Securities Litigation 2023 Mid-Year Update

Client Alert | September 15, 2023

We have seen many notable developments in securities law during the first half of 2023 across a number of different areas. This update provides an overview of those major developments in federal and state securities litigation since our 2022 Year-End Securities Litigation Update:

- We discuss major Supreme Court decisions from October Term 2022, and preview several significant grants of certiorari. In addition, we examine circuit court-level developments that may end up before the Supreme Court.

- We review significant developments in Delaware corporate law, including a number of decisions concerning fiduciary duties in the context of a merger or acquisition, and the intersection of Unocal, Schnell, and Blasius when board action implicates the stockholder franchise.

- We examine developments in federal securities litigation involving special purpose acquisition companies (“SPACs”). As fewer SPAC IPOs and de-SPAC transactions occur, relative to the peak in 2021, we have also seen fewer new SPAC-related cases filed. Earlier SPAC-related litigation continues to proceed through courts—we discuss a proposed class action settlement and two recent decisions on statutory standing.

- We examine developments in securities litigation involving environmental, social, and corporate governance (“ESG”) allegations.

- We survey litigation in the cryptocurrency space as courts continue to grapple with the application of securities laws to cryptocurrencies.

- We discuss the shareholder activism landscape, including recent proxy battles and new SEC regulations related to shareholder proposals and proxy elections that could potentially encourage shareholder activists going forward.

- We continue to monitor the emergence of a potential circuit split regarding the Supreme Court’s 2019 decision in Lorenzo, which allows scheme liability under Rule 10b-5(a) and (c) even if the disseminator did not “make” the statement within the meaning of Rule 10b-5(b). As discussed in our 2022 Mid-Year Securities Litigation Update, a number of courts have grappled with the effects of Lorenzo. In particular, the Second Circuit in SEC v. Rio Tinto provided some clarity for district courts within the Circuit by finding that “something extra” is required beyond misstatements for there to be scheme liability. A recent district court opinion in California, however, acknowledged that the Ninth Circuit has not adopted Rio Tinto.

- Finally, we discuss the Second Circuit’s long-awaited decision in Arkansas Teacher Retirement System v. Goldman Sachs Group, Inc., and a district court’s application of Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System in denying class certification in part.

I. Filing and Settlement Trends

With thanks to analysis from Cornerstone Research, new filings have increased from 93 total securities class action filings in the first half of 2022 to 114 filings in the first half of 2023. Although the median value of settlements has increased compared to the same period in 2022, the number and total value of settlements are lower than any year since 2017. SPAC-, COVID-19-, and cryptocurrency-related filings continue to be a focus, even as the nature of such suits continues to evolve.

A. Filing Trends

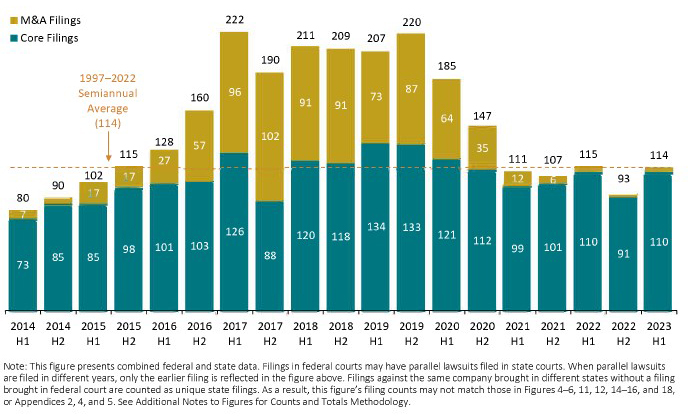

Figure 1 below reflects the semiannual filing rates dating back to 2014 (all charts courtesy of Cornerstone Research). For the fourth six-month period in a row, new filings remained at or below the historical semiannual average. Notably, at 114, filings in the first half of 2023 barely top 50% of the average semi-annual filing rates seen between 2017 and 2019, though this deficit is largely driven by a substantial decrease in M&A-related filings. The 110 total new “core” cases—i.e., securities cases without M&A allegations—filed in the first half of 2023 represent a modest increase from the semi-annual periods since the first half of 2021.

Figure 1:

Semiannual Number of Class Action Filings (CAF Index®)

January 2014 – June 2023

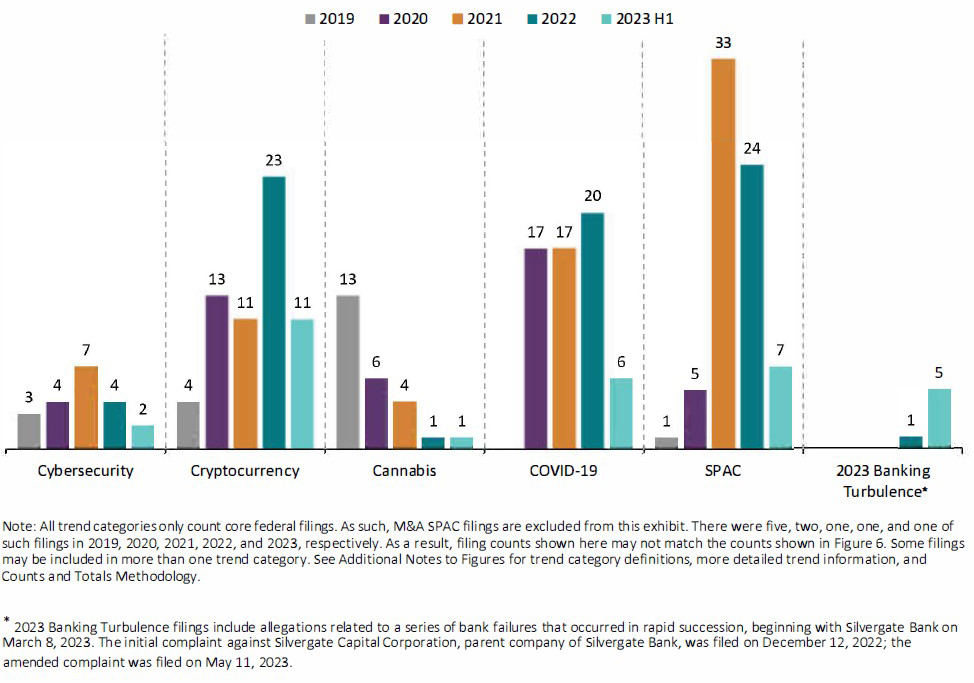

As illustrated in Figure 2 below, cryptocurrency-related actions are nearly on pace to match the record high set in 2022. The annualized number of COVID-19 and SPAC-related filings are markedly lower than prior years. Cybersecurity-related actions are on pace to be in line with historical averages.

Figure 2:

Summary of Trend Cases—Core Federal Filings

2019 – June 2023

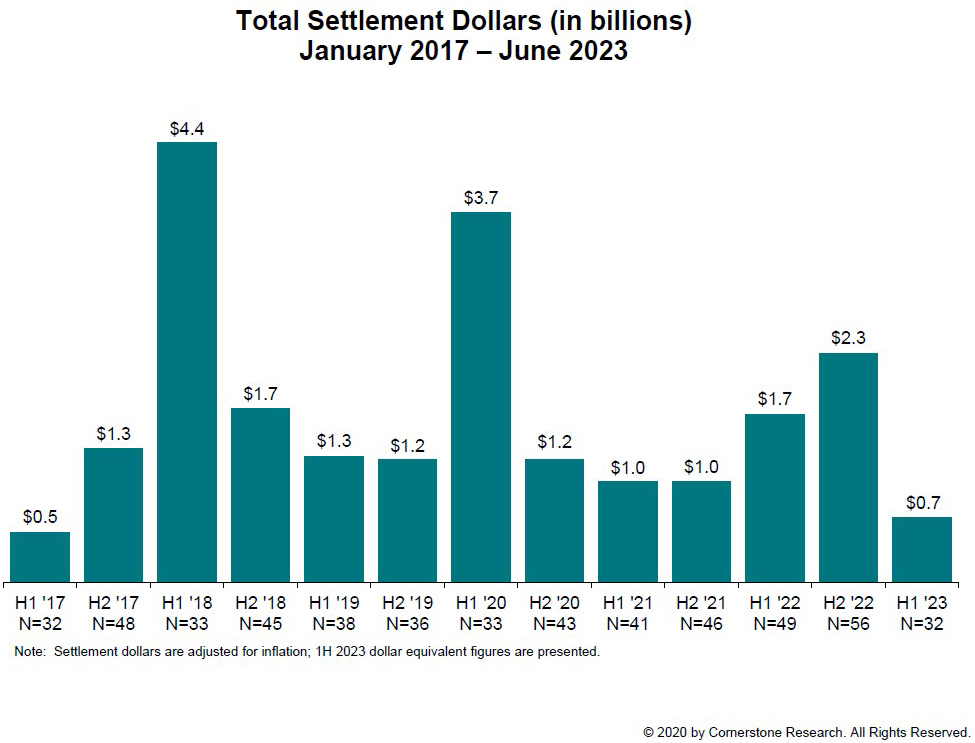

B. Settlement Trends

The first half of 2023 has seen fewer settlements and less total settlement value than any semi-annual period since 2017. Just 32 settlements have been approved through June 2023. Similarly, as reflected in Figure 3, the total settlement value in the first half of 2023 is just $700 million, down from a high of $4.4 billion in the first half of 2018 and $2.3 billion in the previous semi-annual period. The low total settlement value is largely a product of fewer settlements and fewer large settlements (there has only been one settlement greater than or equal to $100 million through June 2023). The median value of settlements approved in the first half of 2023 is nonetheless $16.3 million, however, an increase of over 25% from the median value for the same period in 2022.

