July 22, 2013

At an Open Commission Meeting on July 10, 2013, the Securities and Exchange Commission (the “Commission” or “SEC”) adopted long-awaited final rules to allow advertising of private securities offerings, as required by the Jumpstart Our Business Startups Act (the “JOBS Act”).[1] The Commission approved the rules by a vote of 4-1, with Commissioner Aguilar dissenting. As discussed in greater detail below, the final rules (the “General Solicitation Adopting Release”) include a non-exclusive list of methods that an issuer conducting a private placement under Rule 506 of Regulation D may use to verify that purchasers who are natural persons are accredited investors.

The Commission also adopted final rules to prohibit certain “felons and other ‘bad actors'” from participating in private offerings using Rule 506 (the “Bad Actor Adopting Release”).[2] These rules are required by Section 926 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and were adopted by a unanimous vote.

Finally, the Commission issued a proposing release (the “Regulation D Proposing Release”)[3] that proposed new and amended rules: relating to the content, timing and consequences of failing to file Form D; requiring that written general solicitation materials be submitted to the Commission; and providing guidance relating to when information in sales literature by private funds could be fraudulent or misleading under the federal securities laws. The Regulation D Proposing Release also requested comment on other matters, including potential changes to the definition of “accredited investor” under Regulation D. The amendments are intended to enhance the Commission’s ability to evaluate changes in the private offering market and to address the development of practices in Rule 506 offerings. The Regulation D Proposing Release was approved by a vote of 3-2, with Commissioners Paredes and Gallagher dissenting.

The final rules permitting the use of general solicitation and providing for the disqualification of “bad actors” from Rule 506 offerings will become effective on September 23, 2013. The comment period relating to the additional proposed amendments to Regulation D, Form D and Rule 156 will also end on September 23, 2013.

For an analysis focusing on the impact of the two adopting releases and the proposing release on private funds, please refer to a companion Client Alert issued by Gibson Dunn dated July 17, 2013 entitled SEC Lifts Ban on General Solicitation, Allowing Private Funds to Advertise.[4]

Background

Rule 506 permits an issuer to raise an unlimited amount of capital in an offering sold only to accredited investors[5] and up to thirty-five nonaccredited investors who meet certain sophistication requirements. Rule 144A permits the resale of an unlimited amount of securities to qualified institutional buyers, or QIBs.[6] Under Rules 506 and 144A as currently in effect, issuers and other participants may not use general solicitation to attract investors.

Section 201(a) of the JOBS Act, however, directed the SEC to revise its rules to eliminate the prohibition on general solicitation in securities offerings conducted pursuant to Rules 506 and 144A so long as all purchasers of the securities are accredited investors (in the case of an offering pursuant to Rule 506) or persons reasonably believed to be QIBs (in the case of an offering under Rule 144A). In addition, Section 201(a)(1) provides that the revised provisions relating to offerings under Rule 506 must require that the issuer “take reasonable steps to verify that purchasers of the securities are accredited investors, using such methods as determined by the Commission.”

Separately, Section 926 of the Dodd-Frank Act instructed the Commission to issue rules to disqualify securities offerings involving felons or certain “bad actors” from reliance on Rule 506.[7]

The Commission issued a proposing release relating to the removal of the ban on general solicitation (the “General Solicitation Proposing Release”)[8] in August 2012, and issued a proposing release relating to the disqualification of felons and other “bad actors (the “Bad Actor Proposing Release”) in May 2011.[9] This Client Alert, in part, updates our Client Alert issued on August 31, 2012, entitled SEC Proposes Amendments to Permit Advertising in Rule 506 and Rule 144A Offerings,[10] which analyzed the General Solicitation Proposing Release.

Highlights of the Final and Proposed Rules

Final General Solicitation Rules

The final rules to remove the prohibition against general solicitation in offerings pursuant to Rule 506 and Rule 144A are largely unchanged from the General Solicitation Proposing Release, except that the final rules include a non-exclusive list of methods that issuers may use to satisfy the verification requirement with respect to investors who are natural persons.

The following are highlights of the final rules:

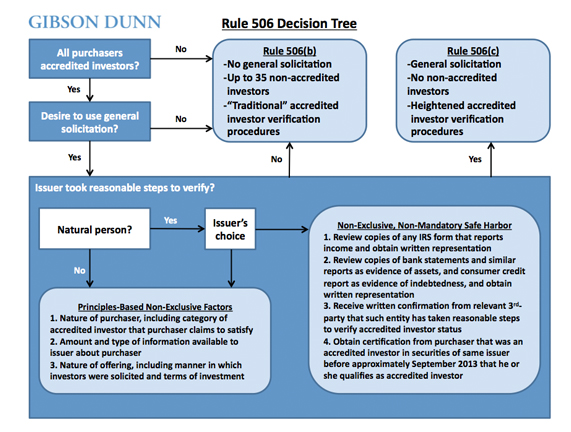

- Rule 506 will be amended by adding a new paragraph (c), which will allow general solicitation if (i) the issuer takes reasonable steps to verify that all purchasers are accredited investors; and (ii) all purchasers of the securities fall within one of the eight categories of persons who are accredited investors under Rule 501(a) of the Securities Act, or the issuer reasonably believes that all purchasers fall within one of those categories. Notably, the existing exemption under paragraph (b) for offerings conducted without engaging in general solicitation will continue to permit up to 35 non-accredited investors and will not be subject to the heightened verification requirements for accredited investors.

- The determination of whether the steps taken to verify that a purchaser is an accredited investor are reasonable will be an objective determination by an issuer based on the facts and circumstances. A non-exclusive list of factors that an issuer should consider in this determination includes: (i) the nature of the purchaser and the category of accredited investor that the purchaser claims to satisfy; (ii) the amount and type of information the issuer has about the purchaser; and (iii) the nature of the offering, including the manner in which purchasers were solicited, and the terms of the investment, such as the minimum investment amount.

- In addition to the principles-based approach described above, the final rule will describe a new, non-exclusive list of methods that an issuer may use to satisfy the verification requirement for a purchaser that is a natural person. These methods will include: (i) reviewing copies of any IRS form that reports the income of the purchaser and obtaining a written representation that the purchaser will likely continue to earn the necessary income in the current year; (ii) reviewing copies of bank, brokerage and similar statements, certificates of deposit, tax assessments and appraisal reports as evidence of the purchaser’s assets, and a consumer credit report as evidence of the purchasers indebtedness, and obtaining a written representation from the purchaser that all liabilities necessary to make a determination of net worth have been disclosed; and (iii) receiving written confirmation from a registered broker-dealer, SEC-registered investment adviser, licensed attorney, or certified public accountant that such entity or person has taken reasonable steps to verify the purchasers accredited status.

