November 21, 2023

A Survey of Disclosures from the S&P 100 During the Three Years Following Adoption of the Securities and Exchange Commission Rule

Human capital resource disclosures by public companies have continued to be a focus since the U.S. Securities and Exchange Commission (the “Commission”) adopted the new rules in 2020; not only for companies making the disclosures, but employees, investors, and other stakeholders reading them. This alert updates the alert we issued in January 2023, “Evolving Human Capital Disclosures: A Survey of Disclosures from the S&P 100 During the Two Years Following Adoption of the Securities and Exchange Commission Rule,” available here, and reviews disclosure trends among S&P 100 companies, each of which has now included human capital disclosure in their past three annual reports on Form 10-K. This alert also provides practical considerations for companies as we head into 2024.

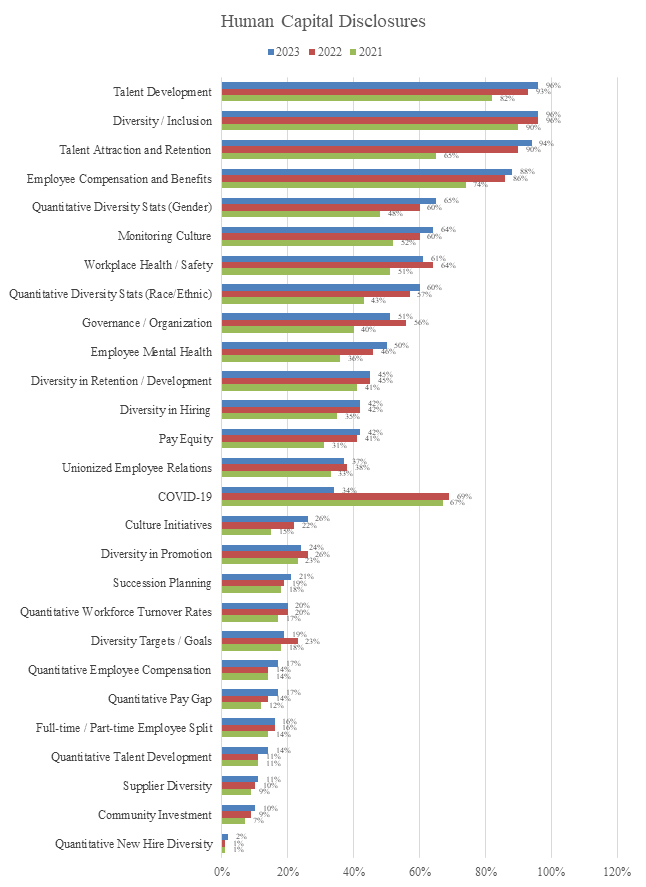

The overall takeaway from our survey, which categorized disclosures into 27 topic areas, was that companies are generally tailoring the length of their disclosures and the topics covered and including slightly more quantitative information in some areas.[1] We note the following trends regarding the S&P 100 companies’ disclosures compared to the previous year:

- Length of disclosure. Forty-eight percent of companies increased the length of their disclosures, four percent of companies’ disclosures remained the same, and the remaining 48% of companies decreased the length of their disclosures (with the decreases generally attributable to the removal of discussion related to COVID-19).

- Number of topics covered. Twenty-two percent of companies increased the number of topics covered (with the categories seeing the most increases being diversity statistics by race/ethnicity and gender, employee mental health, monitoring culture, talent attraction and retention, and talent development), while 34% decreased the number of topics covered (the majority of which were attributable to the removal of disclosures related to COVID-19), and the remaining 46% covered the same number of topics.

- Breadth of topics covered. The prevalence of 16 topics increased, seven decreased, and four remained the same.

- The most significant year-over-year increases in frequency involved the following topics: quantitative diversity statistics on gender (60% to 65%), employee mental health (46% to 50%), culture initiatives (22% to 26%), efforts to monitor culture (60% to 64%), and talent attraction and retention (90% to 94%).

