February 22, 2024

An overview of recent developments, including a U.S. Supreme Court case addressing Item 303 of Regulation S-K; significant Delaware corporate law cases; recent decisions involving special purpose acquisition companies; securities litigation involving ESG-related allegations; notable cryptocurrency cases; and other matters.

This update provides an overview of the major developments in federal and state securities litigation since our 2023 Mid-Year Securities Litigation Update:

- We discuss a major addition to the Supreme Court’s October Term, in which the Court will address the extent to which Item 303 of Regulation S-K can subject a filing company to private shareholder suits. We also discuss a lower-court development calling attention to a circuit split that may end up before the Supreme Court.

- We review significant developments in Delaware corporate law, including those related to the high pleading bar plaintiffs must clear to successfully bring a duty of oversight (or Caremark) claim, advance notice bylaws, lost merger-premium provisions, books and records demands, and identity-based allocations of voting power. We also discuss a case with potentially significant implications for transactions involving controlling stockholders.

- We review developments in federal securities litigation involving special purpose acquisition companies (“SPACs”), including two recent decisions addressing scienter in the SPAC context.

- We examine several developments in securities litigation involving environmental, social, and corporate governance-related allegations.

- We survey notable developments in cryptocurrency litigation and regulation and address certain technological developments in the industry as well.

- We continue to monitor developments regarding the Supreme Court’s 2019 decision Lorenzo v. SEC, in which the Court expanded the scope of scheme liability by finding that even if the disseminator of a false statement did not “make” that false statement within the meaning of Rule 10b-5(b), they may still be liable under Rule 10b-5(a) and (c) if they disseminate a false statement with intent to defraud. As discussed in our prior updates, following Lorenzo, lower courts continue to grapple with what conduct is sufficient to maintain a scheme liability claim.

- We provide an update on the long-running class certification dispute in Arkansas Teacher Retirement System v. Goldman Sachs Group, Inc. and discuss how district courts are applying the Supreme Court’s guidance.

- Finally, we address several other notable developments including: Omnicare developments out of the Third and Second Circuits; the Second Circuit and the Southern District of New York declining to enforce control share acquisition provisions; the Ninth Circuit ruling that SEC Rule 16b-3 does not require purpose-specific board approval of transactions; and updates in the cybersecurity litigation arena.

I. FILING AND SETTLEMENT TRENDS

Data from a recent NERA Economic Consulting (“NERA”) study illustrates several trend changes. Federal securities litigation filings in 2023 increased compared to filings in 2022 and 2021. At the same time, “Health and Technology Services” and “Electronic Technology and Technology Services” filings—which represented over 50% of filings last year—decreased significantly on a relative basis. Cryptocurrency filings also decreased, from 26 filings in 2022 to 16 filings in 2023. Meanwhile, “Finance” sector filings increased to 18%, and “Producer and other Manufacturing” sector filings doubled on a relative basis. Settlement values—excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—stayed relatively consistent. The average settlement value decreased from $37 million to $34 million, while the median settlement value increased from $13 million to $14 million.

A. Filing Trends

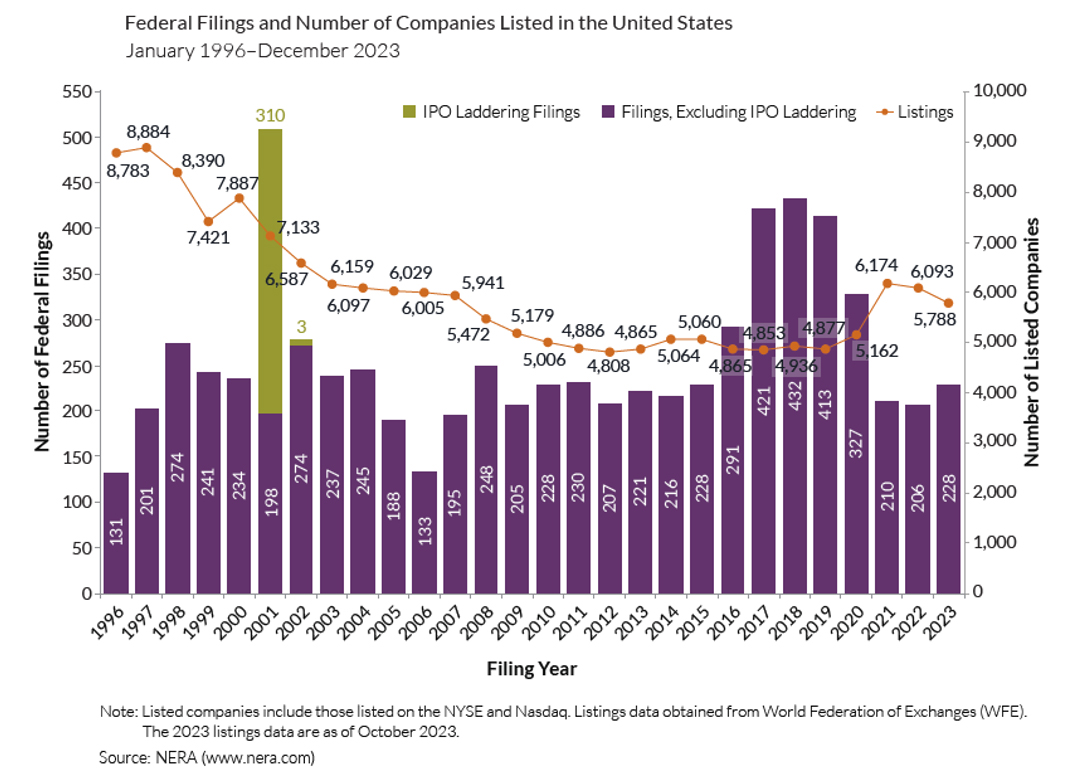

Figure 1 below reflects the federal filing rates from 1996 through 2023 (all charts courtesy of NERA). 228 federal cases were filed in the past year. This is a slight increase in filings compared to 2022 and 2021, but still nowhere near the number of filings in the peak years of 2017-2019. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

B. Mix Of Cases Filed In 2023

1. Filings By Industry Sector

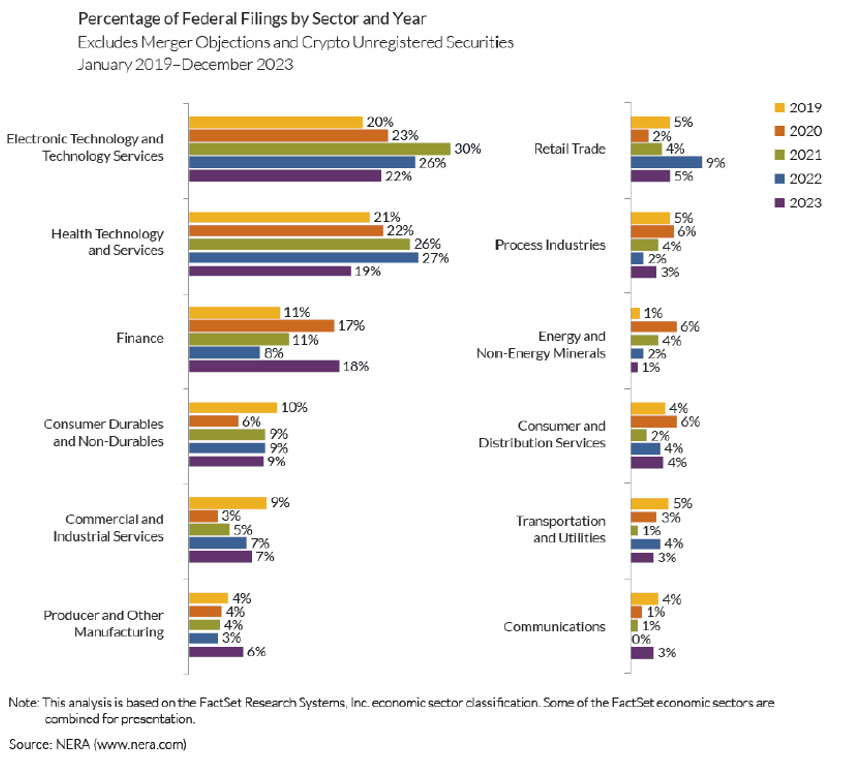

The distribution of non-merger objections and non-crypto unregistered securities filings, as shown in Figure 2 below, had some slight variations this year compared to previous years. Notably, the “Health and Technology Services” sector percentage was the lowest it has been in the last five years, dropping from 27% to 19% in the past year. “Electronic Technology and Technology Services” filings also decreased compared with the two prior years. Thus, while “Health and Technology Services” and “Electronic Technology and Technology Services” filings accounted for over 50% of filings in both 2021 and 2022, that total decreased to 41% this year. Meanwhile, “Finance” sector filings increased steeply on a relative basis, from 8% to 18%, and filings related to the “Producer and Other Manufacturing” sector doubled on a relative basis from 3% to 6%.

Figure 2:

2. Merger Cases

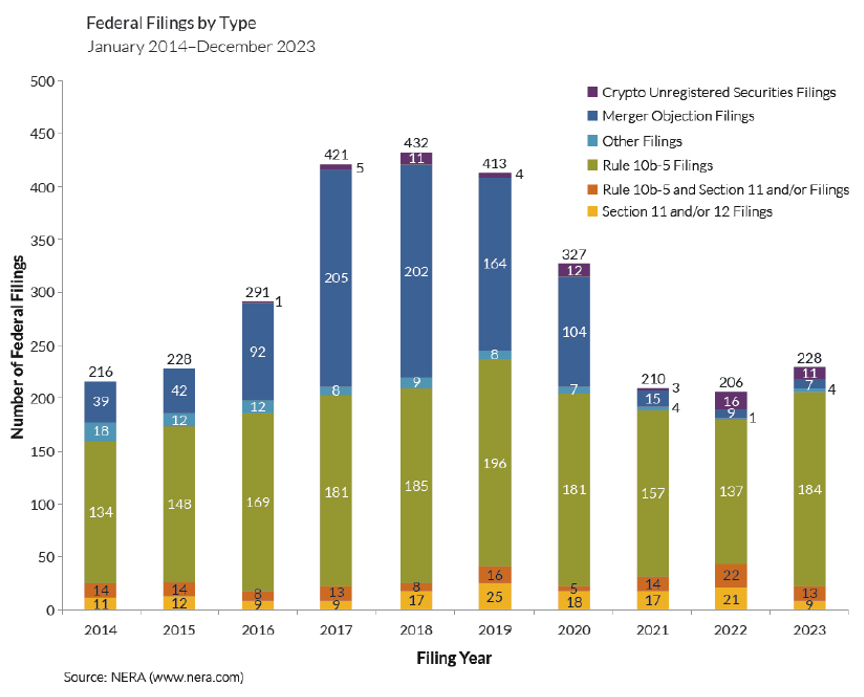

As shown in Figure 3 below, there were seven merger-objection cases filed in federal court in 2023. This continues the downward trend of merger objection filings, beginning in 2020.

