This Royalty Finance Market Update provides an analysis of publicly reported royalty finance transactions for 2020 through 2025 in the life sciences sector, focusing on both traditional and synthetic royalty transactions.

INTRODUCTION

Royalty finance has become one of the most important capital formation tools in the life sciences sector. Over the past six years, more than $32 billion in royalty-linked transactions have closed – funding drug launches, enabling non-dilutive capital raises, and expanding a growing new asset class that sits at the intersection of structured finance and biopharma dealmaking.

This report provides a comprehensive analysis of that market. Drawing from Gibson Dunn’s

proprietary Royalty Finance Tracker (a database of 133 transactions spanning 2020 through 2025) we examine the structural, economic, and competitive dynamics that are shaping how companies, investors, and their advisors approach royalty finance in 2026.

The headline numbers tell a story of resilience and growth: deal value grew 37% from 2020 ($5.2B) to 2025 ($7.1B), with transaction volume stabilizing at 25–27 deals per year even as interest rates climbed to levels not seen in two decades. That durability, with deal flow holding steady while the fed funds rate hovered around 4% for most of 2025 may be the most important finding in this report. But the more interesting story lies beneath the surface in how these deals are being structured, who is doing them, and what the economics look like for both sides.

We hope this report serves as both a useful reference for practitioners and an invitation to engage with Gibson Dunn on the opportunities and challenges ahead.

TRENDS AND MARKET OUTLOOK

Key Takeaways (2020-2025)

- The royalty finance market has nearly doubled in six years. Annual deal value grew 37% from 2020 to 2025 ($5.2B to $7.1B), with transaction count stabilizing at 25–27 deals per year, which we view as a sign of a maturing, not overheating, market.

- The 2022 dip was temporary. Deal activity contracted briefly as rapid monetary tightening and a biotech equity collapse created a market freeze. However, volume has recovered to record levels even as interest rates climbed above 5%, demonstrating that royalty finance demand is embedded in how biopharma companies fund themselves, not dependent on cheap capital.

- The synthetic royalty market is converging on true-sale structures. In 2020–2021, half of

synthetics were structured as true sales; by 2024–2025, that figure reached 71% of deals and 91% of value – representing a structural shift catalyzed by Royalty Pharma’s transaction approach and adopted by the broader buyer market. - Sellers are capturing more value as the market becomes more competitive. Cap structures vary significantly across deal types. Among capped synthetic royalties, the median cap is 2.0x (range: 1.55x–4.0x), although many synthetics remain uncapped, reflecting a broad spectrum of risk allocation. Tiered rates are quite common (functionally creating annual caps at higher net sales tiers), all reflecting improved seller leverage.

- Gibson Dunn advised on 27% of all transactions over the six-year period and accounted for 52% of the deal volume in 2025.

The Macro Picture: Growth, Disruption, and Recovery

Key Takeaways

- Annual volume grew from $5.2B (2020) to $7.1B (2025), with a temporary dip to $3.9B in 2022.

- The 2022 contraction reflected a temporary market freeze driven by rate shock and a simultaneous biotech equity collapse – not a structural weakness in the asset class. Volume recovered to record levels even as interest rates stabilized above 5%.

- Deal count stabilized at 25–27 per year from 2023 onward, suggesting the market has found a sustainable equilibrium.

- Median deal size trended upward to $221M in 2025, as buyers demonstrated comfort with larger commitments.

Please click on the link below to view our complete Royalty Finance 2026 Report:

Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Life Sciences or Royalty Finance practice groups, or the authors:

Ryan Murr – San Francisco (+1 415.393.8373, rmurr@gibsondunn.com)

Karen Spindler – San Francisco (+1 415.393.8298, kspindler@gibsondunn.com)

© 2026 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

This update provides an overview of the major developments in federal and state securities litigation since our 2025 Mid-Year Securities Litigation Update.

This update covers the following 2025 developments:

- We discuss one pending case that will be decided this term, another for which the court has granted review, and a third with a pending certiorari petition. We also discuss a recent precedential decision out of the Third Circuit that cabins the role of securities law relative to other types of corporate misconduct.

- We discuss recent decisions from the Delaware Supreme Court and Delaware Court of Chancery, including those addressing the constitutionality of Senate Bill 21, the line between employment law and corporate governance, demand futility in the case of an expressly neutral company, the controlling stockholder standard, and Brophy claims based on access to confidential information.

- In the Industry Developments section, we again cover (A) recent developments in the cryptocurrency and artificial intelligence (AI) space, and (B) developments involving issues that cut across several industries—e.g., environmental, social, and governance (ESG) and diversity, equity, and inclusion (DEI) policies and disclosures.

- Class certification continues to be an active battleground in securities litigation. Below, we discuss recent “mismatch” challenges after Goldman, market efficiency challenges in the context of meme stocks, and a pending appeal in the Fourth Circuit concerning the sufficiency of a generalized expert methodology under Comcast Corp. v. Behrend, 569 U.S. 27 (2013).

I. FILING AND SETTLEMENT TRENDS

I. FILING AND SETTLEMENT TRENDS

A recent NERA Economic Consulting (NERA) study provides an overview of federal securities litigation filings in 2025. This section highlights several notable trends.

A. Filing Trends

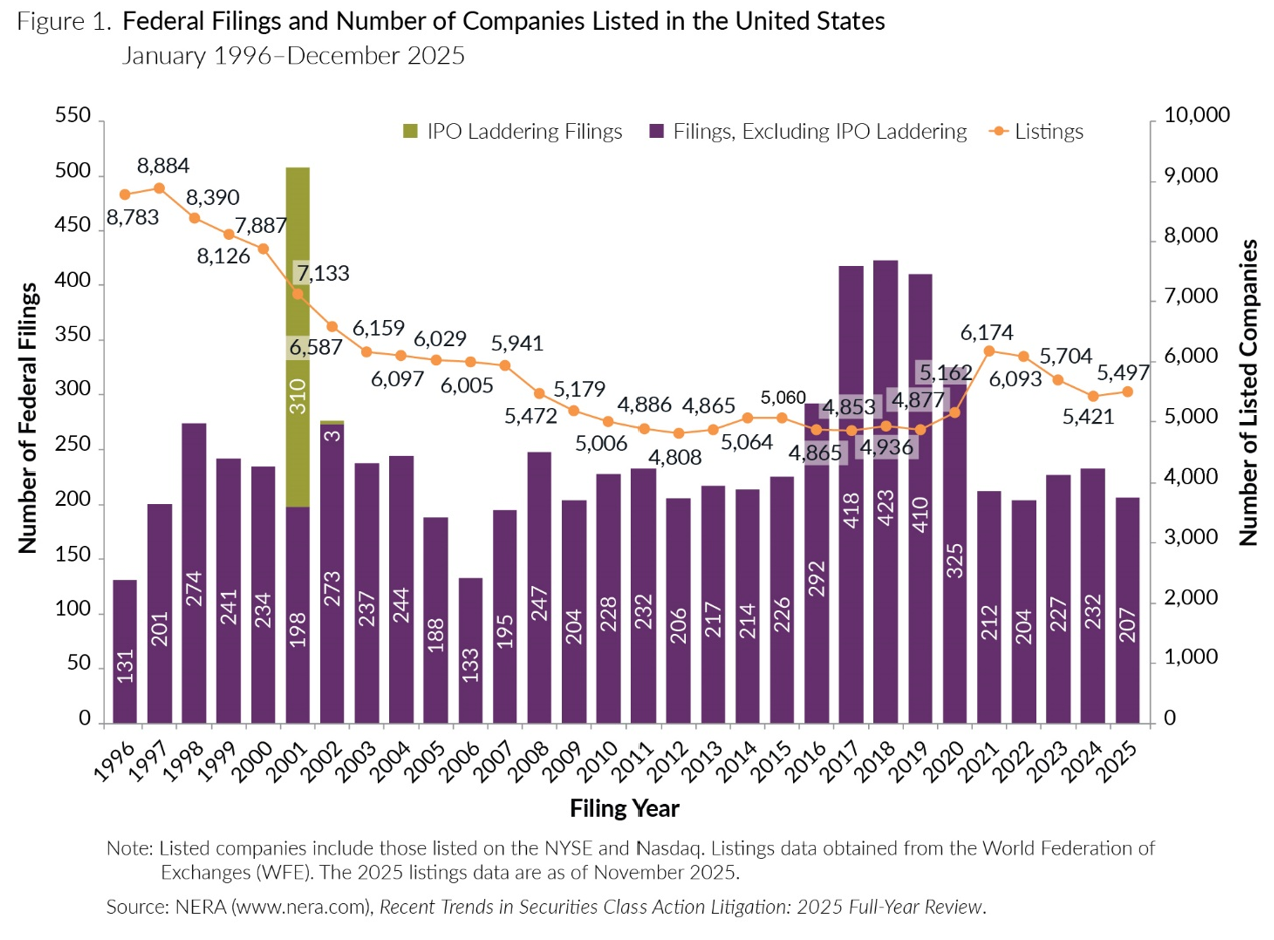

Figure 1 below reflects the federal filing rates from 1996 through the end of 2025. In 2025, 207 federal cases were filed. That number is a decrease from the number of cases filed in 2024. It is also considerably lower than in the peak years of 2017-2019. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