- The most significant year-over-year decrease involved COVID-19 disclosures, which declined in frequency from 69% to 34%. Other year-over-year decreases involved discussion of governance and organizational practices (56% to 51%) and diversity targets and goals (23% to 19%).

- Most common topics covered. The topics most commonly discussed this most recent year generally remained consistent with the previous two years. For example, diversity and inclusion, talent development, talent attraction and retention, and employee compensation and benefits remained four of the five most frequently discussed topics, while quantitative talent development statistics, supplier diversity, community investment, and quantitative statistics on new hire diversity remained four of the five least frequently covered topics.

- Industry trends. Within the technology, finance, and energy industries, the trends that we saw in the previous year regarding the frequency of topics disclosed generally remained the same.

I. Background on the Requirements

On August 26, 2020, the Commission voted three to two to approve amendments to Items 101, 103, and 105 of Regulation S-K, including the principles-based requirement to discuss a registrant’s human capital resources to the extent material to an understanding of the registrant’s business taken as a whole.[2] Specifically, public companies’ human capital disclosure must include “the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction, and retention of personnel).”

Notably, the Commission’s agenda list includes new human capital disclosure rules that are expected to be more prescriptive than the current rules, in part,[3] because one of the main criticisms of the existing human capital rules is lack of comparability across companies. Based on our survey, while company disclosures under the existing principles-based rules vary—which is expected under the principles-based regime—our survey was able to introduce some comparability. The next four sections show the relevant data from our survey.[4]

II. Disclosure Topics

Our survey classifies human capital disclosures into 27 topics, each of which is listed in the following chart, along with the number of companies that discussed the topic in each of 2021, 2022, and 2023. Each topic is described more fully in the sections following the chart.

A. Workforce Composition

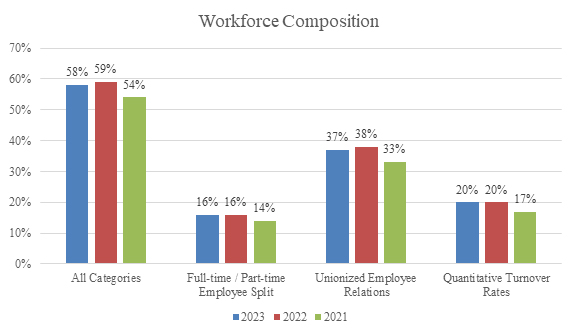

Among S&P 100 companies, 58% included disclosures relating to workforce composition in one or more of the following categories:

- Full-time/part-time employee split. While most companies provided the total number of full-time employees, only 16% of the companies surveyed included a quantitative breakdown of the number of full-time versus part-time employees, compared to the same percentage in the previous year and up slightly from 14% in 2021. Similarly, 67% of companies provided statistics on the number of seasonal employees and/or independent contractors or a breakdown of employees by business segment, job function, or geographical location, up from 65% in 2022 and 61% in 2021.

- Unionized employee relations. Of the companies surveyed, 37% stated that some portion of their workforce was part of a union, works council, or similar collective bargaining agreement, compared to 38% the previous year and 33% in 2021.[5] These disclosures generally included a statement providing the company’s opinion on the quality of labor relations, and in many cases, disclosed the number of unionized employees.

- Quantitative workforce turnover rates. Although a majority of companies discussed employee turnover and the related topics of talent attraction and retention in a qualitative way (as discussed in Section II.B. below), only 20% of companies surveyed provided specific employee turnover rates (whether voluntary or involuntary), compared to the same percentage in the previous year and 17% in 2021.

