Corporate Resolutions 2025 Year-End Update

Client Alert | February 3, 2026

This update analyzes corporate criminal enforcement in 2025 by the numbers and in context of the new United States Presidential Administration’s priorities and policy initiatives.

The change in United States Presidential Administrations in early 2025 involved immediate and significant pronouncements regarding a re-orientation of the U.S. government’s corporate criminal and civil enforcement priorities. Many commentators projected that these policy statements would result in dramatic changes in how the government pursues criminal and civil investigations, and in how corporate subjects and defendants might approach resolving those investigations. Many also raised questions whether corporate enforcement overall would sharply decline. Given the timelines of investigations and corporate enforcement actions, it is too early to comprehensively assess the impact of these changes. The incubation of complicated criminal investigations is quite extended and always slows in Administration changes. By the numbers and consistent with our experience handling government investigations for a wide range of clients, total corporate resolutions in 2025 notably did not dramatically depart from prior years—although overall recoveries were lower than in recent years.

Gibson Dunn’s tally closed out the year in corporate enforcement with 74 public declinations, declinations with disgorgement, non-prosecution agreements (NPAs), deferred prosecution agreements (DPAs), and corporate guilty pleas from the U.S. Department of Justice (DOJ), as compared to 2024’s 104, and 2023’s 83, total corporate agreements. This is also sufficient data for us to at least begin to place enforcement actions in the context of the Administration’s early policy pronouncements, and we offer some preliminary observations along these lines in the sections that follow.

In particular, in this client alert, we: (1) report key statistics regarding corporate resolutions, including an analysis of NPAs, DPAs, and Corporate Enforcement and Voluntary Self-Disclosure Policy (CEP or Corporate Enforcement Policy) declinations from 2000 through 2025 and of corporate guilty pleas between 2022 and 2025, based on data compiled by Gibson Dunn; (2) assess developments in DOJ enforcement policy and priorities in 2025, as well as how completed enforcement actions fit within those priorities; and (3) survey recent developments in DPA- and plea agreement-like regimes in select international jurisdictions. We conclude this update with a table describing key information from the 74 corporate agreements executed in 2025, and attach an Appendix summarizing them in greater detail.

Key Statistics

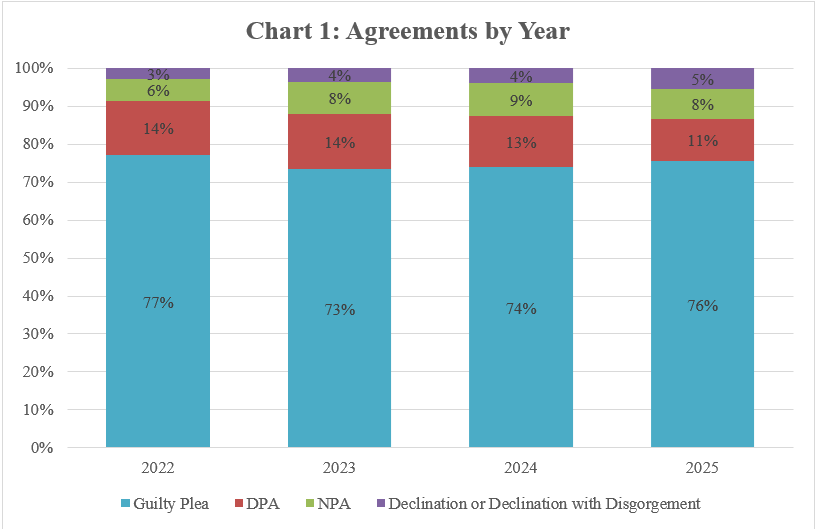

Chart 1 reflects the relative mix of NPAs, DPAs, declinations and declinations-with-disgorgement, and guilty pleas since we began tracking plea agreements in 2022. As a reminder, declination-with-disgorgement is a rather new resolution vehicle that falls between a traditional declination and an NPA.

|

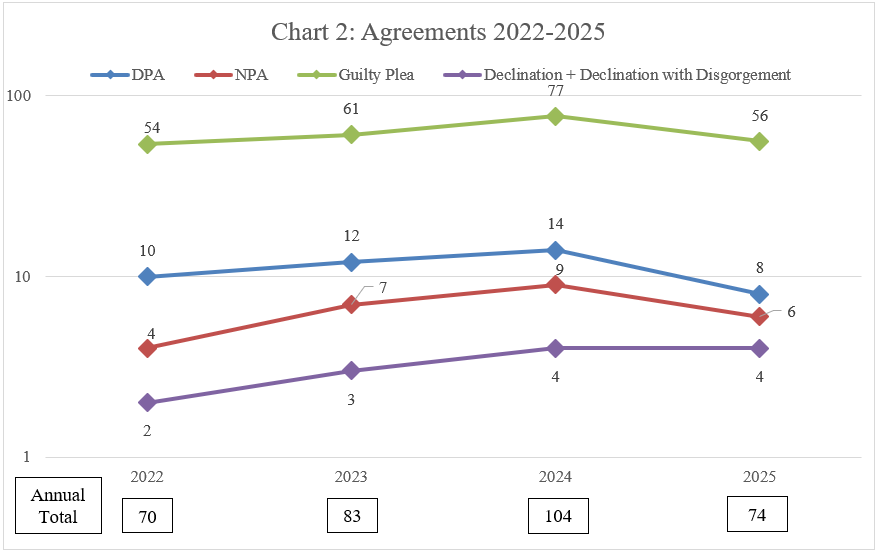

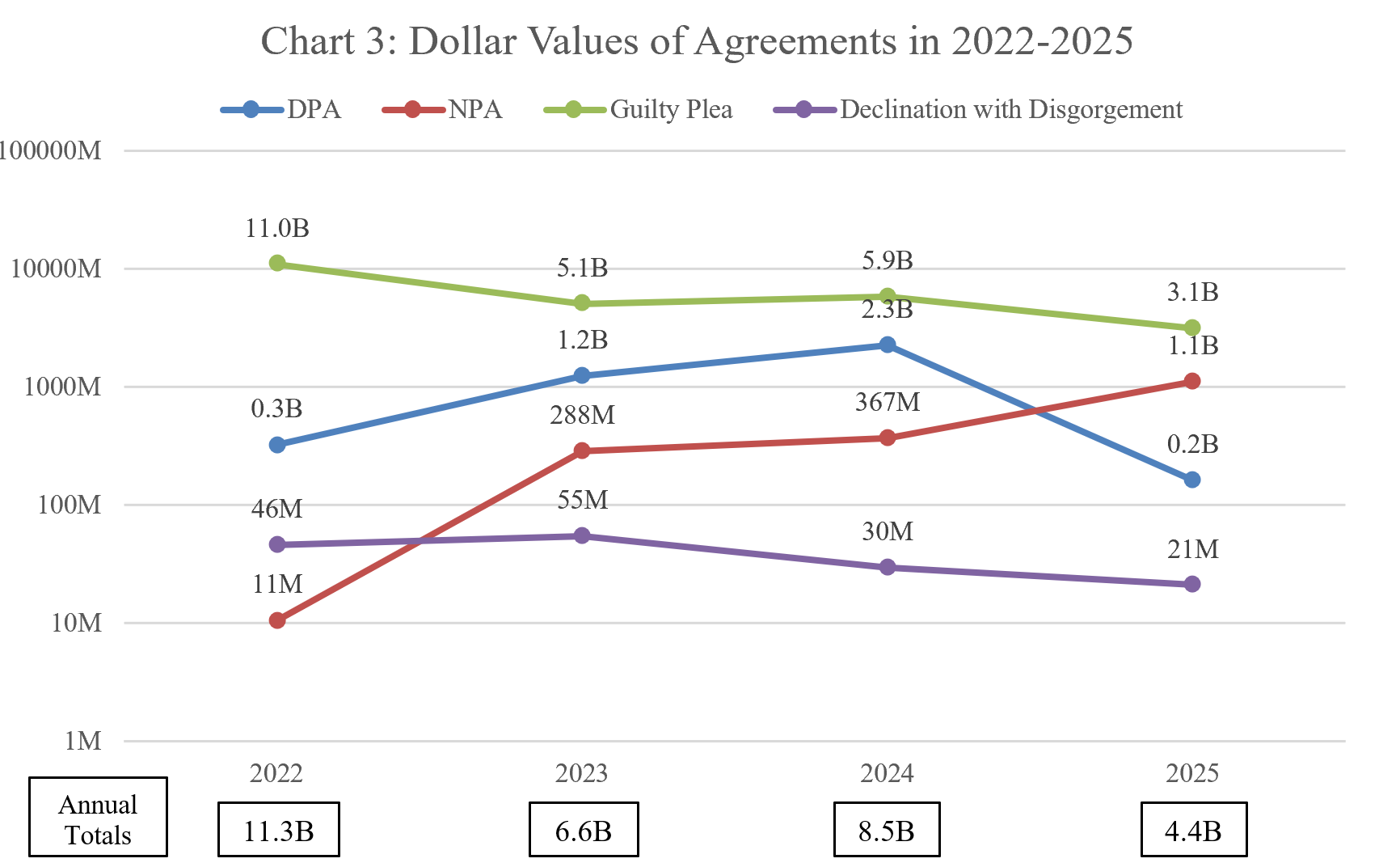

Charts 2 and 3 below focus on 2022 through 2025, and show the numbers of DPAs, NPAs, plea agreements, and declinations with disgorgement in those years, as well as recoveries associated with each category of agreement.[1] These charts illustrate that while DOJ has used all forms of resolution, the relative proportion of guilty pleas to other forms of resolution has not changed significantly in the three years, with 2–3% movement in each category. Consistent with the higher number of plea agreements relative to other forms of resolution, recoveries associated with guilty pleas also have always been highest. At $3.1 billion, recoveries associated with plea agreements in 2025 more than doubled those associated with NPAs, DPAs, and declinations with disgorgement, at a ratio of 2.4. Overall recoveries across categories, at $4.4 billion, are down since 2024, when they totaled approximately $8.5 billion, continuing an overall downward trajectory since we began tracking all categories in 2022.

|

[Values shown on a logarithmic scale.]

|

[Values shown on a logarithmic scale.]