|

B. Mix Of Cases Filed In 2025

1. Filings By Industry Sector

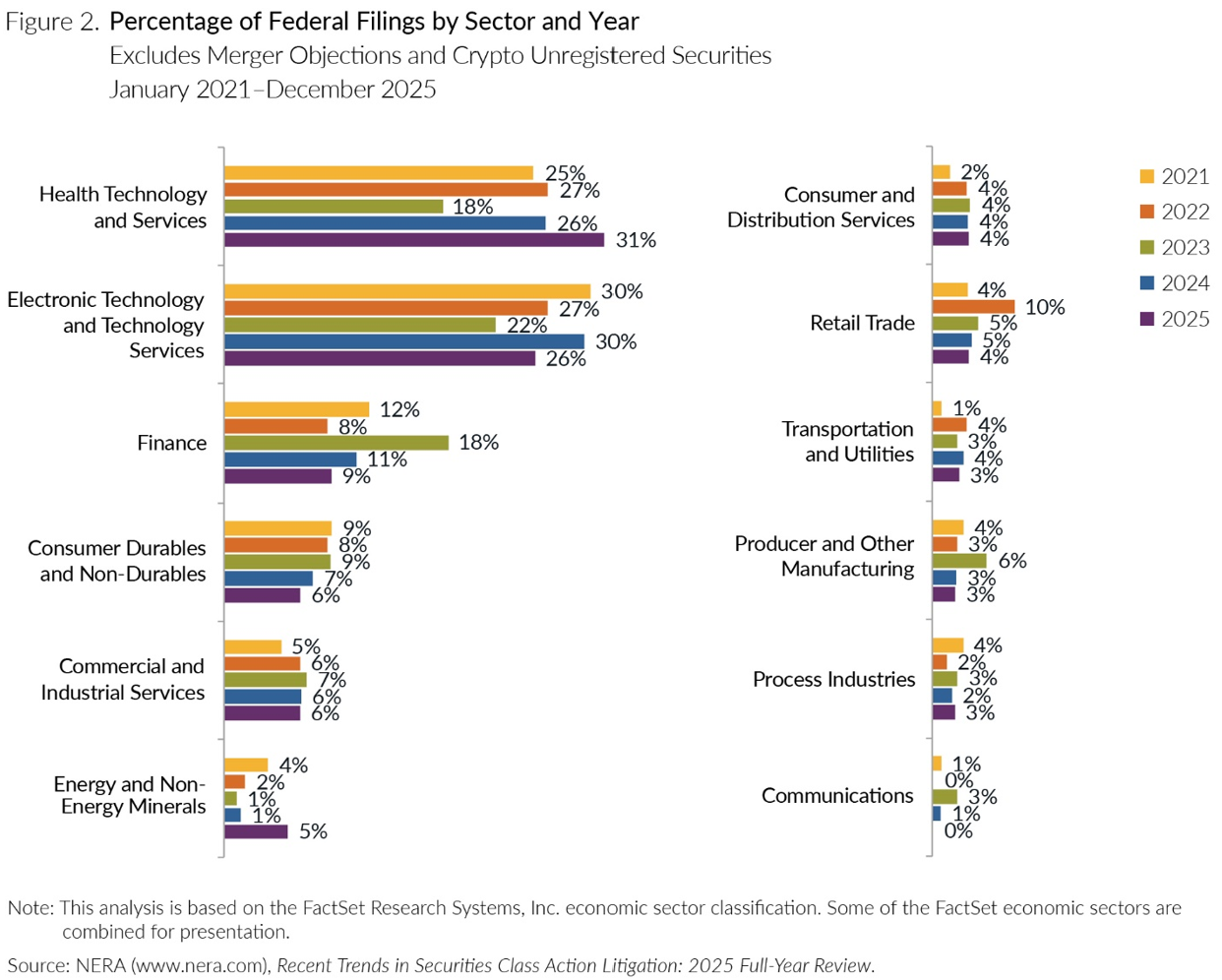

As shown in Figure 2 below, the distribution of non-merger objections and non-crypto unregistered securities filings in 2025 varied somewhat from 2024. Notably, after a dip in 2023, the “Health and Technology Services” sector percentage rose again in 2025, surpassing levels seen in 2021 and 2022. On the other hand, the percentage of “Electronic Technology and Technology Services” dropped slightly in 2025. Together, “Health and Technology Services” and “Electronic Technology and Technology Services” filings once again comprised well over 50% of filings. Meanwhile, “Finance” sector filings decreased from 11% to 9%.

Figure 2:

|

2. Filings By Type

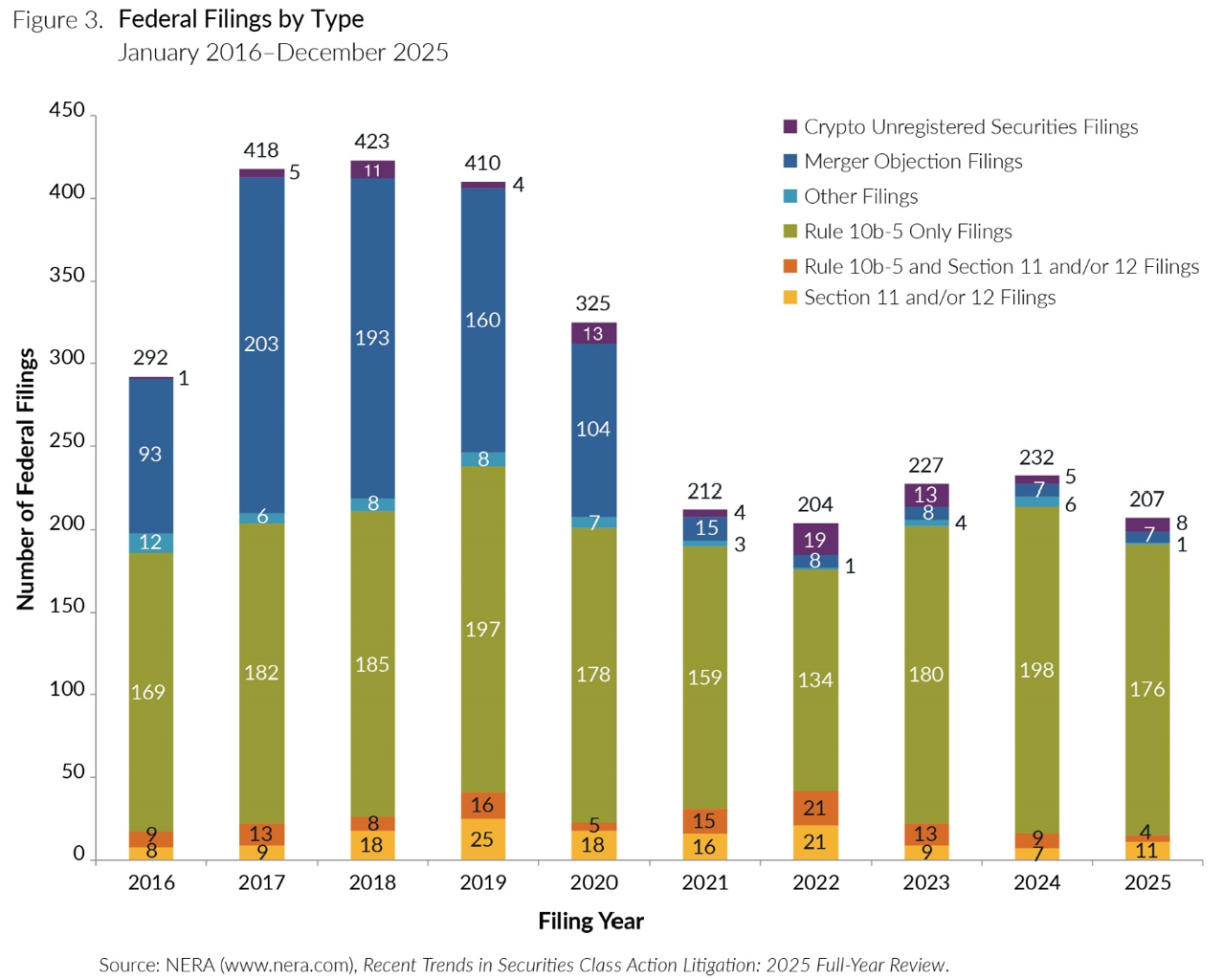

As shown in Figure 3 below, Rule 10b-5 filings made up the vast majority of federal filings this year.

Figure 3:

|

3. Filings By Circuit

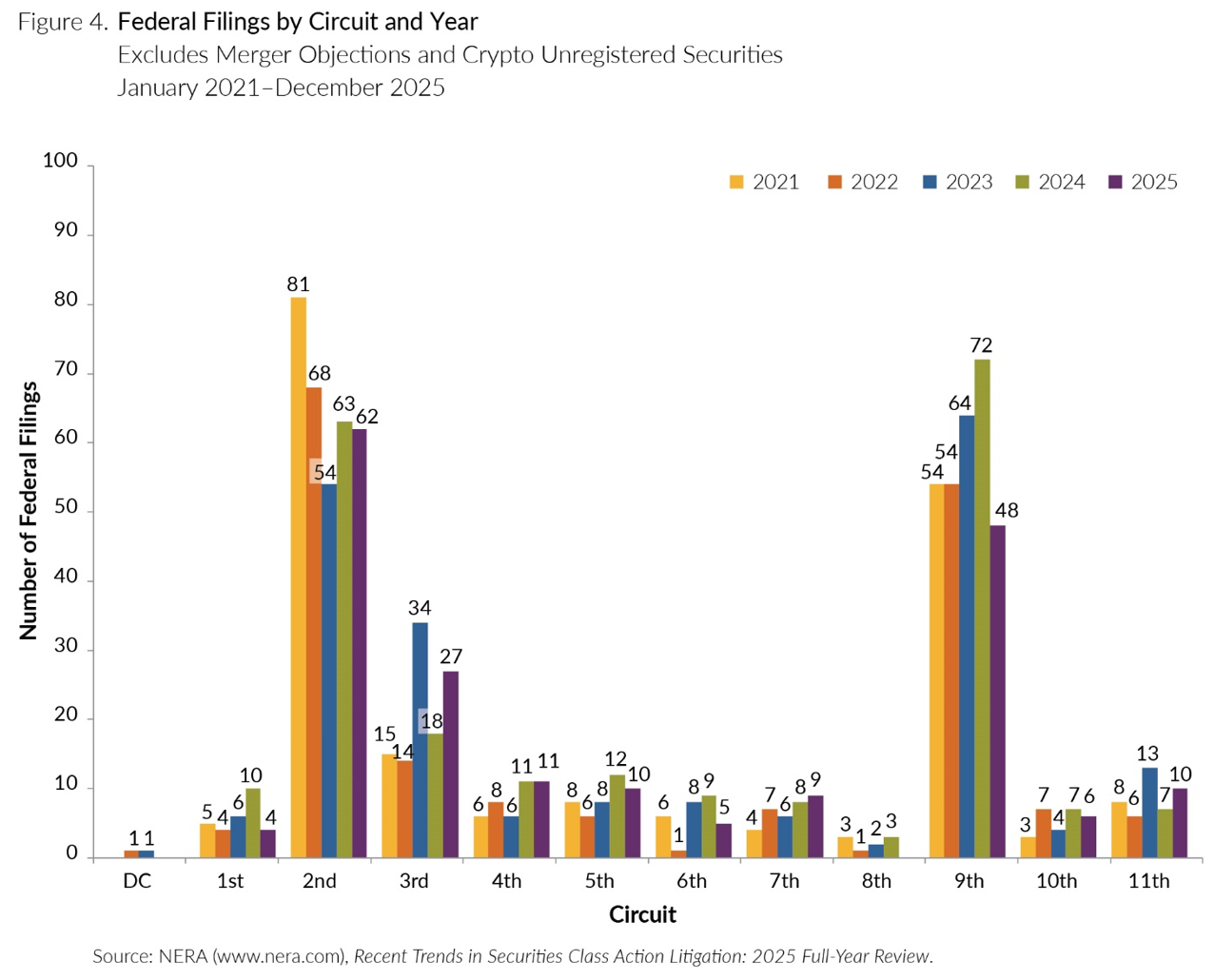

Figure 4 provides insight into the distribution of federal filings by Circuit. Most filings occur in the Second and Ninth Circuits. Filings in the Second Circuit were consistent with 2024. In contrast, the number of filings in the Ninth Circuit was down significantly from 2024 levels.