- The use of general solicitation in offerings by privately offered funds such as hedge funds, venture capital funds and private equity funds pursuant to Rule 506(c) will not cause an issuer to be deemed an “investment company” under the Investment Company Act.

- Rule 144A will be amended to permit “offers” to persons who are not QIBs, and thus to permit general solicitation in offerings conducted pursuant to Rule 144A.

- The use of general solicitation in connection with a Rule 506 or Rule 144A offering will not be a barrier to a concurrent offering by the issuer in an offshore transaction in reliance on Regulation S.

Final Rules Disqualifying Bad Actors from Offerings Under Rule 506

The following are highlights of the final rules to disqualify “felons and other ‘bad actors'” from reliance on the exemption from Securities Act registration pursuant to Rule 506:

- Persons covered by the rule will include issuers; 20 percent beneficial owners of the issuer; promoters; investment managers to issuers that are pooled investment funds; persons compensated for soliciting investors; any director, executive officer, or other officer participating in the offering of an issuer, such investment manager or such solicitor; and any general partner or managing member of the issuer or such solicitor.

- “Disqualifying events” that would disqualify a person from participating in Rule 506 offerings will include: (i) criminal convictions, court injunctions, and restraining orders in connection with the purchase or sale of a security, making a false filing with the SEC, or the conduct of certain financial intermediaries; (ii) certain final orders from the Commodity Futures Trading Commission (“CFTC”), state securities regulators and other federal and state banking, insurance and similar regulators; (iii) certain SEC disciplinary, cease-and-desist, and stop orders; (iv) suspension or expulsion from membership in a self-regulatory organization; and (v) U.S. Postal Service false representation orders. Some of these disqualification events will be subject to look-back periods of up to ten years.

- An issuer will not be subject to disqualification if it did not know and, in the exercise of reasonable care, could not have known that a covered person with a disqualifying event participated in the offering.

- Issuers relying on Rule 506 will be required to disclose events that took place prior to the effective date that would otherwise be disqualifying.

- Participation in an offering for purposes of the rule would have to be more than transitory or incidental involvement, and could include activities such as conducting due diligence activities, involvement in the preparation of disclosure documents, and communication with the issuer, prospective investors or other offering participants.

Proposed Regulation D Amendments and Related Amendments

In addition to adopting the final rules discussed above, the Commission proposed for public comment broader revisions to Regulation D, Form D and Rule 156 under the Securities Act, which are oriented to investor protection and providing more information to the Commission, but some of which could potentially hamper the use of general solicitation in private offerings.

In particular, the proposals would:

- Require that an issuer file a Form D 15 days before engaging in general solicitation for a Rule 506(c) offering, and that an issuer update the information contained in its Form D filings within 30 days of completing a Rule 506 offering;

- Significantly expand the information required to be included on Form D to include more extensive information about the issuer and the offered securities, the types of purchasers in the offering, the use of proceeds from the offering, and, in the case of Rule 506(c) offerings, the types of general solicitation used and the methods used to verify the accredited investor status of purchasers;

- Disqualify an issuer from relying on Rule 506 for one year if the issuer fails to comply with its Form D filing obligations in connection with a Rule 506 offering;

- Require issuers to include, in any written general solicitation materials, legends stating that the offering is limited to accredited investors and that the offering may involve certain risks;

- In the case of written solicitation materials relating to securities of private funds, require issuers to include additional legends, including, if the materials include information about the fund’s past performance, language highlighting the limitations on the usefulness of this type of information and the difficulty of comparing this information with past performance information of other funds;

- For a period of two years from the effective date of the rule, require issuers to submit written general solicitation materials to the SEC; and

- Extend the guidance contained in Rule 156 under the Securities Act, which currently describes when information in sales literature by a registered investment company could be fraudulent or misleading under the federal securities laws, to apply to sales literature of private funds. In this regard, the Commission noted several specific areas that it believes are vulnerable to misleading statements, including misrepresenting prior investment performance; exaggerating personal qualifications; omitting disciplinary information; misrepresenting holdings; making fraudulent performance claims; and falsely valuing investments.

Furthermore, unrelated to any of the proposed rules, the Commission solicited comment on the definition of accredited investor as it related to natural persons, potentially laying the foundation for the Commission to adopt final rules to amend the definition without issuing a further proposing release.

Overview of the Final Rules Removing the Prohibition on General Solicitation

Revised Rule 506 will effectively include two related exemptions: one for offerings using general solicitation and one for offerings that do not use general solicitation. The rules governing offerings that do not use general solicitation will remain in paragraph (b) of the rule, and will be unchanged from the provisions that have heretofore governed offerings conducted under Rule 506. Offerings that use general solicitation will be governed by new paragraph (c). We have included a “Rule 506 Decision Tree” at the end of this Client Alert that sets forth the considerations for analyzing whether a Rule 506 offering should be conducted pursuant to paragraph (b) or (c).Rule 506(c) will provide that general solicitation is permitted if the issuer takes reasonable steps to verify that purchasers of securities sold in the offering are accredited investors, and all purchasers in the offering are accredited investors. The Commission confirmed that the legal standard for accredited investor under the proposal will be the same for purposes of Rule 506(c) as it is under the existing exemption under Rule 506 – that is, “any person who comes within one of the definition’s enumerated categories of persons,[11] or whom the issuer ‘reasonably believes’ comes within any of the enumerated categories, at the time of the sale of the securities to that person.”[12] Thus, Rule 506(c) will allow general solicitation where the issuer takes reasonable steps to verify, and reasonably believes, that each purchaser in the offering satisfies one of the categories of persons defined as an accredited investor.

As a result, an issuer will not lose the benefit of new Rule 506(c) even if a purchaser that does not meet the criteria for any category of accredited investor circumvents the issuer’s verification measures, so long as the issuer has taken reasonable steps to verify, and reasonably believed at the time of purchase, that the purchaser was an accredited investor.[13] Conversely, the Commission noted that an issuer that fails to take reasonable steps will lose the benefit of Rule 506(c) even if all purchasers are accredited investors.[14] In this case, the offering would likely not qualify for the exemption provided by Section 4(a)(2), and thus would violate Section 5 of the Securities Act – a highly consequential outcome for the issuer.