Figure 3:

3. Cryptocurrency Cases

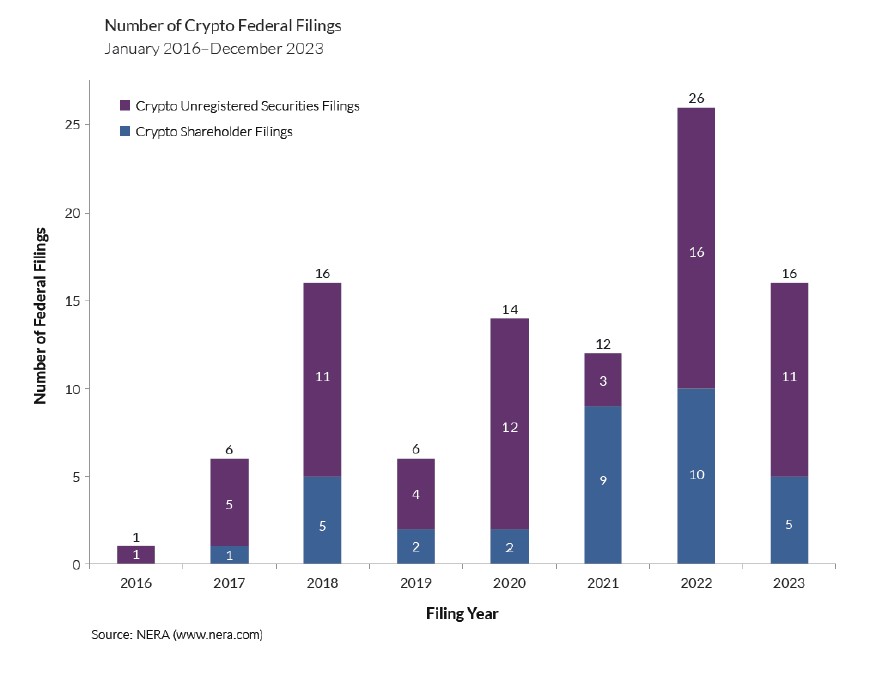

Figure 4 below illustrates the trends in cryptocurrency filings in federal court from 2016 through 2023. This past year, there were 11 crypto unregistered securities filings and five crypto shareholder filings, matching the numbers for 2018. The number of both types of crypto filings decreased from 2022, with the number of crypto shareholder filings cut in half and the number of crypto unregistered securities filings decreasing by 31%.

Figure 4:

C. Settlement Trends

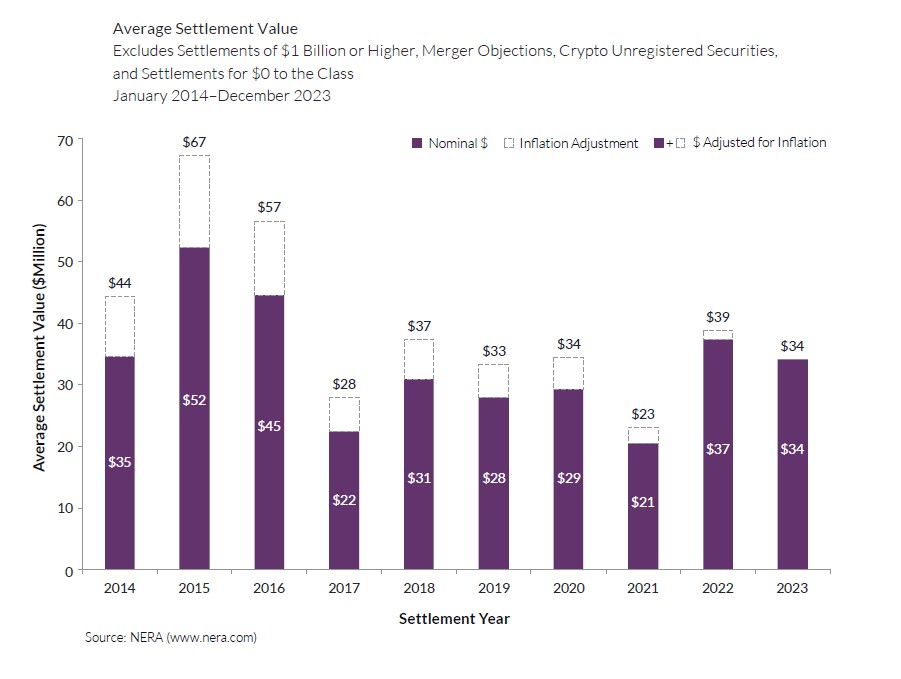

As reflected in Figure 5 below, the average settlement value in 2023 reached $34 million, dropping compared to the average value in 2022 of $37 million. (Note that the average settlement value excludes merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class.)

Figure 5:

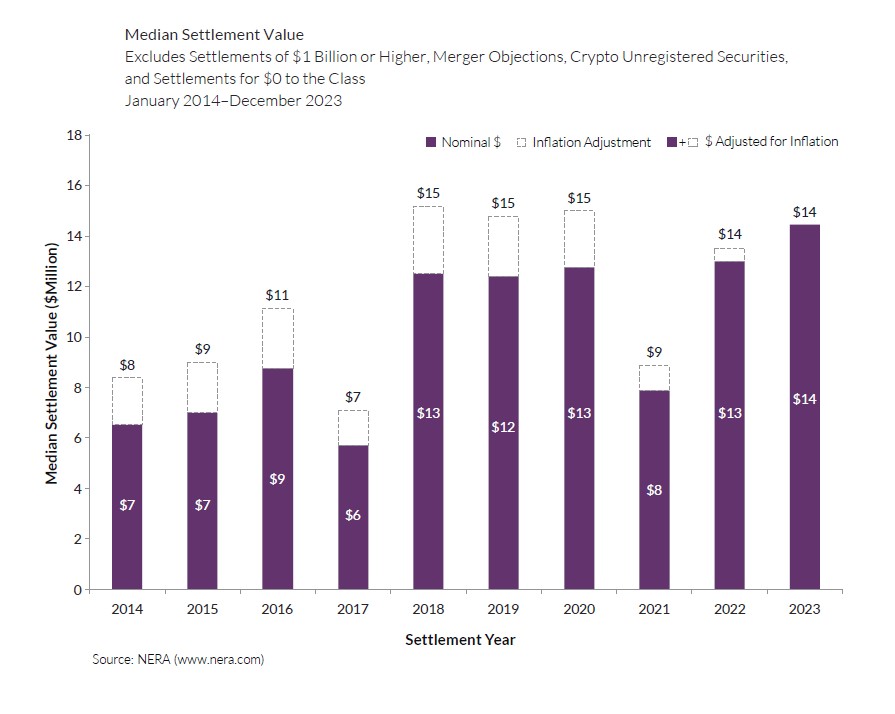

As for median settlement value, Figure 6 shows that the value remained relatively even for 2023 at $14 million. This median value has been consistent over the past 5 years, excluding the low outlier in 2021. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 6:

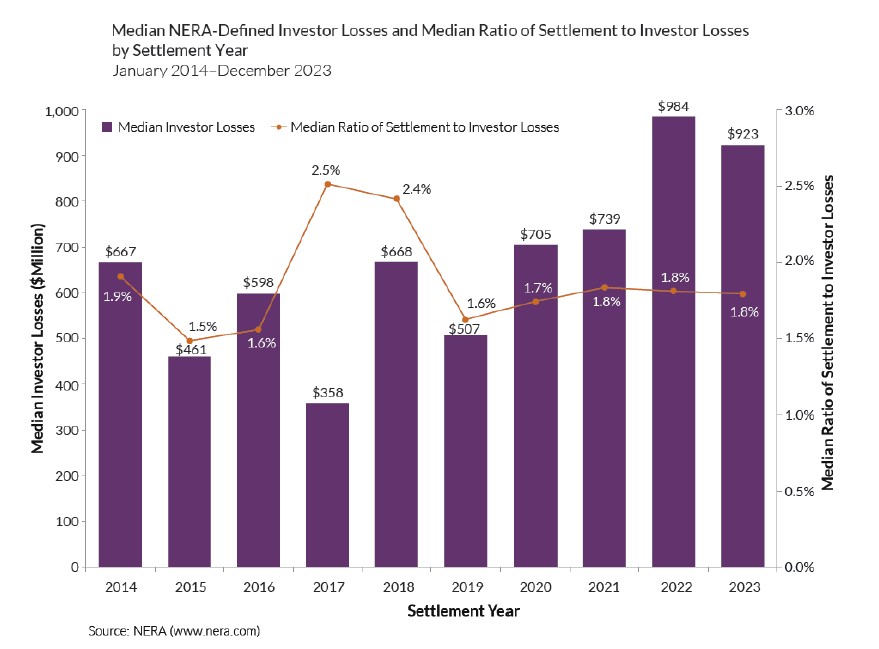

Figure 7:

Finally, as shown in Figure 7, Median NERA-Defined Investor Losses decreased slightly in 2023 to $923 million from $984 million in 2022. This remains relatively high compared to prior years. The Median Ratio of Settlement to Investor Losses continued to hold steady at 1.8% for the third straight year.

II. WHAT TO WATCH FOR IN THE SUPREME COURT

A. Pending Before The Supreme Court: Macquarie Infrastructure Corp. v. Moab Partners, L.P. – Private Actions Based On Violations Of Item 303

On January 16, 2024, the Supreme Court heard argument in Macquarie Infrastructure Corp. v. Moab Partners, L.P., a case with significant implications for securities class actions. The petition in that case presented one question for the Court’s review: whether a failure to make a disclosure required under Item 303 of SEC Regulation S-K can support a private claim under Section 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder, even in the absence of an otherwise-misleading statement. Petition for a Writ of Certiorari at i, 1, Macquarie Infrastructure Corp. v. Moab Partners, L.P., No. 22-1165 (May 30, 2023).

As background, Item 303 is an SEC regulation that requires public companies to disclose in their filings with the SEC any “known trends or uncertainties that have had or that are reasonably likely to have a material favorable or unfavorable impact” on the company’s financial condition. 17 C.F.R. § 229.303(b)(2)(ii). Although at least some courts have indicated that a violation of Item 303 does not give rise to a direct private right of action, see Carvelli v. Ocwen Fin. Corp., 934 F.3d 1307, 1330 (11th Cir. 2019), plaintiffs in this case pursued their Item 303 claim under Section 10(b) of the Exchange Act and Rule 10b-5. Under those provisions, investors may bring a private action against a company to recover losses caused by, among other things, a the company’s material misrepresentations or omissions. City of Riviera Beach Gen. Emps. Ret. Sys. v. Macquarie Infrastructure Corp., 2021 WL 4084572, at *6-7 (S.D.N.Y. Sept. 7, 2021).