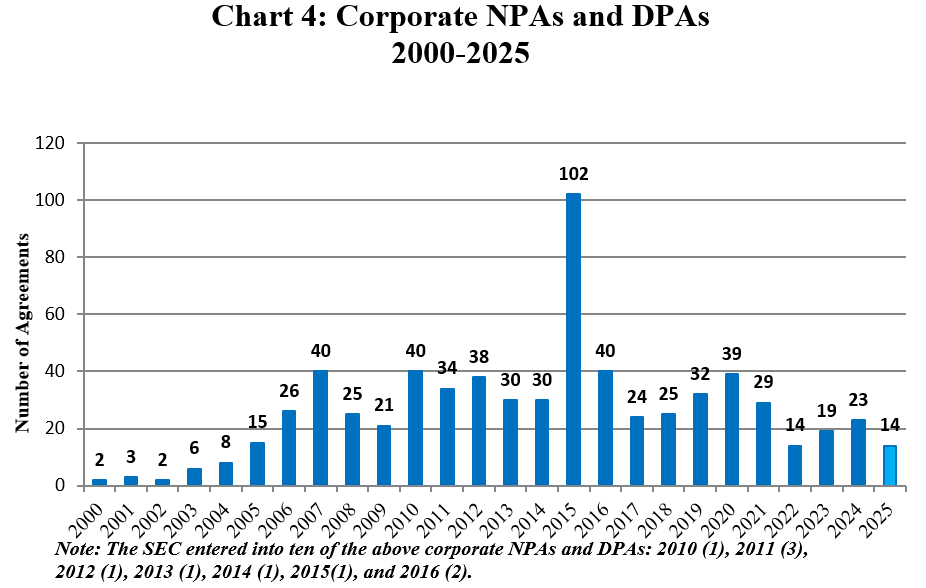

Chart 4 below reflects the NPAs and DPAs that Gibson Dunn has identified through public-source research from 2000 through the end of 2025. Of the 14 total agreements in 2025, there were eight DPAs and six NPAs. The SEC, consistent with its trend since 2016, did not enter any NPAs or DPAs in 2025.

|

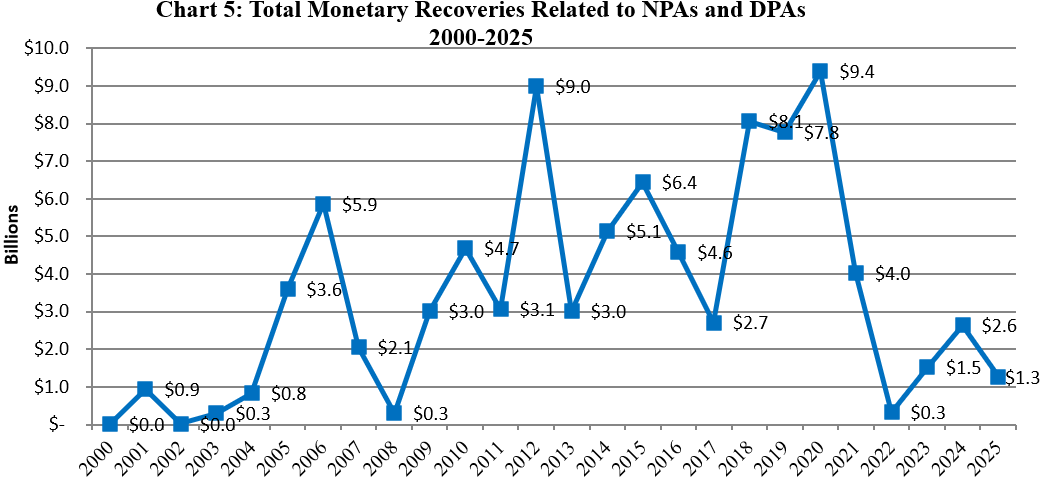

Chart 5 reflects total monetary recoveries related to publicly available NPAs and DPAs from 2000 through the end of 2025. At approximately $1.3 billion, 2025 recoveries associated with DPAs and NPAs are lower than those in 2023 and 2024 and continue their overall downward trend, ranking as the 19th lowest of our 26 years of annual totals.

|

Although it would be impossible to determine with certainty the root cause of the relative decline in NPAs and DPAs that began around 2022, the shift coincided with significant updates announced in the September 2022 Monaco Memorandum (which we analyzed in depth in our October 3, 2022 publication) that broadened policies on voluntary self-disclosure and signaled a meaningful pivot in prosecutors’ charging assessments and continued with remarks earlier this year by then-Head of the Criminal Division, Matthew Galeotti.

We note a few statistics and possible trends, although it is difficult to say whether they reflect any shift in focus, standards, or priorities of the current administration. Indeed, the flat line of some of these statistics remaining constant may prove just as informative as other increasing or decreasing trends. In addition, the continued substantial corporate investment from the last 25 years pays dividends of fewer systemic investigations.

- Since 2022, all “blockbuster” resolutions involving criminal penalties and forfeiture totaling $1 billion or more across parallel criminal and civil settlements involved plea agreements—with three in that category in 2022, one in 2023, three in 2024, and one in 2025. Looking back over time, we note six NPAs and DPAs involving criminal penalties of $1 billion or more, between 2009 and 2020, although two of these resolutions involved ancillary guilty pleas by subsidiaries or affiliated companies.

- Six resolutions in 2025 cited voluntary disclosure. They were pursued by a broader group of prosecuting offices than the prior year, and present a more complex range of results, ranging from a declination and declinations with disgorgement (three) to NPAs (two). Insofar as these cases almost certainly involved voluntary self-disclosures during the prior administration, it is difficult to read too much into these outcomes, and time will tell whether there is any shift in this Administration’s approach to voluntary self-disclosure.

- Historically, corporate declinations or declinations with disgorgement publicly announced pursuant to DOJ Criminal Division’s Corporate Enforcement and Voluntary Self-Disclosure Policy (“CEP”) since 2016 involved the Fraud Section. While this technically remained true in 2025, with the Fraud Section announcing three declinations under the CEP, DOJ’s National Security Division (“NSD”) also issued two declinations in 2024 and one declination in 2025 under its parallel NSD Enforcement Policy for Business Organizations, which NSD revised in 2024. While the number of announced declinations with disgorgement has remained fairly constant over the past four years, the three traditional declinations (i.e., without disgorgement) announced in 2024–2025 reflect an increase from prior years, which had not featured such declinations since 2019.

- The Criminal Division of Main Justice has continued to feature heavily in DPAs, NPAs, and declinations with disgorgement following DOJ’s underscoring in 2023 that the CEP applied to all corporate criminal matters. Since 2018, when DOJ expanded the predecessor to the CEP to reach beyond the Foreign Corrupt Practices Act (“FCPA”), the Criminal Division’s Fraud Section has been involved in approximately one-third (75) of all announced (215) DPAs, NPAs, and declinations with disgorgement (35%). Since 2023, it has been involved in 33 of all 261 corporate resolutions of any type, resulting in total resolution amounts of $6.9 billion. For its part, the Money Laundering, Narcotics and Forfeiture Section (“MNF,” previously known as the Money Laundering and Asset Recovery Section, “MLARS”) of DOJ’s Criminal Division has participated in five resolutions from 2022 through 2025, resulting in total resolution amounts of $6.4 billion.

- For plea agreements, a similar distinction goes to environmental-related prosecutions. Of the 248 corporate guilty pleas publicly announced from 2022–2025, 87 (35%) involved DOJ’s Environmental Natural Resources Division and/or the Environmental Protection Agency.

- DOJ’s Antitrust Division had eight public NPAs and DPAs in 2020-21, three in 2023, and none in 2022, 2024, and 2025. But in 2022–2025, it also entered 17 plea agreements—adding two in 2025. Of these plea agreements, 12 were tied to schemes publicly disclosed in years prior.

- Approximately 51% (362) of all 709 corporate DPAs, NPAs, and public declinations in our 26 years of data involve an allegation or charge of fraud of some sort, ranging from bank or mail fraud to FCPA violations. Since we began tracking plea agreements in 2022, the percentage is slightly lower at 30%, i.e., 100 of the total 331 negotiated corporate resolutions—55 of which were guilty pleas.

- U.S. Attorneys’ Offices continue to play an important role in corporate prosecutions, which were historically concentrated in the biggest DOJ offices or Main Justice units. 85% of 2025’s 74 corporate negotiated resolutions involved a U.S. Attorney’s Office.

- Monitoring obligations, whether in the form of an independent monitor or self-reporting, have continued to feature in corporate resolutions at approximately the same rate for three of the past four years. As a percentage, 23–52% of all publicly reported DPAs, NPAs, and declinations for which data is available for each year between 2022 and 2025 included a monitoring obligation: 25% in 2022, 23% in 2023, 52% in 2024, and 39% in 2025. While these percentages reflect a steep decline from the prior three years, which ranged from 59–73% (59% in 2019, 73% in 2020, and 69% in 2021), monitorships and self-reporting are not extinct. That said, as discussed in more detail below, in 2025, DOJ terminated several monitorships early and also instituted policy to reduce and narrow the imposition of monitorships.

Gibson Dunn negotiated one of the first DPAs by Main Justice on December 30, 2001 – almost 25 years ago. In the last 25 years, the template forms remain varied and it remains that there is no DOJ-required template across divisions and U.S. Attorneys’ Offices. The evolution in form, structure, and elements of corporate resolutions will no doubt continue. As noted, more than 20 years ago, Gibson Dunn led the dramatic shift toward increased use of NPAs and DPAs in corporate cases and has recently been at the forefront of convincing DOJ to allow more self-monitoring and addressing the apparent shift back toward plea agreements.