It is also notable that Rule 506(c) may serve as a “safety net” for a Section 4(a)(2) offering or a “quiet” Rule 506 offering in which the issuer inadvertently makes a communication that is deemed a general solicitation.[15] Importantly, in such a case, the issuer (or a person acting on its behalf) would need to comply with the heightened verification requirements for accredited investors. Otherwise, as noted above, the offering would likely violate Section 5.

Reasonable Steps to Verify

The final rules will not specify the methods that an issuer can or must employ to satisfy its obligation to “take reasonable steps to verify” that a purchaser is an accredited investor, other than four non-mandatory, non-exclusive methods that an issuer may use for natural persons as described below. In light of the different types of issuers and the different types of accredited investors that may be involved in an offering pursuant to Rule 506(c), the Commission instead adopted a principles-based approach. Thus, the adopting release provides that the determination of whether the steps taken to verify that a purchaser is an accredited investor are reasonable will be an objective determination by an issuer based on the facts and circumstances that apply to each purchaser.[16]

The adopting release provides the following non-exclusive list of factors that an issuer should consider when determining the reasonableness of its steps to verify that a purchaser is an accredited investor:

- The nature of the purchaser, including the category of accredited investor that the purchaser claims to satisfy;

- The amount and type of information that is available to the issuer about the purchaser; and

- The nature of the offering, including the manner in which investors were solicited and the terms of the investment.

These factors will interact with each other. Thus, the stronger the support is under one factor indicating that a purchaser is an accredited investor, the less the need for support under the other factors.

The adopting release recognizes that differences among purchasers can affect the reasonableness of steps to verify whether an entity is an accredited investor. It notes that “the steps that may be reasonable to verify that an entity is an accredited investor by virtue of being a registered broker-dealer – such as by going to FINRA’s BrokerCheck website – will necessarily differ from the steps that may be reasonable to verify whether a natural person is an accredited investor.”[17] The Commission recognizes that “the verification of natural persons as accredited investors may pose greater practical difficulties as compared to other categories of accredited investors, particularly for natural persons claiming to be accredited investors based on the net worth test,” and that “[t]hese practical difficulties likely will be exacerbated by privacy concerns about the disclosure of personal financial information.”[18] While the four non-exclusive methods discussed below potentially offer a solution, issuers that opt not to make use of those methods may otherwise need to rely more heavily upon other factors relevant to a natural person’s accredited investor status.

Regarding the amount and type of information that is available to the issuer about the purchaser, the adopting release notes that, “[t]he more information an issuer has indicating that a prospective purchaser is an accredited investor, the fewer steps it would have to take, and vice versa.”[19] Information that issuers could consider relevant in verifying accredited investor status includes: (i) publicly available information in filings with a federal, state or local regulatory body; (ii) third-party information that provides reasonably reliable evidence that a person is an accredited investor; and (iii) verification of a person’s status as an accredited investor by a third party, such as a broker-dealer, attorney or accountant, whom the issuer has a reasonable basis to rely upon.[20]

The adopting release discusses two relevant aspects of the nature of the offering – the manner in which purchasers were solicited and the terms of the investment. With respect to the manner of solicitation, the release states that “[a]n issuer that solicits new investors through a website accessible to the general public, through a widely disseminated email or social media solicitation, or through print media, such as a newspaper, will likely be obligated to take greater measures to verify accredited investor status than an issuer that solicits new investors from a database of pre-screened accredited investors created and maintained by a reasonably reliable third party”[21]

The adopting release notes that an issuer would fail to take reasonable steps to verify the accredited investor status of a person solicited through media such as generally accessible websites by requiring merely that the person represent as to their accredited investor status. In such circumstances, an issuer will need to obtain additional information about the purchaser or otherwise take reasonable steps sufficient to establish a reasonable a belief that the purchaser is an accredited investor.

The terms of the investment, such as the minimum investment amount, may also be relevant to determining accredited investor status. For example, if the minimum investment amount is high enough that only accredited investors could reasonably be expected to meet it, and a purchaser can do so with a direct cash investment that is not financed by the issuer or by any other third party, those facts could be viewed as evidence verifying the purchaser’s accredited investor status. In such a case, the adopting release states that it may be reasonable for an issuer to take no further steps to verify the accredited investor status of a natural person it otherwise knows little about.

In addition to the principles-based approach to the “reasonable steps” requirement under Section 201 of the JOBS Act, the final rule will also describe a list of “non-exclusive and non-mandatory” methods that an issuer may use to satisfy the verification requirement for a purchaser that is a natural person.[22] These methods will include: (i) reviewing a copy of any IRS form[23] that reports the income of the purchaser and obtaining a written representation that the purchaser will likely continue to earn the necessary income in the current year; (ii) reviewing copies of bank, brokerage and similar statements, certificates of deposit, tax assessments and appraisal reports as evidence of the purchaser’s assets, and a consumer credit report as evidence of the purchaser’s indebtedness, and obtaining a written representation from the purchaser that all liabilities necessary to make a determination of net worth have been disclosed; (iii) receiving written confirmation from a registered broker-dealer, SEC-registered investment adviser, licensed attorney, or certified public accountant that such entity or person has taken reasonable steps to verify the purchaser’s accredited status; and (iv) with respect to a purchaser who invested in a Rule 506(b) offering as an accredited investor prior to the effective date of Rule 506(c) and intends to invest in a Rule 506(c) offering by the same issuer, obtaining a certification from the purchaser that he or she qualifies as an accredited investor.

Regardless of the methods used by the issuer in its effort to verify the accredited investor status of the purchasers of its securities, the Commission reminded such issuers of the importance of maintaining adequate records of its verification process.

Revision to Form D

Form D will be amended to include a checkbox indicating that an offering was conducted pursuant to new Rule 506(c). The checkbox is intended to allow the Commission to monitor the use of general solicitation in offerings and to assess the impact of the changes in the market, including the effectiveness of various verification practices used by issuers.

The existing rules requiring issuers to file a Form D with the SEC within 15 days of the first sale of securities pursuant to Regulation D, but providing that the failure to file a Form D will not result in the loss of the Rule 506(c) exemption, remain unchanged. As discussed below, however, the Commission has separately proposed significant changes to the content, filing requirements and consequences of failing to file a Form D.