B. Diversity

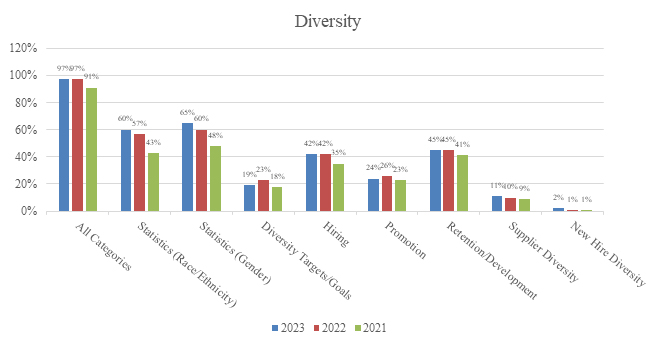

Among S&P 100 companies, 97% included disclosures relating to diversity in one or more of the following categories:

- Diversity and inclusion. This was the most common type of disclosure, with 96% of companies including a qualitative discussion regarding the company’s commitment to diversity, equity, and inclusion (“DEI”), compared to the same percentage the previous year and up from 90% in 2021. The depth of these disclosures varied, ranging from generic statements expressing the company’s support of diversity in the workforce to detailed examples of actions taken to recruit and support underrepresented groups and increase the diversity of the company’s workforce.

- Priorities within diversity. Companies disclosed different areas of focus for diversity efforts and programming within the organization. The most common disclosure was diversity in the retention or development of the company’s current workforce (45% of companies surveyed in 2023, compared to 45% in 2022 and 41% in 2021), followed by diversity in the company’s hiring practices (42% in 2023, compared to 42% in 2022 and 35% in 2021), followed by diversity in the company’s promotion practices (24% in 2023, compared to 26% in 2022 and 23% in 2021), and then diversity in the company’s suppliers (11% in 2023, compared to 10% in 2022 and 9% in 2021).

- Quantitative diversity statistics. Many companies also included a quantitative breakdown of the gender or racial representation of the company’s workforce: 65% included statistics on gender and 60% included statistics on race or ethnicity (compared to 60% and 57% in 2022, respectively, and 48% and 43% in 2021, respectively). Companies provided gender statistics on both a global and U.S. basis, whereas nearly all companies provided race or ethnicity statistics for their U.S. workforce only. Most companies provided these statistics in relation to their workforce generally, regardless of position; however, an increased subset (40% in 2023, compared to 37% in 2022 and 26% in 2021) included separate statistics for different classes of employees (g., managerial, vice president and above, etc.). Similarly, 10% of companies also provided separate statistics for their boards of directors (compared to 10% in 2022 and 4% in 2021). Some companies also included numerical goals for gender or racial representation, either in terms of overall representation, promotions, or hiring; 19% of companies included these diversity goals or targets (compared to 23% in 2022 and 18% in 2021).

C. Recruiting, Training, Succession

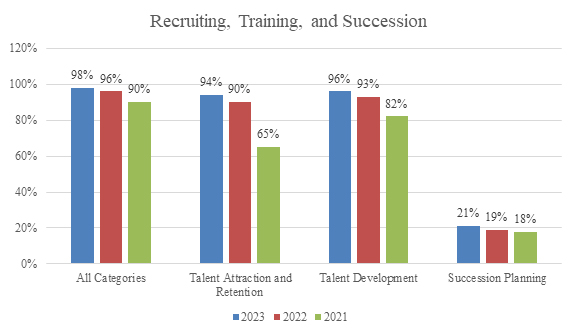

Among S&P 100 companies, 98% included disclosures relating to talent and succession planning in one or more of the following categories:

- Talent attraction and retention. These disclosures were generally qualitative and focused on efforts to recruit and retain qualified individuals. While providing general statements regarding recruiting and retaining talent were common, with 94% of companies including this type of disclosure (compared to 90% in 2022 and 65% in 2021), quantitative measures of retention, like workforce turnover rate, were uncommon, with only 20% of companies disclosing such statistics (as noted above).

- Talent development. Disclosures related to talent development were tied with talent attraction and retention as the most common category, with 96% of companies including a qualitative discussion regarding employee training, learning, and development opportunities, up from 93% the previous year and 82% in 2021. This disclosure tended to focus on the workforce as a whole rather than specifically on senior management. Companies generally discussed training programs such as in-person and online courses, leadership development programs, mentoring opportunities, tuition assistance, and conferences, and a minority also disclosed the number of hours employees spent on learning and development. Some companies discussed quantitative figures related to talent development, such as dollars or hours spent on training, with 14% of companies including this type of disclosure (compared to 11% in both 2022 and 2021).

