July 20, 2023

On July 19, 2023, the U.S. Federal Trade Commission (FTC) and Department of Justice (DOJ) (collectively, the Agencies) jointly released updated draft Merger Guidelines (Proposed Guidelines) for public comment.[1] The Proposed Guidelines address horizontal and vertical mergers and reflect the Biden Administration’s competition policy and existing enforcement priorities[2] while providing guidance about the Agencies’ recent efforts to expand the reach of antitrust and fair competition laws.[3] The Proposed Guidelines will not be formally effective for several months, but, in practice, they already reflect current enforcement policy in reality, and as such are a window into the Agencies’ thinking on competition analysis.

Notable provisions in the Proposed Guidelines that reflect changes from prior agency guidance include: (A) lower market share and concentration thresholds necessary to trigger the structural presumption that a transaction is anticompetitive, (B) de-prioritizing market definition as the starting place for analysis, (C) close scrutiny of transactions that may eliminate potential competition, (D) a framework for analyzing mergers involving multi-sided platforms, (E) a focus on potential harm to rivals, (F) attention to serial or “roll-up” acquisitions, (G) enhanced focus on labor market effects, and (H) expanded use of the FTC’s Section 5 authority.

Overall, the Proposed Guidelines reflect the Agencies’ increased skepticism of the benefits of mergers and acquisitions and a greater willingness to pursue new or revive older theories of competitive harm.

I. Background: The Proposed Guidelines reflect major policy changes.

Historically, the Agencies have jointly issued Guidelines to explain their enforcement policy, most recently in the 2010 Horizontal Merger Guidelines[4] and the 2020 Vertical Merger Guidelines.[5] In September 2021, the FTC withdrew the Vertical Merger Guidelines in favor of a new set of guidance to be developed with DOJ.[6] The new Proposed Guidelines touch on both vertical and horizontal merger enforcement.

II. The Proposed Guidelines reflect the Agencies’ current policy of enhanced scrutiny in merger analysis and pursuit of broader enforcement priorities.

The Proposed Guidelines reflect recent trends in merger review, including enhanced Agency scrutiny and expanded theories. The Proposed Guidelines seek to further these priorities by articulating a range of frameworks that the Agencies may use for assessing a merger’s legality.

A. Lower thresholds to trigger a structural presumption.

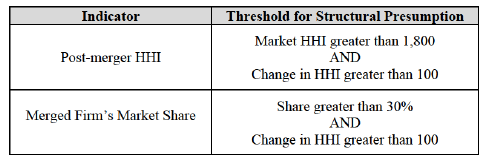

The lowering of the quantitative thresholds of market concentration necessary to trigger the presumption that a merger is anticompetitive is one of the most impactful policy changes articulated in the Proposed Guidelines. As a result of this change, the agencies may use the Proposed Guidelines as grounds to investigate more deeply transactions previously considered low-risk, and to discount pro-competitive features of the industry, regardless of the deal specifics. To apply a structural presumption, however, the Agencies would need to define the relevant market in which to evaluate the competitive effects of a proposed transaction.

While the Agencies have long used market concentration thresholds to guide antitrust analysis in merger review, the Proposed Guidelines utilize lower thresholds and ascribe greater weight to the attendant anticompetitive inferences.[7] Whereas the 2010 Horizontal Merger Guidelines characterize concentrations of seven competitors of equal share or more (utilizing the Herfindahl-Hirschman Index (HHI) index) as “unconcentrated”, the Proposed Guidelines would seek to label as “concentrated” any market with more concentration than, for example, 10 equal players. The specific proposed interplay of concentration and market shares is illustrated below.

B. Decreased focus on market definition in favor of competitive effects and other evidence.

While the 2010 Horizontal Merger Guidelines relied on market definition to focus the inquiry on the relevant competitive dynamics, the Proposed Guidelines eschew this approach. Instead, the Agencies may avoid defining markets and rely instead on non-traditional evidence, including evidence of competition between the merging parties (irrespective of alternative competitive threats), prior industry coordination (regardless of the parties’ participation), or recent mergers in the same market (regardless of whether prior transactions increased competition).