Figure 4:

|

4. Event-Driven And Other Special Cases

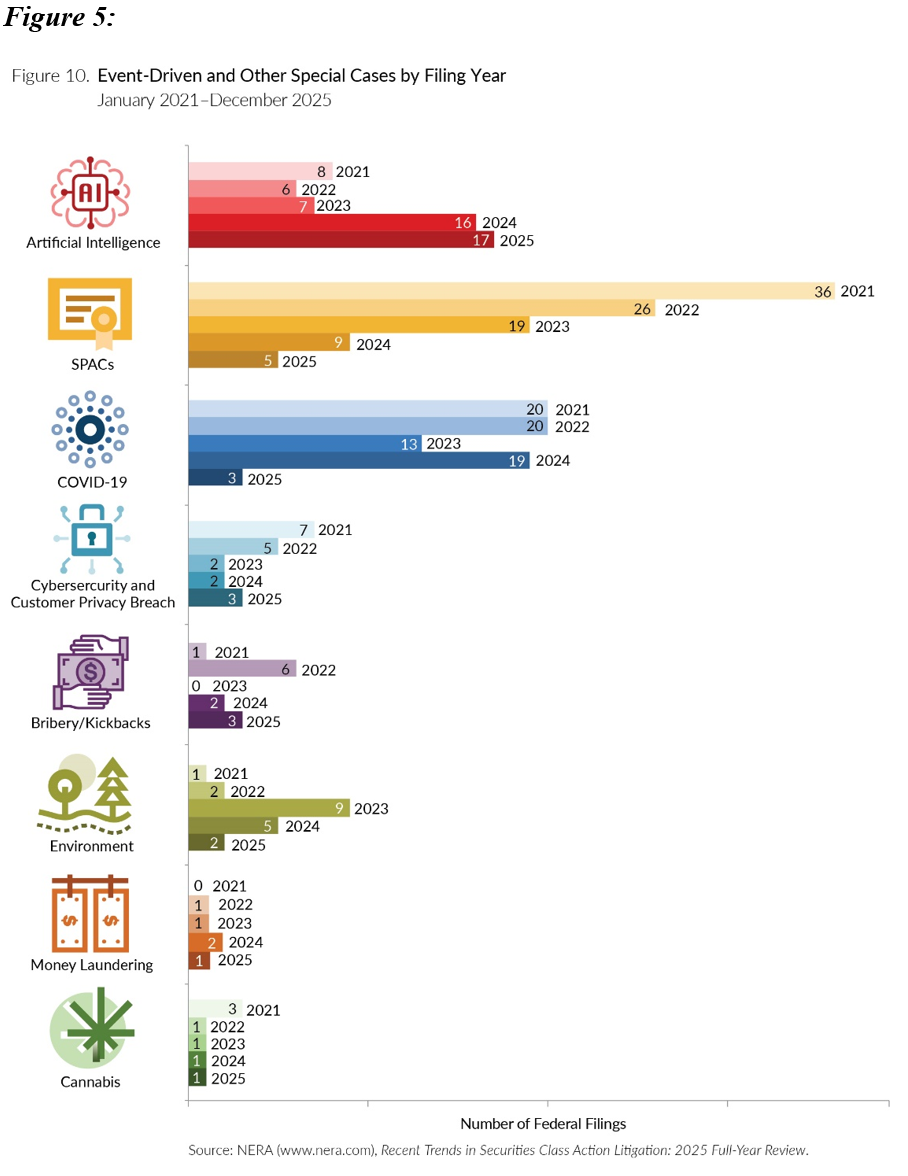

Figure 5 illustrates trends in the number of event-driven and other special case filings since 2021. The number of Artificial Intelligence-related filings continued to increase in 2025. By contrast, SPAC and Cybersecurity and Customer Privacy Breach filings have decreased notably since 2021.

Figure 5:

|

C. Settlement Trends

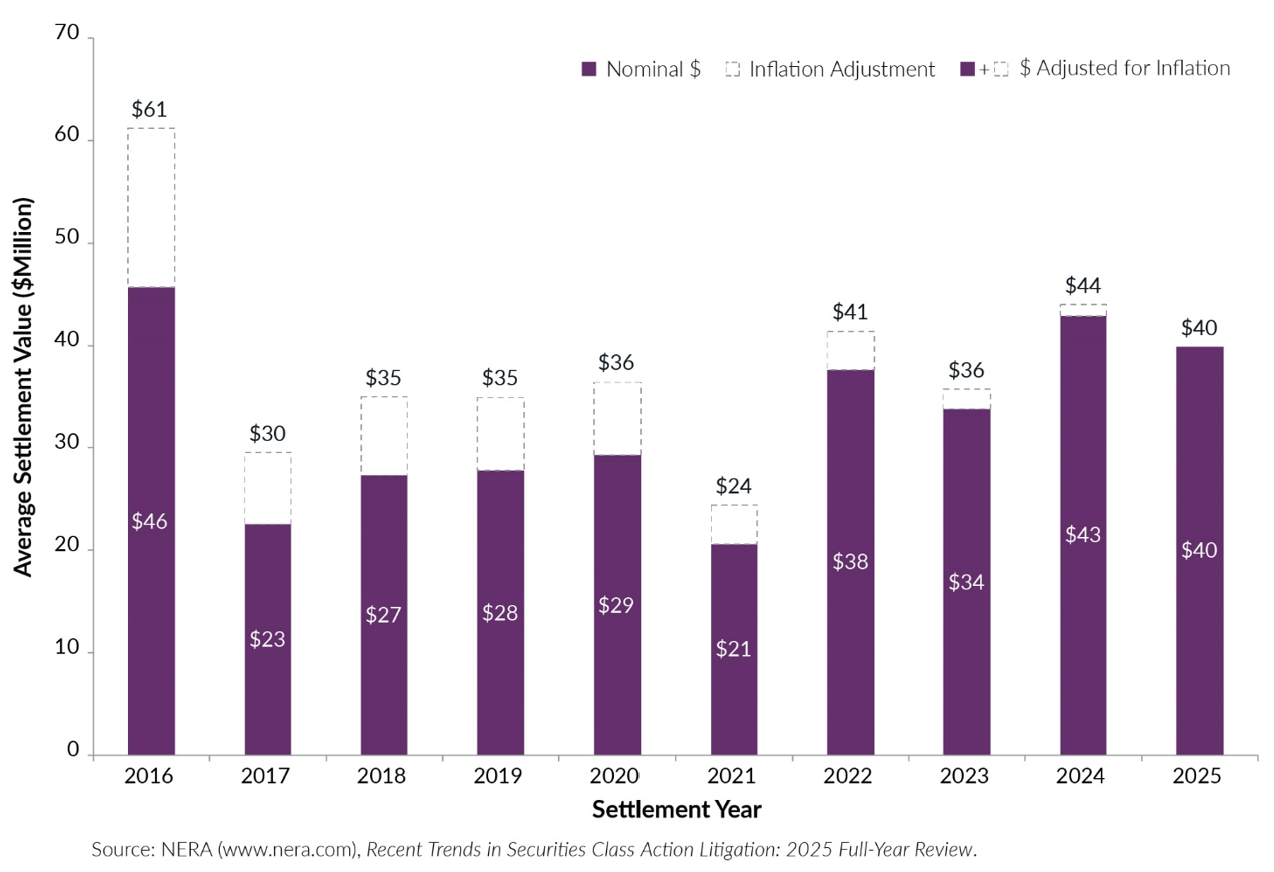

As reflected in Figure 6 below, the average settlement value in 2025 was $40 million. This is a slight drop from last year, but roughly consistent with recent years on an inflation-adjusted basis. (Note that the average settlement value excludes merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class.)

Figure 6:

|

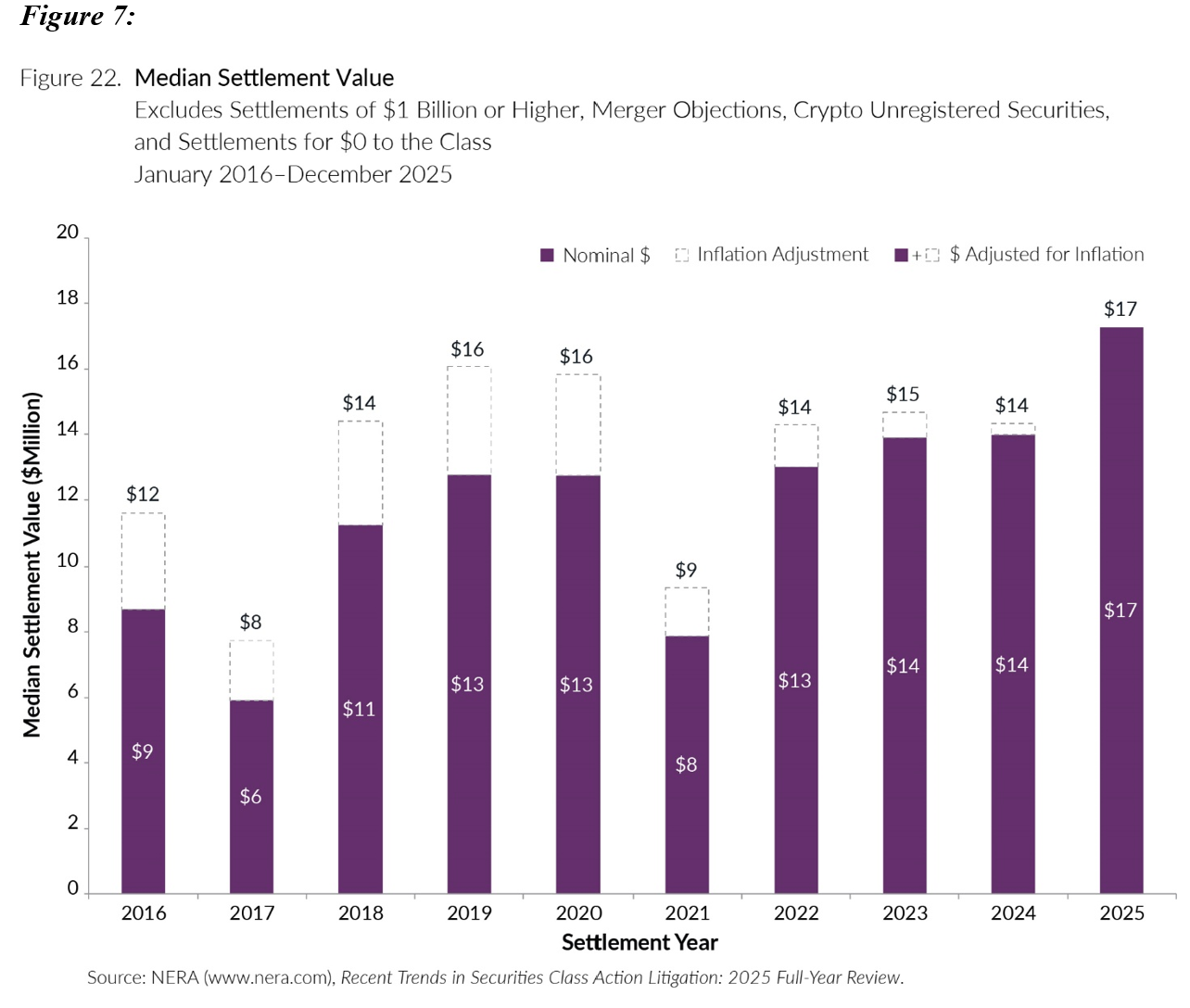

As for median settlement value, it increased notably from $14 million in 2024 to $17 million in 2025. In absolute and inflation-adjusted terms, that is the highest figure in at least a decade. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 7:

|

II. WHAT TO WATCH FOR IN THE SUPREME COURT

A. FS Credit Opportunities Corp. v. Saba Capital Master Fund: Supreme Court Hears Oral Argument on Whether Section 47(b) Provides a Private Right of Action.

In FS Credit Opportunities Corp. v. Saba Capital Master Fund, the Supreme Court agreed to address an asserted circuit split as to whether the Investment Company Act of 1940 (ICA) provides a private right of action and a rescission remedy for substantive violations of its provisions. 145 S. Ct. 2842 (2025). In 2024, the Second Circuit allowed the plaintiff, Saba Capital, to challenge certain resolutions adopted by closed-end funds in which Saba was invested under § 47(b). Saba Cap. Master Fund, LTD. v. BlackRock ESG Cap. Allocation Tr., 2024 WL 3174971, at *1 (2d Cir. June 26, 2024).

