 1188–94 (D.C. Cir. 2025).

The relator, an employee of an information-technology consulting firm, alleged that his employer fraudulently avoided paying money to the government by underpaying employees who should have been classified as H-1B visa holders—thereby reducing payroll taxes—and by applying for less expensive L-1 and B-1 visas instead of H-1B visas to avoid higher application fees. Id. at 1188, 1191–92. He also asserted an FCA retaliation claim based on adverse employment actions following his internal reports. Id. at 1188, 1192.

The D.C. Circuit affirmed the district court’s dismissal of the reverse FCA claim. Id. at 1193–94. Department of Labor regulations governing H-1B visas impose obligations to pay certain wages to employees, not to pay money to the government. Id. at 1192–93. And although payroll taxes are owed to the government, the tax code requires employers to pay taxes only on wages actually paid, not on wages that should have been paid under labor or immigration regulations. Id. at 1193. Because the relator did not allege that the employer failed to pay taxes on wages it actually paid, he failed to plead an existing FCA “obligation.” Id. Affirming on these grounds, the court did not have to reach the question of whether the relator’s tax-based theory was precluded by the FCA’s tax bar, which states that the FCA “does not apply to claims, records, or statements made under the Internal Revenue Code of 1986.” 31 U.S.C. § 3729(d).

The court likewise rejected the theory that the defendant employer had an obligation to pay higher H-1B visa fees for visas it never sought. Kini, 146 F.4th at 1193–94. Immigration regulations require employers to pay fees only for the visa applications they submit. Id. Even if the employer’s visa choices were improper, they did not give rise to a self-executing duty to pay additional fees. Id. In reaching this conclusion, the D.C. Circuit aligned itself with the other circuits that have considered this question. Id. at 1194. As such, the decision marks a further bulwark against attempts to use the reverse false claims provision to bootstrap regulatory disputes into claims of fraud under the FCA.

D. Seventh Circuit Affirms FCA Verdict Based on Manipulation of Medicaid Drug Pricing

In September 2025, the Seventh Circuit affirmed an FCA judgment against Eli Lilly, holding that a drug manufacturer’s exclusion of post-sale price increases from its reported Average Manufacturer Prices (AMPs) violated the Medicaid Drug Rebate Program (MDRP) and supported FCA liability. United States ex rel. Streck v. Eli Lilly & Co., 152 F.4th 816 (7th Cir. 2025). The court upheld summary judgment on falsity and a jury verdict finding scienter and materiality, resulting in trebled damages exceeding $180 million. Id. at 833.

The relator alleged that Lilly understated its AMPs from 2005 to 2017 by excluding “price increase values”—amounts wholesalers were required to remit to Lilly when Lilly raised prices after initial sale but before resale to pharmacies, even though Lilly captured those amounts as revenue. Id. at 830. Lilly characterized these clawbacks as “bona fide service fees” paid to wholesalers that were therefore excludable from AMP calculations. Id. The Seventh Circuit rejected that characterization, holding that the MDRP statute, implementing regulations, and Lilly’s rebate agreement unambiguously required AMP to reflect the full price actually realized by the manufacturer, including post-sale adjustments. Id. at 833–36.

The court reasoned that regulatory complexity in the Medicaid framework does not create ambiguity as to a specific statutory requirement. Id. at 833. Although AMP calculations may involve difficult judgment calls, the court held that the question of whether Lilly could exclude post-sale price increases was not ambiguous in light of the MDRP statute’s text, structure, and purpose. Id. at 834–36. Lilly’s interpretation, the court explained, would undermine the MDRP’s core purpose by allowing manufacturers to raise prices while artificially suppressing rebate obligations. Id. It further held that price increase values failed the bona fide service fee test because they were passed through to pharmacies and were paid to the manufacturer rather than by the manufacturer. Id. at 837.

On scienter, the court held that a reasonable jury could find Lilly acted knowingly or with reckless disregard. Id. at 842. The court cited evidence that senior executives certified AMP submissions without understanding how price increases were excluded, that Lilly treated the price increases as revenue, that it failed to document any purported “reasonable assumptions,” and that it offered no evidence it sought or received legal advice endorsing its AMP methodology. Id. at 842–46. The court rejected Lilly’s reliance on alleged regulatory ambiguity, explaining that “objectively unreasonable” interpretations that are “contrary to regulatory guidance” are probative of scienter. Id. at 842–43.

