DOJ Announces White Collar Enforcement Priorities

Client Alert | May 19, 2025

Gibson Dunn is monitoring regulatory developments and executive orders closely. Our attorneys are available to assist clients as they navigate the challenges and opportunities posed by the current, evolving legal landscape.

Introduction

On May 12, 2025, the Department of Justice (DOJ) Criminal Division announced it was “turning a new page” in its approach to white collar and corporate enforcement and issued four foundational guidance documents: a memorandum outlining the new White-Collar Enforcement Plan (“Enforcement Plan”), an update to the Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy (“Corporate Enforcement Policy”), an update to the Department of Justice Corporate Whistleblower Awards Pilot program, and an updated memorandum describing the process for implementing monitorships and selecting monitors (collectively, the “May 12, 2025 Guidance Documents”).

Although the Criminal Division is but one litigating component in the larger DOJ and its guidance does not bind prosecutors outside it, it is a bellwether for DOJ-wide initiatives, particularly in white collar enforcement, because of its size, role in administering various criminal statutes, and proximity to DOJ leadership. Below we survey the most significant developments outlined in the Criminal Division’s new guidance, beginning with the key takeaways and continuing with developments under each of the three principles of criminal enforcement—”focus, fairness, and efficiency”—declared by the umbrella Enforcement Plan memorandum.[1]

The May 12, 2025 Guidance Documents were released days after President Trump signed an Executive Order aimed at combatting “Overcriminalization in Federal Regulations.” Analysis of that Executive Order can be found here.

Key Takeaways

These policies have immediate implications for the risk profile of certain conduct and the possibility of resolution with the Criminal Division, and potentially other components of the DOJ. Some key takeaways are:

- In an unusual but helpful move, the Criminal Division has now set out a comprehensive strategy for criminal enforcement of white collar cases, providing a roadmap of its priorities with an “America First” and business-friendly emphasis. The Enforcement Plan also explains that the Criminal Division will continue to combat a broad range of white collar crimes to advance the Trump Administration’s law enforcement priorities, some of which have traditionally not been emphasized.

- Like other guidance documents published by government agencies during the Trump Administration, the Enforcement Plan makes clear that overly aggressive government action can “hinder[] innovation.” The Enforcement Plan explicitly instructs prosecutors to consider the impact of their investigations on businesses, rather than simply deterring violations of law. The Enforcement Plan recognizes that the vast majority of American companies act legitimately, and that “it is critical to American prosperity to promote policies that acknowledge law-abiding companies and companies that are willing to learn from their mistakes.”

- The Enforcement Plan begins by emphasizing a focus on the harms to America posed by “dishonest actors [that] exploit government programs” and “[s]chemes that defraud . . . investors and consumers, especially the most vulnerable.”

- The Enforcement Plan also indicates that national security offenses will continue to be a priority of the Criminal Division, supplementing the work of the National Security Division.

- The Criminal Division will continue to prosecute offenses related to foreign corruption, with an emphasis on bribery and money laundering offenses that harm U.S. national security, impact American businesses, and enrich foreign officials.

- The Criminal Division likewise will focus on trade enforcement, including customs fraud and tariff evasion, as well as related money laundering.

- In an exercise of new authority, the Criminal Division will prioritize white collar enforcement of the Federal Food, Drug, and Cosmetic Act.

- The Department of Justice will be particularly focused on offenses related to China, cartels, transnational criminal organizations, and immigration violations.

- The emphasis on the need for expeditious prosecution means that corporations subject to Criminal Division scrutiny can push for efficiency in investigations and faster resolutions, to ensure that investigations do not linger.

- Corporations considering whether to self-disclose will have a clearer understanding of the potential benefits of making a disclosure. Those benefits include declination and higher discounts to any penalties. Prosecutors retain some discretion to conclude there are aggravating factors present that will mean a declination is not assured.