Plaintiffs alleged that defendant Macquarie Infrastructure and related parties violated Section 10(b) and Rule 10b-5 by virtue of a “host of . . . misstatements and omissions” about a then-anticipated marine fuel regulation that could affect Macquarie’s financial condition. Id. at *2, *6-7. Specific allegations included that defendants were required under Item 303 to disclose some uncertainty regarding the pending regulation, and that the failure to disclose any uncertainty was a materially misleading omission actionable under Rule 10b-5. See id. at *10.

On September 7, 2021, a district judge in the Southern District of New York dismissed plaintiffs’ case in its entirety. Id. at *13. As to plaintiffs’ theory of omissions under Item 303, the district court found that plaintiffs had not alleged any “uncertainty that should have been disclosed”; “in what SEC filing or filings Defendants were supposed to disclose it”; that any uncertainty was material enough that it needed to be disclosed under Item 303; or the time at which “Defendants ‘actually kn[ew]’” of any uncertainty that should have been disclosed earlier than February 2018. Id. at *4, *10. But on appeal, the Second Circuit vacated the district court’s dismissal. Moab Partners, L.P. v. Macquarie Infrastructure Corp., 2022 WL 17815767, at *2 (2d Cir. Dec. 20, 2022). It explained that “[t]he failure to make a material disclosure required by Item 303 can serve as the basis for . . . a claim under Section 10(b) if the other elements have been sufficiently pleaded” and held that plaintiffs had met that pleading standard. Id.

The Second Circuit’s ruling in Macquarie raised an opportunity for the Supreme Court to review an apparent split between the Second Circuit’s approach and that of the Third, Ninth, and Eleventh Circuits. Those courts held that, because Item 303 relies on a different disclosure standard than Rule 10b-5, an Item 303 violation does not, on its own, constitute an actionable omission under Rule 10b-5. See Carvelli, 934 F.3d at 1331; In re NVIDIA Corp. Sec. Litig., 768 F.3d 1046, 1056 (9th Cir. 2014); Oran v. Stafford, 226 F.3d 275, 288 (3d Cir. 2000). The Court had granted certiorari in an earlier case presenting this issue, but the parties in that case, Leidos, Inc. v. Indiana Public Retirement System, No. 16-581, agreed to a settlement before the Court heard oral argument. See Petition for a Writ of Certiorari at 1, Macquarie Infrastructure Corp. (citing Leidos); Gibson Dunn Client Alert (Apr. 3, 2017). Macquarie, now fully briefed and argued, is thus expected to bring clarity to this area.

B. Lower Court Development: SEC v. Govil Deepens Circuit Split

On October 31, 2023, the Second Circuit issued its opinion in SEC v. Govil, highlighting a circuit split between the Second and Fifth Circuits on the nature of the disgorgement remedy available under the Exchange Act. 86 F.4th 89 (2d Cir. 2023). For a more detailed discussion of the facts and holding of Govil, please see our November 16, 2023 Client Alert.

The split arises from the courts’ different interpretations of the Supreme Court’s 2020 decision in SEC v. Liu and Congress’ subsequent amendment of the Exchange Act. 591 U.S. ___, 140 S. Ct. 1936 (2020); 15 U.S.C. §§ 78u(d)(5) & 78u(d)(7). In Liu, the Supreme Court interpreted the term “equitable relief” in 15 U.S.C. § 78u(d)(5), which since 2002 had been recognized as expressly authorizing disgorgement as a remedy for violations of securities law. Liu, 140 S. Ct. at 1940; see also Govil, 86 F.4th at 99. The Court in Liu held that certain equitable limits apply to this disgorgement remedy, including that a proper disgorgement award must be “awarded for victims” and must not “exceed a wrongdoer’s net profits.” Liu, 140 S. Ct. at 1940, 1947. Then, six months after Liu was decided, Congress enacted 15 U.S.C. § 78u(d)(7), which expressly permits the SEC to “seek,” and federal courts to “order,” the remedy of “disgorgement.”

Before Govil, the Second and Fifth Circuit reached competing views of the effect of that statutory amendment. First, in SEC v. Hallam, the Fifth Circuit held that § 78u(d)(7) did not codify Liu’s more stringent evidentiary and procedural requirements; instead, Congress’ action was “consistent with a desire to curtail” Liu’s impact, so that the SEC could seek “disgorgement in a legal—not equitable—sense” under § 78u(d)(7), as it could before Liu. 42 F.4th 316, 334-35, 338-41 (5th Cir. 2022). The following year, in SEC v. Ahmed, the Second Circuit interpreted “disgorgement” under § 78u(d)(7) to be subject to the same limitations that Liu imposed on “equitable relief” under § 78u(d)(5). 72 F.4th 379, 296 (2d Cir. 2023). In doing so, the Second Circuit expressly disagreed with the Fifth Circuit’s approach in Hallam. See id. at 395 & n.7.

In Govil, the Second Circuit followed Ahmed, applying § 78u(d)(7) as cabined by Liu. Govil, 86 F.4th at 101-02. Govil thus held that, before ordering disgorgement, the district court was required to find that investors defrauded by a defendant’s actions had suffered pecuniary harm. Id. at 94, 105. In the absence of a finding of harm, the Second Circuit held that the district court abused its discretion by ordering disgorgement as a remedy. Id. Further, even if investors were found to have been harmed, the district court also erred by not “undertaking a valuation” of the securities defendant had already surrendered to the company. Id. at 110-11. In issuing the disgorgement order without valuing the assets already turned over to potential victims, the district court order risked “forcing [the] defendant to pay disgorgement twice,” which would “amount[] to a penalty” impermissible under Liu. Id. at 107. Accordingly, the Second Circuit vacated the district court’s judgment and remanded with instructions to find whether “the defrauded investors suffered pecuniary harm.” Id. at 111.

In reaching this decision, the court explicitly noted the circuit split, reviewing the Hallam decision and recognizing that the Fifth Circuit’s reasoning had relied on “familiar principles of statutory interpretation.” Id. at 100-02. The court also noted that the split could be outcome-determinative in cases like Govil because the Hallam rule “might authorize disgorgement” on Govil’s facts, even without a finding that affected investors were “victims” who had suffered pecuniary loss. Id. at 102 n.13.

Although it follows Second Circuit precedent in recognizing a narrower path for the SEC to seek—and courts to grant—disgorgement, Govil highlights both the existence of the post-Liu circuit split on disgorgement and its potential stakes for defendants.

III. DELAWARE DEVELOPMENTS

Delaware law has continued to develop apace over the last six months, and significant new developments are expected in the year ahead. In December 2023, the Delaware Supreme Court heard oral argument in a case that could substantially alter the landscape for transactions involving a controlling stockholder. Delaware courts also continued issuing decisions in the wake of the SEC’s Universal Proxy rule, which we discussed in our 2023 Mid-Year Securities Litigation Update; so far, Delaware courts have taken a measured approach. Courts continue to confront Caremark claims and reiterate the relatively narrow circumstances in which such claims arise. Other recent decisions applied traditional Delaware law principles to emerging dynamics—e.g., the application of case law regarding books and records demands when the demand is by a potential activist investor, and the application of Sections 151(a) and 212(a) to a certificate of incorporation that provides greater voting power to a subset of entities and individuals than to other stockholders. Finally, the Delaware Court of Chancery recently narrowed the enforceability of a “Con Ed” provision allowing a target company to seek lost stockholder premium as damages resulting from an acquiror’s breach in a failed merger.

A. The Delaware Supreme Court Considers Burdens In Conflicted Controller Transactions

In December 2023, the Delaware Supreme Court heard oral argument in In re Match Group, Inc. Derivative Litigation, a case that could clarify when burdens of proof and standards of review shift in allegedly conflicted controller transactions.

At issue in In re Match Group, Inc. Derivative Litigation is a “multi-step reverse spinoff initiated by a controller.” 2022 WL 3970159, at *1 (Del. Ch. Sept. 1, 2022). After concluding that “the process as pled satisfied MFW,” the Court of Chancery applied the deferential business judgment standard and dismissed the case. Id. MFW, which involved a squeeze-out merger, provided that, “in controller buyouts, the business judgment standard of review w[ould] be applied if and only if” several factors were met. Kahn v. M & F Worldwide Corp., 88 A.3d 635, 645 (Del. 2014). Among them is the requirement that a controller “condition[] the procession of the transaction on the approval of both a Special Committee and a majority of the minority stockholders.” Id.

Plaintiffs then appealed to the Delaware Supreme Court. Relevant here, they argued that the Court of Chancery erred in concluding that MFW can be satisfied when less than the entire special committee is independent. Appellants’ Opening Brief at 18-22, In re Match, 2022 WL 3970159, Dkt. 24 (Dec. 2, 2022).

In response, a group of defendants argued that plaintiffs should carry the burden when something less than MFW is satisfied in conflicted controller transactions outside the merger squeeze-out context. See, e.g., Corrected Answering Brief of IAC Defendants at 8-10, In re Match, 2022 WL 3970159, Dkt. 57 (Jan 12, 2023). In their view, the Supreme Court should put an end to “MFW creep”—i.e., the gradual “expan[sion of] MFW’s scope.” Id. at 1-2.

After the initial round of briefing, the Delaware Supreme Court requested supplemental briefing on the issue. See Supplemental Briefing Order, In re Match Grp., Inc. Deriv. Litig. at 3, No. 368, 2022 (Del.), Dkt. 58 (requesting briefing on “whether the Court of Chancery judgement should be affirmed because [the at-issue] [t]ransactions were approved by either (a) [a special committee] or (b) a majority of the minority stockholder vote?”).

Affirming on the basis that the transactions were approved by either a special committee or a majority of the minority stockholder vote in the context of a conflicted controller transaction other than a squeeze-out merger would indicate that plaintiffs bear the burden when something less than MFW is satisfied. But whichever path it takes—confining MFW to controller squeeze-out mergers or endorsing its application to other contexts—the Supreme Court’s opinion, should it rule on this basis, could alter the playing field considerably.

B. Delaware Courts Begin Addressing Advance Notice Bylaws In The Wake Of The SEC’s Universal Proxy Rule

Since the Universal Proxy rule—discussed in our 2023 Mid-Year Update—took effect, the Delaware Court of Chancery “has only begun to hear disputes involving the wave of new and amended advance notice bylaws.” Kellner v. AIM Immunotech Inc., — A.3d —, 2023 WL 9002424, at *15 (Del. Ch. Dec. 5, 2023). Although early days, the decision discussed below indicates that Delaware courts are taking a measured approach. See, e.g., id. at *15 (“[I]t is apparent that the court must—more than ever—carefully balance the competing interests at play.”).