The court also affirmed the jury’s materiality finding. Id. at 847. It reasoned that AMP is foundational to Medicaid pricing and that large price differentials caused by underreporting strongly support materiality. Id. Although Lilly pointed to government inaction after some disclosure of its methodology as evidence of immateriality, the court held that inaction alone was not dispositive, particularly given the magnitude of the alleged misstatements, AMP’s centrality to the Medicaid program, and the importance of Lilly’s drugs to Medicaid beneficiaries. Id. at 848. Continued government payment did not defeat materiality where the record supported alternative explanations for agency inaction, as the court concluded that it did here. Id.

Streck is notable both for the size of the verdict that it affirmed, and for the potential tension it creates with the Supreme Court’s SuperValu decision. In that decision, the Court held that the FCA’s scienter requirement must be applied by reference to the defendant’s subjective understanding at the time of the alleged fraudulent conduct. In doing so, the Court rejected attempts to vitiate scienter via objectively reasonable post-hoc interpretations of the law. Insofar as Streck suggests that an objectively unreasonable interpretation can support a finding of scienter, the two decisions are in tension. We can expect this feature of the Streck decision to prompt debates about, among other things, the kinds of facts that are sufficient to plead scienter at the motion-to-dismiss stage of a case.

E. Third Circuit Holds That Defense Counsel Need Not Advise Criminal Defendants of Potential FCA Civil Liability

In October 2025, the Third Circuit held that the Sixth Amendment does not require criminal defense counsel to advise defendants that a guilty plea may give rise to collateral estoppel and subsequent civil liability under the FCA. Patel v. United States, 156 F.4th 342, 349–50 (3d Cir. 2025). The court further held that, even if such a duty existed, the non-retroactivity doctrine would bar relief on collateral review. Id.

The decision arose from a criminal case in which the defendants, who operated mobile diagnostic testing companies, pleaded guilty to Medicare fraud after falsely representing that diagnostic tests were physician-supervised and submitting reports bearing forged physician signatures. Id. at 345–47. After the pleas, the government intervened in a pending qui tam action filed by a former employee and obtained summary judgment under the FCA based on collateral estoppel arising from the plea admissions. Id. The district imposed more than $7.7 million in treble damages and civil penalties. Id. Defendants later sought post-conviction relief under 28 U.S.C. § 2255, arguing that their attorneys were constitutionally ineffective for failing to warn them of potential FCA exposure stemming from their guilty pleas. Id.

The Third Circuit affirmed the district court’s denial of relief, concluding that counsel’s failure to advise defendants of potential FCA exposure did not render the pleas constitutionally infirm. Id. at 349–50. Reaffirming the traditional distinction between direct and collateral consequences of a guilty plea, the court held that the Sixth Amendment requires counsel to advise defendants only of direct consequences—such as imprisonment and fines—not collateral consequences that depend on future civil proceedings. Id. The court deemed FCA liability, including via the collateral estoppel effect of a guilty plea, a paradigmatic collateral consequence.

In reaching this conclusion, the court declined to extend Padilla v. Kentucky beyond the immigration context, emphasizing that Padilla carved out a narrow exception based on deportation’s uniquely severe and nearly automatic character. Id. FCA liability, the court reasoned, is neither automatic nor part of the criminal sentence and depends on independent civil enforcement decisions. Id. at 350–51. The court further held that recognizing a duty to advise on FCA consequences would announce a new rule barred from retroactive application under Teague v. Lane. Id. at 351–52.

Patel provides clarity at the intersection of criminal health care fraud prosecutions and FCA enforcement, and the decision is likely to prompt continued efforts by DOJ and relators to pursue FCA cases involving parallel criminal dispositions.

V. CONCLUSION

We will monitor these developments, along with other FCA legislative activity, settlements, and jurisprudence throughout the year and report back in our 2026 False Claims Act Mid-Year Update.

[1] U.S. Dep’t of Justice, Civil Division, FY2025 False Claims Act Statistics 3 (Oct. 1, 1986 – Sep. 30, 2025), https://www.justice.gov/opa/media/1424121/dl (last visited Jan. 21, 2026).

[2] Id. at 2.

[3] Id. at 3.

[4] Id.

