Securities Litigation 2025 Mid-Year Update

Client Alert | September 9, 2025

This update provides an overview of the major developments in federal and state securities litigation since our 2024 Year-End Securities Litigation Update.

This update covers the following developments:

- We review the Supreme Court’s recent grant of certiorari to resolve a circuit split as to whether the Investment Company Act provides a private right of action for rescission, the Court’s denial of certiorari in a separate case leaving an unresolved circuit split over the SEC’s authority to seek disgorgement absent pecuniary harm, and the Court’s request for briefing in response to a petition for certiorari seeking review of the standard for materiality in the context of audit opinion statements. In addition, we briefly cover the follow-up certiorari petition filed in Pirani v. Slack Technologies, Inc. following the Ninth Circuit’s decision on remand.

- We discuss recent decisions from the Delaware Supreme Court and Delaware Court of Chancery, including those addressing advance notice bylaws, the distinction between direct and derivative claims, the decisions of two entities to convert from Delaware to Nevada corporations, and the remedies available to an aggrieved party in light of an LLC agreement.

- For this edition of the Update, we have consolidated several sections into one: Industry Developments. Below, we cover recent developments in the cryptocurrency space along with issues that cut across several industries—e., environmental, social, and governance (ESG) claims. Going forward, this section will cover securities litigation trends in various industries as new issues arise.

- Challenges to the certification of securities class actions tend to fall into two categories, both related to the issue of predominance. First, securities litigations cannot proceed on a classwide basis unless the plaintiff can avail itself of a presumption of reliance. Second, securities litigations cannot proceed on a classwide basis unless damages can be calculated on a classwide basis for a plaintiff’s specific theory of securities fraud. The first half of 2025 has brought us developments in both of these categories, which we discuss below.

TABLE OF CONTENTS

I. FILING AND SETTLEMENT TRENDS

I. FILING AND SETTLEMENT TRENDS

A recent NERA Economic Consulting (NERA) study provides an overview of federal securities litigation filings in the first half of 2025. This section highlights several notable trends.

A. Filing Trends

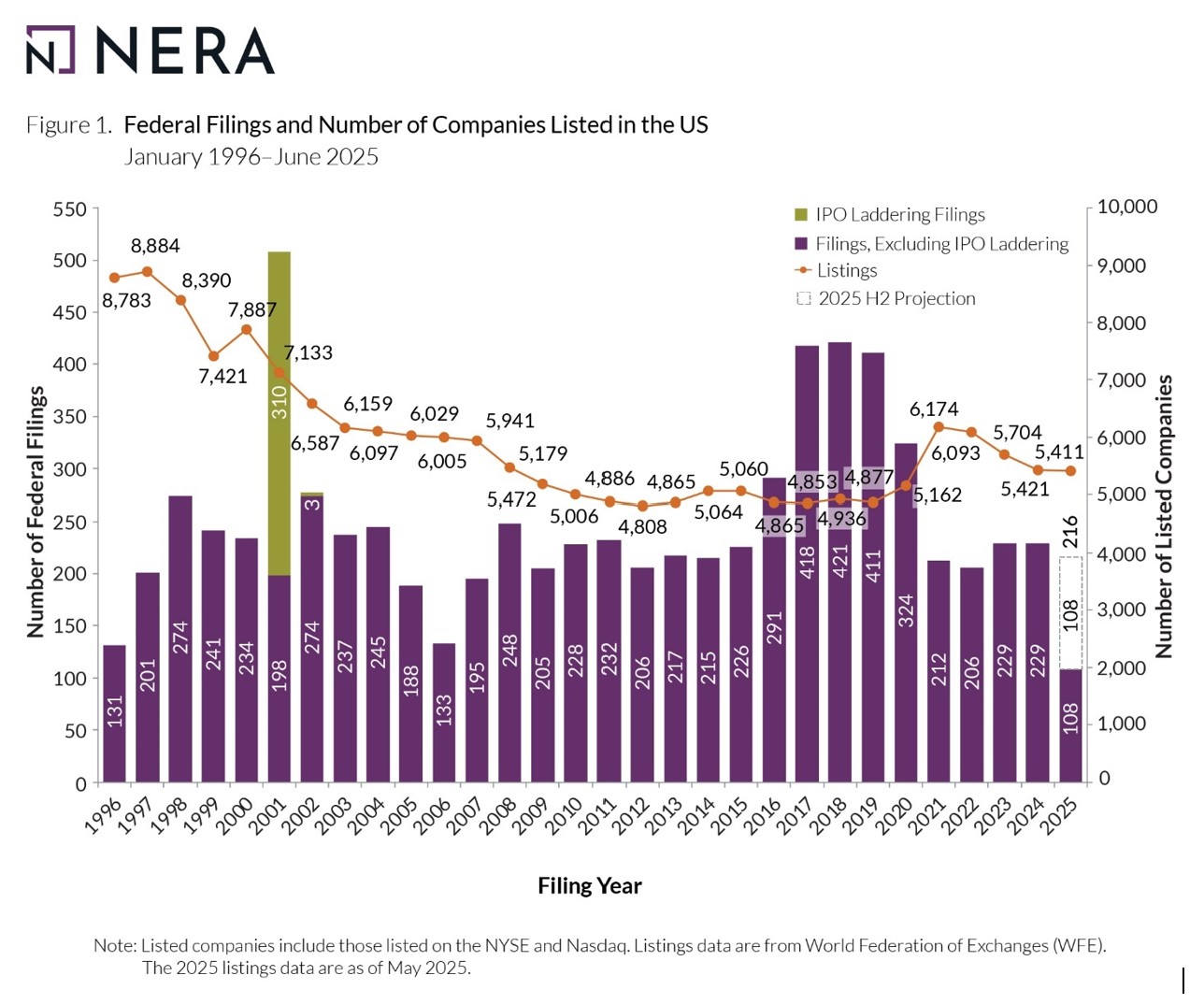

Figure 1 below reflects the federal filing rates from 1996 through the first half of 2025. In the first half of 2025, 108 federal cases have been filed. On an annualized basis, that number is lower than the number of cases filed in 2024. That figure is also considerably lower than in the peak years of 2017-2019 but is consistent with the number of filings from 2021 onwards. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

B. Mix Of Cases Filed In 2023

1. Filings By Industry Sector

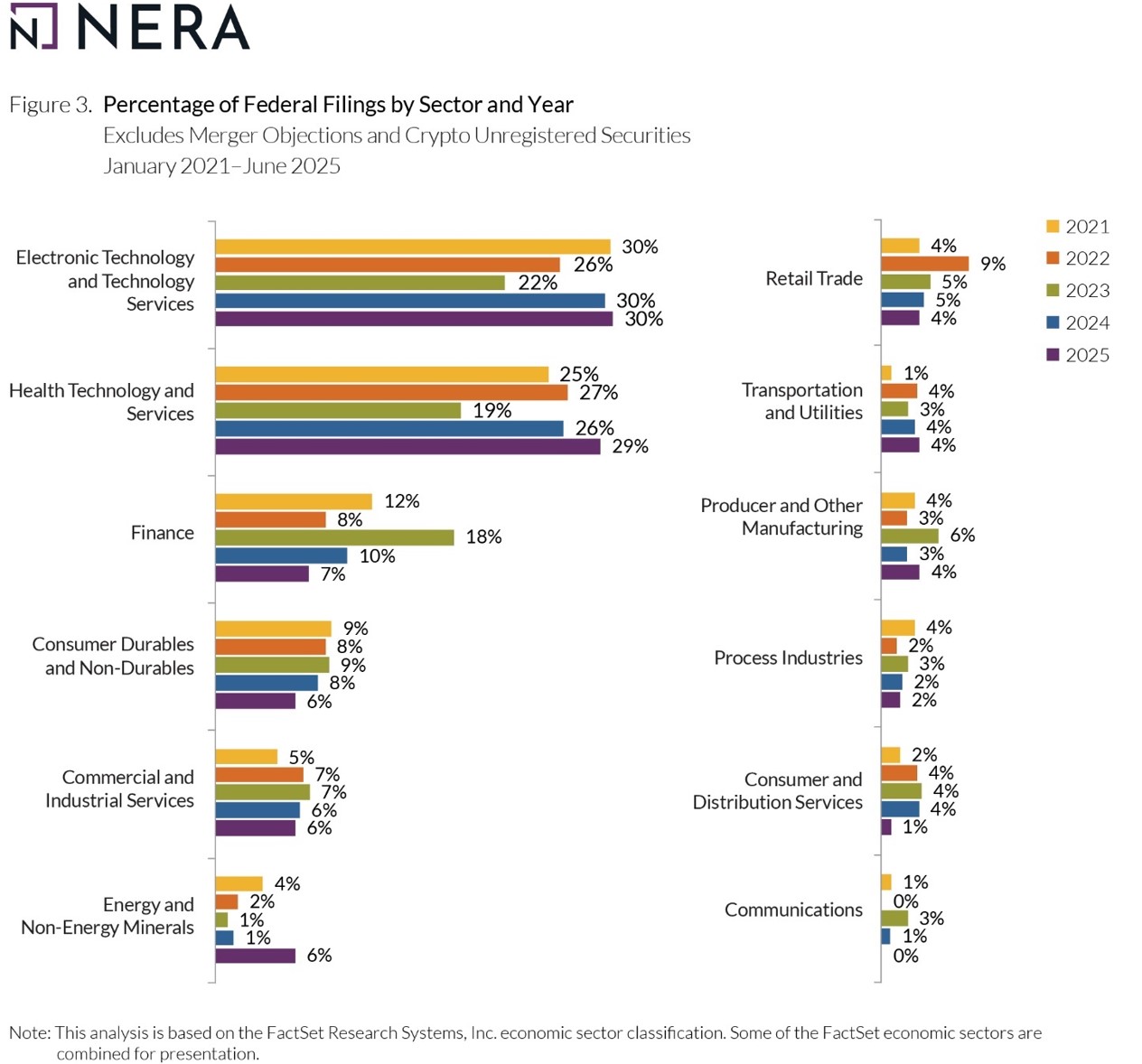

As shown in Figure 2 below, the distribution of non-merger objections and non-crypto unregistered securities filings in the first half of 2025 varied somewhat from 2024. Notably, after a dip in 2023, the “Health and Technology Services” sector percentage rose again in 2025, surpassing levels seen in 2021 and 2022. On the other hand, the percentage of “Electronic Technology and Technology Services” filings remained the same in 2025. Together, “Health and Technology Services” and “Electronic Technology and Technology Services” filings once again comprised well over 50% of filings. Meanwhile, “Finance” sector filings decreased from 10% to 7%.

