2022 Mid-Year Securities Litigation Update

Client Alert | September 20, 2022

The number of securities lawsuits filed since January has remained steady compared to the first half of 2021. We have already seen many notable developments in securities law this year. This mid-year update provides an overview of the major developments in federal and state securities litigation in the first half of 2022:

- We explore what to watch for in the Supreme Court, including the upcoming decision in SEC v. Cochran, which addresses an important jurisdictional question; the decision in West Virginia v. Environmental Protection Agency, which could impact the SEC’s proposed climate disclosure rule; and the future of gag rules.

- We examine a number of developments in the Delaware Court of Chancery, including the applicability of Blasius and Schnell when board action implicates the stockholder franchise; a novel, but “likely rare,” claim that a board’s wrongful refusal of a stockholder demand constituted a breach of fiduciary duty; and when an activist-appointed director might be conflicted by an expectation of future directorships.

- The Second Circuit in SEC v. Rio Tinto held that in order to allege a claim of scheme liability, plaintiffs must show something more than just the misstatements or omissions themselves, such as dissemination. Although it is too early to see the application of Rio Tinto at the district court level, lower courts had previously continued to grapple with the scope of Lorenzo.

- We again survey securities-related litigation arising out of the coronavirus pandemic, including securities class actions alleging that defendants made false claims about the efficacy of their COVID-19 vaccines, treatments, and tests. Notably, since the beginning of the year, the SEC has filed multiple lawsuits related to the pandemic.

- We explore the lower courts’ application of the Supreme Court’s decision in Omnicare, Inc. v. Laborers District Council Construction Industry Pension Fund, which concerned liability based on a false opinion, often to evaluate the sufficiency of pleadings in response to defendants’ motions to dismiss. Recent decisions emphasize that the context surrounding the opinion is a key consideration for determining whether that opinion is actionable. As such, other statements made contemporaneously to an opinion, the reason why an opinion is being offered, and the knowledge level of the speaker can be just as important as the syntax and meaning of the opinion itself.

- We examine various developments in federal securities litigation involving special purpose acquisition companies (“SPACs”), including a surge in Section 10(b) claims against companies reporting under-promised financial results after being acquired by SPACs. We also preview how the SEC’s newly proposed SPAC rules and amendments may potentially impact this litigation.

- Finally, we address several other notable developments in the federal courts, including:

- the Second Circuit’s holding that a company had a duty to disclose a governmental investigation for purposes of a claim under Section 10(b) of the Exchange Act of 1934;

- the Ninth Circuit’s further guidance as to when a general corporate statement by a company is nonactionable;

- the Second Circuit’s affirming the dismissal of a securities class action after reaffirming the PSLRA’s requirements for pleading falsity with sufficient particularity;

- the Ninth Circuit’s clarification and tightening of its loss causation standard; and

- the Eleventh Circuit’s holding that informal mass online communication, such as YouTube videos, can count as “soliciting” the purchase of an unregistered security, affecting the sale of new cryptocurrencies reliant on such methods for traction.

I. Filing And Settlement Trends

According to Cornerstone Research, although new filings remain consistent with the first half of 2021, the number of approved settlements is up over 30% from the same time last year, and the median settlement amount has rebounded from the low that we reported in our 2021 Mid-Year Securities Litigation Update. SPAC and crypto-related filings continue to be a focus of plaintiffs’ attorneys, even as the nature of these suits continues to evolve.

A. Filing Trends

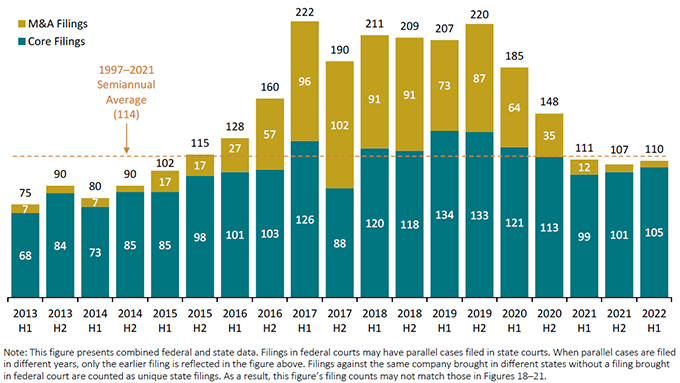

Figure 1 below reflects the semi-annual filing rates dating back to 2013 (all charts courtesy of Cornerstone Research). For the third six-month period in a row, new filings remained below the historical semi-annual average. Notably, at 110, filings in the first half of 2022 barely top 50% of the average semi-annual filing rates seen between 2017 and 2019, though this deficit is largely driven by a substantial decrease in M&A filings. The 105 total new “core” cases—i.e., securities cases without M&A allegations—filed in the first half of 2022 represent a modest increase from both the first and second half of 2021 and are closer to, though still below, other recent periods.

Figure 1:

Semiannual Number of Class Action Filings (CAF Index®)

January 2013 – June 2022

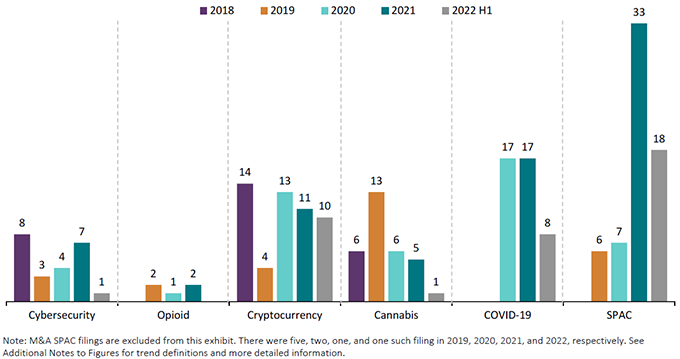

As illustrated in Figure 2 below, SPAC-related filings are on track to meet or exceed last year’s chart-topping performance and already exceed the total SPAC-related filings in all of 2019 and 2020 combined. This increase is driven primarily by SPAC-related actions in the technology and industrial sectors that have offset a potential decline in actions in the consumer space. Cryptocurrency-related actions are also on pace to increase in 2022, driven in part by the continued increase in actions against crypto exchanges and allegations related to securitization in the first half of the year. On the other hand, cybersecurity filings, along with opioid and cannabis cases, are on pace to decrease significantly.

Figure 2:

Summary of Trend Cases—Core Federal Filings

2018 – June 2022

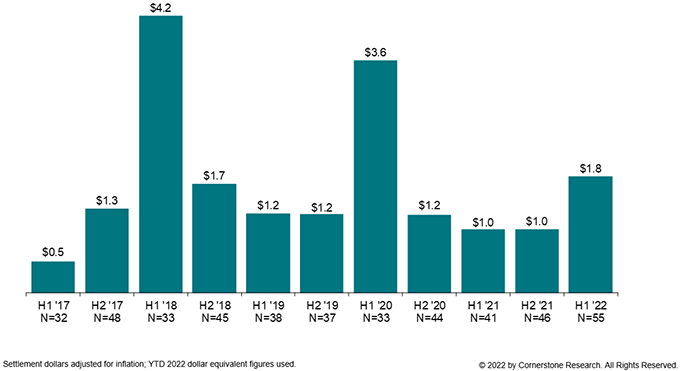

B. Settlement Trends

More settlements were approved in the first half of 2022 than have been in any half-year in the last five years. Additionally, as reflected in Figure 3, the total settlement value in the first half of 2022 is nearly twice that of this time last year, almost meeting the total value of 2021. Of the 55 approved settlements, four topped $100 million, relative to only two this time last year. And the median value of settlements approved is up 56% from the first half of 2021 to $12.5 million.

Figure 3:

Total Settlement Dollars

January 2017 – June 2022

(Dollars in Billions)

II. What To Watch For In The Supreme Court

Although it has been a relatively quiet first half of 2022 for securities litigators in the Supreme Court, one decision has a potential impact on rulemaking and several other decisions could be on the horizon.

A. Cochran To Address Jurisdictional Questions Of Administrative Law Judges

On November 7, 2022, the Supreme Court will hear argument in SEC v. Cochran, No. 21-1239 (5th Cir., 20 F.4th 194; cert. granted, May 16, 2022). The question presented is procedural—whether a federal district court has jurisdiction to hear a suit in which the respondent in an ongoing SEC administrative proceeding seeks to enjoin that proceeding, based on an alleged constitutional defect in the provisions of the Exchange Act that govern the removal of the administrative law judge who will conduct the proceeding.