I. “Focus”

Enforcement Priorities

The Enforcement Plan states that the Criminal Division is to be “laser-focused on the most urgent criminal threats to the country[.]” Consistent with previous policy announcements by the Trump Administration, the Enforcement Plan lists ten high-impact areas that the Criminal Division will prioritize investigating and prosecuting to combat those harms.[2] Similarly, the Whistleblower Awards Pilot Program, which was first announced in August 2024, has been expanded to cover eligible tips in new subject areas that mirror the Criminal Division’s enforcement priorities, including cartels and transnational criminal organizations, violations of the immigration laws, material support of terrorism, sanctions evasion, and fraud involving trade, tariffs, customs and procurement.

Healthcare, Procurement, Investor, and Consumer Fraud

To address “[r]ampant health care fraud and program and procurement fraud,” the Enforcement Plan states that the “Criminal Division will lead the fight in holding accountable those who exploit these programs and harm the public fisc for personal gain.” The focus on health care and procurement fraud aligns with recent Executive Orders of President Trump on these topics.

Foreign Bribery Enforcement

Notwithstanding President Trump’s February 10, 2025 Executive Order pausing enforcement of the Foreign Corrupt Practices Act,[3] the May 12, 2025 Guidance Documents make clear that the Criminal Division will continue to prosecute cases involving foreign bribery. The Enforcement Plan specifically asserts that in doing so the Criminal Division will take a targeted approach to protect American interests, prioritizing offenses that include “[b]ribery and associated money laundering” that affect U.S. national interests, undermine national security, harm U.S. businesses, and enrich corrupt foreign officials.

National Security Offenses

In a memorandum issued on her first day in office, Attorney General Pam Bondi suspended certain requirements for approval by the National Security Division.[4] The May 12, 2025 Guidance Documents prioritize criminal enforcement of national security offenses, including terrorism and sanctions evasion. These documents suggest these offenses will be charged through the Criminal Division or U.S. Attorney’s Offices more often, supplementing the work of the National Security Division.

Tariffs and Customs Enforcement

The May 12, 2025 Guidance Documents make clear that the Criminal Division will prioritize violations of tariff and customs laws. Investigations of such violations are listed as priorities in the Enforcement Plan, and the updated whistleblower program adds such violations as subject areas for whistleblower tips. This adds to other recent indications by the Trump Administration that tariffs enforcement will, unsurprisingly, be heavily emphasized, as Gibson Dunn previously covered here and here.

Bank Secrecy Act Enforcement

Under the principles of the May 12, 2025 Guidance Documents, the Criminal Division will continue to prosecute cases involving violations of the Bank Secrecy Act, with a particular focus on offenses that implicate U.S. sanctions. The Enforcement Plan decries “exploitation of our financial system” that can “enable underlying criminal conduct,” and warns that “[f]inancial institutions, shadow bankers, and other intermediaries aid U.S. adversaries by processing transactions that evade sanctions.” The updated whistleblower program maintains the Department’s focus on violations by financial institutions or their employees for schemes involving money laundering and violations of the Bank Secrecy Act.

Fraud Cases with Individual Victim Losses

In line with the Criminal Division’s focus on vindicating the rights of victims impacted by white collar and corporate crime, the Enforcement Plan also tasks the Criminal Division with seeking forfeiture to compensate victims. The Criminal Division is also tasked with “prioritize[ing] schemes involving senior-level personnel or other culpable actors, demonstrable loss, and efforts to obstruct justice.” The Enforcement Plan focuses on certain crimes that defraud victims, including Ponzi schemes, investment fraud, elder fraud, market manipulation, and “fraud that threatens the health and safety of consumers.”

Federal Food, Drug, and Cosmetic Act Enforcement

As part of a broader reorganization of the Department—and explained in this Gibson Dunn client alert—it recently was announced that the criminal authorities (and most prosecutors) of Civil Division’s Consumer Protection Branch would move to the Criminal Division to become a new consumer protection unit of the Fraud Section. Through that move, the Criminal Division has gained authority to lead criminal enforcement of the Federal Food, Drug, and Cosmetic Act, and the Enforcement Plan makes clear that it intends to exercise that authority and to pursue corporate violations of the Controlled Substances Act.

