February 18, 2020

The number of securities cases filed in federal court continued at a furious pace for the third year in a row. This year-end update highlights what you most need to know in securities litigation trends and developments for the last half of 2019:

- Oral argument in Liu v. SEC, No. 18-1501, is scheduled for March 3, 2020, when the Supreme Court will consider the power of the SEC—and potentially, by extension, other federal agencies—to order “equitable disgorgement” in light of the Supreme Court’s prior ruling in Kokesh v. SEC, 137 S. Ct. 1635 (2017).

- Anticipation for the Supreme Court’s decision in Jander—a case expected to examine the intersection of federal securities laws and ERISA—fizzled recently when the Supreme Court vacated and remanded for the Second Circuit to consider issues not resolved by its prior decision.

- Developments in the Delaware Court of Chancery include continued scrutiny of relationships between directors for purposes of independence analyses, consideration of when a stockholder letter constitutes a formal demand to take corrective actions, and determining whether a buyer is excused from closing on an acquisition when the target discovers that FDA approval of its only product is at risk because of its own officer’s fraud.

- Although no defendant has been found liable as a “disseminator” since the Supreme Court’s 2019 decision in Lorenzo, trial courts and the Tenth Circuit have begun to grapple with the case’s important implications.

- We continue to observe Omnicare’s falsity of opinions standard developing into a formidable pleading barrier to securities fraud claims, with both the Eleventh and Fifth Circuits recently upholding dismissals at the pleadings stage.

- Although the federal circuit courts of appeals did not provide any new guidance on “price impact” theories under Halliburton II during the second half of 2019, we expect the Second Circuit will soon reach a decision in Goldman Sachs II, which has been under consideration since June.

- Finally, New York recently amended the statute of limitations for Martin Act claims, extending it from three years to six years.

I. Filing and Settlement Trends

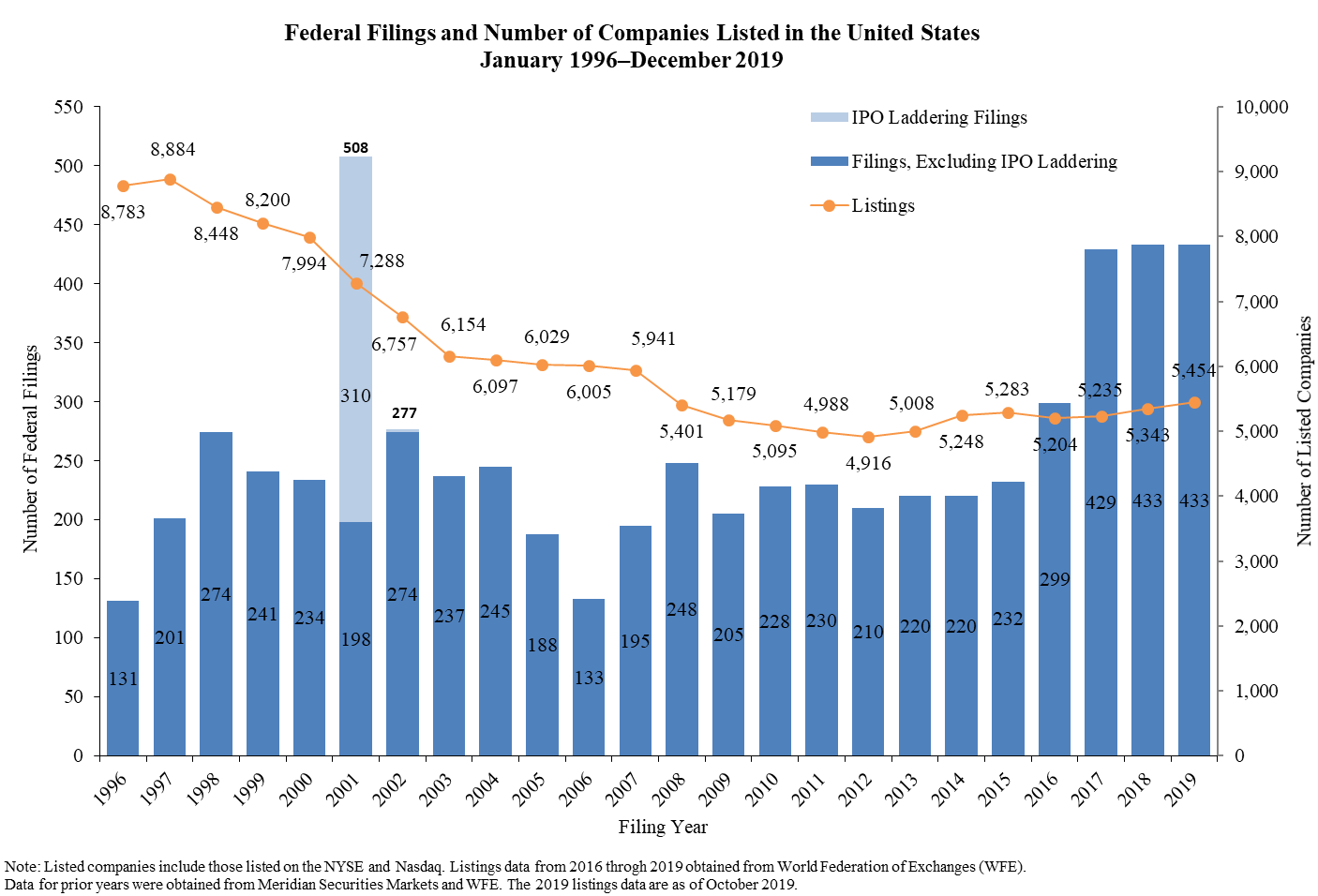

Data from a newly released NERA Economic Consulting (“NERA”) study shows that 2019 was a year largely unchanged from 2018. To start, the number of new federal class action cases filed in 2019 was equal to 2018, which buttressed a trend of increased filings that began in 2017.

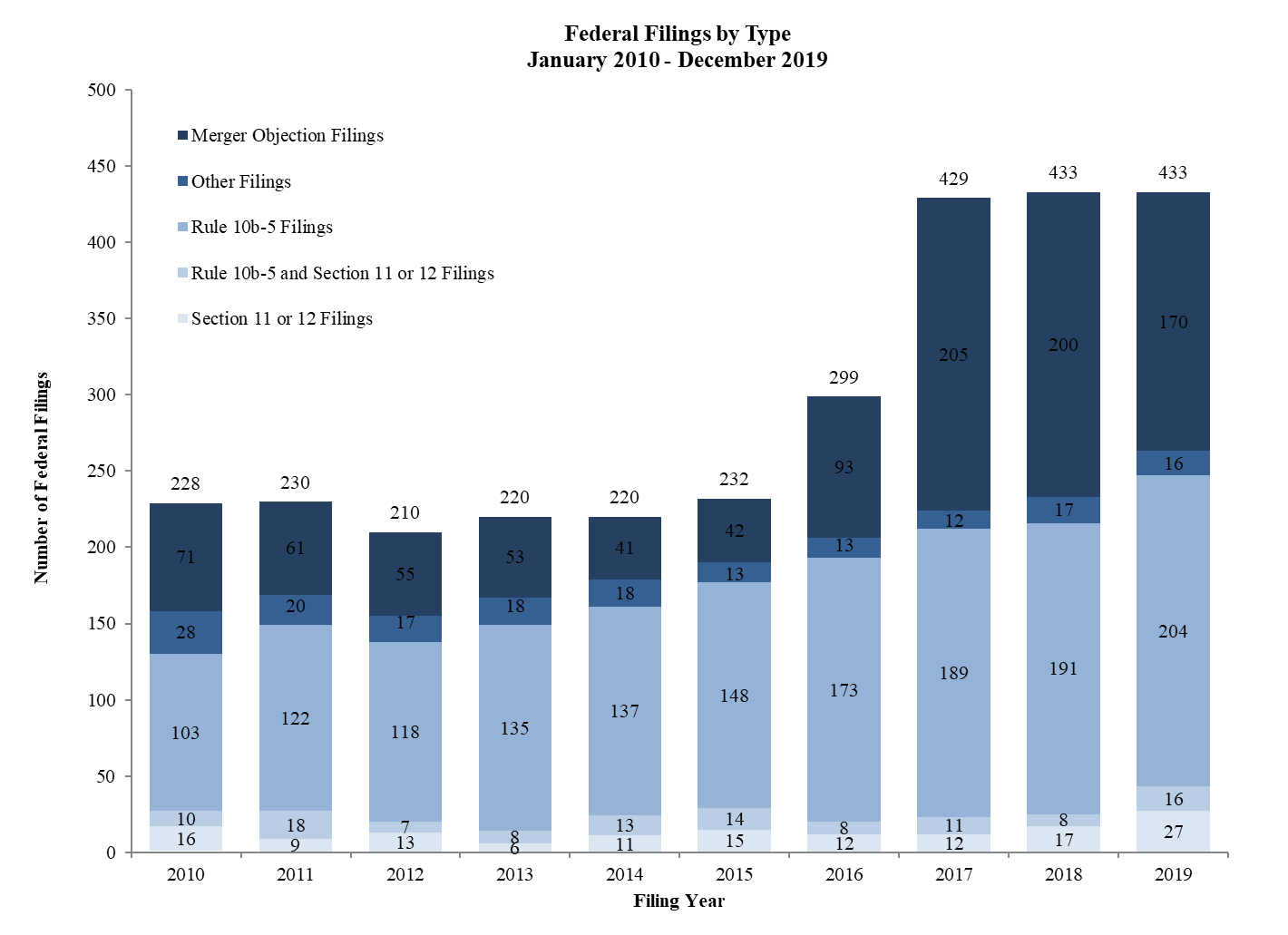

There has also been a continuation of the shift in the types of cases filed. The number of Rule 10b-5, Section 11 and Section 12 cases increased slightly in 2019, with 31 more filings than in 2018, while the number of merger objection cases fell.