Following an enforcement action against Respondent that alleged she failed to comply with federal auditing standards, the ALJ determined Respondent had, indeed, violated the Exchange Act. Then, however, the Supreme Court’s decision in Lucia v. SEC, 138 S. Ct. 2044 (2018), held that the SEC’s ALJs are officers of the United States and that their appointments must comply with the Constitution’s Appointments Clause. Id. at 2049. Thus, in Cochran, the SEC remanded all pending administrative actions for new proceedings before constitutionally appointed ALJs. Cochran v. U.S. Sec. & Exch. Comm’n, 20 F.4th 194, 198 (5th Cir. 2021), cert. granted sub nom. Sec. & Exch. Comm’n v. Cochran, 142 S. Ct. 2707 (2022). Respondent brought suit in the federal district court, seeking (1) a declaration that the SEC’s ALJs are unconstitutionally insulated from the president’s removal power and (2) an injunction barring the SEC from continuing the administrative proceedings against her. Id. at 213. The district court dismissed the action for lack of subject-matter jurisdiction, holding that the Exchange Act implicitly strips district courts of jurisdiction to hear challenges—including structural constitutional claims like the Respondent’s—to ongoing SEC enforcement proceedings. Id. at 198. The Fifth Circuit panel affirmed. Id.

The Fifth Circuit, en banc, reversed, holding that Respondent could bring her removal claim in federal court without waiting for a final determination by the SEC. Cochran, 20 F.4th at 212. The Fifth Circuit’s en banc decision created a split from the Second, Fourth, Eleventh, and D.C. Circuits, which held that the Exchange Act implicitly divests federal courts from jurisdiction to hear constitutional challenges to ongoing SEC administrative proceedings.

Two days after the Supreme Court granted certiorari in Cochran, the Fifth Circuit issued a 2-1 decision in Jarkesy v. Sec. & Exch. Comm’n, 34 F.4th 446 (5th Cir. 2022), which also discussed a challenge to the constitutionality of SEC proceedings before an ALJ in similar circumstances. In its decision, the Fifth Circuit issued three findings: (1) the SEC, through its decision to proceed before an ALJ, deprived Petitioner of his constitutional right to a jury trial for a securities fraud action seeking civil penalties, (2) Congress impermissibly granted legislative authority to the SEC by empowering it to decide whether to bring an enforcement action before a federal court or an ALJ and, therefore, which defendants should receive certain legal processes guaranteed in an Article III proceeding, and (3) because of the insulation provided by the removal restrictions for the SEC’s ALJs, the President cannot take care that the laws are faithfully executed in violation of Article II of the Constitution. Id. at 465. On July 1, 2022, the SEC petitioned the Fifth Circuit for rehearing en banc. A petition for certiorari may follow.

The Supreme Court’s decision in Cochran is unlikely to address the Seventh Amendment and non-delegation questions discussed in Jarkesy. Nonetheless, both Cochran and Jarkesy will potentially have significant implications for defendants in other enforcement proceedings, for other federal agencies that utilize in-house courts, and for parties seeking to challenge ALJ authority. As the SEC continues to face constitutional challenges against its proceedings before ALJs, defendants confronting enforcement actions should expect to see the SEC opting to proceed in federal court when possible.

In Cochran, attorneys from Gibson Dunn submitted amicus briefs supporting Cochran in the Supreme Court on behalf of Raymond J. Lucia, Sr., George R. Jarkesy, Jr., and Christopher M. Gibson, and in the Fifth Circuit on behalf of the Texas Public Policy Foundation. In Lucia, attorneys from Gibson Dunn represented petitioners Lucia and Raymond J. Lucia Companies, Inc.

B. EPA Decision Could Impact SEC’s Proposed Climate Disclosure Rule

On June 30, 2022, in a 6-3 split decision, the Supreme Court held that the Environmental Protection Agency (“EPA”) lacks the authority to change the Clean Air Act’s definition of “best system of emission reduction.” West Virginia v. Environmental Protection Agency, 142 S. Ct. 2587, 2610 (2022). Relying on the Major Questions Doctrine, which requires “a clear statement [] necessary for a court to conclude that Congress intended to delegate [broad economic authority to an agency],” id. at 2594, the Court examined, among other things, Congress’s repeat rejection of an analogous scheme. Id. at 2610.

While appearing irrelevant to securities at first blush, the decision in West Virginia v. EPA has the potential to halt the SEC’s recently proposed climate risk disclosure rule in its tracks. The SEC seeks to “require registrants to include certain climate-related disclosures in their registration statements and periodic reports.” U.S. Securities and Exchange Commission, SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors. Congress, however, has repeatedly failed to authorize such legislation in the past (e.g., Climate Disclosure Act of 2021 [HR 2570], Climate Disclosure Risk Act of 2019 [HR 3623], Climate Disclosure Act of 2018 [S 3481]). It is therefore possible that the SEC’s new proposed rule could run awry of the Supreme Court’s decision.

C. The Court Once Again Asked To Consider Gag Rule In Novinger

On July 12, 2022, the Fifth Circuit issued an order in SEC v. Novinger, 40 F.4th 297 (2022). There, Novinger sought to strike a provision in his 2016 settlement agreement with the SEC, preventing him from saying anything in public that might dispute any of the SEC’s allegations against him. Id. at 300. Novinger argued that such a provision is an unconstitutional restriction of speech by the government, while the SEC argued that even if the gag rule violates Novinger’s constitutional rights, settlement agreements which include voluntary waivers of constitutional rights are not per se invalid, including settlement agreements which waive a right to a jury trial. Id. at 303.

Without dissent, the Fifth Circuit denied Novinger’s challenge, teeing up an opportunity for the Supreme Court to consider the issue. Id. at 308. Less than a month before the Fifth Circuit ruled against Novinger, the Supreme Court declined to hear Romeril v. SEC, 15 F.4th 166 (2d Cir. 2021), cert. denied, 142 S. Ct. 2836 (2022), which challenged a similar gag rule, but from a much older settlement. Even though Novinger’s petition probably will suffer the same fate as Romeril’s, it is clear that challenges to these gag rules will continue. In a concurrence to the Fifth Circuit’s opinion in Novinger, two of the three judges on the panel highlighted that the SEC “never responded” to “a petition to review and revoke the SEC policy [that] was filed nearly four years ago,” and predicted that “it will not be long before the courts are called on to fully consider this policy.” Novinger, 40 F.4th at 30.

Attorneys from Gibson Dunn wrote an amicus brief on behalf of the CATO Institute in support of Romeril’s petition for certiorari.

III. Delaware Developments

A. Court Of Chancery Again Upholds Board’s Rejection Of Non-Compliant Dissident Nomination Under Intermediate Standard Of Review

In February, the Delaware Court of Chancery reiterated that “[f]undamental principles of Delaware law mandate that the court . . . conduct an equitable review of [a] board’s rejection of [a director] nomination” notice pursuant to advance notice bylaws even if such rejection is “contractually proper.” Strategic Investment Opportunities LLC v. Lee Enterprises, Inc., 2022 WL 453607, at *1 (Del. Ch. Feb. 14, 2022). In Lee Enterprises, a beneficial owner of the company sought to nominate several directors as part of a takeover attempt, but it failed to comply with unambiguous advance notice bylaws requiring it to become a record holder and submit the company’s nominee questionnaire forms before the nomination deadline. Id. Denying the beneficial owner’s request to permit its candidates to stand for election, Vice Chancellor Lori W. Will held that the board’s rejection of the non-compliant nomination notice was contractually proper and equitable under the circumstances. Id.

Echoing the court’s recent decision in Rosenbaum v. CytoDyn Inc., 2021 WL 4775140, at *1 (Del. Ch. Oct. 13, 2021), which we discussed in our 2021 Year-End Securities Litigation Update, the court declined to apply both the stringent review of Blasius Industries, Inc. v. Atlas Corp., 564 A.2d 651 (Del. Ch. 1988), and the deferential business judgment rule. See Lee Enterprises, 2022 WL 453607, at *14–15. Instead, the court applied enhanced scrutiny—Delaware’s intermediate standard of review first set forth in Unocal Corp. v. Mesa Petroleum Co., 493 A.2d 946 (Del. 1985)—which requires directors to “identify the proper corporate objectives served by their actions” and “justify their actions as reasonable in relation to those objectives.” Lee Enterprises, 2022 WL 453607, at *16 (quoting Mercier v. Inter-Tel (Del.), Inc., 929 A.2d 786, 810 (Del. Ch. 2007)). The court ultimately held for the defendants, finding that the bylaws were “validly enacted on a clear day,” and the board “did not unfairly apply” them or make “compliance [with them] difficult.” Id. at *18.

B. Court Of Chancery Offers Guidance On “Vague” Schnell Standard

In Coster v. UIP Companies, Inc., 2022 WL 1299127 (Del. Ch. May 2, 2022), the court upheld a board’s decision to dilute a stockholder’s 50% ownership stake under the “compelling justification” standard of review set forth in Blasius Industries, Inc. v. Atlas Corp., 564 A.2d 651 (Del. Ch. 1988). Offering helpful guidance on how the Blasius standard interacts with precedents interpreting Schnell v. Chris-Craft Industries, Inc., 285 A.2d 437 (Del. 1971), when a board’s disenfranchising actions are at issue, the court held that Blasius applied—and Schnell did not—because the board’s disenfranchising action “did not totally lack a good faith basis.” Coster, 2022 WL 1299127, at *10.