C. Close scrutiny of transactions that may eliminate potential competition.

Consistent with the Biden administration’s enforcement program, the Proposed Guidelines endorse an expansive view of the so-called “potential competition” doctrine, which describes transactions that may violate the antitrust laws by eliminating an “actual” or “perceived” potential competitor rather than a current market participant.[8] Under the Proposed Guidelines, a merger may be illegal where it eliminates “actual” potential competition, i.e., “the possibility that entry or expansion by one or both firms would have resulted in new or increased competition in the market in the future.”[9] The agencies may also investigate mergers that eliminate “perceived” potential competition, i.e., “current competitive pressure exerted on other market participants by the mere perception that one of the firms might enter.”[10]

The 2010 Horizontal Merger Guidelines neither distinguish between “actual” or “perceived” potential competition nor devote significant time to discussing them as an Agency priority, and the Agencies have found split Circuit opinions on frameworks for “actual” and “perceived” potential competition claims. The Proposed Guidelines set out a detailed framework under the most Agency-favorable Circuit views for analyzing potential competition issues. For example, the Proposed Guidelines suggest that, in challenging a deal that threatens to eliminate an “actual” potential entrant, the Agencies need only show whether one of the merging firms had a “reasonable probability” of entering the relevant market absent the merger.[11] This standard, while endorsed by some district courts, has been rejected by others (and at one time even the FTC itself) in favor of a more demanding showing of “clear proof.” Both here and elsewhere in the Proposed Guidelines, the Agencies rely on a generous and often selective reading of the relevant case law.

D. Framework for analyzing platform mergers.

The Proposed Guidelines set forth a framework for analyzing and challenging mergers involving competition between, on and to displace platform businesses (businesses that provide different products or services to two or more different groups or “sides” who may benefit from each other’s participation). The Proposed Guidelines provide that transactions involving platforms may attract scrutiny if 1) two platform operators are combining; 2) a platform operator acquires a platform participant; 3) it involves the acquisition of a company that facilitates participation on multiple platforms, or 4) it involves the acquisition by a platform operator of a company that provides important inputs for platform services (such as data enabling matching, sorting, or prediction).

E. Focus on potential harm to rivals.

Historically, the Agencies followed the Brown Shoe rule that antitrust law protections “competition, not competitors”, but the Proposed Guidelines highlight mergers’ potential to harm competitors. Where discussion of harm to competitors previously occurred primarily in a vertical context, the Agencies have expanded potential harms via potential foreclosure of products or services in “related” markets that could impact competition in an overlap product market. Most notably, the Proposed Guidelines indicate potential concerns may arise for related products rivals do not currently use but may in the future, and for circumstances where related products are or could be complementary to rivals’ competitive products and thus increase their value to customers.[12] Through the Proposed Guidelines, the Agencies have expanded theories of harm to include current and potential 3rd party competitors.

F. Investigations of serial or “roll-up” acquisitions.

The Proposed Guidelines also announce a new approach to analyzing multiple acquisitions by the same company. Traditionally, the Agencies have assessed a merger’s potential competitive effects independent of prior acquisitions, with an eye towards how future conduct will change because of the current merger. The Agencies now intend to investigate “pattern[s] or strateg[ies] of multiple small acquisitions, even if no single acquisition on its own would risk substantially lessening competition or tending to create a monopoly.”[13] This follows previously stated goals by the Agencies to bring enforcement actions against “roll-up” acquisitions, particularly in technology, pharmaceuticals, healthcare, and private equity investment.[14]

G. Enhanced focus on labor market effects.

The Proposed Guidelines expand the Agencies’ recent focus of mergers’ competitive effects in labor markets. In her recent Statement on the Proposed Guidelines, FTC Chair Lina Khan noted that “although antitrust law from its founding has been concerned about the effects of monopoly power on workers, merger analysis in recent decades has neglected to focus on labor markets.”[15] The Proposed Guidelines emphasize “labor markets are important buyer markets” that are separately subject to review, and downplay potential efficiencies created by firms combining operations.[16] The Agencies are already inquiring into potential labor market overlaps in Second Request investigations, as well as reviewing documents produced in merger investigations for evidence of wage fixing or no-poach agreements.

H. Expanded use of FTC Section 5 authority.

The Proposed Guidelines note several potential scenarios (and suggest more exist) where the FTC might exercise enforcement powers beyond the scope of the Sherman and Clayton Acts, reflecting Chair Khan’s often articulated intent to expand the FTC’s authority under Section 5 of the FTC Act.[17] The Proposed Guidelines leave the scope of this expanded enforcement authority open but note examples, such as otherwise lawful transactions whose acquisition structures, regulatory jurisdictions, or procurement processes might lessen competition.[18] As a result, the FTC may probe more widely into the acquisition dynamics and acquiring parties’ business structure during investigations and probe deeper into documents and interviews to root out potentially unique industry competitive conditions.

