March 20, 2020

In Salzberg, et al. v. Sciabacucchi (“Blue Apron II”),[1] a unanimous Delaware Supreme Court, with Justice Valihura writing, confirmed the facial validity of federal-forum provisions (“FFPs”)—provisions Delaware corporations adopt in their certificates of incorporation requiring actions arising under the Securities Act of 1933 (the “1933 Act”) to be filed exclusively in federal court. The Court’s decision emphasizes the “broadly enabling” scope of both the Delaware General Corporation Law (“DGCL”) as a whole, and of Section 102(b)(1),[2] which governs the contents of a corporation’s certificate of incorporation, in particular. Rejecting facial challenges to FFPs adopted by Delaware corporations in connection with several recent IPOs, the Court held that Section 102(b)(1) authorizes corporations to adopt provisions regulating matters within an “outer band” of “intra-corporate affairs” extending beyond the “universe of internal affairs” of a Delaware corporation. In this regard, Blue Apron II may offer Delaware corporations, their boards and advisors a valuable new tool for managing complex, multidistrict litigation related to their corporate governance.

Blue Apron I and the Established Scope of “Internal Corporate Claims”

Blue Apron II reversed, on de novo review, the December 2018 decision of the Delaware Court of Chancery in Sciabacucchi v. Salzberg, et al. (“Blue Apron I”).[3] In Blue Apron I, a stockholder in each of Blue Apron, Inc., Roku Inc., and Stitch Fix, Inc. sought a declaratory judgment that FFPs adopted in each corporation’s certificate of incorporation in connection with their 2017 IPOs were facially invalid as a matter of Delaware law.

As detailed by Vice Chancellor Laster, the basic principles underlying the holding in Blue Apron I were developed in Boilermakers,[4] ATP Tour,[5] and DGCL § 115,[6] each of which addressed bylaws for disputes involving Delaware corporations. Relying upon these authorities, the Blue Apron I court held that, despite the broad scope of DGCL § 102(b)(1), the FFPs could not validly restrict a stockholder plaintiff’s choice of forum for actions arising under the 1933 Act because such claims were “external” to the corporations at issue based upon their similarity to “a tort or contract claim brought by a third-party plaintiff who was not a stockholder at the time the claim arose.” The Court of Chancery also concluded that Section 115 implicitly narrowed Section 102(b)(1) to restrict the authority of Delaware corporations to regulating only “internal corporate claims.” Additionally, the trial court also noted, but did not reach, an argument that FFPs are invalid as a matter of public policy, because they “take Delaware out of its traditional lane of corporate governance and into the federal lane of securities regulation” and could even be preempted by federal law providing forum alternatives.

The New Frontier: Intra-Corporate Affairs and the “Outer Band” of Section 102(b)(1)

In Blue Apron II, the Delaware Supreme Court reversed the Court of Chancery, holding that FFPs are facially valid because such provisions “could easily fall within either of the[] broad categories [of Section 102(b)(1)],” and “do not violate the laws or policies of this State” or “federal law or policy.” In doing so, the Supreme Court rejected the Court of Chancery’s conclusions that Section 115 implicitly narrowed Section 102(b)(1) and that, under Boilermakers and ATP Tour, “everything other than an ‘internal affairs’ claim was ‘external’ and, therefore, not the proper subject of a bylaw.”

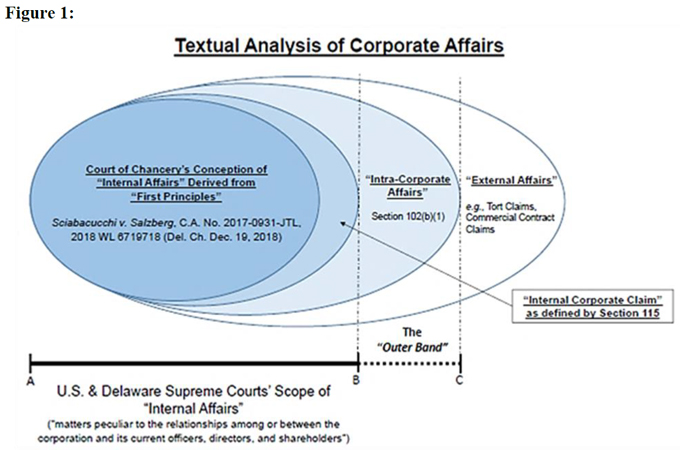

Instead of such a “binary world,” the Supreme Court held that claims involving “intra-corporate affairs” under Section 102(b)(1), such as the federal antitrust claims underlying the fee-shifting bylaws in ATP Tour and certain 1933 Act claims considered hypothetically by the Court in Blue Apron II, sit on a “continuum” of corporate affairs. At one end of the spectrum is “the more traditional realm of ‘internal affairs,’” including “matters peculiar to the relationships among or between the corporation and its current officers, directors, and shareholders.” At the other end are “purely ‘external’ claims,” such as tort claims and commercial contract claims. According to the Supreme Court, the scope of matters that certificates of incorporation may properly regulate under Section 102(b)(1) falls between those poles, as it set forth in Figure 1, below. The “outer band” of Section 102(b)(1), the Court explained, extends to all “[i]ntra-corporate affairs,” which is a “universe of matters” that “is greater than the universe of internal affairs matters.” This includes FFPs “regulating the fora for Section 11 claims involving at least existing stockholders [because such claims] are neither ‘external’ nor ‘internal affairs’ claims.”

Notwithstanding the Supreme Court’s holding that federal-forum provisions are facially valid, the Court acknowledged that the extent to which such provisions will be respected and enforced going forward by Delaware courts, and, even more critically, by other state and federal courts, will depend in large part on the unique facts and circumstances of each case.