In Coster, upon the death of plaintiff’s husband, plaintiff became a 50% shareholder of UIP. Id. at *1. UIP’s two 50% stockholders deadlocked regarding the composition of UIP’s board. Id. To cause UIP to buy her stake for 30 times UIP’s total equity value, plaintiff filed a lawsuit asking the court to appoint a custodian with full control of the company. Id. at *3. For its part, the UIP board believed that the appointment of a custodian “rose to the level of an existential crisis for UIP” because it could “trigger broad termination provisions in key contracts and threaten a substantial portion of UIP’s revenue.” Id. at *12. Thus, in response to the lawsuit, the board issued one-third of the total outstanding shares “to reward and retain an essential employee” who had long been promised them. Id. at *5. Coster then sued again to invalidate the issuance as a per se breach of fiduciary duty. Id. at *1.

After trial, the court entered judgment in favor of the director defendants, finding their actions were motivated at least in part by good faith under the entire fairness standard. Id. at *10. The Delaware Supreme Court reversed and remanded, however, holding the court of Chancery should have extended its inquiry to determine whether the board acted for inequitable reasons, as laid out in Schnell and Blasius. Id. at *1.

On remand, the court offered new guidance on Schnell, which holds that “inequitable action does not become permissible simply because it is legally possible,” and embodies the Delaware doctrine that “director actions are ‘twice-tested,’ first for legal authorization, and second for equity.” Id. at *6. “Heeding the [Delaware Supreme Court’s prior] policy determination that Schnell should be deployed sparingly,” the court interpreted Schnell to apply only where “directors have no good faith basis for approving … disenfranchising action.” Id. at *8. Crediting the UIP board’s good-faith belief that avoiding the appointment of a custodian and rewarding and retaining an essential employee were in UIP’s best interests, the court concluded that the board did not act “exclusively for an inequitable purpose,” and Schnell did not apply. Id. at *10.

Next, the court considered Blasius. Assuming the UIP board acted “for the primary purpose of impeding the exercise of stockholder voting power,” the court focused on “whether the board establishe[d] a compelling justification for [its] action[s]” and “[its] actions were reasonable in relation to [its] legitimate objective.” Id. at *11–12. The court answered the first question in the affirmative: it agreed with the UIP board that the appointment of a custodian was “an existential crisis,” and preventing that crisis was a “compelling justification.” Id. at *12. It also found that diluting two deadlocked stockholders equally was “appropriately tailored” to achieving that goal. Id. at *13. Because it found that the UIP board had a compelling justification for diluting the plaintiff, the court entered judgment in favor of the defendants.

C. The Court Of Chancery Recognizes A “Novel” Wrongful Demand Refusal Claim

In May, the Delaware Court of Chancery in Garfield v. Allen, C.A. No. 2021-0420-JTL, 277 A.3d 296 (Del. Ch. May 24, 2022), declined to dismiss a claim for breach of fiduciary duty arising from a board’s wrongful rejection of a stockholder demand letter. In Garfield, a stockholder of ODP Corporation sent the company a letter demanding that performance share grants awarded to the company’s CEO be modified as they violated the equity compensation plan’s (the “2019 Plan”) share limitation. Id. at 313–14. After the company refused to act on the demand, the stockholder filed claims against the company’s directors and its CEO alleging that their actions breached the 2019 Plan and their fiduciary duties. Id. at 314.

All of the plaintiff’s claims survived the defendants’ motion to dismiss. Although most were governed by settled law, one theory the plaintiff advanced was novel: all of the directors “breached their fiduciary duties by not fixing the obvious violation after the plaintiff sent a demand letter calling the issue to their attention.” Id. at 305; see also id. at 340. “The making of demand has not historically given rise to a new cause of action,” Vice Chancellor J. Travis Laster explained, because “a stockholder who makes demand tacitly concedes that the board was disinterested and independent for purposes of responding to the demand.” Id. at 339. In Garfield, however, the court found that the plaintiff overcame the tacit-concession doctrine because he adequately pleaded facts demonstrating that the board refused the demand in bad faith. Id. at 338–40 (citing City of Tamarac Firefighters’ Pension Tr. Fund v. Corvi, 2019 WL 549938 (Del. Ch. Feb. 12, 2019)). Observing that “[t]he conscious failure to take action to address harm to the corporation animates a type of Caremark claim,” id. at 336–37, the court found that the “conscious decision to leave a violative award in place support[ed] a similar inference that the decision-maker[s] acted disloyally and in bad faith.” Id. at 337–38. It therefore held that this was one of the “likely rare” scenarios in which plaintiff’s claims that all directors acted in bad faith in rejecting the demand—and thus breached their fiduciary duties—were viable. Id. at 340.

Finally, Vice Chancellor Laster was careful to note the dangerous implications of this “novel” theory, which, among other things, include expanding opportunities for plaintiffs to create new claims with demand letters. Id. at 338–39. The court explained that the facts at issue were exceptional, however, because the problem identified by the demand was “obvious,” and established precedent supported an inference that the directors acted in bad faith. Id. at 306, 340.

D. Court Considers Whether Activist-Appointed Outside Directors Lack Independence From Activist

The Court of Chancery recently held that an activist’s practice of rewarding directors with repeat appointments can be sufficient to call a director’s independence into question. In Goldstein v. Denner, 2022 WL 1671006, at *2 (Del. Ch. May 26, 2022), a stockholder plaintiff adequately pleaded that certain members of Bioverativ’s board breached their fiduciary duties during a process to sell the company to Sanofi. Initially, the activist was approached by Sanofi with an initial offer to buy Bioverativ, but rather than alerting the board, the activist engaged in conduct violating Bioverativ’s insider trading policy. Id. at *1. Months later and after multiple offers that were not disclosed to the board, Sanofi submitted another offer to the entire board, and, eventually, the merger was effected at a price below Bioverativ’s standalone valuation under its long-range plan. Id. at *1, *13–*14.

Reviewing the independence of two activist-appointed outside directors, the court credited allegations that the activist had a practice of rewarding supportive directors with additional lucrative directorships and that each director hoped to cultivate such a repeat-player relationship with the activist. Id. at *2. One of the activist-appointed outside directors had a professional relationship with the activist and, shortly before joining the company’s board, allegedly received a lucrative payout for helping the activist complete the sale of another company. Id. at *2, *49. Likewise, another activist-appointed director, who allegedly was unemployed and looking to restart his career at the time the activist appointed him, was quickly appointed to the board of a second company that the activist hoped to put in play. Id. at *2, *50. The court concluded that these allegations were enough to make it reasonably conceivable that the two directors supported a sale of the company based on an expectation of future rewards, rather than because the transaction was in the best interests of the company. Id. at *2–3, *46, *50.

Aspects of the decision in Goldstein suggest this is a topic that the court may be interested in exploring more in the future. Id. at *2, *47. First, the court relied predominantly on scholarship, and not case law, to support its holding that an activist’s practice of rewarding directors with repeat appointments can be sufficient to call a director’s independence into question. Id. at *47–48. Second, the court itself thought its findings regarding the independence of the two activist-appointed directors discussed above were a “close call.” Id. at *46, *50.

IV. Lorenzo Disseminator Liability

As initially discussed in our 2019 Mid-Year Securities Litigation Update, the Supreme Court held in Lorenzo v. SEC, 139 S. Ct. 1094 (2019), that those who disseminate false or misleading information to the investing public with the intent to defraud can be liable under Section 17(a)(1) of the Securities Act and Exchange Act Rules 10b-5(a) and 10b-5(c), even if the disseminator did not “make” the statement within the meaning of Rule 10b-5(b). As a result of Lorenzo, secondary actors—such as financial advisors and lawyers—could face “scheme liability” under Rules 10b-5(a) and 10b-5(c) simply for disseminating the alleged misstatement of another so long as a plaintiff can show that the secondary actor knew the alleged misstatement contained false or misleading information.

The biggest development in this space came from the Second Circuit, which decided SEC v. Rio Tinto Plc., 41 F.4th 47 (2d Cir. 2022). Gibson Dunn represents Rio Tinto in this and other litigation. Several trial courts have also attempted to grapple with the implications of Lorenzo.

In July 2022, as we reported in a Client Alert, the Second Circuit held in Rio Tinto that in order to allege a claim of scheme liability, plaintiffs must show more than just the misstatements or omissions themselves. Id. at 48. The decision in Rio Tinto concerned scheme liability claims made by the SEC against mining company Rio Tinto and its former CEO and CFO under Rule 10b-5(a) and (c) and Section 17(a)(1) and (3) of the Securities Act. Id. at 48. The SEC claimed that Rio Tinto’s financial statements and accounting papers included representations about a newly acquired mining asset that defendants knew were incorrect, that those papers misstated the mining asset’s valuation, and that the company should have taken an impairment on the mining asset at an earlier time. Id. at 50–51. Relying on Lentell v. Merrill Lynch & Co., 396 F.3d 161 (2d Cir. 2005), the Southern District of New York dismissed the scheme liability claims on the basis that the SEC did not allege any fraudulent conduct beyond any misstatements or omissions. Rio Tinto, 41 F.4th at 48. The SEC filed an interlocutory appeal, claiming that Lorenzo abrogated Lentell and its scheme claims based only on misstatements or omissions should be reinstated. Id. at 48–49.