Implications of General Solicitation in Rule 506 Offerings for Privately Offered Funds

Privately offered funds, such as hedge funds, venture capital funds and private equity funds, generally rely on one of two statutory exclusions[24] from the definition of “investment company” under the Investment Company Act, and thus are not subject to the regulatory provisions under that Act. Those exemptions are unavailable, however, to a fund that engages in a public offering of its securities. The Commission reaffirmed its view, stated in the General Solicitation Proposing Release, that the use of general solicitation in offerings by privately offered funds pursuant to Rule 506(c) will not cause an issuer to be deemed an investment company under the Investment Company Act.

It is important to note that other laws applicable to private funds may be impacted by a private fund’s use of general solicitation. For example, usage of Rule 506(c) may impact the availability of certain exemptions available under rules promulgated by the CFTC, including the de minimis exemption from registration as a commodity pool operator under CFTC Rule 4.13(a)(3). The de minimis exemption requires that interests in each applicable fund be “offered and sold without marketing to the public in the United States.” Therefore, absent CFTC action, it appears that private funds seeking to engage in general solicitation may not be able to rely on the 4.13(a)(3) exemption.

Revisions to Rule 144A

Rule 144A(d)(1) will be amended to eliminate the restriction on “offers” to persons who are not QIBs, and thus to permit general solicitation in offerings conducted pursuant to Rule 144A. The rule will continue to condition the exemption on the securities being sold only to QIBs or to purchasers that the seller and any person acting on its behalf reasonably believe is a QIB. The amendments will not add any additional standards for whether a seller reasonably believes a purchaser to be a QIB or otherwise.[25] As a transitional matter, the adopting release provides that, with respect to offerings that were launched before the effective date of the amendment to Rule 144A(d)(1), offering participants may engage in general solicitation for the segment of the offering that is conducted after the effective date.

No Integration with Regulation S Offering

Issuers and offering participants that conduct an offering pursuant to Rule 506 or Rule 144A often conduct a simultaneous offshore offering of the issuer’s securities in reliance on the exemption from registration provided by Regulation S. One condition to the availability of the Regulation S exemption is that there be no “directed selling efforts” in the United States.[26] In practice, “directed selling efforts” under Regulation S has been treated as effectively synonymous with “general solicitation” for purposes of Rule 506 and Rule 144A.

While the Regulation S prohibition on “directed selling efforts” within the United States remains in place following the JOBS Act amendments discussed herein, the adopting release reaffirmed that the use of general solicitation in connection with a Rule 506 or Rule 144A offering will not be a barrier to a concurrent offering in reliance on Regulation S. Regulation S only offerings will, however, continue to be subject to the traditional restrictions on publicity which could be deemed a directed selling effort. Further, for foreign private issuers in Global Rule 144A (or Rule 506) / Regulation S offerings, we expect such issuers to continue to follow the restrictions set forth in the Rule 135e safe harbor for offshore press conferences in which the offshore offering is discussed. In contrast, following the amendments eliminating the prohibition on general solicitation, no such restrictions would be imposed on similar publicity and other statements made within the United States if related to the 144A (or 506) tranche of the offering.

Anti-Fraud Provisions Will Apply to General Solicitations

It is important to note that communications used to solicit prospective investors are subject to the general anti-fraud provisions under the federal securities laws. Furthermore, for investment advisers that are registered with the Commission, certain advertisements may also trigger specific advertising rules and regulations. For example, an investment adviser is severely limited in its ability to utilize an advertisement that refers to any testimonial concerning the investment adviser or refers to past specific investment recommendations. The Investment Advisers Act of 1940 (the “Advisers Act”) also limits the ways in which an investment adviser can present its track record.

Separately, entities registered with regulatory agencies other than the Commission, including the CFTC or the National Futures Association, may be subject to other agency specific marketing rules and regulations. Finally, many states and non-U.S. jurisdictions have their own anti-fraud and market rules that must be considered before marketing materials can be disseminated.

Rule 135c Implications

One consequence of permitting general solicitation in Rule 506(c) and Rule 144A offerings is that notices of such offerings need not be limited to the information permitted by Rule 135c or include the legend prescribed by Rule 135c. Notices of offerings pursuant to Rule 506(b), however, must still comply with Rule 135c.

Consequences of Failing to Comply with Requirements of Rule 506(c)

As we noted in our Client Alert relating to the General Solicitation Proposing Release, although the JOBS Act did not amend Section 4(a)(2), and the adopting release notes that “even after the effective date of Rule 506(c), an issuer relying on Section 4(a)(2) outside of the Rule 506(c) exemption will be restricted in its ability to make public communications to solicit investors for its offering because public advertising will continue to be incompatible with a claim of exemption under Section 4(a)(2),” this principle may come under pressure if issuers and offering participants seek in good faith to comply with Rule 506(c) or Rule 144A but inadvertently fail to comply with a condition or requirement of those safe harbors. Under those circumstances, the effect of such a failure could be that the offering violated Section 5 of the Securities Act – an effect that would have significant consequences for the issuer.

As a result, in the absence of further guidance from the Commission or court decisions that are binding on the Commission, issuers and offering participants should adhere rigorously to Commission rules relating to offering communications and verification of an investor’s accredited investor status in offerings involving the use of general solicitations.

- Rule 506 Decision Tree (PDF format).

Overview of Final Rules Disqualifying Bad Actors from Offerings Under Rule 506

The final rule to disqualify felons and other “bad actors” from participating in Rule 506 offerings will be contained in a new paragraph (d) to Rule 506. This rule is generally consistent with the Bad Actor Proposing Release, except that events that occurred prior to the effective date of the new rules will not result in a person’s disqualification. Instead, the Commission adopted a new paragraph (e) to Rule 506, which will require that the issuer disclose these prior events to each purchaser in the offering.

The disqualification provisions will apply to the following persons:

- the issuer (including any predecessors and any affiliated issuers);

- any director, executive officer, other officer participating in the offering, general partner or managing member of the issuer;

- beneficial owners of 20% or more of the issuer’s outstanding voting equity securities;

- promoters;

- any investment manager of an issuer that is a pooled investment fund;

- any person that is paid to solicit purchasers in connection with the offering;

- any general partner or managing member of any such investment manager or solicitor; and

- any director, executive officer or other officer participating in the offering of any such investment manager or solicitor, or of any general partner or managing member of such investment manager or solicitor.