III. Practically, the Proposed Guidelines would bring greater antitrust scrutiny earlier in the regulatory review process and less certainty to merging parties.

Companies considering transactions should take note of the Proposed Guidelines and consider what changes to existing processes may be required. Companies should review due diligence templates with an eye toward early identification of items that may be the subject of regulatory scrutiny, including new and expanded areas of focus including labor markets, inputs to rivals, and past acquisitions. Companies may also want to proactively develop strong and persuasive advocacy that demonstrates the procompetitive aspects of a transaction and meets potential theories of competitive harm head-on. Finally, document creation and retention guidance continues to be of paramount importance as the number and types of documents that could be a focus item in merger investigations continues to grow, with potential changes to the HSR filing guidelines that may require submission of many additional documents related to the transaction.[19]

IV. Conclusion & Takeaways

The Proposed Guidelines are the latest in a larger trend of expanded and more aggressive antitrust enforcement by the Agencies in the current Administration, as we have noted in our prior Client Alerts regarding changes to the HSR merger notification form, FTC’s enforcement authority under Section 5 of the FTC Act, and interlocking directorates.[20] As with other efforts to expand the reach of the antitrust laws, the enforcement policies articulated in these Proposed Guidelines will be subject to review by federal courts. And, although prior Merger Guidelines have garnered widespread acceptance in the case law, to challenge proposed transactions based on novel theories articulated in these Proposed Guidelines, the Agencies will ultimately need to persuade federal courts that these theories are supported by legal precedent.

In light of this increasingly aggressive and unpredictable merger enforcement environment, firms considering transactions should continue to proactively consult with antitrust counsel to develop appropriate antitrust risk mitigation strategies. While the draft merger guidelines are simply guidance and may yet evolve in response to public comments, they are indicative of the theories that enforcers may study during a merger investigation.

Gibson Dunn attorneys are closely monitoring these developments and are available to discuss these issues as applied to your particular business.

___________________________

[1] Merger Guidelines (Draft for Public Comment), U.S. Dep’t of Justice & Fed. Trade Comm’n (July 19, 2023) (non-final draft for public comment purposes) (“Proposed Guidelines”).

[2] See, e.g., Exec. Order No. 14,036, 86 Fed. Reg. 36,987 (July 9, 2021). See also Fact Sheet: Executive Order on Promoting Competition in the American Economy, The White House (July 9, 2021).

[3] See Gibson Dunn Client Alerts: DOJ Signals Increased Scrutiny on Information Sharing (Feb. 10, 2023); FTC Proposes Rule to Ban Non-Compete Clauses (Jan. 5, 2023); FTC Announces Broader Vision of Its Section 5 Authority to Address Unfair Methods of Competition (Nov. 14, 2023); DOJ Antitrust Secures Conviction for Criminal Monopolization (Nov. 9, 2022); DOJ Antitrust Division Head Promises Litigation to Break Up Director Interlocks (May 2, 2022).

[4] Horizontal Merger Guidelines, U.S. Dep’t of Justice & Fed. Trade Comm’n (August 19, 2010).

[5] Vertical Merger Guidelines, U.S. Dep’t of Justice & Fed. Trade Comm’n (June 30, 2020).

[6] Press Release, Federal Trade Commission Withdraws Vertical Merger Guidelines and Commentary, Fed. Trade Comm’n, (Sept. 15, 2021).

[7] See Proposed Guidelines at 7 n.29 (“The first merger guidelines to reference an HHI threshold were the merger guidelines issued in 1982, which used the 1,800 HHI threshold for a highly concentrated market, and 100 HHI for a significant increase. Each subsequent iteration until 2010 maintained those thresholds. . . . . In practice, the Agencies tended to challenge mergers that greatly exceeded these thresholds to focus their limited resources on the most problematic transactions. The more permissive thresholds included in the 2010 Horizontal Merger Guidelines reflected that agency practice, rather than a judgment of the appropriate thresholds for competitive concem or the requirements of the law. The Agencies consider a threshold of a post-merger 1,800 HHI and an increase in HHI of 100 to better reflect both the law and the risks of competitive harm and have therefore returned to those thresholds here.”)