The Second Circuit rejected the SEC’s expansive reading of Lorenzo, holding that “Lentell remains vital” and that even post-Lorenzo, “misstatements and omissions can form part of a scheme liability claim, but an actionable scheme liability claim also requires something beyond misstatements and omissions, such as dissemination.” Rio Tinto, 41 F.4th at 53, 49. (emphasis in original). To hold otherwise, the court reasoned, would impose primary liability not only upon the maker of a statement, but also on those who participated in the making of the misstatements, and would undermine the principle that primary liability under Rule 10b-5(b) is limited to those actors with ultimate control and authority over the false statement. Id. at 54 (citing Janus Capital Group, Inc. v. First Derivative Traders, 564 U.S. 135 (2011)). Unlike Lorenzo, where the dissemination constituted conduct beyond any misstatement or omission, the SEC did not allege that the defendants did “something extra” that would be sufficient to find scheme liability. Id.

Multiple federal district courts also recently considered the scope of Lorenzo. In SEC v. Johnson, 2022 WL 423492, at *1–5 (C.D. Cal. Feb. 11, 2022), the SEC alleged that defendants—who created, managed, and controlled two issuers—misled and deceived investors with regard to their compensation and misappropriated significant investor funds. All but one defendant consented to judgment. Id. at *1. The district court relied primarily on undisputed material facts as to negligence and scienter in denying summary judgement on the SEC’s theories of scheme liability, in part, because the SEC did not sufficiently brief the issue and provided “little analysis” as to whether the alleged misstatements and omissions “also support scheme liability,” while noting the “considerable overlap” among the subsections of Rules 10(b) and 17(a). Id. at *7.

Then, in Strougo v. Tivity Health, Inc., 2022 WL 2037966, at *10 (M.D. Tenn. June 7, 2022), the defendant was accused of a scheme involving the launching of a diet programming company and misleading investors about the company’s performance. The district court in Tennessee rejected defendant’s argument that “scheme claims must be independent and distinct from misrepresentations claims.” Id. Rather, the court held that scheme liability “can be based upon misrepresentations or omissions and not just deceptive acts.” Id.

Although it is too early to determine the impact of Rio Tinto, these decisions preview how the scope of Lorenzo may develop in other circuits. We will continue to monitor this space.

V. Survey Of Coronavirus-Related Securities Litigation

As we move through the third year of the COVID-19 pandemic, courts continue to work through the aftermath of the wave of coronavirus-related securities litigation that began in 2020. As we discussed in our 2021 Year-End Securities Litigation Update, many cases remain focused on misstatements concerning the efficacy of COVID-19 diagnostic tests, vaccinations, and treatments. In addition, there are a number of cases involving false claims about pandemic and post-pandemic prospects, including premature claims that the pandemic would be “good for business.” Many such cases are moving into the motion to dismiss stage or already have fully briefed motions to dismiss.

It is also worth noting that the SEC has been active since the beginning of the year, for example, by filing securities enforcement actions relating to a CEO’s alleged misstatements concerning the purchase of two million COVID-19 diagnostic tests, as well as individual defendants’ alleged decision to trade on insider information suggesting that a cloud computing company’s earnings were unexpectedly—and artificially—inflated in light of the pandemic.

Additional resources related to the impact of COVID-19 can be found in the Gibson Dunn Coronavirus (COVID-19) Resource Center.

A. Securities Class Actions

1. False Claims About Vaccinations, Treatments, And Testing for COVID-19

In re Chembio Diagnostics, Inc. Sec. Litig., No. 20-CV-2706, 2022 WL 541891 (E.D.N.Y. Feb. 23, 2022): Plaintiffs filed four lawsuits, which were consolidated, against defendant Chembio, a corporation that developed an antibody test during the COVID-19 pandemic. 2022 WL 541891, at *1. More specifically, the plaintiffs sued the company’s executives and underwriters, claiming they overstated the efficacy of the antibody test and its prospects. Id. at *2–5. In a February 2022 decision, the court found that the plaintiffs had not alleged scienter with sufficient specificity against the corporate defendants. Id. at *8–11. The court let certain claims against the underwriters proceed, however, finding that the plaintiffs sufficiently pled that the underwriter defendants made a material misstatement by declaring in the Registration Statement and Prospectus that the test was “100% accurate after eleven days while omitting to disclose the other data in Chembio’s possession that indicated a lower accuracy.” Id. at *17. Accordingly, the court found, “the Registration Statement did not disclose one of the most significant risks to Chembio’s business: the potential loss of sales and marketing authorization in the United States for their flagship product.” Id. On March 9, the plaintiffs moved for reconsideration, and on July 21, 2022, the court denied the motion. See Dkt. No. 106. The court stayed all deadlines in this case on August 31, 2022, given that the parties have reached a settlement in principle. See Minute Order, No. 20-CV-2706 (E.D.N.Y. Aug. 31, 2022).

Sinnathurai v. Novavax, Inc. et al., No. 21-cv-02910 (D. Md. Apr. 25, 2022) (Dkt. No. 64): In this case, plaintiffs alleged that representatives of defendant Novavax made false and misleading statements by overstating the regulatory and commercial prospects for its vaccine, including by overstating its manufacturing capabilities and downplaying manufacturing issues that would impact the company when its COVID vaccine received regulatory approval. On April 25, 2022, defendant Novavax moved to dismiss the complaint, arguing that the alleged misstatements constituted nonactionable puffery and mere statements of opinion. See Dkt. No. 64. Novavax also argued that the PSLRA’s safe harbor—which immunizes from liability statements regarding “the plans and objectives of management for future operations” or “the assumptions underlying or relating” to those plans and objectives—insulates Novavax from liability regarding certain challenged statements about the vaccine’s launch. Id. at 14. In addition, Novavax contended that the complaint does not adequately plead that certain statements about clinical trials and manufacturing issues were false or misleading. Id. at 17–23. In response, plaintiffs argued that the statements are actionable because Novavax touted its business (with statements such as “nearly all major challenges” had been overcome, and “all of the serious hurdles” were eliminated), but failed to disclose known facts contradicting those representations. Dkt. No. 65 at 11. The plaintiffs also disputed that certain statements were opinion, arguing that they are “virtually all flat assertions of fact that falsely assured investors that Novavax was ready to file its [emergency use authorization] quickly” and “had overcome the regulatory and manufacturing hurdles that had delayed that filing.” Id. at 19–20. The motion to dismiss is fully briefed, but the court has yet to issue a decision.

In re Sorrento Therapeutics, Inc. Sec. Litig., No. 20-cv-00966 (S.D. Cal. Apr. 11, 2022) (Dkt. No. 68): We began following this case in our 2020 Mid-Year Securities Litigation Update. Defendant Sorrento Therapeutics, Inc. is a biopharmaceutical company that “purports to develop treatments for cancer, pain, and COVID-19.” During the class period—May 15, 2020 through May 21, 2020—Sorrento was developing a monoclonal antibody treatment and made a number of statements about its efficacy and promise. The plaintiffs argued that the defendants’ statements were misleading because the treatment was still in preclinical testing stages. On April 11, 2022, the court dismissed the complaint in full (with leave to replead), finding that it did not adequately allege that the defendants actually lied to or misled investors about the treatment’s preclinical testing status. Dkt. No. 68 at 15. The court also found that the defendants’ statements that “there is a cure” and “[t]here is a solution that works 100 percent” were unactionable statements of corporate optimism. Id. at 11. Finally, the court concluded that the complaint failed to establish a strong inference of scienter and that the plaintiffs failed to make specific allegations showing that the defendants had any intent to deceive investors or manipulate the preclinical trials. Id. at 13. The decision granting the motion to dismiss has been appealed to the Ninth Circuit.

Yannes v. SCWorx Corp., No. 20-cv-03349 (S.D.N.Y. June 29, 2022) (Dkt. No. 90): This case stems from allegations that defendant SCWorx, a hospital supply chain company, artificially inflated its stock price with a false claim in an April 13, 2020 press release that SCWorx had a “committed purchase order” to buy two million COVID rapid test kits, after which the SCWorx stock price increased 434% from the prior trading day. Dkt. No. 1 at 4–5. In June 2021, Judge Koeltl found that the complaint was adequately pleaded. Dkt. No. 52 at 1–3. After that decision, the parties reached a settlement. On June 29, 2022, Judge Koeltl granted final certification of the settlement class, consisting of all persons or entities who acquired common stock of SCWorx between April 13, 2020 and April 17, 2020. Dkt. No. 90 at 3. Public reports indicate that under the settlement agreement, the insurers for SCWorx and its former CEO, Marc Schessel, will make a payment to the class plaintiffs and issue $600,000 worth of common stock to them. As described below, the SEC announced in May 2022 that it had filed a complaint against SCWorx and Schessel and that the company agreed to a $125,000 civil penalty. Schessel is also facing criminal charges.