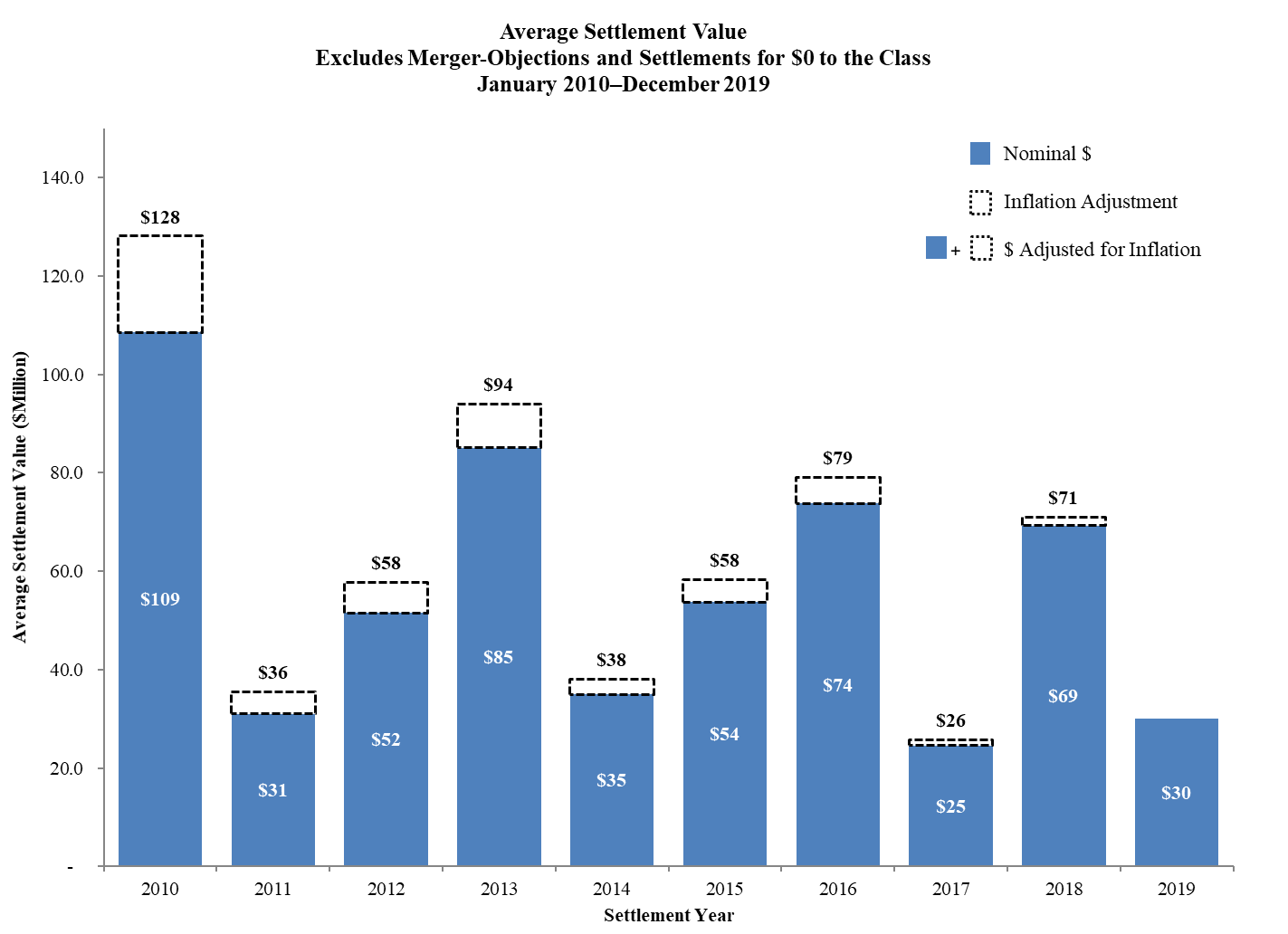

The median settlement values of federal securities cases for 2019—excluding merger-objection cases and cases settling for more than $1 billion or $0 to the class—was roughly equivalent to those in 2018 (at $13 million, up from $12 million in 2018). However, average settlement values were down by more than 50% (at $30 million, down from $71 million in 2018). This discrepancy is due in large part to the settlement of one case in 2018 exceeding $1 billion. Excluding such an outlier, we see only a slight increase in average settlement values compared to the prior two years.

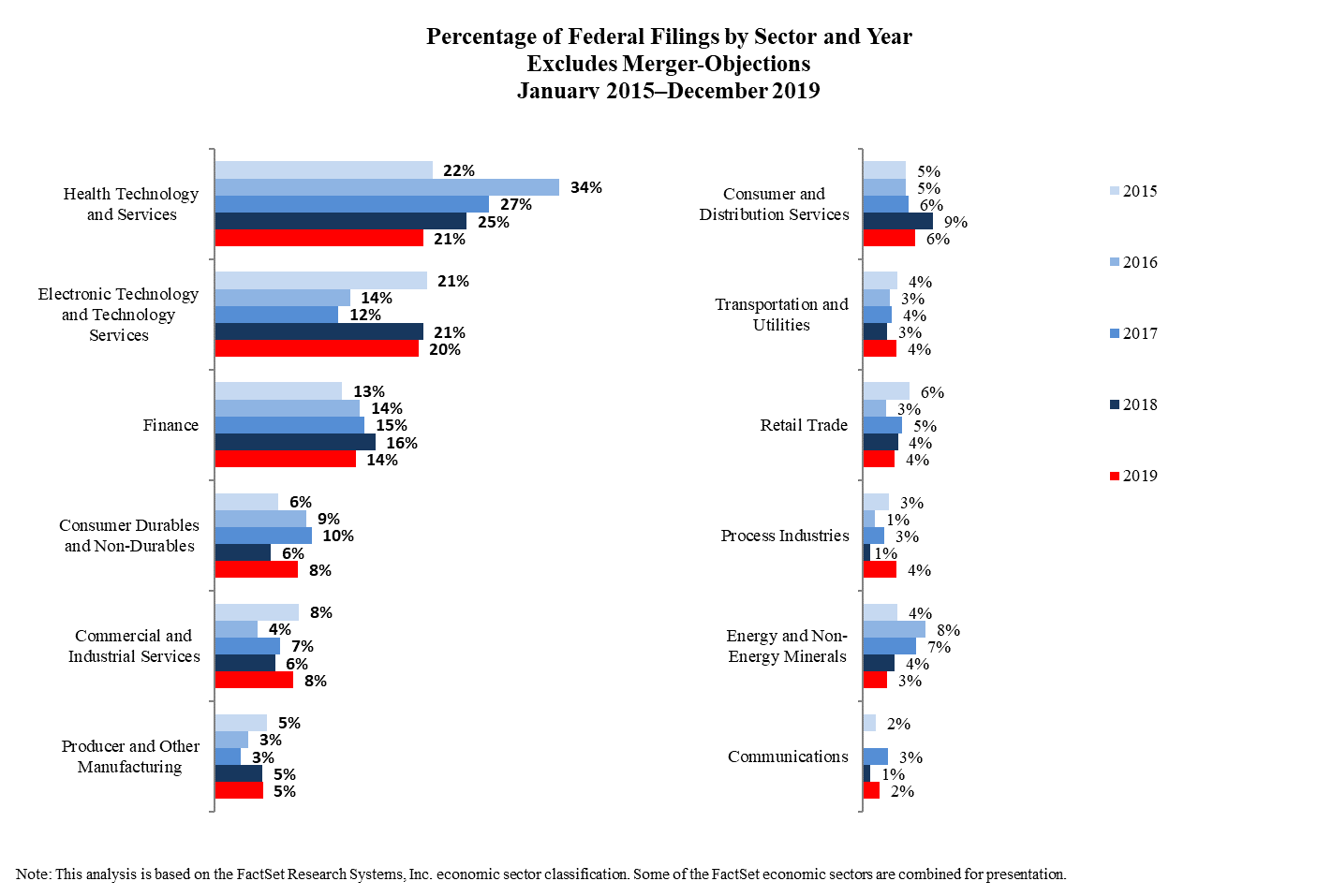

The industry sectors most frequently sued in 2019 continue to be the “Health Technology and Services” and “Electronic Technology and Technology Services” sectors, although 2019 saw the continuation of a downward trend in cases filed against healthcare companies following a spike in 2016.