[5] Id. at 3.

[6] Id. at 2.

[7] Id.

[8] Opinion, United States ex rel. Penelow v. Janssen Prods., LP, No. 3:12-cv-07758 (D.N.J. Mar. 5, 2025), Dkt. No. 496 at 31, 35.

[9] U.S. Dep’t of Justice, Civil Division, FY2025 False Claims Act Statistics 3 (Oct. 1, 1986 – Sep. 30, 2025), https://www.justice.gov/opa/media/1424121/dl (last visited Jan. 21, 2026).

[10] See Press Release, U.S. Dep’t of Justice, Kaiser Permanente Affiliates Pay $556M to Resolve False Claims Act Allegations (Jan. 14, 2026), https://www.justice.gov/opa/pr/kaiser-permanente-affiliates-pay-556m-resolve-false-claims-act-allegations.

[11] The summaries in this section cover the period from July 1, 2025 through December 31, 2025, and focus on settlements valued at $2 million or more.

[12] See P.J. D’Annunzio, CVS PBM Overbilling Judgment Trebled To $290M, Law360 (Aug. 20, 2025), https://www.law360.com/healthcare-authority/articles/2379098.

[13] See Lauraann Wood, 7th Circ. Backs $183M FCA Award Over Eli Lilly Drug Rebates, Law360 (Sep. 11, 2025), https://www.law360.com/articles/2387034/7th-circ-backs-183m-fca-award-over-eli-lilly-drug-rebates.

[14] See Ben Adlin, Jury Clears Novo Nordisk Of Medicaid Fraud Over Blood Drug, Law360 (Nov. 7, 2025), https://www.law360.com/articles/2409038/jury-clears-novo-nordisk-of-medicaid-fraud-over-blood-drug.

[15] The summaries in this section cover the period from July 1, 2025 through December 31, 2025, and focus on settlements valued at $2 million or more.

[16] See Press Release, U.S. Atty’s Office for the Dist. of S.C., United States and the States of Georgia, Colorado, and South Carolina Obtain $114.5M in Judgments in a Sprawling Cancer Genetic Testing Lab Scheme (July 17, 2025), https://www.justice.gov/usao-sc/pr/united-states-and-states-georgia-colorado-and-south-carolina-obtain-1145m-judgments.

[17] See Press Release, U.S. Atty’s Office for the Northern Dist. of Cal., California Behavioral Medicine Provider Agrees to Pay $2.75 Million to Resolve Alleged False Claims for Psychotherapy Services (Aug. 19, 2025), https://www.justice.gov/usao-ndca/pr/california-behavioral-medicine-provider-agrees-pay-275-million-resolve-alleged-false.

[18] See Press Release, U.S. Dep’t of Justice, Semler Scientific Inc. and Bard Peripheral Vascular Inc. to Pay Nearly $37M to Resolve False Claims Act Allegations Relating to FloChec and QuantaFlo Devices (Sep. 26, 2025), https://www.justice.gov/opa/pr/semler-scientific-inc-and-bard-peripheral-vascular-inc-pay-nearly-37m-resolve-false-claims; Settlement Agreement, U.S. Dep’t of Justice and Semler Scientific, Inc. (Sep. 10, 2025), https://www.justice.gov/opa/media/1415526/dl?inline; Settlement Agreement, U.S. Dep’t of Justice and Bard Peripheral Vascular, Inc. (Sep. 3, 2025), https://www.justice.gov/opa/media/1415521/dl?inline.

[19] See Press Release, U.S. Atty’s Office for the Dist. of Md., Exactech Agrees to Pay $8 Million to Resolve False Claims Act Allegations for Selling Defective Knee Implant Devices (Sep. 16, 2025), https://www.justice.gov/usao-md/pr/exactech-agrees-pay-8-million-resolve-false-claims-act-allegations-selling-defective.

[20] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Cal., CVS Pharmacy Inc. Pays $18.2 Million to Resolve Alleged False Claims Act Violations (Nov. 17, 2025), https://www.justice.gov/usao-edca/pr/cvs-pharmacy-inc-pays-182-million-resolve-alleged-false-claims-act-violations; Settlement Agreement at 2, United States, California, and CVS Pharmacy, Inc. (Oct. 31, 2025), https://www.justice.gov/usao-edca/media/1418331/dl?inline.

