Last year witnessed significant developments in False Claims Act enforcement, including a record-breaking number of new FCA cases. In this update, we cover recent developments in FCA jurisprudence, summarize significant enforcement activity, and analyze the most notable legislative, policy, and caselaw developments from the second half of calendar year 2024, picking up where our mid-year 2024 update left off.

Last year, the Department of Justice (DOJ) and qui tam relators smashed 2023’s all-time record for the number of newly filed False Claims Act (FCA) cases. While monetary recoveries from FCA cases in 2024 remained largely in line with trends over the last decade, 2024’s figure was still the highest in three years, coming in just shy of $3 billion. As in previous years, the lion’s share of this figure (approximately $2.2 billion) came from qui tam suits filed by private relators where DOJ subsequently intervened.

Another noteworthy 2024 development threatens to derail this enforcement train. In September 2024, a Florida federal court ruled the FCA’s qui tam provisions unconstitutional under the Appointments Clause. Ordinarily, that decision, in United States ex rel. Zafirov v. Florida Medical Associates, LLC, would seem unlikely to survive the Eleventh Circuit’s scrutiny, given the other cases previously holding that qui tam suits are constitutional. But Zafirov tracks statements by three Supreme Court Justices last year that they had questions about the constitutionality of the qui tam provision. Regardless of the outcome of that case, the robust pace of current enforcement efforts—both DOJ- and relator-led—is likely to continue for the foreseeable future. In this update, we cover both the Zafirov decision and other recent developments in FCA jurisprudence, and consider their implications for companies facing FCA matters that have progressed to litigation.

Last year’s record statistics also serve as a reminder that, while DOJ’s FCA enforcement priorities can shift after a presidential administration transition, it takes far more than a change in the political climate to slow FCA enforcement. In this update, we share our insights on how the second Trump Administration DOJ may distinguish its FCA enforcement efforts from those of the Biden Administration (and the first Trump Administration). And we also assess how relator-led cases are likely to continue to expand potential enforcement theories, forcing DOJ to crystallize its enforcement priorities via its intervention decisions.

This update also summarizes significant enforcement activity and analyzes the most notable legislative, policy, and caselaw developments from the second half of calendar year 2024, picking up where our last update left off. You can find all of Gibson Dunn’s publications regarding the FCA on our website, including a detailed discussion of how the FCA operates, industry-specific presentations, and practical guidance for companies seeking to navigate FCA enforcement.

I. FCA ENFORCEMENT ACTIVITY

A. NEW FCA ACTIVITY

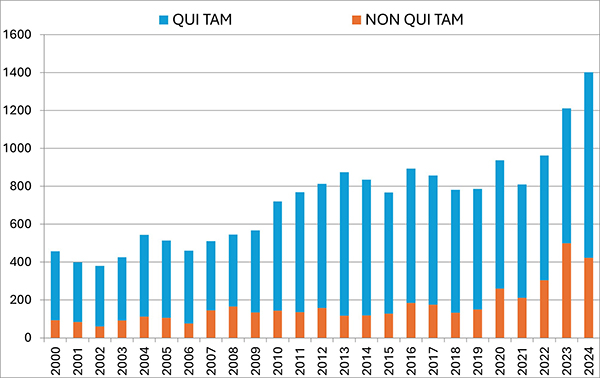

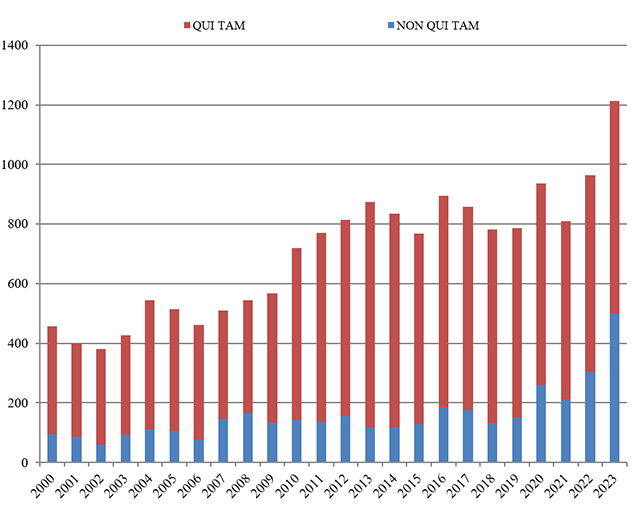

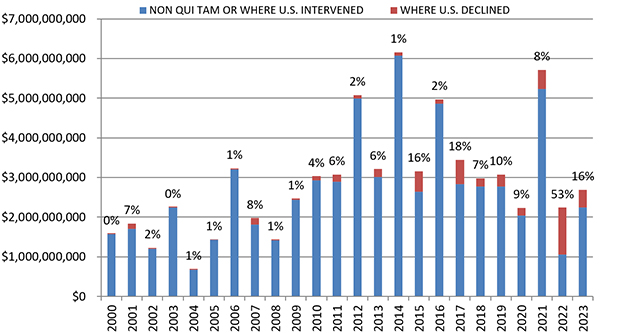

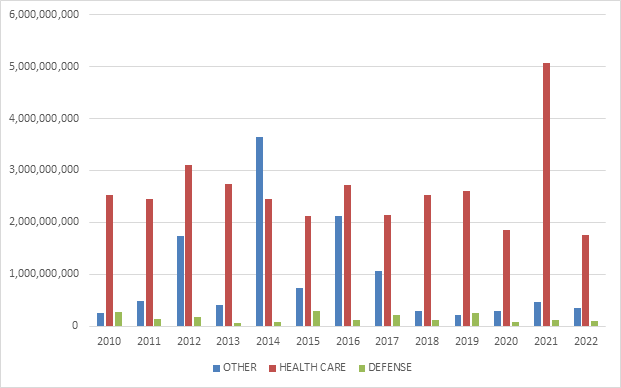

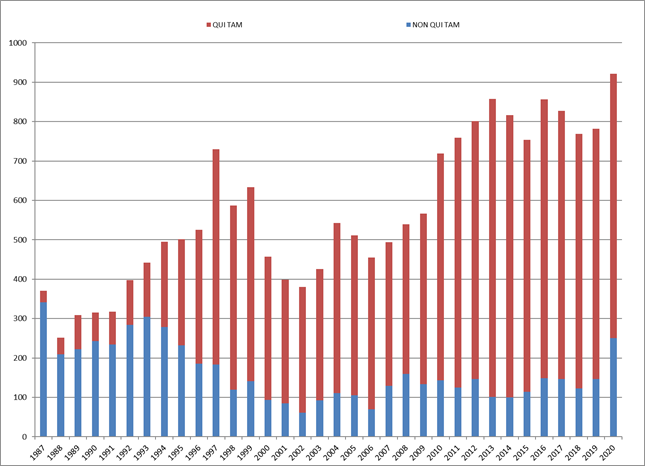

In 2024, FCA enforcement reached staggering new heights—higher, even, than the then-record-setting number of new FCA cases in 2023. The government and qui tam relators filed 1,402 new cases in 2024, representing an additional 190 additional cases (a jump of about 16%) beyond 2023’s previous record total of 1,212 total new cases.

Of these new cases, relators initiated a record 979 qui tam actions in FY 2024—a 37% increase over the prior year, and a number far in excess of the prior record of 757 actions brought in 2013. The 979 new qui tam cases exceed the total number of FCA actions (both qui tam and non-qui tam) brought in all years except 2023.

The government, meanwhile, initiated 423 FCA matters in FY 2024. This is the second-highest number since 1986 (surpassed only by last year’s total of 505) and reflects DOJ’s continued investment in identifying leads for FCA enforcement without the assistance of relators.

For companies trying to anticipate developments in FCA enforcement under the second Trump Administration, FY 2024’s record number of new FCA actions highlights an important reality: regardless of the extent to which overall enforcement priorities evolve in the next four years, the sheer number of pending FCA cases will inevitably shape enforcement dynamics in the near term while these cases wend their way through the investigative and judicial processes. Further, DOJ’s intervention decisions in qui tam cases filed during the prior administration will go a long way toward revealing enforcement priorities going forward.

Number of FCA New Matters, Including Qui Tam Actions

|

Source: DOJ “Fraud Statistics – Overview” (Jan. 15, 2025).