A. Filing Trends

Figure 1 below reflects filing rates for 2019 (all charts courtesy of NERA). Four hundred and thirty-three cases were filed this past year, exactly matching the number of cases filed in 2018 and similar to the number of filings in 2017. However, this figure does not include the many class action suits filed in state courts or the rising number of state court derivative suits, including those filed in the Delaware Court of Chancery.

Figure 1:

B. Mix of Cases Filed in 2019

1. Filings by Industry Sector

As seen in Figure 2 below, the split of non-merger objection class actions filed in 2019 across industry sectors is fairly consistent with the distribution observed in 2018, with few indications of significant shifts or increases in particular sectors. As in 2018, the “Health Technology and Services” and the “Electronic Technology and Technology Services” sectors accounted for over 40% of filings, although there was a slight drop in “Health Technology and Services”-related filings (at 21%, down from 25% in 2018). The other two sectors reflecting the largest changes from 2018 are “Process Industries” (at 4%, up from 1% in 2018) and “Consumer and Distribution Services” (at 6%, down from 9% in 2018).

Figure 2:

2. Merger Cases

As shown in Figure 3 below, there were 170 merger objection cases filed in federal court in 2019. Although this is a 15% decrease from the number of such cases filed in 2018, the 170 filings continue the overall trend of a substantial increase in merger objection suits being filed in federal court after 2016, when the Delaware Court of Chancery put an effective end to the practice of disclosure-only settlements in In re Trulia Inc. Stockholder Litigation, 29 A.3d 884 (Del. Ch. 2016).

Figure 3:

C. Settlement Trends

As Figure 4 shows below, the average settlement value in 2019 declined by more than 50% from $71 million in 2018 to $30 million, but still remained higher than the average of $26 million in 2017. This decrease in the average settlement value can primarily be attributed to the inclusion of a settlement in 2018 that exceeded $1 billion, thereby skewing the average for that year. If our analysis is limited to cases with settlements under $1 billion, there actually is a slight increase in the average settlement value in 2019 compared to the prior years.

Figure 4:

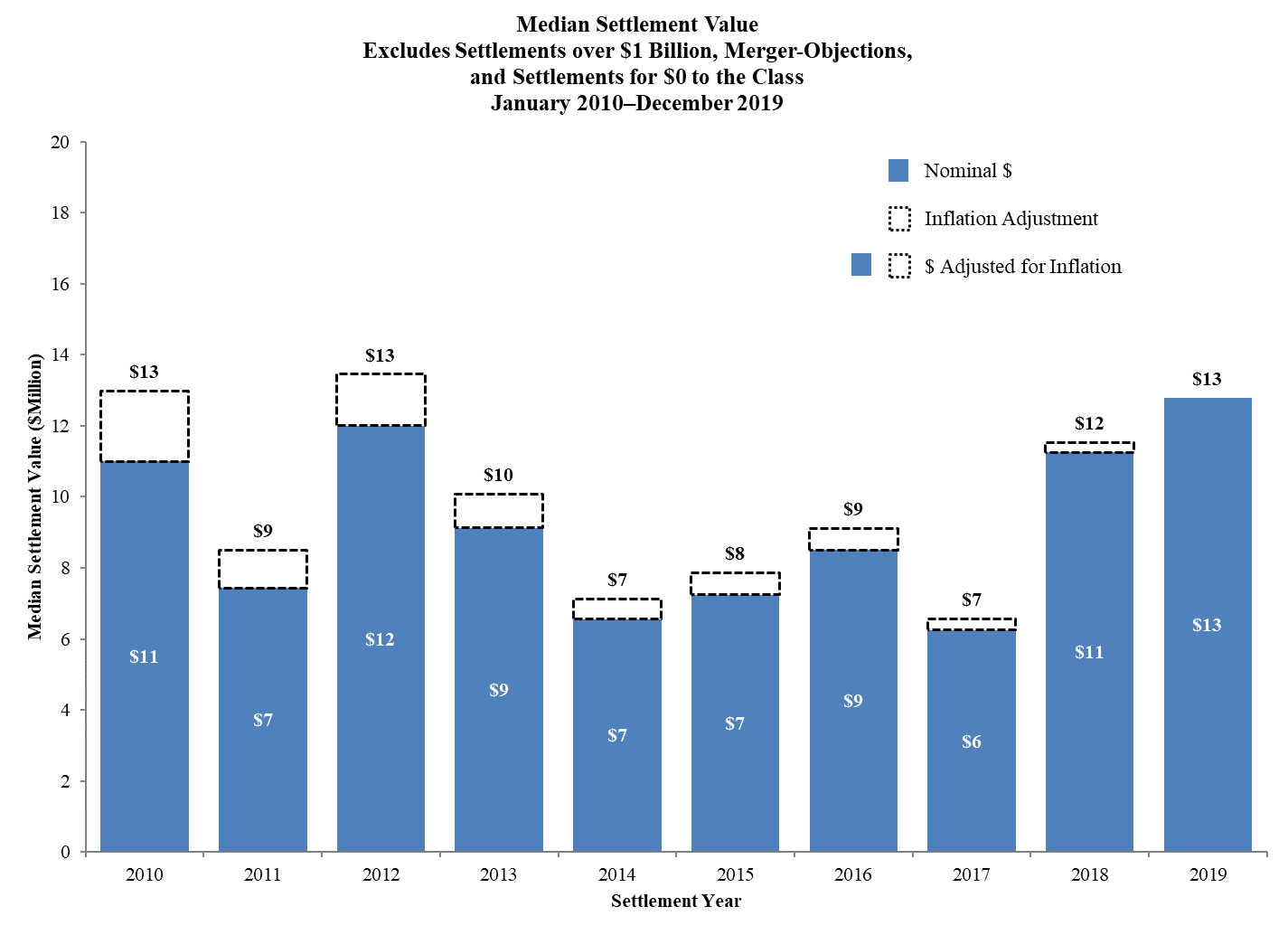

As Figure 5 shows, the median settlement value in 2019 was $13 million, which is similar to the median in 2018 ($12 million) and almost double the median value in 2017 ($7 million).

Figure 5:

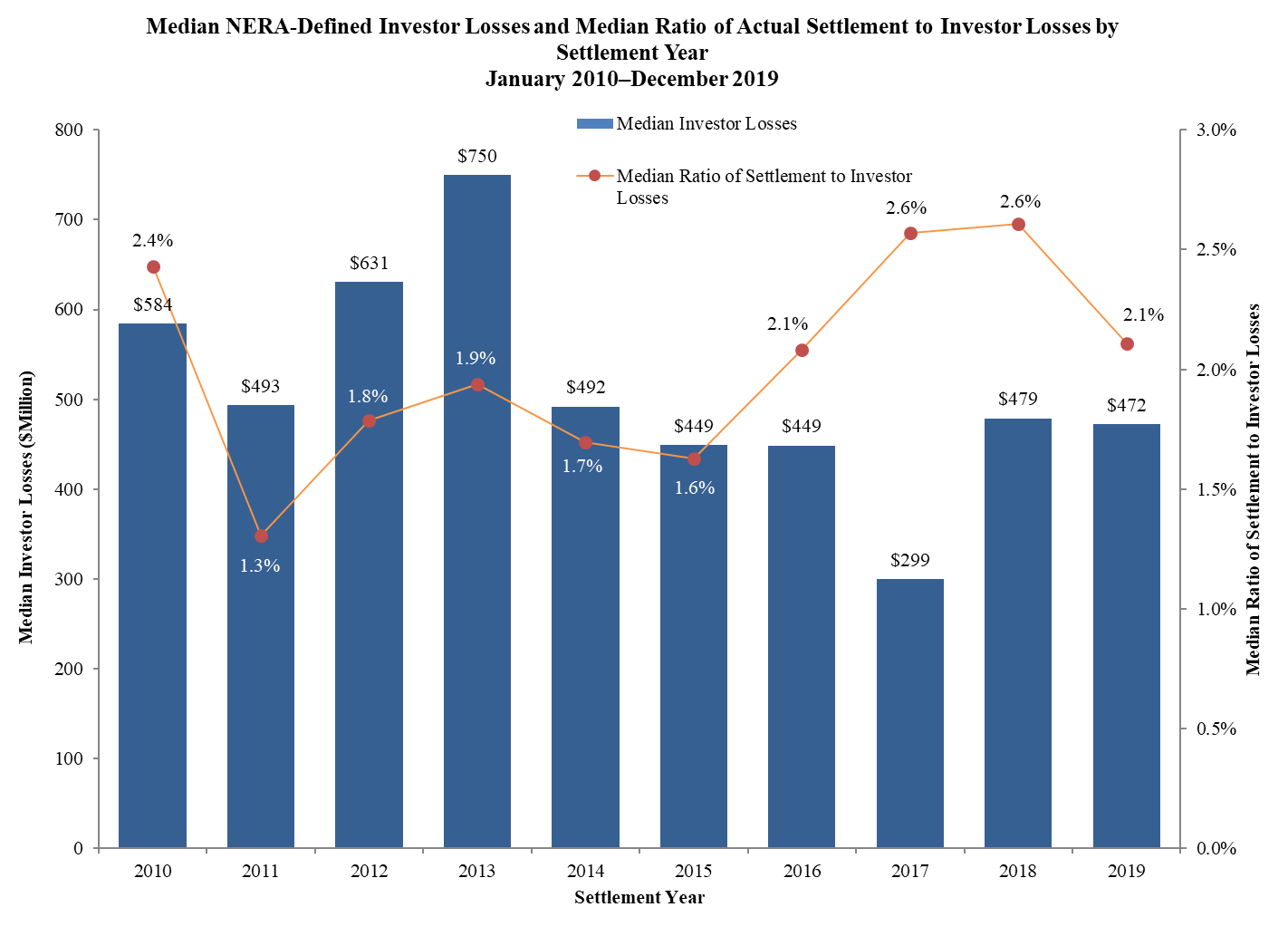

As shown in Figure 6, the Median NERA-Defined Investor Losses and Median Ratio of Actual Settlement to Investor Losses by Settlement Year remained steady in 2019 at $472 million, following a return in 2018 to a number similar to those recorded during the period 2014 through 2016.

Figure 6:

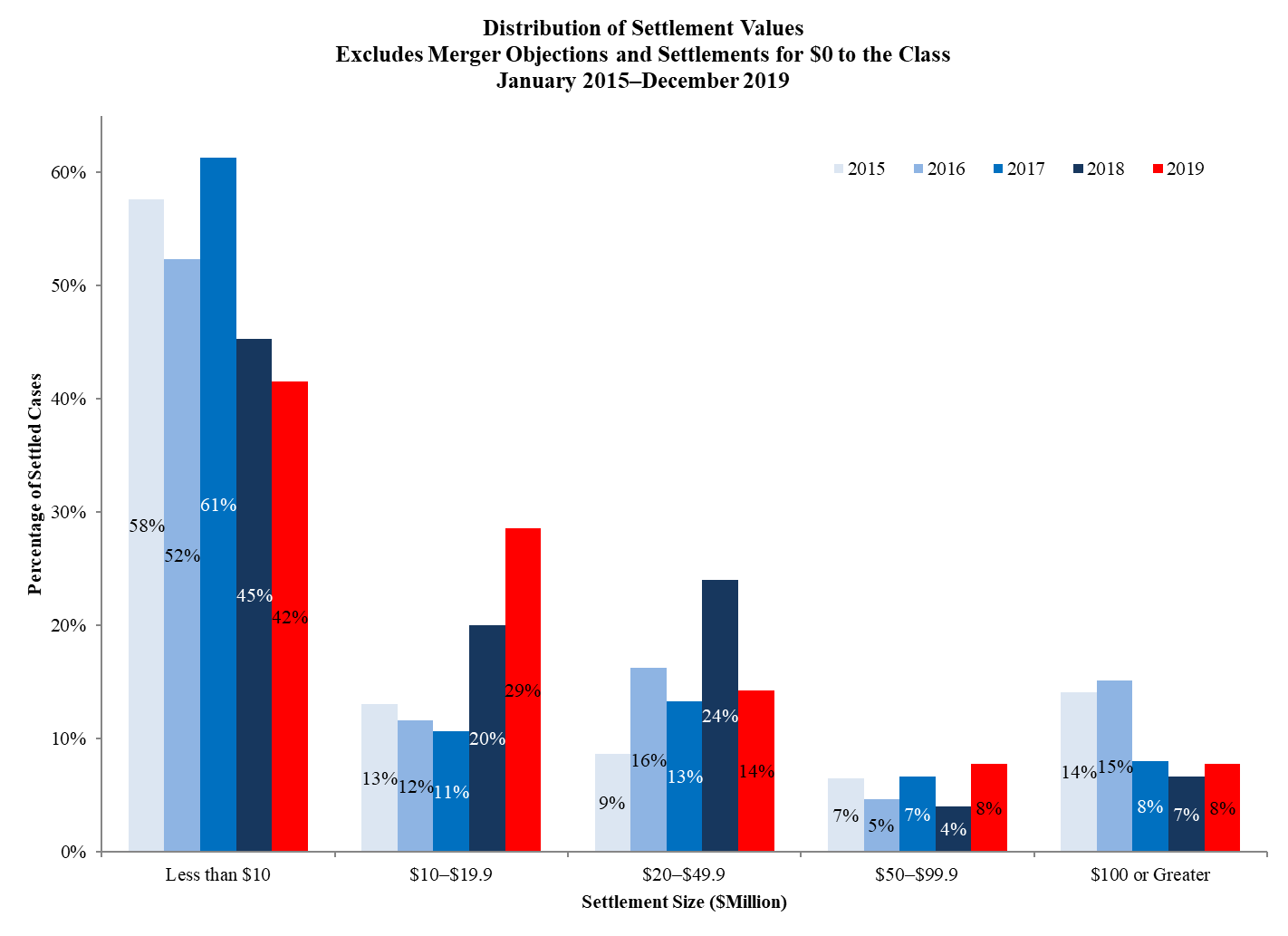

Finally, Figure 7 shows that 2018 saw increases in the percentage of settlements in the $10 to $19.9 million range, $50 to 99.9 million range, and $100+ million range. The perecentage of settlements in the $20 to $49.9 million range returned to virtually the same level that at which it was located in 2017, after experiencing a significant bump in 2018.

Figure 7:

II. What to Watch for in the Supreme Court

A. Disgorgement in SEC Enforcement Actions

On November 1, 2019, the Supreme Court granted certiorari in Charles C. Liu and Xin Wang A/K/A Lisa Wang v. SEC, No. 18-1501, to review a Ninth Circuit decision affirming summary judgment for the Securities and Exchange Commission (“SEC”) on a claim of securities fraud under Section 17(a)(2) of the Securities Act and ordering disgorgement of the entire amount that the petitioners had raised from investors.

Liu and Wang formed and controlled corporate entities presumably to build and operate a proton therapy cancer treatment center in Montebello, California. Liu financed the prospective cancer center with $27 million of international investments raised through the EB–5 Immigrant Investor Program—which allows foreigners to obtain permanent residency in the U.S. by investing at least $500,000 in a “Targeted Employment Area,” thereby creating at least 10 full-time jobs for U.S. workers.

Instead of pursuing proton therapy, Liu funneled over $20 million of investor money to himself, his wife Wang, and marketing companies associated with them. In fact, the bulk of the millions of dollars transferred occurred shortly after the SEC subpoenaed Liu as part of its initial investigation in February 2016. No permit was ever issued for the construction of the treatment center.

The SEC sought summary judgment on three securities fraud causes of action against the defendants but the district court addressed only the Section 17(a)(2) claim, given that it was a sufficient basis for the remedies sought by the SEC. See SEC v. Liu, 262 F. Supp. 3d 957, 970 (C.D. Cal. 2017). The SEC asked the court to, inter alia, order disgorgement of the total amount raised from the investors ($27 million) less the amount left over and available to be returned ($200,000). On the basis of its broad equitable power to order disgorgement of ill-gotten gains, and further discretion to indicate the amount to be disgorged, the court granted the relief sought by the SEC. See id. at 975.

On appeal to the Ninth Circuit, defendants argued that the district court’s disgorgement order was erroneous. SEC v. Liu, 754 F. App’x 505, 509 (9th Cir. 2018). Relying on Kokesh v. SEC, 137 S. Ct. 1635 (2017), defendants asserted that the district court lacked the power to order the disgorgement. Liu, 754 F. App’x at 509. In Kokesh, the Supreme Court held that disgorgement operates as a penalty, and any claim for disgorgement in an SEC enforcement action must be commenced within five years of the date the claim accrued. See Kokesh, 137 S. Ct. at 1645. Reviewing for abuse of discretion, the Ninth Circuit concluded that Kokesh expressly did not address the issue of whether a court had the equitable power to order disgorgement, thereby distinguishing it from Ninth Circuit precedent on this matter. See Liu, 754 F. App’x at 509.