- Succession planning. Only 21% of companies surveyed addressed their succession planning efforts (compared to 19% in 2022 and 18% in 2021), which may be a function of succession being a focus area primarily for executives rather than the human capital resources of a company more broadly.

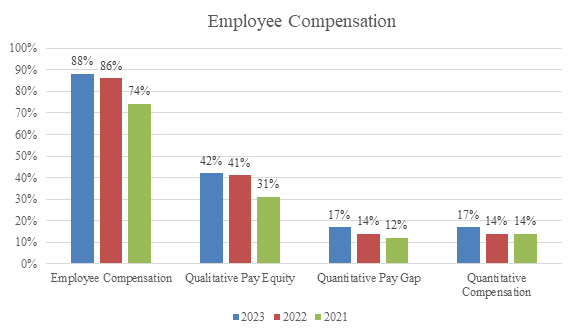

D. Employee Compensation[6]

Among S&P 100 companies, 88% included disclosures relating to employee compensation, up from 86% the previous year and 74% in 2021. All of those companies included a qualitative description of the compensation and/or benefits program offered to employees. Of the companies surveyed, 42% addressed pay equity practices or assessments (up from 41% in 2022 and 31% in 2021), and substantially fewer companies included quantitative measures of the pay gap between racially or ethnically diverse and nondiverse employees or male and female employees (17% of companies surveyed in 2023, 14% in 2022 and 12% in 2021) or quantitative measures such as a minimum wage or investment in benefits (17% of companies surveyed in 2023, 14% in 2022, and 14% in 2021).

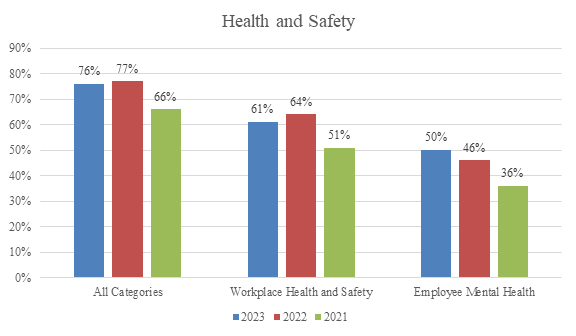

E. Health and Safety

Among S&P 100 companies, 76% included disclosures relating to health and safety in one or both of the following categories:

- Workplace health and safety. Of the companies surveyed, 61% included qualitative disclosures relating to workplace health and safety, down from 64% in the previous year but up from 51% in 2021, typically consisting of statements about the company’s commitment to safety in the workplace generally and compliance with applicable regulatory and legal requirements. However, 8% of companies surveyed provided quantitative disclosures in this category (up from 7% in 2022 and 6% in 2021), generally focusing on historical and/or target incident or safety rates or investments in safety programs. These quantitative disclosures tended to be more prevalent among industrial, energy, and manufacturing companies. While many companies continued to provide disclosures on safety initiatives undertaken in connection with COVID-19, the decrease in safety disclosures in 2022 is largely due to the substantial decline in COVID-19 disclosures generally, which is discussed separately below.

- Employee mental health. In connection with disclosures about standard benefits provided to employees, or additional benefits provided as a result of the pandemic, 50% of companies disclosed initiatives taken to support employees’ mental or emotional health and wellbeing, up from 46% the prior year and 36% in 2021.

