2021 Year-End False Claims Act Update

Client Alert | February 3, 2022

Thirty-five years ago, Congress ushered in the modern era of False Claims Act (“FCA”) enforcement when it enacted the False Claims Amendments Act of 1986. At the time, the FCA was a seldom-enforced statute that resulted in government recoveries each year counted in the tens of millions. Now, 35 years later, the FCA is firmly—and consistently from one administration to another—established as the government’s principal fraud enforcement tool, netting the government annual recoveries counted in the billions. This past year underscored the continuing impact of the FCA and attendant risks to companies that do business—directly or indirectly—with the government.

DOJ announced that it collected more than $5.6 billion in FCA and related recoveries during FY 2021, which is the second-largest total ever for FCA recoveries and the largest since 2014. That figure is inflated by Purdue Pharma’s $2.8 billion bankruptcy payment in connection with its opioid resolutions; but even without the Purdue payment, the government still recovered $2.8 billion from FCA defendants, in line with year-over-year trends for the last 5 years.

Meanwhile, on the legislative and policy front, the chief architect of the 1986 amendments, Senator Chuck Grassley (R-IA), advanced new legislation aimed at strengthening the FCA even further. DOJ also announced several of its own efforts to strengthen the FCA, including plans to unwind Trump Administration policies, leverage the FCA in cybersecurity enforcement, and police fraud on COVID-19 stimulus programs. On the judicial front, the federal appellate courts issued a number of significant decisions in the second half of 2021, including important decisions exploring the FCA’s materiality and scienter requirements, the public disclosure bar, and pleading fraud with particularity under Rule 9(b).

Below, we begin by summarizing recent enforcement activity, then provide an overview of notable legislative and policy developments at the federal and state levels, and finally analyze significant court decisions from the past six months.

As always, Gibson Dunn’s recent publications regarding the FCA may be found on our website, including in-depth discussions of the FCA’s framework and operation, industry-specific presentations, and practical guidance to help companies avoid or limit liability under the FCA. And, of course, we would be happy to discuss these developments—and their implications for your business—with you.

I. FCA ENFORCEMENT ACTIVITY

A. NEW FCA ACTIVITY

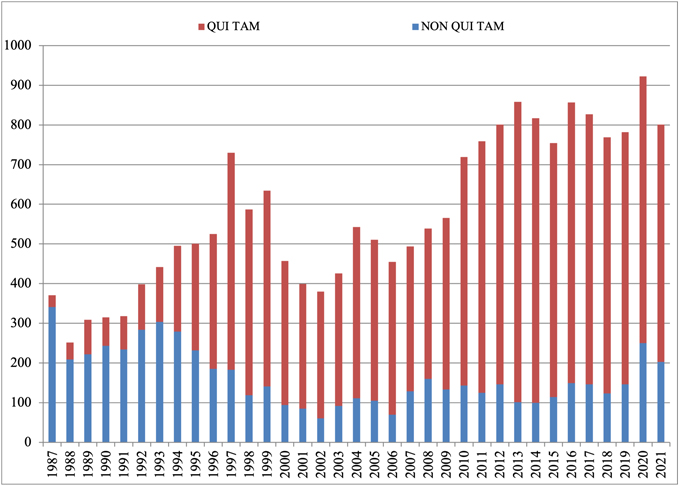

The government and qui tam relators filed 801 new cases in 2022.[1] That number is down from the unprecedented heights reached in 2020 (when there were a record 922 new FCA cases), but is consistent with the pace otherwise set over the past decade, reflecting the upward trend in FCA activity by qui tam relators and the government since the 2009 amendments to the statute.[2]

Last year, we noted that the government filed an abnormally high number of cases (250) on its own—i.e., without the involvement of qui tam relators. Cases of this sort remained historically high in 2021: although they dipped from 2020’s all-time high, DOJ initiated 203 cases in 2021, the second-highest total in the last 25 years. As discussed below, cases where the government is involved—either because the government brought the case, or later intervened—typically account for 90% of all FCA recoveries. If the government continues to bring more than 200 cases a year—up from an average of ~120 in the prior decade—then we will also expect to see increased DOJ recoveries. With the government’s stated commitments to proactive enforcement initiatives focusing on COVID stimulus fraud, cybersecurity, and matters stemming from health care data analysis, the number of government-driven new cases is likely to stay very high in 2022.

Number of FCA New Matters, Including Qui Tam Actions

Source: DOJ “Fraud Statistics – Overview” (Feb. 1, 2022)

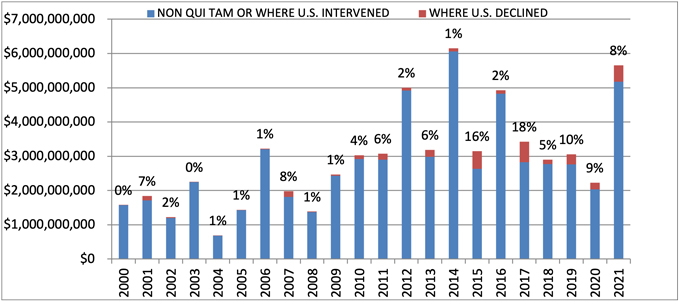

B. TOTAL RECOVERY AMOUNTS: 2021 RECOVERIES EXCEED $5.6 BILLION

The federal government recovered more than $5.6 billion during fiscal year 2021, which ended September 30, 2021. Of this amount, more than 90% was recovered in intervened cases, underscoring once again that companies face more significant exposure in cases in which the government initiated the case or intervened. Still, it is worth noting that relators’ recoveries from declined cases remained historically high since escalating significantly as a percentage of total recoveries in 2015; this data point reflects recent trends in relators’ willingness and ability to pursue cases into litigation after the government declines to intervene.

DOJ touted in its annual press release that the $5.6 billion haul represents the “second largest annual total in False Claims Act history, and the largest since 2014.”[3] But that only tells part of the story. The total includes approximately $3.2 billion in settlements stemming from the opioid crisis, including the $2.8 billion claim that Purdue agreed to allow in its bankruptcy “to resolve civil allegations that the company promoted its opioid drugs to health care providers it knew were prescribing opioids for uses that were unsafe, ineffective, and medically unnecessary, and that often led to abuse and diversion.”[4]

If the Purdue bankruptcy amount is removed, the government’s total recoveries this year are $2.8 billion. That amount is in line with trends during the last 5 years, while marking an increase from last year’s total of $2.2 billion.

Settlements or Judgments in Cases Where the Government Declined Intervention as a Percentage of Total FCA Recoveries

Source: DOJ “Fraud Statistics – Overview” (Feb. 1, 2022)

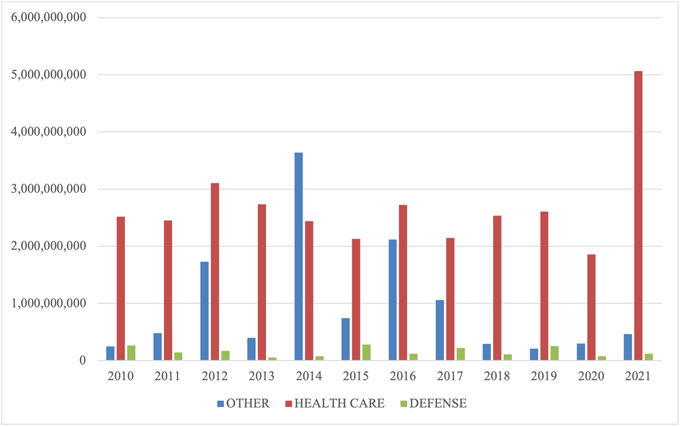

C. INDUSTRY BREAKDOWN

The relative breakdown of FCA recoveries across industries remained consistent with past years. Health care cases comprised 90% of total recoveries, Department of Defense procurement issues made up 2%, and the remaining 8% was split among other industries.[5] If you exclude the Purdue bankruptcy amount, then health care cases were 80% of recoveries, defense procurement cases were 4%, and other cases accounted for the remaining 16%.

Within the health care industry, DOJ announced that its primary areas of enforcement were opioid abuse, Medicare Advantage (Part C) fraud, illegal kickbacks, and provision of medically unnecessary services. While opioids, kickbacks, and provision of medically unnecessary services are familiar entries on the list of top theories for the government, the emergence of alleged Medicare Advantage fraud as one of DOJ’s top sources for FCA settlements is a relatively new development. Although close observers of the FCA have watched for several years as DOJ began to pursue these cases in earnest, those efforts are just beginning to result in significant recoveries for the government.