In their petition for a writ of certiorari, Liu and Wang specifically questioned the equitable power to award disgorgement in the wake of Kokesh. They argued that circuit courts need guidance after Kokesh, and also challenged the use of what was characterized as “equitable disgorgement” by other agencies, including the FTC and the EPA. The Kokesh Court—in providing a historical summary of the SEC’s enforcement powers—seemed to express disapproval of the SEC’s continued use of disgorgement in enforcement proceedings. See 137 S. Ct. at 1640 (“The Act left the Commission with a full panoply of enforcement tools: It may promulgate rules, investigate violations of those rules and the securities laws generally, and seek monetary penalties and injunctive relief for those violations. In the years since the Act, however, the Commission has continued its practice of seeking disgorgement in enforcement proceedings.”).

Oral argument is scheduled for March 3, 2020. Based on the merits brief, it seems possible that the Court could issue a ruling further curtailing the SEC’s reliance on the disgorgement remedy in civil enforcement actions.

B. Intersection Between Securities Laws and ERISA

On June 3, 2019, the Supreme Court granted certiorari in Retirement Plans Committee of IBM v. Jander, No. 18-1165. Fiduciaries of the IBM retirement plan had sought review of the Second Circuit’s decision, which reversed the district court’s dismissal of retirement plan participants’ putative class complaint alleging that the Committee members breached their duties of prudence and loyalty under ERISA by continuing to invest in IBM stock while in possession of inside information about the company’s supposedly fraudulent practices.

IBM offers its employees an ERISA-qualified employee stock ownership plan (“ESOP”), which invests primarily in IBM common stock. See Jander v. Ret. Plans Comm. of IBM, 910 F.3d 620, 622 (2d Cir. 2018). Employees sued, arguing that plan fiduciaries (who were company insiders) breached their duty of prudence under ERISA by continuing to invest the plan in IBM stock despite allegedly knowing its market price was artificially inflated due to the company’s concealment of troubles in IBM’s microelectronics business. See id. at 622–23. Employees claimed that fiduciaries should either have disclosed the issues with the business’s valuation or frozen further investment in IBM stock. See id. at 623.

The district court dismissed the employees’ complaint for failure to state a claim because they failed to meet the pleading standard set forth in Fifth Third Bancorp v. Dudenhoeffer, 573 U.S. 409, 428 (2014), which requires ERISA plaintiffs to “plausibly allege an alternative action that the defendant could have taken that would have been consistent with the securities laws and that a prudent fiduciary in the same circumstances would not have viewed as more likely to harm the fund than to help it.” After employees amended their complaint to allege that disclosure of the fraud was inevitable and the harm of such disclosure would generally increase over time, as well as adding another possible alternative action fiduciaries could have taken, the district court again dismissed under Dudenhoeffer, because fiduciaries could reasonably conclude that all three alternatives would cause more harm than good. See Jander v. Ret. Plans Comm. of IBM, 272 F. Supp. 3d 444, 451–54 (S.D.N.Y. 2017).

The Second Circuit reversed, holding that “when a ‘drop in the value of the stock already held by the fund’ is inevitable, . . . it is far more plausible that a prudent fiduciary would prefer to limit the effects of the stock’s artificial inflation on the ESOP’s beneficiaries through prompt disclosure.” Jander, 910 F.3d at 630 (citation omitted) (quoting Dudenhoeffer, 573 U.S. at 430). The Second Circuit found that the employees therefore met the Dudenhoeffer standard by alleging, in part, research suggesting that the employees’ losses would have been smaller if negative information were disclosed promptly. Id. at 629–30. Plan fiduciaries petitioned for a writ of certiorari.

After certiorari was granted, the fiduciaries (and the Solicitor General, on behalf of the SEC and the Department of Labor) focused on other arguments in their merits briefing. See Ret. Plans Comm. of IBM v. Jander, 2020 WL 201024, at *1 (U.S. Jan. 14, 2020) (per curiam). The fiduciaries argued for a bright-line rule that ERISA could never impose a duty on them to act on inside information. Id. The Government argued that requiring fiduciaries to disclose inside information under ERISA that is not otherwise required to be disclosed by the securities laws would conflict with the complex disclosure requirements imposed by those laws.

Rather than resolve the questions presented on the pleading standard in breach of fiduciary duty cases involving employee-benefit plans, on January 14, 2020 the Supreme Court vacated and remanded back to the Second Circuit for consideration of the issues raised in the merits briefing that were not resolved by the previous decision. Id. at *2. In remanding, the Court referenced its statement in Dudenhoeffer that the SEC’s views “might ‘well be relevant’ to discerning the content of ERISA’s duty of prudence in this context.” Id. (quoting Dudenhoeffer, 573 U.S. at 429).

Justice Kagan authored a concurring opinion, joined by Justice Ginsburg, noting that the Second Circuit could refuse to hear these new arguments if they were not properly preserved. Id. (Kagan, J., concurring). And if the Second Circuit did choose to address them, Justice Kagan opined that they would be hard to square with Dudenhoeffer, as that case “makes clear that an ESOP fiduciary at times has . . . a duty” to act on insider information given that it “sets out exactly what a plaintiff must allege to state a claim that the fiduciary breached his duty of prudence by ‘failing to act on inside information.’” Id. (quoting Dudenhoeffer, 573 U.S. at 423). Justice Kagan disagreed with the Government’s argument that ERISA only imposes such a duty when already imposed by the securities laws, explaining that Dudenhoeffer only holds that there is no duty to disclose when it would “violat[e],” or “conflict[]” with the “requirements” or “objectives” of those laws. Id. (quoting Dudenhoeffer, 573 U.S. at 428–29). Justice Kagan therefore left open the possibility that disclosure might be required under ERISA “even if the securities laws do not require it,” positing that in such a “conflict-free zone” the question would be whether a “prudent fiduciary would think the action more likely to help than to harm the fund.” Id. (citing Dudenhoeffer, 573 U.S. at 428).

Justice Gorsuch also authored a concurring opinion, disagreeing with Justice Kagan’s “broad[]” reading of Dudenhoeffer, and noting that the “pure question of law” raised in the case should be “addressed immediately.” Id. at *3 (Gorsuch, J., concurring). Under Justice Gorsuch’s view, Dudenhoeffer does not impose liability on plan fiduciaries for “alternative actions they could have taken only in a nonfiduciary capacity.” Id.

As Jander involves important questions regarding the fiduciary duties of pension plan managers who invest in company stock, including the intersection between the securities laws and ERISA, readers can expect that this will not be the Supreme Court’s last word on the issue.

III. Delaware Developments

A. The Delaware Court of Chancery Continues to Scrutinize Relationships Between Directors

Over the last several years, Delaware courts have reviewed independence among directors with seemingly increased scrutiny. See, e.g., Marchand v. Barnhill, 212 A.3d 805 (Del. 2019) (director’s 28-year relationship with CEO’s family rebutted presumption of independence); Sandys v. Pincus, 152 A.3d 124 (Del. 2016) (director’s 50-year friendship with controller rebutted presumption of independence); Del. Cty. Emps. Ret. Fund v. Sanchez, 124 A.3d 1017 (Del. 2015) (director and controller’s co-ownership of airplane rebutted presumption of independence). The Court of Chancery continued that apparent trend in In re BGC Partners, Inc., where it closely scrutinized the relationships between the members of BGC’s board of directors and the company’s controller. 2019 WL 4745121, at *1 (Del. Ch. Sept. 30, 2019).

In BGC, stockholders of BGC purported to bring a derivative action against its controlling stockholder—who also served as its Chairman and CEO—and other directors based on the theory that the controller caused BGC to acquire and overpay for another company in which the controller owned a controlling stake. Id. at *1–2. As the controller’s interest in the transaction was conceded, the court’s analysis of whether the plaintiffs adequately pleaded demand futility and rebutted the business judgment rule turned on whether a majority of BGC’s directors were interested in the proposed transaction or lacked independence with respect to the controller. Id. at *9.

Based on a deep dive into three particular directors’ professional and personal connections to the controller, id. at *10–14, the court held that it could infer that a majority of directors lacked independence, id. at *9. For the first director, the court noted that he had a 20-year professional and personal relationship with the controller, including attending galas with each other’s families and the controller’s setting up a private tour of a museum for the director’s family. Id. at *11–12. For the second and third directors, the court focused on their service on the boards of other companies affiliated with the controller and how their income from this service was likely to be material relative to their other sources of income. Id. at *12–14. The Court also referenced both of these directors’ ties to a college to which the controller had made substantial donations. Id. Although one director was no longer affiliated with that college, the court explained that past benefits could be enough to create a sense of obligation to the controller. Id. at *12.