Figure 2:

2. Filings By Type

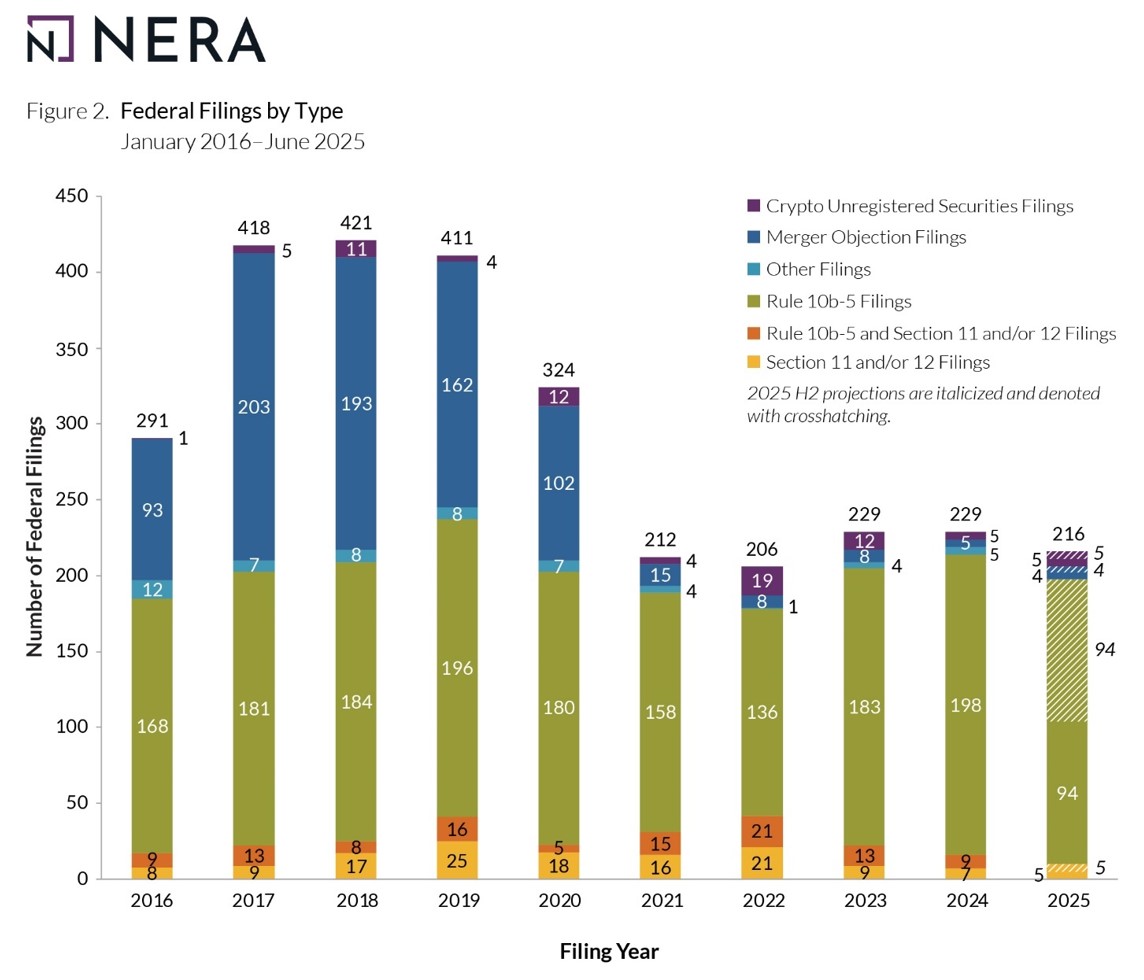

As shown in Figure 3 below, Rule 10b-5 filings make up the vast majority of federal filings this year. In fact, filings of other types are as low as they have been in years.

Figure 3:

3. Filings By Circuit

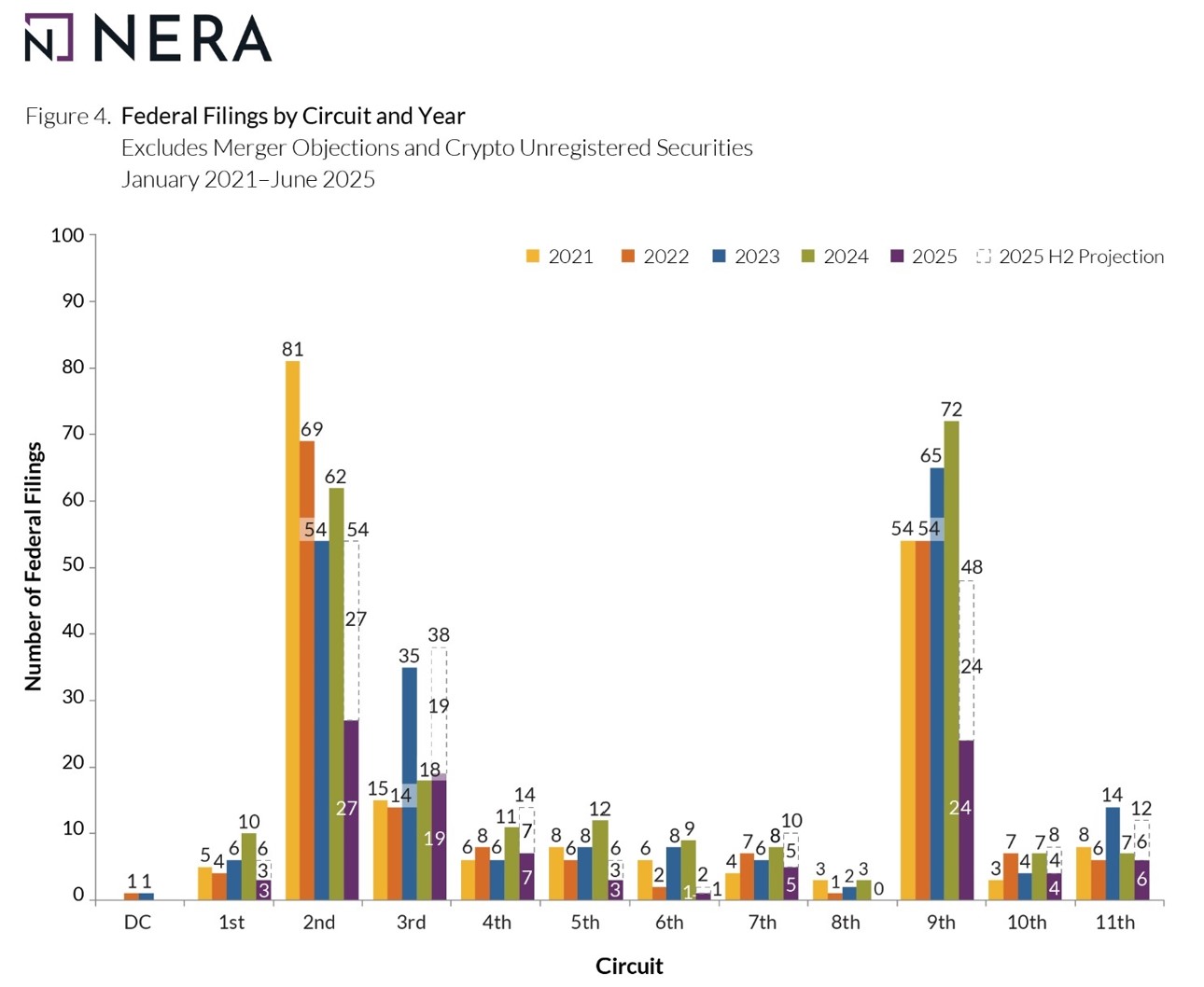

Figure 4 provides insight into the distribution of federal filings by Circuit. Most filings occur in the Second and Ninth Circuits. On an annualized basis, filings in the Second Circuit are down this year. Similarly, the number of filings in the Ninth Circuit on annualized basis is also down significantly from 2024 levels.