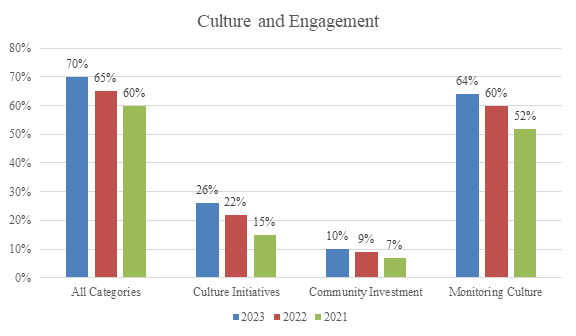

F. Culture and Engagement

In addition to the many instances where companies mentioned a general commitment to culture and values, 70% of S&P 100 companies discussed specific initiatives they were taking related to culture and engagement in one or more of the following categories:

- Culture and engagement initiatives. Of the companies surveyed, 26% included specific disclosures relating to practices and initiatives undertaken to build and maintain their culture and values, up from 22% in the previous year and 15% in 2021. These companies most commonly discussed efforts to communicate with employees (g., through town halls, CEO outreach, trainings, or conferences and presentations) and to recognize employee contributions (e.g., awards programs and individualized feedback). Many companies also discussed culture in the context of diversity-related initiatives to help foster an inclusive culture.

- Community investment. Some companies disclose information about community investment, donations, or volunteer programs sponsored by the company, with 10% of companies surveyed providing such disclosure in 2023, compared to 9% in 2022 and 7% in 2021.

- Monitoring culture. Disclosures about the ways that companies monitor culture and employee engagement were much more common, with 64% of companies providing such disclosure, up from 60% the previous year and 52% in 2021. Companies generally disclosed the frequency of employee surveys used to track employee engagement and satisfaction, with some reporting on the results of these surveys, sometimes measured against prior year results or industry benchmarks.

G. COVID-19

The number of S&P 100 companies that included information regarding COVID-19 and its impact on company policies and procedures or on employees generally declined sharply, with 34% of companies making such disclosure, compared to 69% in 2022 and 67% in 2021. COVID-19-related topics addressed ranged from work-from-home arrangements and safety protocols taken for employees who worked in person to additional benefits and compensation paid to employees as a result of the pandemic and contributions made to organizations supporting those affected by the pandemic. This sharp decline in COVID-19 disclosures is consistent with a more general trend of companies discussing COVID-19 less frequently as a result of its decreasing significance and illustrates the expected evolution of disclosure resulting from a principles-based framework.

H. Human Capital Management Governance and Organizational Practices

Over half of S&P 100 companies (51% of those surveyed, compared to 56% in 2022 and 40% in 2021) addressed their governance and organizational practices (such as oversight by the board of directors or a committee and the organization of the human resources function).

III. Industry Trends

One of the main rationales underlying the adoption of principles-based—rather than prescriptive—requirements for human capital disclosures is that the relative significance of various human capital measures and objectives varies by industry. This is reflected in the following industry trends that we observed:[7]

- Technology Industries (E-Commerce, Internet Media & Services, Hardware, Software & IT Services, and Semiconductors). For the 21 companies in the Technology Industries, at least 85% discussed each of talent development and training opportunities, talent attraction, recruitment and retention, employee compensation, and diversity. Compared to the S&P 100 as a whole, relatively uncommon disclosures among this group included part-time and full-time employee statistics (5%), succession planning (10%), COVID-19 (24%), supplier diversity (5%), and unionized employee relations (19%). However, these industries saw increased rates of disclosure compared to the S&P 100 for quantitative turnover rates (43%) and qualitative pay equity (57%).

- Finance Industries (Asset Management & Custody Activities, Consumer Finance, Commercial Banks, and Investment Banking & Brokerage). For the 13 companies in the Finance Industries, a large majority included quantitative diversity statistics regarding race (85%) and gender (92%) and qualitative disclosures regarding employee compensation (92%), and, compared to other industries, a relatively higher number discussed pay equity (62%) and quantified their pay gap (38%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, unionized employee relations, quantitative workforce turnover rates, and succession planning (in each case less than 16%).