FCA Recoveries by Industry

Source: DOJ “Fraud Statistics – Overview” (Feb. 1, 2022)

II. NOTEWORTHY DOJ ENFORCEMENT ACTIVITY DURING THE SECOND HALF OF 2021

We summarize below the most notable FCA settlements in the second half of calendar year 2021, with a focus on the industries and theories of liability involved. We covered settlements from the first half of the year in our 2021 Mid-Year Update.

A. HEALTH CARE AND LIFE SCIENCE INDUSTRIES

- On July 2, two rehabilitation therapy providers agreed to pay $8.4 million to resolve allegations that they violated the FCA by encouraging skilled nursing facilities in New York and New Jersey to bill Medicare for rehabilitation therapy services that were unnecessary, unreasonable, and performed by unskilled employees. The allegations stemmed from a qui tam suit filed by a former employee of the provider; the whistleblower’s share of the recovery was not reported with the settlement.[6]

- On July 2, an Ohio-based regional hospital system committed to pay $21.25 million to settle allegations that it paid certain physician groups substantially more than fair market value for patient referrals and then billed Medicare for these illegally referred patients, in violation of the Anti-Kickback Statute and the Stark Law. DOJ noted that the hospital system received credit for disclosing the allegedly improper compensation arrangements, which were implemented by the system’s prior leadership. The settlement also resolved claims brought under a qui tam suit filed by the hospital system’s former Director of Internal Audit; the whistleblower’s share of the recovery was not reported at the time of settlement.[7]

- On July 8, two related medical device manufacturers agreed to pay $38.75 million to resolve allegations that they violated the FCA by submitting, and causing others to submit, claims to Medicare for defective blood coagulation monitors (used by patients prescribed anticoagulant drugs to verify that they were taking a clinically appropriate and safe dosage of the medication). The government alleged that the manufacturers knew the monitors contained a material defect, which purportedly produced inaccurate and unreliable results, but nonetheless billed Medicare for use of the devices and did not take appropriate corrective action until the U.S. Food & Drug Administration (“FDA”) initiated a product recall.[8]

- On July 8, a medical device manufacturer committed to pay $27 million to settle allegations that it violated the FCA by knowingly selling defective miniature defibrillators to health care facilities that surgically implanted the devices into patients enrolled in federal health insurance programs. The government alleged that the manufacturer knew that the batteries in some of the defibrillators depleted prematurely and that two serious injuries and one death had been associated with premature battery depletion, but kept this information from the FDA when seeking approval for a change to the device to fix this issue. The settlement also resolved a qui tam suit filed by one of those patients; the whistleblower’s share of the recovery was not reported with the settlement.[9]

- On July 19, one of the country’s largest hospital systems, the system’s chief executive, and a referring physician entered into a $37.5 million joint settlement with DOJ and the California Department of Justice resolving federal and state fraud allegations. The settlement stemmed from two qui tam suits filed by former employees of the hospital system; the United States declined to intervene in those suits, but it participated in negotiating the settlement agreement. The agreement resolved allegations that the hospital system paid kickbacks to the referring physician in exchange for patient referrals; that the hospital system and the referring physician knowingly billed Medicare and Medi-Cal for another, suspended doctor’s services under the referring physician’s billing number; and that the hospital system and its chief executive knowingly overbilled Medi-Cal and two federal programs for implantable medical devices. As part of the settlement, the hospital system and its chief executive entered into a five-year Corporate Integrity Agreement requiring the system to maintain a compliance program and hire an Independent Review Organization to assess certain business transactions. One of the whistleblowers, a former hospital executive, will receive approximately $10 million of the recovery.[10]

- On July 23, a rehabilitation therapy provider in California agreed to pay $2 million to settle allegations that it caused false claims to be submitted to Medicare by pressuring therapists to artificially increase the number of patients who received Medicare’s most expensive level of care for skilled nursing, “Ultra High,” even when that level of services was not necessary. The settlement resolved a qui tam suit filed by a former Director of Rehabilitation at the company, who will receive $360,000 of the settlement proceeds.[11]

- On July 21, an ambulatory electroencephalography (“EEG”) testing company and a private investment firm that owned a minority share in the company, both based in Texas, agreed to pay $15.3 million to settle kickback and false billing allegations. The United States alleged that the testing company improperly: induced physicians to refer patients to the company in exchange for free EEG test-interpretation reports; inflated invoices for certain EEG testing by using inaccurate billing codes; and billed for a specialized digital analysis that it never performed. The United States also alleged that the private investment firm learned about these schemes when performing pre-investment due diligence but allowed the schemes to continue. The settlement agreement consisted of payments to both the federal government and state Medicaid programs and also resolved claims brought under six different qui tam Two of the relators received approximately $3 million of the settlement funds; the respective shares of the other relators were not included in the settlement announcement.[12]

- On July 20, a Billings, Montana rheumatologist committed to pay $2 million to resolve allegations that he violated the FCA by billing Medicare for improper medical treatments. The United States asserted that the rheumatologist knowingly billed Medicare for MRI scans, patient visits, and biologic infusions on behalf of patients who did not have rheumatoid arthritis.[13]

- On August 2, a recently closed mail-order diabetic testing supplier and its parent company agreed to pay $160 million to resolve allegations that they violated the FCA through a kickback scheme and other fraudulent billing practices. The government alleged that the testing supplier, with its parent company’s approval, paid kickbacks to Medicare beneficiaries in the form of free glucometers and waived co-payments; billed Medicare for glucometers for which patients were not eligible; and billed Medicare on behalf of deceased patients, which led Medicare to revoke the company’s supplier number in 2016. In 2019, the testing company’s two founders each paid $500,000 to resolve allegations that they were personally involved in the kickback scheme. The civil settlement also resolves a qui tam suit filed by a former employee who worked at the testing company’s call center; he will receive approximately $28.5 million as his share of the recovery.[14]

- On August 5, a hospital system in Michigan agreed to pay $2.8 million to resolve allegations that it violated the FCA by submitting bills to federal health care programs for medically unnecessary procedures performed by a specific physician. In the settlement announcement, DOJ noted that the hospital system made a submission under the Provider Self-Disclosure Protocol of the U.S. Department of Health & Human Services, Office of Inspector General (“HHS-OIG”) and implemented several remedial measures to address the physician’s conduct, such as hiring another physician to conduct a peer review, placing the physician in a performance improvement plan, and ultimately ending its relationship with the physician. The settlement also resolved a qui tam suit filed by three individuals, who received a combined payment of $532,000 as their share of the recovery.[15]

- On August 6, a county medical center in California agreed to pay $11.4 million to settle allegations that it submitted, or caused the submission of, false claims to Medicare by admitting Medicare beneficiaries for inpatient services that were not medically necessary, such as when no alternative placements for a beneficiary could be found. As a part of the settlement, the medical center entered into a Corporate Integrity Agreement requiring the center to hire an Independent Review Organization to annually review the medical center’s inpatient admissions and billings of federal health insurance programs. The settlement also resolved a qui tam suit filed by a former employee of the medical center; that individual’s share of the recovery was not reported with the settlement announcement.[16]

- On August 25, a California-based provider of home respiratory services and durable medical equipment agreed to pay $3.3 million total to the United States, California, and Nevada to settle allegations that it violated the FCA by billing public health care programs for home ventilators that were not medically necessary or that patients were no longer using. The settlement also resolved a qui tam suit filed by a respiratory therapist who worked for the company, who will receive approximately $612,000 as his share of the settlement amount.[17]

- On August 26, a mental health and addiction treatment services provider agreed to the entry of judgments totaling over $15 million to resolve allegations that it violated the FCA and the Controlled Substances Act. Approximately $13.7 million, plus interest, of the judgment went to resolving allegations that the provider billed Medicare and Medicaid for mental health services performed by unqualified practitioners and billed Medicaid for mental health services using incorrect procedure codes that inflated the price of the care provided. The settlement partially resolved a related whistleblower suit filed by former employees, although the relators in that suit continued to pursue additional FCA claims against the company and its former chief executive. Additionally, the company agreed to the entry of a judgment for approximately $1.6 million, plus interest, to resolve allegations that it negligently failed to document its use of controlled substances and its transfer of controlled substances between locations. DOJ continued to pursue claims against several executives, including the former chief executive, alleging violations of the Controlled Substances Act.[18]

