October 7, 2019

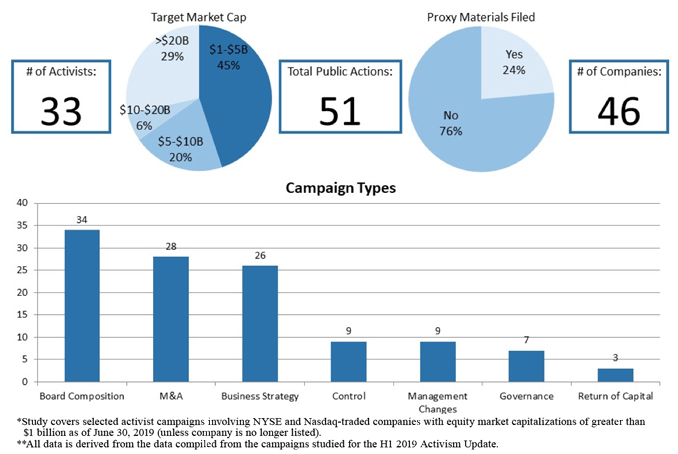

This Client Alert provides an update on shareholder activism activity involving NYSE- and Nasdaq-listed companies with equity market capitalizations in excess of $1 billion during the first half of 2019. As is typically the case during proxy season, shareholder activism rose during the first half of 2019 relative to the second half of 2018 as reflected in the number of public actions (51 vs. 40), in the number of activist investors that launched campaigns (33 vs. 29) and in the number of companies involved (46 vs. 34). As compared to the same period of 2018, however, shareholder activism activity declined, as reflected by the number of public actions in the first half of 2018 (51 vs. 62), the number of activist investors that launched campaigns (33 vs. 41) and the number of companies involved (46 vs. 54).

The types of companies targeted by shareholder activists changed in certain respects as well. During the second half of 2018, activists focused primarily on smaller public companies, as nearly two-thirds of those that were the subject of campaigns had market capitalizations of less than $5 billion and only 17% had market capitalizations in excess of $20 billion. By contrast, in the first half of 2019, companies with a capitalization of less than $5 billion represented only 45% of those targeted by activists, and companies with market capitalizations in excess of $20 billion comprised 29% of those companies targeted. The campaigns launched by NorthStar Asset Management against Alphabet and Facebook, Pershing Square against United Technologies Corporation and Starboard against Bristol-Myers Squibb and Appaloosa (all companies with market capitalizations in excess of $50 billion) stood in contrast with the second half of 2018, when comparatively few campaigns involving companies with market capitalizations in excess of $50 billion were launched.

By the Numbers – H1 2019 Public Activism Trends

Additional statistical analyses may be found in the complete Activism Update linked below.

The rationales for activist campaigns during the first half of 2019 remained consistent with that of the second half of 2018. In both cases, the leading campaign types were focused on board composition, mergers and acquisitions and business strategy. These three rationales collectively comprised approximately 75% of campaigns during both time periods, with other rationales (governance, return of capital, management changes and control) representing a small minority. The frequency with which activists engaged in proxy solicitation increased, however, from 15% of campaigns in the second half of 2018 to 24% of campaigns in the first half of 2019. (Note that the data provided in this Client Alert includes more campaign rationales than the number of campaigns, as certain activist campaigns had multiple rationales.)

A total of 17 settlement agreements were reached in the first half of 2019, and most maintained the key terms that have emerged as typical in recent years. Consistent with the second half of 2018, well over 90% of settlement agreements provided for voting agreements and standstill periods, and over 85% of settlement agreements included minimum and/or maximum share ownership levels and non-disparagement clauses. We delve further into the data and the details in the latter half of this edition of this Client Alert.

We hope you find this Client Alert informative. If you have any questions, please do not hesitate to reach out to a member of your Gibson Dunn team.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this publication. For further information, please contact the Gibson Dunn lawyer with whom you usually work, or any of the following authors in the firm’s New York office:

Barbara L. Becker (+1 212.351.4062, [email protected])

Dennis J. Friedman (+1 212.351.3900, [email protected])

Richard J. Birns (+1 212.351.4032, [email protected])

Eduardo Gallardo (+1 212.351.3847, [email protected])

Saee Muzumdar (+1 212.351.3966, [email protected])

Daniel Alterbaum (+1 212.351.4084, [email protected])

Please also feel free to contact any of the following practice group leaders and members:

Mergers and Acquisitions Group:

Jeffrey A. Chapman – Dallas (+1 214.698.3120, [email protected])

Stephen I. Glover – Washington, D.C. (+1 202.955.8593, [email protected])

Jonathan K. Layne – Los Angeles (+1 310.552.8641, [email protected])

Securities Regulation and Corporate Governance Group:

Brian J. Lane – Washington, D.C. (+1 202.887.3646, [email protected])

Ronald O. Mueller – Washington, D.C. (+1 202.955.8671, [email protected])

James J. Moloney – Orange County, CA (+1 949.451.4343, [email protected])

Elizabeth Ising – Washington, D.C. (+1 202.955.8287, [email protected])

Lori Zyskowski – New York (+1 212.351.2309, [email protected])