- Energy Industries (Oil & Gas Exploration & Production and Electric Utilities & Power). For the seven companies in the Energy Industries, a large majority included quantitative diversity statistics regarding race (71%) and gender (86%), qualitative disclosures regarding employee compensation (86%), and governance and organizational practices (71%), and, compared to other industries, a relatively higher number discussed unionized employee relations (57%) and quantified their workforce turnover rates (57%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, diversity in promotion, diversity targets or goals, culture initiatives, quantitative employee compensation statistics, pay equity, and quantitative pay gap (in each case less than 15%).

IV. Disclosure Format

The format of human capital disclosures in S&P 100 companies’ annual reports on Form 10‑K continued to vary greatly.

Word Count. The length of the disclosures ranged from 106 to 2,094 words, with the following statistical trends in the past three years:

|

2023 |

2022 |

2021 |

|

|

Minimum word count |

106 |

109 |

105 |

|

Maximum word count |

2,094 |

1,995 |

1,931 |

|

Median |

1,025 |

949 |

818 |

|

Mean |

987 |

964 |

828 |

Metrics. The disclosure requirement specifically asks for a description of “any human capital measures or objectives that the registrant focuses on in managing the business” (emphasis added). Our survey revealed that companies are increasingly providing quantitative metrics, with 85% of companies providing disclosure in at least one of the quantitative categories we discuss above (up from 82% in 2022 and 68% in 2021) and only 5% electing not to include any type of quantitative metrics beyond headcount numbers (down from 8% in 2022 and 12% in 2021). The group of companies that identify important objectives they focus on but omit quantitative measures related to those objectives has been shrinking as more companies choose to include metrics. For example, 96% of companies discussed their commitment to diversity, equity, and inclusion (compared to 96% in 2022 and 89% in 2021), and 65% and 61% of companies disclosed quantitative metrics regarding gender and racial diversity, respectively (compared to 60% and 58%, respectively, in 2022 and 47% and 43%, respectively, in 2021).

Graphics. Although the minority practice, 27% of companies surveyed also included tables, charts, graphics or similar formatting used to draw attention to particular elements, up from 24% the previous year and 21% in 2021, which were generally used to present statistical data, such as diversity statistics or breakdowns of the number of employees by geographic location.

Categories. Most companies organized their disclosures by categories similar to those discussed above and included headings to define the types of disclosures presented.

V. Upcoming Rulemaking and Investor Advisory Committee Recommendations

At its meeting on September 21, 2023, the Commission’s Investor Advisory Committee (“IAC”) approved subcommittee recommendations (the “IAC Recommendations”) to expand required human capital management disclosures.[8] The Commission must now decide whether to incorporate the IAC Recommendations into its anticipated human capital management rule proposal, which according to the most recent Regulatory Flexibility agenda, which is admittedly aspirational, was expected to be issued in October.[9]

The IAC Recommendations contain prescriptive disclosure requirements—many of which have been previously considered as part of the 2020 rulemaking—for various quantitative metrics in the business description of Form 10-K under Item 101(c) of Regulation S-K as well as narrative disclosure in Management Discussion and Analysis. The recommended changes to Item 101(c) would require disclosure of the following metrics:

- Headcount Metrics. Companies would be required to disclose “[t]he number of people employed by the issuer, broken down by whether those people are full-time, part-time, or contingent workers.” This disclosure would include “reporting on all similarly situated persons whose work contributes to a material level of revenue or income.”

- Turnover Metrics. Companies would be required to disclose “turnover or comparable workforce stability metrics.” The IAC Recommendations do not address whether the calculation of turnover would be determined by the SEC or by companies individually.

- Components of Compensation. The IAC Recommendations also require disclosure of “[t]he total cost of the issuer’s workforce, broken down into major components of compensation.” This would require companies to break out each component of labor costs (g., salary, equity, etc.), rather than aggregating labor costs with other line-item expenses, such as cost of goods sold or selling, general, and administrative costs, on the companies’ income statements.