2025 Developments in DOJ Corporate Enforcement Policy, in Context

2025 saw a significant overhaul in DOJ’s approach to corporate enforcement, with new stated focuses on immigration, anti-cartel operations, and preventing and punishing harms to ordinary consumers and investors. At the same time, DOJ announced an intent to reduce the impact of government investigations on law-abiding companies and to reward voluntary disclosures and cooperation with well-defined benefits earned according to objective criteria.

This new approach was foreshadowed in two policy memoranda issued by Attorney General Pamela Bondi on February 5, 2025. The first of these rescinded a prior memorandum from the former Attorney General entitled Issuance and Use of Guidance Documents by the Department of Justice (July 1, 2021).[2] The second memorandum, titled Total Elimination of Cartels and Transnational Criminal Organizations, directed DOJ to “work urgently” to “eliminat[e] these threats to U.S. sovereignty,” and signaled the Attorney General’s intent to empower U.S. Attorneys’ Offices to investigate and prosecute cases with less direct involvement by Main Justice.[3] These memoranda were followed, on May 12, 2025, by an announcement from DOJ’s Criminal Division that it was “turning a new page” in its approach to white collar and corporate enforcement.

The Criminal Division in parallel issued four foundational guidance documents:

- A memorandum[4] outlining the new White-Collar Enforcement Plan (“Enforcement Plan”);

- An update[5] to the Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy (“Corporate Enforcement Policy”);

- An update[6] to the Department of Justice Corporate Whistleblower Awards Pilot program, and;

- An updated memorandum[7] describing the process for implementing monitorships and selecting monitors (collectively, the “May 12, 2025 Guidance Documents”), which we reported on in a client alert issued on May 19, 2025.

The Enforcement Plan memorandum identified three principles of criminal enforcement that would guide DOJ’s efforts, “focus, fairness, and efficiency,” for which we provide additional details, and which we analyze in the context of 2025’s enforcement actions, below.

Focus – Enforcement Priorities in Context

The Enforcement Plan stated that the Criminal Division will be “laser-focused on the most urgent criminal threats to the country,” and listed ten high-impact areas that the Criminal Division will prioritize investigating and prosecuting to combat those harms.[8] Given some thematic overlap in the ten areas, for purposes of analysis, we have reduced these priorities to nine key topics: (1) Healthcare, Procurement, Investor, and Consumer Fraud, (2) Foreign Bribery Enforcement, (3) National Security Offenses, (4) Tariffs and Customs Enforcement, (5) Money Laundering Enforcement, (6) Fraud Cases with Individual Victim Losses, (7) Federal Food, Drug, and Cosmetic Act Enforcement, (8) Focus on China, and (9) Digital Assets.[9] We address each below, noting how these enforcement areas have fared in view of publicly announced corporate criminal resolutions in 2025.

Overall, across the criminal resolutions we have tracked this year, enforcement activity has partially aligned with DOJ’s stated priorities, with certain areas showing more activity than others. The strongest follow-through is seen in national security and China-related matters, where DOJ has brought multiple export control and sanctions cases, a number of which have involved Chinese-affiliated entities. We also have noted a strong follow-through in bringing cases relating to healthcare fraud, with multiple resolutions focused on Medicare and Medicaid fraud.

By contrast, other areas of priority have not resulted in notable shifts in the numbers of related corporate resolutions. For example, the DOJ has brought forth a limited number of corporate criminal prosecutions relating to transnational criminal organizations, immigration, controlled substances, and fraud harming individual victims. Most prosecutions in these priority areas have targeted individuals rather than corporations. Overall, enforcement in 2025 did not greatly shift in light of DOJ’s new priorities, but it is the early days in the new Administration, and we will continue to monitor these areas to see how they evolve, over the coming months and years.

- Healthcare, Procurement, Investor, and Consumer Fraud

To address “[r]ampant health care fraud and program and procurement fraud,” the Enforcement Plan stated that the “Criminal Division will lead the fight in holding accountable those who exploit these programs and harm the public fisc for personal gain.”[10] The focus on health care and procurement fraud aligns with recent Executive Orders of President Trump on these topics,[11] and we have indeed seen criminal enforcement activity consistent with a prioritization of the healthcare fraud space. 2025’s public enforcement actions included seven criminal resolutions targeting misconduct in this space.[12]

This demonstrates an increase in enforcement activity relating to healthcare fraud compared to previous years. In 2024, we identified four criminal resolutions relating to healthcare fraud, and in 2023, we identified one. In 2025, almost all corporate resolutions in this area involved allegations that companies engaged in fraud related to Medicare and Medicaid, such as submitting fraudulent claims and thereby improperly diverting federal funds.[13]

As a further enhancement of its healthcare enforcement capabilities, the Criminal Division announced on September 23, 2025, that it would be expanding its Health Care Fraud Unit’s New England Strike Force, to include resources in the District of Massachusetts.[14] The move was intended to bring more enforcement resources to Massachusetts, “accelerat[ing] the detection, investigation, and prosecution of complex fraud crimes.”[15] Boston is a prominent hub for healthcare institutions, life sciences companies, and startups, and the U.S. Attorney’s Office for the District of Massachusetts already has an elite reputation in health care fraud enforcement.[16] The U.S. Attorney’s Office there has been a leader for more than a decade, charging a wide variety of healthcare fraud cases. At the time of the press release for the Strike Force expansion, its Health Care Fraud Unit and Affirmative Civil Enforcement Unit had already recovered over $450 million in fraudulently obtained funds in FY 2025.[17] The Administration’s sharp focus on fraud has continued into 2026, with the White House announcing formation of a new DOJ Division for National Fraud Enforcement—a development that we are following closely.[18]

- Foreign Bribery Enforcement

Following President Trump’s February 10, 2025 Executive Order[19] pausing enforcement of the Foreign Corrupt Practices Act,[20] on May 12, 2025, the Criminal Division released Guidance Documents resuming the prosecution of cases involving foreign bribery. On June 9, 2025, DOJ rolled out updated guidance for FCPA enforcement in the form of a memorandum to the Head of the Criminal Division, issued by Deputy Attorney General Todd Blanche (the “June 9 Blanche Memo”).[21] The Enforcement Plan asserted that the Criminal Division would take a targeted approach to protect American interests, prioritizing offenses that include “[b]ribery and associated money laundering that impact U.S. national interests, undermine U.S. national security, harm the competitiveness of U.S. businesses, and enrich corrupt foreign officials.”[22] The June 9 Blanche Memo expanded upon this framing, laying out a “non-exhaustive” list of factors that the Criminal Division will balance in deciding whether to prosecute FCPA offenses, with no single factor being “necessary or dispositive.”[23] The list includes whether the alleged misconduct: (1) “is associated with the criminal operations of a Cartel or TCOs (Transnational Criminal Organizations),” “utilitizes money launderers or shell companies that engage in money laundering for Cartels or TCOs,” or “is linked to employees of state-owned entities or other foreign officials who have received bribes from Cartels or TCOs;” (2) “deprived specific and identifiable U.S. entities of fair access to compete”; (3) “involves key infrastructure or assets”; or (4) “bears strong indicia of corrupt intent tied to particular individuals and serious misconduct.”[24]

As discussed further in our 2025 FCPA Year-End Update, despite the FCPA enforcement “pause,” other indicators, including the guidance discussed directly above and individual FCPA charges, suggest that FCPA enforcement is shifting but not gone altogether. There were only two corporate criminal FCPA resolutions in 2025 from which to draw conclusions about how the new FCPA Guidelines will be implemented going forward. For the first, a declination with disgorgement, the facts in the declination letter (as is typical of such documents) were too brief to identify which (if any) of the four FCPA Guideline factors apply. The second and final corporate FCPA resolution, a DPA with Comunicaciones Celulares S.A., d/b/a TIGO Guatemala (“TIGO”), highlighted an alleged connection between the conduct and a cartel or TCO. According to the criminal information, TIGO used the services of a banker who also allegedly laundered money for narcotraffickers and who used cash from illegal drug sales to pay bribes. Thus far, there have not been any concluded corporate FCPA enforcement actions highlighting any of the other three factors.

- National Security Offenses

In a memorandum[25] issued on her first day in office, Attorney General Bondi temporarily suspended requirements that the NSD approve most terrorism and International Emergency Economic Powers Act (“IEEPA”) charges brought by U.S. Attorney’s Offices, for the express purpose of promoting “aggressive” prosecution of such offenses.[26] (That 90-day suspension has since elapsed.) The May 12, 2025 Guidance Documents prioritized criminal enforcement of national security offenses, including terrorism and sanctions evasion.[27] They also emphasized that terrorism includes a focus on “recently designated Cartels and TCOs,”[28] a theme on which Mr. Galeotti expanded during remarks on September 17, 2025, in which he referenced cartels and TCOs, particularly those operating in “Mexico and the Western Hemisphere” as among the “key threats to the United States.”[29] In this same speech, Mr. Galeotti further emphasized an enforcement focus on the national security threats presented by “rogue nation-states like North Korea and Iran.”[30]

Recognizing that complex investigations and enforcement actions can take years to complete so investigations initiated in 2025 may not become public for some time, we note that several public cases this year have included a national security focus, with two declinations and three guilty pleas announced that involved companies admitting to violating U.S. export controls and sanctions laws such as the International Emergency Economic Powers Act, the Trading with the Enemy Act, and the Export Control Reform Act (“ECRA”). Another notable example is the November 2025 Comunicaciones Celulares S.A. DPA relating to an alleged government bribery scheme involving the proceeds of narcotrafficking (although we note that this matter was under investigation for many years preceding the DPA).[31]

- Tariffs and Customs Enforcement

The May 12, 2025 Guidance Documents also made clear that the Criminal Division will prioritize violations of tariff and customs laws.[32] Investigations of such violations were listed as priorities in the Enforcement Plan, and the updated whistleblower program added such violations as express subject areas for whistleblower rewards.[33] These updates added to other indications by the Trump Administration that tariff enforcement would be heavily emphasized, as Gibson Dunn previously covered in client alerts here and here.