Figure 4:

4. Event-Driven And Other Special Cases

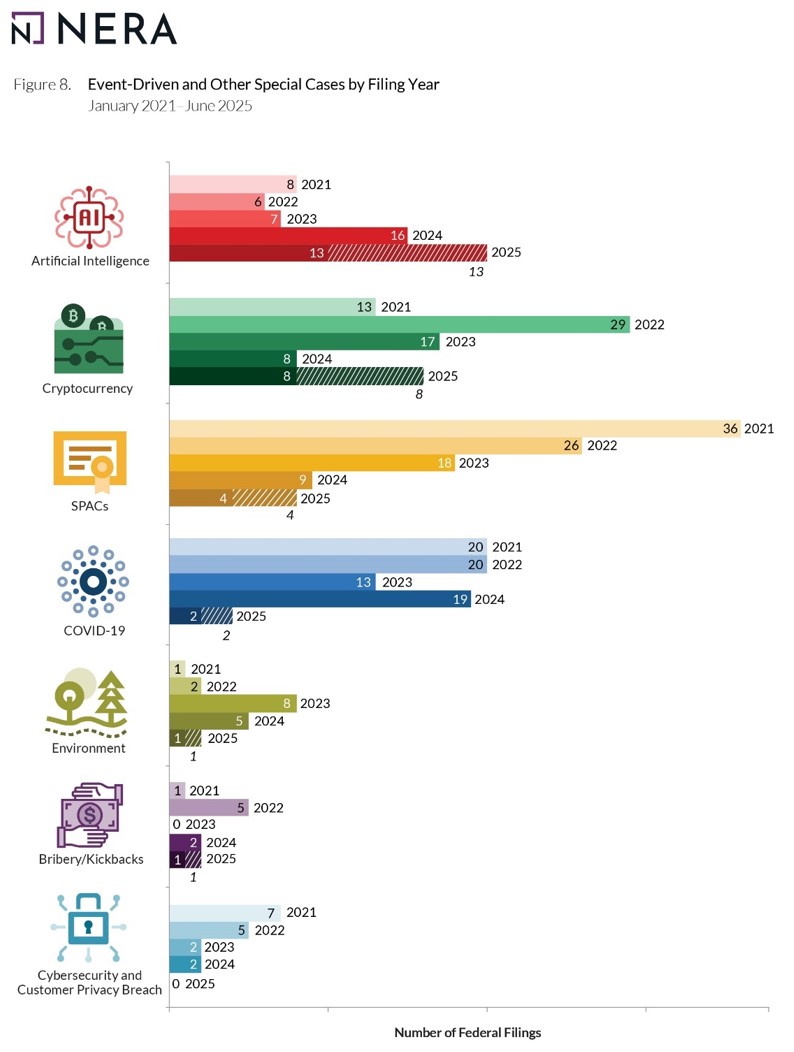

Figure 5 illustrates trends in the number of event-driven and other special case filings since 2020. On an annualized basis, the number of Artificial Intelligence-related filings continued to increase in 2025. By contrast, SPAC and Cybersecurity and Customer Privacy Breach filings have decreased steadily since 2021.

Figure 5:

C. Settlement Trends

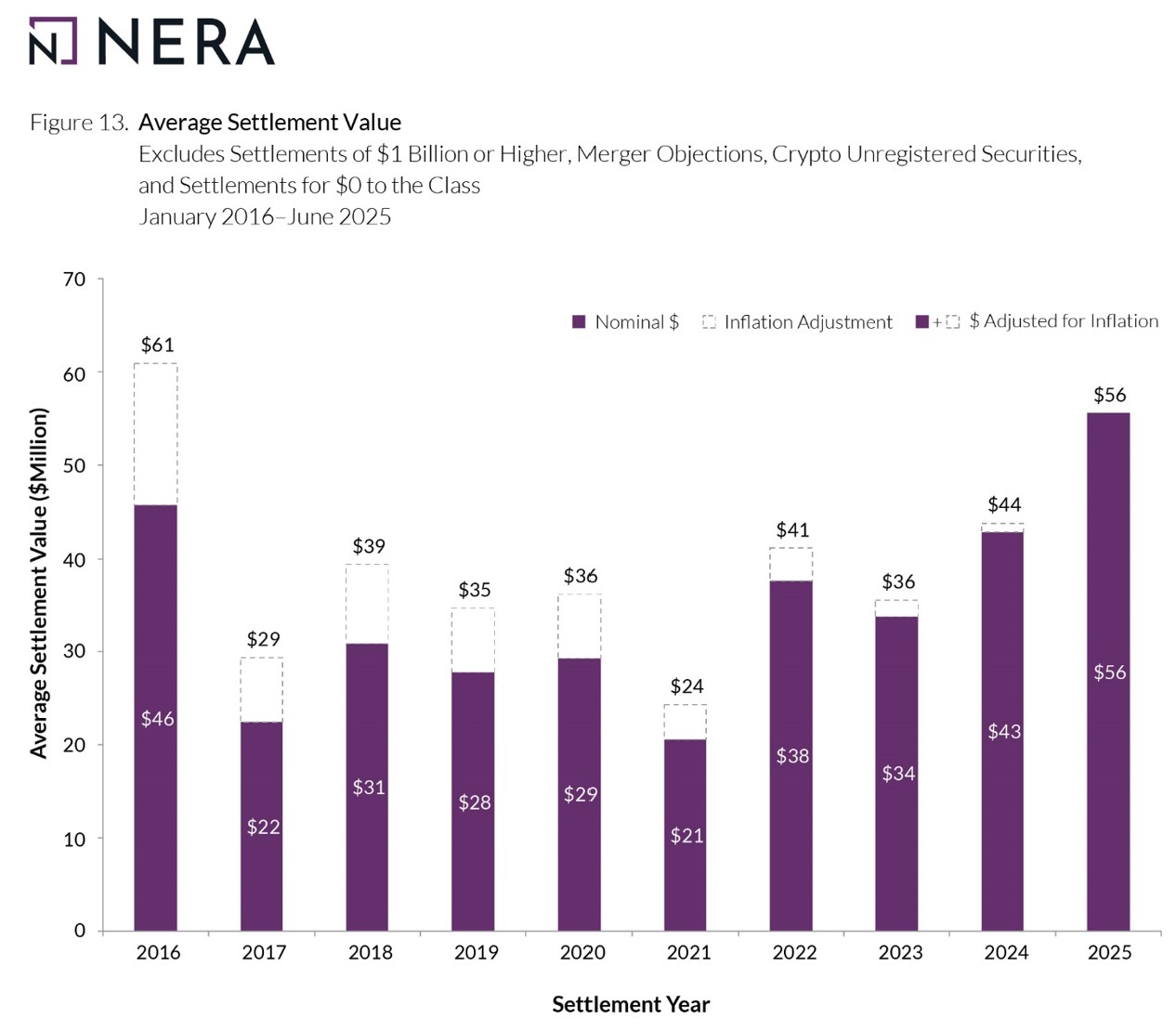

As reflected in Figure 6 below, the average settlement value through the first half of 2025 is $56 million. That is the highest number since 2016 on an inflation-adjusted basis. (Note that the average settlement value excludes merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class.)

Figure 6:

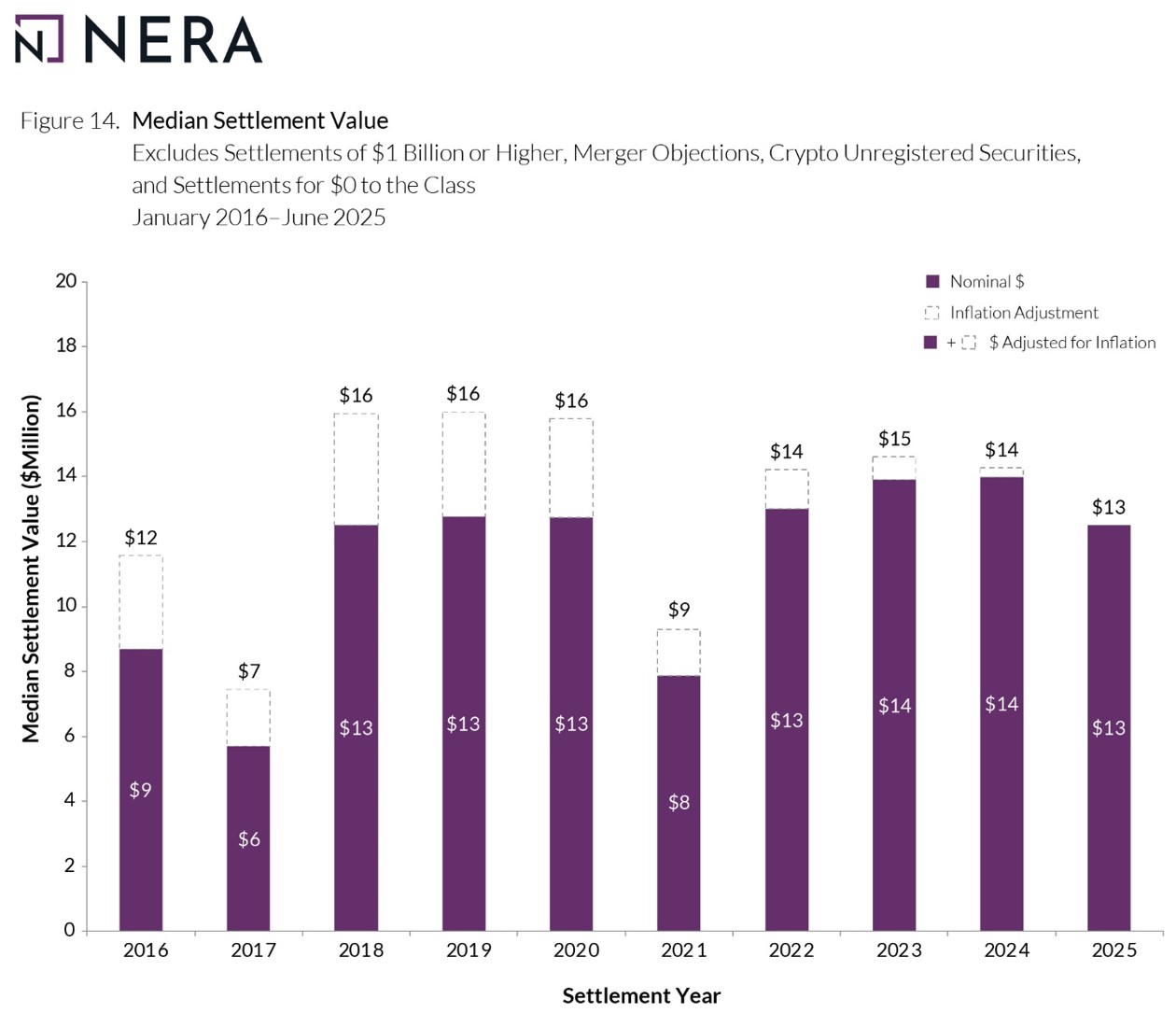

As for median settlement value, it dropped slightly from 2024 to $13 million. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 7:

II. WHAT TO WATCH FOR IN THE SUPREME COURT

As we discussed in our 2024 Year-End Securities Litigation Update, the Supreme Court dismissed two securities cases at the beginning of its 2024 Term as “improvidently granted,” sending each case back to the lower court without a resolution on the merits. See NVIDIA Corp. v. E. Ohman J:or Fonder AB, 604 U.S. 20 (2024); Facebook, Inc. v. Amalgamated Bank, 604 U.S. 4 (2024). Accordingly, the Supreme Court did not issue any securities decisions last Term. In this update, we discuss recent certiorari petitions and related Supreme Court activity that could shape securities law in a future Term.