- Demographic Data. Companies would also be required to disclose “[w]orkforce demographic data sufficient to allow investors to understand the company’s efforts to access and develop new sources of talent, and to evaluate the effectiveness of these efforts.” This disclosure would include “diversity across gender, race/ethnicity, age, disability, and/or other categories viewed as important to investors and relevant to the business” and “diversity at senior levels.” The IAC Recommendations includes a brief reference in a footnote that any new rules could provide a “limited exception for disclosure of workforce composition outside the United States to consider laws and regulations in non-U.S. jurisdictions” without providing any additional guidance.

The recommended narrative disclosure in MD&A would discuss how the company’s “labor practices, compensation incentives, and staffing fit within the broader firm strategy. Such a discussion would address what portion of labor costs management views as an investment and why, including how labor is allocated across areas designed to promote firm growth (e.g., R&D) and those necessary to maintain current operations rather than increase sales revenue (e.g., compliance).”

While one of the key criticisms of the current rule appears to be lack of standardized disclosure that would allow for greater comparability among companies, it is not clear that human capital disclosures that are material to each company can be truly standardized given the different industries, sizes, geographic reach, and other qualities of public companies. As shown by the data discussed above, in response to the 2020 principles-based rules, public companies are providing more robust human capital disclosures in their SEC filings and are continuing to evolve these disclosures with each filing.

VI. Comment Letter Correspondence

Comment letter correspondence from the staff of the Division of Corporation Finance (the “Staff”), which often helps put a finer point on principles-based disclosure requirements like this one, has shed relatively little light on how the Staff believes the new requirements should be interpreted. Consistent with what we found at this time last year and the year before, the comment letters, all of which involved reviews of registration statements, were generally issued to companies whose disclosures about employees were limited to the bare-bones items companies have discussed historically, such as the number of persons employed and the quality of employee relations. From these companies, the Staff simply sought a more detailed discussion of the company’s human capital resources, including any human capital measures or objectives upon which the company focuses in managing its business. There were also a few comment letters where the Staff asked companies to clarify statements in their human capital disclosures. Based on our review of the responses to those comment letters, we have not seen a company take the position that a discussion of human capital resources was immaterial and therefore unnecessary.

VII. Implications of Recent U.S. Supreme Court Decisions

On June 29, 2023, the United States Supreme Court released its opinion in Students for Fair Admissions v. Harvard, in which the Court held that Harvard’s and the University of North Carolina’s use of race in their admissions policies was unlawful. Although the Supreme Court’s holding addressed only college and university admissions and not private-sector employers, the increased scrutiny on affirmative action programs in the workplace in the wake of SFFA has heightened the risk that employers with robust DEI initiatives may face litigation from employees, potential contracting partners, advocacy groups, and government agencies. Since the SFFA opinion was released, advocacy groups have sent dozens of letters to companies claiming that their DEI programs violate federal antidiscrimination law, including Title VII (discrimination in employment) and Section 1981 (discrimination in contracting), and arguing that the legal risk associated with DEI programs threatens stockholders’ value, and a number of lawsuits have been filed. Many companies are carefully reviewing their DEI programs and related public disclosures in light of these risks. For more information on the latest DEI developments, please see our DEI Task Force newsletter here.

VIII. Conclusion

Based on our survey, companies continue to be thoughtful about their human capital disclosures—expanding their disclosures in some areas (e.g., quantitative diversity statistics on gender) and reducing them in others (e.g., COVID-19)—in response to ever-changing circumstances. That is precisely what principles-based disclosure rules are designed to elicit.

To that end, as companies prepare for the upcoming Form 10-K reporting season, they should consider the following:

- Confirming (or reconfirming) that the company’s disclosure controls and procedures support the statements made in human capital disclosures and that the human capital disclosures included in the Form 10-K remain appropriate and relevant. In this regard, companies may want to compare their own disclosures against what their industry peers did these past three years, including specifically any notable additional disclosures made in the past year.

- Reviewing disclosures in light of the IAC Recommendations to assess whether any of the human capital measures or objectives may be material to the company.