“Disqualifying events” that would disqualify a person from participating in Rule 506 offerings will include:

- certain criminal convictions, court injunctions, and restraining orders in connection with the purchase or sale of a security, involving making a false filing with the SEC, or the conduct of certain financial intermediaries;

- certain final orders from the CFTC, state securities regulators and other federal and state banking, insurance and similar regulators;

- certain SEC disciplinary, cease-and-desist, and stop orders;

- suspension or expulsion from membership in a self-regulatory organization;

- having filed (as a registrant or issuer), or having been an underwriter or having been named as an underwriter in a registration statement or Regulation A offering statement that was the subject of certain Commission orders, investigations or proceedings; and

- U.S. Postal Service false representation orders.

Some of these disqualification events will be subject to look-back periods of up to ten years.

The release notes that the determination of whether officers are “participating in an offering will be a question of fact” and that “[p]articipation . . . would have to be more than transitory or incidental involvement.” Participation could include:

- participation or involvement in due diligence activities;

- involvement in the preparation of disclosure documents; and

- communication with the issuer, prospective investors or other offering participants.

The disqualification provisions will include a “reasonable care” exception for an issuer that can “establish[] that it did not know and, in the exercise of reasonable care, could not have known that” a covered person with a disqualifying event participated in the offering.” The instructions to the rule will note that the issuer must conduct a factual inquiry, in light of the particular circumstances, to establish that the issuer exercised reasonable care.

As a consequence, an issuer that anticipates that it may conduct a private offering pursuant to Rule 506 should conduct appropriate due diligence with respect to persons that are covered by the rule, including its directors, officers and large shareholders and, in the case of a pooled investment fund, its investment manager (and the relevant persons associated with its investment manager), well in advance of any potential offering in order to ensure that no covered person is subject to a disqualifying event. In addition, prior to conducting a planned Rule 506 offering, the issuer will need to ensure that other offering participants, such as placement agents, are not subject to such events.[27]

The Commission also noted in the adopting release that, for continuous, delayed or long-lived offerings, reasonable care would include updating the factual inquiry on a reasonable basis, with the frequency and degree of updating dependent on the circumstances.

Finally, the disqualification provisions will provide that the Commission can waive the disqualification, either upon a showing of good cause if the Commission determines that it is not necessary to deny the exemption, or if the court or regulatory authority that entered the order, judgment or decree that would result in disqualification advises in writing that disqualification should not arise as a consequence of its action.

For disqualifying events that occurred before the effective date of the final rule, the rule will require written disclosure of such matters. The Commission expects the disclosure to have “reasonable prominence” to ensure that this information is “appropriately presented in the total mix of information available to investors,”[28] and that it be made a reasonable time prior to sale.[29] The rule will also include a reasonable care exception, similar to the one included in the disqualification provision.

Overview of Proposed Regulation D Amendments and Related Amendments

In addition to adopting the final rules discussed above, the Commission proposed broader revisions to Regulation D, Form D, and Rule 156 under the Securities Act. The proposed rules, if adopted, would enable the SEC to collect additional information on the private offering market, including the effects of general solicitation on the market and on developing offering practices. In addition, in response to concerns raised by some commenters in connection with the General Solicitation Proposing Release, the Commission proposed other significant provisions, which are oriented to investor protection, but some of which could potentially hamper the use of general solicitation in private offerings.

We summarize below the main proposals and requests for comment in the Regulation D Proposing Release, which principally relate to changes to the content, filing requirements, and consequences of failing to file a Form D; requirements to include legends and other disclosure in written general solicitation materials and to submit such materials to the Commission; a “comprehensive work plan” to be conducted by the SEC’s staff (the “Staff”) regarding the use of Rule 506(c); and amendments to the definition of accredited investor. We emphasize, however, that the scope of the requests for comment in the proposing release is broader in many respects than the amendments that were formally proposed. As a result, participants in the private offering market should carefully review the release in order to fully understand the scope and nature of the potential amendments.

The comment period for the proposing release will expire on September 23, 2013.

Expanded Content of Form D

The Commission proposed to dramatically expand the information required to be included on Form D in connection with Rule 506 offerings,[30] whether or not the issuer will rely on new Rule 506(c) permitting the use of general solicitation, reasoning that the expanded information would assist the Commission in evaluating the impact of Rule 506(c) on the existing Rule 506 offering market and would be useful to state regulators and investors. The additional information requirements would include, among other information:

- The issuer’s publicly accessible website address, if any;

- The name and address of any person who directly or indirectly controls the issuer;

- The number of accredited investors and non-accredited investors that have purchased in the offering, whether they are natural persons or legal entities, and the amount raised from each category of investors;

- Certain information regarding the use of proceeds of the offering;[31]

- The number and types of accredited investors that purchased securities in the offering (e.g., natural persons who qualified as accredited investors on the basis of income or net worth);

- The name of the exchange, alternative trading system or trading venue, if any, on which any class of the issuer’s securities is traded, and whether the securities being offered under Rule 506 are of the same class or are convertible into or exercisable or exchangeable for such class;

- If the issuer used a registered broker-dealer in connection with the offering, whether any general solicitation materials were filed with FINRA;

- In the case of a pooled investment fund, the name and SEC file number for each registered investment adviser or exempt reporting adviser who functions directly or indirectly as a promoter of the issuer;

- For Rule 506(c) offerings, the types of general solicitation used or to be used (e.g., mass mailings, emails, public websites, social media, print media and broadcast media); and

- For Rule 506(c) offerings, the methods used or to be used to verify accredited investor status (e.g., principles-based method using publicly available information, documentation provided by the purchaser or a third party, reliance on verification by a third party, or other sources of information; one of the methods in the non-exclusive list of verification methods in Rule 506(c)(2)(ii); or another method).

Revisions to Form D Filing Requirements

The proposed rules would also require issuers that intend to engage in general solicitation under Rule 506(c) to file an initial Form D (an “Advance Form D”) at least 15 calendar days before the issuer commences general solicitation for the offering. The Advance Form D would include certain identifying and general information about the issuer and the offering, including information on the issuer’s related persons, the type(s) of security to be offered and the use of proceeds of the offering, but could exclude more detailed information about the issuer and the offering required by Form D, such as the issuer’s size, the intended duration of the offering, and the minimum investment amount.