Consistent with this focus, on August 29, 2025, DOJ announced a new “Trade Fraud Task Force” to increase enforcement actions against parties who unlawfully import prohibited goods or seek to evade tariffs and other duties.[34] The announcement contained few specifics about the membership or authority of the task force, but as reported by Civil Division Deputy Assistant Attorney General Brenna Jenny, it aims to “enhance[] coordination and information sharing with [the Division’s] law enforcement colleagues.”[35] The announcement indicated that the task force is in furtherance of the administration’s “America First Trade Policy,” and it will encompass civil claims under the Tariff Act of 1930 and the False Claims Act as well as criminal prosecutions under Title 18’s trade fraud and conspiracy provisions.[36]

The announcement also welcomed referrals by those in industries harmed by unfair trade practices and encouraged cooperation through use of the Criminal Division’s Corporate Whistleblower Program.[37] We discussed several other potential implications of the program in a September 8, 2025 client alert. Thus far, it appears that no criminal enforcement actions have been taken against corporate entities that involve alleged violations of tariffs or customs laws; corporate resolutions involving alleged customs and tariffs evasion have been limited to civil settlements.

- Money Laundering Enforcement

Under the principles of the May 12, 2025 Guidance Documents, the Criminal Division will continue to prosecute cases involving violations of applicable money laundering laws, with a particular focus on complex money laundering and offenses that implicate U.S. sanctions.[38] The Enforcement Plan decried “exploitation of our financial system” that can “enable underlying criminal conduct,” and warned that “[f]inancial institutions, shadow bankers, and other intermediaries aid U.S. adversaries by processing transactions that evade sanctions.”[39] The updated whistleblower program also maintains the Department’s focus on violations by financial institutions or their employees for schemes involving money laundering and violations of the Bank Secrecy Act.[40]

In 2025, the US government resolved four money laundering-related corporate investigations, of which three were concluded before issuance of the May 12, 2025 Guidance Documents.[41] After May 12, 2025, the DOJ Criminal Division secured a guilty plea for violations related to effective AML programs, operating an unlicensed money transmitting business, and violating the Travel Act.[42] Given the limited data points, it is too early to tell how DOJ’s express focus on money laundering enforcement will play out as compared to historical practice.

- Fraud Cases with Individual Victim Losses

In line with the Criminal Division’s focus on vindicating the rights of victims impacted by white collar and corporate crime, the Enforcement Plan also tasked the Criminal Division with seeking forfeiture to compensate victims,[43] along with “prioritiz[ing] schemes involving senior-level personnel or other culpable actors, demonstrable loss, and efforts to obstruct justice.”[44] The Enforcement Plan focused on certain crimes that defraud victims, including Ponzi schemes, investment fraud, elder fraud, market manipulation, and “fraud that threatens the health and safety of consumers.”[45]

In 2025, the number of criminal corporate resolutions in this space does not appear to have increased compared to prior years. Instead, fraud cases involving individual victim losses have overwhelmingly targeted individual defendants, with corporations involved only in a minority of cases.

Among the limited corporate cases identified, two involve cryptocurrency-related schemes in which companies manipulated markets by artificially inflating the value of crypto assets, resulting in demonstrable investor losses and ultimately guilty pleas.[46] In addition, DOJ issued a declination to an investment bank following the firm’s voluntary self-disclosure of misconduct by two employees who manipulated the secondary and futures markets. Consistent with the Enforcement Plan’s emphasis on compensating victims, the declination involved disgorgement and establishment of a victim compensation fund.[47]

- Federal Food, Drug, and Cosmetic Act Enforcement

As part of a broader reorganization of the Department—and as explained in this Gibson Dunn May 16, 2025 client alert—the criminal enforcement work (and most prosecutors) of Civil Division’s Consumer Protection Branch has now moved to the Criminal Division to become a new consumer protection unit of the Fraud Section. Through that move, the Criminal Division is now positioned to lead criminal enforcement of the Federal Food, Drug, and Cosmetic Act (“FDCA”), and the Enforcement Plan made clear that the Criminal Division will exercise that authority and pursue corporate violations of the Controlled Substances Act. This focal area includes an express focus on the unlawful manufacture and distribution of chemicals and equipment used to create counterfeit pills laced with fentanyl and unlawful distribution of opioids.

Perhaps due to the DOJ adjusting to the reorganization of the prior Consumer Protection Branch, enforcement in the FDCA space appears to have dropped significantly since 2024, with four criminal resolutions involving FDCA violations in 2025,[48] only one of which was a guilty plea, compared to approximately 14 in 2024, all but one of which were guilty pleas. Similarly, corporate criminal enforcement involving controlled substances has been comparatively limited thus far, with most cases being brought against individual defendants or resulting in a civil settlement. There have, however, been recent criminal indictments in this space that we will watch for future reporting.[49]

- Focus on China

The Criminal Division outlined a renewed focus on criminal conduct related to China. The Enforcement Plan, for example, made multiple references to criminal conduct involving Chinese-connected companies and entities, including variable interest entities and sophisticated money laundering operations connected to China,[50] and on September 17, 2025, Mr. Galeotti again emphasized an enforcement focus on “Chinese money laundering organizations” during a speech at ACAMS, the Association of Certified Anti-Money Laundering Specialists conference.[51]

Amid this heightened focus on China, our review shows a modest rise in enforcement actions targeting Chinese companies and China‑affiliated entities or involving China relative to 2024. Export control violations dominated these cases, with four of the five export control resolutions involving some form of improper export activity involving China. Several of these cases involved the export of highly sensitive software or hardware to Chinese universities or entities with military affiliation, underscoring heightened scrutiny of transactions involving China-based end users.[52]

- Digital Assets

The Enforcement Plan outlined an emphasis on crimes involving digital assets, including (1) those involving digital assets that victimize investors and consumers, (2) those that use digital assets in furtherance of other crimes, and (3) those that involve willful violates that facilitate significant criminal activity.[53]

Additionally, as discussed in more detail in a separate client alert, in April 2025, Deputy Attorney General Blanche issued a memorandum entitled “Ending Regulation by Prosecution” focused on the digital assets space, stating in relevant part that DOJ “will no longer pursue litigation or enforcement actions that have the effect of superimposing regulatory frameworks on digital assets while President Trump’s actual regulators do this work outside the punitive criminal justice framework.”[54] The memorandum included a specific directive that DOJ would not pursue “regulatory violations in cases involving digital assets —including but not limited to unlicensed money transmitting under 18 U.S.C. §1960(b)(1)(A) and (B) [or] violations of the Bank Secrecy Act, [or other registration-related charges]—unless there is evidence that the defendant knew of the licensing or registration requirement at issue and violated such a requirement willfully.”[55] Consistent with the April 2025 memorandum, on August 21, 2025, Mr. Galeotti clarified in delivered remarks that the DOJ will not charge regulatory violations as crimes in cases involving digital assets “in the absence of evidence that a defendant knew of the specific legal requirement and willfully violated it.”[56]

Fairness

Additional Paths to Avoid or Mitigate Corporate Criminal Enforcement

The Criminal Division’s Enforcement Plan created additional opportunities for white collar defense attorneys to advocate for non-criminal resolutions for their corporate clients.[57] In particular, while it reiterated foundational principles for corporate charging decisions identified in the Justice Manual, such as whether the company self-reported, the company’s willingness to cooperate with the government, and the company’s actions to remediate the misconduct, the Enforcement Plan also emphasized that, in many cases, prosecution of individuals will suffice to “vindicate U.S. interests,” leaving civil or administrative remedies to address misconduct at the corporate level.[58]

The Enforcement Plan also directed the Fraud Section and the Money Laundering and Asset Recovery Section to re-review all existing agreements between the Criminal Division and companies and determine whether to terminate those agreements early based on a number of factors.[59] And indeed, the Criminal Division has publicly terminated several agreements early as a result of the new policy. In particular, the Criminal Division filed motions to dismiss criminal cases against ABB Ltd., Honeywell, and Stericycle, Inc. months before their respective expirations because the companies had complied with their obligations under their deferred prosecution agreements.[60] The Division also terminated its non-prosecution agreement with Albemarle Corporation more than a year early, concluding that the terms of the agreement had been satisfied, and it cut short two monitorships placed on Glencore, using its “sole discretion” after having “assessed the facts and circumstances.”[61]

For future resolutions, the Enforcement Plan suggested that the duration of resolutions will be shorter than before, directing that prosecutors “must impose a term that is appropriate and necessary in light of, among other things, the severity of the misconduct, the company’s degree of cooperation and remediation, and the effectiveness of the company’s compliance program at the time of resolution.”[62] The Enforcement Plan stated that these terms usually should not exceed three years and should be regularly reviewed for the possibility of early termination.[63] Factors such as those described in the Enforcement Plan have always been considerations in setting resolution terms, and in 2025, perhaps beginning to reflect the Enforcement Plan’s prioritization of shorter resolution terms, it appears that prosecutors have reached slightly lower terms of agreement as were made in immediately preceding years. Indeed, the average term length of 2025 resolutions with set term lengths (approximately 28.2 months) is lower than the average for 2024’s resolutions (33.0 months) and 2023’s (32.0 months). DOJ has also leaned into early termination, notably bringing agreements with ABB Ltd., Albemarle Corp., Glencore, Honeywell, and Stericycle, to early conclusion, as described above.