- Setting expectations internally that these disclosures likely will evolve. As shown by the measurable increase in disclosure in the third year of reporting, companies should expect to develop their disclosure over the course of the next couple of annual reports in response to peer practices, regulatory changes, and investor expectations, as appropriate. The types of disclosures that are material to each company may also change in response to current events, as was shown by the sharp decrease in COVID-19 related disclosures this past year.

- Addressing in the upcoming disclosure, if not already disclosed, the progress that management has made with respect to any significant objectives it has set regarding its human capital resources as investors are likely to focus on year-over-year changes and the company’s performance versus stated goals.

- Addressing significant areas of focus highlighted in engagement meetings with investors and other stakeholders. In a 2021 survey, 64% of institutional investors surveyed cited human capital management as a key issue when engaging with boards (second only to climate change at 85%).[10]

- Revalidating the methodology for calculating quantitative metrics and assessing consistency with the prior year. Former Chairman Clayton commented that he would expect companies to “maintain metric definitions constant from period to period or to disclose prominently any changes to the metrics.”

_________________

[1] Data provided is as of November 3, 2023. The categorization data necessarily involves subjective assessment and should be considered approximate.

[2] See 17 C.F.R. § 229.101(c)(2)(ii).

[3] Agency Rule List – Spring 2023 Securities and Exchange Commission, Office of Information and Regulatory Affairs (2023), available here.

[4] Note that companies often include additional human capital management-related disclosures in their ESG/sustainability/social responsibility reports, on their websites, and in their proxy statements, but these disclosures are outside the scope of the survey, which is focused on disclosures included in Part I, Item 1 of annual reports on Form 10-K.

[5] While never expressly required by Regulation S-K, as a result of disclosure review comments issued by the Division of Corporation Finance over the years and a decades-old and since-deleted requirement in Form 1-A, it has been a relatively common practice to discuss collective bargaining and employee relations in the Form 10-K or in an IPO Form S-1, particularly since the threat of a workforce strike could be material.

[6] Our survey reviewed the employee compensation disclosures contained in Part I, Item 1 of each company’s Form 10-K and did not separately review any employee compensation information included in companies’ financial statements or the notes thereto.

[7] For purposes of our survey, we grouped companies in similar industries based on both their four-digit Standard Industrial Classification code and their designated industry within the Sustainable Industry Classification System. The industry groups discussed in this section cover 41% of the companies included in our survey.

[8] Available at https://www.sec.gov/files/spotlight/iac/20230921-recommendation-regarding-hcm.pdf.

[9] Agency Rule List – Spring 2023 Securities and Exchange Commission, Office of Information and Regulatory Affairs (2023), available here.

[10] See Morrow Sodali 2021 Institutional Investor Survey, available at https://morrowsodali.com/insights/institutional-investor-survey-2021.

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding these developments. To learn more about these issues, please contact the Gibson Dunn lawyer with whom you usually work in the firm’s Securities Regulation and Corporate Governance or Labor and Employment practice groups, or any of the following practice leaders and members:

Securities Regulation and Corporate Governance:

Elizabeth Ising – Co-Chair, Washington, D.C. (+1 202.955.8287, [email protected])

James J. Moloney – Co-Chair, Orange County (+1 949.451.4343, [email protected])

Lori Zyskowski – Co-Chair, New York (+1 212.351.2309, [email protected])

Brian J. Lane – Washington, D.C. (+1 202.887.3646, [email protected])

Ronald O. Mueller – Washington, D.C. (+1 202.955.8671, [email protected])

Thomas J. Kim – Washington, D.C. (+1 202.887.3550, [email protected])

Michael A. Titera – Orange County (+1 949.451.4365, [email protected])

Aaron Briggs – San Francisco (+1 415.393.8297, [email protected])

Julia Lapitskaya – New York (+1 212.351.2354, [email protected])

Labor and Employment:

Jason C. Schwartz – Co-Chair, Washington, D.C. (+1 202.955.8242, [email protected])

Katherine V.A. Smith – Co-Chair, Los Angeles (+1 213.229.7107, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.