May 17, 2023

On May 12, 2023, the IRS and Treasury issued Notice 2023-38 (the “Notice”) (here), which provides initial guidance for developers and investors seeking to qualify projects for the domestic content bonus credit available under sections 45, 45Y, 48, and 48E (the “Domestic Content Bonus Credit”).[1] Although not explicit, the Notice also provides guidance regarding the receipt of full “direct pay” amounts for projects beginning construction after 2023.

The Inflation Reduction Act of 2022 (the “IRA”)[2] provided for an enhanced or “bonus” credit in respect of certain qualified facilities, energy projects, and energy storage technologies if a taxpayer certifies that the steel, iron, or manufactured products that are components of such a facility, project or technology were produced in the United States (the “Domestic Content Requirement”).[3] The IRA also made credits under sections 45, 45Y, 48 and 48E refundable for certain tax-exempt entities.[4] Beginning in 2024, however, these refunds (so-called “direct pay”) are subject to phaseout for projects that do not meet the Domestic Content Requirement; specifically, a 10-percent haircut applies to projects begun in 2024, a 15-percent haircut for projects begun in 2025, and projects begun in 2026 and after would be wholly ineligible for refunds, in each case unless the IRS makes an exception to the requirement.[5]

The Notice provides rules on which taxpayers may, subject to limitations discussed below, rely for determining whether projects will meet the Domestic Content Requirement. Before providing a number of practical observations regarding the guidance in the Notice, the Alert covers the following:

- Background. Increased tax credits are available with respect to certain energy generation (e.g., wind, solar) and storage projects that satisfy the Domestic Content Requirement.

- Domestic Content Requirement.

- Manufactured Products vs. Steel/Iron Components. The Domestic Content Requirement applies differently for (i) manufactured products and (ii) steel or iron components of a project. The Notice provides helpful guidance for determining whether a particular component is a manufactured product or a steel or iron component, including a useful safe harbor that applies to certain types of projects.

- Determining Whether Domestic Content Requirement Satisfied. Once a component has been categorized as either a manufactured product or a steel or iron component, the Notice provides guidance for determining whether the Domestic Content Requirement is satisfied with respect to the relevant project. The rules for manufactured products are particularly complicated and may be challenging to satisfy.

- Certification and Substantiation. In addition to meeting substantive requirements, taxpayers seeking to satisfy the Domestic Content Requirement must meet detailed certification and substantiation requirements.

Background

A taxpayer is eligible to claim a Domestic Content Bonus Credit in respect of projects that meet the Domestic Content Requirement under sections 45 and 45Y (the “PTC”) and sections 48 and 48E (the “ITC”) if the taxpayer timely certifies to the IRS that the applicable requirements have been satisfied. For PTC projects, if the Domestic Content Bonus Credit is available, the amount of the section 45 or 45Y credit is increased by a maximum of 10 percent, and for ITC projects, the amount of the section 48 or 48Y credit is increased by 10 percentage points.[6]

Under current law, the PTC is claimed in respect of the production of electricity from qualified energy resources (e.g., wind and solar) at a qualified facility during the 10-year period beginning on the date on which the project was placed in service. For zero-emission energy projects that begin construction after 2024, the PTC will transition to a new technology-neutral credit under section 45Y . The current ITC is claimable in respect of the basis of certain energy property (e.g., wind, solar, and energy storage property). Like the PTC, for zero-emission energy projects that begin construction after 2024, the ITC will transition to a new technology-neutral ITC under section 48E.

Domestic Content Requirement

The Domestic Content Requirement applies differently with respect to two different categories of components: (1) steel or iron components, which are subject to a more stringent test, and (ii) “Manufactured Products” (defined as any item produced as a result of a manufacturing process).[7]

Application of the Domestic Content Requirement is a two-step process:

- In the first step, each article, material, or supply that is directly incorporated into a project (each, a “Project Component”) is categorized to determine whether that Project Component must meet either the Steel or Iron Requirement or the Manufactured Products Requirement (each as defined below).

- In the second step, each Project Component is analyzed to determine whether it satisfies the Steel or Iron Requirement or the Manufactured Products Requirement, as applicable.

Step one is applied by first analyzing Project Components that are made primarily of steel or iron. If a steel or iron Project Component is both (i) a construction material and (ii) “structural in function” (e.g., towers (wind facilities) or photovoltaic module racking (solar facilities)), the component is subject to the Steel or Iron Requirement. The Notice provides a non-exhaustive list of steel or iron items that are not “structural in function” (and therefore not subject to the Steel or Iron Requirement): nuts, bolts, screws, washers, cabinets, covers, shelves, clamps, fittings, sleeves, adapters, tie wire, spacers and door hinges. Any Project Components that are Manufactured Products (i.e., those Project Components that are not steel or iron Project Components and that underwent a manufacturing process) are subject to the Manufactured Products Requirement.