Recognition of Compliance and Law-Abiding Companies

In a May 12 speech, Mr. Galeotti stated that the Criminal Division recognizes “that law-abiding companies are key to a prosperous America [and] [e]conomic security is national security.”[64] He added: “[m]ost corporations and financial institutions want to play by the rules and provide value for their shareholders and their customers. And that is what we want them to remain focused on. Excessive enforcement and unfocused corporate investigations stymie innovation, limit[] prosperity, and reduce[] efficiency.”[65] The Enforcement Plan similarly recognized that “it is critical to American prosperity to promote policies that acknowledge law-abiding companies and companies that are willing to learn from their mistakes.”[66]

These messages underscored the importance of corporate compliance and appropriate remediation. In line with this message, the CEP was revised in May 2025 “[t]o ensure fairness and individualized assessments,” with a focus on benefits for companies that self-disclose and cooperate.[67] Mr. Galeotti stated that under the updated CEP, “[s]elf-disclosure is key to receiving the most generous benefits the Criminal Division can offer.”[68] The CEP updates notably preserved prior compliance components in the definition of appropriate remediation, again signaling the importance of compliance.[69]

More Certain Paths to Specific Results

Mr. Galeotti also stated that the CEP was simplified to allow companies to better anticipate outcomes when self-reporting. Under the updated CEP, the Criminal Division will publicly decline to prosecute a company for criminal conduct when all of the following four criteria are met:[70]

- The company voluntarily self-disclosed the misconduct to the Criminal Division. These disclosures qualify so long as “the company had no preexisting obligation to disclose the misconduct to the Department of Justice,” which seems to allow for self-disclosures that were undertaken out of obligation to agencies other than DOJ.

- The company fully cooperates with the Criminal Division’s investigation.

- The company timely and appropriately remediated the conduct.

- There are no aggravating circumstances (which involve “the nature and seriousness of the offense, egregiousness or pervasiveness of the misconduct within the company, severity of harm caused by the misconduct, or criminal adjudication or resolution within the last five years based on similar misconduct by the entity engaged in the current misconduct.”). This definition suggests that only criminal resolutions by the same corporation for “similar misconduct” will be considered an aggravating factor, rather than any prior misconduct or by an affiliated entity.[71] Where there are aggravating circumstances, prosecutors can still recommend declination after weighing the severity of the circumstances. In the MGI International, LLC matter resolved in 2025, for example, DOJ issued a declination letter despite the involvement of a member of senior management in the alleged misconduct, noting that none of the aggravating factors outweighed MGI’s cooperation and remediation.[72]

In instances of “near miss self-disclosures” or where there are aggravating circumstances, the guidance requires the Criminal Division to provide an NPA (absent egregious or multiple aggravating factors) for a term of less than three years and without a monitorship, and a 75% reduction off of the low end of the U.S. Sentencing Guidelines fine range.[73] In a June 2025 speech, Mr. Galeotti notably stated that to receive a penalty more severe than a declination for a voluntarily self-disclosing company, the circumstances would have to be “truly aggravating” and “sufficient to outweigh the fact that the company voluntarily came forward.”[74]

For resolutions in other cases involving voluntary disclosure, there is a presumption that any sentencing reduction will be taken from the low end of the Guidelines.

Efficiency

Streamlined Investigations

In his May 12, 2025 remarks, Mr. Galeotti stated that businesses have been deterred from utilizing benefits of self-reporting misconduct to governmental authorities by the possibility of “lengthy drawn-out investigations that are ultimately detrimental to companies[.]”[75] He argued that this deterrence of self-reporting diverts Department resources away from “tackling the most significant threats facing our country.”[76] The Enforcement Plan instructed the Criminal Division to take all reasonable steps to minimize the length and collateral impact of its investigations and to ensure that “bad actors” are quickly brought to justice.[77] While framed as a shift in approach, prior Administrations have included similar language in guidance documents; any meaningful change will depend on Criminal Division supervisors driving more efficient investigations.

In a June 2025 speech, Mr. Galeotti notably maintained that the Criminal Division is committed to making quick charging decisions, and that companies can do their part to promote efficiency by working closely with Criminal Division teams to narrow disagreements and exhaust discussions before reaching out to DOJ leadership.[78]

Limited Use of Monitors

In addition to taking reasonable steps to minimize length and impact of investigations, the Enforcement Plan instructed the Criminal Division to utilize independent compliance monitors only when necessary and that use of those monitors should be narrowly tailored.[79]

The Criminal Division also released a memorandum on May 12, 2025, entitled “Memorandum on Selection of Monitors in Criminal Division Matters,” which requires prosecutors to consider four factors when weighing the possibility of imposing a monitorship:

- Risk of recurrence of criminal conduct that significantly impacts U.S. interests.

- Availability and efficacy of other independent government oversight.

- Efficacy of the compliance program and culture of compliance at the time of the resolution.

- Maturity of the company’s controls and its ability to independently test and update its compliance program.[80]

In subsequent remarks in June 2025, Mr. Galeotti referred to monitors as a “temporary bridge and accountability measure,” emphasizing the Criminal Division’s express intent to reduce its use of monitorships where alternatives can achieve compliance more efficiently.[81]

Even if a monitor is appropriate, the May memorandum requires that prosecutors tailor the monitorship to be cost efficient and effective. The company’s counsel must present three to five monitor candidates for consideration, which is an increase from previous guidance.[82] After a monitor is approved, the Criminal Division must ensure the costs are proportionate to the severity of the underlying conduct, the company’s profits, and the company’s size and risk profile.[83] There will be a cap on hourly rates, and the monitor will be required to submit a budget for the entire monitorship at the time it submits its first work plan to the Criminal Division and company for review.[84] The monitor will also attend at least two additional meetings a year with the company and the government to ensure alignment.[85]

Consistent with the Enforcement Plan’s stated policy of imposing fewer monitors, DOJ’s Criminal Division has not imposed a monitorship in any criminal corporate resolution in 2025. Additionally, DOJ dismissed two pre-existing monitorships: Glencore International AG / Glencore Ltd. on March 19, 2025,[86] and NatWest Markets Plc on September 4, 2025.[87] U.S. Attorneys’ Offices, which are not held to Criminal Division policies, also did not impose monitorships in 2025, although one “independent consultant” arrangement imposed by the U.S. Attorney’s Office for the District of New Hampshire imposes similar requirements to a more traditional monitorship, as discussed in detail below.

Criminal Division Monitoring

The closest term to a monitorship imposed in a resolution with a Criminal Division component in 2025 was an “independent compliance consultant” required by DOJ’s renegotiated resolution in United States v. The Boeing Co.[88] By way of background, Boeing negotiated a DPA with DOJ in 2021, stemming from Boeing’s alleged concealment of software failures from the FAA.[89] The DPA did not impose a monitor and had a term of three years, to end in January 2024.[90] Before the expiration of the DPA’s term, DOJ alleged that Boeing had breached the DPA.[91] In 2025, DOJ agreed with withdrawing the charge and the parties entered into a negotiated NPA that required Boeing to retain an “independent compliance consultant.”[92]

Upon analysis of the terms applicable to the consultancy, the “independent compliance consultant” is not a monitor by another name; the consultant’s selection will not follow the same process required for monitor selection, and the terms of engagement are more deferential to the company.[93] In particular, we analyze below the terms of Boeing’s compliance obligations against recently imposed Criminal Division monitorships (Glencore (2022), Raytheon (2024), and TD Bank (2024)).

| Term | “Independent Compliance Consultant” (Boeing) | “Compliance Monitor”(Glencore, Raytheon, TD Bank) |

| Selection | Company selects a consultant, subject to DOJ approval | Company proposes three candidates for a monitor, DOJ can either select a monitor from those three candidates or reject all of them and require the company to propose additional candidates |

| Duration | Two years | Three years |

| Workplan | Company and consultant jointly prepare and submit a work plan to DOJ | Monitor prepares and submits a work plan to DOJ, and Company has the ability to comment on the workplan |

| Scope | Assist Company in assessing its program, including by observing Company’s self-testing protocols | Wide-ranging mandate to assess and monitor compliance with terms of the settlement and relevant laws, and evaluate effectiveness of compliance program; monitor typically conducts its own testing |

| Reports | Consultant, with Company’s input, submits reports to DOJ | Monitor drafts and submits the reports to the company and DOJ at the same time; monitor may, but is not required to, share drafts with the company |

| Access | The agreement does not address scope of access to company resources and information | Comprehensive access to information, including Company’s facilities, policies and procedures, processes, internal systems, employees, and records; generally likely to be more disruptive to Company’s day-to-day operations |

| Recommendations | Consultant makes recommendations, but Company retains ultimate decision making over implementing any particular recommendation (subject to providing a reason) | Company must adopt all recommendations within a specified timeframe, unless successfully contested with DOJ; DOJ retains ultimate decision authority on implementation |

Consistent with historical practice, self-reporting was by far the most common method of continued monitoring imposed in connection with corporate resolutions in 2025. For example, DOJ imposed ongoing compliance reporting requirements on both Paxful Holdings, Inc. (“Paxful”) and Comunicaciones Celulares S.A., d/b/a TIGO Guatemala (“TIGO”) in their respective plea agreement[94] and DPA.[95] Both resolution agreements require each company to prepare and submit to DOJ annual reports (two for Paxful and three for TIGO) detailing compliance and remediation efforts.[96] These reporting obligations appear similar to those imposed in agreements under the prior Administration, if perhaps slightly less burdensome in some cases. For example, we noted that while two 2024 DPAs and plea agreements included “at least quarterly” meetings between the company and DOJ to discuss the company’s compliance efforts on top of annual reports,[97] no such requirement was included in the Paxful or TIGO resolutions, or any other resolutions, in 2025. By way of background, many of the earliest agreements had an annual reporting requirement.