- On August 27, a hospital in Texas agreed to pay $3.3 million to settle a qui tam suit brought by its former Director of Compliance resolving allegations that the hospital improperly utilized billing modifiers to inflate the cost of care it billed to federal health care programs. The relator received approximately $912,000 of the recovery. The settlement announcement noted that, although the government did not intervene in the case, it investigated the relator’s allegations and collaborated with the relator.[19]

- On August 30, a California-based company who contracted to provide health care services to certain Medicare Advantage patients committed to pay $90 million to resolve allegations that it knowingly submitted incorrect diagnosis codes for those patients who inflated federal payments made to Medicare Advantage plans and, in turn, the provider. The settlement also resolved a qui tam suit filed by a former employee of the provider; the United States intervened in the claims against some, but not all, of the defendants named in the suit. Also, pursuant to the settlement, the provider entered into a five-year Corporate Integrity Agreement requiring it to implement a risk assessment program into its overarching compliance program and hire an Independent Review Organization to review a sample of its Medicare Advantage patients’ medical records and diagnosis codes each year.[20]

- On September 3, the U.S. District Court for the District of South Carolina entered default judgments totaling $140 million against various pain management clinics, drug testing laboratories, and a substance abuse counseling center. The government alleged the defendant entities violated the FCA by providing illegal financial incentives to providers to induce drug test referrals and billed the federal government for unnecessary drug tests. The allegations arose from qui tam complaints by five former employees of the defendant pain management clinics.[21]

- On September 8, a collection of home health care companies agreed to pay $17 million to settle allegations that they violated the FCA by paying a kickback to a retirement home operator when they purchased two of its home health agencies. The government alleged the companies bought the home health agencies to induce the seller to refer Medicare beneficiaries residing in its retirement homes throughout the United States, and then submitted false claims to Medicare for the resulting services. The allegations stem from a qui tam complaint, and the whistleblower’s share of the recovery was not disclosed at the time of the settlement announcement.[22]

- On September 15, a cardiologist agreed to pay $6.75 million to settle allegations that he violated the FCA by billing federal health care programs for medically unnecessary ablations and vein stent procedures performed on patients. The government alleged that the cardiologist made false statements in patient medical records to justify the procedures, and that many of the ablations were performed by ultrasound technicians outside the scope of their practice. The cardiologist and his consulting company entered into a multi-year integrity agreement including requirements for training, reporting, and independent quarterly claims reviews.[23]

- On October 1, three pharmaceutical manufacturers agreed to pay $447.2 million to resolve allegations that they violated the FCA by conspiring to fix prices for various generic drugs, resulting in higher drug prices for federal health care programs. DOJ alleged a novel theory of remuneration, contending that the manufacturers conveyed value in the form of agreements on pricing. The settlement is in addition to $424.7 million previously paid by the companies to resolve related criminal charges. The government alleged that between 2013 and 2015, the companies entered agreements on pricing, supply, and allocation of customers with other pharmaceutical manufacturers for drugs manufactured by the companies, purportedly in violation of the Anti-Kickback Statute. Each company also entered into a five-year Corporate Integrity Agreement, which includes monitoring, price transparency, and other compliance provisions.[24]

- On October 8, two providers of home-based health care services agreed to pay $8.5 million to settle allegations that they violated the FCA by submitting claims to Medicare for laboratory and diagnostic testing performed between 2010 and 2015 that was not medically necessary. The allegations arose from five qui tam lawsuits; the first-to-file whistleblower will receive $1.53 million as a result of the settlement.[25]

- On October 22, two physicians agreed to pay $3.9 million to settle allegations that they violated the FCA by ordering unnecessary drug tests for patients at their pain management clinic and lab. The allegations stem from a lawsuit filed by two qui tam The relators will receive 17% of the United States’ portion of the settlement, totaling approximately $618,000.[26]

- On October 25, a group of pharmacies agreed to pay $4.6 million to resolve allegations that the pharmacies violated the FCA in various ways, including by charging the government higher prices than those charged to other patients and paying kickbacks to a third-party marketer who assisted in arranging for medically unnecessary prescriptions of pain and scar creams. The allegations arose from a qui tam lawsuit filed by a former pharmacist. The whistleblower will receive approximately $800,000 from the settlement.[27]

- On October 28, a physical therapy company agreed to pay $4 million to settle allegations that it violated the FCA by billing the government for outpatient physical therapy that was not provided. The allegations stem from a qui tam lawsuit, and the relator’s share was not disclosed at the time of the settlement announcement.[28]

- On November 8, a medical device company agreed to pay $16 million to resolve allegations that it violated the FCA by causing the submission of false claims to Medicare. The company made royalty payments to an orthopedic surgeon related to the surgeon’s contributions towards the company’s products. However, according to the government, these payments constituted illegal kickbacks because they were allegedly intended to encourage the surgeon to use and recommend the company’s products to patients. The underlying allegations relate to a qui tam suit, and the whistleblower will receive approximately $2.5 million of the settlement payment.[29]

- On November 9, several anesthesia providers and outpatient surgery centers agreed to pay more than $28 million to resolve allegations that they violated the FCA by entering into arrangements involving purported kickbacks. The government alleged that the anesthesia providers sought to enter exclusive contracts with the outpatient surgery centers by offering kickbacks in the form of payments for drugs, supplies, and equipment and labor, as well as through the provision of free staffing services. According to the government, the alleged kickback scheme caused the submission of false claims. Relators who brought the underlying qui tam suit will receive over $4.7 million of the settlement payment.[30]

- On November 9, a pharmaceutical manufacturer agreed to pay $12.7 million to resolve allegations that it violated the FCA by causing the submission of false claims for an injectable drug. The company allegedly directed doctors to preferred pharmacies despite being aware that certain of those preferred pharmacies submitted false prior authorization requests that misrepresented to insurers that the requests were submitted by physicians instead of by the pharmacies themselves, and/or included false or misleading information about the underlying patients’ medical histories. The allegations relate to a qui tam suit, and the whistleblower will receive approximately $2.5 million of the settlement payment.[31]

- On November 22, a chiropractor agreed to a $9 million civil consent judgment to resolve allegations that he violated the FCA by conspiring to pay illegal kickbacks and bill for unnecessary medical services. The chiropractor purportedly caused the submission of false claims to federal health care programs through kickbacks paid to physicians for urine drug testing referrals, as well as through medically unnecessary prescriptions for pain creams. The chiropractor pleaded guilty to criminal charges arising from the same conduct and faces a potential sentence of up to five years in prison and a fine of $250,000.[32]

- On November 22, a home health agency agreed to pay $4.2 million to resolve allegations that it violated the FCA by submitting claims for services that were not covered by Medicare or Medicaid, and by failing to timely refund associated overpayments. The non-covered services underlying the allegedly false claims included, among other things, services that lacked the required face-to-face certifications or plans, and services that did not document the beneficiary’s need for home care. The underlying allegations relate to a qui tam suit, and the relator will receive over $700,000 from the settlement.[33]

- On November 23, a hospice and palliative care provider operating in Ohio and Tennessee agreed to pay $5.5 million to settle allegations that it violated the FCA by submitting claims to Medicare for non-covered hospice services. The provider allegedly submitted false claims to Medicare between January 2012 and December 2014 for hospice services and care provided to patients who were not terminally ill for at least a portion of the relevant time period during which they received care. The allegations arise from a qui tam lawsuit, and the whistleblower will receive approximately $1 million of the settlement payment.[34]

- On December 2, a hospital agreed to pay $18.2 million to resolve allegations that it violated the FCA by submitting claims to Medicare, Medicaid, and TRICARE for services referred to the hospital as a result of alleged kickbacks. The hospital allegedly induced certain physicians to refer patients to the hospital by giving those physicians shares repurchased from older physician-owners. According to the government, the hospital then violated the FCA by submitting claims for services referred or ordered by the physicians who received the newly repurchased shares. The underlying allegations stem from a qui tam lawsuit, and the associated whistleblower will receive approximately $3 million of the settlement payment.[35]

- On December 7, a pathology practice agreed to pay $2.4 million to resolve allegations that it violated the FCA by making false representations in connection with submissions to the government. The practice allegedly submitted certain claims to the government without written substantiation, and as a result billed Medicare for a type of testing analysis that was not actually required. Contemporaneous with the settlement, the pathology practice entered into a three-year Corporate Integrity Agreement requiring training, auditing, and monitoring designed to address the alleged misconduct along with other evolving compliance risks. The underlying allegations arose from a qui tam lawsuit, and the whistleblower for that suit will receive approximately $450,000 from the settlement.[36]