[21] See Press Release, U.S. Atty’s Office for the Dist. of Md., Diagnostic Laboratory Agrees to Pay More Than $9 Million to Settle Alleged False Claims Act Violations (Nov. 13, 2025), https://www.justice.gov/usao-md/pr/diagnostic-laboratory-agrees-pay-more-9-million-settle-alleged-false-claims-act.

[22] See Press Release, U.S. Atty’s Office for the Middle Dist. of Fl., VRA Enterprises Agrees To Pay Over $17 Million For Allegedly Billing Medicare For Over-The-Counter COVID-19 Tests That Were Not Provided To Beneficiaries, Or That Were Sent To Beneficiaries Months After Being Billed To Medicare (Nov. 14, 2025), https://www.justice.gov/usao-mdfl/pr/vra-enterprises-agrees-pay-over-17-million-allegedly-billing-medicare-over-counter.

[23] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Wash., Tri-Cities Urgent Care Clinic Agrees to Pay $2.8 Million to Resolve Claims of Overbilling for Diagnostic Tests (Nov. 17, 2025), https://www.justice.gov/usao-edwa/pr/tri-cities-urgent-care-clinic-agrees-pay-28-million-resolve-claims-overbilling-0.

[24] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Pa., Aesculap Implant Systems Agrees to Pay $38.5 Million to Resolve False Claims Act Allegations Related to Knee Implant Failures (Nov. 17, 2025), https://www.justice.gov/usao-edpa/pr/aesculap-implant-systems-agrees-pay-385-million-resolve-false-claims-act-allegations.

[25] See Press Release, U.S. Dep’t of Justice, Vohra Wound Physicians and its Owner Agree to Pay $45M to Settle Fraud Allegations of Overbilling for Wound Care Services (Nov. 21, 2025), https://www.justice.gov/opa/pr/vohra-wound-physicians-and-its-owner-agree-pay-45m-settle-fraud-allegations-overbilling.

[26] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Pa., Recovery Centers of America Agrees to Pay $2 Million to Resolve Allegations That It Violated the Controlled Substances Act and the False Claims Act by Mishandling Controlled Substances and Providing Inadequate Treatment Services (Dec. 10, 2025), https://www.justice.gov/usao-edpa/pr/recovery-centers-america-agrees-pay-2-million-resolve-allegations-it-violated.

[27] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Wound Graft Company Owners Sentenced for $1.2B Health Care Fraud and Agree to Pay $309M to Resolve Civil Liability Under the False Claims Act (Dec. 12, 2025), https://www.justice.gov/opa/pr/wound-graft-company-owners-sentenced-12b-health-care-fraud-and-agree-pay-309m-resolve-civil.

[28] See Press Release, U.S. Dep’t of Justice, Dana-Farber Cancer Institute Agrees to Pay $15M to Settle Fraud Allegations Related to Scientific Research Grants (Dec. 16, 2025), https://www.justice.gov/opa/pr/dana-farber-cancer-institute-agrees-pay-15m-settle-fraud-allegations-related-scientific; Settlement Agreement, U.S. Dep’t of Justice and Dana-Farber Cancer Institute, Inc. et al. (Dec. 11, 2025), https://www.justice.gov/d9/2025-12/usa_v._dana-farber_cancer_institute_-_settlement_agreement.pdf.

[29] See Press Release, U.S. Atty’s Office for the Southern Dist. of N.Y., U.S. Attorney Announces $6.8 Million Settlement With New York-Presbyterian Hudson Valley Hospital For Paying Kickbacks To A Westchester Oncology Practice In Order To Obtain Referrals (Dec. 22, 2025), https://www.justice.gov/usao-sdny/pr/us-attorney-announces-68-million-settlement-new-york-presbyterian-hudson-valley; Settlement Agreement, U.S. Dep’t of Justice and New York-Presbyterian Hudson Valley Hospital et al. (Dec. 18, 2025), www.justice.gov/usao-sdny/media/1421811/dl.

[30] See Press Release, U.S. Dep’t of Justice, Illumina Inc. to Pay $9.8M to Resolve False Claims Act Allegations Arising from Cybersecurity Vulnerabilities in Genomic Sequencing Systems (July 31, 2025), https://www.justice.gov/opa/pr/illumina-inc-pay-98m-resolve-false-claims-act-allegations-arising-cybersecurity; Settlement Agreement, U.S. Dep’t of Justice and Illumina, Inc. et al. (July 22, 2025), https://www.justice.gov/opa/media/1409561/dl.