A. FS Credit Corp. v. Saba Capital Master Fund: Supreme Court Agrees To Address Whether Section 47(b) Of The Investment Company Act Provides A Private Right Of Action.

On June 30, 2025, the Supreme Court granted a petition for a writ of certiorari in FS Credit Corp. v. Saba Capital Master Fund, No. 24-345, 2025 WL 1787708 (U.S. June 30, 2025), agreeing to address an asserted circuit split as to whether the Investment Company Act of 1940 (ICA) provides a private right of action and a recission remedy for substantive violations of its provisions. The decision below is Saba Capital Master Fund, LTD. v. Blackrock ESG Capital Allocation Trust (Saba), No. 23-8104, 2024 WL 3174971 (2d Cir. June 26, 2024).

In 2019, the Second Circuit became the first court to find a freestanding private right of action under Section 47(b)(2) of the ICA, 15 U.S.C. § 80a-46(b)(2), separate from the narrow right provided in Section 36(b) allowing a “security holder” to sue a fund’s investment advisor for breach of fiduciary duty with regard to advisory fees, 15 U.S.C. § 80a-35(b); Oxford Univ. Bank v. Lansuppe Feeder, LLC, 933 F.3d 99, 109 (2d Cir. 2019). Under Section 47(b)(2), if a contract, including a corporation’s bylaws, violates the ICA, then “a court may not deny rescission at the instance of any party unless such court finds that under the circumstances the denial of rescission would produce a more equitable result than its grant and would not be inconsistent with the purposes of this subchapter.” 15 U.S.C. § 80a-46(b)(2). In Oxford University Bank, the court found that Section 47(b) “creates an implied private right of action for a party to a contract that violates the ICA to seek rescission of that violative contract.” 933 F.3d at 109. In so ruling, the Second Circuit departed from the Third, Fourth, and Ninth Circuits, which have explicitly rejected such an implication. See UFCW Loc. 1500 Pension Fund v. Mayer, 895 F.3d 695, 700-01 (9th Cir. 2018); Santomenno ex rel. John Hancock Tr. v. John Hancock Life Ins. Co. (U.S.A.), 677 F.3d 178, 185-87 (3d Cir. 2012); Steinberg v. Janus Cap. Mgmt., LLC, 457 F. App’x 261, 267 (4th Cir. 2011) (per curiam).

This private right, uniquely available in the Second Circuit, recently led to a judgment that, if left undisturbed, would unravel negotiated voting rights in a closed-end fund. See Saba, 2024 WL 3174971, at *4. In Saba, the plaintiff hedge fund, Saba Capital Master Fund (Saba), alleged that certain resolutions adopted by the defendant closed-end funds (CEFs), violated provisions of the ICA. Id. at *1. Each CEF adopted a resolution that opted into a provision of the Maryland state law (the “Control Share Provision”) that effectively stripped the voting rights of any shares in the CEFs that would put the holder of those shares at more than 10% of a given CEF’s voting power. Id. at *1. Saba argued, and the Second Circuit agreed, that such a provision violated Section 18(i) of the ICA, which states that, barring exceptions, “every share of stock hereafter issued by a registered management company . . . shall be a voting stock and have equal voting rights with every other outstanding voting stock.” 15 U.S.C. § 80a-18(i); Saba, 2024 WL 3174971 at *4. Based on this violation, and the remedies described in Section 47(b), the Second Circuit upheld the district court’s grant of summary judgment in favor of Saba and recission of the challenged CEF resolutions, effectively removing the Control Share Provisions. Id. at *1, *4. The defendants petitioned for certiorari on the sole issue of whether § 47(b) of the ICA creates an implied private right of action, which the Court granted on June 30, 2025. FS Credit Corp., 2025 WL 1787708 at *1.

B. SEC v. Navellier & Associates, Inc.: Supreme Court Leaves Alleged Circuit Split Over SEC Disgorgement In Place.

On June 6, 2025, the Supreme Court denied a petition for certiorari in Navellier & Associates, Inc. v. SEC, which sought review of a $22.7 million disgorgement order in a case involving false marketing of a trading strategy. Navellier & Assocs. v. SEC, No. 24-949, 2025 WL 1603606 (U.S. June 6, 2025). The Court’s denial leaves in place an asserted circuit split on whether the SEC may seek disgorgement for investors who suffered no pecuniary harm as a result of their investment adviser’s violation of the anti-fraud provisions of the federal securities laws.

In Liu v. SEC, 591 U.S. 71 (2020), the Supreme Court considered whether the SEC may obtain “disgorgement” as a form of “equitable relief” under Section 21(d)(5) of the Exchange Act. The Court held that “a disgorgement award that does not exceed a wrongdoer’s net profits and is awarded for victims is equitable relief permissible under § 78u(d)(5).” Liu, 591 U.S. at 74. The following year, Congress amended the Exchange Act and expressly authorized “disgorgement” in SEC enforcement actions, including through the addition of § 21(d)(7), which provides that the SEC may seek disgorgement under any provision of the securities laws. 15 U.S.C. § 78u(d)(7). In Navellier, the SEC brought suit against the defendants for concealing material information about a trading strategy offered to clients, in violation of the anti-fraud provisions in §§ 206(1) and 206(2) of the Investment Advisers Act. SEC v. Navellier & Assocs., Inc., 108 F.4th 19, 32-33 (1st Cir. 2024). The marketing materials for the strategy stated that the strategy’s performance record was based on live trading when in fact, it was based on historical data. Id. at 36-37. The district court granted partial summary judgment to the SEC and initially ordered the defendants to disgorge nearly $29 million and pay more than $6 million in interest. Id. at 33. After the Supeme Court’s Liu decision, the district court reduced the disgorgement order to $22.7 million. Id. at 42-43. On appeal, the defendants argued that disgorgement was not an available equitable remedy because the clients suffered no pecuniary harm from the misrepresentations at issue. Id. at 41.

The First Circuit rejected this argument, explaining that disgorgement is a “profit-based measure of unjust enrichment” that does not require losses to a victim. Id. (citing Liu, 591 U.S. at 79-80). By holding that the SEC may seek disgorgement under the Exchange Act even when the victim suffers no pecuniary harm, the First Circuit joined the Fifth Circuit and diverged from the Second Circuit. Id. at 41; see also SEC v. Hallam, 42 F.4th 316, 341 (5th Cir. 2022); SEC v. Govil, 86 F.4th 89, 94, 98 (2d Cir. 2023) (requiring a showing of pecuniary harm for disgorgement). The Navellier petitioner also argued that the First Circuit’s decision widened a circuit split concerning the nature of disgorgement as a remedy under the Exchange Act: The First and Second Circuits agree that disgorgement under 15 U.S.C. § 78u(d)(7) is an equitable remedy, while the Fifth Circuit views it as a legal remedy. See Navellier, 108 F.4th at 41; Govil, 86 F.4th at 106; Hallam, 42. F.4th at 341. The Supreme Court’s denial of the Navellier certiorari petition leaves these differences in place.

C. BDO USA LLP v. New England Carpenters Guaranteed Annuity And Pension Funds: Defendants Seek Supreme Court Review Of Second Circuit’s Expansion Of Materiality Standard For Accounting Cases.

The Court requested briefing on a pending petition for certiorari, BDO USA LLP v. New England Carpenters Guaranteed Annuity and Pension Funds, No. 24-1151 (U.S. June 12, 2025) (BDO USA LLP). The petition arises from a Second Circuit decision discussing “when . . . a statement of opinion that reflects some subjective judgment [is] nevertheless actionable under the federal securities laws.” New Eng. Carpenters Guaranteed Annuity & Pension Funds v. DeCarlo (DeCarlo), 122 F.4th 28, 36 (2d Cir. 2023). Petitioner-defendant auditor BDO USA LLP (BDO) sought review of the Second Circuit’s ruling that its allegedly false statements—asserting compliance with the Public Company Accountability Review Board (PCAOB) standards and a belief that its audit provided a reasonable basis for signing off on the financial statements—were material, even in the absence of allegations linking those statements with specific errors in the audited financial statements. Id. at 53; Petition for a Writ of Certiorari, BDO USA LLP, No. 24-1151, at 1-2 (U.S. filed May 7, 2025) (Petition). Respondents (plaintiffs-appellees below) originally waived their right to respond to the petition for certiorari. BDO USA LLP, No. 24-1151 (June 6, 2025). After amici submitted briefs on behalf of BDO and the petition was submitted for conference, the Supreme Court requested briefing from the respondents. BDO USA LLP, No. 24-1151 (June 12, 2025). Respondents submitted their response on August 13, 2025.

In the underlying case, the defendant-issuer, AmTrust Financial Services, Inc. (AmTrust), restated five years of its financial results, acknowledging its prior SEC filings significantly overstated its income and earnings and contained material accounting errors. DeCarlo, 122 F.4th at 36, 38. AmTrust’s investors brought a suit against AmTrust, certain of its officers and directors, its former auditor BDO, and certain underwriters, alleging violations of §§ 11, 12, and 15 of the Securities Act of 1933 and Section 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5. Id. at 36. The district court dismissed all claims, holding that none of the alleged misstatements were actionable. Id.