In addition, no later than 15 calendar days after the first sale of securities under the offering (which is the date on which the Form D is required to be filed under current rules), the issuer would be required to file an amendment to the Form D with the remainder of the information required by Form D.[32]

The Advance Form D filing requirement is intended to enhance the ability of the Commission, state securities regulators, and investors to gather timely information about Rule 506(c) offerings and the use of Rule 506(c).

The proposed rules would also require that issuers file a final amendment to Form D (a “Closing Amendment”) no later than 30 calendar days after the termination of any offering relying on Rule 506(b) or Rule 506(c). The Commission anticipates that the Closing Amendments will provide the Commission with substantially complete information about the Regulation D market, given that the vast majority of Regulation D offerings rely on Rule 506.

Revised Penalties for Non-Compliance with Form D Filing Requirements

Currently, an issuer is penalized for failing to comply with the Form D filing requirements only if it is enjoined by a court for non-compliance. Under the proposed amendments, an issuer would be automatically disqualified from using Rule 506 in any new offering if the issuer, or any predecessor or affiliate of the issuer, failed to comply, within the past five years (excluding any failure before the effective date of the rule amendment), with the Form D filing requirements in a Rule 506 offering. The disqualification period would terminate one year after the required Form D filings are made or, if the offering has been terminated, after the Closing Amendment is filed.

Issuers would have 30 calendar days to cure a failure to comply with the filing deadlines for a Form D or Form D amendment. However, this cure period would only be available for an issuer’s first failure to file timely a Form D or Form D amendment in connection with an offering. The Commission would also reserve for itself (and likely delegate to the Director of the Division of Corporate Finance) the ability to waive non-compliance with the Form D filing requirements if, upon the issuer demonstrating good cause, the Commission determines that it is not necessary to deny the exemption.

Legends and Information Required in Written General Solicitation Materials

The Commission proposed a new rule[33] to require all issuers to include, in any written general solicitation materials,[34] legends stating that[35]:

- The securities may be sold only to accredited investors;

- The securities are being offered in reliance on an exemption from the registration requirements, and therefore are not required to comply with certain specific disclosure requirements;

- The Commission has not passed upon the merits of or approved the securities, the terms of the offering, or the accuracy of the materials;

- The securities are subject to transfer restrictions; and

- Investing in securities involves risk and investors should be able to bear the loss of their investment.

The proposal would require private funds (such as hedge funds, venture capital funds, and private equity funds) to include an additional legend on written solicitation materials disclosing that the securities offered are not subject to the protections of the Investment Company Act.[36] In addition, if the written general solicitation materials include performance data, then the private funds would also be required to disclosure that[37]:

- Performance data represents past performance;

- Past performance does not guarantee future results;

- Current performance may be different than the performance data presented;

- The private fund is not required by law to follow any standard methodology when calculating and representing performance data; and

- The performance of the fund may not be directly comparable to the performance of other private or registered funds.

In addition, the proposed rules would require that performance data be given as of the latest practicable date and that, if the data do not reflect the deduction of fees and expenses, the fund disclose this fact.

Under the proposal, the failure to include any required legends or other disclosures or to submit written general solicitation materials to the Commission would not render Rule 506(c) unavailable for the offering, as the Commission believes that the loss of the exemption would be a “disproportionate consequence[].”[38] However, an issuer that is subject to an injunction for failure to comply with these requirements would be disqualified from engaging in all future Rule 506 offerings.

The Commission also proposed to extend the guidance contained in Rule 156 under the Securities Act, which currently describes when information in sales literature by a registered investment company could be fraudulent or misleading under the federal securities laws, to apply to sales literature of private funds. In this regard, the Commission noted several specific areas that it believes are vulnerable to misleading statements, including misrepresenting prior investment performance; exaggerating personal qualifications; omitting disciplinary information; misrepresenting holdings; making fraudulent performance claims; and falsely valuing investments.[39] Furthermore, the Form D Proposing Release noted that, even before rules are adopted and become effective to formally extend Rule 156 to the sales literature of private funds, the Commission is “of the view that private funds should now be considering the principles underlying Rule 156 to avoid making fraudulent statements in their sales literature.”[40]

Proposed Temporary Rule for Mandatory Submission of Written General Solicitation Materials

The Commission also proposed a new rule[41] to require, for a period of two years from the effective date of the rule, that issuers conducting Rule 506(c) offerings submit to the Commission all written general solicitation materials used in connection with the offerings.[42] This rule is intended to assist the Commission in understanding developments in the market regarding how issuers solicit potential purchasers of securities in Rule 506(c) offerings.[43] The written general solicitation materials submitted would not be considered “filed” or “furnished,” and thus would not expose issuers to liability provisions that apply to materials furnished or filed with the Commission.[44] The content of such solicitations would, of course, still be subject to general anti-fraud provisions of the securities laws.

Furthermore, for investment advisers that are registered with the SEC, certain advertisements may also trigger specific advertising rules and regulation. For example, an investment adviser is severely limited in its ability to utilize an advertisement that refers to any testimonial concerning the investment adviser or refers to past specific investment recommendations. The Advisers Act also limits the ways in which an investment adviser can present their track record. Separately, entities registered with regulatory agencies other than the Commission, including the CFTC and/or the National Futures Association, may be subject to other agency specific marketing rules and regulations. Finally, many states and non-U.S. jurisdictions have their own anti-fraud and market rules that must be considered before marketing materials can be disseminated.

SEC Work Plan Related to General Solicitation

The amendments proposed in the Regulation D Proposing Release are intended to support a “comprehensive work plan” the Commission has directed the Staff to execute regarding the use and effectiveness of Rule 506(c) (the “Rule 506 Work Plan”). The Rule 506 Work Plan will, among other things:

- evaluate the range of purchaser verification practices used by issuers and other participants in Rule 506(c) offerings, including whether these verification practices are excluding or identifying non-accredited investors;

- evaluate whether the absence of the prohibition against general solicitation has been accompanied by an increase in sales to non-accredited investors;

- assess whether the availability of Rule 506(c) has facilitated new capital formation or has shifted capital formation from registered offerings and unregistered non-Rule 506(c) offerings to Rule 506(c) offerings;

- examine the information submitted or available to the Commission on Rule 506(c) offerings, including the information in Form D filings and the form and content of written general solicitation materials submitted to the Commission;

- monitor the market for Rule 506(c) offerings for increased incidence of fraud and develop risk characteristics regarding the types of issuers and market participants that conduct or participate in Rule 506(c) offerings and the types of investors targeted in these offerings to assist with this effort;

- incorporate an evaluation of the practices in Rule 506(c) offerings in the Staff’s examinations of registered broker-dealers and registered investment advisers; and

- coordinate with state securities regulators on sharing information about Rule 506(c) offerings.