Figure 3:

II. What to Watch for in the Supreme Court

A. Recent Supreme Court Decisions

1. Slack Prevails at the Supreme Court

On June 1, 2023, the Supreme Court unanimously held that in a direct listing (as in traditional initial public offerings), a plaintiff who claims that a company’s registration statement is misleading and who sues under Section 11 of the Securities Act of 1933 must plead and prove that they bought shares registered under that registration statement. Slack Techs., LLC v. Pirani, 143 S. Ct. 1433 (2023). See our 2022 Year-End Securities Litigation Update for additional background on the case.

The Court’s opinion adopted the longstanding “tracing” requirement, noting that although “direct listings are new, the question how far § 11(a) liability extends is not,” and that “every court of appeals to consider the issue . . . reached the . . . conclusion”—like the Court—that “[t]o bring a claim under § 11, the securities held by the plaintiff must be traceable to the particular registration statement alleged to be false or misleading.” Slack Techs, 143 S. Ct. at 1440–41. In so concluding, the Court rejected Pirani’s textual argument—that the key phrase, “such security,” “should [be] read . . . to include other securities that bear some sort of minimal relationship to a defective registration statement”—and his arguments “from policy and purpose.” Id. at 1441. And in rejecting Pirani’s view of Section 11, the Court avoided an interpretation that could have unsettled the scope of liability under that section in cases beyond direct listings, including traditional IPOs and follow-on offerings. The Court’s holding thus protects reasonable expectations and avoids a potentially massive increase in litigation for companies that recently went public.

The Court, however, declined to resolve whether Section 12 of the ‘33 Act, which enforces the Act’s prospectus requirement and permits anyone who buys “such security” from the defendant to sue, 15 U.S.C. § 77l(a)(1), likewise requires proof of purchase of registered shares. It “express[ed] no views” about that question and remanded the matter to the lower courts to decide that question in the first instance. Id. at 1442 n.3. Gibson Dunn will provide further updates on this case and related issues as they arise.

Gibson Dunn represented Slack Technologies, LLC in the case. Thomas Hungar, a Gibson Dunn partner in the Washington, D.C. office, argued the case on its behalf.

2. Axon and Cochran Prevail at the Supreme Court

As detailed in our 2022 Year-End Securities Litigation Update, the Supreme Court heard oral argument in Securities and Exchange Commission v. Cochran, No. 21-1239, and a companion case, Axon Enterprise, Inc. v. Federal Trade Commission, No. 21-86, on November 7, 2022.

On April 14, 2023, the Supreme Court issued its decision and determined that “the review schemes set out in the Exchange Act and the FTC Act do not displace district court jurisdiction over Axon’s and Cochran’s far-reaching constitutional claims.” Axon Enter., Inc. v. Fed. Trade Comm’n, 143 S. Ct. 890, 900 (2023). In reaching its conclusion, the Court considered the three factors set forth in Thunder Basin Coal Co. v. Reich, 510 U.S. 200 (1994): (1) whether precluding district court jurisdiction could “foreclose all meaningful judicial review” of the claim, (2) whether the claim is “wholly collateral” to the statute’s review provisions, and (3) whether the claim is “outside the agency’s expertise,” Axon, 143 S. Ct. at 900.

In an opinion authored by Justice Kagan, the Court found all three factors weighed in favor of federal court jurisdiction. First, relying on internal administrative review would “foreclose all meaningful judicial review” because Cochran and Axon would lose their “rights not to undergo the complained-of agency proceedings if they cannot assert those rights until the proceedings are over.” Id. at 904. Second, Axon’s and Cochran’s claims had “nothing to do with either the enforcement-related matters the Commissions regularly adjudicate or those they would adjudicate in assessing the charges against Axon and Cochran,” and were thus wholly collateral. Id. at 904–05. Finally, Axon’s and Cochran’s constitutional assertions were “outside the agency’s expertise.” Id. at 905.

B. Grants of Certiorari

1. Murray v. UBS Securities, LLC – Retaliation Under Sarbanes-Oxley

On May 1, 2023, the Supreme Court granted certiorari in Murray v. UBS Securities LLC, et al., a case arising from the Second Circuit that could impact the ability of whistleblowers to bring claims of retaliation under 18 U.S.C. § 1514A of the Sarbanes-Oxley Act (“SOX”). See 143 S. Ct. 2429 (2023). The case is scheduled to be argued on October 10, 2023.

The case concerns a SOX retaliation claim by former UBS employee Trevor Murray. See Murray v. UBS Securities LLC, et al., 43 F.4th 254, 256 (2d Cir. 2022). UBS had hired Murray as a strategist supporting its commercial mortgage-backed securities business. Id. After “a shift in strategy prompted by financial difficulties,” which resulted in a “series of reductions in force,” UBS terminated his employment. Id. at 257. Murray alleged that he was terminated because he had reported being pressured “to skew his research and to publish reports to support their business strategies.” Id. at 256–57.

In 2014, Murray sued UBS, and a jury returned a verdict in his favor. Id. at 258. UBS appealed, arguing the district court committed reversible error when it failed to instruct the jury that a SOX whistleblower claim requires a showing of the employer’s retaliatory intent. Id. at 256. The Second Circuit agreed with UBS, finding “retaliatory intent is an element of a section 1514A claim,” a conclusion that “flow[ed] from the plain meaning of the statutory language and [wa]s supported by [the Second Circuit’s] interpretation of nearly identical language in the [Federal Railroad Safety Act].” Id. at 262–63. The Second Circuit thus vacated the district court’s judgment and remanded for a new trial. Id. at 263.

The Supreme Court subsequently granted review. In his opening brief filed on June 27, 2023, Murray argued that a plaintiff under the burden-allocation regime applicable to SOX retaliation claims need not prove “retaliatory intent.” In response, in its brief filed on August 8, 2023, UBS argued that SOX’s statutory language—which prohibits “discrimination … because of” protected activity—requires a plaintiff to show discriminatory intent and that the burden-allocation framework does not alter that requirement.

Gibson Dunn attorneys Eugene Scalia, Thomas Hungar, and Gabrielle Levin represent UBS Securities LLC and UBS AG.

2. SEC v. Jarkesy – Constitutional Challenges to the SEC’s Enforcement Powers

On June 30, 2023, the Supreme Court granted the SEC’s petition for writ of certiorari in Securities and Exchange Commission v. Jarkesy, 2023 WL 4278448, at *1 (U.S. June 30, 2023). The case presents three questions: (1) “Whether statutory provisions that empower the Securities and Exchange Commission (SEC) to initiate and adjudicate administrative enforcement proceedings seeking civil penalties violate the Seventh Amendment”; (2) “Whether statutory provisions that authorize the SEC to choose to enforce the securities laws through an agency adjudication instead of filing a district court action violate the nondelegation doctrine”; and (3) “Whether Congress violated Article II by granting for-cause removal protection to administrative law judges in agencies whose heads enjoy for-cause removal protection.” See Petition for a Writ of Certiorari, Securities and Exchange Commission v. Jarkesy, No. 22-859, at (ii) (Mar. 8, 2023).

On May 18, 2022, the Fifth Circuit issued an opinion holding that (1) the Jarkesy parties were deprived of their Seventh Amendment right to a jury trial, (2) Congress “unconstitutionally delegated legislative power to the SEC by failing to provide it with an intelligible principle by which to exercise the delegated power,” and (3) the “statutory removal restrictions on SEC ALJs violate Article II.” Jarkesy v. SEC, 34 F.4th 446, 451 (5th Cir. 2022). As to the first, the court reasoned that because the right to a jury trial attaches to “traditional actions at law,” and enforcement proceedings carrying civil penalties are “akin” to those “traditional actions,” parties to such enforcement proceedings have a jury trial right. Id. at 451. In addition, the Court rejected the SEC’s argument that “the action [it] brought . . . [wa]s . . . the sort that may be properly assigned to agency adjudication under the public-rights doctrine.” Id. at 455–57. As to the second, the Fifth Circuit explained that because “Congress . . . delegated to the SEC what would be legislative power absent a guiding intelligible principle”—i.e., the power to bring securities fraud actions for monetary penalties within the agency instead of in an Article III court—and Congress failed to “provide the SEC with an intelligible principle by which to exercise that power,” “Congress unconstitutionally delegated legislative power to the SEC.” Id. at 460–62. Finally, the Court reasoned that because ALJs “perform substantial executive functions,” the two layers of for-cause removal restrictions are an unconstitutional impediment to the Article II requirement that the President “take Care that the Laws be faithfully executed.” Id. at 463.

In its petition for certiorari, the SEC argued that all three of these “highly consequential” conclusions warrant the Court’s review, as they “call[] into question longstanding practices at the SEC and many other agencies.” Petition for a Writ of Certiorari, at 9. Among other things, the SEC argued that “[u]nder [a] long line of precedent, SEC administrative adjudications seeking civil penalties qualify as matters involving public rights,” id. at 11; “[t]he Commission’s decision whether to pursue an administrative or judicial remedy in a particular case is a core executive function” rather than an “exercise of legislative power,” id. at 13; ALJs are not improperly insulated because, inter alia, they “perform adjudicative rather than enforcement or policymaking functions,” id. at 18 (quoting Free Enter. Fund v. PCAOB, 561 U.S. 477, 507 n.10 (2010)), and the standard for their removal is “less stringent than the removal standard . . . held invalid in Free Enterprise Fund;” and the Merit Systems Protection Board’s “involvement in reviewing the removal of ALJs” does not “contribute[] to the violation of Article II,” id. at 18–19.