In re Emergent Biosolutions Inc. Sec. Litig., No. 21-cv-00955 (D. Md. July 19, 2022) (Dkt. No. 77): This case involves allegations that certain high-level employees at Emergent, a biopharmaceutical company that provides manufacturing services for vaccines and antibody therapies, misled the public about the company’s vaccine manufacturing business. Dkt. No. 54 at 1–8. In June 2020, Emergent received funds from the federal government’s Operation Warp Speed program, which it used to reserve space for COVID vaccine manufacturing at Emergent’s Baltimore facilities. Dkt. No. 54 at 2. Emergent also entered into agreements with J&J and AstraZeneca to support the mass production of their vaccines. Id. The plaintiffs claim that, contrary to Emergent’s public proclamations of, inter alia, “manufacturing strength” and “expertise,” Emergent did not disclose myriad issues at the facilities, including that up to 15 million doses of the J&J vaccine became contaminated at the Baltimore facilities. Id. at 5–6, 74, 98. In response to reports that problems at the facilities were not isolated incidents, the government placed J&J in charge of the plant and prohibited it from producing the AstraZeneca vaccine. Id. at 6. Emergent’s stock fell drastically as a result. Id. at 7. On May 19, 2022, Emergent moved to dismiss the complaint for failure to state a claim. Dkt. No. 72. Lead plaintiffs sought judicial notice of a newly published Congressional report and related materials that the plaintiffs contend show that many more doses of the vaccine were destroyed due to Emergent’s quality control failures and that Emergent hid evidence of contamination in an attempt to evade oversight from government regulators. Dkt. No. 77. That motion, as well as the motion to dismiss, remain pending.

Wandel v. Gao, No. 20-CV-03259, 2022 WL 768975 (S.D.N.Y. Mar. 14, 2022): This lawsuit was brought by shareholders of Phoenix Tree, a residential rental company based in China with operations in Wuhan, which went public in January 2020 on the New York Stock Exchange, just as the pandemic was in its earliest stages. 2022 WL 768975 at *1. At bottom, the plaintiffs alleged that “by January 16, 2020 (when the offering documents became effective) and certainly by January 22, 2020 (when the IPO ended),” Phoenix Tree “had enough information to know that China—and Wuhan, in particular—was already under siege by the coronavirus, and that it was reasonably likely to have a material adverse effect on the Company’s operations and revenues.” Id. at *2 (internal quotation marks omitted). Unsurprisingly, the COVID-19 pandemic impacted the company, which saw the early termination of rental leases. Defendants moved to dismiss, and in a March 14, 2022 opinion and order, the court granted their motion in full. Id. at *12. The court dove deep into the timeline of COVID-19 in the region, finding that COVID-19 had not sufficiently escalated by January 17 (the day after the offering documents became effective) such that Phoenix should have been aware, then, of the material risks its business would face as a result. Id. at *6–9. The court rejected arguments that Phoenix was in a “unique position” to recognize the threat of COVID-19 because it had operations in Wuhan. Id. at *7. After the plaintiffs did not amend their complaint, on April 21, 2022, the court entered judgment, dismissing the case with prejudice. Dkt. No. 83.

2. Failure To Disclose Specific Risks

Martinez v. Bright Health Grp. Inc., No. 22-cv-00101 (E.D.N.Y. June 24, 2022) (Dkt. No. 38): As discussed in our 2021 Year-End Securities Litigation Update, in this case, the plaintiffs allege that Bright Health, a company that delivers and finances U.S. health insurance plans, made a series of materially false or misleading statements about itself in its IPO registration statement and prospectus, which overstated the company’s prospects, failed to disclose that it was unprepared to handle the impact of COVID-19-related costs, and failed to disclose that it was experiencing a decline in premium revenue. In April 2022, the court granted one of six competing motions to appoint a lead plaintiff. Dkt. No. 31. Then, plaintiffs filed an amended complaint on June 24, 2022 adding nine new parties as defendants and claiming that although Bright Health warned of potential risks in its IPO documents, it was already experiencing those risks and their adverse impacts “would foreseeably manifest further near-immediately after the IPO.” Dkt. No. 38 at 5. Defendants’ motion to dismiss is due by October 12, 2022. See Minute Order, No. 22-cv-00101 (E.D.N.Y. Sept. 12, 2022).

3. False Claims About Pandemic And Post-Pandemic Prospects

Dixon v. The Honest Co., Inc., No. 21-cv-07405 (C.D. Cal. July 18, 2022) (Dkt. No. 71): This is a putative class action against The Honest Company, a seller of “clean lifestyle” products, alleging that the company’s registration statement omitted that the company’s results were skewed by a multimillion-dollar increase in demand by COVID-19 at the time of its IPO and that the company was experiencing decreasing demand for its products. Dkt. No. 59 at 2–3. Recently, the court denied defendants’ motion to dismiss in part, finding that the plaintiffs plausibly alleged that COVID-19-related product demand was declining at the time the company published the offering documents, which claimed that the pandemic was good for the Honest Company’s business. Dkt. No. 71 at 4–5. On August 1, 2022, defendant moved for partial reconsideration of the court’s decision on the motion to dismiss. Dkt. No. 75. The court denied that motion on August 25, 2022 without further discussion. Dkt. No. 84.

Douvia v. ON24, Inc., No. 21-cv-08578 (N.D. Cal. May 2, 2022) (Dkt. No. 83): In this case, the plaintiffs allege that offering documents promulgated by defendant ON24, Inc., a “cloud-based digital experience platform,” were materially inaccurate, misleading, and incomplete because they failed to disclose that the company’s surge in new customers due to COVID-19 did not fit the company’s traditional customer profile and that those new customers were thus unlikely to renew their contracts. Dkt. No. 80 at 2–3. This case was consolidated with another action against ON24 asserting similar allegations. In May 2022, the defendants moved to dismiss the consolidated class action complaint, claiming that the statements at issue were inactionable puffery, statements of opinion, merely forward-looking, or protected by the bespeaks-caution doctrine. Dkt. No. 83 at 7–12. The motion is fully briefed and awaiting a decision.

City of Hollywood Police Officers’ Ret. Sys. v. Citrix Sys., Inc., No. 21-cv-62380 (S.D. Fla. Aug. 8, 2022) (Dkt. No. 75): Citrix is a software company that provides digital workspaces to businesses. See Dkt. No. 62 at 7. The plaintiffs claim that during the pandemic, Citrix hid numerous corporate problems and sold heavily discounted, short-term licenses that boosted its sales. Id. at 2–3. The plaintiffs allege that the company’s transition to subscription licenses was not as successful as the company had disclosed, as customers failed to make the transition, instead preferring short-term on-premise licensing due to the COVID-19 pandemic. Id. The defendants have moved to dismiss, claiming that the operative complaint inadequately alleges scienter and that the statements at issue were forward-looking statements, opinion, and/or puffery. Dkt. No. 68 at 10–23. The court will hear arguments on the motion to dismiss on September 29, 2022. Dkt. No. 77.

Leventhal v. Chegg, Inc., No. 21-cv-09953 (N.D. Cal.): The plaintiffs claim that Chegg, a textbook, tutoring, and online research provider, falsely claimed that as a result of its “unique position to impact the future of the higher education ecosystem” and “strong brand and momentum,” Chegg would continue to grow post-pandemic. Dkt. No. 1 at 1. The complaint alleges that Chegg knew that its growth was a temporary effect of the pandemic and was not sustainable. Id. In April 2022, the case was consolidated with a similar action (Robinson v. Rosensweig, No. 22-cv-02049 (N.D. Cal.)). On September 7, 2022, the court appointed joint lead plaintiffs and lead co-counsel. Dkt. No. 105.

In re Progenity, Inc., No. 20-cv-1683 (S.D. Cal.): In this case, the plaintiffs allege that Progenity, a biotechnology company that develops testing products, made misleading statements and omitted material facts in its registration statement, including that Progenity failed to disclose that it had overbilled government payors and that it was experiencing negative trends in its testing volumes, selling prices, and revenues as a result of the COVID-19 pandemic. On September 1, 2021, the court dismissed the case with leave to file a second amended complaint, finding no actionable false or misleading statements. See Dkt. No. 48. The plaintiffs then filed a second amended complaint on September 22, 2021. See Dkt. No. 49. The company filed a second motion to dismiss on November 15, 2021, which remains pending, Dkt. No. 52, and the parties participated in a settlement conference in May 2022, Dkt. No. 58. Gibson Dunn represents the company and its directors and officers in this litigation.