As relevant to BDO’s petition, the district court held, and the Second Circuit agreed, that the plaintiffs adequately alleged that BDO’s statements in its audit certifications—that the audits were conducted in accordance with PCAOB standards and that BDO believed its audits provided a reasonable basis for BDO’s opinion that AmTrust’s financial statements were fairly presented— were potentially actionable misstatements of opinion. Id. at 52-53. The plaintiffs alleged these statements were false because BDO failed to complete necessary checks and work papers, signed other work papers without reviewing them, and otherwise failed to verify all audit work was performed. Id. at 52. The Second Circuit held that the plaintiffs were not required to allege a link between BDO’s false certification and specific errors in AmTrust’s financial statements to establish materiality and revived the Exchange Act claims against BDO, vacating the district court’s holding on that issue. Id. at 53, 55.

BDO argues that the Second Circuit’s decision splits with the Sixth Circuit, which has held that the materiality of a failure to conform to generally accepted accounting principles (GAAP) and generally accepted auditing standards (GAAS) depends on “whether, given all the financial information, there was a substantial risk that the actual value of assets or profits were significantly less than [the defendant accounting firm] stated them to be” through its certification that the financial statements were accurate. Petition at 12-14 (quoting Adams v. Standard Knitting Mills, Inc., 623 F.2d 422, 432 (6th Cir. 1980)).

The Supreme Court’s demonstrated interest in the case bears watching. For additional background on the case, see our 2024 Year-End Securities Litigation Update.

D. Slack v. Pirani: Plaintiff Seeks Supreme Court Review Of New Tracing Theory’s Application To Section 12(a)(2) Claims.

In 2023, the Supreme Court confirmed that “[t]o bring a claim under § 11 [of the Securities Act of 1933], the securities held by the plaintiff must be traceable to the particular registration statement alleged to be false or misleading.” Slack Techs., LLC v. Pirani, 598 U.S. 759, 768 (2023). On remand, the Ninth Circuit held that plaintiff Pirani failed to state a claim under Section 11 because he expressly waived the argument that “the shares he purchased were directly traceable to the allegedly false and misleading registration statement,” and that because Pirani’s waiver applied equally to his Section 12(a)(2) claim, he also failed to state a claim under Section 12(a)(2). Pirani v. Slack Techs., Inc., 127 F.4th 1183, 1191-93 (9th Cir. 2025). The Ninth Circuit reversed the district court’s partial denial of the defendants’ motion to dismiss and remanded the case with instructions to dismiss the complaint in full and with prejudice. Id. at 1193. In reaching its holding, the Ninth Circuit rejected Pirani’s statistical tracing theory as “contrary to [Circuit] precedent” and declined to adopt a burden-shifting approach that would give the issuer “the burden to prove that the [investor’s] shares were not registered.” Id. at 1190-91. On July 10, 2025, Pirani filed a certiorari petition urging the Supreme Court to decide whether Section 12(a)(2) imposes the same traceability requirement as Section 11, and whether courts should shift the evidentiary burden in the context of direct listings. Petition for Writ of Certiorari, Pirani v. Slack Techs., Inc., No. 25-44 (U.S. July 10, 2025). The petition has been slated for Conference in September.

Gibson Dunn represents the defendants in the case. Thomas Hungar, a Gibson Dunn partner in the Washington, D.C. office, argued the case on their behalf before the Supreme Court. For additional background on the case, see our 2023 Mid-Year and 2022 Year-End Securities Litigation Updates.

A. Equitable Challenges To Advance Notice Bylaws Adopted On Clear Day Unripe.

The Delaware Court of Chancery recently dismissed as unripe two stockholders’ equitable challenges to advance notice bylaws where the bylaws allegedly “chilled” the stockholder franchise but the fairness of their adoption, amendment, or application was not at issue. The two cases—Siegel v. Morse, 2025 WL 1101624 (Del. Ch. Apr. 14, 2025), and Assad v. Chambers, 2025 WL 1554609 (Del. Ch. June 2, 2025)—involved substantially similar facts, were brought by the same law firms, and featured plaintiffs who disavowed any intent to run a proxy contest.

In December 2022, following the SEC’s adoption of Rule 14a-19 (the “Universal Proxy Rule”), the SEC issued supplemental guidance clarifying that a company could still exclude stockholder nominees from its proxy card if a dissident failed to comply with advance notice bylaw requirements. See Proxy Rules and Schedules 14A/14C, Questions and Answers of General Applicability, Question 139.04 (Dec. 6, 2022), https://www.sec.gov/rules-regulations/staff-guidance/compliance-disclosure-interpretations/proxy-rules-schedules-14a14c. The company in Assad refreshed its advance notice bylaws in June 2023, and the company in Siegel refreshed its advance notice bylaws in August 2023. Siegel, 2025 WL 1101624, at *1; Assad, 2025 WL 1554609, at *1. Both did so with the advice of outside counsel. Id.

In June 2024, the plaintiffs in Siegel and Assad filed facial challenges after obtaining company books and records. Each made clear that it was asserting a facial challenge because neither it nor any other stockholder intended to nominate a director or run a proxy fight. Siegel, 2025 WL 1101624, at *3; Assad, 2025 WL 1554609, at *2. Yet each also argued that its respective board had acted defensively in adopting the bylaws and, therefore, enhanced scrutiny should apply. Siegel, 2025 WL 1101624, at *3; Assad, 2025 WL 1554609, at *4. Then, the Delaware Supreme Court’s July 2024 decision in Kellner II seemingly foreclosed the facial challenges presented in Siegel and Assad. See Kellner v. AIM ImmunoTech Inc., 320 A.3d 239, 262 (Del. 2024). In response, the plaintiffs in Siegel and Assad each amended its complaint, disclaiming any facial validity challenge and asserting equitable challenges under Unocal and Blasius instead. Siegel, 2025 WL 1101624, at *4; Assad, 2025 WL 1554609, at *2.

Vice Chancellor Cook held in each case that the challenge presented was not ripe for the same reasons. Siegel, 2025 WL 1101624, at *5; Assad, 2025 WL 1554609, at *2. The Court applied the framework rearticulated by the Delaware Supreme Court in Kellner II. As a threshold matter, bylaws are presumed valid under Delaware law. Siegel, 2025 WL 1101624, at *4-7; Assad, 2025 WL 1554609, at *3-4. When a stockholder challenges the facial validity of advance notice bylaws, the Court considers whether the bylaws “cannot operate lawfully or equitably under any circumstances.” Siegel, 2025 WL 1101624, at *4 (quoting Kellner II, 320 A.3d at 258). When a stockholder raises an equitable challenge, by contrast, it asserts that the bylaws’ adoption, amendment, or application was inequitable under the specific circumstances of the case. Kellner II, 320 A.3d at 259. In this paradigm, the Court considers whether a board applied bylaws reasonably and whether the bylaws unfairly interfered with stockholder voting. Id. In no case will the Court consider hypotheticals or speculate about whether the bylaw might be invalid under certain circumstances. Kellner II, 320 A.3d at 263.

In both Siegel and Assad, the Court declined to reach the merits of the equitable challenges because it concluded each plaintiff’s claims did not present a ripe dispute. Siegel, 2025 WL 1101624, at *5; Assad, 2025 WL 1554609, at *2. Applying Kellner II, the Court determined there was no “genuine, extant controversy” because each plaintiff acknowledged that neither it nor any other stockholder intended to run a proxy contest. Siegel, 2025 WL 1101624, at *6-7; Assad, 2025 WL 1554609, at *4. The Court rejected each plaintiff’s contention that its respective board had acted defensively when it adopted or refreshed advance notice bylaws on a clear day. Id. The Court also declined to engage in the “hypothetical” alleged by each plaintiff, namely that the bylaws chilled and impermissibly burdened the free exercise of the stockholder franchise. Siegel, 2025 WL 1101624, at *6; Assad, 2025 WL 1554609, at *5.

B. Delaware Supreme Court Concludes Business Judgment Rule Applies To Decisions To Convert Corporate Domicile To Nevada Based On Facts Alleged.

With states like Texas and Nevada seeking to lure corporations away from Delaware, how Delaware courts treat the decisions of corporations to relocate—the so-called “DExit”—is no small matter. Earlier this year, the Delaware Supreme Court weighed in on that issue—reversing the Court of Chancery and concluding on the facts alleged that the decisions of two allegedly controlled companies to reincorporate in Nevada are subject to the business judgment rule. Maffei v. Palkon, — A.3d —, 2025 WL 384054 (Del. Feb. 4, 2025). For background on the Court of Chancery’s decision, see our Securities Litigation 2024 Mid-Year Update.

At the core of the Supreme Court’s holding was its determination that, “based on the pleaded allegations,” the defendants would “not receive a non-ratable benefit” by changing the companies’ corporate domiciles from Delaware to Nevada. Id. *18. By contrast, the Court of Chancery had held that the plaintiffs “adequately alleged that Defendants will receive a non-ratable benefit in the form of reduced liability exposure and that the Complaint alleged facts supporting a reasonable inference that the Conversions were not entirely fair.” Id. at *1.

The Supreme Court arrived at its conclusion in several steps. First, the Supreme Court defined what a non-ratable benefit is and when it exists in the controller context—e.g., “when the controller receives a unique benefit by extracting something uniquely valuable to the controller, even if the controller nominally receives the same consideration as all other stockholders.” Id. at *19 (quotation marks omitted).

Second, the Court explained that a non-ratable benefit must be material and “temporality is a key factor” in the materiality analysis. Id. at *20-21. Here, the Supreme Court explained, the plaintiffs failed to allege the conversion “decisions were made to avoid any existing or threatened litigation or that they were made in contemplation of any particular transaction.” Id. at *26. Thus, the Supreme Court concluded, “the hypothetical and contingent impact of Nevada law on unspecified corporate actions that may or may not occur in the future is too speculative to constitute a material, non-ratable benefit triggering entire fairness review.” Id.

Third, the Supreme Court rejected the Court of Chancery’s view that the temporal distinction is “arbitrary” and “hard to follow,” id. at *26, and noted that the decision both “furthers the goals of comity,” id. at *28, and aligns with Delaware policy that has “long recognized the values of flexibility and private ordering,” id. at *30.