B. Court of Chancery Interprets Demand Letter

Whether a stockholder’s letter to the board is a “demand” affects the standard of review applicable to any litigation arising from that letter. If the letter is indeed a demand, then, under Delaware law, the stockholder has “tacitly concede[d]” that the board was able to exercise its business judgment in considering it. Spiegel v. Buntrock, 571 A.2d 767, 777 (Del. 1990). In Solak v. Welch, 2019 WL 5588877 (Del. Ch. Oct. 30, 2019), the Delaware Court of Chancery held that a stockholder’s letter was a “demand” even though it did not expressly demand litigation.

The stockholder plaintiff in Solak sent a letter to the company’s board of directors “to suggest that the [board] take corrective action to address excessive director compensation as well as compensation practices and policies pertaining to directors.” Solak, 2019 WL 5588877, at *2. The letter asserted that the company’s compensation policy “lacks any meaningful limitations” and “warn[ed]” that “[t]he company is more susceptible than ever to shareholder challenges unless it revises or amends its director compensation practices and policies.” Id. The letter “suggest[ed]” that the board “take immediate remedial measures” and stated that the plaintiff “would consider ‘all available stockholder remedies’” if the board failed to respond within 30 days. Id. But the letter also included a footnote saying that “nothing contained herein shall be construed as a pre-suit litigation demand under Delaware Chancery Rule 23.1,” and that “[w]e do not seek or expect the board to initiate any legal action against its members.” Id.

The board sent a response letter explaining that it viewed the stockholder letter as a demand, and declined to take any of the remedial actions suggested in the stockholder letter. Id. at *3. So the stockholder sued, purporting to assert derivative claims. Id. At issue was whether the letter counted as a “demand” on the board. Id. at *4. The court explained that a pre-suit communication need not expressly demand litigation to be deemed a demand. Id. at *5–6. Rather, the letter need only “clearly articulat[e] the remedial action to be taken by the board” or “clearly demand[] corporate action.” Id. at *5. The letter’s “strong overtures of litigation” and suggested remedial measures met this test, notwithstanding its footnote purportedly disclaiming that it was a demand. Id. at *6–7. And because the letter was a demand, the strict demand-refused standard applied, which the plaintiff could not overcome. Id. at *8–9.

C. Despite Akorn, an MAE Is Still a Rare Event Requiring a Buyer to Carry a Heavy Burden

As we discussed in our 2018 Year-End Securities Litigation Update, in 2018, the Delaware Supreme Court affirmed the Court of Chancery’s conclusion that a buyer had proven it properly terminated a merger agreement because the target had suffered a “material adverse effect” (or “MAE”)—a first for both courts. See Akorn, Inc. v. Fresenius Kabi AG, 2018 WL 4719347 (Del. Ch. Oct. 1, 2018), aff’d, 198 A.3d 724 (Del. 2018). As the Court of Chancery explained, the test for an MAE is “whether there has been an adverse change in the target’s business that is consequential to the company’s long-term earnings power over a reasonable period, which one would expect to be measured in years rather than months.” Id. at *53.

In Channel Medsystems, the first case since Akorn to consider whether an MAE had occurred, the Court of Chancery confirmed that triggering an MAE clause remains a high bar. Channel Medsystems, Inc. v. Boston Scientific Corp., 2019 WL 6896462 (Del. Ch. Dec. 18, 2019). In that case, Boston Scientific sought to be relieved from its agreement to acquire Channel after Channel learned and disclosed that fraud committed by its Vice President of Quality put at risk FDA approval of its only device even though “the FDA [had] accepted Channel’s remediation plan” and “made the FDA’s approval a distinct possibility.” Id. at *1. Indeed, one month before trial in Channel Medsystems, and “consistent with the timeframe for receiving FDA approval the parties expected when they entered into the [merger agreement],” the FDA approved the device. Id.

The Court of Chancery concluded that “Boston Scientific failed to prove based on both qualitative and quantitative factors that it was entitled to terminate [the parties’ agreement].” Id. at *36.

First, the court considered whether Boston Scientific held, at the time it purported to terminate the deal, “a reasonable expectation” that Channel “would reasonably be expected” to suffer a qualitatively significant adverse effect as of the closing date. Id. at *25, *29. But the court found virtually no contemporaneous evidence suggesting that Boston Scientific held such an expectation. Id. at *33. To the contrary, Boston Scientific had failed to take any reasonable steps to make an informed decision regarding the likely impact of the fraud on Channel and instead had relied solely on a report provided by Channel, which actually concluded the fraud had no impact on the device. Id. at *29–30.

Second, the court rejected Boston Scientific’s attempt to demonstrate the quantitative impact of the fraud on Channel’s value to Boston Scientific as of the date that the merger agreement was signed. Id. at *34. The court did so in large part because Boston Scientific based its expert’s analysis on assumptions that were not objectively reasonable. Id. In particular, Boston Scientific’s expert assumed that Channel’s only product would have to be held off the market for two to four years for remediation and retesting. Id. The court found that this assumption was not objectively reasonable, however, because “Boston Scientific’s own track record and the testimony of its own witnesses belie[d] the contention that it was necessary to remediate an retest [the device] before placing it on the market given the FDA’s approval of the device.” Id. at *28–29, 35.

IV. Lower Courts Grappling with Implications of Lorenzo

As we discussed in our 2019 Mid-Year Securities Litigation Update, on March 27, 2019, the Supreme Court held in Lorenzo v. SEC, 139 S. Ct. 1094 (2019), that those who disseminate false or misleading information to the investing public with the intent to defraud can be found liable under Section 17(a)(1) of the Securities Act and under Exchange Act Rules 10b-5(a) and 10b-5(c), even if the disseminator did not “make” the statements and was thus not subject to enforcement under Rule 10b-5(b).

Importantly, in Lorenzo, the Court stated that “[t]hose who disseminate false statements with intent to defraud are primarily liable under Rules 10b-5(a) and (c),” as well as Section 10(b) of the Exchange Act and Section 17(a)(1) of the Securities Act, “even if they are secondarily liable under Rule 10b-5(b).” Lorenzo, 139 S. Ct. at 1104. This holding raises the possibility that secondary actors could face liability under Exchange Act Rules 10b-5(a) and 10b-5(c) simply for disseminating the alleged misstatement of another if a plaintiff can show that they knew the statements contained false or misleading information. Although this issue has yet to come up in other cases, over the last year, three lower federal courts have grappled with how to apply Lorenzo in other ways.

First, in April 2019, the Southern District of New York relied on Lorenzo to find that the SEC had adequately pleaded scheme liability under Rule 10b-5(a) and (c) even though it had alleged no deceptive act other than misstatements or omissions. SEC v. SeeThruEquity, LLC, 2019 WL 1998027 (S.D.N.Y. Apr. 26, 2019). The defendants, a stock research company and its co-founders, were accused of failing to disclose that they were paid by a company that they were recommending in their research reports. Id. at *1–3. They argued the SEC could not plead “scheme liability” under Rule 10b-5 because they had been accused of no deceptive acts beyond the misstatements themselves. Id. at *5. The court rejected this argument, stating that “[t]he complaint alleges that the defendants’ entire business model, beyond any misstatements or omissions, is deceptive.” Id.

Then, in August 2019, the Tenth Circuit expanded Lorenzo further, holding that scheme liability could be found based on a failure to correct a misstatement. See Malouf v. SEC, 933 F.3d 1248 (10th Cir. 2019). In Malouf, the defendant had occupied two key positions at separate firms—one was a branch of the broker-dealer firm Raymond James Financial Services (“Raymond James”) and the other, UASNM, Inc. (“UASNM”), provided clients with investment advice. Id. at 1253–54. After Raymond James became concerned about the defendant’s dual role at the two firms, the defendant sold his Raymond James branch, which was to be paid for in installments based on the branch’s “collection of securities-related fees.” Id. at 1254. To collect on the sale, the defendant routed bond trades for his UASNM clients through the Raymond James branch so that the branch’s buyer could pay the defendant back with money accrued through commissions. Id. The defendant did not disclose this arrangement to anyone at UASNM, which publicly touted that it provided its clients with “impartial advice untainted by any conflicts of interest.” Id. Meanwhile, the defendant also helped decide what UASNM would include in its public disclosures, but “took no steps to remedy UASNM’s misstatements or to disclose his own conflict of interest.” Id. at 1254–55. Ultimately, after an outside consultant caught wind of the conflict, it was disclosed. Id. at 1255. During an enforcement action, the administrative law judge found that the defendant had violated, among other things, Section 17(a)(1) of the Securities Act and Exchange Act Rules 10b-5(a) and 10b-5(c). Id.

On appeal, the Tenth Circuit affirmed. Id. at 1253. In connection with Section 17(a)(1) of the Securities Act and Exchange Act Rules 10b-5(a) and 10b-5(c), the court stated “we conclude that [the defendant’s] failure to correct UASNM’s misstatements could trigger liability” because, under Lorenzo, “a person could incur liability under these provisions when the conduct involves another person’s false or misleading statement.” Id. at 1259–60 (citing 139 S. Ct. at 1101–03). In other words, the panel accepted that the defendant was liable because, although he did not disseminate UASNM’s alleged misstatements, he failed to correct the relevant disclosures that he knew were false.