In Kellner v. AIM Immunotech Inc., the Court of Chancery reviewed a set of bylaws prompted, in part, by prior “activist activity.” 2023 WL 9002424, at *9. According to counsel for AIM, the group of activists had “engag[ed] in efforts to conceal who was supporting and who was funding the nomination efforts and to conceal the group’s plans for the Company.” Id. This decision arises out of a “renewed nomination attempt” made by a similar group, albeit one described as “smarter” “in many ways” “than the preceding effort.” Id. at *1.

In the end, the decision “is a tale of wins and losses on both sides.” Id. For plaintiff, for example, the court concluded that his notice “contravened valid bylaws” and “suffer[ed] from the same primary defect as his predecessor’s: it obscure[d] obvious arrangements or understandings pertaining to the nomination.” Id.

For defendants, certain bylaws were held invalid “because they inequitably imperil[ed] the stockholder franchise to no legitimate end.” Id. at *1, *16. To that end, the court reviewed the bylaws under enhanced scrutiny, asking first “whether the board faced a threat to an important corporate interest or to the achievement of a significant corporate benefit,” and, second, “whether the board’s response to the threat was reasonable in relation to the threat posed and was not preclusive or coercive to the stockholder franchise.” Id. at *17 (citation and quotation marks omitted).

After concluding that the Board’s response was objectively reasonable at step one, the court found that the Board “failed to show that certain of the provisions [we]re proportionate in relation to [the Board’s] objectives.” Id. For example, one provision generally required “the disclosure of all arrangements, agreements, or understandings [“AAUs”] ‘whether written or oral, and including promises,’ relating to a Board nomination.” Id. at *19. In addition, the provision contained a “a bespoke 24-month lookback provision” and required “a nominating stockholder to disclose AAUs both with persons acting in concert with the stockholder and any”—broadly defined—”‘Stockholder Associated Person’ (or ‘SAP’).” Id. at *20-21. This latter requirement was where the provision went “off the rails,” as it created “an ill-defined web of disclosure requirements” more “akin to a tripwire than an information gathering tool.” Id. at *22. In short, it “render[ed] the AAU Provision overbroad, unworkable, and ripe for subjective interpretation by the Board.” Id. In addition, the Board “presented no evidence to suggest that” it was “proportionate to its objective of preventing stockholders from misconstruing and evading the Amended Bylaws’ disclosure requirements.” Id

As another example, the bylaws required “the nominator and nominees to list all known supporters.” Id. at *23. AIM argued that the bylaw was consistent with a prior decision, Rosenbaum v. CytoDyn, Inc., 2021 WL 4775140 (Del. Ch. Oct. 13, 2021). (Discussed in our 2021 Year-End Update.) The court disagreed, noting the provision went “farther than what the precedent supports.” Kellner, 2023 WL 9002424, at *23. Whereas, the court explained, CytoDyn concerned a bylaw mandating the disclosure of known financial supports, the bylaw at issue in AIM “s[ought] disclosure of any sort of support whatsoever, including that of other stockholders known by SAPs to support the nomination.” Id. As a result, its “limits . . . [we]re ambiguous—both in the terms of the types of support and supporters one must disclose.” Id. Accordingly, it “impede[d] the stockholder franchise while exceeding any reasonable approach to ensuring thorough disclosure.” Id.

This decision “hints at what coming activism disputes may bring,” id. at *1, and Gibson Dunn will follow future developments.

C. Delaware Courts Reiterate The Requirements For Pleading Caremark Claims

In In re ProAssurance Corp. Stockholder Derivative Litigation, the court dismissed duty of oversight—i.e., Caremark—and disclosure claims brought against the officers and directors of ProAssurance, a healthcare professional liability insurance provider. 2023 WL 6426294, at *1 (Del. Ch. Oct. 2, 2023). In doing so, the court emphasized that Caremark claims are “reserved for extreme events.” Id. By contrast, the events underlying the litigation “quite obviously[] involve[d] a commercial decision that went poorly—the stuff that business judgment is made of.” Id. Together with Segway, discussed below, ProAssurance reaffirms the high pleading bar set by Caremark and its progeny.

Starting around 2015, the healthcare professional liability insurance “competitive marketplace shifted toward underwriting policies for larger physician groups, hospitals, and major national healthcare provider entities.” Id. at *2. Concomitantly, ProAssurance began to consider following—and ultimately did follow—that trend, which presented business risks and opportunities. See, e.g., id. at *3-4. Recognizing as much, ProAssurance focused on potential risks and worked with third parties to assess the same. Id. at *3. Indeed, the court found, ProAssurance’s “Board was consistently—even painfully—involved in monitoring the Company’s underwriting and reserves.” Id. at *10. Meanwhile, “[t]he Company. . . attest[ed] to the conservative nature of its loss reserves practices.” Id. at *6. Over time, however, claims grew, and in early 2020, ProAssurance publicly announced “adverse development[s]” related to “large national healthcare account.” Id. at *9.

In dismissing the complaint on demand futility grounds, the court explained, among other things, that plaintiffs’ allegations fell far short of pleading either of the two “necessary conditions predicate for director oversight liability: (a) the directors utterly failed to implement any reporting or information system or controls; or (b) having implemented such a system or controls, consciously failed to monitor or oversee its operations.” Id. at *12. Among other things, the court highlighted that, in addition to failing to allege illegality or bad faith, the pleadings “detail[ed] the engagement of auditors and actuarial advisors, oversight of management charged with the Company’s underwriting functions, meetings to discuss severity trends and reserves, and Board-level updates on large accounts.” Id. at *13. As for plaintiffs’ disclosure claims, they were dismissed due to a lack of “any particularized allegations of scienter.” Id. at 16.

In Segway Inc., v. Cai, the court dismissed at the pleading stage a Caremark claim brought against the former president and “in-house accountant” of Segway Inc., related to Segway’s “declining sales . . . and increased accounts receivable.” 2023 WL 8643017, at *1 (Del. Ch. Dec. 14, 2023). The complaint alleged that the former president “knew or should have known that there were potential issues” with “some of [Segway’s] customers, which caused [Segway’s] accounts receivable to continuously rise.” Id. at *3. Thus, plaintiffs claimed, the former president “breached her fiduciary duties as an officer of Segway by ‘continuously ignoring’ these ‘issues (and the resulting impact on [Segway’s] profitability), fail[ing] to take any action to address them . . . and/or fail[ing] to advise [Segway’s] board.’” Id. (alterations in original).

In dismissing Segway’s Caremark claim, the court took pains to correct a “distressing reading of” Delaware law—i.e., that “the high bar to plead a Caremark claim is lowered when the claim is brought against an officer.” Id. at *1. “[B]ad faith remains a necessary predicate to any Caremark claim,” the court explained, and “[l]iability can only attach in the rare case where fiduciaries knowingly disregard this oversight obligation and trauma ensues.” Id. Emphasizing that the Caremark doctrine is “not a tool to hold fiduciaries liable for everyday business problems,” the court dismissed Segway’s claims because they failed to adequately plead bad faith or illegality. Id. at *5.

Both Segway and ProAssurance reinforce that, “[i]rrespective of the defendant’s corporate title, a Caremark claim is ‘possibly the most difficult theory in corporation law upon which a plaintiff might hope to win a judgment.’” Id. at *5 (quoting In re Caremark Int’l Inc. Deriv. Litig., 698 A.2d 959, 967 (Del. Ch. 1996)).

D. Section 220 Demands In The Context Of Potential Stockholder Activism

In Greenlight Capital Offshore Partners, Ltd. v Brighthouse Financial, Inc., the court ruled largely in defendant’s favor in a case concerning a books and records demand under Section 220 of the DGCL. 2023 WL 8009057, at *1 (Del. Ch. 2023). Although concluding that plaintiff Greenlight Capital’s purpose for the demand was proper, the court nonetheless found that Greenlight had “only proven that a narrow subset of the materials it request[ed] [we]re necessary and essential to its valuation purpose.” Id. at *1, *8.

Greenlight, a hedge fund, owned shares of defendant Brighthouse Financial, Inc. Id. Brighthouse Financial, Inc. “is a public holding company that sells insurance products through private subsidiaries.” Id. “In 2020 and 2021, Brighthouse’s stock price jumped after [a subsidiary] . . . issued extraordinary dividends with the approval of the Delaware Department of Insurance.” Id. Those dividends, in turn, aroused Greenlight’s interest in that subsidiary and prompted Greenlight to “‘consider activism’ towards Brighthouse.” Id. at *1, *6.

After its FOIA request failed, Greenlight turned to a books and records demand with the stated purpose of “‘more accurately determin[ing] the value’ of its Brighthouse shares;” “[i]t sought, ‘[i]n particular[,] . . . to determine the true financial impact of [the dividend-issuing subsidiary] . . . on the value of’ the shares.” Id. at *4. To that end, Greenlight requested several categories of documents spanning a number of years. Id. Brighthouse rejected Greenlight’s demand for several reasons, including that they were overbroad, it could glean the information it sought from public filings, and its stated purpose was neither its real purpose nor, possibly, a proper purpose. Id.

Greenlight then filed suit. Id. To prevail on a Section 220 claim, a party must, among other things, offer a proper purpose for its request and demonstrate that the requested materials are “essential to accomplish[] the . . . articulated purpose.” Id. at *5.

After trial, the court found that Greenlight’s stated purpose was “a proper purpose” under “settled law in Delaware” and rejected Brighthouse’s contention that Greenlight’s stated purpose was merely “a pretext [for] activism.” Id. at *5-6. The court explained that “[activism] is not . . . a purpose unto itself,” and because Greenlight demonstrated a proper primary purpose, any additional motivations were irrelevant. Id. at *7.

Turning to Greenlight’s specific requests, the court found that it had “only proven that a narrow subset of the materials it request[ed] [we]re necessary and essential to its valuation purpose.” Id. at *8. This was partly due to Brighthouse’s and its subsidiary’s public filings and partly due to Greenlight’s requests seeking either stale information or information pertaining to “future potential dividend capacity”—both of which were “too attenuated from Greenlight’s purpose of more accurately determining the current value of its Brighthouse shares.” Id. at *8-9.

E. Court Of Chancery Upholds Differential Voting Power Based On Identity

In Colon v. Bumble, Inc., the Delaware Court of Chancery upheld the validity of provisions that resulted in all shares of Bumble stock carrying one vote unless held by a “Principal Stockholder.” — A.3d —-, 2023 WL 5920100, at *2-4, *9 (Del. Ch. Sept. 12, 2023). Principal Stockholders (who are party to a separate, publicly disclosed stockholder agreement) are, by contrast, entitled to 10 votes per share. Id. at *3-4.