The decision to convert in Palkon occurred against the backdrop of a “clear day.” Id. at *28 n.249. Accordingly, we will continue to monitor this space and DExit discourse more broadly.

C. Court Dismisses Quasi-Fiduciary Theory “Disguised” As An Implied Covenant Claim In Light Of Limited Liability Company Agreement.

A recent decision from the Delaware Court of Chancery serves as a good reminder of the different remedial rights available to investors in limited liability companies as compared to corporations. In Kahn v. Warburg Pincus, LLC, 2025 WL 1251237 (Del. Ch. Apr. 30, 2025), the Court dismissed a complaint brought by minority members of an LLC against the majority owner of the LLC, the merged company, and others that “chiefly assert[ed] that the implied covenant of good faith and fair dealing in the limited liability company agreement was breached.” Id. at *1. As the Court explained, “[t]he matters at hand are contractual ones,” and “Delaware law does not provide for quasi-fiduciary damages for a breach of the implied covenant where the contract belies the plaintiff’s position.” Id. at *10.

In 2019, CityMD announced that it was planning to merge with Summit Medical Group. Id. at *1. That merger eventually closed, resulting in WP CityMD Topco LLC (the “Company”). Id. As part of the merger, investors rolled over their equity into the Company, with some investors receiving Class A units and others receiving Class B units. Id. at *2. After the merger, the investors’ relationship was governed by an LLC agreement. Id. Among other things, the LLC agreement included “broad waivers” of the majority owner’s fiduciary duties. Id.

In 2021, the majority owner began looking to sell the Company. Id. In 2022, it received a letter of intent from VillageMD, which provided for Class A and Class B unitholders receiving different consideration. Id. The former would receive all cash, while the latter would receive a mix of cash and equity. Id. “Because the Merger Agreement contemplated disparate consideration for different unitholder classes, an amendment to the LLC [a]greement was required.” Id. at *3. The amendment was eventually approved, and the merger eventually closed. Id. at *3-4.

Roughly one year after the merger closed, the controller of the combined company disclosed a significant goodwill impairment charge on VillageMD. Id. at *4. The plaintiffs filed suit shortly thereafter, bringing implied covenant, tortious interference, and unjust enrichment claims. Id.

In April 2025, the Court of Chancery dismissed the plaintiffs’ complaint. Id. at *1. The Court explained that the “[t]he implied covenant of good faith and fair dealing is a limited and extraordinary legal remedy” that “does not apply when the contract addresses the conduct at issue, but only when the contract is truly silent concerning the matter at hand.” Id. at *5 (quotation marks omitted). It then analyzed the plaintiffs’ claims, finding that the “LLC [a]greement explicitly addressed the matters at issue” and left “no gap for the complied covenant to fill.” Id. at *6. Having found that the plaintiffs failed to allege a breach of an express or implied term in the LLC agreement, the Court then dismissed the plaintiffs’ tortious interference claims because no breach was pled and dismissed the plaintiffs’ unjust enrichment claim because the LLC agreement controlled the parties’ relationships. Id. at *10-11.

D. Court Dismisses Case After Finding Dilution Claim Was Derivative Rather Than Direct.

Whether a claim is direct or derivative can have significant knock-on effects—particularly at the pleading stage. In Siegel v. Cantor Fitzgerald, L.P., 2025 WL 1074604 (Del. Ch. Apr. 10, 2025), the distinction was dispositive. There, the plaintiff failed either to make a pre-suit demand or to make allegations of demand futility, resulting in the Court of Chancery dismissing Siegel’s complaint under Rule 23.1 after finding his claims were derivative rather than direct. Id. at *13-14.

In February 2024, Martin Siegel brought a putative class action alleging that Cantor Fitzgerald, L.P., the alleged controller of BGC Partners, Inc., and Howard Lutnick, its alleged “ultimate controller,” breached their fiduciary duties through a reorganization that benefitted Cantor Fitzgerald and harmed the minority stockholders. Id. at *1, *6. Siegel alleged the reorganization of BGC—in which it “converted from an umbrella partnership corporation to a full C corporation”—was unfair because it “increased Cantor’s voting power without Cantor paying adequate consideration.” Id. (quotation marks omitted). The defendants moved to dismiss, arguing the plaintiff’s claim should be dismissed under Rules 23.1 and 12(b)(6).

Applying the Tooley test, the Court dismissed the complaint, agreeing with the defendants that the claims were derivative and that the plaintiff had failed to plead demand futility or to make a demand. Under Tooley, whether a claim is direct or derivative depends “solely” on the answers to two questions: “(1) who suffered the alleged harm (the corporation or suing stockholders, individually); and (2) who would receive the benefit of any recovery or other remedy (the corporation or the stockholders, individually)?” Id. at *6 (citing Tooley v. Donaldson, Lufkin & Jenrette, Inc., 845 A.2d 1031, 1033 (Del. 2004)). Here, the Court concluded the answer to both questions was BGC—particularly in light of Brookfield Asset Management., Inc. v. Rosson, 261 A.3d 1251 (Del. 2021). As to the first question, the Court explained that “plaintiff’s claim . . . is that BGC overissued high-vote Class B shares to Cantor—its controlling stockholder,” and “[t]he resulting injury was to BGC, which has a claim to compel the restoration of value of the overpayment to Cantor.” Cantor Fitzgerald, L.P., 2025 WL 1074604, at *7 (quotation marks omitted). By contrast, “[a]ny harm to the minority stockholders flowed indirectly to them in proportion to, and via, their shares in BGC.” Id. (quotation marks omitted). As to the second question, the Court explained that “[b]ecause BGC suffered the primary harm for its alleged overissuance of Class B shares to Cantor, it logically follows that BGC would receive the benefit of any recovery.” Id. at *8 (citation modified). At bottom, in the Court’s words, Siegel’s claim was a “classic overpayment claim, which is exclusively derivative.” Id. at *6 (quotation marks omitted).

A. Technology

The GENIUS Act: On July 18, 2025, the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act or the Act) was signed into law. GENIUS Act, Pub. L. No. 119-27 (codified at 12 U.S.C. §§ 5901–5916). The GENIUS Act is aimed at regulating the digital assets industry, and focuses on the issuance of “payment stablecoins,” which the Act defines as any digital asset (1) that is, or is designed to be, used as a means of payment or settlement, and (2) the issuer of which is obligated to convert, redeem, or repurchase for a fixed amount of monetary value and represents (or creates the reasonable expectation) that such issuer will maintain a stable value for the asset, tied to a fixed amount of monetary value. 12 U.S.C. § 5901(22). The Act establishes a federal regulatory framework for the issuance of payment stablecoins that limits issuers to approved subsidiaries of an insured depository institution, entities approved by the Office of the Comptroller of the Currency, and certain State-regulated entities. Id. § 5901(23)–(25). The GENIUS Act also establishes the Stablecoin Certification Review Committee (SCRC) and introduces a number of safeguards aimed at protecting stablecoin holders, including the requirement that public companies must either be predominantly engaged in one or more “financial activities” (as defined by the Bank Holding Company Act of 1956) or approved by the SCRC to issue stablecoin, id. § 5903(a)(12); the designation of stablecoin issuers as “financial institutions” under the Bank Secrecy Act, subjecting them to anti-money laundering, customer due diligence, and transaction monitoring requirements, id. § 5903(a)(5); and risk management requirements for issuers, including requirements for reserve portfolio diversification, capital and liquidity requirements, and stress testing, id. § 5903(a)(4). For more details, please see Gibson Dunn’s July 18, 2025 Client Alert.

Risley v. Universal Navigation Inc., 2025 WL 615185 (2d Cir. Feb. 26, 2025): The plaintiffs in this case alleged that the defendants violated Sections 5, 12(a)(1), and 15 of the Securities Act of 1933 and Sections 20 and 29(b) of the Securities Exchange Act of 1934 by, among other things, facilitating the trading of unregistered securities through the Uniswap Protocol, a decentralized cryptocurrency exchange. Id. at *1. They also alleged that the defendants exerted control over the Uniswap Protocol and were aware of numerous fraudulent activities including “rug pulls” and “pump and dump” scams occurring on the exchange, but did nothing to prevent them. Id. at *2. On February 26, 2025, the Second Circuit affirmed the district court’s dismissal of the plaintiffs’ federal claims, but vacated and remanded the dismissal of the plaintiffs’ various state law claims. Id. at *3-4. Among other things, the Second Circuit agreed with the district court that the plaintiffs failed to adequately allege that the defendants were statutory sellers of the tokens in question or that they actively solicited the sale of the tokens for their own financial gain by promoting the Uniswap Protocol on social media and selling their own issued token on the platform. Id. at *2-3. The Court also agreed that the “smart contracts” used in the Uniswap Protocol, which the plaintiffs alleged are “self-executing and self-enforcing computer programs that autonomously write the terms of an agreement between the traders” on the platform were “more analogous to overarching user agreements than to securities transactions conducted by traditional broker dealers,” and therefore were at best collateral to the actual token sales and the type of tangential activity that generally falls outside of Sections 12(a)1 and 29(b). Id. at *2, 4. The Second Circuit vacated and remanded the dismissal of the state law claims, however, concluding the district court improperly declined to exercise supplemental jurisdiction despite the plaintiffs’ adequate pleading of diversity jurisdiction under the Class Action Fairness Act. Id. at *4.