Focus on China

The Criminal Division will renew its focus on criminal conduct related to China. The Enforcement Plan makes multiple references to criminal conduct involving Chinese-connected companies and entities, including variable interest entities and sophisticated money laundering operations connected to China.

II. “Fairness”

Additional Paths to Avoid or Mitigate Corporate Criminal Enforcement

The Enforcement Plan creates additional opportunities for white collar defense attorneys to advocate for non-criminal resolutions for their corporate clients. The Enforcement Plan states that, in many cases, prosecution of individuals will suffice to “vindicate U.S. interests,” leaving civil or administrative remedies to address misconduct at the corporate level. The Enforcement Plan reiterates that prosecutors should consider certain factors identified in the Justice Manual when determining whether to charge corporations, including whether the company self-reported, the company’s willingness to cooperate with the government, and the company’s actions to remediate the misconduct.

The Enforcement Plan also directs the Fraud and Money Laundering and Asset Recovery Sections to re-review all existing agreements between the Criminal Division and companies and determine whether to terminate those agreements early. Factors that could lead to early termination include the duration of the post-resolution period, a change in a company’s risk profile, the state of the company’s compliance program, and whether the company self-reported the conduct. According to the Enforcement Plan, the Criminal Division has already terminated some agreements early as a result of the new policy.

For future resolutions, the Enforcement Plan suggests that the duration of resolutions will be shorter than before, directing that prosecutors “must impose a term that is appropriate and necessary in light of, among other things, the severity of the misconduct, the company’s degree of cooperation and remediation, and the effectiveness of the company’s compliance program at the time of resolution.” The Enforcement Plan states that these terms are usually not to exceed three years and should be regularly reviewed for the possibility of early termination.

Recognition of Compliance and Law-Abiding Companies

In his May 12 speech at the annual Anti-Money Laundering and Financial Crimes Conference held by the Securities Industry and Financial Markets Association introducing the new enforcement policies and priorities, Matthew Galeotti, the Head of the Criminal Division, stated that the Criminal Division recognizes “that law-abiding companies are key to a prosperous America [and] [e]conomic security is national security.” In his speech, Galeotti further stated: “[m]ost corporations and financial institutions want to play by the rules and provide value for their shareholders and their customers. And that is what we want them to remain focused on. Excessive enforcement and unfocused corporate investigations stymie innovation, limits prosperity, and reduces efficiency.” The Enforcement Plan similarly recognizes that “it is critical to American prosperity to promote policies that acknowledge law-abiding companies and companies that are willing to learn from their mistakes.”

These messages make clear the importance of corporate compliance and appropriate remediation. In line with this message, the Corporate Enforcement Policy has been revised “[t]o ensure fairness and individualized assessments,” with a focus on benefits for companies that self-disclose and cooperate. Under the new Corporate Enforcement Policy, the Criminal Division is to make a “case-by-case analysis about the appropriate disposition” and consider all forms of corporate criminal resolutions: non-prosecution agreements (NPAs), deferred prosecution agreements, and guilty pleas. In his May 12 remarks, Mr. Galeotti stated that under the new policy, “[s]elf-disclosure is key to receiving the most generous benefits the Criminal Division can offer.” The Corporate Enforcement Policy also preserves prior compliance components in the definition of appropriate remediation, again signaling the importance of compliance.

More Certain Paths to Specific Results

Mr. Galeotti also stated that the new Corporate Enforcement Policy was simplified to allow companies to better anticipate outcomes when self-reporting. Under the updated Corporate Enforcement Policy, the Criminal Division will publicly decline to prosecute a company for criminal conduct when:

- The company voluntarily self-disclosed the misconduct to the Criminal Division. These disclosures qualify so long as “the company had no preexisting obligation to disclose the misconduct to the Department of Justice.” This seems to allow for self-disclosures that were undertaken out of obligation to agencies other than DOJ.

- The company fully cooperates with the Criminal Division’s investigation.

- The company timely and appropriately remediated the conduct.

- There are no aggravating circumstances (which are “the nature and seriousness of the offense, egregiousness or pervasiveness of the misconduct within the company, severity of harm caused by the misconduct, or criminal adjudication or resolution within the last five years based on similar misconduct by the entity engaged in the current misconduct.”). This definition suggests that only criminal resolutions by the same corporation for “similar misconduct” will be considered an aggravating factor, rather than any prior misconduct or by an affiliated entity.[5] Where there are aggravating circumstances, prosecutors can still recommend declination after weighing the severity of the circumstances.

In instances of “near miss self-disclosures” or where there are aggravating circumstances, the guidance requires the Criminal Division provide an NPA (absent egregious or multiple aggravating factors) for a term of less than 3 years without a monitorship, and a 75% reduction off of the low end of the U.S. Sentencing Guidelines fine range.

For resolutions in other cases, there is a presumption that any sentencing reduction will be taken from the low end of the Guidelines.

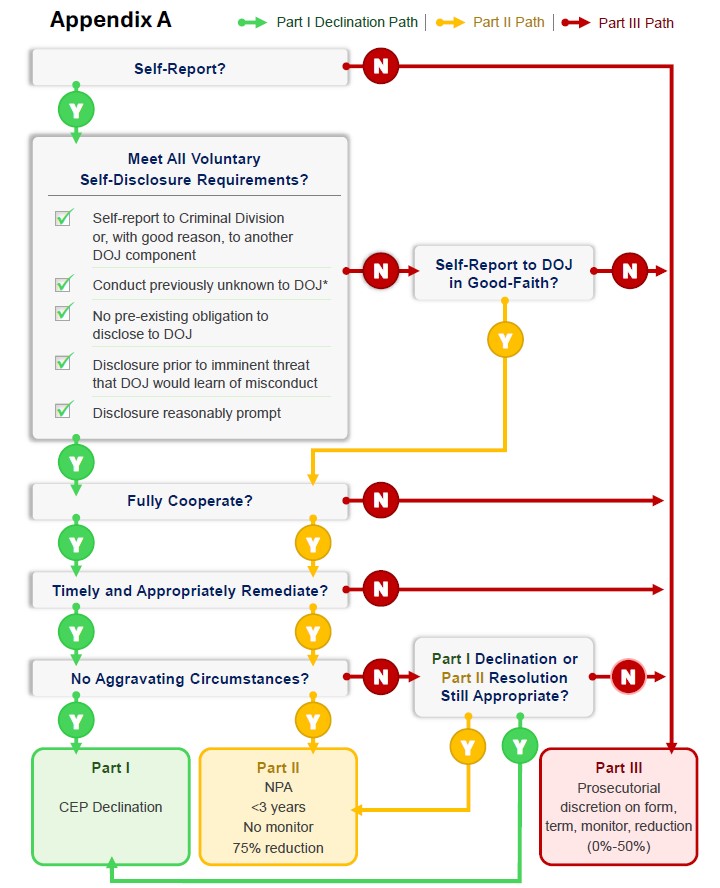

In addition to the updated language of the policy, the Criminal Division has also provided a flowchart illustrating enforcement “paths” in line with the policies summarized above.

III. “Efficiency”

Streamlined Investigations

In his remarks, Mr. Galeotti stated that businesses have been deterred from utilizing benefits of self-reporting misconduct to governmental authorities by the possibility of “lengthy drawn-out investigations that are ultimately detrimental to companies[.]” He argued that this deterrence of self-reporting diverts Department resources away from “tackling the most significant threats facing our country.” The Enforcement Plan instructs the Criminal Division to take all reasonable steps to minimize the length and collateral impact of their investigation and to ensure that “bad actors” are quickly brought to justice. While framed as a novel insight, many prior Administrations have included similar language in guidance documents; any meaningful change will depend on Criminal Division supervisors driving more efficient investigations.

Limited Use of Monitors

In addition to taking reasonable steps to minimize length and impact of investigations, the Enforcement Plan instructs the Criminal Division to utilize independent compliance monitors only when necessary and that use of those monitors should be narrowly tailored.

The Criminal Division also released a memorandum entitled “Memorandum on Selection of Monitors in Criminal Division Matters,” which requires prosecutors to consider four factors when weighing the possibility of imposing a monitorship:

- Risk of recurrence of criminal conduct that significantly impact U.S. interests.

- Availability and efficacy of other independent government oversight.

- Efficacy of the compliance program and culture of compliance at the time of the resolution.

- Maturity of the company’s controls and its ability to independently test and update its compliance program.

Even if a monitor is appropriate, the memorandum requires that prosecutors tailor the monitorship to be cost efficient and effective. The company’s counsel must present three to five monitor candidates for consideration, which is an increase from previous guidance. After a monitor is approved, the Criminal Division must ensure the costs are proportionate to the severity of the underlying conduct, the company’s profits, and the company’s size and risk profile. There will be a cap on hourly rates, and the monitor will be required to submit a budget for the entire monitorship at the time is submits its first work plan to the Criminal Division and company for review. The monitor will also attend at least two additional meetings a year with the company and the government to ensure alignment.

Conclusion

The May 12, 2025 Guidance Documents, taken together, indicate that the Criminal Division will continue to aggressively prosecute violations of law while rewarding compliant companies with non-criminal enforcement alternatives to resolve any misconduct. This development underscores the continued importance for companies to maintain effective compliance programs that address risks relating to government procurement, corruption, money laundering, national security and tariff offenses, sanctions evasion, and other priorities, to mitigate the corresponding liability that may arise under the criminal statutes. Companies therefore will be well served by reviewing their compliance programs and calibrating their compliance-related risk assessments to mitigate against changing risk and enforcement realities.

[1] Guidance documents like these are often issued by the Deputy Attorney General and thus are also applicable to other DOJ components like U.S. Attorney’s Offices. It remains to be seen how the May 12, 2025 Guidance Documents will, if at all, also govern those other DOJ components.

[2] The ten high-impact areas are:

“1. Waste, fraud, and abuse, including health care fraud and federal program and procurement fraud that harm the public fisc;

2. Trade and customs fraud, including tariff evasion;

3. Fraud perpetrated through [variable interest entities], including, but not limited to, offering fraud, “ramp and dumps,” elder fraud, securities fraud, and other market manipulation schemes;

4. Fraud that victimizes U.S. investors, individuals, and markets including, but not limited to, Ponzi schemes, investment fraud, elder fraud, servicemember fraud, and fraud that threatens the health and safety of consumers;

5. Conduct that threatens the country’s national security, including threats to the U.S. financial system by gatekeepers, such as financial institutions and their insiders that commit sanctions violations or enable transactions by Cartels, TCOs, hostile nation-states, and/or foreign terrorist organizations;

6. Material support by corporations to foreign terrorist organizations, including recently designated Cartels and TCOs;

7. Complex money laundering, including Chinese Money Laundering Organizations, and other organizations involved in laundering funds used in the manufacturing of illegal drugs;

8. Violations of the Controlled Substances Act and the Federal Food, Drug, and Cosmetic Act (FDCA), including the unlawful manufacture and distribution of chemicals and equipment used to create counterfeit pills laced with fentanyl and unlawful distribution of opioids by medical professionals and companies;

9. Bribery and associated money laundering that impact U.S. national interests, undermine U.S. national security, harm the competitiveness of U.S. businesses, and enrich foreign corrupt officials; and

10. As provided by the Digital Assets DAG Memorandum: crimes (1) involving digital assets that victimize investors and consumers; (2) that use digital assets in furtherance of other criminal conduct; and (3) willful violations that facilitate significant criminal activity. Cases impacting victims, involving cartels, TCOs, or terrorist groups, or facilitating drug money laundering or sanctions evasion shall receive highest priority.”

[3] Gibson Dunn’s analysis of that Executive Order can be found at https://www.gibsondunn.com/president-trump-pauses-new-fcpa-enforcement-initiates-enforcement-review-and-directs-preparation-of-new-guidance/.

[4] Gibson Dunn’s analysis of this and other memoranda issued by Attorney General Bondi can be found at https://www.gibsondunn.com/new-memoranda-from-attorney-general-bondi-topics-to-watch-in-corporate-enforcement/.

[5] DOJ policy under the Biden Administration directed prosecutors considering non-prosecution to give the “greatest significance” to “recent U.S. criminal resolutions, and to prior misconduct involving the same personnel or management.” This policy de-emphasized conduct addressed by criminal resolution more than ten years prior, or civil / regulatory resolutions finalized more than five years prior. However, conduct that fell outside of this timeframe could still be considered if it was part of a pattern of behavior indicative of deficient corporate “compliance culture or institutional safeguards.” See Memorandum from Deputy Attorney General Lisa O. Monaco, Further Revisions to Corporate Criminal Enforcement Policies Following Discussions with Corporate Crime Advisory Group (Sept. 15, 2022). See also Deputy Attorney General Lisa O. Monaco Delivers Remarks on Corporate Criminal Enforcement (Sept. 15, 2022), https://www.justice.gov/archives/opa/speech/deputy-attorney-general-lisa-o-monaco-delivers-remarks-corporate-criminal-enforcement.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of Gibson Dunn’s White Collar Defense and Investigations practice group:

Washington, D.C.

F. Joseph Warin (+1 202.887.3609, fwarin@gibsondunn.com)

Stephanie Brooker (+1 202.887.3502, sbrooker@gibsondunn.com)

Matthew S. Axelrod – Washington, D.C. (+1 202.955.8517, maxelrod@gibsondunn.com)

Courtney M. Brown (+1 202.955.8685, cmbrown@gibsondunn.com)

David P. Burns (+1 202.887.3786, dburns@gibsondunn.com)

John W.F. Chesley (+1 202.887.3788, jchesley@gibsondunn.com)

Daniel P. Chung (+1 202.887.3729, dchung@gibsondunn.com)

M. Kendall Day (+1 202.955.8220, kday@gibsondunn.com)

Stuart F. Delery (+1 202.955.8515, sdelery@gibsondunn.com)

Michael S. Diamant (+1 202.887.3604, mdiamant@gibsondunn.com)

Gustav W. Eyler (+1 202.955.8610, geyler@gibsondunn.com)

Melissa Farrar (+1 202.887.3579, mfarrar@gibsondunn.com)

Amy Feagles (+1 202.887.3699, afeagles@gibsondunn.com)

Scott D. Hammond (+1 202.887.3684, shammond@gibsondunn.com)

George J. Hazel (+1 202.887.3674, ghazel@gibsondunn.com)

Jake M. Shields (+1 202.955.8201, jmshields@gibsondunn.com)

Adam M. Smith (+1 202.887.3547, asmith@gibsondunn.com)

Patrick F. Stokes (+1 202.955.8504, pstokes@gibsondunn.com)

Oleh Vretsona (+1 202.887.3779, ovretsona@gibsondunn.com)

David C. Ware (+1 202.887.3652, dware@gibsondunn.com)

Ella Alves Capone (+1 202.887.3511, ecapone@gibsondunn.com)

Lora Elizabeth MacDonald (+1 202.887.3738, lmacdonald@gibsondunn.com)

Bryan Parr (+1 202.777.9560, bparr@gibsondunn.com)

Pedro G. Soto (+1 202.955.8661, psoto@gibsondunn.com)

New York

Zainab N. Ahmad (+1 212.351.2609, zahmad@gibsondunn.com)

Barry H. Berke (+1 212.351.3860, bberke@gibsondunn.com)

Reed Brodsky (+1 212.351.5334, rbrodsky@gibsondunn.com)

Mylan L. Denerstein (+1 212.351.3850, mdenerstein@gibsondunn.com)

Jordan Estes (+1 212.351.3906, jestes@gibsondunn.com)

Dani R. James (+1 212.351.3880, djames@gibsondunn.com)

Darren LaVerne (+1 212.351.3936, dlaverne@gibsondunn.com)

Michael Martinez (+1 212.351.4076, mmartinez2@gibsondunn.com)

Osman Nawaz (+1 212.351.3940, onawaz@gibsondunn.com)

Karin Portlock (+1 212.351.2666, kportlock@gibsondunn.com)

Mark K. Schonfeld (+1 212.351.2433, mschonfeld@gibsondunn.com)

Orin Snyder (+1 212.351.2400, osnyder@gibsondunn.com)

Sam Raymond (+1 212.351.2499, sraymond@gibsondunn.com)

Dallas

David Woodcock (+1 214.698.3211, dwoodcock@gibsondunn.com)

Denver

Ryan T. Bergsieker (+1 303.298.5774, rbergsieker@gibsondunn.com)

Robert C. Blume (+1 303.298.5758, rblume@gibsondunn.com)

John D.W. Partridge (+1 303.298.5931, jpartridge@gibsondunn.com)

Laura M. Sturges (+1 303.298.5929, lsturges@gibsondunn.com)

Houston

Gregg J. Costa (+1 346.718.6649, gcosta@gibsondunn.com)

Los Angeles

Michael H. Dore (+1 213.229.7652, mdore@gibsondunn.com)

Michael M. Farhang (+1 213.229.7005, mfarhang@gibsondunn.com)

Diana M. Feinstein (+1 213.229.7351, dfeinstein@gibsondunn.com)

Douglas Fuchs (+1 213.229.7605, dfuchs@gibsondunn.com)

Nicola T. Hanna (+1 213.229.7269, nhanna@gibsondunn.com)

Poonam G. Kumar (+1 213.229.7554, pkumar@gibsondunn.com)

Marcellus McRae (+1 213.229.7675, mmcrae@gibsondunn.com)

Eric D. Vandevelde (+1 213.229.7186, evandevelde@gibsondunn.com)

Debra Wong Yang (+1 213.229.7472, dwongyang@gibsondunn.com)

San Francisco

Winston Y. Chan (+1 415.393.8362, wchan@gibsondunn.com)

Jina L. Choi (+1 415.393.8221, jchoi@gibsondunn.com)

Charles J. Stevens (+1 415.393.8391, cstevens@gibsondunn.com)

Palo Alto

Benjamin Wagner (+1 650.849.5395, bwagner@gibsondunn.com)

London

Patrick Doris (+44 20 7071 4276, pdoris@gibsondunn.com)

Sacha Harber-Kelly (+44 20 7071 4205, sharber-kelly@gibsondunn.com)

Michelle Kirschner (+44 20 7071 4212, mkirschner@gibsondunn.com)

Allan Neil (+44 20 7071 4296, aneil@gibsondunn.com)

Philip Rocher (+44 20 7071 4202, procher@gibsondunn.com)

Paris

Benoît Fleury (+33 1 56 43 13 00, bfleury@gibsondunn.com)

Bernard Grinspan (+33 1 56 43 13 00, bgrinspan@gibsondunn.com)

Frankfurt

Finn Zeidler (+49 69 247 411 530, fzeidler@gibsondunn.com)

Munich

Kai Gesing (+49 89 189 33 285, kgesing@gibsondunn.com)

Katharina Humphrey (+49 89 189 33 155, khumphrey@gibsondunn.com)

Benno Schwarz (+49 89 189 33 110, bschwarz@gibsondunn.com)

Hong Kong

Oliver D. Welch (+852 2214 3716, owelch@gibsondunn.com)

Singapore

Oliver D. Welch (+852 2214 3716, owelch@gibsondunn.com)

Karthik Ashwin Thiagarajan (+65 6507 3636, kthiagarajan@gibsondunn.com)

Ashley Wilson, a recent law graduate in New York, is not admitted to practice law.

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.