B. TOTAL RECOVERY AMOUNTS

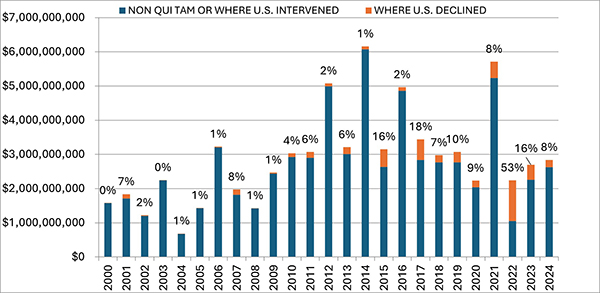

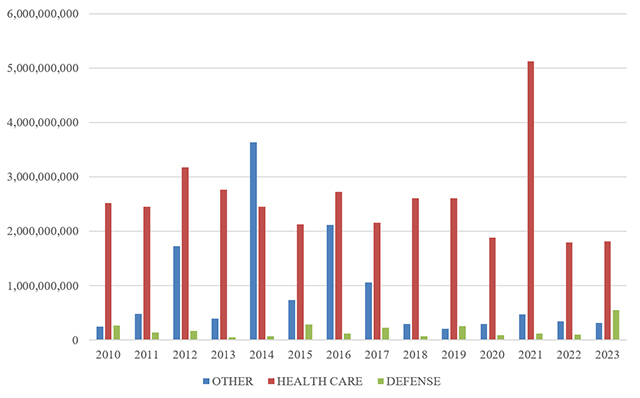

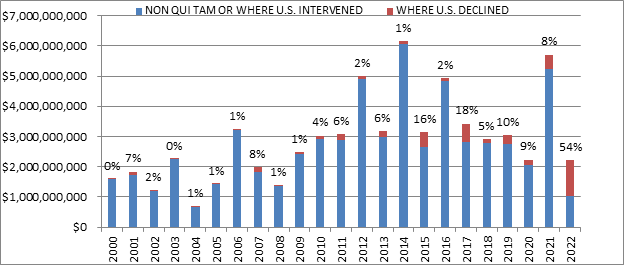

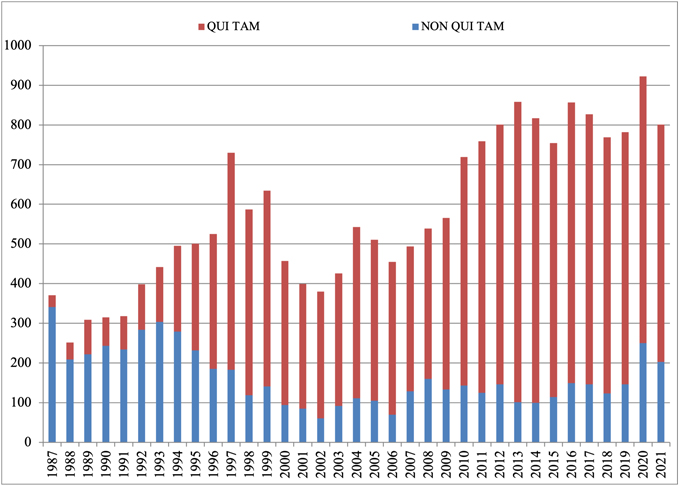

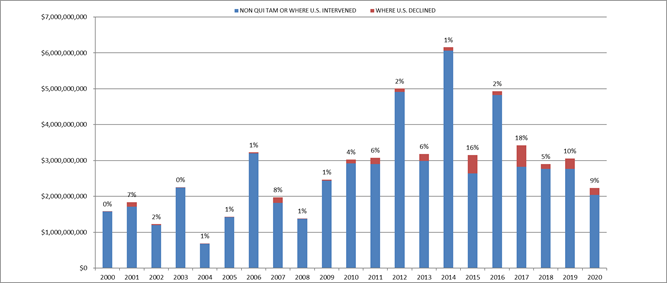

In FY 2024, settlements and judgments under the FCA resulted in over $2.9 billion in recoveries, a figure just slightly above last year’s recovery of $2.7 billion. FY 2024’s total is broadly in line with yearly totals dating back to 2017, suggesting that 2021’s all-time record of $5.7 billion may be an outlier.

Notably, the government’s already sizeable recoveries in FY 2024 do not include two large settlements DOJ announced after the close of its 2024 fiscal year. In mid-October 2024, DOJ announced a $425 million settlement with a pharmaceutical company and a $428 million settlement with a defense contractor; the latter, according to DOJ, is the second largest government procurement-related recovery in FCA history. Together, these two settlements already bring FY 2025’s running total to over $850 million, suggesting that FY 2025 could surpass FY 2024 and mark the fourth straight year of increasing recoveries.

Settlements or Judgments in Cases Where the Government Declined Intervention as a Percentage of Total FCA Recoveries

|

Source: DOJ “Fraud Statistics – Overview” (Jan. 15, 2025).

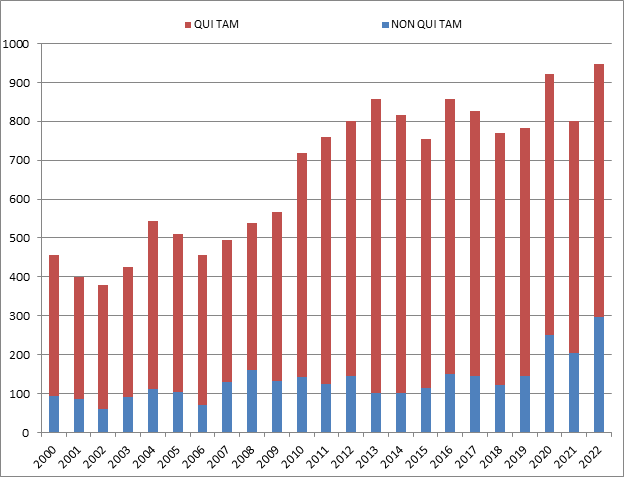

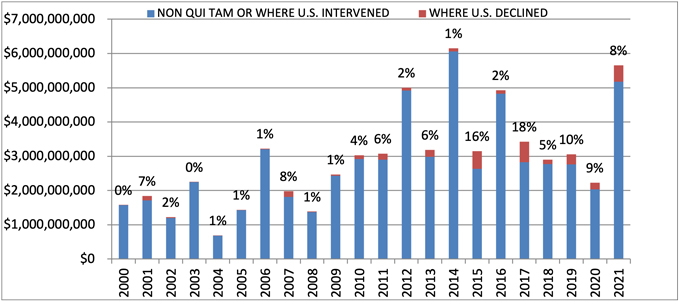

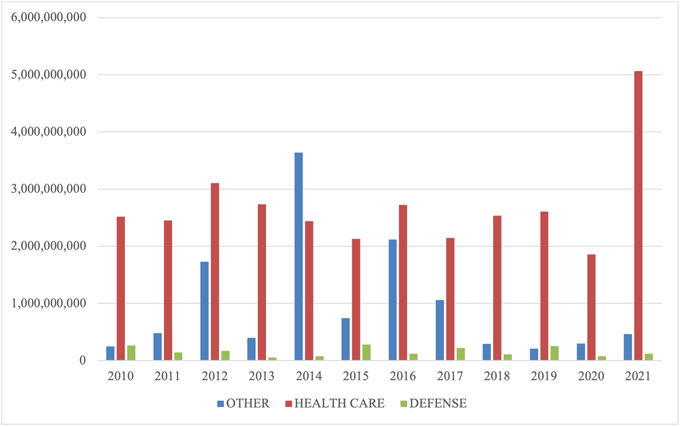

C. FCA RECOVERIES BY INDUSTRY

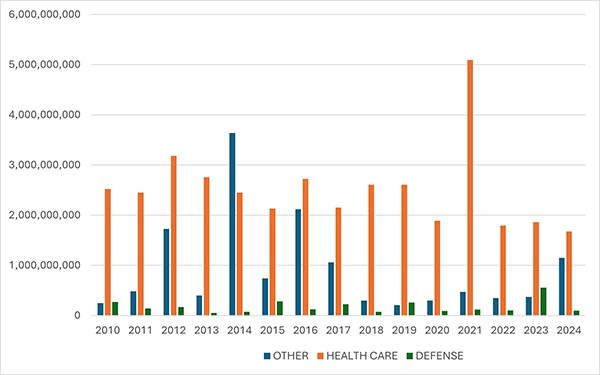

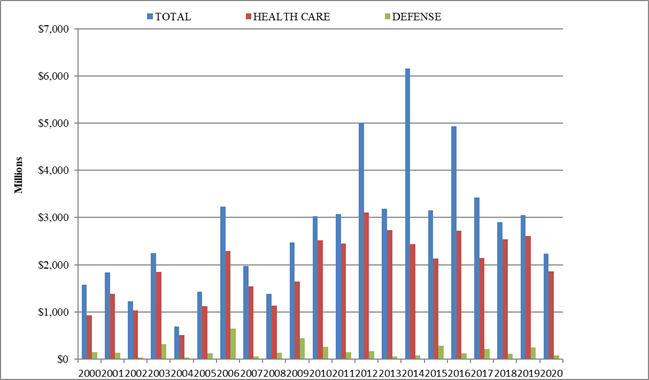

In keeping with prior years, most recoveries under the FCA in 2024 came from the health care sector, which saw approximately $1.7 billion in settlements and judgments. That figure represents a slight decrease from last year—and is in fact the lowest amount since 2009.

On the other hand, settlements and judgments in DOJ’s “Other” category (i.e., non-health care, non-defense) tripled from $370 million in FY 2023 to approximately $1.15 billion in FY 2024. Major recoveries in this area included a $38.2 million settlement agreement with a city government regarding its receipt of federal Department of Housing and Urban Development grant funds.

FCA Recoveries by Industry

|

Source: DOJ “Fraud Statistics – Health and Human Services”; “Fraud Statistics – Department of Defense”; “Fraud Statistics – Other (Non-HHS and Non-DoD)” (Jan. 15, 2025).