Weston v. DocuSign, Inc., No. 22-cv-00824 (N.D. Cal. July 8, 2022) (Dkt. No. 59): The plaintiffs allege that DocuSign, a software company that enables users to electronically sign documents, made false and misleading statements that the “massive surge in customer demand” brought on by the pandemic was “sustained” and “not a short term thing.” Dkt. No. 59 at 2. The plaintiffs allege that the defendants knew that the demand was unsustainable after the pandemic subsided, and that the defendants made corrective disclosures revealing that the company had missed billings-growth expectations after the initial surge of demand dissipated. Id. The court appointed lead plaintiff and lead counsel on April 18, 2022, see Dkt. No. 42, and plaintiffs filed the amended complaint on July 8, 2022, see Dkt. No. 59.

4. Insider Trading And “Pump And Dump” Schemes

In re Eastman Kodak Co. Sec. Litig., No. 21-cv-6418, 2021 WL 3361162 (W.D.N.Y. Aug. 2, 2021): We have been following the consolidated cases captioned under the heading In re Eastman Kodak Co. Securities Litigation since our 2020 Year-End Securities Litigation Update. The plaintiffs in this putative class action allege that Eastman Kodak and certain of its current and former directors and select current officers violated securities laws by failing to disclose that its officers were granted stock options prior to the company’s public announcement that it had received a loan to produce drugs to treat COVID-19. Dkt. No. 116 at 2. The defendants moved to dismiss earlier this year, arguing in part that the stock options grants did not constitute insider trading because the complaint lacked any allegation that the company and the individual defendants did not have the same information before the options grants were issued, which is necessary “[b]ecause an option grant is a ‘trade’ between a company and an officer,” Dkt. No. 159-1 at 21. The defendants also argued that the plaintiffs failed to allege that the “timing of the [o]ptions [g]rants was manipulated to provide additional compensation to the officers.” Id. The court recently heard oral argument on the pending motion, but has yet to issue a decision. Dkt. No. 196.

In re Vaxart Inc. Sec. Litig., No. 20-cv-05949, 2021 WL 6061518 (N.D. Cal. Dec. 22, 2021): Stockholders allege that Vaxart insiders—directors, officers, and a major stockholder—profited from misleading statements that (1) overstated Vaxart’s progress toward a successful COVID-19 vaccine and (2) implied that Vaxart’s “supposed vaccine” had been “selected” by the federal government’s Operation Warp Speed program. Dkt. No. 1 at 6–7. After Vaxart’s stock price rose in response to these statements, the insiders “cashed out,” exercising options and warrants worth millions of dollars. Id. at 7–8. As we discussed in the 2021 Year-End Securities Litigation Update, the court concluded that the complaint adequately alleged that certain defendants committed securities fraud, but the plaintiffs failed to allege securities fraud on the part of a hedge fund that was the company’s major stockholder because the complaint did not demonstrate that the entity was a “maker” of the misleading statements or controlled Vaxart’s public statements. 2021 WL 6061518 at *8. The parties engaged in discovery, and the plaintiffs recently reached a settlement with all remaining defendants, except two individual representatives from the hedge fund. Dkt. No. 215 at 6; Dkt. No. 216. The two individual defendants sought to stay additional discovery, arguing that the plaintiffs improperly used discovery from the other defendants to seek to amend their pleadings to raise new allegations against the two individual defendants and bring new claims against the hedge fund. Dkt. No. 215 at 6. The plaintiffs, in turn, sought leave to extend the time to amend the complaint until 30 days after the two individual defendants substantially completed document production, Dkt. No. 216, which was opposed by the two defendants, Dkt. No. 219. On September 8, 2022, the court granted the motion to stay further discovery and noted that the deadline to file the amended complaint could be discussed further at a hearing scheduled for September 29, 2022. Dkt. No. 235.

B. Stockholder Derivative Actions

In re Vaxart, Inc. Stockholder Litig., No. 2020-0767-PAF, 2022 WL 1837452 (Del. Ch. June 3, 2022): Unlike the Vaxart securities class action discussed above, this case was filed derivatively on behalf of the Vaxart corporate entity. In particular, Vaxart stockholders alleged that the officers, directors, and purported controlling stockholder kept private the announcement regarding the company’s selection to participate in Operation Warp Speed so that they could keep the stock price artificially low before exercising their options. 2021 WL 5858696, at *1, *13. As discussed in our 2021 Year-End Securities Litigation Update, the court granted the defendants’ motion to dismiss as to the derivative claims because the plaintiffs failed to plead demand futility, but requested supplemental briefing on the plaintiffs’ remaining claims. Id. at *24. The court recently dismissed the plaintiffs’ remaining breach of fiduciary duty claim relating to an amendment to the equity incentive plan and their unjust enrichment claim arising from compensation decisions made before and after the approval of the amendment. 2022 WL 1837452, at *1. The case is now fully dismissed.

In re Emergent Biosolutions Inc. Derivative Litig., No. 2021-0974 (Del. Ch.): In addition to the putative securities class action discussed above, the directors of Emergent BioSolutions Inc. and its current and former CEO are facing a shareholders’ derivative suit in the Delaware Court of Chancery. See Compl. at 1–8. The complaint alleges fiduciary duty breaches, unjust enrichment, corporate waste against all defendants, and an insider trading claim on the part of the current CEO. See id. at 96–97. The plaintiffs claim that the defendants failed to put in place any compliance structures to monitor its vaccine-manufacturing business, resulting in significant quality control issues with its COVID-19 vaccine. See id. at 94. The case is currently stayed pending the outcome of the securities lawsuit discussed above.

C. SEC Cases

SEC v. Berman, No. 20-cv-10658, 2021 WL 2895148 (S.D.N.Y. June 8, 2021): In both our 2020 Year-End Securities Litigation Update and our 2021 Year-End Securities Litigation Update, we discussed a related civil and criminal case filed against the CEO of Decision Diagnostics Corp. In the criminal case, a federal grand jury indicted the CEO on December 15, 2020 for allegedly attempting to defraud investors by making false and misleading statements about the development of a new COVID-19 rapid test. Dkt. No. 1 at 6–7. The CEO allegedly claimed the test was on the verge of FDA approval even though the test had not been developed beyond the conceptual stage. Id. at 6–7, 9. Only two days after the indictment in the criminal case, the SEC filed a civil enforcement action based on the same underlying facts against both Decision Diagnostics Corp. and its CEO. The SEC claims that the defendants violated Section 10(b) of the Exchange Act and Rule 10b-5. 2021 WL 2895148, at *1. The court stayed discovery in June 2021 in the civil case in light of the parallel criminal case against the CEO. Id. Discovery remains stayed, and the criminal trial is set for this coming December. Dkt. No. 30.

SEC v. SCWorx Corp., No. 22-cv-03287 (D.N.J. May 31, 2022): In addition to the private securities lawsuit discussed above, the SEC recently filed a securities enforcement action against hospital supply chain SCWorx and its CEO, alleging that the defendants falsely claimed in a press release to have a “committed purchase order” from a telehealth company for “two million COVID-19 tests” amounting to $840 million when the “committed purchase order” was, in reality, only a “preliminary summary draft.” Dkt. No. 1 at 2–3. SCWorx has agreed to pay a penalty of $125,000, in addition to disgorgement of approximately $500,000. The CEO was also indicted in a parallel criminal fraud case arising from the same allegations. 2:22-cr-00374-ES, Dkt. No. 1. On August 17, 2022, the court ordered that the SEC’s enforcement action be stayed until the parallel criminal case is completed. Dkt. No. 20.

SEC v. Sure, No. 22-cv-01967 (N.D. Cal. Mar. 28, 2022): The SEC filed this civil enforcement action in March against a group of employees at Twilio, a cloud computing company, and their friends and family, alleging that they violated Section 10(b) and Rule 10b-5 by engaging in insider trading in May 2020. Dkt. No. at 1. The SEC alleges that the employees learned that Twilio’s customers unexpectedly increased their usage of the cloud computing services because of the COVID-19 pandemic, leading to significantly increased earnings for the company that exceed its revenue guidance. Id. at 5–6. According to the SEC’s complaint, the employees informed the other defendants about Twilio’s anticipated performance in advance of its May 6, 2020 earnings announcement, who, in turn, traded on this information. Id. at 8–9. Parallel criminal charges were also announced against one of the defendants.

VI. Falsity Of Opinions – Omnicare Update

As readers will recall, in Omnicare, the Supreme Court held that “a sincere statement of pure opinion is not an ‘untrue statement of material fact,’ regardless whether an investor can ultimately prove the belief wrong,” but that an opinion statement can form the basis for liability in three different situations: (1) the speaker did not actually hold the belief professed; (2) the opinion contained embedded statements of untrue facts; and (3) the speaker omitted information whose omission made the statement misleading to a reasonable investor. 575 U.S. at 184–89. Since that decision was handed down in 2015, there has been significant activity with respect to “opinion” liability under the federal securities laws, and the first half of 2022 has been no exception.