In a very welcome development, the Notice provides a safe harbor for applying step one to certain identified and commonly analyzed Project Components. The list of Project Components covers only limited categories of projects and does not include all Project Components that may comprise those projects. These classifications nevertheless provide helpful guidance that should permit taxpayers to make strategic sourcing decisions pending the publication of regulations. These safe harbor classifications are outlined in Table 2 of the Notice, which is reproduced immediately below.

|

Applicable Project |

Applicable Project Component |

Categorization |

|

Utility-scale photovoltaic system |

Steel photovoltaic module racking |

Steel/Iron |

|

Pile or ground screw |

Steel/Iron |

|

|

Steel or iron rebar in foundation (e.g., concrete pad) |

Steel/Iron |

|

|

Photovoltaic tracker |

Manufactured Product |

|

|

Photovoltaic module (which includes the following Manufactured Product Components, if applicable: photovoltaic cells, mounting frame or backrail, glass, encapsulant, backsheet, junction box (including pigtails and connectors), edge seals, pottants, adhesives, bus ribbons, and bypass diodes) |

Manufactured Product |

|

|

Inverter |

Manufactured Product |

|

|

Land-based wind facility |

Tower |

Steel/Iron |

|

Steel or iron rebar in foundation (e.g., spread footing) |

Steel/Iron |

|

|

Wind turbine (which includes the following Manufactured Product Components, if applicable: the nacelle, blades, rotor hub, and power converter) |

Manufactured Product |

|

|

Wind tower flanges |

Manufactured Product |

|

|

Offshore wind facility |

Tower |

Steel/Iron |

|

Jacket foundation |

Steel/Iron |

|

|

Wind tower flanges |

Manufactured Product |

|

|

Wind turbine (which includes the following Manufactured Product Components, if applicable: the nacelle, blades, rotor hub, and power converter) |

Manufactured Product |

|

|

Transition piece |

Manufactured Product |

|

|

Monopile |

Manufactured Product |

|

|

Inter-array cable |

Manufactured Product |

|

|

Offshore substation |

Manufactured Product |

|

|

Export cable |

Manufactured Product |

|

|

Battery energy storage technology |

Steel or iron rebar in foundation (e.g., concrete pad) |

Steel/Iron |

|

Battery pack (which includes the following Manufactured Product Components, if applicable: cells, packaging, thermal management system, and battery management system) |

Manufactured Product |

|

|

Battery container/housing |

Manufactured Product |

|

|

Inverter |

Manufactured Product |

Once each Project Component has been categorized at step one, in the second step each Project Component is analyzed to determine whether it satisfies the Steel or Iron Requirement or the Manufactured Products Requirement.

Steel or Iron Requirement

The “Steel or Iron Requirement” is satisfied with respect to a Project Component if all manufacturing processes with respect to the Project Component (other than metallurgical processes involving refinement of steel additives) take place in the United States.[8]

Manufactured Products Requirement

The “Manufactured Products Requirement” is satisfied if a statutory percentage (ranging from 20 percent to 55 percent, as discussed below) of the total costs of the Project Components that are Manufactured Products are attributable to (i) “U.S. Manufactured Products” or (ii) “U.S. Components” (each as defined below).[9]

Application of the Manufactured Products Requirement is a five-step process:

- First, each Project Component that is a Manufactured Product must be separated into those Project Components for which all of the manufacturing processes take place in the United States, and those Project Components that do not.

- Second, each Project Component must be separated into its individual direct components. A component that is “directly” incorporated into a Project Component is referred to in the Notice as a “Manufactured Product Component.” The safe harbor in Table 2 of the Notice (reproduced above) lists certain “Manufactured Product Components” of specified Manufactured Products.

- Third, for Project Components manufactured in the United States as determined at step one, it must be determined whether each “Manufactured Product Component” of such Project Component is “of U.S. origin” (in the case of manufactured components, “regardless of the origin of its subcomponents”). Project Components satisfying step 3 are “U.S. Manufactured Products.”

- Fourth, for Project Components that are not U.S. Manufactured Products, it must be determined which (if any) “Manufactured Product Components” of such Project Component are mined, produced, or manufactured in the United States. Any such Manufactured Product Components are “U.S. Components.”

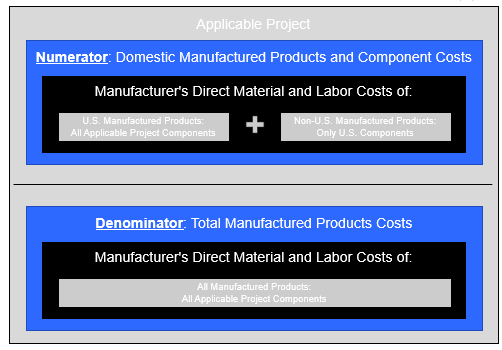

- Fifth, and finally, the costs of the U.S. Manufactured Products and the U.S. Components for the project must be divided by the total cost of the Project Components that are Manufactured Products to reach a percentage that is compared to the applicable statutory percentage (discussed below). If the percentage determined at step 5 equals or exceeds the applicable statutory percentage, the project satisfies the Manufactured Products Requirement.