The Commission believes that the proposed amendments will support the Rule 506 Work Plan by improving the timeliness, quality, and comprehensiveness of information on issuers, investors and financial intermediaries participating in Rule 506 offerings and by mandating that written general solicitation materials be submitted to the Commission.

Definition of “Accredited Investor”

The Commission expressed its belief in the Regulation D Proposing Release that “the definition of accredited investor as it relates to natural persons should be reviewed and, if necessary or appropriate, amended.”[45] Section 415 of the Dodd-Frank Act requires the Government Accountability Office to complete a study of the definition by July 20, 2013, and Section 413(b) of the Dodd-Frank Act requires the Commission to review the definition by July 20, 2014. Because the Commission noted that any proposed changes to the accredited investor definition would benefit from considering these two studies, and because the Dodd-Frank Act stipulates the net worth thresholds in the definition through July 2014, the Commission did not propose any specific amendments. However, the proposing release noted that the Staff has begun a review of the accredited investor definition, and the release explicitly solicits comment regarding the net worth and income tests, and the tests’ respective financial thresholds. Significantly, this request for comment potentially lays the foundation for the Commission to adopt final rules to amend the definition without a further proposing release.

What Should Investment Banks, Broker-Dealers and Private Funds Do Now?

The elimination of the prohibition on general solicitation in Rule 506(c) and 144A offerings presents risks and opportunities for investment banks, broker-dealers and privately offered funds. On one hand, this change will create new opportunities for these entities to expand their businesses, and will subject those entities to the risk of losing business and investors to competitors that respond more quickly. On the other hand, those that move aggressively without appropriate controls, policies and procedures will face significant compliance risks that could result in reputational damage, fines, penalties, injunctions or other legal ramifications.

Accordingly, banks, broker-dealers and funds that intend to participate in Rule 506(c) offerings should use the time before the effective date of the new rules to prepare for a fundamentally changed legal environment. For decades, policies, procedures and legal forms relating to a wide array of business practices – from customer and investor intake procedures and handling investor inquiries, to dealing with the press, to transaction agreements – have been crafted with a view to avoiding general solicitation under all circumstances. With the liberalization of the private offering communication rules, these entities should revise these policies, procedures and form transaction documents so that they can quickly and safely take advantage of the new legal environment.

To help our clients and friends to begin this process, we have included below a chart identifying some of these policies, procedures and forms that should be included in this review.

* * * * *

The following are links to the General Solicitation Adopting Release, the Bad Actor Adopting Release, the Regulation D Proposing Release and the related Fact Sheets:

- Final Rule – Lifting General Solicitation Ban

- Fact Sheet – Lifting General Solicitation Ban

- Final Rule – Disqualification of Felons and Other “Bad Actors” from Rule 506 Offerings

- Fact Sheet — Disqualification of Felons and Other “Bad Actors” from Rule 506 Offerings

- Rule Proposal—Regulation D Amendments

- Fact Sheet – Regulation D Amendments

Revisions to Policies, Procedures and Forms To Take Advantage of General Solicitation Under Rule 506(c) and Rule 144A

The chart below lists certain policies, procedures and forms that issuers and other persons that participate in Rule 506(c) and Rule 144A offerings should review in light of the removal of the prohibition on general solicitation and advertising (“general solicitation”).

Note that the prohibition on general solicitation will remain for Rule 506 offerings in which any purchaser is not an accredited investor (“AI”). For these transactions and for other Rule 506 transactions in which a decision is made not to engage in general solicitation, existing policies, procedures and forms will need to be maintained to ensure compliance with Rule 506(b). Offering participants should also design and implement appropriate controls to identify upfront whether an offering will rely on Rule 506(b) or (c) and to ensure the appropriate policies, procedures and forms are used.

Finally, consideration should be given to such other matters as whether an issuer anticipates undertaking a public offering, as the gun-jumping rules for public offerings remain in effect.

| Function / Document | Responsible Person | Potential Revisions to Policies / Procedures / Forms |

| Customer / Investor Intake | Back office |

|

| Inquiry Handling | Back office | No longer need staff scripts to turn away inquiries; instead, develop controls and procedures to screen inquiries arising from general solicitation, based on AI status, and to funnel into customer intake process where appropriate |

| Press Interactions | Legal department | Consider revising policies to reflect that the securities laws no longer prohibit discussion that might lead to publicity for an offering |

| Offering Materials | Legal department | Consider revising / easing policies calling for strict numbering and tracking of private placement memorandum, offering memorandum or offering circular |

| Websites (offerings) | Legal department | Consider revising / easing policies calling for password-protection or questionnaires that confirm preexisting relationship |

| Websites (issuers) | Deal team / legal due diligence | Consider policies and practices for scrubbing issuer websites for discussion of fundraising plans or other materials that could be construed as priming the market |

| Advertising / Publicity | Legal and marketing departments |

|

| Engagement Letter | Legal department | Consider whether revisions are necessary / appropriate regarding investor verification procedures and advertising |

| Investor Purchase / Subscription Agreement (private placement) | Legal department and outside counsel | Consider revisions to investor representations and warranties |

| Agreement Among Initial Purchasers (144A) | Industry | Consider revisions to representations and covenants from syndicate members regarding advertising of offering |

| Purchase Agreement – Initial Purchaser (144A) | Industry | Consider revisions to representations and covenants regarding advertising of offerings |

[1] “Eliminating the Prohibition Against General Solicitation and General Advertising in Rule 506 and Rule 144A Offerings,” Securities and Exchange Commission (July 10, 2013).

[2] “Disqualification of Felons and Other ‘Bad Actors’ from Rule 506 Offerings,” Securities and Exchange Commission (July 10, 2013).

[3] “Amendments to Regulation D, Form D and Rule 156 under the Securities Act,” Securities and Exchange Commission (July 10, 2013).