Plaintiff claimed that the provisions giving rise to that dynamic violated Sections 151(a) and 212(a) of the DGCL. Id. at *4. In rejecting plaintiff’s challenge and concluding that it “is permissible” to “hav[e] the level of voting power turn on the identity of the owner,” id. at *9, the court explained that Delaware precedent already concluded that formula-based allocations of voting power are consistent with Delaware law, and the DGCL expressly permits voting power to “depend on facts ascertainable outside of the certificate of incorporation.” Id. at *8.

As to Section 212(a), the court disagreed with plaintiff’s assertion—based not on Section 212(a)’s text but on an earlier Delaware Supreme Court opinion—that “a corporation cannot create a mechanism in which shares of the same class differ in their share-based voting power depending on who holds them.” Id. at *9. Among other things, it explained that despite the Supreme Court’s somewhat “puzzl[ing]” reasoning, it approved of provisions that are relevantly similar to the ones before the court. Id. at *9-15.

As to Section 151(a), the court rejected the assertion that it requires “a class of stock [to] assign the same voting rights to all shares.” Id. at *15. Section 151(a), the court explained, does not require either that a formula “generate the same result for all shares,” or that different results can flow from the formula “but it must be a formula that gives any holder an opportunity to gain” its benefits. Id. Section 151(a) only requires that “the method”—”not the outcome”—”be identical across all shares in [a] class.” Id. at *10 (“Section 151(a) expressly permits the use of formulas and procedures that apply across all shares but which can generate different results for different shares based on facts ascertainable outside of the charter (such as the identity of the holder).”).

F. Court Of Chancery Limits The Options For “Con Ed” Provisions

In October 2023, the court in Crispo v. Musk held that a so-called “Con Ed” provision in a merger agreement between Elon Musk and Twitter, Inc., which “purport[ed] to define a target company’s damages to include lost-premium damages,” was an unenforceable contract penalty. 304 A.3d 567, 584 (Del. Ch. 2023). In this decision on plaintiff’s mootness fee petition, the court found that plaintiff lacked standing because the merger agreement did not confer third-party beneficiary status to stockholders and Twitter’s pursuit of a claim for specific performance of the merger agreement negated plaintiff’s ability to pursue damages under a theory that Lost-Premium Provision provided plaintiff with implicit third-party status. Id. at 578. In the course of determining the viability of plaintiff’s claim, the court also held that a Lost-Premium Provision that defines lost-premium damages as exclusive to the target, a damages-definition “Con-Ed” provision, is unenforceable as an unlawful contract penalty under Delaware Law. Id. at 584. We discussed this decision in greater detail in our November 8, 2023 Client Alert.

G. Court Of Chancery Invalides $55.8 Billion Equity Compensation Package

In Tornetta v. Musk, a court ruled in favor of Tesla stockholders who brought a derivative lawsuit challenging the multiyear compensation arrangement awarded to Tesla CEO Elon Musk. — A.3d —, 2024 WL 343699, at *1 (Del. Ch. Jan. 30, 2024). For more information, please see our February 5, 2024 Client Alert.

IV. FEDERAL SPAC LITIGATION

In 2023, the number of SPAC IPOs again declined, continuing a trend noted in our 2022 and 2023 Mid-Year Securities Litigation Updates. Between January and November 2023, there were 28 SPAC IPOs, compared to 86 in 2022 and 613 in 2021. 2023 saw a corresponding decline in SPAC-related securities suits, with just 18 new SPAC-related federal securities complaints filed in 2023, down from 29 in 2022.

Although the filing of SPAC-related litigation has slowed, existing cases continue to make their way through the courts. In September 2023, a pair of district courts considered whether allegations of scienter based on general incentives present in de-SPAC transactions were sufficient and found that they were not.

Phoenix Insurance Company, Ltd. v. ATI Physical Therapy, Inc., 2023 WL 5748359 (N.D. Ill. Sept. 6, 2023): Investors brought a putative class action alleging securities fraud claims against a physical therapy services company that went public via a de-SPAC, the company’s former CEO and CFO, and the former CEO of the SPAC. Id. at *1. Plaintiffs alleged that defendants made misleading statements and omissions in proxy statements issued before the merger relating to the attrition rate of the company’s physical therapists. Id. at *4, *8. Investors alleged that the former CEO of the SPAC, who was also the former CEO of the target, acted with scienter based in part on the theory that officers of a SPAC have incentives to “present a target company in a misleadingly favorable light to ensure the company is acquired,” allowing the officers of the SPAC to “gain favorable employment in the post-merger company rather than returning the funds to the investors.” Id. at *2, *15 (internal quotations omitted).

The court found that these “exceedingly generic” motive allegations did “not contribute much to a strong inference of scienter” because they said “nothing about the motivations, circumstances, and factors particular to” the former SPAC CEO. Id. (emphasis in original). Ultimately, the court dismissed the claims against the former CEO of the SPAC, finding plaintiffs fell “far short of pleading a strong inference of scienter.” Id. at *20. The claims against the company and its former executives survived.

In re Danimer Scientific, Inc. Securities Litigation, 2023 WL 6385642 (E.D.N.Y. Sept. 30, 2023): We first reported on this case in our 2022 Year-End Securities Litigation Update. Danimer, a bioplastics company, went public in 2020 via a de-SPAC merger. Id. at *1-2. Danimer stockholders brought a class action asserting securities fraud claims against the company and several of its directors and officers, including one director who was previously the CEO of the SPAC. Id. During the period between announcing the merger agreement and the shareholder vote, defendants made allegedly misleading statements in investor presentations and press releases regarding the biodegradability of Danimer’s products, production capacity, product demand, and managerial success of Danimer’s CEO. Id. at *4-5.

The court granted defendants’ motion to dismiss because plaintiffs failed adequately to allege scienter. Id. at *1, *10-12. Plaintiffs asserted that, given the limited lifespan of a SPAC, Danimer’s former CEO was incentivized to complete the de-SPAC merger to avoid returning the money the SPAC had raised from its investors. Id. at *11. The court characterized what it described as plaintiffs’ “bet the company theory” of scienter as “still far too generalized . . . to allege the proper concrete and personal benefit required” under Second Circuit precedent, rejecting the idea that “the SPAC model of taking a company public puts unique pressures on . . . management to complete a bad deal[.]” Id. (internal citation omitted). Plaintiffs further asserted that the company and two of its directors were motivated to close the de-SPAC merger because it would provide the only available means of funding Danimer’s plans to expand its facilities. Id. at *11. Plaintiffs’ scienter allegations fell short there as well, the court explained, as defendants shared “a goal possessed by virtually all corporate insiders[,]” which “remains true even if a company decides to raise capital through merging with another company.” Id. (internal citations omitted). Thus, plaintiffs failed to meet the PSLRA’s scienter pleading standards because they invoked only “incentives supposedly faced by SPACs generally.” Id. (citing Phoenix Ins., 2023 WL 5748359, at *15).

Gibson Dunn represents defendants in this action.

V. ESG CIVIL LITIGATION

A growing number of lawsuits have been filed challenging public companies’ environmental, social, and governance (“ESG”) disclosures and policies. The following section surveys notable developments in pending cases that involve ESG allegations.

A. Environmental Litigation

In re Danimer Scientific, Inc. Securities Litigation, 2023 WL 6385642 (E.D.N.Y. Sept. 30, 2023): As noted above, plaintiffs in this action alleged that defendants made misleading statements in investor presentations and press releases regarding, among other things, the biodegradability of Danimer’s products. ECF No. 44 at 2-3. They further alleged that when an article published in The Wall Street Journal claimed that the timing in which the company’s product would biodegrade was more variable than suggested, the company’s stock price allegedly dropped. Id. at 11-13. As noted, the court concluded that plaintiffs had not adequately alleged scienter and entered an order dismissing the complaint with prejudice on September 30, 2023. In re Danimer Sci., Inc. Sec. Litig., 2023 WL 6385642 (E.D.N.Y. Sept. 30, 2023). Gibson Dunn represents the defendants in this action.

General Retirement System of the City of Detroit v. Verizon Communications Inc., No. 23-cv-05218 (D.N.J. Aug. 18, 2023): In this case, plaintiffs allege that Verizon made false or misleading statements regarding its responsibility for “an extensive network of lead cables . . . around the country, causing harm and posing the risk of further harm to the environment, Company employees, and surrounding communities.” ECF No. 1, at 5. The amended complaint alleges that Verizon’s stock price dropped after The Wall Street Journal released an article profiling workers who claimed they were sick from lead exposure. Id. at 35-39. A motion to dismiss the amended complaint is due by February 27, 2024. ECF No. 34. A similar case was filed in the Western District of Pennsylvania on August 1, 2023, and was voluntarily dismissed on October 27, 2023. See Meehan v. Verizon Commc’ns, Inc., No. 23-cv-01375 (W. D. Pa. Aug. 1, 2023).

Brazinsky v. AT&T Inc., No. 23-cv-04064 (D.N.J. July 28, 2023): In this case, plaintiff alleged that AT&T misled investors by failing to disclose ownership of lead cables around the United States, which pose risks of environmental harm. ECF No. 1, at 9. AT&T has neither answered nor moved to dismiss this complaint. AT&T filed a motion to transfer the case to the Northern District of Texas, which remains pending before the court. ECF. No. 43.

In re Oatly Group AB Securities Litigation, No. 21-cv-06360 (S.D.N.Y. July 26, 2021): A putative class action complaint has been filed against Oatly Group AB, the world’s largest oat milk company, and several of its officers and directors. Plaintiffs allege that Oatly made false or misleading statements related to the sustainability of its product. ECF No. 91, at 29-34. More specifically, plaintiffs allege that Oatly overstated its substantiality practices and minimized its environmental impact, which led to an inflated share price. Id. Oatly has not answered or filed a motion to dismiss the complaint. On November 3, 2023, the parties disclosed an intent to settle the litigation. ECF No. 95. On February 16, 2024, plaintiffs moved for preliminary approval of settlement, and the parties are scheduled to appear before the court to discuss the settlement on February 21, 2024. ECF No. 99, at 1-2.

City of St. Clair Shores Police and Fire Retirement System v. Unilever PLC, No. 22-cv-05011 (S.D.N.Y. June 15, 2022): We reported on this case in our 2022 Year-End Securities Litigation Update and our 2023 Mid-Year Securities Litigation Update. The allegations against Unilever arose from a proposed Ben & Jerry’s board resolution purporting to end the sale of Ben & Jerry’s products in areas deemed “to be Palestinian territories illegally occupied by Israel.” ECF No. 1, at 6. Plaintiffs alleged that Ben & Jerry’s parent company made misleading statements to investors by failing to adequately disclose the business risks associated with the resolution. Id. at 10-18. Defendants in Unilever filed a motion to dismiss these allegations. ECF No. 31. The court granted the motion to dismiss, holding plaintiffs failed to plead scienter because the complaint lacked plausible allegations that defendants knew implementation of the board resolution “was a certainty or at least probable.” City of St. Clair Shores Police and Fire Ret. Sys. v. Unilever PLC, 2023 WL 5578090, at *3-5 (S.D.N.Y. Aug. 29, 2023).