- On December 8, a physician and a medical device manufacturer agreed to pay a collective $4.2 million to resolve allegations that they violated the FCA by entering into kickback arrangements. The government alleged that, between 2014 and 2018, the company provided kickbacks—in the form of cash payments, commissions, and all-expense paid trips—to the physician to induce him to direct physicians at his institute to utilize the company’s medical devices and to increase the number of certain surgeries performed in order to then increase orders of the company’s supplies. The physician also allegedly directed physicians to order toxicology and genetic tests from a medical testing laboratory from which he accepted additional kickbacks. The civil settlement resolved claims brought under a qui tam suit, and the whistleblower will receive approximately $600,000 from the settlement.[37]

B. GOVERNMENT CONTRACTING AND PROCUREMENT

- On July 6, an aviation company based in Illinois and Florida agreed to pay $11 million to resolve allegations that it violated the FCA in connection with two U.S. Transportation Command contracts for aircraft maintenance services supporting U.S. Department of Defense (“DOD”) operations in Afghanistan and Africa. According to the government, the company knowingly failed to maintain several helicopters utilized by the Department of Defense to transport cargo and personnel in accordance with contract requirements, such that the helicopters were not airworthy and should not have been certified as “fully mission capable.” The settlement included a resolution of claims brought in a qui tam suit filed by a former employee, who received approximately $2.2 million of the settlement proceeds. The company also agreed to pay a separate $429,000 fine to the Federal Aviation Administration for purported deficiencies in its helicopter maintenance program.[38]

- On September 27, an oil and natural gas exploration and production company agreed to pay $6.15 million to settle allegations that it violated the FCA by underpaying royalties for natural gas from federal lands. The government alleged that the company improperly deducted processing costs from the royalties due to the United States under a lease that permitted the company to extract natural gas from federal lands as long as the gas was placed in marketable condition at no cost to the United States.[39]

- On October 6, a military supplier agreed to pay over $4.5 million to settle allegations that it violated the FCA by failing to comply with requirements for certain products supplied to the military. The government alleged that the supplier had provided high-performance butterfly valves to military ship builders from May 2011 through September 2017 and failed to disclose that there had been unapproved modifications made to the valves. The allegations stem from a qui tam lawsuit brought by a former employee, and the whistleblower will receive approximately $850,000 of the recovery.[40]

- On October 15, a contracting company entered into a consent judgment, agreeing to pay $4.8 million to settle allegations that it violated the FCA by submitting false certifications of eligibility to obtain federal contracts intended to benefit service-disabled veterans. The complaint alleged that the company was not owned by a veteran but instead recruited a service-disabled veteran to nominally run a pass-through entity that enabled the company to obtain federal contracts for which it otherwise would not have been eligible.[41]

- On December 21, an information technology contractor agreed to pay over $1.3 million to resolve allegations that it violated the FCA when seeking payment for information technology and cybersecurity services. The government alleged that the company caused the submission of false claims by billing the government for labor hours in excess of time worked, labor rates that exceeded the rates actually paid to employees, labor costs exceeding the company’s actual recorded costs, and overly high indirect rates.[42]

- On December 22, an aircraft manufacturer agreed to pay $1.9 million to resolve allegations related to a jet fuel spill, including allegations that it violated the FCA during the government’s investigation of the incident. According to the government, employees of the manufacturer made material false statements to avoid contractual liability for cleanup related to the spill and, by doing so, violated the reverse false claims provision of the FCA.[43]

C. OTHER

- On July 12, the Florida Department of Children and Families (“FDCF”) agreed to pay $17.5 million to settle allegations that its management of federal Supplemental Nutrition Assistance Program (“SNAP”) funds violated the FCA, one of several settlement agreements the United States has secured recently with state agencies and a private consulting firm regarding alleged manipulation of SNAP data. The U.S. Department of Agriculture (“USDA”) requires states to determine individuals’ eligibility for SNAP benefits and maintain quality control processes to confirm eligibility decisions. Additionally, states must accurately report their error rates in awarding benefits to USDA, and USDA pays performance bonuses to states that report low error rates and demonstrate decreasing error rates. The government alleged that FDCF improperly injected bias into its SNAP quality control program that caused the submission of false information to USDA regarding FDCF’s error rate. This, in turn, allegedly led USDA to pay FDCF performance bonuses that it did not earn. As part of the settlement, FDCF also agreed to forego $14.7 million in pending bonus payments that it had not yet received from USDA.[44]

- On July 28, two clothing companies and their former chief executive and owner agreed to pay $6 million to resolve allegations of underreporting the value of imports on invoices submitted to U.S. Customs & Border Protection in order to pay less in customs duties. In a related criminal prosecution from 2020, the former chief executive and owner also pled guilty to a subset of this conduct, was sentenced to six months in prison, and paid a separate forfeiture amount of $1.7 million. The allegations leading to his conviction and the subsequent civil settlement agreement stemmed from a qui tam complaint, but the whistleblower share of the recovery was not announced with the settlement.[45]

- On August 5, the Tennessee Department of Human Services (“TDHS”) committed to pay $6.8 million to resolve allegations that it submitted false quality control data to USDA regarding TDHS’s award of SNAP benefits to low-income individuals. The United States alleged that TDHS, in implementing the recommendations of an outside consulting firm, inserted bias into its quality control program that led to the submission of false quality control data to USDA. According to the government, TDHS then received performance bonuses from USDA on the basis of this false data.[46]

III. LEGISLATIVE AND POLICY DEVELOPMENTS

A. FEDERAL POLICY DEVELOPMENTS

In its first year, the Biden Administration has not ushered in a major shift in overarching FCA policy. But the Administration has emphasized that it remains focused on FCA enforcement, and significant changes have nonetheless begun to take shape.

1. Biden Administration Continues Move Away from “Brand” Memo

In July 2021, DOJ promulgated an interim final rule that opens the door for DOJ attorneys to leverage agency guidance in enforcement actions. This step culminates a shift that we flagged in our 2021 Mid-Year Update, in which we discussed Executive Order 13992, issued on the day of President Biden’s inauguration. That Order foreshadowed a possible shift away from DOJ’s so-called Brand Memo.

By way of background, the internal DOJ guidance communicated by the January 2018 Brand Memo stated that agency “[g]uidance documents” without notice-and-comment rulemaking “cannot create binding requirements that do not already exist by statute or regulation.”[47] In December 2018, DOJ codified the Brand Memo at Section 1-20.100 of the Justice Manual, which explained that with limited exceptions, DOJ “should not treat a party’s noncompliance with a guidance document as itself a violation of applicable statutes or regulations.”[48] Executive Order 13992 did not refer expressly to DOJ’s civil enforcement of the FCA, but it did explicitly revoke President Trump’s Executive Order 13891, which expressed a principle similar to that codified in Section 1-20.100 of the Justice Manual.

Effective July 1, 2021, DOJ issued the interim final rule implementing Executive Order 13992 and rescinding DOJ regulations that proscribed use of guidance documents in DOJ enforcement actions.[49] On the same date, Attorney General Merrick Garland issued a memo to all DOJ component heads explaining that, while guidance alone cannot form the basis for an enforcement action, it “may be entitled to deference or otherwise carry persuasive weight with respect to the meaning of the applicable legal requirements” in a particular case.[50] The memo stated that “[t]o the extent guidance documents are relevant to claims or defenses in litigation, Department attorneys are free to cite or rely on such documents as appropriate.”[51] These developments surely will open back up the reliance that many DOJ attorneys placed on sub-regulatory guidance as evidence both that a claim is materially false and that defendants recklessly disregarded statutory and regulatory requirements. On the other hand, while the Brand Memo’s safeguards against the use of guidance as the basis for asserting falsity under the FCA have eroded, certain federal courts—and Supreme Court justices—have signaled significant skepticism about use of sub-regulatory guidance to impose substantive legal standards. E.g., Whitman v. United States, 574 U.S. 1003 (2014) (statement of Justice Scalia and Justice Thomas on denial of certiorari, warning that courts should not defer to “executive interpretations of a variety of laws that have both criminal and administrative applications”).

This is a development we will continue to closely watch.