The Court heard oral argument on December 10, 2025, and much of the discussion centered around legislative history and intent. Counsel for Petitioners argued that § 47(b) contains no private right of action because Congress did not “speak clearly and unambiguously,” Oral Tr. 4:13-15, and Congress has already “vested the SEC with an array of powers to enforce the ICA, from investigation and rulemaking to exemption and filing suit,” diminishing any need for a concurrent enforcement mechanism, id. 5:20-25. The U.S. Solicitor General’s Office also supported Petitioners’ position, arguing that the “SEC is the primary regulator in this area. . . . It brings enforcement actions. . . . [F]or private parties to come in and seek to upset these contracts that the SEC is aware of . . . we don’t think Congress anticipated that necessarily.” Id. 54:5-16. Counsel for Respondents argued that § 47(b) contained an “express cause of action” and that Congress clearly intended for private parties to have a right of action in federal court. Id. 55:14-57:24. The deciding vote may come from Justice Kavanaugh, who called the case “extremely close.” Id. 22:14. Justice Kavanaugh seemed primarily concerned with the effect of directing litigation to the state courts, as that may be the practical consequence of finding no implied cause of action in the ICA. Id. 23:13-24:16, 26:11-18, 28:3-6. A decision following this oral argument is expected between March and June.

B. SEC v. Sripetch: Supreme Court Agrees to Address Required Showing for Disgorgement Awards.

The Supreme Court recently granted certiorari in the case of SEC v. Sripetch. In that case, the SEC successfully sought disgorgement against the defendant, Ongkaruck Sripetch, for securities fraud. SEC v. Sripetch, 154 F.4th 980, 984-85 (9th Cir. 2025). Sripetch and the other defendants allegedly orchestrated scalping and pump and dump schemes in a number of penny stocks. SEC v. Sripetch, 2024 WL 1546917, at *2-3 (S.D. Cal. Apr. 8, 2024). On appeal, Sripetch argued that disgorgement was an improper remedy because the SEC failed to show victims had suffered pecuniary harm. Sripetch, 154 F.4th at 985. The Ninth Circuit, siding with case law from the First Circuit, held that no such showing was required “as a precondition to a disgorgement award under [15 U.S.C.] § 78u(d)(5) or (d)(7).” Id. at 989. This broadened a potential circuit split, as the Second Circuit requires a showing of pecuniary harm. SEC v. Govil, 86 F.4th 89, 111 (2d Cir. 2023). The Supreme Court has agreed to address this, Sripetch v. SEC, 2026 WL 73091 (U.S. Jan. 9, 2026), and we will provide updates as the case proceeds.

C. Barton v. SEC: Defendant Seeks Supreme Court Review of Fifth Circuit’s Broad Grant of a Receivership Over Defendant’s Assets.

The Supreme Court has yet to rule on a certiorari petition in the case of SEC v. Barton. The SEC initiated civil proceedings in Barton to recover investor funds allegedly obtained by fraud, leading the district court to place half of the defendant’s companies in receivership. SEC v. Barton, 135 F.4th 206, 214 (5th Cir. 2025). The Fifth Circuit affirmed the district court’s opinion, holding that the district court could install a receivership over entities that “received or benefited from assets traceable to [defendant’s] alleged fraudulent activities that are the subject of this litigation.” Id. The panel reasoned that any benefit from the disputed funds, no matter how small, could justify receivership over an entity because requiring a larger benefit would incentivize shuffling funds around multiple entities. Id. at 221.

In his petition, Barton argues that the Fifth Circuit’s ruling is unduly punitive, asserting that receiverships must be more closely tailored to the disputed property, as they otherwise constitute a pre-trial punishment in personam, not an in rem protective measure. Petition for Writ of Certiorari at 18, Barton v. SEC, No. 25-465. Barton submits that this broad seizure of assets was unknown at the time of the country’s founding, such that the SEC’s statutory grant to seek “equitable relief” would not include this sweeping seizure power in light of the Court’s recent limitations on equitable relief. Id. at 24.

D. Handal v. Innovative Indus. Props., Inc.: Third Circuit Cabins Securities Litigation in Cases of General Corporate Misconduct.

The Third Circuit recently affirmed the dismissal of a lawsuit for failing to state a claim under §§ 10(b) and 20(a). Handal v. Innovative Indus. Props., Inc., 157 F.4th 279, 287 (3d Cir. 2025). Defendant Innovative Industrial Properties, Inc. (Innovative), a real estate investment trust, allegedly was defrauded by one of its tenants, a cannabis enterprise called Kings Garden. Id. at 286. Before Kings Garden’s alleged fraud was brought to light, Innovative’s securities filings included remarks regarding its due diligence and monitoring processes on prospective and current tenants, along with praise for Kings Garden during earnings calls. Id. at 288-91. After Kings Garden’s alleged fraud was revealed, plaintiff-shareholders of Innovative alleged that Innovative violated §§ 10(b) and 20(a) by making false or misleading statements regarding Kings Garden. Id. at 288.

The Third Circuit held that even if Innovative’s diligence was considered “subpar,” “Innovative never promised that its diligence would meet any particular standard of thoroughness” and such oversight does not necessarily make way for securities litigation. Id. at 295. The Third Circuit noted that neither “corporate trauma” nor “ordinary negligence” amounts to securities fraud, and that the antifraud provisions do not function as “a general charter of shareholder protection.” Id. at 286 (citation omitted). With no currently pending certiorari petition, the decision could remain an important limitation on the reach of the securities laws at least within the Third Circuit.

A. Delaware Supreme Court Concludes Challenged Aspects of Senate Bill 21 Are Constitutional.

As discussed in our Client Alert from last year, Senate Bill 21 (SB 21) lowered Delaware courts’ scrutiny of controlling stockholder transactions under certain circumstances, provided a safe harbor, and strengthened the presumption that a public company director is disinterested and independent. On May 6, 2025, plaintiff Thomas Rutledge, a stockholder, filed a derivative action challenging a transaction between Clearway Energy, Inc. (Clearway) and its controlling stockholder Clearway Energy Group LLC, alleging that the former overpaid in purchasing a project from the latter. Appellee’s Br. at 16, Rutledge v. Clearway Energy Group LLC, C.A. No. 248 (Del. Jul. 31, 2025). The defendants moved to dismiss and on June 6, 2025, the Court of Chancery granted Rutledge’s unopposed motion to certify two constitutional questions to the Delaware Supreme Court. Intervenor’s Br. at 12-13. Gibson Dunn represents Clearway in this matter.

On November 5, 2025, the Delaware Supreme Court heard oral argument in Rutledge v. Clearway Energy Group LLC. Two questions were at issue on appeal: (1) whether Section 1 of SB 21 (codified at 8 Del. C. § 144), which eliminates the Court of Chancery’s ability to award “equitable relief” or “damages” where safe harbor provisions are satisfied, violates the Delaware Constitution by depriving the Court of Chancery of its equitable jurisdiction, and (2) whether Section 3 of SB 21, which applies the safe harbor provisions to breach of fiduciary duty claims arising from acts or transactions that occurred before the date SB 21 was enacted, violates the Delaware Constitution. Appellant’s Br. at 1.

On the first question, Appellant contended that Section 1 of SB 21 violates Article IV, Section 10 of the Delaware Constitution by “reduc[ing] the Court of Chancery’s equitable powers below the general equity jurisdiction of the High Court of Chancery of Great Britain as it existed prior to the separation of colonies” without “creat[ing] an adequate alternative remedy.” Appellant’s Br. at 13-14.

In response, Clearway rejected this characterization and argued that the provision is permissible because it does not limit the Court of Chancery’s jurisdiction to hear fiduciary duty disputes, modify the contours of any fiduciary duty, or curtail the remedies the Court of Chancery can issue. Appellee’s Br. at 4. Instead, Clearway contended that SB 21 provides only a “review framework” for the Court of Chancery to apply in “resolving fiduciary duty claims involving interested transactions,” which remain within the Court of Chancery’s jurisdiction. Id.

Intervenor the State of Delaware on behalf of Governor Matthew Meyer, likewise asserted that the amendments to Section 144 were constitutionally permissible. Intervenor’s Br. at 1. It argued that the safe harbor provisions follow a “long tradition” of the Delaware General Assembly amending the DGCL to define the contours of directors’ and officers’ duties and the standards that the Court of Chancery applies in evaluating claims of breach of those duties. Id. at 2. It continued that “[s]uch amendments do not diminish ‘the jurisdiction and powers vested by the laws of this State in the Court of Chancery’ or otherwise violate its traditional equitable jurisdiction because they do not alter its power to adjudicate fiduciary breach claims.” Id.

On the second question, Appellant asserted that Section 3 of SB 21 violates Article I, Section 9 of the Delaware Constitution by depriving parties “of their property rights, i.e., causes of action that accrued before [SB 21] was enacted.” Appellant’s Br. at 32.

In response, Clearway argued that Section 144 is not unconstitutionally retroactive for two reasons. First, Section 144 does not eliminate any fiduciary duty claims but alters the framework under which they are adjudicated. Appellee’s Br. at 4. Second, while Section 144 does not “extinguish any vested right,” based on longstanding precedent, the General Assembly may impose new obligations on vested rights so long as they rationally serve the public interest, which Section 144 does. Id. at 4-5.

On this issue, the Intervenor asserted that Appellant “misapprehend[ed] both the Constitution and the nature of stockholder claims.” Intervenor’s Br. at 3. Rather, the Intervenor claimed that where the General Assembly intends to apply retroactive obligations, the Delaware Constitution only requires that the Assembly act with a “legitimate purpose,” and the Assembly’s desire to address recent judicial decisions that, in its view, negatively impacted the state’s corporate law constitutes a legitimate purpose. Id. Additionally, the Intervenor asserted that no vested rights exist in derivative claims because they arise from statutory corporate law which the General Assembly is free to amend pursuant to its plenary powers. Id.

On February 27, 2026, the Delaware Supreme Court concluded the challenged provisions of SB 21 are constitutional under the Delaware Constitution, having neither divested the Court of Chancery of equity jurisdiction nor retroactively extinguished any vested plaintiff rights. On the former, the Court held that “Rutledge ha[d] not met his burden of overcoming the presumption of SB 21’s constitutional validity,” and that “[t]he General Assembly’s enactment of SB 21 f[ell] within the broad and ample sweep of its legislative power.” Slip Op. at 31 (quotation marks omitted). On the latter, the Court concluded the same—that “Rutledge ha[d] not met his burden of overcoming the presumption that § 3 of SB 21 is constitutionally valid.” Id. at 37.

The decision both reinforces the legislature’s important role in shaping Delaware’s corporate law and provides assurance to corporations and investors that they can trust that Delaware’s corporate law means what it says and that when the legislature changes the law—including in the wake of judicial decisions interpreting it—Delaware courts will give effect to that law. For additional insight into the case, see Law.com’s Litigators of the Week.

B. Chancery Draws Line Between Employment Law and Corporate Governance.

The point at which employment law ends and Delaware corporate law begins has been subject to some debate by Delaware commentators and courts in recent years. In Brola ex rel. Credit Glory Inc. v. Lundgren, __ A.3d __, 2025 WL 3439671 (Del. Ch. Dec. 1, 2025), the Delaware Court of Chancery drew a clear line between the two bodies of law in dismissing a stockholder derivative complaint for failing to plead demand futility. As the court explained, the “core issue” in Brola was “whether corporate law can be broadened to encompass interpersonal workplace disputes.” Id. at *4. In the court’s view, “it c[ould] not.” Id.

Credit Glory Inc. has two directors and two stockholders: Alex Brola (the plaintiff) and Christopher Lundgren (the defendant). Id. at *1. The defendant, also formerly an officer, “allegedly ‘used his positions at the Company to sexually harass its employees and expose them to his reprehensible racist views and conduct.’” Id. The defendant’s behavior resulted in judgments against the company totaling over $1.8 million and a derivative lawsuit brought against him. See id. In the derivative action, the plaintiff sought to hold the defendant “liable to the Company for th[e] judgments and other losses on the theory that Lundgren’s actions breached his duty of loyalty.” Id.