3. Loper Bright Enterprises v. Raimondo – Chevron’s Vitality

On May 1, 2023, the Supreme Court granted certiorari in Loper Bright Enterprises v. Raimondo. It presents the question of whether the Supreme Court should overrule Chevron v. Natural Resources Defense Council, 467 U.S. 837 (1984), “or at least clarify that statutory silence concerning controversial powers expressly but narrowly granted elsewhere in the statute does not constitute an ambiguity requiring deference to the agency.” Petition for Writ of Certiorari, Loper Bright Enters. v. Raimondo, No. 22-451 (Nov. 10, 2022); Loper Bright Enters. v. Raimondo, 143 S. Ct. 2429 (2023).

The case involves a group of commercial fishing companies and certain actions taken by the National Marine Fisheries Service (“the Service”). Loper Bright Enters., Inc. v. Raimondo, 45 F.4th 359, 363 (D.C. Cir. 2022). Specifically, “[i]n implementing an Omnibus Amendment that establishes industry-funded monitoring programs in New England fishery management plans, [the Service] promulgated a rule that required industry to fund at-sea monitoring programs.” Id. The group of commercial fishing companies then sued, “contend[ing] that the [Magnuson-Stevens Fishery Conservation and Management Act of 1976 (the “Act”)] does not specify that industry may be required to bear such costs and that the process by which the Service approved the Omnibus Amendment and promulgated the Final Rule was improper.” Id.

The district court ruled in favor of the Government, and the D.C. Circuit, relying partly on the limited scope of review permitted by Chevron, 467 U.S. 837, affirmed. Chevron requires courts to evaluate the Government’s interpretation of certain statutes by asking first “whether Congress has spoken clearly,” and if not, then, second, “whether the implementing agency’s interpretation is reasonable.” Loper Bright, 45 F.4th at 365. Here, the D.C. Circuit concluded that “[a]lthough the Act may not unambiguously resolve whether the Service can require industry-funded monitoring, the Service’s interpretation of the Act as allowing it to do so [wa]s reasonable.” Id.; see also id. at 370.

C. Circuit-Level Developments

1. Lee v. Fisher – Potential Circuit Split on Forum Selection Clauses and Section 14

On June 1, 2023, an en banc panel of the Ninth Circuit issued its opinion in Lee v. Fisher, thereby furthering a potential split with the Seventh Circuit. 70 F.4th 1129 (9th Cir. 2023). As discussed in our 2022 Year-End Securities Litigation Update, Lee concerns whether investors can file derivative suits in federal court when a company’s bylaws contain a forum-selection clause that mandates such cases be filed in Delaware state court. In Seafarers Pension Plan v. Bradway, the Seventh Circuit held that a forum-selection clause similar to the one at issue in Lee was not enforceable. 23 F.4th 714, 724 (7th Cir. 2022).

In contrast to the Seventh Circuit, the Ninth Circuit held that the at-issue forum selection clause contained in the company’s bylaws, which required “any derivative action or proceeding brought on behalf of the Corporation” to be adjudicated in the Delaware Court of Chancery, was enforceable. Lee, 70 F.4th at 1138. First, the Court held that the forum selection clause did not waive substantive compliance with the Exchange Act, i.e., compliance with the obligation not to make false or misleading statements in a proxy statement. The court explained that Lee could enforce substantive compliance through direct claims that are outside the ambit of the forum selection clause. See Lee, 70 F.4th at 1139; see also id. at 1139 n.5 (“Lee can also enforce the substantive obligation to refrain from making false or misleading statements in a proxy statement under Delaware law.”). It also rejected Lee’s argument that “the forum selection clause conflicts with § 29(a)’s antiwaiver provision” because it forecloses the “right to bring a derivative § 14(a) action,” explaining, among other things, that § 29(a) does not “forbid . . . waiver of a particular procedure for enforcing such duties.” Id. at 1141. Next, the court rejected Lee’s argument—which relied largely on J.I. Case Co. v. Borak, 337 U.S. 426 (1964)—that there is a strong public policy “of allowing shareholders to bring a § 14(a) derivative action.” Id. at 1143. The court observed, among other things, that “the [Supreme] Court now looks to state law rather than federal common law to fill in gaps relating to federal securities claims, and under Delaware law, a § 14(a) action is direct, not derivative.” Id. at 1149. The court further noted that the Supreme Court “now views implied private rights of action with disapproval, construing them narrowly, and casting doubt on the viability of a corporation’s standing to bring a § 14(a) action.” Id. The court also rejected Lee’s argument that enforcement of the forum selection clause would conflict with “the federal forum’s strong public policy of giving federal courts exclusive jurisdiction over Exchange Act claims under § 27(a).” Id. at 1150–51. Last, the court held that because “the Delaware Supreme Court has indicated that federal claims like Lee’s derivative § 14(a) action are not ‘internal corporate claims’ as defined in Section 115, and because no language in [Delaware precedent], Section 115, or the official synopsis operates to the limit the scope of what constitutes a permissible forum-selection bylaw under Section 109(b),” the forum-selection clause was valid under Delaware law. Id. at 1156.

Some had criticized the original Lee opinion for potentially foreclosing federal courts as a forum to hear federal derivative suits. Under the en banc court’s reasoning, however, that criticism rests on a mistaken premise. Whereas Seafarers concluded that “Section 14(a) may be enforced . . . in derivative actions asserting rights of a corporation harmed by a violation,” 23 F.4th at 719 (citing Borak, 337 U.S. at 431–32), the en banc panel all but held that federal derivative actions are outside the scope of the Exchange Act, see, e.g., Lee, 70 F.4th at 1147 (“[T]he injury caused by a violation of § 14(a) gives rise to a direct action under Delaware law, not a derivative action.”); id. at 1149 (“Virginia Bankshares casts grave doubt on whether a shareholder can bring a derivative § 14(a) action on behalf of a corporation. . . . [T]he [Supreme] Court now views implied private rights of action with disapproval, construing them narrowly, and casting doubt on the viability of a corporation’s standing to bring a § 14(a) action.”); id. at 1158 (“The Seventh Circuit . . . misread Borak.”).

2. Chamber of Commerce v. SEC – Challenges to the SEC’s Share-Repurchase Final Rule

On May 12, 2023, the U.S. Chamber of Commerce filed a Petition for Review challenging the SEC’s recently announced share-repurchase rule. Petition For Review, Chamber of Com. of the United States v. SEC, No. 23-60255 (May 16, 2023). As detailed in a recent Client Update, it requires companies to: (1) disclose daily repurchase data in a new table filed as an exhibit to Form 10-Q and Form 10-K, (2) indicate by a check box whether any executives or directors traded in the company’s equity securities within four business days before or after the public announcement of the repurchase plan or program or the announcement of an increase of an existing share repurchase plan or program, (3) provide narrative disclosure about the repurchase program, including its objectives and rationale, in the filing, and (4) provide quarterly disclosure regarding the company’s adoption or termination of any Rule 10b5-1 trading arrangements. Share Repurchase Disclosure Modernization, Release Nos. 34-97424; IC-34906; File No. S7-21-21. The Chamber of Commerce contends that the rule disincentivizes companies from using stock buybacks and violates both the Administrative Procedure Act and the First Amendment. Press Release, U.S. Chamber of Commerce, U.S. Chamber Sues the Securities and Exchange Commission Over Stock Buyback Rule (May 12, 2023).

3. Update on Goldman Sachs Group v. Arkansas Teacher Retirement System

On August 9, 2023, the Second Circuit issued its long-awaited decision in Arkansas Teacher Retirement System v. Goldman Sachs Group Inc., No. 22-484. As noted in our 2022 Year-End Securities Litigation Update, oral argument was held on September 21, 2022, before a panel consisting of Judges Richard Sullivan, Denny Chen, and Richard Wesley. In an opinion by Judge Wesley, the Second Circuit concluded that Goldman successfully rebutted Basic’s presumption of reliance and decertified the class. For a detailed discussion of the case, see the Market Efficiency and “Price Impact” Cases section in Part IX, infra. We will report on any future developments.

III. Delaware Developments

The Delaware Supreme Court has said that Delaware’s “corporate law is not static,” Unocal Corp. v. Mesa Petroleum Co., 493 A.2d 946, 957 (Del. 1985), and that was certainly true in the last half-year. In some areas, Delaware courts held steady, affirming, for example, that controllers who distance themselves from conflicted transactions can win court approval, that transactions that are fair to minority stockholders can withstand scrutiny under the entire fairness standard, and that backchanneled mergers may fail to pass muster. In other areas, Delaware law marched forward with trends that began last year. For example, the Court of Chancery continued its developing trend of applying entire fairness to SPAC deals. And still elsewhere, Delaware courts broke new ground, raising the bar for merger-disclosure strike suits and reshaping the standards for board measures in control contests.

A. Delaware Carves Path for Conflicted Controllers in Oracle

In May 2023, the Delaware Court of Chancery ruled in favor of Oracle founder Larry Ellison in a lawsuit arising from Oracle’s $9.3 billion acquisition of NetSuite. In re Oracle Corp. Derivative Litig., 2023 WL 3408772 (Del. Ch. May 12, 2023). The court held that Ellison was not a controlling stockholder and therefore the transaction was governed by the business judgment rule. Id. at *27.