Finally, in December 2019, in EnSource Investments LLC v. Willis, 2019 WL 6700403 (S.D. Cal. Dec. 6, 2019), a court found that Lorenzo did not apply to entities involved in an allegedly fraudulent scheme because those entities had not “disseminated any false statements.” Id. at *13. In EnSource, two entities were “under the umbrella” of another company and its founder, both of whom were defendants in the case. Id. at *1. The founder and parent company were found to have made misstatements “on behalf” of the entities. Id. at *13. Rather than holding that these entities had a duty under Lorenzo to correct the misstatements made on their behalf, the EnSource court simply found that because the entities did not disseminate the misstatements, Lorenzo did not apply. Id. at *13.

It remains to be seen whether cases such as SeeThruEquity or Malouf will be confined to their facts or whether courts will adopt or expand on these holdings to increase the reach of scheme liability. We will, of course, provide an update on the direction that courts take Lorenzo and scheme liability in our 2020 Mid-Year Securities Litigation Update.

V. Falsity of Opinions – Omnicare Update

As we discussed in our prior securities litigation updates, lower courts continue to explore application of the standard set forth in Omnicare, Inc. v. Laborers District Council Construction Industry Pension Fund, 575 U.S. 175 (2015), for determining falsity of an opinion. In its Omnicare decision, the Supreme Court addressed the scope of liability for false opinion statements under Section 11 of the Securities Act and held that “a sincere statement of pure opinion is not an ‘untrue statement of material fact,’ regardless whether an investor can ultimately prove the belief wrong.” Id. at 186. According to that standard, an opinion statement can give rise to liability only when the speaker does not “actually hold[] the stated belief,” or when the opinion statement contains “embedded statements of fact” that are untrue. Id. at 184–85. In the “omission” section of the opinion, the Court held that a factual omission “about the issuer’s inquiry into or knowledge concerning a statement of opinion” gives rise to liability when the omitted facts “conflict with what a reasonable investor would take from the statement itself.” Id. at 1329.

Omnicare’s falsity of opinions standard continues to serve as a significant pleading barrier to securities fraud claims. In Carvelli v. Ocwen Financial Corp., the Eleventh Circuit Court of Appeals held that the plaintiff failed to show the defendant’s “statements of opinion are mutually exclusive of—or even inconsistent with—[the company]’s alleged knowledge,” and therefore the complaint failed to meet the pleading standard set forth in Omnicare. 934 F.3d 1307, 1323 (11th Cir. 2019). The court noted that merely an inference that the company “could or should have known” that its belief about the company’s economic vitality conflicted with the company’s “persistent” technology problems is insufficient to show the company did not believe its statements of opinion. Id. (emphasis original).

In its first decision applying the standard for opinion liability post-Omnicare, the Fifth Circuit Court of Appeals affirmed the dismissal of a case concerning an oil company’s stated belief that it was in “substantial compliance” with regulatory obligations. Police & Fire Ret. Sys. of City of Detroit v. Plains All Am. Pipeline, L.P., 777 F. App’x 726 (5th Cir. 2019) (“Plains II”). As discussed in our 2018 Mid-Year Securities Litigation Update, the Southern District of Texas dismissed allegations that statements concerning compliance were misleading on the basis that a regulatory agency had identified issues that concerned only a different and small part of the company’s varied operations. In re Plains All Am. Pipeline, L.P. Sec. Litig., 307 F. Supp. 3d 583, 621–22 (S.D. Tex. 2018). The Fifth Circuit concurred that the company’s “belief statements” regarding its compliance “were broadly applicable and therefore were not rendered false or misleading” by issues that affected “a small percentage” of the company’s pipelines. Plains II, 777 F. App’x at 731.

In the latter half of 2019, several courts reached differing conclusions on whether companies could be held liable for opinions about the results of scientific research. In Lehman v. Ohr Pharmaceuticals, plaintiffs alleged that a company’s optimistic announcements about second-phase drug trials were misleading where the company omitted that the results were only meaningful because the control group fared significantly worse than in historical trials. 2019 WL 4572765 (S.D.N.Y. Sept. 20, 2019). The Southern District of New York disagreed, relying on the Second Circuit’s opinion in Tongue v. Sanofi, in which the court found that a pharmaceutical company’s statements were not misleading even though they did not “include a fact that would have potentially undermined Defendants’ optimistic projections.” Id. at *3 (citing Tongue v. Sanofi, 816 F.3d 199, 212 (2d Cir. 2016)). Judge Preska also cautioned against courts issuing decisions that would compel caution rather than optimism about the results of such an experiment: “[T]he law does not abide attempts at using the judiciary to stifle the risk-taking that undergirds scientific advancement and human progress. The answer to bad science is more science, not this Court’s acting as the Southern District for the Inquisition.” Id. at *5.

By contrast, in Micholle v. Ophthotech Corp., the court considered whether an opinion that a change in testing methodology had no “meaningful” impact on who was eligible to participate in a certain drug trial was actionable in light of plaintiff’s allegations that there was at least a 17% difference. 2019 WL 4464802, at *12 (S.D.N.Y. Sept. 17, 2019). The court denied dismissal because “[m]ateriality is a fact-specific inquiry” and an “investor may well have considered the degree of similarity between the parameters of a new clinical trial and those of a recently completed—and purportedly very successful—clinical trial important.” Id. at *13.

There were a handful of reported decisions that focused on whether a complaint sufficiently pled the omission of contrary facts that rendered positive opinions regarding the company’s business misleading. For example, in Hawaii Structural Ironworkers Pension Trust Fund v. AMC Entertainment Holdings, Inc., plaintiffs plausibly alleged that opinions about the “smooth” process of integrating a recent acquisition implied “that there were no significant or systemic obstacles to [the] integration.” 2019 WL 4601644, at *12 (S.D.N.Y. Sept. 23, 2019). Similarly, in Vignola v. FAT Brands, Inc., a Central District of California court denied the defendants’ motion to dismiss statements concerning the experience and track record of the company’s senior leadership team. 2019 WL 6888051, at *10 (C.D. Cal. Dec. 17, 2019). The court considered that while investors do understand that opinions generally are formed by weighing competing facts, here, the company allegedly omitted the key fact “that the same leadership team had previously steered the subsidiaries of its same flagship brand into bankruptcy.” Id. at *10 (emphasis original).

VI. Halliburton II Market Efficiency and “Price Impact” Cases

We are continuing to monitor significant decisions interpreting Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014) (“Halliburton II”). The federal circuit courts of appeals did not provide any new guidance in the second half of 2019, but certain questions have been recurring in trial courts recently. Recall that in Halliburton II, the Supreme Court preserved the “fraud-on-the-market” presumption, permitting plaintiffs to maintain the common proof of reliance that is required for class certification in a Rule 10b-5 case, but also permitting defendants to rebut the presumption at the class certification stage with evidence that the alleged misrepresentation did not impact the issuer’s stock price. The key questions we have been following in the wake of Halliburton II are the following: (1) How should courts reconcile the Supreme Court’s explicit ruling in Halliburton II that direct and indirect evidence of price impact must be considered at the class certification stage, Halliburton II, 573 U.S. at 283, with the Supreme Court’s previous decisions in Erica P. John Fund, Inc. v. Halliburton Co., 563 U.S. 804 (2011) (“Halliburton I”), and Amgen Inc. v. Connecticut Retirement Plans & Trust Funds, 568 U.S. 455 (2013), holding that plaintiffs need not prove loss causation or materiality until the merits stage?; (2) What standard of proof must defendants meet to rebut the presumption with evidence of no price impact?; and (3) What evidence is required to successfully rebut the presumption?

As previously discussed in our 2018 Year-End Securities Litigation Update, the Second Circuit addressed the first two questions in Waggoner v. Barclays PLC, 875 F.3d 79 (2d Cir. 2017) (“Barclays”) and Arkansas Teachers Retirement System v. Goldman Sachs, 879 F.3d 474 (2d Cir. 2018) (“Goldman Sachs”). Those decisions remain the most substantive interpretations of Halliburton II. Barclays held that after a plaintiff establishes the presumption of reliance applies, the defendant bears the burden of persuasion to rebut the presumption by a preponderance of the evidence. Barclays, 875 F.3d at 100–03. Though this appeared to put the Second Circuit at odds with the Eighth Circuit, which cited Rule 301 of the Federal Rules of Evidence when reversing a trial court’s certification order on price impact grounds, IBEW Local 98 Pension Fund v. Best Buy Co., 818 F.3d 775, 782 (8th Cir. 2016), the inconsistency was not enough to persuade the Supreme Court to take up the issue, Barclays PLC v. Waggoner, 138 S. Ct. 1702 (Mem.) (2018) (denying writ of certiorari).