[8] See id. at 11–13.

[9] Id. at 13.

[10] Id. at 11.

[11] Id. at 11–12.

[12] See Proposed Guidelines at 14 (Section II. Guideline 5. Subsection A. “The Ability and Incentive to Weaken or Exclude Rivals”).

[13] Proposed Guidelines at 22 (Section II. Guideline 9. “When a Merger is Part of a Series of Multiple Acquisitions, the Agencies May Examine the Whole Series.”).

[14] See, e.g., Statement of Commissioner Rohit Chopra Regarding Private Equity Roll-ups and the Hart-Scott Rodino Annual Report to Congress, Fed. Trade Comm’n (July 8, 2020); Deputy Assistant Attorney General Andrew Forman, The Importance of Vigorous Antitrust Enforcement in Healthcare (June 3, 2022).

[15] Statement of Chair Lina M. Khan Joined by Commissioner Rebecca Kelly Slaughter and Commissioner Alvaro M. Bedoya Regarding FTC-DOJ Proposed Merger Guidelines, Fed. Trade Comm’n (July 19, 2023).

[16] See Proposed Guidelines at 26 (Section II. Guideline 11. “When A Merger Involves Competing Buyers, the Agencies Examine Whether It May Substantially Lessen Competition for Workers or Other Sellers.”).

[17] Statement of Chair Lina M. Khan Joined by Commissioner Rebecca Kelly Slaughter and Commissioner Alvaro M. Bedoya On the Adoption of the Statement of Enforcement Policy Regarding Unfair Methods of Competition Under Section 5 of the FTC Act, Fed. Trade Comm’n (Nov. 10. 2022); Statement of Chair Lina M. Khan Joined by Commissioner Rohit Chopra and Commissioner Rebecca Kelly Slaughter on the Withdrawal of the Statement of Enforcement Principles Regarding “Unfair Methods of Competition” Under Section 5 of the FTC Act, Fed. Trade Comm’n (July 1, 2021).

[18] Proposed Guidelines at 28 (Section II. Guideline 13. “Mergers Should Not Otherwise Substantially Lessen Competition or Tend to Create a Monopoly.”).

[19] See Gibson Dunn Client Alert: FTC Proposes Dramatic Expansion and Revision of HSR Merger Notification Form (June 29, 2023).

[20] See Gibson Dunn Client Alerts: DOJ Signals Increased Scrutiny on Information Sharing (Feb. 10, 2023); FTC Proposes Rule to Ban Non-Compete Clauses (Jan. 5, 2023); FTC Announces Broader Vision of Its Section 5 Authority to Address Unfair Methods of Competition (Nov. 14, 2023); DOJ Antitrust Secures Conviction for Criminal Monopolization (Nov. 9, 2022); DOJ Antitrust Division Head Promises Litigation to Break Up Director Interlocks (May 2, 2022).

The following Gibson Dunn lawyers prepared this client alert: Sophie Hansell, Kristen Limarzi, Josh Lipton, Michael Perry, Chris Wilson, Jamie France, Logan Billman, Zoë Hutchinson, Connor Leydecker, and Steve Pet.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Antitrust and Competition, Mergers and Acquisitions, or Private Equity practice groups, or the following practice leaders:

Antitrust and Competition Group:

Rachel S. Brass – Co-Chair, San Francisco (+1 415-393-8293, [email protected])

Stephen Weissman – Co-Chair, Washington, D.C. (+1 202-955-8678, [email protected])

Ali Nikpay – Co-Chair, London (+44 (0) 20 7071 4273, [email protected])

Christian Riis-Madsen – Co-Chair, Brussels (+32 2 554 72 05, [email protected])

Mergers and Acquisitions Group:

Robert B. Little – Co-Chair, Dallas (+1 214-698-3260, [email protected])

Saee Muzumdar – Co-Chair, New York (+1 212-351-3966, [email protected])

Private Equity Group:

Richard J. Birns – Co-Chair, New York (+1 212-351-4032, [email protected])

Ari Lanin – Co-Chair, Los Angeles (+1 310-552-8581, [email protected])

Michael Piazza – Co-Chair, Houston (+1 346-718-6670, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome