November 7, 2023

On October 8, 2023, California signed into law Senate Bill 54 (“SB 54”)[1], which seeks to increase transparency into the diversity of founding teams in the venture capital industry. We expect that many of our private fund adviser clients may be picked up under SB 54’s broad definition of “Covered Entities,” and will thus be required to report diversity statistics to the California Civil Rights Department (“CRD”) if their portfolio companies or investors have a connection to California. We expect this legislation will have wide impact including to venture capital funds and potentially private equity funds with an active investment strategy (a) headquartered in California, (b) investing in portfolio companies based in California, or (c) soliciting or having limited partners based in California. SB 54 is currently scheduled to go into effect on March 1, 2025.

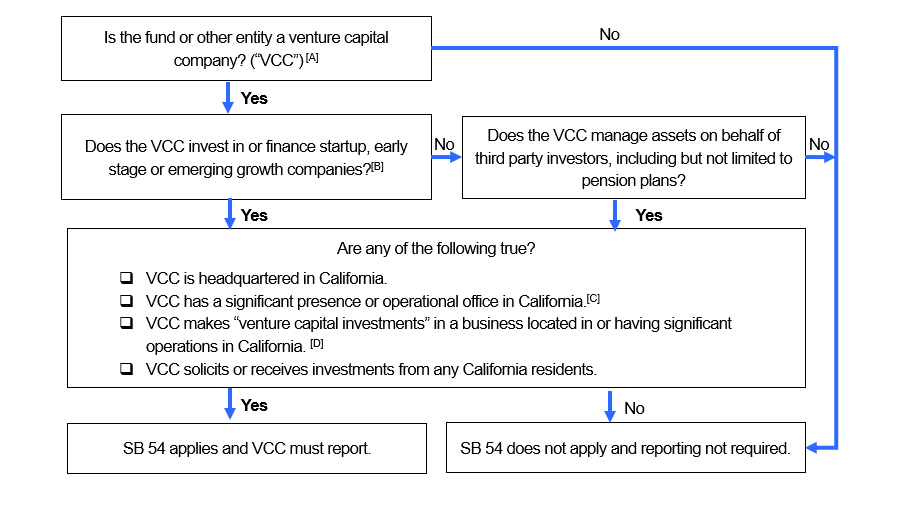

The below decision tree sets forth how to determine if SB 54’s reporting requirements apply to an entity.

Covered Entities Subject to the Reporting Requirements

Chart Footnotes

- The California Code’s definition of a “Venture Capital Company” is complex, and whether an entity will be considered a VCC merits a case-by-case analysis. In simple terms, an entity generally will be a VCC in California if it is (i) a “Venture Capital Fund” as defined by the SEC, meaning it is a private fund that (1) holds itself out to investors as pursuing a venture capital strategy, (2) holds no more than 20% of the fund’s commitments in non-qualifying investments, including non-convertible debt, secondaries, public issuances, other private or registered funds, certain digital assets, or leveraged buyouts, (3) does not borrow or otherwise incur leverage in excess of 15% of the fund’s commitments, and then only on a short-term basis, and (4) limits investor redemption rights to “extraordinary circumstances”; (ii) a “Venture Capital Operating Company” as defined by the Department of Labor, meaning 50% of fund assets (valued at cost) must be invested in operating companies or derivative investments in which the fund has direct contractual management rights and the fund must exercise such management rights with respect to at least one portfolio company; or (iii) if 50% or more of the entity’s assets are “Venture Capital Investments” or related derivatives per Section 260.204.9 of the California Code at any time in a given reportable year. “Venture Capital Investment” means an acquisition of securities in an operating company as to which the investment adviser, the entity advised by the investment adviser, or an affiliated person of either has or obtains management rights, or the right to substantially participate in, to substantially influence the conduct of, or to provide (or to offer to provide) significant guidance and counsel concerning, the management, operations or business objectives of the operating company in which the venture capital investment is made.

- No guidance or cross-reference was given regarding the definitions of “Early Stage” or “Emerging Growth Companies” under SB 54.

- No guidance or cross-reference was given regarding what constitutes a “significant presence” in California under SB 54 and sponsors will need to make a subjective determination regarding the same.

- See footnote [A] for the definition of Venture Capital Investment. No guidance or cross-reference was given regarding what constitutes “significant operations in California” under SB 54 and sponsors will need to make a subjective determination regarding the same.

Reporting Requirements

Under SB 54, covered entities are required to provide portfolio companies the opportunity to provide demographic data annually on a form that will be prescribed, and then make annual reports to the CRD with respect to portfolio companies in which they have invested over the prior calendar year on the (i) founding team demographics of their portfolio companies and (ii) investments each covered entity makes in portfolio companies with diverse founding teams.