II. NOTEWORTHY DOJ ENFORCEMENT ACTIVITY DURING THE SECOND HALF OF 2024

A. HEALTH CARE AND LIFE SCIENCES INDUSTRIES

- On July 1, two home health agencies and their parent entity agreed to pay approximately $4.5 million to resolve allegations that they provided illegal kickbacks to providers in exchange for Medicare referrals, in violation of the Anti-Kickback Statute (AKS) and the FCA. The government claimed that the agencies provided kickbacks in the form of lease payments, wellness health services, sports tickets, and meals. DOJ awarded the agencies an unspecified amount of credit for self-disclosure and cooperation with the government’s investigation, including in the form of assistance in determining the government’s alleged losses.[1]

- On July 10, a pharmacy chain and three subsidiaries agreed to settle claims that they violated the FCA by improperly reporting rebates received by drug manufacturers as service fees to the Centers for Medicare and Medicaid Services (CMS). As part of the settlement, the pharmacy and one of its subsidiaries will pay $101 million to the federal government. Further, the pharmacy’s other two subsidiaries will grant the United States an allowed, unsubordinated, general unsecured claim of $20 million in the pharmacy’s bankruptcy case in the District of New Jersey. The settlements resolved a qui tam suit brought by a former employee.[2]

- On July 10, a health care provider and twelve affiliated skilled nursing facilities agreed to pay $21.3 million to resolve allegations that they submitted false claims for rehabilitation therapy services. The government alleged that the provider created a quota system that incentivized employees to bill Medicare for therapy services that were “unreasonable, unnecessary, unskilled, or that simply did not occur as billed.” The government further alleged that the provider submitted false claims to Medicaid by using an inflated reimbursement rate that relied on data inaccurately reflecting the type and degree of care needed by the patients. The settlement resolved a qui tam lawsuit brought by two former employees of the company. In connection with the settlement, the provider entered into a five-year corporate integrity agreement (CIA) with the Department of Health and Human Services Office of Inspector General (HHS-OIG) that requires an independent review organization to assess annually the medical necessity and appropriateness of therapy services billed to Medicare.[3]

- On July 11, a pharmacy chain and 10 subsidiaries agreed to settle allegations that they violated the FCA by knowingly dispensing unlawful prescriptions for opioids. According to the government, the prescriptions lacked a legitimate medical purpose, were not issued in the usual course of professional practice, were not for a medically accepted indication, or were medically unnecessary or otherwise invalid. As part of the settlement, the government will be paid $7.5 million and have an allowed, unsubordinated, general unsecured claim of $401.8 million in the pharmacy’s bankruptcy case in the District of New Jersey. The settlement resolves claims brought in a qui tam suit by former pharmacy employees. In conjunction with the settlement, the pharmacy chain entered into a Memorandum of Agreement (MOA) with the Drug Enforcement Administration (DEA), which includes employee training requirements and imposes certain recording-keeping obligations on the pharmacy for five years. The pharmacy chain also entered into a CIA with HHS-OIG that requires an independent review organization to determine whether prescription drugs are properly prescribed, dispensed, and billed.[4]

- On July 12, a provider of biopharmaceutical research services agreed to pay $5.38 million to settle allegations that it violated the FCA and the AKS. The government alleged that the company paid commissions to independent marketers in exchange for recommending the company’s services, and then submitted reimbursement claims for those services to Medicare and Medicaid. The government also alleged that the company continued to pay commissions to independent marketers even after learning that such payments violated the AKS. The settlement resolved a qui tam suit brought by two co-founders of a former independent marketer for the company. The company separately agreed to pay $147,851 to individual states for reimbursement claims paid by state Medicaid programs.[5]

- On July 18, a hospice center and its affiliates agreed to pay more than $19.4 million to resolve FCA claims premised on the alleged knowing submission of false claims for hospice services for patients who were not terminally ill or were otherwise ineligible for hospice care. The settlement also resolved nine qui tam lawsuits brought by current and former employees.[6]

- On July 18, a kidney dialysis provider agreed to pay over $34.4 million to resolve allegations that it improperly induced referrals to a former subsidiary that provided pharmacy services to dialysis patients. The government also alleged that the provider paid purported kickbacks to physicians to induce referrals to the company’s dialysis centers. This settlement resolved a qui tam suit brought by a former Chief Operating Officer of the provider.[7]

- On August 1, a Florida county agreed to pay $3.5 million to settle FCA allegations of fraudulent billing by the county’s Emergency Medical Service department. Specifically, the government alleged that over a seven-year period, the county billed federal health care programs for emergency medicine and transportation services performed by technicians who lacked appropriate certifications. The settlement also resolves a qui tam suit brought by the medical director of the county’s Emergency Medical Service.[8]

- On August 12, a Texas medical group and its founder and CEO agreed to pay a total of $8.9 million to settle allegations that they submitted false claims to Medicare by offering and providing illegal remuneration to physicians to induce referrals to their surgical centers, in violation of the AKS. The settlement resolves claims brought in a qui tam suit by a radiologist.[9]

- On August 20, a home health care and hospice provider and its subsidiaries agreed to pay approximately $3.8 million to resolve claims that the provider knowingly submitted false Medicare claims for patients who were ineligible for home health care or hospice benefits, for services that were unreasonable or not medically necessary, for services performed by untrained staff, or for services that were never performed. The settlement also resolved two additional qui tam suits brought by a former travel nurse, former managers, and former directors.[10]

- On August 26, a Missouri-based company specializing in durable medical equipment agreed to pay $13.5 million to resolve allegations that the company violated the FCA when it knowingly submitted claims based on patient evaluations that were unlawfully authored, completed, or signed by company employees rather than qualified medical professionals. The settlement agreement resolves three qui tam suits brought by employees or former employees. In agreeing to the settlement amount, the government considered the company’s self-disclosure of several overpayments and its cooperation with the government’s investigation.[11]

- On August 27, a Montana health care system agreed to pay $10.8 million to resolve allegations that it submitted false claims related to services performed by an oncologist. Over a five-year period, the health care system allegedly submitted false claims for the oncologist’s services that it knew or should have known were coded at a higher level than what was performed or did not meet requirements to constitute separate identifiable services. Additionally, the government alleged that the oncologist’s salary was inconsistent with fair market value because it was calculated in reliance on the alleged false documentation and certifications regarding the oncologist’s services. The health care system received an unspecified amount of credit for undertaking an internal investigation, voluntarily self-disclosing the doctor’s misconduct, significantly cooperating with the government (including by providing documents it was not legally required to produce and making relevant individuals available for interviews), and enhancing its corporate compliance program. The settlement agreement specifies that $9,988,970.15 of the settlement is restitution, amounting to just under a 1.1x multiplier if the restitution amount specified in the resolution is treated as a proxy for single damages.[12]

- On September 4, a generic pharmaceutical manufacturer agreed to pay $25 million to settle allegations under the FCA that it conspired to fix the price of a generic drug. According to the government, the company violated the AKS by making and receiving payments in connection with arrangements with other pharmaceutical manufacturers on price, supply, and customer allocation. The company previously entered into a $30 million deferred prosecution agreement with DOJ to resolve criminal antitrust charges stemming from the same conduct. DOJ’s press release makes clear that the FCA settlement amount “is in addition to the criminal penalty paid by the company,” meaning the government did not offset one amount against the other.[13]

- On September 13, a major U.S. pharmacy retailer and its parent holding company agreed to pay $106.8 million to resolve allegations that the pharmacy violated the FCA and related state statutes by billing government health care programs for prescriptions that were never dispensed to patients. The government alleged that over an eleven-year period, the pharmacy restocked and resold prescriptions to beneficiaries that had initially been filled for other beneficiaries who failed to pick up the prescriptions. The pharmacy obtained a very favorable settlement, including credit for self-disclosure of certain conduct, cooperation, and remediation of its electronic pharmacy management system, as well as credit for $66 million that it had already refunded to the government.[14]

- On September 16, a surgery center and its affiliates agreed to pay approximately $12.76 million to resolve alleged FCA violations stemming from improper financial relationships between the surgery center and two physician groups. The government alleged that the surgery center made improper financial contributions to the physician groups in violation of the FCA, AKS, and Stark Law, by funding athletic trainers’ salaries in exchange for referrals by the trainers to the center. As part of the settlement, approximately $12.76 million will be paid to the federal government, and South Dakota, Iowa, and Nebraska will collectively receive approximately $1.37 million. The government acknowledged that the surgery center took significant steps entitling it to credit for cooperating with the government.[15]

- On September 18, a provider agreed to pay $60 million to resolve allegations that it made payments to third-party insurance agents in return for referrals of Medicare Advantage beneficiaries, in violation of the AKS and the FCA. The government claimed that the provider’s conduct caused the submission of false claims to Medicare Advantage organizations and in turn to the federal government. The settlement resolves a qui tam lawsuit.[16]

- On September 26, a health care company that owns and operates inpatient behavioral-health facilities in multiple states agreed to pay $19.85 million to resolve allegations that it submitted false claims to government health care programs. According to the government, the company submitted claims for unreasonable and medically unnecessary behavioral health services, including improperly admitting and failing to discharge patients who either never required or no longer needed inpatient care. Further, the government alleged the company knowingly failed in its training, supervision, and scheduling of staff, resulting in significant harm to patients, and failed to meet regulatory obligations for developing plans for assessments, treatment, and discharge and to provide required patient therapy. The federal government will receive around $16.66 million of the recovery, while Florida, Georgia, Michigan, and Nevada will collectively receive $3.18 million. The settlement resolves qui tam suits brought by former employees of the health care company.[17]

- On September 30, two Brooklyn-based licensed home-care service agencies agreed to pay $3.9 million to the United States and $5.85 million to New York State to resolve allegations that the companies used Medicaid payments to pay the wages and benefits of its home health aides, violating the federal FCA and New York State’s FCA by claiming that they paid the minimum wages required under New York state law.[18]

- On September 30, a behavioral health organization in Massachusetts agreed to pay at least $5.5 million and up to $6.5 million to resolve allegations that it violated the federal FCA and the Massachusetts False Claims Act. The settlement resolved allegations that the company provided free sober housing to substance use recovery patients enrolled in Medicare and Medicaid to induce these patients to participate in its program, in violation of the federal and Massachusetts Anti-Kickback Statutes. The allegations underlying the settlement agreement stemmed from a qui tam suit brought by the president of a company with whom the behavioral health organization contracted for patient housing.[19]