2. DOJ Announces Initiative to Use FCA in Cybersecurity Cases

On October 6, 2021, Deputy Attorney General Lisa Monaco announced a new Civil Cyber Fraud Initiative that will leverage the FCA to “hold accountable entities or individuals that put U.S. information or systems at risk by knowingly providing deficient cybersecurity products or services, knowingly misrepresenting their cybersecurity practices or protocols, or knowingly violating obligations to monitor and report cybersecurity incidents and breaches.”[52] The new effort will “combine [DOJ’s] expertise in civil fraud enforcement, government procurement and cybersecurity to combat new and emerging cyber threats to the security of sensitive information and critical systems.”[53]

On October 13, 2021, Acting Assistant Attorney General Brian Boynton delivered remarks on this new initiative at the Cybersecurity and Infrastructure Security Agency Fourth Annual National Cybersecurity Summit.[54] AAG Boynton noted that the Civil Cyber Fraud Initiative “will use the [FCA] to identify, pursue and deter cyber vulnerabilities and incidents that arise with government contracts and grants and that put sensitive information and critical government systems at risk.” He indicated that “three common cybersecurity failures” are “prime candidates” for potential FCA enforcement by DOJ: (1) “knowing failures to comply with cybersecurity standards,” such as those negotiated with government contractors; (2) “knowing misrepresentation of security controls and practices”; and (3) “knowing failure to timely report suspected breaches.”

3. DOJ Continues FCA Enforcement to Protect COVID-19 Spending

Spending packages tied to COVID-19 also continue to be a focus for federal FCA enforcement. Under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”)[55] and subsequent stimulus programs, including the American Rescue Plan in March 2021,[56] the government provided trillions of dollars in government funds to mitigate the effects of COVID-19. Anytime the government spends money, particularly massive amounts, there is a possibility the funds are misspent. This, in turn, brings the FCA into play as a potential remedy; unsurprisingly, the government has repeatedly indicated its intent to rely heavily on the FCA to police any fraud associated with pandemic relief funds.

The Paycheck Protection Program (“PPP”), one of several programs created by the CARES Act, aims to allow businesses to receive low-interest private loans to pay for their payroll and certain other costs. In January 2021, DOJ settled its first civil case involving the Paycheck Protection Program with SlideBelts, Inc. and its President and CEO.[57] Since then, DOJ has entered into at least two other settlements related to the Program.

- Pursuant to the settlement agreement reached in United States ex rel. Hablitzel v. All in Jets, LLC & Seth A. Bernstein, the owner of a jet charter company agreed to pay almost $290,000 to settle allegations that he diverted nearly $100,000 from a $1.2 million PPP loan for personal, non-company related expenses within a day of receiving the loan. The relator (a former employee) who initially filed the action received close to $60,000.[58]

- In United States ex rel. Quesenberry v. Sextant Marine Consulting LLC et al., a duct cleaning company agreed to pay $30,000 in damages and civil penalties for conduct associated with two PPP loans, in addition to repaying the duplicative PPP funds in full.[59] The relator received $4,500 of this amount. According to DOJ, additional claims against other entities remain under seal in Quesenberry.

These sorts of relatively small dollar-value settlements likely do not represent the extent of DOJ’s focus on FCA enforcement related to PPP funds. FCA investigations—and subsequent litigation—often take years to play out. And all signs indicate that the biggest and most important FCA cases to come out of the COVID-19 pandemic are still to come.

The CARES Act also contained a provision establishing a Special Inspector General for Pandemic Recovery (“SIGPR”),[60] who “has the duty to conduct, supervise, and coordinate audits and investigations of the making, purchase, management, and sale of loans, loan guarantees, and other investments by the Secretary of the Treasury under any program established by the Secretary under Division A of the CARES Act.”[61] Since September 2020, the SIGPR has added thirty-three staff members, and it has sought “a place in the annual federal budget” beyond the original $25 million first allocated for five years of the office’s service.[62] The SIGPR has thus far focused on cases where CARES Act participants allegedly sought funding from multiple programs to be used for the same purpose.[63] Although the SIGPR has not focused on FCA claims, the fact that it has referred a significant number of fraud-related claims to other agencies for investigation leaves the door open to new FCA claims arising from this office.

4. DOJ Updates FCA Penalty Amount to Adjust for Inflation

DOJ is required by law to adjust penalties to keep pace with inflation. In December, DOJ issued a final rule to update penalties for 2021. See 86 Fed. Reg. 70740 (Dec. 13, 2021). Under the final rule, FCA penalties now range from a minimum of $11,803 to a maximum of $23,607 for penalties assessed after December 13, 2021, compared to the prior range of $11,665–$23,331. These increased amounts apply to any violation of the FCA that occurred after November 2, 2015, when the law requiring inflation adjustments took effect.

B. FEDERAL LEGISLATIVE DEVELOPMENTS

Congressional attention on FCA enforcement reignited in the latter half of 2021 with the introduction of proposed legislative amendments by Senator Chuck Grassley (R-IA). Senator Grassley, the architect of the 1986 amendments, has long touted himself as a leading advocate of the FCA. This past year, he set his sights on cementing his legacy as the FCA’s principal champion.

As discussed in our Mid-Year Update, in February 2021, Senator Grassley sent a letter to then-Attorney General Nominee Merrick Garland, criticizing DOJ’s actions in dismissing relator claims, decrying the effects of the Supreme Court’s decision in Escobar, and requesting assistance in crafting new legislation to address his concerns.[64]

In July 2021, Senator Grassley—joined by a bipartisan group of four co-sponsors—made good on his promise and introduced the False Claims Amendments Act of 2021 (the “Amendments”), which included four main provisions.[65] First, the Amendments would implement a burden-shifting scheme under which the plaintiff (government or relator) may establish materiality by a simple “preponderance of the evidence,” at which point the defendant “may” rebut evidence of materiality by “clear and convincing” proof. Second, the Amendments would require that, when DOJ seeks to dismiss declined qui tam cases, the relator must first have an opportunity to show that the reasons for dismissal are fraudulent, arbitrary and capricious, or contrary to law. Third, the Amendments would allow DOJ to shift the cost of discovery defendant served on the government to the defendant if the defendant’s discovery requests are irrelevant, disproportional, or unduly burdensome. Finally, the Amendments would expressly apply the FCA’s existing anti-retaliation provisions to post-employment retaliation. The Amendments would be applicable to all pending and future litigation “to ensure that [the FCA] covers the trillions of dollars spent on COVID relief.”[66]

In October 2021, Senator Grassley amended his proposal in several respects. First, he eliminated the burden-shifting approach to the materiality standard. This portion of the bill now reads: “In determining materiality, the decision of the Government to forego a refund or pay a claim despite actual knowledge of fraud or falsity shall not be considered dispositive if other reasons exist for the decision of the Government with respect to such refund or payment.”[67] With this revision, Senator Grassley again is targeting the Supreme Court’s decision in Escobar.

If adopted, this provision could have broader implications than the original burden‑shifting framework. The original framework, by its plain language, focused only on evidentiary burdens, whereas the revised framework speaks in more general terms of “determin[ations]” of materiality.[68] Such determinations could occur at the motion-to-dismiss stage, as the Escobar Court clearly contemplated, even before litigation stages involving evidentiary determinations. A basic principle of civil pleading is that an “obvious alternative explanation” for the conduct a plaintiff alleges is enough to make the plaintiff’s allegations legally implausible and subject to dismissal. See Bell Atl. Corp. v. Twombly, 550 U.S. 544, 567–68 (2007). The revised provision of the Amendments threatens to upend this principle by making payment of claims notwithstanding their falsity “not . . . dispositive” of materiality as a matter of law, where otherwise such facts could form the basis for an argument that an “obvious alternative explanation” for the government’s payments was that it spotted the alleged fraud and decided it was immaterial. Senator Grassley’s amendments also removed the original bill’s cost-shifting provisions for discovery expenses.[69]

This revised bill was reported out of Committee in November 2021,[70] but it remains unclear if the bill will receive a vote on the Senate floor. If enacted, however, the Amendments would surely give DOJ and relators new arguments in a variety of different FCA scenarios, and could have a meaningful impact on the cost of defending against FCA cases, particularly including meritless cases brought by a would-be whistleblower.

Gibson Dunn will continue to monitor this and other legislative developments.