U.S. Attorney’s Office Monitoring Practices

As for U.S. Attorney’s Office resolutions, we identified no resolutions imposing a “monitor,” but at least two resolutions with U.S. Attorney’s Offices that imposed independent consultants: United States v. Aux Cayes Fintech Co. Ltd. d/b/a “OKEx,” d/b/a “OKX”[98] and United States v. Old Dutch Mustard Co., Inc. d/b/a Pilgrim Foods, Inc.[99] The “external compliance consultant” in the OKX agreement imposed by the U.S. Attorney for the Southern District of New York is similar in construction to that described in Boeing’s NPA, but it is different in a few respects.[100] Like Boeing, OKX is only required to retain a compliance consultant for a term of two years.[101] Further, the plea agreement provides that the consultant will prepare the work plan for two annual assessments “with cooperation from OKX,” suggesting OKX may have greater ability to shape the work plan than companies with traditional monitors.[102] On the other hand, OKX’s plea agreement devotes more discussion to the scope of the consultant’s work than does the Boeing NPA, including specific aspects of the OKX’s compliance program that must be annually tested for reasonableness of design and implementation.[103]

The Old Dutch independent consultant imposed by the U.S. Attorney for the District of New Hampshire even more closely resembles a traditional monitorship. In particular, the selection process detailed by the Old Dutch DPA resembles the traditional selection process of monitors, with the company nominating three candidates from which the government can choose or, in the event there is no consensus on a candidate, reject and require new nominees.[104] Further, Old Dutch’s consultant, who will serve a five-year term, is entitled to “full access to all records, personnel, and other information,” and provides binding recommendations that Old Dutch must implement.[105]

There are several possible explanations as to why these compliance consultants do not more closely mirror the one imposed by Boeing’s NPA. First, these resolutions did not include a Criminal Division component. U.S. Attorney’s Offices generally have more flexibility to impose terms of resolutions than Main Justice components, because Criminal Division policies do not typically bind U.S. Attorney’s Offices. Second, the underlying facts of each resolution could reasonably warrant different treatment than Boeing. Specifically, each agreement provides specific goals for each consultant rather than broad compliance monitoring: OKX’s external consultant is geared toward ensuring U.S. users cannot access the cryptocurrency exchange,[106] and Old Dutch’s independent consultant must ensure that the company is implementing an Environmental Compliance Program to remediate and prevent Clean Water Act violations.[107] Third, with respect to Old Dutch, it is possible that EPA’s involvement in the resolution resulted in a different formulation that is more specific to environmental resolutions. All said, we would expect that resolutions that do not include a Main Justice component to be more variable.

Other DOJ Enforcement Developments in 2025

Criminal Division Crediting Policy

As we previously reported in a client alert on June 17, 2025, on June 5, 2025, Mr. Galeotti released guidance to Criminal Division prosecutors focusing on victim compensation when deciding whether and how to credit penalties in multi-agency and multi-jurisdiction resolutions.[108] The memorandum, titled Guidance on Coordinating Corporate Resolution Penalties in Parallel Criminal, Civil, Regulatory, and Administrative Proceedings, asserted that the goal of the Criminal Division was to “vindicate victims’ rights when resolving such cases” and that “prosecutors must seek to maximize recoveries for and assistance to victims of crime.”[109]

As an initial matter, the memorandum notes that “Criminal Division prosecutors will not credit payments to other authorities when a company does not meaningfully attempt to coordinate resolutions.”[110] When such an effort is made, however, in making crediting decisions the memorandum instructs prosecutors to: (1) “not credit penalties imposed by other domestic authorities by forgoing either (a) restitution or (b) forfeiture that could be used for remission to compensate those victims, unless other authorities have an effective mechanism to compensate victims of the underlying crime”; and (2) “not credit penalties imposed by other domestic authorities from criminal penalties that would otherwise be used for general victim support through mechanisms such as the CVF, unless those other authorities use their penalties to similarly support victims.”[111]

The calculus for determining whether to credit payments to foreign authorities is somewhat complex. In particular, the memorandum asserts that in situation where “the only payments available for crediting are criminal penalties that would otherwise be used to provide general victim assistance through deposit in the CVF,” then “prosecutors must seek to balance” three key considerations: (1) “the interest in providing general assistance to victims of crime through such deposits”; (2) “the interests of jurisdictions where the misconduct occurred, where the effects of the misconduct are most acutely felt, or who have other equities in the investigation”; and (3) “the advancement of other critical Department and Division goals.”[112] The memorandum further recommends that prosecutors also consider a number of additional factors in balancing those interests.[113]

As we reported last June, it is unclear how significantly this guidance will impact future corporate resolutions, given that most past corporate resolutions have not involved identifiable victims, but also in light of the Criminal Division’s stated focus on prosecuting cases with individual victim losses, as described above. The memorandum at least implicitly suggests that the Department may be less inclined to credit payments to other agencies or regulators in individual victim cases, resulting in greater overall penalties and reduced flexibility in negotiating resolution payment offsets.[114]

Antitrust Division Signals Commitment to Robust Enforcement

In remarks delivered to the Global Competition Review on March 11, 2025, the then-Director Emma Burnham of the Antitrust Division’s Criminal Enforcement Section confirmed that the Antitrust Division’s robust criminal enforcement would continue across a “wide array of sectors and all levels of the economy” despite transitions at the Division.[115] Emphasizing that the Antitrust Division was continuing to deploy resources aggressively and that cartel enforcement would be no exception, she noted that the Division had charged 15 defendants since the start of the calendar year (one company, 14 individuals) and that 24 guilty pleas had been entered (two companies, 22 individuals).[116] At the time of her remarks, recent guilty pleas included defendants charged with monopolization crimes, conspiracies targeting government procurement, bid rigging and fraud targeting sports equipment for schools, and bid rigging and collusion in construction and infrastructure industries.[117]

Ms. Burnham noted that the Antitrust Division remains “deeply committed” to individual accountability, and that its charges will “continue to expose individuals to real prison sentences.”[118] She also explained that, where warranted, the Antitrust Division will continue to follow its recent trend of charging using Section 2 of the Sherman Act for monopolization crimes.[119]

Ms. Burnham further noted that the Antitrust Division had more than twice as many open grand jury investigations as it had a decade prior.[120] In terms of concluded enforcement actions in 2025, the Antitrust Division was involved in three corporate resolutions (all guilty pleas), which is generally consistent with its corporate enforcement track record over the past several years.[121]

Antitrust Division Announces Whistleblower Rewards Program

As we discussed in more detail in a client alert on July 31, 2025, the Antitrust Division announced a new program to incentivize reporting of antitrust violations.[122] In partnership with the United States Postal Service, the program will allow individuals who provide information about price fixing or other antitrust violations to recover between 15% and 30% of any criminal fines secured by the Division.[123]

To be eligible for a reward, the anticompetitive conduct reported must “affect[] the Postal Service, its revenues, or property,” which requires there be an “identifiable”–but not necessarily a “material” or “substantial[ly] detriment[al]”–impact on the Postal Service.[124] The total fines recovered must also be over $1,000,000, and the whistleblower must provide “original” information that is derived from their independent knowledge and not already known to the Antitrust Division, USPIS, or USPS OIG from other sources.[125] Individuals who benefited from or participated in the activity are eligible to recover the reward, provided they did not “coerce[] another party to participate in the illegal activity” and were not “clearly the leader or originator of that activity.”[126]

The program aims to “create a new pipeline of leads from individuals with firsthand knowledge of criminal antitrust and related offenses,”[127] and it has similarities with whistleblower systems available for the SEC, CFTC, and FinCEN, which have proven successful in increasing whistleblower activity.[128] The Antitrust Division announced its first reward on January 29, 2026, a $1 million reward for a whistleblower who referred an alleged bid-rigging scheme in the used vehicle market. [129]

International Developments

In 2025, the importance of negotiated corporate outcomes was clear across several key non-U.S. jurisdictions. Such outcomes were achieved through a variety of legal vehicles, including DPAs in Singapore, statutory settlement vehicles such as France’s convention judiciaire d’intérêt public (“CJIP”), and prosecutor‑imposed penalty orders in the Netherlands. At the same time, several jurisdictions made meaningful efforts in 2025 to refine (and, in some cases, expand) the frameworks that govern corporate criminal exposure, self‑reporting and cooperation expectations, and the availability or attractiveness of resolutions for companies. Below we discuss several example jurisdictions that exemplified these trends.

United Kingdom

In the United Kingdom, 2025 was notable less for the volume of newly announced corporate DPAs than for guidance and statutory developments that are likely to influence charging decisions and compliance expectations applied by prosecutors when assessing cooperation and remediation.

In April 2025, the Serious Fraud Office (“SFO”) issued new Corporate Co‑Operation Guidance that is expressly designed to incentivize self‑reporting and cooperation.[129a] Among other things, the guidance states that a company that promptly self‑reports and cooperates will, in the ordinary course, be invited to enter into DPA negotiations absent exceptional circumstances, and it also outlines expected cooperation behaviors and indicative engagement timelines (including early responsiveness to incoming self‑reports).[130] For instance, the guidance commits the SFO to responding to self-reports within 48 hours, deciding whether to open an investigation within six months, and endeavoring to conclude DPA negotiations within a further six months.[131]

In August 2025, the SFO and Crown Prosecution Service (“CPS”) published updated joint guidance on corporate prosecutions, replacing the 2021 guidance.[132] The update signals the CPS’s intent to sit alongside the SFO as a corporate crime enforcer and provides detailed guidance on charging strategy and other issues relevant to corporate prosecutions. UK corporate criminal exposure should therefore be assessed with an eye toward both agencies’ enforcement footprints, rather than treating the SFO as the sole UK gatekeeper for complex corporate criminal matters.

On September 1, 2025, a new “failure to prevent fraud” offence came into force.[133] As a result, large organizations are now strictly liable where an associated person commits a specified fraud offence intended to benefit the organization, unless reasonable fraud prevention procedures were in place. Notably, the offence has been added to Schedule 17 of the Crime and Courts Act 2013, meaning that DPAs are available as a resolution mechanism for such offenses.