In Goldman Sachs, the Second Circuit vacated the trial court’s ruling certifying a class and remanded the action, directing that price impact evidence must be analyzed prior to certification, even if price impact “touches” on the issue of materiality. Goldman Sachs, 879 F.3d at 486. Recent district court decisions in the latter half of 2019 have embraced this approach when reconciling Halliburton II with Halliburton I and Amgen. See, e.g., In re Chicago Bridge & Iron Co. N.V. Sec. Litig., 2019 WL 5287980, at *21–23 (S.D.N.Y. Oct. 18, 2019) (concluding price impact analysis appropriate prior to class certification even if it may “touch on materiality”); Di Donato v. Insys Therapeutics, Inc., 2019 WL 4573443, at *6 (D. Ariz. Sept. 20, 2019) (explaining that a plaintiff need not prove materiality at the class certification stage). The Southern District of New York again certified the Goldman Sachs class, In re Goldman Sachs Grp. Sec. Litig., 2018 WL 3854757, at *1–2 (S.D.N.Y. Aug. 14, 2018), holding that while the price had not moved in response to previous statements on the same subject as the alleged corrective disclosures, those disclosures were sufficiently different to credit plaintiff’s expert’s “link between the news of [defendant]’s conflicts and the subsequent stock price declines,” and that defendants’ expert testimony was insufficient to “sever” that link. Id. at *4–6. The Second Circuit agreed to review the decision recertifying the class, see Order, Ark. Teachers Ret. Sys. v. Goldman Sachs, Case No. 18-3667 (2d Cir. Jan. 31, 2019) (“Goldman Sachs II”), and the case was fully briefed, argued and taken under consideration in June. A decision could be reached in the case any day now.

In 2019, the Third Circuit also weighed in, providing some guidance on the type of evidence defendants must present to rebut the presumption of reliance at the class certification stage. That court affirmed the district court’s grant of plaintiff’s motion for certification, finding that the district court did not abuse its discretion in considering conflicting expert testimony. Vizirgianakis v. Aeterna Zentaris, Inc., 775 F. App’x 51, 53–54 (3d Cir. 2019). Most significantly, the Third Circuit rejected defendants’ argument that plaintiff’s expert’s event study, which was offered for the purpose of proving market efficiency (i.e., that the stock price moved in reaction to news about the company), was actually evidence that the statements at issue had no price impact. Id. at 53. Specifically, Defendants argued that because plaintiff’s expert had not proven a stock price movement in response to one of the alleged corrective disclosures at the statistically significant 95% confidence level, the relevant statement had no price impact. Id. at 53. The Court observed that plaintiff’s expert’s report was not written for the purpose of proving or disproving price impact and plaintiff’s inconclusive evidence regarding a stock price movement is not evidence of a lack of price impact. Id. at *53. Similar attempts to use plaintiffs’ market efficiency studies as evidence of a lack of price impact have been rejected by a number of district courts as well. See, e.g., In re Signet Jewelers Ltd. Sec. Litig., 2019 WL 3001084, at *13–15 (S.D.N.Y. July 10, 2019) (“Defendants’ failure to . . . supplement [their expert’s] report with an event study showing the absence of price impact is, on its own, a basis for rejecting Defendants’ arguments.”); Di Donato, 2019 WL 4573443, at *13 (“The lack of statistically significant proof that a statement affected the stock price is not a statistically significant proof of the opposite[.]”) (emphasis original); accord Chicago Bridge, 2019 WL 5287980, at *12–14 (noting that even statistically insignificant findings of causes of price impacts should be considered, albeit possibly granted less weight than statistically significant findings).

These cases suggest defendants should consider performing their own event studies if defendants intend to argue a lack of price impact rather than simply criticizing event studies offered by plaintiffs. Defendants should also account for the precise facts and circumstances of each case before settling on a strategy for challenging price impact in whole or in part.

We will continue to monitor developments in Goldman Sachs II and related cases.

VII. Statute of Limitations for Martin Act Claims Extended to Six Years

On August 26, 2019, New York Governor Andrew Cuomo signed into law a bill extending the statute of limitations for all claims brought pursuant to the Martin Act, New York’s blue sky law, to six years. This reverses a 2018 decision from New York’s highest court, which held that many Martin Act claims must be brought within three years. See generally Schneiderman v. Credit Suisse Sec. (USA) LLC, 31 N.Y.3d 622 (2018). According to the bill’s sponsor memo, a “six-year timeline was essential to some of the most meaningful cases that have reined in Wall Street excesses, halted fraudulent practices, and returned millions of dollars to defrauded consumers and investors,” and the law’s drafters expect this new six-year period to give New York’s Attorney General time to make “extensive investigations” into “novel areas of business practices.” See NY State Senate Bill S6536, The New York State Senate, https://www.nysenate.gov/legislation/bills/2019/s6536.

As readers will know, the Martin Act permits New York “to investigate and enjoin fraudulent practices in the marketing of stocks, bonds and other securities within or from New York State.” Credit Suisse, 31 N.Y.3d at 629. The Martin Act defines “fraudulent practices” “expansive[ly],” and “prohibitions against fraud, misrepresentation and material omission are found throughout the statutory scheme.” Id.; N.Y. Gen. Bus. L. §§ 352–353. Moreover, unlike common law fraud, Martin Act liability does not require any showing of “scienter or justifiable reliance on the part of investors.” Credit Suisse, 31 N.Y.3d at 632. A violation of the Martin Act can lead to both civil and criminal liability. N.Y. Gen. Bus. L. §§ 353, 358.

In 2018, in Credit Suisse, the New York Court of Appeals held that different theories of Martin Act liability would be subject to different limitations periods. When a case was premised on a legal theory akin to “fraud recognized in the common law,” the applicable statute of limitations would be six years, but for liability premised on the more “expansive” notions of a “fraudulent practice” solely created by statute, the applicable limitations period would be three years. See Credit Suisse, 31 N.Y.3d at 633–34 (dismissing stale claims).

Credit Suisse now has been expressly superseded. It is too early to predict the practical impact of this development. However, it is reasonable to assume that New York enforcement officials will quickly take advantage of the longer limitations period. In a joint statement with New York Attorney General Letitia James, Governor Cuomo trumpeted the new law as “enhancing one of the state’s most powerful tools to prosecute financial fraud so we can hold more bad actors accountable, protect investors and achieve a fairer New York for all.” New Law Strengthens AG James’ Authority To Take On Corporate Misconduct, New York State Attorney General (Aug. 26, 2019), https://ag.ny.gov/press-release/2019/new-law-strengthens-ag-james-authority-take-corporate-misconduct. Attorney General James stated that “[a]s the federal government continues to abdicate its role of protecting investors and consumers, this law is particularly important. New York remains committed to finding and prosecuting the bad actors that rob victims and destabilize markets.” Governor Cuomo Signs Legislation Increasing New York’s Capacity to Prosecute Financial Fraud, Official Website of the State of New York (Aug. 26, 2019), https://www.governor.ny.gov/news/governor-cuomo-signs-legislation-increasing-new-yorks-capacity-prosecute-financial-fraud.

The following Gibson Dunn lawyers assisted in the preparation of this client update: Mark Perry, Monica Loseman, Brian Lutz, Jefferson Bell, Shireen Barday, Nancy Hart, Lissa Percopo, Mark Mixon, Zoey Goldnick, Jason Hilborn, Hannah Kirshner, Emily Riff, Andrew Bernstein, Tim Deal, Luke Dougherty, Marc Aaron Takagaki, Patrick Taqui, Michael Klurfeld, Alisha Siqueira, Collin Vierra, and Chase Weidner.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, or any of the following members of the Securities Litigation practice group steering committee:

Brian M. Lutz – Co-Chair, San Francisco/New York (+1 415-393-8379/+1 212-351-3881, [email protected])

Robert F. Serio – Co-Chair, New York (+1 212-351-3917, [email protected])

Meryl L. Young – Co-Chair, Orange County (+1 949-451-4229, [email protected])

Jefferson Bell – New York (+1 212-351-2395, [email protected])

Jennifer L. Conn – New York (+1 212-351-4086, [email protected])

Thad A. Davis – San Francisco (+1 415-393-8251, [email protected])

Ethan Dettmer – San Francisco (+1 415-393-8292, [email protected])

Barry R. Goldsmith – New York (+1 212-351-2440, [email protected])

Mark A. Kirsch – New York (+1 212-351-2662, [email protected])

Gabrielle Levin – New York (+1 212-351-3901, [email protected])

Monica K. Loseman – Denver (+1 303-298-5784, [email protected])

Jason J. Mendro – Washington, D.C. (+1 202-887-3726, [email protected])

Alex Mircheff – Los Angeles (+1 213-229-7307, [email protected])

Robert C. Walters – Dallas (+1 214-698-3114, [email protected])

Aric H. Wu – New York (+1 212-351-3820, [email protected])

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.