In computing the “costs” included in the numerator and the denominator of the fraction at step 5, only direct material costs and labor costs that were paid or incurred by the manufacturer (i.e., the person that performed the manufacturing process that produced the relevant component or product) are included.[10] In computing the cost of any U.S. Component that is incorporated into a Manufactured Product that also includes Manufactured Product Components not manufactured in the United States, the taxpayer only may include the costs to produce or acquire the specific U.S. Component, and must exclude any other direct materials or direct labor costs related to the Manufactured Product.

Further, installation and other project-site costs (including direct costs and labor costs of incorporating the Project Components into a project) are excluded.

Statutory Percentages

For PTC and ITC projects beginning construction before 2025, the statutory percentage is 20 percent for offshore wind facilities and 40 percent for all other projects.

For PTC projects that begin construction in 2025, the percentage is 45 percent (27.5 percent for offshore wind), increasing to 50 percent in 2026 (35 percent for offshore wind) and 55 percent in 2027 and thereafter (45 percent for offshore wind in 2027 and 55 percent thereafter).

For ITC projects, the statutory percentage remains 40 percent (20 percent for offshore wind), although a recent report from the Joint Committee on Taxation states that this was not Congress’s intent and that a technical correction may be necessary to conform the statutory percentage increases for the ITC to that of the PTC.[11]

Retrofitted Projects

Consistent with long-standing guidance, the Notice allows a project to qualify as originally placed in service even if it contains some used property, as long as the fair market value of the used property is no more than 20 percent of the total value of the project (the “80/20 Rule”). This calculation is made by adding the cost of the new property to the value of the used property. The cost of the new property includes all costs properly included in the depreciable basis of the new property.

If a project meets the 80/20 Rule and is placed in service after 2022, the project is eligible for the Domestic Content Bonus Credit as long as the new property in the project meets the Domestic Content Requirement and the taxpayer otherwise complies with the requirements in the Notice.

Certification and Substantiation

The Notice also provides that a “taxpayer” reporting a Domestic Content Bonus Credit must provide a statement to the IRS certifying, as of the date the project is placed in service, that the project satisfies the Steel or Iron Requirement and the Manufactured Products Requirement and provides details concerning both the contents of the certification and its submission. In addition, the Notice makes clear that taxpayers claiming the Domestic Content Bonus Credit must maintain records substantiating compliance with the applicable requirements.

Observations

Substantiating U.S. Component costs may be challenging as component manufacturers may be unwilling to disclose such pricing information or their own margins, and even where third-party manufacturers are willing to disclose this type of information, it is unclear what documentation or evidence, if any, is needed to substantiate a third-party manufacturer’s determination of its costs.

Moreover, for those Project Components not described in the safe harbor in Table 2 of the Notice (which has been reproduced above), taxpayers likely will face uncertainty as to whether the more exacting Steel or Iron Requirement or the less exacting Manufactured Products Requirement should apply to those individual Project Components. For example, the Notice provides that the Steel or Iron Requirement applies to materials that are “structural in function” and are made “primarily of steel or iron” but fails to provide rules for determining whether a component is “primarily” made of steel or iron and does not provide a precise definition for what constitutes a construction material that is “structural in function.” Similarly, although the Notice makes clear that mere assembly does not constitute manufacturing, the Notice provides limited practical guidance on how to draw the distinction between manufacturing and assembly—a crucial distinction both for purposes of determining whether a component constitutes a Manufactured Product and for purposes of determining whether Project Components are U.S. Manufactured Products.

The Notice provides that a “taxpayer” reporting a Domestic Content Bonus Credit must make the required certification on IRS Form 8835 (Renewable Electricity Product Credit) or IRS Form 3468 (Investment Credit), or other applicable form, but does not indicate, in the case of a credit transfer under section 6418, which taxpayer must make the certification. Instructions for taxpayers with 2023 short years provide (here) that only transferors of credits need to file these source credit forms, but the Notice does not provide this level of guidance.

While the ITC is calculated on a property-by-property basis, the Domestic Content Requirement is determined on an “energy project” basis, which is defined as “a project consisting of one or more energy properties that are part of a single project.” The IRS and Treasury have not yet provided any guidance regarding what constitutes a “single project” for purposes of this definition; however, the statutory language tracks certain language in Notice 2018-59 (concerning commencement of construction), and it would be helpful if the IRS were to confirm that the “single project” definition in Notice 2018-59 applies for these purposes.