- On October 2, a toxicology laboratory agreed to pay $27 million to resolve claims that it billed federal health care programs for medically unnecessary urine tests and provided physicians with free items in exchange for testing referrals. The United States will receive $18.2 million of the settlement amount. The remainder will be paid to affected states, including Maryland, Illinois, Minnesota, Virginia, Georgia, and Colorado. This settlement resolves a qui tam suit.[20] As part of the settlement, the laboratory entered a five-year CIA with HHS-OIG that mandates engagement of an independent review organization to ensure that claims submitted to Medicaid or Medicare for reimbursement are properly coded, submitted, and reimbursed, and that the items and services involved are medically necessary. The CIA also mandates the appointment of a compliance officer with prescribed oversight responsibilities, and the creation of an anonymous whistleblower program for reporting potential violations.[21]

- On October 3, a Medicaid call center operator agreed to pay $11.36 million to resolve allegations that it violated the FCA by fraudulently reporting call center performance metrics. The Company faced up to $26 million in FCA liability due to the conduct of two employees who, from 2018 to 2023, allegedly submitted fabricated call center performance metrics and adjusted invoices to the South Carolina Department of Health and Human Services. In entering into the settlement, the government took into consideration the call center operator’s voluntary disclosure and remedial action.[22]

- On October 4, a medical center agreed to pay $14.2 million to settle FCA allegations that it violated Medicare regulations and the Stark Law, which prohibits physician self-referrals. The government alleged that the medical center submitted claims for Medicare reimbursement that did not include a “PN” modifier indicating that the services were provided at a non-excepted off-campus outpatient facility. Further, according to the government, the medical center maintained agreements that created financial relationships between the hospital and physician-owners who referred Medicare beneficiaries to the hospital in violation of the Stark Law. The medical center self-reported the alleged conduct to DOJ. As part of its disclosure, the medical center provided an independent third-party expert’s analysis of the financial impact of the omitted “PN” modifiers and disclosed the existence of its various agreements related to physical referrals. The settlement agreement credits the medical center for its voluntary self-disclosure and subsequent cooperation with investigators. Of the total settlement amount, $9.46 million (approximately 66%) constituted restitution.[23]

- On October 10, a generic pharmaceutical manufacturer agreed to pay $25 million to settle allegations under the FCA that the company conspired to fix prices and allocate markets for two generic drugs. This settlement constituted one part of a larger resolution with the company totaling $450 million. The government specifically alleged that the company violated the AKS by making and receiving payments in connection with arrangements with other pharmaceutical manufacturers on price, supply, and customer allocation. The company previously entered into a deferred prosecution agreement with DOJ to resolve criminal antitrust charges stemming from the same conduct. This was the second FCA resolution in as many months in which the Eastern District of Pennsylvania U.S. Attorney’s Office settled on an antitrust-related theory. As part of the broader $450 million settlement, the company agreed to pay $425 million to resolve allegations that it paid kickbacks via two co-pay assistance foundations in violation of the AKS and the FCA.[24]

- On November 1, a supplier of compound prescription ingredients agreed to pay $21.75 million to resolve allegations that it violated the FCA by falsely inflating its Average Wholesale Prices (AWPs) for certain ingredients used to fill prescriptions reimbursed by the TRICARE program. The government alleged “spreads” of hundreds (and in one case, thousands) of dollars as between reported AWP and the price at which the supplier bought and sold the ingredients. The government claimed that the supplier used these spreads to induce pharmacy customers to purchase the ingredients from the supplier given the profit potential that the spreads created for the pharmacies. This settlement resolves the qui tam suit underlying the settlement.[25]

- On November 1, a pharmaceutical manufacturer and its CEO agreed to pay $47 million to resolve allegations that they caused the submission of false claims to federal health care programs, in violation of the FCA, by offering kickbacks. The government alleged that the manufacturer distributed breath test kits to health care providers to give to patients and then paid a laboratory to analyze and report the results to the manufacturer, which results the manufacturer then allegedly disseminated to its sales force. The federal portion of the recovery amounts to approximately $43.6 million, while the remainder constitutes a recovery for state Medicaid programs. The allegations resolved by the settlement agreement were, in part, originally raised in a qui tam suit brought by former employees of the manufacturer.[26] In connection with the settlement, the manufacturer and its CEO entered into a CIA with HHS-OIG, which requires the establishment of a compliance program, the engagement of an independent review organization, and the development and implementation of a centralized annual risk assessment and internal review process.[27]

- On November 7, a Kentucky-based laboratory agreed to pay $6.5 million to resolve allegations that it submitted false claims for payment to Medicare for urine drug testing and for its proprietary test for chronic pain. The government alleged that the laboratory submitted multiple claims for the testing for the same patient, on the same date of service, using the same urine sample. The settlement agreement further states that the laboratory submitted claims for testing for chronic pain for patients without any individualized determination of medical necessity by the ordering provider.[28] In connection with the settlement, the company also entered into a five-year CIA with HHS-OIG. The CIA requires that the company engage an independent review organization to ensure that claims submitted to Medicaid for reimbursement are properly coded, submitted, and reimbursed, and that the items and services involved are medically necessary. The CIA also mandates the appointment of a compliance officer with prescribed oversight responsibilities, and the creation of an anonymous whistleblower program for reporting potential violations.[29]

- On November 12, a hospital network agreed to pay $23 million to resolve allegations that it falsely coded certain evaluation and management claims submitted to federal Medicare and TRICARE programs. Specifically, the government alleged that the hospital network automatically used a certain code every time a provider checked a patient’s set of vital signs more times than the total number of hours the patient was in the emergency room. The government alleged that the automatic use of this code did not appropriately reflect the utilization of hospital resources and therefore violated Medicare billing requirements. The settlement resolved a qui tam suit.[30]

- On November 21, a California hospital agreed to pay $10.25 million to resolve FCA allegations of a kickback and self-referral scheme to increase hospital admissions. The hospital allegedly paid a bonus to physicians based on the number of patients they admitted, and then submitted knowingly false claims to Medicare and Medi-Cal (California’s Medicaid program) for medically unnecessary hospital admissions. The settlement agreement also resolved allegations that the hospital knowingly admitted patients when it knew inpatient care was not medically necessary and submitted claims that included false diagnosis codes. Under the settlement, the hospital paid approximately $9.5 million to the federal government, of which nearly $4.8 million was restitution; and approximately $730,000 to the State of California. The settlement resolved a qui tam suit.[31] In connection with the settlement, the hospital entered into a five-year CIA with HHS-OIG that requires the implementation of a risk assessment and internal review process and an annual review by an independent review organization to assess the necessity and appropriateness of Medicare claim submissions and systems to track arrangements with referral sources.[32]

- On December 11, a management consulting firm agreed to pay over $323 million to settle allegations under the FCA for allegedly providing advice to a pharmaceutical company that caused the submission of false and fraudulent claims to federal health care programs for medically unnecessary prescriptions of opioids, as well as allegedly failing to disclose to the U.S. Food and Drug Administration (FDA) conflicts of interest arising from the firm’s concurrent work for the pharmaceutical company and the FDA. Alongside the civil settlement, the management consulting firm entered into a five-year CIA with HHS-OIG focused on risk assessment and quality control. This is the first CIA that the HHS-OIG has entered into with a management consulting firm. The firm also entered into a parallel criminal resolution.[33]

- On December 20, a health insurance provider and its affiliate agreed to pay $98 million to settle an FCA case related to Medicare Part C. Under Medicare Part C, CMS reimburses health insurance providers for certain plans based partly on the “risk score” of the beneficiaries, which in turn is based on demographic and diagnosis information. The government alleged that the provider in this case had created a wholly owned subsidiary to retrospectively search medical records and query physicians for information to support additional diagnoses that would increase beneficiaries’ risk scores for purposes of Medicare Part C reimbursement. The beneficiaries’ medical records allegedly did not support the additional diagnoses or higher risk scores. Under the settlement agreement, the provider will make guaranteed payments of $34.5 million and contingent payments of up to $63.5 million based on its ability to pay. In connection with the settlement, the provider entered into a five-year Corporate Integrity Agreement with HHS-OIG. The CIA requires that the provider hire an independent review organization to review annually a sample of the provider’s patients’ medical records as well as associated internal controls to ensure appropriate risk adjustment payments. The settlement resolves a qui tam suit brought by a former employee of another insurance provider.[34]

- On December 20, sixteen cardiology practices agreed to pay a total of nearly $17.8 million to resolve claims that they overbilled Medicare for diagnostic radiopharmaceuticals used for cancer detection and treatment. The government alleged that over a period of at least a year and for some providers, more than ten years, the cardiology practices overinflated the acquisition costs of radiopharmaceuticals based on their actual costs, in contravention of Medicare Part B guidance. The settlements ranged in value from $50,000 for one of the practices to $6.75 million for another of the practices. These settlements resolve qui tam The qui tam suits stemmed from data mining practices that originally identified hundreds of defendants.[35] One of the cardiology practices entered into a CIA with HHS-OIG, which requires the engagement of an independent review agency to review the practice’s fee-for service Medicare claims to confirm medical necessity, appropriate documentation, and proper coding.[36]

- On December 20, a pharmacy agreed to pay approximately $8.2 million to resolve allegations that it violated the FCA by billing for COVID-19 tests that were not actually provided to Medicare beneficiaries. The investigation arose out of a demonstration project CMS conducted whereby Medicare Part B providers could secure reimbursement for up to eight over-the-counter COVID-19 tests per Medicare Part B beneficiary. The government claimed that the pharmacy billed for tests without shipping the tests to beneficiaries.[37]