Wong v. New York City Employee Retirement System, No. 652297/2023 (N.Y. Sup. Ct., N.Y. Cnty. May 11, 2023): We first reported on this case in our 2023 Mid-Year Securities Litigation Update. Plaintiffs in this case filed breach of fiduciary duty claims against three New York City pension funds that divested approximately $4 billion in fossil fuel investments. NYSCEF No. 2. The divestment allegedly caused the pension fund to lose out on the energy’s sector significant growth, and therefore lucrative returns, over the past few years and was undertaken for political reasons unrelated to the retirement interests of plan participants. Id. at 19. Plaintiffs seek an injunction, requiring the pension fund to cease the ongoing divestment and make decisions regarding fuel-related and other potential investments “exclusively on relevant risk-return factors.” Id. at 25. Defendants filed a motion to dismiss the complaint, arguing that the plaintiffs lack standing and fail to state a claim because the complaint does not contain any allegations showing that the funds’ trustees acted disloyally or carelessly and the decision to divest was made based on relevant financial considerations. NYSCEF No. 20, at 6-7. The motion to dismiss is pending before the court. Gibson Dunn represents plaintiffs in this case.

Exxon Mobile Corp. v. Arjuna Capital, No. 24-cv-00069 (N.D. Tex. Jan. 21, 2024): ExxonMobil filed a complaint seeking a declaratory judgment that it may exclude activist investors’ shareholder proposal from Exxon’s 2024 proxy statement. ECF No. 1, at 25. The complaint alleges that defendants’ proposal, requesting Exxon to accelerate greenhouse gas emissions reductions, “does not seek to improve ExxonMobil’s economic performance or create shareholder value.” Id. at 3-4. Exxon asserts that it may properly exclude defendants’ proposal under the ordinary business (Rule 14a-8(i)(7)) and resubmission exclusions ((i)(12)). Defendants responded to the complaint by withdrawing their proposal and agreeing not to propose it again in the future. The litigation is continuing. Gibson Dunn represents plaintiff in this action.

Securities Industry & Financial Markets Association v. Ashcroft, No. 23-cv-04154 (W.D. Mo. Aug. 10, 2023): In June 2023, the Missouri Securities Division adopted new rules requiring investment professionals to obtain client signatures before providing advice that “incorporates a social objective or other nonfinancial objective.” ECF No. 24, at 22-33. In August 2023, plaintiff filed a lawsuit challenging these rules. ECF No. 1, at 41. Plaintiff alleges that the rules are preempted by the National Securities Markets Improvement Act of 1996 and the Employee Retirement Income Security Act, violate the First Amendment, and are unconstitutionally vague. ECF No. 24, at 33-42. On January 5, 2024, the court denied defendant’s motion to dismiss, allowing this matter to proceed to discovery. ECF No. 39.

B. Diversity And Inclusion

Ardalan v. Wells Fargo & Co., No. 22-cv-03811 (N.D. Cal. July 28, 2022): We first reported on this case in our 2023 Mid-Year Securities Litigation Update. After the district court dismissed the initial complaint, ECF Nos. 112, at 15, plaintiffs filed an amended complaint. ECF No. 116. In the amended complaint, plaintiffs allege that Wells Fargo conducted interviews for positions that had already been filled to comply with its disclosed intent that 50 percent of interviewees be diverse for most roles above a certain salary threshold. ECF No. 116, at 9-10. In particular, the amended complaint alleges that diverse interviewees either did not have a legitimate chance to obtain the job for which they were interviewing or were interviewing for roles already filled. Id. at 44-48. Defendants filed a motion to dismiss the amended complaint, which is fully briefed and pending before the court.

National Center for Public Policy Research v. Schultz, 2023 WL 5945958 (E.D. Wa. Sept. 11, 2023): In this derivative action, plaintiff alleged that directors and officers of Starbucks breached their fiduciary duties by rejecting a proposal (that plaintiff itself filed) challenging Starbucks’ diversity, equity, and inclusion (“DEI”) initiatives. ECF No. 1-2, at 33-35. Defendants filed a motion to dismiss the complaint, arguing that plaintiff does not fairly and adequately represent the interest of shareholders. ECF No. 19, at 12-21. The court granted defendants’ motions to dismiss, holding that plaintiff had filed this action “to advance its own political and public policy agenda” and failed to allege that the board’s rejection of its demand to retract the DEI initiatives was wrongful. Nat’l Ctr. for Pub. Pol’y Rsch. v. Schultz, 2023 WL 5945958, at *3-4 (E.D. Wa. Sept. 11, 2023).

VI. CRYPTOCURRENCY LITIGATION

A. Class Actions

Risley v. Universal Navigation Inc., 2023 WL 5609200 (S.D.N.Y. Aug. 29, 2023): On August 29, 2023, a U.S. District Judge dismissed a putative class action complaint against the developers of and investors in the Uniswap Protocol trading platform, a decentralized cryptocurrency exchange. Id. at *1. Plaintiffs, a class made up of individuals who each purchased certain of the tokens that were issued and traded on this exchange, brought claims under Section 12(a)(1) of the Securities Act and Section 29(b) of the Securities Exchange Act, alleging that they lost money after investing in what turned out to be “scam tokens.” Id. at *1, *11. The District Judge, in assuming (but not confirming) that the tokens were securities, dismissed the complaint in full, emphasizing that the identity of the issuers of the tokens was largely unknown both to plaintiffs and defendants due to the decentralized nature of the exchange. Id. at *11. The District Judge observed that plaintiffs are “looking for a scapegoat for their claims because defendants they truly seek are unidentifiable” and opined that whether “this anonymity is troublesome enough to merit regulation is not for the court to decide, but for Congress.” Id. at *19. This case is currently on appeal to the Second Circuit. Risley v. Universal Navigation Inc., 2023 WL 5609200 (S.D.N.Y. Aug. 29, 2023), appeal docketed, No. 23-1340 (2d Cir. Sept. 28, 2023).

Ohman J:or Fonder AB v. NVIDIA Corp., 81 F.4th 918 (9th Cir. 2023): On August 25, 2023, the Ninth Circuit partially revived a putative class’s securities fraud claims against NVIDIA and its officers. In this case, the putative class of shareholders alleged that defendants knowingly or recklessly made materially “misleading and false statements regarding the impact of cryptocurrency sales on NVIDIA’s financial performance” in order to conceal the extent to which NVIDIA’s revenue growth depended on the demand for cryptocurrency, in violation of Sections 10(b) and 20(a) of the Exchange Act and Rule. Id. at 923. The U.S. District Court for the Northern District of California initially dismissed the amended complaint in its entirety. However, on appeal, the Ninth Circuit, in a split opinion, reversed in part and remanded for further proceedings, finding that plaintiffs had stated claims against NVIDIA and its cofounder, President, and CEO, but not against the other officers. Id. at 947. The appellate court concluded that the complaint sufficiently alleged that the cofounder, President, and CEO knowingly or recklessly made false or misleading statements about the degree to which NVIDIA’s revenues were dependent on sales of GeForce GPUs to crypto miners, based on his repeated statements to investors and analysts throughout 2017 and 2018 downplaying the degree of such dependency. Id. at 933-34, 937, 940. Judge Gabriel Sanchez dissented, concluding that the complaint was entirely based on a post hoc, unreliable analysis done by an outside expert and that it did not allege with sufficient particularity information that would have put NVIDIA’s executives on notice that their public statements were false or misleading when made. Id. at 947. The petition for rehearing en banc was denied. See E. Ohman J.:or Fonder AB v. Nvidia Corp., 2023 WL 7984780, at *1 (9th Cir. Nov. 15, 2023). On December 5, 2023, the Ninth Circuit granted defendants’ motion to stay the mandate for ninety days. See Order, E. Ohman J. or Fonder AB v. NVIDIA Corp., No. 21-15604 (9th Cir. Dec. 5, 2023).

B. Regulatory Lawsuits

SEC v. Binance Holdings Ltd., No. 23-cv-01599 (D.D.C. June 5, 2023): As reported in our Securities Litigation 2023 Mid-Year Update, on June 5, 2023, the SEC filed a 13-claim complaint against Binance Holdings Limited, BAM Trading Services Inc., BAM Management Holdings Inc. and Changpeng Zhao in D.C. federal court, alleging defendants engaged in unregistered offers and sales of crypto asset securities. ECF No. 1. On June 13, 2023, consistent with the arguments set forth in defendants’ briefing, the government admitted that it had no evidence that customer assets have been misused or dissipated and, as a result, defendants successfully prevented the SEC from obtaining the extensive relief it sought. Instead, at the court’s direction, Binance, the SEC, and the other defendants in the action negotiated a consent order that will remain in place while the action is pending. ECF No. 71. After the entry of the Consent Order, defendants filed motions to dismiss. ECF No. 114. Primarily, defendants argued that the cryptocurrencies at issue are not “investment contracts” under SEC v. W.J. Howey Co., 328 U.S. 293 (1946) (“Howey”) and that the major-questions doctrine bars the SEC from unilaterally deciding it can regulate the burgeoning cryptocurrency industry. ECF Nos. 117-1, 118. Judge Amy Berman Jackson heard oral argument on the pending motions to dismiss on January 22, 2024.

In the backdrop of this ongoing SEC litigation, Binance and related entities entered into settlements with the DOJ and CFTC. On November 21, 2023, Binance and its CEO entered a guilty plea to resolve its outstanding DOJ litigation. See Binance and CEO Plead Guilty to Federal Charges in $4B Resolution, Dep’t of Just. (Nov. 21, 2023). Subsequently, on December 18, 2023, a federal court approved a separate settlement with the CFTC. See Federal Court Enters Order Against Binance and Former CEO, Zhao, Concluding CFTC Enforcement Action, Commodities Futures Trading Comm’n (Dec. 18, 2023).

Gibson Dunn represents Binance Holdings Limited.