[4] See Gibson, Dunn & Crutcher Client Alert, SEC Lifts Ban on General Solicitation, Allowing Private Funds to Advertise (July 17, 2013).

[5] “Accredited investor” is defined in Rule 501(a) of Regulation D to include any person who falls within one of eight enumerated categories, or who the issuer reasonably believes falls within one of those categories, at the time of sale.

[6] “Qualified institutional buyer” is defined in Rule 144A(a)(1) to include any entity who falls within one of six enumerated categories.

[8] “Eliminating the Prohibition Against General Solicitation and General Advertising in Rule 506 and Rule 144A Offerings,” Securities and Exchange Commission (August 31, 2012).

[9] “Disqualification of Felons and Other ‘Bad Actors’ from Rule 506 Offerings,” Securities and Exchange Commission (May 25, 2011).

[10] Gibson, Dunn & Crutcher Client Alert, SEC Proposes Amendments to Permit Advertising in Rule 506 and Rule 144A Offerings (August 31, 2012).

[11] These categories generally include natural persons, public and private for-profit and not-for-profit corporations, general and limited partnerships, business and other types of trusts, and funds and other types of collective investment vehicles. See Rule 501(a)(1)-(8).

[13] Conversely, the Commission noted that an issuer that fails to take reasonable steps will lose the benefit of Rule 506(c) even if all purchasers are accredited investors. See id. at 26. In this case, the offering would likely not qualify for the exemption provided by Section 4(a)(2), and thus would violate Section 5 of the Securities Act.

[15] As discussed below, however, the Commission has issued additional rule proposals that would require, among other things, that an issuer in a Rule 506(c) offering file a Form D 15 days prior to engaging in any general solicitation, include certain legends and disclosures in any written general solicitation materials, and submit such materials to the Commission at the time of first use. If some or all of these provisions are adopted, the ability to rely on Rule 506(c) as a “safety net” for an inadvertent statement constituting a general solicitation may be limited.

[16] In this regard, the Commission notes that “we anticipate that many practices currently used by issuers in connection with existing Rule 506 offerings will satisfy the verification requirement for offerings pursuant to Rule 506(c).” General Solicitation Adopting Release at 35. The SEC also stated its desire to leave room for future methods of ascertaining accredited investor status, such as third-party services. Id. at 35.

[25] Rule 144A specifies non-exclusive methods by which a seller may establish that an investor is a QIB.

[26] See Rule 902(c). The Commission notes that the adopting release for Regulation S made clear that “[o]ffshore transactions made in compliance with Regulation S will not be integrated with registered domestic offerings or domestic offerings that satisfy the requirements for an exemption from registration under the Securities Act.” General Solicitation Adopting Release at 57.

[27] While market practices for conducting the requisite factual inquiry with respect to such participants will likely develop over time, the release helpfully noted that, in the case of a registered broker-dealer that is acting as placement agent, it may be sufficient for the issuer to inquire with the placement agent concerning the relevant set of covered officers and controlling persons, and to consult publicly available databases concerning the past disciplinary history of the relevant persons via FINRA’s BrokerCheck website.

[30] Certain proposed changes would also require additional information on offerings relying on Rule 504, Rule 505 and Securities Act Section 4(a)(5).

[31] This requirement would apply only to Rule 506 offerings by issuers that are not pooled investment funds.

[32] The issuer could also include all of the information required by Form D in the Advance Form D. See Regulation D Proposing Release at 25.

[34] The Commission uses phrase “written general solicitation materials” in the text of the release to refer generally to a written communication that would constitute a general solicitation or general advertising. The proposed rules do not define the phrase, however, which may raise questions regarding what may be deemed to constitute a written communication subject to the proposed rules.

[42] Regulation D Proposing Release at 87.

An abbreviated version of this Alert was posted on July 11, 2013, as a blog on the Gibson Dunn Securities Regulation and Corporate Governance Monitor, available at https://securitiesregulationmonitor.com. We encourage you to sign up at the Monitor website to receive email alerts when we post information on developments and trends in securities regulation, corporate governance and executive compensation.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed above. Please contact the Gibson Dunn lawyer with whom you usually work, or any of the following:

California

Jennifer Bellah Maguire (213-229-7986, [email protected])

Michelle Hodges (949-451-3954, [email protected])

Ari Lanin (310-552-8581, [email protected])

Jonathan K. Layne (310-552-8641, [email protected]

David C. Lee (949-451-4069, [email protected])

Stewart L. McDowell (415-393-8322, [email protected])

James J. Moloney (949-451-4343, [email protected])

Douglas D. Smith (415-393-8390, [email protected])

Peter W. Wardle (213-229-7242, [email protected])

Dallas

Jeffrey A. Chapman (214-698-3120, [email protected])

Robert B. Little (214-698-3260, [email protected])

Denver

Robyn E. Zolman (303-298-5740, [email protected])

International

Joseph M. Barbeau – Hong Kong (+852-2214-3888, [email protected])

Claibourne S. Harrison – London (+44-(0)20-7071-4220, [email protected])

Paul Harter – Dubai (+971 (0)4 704 6821, [email protected])

New York

J. Alan Bannister (212-351-2310, [email protected])

Barbara L. Becker (212-351-4062, [email protected])

Andrew L. Fabens (212-351-4034, [email protected])

John T. Gaffney (212-351-2626, [email protected])

Lois F. Herzeca (212-351-2688, [email protected])

Kevin W. Kelley (212-351-4022, [email protected])

Emad H. Khalil (212-351-2677, [email protected])

Edward D. Nelson (212-351-2666, [email protected])

Glenn R. Pollner (212-351-2333, [email protected])

Edward D. Sopher (212-351-3918, [email protected])

Sean Sullivan (212-351-2453, [email protected])

Washington, D.C.

Howard B. Adler (202-955-8589, [email protected])

Anne Benedict (202-955-8654, [email protected])

Blaise F. Brennan (202-887-3700, [email protected])

Stephen I. Glover (202-955-8593, [email protected])

Amy L. Goodman (202-955-8653, [email protected])

Elizabeth Ising (202-955-8287, [email protected])

Brian J. Lane (202-887-3646, [email protected])

Ronald O. Mueller (202-955-8671, [email protected])

John F. Olson (202-955-8522, [email protected])

C. William Thomas, Jr. (202-887-3735, [email protected])

© 2013 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.