Moreover, both the Notice and Notice 2023-29 (concerning energy community bonus credits, discussed in an earlier Gibson Dunn alert here) observe that bonus credits are available with respect to “qualified property for which a valid irrevocable election under section 48(a)(5) has been made to treat such qualified property as energy property under section 48” (i.e., the ITC in lieu of PTC election). However, neither notice mentions the availability of bonus credits with respect to a specified clean hydrogen production facility for which an ITC is irrevocably elected under section 48(a)(15). While bonus credits are not available if the clean hydrogen PTC is elected under 45V (or the carbon capture and sequestration credit under section 45Q is claimed with respect to the facility), the bonus credits are apparently available if the ITC is elected for such facility. It would be helpful for the IRS and Treasury to confirm that bonus credits are available for taxpayers that elect the ITC for projects under section 48(a)(15) in the same manner as taxpayers that elect the ITC for projects under section 48(a)(5).

Effective Date

The IRS and Treasury expect to issue proposed regulations addressing the Domestic Content Requirement that would apply to taxable years ending after May 12, 2023. The Notice provides that taxpayers may rely on the rules provided in the Notice with respect to projects on which construction begins before the date that is ninety days after the date of publication of those forthcoming proposed regulations.

____________________________

[1] Unless indicated otherwise, all section references are to the Internal Revenue Code of 1986, as amended (the “Code”), and all “Treas. Reg. §” references are to the Treasury Regulations promulgated under the Code.

[2] As was the case with the so-called Tax Cuts and Jobs Act, the Senate’s reconciliation rules prevented Senators from changing the formal name of the Act. Thus, the formal name of the Inflation Reduction Act is “An Act to provide for reconciliation pursuant to title II of S. Con. Res. 14.”

[3] For purposes of this Notice, the United States includes the States, the District of Columbia, the Commonwealth of Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Commonwealth of Northern Mariana Islands.

[4] Tax-exempt entities for these purposes include any organizations exempt from tax imposed by subtitle A of the Code, state and local governments, the Tennessee Valley Authority, Indian tribal governments, any Alaska Native Corporation, and rural electric cooperatives.

[5] The IRA authorizes the IRS to provide exceptions to the direct pay phaseout if (i) the inclusion of steel, iron, or manufactured products that are produced in the United States either increases the overall costs of construction of projects by more than 25 percent or (ii) there are either insufficient materials of these types produced in the United States or the materials produced in the United States are not of satisfactory quality.

[6] In the case of projects subject to prevailing wage and apprenticeship requirements, failure to satisfy those requirements reduces the bonus credits amount to 2 percent (for PTC projects) or 2 percentage points (for ITC projects).

[7] For purposes of this Notice, a “manufacturing process” is the application of processes to alter the form or function of materials or of elements of a product in a manner adding value and transforming those materials or elements so that they represent a new item functionally different from the functionality that would result from mere assembly of the elements or materials.

[8] The Steel or Iron Requirement applies in a manner consistent with Section 661.5(b) and (c) of title 49 of the Code of Federal Regulations (the “CFR”). 49 CFR §§ 661.1 through 661.21 (also known as the “Buy America” requirements).

[9] The Manufactured Products Requirement applies in a manner consistent with 49 CFR § 661.5(d).

[10] Direct costs are defined by reference to Treas. Reg. § 1.263A-1(e)(2)(i).

[11] Joint Committee on Tax’n, Description of Energy Tax Law Changes Made by Public Law 117-169, JCX 5-23 (April 17, 2023), at n. 201.

This alert was prepared by Josiah Bethards, Emily Brooks, Mike Cannon, Matt Donnelly, Alissa Fromkin Freltz*, Duncan Hamilton, Kathryn Kelly, and Simon Moskovitz.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. To learn more about these issues, please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Tax or Power and Renewables practice groups, or the following authors:

Tax Group:

Michael Q. Cannon – Dallas (+1 214-698-3232, [email protected])

Matt Donnelly – Washington, D.C. (+1 202-887-3567, [email protected])

Kathryn A. Kelly – New York (+1 212-351-3876, [email protected])

Josiah Bethards – Dallas (+1 214-698-3354, [email protected])

Emily Risher Brooks – Dallas (+1 214-698-3104, [email protected])

Duncan Hamilton– Dallas (+1 214-698-3135, [email protected])

Simon Moskovitz – Washington, D.C. (+1 202-777-9532 , [email protected])

Power and Renewables Group:

Gerald P. Farano – Denver (+1 303-298-5732, [email protected])

Peter J. Hanlon – New York (+1 212-351-2425, [email protected])

Nicholas H. Politan, Jr. – New York (+1 212-351-2616, [email protected])

*Alissa Fromkin Freltz is an associate working in the firm’s Washington, D.C. office who currently is admitted to practice only in Illinois and New York.

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.