SEC v. Schueler, No. 23-cv-05749 (E.D.N.Y. July 31, 2023): On July 31, 2023, the SEC charged Richard Schueler (otherwise known as “Richard Heart”) and three affiliated companies for the unregistered offer and sale of securities as well as the misappropriation of investor assets. According to the SEC’s complaint, Heart created and marketed his “Hex” token to investors, promising them a 38% annual return on investment in the form of future Hex tokens if they “staked,” or locked up, their existing Hex tokens. ECF No. 1, at 7. Through the “staking” process, Heart purportedly hoped to inflate the price of Hex tokens. Id. The SEC also alleged that Heart developed Pulsechain and PulseX, a blockchain and crypto token, that each raised hundreds of millions of dollars from investors. Id. at 16-18, 21. Heart allegedly misappropriated at least 12.1 million dollars of investor assets in order to purchase luxury goods, including a 555-carat black diamond. Id. at 19-20. Accordingly, the SEC charged Heart both with fraud under Sections 10(b), 17(a)(1), and 17(a)(3) of the Exchange Act, as well as with failure to comply with the registration provisions of Section 5 of the Securities Act. Id. at 4. Defendants’ motion to dismiss is due by April 8, 2024 with Judge Carol Bagley Amon set to hear oral arguments on October 24, 2024. Scheduling Order, SEC v. Schueler, No. 23-cv-05749 (E.D.N.Y. Jan. 18, 2024).

SEC v. Payward, Inc. and Payward Ventures, Inc., No. 23-cv-06003 (N. D. Cal. Nov. 20, 2023): On November 20, 2023, the SEC filed a three-count complaint against Payward Ventures and Payward Trading, Ltd. (also known as “Kraken”) in the United States District Court for the Northern District of California for violations of Sections 5, 15(a), and 17A(b) of the Exchange Act. ECF No. 1, at 4. In its complaint, the SEC alleged that 11 assets that Kraken traded were “investment contracts represented by the underlying crypto asset” and that they are therefore subject to the Exchange Act’s regulations. Id. at 15. In addition to claiming that Kraken’s traded assets should have been registered, the SEC also alleged that the online trading platform acted as an exchange, broker, dealer, and clearing agency for crypto assets without first registering with the agency. Id. at 18-35. Further, the SEC alleged that Kraken’s failure to register enabled it to commingle its customers’ crypto assets along with fiat in its custodial accounts without ever disclosing that fact to customers. Id. at 39. Accordingly, the SEC seeks injunctive relief, disgorgement of gains with interest, and civil money penalties. Id. at 4. Defendants’ motion to dismiss is due on February 22, 2024. ECF No. 21, at 1.

People v. Mek Global Ltd., d/b/a/ KuCoin, Index No. 450703/2023 (Sup. Ct. N.Y. Cnty. Dec. 12, 2023): In March 2023, the New York Attorney General’s Office brought claims against the Seychelles-based crypto exchange KuCoin, alleging that KuCoin violated New York securities laws by unlawfully offering and selling cryptocurrency and by unlawfully representing itself as an “exchange.” Stipulation and Consent Order at 1, People v. Mek Global Ltd., d/b/a/ KuCoin, Index No. 450703/2023 (Sup. Ct. N.Y. Cnty. Dec. 12, 2023). On December 12, 2023, KuCoin agreed to return $16.7 million dollars to New York investors, pay $5.3 million in fines, take steps to close New York accounts within 120 days, and preclude the creation of new New York-based accounts. Id. at 3-4. KuCoin also admitted that it falsely represented itself as a registered exchange and that it operated in New York as an unregistered securities or commodities broker-dealer. Id. at 2-3. As a part of the consent order, KuCoin must update the Office of the Attorney General (“OAG”) on the number of New York customers that have withdrawn money and also provide the Office with detailed information on New York customers who have had an open account at KuCoin. Id. at 10-11. The consent order resolves the OAG’s claims against KuCoin. Id. at 2.

SEC v. Terraform Labs Pte. Ltd., 2023 WL 8944860 (S.D.N.Y. Dec. 28, 2023): As reported in our 2023 Mid-Year Litigation Update, the SEC brought an enforcement action early last year alleging that Terraform Labs and its founder perpetrated a multibillion dollar crypto asset securities fraud scheme by offering and selling crypto asset securities in unregistered transactions and misleading investors about the Terraform blockchain and its crypto assets. On July 31, 2023, U.S. District Judge Jed S. Rakoff denied defendants’ motion to dismiss. On December 28, 2023, Judge Rakoff granted summary judgment for the SEC, finding that Terraform’s crypto assets—UST, LUNA, wLUNA, and MIR—are securities because they are investment contracts under Howey, and that defendants offered and sold LUNA and MIR in unregistered transactions in violation of the federal securities laws. 2023 WL 8944860, at *12-16. Judge Rakoff further held that defendants offered unregistered security-based swaps to non-eligible contract participants and effected transactions in security-based swaps with non-eligible contract participants in violation of the federal securities laws. Id. at *17. Trial on the remaining fraud claims is scheduled for late March of 2024.

C. Other Developments

1. SEC Grants Approval For Certain ETFs To Track Bitcoin

On January 10, 2024, the SEC granted approval for the first U.S.-listed exchange-traded funds (“ETFs”) to track bitcoin. SEC, Statement on the Approval of Spot Bitcoin Exchange-Traded Products (Jan. 10, 2024). The approval includes applications from 11 major entities like BlackRock, Ark Investments/21Shares, Fidelity, Invesco, and VanEck. This marks a potentially significant development for Bitcoin as the world’s largest cryptocurrency and for the broader crypto industry. Some consider the ETFs a pivotal development for Bitcoin, offering investors exposure to the cryptocurrency without directly holding it. Analysts predict significant inflows, with estimates ranging from $50 billion to $100 billion this year alone.

This move marks a change for the SEC, which had previously rejected bitcoin ETFs. Hannah Lang & Suzanne McGee, US SEC Approves Bitcoin ETFs in Watershed for Crypto Market, Reuters (Jan. 11, 2024). However, SEC Chair Gary Gensler suggested that the approval was partly in response to a circuit court ruling that the SEC wrongly denied an application from Grayscale Investments to convert its existing Grayscale Bitcoin Trust into an ETF. See SEC, Statement on the Approval of Spot Bitcoin Exchange-Traded Products (Jan. 10, 2024) (citing Grayscale Investments, LLC v. SEC, 82 F.4th 1239 (D.C. Cir. 2023)). Gensler also emphasized that the action would not change the SEC’s enforcement of “non-compliance of certain crypto asset market participants with the federal securities laws,” nor does the SEC “approve or endorse crypto trading platforms or intermediaries, which, for the most part, are non-compliant with the federal securities laws and often have conflicts of interest.” SEC, Statement on the Approval of Spot Bitcoin Exchange-Traded Products (Jan. 10, 2024).

2. Coinbase Petition For Rulemaking

On July 21, 2022, Coinbase filed a petition for rulemaking with the SEC seeking “new rules facilitating the use” of digital asset securities. See Letter from Paul Grewal, Chief Legal Officer, Coinbase Glob., Inc., to Vanessa A. Countryman, Sec’y, SEC (July 21, 2022). On December 15, 2023, in a 3-2 decision, the Commission denied Coinbase’s petition. See Letter from Vanessa A. Countryman, Sec’y, SEC, to Paul Grewal, Chief Legal Officer, Coinbase Glob., Inc. (Dec. 15, 2023). In its ruling, the Commission stated that it disagreed with the “assertion that application of existing securities statutes and regulations to crypto asset securities, issuers of those securities, and intermediaries in the trading, settlement, and custody of those securities is unworkable.” Id. In a statement supporting this decision, Chairman Gensler reaffirmed the SEC’s approach stating that “existing laws and regulations apply to the crypto securities markets.” See Statement on the Denial of a Rulemaking Petition Submitted on behalf of Coinbase Global, Inc. (Dec. 15, 2023).

On December 15, 2023, Coinbase filed a petition for review with the U.S. Court of Appeals for the Third Circuit regarding the SEC’s order. See Coinbase Inc. v. SEC, No. 23-3202 (3d Cir. Dec. 15, 2023), ECF No. 1.

Gibson Dunn represents Coinbase in its petition for review.

3. Non-fungible Tokens (NFTs)

Recent SEC enforcement actions indicate that NFTs may become part of the SEC’s increasing crypto asset enforcement efforts. See, e.g., Press Release, SEC Charges Creator of Stoner Cats Web Series for Unregistered Offerings of NFTs (Sept. 13, 2023) (charging a company with conducting an $8 million unregistered offering in the form of NFTs); Press Release, SEC Charges LA-Based Media and Entertainment Co. Impact Theory for Unregistered Offering of NFT (Aug. 28, 2023) (settling with a company for conducting an unregistered offering of crypto asset securities). In these cases, the SEC has generally relied on the Supreme Court’s test in Howey to contend that the NFTs that companies like Impact Theory sell are investment contracts, offered to investors with the process of “tremendous” future value. See Order Instituting Cease and Desist Proceedings, In re Impact Theory, No. 3-21585 (Aug. 28, 2023). The Commission’s position on NFT regulation is still unsettled with at least some commissioners objecting to the regulation of NFTs under Howey given that “NFTs were not shares of a company and did not generate any type of dividend for the purchasers.” NFTs & SEC: Statement on Impact Theory, LLC (Aug. 28, 2023).

VII. LORENZO DISSEMINATOR LIABILITY

As previously discussed in our 2019, 2022, and 2023 Mid-Year Updates, in Lorenzo, the Supreme Court expanded the scope of scheme liability to include individuals who disseminate false or misleading information, but do not make misstatement(s), to potential investors with the intent to defraud. 139 S. Ct. 1094 (2019). As a result, individuals who do not make false or misleading statements may nevertheless be subject to “scheme liability” under Rules 10b-5(a) and 10b-5(c) for disseminating the alleged misstatement(s) of another if plaintiff can show that the individual knew the alleged misstatement(s) contained false or misleading information. Following Lorenzo, the Second Circuit found that defendants must do “something beyond” making material misstatements or omissions, such as disseminating the alleged misstatements, to be subject to scheme liability under Rules 10b-5(a) and (c). SEC v. Rio Tinto plc, 41 F.4th 47, 54 (2d Cir. 2022); see also Client Alert (Gibson Dunn represents Rio Tinto in this litigation).

Although the Supreme Court and most circuit courts have not directly addressed the requirements for scheme liability after Lorenzo, several recent district court decisions have added to the debate.

In SEC v. Hwang, a case involving market manipulation claims against the CFO and principal of a family office stemming from alleged misrepresentations to counterparties in swap transactions, the Southern District of New York dismissed the scheme liability claims against the CFO while upholding the scheme liability claims against the principal. 2023 WL 6124041, at *5, *7-8, *18 (S.D.N.Y. Sept. 19, 2023). In applying the Rio Tinto “something beyond” standard, the court dismissed the scheme liability claims against the CFO because he merely directed his subordinates to craft the alleged misrepresentations and he did not participate in the dissemination of the misrepresentations himself. Id. at *8. Unlike the claims against the CFO, the court upheld scheme liability claims against the principal because the court accepted the SEC’s allegations that the principal “directed Archego’s staff to trade in a manner that would artificially inflate the price of [his company’s] holdings.” Id. at *9.