The court dismissed the plaintiff’s claim for failing to plead demand futility under Rule 23.1. Id. at *7. The question for demand futility purposes was whether demand was excused because the defendant faced a substantial likelihood of liability; a question that itself turned on the viability of the plaintiff’s underlying claim. Id. at *3. As to that claim, the court explained, “fiduciary liability is not a catch-all for every wrong committed in the workplace simply because the perpetrator happens to hold a title. Egregious interpersonal misconduct, even when violative of employment law and company policy, generally falls outside the scope of Delaware corporate law.” Id. at *5. Such was the case here: “[h]owever deplorable, [the defendant’s] harassment and bigotry were personal malfeasance, not a misuse of his corporate office.” Id.

In support of its decision, the court reasoned that, “aside from the risk of doctrinal sprawl,” several other factors militated against the plaintiff’s “invitation to place workplace misconduct under the banner of fiduciary duty.” Id. at *6. They included the fact that employment “disputes are regulated by comprehensive state and federal laws that reflect careful legislative choices,” “the internal affairs doctrine and comity principles underlying it,” and the “perverse incentives” that “treating sexual harassment-based claims as corporate assets [would] create[].” Id. at *6-7.

The development of Delaware law concerning the circumstances in which directors and officers of Delaware corporations could be held personally liable for harm to the company arising from workplace misconduct is ongoing. Watch this space for further updates.

C. Derivative Claims Dismissed Despite Company Neutrality.

A recent opinion dismissing a derivative action contains interesting and instructive commentary on demand futility, control, and Brophy claims. In Witmer v. Armistice Capital, a stockholder brought derivative claims against the board of Aytu Biopharma Inc. and the company’s allegedly controlling 41.4% stockholder, Armistice Capital. 344 A.3d 632, 640 (Del. Ch. 2025). Among other things, the plaintiff challenged the fairness of transactions between Aytu and entities affiliated with Armistice Capital and asserted so-called Brophy claims (i.e., claims alleging insider trading based on duty of loyalty principles). Id. at 639-40. At an earlier stage of the case, the plaintiff entered into a settlement agreement dismissing all of the defendants from the case except Armistice Capital. Armistice Capital moved to dismiss based on the plaintiff’s failure to adequately plead demand futility and failure to state a claim. Id. at 645. The court found that demand was excused but dismissed the case because the plaintiff failed to state a claim against Armistice Capital, including for breach of fiduciary duty and Brophy-based insider trading. Id. at 648-49.

The court agreed with the plaintiff that demand was excused as futile because Aytu had “taken a position of neutrality on the claims against Armistice” in its settlement agreement with the other defendants. Id. at 646. Armistice Capital did not dispute that Aytu had taken a neutral stance in the settlement agreement. Id. at 647. Instead, it argued that the court should perform a demand futility analysis nonetheless. Id. According to the court, however, precedent dictates that “a company’s enunciated position on a derivative claim takes precedence over the court’s Rule 23.1 assessment of the position the company might be able to take.” Id. at 646. Further, the court found no basis to question the board’s competence, loyalty, or independence in making its decision to take a position of neutrality on the claims here and thus had no basis to displace it. Id. at 647-48.

The court nonetheless agreed with Armistice Capital that the plaintiff failed to plead meritorious claims. The court first dismissed the breach of fiduciary duty claim pertaining to allegedly conflicted transactions based upon its conclusion that Armistice Capital was not conceivably a controlling stockholder and therefore owed no fiduciary duties. Id. at 654. The plaintiff argued Armistice Capital was a controlling stockholder based on a number of factors, namely (i) its 41% ownership of Aytu, (ii) Aytu’s disclosure that Armistice Capital could exert significant control over the company, (iii) Armistice Capital’s ownership stake in the parties across from Aytu in the challenged transactions, (iv) Armistice Capital’s managing partner’s business relationship with Aytu’s CEO, (v) Armistice Capital’s managing partner sitting on Aytu’s board and review committee, and (vi) the approval process for the challenged transactions. Id. at 650. The court disagreed, reasoning that although Armistice Capital “held a large stake in Aytu, it did not control the board, dictate its decision making, or compel the challenged outcomes.” Id. at 654. The plaintiff’s allegations therefore failed to create an inference of control.

The court followed suit on the plaintiff’s Brophy claim, rejecting the plaintiff’s attempt to, in its view, extend the reach of fiduciary duties. The plaintiff alleged that Armistice Capital owed fiduciary duties “because it possessed . . . Aytu’s confidential information” through its board designee. Id. at 655. The plaintiff further alleged that Armistice Capital breached those duties by trading on MNPI. Id. at 654. The court rejected the plaintiff’s fiduciary duty theory, finding “[a]n investor does not become a fiduciary simply because it has a board designee” and therefore “access to confidential information.” Id. at 656-57 n.193. As Armistice Capital owed no fiduciary duties, the court dismissed the plaintiff’s Brophy claim.

D. In re Tesla, Inc. Derivative Litig., 2025 WL 3689114 (Del. Dec. 19, 2025).

In December 2025, the Delaware Supreme Court reinstated Elon Musk’s 2018 equity compensation package and slashed the plaintiff’s attorneys’ $345 million fee award granted by the Court of Chancery. In re Tesla, Inc. Derivative Litig., 2025 WL 3689114 (Del. Dec. 19, 2025). For further information, see our Client Alert.

A. Technology Updates

1. Digital Asset Developments.

In re EthereumMax Investor Litig., 2025 WL 2377070 (C.D. Cal. Aug. 6, 2025): On August 6, 2025, the U.S. District Court for the Central District of California granted certification of four state‑specific classes but refused to certify a nationwide class in a crypto‑asset securities and consumer class action. In re EthereumMax Investor Litig., 2025 WL 2377070, at *1-2, *17 (C.D. Cal. Aug. 6, 2025). The plaintiffs alleged that the defendants coordinated a celebrity‑driven social‑media campaign to “misleadingly promote and sell” EthereumMax (EMAX) tokens and that the tokens were unregistered securities marketed as “safe, worthwhile, and advantageous.” Id. at *1, *3-5. The court held that common questions predominated under Rule 23(b)(3) for the state‑specific classes because the plaintiffs presented evidence of a “uniform, highly orchestrated” promotional scheme, and reliance could be shown on a class-wide basis either through that coordinated campaign or a fraud‑on‑the‑market theory. Id. at *4-6, *11. The court did not address whether EMAX tokens qualify as “securities,” concluding that was a merits question “capable of class‑wide resolution.” Id. at *8. The court held that predominance defeated the proposed nationwide class, however, because of territorial limitations in California and Florida securities statutes applicable only to transactions occurring “in” or “within” those states. Id. at *12-13. These territorial limitations “create[d] a significant predominance and superiority concern as to the Nationwide Class” because determining whether each EMAX purchase occurred in California, Florida, or elsewhere—particularly given pseudonymous blockchain transactions—would require “very individuated questions of fact as to the substantial majority of purchasers . . . not amenable to common proof,” creating “the risk of inappropriate extraterritorial application” and preventing class‑wide adjudication. Id. at *13.

Underwood v. Coinbase Glob., Inc., 2025 WL 1984293 (S.D.N.Y. July 17, 2025): On July 17, 2025, the U.S. District Court for the Southern District of New York resolved a discovery dispute in a putative securities class action alleging that Coinbase unlawfully listed and sold digital tokens that qualified as unregistered securities. Underwood v. Coinbase Glob., Inc., 2025 WL 1984293, at *1, *3 (S.D.N.Y. July 17, 2025). The court explained that the viability of the plaintiffs’ Securities Act claims—particularly under Section 12(a)(1)—turned on whether Coinbase qualified as a “statutory seller,” which depended in part on whether it “passed title, or other interest in the security, to the buyer.” Id. at *1-2. Focusing on that ownership question, the court held that discovery into Coinbase’s treatment of customer crypto-assets in bankruptcy or vis-à-vis creditors was relevant because it could shed light on whether Coinbase retained an ownership interest in the tokens. Id. at *3. The court also compelled the plaintiffs to produce certain documents to Coinbase, including those related to how the plaintiffs sold, accounted for, and reported their tokens because “both parties’ conduct may be germane to . . . [w]hether title passed to Coinbase” under traditional principles of property law. Id. at *3-4. In doing so, the court emphasized that title and privity are not determined solely by user agreements but may turn on the economic realities of how tokens are held and transferred on the platform. Id.

2. Developments in the Application of the Howey Test for Determining When a Transaction Constitutes a Security.

Recent decisions have taken different approaches in applying the test to determine when a digital asset is an “investment contract” and thus a security. Real v. Yuga Labs looked to the NFTs’ public‑blockchain design and marketplace structure, while Holland v. CryptoZoo focused on economic reality and stated that disclaimers could not overcome allegations that the tokens were securities.

On September 30, 2025, the U.S. District Court for the Central District of California granted a motion to dismiss securities claims brought against Yuga Labs and related parties. Real v. Yuga Labs, Inc., 2025 WL 3437389, at *1-2 (C.D. Cal. Sept. 30, 2025). The court held that the plaintiffs failed to plausibly allege that Yuga’s NFTs and ApeCoin constituted “securities” under the Howey test. Id. at *11. Notably, the court highlighted that the non-fungible and non-proprietary nature of Yuga’s NFTs—“recorded on the Ethereum blockchain” rather than a private, issuer-controlled system—undermined any inference of horizontal or vertical commonality. Id. at *8-10. The court distinguished prior digital assets cases on technological architecture grounds, noting that unlike in other cases, here, the NFTs were recorded on a public blockchain that did not rely on these NFTs and ApeCoin “for its survival.” Id. at *8-9. Further, Yuga NFTs were purchased on “independent exchanges.” Id. at *8. On the “investment of money” and “expectation of profits” questions, the court took a narrow view of promotional conduct, rejecting the idea that statements about ecosystem growth, “inherent, long-term value,” “intrinsic value,” or “trade volume”—without explicit profit-oriented signaling—objectively transform digital assets with membership or other utility into investment contracts. Id. at *6-7, *10. Although the court acknowledged that any potential profits tied to Yuga products would have likely depended on Yuga’s own developmental efforts, it dismissed the complaint because the plaintiffs failed to meet Howey’s other elements. Id. at *11-12.

By contrast, in a separate case, the U.S. District Court for the Western District of Texas took a broader view of Howey’s “expectation of profits” inquiry by rejecting the defendants’ attempt to defeat Howey through formalistic distinctions. In Holland v. CryptoZoo Inc., the court held that the plaintiffs plausibly alleged that the tokens and NFTs at issue constituted “securities.” 2025 WL 2492970, at *28 (W.D. Tex. Aug. 14, 2025), report and recommendation adopted, 2025 WL 3028689 (W.D. Tex. Oct. 29, 2025). The court emphasized that contractual disclaimers and labels cannot override the “economic reality” and “totality of the circumstances” and dismissed “volatility of the market” arguments due to the inherent volatility of cryptocurrency. Id. at *26-28. The court noted that treating volatility as dispositive would mean that “virtually no crypto transactions would ever qualify as investment contracts.” Id.