A. Survival At The Motion To Dismiss Stage

In the first half of 2022, cases with claims premised on allegedly misleading opinions survived motions to dismiss based on Omnicare. For example, in Fryman v. Atlas Financial Holdings Inc., No. 18-cv-01640, 2022 WL 1136577, at *9–21 (N.D. Ill. Apr. 18, 2022), an Illinois district court held that plaintiff investors adequately stated a Section 10b-5 claim against a financial services holding company based on misleading statements by company executives. The plaintiffs alleged that the company misled investors with regard to a substantial increase in its loss reserves. Id. at *2–4. The complaint alleged a number of misstatements, including statements by the CEO that the reserve increases were caused by isolated issues, that “[w]e feel very strongly that we’ve isolated the issue,” and that the reserves were sufficient and “appear to be holding up consistent with the expectations we had.” Id. at *14. Despite being phrased as a belief (“[w]e feel strongly”), the court considered the pleading sufficient. Id. at *14–15. In the court’s view, the statements omitted material facts that “conflict[ed] with what a reasonable investor would take from the statement[s]” themselves. Id. at *14 (internal quotation omitted). The court concluded the defendants’ “contemporaneous knowledge surrounding the reserve deficiencies” evidenced that they “did not actually believe” the reserves were adequate or that the “increases were caused by isolated incidents.” Id. “Thus, the opinion statements concerning the cause or adequacy of [the company’s] reserves could still be misleading under Omnicare because the defendants did not hold the beliefs professed.” Id. (internal quotation and corrections omitted).

The Fryman court further considered the significance of the context surrounding the statements at issue to determine the opinion was actionable under Omnicare. “Context matters,” and whether an opinion is actionable under Omnicare depends on its “full context.” Omnicare, 575 U.S. at 190; see Fryman, 2022 WL 1136577, at *11, 20. The court rejected the defendants’ assertions that the CEO’s statements were nothing more than inactionable puffery; “when assessed in context,” those statements were “not puffery because they are not vague or unimportant to a reasonable investor, who would want to know if future reserve increases would be needed which could diminish [the company]’s net income.” Id. at *20.

Context is a common thread running through recent Omnicare cases. In City of Sterling Heights Police & Fire Retirement System v. Reckitt Benckiser Group PLC, No. 20-cv-10041, 2022 WL 596679, at *18–19 (S.D.N.Y. Feb. 28, 2022), plaintiffs plausibly alleged that some of the defendant pharmaceutical company’s statements of opinion were actionable as “more than mere puffery or statements of opinion” in light of the full context in which the statements were made. The company’s CEO made several factual statements about a product’s market share and “commercial success” without disclosing it had carried out anticompetitive practices. Id. at *2, 6. The court identified a number of adequately pleaded misstatements, including: (1) “the data has already demonstrated that [the specific product] is very clearly the preferred product”; (2) the product’s “resilience” and “market share performance” demonstrated it was “the top choice” on the market; (3) the product was “designed with the intent of being a lower potential for abuse and misuse than the previous products on the market”; and (4) “we’re not in the business of forcing the market or patients to do anything.” Id. at *18–20 (internal quotations omitted). In the court’s view, the CEO “placed at issue the reason for the [product’s] strong sales” and therefore “had a duty to disclose that sales were derived at least in part from allegedly untruthful statements and anticompetitive conduct.” Id. at *18. This was information “a reasonable investor would have considered . . . material to know.” Id. at *19. The CEO thereby “materially mispresented the reasons for the strong market position” of the product. Id. at *20.

B. Omnicare As A Pleading Barrier

In another line of cases, defendants have used Omnicare to successfully argue for the dismissal of inadequately pleaded claims relying on allegedly false or misleading opinions. In In re Peabody Energy Corp. Securities Litigation, the Southern District of New York dismissed claims against Peabody—an energy company—given the “broader surrounding context,” among other reasons. No. 20-CV-8024, 2022 WL 671222, at *18 (S.D.N.Y. Mar. 7, 2022). There, the court examined multiple statements made by Peabody and its executives regarding a fire at a mine in Queensland, Australia. One statement by an executive, that the “vast majority of the mine is unaffected,” was held to be non-actionable because, read in “the appropriate context,” the opinion was an estimate based on available data and was not “rendered misleading and actionable just because Peabody was actually unable” to ascertain damages to all parts of the mine. Id. at *18.

In In re Ascena Retail Group, Inc. Securities Litigation, the District of New Jersey relied on Omnicare to dismiss Section 10(b) and Rule 10b-5 claims against a retail clothing brand and two of its executives. Civ. No. 19-13529, 2022 WL 2314890, at *9 (D.N.J. June 28, 2022). According to the plaintiffs, the defendants made false statements about the value of the company’s goodwill and tradename. Id. at *6. They argued that defendants overstated the value of these assets in public statements and financial disclosures under GAAP, despite contemporaneous indicators of impairment, including (1) deteriorating performance; (2) changes in “consumer behavior and spending;” (3) changes in the company’s commercial strategy; and (4) falling share price. Id. Defendants countered that plaintiffs did not allege “a single particularized allegation” that they “disbelieved” the challenged statements or “omitted material non-public information.” Id.

The court agreed with defendants, finding plaintiffs had not shown the defendants “disbelieved their own statements, conveyed false statements of fact, or omitted material facts going to the basis of their opinions.” Id. at *7. The statements did little more than show the defendants were “aware” of the company’s “increasingly difficult business environment.” Id. The company’s statements about goodwill and tradenames “rest[ed] on the accounting procedures outlined by GAAP for evaluating and testing these assets,” which “require the exercise of subjective judgment.” Id. Applying Omnicare, the court held that the challenged statements were not false or misleading because, even though the company knew of its challenging business environment, GAAP granted it discretion. Id. The size of the impairment “suggests that Defendants’ valuations were overly optimistic and that an impairment could or even should have been recorded earlier,” but the company’s “impairment charge appears better explained as a result of Defendants’ mistakes, bad luck, or poor performance, not a longstanding effort by Defendants to dupe investors and fraudulently inflate Ascena’s share price.” Id. at *8. Accordingly, the court dismissed the complaint. Id. at *9; see also Nacif v. Athira Pharma, Inc., No. C21-861, 2022 WL 3028579, at *1, 15 (W.D. Wash. July 29, 2022) (holding that “laudatory opinions” about a biopharmaceutical company’s CEO, where the company allegedly misled investors by omitting “material facts concerning [the CEO’s] prior research,” were not actionable where plaintiffs failed to show “that the opinions were either provided without reasonable investigation or in conflict with then-known information”) (emphasis in original); Building Trades Pension Fund of Western Pennsylvania v. Insperity, Inc., 20 Civ. 5635, 2022 WL 784017, at *10 (S.D.N.Y. Mar. 15, 2022) (finding an “overly optimistic” statement “exuding confidence while acknowledging risk does not constitute a misstatement” actionable under Omnicare, particularly where such statements are “predictions, not guarantees”); In re Peabody Energy Corp. Securities Litigation, 2022 WL 671222, at *19 (finding a statement concerning an expected production timeline non-actionable where defendants had separately “cautioned that . . . production estimates were subject to reevaluation”).

We will continue to monitor developments in these and similar cases.

VII. Federal SPAC Litigation

The use of special purpose acquisition companies (“SPACs”) surged during the coronavirus pandemic. Using a SPAC to go public has several perceived advantages, including a more streamlined path than a traditional IPO. The surge in SPAC transactions generated new opportunities for start-ups, high-growth companies, and retail investors to access the public markets. The first half of 2022 saw both a corresponding spike in SPAC-related securities litigation and a set of newly proposed SPAC-related rules and amendments from the SEC.

Section 10(b) material misstatement or omission claims proved to be the most common avenue for SPAC-related securities claims. Such claims frequently are filed against operating companies that are acquired by SPACs and begin reporting financial results that aren’t aligned with prior, more optimistic business projections. The SEC, meanwhile, has proposed a set of new rules and amendments that seek to impose traditional IPO concepts and regulations on the SPAC transaction process. Complying with the proposed rules, which are explained in depth in our recent Client Alert, will curtail SPAC flexibility and increase the complexity and cost of completing a de-SPAC transaction. These litigation trends, alongside the SEC’s increased interest in regulating SPAC transactions, underline the importance of robust disclosure controls and disciplined due diligence throughout the SPAC process.

A. Clover Health: Prototypical 10(b) And 20(a) Claims In The SPAC Context

A notable number of claims involving SPACs survived motions to dismiss in the first half of 2022, several of which were based on fairly routine allegations of misleading statements made during pre-merger and post-merger disclosures. See, e.g., In re Romeo Power Inc. Sec. Litig., 2022 WL 1806303 (S.D.N.Y. June 2, 2022) (alleging misleading statements in the relevant registration statement, proxy statement, and prospectus); In re XL Fleet Corp. Sec. Litig., 2022 WL 493629 (S.D.N.Y. Feb. 17, 2022) (alleging misleading statements in press releases and SEC filings starting the date the de-SPAC merger agreement was announced). The recent decision in Bond v. Clover Health Investments, Corp. is a prototypical example with a fulsome opinion; it appears to be the first time a federal court has expressly credited a fraud-on-the-market theory when deciding a motion to dismiss federal securities claims arising from a SPAC-related offering. 2022 WL 602432 (M.D. Tenn. Feb. 28, 2022).