In January 2016, Oracle’s board of directors created a special committee to assess a potential takeover of NetSuite, a company co-founded and partly owned by Ellison. Id. at *4, *6. Oracle announced a tender offer for NetSuite in July 2016 for $109 per share. Id. at *14–15. After the purchase, Oracle stockholders sued, alleging that, in spite of the independent committee, Ellison’s status as Oracle’s controller meant the board lacked independence and that Ellison had forced the company to overpay for NetSuite for his personal benefit. Id. at *18. In 2018, the court denied Ellison’s motion to dismiss. Id. at *16.

After trial, the court issued a decision holding that even though “[p]laintiff-friendly presumptions” that Ellison’s roughly 25% holdings in Oracle and control over its actions meant the board was conflicted “were sufficient to carry this matter to trial,” the post-trial evidence did not support this theory. Id. at *2. The court distinguished earlier cases holding that minority stockholders caused a conflict because of a “combination of [their] stock holdings” and “affirmative actions taken to control the transaction.” Id. at *26. It noted that Ellison “neither possessed voting control, nor ran the company de facto,” and emphasized that even though he “had the potential to control the transaction at issue . . . he scrupulously avoided influencing the transaction.” Id. at *27. Accordingly, the business judgment rule applied. Id.

Oracle demonstrates that although Delaware courts may find that a minority holder is a controller and entire fairness applies for pleading-stage purposes, it is still possible for a putative controller to avoid application of that exacting standard at trial where he or she actively removes him or herself from the transaction at issue.

B. Mixed Verdict for Drag-Along Covenants Not to Sue

In May 2023, the Delaware Court of Chancery refused to enforce an explicit covenant not to sue over a drag-along sale. New Enter. Assocs. 14, L.P. v. Rich, 295 A.3d 520 (Del. Ch. 2023). The court explained that as a matter of public policy, a covenant not to sue cannot insulate defendants from tort liability based on intentional wrongdoing. Id. at 536. The court clarified that covenants not to sue for fiduciary-duty breaches are not facially invalid and signaled a continued receptiveness to some tailoring of fiduciary duties, despite the outcome of this decision. Id. at 530–31. We discussed the decision and its implications in more detail in our May 8, 2023 M&A Report.

C. Court Finds Merger Backchannelling Caused Conflict

In April 2023, Chancellor McCormick held that the CEO of software company Mindbody Inc. violated his fiduciary duties by tilting the company’s sales process in favor of a private-equity buyer. In re Mindbody, Inc. S’holder Litig., 2023 WL 2518149 (Del. Ch. Mar. 15, 2023). The suit followed Mindbody’s 2019 take-private transaction by Vista Equity Partners. Id. According to the court, the CEO was motivated by a personal need for liquidity and had been partial to Vista throughout the process. Id. at *2, *35. His backchanneling with Vista as the company’s formal sale process continued was, the court concluded, a breach of fiduciary duties. Id. at *35–38. He also breached his duty of disclosure by failing to disclose several meetings he had with Vista, including attending a private summit that it hosted. Id. at *1, *9, *12, *36. This case is discussed further in our April 10, 2023 M&A Report.

D. Supreme Court Affirms Tesla’s Acquisition of SolarCity Was Entirely Fair

The Delaware Supreme Court recently affirmed the Delaware Court of Chancery’s holding that Tesla’s 2016 acquisition of SolarCity was entirely fair to Tesla’s stockholders. In re Tesla Motors, Inc. S’holder Litig., — A.3d —, 2023 WL 3854008 (Del. June 6, 2023) (Tesla II). In 2016, Tesla stockholders accused Elon Musk of forcing Tesla’s board to overpay for SolarCity, a producer of solar panels that the plaintiffs claimed was insolvent at the time. Id. at *1. In addition to his Tesla leadership role, Musk was the chairman of SolarCity and the company’s largest stockholder. Id. at *2. The Court of Chancery had held, after trial, that the transaction process and price were ultimately fair despite Musk’s participation. In re Tesla Motors, Inc. S’holder Litig., 2022 WL 1237185, at *2 (Del. Ch. Apr. 27, 2022) (Tesla I). The high court’s June opinion in Tesla II affirmed that finding. 2023 WL 3854008, at *2.

The Delaware Supreme Court’s opinion reaffirms and clarifies several aspects of the entire fairness analysis. The plaintiffs had made a number of arguments on appeal as to why the trial court erred in applying that standard, but the court rejected each in turn. See Tesla II, 2023 WL 3854008, at *24, *33, *44. First, the court affirmed that a conflicted board’s decision not to utilize a special committee to negotiate a merger “does not automatically result in a finding of liability.” Id. at *26. A board may choose to subject itself to the “expensive, risky, and ‘heavy lift’” of satisfying entire fairness for a number of strategic reasons, including to avoid “transaction execution risk,” to maintain flexibility, and “to access the technical expertise and strategic vision and perspectives of the controller.” Id. at *27.

Second, the Supreme Court held that although the Court of Chancery’s analysis placed too much weight on Tesla’s pre-merger stock price—which, the Supreme Court concluded, failed to factor in material nonpublic information—the court’s overall focus on the merger price was not misplaced, and there was sufficient evidence establishing that the price was fair. Tesla II, 2023 WL 3854008, at *34. The plaintiffs had argued that the trial court “applied a bifurcated entire fairness test, concluding that its separate fair price analysis alone satisfied entire fairness.” Id. The Supreme Court disagreed, pointing out that the trial court had, in fact, made “extensive fact and credibility findings relating to the Acquisition’s process.” Id. The Supreme Court further concluded that the trial court was correct to put great weight on price because although a fair price “is not a safe-harbor that permits controllers to extract barely fair transactions,” it is “the paramount consideration” in deciding whether the merger as a whole was fair. Id. (citations omitted).

The Supreme Court, however, departed from the Court of Chancery in how the price analysis should be conducted, agreeing with the plaintiffs that the trial court should not have relied on a pre-merger stock price that did not factor in later-revealed nonpublic information. Id. at *44. Indeed, the court “cautioned against reliance on a stock price that did not account for material, nonpublic information” and “sole reliance on the unaffected market price.” Id. at *46 (citation omitted). Nonetheless, the Supreme Court found that other evidence “amply supports the [trial] court’s finding that the price was fair”; in addition to the stock price, the trial court had relied on “an array of valuation and fair price evidence,” such as its financial advisor’s analysis and evidence of SolarCity’s financial performance. Id.

E. Court of Chancery Again Holds Entire Fairness Governs De-SPAC Transactions

The Delaware Court of Chancery again affirmed that de-SPAC mergers are subject to the entire fairness standard of review. In Laidlaw v. GigAcquisitions2, LLC, stockholders brought fiduciary duty claims against the directors and controlling stockholder of GigCapital2, Inc., a special purpose acquisition company (“SPAC”). 2023 WL 2292488, at *1 (Del. Ch. Mar. 1, 2023). SPACs are publicly traded corporations created with the sole purpose of merging with a private business before a set deadline, which allows the private business to go public. When the merger takes place, the investors of the SPAC can choose to redeem their investments or invest in the post-merger company. In Laidlaw, the stockholders alleged that the defendants had issued a false and misleading proxy statement that prevented the stockholders from making an informed decision about whether to redeem their investments in the SPAC. Id.

The opinion by Vice Chancellor Will followed her earlier decisions in In re MultiPlan Corporation Stockholders Litigation, 268 A.3d 784 (Del. Ch. 2022) and Delman v. GigAcquisitions3, LLC, 288 A.3d 692 (Del. Ch. Jan 4, 2023). These earlier cases held that mergers between SPACs and their targets, also referred to as de-SPAC transactions, were inherently conflicted because the sponsors of the SPACs would lose their investments if they did not consummate the mergers before the given deadlines. Each of the earlier decisions held that the at-issue de-SPAC transaction was subject to the entire fairness standard. In re Multiplan, 268 A.3d at 813; Delman, 288 A.3d at 709.

In her recent decision, Vice Chancellor Will noted that the legal questions presented in Laidlaw were “largely indistinguishable” from those in Delman. Laidlaw, 2023 WL 2292488, at *1. The court held that the sponsors were conflicted because of the way the de-SPAC was structured: the sponsors allegedly preferred a bad merger to no merger because they would lose their Founder Shares and Private Placement Units if the SPAC did not merge with another company, while public stockholders would prefer no deal to a bad one because they would still receive their full investment plus liquidation interest if there were no merger. Id. at *8. And even after the merger agreements were signed, the sponsor had an interest in minimizing redemptions by stockholders because the deals required the SPAC to have $150 million in cash. Id. The court further noted that it was reasonably conceivable that the de-SPAC transaction was conflicted because a majority of the board members lacked independence from the owner and controller of the sponsor. Id. at *9.

As a result, the court rejected the defendant’s motion to dismiss and the plaintiffs’ claims that the defendant issued a false and misleading proxy statement were allowed to proceed. Id. at *14.