SEC v. Payward, Inc., 763 F. Supp. 3d 901 (N.D. Cal. 2025): On January 24, 2025, the Northern District of California granted in part and denied in part a motion by the SEC for judgment on the pleadings regarding three of Payward, Inc.’s (d/b/a “Kraken”) affirmative defenses to the SEC’s claims that Kraken violated Sections 5, 15(a), and 17A(b) of the Securities Exchange Act by acting as an unregistered broker, dealer, exchange, and clearing agency with respect to “crypto asset securities.” Id. at 905. The Court granted the SEC’s motion for judgment as to Kraken’s major questions doctrine affirmative defense, id. at 914, but declined to enter judgment on the pleadings regarding Kraken’s fair notice and due process affirmative defenses, finding that Kraken adequately alleged it lacked fair notice that its digital assets could be securities under the test laid out in SEC v. W.J. Howey Co., 328 U.S. 293 (1946). Id. at 910-14. Specifically, the Court found that “there is room in this case for Kraken to argue in its defense that an entity of ordinary intelligence in its position would not understand how the Howey test applies to the transactions on its platform.” Id. at 913. Further, the Court noted that “[t]he SEC’s previous lawsuits, its public commentary, and its testimony in front of Congress all inform [the Court’s] examination” of whether Kraken had fair notice that its trading of digital assets on its platform would be considered “investment contracts” under Howey. Id. at 912. On March 27, 2025, the parties entered a joint stipulation to dismiss the case. SEC v. Payward, Inc., No. 23-cv-06003, ECF No. 127.

SEC v. Ripple Labs, Inc., No. 20-cv-10832 (S.D.N.Y. June 26, 2025), ECF No. 989: In August 2024, the Southern District of New York entered judgment against Ripple Labs, Inc. (Ripple), permanently restraining it from violating Section 5 of the Securities Act by requiring that a registration statement be filed for any security Ripple offers for sale, and holding it liable for a $125,035,150 civil penalty in a case concerning Ripple’s offer and sale of XRP, a crypto token. ECF No. 974. The judgment effectuated the Court’s July 2023 decision wherein it determined that Ripple’s XRP sales on public exchanges were not offers of securities, but that XRP sales to sophisticated investors were unregistered sales of securities. SEC v. Ripple Labs, Inc., 682 F. Supp. 3d 308, 324-33 (S.D.N.Y.). After the Court entered judgment, both parties appealed. See SEC v. Ripple Labs, Inc., No. 24-2648 (2d Cir. Oct. 3, 2024), ECF No. 1; SEC v. Ripple Labs, Inc., No. 24-2705 (2d Cir. Oct. 10, 2024), ECF No. 1. In the spring of this year, the parties reached a settlement agreement under which both parties agreed to drop their respective appeals and reduce the civil penalty to $50,000. SEC v. Ripple Labs, Inc., No. 1:20-cv-10832 (S.D.N.Y. May 8, 2025), ECF No. 983-1. On June 26, 2025, however, the district court issued an opinion stating it would reject any related motion to eliminate the injunction and reduce the civil penalty, noting that none of the previous considerations put forth by the SEC and relied upon by the Court regarding the “severity and pervasiveness of Ripple’s misconduct” or “the need to send a strong deterrent message” had changed, and concluding that the parties had not shown “exceptional circumstances that outweigh the public interest or the administration of justice.” ECF No. 989, at 3, 5. On August 11, 2025, the parties filed a joint stipulation of dismissal regarding their cross appeals. Ripple Labs, Inc., No. 24-2648, ECF No. 66.1.

SEC v. Coinbase, Inc., 761 F. Supp. 3d 702 (S.D.N.Y. 2025): On January 7, 2025, the Southern District of New York granted Coinbase, Inc.’s (Coinbase) motion to certify for interlocutory appeal a March 27, 2024 order in which the Court granted in part and denied in part Coinbase’s motion for judgment on the pleadings. Id. at 707-08; see SEC v. Coinbase, Inc., 726 F. Supp. 3d 260, 307 (S.D.N.Y. 2024). In the March 2024 order, the Court concluded that certain of the transactions Coinbase intermediated on its platform involving digital assets plausibly qualified as investment contracts under the Howey test and therefore fell within the SEC’s regulatory purview because the SEC had adequately alleged (1) an investment of money; (2) horizontal commonality, as “[t]he ability of a Crypto-Asset purchaser to profit . . . [wa]s dependent on both the successful launch of the token and the post-launch development and expansion of the token’s ecosystem”; and (3) purchasers had a reasonable expectation of profits from the efforts of others where the SEC alleged that issuers and promoters of the digital assets at issue “repeatedly encouraged investors to purchase tokens by advertising the ways in which their technical and entrepreneurial efforts would be used to improve the value of the asset, and continued to do so long after the tokens were made available for trading on the secondary market.” Coinbase, 726 F. Supp. 3d at 290-93. The Court also granted Coinbase judgment on the pleadings with respect to the SEC’s claim that Coinbase acts as a broker through its Coinbase Wallet service. Coinbase petitioned the Second Circuit for leave to appeal the district court’s March 2024 order. Coinbase, Inc. v. SEC, No. 25-145 (2d Cir. Jan. 17, 2025), ECF No. 1. The parties, however, filed a joint stipulation of dismissal on March 4, 2025, before the Second Circuit could hear and rule on the case. ECF No. 56.

B. Cross-Cutting Issues

For the past several years, shareholders have been filing private litigation challenging Environmental, Social, and Governance (ESG) policies and disclosures. We previously reported that these lawsuits have had mixed results and discussed various ESG theories that have been advanced by private litigants. For our most recent previous coverage, see the Securities Litigation 2024 Year-End Update and Securities Litigation 2024 Mid-Year Update.

1. Climate-Related Disclosures

KBC Asset Mgmt. NV v. Discover Fin. Servs., 2025 WL 976120 (N.D. Ill. Mar. 31, 2025): On March 31, 2025, the U.S. District Court for the Northern District of Illinois dismissed a putative securities class action complaint alleging the defendants made false or misleading statements about Discover’s risk management framework, including about its management of “climate-related risks.” 2025 WL 976120, at *1, *20. The Court found that these statements touting the company’s risk-governance framework were not actionable because they were “exactly the types of routine representations of risk-management practices that almost every bank makes.” Id. at *20 (citation, internal quotation marks, and ellipsis omitted). The motion to dismiss was granted without prejudice. Id. at *30.

2. Other ESG-Related Disclosures

Carper v. TMC the metals company Inc. et al., No. 21-cv-05991 (E.D.N.Y): On July 11, 2025, the U.S. District Court for the Eastern District of New York dismissed a putative securities class action against The Metals Company, Inc. (TMC) and two of its officers. ECF No. 56. TMC is a Canadian deep-sea minerals exploration company that collects, processes, and refines metals for use in electric vehicle batteries, with the stated mission of minimizing its negative environmental and social impacts. ECF No. 1 at ¶ 3. The complaint, which was filed in October 2021, alleged that TMC misled consumers and investors about its “green credentials,” including by claiming that TMC’s planned deep-sea mining would “guarantee . . . zero waste.” Id. ¶¶ 6, 30. In granting the motion to dismiss, the Court reasoned that (1) the plaintiffs lacked standing to challenge certain of the alleged misstatements, and (2) the complaint did not adequately allege falsity or scienter as to any of the alleged misstatements. ECF No. 56 at 19, 33, 60.

In re Lumen Techs., Inc. Sec. Litig. II, 2025 WL 978229 (W.D. La. Mar. 14, 2025), report and recommendation adopted, 2025 WL 971748 (W.D. La. Mar. 31, 2025): On March 31, 2025, the U.S. District Court for the Western District of Louisiana dismissed a putative securities class action complaint against Lumen—the telecommunications company formerly known as CenturyLink. 2025 WL 971748, at *1. In July 2023, The Wall Street Journal published a series of articles publicizing the “dangers posed by legacy . . . lead-sheathed copper telephone cables.” 2025 WL 978229, at *2. These lead-sheathed cables were installed by a predecessor phone company in the twentieth century, and Lumen had “assumed responsibility” over a portion of those cables through an acquisition. Id. Lumen’s share price dropped following The Wall Street Journal’s reporting. Id. The complaint in this action followed, alleging that the defendants misled investors about several aspects of Lumen’s business, including its “corporate citizenship and ESG initiatives.” 2025 WL 978229, at *5-6; see also id. at *19. A magistrate judge recommended dismissing the complaint, concluding the plaintiffs were asserting non-cognizable “fraud by hindsight” securities claims. Id. at *48. The magistrate judge’s report and recommendation found that most of the information in The Wall Street Journal’s reporting “certainly was not a secret”—and that to the extent the reporting did reveal certain environmental and financial risks associated with lead-sheathed wires, there were no allegations that “any individual [d]efendant was aware” of those dangers at Lumen before the reporting was published. Id. at *19-21. The district court adopted the magistrate judge’s report in its entirety and dismissed the complaint with prejudice. 2025 WL 971748, at *1.

Stichting Pensioenfonds Metaal en Techniek v. Verizon Commc’ns, Inc., 775 F. Supp. 3d 826 (D.N.J. 2025): On March 31, 2025, the U.S. District Court for the District of New Jersey granted the defendants’ motion to dismiss this securities class action against Verizon. 775 F. Supp. 3d at 835-36. In relevant part, the complaint alleged that the defendants made false and misleading statements and omissions regarding lead-encased copper cables owned by Verizon, which brought “enormous risk and financial exposure to Verizon and its shareholders because of the serious health effects . . . of lead exposure.” Id. at 836. After The Wall Street Journal published a series of “‘bombshell’ articles” in July 2023 on these lead-sheathed cables—the same reporting at issue in Lumen—Verizon’s stock price dropped. Id. The plaintiffs’ lawsuit followed. In granting the defendants’ motion to dismiss, the Court held that the statements the plaintiffs challenged—which included representations that Verizon was “work[ing] to reduce the environmental impact” of its products through “recycling, refurbishing, and/or reusing [those] products,” and Verizon’s “recycling practices exceed[ed] regulatory mandates”—were not actionable securities fraud. Id. at 845-46. The plaintiffs adequately alleged that these and other statements were material but failed to plead that the statements were misleading or that the defendants had scienter as to any statements. Id. at 839-51. The complaint was dismissed without prejudice; the plaintiffs filed a second amended complaint on April 21, 2025. ECF No. 79.

A. Presuming Reliance On Alleged Misstatements In An Efficient Market And Rebutting The Presumption With Evidence Of No Price Impact.