Finally, in November 2025, the SFO issued further guidance regarding how it evaluates corporate compliance programs, which provides a clearer view of the factors the SFO will consider when assessing the effectiveness of controls, remediation efforts, and (by extension) the credibility of future‑looking compliance undertakings commonly seen in negotiated outcomes.[134]

Netherlands

The Dutch Public Prosecution Service (Openbaar Ministerie, “OM”) continued to use prosecutor‑driven mechanisms—particularly penalty orders (strafbeschikking)—to resolve matters without full trials in 2025. Specifically, OM’s enforcement focus was on complex tax‑related misconduct such as dividend tax evasion. For example, in May 2025, OM imposed a €14 million penalty order on ABN AMRO in connection with alleged complicity in dividend tax evasion by another bank through incorrect tax filings.[135] In November 2025, the OM imposed penalty orders totaling €101 million on two Morgan Stanley entities (in London and Amsterdam) for alleged dividend tax evasion, with the OM describing the sanction as approaching the statutory maximum and separate from amounts paid to the Dutch tax authorities in late 2024.[136] These resolutions emphasize that Dutch prosecutors remain active with regards to dividend‑tax matters and that negotiated, non‑trial outcomes may still carry substantial financial consequences in this jurisdiction.

Brazil

Brazil remained a significant jurisdiction for negotiated resolutions in 2025, with federal leniency agreements continuing to serve as a primary vehicle for resolving corporate exposure. Public announcements by the Controladoria‑Geral da União (“CGU”) and Advocacia‑Geral da União (“AGU”) reflect multiple sizeable leniency agreements in 2025, including agreements with Qualicorp (exceeding R$ 44 million in fines and restitution), Trafigura (exceeding R$ 435 million), and Minerva (exceeding R$ 22 million) in the first half of 2025.[137] In July 2025, CGU and AGU announced a multi‑entity leniency agreement involving Seatrium Limited, Jurong Shipyard Pte. Ltd., and Estaleiro Jurong Aracruz, described as exceeding R$ 728 million and tied to conduct occurring between 2007 and 2014.[138]

In December 2025, CGU and AGU announced a new ordinance that reorganizes the rules for negotiation, signing, and monitoring of leniency agreements.[139] The key innovation is the introduction of a mechanism that allows a company to signal its intent to cooperate and reserve leniency benefits while completing internal investigations, with protections if no agreement is finalized. The ordinance also establishes objective methodologies for calculating financial obligations, including assessment of unlawful gains, loss of those amounts, and structured payment options based on ability to pay.[140] The ordinance does not affect leniency agreements negotiated in the criminal context by the Ministério Público Federal, however.

Singapore

2025 saw the first DPA entered by Singaporean law enforcement. On July 30, 2025, Singapore’s Public Prosecutor entered into a DPA with Seatrium to resolve alleged corruption offenses arising from conduct in Brazil (see also discussion of Brazil enforcement above).[141] Singapore’s Attorney‑General’s Chambers stated that the DPA includes a $110 million financial penalty and compliance program improvement obligations.[142] The DPA is subject to High Court approval before it comes into force.[143]

Cross-Border Cooperation and Coordinated Enforcement

Cross‑border cooperation continued to be a defining feature of corporate enforcement in 2025. For example, in March 2025, the UK SFO, France’s Parquet national financier (“PNF”), and Switzerland’s Office of the Attorney General (“OAG”) announced the creation of an International Anti‑Corruption Prosecutorial Taskforce aimed at strengthening cooperation through increased information‑sharing, case collaboration, and best‑practice exchange.[144] For multinational companies, this development underscores the need to manage investigation strategy, privilege, data, and settlement sequencing with the understanding that European authorities may pursue more structured and closely coordinated cooperation, particularly in international bribery and corruption cases.

TABLE: 2025 U.S. RESOLUTIONS

The chart below summarizes the U.S. agreements concluded from January through December 2025. The complete text of each publicly available agreement is hyperlinked in the chart. It is notable that there are very few Fortune 1,000 companies charged in 2025.

The figures for “Monetary Recoveries” may include amounts not strictly limited to an NPA, DPA, or guilty plea, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA, DPA, or plea agreement paid by the named entity and/or subsidiaries. The term “Monitoring & Reporting” includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in resolution agreements, but does not include probation.

| U.S. DPAs, NPAs, Declinations, and Plea Agreements January-December 2025 | ||||||

| Company | Agency | Alleged Violation | Type | Monetary Recoveries | Monitoring & Reporting | Term of Agreement (Months) [146] |

| Abda Moving, LLC | D.N.J. | Conspiracy to commit wire fraud | Guilty Plea | $1,908,486 | None | 60 |

| Able Groupe, Inc. | DOJ Civil; DOJ CPB; N.D. Tex. | FDCA | Guilty Plea | $304,640 | None | 36 |

| Advanced Inventory Management, Inc. | N.D. Ill. | Misbranding of a medical device with intent to defraud | DPA | $1,000,000 | Self-reporting | 36 |

| Aesculap Implant Systems, LLC | E.D. Pa. | FDCA | NPA | $38,500,000 | None | 0 |

| Aghorn Operating Inc. | DOJ ENRD | Clean Air Act; OSHA | Guilty Plea | $1,000,000 | 2-year self-reporting | 24 |

| Allwaste Onsite (“Onsite Environmental”) | DOJ ENRD; M.D. Tenn. | Clean Water Act | Guilty Plea | $948,592 | Compliance with Facility Operating Plan | 36 |

| American Express Company | E.D.N.Y. | Wire fraud; Conspiracy to commit wire fraud | NPA | $199,096,000 | None | 36 |

| American Premium Water Corp. | N.D. Ohio | Conspiracy to Commit Securities Fraud | DPA | $0 | None | 24 |

| Anderson Pest Control, Inc. | S.D. Fla. | Federal Insecticide, Fungicide, and Rodenticide Act | Guilty Plea | $345,250 | None | 60 |

| Applied Partners, LLC | DOJ ENRD | Clean Air Act | Guilty Plea | $500,000 | None | 24 |

| Apprio, Inc. | DOJ Criminal Division; DOJ Fraud; D. Md. | Conspiracy to commit bribery of a public official; Securities fraud | DPA | $500,000 | Annual self-reporting | 36 |

| ASL Singapore Shipping LTD and Jia Feng Shipping LTD | E.D. La. | Act to Prevent Pollution from Ships violation; Obstruction of Justice | Guilty Plea | $1,850,000 | None | 48 |

| Aux Cayes Fintech Co. Ltd. (“OKX”) | S.D.N.Y. | Unlicensed Money Transmitting Business | Guilty Plea | $504,811,203 | Independent compliance monitor | 24 |

| Barlow Herbal Specialties LLC | D. Utah | Lacey Act | DPA | $58,064 | Third-party auditor | 6 |

| BJS & T Enterprises, Inc. | S.D. Cal. | Hiring individuals unauthorized to work in the U.S. | Guilty Plea | $251,000 | None | 24 |

| The Boeing Company | N.D. Tex.; DOJ Fraud | Conspiracy to Defraud the United States | NPA | $688,100,000 | Independent compliance consultant | 24 |

| BofA Securities, Inc. | DOJ Criminal Division; DOJ Fraud | Market manipulation schemes | Declination with Disgorgement | $5,570,142 | None | 0 |

| Brew City Environmental & Restoration Services, LLC | E.D. Wis. | Clean Air Act | Guilty Plea | Pending | Pending | Pending |

| Brink’s Global Services USA, Inc. | S.D. Cal. | Bank Secrecy Act | NPA | $42,000,000 | None | 24 |

| Burns Hunting Club LLC | S.D. Ill. | Lacey Act | Guilty Plea | $35,500 | None | 24 |

| Cadence Design Systems, Inc. | DOJ National Security; N.D. Cal. | Violation of export control laws | Guilty Plea | $117,793,825 | Annual self- reporting | 36 |

| Campbell Sales Group, Inc. | E.D.N.C. | Wire fraud (in connection with PPP loans) | DPA | $1,499,165 | None | 36 |

| Chamness Dirt Works Inc. | D. Or. | Clean Air Act violation | Guilty Plea | $0 | None | 36 |

| Clark & Garner, LLC | DOJ Antitrust | Sherman Act violation | Guilty Plea | $80,000 | None | 0 |

| CLS Global FZE LLC | D. Mass. | Wire fraud; Conspiracy to commit market manipulation; conspiracy to commit wire fraud | Guilty Plea | $428,060 | None | 36 |

| Comunicaciones Celulares S.A. (TIGO Guatemala) | S.D. Fla.; DOJ Fraud | FCPA | DPA | $118,198,343 | Annual self-reporting | 24 |

| Credit Suisse Services AG | E.D. Va.; DOJ Tax | Tax law | NPA | $138,700,000 | None | 36 |

| Credit Suisse Services AG | E.D. Va.; DOJ Tax | Tax law | Guilty Plea | $371,908,509 | None | 36 |

| Dune Medical Supply, LLC | M.D.N.C. | Healthcare fraud | Guilty Plea | $6,875,756 | None | 0 |

| E&A Auto Cores, LLC | E.D. Mo. | Transportation of Stolen Goods | Guilty Plea | $140,000 | None | 12 |

| Eagle Ship Management, LLC | E.D. La.; DOJ ENRD | Act to Prevent Pollution from Ships violation | Guilty Plea | $1,750,000 | Court-appointed monitor | 48 |

| Elecsurf Trading Ltd. | N.D. Ill. | Copyright Infringement | Guilty Plea | $1,700,000 | None | 0 |

| Eleview International Inc. | E.D. Va. | Export Control Reform Act violation | Guilty Plea | $125,000 | None | 36 |

| Erie Coke Corporation | W.D. Pa. | Clean Air Act violations; Conspiracy to defraud the United States | Guilty Plea | $700,000 | None | 0 |

| Eurobulk Ltd. | S.D. Tex.; DOJ ENRD | Act to Prevent Pollution from Ships violation; Falsification of Records | Guilty Plea | $1,500,000 | Third-Party External Auditor and Court-Appointed Monitor | 48 |

| Exploring Together Therapy LLC | D.P.R. | Stealing federal funds | Guilty Plea | $190,820 | None | 0 |

| Fabcon Precast LLC | DOJ ENRD | OSHA violation | Guilty Plea | $500,000 | None | 24 |