[31] See Press Release, U.S. Atty’s Office for the Dist. of N.J., Government Contractor to Pay Over $4 Million to Settle False Claims Act Allegations (Sep. 18, 2025), https://www.justice.gov/usao-nj/pr/government-contractor-pay-over-4-million-settle-false-claims-act-allegations; Settlement Agreement, U.S. Dep’t of Justice and Bayonne Drydock and Repair Corp. et al. (Sep. 9, 2025), https://www.justice.gov/usao-nj/media/1414546.

[32] See Press Release, U.S. Atty’s Office for the Dist. of N.J., Government Contractor Agrees to Pay $3.1 Million to Resolve Alleged Violations of the False Claims Act (Sep. 2, 2025), https://www.justice.gov/usao-id/pr/government-contractor-agrees-pay-31-million-resolve-alleged-violations-false-claims-act; Settlement Agreement, U.S. Dep’t of Justice and Sanford Federal, Inc. and Joseph Mandour (Aug. 22, 2025), https://www.justice.gov/usao-id/media/1413511/dl?inline.

[33] See Press Release, U.S. Dep’t of Justice, Patio Furniture Company Grosfillex Inc. to Pay $4.9 Million to Resolve Allegations it Evaded Duties on Extruded Aluminum from the PRC (July 24, 2025, updated July 31, 2025), https://www.justice.gov/opa/pr/patio-furniture-company-grosfillex-inc-pay-49-million-resolve-allegations-it-evaded-duties; Settlement Agreement, U.S. Dep’t of Justice and Grosfillex, Inc. (July 17, 2025), https://www.justice.gov/opa/media/1409616/dl.

[34] See Press Release, U.S. Dep’t of Justice, Importers Agree to Pay $6.8M to Resolve False Claims Act Liability Relating to Voluntary Self-Disclosure of Unpaid Customs Duties (July 23, 2025, updated July 31, 2025), https://www.justice.gov/opa/pr/importers-agree-pay-68m-resolve-false-claims-act-liability-relating-voluntary-self; Settlement Agreement, U.S. Dep’t of Justice and MGI International, LLC (July 22, 2025), https://www.justice.gov/opa/media/1409606/dl.

[35] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Mi., International Audio Electronics Company Harman Pays $11.8 Million to Settle Fraud Allegations for Evading Customs Duties on Chinse Extruded Aluminum (Nov. 26, 2025), https://www.justice.gov/usao-edmi/pr/international-audio-electronics-company-harman-pays-118-million-settle-fraud; Settlement Agreement, United States of America et al v. Harman International Industries, Inc., No. 2:20-cv-12487 (E.D. Mich. Nov. 21, 2025), Dkt. No. 43-1.

[36] See Press Release, U.S. Dep’t of Justice, Ceratizit USA LLC Agrees to Pay $54.4M to Settle False Claims Act Allegations Relating to Evaded Customs Duties (Dec. 18, 2025), https://www.justice.gov/opa/pr/ceratizit-usa-llc-agrees-pay-544m-settle-false-claims-act-allegations-relating-evaded-0; Settlement Agreement, U.S. Dep’t of Justice and Ceratizit USA LLC et al. (Dec. 4, 2025), www.justice.gov/opa/media/1421296/dl.

[37] See Press Release, U.S. Dep’t of Justice, Japanese-Based Toyo Ink and Affiliates in New Jersey and Illinois Settle False Claims Allegation for $45 Million (Dec. 17, 2012), https://www.justice.gov/archives/opa/pr/japanese-based-toyo-ink-and-affiliates-new-jersey-and-illinois-settle-false-claims-allegation.

[38] See Press Release, U.S. Atty’s Office for the Western Dist. of N.C., Beko Technologies Agrees To Pay Over $3.6 Million To Resolve False Claims Act Allegations Involving Improper Paycheck Protection Program Loans (July 22, 2025), https://www.justice.gov/usao-wdnc/pr/beko-technologies-agrees-pay-over-36-million-resolve-false-claims-act-allegations.