B. The Northern District Of California Continues To Apply The PSLRA’s “Safe Harbor” Provision For Forward-Looking Statements

Although use of the PSLRA’s safe harbor provision for “forward-looking statements” has been questioned in the context of SPACs due to their speculative nature, courts have continued applying the safe harbor to dismiss claims involving SPACs. The Northern District of California, for example, recently dismissed claims of alleged misstatements related to business growth and anticipated revenue under the safe harbor. Moradpour v. Velodyne Lidar, Inc., 2022 WL 2391004, at *14–16 (N.D. Cal. July 1, 2022). The court found that the defendants’ statements related to business growth and anticipated revenue from existing contracts were, in fact, forward-looking and accompanied by appropriate cautionary language, as the PSLRA requires. Id.

Although no court has yet found that the “forward-looking statement” safe harbor does not apply to SPAC transactions, the safe harbor’s future in federal SPAC litigation remains uncertain. The SEC has recently proposed a rule that would disqualify SPACs from the safe harbor by revising the definition of “blank check company” to omit the requirement that the company issue “penny stock.” If the proposed rule were to become effective, the term “blank check company” would encompass any development-state company with no specific business plan or purpose, or which has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person—including SPACs. Because the forward-looking statement safe harbor would not be available for statements made in connection with an offering by a “blank check company,” the change would eliminate a vital defense against SPAC-related claims.

C. One Plaintiff Is Pursuing New Theories Of Liability Against SPACs And Their Advisers

One plaintiff has gained attention by filing three actions asserting violations of the Investment Company Act of 1940 (the “ICA”) and the Investment Advisers Act of 1940 (the “IAA”). These suits attempt to classify SPACs as investment companies and certain involved individuals as investment advisers, which would subject them to different sets of regulations and theories of liability. One action was voluntarily dismissed because the target company ceased operations, and another is stayed. A third, Assad v. E.Merge Technology Acquisition Corp., No. 1:21-cv-07072 (S.D.N.Y. Aug. 20, 2021), is active and pending in the Southern District of New York.

In Assad, a stockholder plaintiff alleged that E.Merge, the defendant SPAC, is subject to liability under the ICA as “an investment company . . . whose primary business is investing in securities” because “this is all E.Merge has ever done with its assets.” Dkt. No. 1 at ¶ 4. The plaintiff in the case has asserted that E.Merge—as an “investment company”—violated the ICA’s rule against issuing shares of common stock for less than their net asset value by providing shares of common stock as compensation to its sponsors and directors. Id. ¶¶ 82–90. E.Merge has moved to dismiss the claims, arguing that (1) the ICA does not confer a private right of action; (2) E.Merge is not an investment company, namely because it does not engage primarily in the business of investing in securities; and (3) plaintiff has not alleged any violation of the ICA. See Dkt. No. 31. In light of E.Merge’s forthcoming dissolution and liquidation, during which it intends to return all investor funds, this case was stayed on September 2, 2022 pending the submission of a stipulation of dismissal, which is the parties anticipate filing by the end of September. See Dkt. No. 56–57.

In September 2021, shortly after the plaintiff began filing these claims, more than sixty law firms—including Gibson Dunn—issued a joint statement urging that no legal or factual basis exists for classifying SPACs as investment companies. It appears the SEC agrees. As we discussed in our recent Client Alert, the SEC’s proposed rules relating to SPACs provide a safe harbor that will exempt SPACs from the ICA. To qualify for the safe harbor, the SPAC (1) must maintain assets consisting solely of cash items, government securities, and certain money market funds; (2) seek to complete a single de-SPAC transaction where the surviving public company will be “primarily engaged in the business of the target company;” and (3) must enter into an agreement with a target company to engage in a de-SPAC transaction within 18 months after its IPO and complete its de-SPAC transaction within 24 months of such offering.

VIII. Other Notable Developments

A. Second Circuit Holds That Company Has Duty To Disclose SEC Investigation

In May, the Second Circuit, in Noto v. 22nd Century Grp., Inc., 35 F.4th 95 (2d Cir. 2022), issued an opinion that may raise questions as to when a company must disclose a governmental investigation. The plaintiffs in Noto alleged that 22nd Century Group “reported material weaknesses in its internal financial controls” in several public SEC filings over a two-year period, and they claimed that the company’s statements regarding these accounting weaknesses were misleading because the company did not disclose the existence of an SEC investigation into those same accounting weaknesses. Id. at 105.

On appeal, the Second Circuit reversed the district court’s dismissal on this point. The court reasoned, “[b]ecause defendants here specifically noted the deficiencies [in their internal financial controls] and that they were working on the problem, and then stated that they had solved the issue, the failure to disclose the investigation would cause a reasonable investor to make an overly optimistic assessment of the risk.” Id. (quotation marks and brackets omitted). The court emphasized that the Company “represented that it had rectified the problem” even though “the SEC investigation was ongoing.” Id. at 106.

It remains to be seen whether the Second Circuit’s ruling in Noto will be confined to that case’s unique facts, which included the company’s public statement that it had “solved” the accounting weaknesses while the SEC’s investigation into those weaknesses was still ongoing. Id. at 105. The decision is also silent on precisely when the Company should have disclosed the SEC investigation into its accounting practices. Nevertheless, Noto creates some potential risks for companies that report a material weakness in their internal controls and then face a related SEC investigation into those same accounting issues.

B. Ninth Circuit Further Clarifies Standard For Non-Actionable Corporate ‘Puffery’

In March, the Ninth Circuit in Weston Family Partnership LLLP v. Twitter, Inc., 29 F.4th 611 (9th Cir. 2022), took yet another opportunity to clarify the types of general corporate statements that may be actionable under federal securities laws.

Twitter concerned several public statements by the company regarding the development of an update to its Mobile App Promotion (“MAP”) product. These included, in particular, statements by Twitter that “MAP work is ongoing” and that Twitter was “continuing [its] work to increase the stability, performance, and flexibility of [MAP] . . . but we’re not there yet.” Twitter, 29 F.4th at 616–17.

When Twitter later disclosed that it had discovered software bugs with the updated MAP product, its stock price decreased, and a putative shareholder class action followed soon thereafter. The plaintiffs in Twitter alleged, among other things, that Twitter’s general statements about the development of its MAP product were misleading because the company did not also disclose the existence of the software bugs. Twitter, 29 F.4th at 615. The plaintiffs claimed that these bugs delayed development of the updated MAP product, leading to lost revenues. Id. at 621. The district court rejected this theory and granted Twitter’s motion to dismiss.

On appeal, the Ninth Circuit agreed with the district court and upheld dismissal. Among other things, the court held that Twitter’s statements that its development of MAP was “continuing” and “ongoing” were “vague” expressions of corporate optimism—i.e., non-actionable corporate “puffery”—because they were “so imprecise and noncommittal that they are incapable of objective verification.” Id. at 620–21. As part of its reasoning, the Ninth Circuit also stressed that “companies do not have an obligation to offer an instantaneous update of every internal development, especially when it involves the oft-tortuous path of product development.” Id. at 620.

C. Second Circuit Reaffirms Requirements For Pleading Falsity Under PSLRA

Also in March, the Second Circuit, in Arkansas Public Employees Retirement System v. Bristol-Myers Squibb Co., 28 F.4th 343 (2d Cir. 2022), upheld the dismissal of a securities class action against a pharmaceutical company based, in part, on a failure to plead falsity under the PSLRA.

Bristol-Myers Squibb involved statements that the pharmaceutical company had made about a lung cancer drug that it was developing. Id. at 347. A clinical trial for the drug sponsored by Bristol-Myers Squibb targeted patients whose cancer cells had a certain level of a particular protein called PD-L1; this was referred to as an “expression” of the protein, and it could be measured as a percentage value. Id. at 347–49. In public disclosures, Bristol-Myers Squibb described these patients as “strongly expressing” the protein, but, for competitive reasons the company did not disclose the exact expression threshold for eligibility in the clinical trial, which was 5%. Id. at 347, 353. When the clinical trial later failed, Bristol-Myers Squibb publicly disclosed for the first time that the threshold was 5% and later attributed the trial’s failure to its use of this threshold. Id. at 347.

The plaintiffs in Bristol-Myers Squibb claimed, among other things, that the company’s description of the clinical trial participants as “strongly expressing” the PD-L1 protein was misleading because the company had not also disclosed that the exact percentage of expression was 5%. Id. at 350. On appeal, the Second Circuit rejected this argument, agreeing with the district court that the pharmaceutical company “had no obligation to disclose the precise percentage of [protein] expression which defined ‘strong’ expression in the . . . trial.” Id. at 353.