- On December 23, a regional health insurance provider agreed to pay $15.23 million to resolve allegations that it provided gift cards to administrative service providers to induce the referral and enrollment of Medicare beneficiaries into the insurer’s Medicare Advantage plan, in violation of the AKS and the FCA. The settlement agreement was accompanied by a CIA with HHS-OIG, which required that the insurer to institute a compliance program and put in place processes to avoid marketing arrangements that violate AKS and engage an independent organization to annually review these procedures.[38]

- On December 23, a regional grocery store chain headquartered in Virginia agreed to pay approximately $8 million to resolve allegations that store pharmacies dispensed controlled substances, including opioids, that were medically unnecessary, lacked a legitimate medical purpose or medically accepted indication, and/or were not dispensed pursuant to valid prescriptions. The civil settlement includes the resolution of claims brought under the qui tam of the FCA.[39]

- On December 26, a California-based medical center and laboratory, along with the physician-owner and an executive, agreed to pay $15 million to resolve allegations that they submitted false claims to Medicare and Medi-Cal by paying kickbacks to Medicare and Medi-Cal beneficiaries and third-party clinics for patient referrals and referring those same patients to the lab, in violation of the Stark Law, AKS, and FCA. The allegations underlying the settlement agreement stemmed from a qui tam suit brought by four former employees and managers of the medical center and lab.[40]

B. GOVERNMENT CONTRACTING AND PROCUREMENT

- On July 31, a biotech company agreed to pay $5 million to settle allegations under the FCA that its subsidiary fraudulently overcharged federal agencies for scientific and technical laboratory supplies. The government specifically alleged that the subsidiary violated “Most Favored Customer Pricing” provisions and other pricing terms in contracts with the Department of Defense, Department of Veterans Affairs (VA), and National Institutes of Health. The company acquired the subsidiary in 2017; however, the subsidiary’s conduct covered by the agreement allegedly occurred between 2008 and 2017. The settlement resolved a qui tam suit brought by a former company employee.[41]

- On October 16, a defense contractor agreed to pay $428 million to settle allegations that the company violated the FCA by knowingly failing to provide truthful certified cost and pricing data during negotiations on numerous government contracts, in violation of the Truth in Negotiations Act. The company received credit in the settlement for its cooperation and remediation efforts. The company also entered into a parallel $147 million criminal resolution with DOJ.[42]

- On November 5, a federal government contractor for protective security guard services agreed to pay $52 million to settle allegations that the company violated the FCA by knowingly causing entities that it controlled to fraudulently obtain U.S. Department of Homeland Security set-aside contracts reserved for small businesses. The settlement further resolved allegations that the arrangements with the purported small businesses violated the Anti-Kickback Act, which prohibits kickbacks in exchange for favorable treatment in connection with government procurement efforts. The allegations underlying the settlement agreement stemmed from a qui tam suit brought by the CEO and President of another government contractor.[43]

- On November 19, two technology companies agreed to pay $2.3 million and $2.05 million, respectively, to resolve FCA allegations premised on a scheme to submit non-competitive contract bids. DOJ alleged that one company gave the other company advantageous pricing to sell products to the Army, and then the first company submitted its own direct bids to create the illusion of competition. The allegations against one of the companies were the subject of a qui tam suit.[44]

- On December 19, an international development contractor agreed to pay approximately $3.1 million to resolve allegations that it submitted fraudulent claims for payment to the U.S. Agency for International Development (USAID). Specifically, the government claimed that the contractor billed USAID for charges fraudulently submitted to the contractor by its own subcontractor, without the contractor detecting the issue. DOJ credited the company for taking “a number of significant steps” in the course of the investigation.[45]

- On December 31, an information technology and professional services contractor headquartered in Newport News, Virginia, agreed to pay $2.63 million to resolve claims under the FCA that it misrepresented to the General Services Administration that it was eligible for certain small business set-aside contracts. The government alleged that the company attempted to qualify for the set-asides (which had eligibility criteria based on average revenue) by novating a contract to another company and then misrepresenting that the two companies were unrelated. The government alleged that the companies were in fact linked because, among other reasons, the owners of each company were married, and the two companies shared executives.[46]

C. CUSTOMS, FINANCIAL INDUSTRY, AND MISCELLANEOUS FEDERAL FUNDING

- On August 7, a Texas-based company agreed to pay $2.05 million—of which $1.02 million is restitution—to resolve allegations that the company improperly obtained Post 9/11 GI Bill funding through its operation of vocational schools. The government alleged that the company enrolled VA-supported veterans in courses where more than 85% of the students had at least some of their costs paid by the school or the VA; this allegedly violated the 85/15 rule, which was meant to ensure that veterans were enrolled in quality courses by weeding out those programs which depend on federal funds to remain afloat.[47]

- On August 8, two Wisconsin-based companies and their two principals agreed to pay a total of $10.2 million to settle allegations that they failed to pay millions in customs duties on goods imported from China. The government alleged that for five years, the companies engaged in an undervaluation scheme by providing falsified invoices to their customs broker (with the actual prices of imported goods typically reduced by 70%), who then unknowingly submitted these false invoices to customs officials. The settlement resolves a related qui tam suit brought by a former employee. DOJ’s announcement of the resolution explains that $4.2 million of the total settlement amount was paid to U.S. Customs and Border Protection before the DOJ settlement; this may help explain why the relator’s share was quite low compared to the full $10.2 million.[48]

- On August 9, a women’s apparel company agreed to pay $7.6 million to resolve allegations that it underpaid customs duties over a seven-year period by falsely representing to customs officials the true value of its apparel imports. Specifically, the government alleged that the company failed to include the value of certain fabric and garment trims in the value of the imports, failed to report discrepancies it discovered on customs forms, and made additional errors in classifying textiles and providing port of entry codes. The government noted the apparel company’s voluntary and timely disclosure of relevant evidence and the company’s efforts to prevent future issues through training and compliance measures. The settlement resolves a qui tam suit.[49]

- On August 26, a California city agreed to pay $38.2 million to resolve allegations that it knowingly misrepresented its compliance with certain federal housing development grant requirements by failing to follow federal accessibility laws when building and rehabilitating affordable multifamily properties and failing to make its affordable multifamily housing program accessible to people with disabilities. The allegations underlying the settlement agreement stemmed from a qui tam suit brought by a city resident.[50]

- On September 18, a Missouri-based former mortgage lender agreed to pay $2.4 million to resolve allegations that it violated the FCA and the Financial Institutions Reform, Recovery, and Enforcement Act by knowingly underwriting Home Equity Conversion Mortgages (HECM) insured by the Department of Housing and Urban Development’s Federal Housing Administration (FHA) that did not meet program eligibility requirements. The FHA offers the HECM as a reverse mortgage program specifically for senior homeowners aged 62 and older. The government alleged that the mortgage lender knowingly violated underwriting requirements by allowing inexperienced temporary staff to underwrite FHA-insured loans; the government also asserted that the lender submitted loans for FHA insurance with underwriter signatures that were falsified or affixed before all the documentation the underwriter should have reviewed was complete.[51]

D. PAYCHECK PROTECTION PROGRAM (PPP) RESOLUTIONS

After entering into a large PPP-related settlement in May 2024 (as covered in our Mid-Year 2024 FCA Update), DOJ secured a number of smaller settlements resolving FCA allegations related to PPP eligibility criteria in the second half of 2024.

- On July 17, a GPS manufacturer agreed to pay $2.6 million to settle FCA allegations that it made false certifications regarding its ties to the People’s Republic of China, rendering it in fact ineligible for the PPP loan it received and later had forgiven.[52]

- On August 8, a New Jersey non-profit health system agreed to pay $3.15 million to settle FCA claims that it was affiliated with a larger health care system and thus was ineligible for a PPP loan.[53]

- On August 8, a California-based company operating a network of dental offices in Southern California, along with its founders and former owners, agreed to pay $6.3 million to resolve FCA allegations that they misrepresented their affiliations—and, thus, the network’s size—when applying for PPP loans.[54]

- On September 17, a Florida-based consulting company specializing in travel and tourism agreed to pay approximately $2.28 million to settle FCA claims that it obtained a PPP loan without filing a required registration statement under the Foreign Agents Registration Act (FARA).[55]

- On October 22, a California agricultural association and its chief executive officer agreed to pay approximately $5.66 million to resolve FCA allegations that the association was not eligible for the PPP loan that it obtained because the association was government owned.[56]

- On December 13, a Wisconsin-based subsidiary of a Swiss machinery cutting and software company agreed to pay $2.3 million to resolve FCA allegations that the company’s affiliation with its Swiss parent made it too large—in terms of employee headcount—to obtain a PPP loan.[57]

III. LEGISLATIVE AND POLICY DEVELOPMENTS

A. FEDERAL POLICY AND LEGISLATIVE DEVELOPMENTS

1. Issues to Watch During the New Administration

Combating fraud on the government fisc has historically had bipartisan appeal. Typically, when the White House changes hands between political parties, the pace of FCA enforcement may change at the margins but rarely changes by an order of magnitude. What often does change is the relative balance of enforcement priorities within the FCA sphere—the policy agenda that is set by appointed officials and that forms the framework in which career DOJ attorneys perform the day-to-day work of investigating and litigating cases. More often than not, companies trying to discern a new administration’s enforcement agenda in early days are left to rely on the pronouncements of newly appointed officials.

Given President Trump’s status as the only modern U.S. president to serve non-consecutive terms, however, FCA developments during his first term provide a natural starting place for highlighting areas to watch over the next four years. Chief among these are cybersecurity, sub-regulatory guidance, and voluntary dismissal of qui tam cases.