F. Supreme Court Clarifies Standard for Voting Control Measures

In Coster v. UIP Companies, Inc., the Delaware Supreme Court clarified the standards applicable to board action in a contest for corporate control that interferes with stockholders’ voting rights. — A.3d —, 2023 WL 4239581 (Del. June 28, 2023) (Coster IV). As we wrote in our 2022 Year-End Securities Litigation Update, this case arose when the plaintiff became a 50% stockholder in UIP and deadlocked with the company’s other half-owner regarding UIP’s board composition. Coster v. UIP Companies, Inc., 2022 WL 1299127, at *1 (Del. Ch. May 2, 2022) (Coster III). The plaintiff brought an action to appoint a custodian with full control over the company, and the board responded by issuing one-third of the total outstanding shares to an “essential” employee who broke the deadlock. Id. at *3. After unsuccessfully challenging the stock issuance in the Court of Chancery, the plaintiff appealed to the Delaware Supreme Court, which remanded with instructions to apply the standards laid out in Blasius Industries, Inc. v. Atlas Corporation, 564 A.2d 651 (Del. Ch. 1988), and Schnell v. Chris-Craft Industries, Inc., 285 A.2d 437 (Del. 1971). Coster IV, 2023 WL 4239581, at *4. The trial court again ruled for the defendants, and she again appealed. Id. at *5.

On June 28, 2023, the Supreme Court reconciled the various applicable standards: Schnell for board-entrenchment measures, Blasius for interference with the stockholder franchise, and Unocal Corp. v. Mesa Petroleum Co., 493 A.2d 946 (Del. 1985), for antitakeover strategies. Where the board “interferes with the election of directors or a shareholder vote in a contest for corporate control”—that is, where both entrenchment or antitakeover measures and the stockholder franchise are at issue—courts should apply “Unocal . . . with the sensitivity Blasius review brings.” Coster IV, 2023 WL 4239581, at *12. First, courts should judge whether there was a threat to “an important corporate interest” that was “real and not pretextual,” such that the board’s motivation was “proper and not . . . disloyal.” Id. Per Blasius, boards cannot rely on the justification that they know what is best for stockholders. Id. Second, courts should review, per Unocal, whether the board’s response was “reasonable in relation to the threat” and “not preclusive or coercive to the stockholder franchise.” Id. Applied in this fashion, the standard also “subsume[s] the question of loyalty” and “thus address[es] issues of good faith such as were at stake in Schnell.” Id. at *11.

Judged by this standard, the court affirmed the Court of Chancery’s decision, finding the company’s actions passed muster. Id. at *17. As the trial court held, the plaintiff’s broad request for a custodian posed significant risks to the company, and even though the trial court found that “some of the board’s reasons for approving the Stock Sale were problematic, on balance[,] . . . the board was properly motivated in responding to the threat.” Id. at *14.

G. Delaware Raises the Bar for Merger Plaintiffs’ Fees

The Delaware Court of Chancery raised the bar for attorneys’ fees in cases where a plaintiff’s suit over allegedly inadequate merger disclosures causes the defendant to supplement those disclosures. Anderson v. Magellan Health, Inc., 298 A.3d 734 (Del. Ch. 2023). In Anderson, a stockholder sued the selling company in a merger saying that its proxy materials were inadequate and its deal protections stood in the way of getting the best price; in response, the company loosened the deal protections and made new disclosures. Id. In July 2023, the court held that the loosened deal protections, as a practical matter, did not create a “corporate benefit” allowing the plaintiff to collect attorneys’ fees because they had no effect on the ultimate deal price. Id. at *741–45. And the court changed the standard for when supplemental disclosures justify a fee award—previously, these only had to be “helpful,” whereas the Court of Chancery held that fees are justified “only when the information is material.” Id. at *747–51. We discussed this decision in greater detail in our August 2, 2023 Client Alert.

IV. Federal SPAC Litigation

The number of SPAC IPOs and the value of de-SPAC transactions have decreased significantly since their peak in 2021, as noted in our 2022 Mid-Year Securities Litigation Update. De-SPAC transactions, however, have given rise to significantly more securities class actions than other IPOs, and plaintiffs have generally had more success in surviving the motion to dismiss stage.

A. Clover Health: Settlement Offer Proposed in Fraud-on-the-Market SPAC Litigation

Our 2022 Mid-Year Securities Litigation Update highlighted Bond v. Clover Health Investments, Corp., 587 F. Supp. 2d 641 (M.D. Tenn. Feb. 28, 2022), as a prototypical example of the Section 10(b) class actions that survived the motion-to-dismiss stage after the 2021 SPAC boom. We also noted that, in denying the motion to dismiss in that case, the district court for the Middle District of Tennessee expressly credited a fraud-on-the-market theory, see id. at 664–66, and was apparently the first federal court to do so in the context of claims arising from a SPAC-related offering. In April 2023, less than three months after the court granted the plaintiffs’ motion for class certification, Bond v. Clover Health Invs., Corp., 2023 WL 1999859 (M.D. Tenn. Feb. 14, 2023), Clover Health announced that the parties had agreed to a proposed settlement. Under the parties’ agreement, which is subject to final court approval, the class will receive $22 million and the defendants will receive customary releases. Press Release, Clover Health, Clover Health Announces Agreement to Settle Securities Class Action Litigation (Apr. 24, 2023), https://investors.cloverhealth.com/news-releases/news-release-details/clover-health-announces-agreement-settle-securities-class-action. In May, the court preliminarily approved the agreement and scheduled a settlement hearing for October 2, 2023. Bond v. Clover Health Invs., Corp., 3:21-CV-00096 (M.D. Tenn. May 26, 2023), Dkt. No. 132.

B. Statutory Standing in the SPAC Context

Our 2022 Year-End Securities Litigation Update highlighted a decision, In re CCIV/Lucid Motors Securities Litigation, 2023 WL 325251 (N.D. Cal. Jan. 11, 2023), addressing the standing requirements for bringing a Section 10(b) action in the SPAC context. In two recent cases, lower courts continued to examine how statutory standing requirements apply in the context of SPAC litigation.

In March 2023, a SPAC-related class action in the Southern District of New York, In re CarLotz, Inc. Securities Litigation, 2023 WL 2744064 (S.D.N.Y. Mar. 31, 2023), was dismissed on standing grounds, based on the fact that the plaintiffs did not own shares of the privately held, pre-merger target, id. at *1, *5. The de-SPAC transaction in CarLotz concerned Acamar, a SPAC that went public and then identified CarLotz, a used vehicle marketplace, as a target company. Id. at *1. The plaintiffs alleged that officers of pre-merger CarLotz made materially false and misleading statements, and that the falsity of those statements was revealed in disclosures that were made after the merger. Id. at *2. In dismissing the case, the CarLotz court followed Second Circuit precedent that the CCIV court had considered, Menora Mivtachim Insurance Ltd. v. Frutarom Industries Ltd., 54 F.4th 82 (2d. Cir. 2022), but was not “compell[ed]” to follow, 2023 WL 2744064, at *4–5; see also In re CCIV/Lucid Motors, 2023 WL 325251, at *7–8.

The court applied the rule from an earlier Second Circuit decision that did not directly concern SPACs, Menora Mivtachim, 54 F.4th 82, which held that shareholders of an acquiring company could not sue the target company for alleged misstatements that had been made prior to the merger between the two companies, id. at 86.

The plaintiffs argued that applying Menora to companies acquired by SPACs would create a “loophole” that shields from liability the pre-merger statements of parties to SPAC transactions. CarLotz, 2023 WL 2744064, at *5. Although the court acknowledged this policy concern, it stated that it was bound by the Menora precedent. Id. The court also noted alternative means of accountability for pre-merger actions taken by a target company, such as SEC enforcement actions, shareholder derivative suits, or actions brought under state law. Id.

CarLotz and another case, Mehedi v. View, Inc., 2023 WL 3592098 (N.D. Cal. May 22, 2023), also addressed requirements for standing under Section 11 of the Securities Act, which imposes strict liability for any materially misleading statements or omissions in a registration statement, see CarLotz, 2023 WL 2744064, at *5–8; Mehedi, 2023 WL 3592098, at *5–7. Section 11 requires each plaintiff to demonstrate that he or she can trace the shares he or she purchased to the offering related to the allegedly misleading document or statement, rather than from some other source. Mehedi, 2023 WL 3592098, at *5.

In Mehedi, the plaintiffs did not allege that they had purchased securities that were directly traceable to the relevant registration statement. Id. at *5–7. In CarLotz, the plaintiffs conceded that one named plaintiff had purchased shares in Acamar, the public company, even before the de-SPAC registration statement and prospectus were effective, but argued that his shares were still traceable to the registration statement because the merger itself “functionally transformed” his Acamar shares into shares of the new public company, CarLotz. 2023 WL 2744064, at *7. The court acknowledged this theory was “creative,” but found it foreclosed by Second Circuit precedent on Section 11 traceability, which requires the plaintiff to have purchased shares “under” “the same registration statement” being challenged. Id. The plaintiffs again identified policy reasons for loosening these standing requirements in the context of SPAC transactions, including a proposed SEC regulation that, “if promulgated, would subject registration statements for de-SPAC transactions to Section 11 liability.” Id. at *8. But the court found that proposed non-final rule and other policy considerations insufficient to overcome the current binding precedent. Id.

V. ESG Civil Litigation

For the past several years, a number of lawsuits have been filed against public companies or their boards related to the companies’ environmental, social, and governance (“ESG”) disclosures and policies. The following section surveys notable developments in pending cases that involve ESG allegations.