C. STATE LEGISLATIVE DEVELOPMENTS

The federal government provides incentives for states to enact false claims statutes in keeping with the federal FCA. In particular, HHS-OIG grants “a 10-percentage-point increase” in a state’s share of any recoveries under the relevant laws to any state that obtains HHS-OIG approval for its false claims statute.[71] Such approval requires that the statute in question, among other requirements, “contain provisions that are at least as effective in rewarding and facilitating qui tam actions for false or fraudulent claims as those described in the [federal] FCA.”[72] Approval is also contingent on the statute containing a sixty-day sealing provision and “a civil penalty that is not less than the amount of the civil penalty authorized under the [federal] FCA.”[73] The total number of states with approved statutes remains at twenty-two, with Montana (which was previously on the “approved” list) having obtained approval on October 4, 2021 for the amendments to its false claims act that we covered in our 2021 Mid-Year Update.[74] The list of seven states with false claims statutes listed by HHS-OIG as “not approved” likewise remains the same: Florida, Louisiana, Michigan, New Hampshire, New Jersey, New Mexico, and Wisconsin.[75]

The “not approved” list may soon shrink, however. On October 20, 2021, the Wisconsin legislature introduced a bill that would “restore[] a private individual’s authority to bring a qui tam claim against a person who makes a false claim for medical assistance, which was eliminated in 2015 Wisconsin Act 55.”[76] The bill also provides for qui tam awards of up to thirty percent of recoveries, which is consistent with the federal FCA, and for “additional changes not included in the prior law to conform state law to the federal [FCA], including expanding provisions to facilitate qui tam actions and modifying the bases for liability to parallel the liability provisions under the federal False Claims Act.”[77] While Wisconsin’s 2015 repeal of false claims liability for Medicaid claims was not expressly one of the grounds HHS-OIG relied on in refusing to grant federal incentives, the government did in 2016 cite the state statute’s lack of a provision pegging civil penalties to inflation as grounds for the government’s continued “not approved” designation.[78] The 2021 bill ostensibly seeks to address this issue (among others cited by HHS-OIG) by incorporating the federal FCA penalty amounts, which are pegged to inflation.[79]

IV. CASE LAW DEVELOPMENTS

The second half of 2021 saw a number of notable federal appellate court decisions, which we have summarized below.

A. Seventh and Second Circuits Evaluate How Government’s Continued Payment Bears on Materiality Under Escobar

During the latter half of 2021, courts continued to refine the FCA’s materiality requirement, applying the standard articulated by the Supreme Court in Universal Health Services Inc. v. United States ex rel. Escobar, 579 U.S. 176 (2016). In Escobar, the Supreme Court noted that to survive a motion to dismiss plaintiffs must “plead[] facts to support allegations of materiality” when bringing claims under the FCA. Id. at 195 n.6. In the five years since Escobar, materiality has become a key consideration at the motion-to-dismiss stage, even when it requires courts to make factually specific, case-by-case determinations.

In United States v. Molina Healthcare of Illinois, Inc., 17 F.4th 732 (7th Cir. 2021), the Seventh Circuit reversed a district court’s order dismissing a complaint involving alleged false certifications by Molina Healthcare of Illinois, Inc. relating to Medicaid reimbursement. Molina Healthcare and the State of Illinois had agreed to a capitated system of Medicaid payments—payments based on the number of patients a health care provider projects it will serve based on patients’ risk levels. Id. at 736. As part of the agreement, Molina agreed to provide skilled nursing facility services to the most expensive (riskiest) tier of patients. Id. A relator filed an FCA complaint alleging that Molina falsely certified that it was providing such services to patients. According to the relator, Molina stopped providing these services a year into the agreement, yet continued to collect the Medicaid payments owed under the capitated payment system for the most expensive tier of patients. Id. at 737.

The Seventh Circuit allowed the relator’s suit to proceed, concluding that Molina Healthcare’s certification regarding its skilled nursing facility services was material to the State’s decision to continue making Medicaid payments to Molina Healthcare. Id. at 744. The court acknowledged that the State continued paying even after it knew that Molina Healthcare did not provide the relevant services. Id. at 743–44. But it concluded this did not dispose of the materiality inquiry. Rather, the court focused on the fact that those patients who qualified for skilled nursing facility services were in a much more expensive tier in the capitation system than other patients. Id. at 743. The difference in cost between patients in the most expensive tier and those in lower tiers suggested that Molina Healthcare’s certification was material, notwithstanding the inference that the government knew of the alleged misconduct and disregarded it in its payment decision.

The court also held that the relator adequately alleged Molina Healthcare knew its certifications were material. Id. at 745. The district court had also premised its dismissal on the relator’s failure to plead specific allegations about Molina Healthcare’s knowledge. The Seventh Circuit disagreed. It concluded that because Molina Healthcare was “a highly sophisticated member of the medical-services industry,” relator plausibly alleged that the company may have known the importance of its false certifications in Medicaid payment decisions. Id. at 744-5.

In United States ex rel. Foreman v. AECOM, 19 F.4th 85 (2d Cir. 2021), the Second Circuit applied Escobar’s materiality factors and affirmed, in part, a district court’s decision to dismiss a relator’s FCA complaint. The case involved allegations that AECOM, a company that provided maintenance and management services to the U.S. Army in Afghanistan, violated the FCA by failing to live up to contractual obligations. Id. at 95. Specifically, the relator alleged that AECOM overstated its man-hour utilization rate, overbilled the government for labor not actually performed, and failed to properly track government property. Id. AECOM moved to dismiss, arguing that the alleged misrepresentations to the government were not material to any payments, pointing to government reports suggesting that the government knew about the issues and continued to pay in any event. The district court agreed and dismissed the complaint.

The Second Circuit affirmed in part and reversed in part. In doing so, the Second Circuit focused on three factors identified in Escobar to determine whether a false certification of compliance with a contract was material to payment by the government: (1) whether the government “expressly identified a provision as a condition of payment,” id. at 110, (2) “the government’s response to noncompliance” with the contract, id. at 111, and (3) whether the “alleged noncompliance was substantial,” id. at 116. In granting AECOM’s motion to dismiss, the district court had focused on the second factor, relying on government reports indicating that the government had been aware of the alleged false claims and still chose to pay AECOM for its work under the contract.

Although the Second Circuit observed that the government’s continued payment—i.e., the “response to noncompliance”—bore heavily on the question of materiality, the court took a restrictive view of what documents it could consider at the motion-to-dismiss stage to demonstrate the government’s “response to noncompliance.” In drafting the complaint, the relator had expressly referenced and relied on government reports about man-hour-utilization rate and property tracking. Id. at 113–14. Because the relator’s complaint included those documents, the Second Circuit determined that the trial court could consider these documents. And those reports indicated that the government knew about the alleged fraud and “not only continued to extend and pay claims under the [contract], but also never demanded repayment, disallowed any charged costs, or penalized AECOM.” Id. at 115. By contrast, the court concluded that separate government reports referencing overbilling—which the district court also relied on—were not integral to or referenced in the complaint and, thus, should not have been considered at the pleading stage. Id. at 116. Without the presence of those reports for consideration on the motion to dismiss stage showing the government’s response to AECOM’s alleged overbilling practices, the court allowed the relator to proceed on those claims. Id. at 117–18.

B. Seventh and Eighth Circuits Issue Important Decisions on the FCA’s Scienter and Falsity Requirements

In United States ex rel. Schutte v. SuperValu, Inc., 9 F.4th 455 (7th Cir. 2021), the Seventh Circuit became the latest circuit court to apply the scienter standard announced by the U.S. Supreme Court in Safeco Insurance Company of America v. Burr, 551 U.S. 47 (2007), to the FCA. The FCA defines “knowingly” to mean that a person “(i) has actual knowledge of the information, (ii) acts in deliberate ignorance of the truth or falsity of the information, or (iii) acts in reckless disregard of the truth or falsity of the information.” 31 U.S.C. § 3729(b)(1)(A). In Safeco, which addressed the Fair Credit Reporting Act’s nearly identical scienter requirement, the Supreme Court determined that a person who acts under an incorrect interpretation of a relevant statute or regulation does not act with “reckless disregard” if the interpretation is objectively reasonable and no authoritative guidance cautioned the person against it. Safeco, 551 U.S. at 70.