In October 2021, DOJ announced the Civil Cyber-Fraud Initiative, which has since been a key focus of FCA actions pursued for the last four years.[58] The Initiative was emblematic of the Biden Administration’s emphasis on cybersecurity issues as part of its broader National Cybersecurity Strategy. Under the Initiative, DOJ pursued FCA recoveries from companies for alleged fraudulent noncompliance with cybersecurity requirements, entering into a number of settlements and filing its first lawsuit against a federal contractor under the Initiative this past August. At this juncture, it is not entirely clear whether the Trump Administration will continue with the Initiative or otherwise focus on cybersecurity cases. However, cybersecurity tends to be a bi-partisan issue, with major developments in this area occurring in each of the last three administrations, including President Trump’s first term. Relators also are likely to continue filing qui tam complaints in this area, automatically triggering investigations of their allegations. Moreover, given recent high-profile cybersecurity attacks against U.S. interests—including President Trump’s presidential campaign[59] and at least one major federal contractor[60]—there is a good chance that cybersecurity enforcement will continue to be an area of focus.

On the other hand, premising FCA liability on sub-regulatory guidance may lose favor under the new Trump Administration, if the past is any guide. It was under the first Trump Administration that DOJ issued the Brand Memo, which stated that agency “[g]uidance documents” without notice-and-comment rulemaking could not “create binding requirements that do not already exist by statute or regulation.”[61] DOJ guidance later that same year stated that DOJ “should not treat a party’s noncompliance with a guidance document as itself a violation of applicable statutes or regulations.”[62]

Early in the Biden Administration, this policy was reversed—with then-Attorney General Merrick Garland stating that guidance “may be entitled to deference or otherwise carry persuasive weight with respect to the meaning of the applicable legal requirements” in a particular case.[63] Given the second Trump Administration’s apparent focus on decreasing the reach of the administrative state, we expect that DOJ will again explore ways of limiting the use of sub-regulatory guidance to impose legal requirements on which FCA liability can be predicated.

Despite this shift, however, this administration is likely to use the FCA—as past administrations have—to enforce aspects of its policy agenda. In a notable early sign of this, President Trump’s January 21, 2025 Executive Order rescinding affirmative action obligations for federal government contractors requires that federal contracts and grants include a clause requiring contractors to agree that compliance “with applicable Federal anti-discrimination laws” is a term “material to the government’s payment decisions” for purposes of the FCA.[64]

It remains an open question whether DOJ under the second Trump Administration will place as much relative emphasis on voluntary dismissal of qui tam cases as DOJ did during Trump’s first term (after the release of the Granston Memo).[65] After the Granston Memo, voluntary dismissals spiked for the remainder of President Trump’s first term but immediately declined again when President Biden took office.

In outcome-oriented terms, one way to view voluntary dismissal under 31 U.S.C. § 3730(c)(2)(A) is as a business-friendly step that prioritizes the government’s view of a qui tam case’s prospects over the views of an incentivized relator. Voluntary dismissal by DOJ also could provide an answer to the concern expressed by Justices Thomas, Kavanaugh, and Barrett regarding the constitutionality of allowing unappointed relators to prosecute FCA cases in the government’s name. Indeed, voluntary dismissal permits DOJ to police unscrupulous relators and avoid a perception that it is letting itself be weaponized by private citizens. By the same token, voluntary dismissal also can help ensure that DOJ resources are appropriately conserved for the cases that most merit the government’s involvement—including cases without qui tam relators at all. Time will tell whether DOJ under the second Trump Administration uses its voluntary dismissal authority more frequently than has been the case over the last four years. But even that data point, by itself, is likely to be a poor predictor of DOJ’s overall level of aggressiveness when it comes to pursuing FCA cases, and more an indicator of how much stock it places in the available alternatives for doing so.

2. Anticipated Nominee to Head DOJ’s Civil Division

President Trump is expected to nominate Brett Shumate to serve as the Assistant Attorney General for the Civil Division. Shumate served as the Deputy Assistant Attorney General for the Civil Division’s Federal Programs Branch during the first Trump Administration. As the branch of the Civil Division that focuses “primarily o[n] defending suits that challenge actions of Government agencies and officers in which the plaintiffs seek injunctive or declaratory relief,” Federal Programs was a focal point of DOJ activity in the first Trump Administration. The appointment of a former Federal Program DAAG to run the entire Civil Division suggests that the administration is anticipating having to again devote significant resources to defending government actions in response to challenges.

3. Continued Emphasis on Cooperation and Remediation

The second half of 2024 witnessed a notable increase in the number of settlements that state that DOJ had credited settling parties for voluntary self-disclosures, remediation efforts, and/or cooperation with the government’s investigation. These factors are all relevant under the DOJ’s Guidelines for Taking Disclosure, Cooperation, and Remediation into Account in False Claims Act Matters.[66] Notably, while the frequency with which DOJ called out the fact of cooperation credit increased, details of exactly what steps earned the credit—and, critically, how much credit relative to the government’s claimed losses—remained few and far between.

In some instances, DOJ specified that it awarded “full credit” under its guidelines for voluntary disclosure in FCA cases. For instance, when a Northern Virginia hospital system agreed to pay $2.37 million to settle FCA allegations that it submitted claims for reimbursement to Medicaid that included documentation regarding sterilization and hysterectomy procedures that had been improperly modified, DOJ stated that the hospital system received “full credit” for disclosing the misconduct after undertaking an internal investigation, as well as for cooperating and taking “remedial actions.”[67]

DOJ policy caps cooperation credit so that the government does not receive “less than full compensation for the losses caused by the defendant’s misconduct (including the government’s damages, lost interest, costs of investigation, and relator share).”[68] In practice, that means a damages multiple above 1x—but how much above depends on the facts and circumstances. Without more details of the government’s claimed losses, the precise calculations and considerations are difficult to determine from the outside. It remains to be seen whether DOJ will introduce more transparency regarding its cooperation credit calculations into settlement agreements, of the sort that has become routine in criminal resolutions such as deferred prosecution agreements.

4. Administrative False Claims Act

In the final weeks of his term, President Biden signed into law a bill that authorized—with little fanfare—the Administrative False Claims Act (AFCA). The provisions establishing the AFCA were buried within defense spending legislation,[69] after attempts by Senator Chuck Grassley to pass the AFCA as a stand-alone bill failed in 2023 due to lack of House support.[70] The AFCA expands and replaces the Program Fraud Civil Remedies Act of 1986 (PFCRA), which provided an administrative remedy for false claims and statements with liability of less than $150,000.[71] As an administrative tool, the PFCRA allowed agencies to pursue small claims before an Administrative Law Judge (ALJ)—proceedings which lack the usual safeguards available to defendants charged in federal court, including the right to a trial by jury. The AFCA now authorizes agencies to challenge claims valued at up to $1 million before an ALJ and extends to false statements made even in the absence of a claim for payment. Agencies can seek civil penalties of up to $5,000 per claim, in addition to damages of up to twice the value of the claim. This significantly increases agencies’ ability to pursue and settle false claims allegations outside the federal judicial process.

The constitutionality of the AFCA may prove open to challenge. Last year, in SEC v. Jarkesy, the SEC attempted to impose civil penalties against an investment advisor for violating antifraud provisions in the federal securities laws.[72] The SEC elected to pursue an administrative remedy and adjudicate the matter before one of its ALJs, rather than in federal court where Jarkesy could have demanded a jury trial.[73] On appeal, the Supreme Court held that this violated the Seventh Amendment because the SEC’s claim against Jarkesy was “legal in nature,” which triggered the Seventh Amendment’s guarantee of a right to trial by jury.[74] Notably, the Supreme Court justified its decision, in part, by reasoning that the civil penalties sought were plainly punitive and therefore were the sort of common law remedy that could only be enforced in a court of law.[75] The SEC argued that the “public rights exception” should apply, which allows Congress to assign matters for decision to an agency when the issue historically could have been determined without judicial involvement.[76] But the Supreme Court disagreed, finding that the securities fraud action resembled a traditional legal claim modeled on common law fraud, which must be adjudicated by an Article III court.[77]

Although this ruling was limited to securities fraud, the similarities between the action brought in Jarkesy and those authorized under the AFCA cannot be ignored. Insofar as the AFCA is derivative of the FCA, it draws on common-law fraud and imposes remedies that are punitive in nature.[78] It remains to be seen whether defendants in AFCA actions are able to challenge the statute’s constitutionality using Jarkesy as a jumping-off point.

5. HHS-OIG Skilled Nursing Facilities and Nursing Facilities Compliance Program Guidance

One year after HHS-OIG’s release of its General Compliance Program Guidance, on November 20, 2024, HHS-OIG issued new industry segment-specific compliance program guidance for Skilled Nursing Facilities and Nursing Facilities (“Nursing Facility Guidance”).[79] The Nursing Facility Guidance has not been supplemented since 2008. In this iteration, HHS-OIG offers a deep dive on several compliance issues that could open nursing facilities to potential FCA liability. For example, the guidance cautions that sub-standard quality of care resulting from a lack of patient activities, staffing shortages, and poor medication management could lead to FCA violations.

This emphasis on quality of care as a vehicle for FCA enforcement actions underscores that regulators continue to take a more expansive view of what might qualify as an FCA violation under a “worthless services” theory—that is, the idea that the government receives nothing of value if it pays for services that are falsely represented as meeting relevant certification requirements. The Nursing Facility Guidance also details how AKS violations, referral relationships, more nuanced errors in Medicare and Medicaid billing, and data submission to managed plans can lead to the submission of false claims, signaling that the agency may continue to pursue aggressive FCA theories in these areas moving forward.