A. Environmental Litigation

Fagen v. Enviva Inc., No. 8:22-CV-02844 (D. Md. Nov. 3, 2022): We first reported on this case in our 2022 Year-End Securities Litigation Update. After the court appointed a lead plaintiff in January 2023, an amended complaint was filed in April 2023. ECF No. 34. In the amended complaint, the plaintiff alleges that Enviva made false or misleading statements in offering documents and other communications to investors that exaggerated the sustainability of Enviva’s wood pellet production and procurement methods. Id. at 1–4. The amended complaint claims Enviva’s stock price dropped after various third parties published reports challenging Enviva’s environmental claims. Id. at 3. The defendants have filed motions to dismiss the amended complaint. ECF Nos. 62, 63. In those motions, the defendants argue that the alleged “misrepresentations” are merely part of “an ongoing public debate about the environmental benefits of using wood pellets—rather than fossil fuels—to generate heat and electricity,” which cannot give rise to securities fraud. ECF No. 62-1 at 1. The motions to dismiss are fully briefed and pending before the court.

Wong v. New York City Emp. Ret. Sys., No. 652297/2023 (N.Y. Sup. Ct., N.Y. Cnty. May 11, 2023): In Wong, the plaintiffs have brought breach of fiduciary duty claims against three New York City pension funds that divested approximately $4 billion in fossil fuel investments. NYSCEF No. 2. The plaintiffs allege that the retirement boards impermissibly prioritized political goals unrelated to the financial health of the plans over their obligation to pursue the best financial returns for plan participants, declaring the pension fund’s actions an “utter abandonment of fiduciary responsibilities.” Id. at 2–3. The divestment allegedly caused the pension fund to lose out on the energy’s sector significant growth, and therefore lucrative returns, over the past few years. Id. at 18. The plaintiffs sought an injunction, requiring the pension fund to cease the ongoing divestment and make decisions regarding fuel-related and other potential investments “exclusively on relevant risk-return factors” going forward. Id. at 24. The defendants filed a motion to dismiss the complaint on August 7, 2023. NYSCEF No. 20 at 1. Gibson Dunn is representing Plaintiffs in this case.

B. Social Litigation

City of St. Clair Shores Police and Fire Ret. Sys. v. Unilever PLC, No. 22-CV-05011 (S.D.N.Y. June 15, 2022): As reported in our 2022 Year-End Securities Litigation Update, in at least one action, investors challenged corporate commitments on ESG-related topics. The allegations in Unilever arose from a Ben & Jerry’s board resolution purporting to end the sale of Ben & Jerry’s products in areas deemed “to be Palestinian territories illegally occupied by Israel.” ECF No. 1 at 6. The plaintiffs alleged that Ben & Jerry’s parent company made misleading statements to investors by failing to adequately disclose the business risks associated with the resolution. Id. at 10–18. The defendants filed a motion to dismiss in late 2022, arguing, among other things, that the plaintiffs failed to plead an actionable misstatement or omission and failed to plead scienter. See, e.g., ECF No. 31 at 3. The motion to dismiss is now fully briefed and pending before the court.

C. Diversity and Inclusion

Ardalan v. Wells Fargo & Co., No. 22-CV-03811 (N.D. Cal. July 28, 2022): In this putative class action, the plaintiffs alleged that Wells Fargo announced an initiative which required that 50 percent of interviewees be diverse for most roles above a certain salary threshold, and then purported to meet that requirement by conducting interviews for positions that had already been filled. ECF No. 1 at 2–4. These practices, the plaintiffs allege, made the bank’s statements about its diversity initiatives materially misleading. Id. The plaintiffs alleged that the bank’s stock price fell by more than ten percent after the New York Times published an article purporting to reveal that certain of the bank’s employees were holding interviews for filled positions. Id. In April 2023, the defendants filed a motion to dismiss the complaint. In that motion, the defendants argued that the plaintiffs’ allegations of isolated incidents of employee misconduct cannot render the bank’s general statements about its diversity program false or misleading. ECF No. 100 at 2–3. The district court agreed. In an August 18, 2023 opinion granting the defendants’ motion to dismiss, the district court held that the PSLRA “requires particularized allegations sufficient to infer that sham interviews took place during the Class Period and that they were widespread.” ECF No. 112 at 8. The district court dismissed the complaint without prejudice. Id. at 15.

* * * * *

Gibson Dunn will continue to monitor developments in ESG-related securities litigation. Additional resources relating to ESG issues can be found on Gibson Dunn’s ESG practice group page.

VI. Cryptocurrency Litigation

A growing number of both class action and regulatory lawsuits are being filed against cryptocurrency platforms and their operators. Many of these lawsuits seek to classify cryptocurrencies as “securities” under existing federal securities law, and courts continue to grapple with the application of securities laws to cryptocurrency. Defendants have crafted multiple arguments in favor of dismissing these actions, with varying levels of success.

A. Class Actions

Underwood v. Coinbase Glob., Inc., 2023 WL 1431965 (S.D.N.Y. Feb. 1, 2023): A putative class of users of Coinbase’s trading platform, a platform which facilitates cryptocurrency transactions, brought claims under Sections 12(a)(1) and 15 of the Securities Act, Section 29(b) of the Exchange Act, and state law, alleging that they suffered damages in connection with the defendants’ sale and solicitation of allegedly unregistered securities. 2023 WL 1431965 at *1. The defendants filed a motion to dismiss arguing that under the terms of Section 12, Coinbase was not the “statutory seller” of the tokens sold to the plaintiffs. Id. at *1, 6. The court concluded in ruling on a motion to dismiss the Section 12 claims that Coinbase did not directly sell tokens to the plaintiffs because the company did not hold title to the cryptocurrency traded on its platform during the transaction. Id. at *6–8. The court also reasoned that Coinbase did not “solicit” transactions because it did not partake in the “direct and active participation in the solicitation of the immediate sale.” Id. at *9. Based on this reasoning, the court dismissed the plaintiffs’ Section 12 claim as Coinbase was not the “statutory seller” of the tokens. The court also dismissed the plaintiffs’ control-person claim, which was predicated on the Section 12 violation. Id. at *10. The court likewise dismissed the plaintiffs’ claim under Section 29(b) of the Exchange Act, holding that the plaintiffs failed to demonstrate that their user agreements with Coinbase’s platform involved a “prohibited transaction” under Section 29(b). Id. at *11–12. The court declined to exercise supplemental jurisdiction over the plaintiffs’ state law claims. Id. at *12–13. The plaintiffs are currently appealing the district court’s decision to the Second Circuit. See Underwood v. Coinbase Glob., Inc., 2023 WL 1431965 (S.D.N.Y. Feb. 1, 2023), appeal docketed, No. 23-184 (2d Cir. Feb. 9, 2023).

De Ford v. Koutoulas, 2023 WL 2709816 (M.D. Fla. Mar. 30, 2023), reconsideration denied, 2023 WL 3584077 (M.D. Fla. May 22, 2023): The plaintiffs represent a group of individuals who purchased the token “LGBCoin.” The plaintiffs brought a putative class action asserting multiple claims, including a claim under Section 12 of the Securities Act. 2023 WL 2709816 at *13–16. Section 12(a)(1) of the Securities Act provides a private right of action against any person who offers or sells a security in violation of Section 5 of the Securities Act. The plaintiffs allege in their complaint that LGBCoin is a security, and that the defendants created, marketed, and offered the tokens for sale to customers in the United States. See ECF No. 1 at ¶¶ 173–83. Two defendants filed motions to dismiss the Section 12 claims for failure to state a claim. ECF Nos. 101, 104. While ruling on the motions to dismiss, the court held that, when drawing “all reasonable inferences in Plaintiffs’ favor . . . it is at least plausible that LGBCoin is a security.” 2023 WL 2709816, at *13–15. The court then concluded that the plaintiffs had plausibly alleged that one of the defendants, an executive at LGBCoin who made social media posts promoting the token, could be held liable as a “seller” of a security under Section 12. Id. at *15. The court reasoned that because of this defendant’s “extensively documented alleged promotion of LGBCoin in-person or online in videos, on social media, and on podcasts,” he was a seller and was “plausibly alleged to have made the[] solicitations to serve his own financial interests.” Id. The court found, however, that a separate defendant-executive of the company who was not alleged to have made similar public solicitations for his own financial interest, was not a seller. Id. The court thus denied the former executive’s motion to dismiss the securities fraud claim, while granting the latter executive’s motion to dismiss. Id. at *16–17. On April 14, 2023, the plaintiffs filed a third amended complaint. ECF No. 245.

B. Regulatory Lawsuits

SEC v. Arbitrade Ltd., 2023 WL 2785015 (S.D. Fla. Apr. 5, 2023): The SEC brought claims under Sections 5 and 17 of the Securities Act and under Section 10b of the Exchange Act, alleging that Arbitrade Ltd., Cryptobontix Inc., SION Trading FZE, and their respective control persons were operating “a classic pump and dump scheme” involving the crypto asset “Dignity” (“DIG”). 2023 WL 2785015 at *1–2. Specifically, the SEC alleged that defendants generated artificial demand for DIG tokens by claiming that they had received title to $10 billion in gold bullion that they would use to back the tokens. Id. The defendants then sold their DIG tokens and converted the proceeds to cash. DIG tokens reached a zero dollar valuation soon after. Id. at *2. On April 5, 2023, the court denied two separate motions to dismiss brought by individual defendants. Id. at *11. In doing so, the court held that the SEC had jurisdiction over the case because, based on the facts alleged in the complaint, DIG tokens could be considered securities from which investors expected to derive profits. Id. at *3–6.