[39] See Press Release, U.S. Atty’s Office for the Dist. of Mass., Labor Union Agrees to Pay $2 Million to Resolve Allegations of PPP Loan Fraud (Sep. 17, 2025), https://www.justice.gov/usao-ma/pr/labor-union-agrees-pay-2-million-resolve-allegations-ppp-loan-fraud; Settlement Agreement, U.S. Dep’t of Justice and International Brotherhood of Electrical Workers Local 103 (July 23, 2025), https://www.justice.gov/d9/2025-09/us_v._ibew_-_settlement_agreement.pdf.

[40] See Press Release, U.S. Dep’t of Justice Office of Public Affairs, Three Chinese-Owned Companies to Pay More than $21.6M to Resolve False Claims Act Allegations Relating to Paycheck Protection Program Loans (Aug. 12, 2025), https://www.justice.gov/opa/pr/three-chinese-owned-companies-pay-more-216m-resolve-false-claims-act-allegations-relating.

[41] See Press Release, U.S. Atty’s Office for the Dist. of N.J., Bergen County Company Settles Matter Alleging Receipt of Improper CARES Act Loans (Sep. 22, 2025), https://www.justice.gov/usao-nj/pr/bergen-county-company-settles-matter-alleging-receipt-improper-cares-act-loans; Settlement Agreement, U.S. Dep’t of Justice and Ulma Form Works, Inc. et al. (Sep. 3, 2025), https://www.justice.gov/usao-nj/media/1414726/dl?inline.

[42] See Press Release, U.S. Atty’s Office for the Middle Dist. of Fla., Georgia Non-Profit Entity Pays $3.5 Million To Settle False Claims Act Allegations Involving Paycheck Protection Program (Nov. 14, 2025), https://www.justice.gov/usao-mdfl/pr/georgia-non-profit-entity-pays-35-million-settle-false-claims-act-allegations.

[43] See Press Release, U.S. Atty’s Office for the Western Dist. of N.Y., Transportation Companies Agree to Pay $4.4 million to Resolve False Claims Act Allegations Involving Fraudulently Obtained PPP Loans (Nov. 17, 2025), https://www.justice.gov/usao-wdny/pr/transportation-companies-agree-pay-44-million-resolve-false-claims-act-allegations.

[44] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Va., Idaho Construction Company Settles Paycheck Protection Program Loan Allegations (Nov. 25, 2025), https://www.justice.gov/usao-edva/pr/idaho-construction-company-settles-paycheck-protection-program-loan-allegations.

[45] See Press Release, U.S. Atty’s Office for the Western Dist. of Wash., Three Companies Settle Allegations They Applied for and Received Pandemic Related Loans That Were Illegal (Dec. 3, 2025), https://www.justice.gov/usao-wdwa/pr/three-companies-settle-allegations-they-applied-and-received-pandemic-related-loans.

[46] See Press Release, U.S. Atty’s Office for the Dist. of N.J., Morris County Company Settles Matter Alleging it Received Improper Paycheck Protection Program Loan (Dec. 15, 2025), https://www.justice.gov/usao-nj/pr/morris-county-company-settles-matter-alleging-it-received-improper-paycheck-protection-0; Settlement Agreement, U.S. Dep’t of Justice and C.I.E. Tours International, Inc. (Nov. 5, 2025), https://www.justice.gov/usao-nj/media/1420866/dl?inline.

[47] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Wisc., Three Chinese-Owned Companies to Pay More Than $7.3 Million to Resolve False Claims Act Allegations Relating to Paycheck Protection Program Loans (Dec. 16, 2025) https://www.justice.gov/usao-edwi/pr/three-chinese-owned-companies-pay-more-73-million-resolve-false-claims-act-allegations.

[48] See Press Release, U.S. Atty’s Office for the Southern Dist. of Tex., International Ocean Bottom Seismic Operations Company Pays Over $4 Million to Settle False Claims Act Allegations (Dec. 18, 2025), https://www.justice.gov/usao-sdtx/pr/international-ocean-bottom-seismic-operations-company-pays-over-4-million-settle-false.

[49] See Press Release, U.S. Atty’s Office for the Southern Dist. of N.Y., $8.39 Million Settlement With College Relating To Improper Receipt Of Paycheck Protection Program Loan (Dec. 19, 2025), https://www.justice.gov/usao-sdny/pr/839-million-settlement-college-relating-improper-receipt-paycheck-protection-program; Settlement Agreement, U.S. Dep’t of Justice and Marymount Manhattan College (Dec. 18, 2025), www.justice.gov/usao-sdny/media/1421606/dl.