Plaintiffs in securities class actions often invoke the presumption of reliance first outlined in Basic Inc. v. Levinson, 485 U.S. 224, 247 (1988), which is based on the theory that if a company’s stock trades in an efficient market, any alleged misstatements would be reflected in the stock’s market price, and, therefore, any investor who decided to purchase a company’s stock indirectly relied on all public information. One way that defendants can rebut this presumption is by showing that the alleged misrepresentations did not impact the stock’s market price. See Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014). As we have previously covered, the Supreme Court held in Goldman Sachs Group., Inc. v. Arkansas Teacher Retirement System that courts must consider all evidence of price impact when assessing motions for class certification, even if the evidence overlaps with materiality and other merits questions. Goldman Sachs Grp., Inc. v. Ark. Tchr. Ret. Sys., 594 U.S. 113, 121-22 (2021). When plaintiffs proceed under an “inflation-maintenance” price impact theory—where the price impact of material misstatements is shown indirectly by a drop in the company’s stock price following a corrective disclosure, instead of a price increase when the material misstatements are made—courts must consider the alleged corrective disclosure accompanying the price decline. Id. at 123.

In the first half of 2025, lower courts continue to grapple with price impact issues in ruling on class certification motions, closely scrutinizing the nature of the alleged misrepresentations and the robustness of price impact evidence. For example, in In re Concho Resources Inc. Securities Litigation, the Southern District of Texas granted class certification in part but excluded a number of alleged misstatements on grounds that the alleged corrective disclosures were not a sufficient “match” for the change in price to be attributed to the earlier statements. 2025 WL 1040379 (S.D. Tex. Apr. 7, 2025). There, the plaintiffs challenged certain generic, positive statements (for example “this industry is exciting” and “our strategy allows us to adapt quickly”), which the Court held were too much of a “mismatch” to the specific corrective disclosures concerning the Company’s financial results and changes in production targets and manufacturing strategies for the drop accompanying the alleged corrective disclosure to be evidence that the generic statements had a price impact. Id. at *14. The Court also agreed with the defendants’ arguments that there was a substantive mismatch between other, more concrete challenged statements (for example, financial results for the years 2017 and 2018, and projections for 2018) and their alleged corrective disclosures (for example actual financial results for 2019 and a change to production targets and manufacturing strategies). Id. at * 16. For those, the disparity in subject matter was evidence that the statements had no impact. Id. The Court did certify a class for certain other alleged misstatements, where the challenged statements and alleged corrective disclosures were sufficiently similar. Id. at *16.

We also continue to follow Jaeger v. Zillow Group, Inc., No. 24-6605 (9th Cir. Oct. 29, 2024) an interlocutory appeal in the Ninth Circuit, which will provide the circuit court with its first opportunity to apply the Supreme Court’s Goldman decision. In Zillow Group, the defendants have appealed the district court’s decision certifying a class, arguing that the district court incorrectly applied Goldman and ignored their evidence of mismatch because it “goes to loss causation and the merits.” Opening Brief, No. 24-6605, at 2. Oral argument occurred in mid-August.

B. Affiliated Ute Presumption

On August 13, 2025, the Sixth Circuit decertified a class of investors who sued First Energy following the public allegations of a bribery scandal. In re: FirstEnergy Corp. Sec. Litig., Case No. 23-3940 (6th Cir. Aug. 13, 2025). As discussed in our 2024 Year-End Update, this appeal presented the Sixth Circuit with the opportunity to weigh in on whether plaintiffs in cases involving a “mix” of alleged omissions and misrepresentations can forego the requirements of the Basic presumption and deny defendants the right to rebut the presumption by instead relying on the Affiliated Ute presumption of reliance, which applies when claims “primarily” involve omissions. The district court found that the plaintiffs’ theory was based primarily on omissions, and so it analyzed the plaintiffs’ class certification motion applying the Affiliated Ute presumption of reliance, not Basic. See In re: FirstEnergy Corp. Sec. Litig., 2023 WL 2709373, at *20-22 (S.D. Ohio Mar. 30, 2023).

The Sixth Circuit disagreed, concluding that this was “a mixed case that is primarily based on misrepresentations,” and so is “subject to analysis under Basic, not Affiliated Ute.” Id. The Court vacated the class certification order to the extent it was based on the district court’s application of Affiliated Ute and remanded to the district court, with instructions to conduct its analysis under the Basic presumption. Id. at 36.

In reaching this conclusion, the Sixth Circuit outlined a multi-factor test to determine whether a “mixed” case is primarily based on omissions or misrepresentations. In re: FirstEnergy Corp. Sec. Litig., Case No. 23-3940 (6th Cir. Aug. 13, 2025), slip op. at 11. First, courts must “classify each claim or group of claims as alleging either an omission or a misrepresentation,” while keeping in mind that “[b]oth half-truths and generic, aspirational corporate statements are misrepresentations.” Id. Second, courts must determine whether the overall case is based “primarily” on omissions or misrepresentations by analyzing whether any of four factors are satisfied: (1) “the alleged omissions are only the inverse of the misrepresentations, i.e., the only omissions are the truth that is misrepresented”; (2) reliance can be proved “by pointing to an alleged misrepresentation and connecting it to an injury”; (3) “the preponderance and primary thrust of the claims involve alleged misrepresentations made by the defendant(s)”; and (4) “the alleged omissions have no standalone impact apart from any alleged misrepresentations.” Id. Only one of the four preceding factors needs to be satisfied in order for a mixed case to be “primarily based on misrepresentations and thus subject to analysis under the Basic presumption.” Id. A “mixed” case is primarily based on omissions only where none of the four factors are satisfied. Id. For Affiliated Ute to apply, the Sixth Circuit emphasized that an omission must be a pure omission, as opposed to a half-truth or a statement that was alleged to be misleading by omission. See Macquarie Infrastructure Corp. v. Moab Partners, L.P., 601 U.S. 257 (2024).

The Sixth Circuit’s decision aligns with courts in other circuits that hold that Affiliated Ute does not apply to cases challenging statements that are misleading by omission. See, e.g., In re DiDi Global Inc. Sec. Litig., 2025 WL 1909295, at *12-16 (S.D.N.Y. Jul. 7, 2025), report and recommendation adopted, 2025 WL 2345696 (S.D.N.Y. Aug. 13, 2025) (applying majority rule that plaintiffs cannot rely on the Affiliated Ute presumption of reliance for claims based on challenges to affirmative statements that plaintiffs claimed were “half-truths” but allowing the Affiliated Ute presumption for scheme liability claims).

C. Basic Presumption

Defendants also continue to use Comcast Corp. v. Behrend to argue that class certification is inappropriate because plaintiffs cannot propose a damages methodology consistent with their theory of fraud and capable of “measurement on a classwide basis.” Comcast Corp. v. Behrend, 569 U.S. 27, 34 (2013). Successful Comcast arguments are rare in traditional securities class actions where plaintiffs often argue that any drop at the time of the alleged corrective disclosure measures the inflation in the stock on each prior day during the class period. The Fourth Circuit has agreed to consider whether Comcast prevents the certification of a class in In re The Boeing Company Securities Litigation, No. 25-135 (4th Cir. 2025). There, a federal district court in the Eastern District of Virginia certified a class of investors who alleged Boeing made misrepresentations about their commitment to safety and were damaged when a mid-flight incident with a door plug supposedly corrected those statements. In re Boeing Co. Sec. Lit., No. 24-cv-00151 (E.D. Va. Mar. 7, 2025), Dkt. No. 143. The plaintiffs’ theory rested on the premise that generic statements about a commitment to safety did not immediately inflate the price of Boeing’s stock, but that the inflation grew over time. Boeing argues on appeal that the district court improperly certified the class because the plaintiffs’ expert failed to identify a class-wide methodology for determining the recoverable inflation during the class period consistent with that theory. Opening Brief, No. 25-135, at 4-5. Specifically, Boeing argued the plaintiffs were attempting to hide the ball “on how they intend to measure inflation until after the class is certified,” by reciting a general method for calculating out-of-pocket damages without tailoring it to the plaintiffs’ theory. Id. at 38.

We will continue to monitor these cases and others.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any of the following leaders and members of the firm’s Securities Litigation practice group:

Christopher D. Belelieu – New York (+1 212.351.3801, cbelelieu@gibsondunn.com)

Jefferson Bell – New York (+1 212.351.2395, jbell@gibsondunn.com)

Michael D. Celio – Palo Alto (+1 650.849.5326, mcelio@gibsondunn.com)

Colin B. Davis – Orange County (+1 949.451.3993, cdavis@gibsondunn.com)

Jonathan D. Fortney – New York (+1 212.351.2386, jfortney@gibsondunn.com)

Michael J. Kahn – San Francisco (+1 415.393.8316, mjkahn@gibsondunn.com)

Allison K. Kostecka – Denver (+1 303.298.5718, akostecka@gibsondunn.com)

Monica K. Loseman – Co-Chair, Denver (+1 303.298.5784, mloseman@gibsondunn.com)

Brian M. Lutz – Co-Chair, San Francisco (+1 415.393.8379, blutz@gibsondunn.com)

Mary Beth Maloney – New York (+1 212.351.2315, mmaloney@gibsondunn.com)

Jason J. Mendro – Co-Chair, Washington, D.C. (+1 202.887.3726, jmendro@gibsondunn.com)

Alex Mircheff – Los Angeles (+1 213.229.7307, amircheff@gibsondunn.com)

Lissa M. Percopo – Washington, D.C. (+1 202.887.3770, lpercopo@gibsondunn.com)

Jessica Valenzuela – Palo Alto (+1 650.849.5282, jvalenzuela@gibsondunn.com)

Craig Varnen – Co-Chair, Los Angeles (+1 213.229.7922, cvarnen@gibsondunn.com)

Mark H. Mixon, Jr. – New York (+1 212.351.2394, mmixon@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.