Key Takeaways

Blue Apron II provides valuable guidance to Delaware litigators and board advisors on best practices for adopting FFPs and other provisions governing the procedural aspects of intra-corporate litigation pursuant to Section 102(b)(1) of the DGCL:

- In the wake of this development, Delaware corporations that have not done so already may amend their charters to require claims under the 1933 Act to be filed in federal court.[7] After Cyan was decided in 2018, the filing of 1933 Act claims in state courts increased significantly.[8] Given that such claims cannot be removed to federal court under Cyan, corporations have increasingly been mired in unnecessarily costly, and sometimes duplicative, state and federal court litigation throughout the country.

- The Supreme Court in Blue Apron II quells “concern that if [FFPs were] upheld, the ‘next move’ might be forum provisions that require arbitration of internal corporate claims,” explicitly reasoning that “[s]uch provisions, at least from [Delaware] state law perspective, would violate Section 115 . . . .” But it is not yet clear whether practitioners will continue to push to include arbitration as an exclusive means to resolve certain intra-corporate disputes lying within the “outer bound” of Section 102(b)(1).

- Although Delaware law prohibits Delaware corporations from adopting mandatory arbitration provisions in their certificates of incorporation or bylaws, it remains to be seen whether other states will follow suit. States competing for Delaware’s franchise might attempt to attract corporations by authorizing such arbitration provisions to minimize the burden and cost of litigation.

- FFPs clearly benefit stockholders by minimizing wasteful multi-jurisdictional litigation over many disputes involving the corporations they own. Nonetheless, corporate directors and officers should anticipate that some stockholders may be wary of the provisions, including broader FFPs adopted or approved under Blue Apron II. This decision should serve as a reminder that corporations may be well advised to engage with key stockholders to discuss the benefits these provisions provide before their adoption.

____________________

[1] Salzberg, et al. v. Sciabacucchi, No. 346, 2019 (Del. Mar. 18, 2020) [hereinafter “Blue Apron II”)].

[2] 8 Del. C. § 102(b)(1) (“[T]he certificate of incorporation may also contain . . . [a]ny provision for the management of the business and for the conduct of the affairs of the corporation , and any provision creating, defining, limiting and regulating the powers of the corporation, the directors, and the stockholders . . . .”).

[3] Sciabacucchi v. Salzberg, et al., 2018 WL 6719718 (Del. Ch. Dec. 19, 2018) [hereinafter “Blue Apron I”].

[4] Boilermakers Local 154 Retirement Fund v. Chevron, 73 A.3d 934, 942, 952 (Del. Ch. 2013).

[5] ATP Tour, Inc. v. Deutscher Tennis Bund, 91 A.3d 554 (Del. 2014).

[6] 8 Del. C. § 115 (“‘Internal corporate claims’ means claims, including claims in the right of the corporation, (i) that are based upon a violation of a duty by a current or former director or officer or stockholder in such capacity, or (ii) as to which this title confers jurisdiction upon the Court of Chancery.”).

[7] Blue Apron II does not address the applicability of an FFP to claims arising under the Securities Exchange Act of 1934 (the “1934 Act”), which unlike the 1933 Act vests exclusive jurisdiction with federal courts and does not include a bar to removing claims improperly filed in state court. Compare 15 U.S.C. 78aa(a) (1934 Act), with 15 U.S.C. 77v (1933 Act).

[8] Stanford L. Sch. Sec. Class Action Clearinghouse & Cornerstone Research, Sec. Class Action Filings 2019 Year in Review 4 (2020).

The following Gibson Dunn lawyers assisted in the preparation of this client update: James Hallowell, Jason J. Mendro, Brian M. Lutz,

Mark H. Mixon, Jr., Sam Berman and Andrew Kuntz.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any of the following practice group leaders and members, or the authors:

James L. Hallowell – New York (+1 212-351-3804, [email protected])

Jason J. Mendro – Washington, D.C. (+1 202-887-3726, [email protected])

Brian M. Lutz – San Francisco/New York (+1 415-393-8379/+1 212-351-3881, [email protected])

Mark H. Mixon, Jr. – New York (+1 212-351-2394, [email protected])

Securities Litigation Group:

Brian M. Lutz – Co-Chair, San Francisco/New York (+1 415-393-8379/+1 212-351-3881, [email protected])

Robert F. Serio – Co-Chair, New York (+1 212-351-3917, [email protected])

Jefferson Bell – New York (+1 212-351-2395, [email protected])

Paul J. Collins – Palo Alto (+1 650-849-5309, [email protected])

Jennifer L. Conn – New York (+1 212-351-4086, [email protected])

Ethan Dettmer – San Francisco (+1 415-393-8292, [email protected])

Mark A. Kirsch – New York (+1 212-351-2662, [email protected])

Monica K. Loseman – Denver (+1 303-298-5784, [email protected])

Jason J. Mendro – Washington, D.C. (+1 202-887-3726, [email protected])

Alex Mircheff – Los Angeles (+1 213-229-7307, [email protected])

Robert C. Walters – Dallas (+1 214-698-3114, [email protected])

Aric H. Wu – New York (+1 212-351-3820, [email protected])

Securities Enforcement Group:

Richard W. Grime – Washington, D.C. (+1 202-955-8219, [email protected])

Barry R. Goldsmith – New York (+1 212-351-2440, [email protected])

Mark K. Schonfeld – New York (+1 212-351-2433, [email protected])

Securities Regulation and Corporate Governance Group:

Elizabeth Ising – Washington, D.C. (+1 202-955-8287, [email protected])

James J. Moloney – Orange County, CA (+ 949-451-4343, [email protected])

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.