B. STATE LEGISLATIVE DEVELOPMENTS

There were no major developments with respect to state FCA legislation in the second half of 2024. HHS-OIG provides an incentive for states to enact false claims statutes in keeping with the federal FCA. If HHS OIG approves a state’s FCA, the state receives an increase of 10 percentage points in its share of any recoveries in cases involving Medicaid. The lists of “approved” state false claims statutes remains at 23 following the approval of Connecticut’s statute in February 2024; six states remain on the “not approved” list.[80] The other 21 states have either not enacted a state analogue or have not submitted their statutes for approval.

IV. CASE LAW DEVELOPMENTS

A. Federal District Court Holds That the Qui Tam Provisions Violate Article II of the Constitution

In September 2024, the Middle District of Florida held that the FCA’s qui tam provisions are unconstitutional because they violate the Appointments Clause. United States ex rel. Zafirov v. Fla. Med. Assocs., LLC, 2024 WL 4349242, at *1, *4 (M.D. Fla. Sept. 30, 2024). The issue arose from a qui tam suit filed by Clarissa Zafirov, who sued her employer and other defendants for violating the FCA by allegedly misrepresenting patients’ medical conditions to Medicare. Id. at *3. The government declined to intervene, and Zafirov continued litigating the action for five years. Id. at *4. Defendants moved for judgment on the pleadings, arguing that the FCA’s qui tam provisions violate Article II’s Appointments Clause, Take Care Clause, and Vesting Clause. Id. As to the Appointments Clause, defendants contended that the qui tam provisions violated the Appointments Clause because a relator is an improperly appointed officer of the United States. Id.

The Appointments Clause creates two different paths for appointment—one for “principal officers” and the other for “inferior officers.” Id. at *5. The appointment of inferior officers can be vested “in the President alone, in the Courts of Law, or in the Heads of Departments,” while principal officers that must be confirmed by the Senate. Id. (quotation omitted). An individual is considered an “officer of the United States” if she “exercis[es] significant authority pursuant to the laws of the United States,” and “occup[ies] a continuing position established by law.” Id. at *6 (quotations omitted).

In Zafirov, the court determined that FCA relators exercise “significant authority” because they possess civil enforcement authority on behalf of the United States through their “power to initiate an enforcement action in the name of the United States to vindicate a public right.” Id. (quotation omitted). The Court emphasized relators’ power to litigate appeals in FCA cases that can create binding precedent on the government. Id. at *7. As the Court noted, relators have the ability to initiate an action and litigate it in a way that binds the federal government while choosing “which defendants to sue,” “which theories to raise, which motions to file, and which evidence to obtain.” Id. at 11. The Court pointed to these as relators’ “powers.” Id. at 11. Lastly, the Court found that relators receive emoluments because they may receive a portion of the proceeds if their claims are successful. Id.

The court evaluated whether Article II included an exception for FCA relators to hold executive powers without complying with the process outlined in the Appointments Clause, but concluded that no such exception existed. Id. at *18. Because Zafirov was not appointed through the process outlined in the Appointments Clause, the court concluded that her lawsuit must be dismissed because “in Appointments Clause cases, invalidation is the remedy, which follows directly from the government actor’s lack of authority to take the challenged action in the first place.” Id. at 19 (internal quotation marks omitted). The United States promptly noticed an appeal to the Eleventh Circuit, where the case remains pending.

The Zafirov case has garnered much attention, not least of all for its apparent attempt to advance similar arguments that appeared in Justice Thomas’s dissenting opinion in United States ex rel. Polansky v. Executive Health Resources, Inc., 143 S. Ct. 1720 (2023). Those arguments were notable when they were published, both for their content and because they had not previously appeared in the majority opinions Justice Thomas has written on FCA issues in recent years (including Escobar, in which DOJ had declined to intervene). The arguments also gained support from Justices Kavanaugh and Barrett, who stated in a concurrence that the arguments were “substantial” and “should [be] consider[ed] . . . in an appropriate case.” Id. at 1737. (We covered the Polansky decision in more detail in Gibson Dunn’s 2023 Mid-Year False Claims Act Update.)

Those statements by Justices Thomas, Kavanaugh, and Barrett could mean that the Supreme Court will address the constitutionality of the qui tam provisions sooner than might otherwise be expected. On the other hand, a Supreme Court opinion on the constitutionality of the FCA’s qui tam provisions would arguably be the most significant decision by the Court on an FCA issue in the statute’s modern history, and other FCA issues that are highly consequential have taken years to find their way to the Court. (It took over two decades, for example, for the implied false certification theory to journey from a one-off Court of Federal Claims decision about the false “withholding of . . . information critical to the decision to pay” to the Supreme Court’s seminal decision on materiality in Escobar in 2016. See Ab-Tech Constr., Inc. v. United States, 31 Fed. Cl. 429 (1994).)

Regardless of the time horizon, we are likely to see continued momentum in efforts by qui tam relators to pursue cases—a reality foreshadowed by the record number of qui tam cases initiated in FY 2024, after the Polansky opinions were published. And defendants attempting to persuade courts to be skeptical of the qui tam provisions’ constitutionality will have to contend with longstanding precedents at the circuit level which hold that the provisions do not violate the Appointments Clause. See, e.g., Riley v. St. Luke’s Episcopal Hosp., 252 F.3d 749, 757 (5th Cir. 2001) (upholding the provisions on the grounds that relators do not meet “the constitutional definition of an ‘officer,’” which “encompasses, at a minimum, a continuing and formalized relationship of employment with the United States Government”); United States ex rel. Taxpayers Against Fraud v. Gen. Elec. Co., 41 F.3d 1032, 1041 (6th Cir. 1994) (similar).

B. The Second Circuit Adopts the “One-Purpose” Test for Pleading AKS Violations

In December 2024, the Second Circuit issued an opinion in United States ex rel. Camburn v. Novartis Pharms. Corp. that adopted the “at-least-one-purpose” rule for pleading the inducement element of an AKS-based FCA case. According to the Second Circuit, “a plaintiff adequately pleads an [AKS] violation when she states with the requisite particularity that at least one purpose of the alleged scheme was to induce fraudulent conduct.” 124 F.4th 129, 133 (2d Cir. 2024).

In Camburn, a former sales representative brought a qui tam lawsuit against the company alleging that it used speaker programs for its multiple sclerosis drug, Gilenya, as a vehicle to improperly remunerate physicians. Id. at 134. He alleged that Novartis orchestrated “sham” speaker events and engaged in other improper activities, all to incentivize physicians to improperly prescribe Gilenya. Id. at 135. The government declined to intervene. Id.

Camburn’s initial complaint was dismissed for failing to plead fraud with particularity under Rule 9(b). Id. Over successive amendments, Camburn incorporated testimony from 21 confidential witnesses spanning 21 states, supplementing his claims with additional factual allegations. Id. Nevertheless, the district court dismissed his Third Amended Complaint with prejudice, concluding that Camburn failed to adequately allege the existence of an AKS violation as a predicate for FCA liability. Id. Specifically, the court found that Camburn’s allegations lacked the requisite detail to support an inference that the company’s conduct was intended to induce fraudulent claims. Id.

The Second Circuit, however, partially reversed, concluding that Camburn’s specific allegations related to three categories of factual allegations—including dates, locations, and individuals involved—gave rise to a strong inference that one purpose of the conduct was to induce fraudulent claims, which was all that was needed to allege an AKS violation. Id. at 136-40. The court expressly rejected the notion that an FCA relator needs to allege “a cause-and-effect relationship (a quid pro quo) between the payments and the physicians’ prescribing habits” to plead an AKS violation. Id. at 137. With this ruling, the Second Circuit joined the First, Third, Fourth, Fifth, Seventh, Ninth, and Tenth Circuits in applying the “one-purpose” rule to the AKS. See Guilfoile v. Shields, 913 F.3d 178 (1st Cir. 2019); United States v. Greber, 760 F.2d 68 (3d Cir. 1985); United States v. Mallory, 988 F.3d 730 (4th Cir. 2021); United States v. Davis, 132 F.3d 1092 (5th Cir. 1998); United States v. Borrasi, 639 F.3d 774 (7th Cir. 2011); United States v. Kats, 871 F.2d 105 (9th Cir. 1989); United States v. McClatchey, 217 F.3d 823 (10th Cir. 2000).

Importantly, the question of what it means for false claims to “result[] from a violation” of the AKS, 42 U.S.C. § 1320a-7b(g) was not before the court. It remains to be seen whether the Second Circuit will adopt the stricter “but-for” causation standard advanced by the Sixth and Eighth Circuits, or the Third Circuit’s looser standard under which only some causal connection between kickback and false claim is required.

C. The Fifth Circuit Denies Relator a Share of Settlement Proceeds After Settlement with the Government

In a July opinion, the Fifth Circuit addressed whether a relator is entitled to a share of FCA settlement proceeds when the settlement does not resolve any of the claims brought by the relator. United States ex rel. Conyers, 108 F.4th 351 (5th Cir. 2024). The court concluded that a relator is entitled only to a share of the proceeds from the settlement of the specific claims they initiated, not from settlement of additional claims introduced by the government. Id. at 359.

The case originated when Bud Conyers filed a qui tam lawsuit alleging that a military contractor had violated the FCA. Id. at 353-54. The government intervened in the suit and added its own claims against the contractor that were focused on the alleged conduct of three employees and thus were distinct from Conyers’s original allegations. Id. at 354-55.

The parties eventually settled, with the contractor agreeing to pay approximately $13.7 million to resolve the government’s claims related to the three individuals, and with the agreement expressly reserving all other claims. Id. at 355. Conyers’ estate (the relator by then had passed away) sought a share of the settlement proceeds, arguing entitlement under the FCA. Id. The district court awarded Conyers’s estate approximately $1.1 million, finding some factual overlap between Conyers’s allegations and the government’s settled claims. Id.