The relators in SuperValu alleged that when SuperValu sought Medicare and Medicaid reimbursements, it misrepresented its “usual and customary” drug prices. See 9 F.4th at 459. After interpreting the relevant regulations, SuperValu reported its retail cash prices as its usual and customary drug prices rather than the lower, price-matched amounts that it charged customers under its price-match discount drug program, through which SuperValu would match discounted prices of local competitors upon request from anyone purchasing. Id. The court agreed with the relator that SuperValu’s discounted prices were the correct usual and customary prices under the relevant regulations, and that SuperValu therefore should have reported those prices. The court applied the Safeco scienter standard, however, and concluded that SuperValu’s interpretation of the regulations was objectively reasonable and that there was no authoritative guidance that warned SuperValu away from its interpretation. Id. at 472. The court therefore found that SuperValu faced no liability under the FCA. Id.

The SuperValu opinion is significant for FCA defendants who are often required to interpret vague and ambiguous regulations. It provides FCA defendants with a basis to contest scienter as a matter of law, instead of leaving scienter issues for juries to decide.

In Thayer v. Planned Parenthood of the Heartland, 11 F.4th 934 (8th Cir. 2021), the Eighth Circuit explored the intersection of FCA’s scienter and falsity requirements. In that case, the relator alleged two distinct bases for FCA liability. The relator alleged that Planned Parenthood dispensed extra cycles of contraceptives without a physician’s order in violation of Iowa law and knowingly billed Iowa Medicaid Enterprise for post-abortion-related services in violation of state and federal law. The district court granted summary judgment to Planned Parenthood on both counts.

The Eighth Circuit first disposed of the claim that Planned Parenthood illegally dispensed extra cycles of contraceptives without a physician’s order, affirming that relator’s complaint was not particular enough to survive summary judgment. Id. at 940. Next, the court turned to the allegations of illegal billing for post-abortion related services. As to two of the patients, the Eighth Circuit held that the billing codes used were appropriate for the services provided, and therefore “there [was] no real dispute that Planned Parenthood did not submit a false claim for these patients.” Id. at 942. In other words, Iowa may not have intended to pay those types of claims, but there was nothing false about the information submitted. As to the remaining patients, the court noted that “to prove knowing falsity, [relator] must do more than show that the . . . billing code was wrong; she must have evidence that the defendants knowingly or recklessly cheated the government.” Id. at 943 (emphasis in original) (internal quotation marks and citation omitted). The relator contended that Planned Parenthood improperly and knowingly entered level-three billing codes for services that justified only level-two billing codes on four occasions, resulting in a minor difference in the amount reimbursed. But, in the court’s view, “a one-level difference in billing, resulting in less than a $12.00 reimbursement difference, is at most evidence of an innocent mistake or negligence, not a willful lie to cheat the government.” Id. at 944. Therefore, the court held there was no knowing falsity.

C. Fifth and Second Circuits Grapple with Scope of Public Disclosure Bar

The FCA’s public disclosure bar requires dismissal of an FCA case brought by a private plaintiff “if substantially the same allegations or transactions” forming the basis of the action have been publicly disclosed, including “in a Federal criminal, civil, or administrative hearing in which the Government or its agent is a party,” unless the relator is an “original source of the information.” 31 U.S.C. § 3730(e)(4).

In United States ex rel. Schweizer v. Canon, Inc., 9 F.4th 269 (5th Cir. 2021), the Fifth Circuit took up the issue of whether a copycat lawsuit premised on the same fundamental facts, but against a different defendant, is prohibited by the public disclosure bar. From November 2004 to December 2005, the relator worked as a General Services Administration (“GSA”) contracts manager for Océ North America Inc., a company that sold printers, copiers, and related services to the government. In 2006, the relator filed an FCA suit against Océ. She alleged that the United States was “overpaying Océ for copiers and services, and that its products were manufactured in noncompliant countries including China.” Id. at 272. Before the district court, she alleged that Océ violated the applicable “Price Reductions Clause” (by charging the government more than it did its commercial customers) and the Trade Agreements Act (by sourcing products from China and other non-TAA-compliant countries). In 2013, the district court presiding over that action approved a settlement in which Océ agreed to pay the government $1,200,000 in exchange for a release of the asserted FCA claims. In 2012—before the action became final—Océ was acquired by Canon. Id.

In 2016, the relator filed another FCA suit, this time against Canon. She alleged the same violations of the FCA as she had alleged against Océ in 2006. Canon moved to dismiss the suit, arguing that the FCA’s public disclosure bar prevented Schweizer’s claims. The district court agreed, and the Fifth Circuit affirmed the district court’s judgment on appeal. As the Fifth Circuit explained: “Schweizer’s allegations against Canon are ‘based upon’ the allegations and transactions asserted in the Océ litigation,” and “one could have produced the substance of the [Canon] complaint merely by synthesizing the public disclosures’ description of the [Océ] scheme.” Id. at 275–76 (internal quotation marks and citation omitted). The court rejected the relator’s arguments that the public disclosure bar did not apply because the companies were different, that Canon’s alleged scheme occurred at a later time, and that Canon allegedly violated additional government contracts. Id. at 276–77.

In United States ex rel. Foreman v. AECOM, 19 F.4th 85 (2d Cir. 2021) (discussed above), the Second Circuit also analyzed whether the FCA’s public disclosure bar precluded relator’s claims. The FCA disallows an action if substantially the same allegations have been “publicly disclosed” in a federal report. See 31 U.S.C. § 3730(e)(4)(A)(ii). AECOM argued that all the claims had been made available to the public through government reports presented to AECOM’s employees. The court disagreed. In interpreting the FCA’s requirement that disclosure be public, the court concluded that information does not become “public” if it is (1) not disclosed to innocent employees of the government contractor and (2) when information is disclosed, it comes with the obligation that employees keep the information confidential. Id. at 125. The court thus determined that the information had not been made public here when provided to AECOM employees through a government report. As such, the Second Circuit held that the public disclosure bar did not put an end to relator’s claim.

D. Several Courts Issue Notable Decisions on Pleading Fraud with Particularity Under Rule 9(B) in FCA Cases, and Supreme Court Invites Solicitor General’s View on Topic

In United States ex rel. Mamalakis v. Anesthetix Management LLC, 20 F.4th 295 (7th Cir. 2021), the Seventh Circuit addressed the level of specificity required for a relator’s allegations to satisfy the heightened pleading standards of Federal Rule of Civil Procedure 9(b). The relator alleged that Anesthetix fraudulently billed Medicare and Medicaid for services performed by anesthesiologists by using the code for “medically directed” services rather than the more appropriate and lower rate “medically supervised” services code. Id. at 297. After an initial dismissal without prejudice for failure to meet Rule 9(b)’s requirements, the relator filed an amended complaint including ten examples, identifying a particular procedure and anesthesiologist, and alleging the services did not qualify for payment at the medical-directed billing rate. Id.

The Seventh Circuit held that the district court’s decision to dismiss the amended complaint was “error” because the “ten examples, read in context with the other allegations in the amended complaint, provide sufficient particularity about the alleged fraudulent billing to survive dismissal.” Id. Although a relator “need not produce the invoices and accompanying representations at the outset of the suit, it is nevertheless essential to show a false statement, though this can be accomplished by including particularized factual allegations that give rise to a plausible inference of fraud.” Id. at 301 (internal quotation marks and citation omitted). The court concluded that the ten examples identifying specific procedures, anesthesiologists, and billing rates “provide[d] a particularized basis from which to plausibly infer that at least on these occasions, [defendant] presented false claims to the government.” Id. at 303. By providing such examples, the relator “injected enough precision and substantiation into his allegations of fraud to entitle him to move forward with his case.” Id.

The Sixth Circuit took a similar approach to Rule 9(b) pleading requirements in United States ex rel. Owsley v. Fazzi Associates, Inc., 16 F.4th 192 (6th Cir. 2021). There, the relator alleged “in detail, a fraudulent scheme” in which defendants allegedly fraudulently up-coded patient data and subsequently submitted inflated requests for payment to the Centers for Medicare and Medicaid Services (“CMS”). Id. at 196. But fatal to the relator’s claim was her failure “to identify any specific claims that [defendants] submitted pursuant to the scheme.” Id. (emphasis added) (internal quotation marks and citation omitted).