SEC v. Morocoin Tech Corp., 25-cv-04102 (D. Colo. filed Dec. 22, 2025): In SEC v. Morocoin Tech Corp., filed in the U.S. District Court for the District of Colorado on December 22, 2025, the SEC alleged that seven companies stole from U.S. investors in a cryptocurrency “confidence scam” and violated Section 17(a) of the Securities Act and Section 10(b) of the Exchange Act. SEC v. Morocoin Tech. Corp., 25-CV-04102 (D. Colo. filed Dec. 22, 2025), Complaint, at ¶¶ 1–7, 25–26. The complaint alleges that four companies—AI Wealth Inc., Lane Wealth Inc., AI Investment Education Foundation Ltd., and Zenith Asset Tech Foundation—established trust with U.S.-based investors by operating “investment clubs that were WhatsApp chats purportedly run by experienced financial professionals who gave purported investment recommendations to investors.” Id. ¶ 2. However, the SEC alleges that the companies’ agents “falsely claimed [these recommendations] were based on AI-generated ‘signals.’” Id. ¶ 25. Some social media ads featured “deepfake videos of prominent financial professionals.” Id. ¶ 18. The defendants then recommended that investors trade crypto assets by opening accounts on “purported crypto asset trading platforms” operated by three other defendants—Morocoin Tech Corp., Berge Blockchain Technology Co., Ltd., and Cirkor Inc. Id. ¶ 3. The defendants offered “security token offerings” purportedly issued by legitimate businesses that the SEC alleges “were not genuine trading platforms,” alleging “no trading took place on [them]” because both the security token offerings and their purported issuing companies were fictitious. Id. The SEC asserts that the defendants “acted in concert to misappropriate at least $14 million from U.S.-based retail investors, which was then funneled overseas through a web of bank accounts and crypto asset wallets.” Id. ¶ 6.

3. Regulatory Updates.

Recent task forces constituted by the SEC could suggest an effort to embrace the inclusion of new technologies across multiple regulated products, and could indicate an emphasis on policy-driven approaches in addition to ad hoc securities enforcement.

SEC-CFTC Joint Staff Statement (Project Crypto-Crypto Sprint) (Sept. 2, 2025): On September 2, 2025, the SEC’s Division of Trading and Markets and the CFTC’s Division of Market Oversight and Division of Clearing and Risk issued a coordinated joint statement “regarding the listing of leveraged, margined, or financed spot retail commodity transactions on digital assets.” SEC—CFTC Joint Staff Statement (Sept. 2, 2025). The Commodity Exchange Act (CEA) requires certain of these transactions be conducted on a CFTC-registered designated contract market or foreign board of trade, unless they are listed on an SEC-registered national securities exchange or meet some other exception. Id. In furtherance of the SEC’s Project Crypto and the CFTC’s Crypto Sprint initiatives, the agencies announced their view that designated contract markets, foreign boards of trade, and national securities exchanges are “not prohibited from facilitating the trading of certain spot crypto asset products.” Id. As a result, both the SEC and the CFTC will review filings and requests by such designated contract markets, foreign boards of trade, and national securities exchanges seeking to facilitate trading of “spot crypto asset products.” Id.

SEC’s Recent Engagement on Crypto, Blockchain Privacy, and Artificial Intelligence: As the SEC’s Crypto Task Force approaches the one-year anniversary of its inception, it is increasing its efforts to bring the emerging issues of crypto, blockchain privacy, and artificial intelligence to the forefront of its discussions with market participants. In August 2025, the SEC’s Crypto Task Force launched a series of Crypto on the Road meetings following five roundtables in Washington, D.C. and hundreds of written submissions from industry participants. SEC, Crypto Task Force: On the Road, https://www.sec.gov/featured-topics/crypto-task-force/crypto-task-force-road (last updated Jan. 16, 2026). At roundtables held in Berkeley, Boston, Dallas/Fort Worth, Chicago, and Ann Arbor, stakeholders were invited to meet with Commissioner Hester Peirce, head of the Crypto Task Force. Id. The Crypto Task Force then held another roundtable on Financial Surveillance and Privacy in Washington, D.C. on December 15 that focused on the tension between the transparency of blockchain technology and the need for privacy enhancement in securities and other transactions. SEC, Crypto Task Force Roundtable on Financial Surveillance and Privacy (Dec. 15, 2025). Finally, the SEC also established a new task force on artificial intelligence led by Valerie Szczepanik to “spearhead the agency’s efforts to enhance innovation and efficiency across the agency.” Press Release, SEC Creates Task Force to Tap Artificial Intelligence for Enhanced Innovation and Efficiency Across the Agency (Aug. 1, 2025).

B. Cross-Cutting Issues

Litigation continues to challenge environmental, social, and governance (ESG) and diversity, equity, and inclusion (DEI) statements and positions taken by public companies. In previous editions of the Securities Litigation Update, we noted that securities cases challenging ESG and DEI policies and disclosures have had mixed results, potentially impacted by shifting political, social, and commercial trends. For our most recent coverage, see the Securities Litigation 2025 Mid-Year Update and the Securities Litigation 2024 Year-End Update.

The following section discusses developments in pending securities cases that involve allegations regarding ESG or DEI policies and disclosures.

Lyall v. Elsevier Inc., 2025 WL 2959908 (D. Mass. Oct. 17, 2025): We previously covered this case in the 2024 Year-End Update. The plaintiff in this case filed a putative class action against RELX PLC and its subsidiaries (RELX) for, among other claims, alleged violations of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5. 2025 WL 2959908, at *1. The plaintiff alleged that RELX misled investors through “greenwashing” (i.e., representing that RELX was doing more to protect the environment than it was actually doing), and that the defendants’ business activities were inconsistent with their stated climate goals. Id. at *2. After the plaintiff filed a second amended complaint in May 2025, the defendants moved to dismiss for failure to state a claim. Id. at *1; see also ECF Nos. 45, 49. The court granted that motion, dismissing the securities claim with prejudice. 2025 WL 2959908, at *1, *7. The court concluded that the plaintiff “[did] not adequately [plead] the related elements of economic loss and loss causation” as she did not allege any drop in RELX’s stock price after the alleged “truth” about the greenwashing was revealed. Id. at *4.

In re Target Corp. Shareholder Class Action Litigation, 2025 WL 3187126 (M.D. Fla. Nov. 14, 2025); 0:25-cv-04380 (D. Minn.): This case is a consolidated shareholder class action against Target Corporation and its board of directors, filed after Target undertook a 2023 LGBTQIA+ Pride Month campaign that featured more than 2,000 Pride-themed products. Id. at *1. The plaintiffs allege the Pride Month campaign triggered a customer boycott, which led to Target’s longest stock-price losing streak in 23 years and an estimated $25 billion loss in market capitalization in the second half of 2023. Id. at *1. A first shareholder lawsuit was filed in the Middle District of Florida, followed by two securities class actions and three related derivative actions, alleging that Target “did not oversee or disclose … the obvious risks of its 2023 LGBT-Pride Campaign and the ESG/DEI initiatives which it advanced.” Id. at *1 (citation modified). The consolidated actions survived a motion to dismiss in late 2024, and in November 2025, the court granted Target’s motion to transfer the cases to the District of Minnesota. Id. at *1, *5.

Spence v. Am. Airlines, Inc., No. 4:23-CV-00552-O, 2025 WL 3537280 (N.D. Tex. Sept. 30, 2025): Following a bench trial, the court in this case found that American Airlines, Inc. and its Employee Benefits Committee breached ERISA’s fiduciary duty of loyalty by allowing for a “focus on [ESG] investing to influence the Plan.” Id. at *1; see Spence v. Am. Airlines, Inc., 775 F. Supp. 3d 963 (N.D. Tex. 2025). Issued months after its earlier findings, the court’s final judgment concluded that the plaintiff failed to “sufficiently establish actual monetary losses to the Plan.” 2025 WL 3537280, at *1. As a result, the court did not grant damages or any monetary relief. Id. at *1, *2. But the court issued a permanent injunction and imposed equitable remedies tailored “to ensure that Defendants and their investment managers act solely for the pecuniary benefit of the Plan and implement compliance measures to ensure fidelity to ERISA’s fiduciary standards.” Id. at *1. On February 10, 2026, the court denied a motion for reconsideration of its final judgment, clarified the injunction, and awarded the plaintiffs more than $4.5 million in attorney’s fees. ECF 188.

SEB Inv. Mgmt. AB v. Wells Fargo & Co., No. 22-CV-03811-TLT (N.D. Cal. Nov. 13, 2025): We have previously reported on this case, including in our 2023 Year-End Securities Litigation Update. The plaintiffs in this case filed a class action complaint against Wells Fargo & Company (Wells Fargo) and its executive officers, alleging violations of Sections 10(b) and 20(a) of the Exchange Act and Rule 10b-5. 2025 WL 1243818, at *1 (N.D. Cal. Apr. 25, 2025). The case concerns allegations that Wells Fargo conducted interviews for positions that had already been filled to comply with its disclosed intent that 50 percent of interviewees be diverse for most roles above a certain salary threshold. On April 25, 2025, the court granted the plaintiffs’ motion for class certification. Id. at *8. The defendants’ subsequent petition for Ninth Circuit review was denied. SEB Inv. Mgmt. AB v. Wells Fargo & Co., No. 25-3021, 2025 WL 2028400, at *1 (9th Cir. July 17, 2025). In October 2025, the parties reached an agreement to settle the litigation, and the Court approved the settlement on November 13, 2025. ECF 269.

A. Presuming Reliance Under Basic and Rebutting the Presumption With “Mismatch” Evidence After Goldman.

As we have previously covered, class certification in Rule 10b-5 actions often turns on whether the plaintiffs can invoke the rebuttable presumption of class-wide reliance recognized in Basic Inc. v. Levinson, 485 U.S. 224, 247 (1988). Under Basic, a showing that the challenged securities traded in an efficient market establishes that the price theoretically reflects all material public information, and so investors are afforded the presumption that they relied on challenged statements. Id. In Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258, 263-64 (2014), the Supreme Court held that the Basic presumption could be rebutted by showing a lack of “price impact” of the alleged misrepresentation. And since Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System (Goldman), in “inflation-maintenance” cases, where the plaintiffs infer “front-end” price impact at the time the statements were made from a “back-end” price decline following a corrective disclosure, courts have evaluated whether there is a “mismatch” between the challenged statements and the alleged corrective disclosure. 594 U.S. 113, 119-23 (2021). This analysis is to determine whether the corrective disclosure and challenged statement are similar enough that the later drop can be attributed to a correction of the challenged statement. Id.; see also Arkansas Tchr. Ret. Sys. v. Goldman Sachs Grp., Inc., 77 F.4th 74, 81, 102 (2d Cir. 2023) (explaining that generic front-end challenged statements can create a “mismatch in specificity” when paired with a more concrete back-end disclosure).

As previewed in our mid-year update, the Ninth Circuit in September issued its decision in Jaeger v. Zillow Group, Inc., which is its first decision applying Goldman. In Zillow, the Ninth Circuit affirmed the district court’s class certification order and rejected the defendants’ mismatch challenge to price impact. 2025 WL 2741642, at *1-2 (9th Cir. Sept. 26, 2025). Zillow argued that information allegedly concealed by the challenged statements was not revealed until after the class period and therefore could not support an inference that the challenged statements maintained inflation. Id. But the court disagreed, noting the back-end disclosures “revealed new information” that suggested earlier statements may have been “obscured” and the front-end and back-end statements “matched enough.” Id. at *2. The Ninth Circuit held the district court did not abuse its discretion in concluding the defendants failed to rebut the Basic presumption. Id. Notably, the Ninth Circuit acknowledged that the “price impact” analysis is similar to the merits issue of loss-causation and did not fault the lower court for drawing upon loss-causation caselaw for guidance. Id. at *1.