SEC v. Payward Ventures, No. 23-CV-0588 (N.D. Cal. Feb. 9, 2023): The SEC charged Payward Ventures, Inc. and Payward Trading, Ltd., both commonly known as “Kraken,” for their crypto staking service. ECF No. 1 at 1–2. Crypto staking is a process that crypto networks use to process and validate transactions. Id. at 2. The SEC alleged that Kraken’s staking service, which launched in 2019, caused investors to lose control of their assets and assume the risk of the staking platform. Id. at 3, 9. The SEC alleged that Kraken did not provide sufficient information to substantiate the staking program’s representations of certain program features. See id. at 10–17. The complaint further claimed that because crypto investors entrust money to the staking service with expectations of profit, Kraken’s staking program was marketed as an investment opportunity, and that the service was offered and sold as a security. Id. at 16, 19–22. The SEC complaint concluded that Kraken needed to register the offers and sales on the platform with the SEC and make adequate disclosures under the Securities Act because it used interstate commerce to offer investment contracts in exchange for investors’ cryptocurrency. Id. at 22. Kraken settled the case by ceasing the offering and selling of alleged securities through its staking program, and by agreeing to pay $30 million in disgorgement, prejudgment interest, and civil penalties. See Press Release, Kraken to Discontinue Unregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges (Feb. 9, 2023), https://www.sec.gov/news/press-release/2023-25.

SEC v. Binance Holdings Ltd., No. 23-CV-01599 (D.D.C. June 5, 2023): On June 5, 2023, the SEC filed a 13-claim complaint against Binance Holdings Limited, BAM Trading Services Inc., BAM Management Holdings Inc. and Changpeng Zhao in D.C. federal court, alleging they engaged in unregistered offers and sales of crypto asset securities. ECF No. 1. The SEC claims Binance Holdings Limited and BAM were both acting as exchanges, broker-dealers, and clearing agencies, and that they intentionally chose not to register with the SEC. Id. at 2. A day after filing the complaint, the SEC filed a motion for a TRO, seeking to freeze BAM’s assets. ECF No. 4. On June 13, 2023, consistent with the arguments set forth in the defendants’ briefing, the government admitted that it had no evidence that customer assets have been misused or dissipated and, as a result, the defendants successfully prevented the SEC from obtaining the extensive relief it sought. Instead, at the court’s direction, Binance, the SEC, and the other defendants in the action negotiated a consent order that will remain in place while the action is pending. ECF No. 71. Gibson Dunn is representing Binance Holdings Limited.

SEC v. Coinbase, Inc., No. 23-CV-4738 (S.D.N.Y. June 6, 2023): On June 6, 2023 the SEC filed a 5-count complaint against Coinbase and its parent company Coinbase Global. ECF No. 1. The SEC alleges that Coinbase has violated the securities laws since 2019 by failing to register as an exchange, broker, or clearing agency despite facilitating trading and settlement of several digital assets that the SEC alleges are securities, including ADA, SOL, MATIC, and others. Id. at 1, 33. The SEC also alleges that Coinbase has operated as an unregistered broker by offering its Coinbase Prime and Coinbase Wallet services, and that Coinbase’s staking service for several digital assets, including Ethereum, constitutes unregistered securities offerings. Id. at 2. On June 28, 2023, Coinbase filed a 177-page answer to the SEC’s complaint, calling the suit an “extraordinary abuse of process” that “offends due process and the constitutional separation of powers.” ECF No. 22. at 2. On August 4, 2023, Coinbase filed its motion for judgment on the pleadings claiming both that in bringing the action the “SEC has violated due process, abused its discretion, and abandoned its own earlier interpretations of the securities laws” and that “[t]he subject matter falls outside the agency’s delegated authority” because none of the digital assets identified in the complaint qualify as securities under the Securities Act. ECF No. 36 at 1.

SEC v. Ripple Labs, Inc., 2023 WL 4507900 (S.D.N.Y. July 13, 2023): In 2020, the SEC sued Ripple in the Southern District of New York for the unregistered offer and sale of securities in violation of Section 5 of the Securities Act related to Ripple’s offer and sale of XRP, a crypto token. 2023 WL 4507900 at *1–4. In September 2022, the parties filed cross-motions for summary judgment. Id. at *4. On July 13, U.S. District Judge Analisa Torres ruled that the SEC could not establish as a matter of law that a crypto token was a security in and of itself. In a partial victory for Ripple, the court determined that Ripple’s XRP sales on public exchanges were not offers of securities. In a partial victory for the SEC, the ruling also found that sales to sophisticated investors did amount to unregistered sales of securities. On August 17, 2023, the court permitted the SEC to file a motion for leave to file an interlocutory appeal. ECF No. 891. Briefing on the motion is set to conclude on September 8, 2023. ECF No. 892.

SEC v. Terraform Labs Pte. Ltd., 2023 WL 4858299 (S.D.N.Y. July 31, 2023): The SEC brought an enforcement action in February of this year alleging that Terraform Labs and its founder, Do Hyeong Kwon, perpetrated a multi-billion dollar crypto asset securities fraud scheme by offering and selling crypto asset securities in unregistered transactions and misleading investors about the Terraform blockchain and its crypto assets. ECF No. 1. The complaint alleges violations of the anti-fraud provisions of the Securities Act and Exchange Act and the securities-offering-registration and security-based swap provisions of the federal securities laws. Id. at 4. On July 31, 2023, Judge Rakoff denied the defendants’ motion to dismiss, finding that the court had personal jurisdiction over the defendants and that the complaint plausibly alleged that “the defendants used false and materially misleading statements to entice U.S. investors to purchase and hold on to the defendants’ products;” the products being “unregistered investment-contract securities that enabled investors to profit from the supposed investment activities of the defendants and others.” 2023 WL 4858299 at 1–2. Notably, Judge Rakoff agreed with the Ripple ruling’s holding that the SEC could not establish as a matter of law that a crypto token was a security in and of itself. But Judge Rakoff rejected Judge Torres’s distinction between institutional and retail purchasers as to whether a token was offered as a security. Id. at *15. Instead, Judge Rakoff found that “secondary-market purchasers had every bit as good a reason to believe that the defendants would take their capital contributions and use it to generate profits on their behalf,” and thus held that “the SEC’s assertion that the crypto assets at issue here are securities . . . survives the defendants’ motion to dismiss.” Id.

VII. Shareholder Activism

Activists have continued targeting large U.S. companies in the first half of 2023, and recent changes to SEC regulations related to shareholder proposals and proxy elections could potentially encourage shareholder activists going forward.

A. Activist Campaigns Persist, with Companies Responding Swiftly

Four out of the six largest activist campaigns by volume in the first half of 2023 were resolved prior to formal proxy fights. The remaining contests have had different outcomes: one activist investor successfully replaced an incumbent director, and the final campaign has litigation in progress.

Salesforce, Inc.: In January 2023, Elliott Management announced a multibillion-dollar stake in Salesforce and nominated a slate of directors pushing for changes in corporate governance in light of Elliott Management’s view of the company’s performance. See Lauren Thomas and Laura Cooper, Elliott Management Takes Big Stake in Salesforce, Wall Street Journal (Jan. 23, 2023). The activists dropped the campaign in light of the company’s “announced ‘New Day’ multi-year profitable growth framework, strong fiscal year 2023 results, fiscal year 2024 transformation initiatives, Board and management actions and clear focus on value creation.” Salesforce and Elliott Issue Joint Statement, Salesforce (Mar. 27, 2023).

The Walt Disney Company: In January 2023, Trian Partners, led by activist investor Nelson Peltz, announced a $900 million position in Disney and released a detailed press release describing its intention to nominate Peltz to the Disney board of directors. Trian Nominates Nelson Pretz for Election to Disney Board, Trian Partners (Jan. 11, 2023). In the press release, Trian described examples of what it viewed as poor corporate governance, strategic decisions, and capital allocation decisions that had caused Disney to underperform its peers. A week after the launch of the proxy fight, Disney replaced its then-CEO, Bob Chapek, with former CEO Bob Iger, whom Trian said it would not oppose. Trian Applauds Recent Initiatives Announced by Disney as a Win for All Shareholders and Concludes Proxy Campaign, Trian Partners (Feb. 9, 2023). Trian abandoned Peltz’s board nomination after Disney announced corporate restructuring and cost-cutting plans. Id.

Fleetcor Technologies, Inc.: In March 2023, Fleetcor Technologies, Inc., a business payments company operating in the fuel, corporate payments, toll and lodging spaces, reached a cooperation agreement with its longstanding shareholder D. E. Shaw to add two new directors and form an ad hoc strategic review committee to explore possible divestiture. See Fleetcor Technologies, Inc., Cooperation Agreement (Mar. 15, 2023). Following the agreement, the ad hoc strategic review committee will assess alternatives for Fleetcor’s portfolio, including a possible separation of one or more of its businesses. See FLEETCOR Enters into Cooperation Agreement with the D. E. Shaw Group, FleetCor (Mar. 20, 2023).

Bath & Body Works, Inc.: In March 2023, Bath & Body Works avoided a proxy fight with the hedge fund Third Point, led by Third Point’s founder and CEO, Dan Loeb. At Third Point’s request, Bath & Body Works agreed to appoint Lucy Brady as a director and hire a technology services firm, and agreed with Third Point’s feedback that the Board would benefit from additional financial and capital allocation expertise. See Bath & Body Works Board of Directors Sends Letter to Shareholders Highlighting Transformative Value-Creating Actions and Responding to Third Point’s Potential Proxy Contest, Bath & Body Works (Feb. 27, 2023). Bath & Body Works also agreed to appoint Thomas J. Kuhn to the board in exchange for Third Point’s promise not to nominate other candidates at the 2023 annual shareholder meeting. See Bath & Body Works Announces Appointment of Thomas J. Kuhn to Board of Directors, Bath & Body Works (Mar. 6, 2023). Third Point ultimately opted to abandon its proxy contest.