The court explained that the relator could have satisfied Rule 9(b)’s standard in one of two ways: identifying a “representative claim that was actually submitted to the government for payment,” or otherwise alleging facts “based on personal knowledge of billing practice” sufficient to support “a strong inference that particular identified claims were submitted to the government for payment.” Id. (emphasis in original) (internal quotation marks and citations omitted). The relator alleged “personal knowledge of billing practices” but “did not allege facts that identify any specific fraudulent claims” because she failed to identify the dates on which she reviewed patient records, the dates of any related claims for payment, or the amounts of those claims. Id. at 196–97. Acknowledging that the Rule 9(b) inquiry will turn on the facts of each particular case, the court clarified the “touchstone” consideration is “whether the complaint provides the defendant with notice of a specific representative claim that the plaintiff thinks was fraudulent.” Id. at 197. The information in the relator’s complaint failed to meet this standard and thus did not satisfy Rule 9(b). Id.

Finally, the Supreme Court invited the views of the Solicitor General on the issue of application of Rule 9(b) in FCA cases. See Johnson, et al. v. Bethany Hospice and Palliative Care LLC, No. 21-462, 2022 WL 145173, at *1 (U.S. Jan. 18, 2022). But it remains to be seen whether the Court will take up the issue. Indeed, this is not the first time parties have petitioned the Court on this issue, and the Supreme Court has rejected multiple petitions to clarify the interplay of Rule 9(b) and the FCA in recent years. See e.g., 81 U.S.L.W. 3650 (U.S. Mar. 31, 2014) (No. 12-1349). This is also not the first time the Supreme Court has asked for the views of the Solicitor General on this issue: in 2014, the Court asked for the input of the Solicitor General on whether to grant certiorari on this issue in the Fourth Circuit case of United States ex rel. Nathan v. Takeda Pharm., 707 F.3d 451 (4th Cir. 2013). After the Solicitor General urged the Court not to take up the issue, the Supreme Court denied certiorari, see Brief for the United States as Amicus Curiae Supporting Respondents, United States ex re. Nathan v. Takeda Pharm., 572 U.S. 1003 (2014); 81 U.S.L.W. 3650 (U.S. Mar. 31, 2014) (No. 12-1349).

E. Third Circuit Analyzes DOJ’s Authority to Dismiss Qui Tam FCA Cases

In October, the Third Circuit waded into the circuit split concerning the government’s statutory authority to dismiss an FCA qui tam suit. In Polansky v. Exec. Health Res. Inc., 17 F.4th 376 (3d Cir. 2021), a case in which the government initially declined to intervene in relator’s suit but then later moved to dismiss without formally intervening, the court considered two questions: (1) whether the government may move to dismiss a relator’s suit without intervening, and (2) what standard must the government meet for dismissal to be granted.

First, the court considered the government’s statutory authority to seek dismissal when it does not intervene. The court recognized the split between the D.C., Ninth, and Tenth Circuits, which read 31 U.S.C. § 3730(c) as granting authority to move for dismissal at any point in the litigation regardless of whether the government intervenes, and the Sixth and Seventh Circuits, which interpret the section to only grant authority to seek dismissal after intervention pursuant to Federal Rule of Civil Procedure 41.

In analyzing the question, the court accepted that the government may only dismiss cases where it has intervened. The court concluded that 31 U.S.C. § 3730(c)(2)(A) is not “a standalone provision that grants the Government unconditional authority to seek dismissal as a non-party.” Id. at 385. The court held that, when read in context along canons of statutory construction, 31 U.S.C. § 3730(c)(2)(A) served as a limit on relator’s rights “if—and only if—the Government proceeds with the action.” Id. The court noted that the other limitations in section 3730(c)(2), such as enabling the government to limit a relator’s ability to call witnesses where it “would interfere with … the Government’s prosecution of the case,” only make sense if the government is party to the case. Id. Furthermore, to allow the government to dismiss without intervention would limit the relator regardless of whether the government “proceeds with the action,” rendering those words superfluous. However, the Third Circuit rejected the relator’s argument that the government may only move to dismiss if it intervenes at the outset of a case. Id. at 387.

Second, the court held that, “[h]aving intervened, the Government becomes a party, and like any party, it is subject to the Federal Rules of Civil Procedure, including the rule governing Voluntary Dismissal.” Id. at 389. Recognizing that the FCA added “certain wrinkles,” the court concluded that the government must only meet the threshold requirements of Federal Rule of Civil Procedure 41(a), while also providing relator “notice and an opportunity for a hearing” under 31 U.S.C. § 3730(c)(2)(A). Id. In doing so, the Third Circuit agreed with the Seventh Circuit and expressly rejected both the Swift approach of the D.C. Circuit for being incongruous with other provisions of the FCA and relegating the Article III judge to the role of “serv[ing] . . . some donuts and coffee” as well as the Sequoia Orange approach of the Ninth Circuit for focusing solely on constitutional limits and for failing to consider the limitations of the Federal Rules of Civil Procedure on voluntary dismissal. Id. at 392–93 (quoting United States ex rel. CIMZNHCA, LLC v. UCB, Inc., 970 F.3d 835, 850 (7th Cir. 2020)).

Despite holding that the government must “intervene under § 3730(c)(3) before seeking to dismiss relator’s case,” the court ultimately construed the government’s motion to dismiss as including a motion to intervene, again adhering to the Seventh Circuit’s approach. Id. at 392. Further, the court found no abuse of discretion “[i]n light of [the] thorough examination and weighing of the interests of all the parties, and Rule 41(a)(2)’s ‘broad grant of discretion’ to shape the ‘proper’ terms of dismissal.” Id. at 393. In sum, the Third Circuit has responded to the growing circuit split over the authority of the government to dismiss whistleblower lawsuits by adopting the Seventh Circuit’s position in CIMZNHCA; the government must intervene to dismiss and the standard for dismissal should be primarily informed by Federal Rule of Civil Procedure 41.

F. Third Circuit Considers Retroactivity of Amendments to FCA

In United States ex rel. International Brotherhood of Electrical Workers Local Union No. 98 v. Fairfield Co., 5 F.4th 315 (3d Cir. 2021), the Third Circuit grappled with the question of whether (relatively) recent amendments to the FCA had retroactive effect. The Fraud Enforcement and Recovery Act of 2009 (“FERA”), Pub. L. No. 111-21, § 4, 123 Stat. 1625, amended several portions of the FCA, including eliminating the requirement that the false claim be presented to an office or employee of the United States, and removing the requirement for specific intent. Id. at 324. Fairfield challenged the purported retroactivity of the FERA amendments, claiming that should the specific intent provision remain, judgment must be in Fairfield’s favor. Id. at 329–30. The Third Circuit concluded, however, that the statute included a clear expression of retroactivity. The court also held that applying FERA’s amendments would not violate the ex post facto clause of the U.S. Constitution, because the penalties under the FCA were insufficiently punitive in nature to trigger that clause. Id. at 330–41.

After resolving the retroactivity point, the Third Circuit affirmed the district court’s orders entering judgment against Fairfield for FCA violations stemming from Fairfield’s alleged violation of the Davis Bacon Act, 40 U.S.C. § 3142, et. seq., which requires contractors performing work on federally funded construction projects to pay prevailing wages to their employees based on the classification of work performed. Id. at 323. As the court explained, a misclassification of employees may result in those individuals being underpaid, which means accompanying certifications to the government that a contractor is in compliance with the Act may be both false and material to payment for contractual performance. Id. at 323–24. Fairfield allegedly underpaid its employees as compared to the wages the Act required, but still submitted certifications to the government that it satisfied applicable wage requirements. Id. at 326–27.

G. Eleventh Circuit Addresses Novel Excessive Fines Issue

In Yates v. Pinellas Hematology & Oncology, P.A., 21 F.4th 1288 (11th Cir. 2021), the Eleventh Circuit considered whether a penalty imposed under the FCA violated the Eighth Amendment’s Excessive Fines Clause. Pinellas was a medical practice that collected and tested blood samples at its clinical laboratory. The entity purchased a second location—an oncology practice—at which it also performed testing allegedly without obtaining a new certification under the Clinical Laboratory Improvement Amendments (“CLIA”) of 1988, as required, for almost a year after the purchase. Id. at 1295. According to the qui tam suit, in which the government declined to intervene, the defendant allegedly then submitted reimbursement claims for blood tests to Medicare that miscited the CLIA certificate at its other location and other claims that misrepresented the location of service. Id. at 1296. A jury ultimately found the defendant liable for submitting 214 false claims to Medicare and found that the government sustained $755.54 in damages. Id. Under the FCA’s treble damages and statutory penalty provisions, discussed above, the district court imposed a total monetary award of $1,179,266.62 (composed of $2,266.62 in treble damages (3 x $755.54) and $1,177,000 in statutory penalties (214 x $5,500)). Id. at 1297.