Lower courts also continue to scrutinize “mismatch” arguments closely, sometimes drawing out incongruities between the alleged front-end misstatement and the purported back-end disclosure. Recently, in Gambrill v. CS Disco, Inc., a magistrate judge in the Western District of Texas walked through such an analysis, resulting in a recommendation to deny class certification after concluding that the defendants had rebutted the Basic presumption because the alleged corrective disclosures did not sufficiently “match” the challenged statements. 2025 WL 3771433, at *7-11, *15 (W.D. Tex. Dec. 16, 2025) (report and recommendation). The recommendation emphasized careful comparison of the exact language the plaintiffs challenged to the purported back-end corrective disclosures, and in this case determined that several of the challenged statements were “quite different” from the back-end disclosures. Id. at *10. The report also noted that other corrective disclosures “d[id] not contradict” the alleged misrepresentations. Id. The magistrate’s report also faulted the plaintiffs’ expert for failing to “tease[] out the impact on [the defendant’s] stock price from the revised earnings guidance as opposed to the allegedly new knowledge” while noting that the plaintiffs’ expert provided no comparison of the front-end and back-end disclosures. Id. at *12.

B. Market Efficiency and “Meme Stock” Dynamics.

In another angle of attack for some securities litigation defendants, the Fifth Circuit has granted interlocutory review under Rule 23(f) in Bozorgi v. Cassava Sciences, Inc., to hear a challenge to class certification under the premise that Cassava’s stock, a so-called “meme stock,” traded in a world divorced from traditional informational efficiency and without regard to whether any new information was disclosed. See Order Granting Motion for Leave to Appeal, Misc. No. 25-90021 (5th Cir. Oct. 21, 2025); see also Defendants-Appellants’ Opening Br. at 1-5, Bozorgi v. Cassava Sciences, Inc., No. 25-50855 (5th Cir. Jan. 15, 2026). Gibson Dunn represents the defendants-appellants.

On appeal, the defendants seek to show the Basic presumption should not apply by establishing that the market for Cassava—which was exceedingly volatile and had huge fluctuations in price during the alleged class period—was not efficient and, therefore, did not incorporate all publicly available information. Defendants-Appellants’ Br. at 3-4. The defendants also argue that even if the market was efficient, the majority of traders were trading on a strategy that rejected the market price’s integrity. Id. The defendants have also framed the appeal to raise related class certification questions, including typicality and whether the plaintiffs offered a class-wide damages methodology consistent with their theory in a market allegedly dominated by meme-stock dynamics. Id. at 5. We will continue to monitor Cassava for what could become the first circuit-level guidance addressing the Basic presumption in the meme-stock context.

C. Other Class Certification Issues: Damages Methodologies.

Finally, in a further update to In re The Boeing Company Securities Litigation, No. 25-1492 (4th Cir.) (originally discussed in our mid-year update), the Fourth Circuit is poised to consider whether plaintiffs can satisfy Comcast Corp. v. Behrend, 569 U.S. 27 (2013), when their expert offers only a generalized framework without a developed class-wide methodology tailored to the plaintiffs’ alleged inflation theory. Oral argument is currently scheduled for March 2026. We will continue to follow developments in Boeing and related appellate cases that may further shape the contours of class certification in securities litigation.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any of the following leaders and members of the firm’s Securities Litigation practice group:

Christopher D. Belelieu – New York (+1 212.351.3801, cbelelieu@gibsondunn.com)

Jefferson Bell – New York (+1 212.351.2395, jbell@gibsondunn.com)

Michael D. Celio – Palo Alto (+1 650.849.5326, mcelio@gibsondunn.com)

Colin B. Davis – Orange County (+1 949.451.3993, cdavis@gibsondunn.com)

Jonathan D. Fortney – New York (+1 212.351.2386, jfortney@gibsondunn.com)

Michael J. Kahn – San Francisco (+1 415.393.8316, mjkahn@gibsondunn.com)

Allison K. Kostecka – Denver (+1 303.298.5718, akostecka@gibsondunn.com)

David M. Kusnetz – New York (+1 212.351.2657, dkusnetz@gibsondunn.com

Jeff Lombard – Palo Alto (+1 650.849.5340, jlombard@gibsondunn.com)

Monica K. Loseman – Co-Chair, Denver (+1 303.298.5784, mloseman@gibsondunn.com)

Brian M. Lutz – Co-Chair, San Francisco (+1 415.393.8379, blutz@gibsondunn.com)

Mary Beth Maloney – New York (+1 212.351.2315, mmaloney@gibsondunn.com)

Mark H. Mixon, Jr. – New York (+1 212.351.2394, mmixon@gibsondunn.com)

Jason J. Mendro – Co-Chair, Washington, D.C. (+1 202.887.3726, jmendro@gibsondunn.com)

Laura K. O’Boyle – New York (+1 212.351.2304, loboyle@gibsondunn.com)

Lissa M. Percopo – Washington, D.C. (+1 202.887.3770, lpercopo@gibsondunn.com)

Jessica Valenzuela – Palo Alto (+1 650.849.5282, jvalenzuela@gibsondunn.com)

Craig Varnen – Co-Chair, Los Angeles (+1 213.229.7922, cvarnen@gibsondunn.com)

© 2026 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Companies and their advisors should continue to monitor these developments closely as they consider how Texas’s evolving corporate ecosystem may contribute to their strategic objectives.

Texas is entering a watershed moment in corporate law and market development. Over just the past few months, the state has attracted headline‑making redomestications, launched multiple nationally significant stock exchanges, and expanded the reach and influence of the Texas Business Court. Together, these developments signal more than incremental progress—they reflect Texas’s accelerating rise as a premier jurisdiction for corporate governance, capital formation, and high‑stakes commercial dispute resolution. For officers and directors evaluating strategic opportunities in 2026, understanding Texas’s rapidly evolving corporate landscape has never been more important.

I. Corporate Redomestications to Texas

A growing number of companies are redomesticating to Texas, drawn by the state’s pro-growth corporate environment, business-friendly regulatory posture, and sophisticated corporate‑law infrastructure. Companies choosing Texas cite several advantages:

- Alignment with operational footprint. Many redomesticating companies already have major headquarters or asset concentrations in Texas, making governance, business and political relations, and litigation more efficient.

- Predictability of statute-based and business-friendly legal environment. Legislative amendments to the Texas Business Organizations Code (TBOC) and the establishment of the Business Court have created an even more stable and modern governance framework. Learn more about the 2025 amendments to the TBOC and related developments in our Guidebook memo, June webcast, and September presentation.

- Comparable or stronger shareholder‑rights regime. Companies have noted that shareholder rights under Texas law parallel other jurisdictions while offering additional clarity in key areas.

Following the amendments to the TBOC in 2025, a few publicly traded corporations with concentrated share ownership (controlled companies) announced plans to redomesticate to Texas, including Dillard’s, Coinbase Global, Inc., and Exodus Movement, Inc. In 2026, additional publicly traded companies that do not have concentrated share ownership and must solicit shareholder approval announced plans to redomesticate to Texas. These include companies such as eXp World Holdings, Inc., Forward Industries, Inc., Texas Capital Bancshares, Inc. and Pelican Acquisition Corporation.

Most notably, on March 10, 2026, Exxon Mobil Corporation announced its plans to redomesticate to Texas from its long-time historic legal home of New Jersey. ExxonMobil’s move to Texas demonstrates confidence in the state’s pro-growth policies and aligns its corporate home with its physical headquarters in greater Houston. Texas has been the company’s physical home since 1989.

In its preliminary proxy statement, ExxonMobil says it believes that Texas’ public policy, generally, is consistent with the company’s values, strategy and efforts to protect and enhance shareholder value. The company also provided supplemental material with key messages and frequently asked questions. “Over the past several years, Texas has made a noticeable effort to embrace the business community. In doing so, it has created a policy and regulatory environment that can allow the company to maximize shareholder value,” said Darren Woods, ExxonMobil chairman and chief executive officer. “Aligning our legal home with our operating home, in a state that understands our business and has a stake in the company’s success, is important.” More specifically, ExxonMobil states that it expects shareholders to benefit from the redomestication to Texas for several reasons. These include, among others:

- Legislators, judges and juries, who may make decisions that impact shareholders’ interests, are generally more familiar with the company’s operations and positive local impact. This makes it more likely that decision makers appreciate the tangible consequences of their decisions.

- Texas’ stable and supportive business environment, reinforced by recent amendments to the Texas Business Organizations Code and the creation of the Texas Business Court, provides legal and regulatory certainty that can benefit long-term shareholder value.

- Texas is one of the largest economies in the world, and ExxonMobil believes the state is deliberate in the creation of its common-sense regulatory environment, which fosters innovation, job creation, and economic growth.

Gibson Dunn is advising ExxonMobil on its redomestication to Texas.

Looking ahead, as more proxy statements are filed for the 2026 annual meetings of shareholders over the next few months, we expect more companies to announce proposed redomestications to Texas as part of the annual meeting agenda. We also expect more companies will explore and pursue plans to redomesticate to Texas as they gain comfort with the passage of time following the TBOC amendments, the use of the Business Court and additional companies choosing Texas. We will continue to monitor this activity and provide updates on our website, which includes a tracker showing completed and pending Texas redomestications.

II. The SEC Weighs In on Redomestications

Increased redomestication activity has caught the attention of market regulators, who have acknowledged the benefits offered by the Texas corporate law regime. Securities and Exchange Commission (SEC) Chairman Paul S. Atkins recently discussed corporate redomestications to Texas at the Texas A&M School of Law Corporate Law Symposium, chaired by Gibson Dunn partner David Woodcock, which took place on February 17, 2026. In his remarks, Chairman Atkins noted that Texas is building a “framework designed to attract companies with shareholders who are eager to get back to basics, with less politicization, abusive litigation, and overall drama.” The Chaiman acknowledged that state corporate law, in conjunction with federal securities law, has the power to “protect shareholders without needlessly paralyzing companies.” He went on to state that competition among states is healthy for the capital markets and drives American prosperity.

In support of redomestication efforts, the SEC has taken steps to limit the potential regulatory burden associated with redomestication. Earlier this year, the Staff of the Division of Corporation Finance at the SEC issued new interpretive guidance affirming that companies wishing to redomesticate within the United States through the formation of a holding company are not required to undertake the time-consuming and costly Form S-4 registration process. Specifically, the Division Staff issued revised Compliance and Disclosure Interpretation 139.03 clarifying that a merger by a publicly traded company with a new holding company formed by that publicly traded company in a different state qualifies for the change-in-domicile exception in Rule 145(a)(2) when the sole purpose of the transaction is to effect a change of domicile within the United States and not to, for example, significantly change regulatory regimes applicable to the organization other than state corporate law.

III. Three Texas Stock Exchanges

Texas now hosts three national securities exchanges, reflecting the state’s growing influence in the national financial sector.

- NYSE Texas, which launched corporate listings on March 31, 2025.

- Nasdaq Texas, which launched corporate listings on March 5, 2026.

- The Texas Stock Exchange (TXSE), the first national securities exchange to receive SEC approval in decades, which plans to launch corporate listings in the second half of 2026.

These stock exchanges have already generated significant interest and action in the business sector and received significant and visible support from the state government. Each fully electronic exchange is building physical headquarters in Dallas, intended as spaces to foster corporate and financial networking and development for Texas leaders, entrepreneurs and innovators.

NYSE Texas has attracted over 100 dual listings since launch. Interested companies may review the NYSE Texas Rules and complete the NYSE Texas Listing Application directly through the website. In September 2025, WaterBridge Infrastructure LLC, a Houston headquartered energy company, became the first company to IPO on both the NYSE and NYSE Texas.