Illumina, Inc.: In May 2023, gene sequencing company Illumina faced a proxy fight led by activist investor Carl Icahn. Icahn protested Illumina’s decision to acquire a cancer test developer company, Grail, Inc., without informing the shareholders of European and U.S. regulatory opposition. See Carl Icahn, Carl C. Icahn Issues Open Letter to Shareholders of Illumina, Inc. (Mar. 13, 2023). Icahn nominated three new director candidates to prevent the current board from further pursuing the deal. Id. The European Commission ultimately blocked the acquisition due to antitrust concerns last year, a result Illumina has now appealed. Annika Kim Constantino, Biotech Company Illumina Pushes Back against Carl Icahn’s Proxy Fight over $7.1 Billion Grail Deal, CNBC (Mar. 20, 2023). An unsuccessful appeal could result in a fine of up to 10% of Illumina’s annual revenues. Id. Illumina set aside $453 million in case of an EU fine. See Foo Yun Chee, Exclusive: Illumina to face EU fine of 10% of turnover over Grail deal-sources, Reuters (Jan. 11, 2023). The two-month proxy contest resulted in the board appointment of Andrew Teno, portfolio manager at Icahn Capital LP. See Illumina Announces Preliminary Results of Annual Meeting, Illumina (May 25, 2023).

Freshpet, Inc.: In May and June 2023, JANA Partners (the largest shareholder of Freshpet, Inc.) and James Panek (a putative stockholder of Freshpet) filed two separate actions against Fresphet, Inc. and its directors for allegedly interfering with Freshpet, Inc.’s shareholders’ right to nominate directors for the upcoming election, and thereby entrenching the incumbent directors. See Compl. ¶¶ 12, 19, 102, 120, JANA Partners LLC v. Norris, 2023 WL 3764931 (Del. Ch. June 1, 2023); and Compl. ¶¶ 4, 9, 32, 40, 44, Panek v. Cyr, 2023 WL 3738885 (Del. Ch. May 30, 2023). JANA Partners intended to nominate four candidates for election at Freshpet’s 2023 annual meeting. See Compl. ¶¶ 1, 81, JANA Partners LLC v. Norris, 2023 WL 3764931 (Del. Ch. June 1, 2023). Amid settlement discussions regarding board composition, Freshpet accelerated the 2023 annual meeting to an earlier date and reduced the number of directors up for election from four to three. Id. ¶ 1. JANA subsequently filed a lawsuit alleging a breach of the duty of loyalty, and seeking declaratory relief that (1) JANA has an opportunity to nominate, and the shareholders have an opportunity to elect, four directors at the 2023 annual meeting; and (2) the Freshpet directors breached their fiduciary duties. See id. at Prayer for Relief. Freshpet has postponed the 2023 annual meeting to October. Freshpet Provides Update on 2023 Annual Meeting of Stockholders, Freshpet (June 6, 2023). Gibson Dunn will continue to monitor developments on the two ongoing cases.

B. Two Regulatory Changes over SEC Proxy Rules Could Potentially Embolden Activist Investors

A new SEC rule and proposed amendments to Rule 14a-8 of the Securities Exchange Act of 1934 could potentially encourage activist campaigns to nominate new board members or submit shareholder proposals ahead of upcoming shareholder meetings. The SEC’s new “Universal Proxy” rule provides activist campaigns with potential support in efforts to elect new board members and bring provisions to a vote at corporate meetings. And proposed SEC amendments to Rule 14a-8, which could take effect in October 2023, would require companies to include with greater specificity why shareholder proposals should be excluded on implementation, duplication, or resubmission grounds.

The “Universal Proxy” rule that went into effect in January 2022 requires the issuer of a proxy card to list all candidates rather than the slate of candidates they support only. Universal Proxy, 86 Fed. Reg. 68330 (Dec. 1, 2021). The use of a “universal proxy card” is required in all non-exempt solicitations involving director election contests. Id. With universal proxies, shareholders can more easily vote for nominees from a combination of two slates, potentially increasing the chance for activist investors to have at least one of their dissident nominees elected. SEC Adopts Rules Mandating Use of Universal Proxy Card, Gibson Dunn (Nov. 18, 2021).

Among other things, incumbent boards have responded to the Universal Proxy rule by implementing advance notice bylaw provisions that include additional disclosure requirements. For example, medical device maker Masimo enacted and subsequently withdrew a bylaw amendment in 2022 that required “any person (including any hedge fund) seeking to nominate a candidate for election to the board to disclose,” among other things, “the identity of . . . any limited partner or other investor who owned 5% or more of the hedge fund, as well as all investors in any sidecar vehicle.” John C. Coffee, Jr., Proxy Tactics Are Changing: Can Advance Notice Bylaws Do What Poison Pills Cannot?, The CLS Blue Sky Blog (Oct. 19, 2022); see Masimo Corp., Current Report (Form 8-K) (Feb. 5, 2023). The case law in this area is still developing. See Coffee, supra; see also Jorgl v. AIM ImmunoTech Inc., 2022 WL 16543834 at *11 (Del. Ch. Oct. 28, 2022); Rosenbaum v. CytoDyn Inc., 2021 WL 4775140, at *12 (Del. Ch. Oct. 13, 2021).

The SEC is poised to finalize its proposed amendments to SEC Rule 14a-8 in October 2023. Substantial Implementation, Duplication, and Resubmission of Shareholder Proposals Under Exchange Act Rule 14a-8, Release No. 34-95267, SEC (July 13, 2022); Office of Information and Regulatory Affairs, Agency Rule List – Spring 2023, RIN: 3235-AM91 . The new amendments, if enacted, would heighten the bar for a company to exclude shareholder proposals on substantial implementation, duplication, and resubmission grounds. Id. The amendments could potentially build on the recent rise in shareholder proposals reaching a shareholder vote. From 2021 to 2023, there was an 18% increase in shareholder proposals and a 40% increase on proposals that were voted on. Mark T. Uyeda, Commissioner, SEC, Remarks at the Society for Corporate Governance 2023 National Conference (June 21, 2023).

VIII. Lorenzo Disseminator Liability

As discussed in our 2019 Mid-Year Securities Litigation Update, in Lorenzo v. Securities and Exchange Commission, the Supreme Court expanded scheme liability to encompass “those who do not ‘make’ statements” but nevertheless “disseminate false or misleading statements to potential investors with the intent to defraud.” 139 S. Ct. 1094, 1099 (2019). In the wake of Lorenzo, secondary actors—such as financial advisors and lawyers—face potential scheme liability under SEC Rules 10b-5(a) and 10b-5(c) for disseminating the alleged misstatement of another if a plaintiff can show that the secondary actor knew the alleged misstatement contained false or misleading information.

In 2022, the Second Circuit, interpreting Lorenzo, held in Securities and Exchange Commission v. Rio Tinto plc, that the defendants must do “something extra” beyond making material misstatements or omissions to be subject to scheme liability under SEC Rule 10b-5(a) and (c). 41 F.4th 47, 54 (2d Cir. 2022); see Client Alert (Gibson Dunn represents Rio Tinto in this litigation.) Although the Supreme Court and other circuit courts have not directly addressed the requirements for scheme liability after Lorenzo, several recent district court decisions have added to the debate. Specifically, one California district court has explicitly refused to apply Rio Tinto’s “something extra” requirement, another California district court has adopted a less onerous standard for plaintiffs than the Rio Tinto court, and one district court in Massachusetts engaged in an analysis similar to the Rio Tinto decision without specifically adopting the Second Circuit’s analysis.

In Securities and Exchange Commission v. Earle, a California district court declined to adopt Rio Tinto and noted that the Ninth Circuit “has not adopted” the “something extra” requirement, while denying an individual defendant’s motion to dismiss the SEC’s scheme liability claims. 2023 WL 2899529, at *7 (S.D. Cal. Apr. 11, 2023). In Earle, the defendant, citing Rio Tinto, moved to dismiss the SEC’s 10b-5(a) and (c) claims on the grounds that the SEC had not alleged “something extra” beyond a “recitation of allegations of a violation of Rule 10b-5(b).” Id. The court disagreed with the defendant. The court reasoned that the Supreme Court in Lorenzo had “recognized the ‘considerable overlap’ between the subsections of Rule 10b-5,” and that the Ninth Circuit made “clear that the argument that Rule 10b-5(a) and (c) claims cannot overlap with Rule 10b-5(b) statement liability claims is foreclosed by Lorenzo.” Id. (citation and quotation marks omitted). The court also found that the SEC alleged that the defendant disseminated misstatements, which the Supreme Court in Lorenzo held was enough to establish scheme liability. Id.

In another recent order rejecting defendants’ motion to dismiss 10b-5(a) and (c) claims, a different district court in California also emphasized the “‘considerable overlap’ between the subsections of Rule 10b-5.” In re Vaxart, Inc. Sec. Litig., 2023 WL 3637093, at *3 (N.D. Cal. May 25, 2023). The court stated that, although Lorenzo established that the dissemination of material misstatements can serve as the basis of 10b-5 scheme liability, “Rule 10b-5(a) and (c) prohibit more than just the dissemination of misleading statements; the language of these provisions is ‘expansive.’” Id. (quoting Lorenzo, 139 S. Ct. at 1102). Although the court did not mention Rio Tinto in its order, the court found that the defendants had allegedly committed many acts beyond misstatements and omissions—acts that were potentially sufficient to establish a claim for scheme liability even under a “something extra” requirement. Id.