On appeal, however, the Fifth Circuit reversed this decision, holding that under 31 U.S.C. § 3730(d)(1), a relator’s right to a share of the settlement proceeds is limited to the settlement of the specific claims that the relator brought. Id. at 356-61. The court stated that allowing relators to recover from settlements of claims they did not initiate would be inconsistent with the text of the FCA, which frames the relator’s share in a settlement scenario in terms of “claim[s].” Id. at 359. The court also invoked caselaw in the “alternate remedy” context which has held that that provision of the FCA only permits a relator to recover to the extent their claims “overlap[]” with the government’s claims. Id. at 358. The court further relied on the FCA’s purpose and structure as reflected in the reduction in a relator’s share that automatically comes with DOJ intervention, reasoning that it would run contrary to that framework to increase a relator’s share when the government opts not to pursue the claims the relator brings. Id. at 358-59.

Notably, the Fifth Circuit declined to decide whether Conyers would have been entitled to a share of the settlement proceeds if his claims had “factually overlapped” with those of the government, holding that the district court erred in determining there was sufficient overlap to merit that outcome even under such a standard. Id. at 359-60. At the core of the reversal decision was the fact that the three individuals whose conduct formed the basis of the settlement had never been mentioned in Conyers’s complaint. Id. at 359. Given that, one potential implication of the Conyers decision is an increased focus by relators on naming as many individuals as possible when making initial allegations, to maximize the chances that whatever claims-in-intervention the government may later bring bear a substantial enough relationship to the relator’s claims to justify the awarding of a relator’s share.

D. The Ninth Circuit Overrules Its Own Precedents on the First-to-File Bar, Holding the Bar Is Not Jurisdictional

The FCA’s first-to-file bar prevents anyone but the government from “interven[ing in] or bringing a related action based on the facts underlying [a] pending [FCA] action.” 31 U.S.C. § 3730(b)(5). In Stein v. Kaiser Found. Health Plan, Inc., the Ninth Circuit overturned its own precedents and held that the FCA’s first-to-file rule is not jurisdictional. 115 F.4th 1244, 1247 (9th Cir. 2024).

The district court had dismissed the case under the first-to-file bar because of its relation to already-pending actions against the same or other related entities. Id. at 1245. On appeal, a three-judge panel upheld the decision, but the full Ninth Circuit reversed after an en banc rehearing. Id. Citing recent Supreme Court decisions, the court ruled that a statutory bar is jurisdictional only if Congress explicitly says so. Id. at 1246 (citing Santos-Zacaria v. Garland, 598 U.S. 411, 416 (2023) (quoting Boechler, P.C. v. Comm’r, 596 U.S. 199, 203 (2022))). Because Section 3730(b)(5) does not use the term “jurisdiction” or include any other textual clue that points to jurisdiction, the court held that the FCA’s first-to-file rule is not jurisdictional. Id.

In so ruling, the Ninth Circuit joined five other circuits which had previously held that the FCA’s first-to-file rule is not jurisdictional. See United States ex rel. Bryant v. Cmty. Health Sys., Inc., 24 F.4th 1024, 1036 (6th Cir. 2022); In re Plavix Mktg., Sales Pracs. & Prods. Liab. Litig. (No. II), 974 F.3d 228, 232 (3d Cir. 2020); United States v. Millenium Lab’ys, Inc., 923 F.3d 240, 248-51 (1st Cir. 2019); United States ex rel. Hayes v. Allstate Ins. Co., 853 F.3d 80, 85-86 (2d Cir. 2017) (per curiam); United States ex rel. Heath v. AT&T, Inc., 791 F.3d 112, 119-21 (D.C. Cir. 2015).

The decision in Stein has at least three procedural implications. First, FCA defendants in the Ninth Circuit seeking to dismiss an FCA complaint based on the first-to-file rule can no longer make a Fed. R. Civ. P. 12(b)(1) motion to dismiss for lack of subject-matter jurisdiction, under which plaintiffs bear the burden of persuasion on the question of jurisdiction. Instead, defendants are left to rely on a Fed. R. Civ. P. 12(b)(6) motion to dismiss, which requires the moving party to show that the first-to-file bar requires dismissal of the FCA action. Second, before Stein, as an issue of subject-matter jurisdiction, a first-to-file challenge could be raised any time, and even sua sponte by the court. After Stein, defendants must raise the first-to-file challenge before the close of trial or risk waiving the defense altogether. Third, because the first-to-file rule is no longer considered jurisdictional after Stein, plaintiffs may have more flexibility to amend their complaints in response to a first-to-file pleading defense.

E. The Ninth Circuit Clarifies the Applicable Framework for FCA Retaliation Claims

The FCA prohibits retaliation against employees who report potential FCA violations. See 31 U.S.C. § 3730(h)(1). To prove retaliation under the FCA, an employee must have been engaging in protected conduct, the employer must have known that the employee was engaging in protected conduct, and the employer must have discriminated against the employee because of the protected conduct. In Mooney v. Fife, the Ninth Circuit (1) ruled that the McDonnell Douglas burden-shifting framework applies to FCA retaliation claims, and (2) clarified the “protected conduct” and “notice” requirements of a prima facie FCA retaliation claim. 118 F.4th 1081, 1090 (9th Cir. 2024).

The plaintiff in Mooney filed an FCA retaliation claim, alleging he was fired for reporting billing irregularities to his superiors, and claiming his employer used the confidentiality clause in his employment contract as a pretext for his termination. Id. at 1088. The district court rejected these claims and granted summary judgement for the defendant. Id. It concluded that the plaintiff’s reporting of irregularities could not have put his employer on notice of potentially protected conduct because the plaintiff’s job consisted of helping his employer ensure compliance with the law in the first instance. Id.

The Ninth Circuit reversed, concluding that the plaintiff had satisfied the three elements of a prima facie FCA retaliation claim, and noting that there were genuine issues of material fact as to plaintiff’s alleged pretextual firing. Id. at 1096-98. The Ninth Circuit joined a cohort of circuit courts that apply the McDonnell Douglas burden-shifting framework to FCA retaliation claims. Under this framework, once the employee has established a prima facie case of FCA retaliation, the burden shifts to the employer to produce a legitimate, non-retaliatory reason for the employee’s termination. Mooney, 118 F.4th at 1089. If the employer produces such a reason, the burden shifts back to the employee to show that the employer’s reason was pretextual. For purposes of pretext, it is irrelevant whether the employer’s proffered reason was objectively false; the only requirement is that the employer honestly believed the reasons for its actions, even if those reasons are foolish or trivial or even baseless. Id. at 1097 (citing Villiarimo v. Aloha Island Air, Inc., 281 F.3d 1054, 1063 (9th Cir. 2002)).

The Ninth Circuit also clarified the “protected conduct” and “notice” elements of an FCA retaliation claim. Regarding the “protected conduct” element, the Ninth Circuit stated that the applicable test, which contains both a subjective and an objective component, “does not set a high bar.” Mooney, 118 F.4th at 1092. The court narrowed the requirements applicable to both components. For the subjective component, the court noted that “the employee need not know for certain that the employer has committed fraud,” while for the objective component, the court noted that the only requirement is that “a reasonable employee in the same or similar circumstances might believe, that the employer is possibly committing fraud against the government.” Mooney, 118 F.4th at 1092 (citing Moore, 275 F.3d at 845). The Ninth Circuit also held that Hopper’s “investigating” requirement does not apply when the plaintiff alleges that he was discharged because of other efforts to stop one or more FCA violations. Id. at 1091. As to the “notice” requirement, the court refused to adopt a heightened pleading standard for employees with compliance duties. Id. at 1096. The Ninth Circuit reasoned that if compliance employees “were to have no protection from retaliation” under the FCA, “then fear of that retaliation could intimidate and discourage employees in such positions from trying to stop fraudulent billing practices.” Id. Instead, the court held that the “notice” element of an FCA retaliation claim only requires the employer to be aware of an employee’s efforts to stop one or more FCA violations. Id. (citing 31 U.S.C. § 3730(h)(1)).

F. The Third and Eleventh Circuits Apply the Public Disclosure Bar

1. The Third Circuit Finds the Bar Satisfied by Information in CMS’s Physician Payments Database

In United States ex rel. Stebbins v. Maraposa Surgical, Inc., 2024 WL 4947274, (3d Cir. Dec. 3, 2024), the Third Circuit Court of Appeals affirmed a district court’s dismissal of a qui tam action based on the public disclosure bar. In that case, a relator alleged that a medical office in Pennsylvania had violated the FCA by submitting reimbursement claims for arteriograms (medical imaging of arteries to identify and assess blockages) performed in its office. The relator claimed that because arteriograms could only be performed by a state licensed ambulatory surgery center, which the medical office was not, the medical office had fraudulently submitted reimbursements for its services.

After the medical center moved to dismiss the relator’s claims under Fed. R. Civ. P. 12(b)(6), the district court granted the motion. The relator appealed, and the Third Circuit affirmed, reasoning that because (1) the medical office’s reimbursement requests were publicly available on CMS’s payment database, (2) the medical office was not listed on the state’s online database of licensed ambulatory surgery centers, and (3) the state published the regulations on which the relator based his claims, the “essential elements” of the relator’s claims were “previously disclosed in publicly available databases.” Id. at *3. Because the relator was not a “original source of the information,” the Third Circuit determined that “anyone could [have] file[d] the same suit,” and, thus, the public disclosure bar applied. Id. at *2-3.