| Gadsden, Gaillard and West LLC | S.D.W. Va. | Clean Water Act | Guilty Plea | Pending | Pending | Pending |

| Gotbit Consulting LLC | D. Miss | Wire fraud; Securities fraud | Guilty Plea | $22,893,675 | None | 60 |

| Hao Global LLC | S.D. Tex. | Smuggling; Unlawful Export Activities | Guilty Plea | Pending | Pending | Pending |

| Hino Motors, Ltd. | DOJ ENRD | Clean Air Act; Conspiracy to commit wire fraud; Conspiracy to smuggle goods; Conspiracy to defraud the United States | Guilty Plea | $1,608,760,000 | Self-Reporting; Independent Compliance Auditor | 60 |

| Horseshoe Grove LLC | D. Or. | Clean Air Act | Guilty Plea | $0 | None | 36 |

| Hytera Communications Corporation, Ltd. | N.D. Ill. | Conspiracy to steal trade secrets | Guilty Plea | Pending | Pending | Pending |

| J.H. Baxter & Co., Inc. | DOJ ENRD | Clean Air Act; Resource Conservation and Recovery Act | Guilty Plea | $1,000,000 | None | 60 |

| KBWB Operations LLC | DOJ CPB; W.D. Wis. | Healthcare Fraud; Tax Conspiracy | Guilty Plea | $154,656,458 | None | 60 |

| Kimberly-Clark Corporation | DOJ Fraud; DOJ CPB | Violation of FDCA | DPA | $40,400,000 | None | 12 |

| Kodiak Roustabout, Inc. | DOJ ENRD | Safe Drinking Water Act | Guilty Plea | $400,000 | Self-reporting subject to third-party testing requirements | 12 |

| Liberty Mutual Insurance Company | D. Mass; DOJ Fraud | FCPA | Declination with Disgorgement | $4,699,088 | None | 0 |

| Life Touch LLC | E.D.N.C. | Medicaid fraud | Guilty Plea | Pending | Pending | Pending |

| Mallad Trading, LLC | D.N.J. | Conspiracy to commit wire fraud | Guilty Plea | $314,761 | None | 60 |

| Mayhem Services, LLC | DOJ ENRD | Lacey Act | Guilty Plea | $75,000 | None | 36 |

| MGI International, LLC, Global Plastics LLC, Marco Polo International LLC | DOJ Fraud; D.N.H. | Trade fraud | Declination with Disgorgement | $10,801,203 | None | 0 |

| Millenia Productions, LLC | D. Kan. | Illegal storage of hazardous waste | Guilty Plea | $285,000 | Self-reporting; Independent Compliance Consultant and Auditor | 36 |

| Mudafort Xtreme Sports and Motorsports, Inc. | D.P.R. | Failure to Maintain Records as an Federal Firearms Dealer | Guilty Plea | $6,000 | None | 12 |

| Murex Management, Inc. | E.D. La. | Fraudulent Transactions; Aiding & Abetting | Guilty Plea | $15,745,846 | None | 0 |

| OHM Pharmacy Services, Inc. | D. Mass. | Healthcare fraud | Guilty Plea | $1,100,000 | None | 12 |

| Old Dutch Mustard Co., Inc. | D.N.H.; DOJ ENRD | Clean Water Act | Guilty Plea | $1,500,000 | Independent Compliance Consultant | 60 |

| PT Services, Inc. | W.D. Tenn. | Clean Air Act | Guilty Plea | $150,000 | None | 36 |

| Paxful Holdings, Inc. | E.D. Cal.; DOJ Criminal Division MNF | Bank Secrecy Act; Travel Act | Guilty Plea | Pending | Self-reporting | 24 |

| Peken Global Limited (KuCoin) | S.D.N.Y. | Bank Secrecy Act; Unlicensed Money Transmitting Business | Guilty Plea | $297,414,000 | None | 0 |

| PM Consulting Group LLC (Vistant) | D. Md. | Conspiracy to commit bribery of a public official; Securities fraud | DPA | $100,000 | Annual self-reporting | 36 |

| Prospect Health Solutions, Inc. | M.D.N.C. | Healthcare fraud | Guilty Plea | $9,503,246 | None | 0 |

| Quadrant Magnetics LLC | W.D. Ky.; DOJ National Security Division | Arms Export Control Act; International Traffic In Arms Regulations | Guilty Plea | $2,332,515 | None | 24 |

| Rossy Sport Bar Panoramico, LLC | D.P.R. | Bank Fraud | Guilty Plea | $71,464 | None | 60 |

| Royal Sovereign International, Inc. | D.N.J.; DOJ CPB | Failure to report consumer product safety defect | Guilty Plea | $495,786 | None | 0 |

| Servismed, LLC | N.D. Fla. | Conspiracy to violate FIFRA | Guilty Plea | $53,330 | None | 0 |

| ShotStop Ballistics, LLC | N.D. Ohio | Conspiracy to smuggle goods into the U.S.; Conspiracy to Traffic in Counterfeit Goods; Conspiracy to Commit Mail and Wire Fraud | Guilty Plea | $5,883,896 | None | 0 |

| Trans World Services, Inc. (“SSAS, Inc.,” “Trans World Services of Texas, Inc.,” “Genuine Parts Planet”) | S.D. Tex. | Trafficking in Counterfeit Goods or Services | Guilty Plea | $102,250 | None | 12 |

| TranscendBS, LLC | DOJ Antitrust | Bid rigging | Guilty Plea | $141,511 | None | 24 |

| Troy Health, Inc. | W.D.N.C.; DOJ Fraud | Health Care fraud; Identity theft scheme | NPA | $1,430,008 | Self-reporting | 18 |

| Universities Space Research Association (USRA) | DOJ NSD; N.D. Cal. | Violation of export control laws | Declination | $0 | None | 0 |

| V. Ships Norway A.S. | DOJ ENRD; E.D. Tex. | Act to Prevent Pollution from Ships | Guilty Plea | $2,000,000 | Third-party auditor | 48 |

| Vallmar Studios, LLC | N.D. Ohio | Conspiracy to smuggle goods into the U.S.; Conspiracy to traffic counterfeit goods; Conspiracy to commit mail fraud; Conspiracy to commit wire fraud | Guilty Plea | $0 | None | 0 |

| Virginia Pump and Motor Company, Inc. | E.D. Va. | Clean Water Act | Guilty Plea | $376,000 | None | 36 |

APPENDIX: 2025 Resolutions

This portion of the alert summarizes publicly available corporate resolutions from January 1, 2025 through December 31, 2025. The appendix provides key facts and figures regarding all 74 resolutions,[145] along with links to the resolution documents themselves (where available).

Abda Moving, LLC & Mallad Trading, LLC (Guilty Pleas)

On May 21, 2025, Abda Moving, LLC, d/b/a 11Even Movers & Storage (“11Even Movers”), and Mallad Trading, LLC (“Mallad Trading”) entered into plea agreements with the U.S. Attorney’s Office for the District of New Jersey to resolve charges of conspiracy to commit wire fraud.[146a] According to the plea agreements, these moving companies defrauded customers seeking moving services by securing contracts for moving services via a broker and then demanding significantly higher fees after taking possession of the customers’ goods.[147] The companies allegedly refused to release customers’ goods until they were paid the inflated prices.[148] In October 2025, 11Even Movers and Mallad Trading were each sentenced to five years of probation. The companies were ordered to pay full restitution to victims of the scheme, with 11Even Movers ordered to pay restitution in the amount of $1,908,485.67 and Mallad Trading ordered to pay restitution in the amount of $314,761.06.[149]

Able Groupe, Inc. (Guilty Plea)

On August 15, 2025, Able Groupe, Inc. (“Able”), a Nevada corporation that sold European infant formula to U.S. consumers through LittleBundle.com and related brands, pleaded guilty in the Northern District of Texas to two felony counts arising from its importation and distribution of non-compliant infant formula between 2019 and 2021. The plea agreement states that Able admitted to violating 21 U.S.C. § 331(ee) and 21 U.S.C. § 333(a)(2) of the Federal Food, Drug and Cosmetic Act (“FDCA”) by importing food in violation of the FDA’s Prior Notice requirements with the intent to defraud or mislead, and to smuggling in violation of 18 U.S.C. § 545, by smuggling goods into the United States.[150] DOJ announced that several of Able’s infant formulas failed to meet FDA nutrient or labeling requirements, and that Able attempted to avoid detection by using false commodity descriptions.[151] After an FDA inspection in 2021, Able ceased operations and recalled approximately 76,000 units of formula.[152]

Under the plea agreement, the parties agreed to a binding sentence of three years of corporate probation and forfeiture of $304,640.[153] DOJ stated that this is the first time a defendant has pleaded guilty to a felony violation for failing to provide such notices to the FDA.[154]

Advanced Inventory Management, Inc. (DPA)

On February 14, 2025, Advanced Inventory Management, Inc. (“AIM”), an Illinois-based medical device distributor, entered into a three-year DPA with the U.S. Attorney’s Office for the Northern District of Illinois to resolve a one-count criminal Information charging misbranding of a medical device with intent to defraud in violation of the FDCA, 21 U.S.C. §§ 331(k) and 333(a)(2).[155] According to the Statement of Facts, from 2016 to 2023 AIM purchased medical devices abroad at reduced prices, removed labeling indicating that the products were not authorized for resale outside designated foreign markets, and submitted false statements of intended use to customs authorities to conceal that the products would be resold domestically.[156] The company’s conduct rendered the products misbranded under the FDCA.[157] DOJ stated that AIM resold the imported devices in the U.S. at substantial markups, generating approximately $500,000 in profit margins of 35% to 50%.[158]

Under the DPA, AIM agreed to pay a $1,000,000 criminal penalty.[159] Additional obligations include maintaining and enhancing compliance measures and reporting to the U.S. Attorney’s Office annually on remediation and compliance.[160]

Aesculap Implant Systems (NPA)