In another case in the Southern District of New York, SEC v. Farnsworth, the court sustained scheme liability claims against former executives of MoviePass, Farnsworth and Lowe, for making public statements that MoviePass was seeing a natural drop off in users, when MoviePass was allegedly manufacturing a decrease in users by artificially interfering with its own users’ ability to take full advantage of the services MoviePass offered. 2023 WL 5977240, at *1-2, *18 (S.D.N.Y. Sept. 14, 2023). Specifically, the court found that allegedly resetting customers’ passwords or subjecting them to ticket-verification procedures to discourage usage of the subscription service was sufficient additional conduct to sustain scheme liability claims under Lorenzo and Rio Tinto. Id. at *18.

In a case from the United States District Court for the District of Columbia, In re Bed Bath & Beyond Corporation Securities Litigation, the court cited positively to Rio Tinto, although it did not explicitly adopt the Second Circuit’s “something beyond” standard. 2023 WL 4824734, at *12 (D.D.C. July 27, 2023). In that case, the court sustained scheme liability claims against Bed Bath & Beyond for allegedly delaying its SEC filings to stimulate trading of its stock to piggyback off the alleged misstatements of an activist investor.

In a recent case from the Northern District Court of Texas, the Court found that the allegedly inflated valuations contained in internal planning documents were sufficient to sustain a scheme liability claim. Yoshikawa v. Exxon Mobil Corporation, 2023 WL 5489054, at *8-9 (N.D. Tex. Aug. 24, 2023). Plaintiffs alleged that an employee instructed her team to manipulate internal valuations of certain assets to support the company’s allegedly prior misleading public statements regarding the growth potential of certain assets to investors. Id. at *4-5, *8-9. Defendants argued that plaintiffs failed to plead deceptive conduct beyond misstatements and omissions, but, citing to Rio Tinto, the Court disagreed and denied the motion to dismiss with respect to the scheme liability claim. Id. at *9. The Court otherwise dismissed 10b-5(b) misstatement and omissions claims in their entirety for failure to adequately plead scienter with respect to the challenged statements. Id. at *10.

In another case from the Northern District Court of Texas, Linenweber v. Southwest Airlines Co., the court, citing Rio Tinto, granted defendants’ motion to dismiss, concluding that “misstatements and omissions alone do not suffice for scheme liability.” 2023 WL 6149106, at *14 (N.D. Tex. Sept. 19, 2023) (quoting SEC v. Rio Tinto plc, 41 F.4th 47, 48 (2d Cir. 2022)). In the case, plaintiffs claimed that defendants’ scheme was “portraying Southwest’s aircraft as safe and compliant while concealing a wide-range of safety hazards and regulatory non-compliance issues.” Id. at *14. The court dismissed plaintiffs’ scheme liability claims because plaintiffs failed to identify any fraudulent or deceptive acts beyond the misleading statements portraying Southwest’s aircraft as safe while allegedly concealing other safety hazards. Id.

VIII. MARKET EFFICIENCY AND “PRICE IMPACT” CASES

As discussed in our Client Alert and Mid-Year Update, the long-running class certification dispute in Arkansas Teacher Retirement System v. Goldman Sachs Group, Inc., 77 F.4th 74, 105 (2d Cir. 2023) (“ATRS”), ended this year, with the Second Circuit reversing the class certification order and remanding with instructions to decertify the class. Following the class decertification—and more than a decade after the case was initially filed—the parties stipulated to a voluntary dismissal with prejudice.

The Second Circuit’s decision to decertify was based on guidance from the Supreme Court’s 2021 decision in Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System, 141 S. Ct. 1951 (2021) (“Goldman”), which we previously detailed in our 2021 Mid-Year Securities Litigation Update. In Goldman, the Supreme Court held that courts analyzing whether to grant class certification should consider evidence, including expert evidence, of whether the alleged misstatements were too generic to affect the price of securities, even though that same evidence could be relevant to whether the alleged misstatements were material. Goldman, 141 S. Ct. at 1960-61. The Supreme Court also held that if a plaintiffs’ price impact theory is based on “inflation maintenance” (meaning the alleged misstatement did not cause the stock price to increase but instead prevented the price from dropping), then any mismatch between the generic nature of the challenged statements and the specificity of the alleged corrective disclosures is critical in determining whether defendants have rebutted the Basic presumption of class-wide reliance. Id.

In ATRS, the Second Circuit considered—again—whether this class of investors was properly certified. ATRS, 77 F.4th at 80-81. Applying the Supreme Court’s “mismatch framework,” the Second Circuit held that when plaintiffs rely on the inflation-maintenance theory—like plaintiffs in ATRS did—they cannot simply “identify a specific back-end, price-dropping event” and match it to “a front-end disclosure bearing on the same subject” unless “the front-end disclosure is sufficiently detailed in the first place.” Id. at 81, 102. After examining the evidence in the case, the Second Circuit ultimately concluded that the mismatch between the generic nature of the alleged misstatements and the specificity of the alleged corrective disclosure was sufficient to “sever the link” between the statements and the stock price drop. Id. at 104.

Following Goldman and ATRS, lower court decisions are engaging in a more searching analysis of all evidence of price impact, including scrutiny regarding whether the alleged corrective disclosure sufficiently matches the challenged statement. See e.g., Ramirez v. Exxon Mobil Corp., 2023 WL 5415315, at *11-21 (N.D. Tex. Aug. 21, 2023); Del. Cnty. Emp. Ret. Sys. v. Cabot Oil & Gas Corp., 2023 WL 6300569, at *10-13 (S.D. Tex. Sept. 27, 2023); Hall v. Johnson & Johnson, 2023 WL 9017023, at *10-15 (D.N.J. Dec. 29, 2023).

In Ramirez, for example, a U.S. District Judge in the Northern District of Texas rejected six out of seven of plaintiffs’ alleged corrective disclosures for various reasons. These reasons included that the experts found no statistically significant price change, Ramirez, 2023 WL 5415315, at *15, *17, *20, *21; there was a lack of analyst commentary about the alleged corrective disclosures, id. at *15-16; the negative price reaction was not properly attributable to the alleged corrective disclosures, id. at *16; and one of the alleged corrective disclosures did not offer any new corrective information, id. at *20. The court held that the sole remaining alleged corrective disclosure sufficiently illustrated price impact but only in connection with some of the alleged misrepresentations. Id. at *20. Based on this analysis, the court certified a class covering a limited period and as to only a subset of challenged statements. Id. at *22.

We will continue to monitor developments in this area.

IX. OTHER NOTABLE DEVELOPMENTS

A. Circuit Developments In Omnicare Cases

As noted in prior updates, in the nearly nine years since the Supreme Court issued its seminal decision concerning opinion statements in Omnicare, Inc. v. Laborers District Council Construction Industry Pension Fund, 575 U.S. 175 (2015), courts have regularly applied Omnicare, which was decided in the context of a Section 11 claim, to claims brought under the Exchange Act.

In a June 2023 decision, the Third Circuit joined the trend of applying Omnicare to claims brought under the Exchange Act, holding that Omnicare’s opinion-falsity framework applies to claims for violations of Rule 10b-5. City of Warren Police and Fire Retirement Sys. v. Prudential Fin., Inc., 70 F.4th 668, 685 (3d Cir. 2023). Plaintiff’s claims stemmed from announcements made by the publicly traded life insurance company, Prudential Financial, Inc. (“Prudential”), that it would need to increase its reserves by $208 million and that its earnings would be reduced by $25 million per quarter for the foreseeable future. Id. at 676. Plaintiff, a municipal retirement system and investor in Prudential, alleged that the company knew about problems with its reserves and misled investors about those issues. Id. The district court granted Prudential’s motion to dismiss the case for failure to state a claim, reasoning that plaintiff did not adequately plead falsity. Id.

On appeal, plaintiff argued that four sets of statements were pleaded with particularity and were plausibly false or misleading. Id. at 681. The Third Circuit remanded one set of statements to the district court and affirmed the district court’s dismissal of the remaining three sets of statements. Id. at 676-77. In affirming the dismissal of claims related to one set of statements, the Third Circuit applied, for the first time, Omnicare’s bases of liability to a claim brought under Section 10(b). In its ruling, the Third Circuit noted that “every other Court of Appeals to encounter the issue has applied the Omnicare framework for opinion falsity to claims for Rule 10b-5 violations.” Id. at 685. The Third Circuit ultimately held that defendant’s representations about the adequacy of its reserve were non-actionable opinions because plaintiff had failed to allege any of the three Omnicare situations in which a statement of opinion could form the basis for liability. Id. at 686-87.

In an August 2023 decision, the Second Circuit held that a statement of opinion that reflects some subjective judgment must have a sufficient evidentiary basis in order to be non-actionable under Omnicare. New Eng. Carpenters Guaranteed Annuity & Pension Funds v. DeCarlo, 80 F.4th 158, 174 (2d Cir. 2023). Plaintiffs’ claims stemmed from restatements made by the publicly traded property and casual insurance company, AmTrust Financial Services (“AmTrust”), of five years of financial results to correct “significant errors in its annual and quarterly reports.” Id. at 165. Specifically, AmTrust disclosed that it had improperly accounted for certain extended-warranty contracts and certain discretionary employee bonuses. Id. In response to the restatements, plaintiffs brought claims against AmTrust for allegedly misstating the company’s financial condition and results in violation of Sections 11, 12, and 15 of the Securities Act, Sections 10(b) and 20(a) of the Exchange Act, and Rule 10b-5. Id. The district court dismissed all claims as non-actionable statements of opinion. Id.

On appeal, the Second Circuit affirmed the district court’s dismissal of plaintiffs’ Section 10(b) and Rule 10b-5 claims against AmTrust for failure to raise a strong inference of scienter. Id. at 178-79. But the Second Circuit vacated the district court’s dismissal of (1) plaintiffs’ Section 11 claims related to AmTrust’s accounting for certain extended-warranty contracts and (2) plaintiffs’ Section 11 and Section 12(a)(2) claims related to AmTrust’s accounting of discretionary employee bonuses. Id. at 172, 174-76.

First, the Second Circuit held that plaintiffs sufficiently alleged that AmTrust omitted material facts such that its financial statements related to warranty-contract revenue were misleading and reversed the district court’s dismissal of plaintiffs’ Section 11 claims arising from these statements. Id. at 174 (citing Omnicare, 575 U.S. at 192). The court rejected the argument that the accounting decision was a “judgment call” and thus non-actionable, reasoning that subjective judgments presume some historical evidence, and GAAP allows time-of-sale recognition only if evidence justifies doing so. Id.