Nasdaq Texas launched with dual-listed companies that are headquartered both within and without Texas. Interested companies may review the Nasdaq Texas Rulebook and follow the listing process detailed in the Nasdaq Listing Center on the website.

The Texas Stock Exchange (TXSE) is targeting July 2026 for initial primary listings, starting each day with the sound of a cannon instead of a bell. The proposed TXSE Rulebook (submitted with the exchange’s approval application to the SEC) and listing qualification information is available, although the final rulebook has not yet been made available.

Dual listing on NYSE Texas or Nasdaq Texas is a relatively simple process and does not currently create significant incremental regulatory requirements. Personnel at all the exchanges are easy to contact to answer questions about requirements or help with applications.

In connection with listing on a new exchange, a company should take certain steps under SEC rules and regulations, such as (1) filing a Form 8-A 12B with the SEC relating to the expected new stock exchange listing under the Securities Exchange Act of 1934, (2) updating its Edgar profile, and (3) updating the list of stock exchanges on the cover page of the next Forms 10-K and 10-Q and Part II, Item 5 of Form 10-K.

Having multiple stock exchanges based in Texas can give more options to Texas corporations that want to take advantage of the law that allows “nationally listed corporations” to impose enhanced shareholder-proposal requirements. A “nationally listed corporation” is a publicly traded Texas corporation that has either (i) its principal office in Texas or (ii) a listing on a Texas-headquartered stock exchange that has been approved by the Texas Securities Commissioner. If this definition applies, then the corporation may opt into Section 21.373 of the TBOC and require that shareholders seeking to submit a proposal (1) beneficially own at least the greater of $1 million in shares or 3% of the company’s voting shares, (2) hold such shares for at least six months prior to the shareholder meeting, (3) continue holding such shares through the duration of the meeting, and (4) solicit holders representing at least 67% of the voting power of shares entitled to vote. To date, TXSE and NYSE Texas are each approved by the Texas Securities Commissioner, and Nasdaq Texas is seeking approval. As such, in order to opt into TBOC 21.373 well before the 2027 proxy season, the corporation will need to be incorporated in Texas with either (a) its headquarters in Texas or (b) its stock listed or dual listed on Nasdaq Texas (assuming approval referenced above is received), NYSE Texas or the Texas Stock Exchange (TXSE).

Together, these Texas-based national stock exchanges’ innovation and initiative, and the State government’s strong and swift support of them, reinforces Texas’ reputation as a pro-business destination, potentially accelerating the ongoing trend of corporate relocations from other states and solidifying Texas’ role as an economic powerhouse.

IV. The Texas Business Court

The Texas Business Court has continued to stake a larger role in the Texas judiciary and business community. Companies can now remove most derivative, corporate-governance, securities, contract, and trade secret disputes to Business Court, where the case will be presided over by a judge with heightened business qualifications and a lighter caseload than their district court counterparts. The growing prominence of the Business Court and its business-friendly forum for resolving complicated disputes has been a further inducement for companies to re-domesticate in Texas. Many companies have cited the Business Court as reason for leaving Delaware or other states and reincorporating in Texas—such as cryptocurrency giant Coinbase, in whose view “the establishment of the Texas Business Court system gives companies a business-friendly legal ecosystem with strong protections and efficient dispute resolution.” (Paul Grewal, Why Coinbase Is Leaving Delaware for Texas, Wall St. J. (Nov. 12, 2025)).

Since its creation in September 2024 using legislation Gibson Dunn attorneys authored, the new court has lived up to its goal of offering businesses a more efficient and predictable forum for high-stakes commercial litigation. (For more detailed information, see Gibson Dunn’s memorandum on the basics of the Business Court or its webcast on practice before the court.) Industry has trusted the Business Court with their most sensitive cases and filed hundreds of cases in the first year, including many actions with eight-, nine-, and ten-figure sums in controversy. And the new court has rewarded that trust with efficient and careful management of the cases on its docket, issuing dozens of written opinions in an effort to develop a more stable and predictable body of corporate law. Likewise, in the last several months, the Business Court presided over its first four trials—all of which occurred less than 18 months after the cases were initially filed, and in some instances as fast as just 8 months.

The Texas Legislature recently implemented reforms to the Business Court and Texas corporate law that enhance Texas’s desirability as a legal forum. During the 89th legislative session in 2025, the legislature passed House Bill 40, which expands the Business Court’s jurisdiction to additional categories of claims, and broadens active Business Court divisions to include Montgomery and Bastrop Counties—growing centers of industry. These amendments open the Business Court to a larger percentage of corporate disputes and strengthen the protections afforded to Texas businesses under state law.

Decisions in the first year-and-a-half of practice in the Business Court have cemented Texas as a reliable home for business disputes. In one of the most significant decisions so far, the Business Court upheld a partnership’s right to limit fiduciary duties to the maximum extent allowed under Texas law. Primexx Energy Opp. Fund, LP v. Primexx Energy Corp., 709 S.W.3d 619 (Tex. Bus. Ct. 1st Div. 2025). Other rulings, including one obtained by Gibson Dunn Houston partners Gregg Costa and Sydney Scott, upheld in-house counsel’s immunity from civil liability for actions taken in their legal capacity. In re Jackson, No. 25-15-235-CV, 2026 WL 524404 (Tex. App.—15th Dist. Feb. 23, 2026).

In keeping with the court’s goal of deciding high-stakes commercial cases, in a timely manner, the Business Court recently presided over its first four trials.[1] The court completed each of these trials less than 18 months after the case was filed—a stark improvement from ordinary district court practice where it is not uncommon for complex business cases to remain pending for years. The court, with dedicated law clerks, also furthered the mission of developing a stable body of corporate law by issuing detailed written opinions explaining its decisions, rather than the historical trial-court practice of summary rulings. See, e.g., Mesquite Energy Inc. v. Sanchez Oil & Gas Corp., —S.W.3d—, 2026 WL 612263 (Tex. Bus. Ct. 11th Div. Mar. 4, 2026) (in a case led by Gibson Dunn Houston partner Collin Cox, ruling in favor of Gibson Dunn’s client in a case concerning the distribution of settlement proceeds from a prior trade-secrets lawsuit involving formerly related energy companies).

V. Key Takeaways for Companies and Boards Considering Redomestication to Texas

- Assess potential benefits of redomestication, including Texas’ pro-business culture, access to the Texas Business Court, and whether alignment of operations and corporate domicile could increase governance efficiency.

- Evaluate how Texas’ corporate statutes and case law compare to your current jurisdiction—consider predictability of statute-based approach, elective provisions under TBOC, and Business Court jurisprudence.

- Understand SEC process and guidance on redomestication structures, including as related to holding company structures, to ensure proper planning and compliance during shareholder approval and transition processes.

- Texas’ “nationally listed corporation” provisions may permit enhanced shareholder‑proposal thresholds—an important consideration for companies weighing a Texas redomestication and a Texas headquarters or a Texas stock exchange listing.

- Multiple Texas exchanges create new opportunities for dual listings that are relatively simple to execute, and may influence discussions around investor engagement, liquidity, and regulatory strategy.

- The Texas Business Court offers faster case resolution and judges with deep business-law expertise, which may influence venue strategy in governing documents and future contracts.

Conclusion

Corporate redomestications, the establishment of multiple stock exchanges, and the continued development of the Texas Business Court collectively signal a transformative period for Texas’s corporate landscape. Texas continues to emerge as an alternative to traditional corporate jurisdictions. Companies redomesticating to Texas have emphasized that Texas offers companies a compelling value proposition: legal predictability, business-friendly policies, and robust capital markets infrastructure.

The first quarter of 2026 represents not a culmination, but rather an inflection point in Texas’ development as a national leader in corporate governance, capital markets, and commercial dispute resolution. Continued redomestications, decisions in the Business Court, and potential additional refinement of the TBOC in the 80th Legislature are expected to strengthen Texas’s competitive position. Companies and their advisors should continue to monitor these developments closely as they consider how Texas’s evolving corporate ecosystem may contribute to their strategic objectives.

[1] See Marathon Oil Co. v. Mercuria Energy Am. LLC, No. 25-BC11A-0013 (Tex. Bus. Ct. 11th Div.); Mesquite Energy Inc. v. Sanchez Oil & Gas Corp., No. 24-BC11B-18 (Tex. Bus. Ct. 11th Div.); Antero Resources Corp. v. Stonewall Gas Gathering, LLC, No. 24-BC11A-0027 (Tex. Bus. Ct. 11th Div.); Powers v. Axis Midstream Holdings, LLC, No. 24-BC11A-0025 (Tex. Bus. Ct. 11th Div.).

Gibson Dunn will continue to provide thought leadership on Texas developments, providing the unique advantage of deep expertise across Texas corporate law, corporate governance, federal securities regulation, shareholder proposals, Texas litigation, and Texas political strategy. Clients and friends will find helpful resources through publications, CLE presentations, and other literary or speaking engagements, including on our Texas Corporate Law resources website.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Texas team or its Capital Markets, Mergers & Acquisitions, Securities Regulation & Corporate Governance, or Litigation practice groups, or any of the following:

Hillary H. Holmes – Co-Managing Partner, Houston Office, and Co-Chair, Capital Markets Group Firmwide | Houston & Dallas (+1 346.718.6602, hholmes@gibsondunn.com)

Gerry Spedale – Partner, Capital Markets Group,

Houston (+1 346.718.6888, gspedale@gibsondunn.com)

Ronald O. Mueller – Co-Founder, Securities Regulation & Corporate Governance Group,

Washington, D.C. (+1 202.955.8671, rmueller@gibsondunn.com)

Collin J. Cox – Co-Managing Partner, Houston Office, Litigation Group,

Houston (+1 346.718.6604, ccox@gibsondunn.com)

Gregg Costa – Co-Chair, Trials Group,

Houston (+1 346.718.6649, gcosta@gibsondunn.com)

Trey Cox – Co-Managing Partner, Dallas Office, and Co-Chair, Global Litigation Group,

Dallas (+1 214.698.3256, tcox@gibsondunn.com)

David Woodcock – Co-Chair, Securities Enforcement Group,

Dallas & Washington, D.C. (+1 214.698.3211, dwoodcock@gibsondunn.com)

© 2026 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Gibson Dunn announces release of Global Investigations Review’s The Guide to Multilateral Development Bank Investigations – Second Edition

Gibson Dunn is pleased to announce with Global Investigations Review the release of GIR’s The Guide to Multilateral Development Bank Investigations – Second Edition. Gibson Dunn partners Michael Diamant and Oleh Vretsona and of counsel Pedro Soto are contributing editors of the publication, which provides a comprehensive analysis of MDB integrity, bringing together perspectives from legal practitioners, consultants and MDBs with the aim of fostering greater accountability and collaboration in the fight against misconduct in MDB-financed projects. The Guide, comprised of 4 sections, is live and published free-to-view on the GIR website HERE.

Mr. Diamant, Mr. Vretsona, and Mr. Soto jointly authored the article on “Avoiding common pitfalls in multilateral development bank audits on the path to effective settlement of allegations.”

Gibson Dunn has one of the most experienced practices in defending companies and individuals in MDB investigations.

You can view the informative and comprehensive articles via the links below:

CLICK HERE to view The Guide to Multilateral Development Bank Investigations – Second Edition

CLICK HERE to view Avoiding common pitfalls in multilateral development bank audits on the path to effective settlement of allegations

This article was first published on Global Investigations Review in February 2026; for further in-depth analysis, please visit GIR The Guide to Multilateral Development Bank Investigations – Edition 2.