Demographic data of portfolio company founding teams that must be reported under SB 54 on an aggregated and anonymized basis, to the extent it was provided by the covered entity[2], includes:

- Race;

- Ethnic identity;

- Individuals who identity as LGBTQ+;

- Gender identity, including nonbinary and gender-fluid identities;

- Disability status;

- Veteran status; and

- California resident status.

Investments made in the prior calendar year in portfolio companies with diverse founding teams must also be reported as a percentage of the covered entity’s aggregate venture capital investments. SB 54 requires both aggregate reporting and categorical reports for each enumerated group above. Additionally, the covered entity must report the dollar amount of its portfolio company investments for the prior calendar year and the principal place of business of each portfolio company. SB 54 allows the CRD to publish this anonymized information online and collect fees for the administration of SB 54, and provides for legal recourse for failure to comply within sixty (60) days after March 1, 2025.

SB 54 notes that the CRD “may use any information collected…in a civil action brought by the CRD under this chapter or other law.” The introduction to the legislation also notes that existing law makes discrimination illegal, provides a cause of action against any person who “denies, aids or incites a denial, or makes any discrimination or distinction on the bases listed, as specified, and permits the recovery of attorney’s fees,” and establishes the CRD to investigate and prosecute complaints alleging discrimination. Accordingly, SB 54 conceivably lays the groundwork for the CRD to potentially sue sponsors on the basis of discrimination.

Consequences of Non-Compliance

If a covered entity does not comply with the reporting requirements, a court of competent jurisdiction can order injunctive relief and levy fines against the covered entity. The amount of the fine will depend on the “amount necessary to ensure compliance” and the court will take into account the covered entity’s size, assets under management, and reason for noncompliance.

Uncertainties and Timeline

The enforceability, scope, and furtherance of the legislative intent of SB 54 remain to be seen without further clarification from Governor Newsom’s administration and the California Attorney General’s Office. Areas of uncertainty could include the following:

- Ambiguity of the scope of the law’s coverage regarding out-of-state entities, covered entities and its enforceability generally.

- Litigation in light of the scope and whether the law meets its intent to further diversity, equity, and inclusion given the onerous reporting requirements.

- The effect of the law is not applied evenly when considering smaller funds who could themselves be diverse as compared to activist arms of large institutional investors with more resources.

- Dissuasion of soliciting and accepting California investors if a private fund does not otherwise have a connection to California.

- Given there are no threshold requirements to the investor prong of the covered entity definition, such as a minimum investment amount, this provision could expose clients who are non-California entities that meet the California definition of a “Venture Capital Company” to SB 54’s reporting requirements if they accept subscriptions from California residents, even if they are not marketing in California.

- Whether the CRD will exercise its authority to take action against against founders who they determine discriminate in their selection of portfolio companies and managers.

The proposed effective date of March 1, 2025 would require all covered entities to collect the requested information for fiscal year 2024. This effective date likely will be in flux due to the uncertainties above. Nevertheless, it is advisable that private fund sponsors begin working to ensure they have the infrastructure to meet the reporting requirements due to the breadth of the law as it currently stands.

_____________________________

[1] Senate Bill 54, Ch. 594, 8 October 2023 available here.

[2] Portfolio companies may choose to provide diversity statistics, but also may decline to provide them, in their discretion. Sponsors are not permitted to discourage portfolio companies from providing the information.

The following Gibson Dunn attorneys assisted in preparing this client update: Lexi Hart, Shannon Errico, and Kevin Bettsteller.

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding the issues and considerations discussed above. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any of the following leaders and members of the firm’s Investment Funds practice group:

Investment Funds Group:

Jennifer Bellah Maguire – Los Angeles (+1 213-229-7986, [email protected])

Kevin Bettsteller – Los Angeles (+1 310-552-8566, [email protected])

Albert S. Cho – Hong Kong (+852 2214 3811, [email protected])

Candice S. Choh – Los Angeles (+1 310-552-8658, [email protected])

John Fadely – Singapore/Hong Kong (+65 6507 3688/+852 2214 3810, [email protected])

A.J. Frey – Washington, D.C./New York (+1 202-887-3793, [email protected])

Shukie Grossman – New York (+1 212-351-2369, [email protected])

James M. Hays – Houston (+1 346-718-6642, [email protected])

Kira Idoko – New York (+1 212-351-3951, [email protected])

Gregory Merz – Washington, D.C. (+1 202-887-3637, [email protected])

Eve Mrozek – New York (+1 212-351-4053, [email protected])

Roger D. Singer – New York (+1 212-351-3888, [email protected])

Edward D. Sopher – New York (+1 212-351-3918, [email protected])

William Thomas, Jr. – Washington, D.C. (+1 202-887-3735, [email protected])

Shannon Errico – New York (+1 212-351-2448, [email protected])

Lexi Hart – Washington, D.C. (+1 202-777-9552, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.