[50] Memorandum from Attorney General Pamela Bondi, U.S. Dep’t of Justice, Guidance for Recipients of Federal Funding Regarding Unlawful Discrimination (July 29, 2025), https://www.justice.gov/ag/media/1409486/dl?inline=&utm_medium=email&utm_source=govdelivery.

[51] Id.

[52] Id.

[53] Exec. Order 14173, 90 FR 8633 (Jan. 21, 2025), https://www.federalregister.gov/documents/2025/01/31/2025-02097/ending-illegal-discrimination-and-restoring-merit-based-opportunity.

[54] Memorandum from Deputy Attorney General Todd Blanche, U.S. Dep’t of Justice, Civil Rights Fraud Initiative (May 19, 2025), https://www.justice.gov/dag/media/1400826/dl.

[55] Ken Paxton, Att’y Gen. of Tex., Re: “Diversity, Equity, and Inclusion” in Texas, Op. No. KP-0505 (Jan. 19, 2026), https://www.texasattorneygeneral.gov/sites/default/files/opinion-files/opinion/2026/kp-0505_0.pdf.

[56] Preventing Woke AI in the Federal Government, Executive Order 14319, 90 FR 35389 (July 28, 2025), https://www.federalregister.gov/documents/2025/07/28/2025-14217/preventing-woke-ai-in-the-federal-government.

[57] Id.

[58] Id.

[59] Id.

[60] Memorandum from Russell T. Vought to Heads of Executive Departments and Agencies (Dec. 11, 2025), https://www.whitehouse.gov/wp-content/uploads/2025/12/M-26-04-Increasing-Public-Trust-in-Artificial-Intelligence-Through-Unbiased-AI-Principles-1.pdf.

[61] Id.

[62] Id.

[63] Press Release, U.S. Dep’t of Justice, Departments of Justice and Homeland Security Partnering on Cross-Agency Trade Fraud Task Force (August 29, 2025), https://www.justice.gov/opa/pr/departments-justice-and-homeland-security-partnering-cross-agency-trade-fraud-task-force.

[64] Id.

[65] Id.

[66] See Press Release, U.S. Dep’t of Justice, Ceratizit USA LLC Agrees to Pay $54.4M to Settle False Claims Act Allegations Relating to Evaded Customs Duties (Dec. 18, 2025), https://www.justice.gov/opa/pr/ceratizit-usa-llc-agrees-pay-544m-settle-false-claims-act-allegations-relating-evaded-0; Settlement Agreement, U.S. Dep’t of Justice and Ceratizit USA LLC et al. (Dec. 4, 2025), www.justice.gov/opa/media/1421296/dl (Ceratizit Settlement Agreement).

[67] Ceratizit Settlement Agreement, at 2. See also United States v. Customs Fraud Investigs., LLC v. Victaulic Co., 839 F.3d 242 (3d Cir. 2016) (discussing a similar theory).

[68] https://www.justice.gov/archives/opa/pr/japanese-based-toyo-ink-and-affiliates-new-jersey-and-illinois-settle-false-claims-allegation.

[69] See Learning Resources, Inc. v. Trump, No. 24-1287 (argued Nov. 5, 2025).

[70] Medicaid Program; Prohibition on Federal Medicaid and Children’s Health Insurance Program Funding for Sex-Rejecting Procedures Furnished to Children, 90 Fed. Reg. 59441 (proposed Dec. 19, 2025); Medicare and Medicaid Programs; Hospital Condition of Participation: Prohibiting Sex-Rejecting Procedures for Children, 90 Fed. Reg. 59463 (proposed Dec. 19, 2025).

[71] 90 Fed. Reg. 59441.

[72] 90 Fed. Reg. 59471.

[73] H.R. 2051, 2026 Gen. Assemb., Reg. Sess. (Pa. 2026).

[74] S.B. 38, 2025 Gen. Assemb., Reg. Sess. (Pa. 2025).

[75] See, e.g., id. at § 6311(a)(8).

[76] See Mass. Gen. Laws ch. 12 § 5B(a)(10).